Exhibit 99.(C)(5)

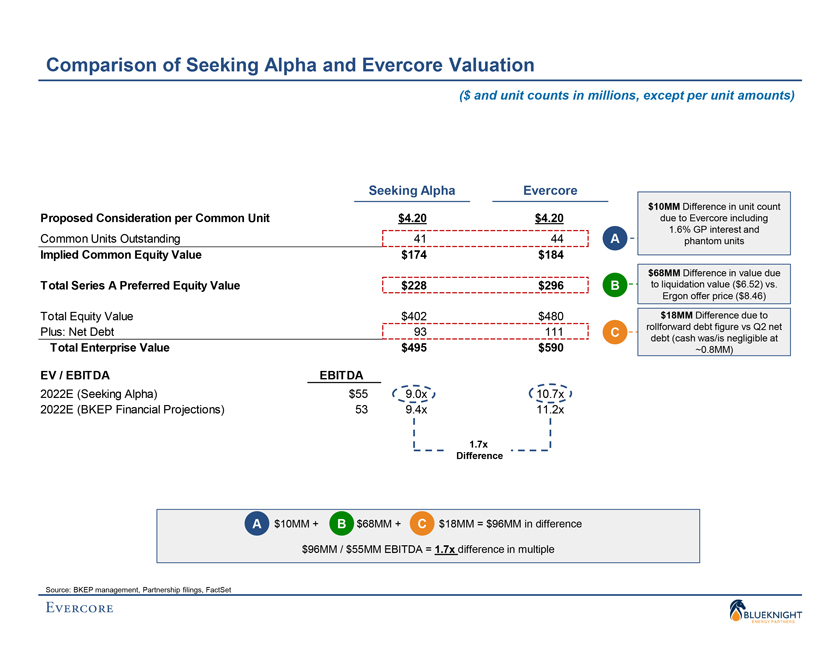

Confidential Comparison of Seeking Alpha and Evercore Valuation ($ and unit counts in millions, except per unit amounts) Seeking Alpha Evercore $10MM Difference in unit count Proposed Consideration per Common Unit $4.20 $4.20 due to Evercore including Common Units Outstanding 41 44 1.6% GP interest and A phantom units Implied Common Equity Value $174 $184 $68MM Difference in value due Total Series A Preferred Equity Value $228 $296 B to liquidation value ($6.52) vs. Ergon offer price ($8.46) Total Equity Value $402 $480 $18MM Difference due to Plus: Net Debt 93 111 rollforward debt figure vs Q2 net C Total Enterprise Value $495 $590 debt (cash was/is negligible at ~0.8MM) EV / EBITDA EBITDA 2022E (Seeking Alpha) $55 9.0x 10.7x 2022E (BKEP Financial Projections) 53 9.4x 11.2x 1.7x Difference A $10MM + B $68MM + C $18MM = $96MM in difference $96MM / $55MM EBITDA = 1.7x difference in multiple Source: BKEP management, Partnership filings, FactSet