Exhibit 99.(C)(6)

Preliminary Draft – Confidential DG Capital Valuation Regarding Project Thunder December 20, 2021

Exhibit 99.(C)(6)

Preliminary Draft – Confidential DG Capital Valuation Regarding Project Thunder December 20, 2021

Preliminary Draft – Confidential These materials have been prepared by Evercore Group L.L.C. (“Evercore”) for the Conflicts Committee (the “Conflicts Committee”) of the Board of Directors of Blueknight Energy Partners G.P., LLC, the general partner of Blueknight Energy Partners, L.P. (the “Partnership”), to whom such materials are directly addressed and delivered and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Evercore. These materials are based on information provided by or on behalf of the Conflicts Committee, from public sources or otherwise reviewed by Evercore. Evercore assumes no responsibility for independent investigation or verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance prepared by or reviewed with the management of the Partnership and/or other potential transaction participants or obtained from public sources, Evercore has assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such management (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. These materials were designed for use by specific persons familiar with the business and affairs of the Partnership. These materials are not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any transaction or other matter. These materials have been developed by and are proprietary to Evercore and were prepared exclusively for the benefit and internal use of the Conflicts Committee. These materials were compiled on a confidential basis for use by the Conflicts Committee and not with a view to public disclosure or filing thereof under state or federal securities laws, and may not be reproduced, disseminated, quoted or referred to, in whole or in part, without the prior written consent of Evercore. These materials do not constitute an offer or solicitation to sell or purchase any securities and are not a commitment by Evercore or any of its affiliates to provide or arrange any financing for any transaction or to purchase any security in connection therewith. Evercore assumes no obligation to update or otherwise revise these materials. These materials may not reflect information known to other professionals in other business areas of Evercore and its affiliates. Evercore and its affiliates do not provide legal, accounting or tax advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by Evercore or its affiliates to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. Each person should seek legal, accounting and tax advice based on his, her or its particular circumstances from independent advisors regarding the impact of the transactions or matters described herein.

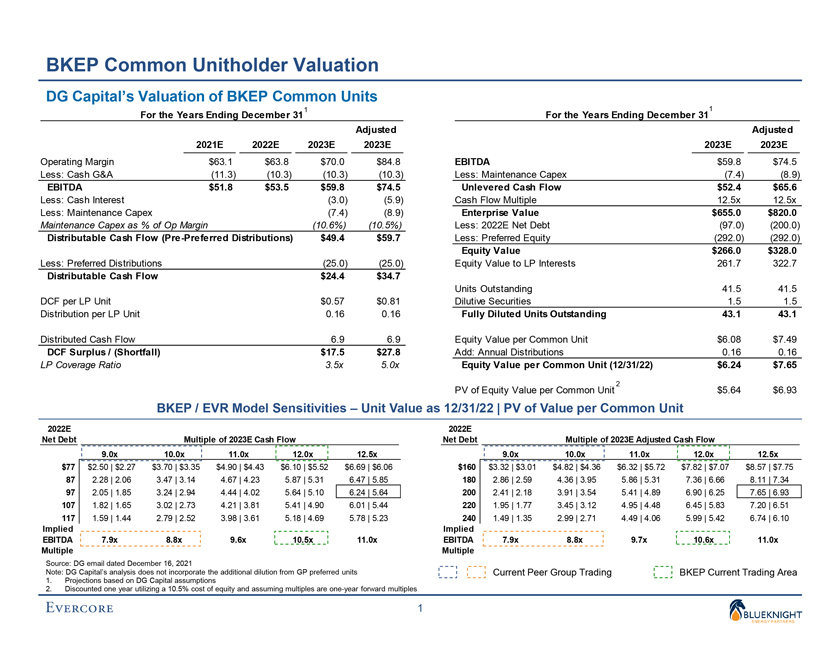

Preliminary Draft – Confidential BKEP Common Unitholder Valuation DG Capital’s Valuation of BKEP Common Units 1 1 For the Years Ending December 31 For the Years Ending December 31 Adjusted Adjusted 2021E 2022E 2023E 2023E 2023E 2023E Operating Margin $63.1 $63.8 $70.0 $84.8 EBITDA $59.8 $74.5 Less: Cash G&A (11.3) (10.3) (10.3) (10.3) Less: Maintenance Capex (7.4) (8.9) EBITDA $51.8 $53.5 $59.8 $74.5 Unlevered Cash Flow $52.4 $65.6 Less: Cash Interest (3.0) (5.9) Cash Flow Multiple 12.5x 12.5x Less: Maintenance Capex (7.4) (8.9) Enterprise Value $655.0 $820.0 Maintenance Capex as % of Op Margin (10.6%) (10.5%) Less: 2022E Net Debt (97.0) (200.0) Distributable Cash Flow (Pre-Preferred Distributions) $49.4 $59.7 Less: Preferred Equity (292.0) (292.0) Equity Value $266.0 $328.0 Less: Preferred Distributions (25.0) (25.0) Equity Value to LP Interests 261.7 322.7 Distributable Cash Flow $24.4 $34.7 Units Outstanding 41.5 41.5 DCF per LP Unit $0.57 $0.81 Dilutive Securities 1.5 1.5 Distribution per LP Unit 0.16 0.16 Fully Diluted Units Outstanding 43.1 43.1 Distributed Cash Flow 6.9 6.9 Equity Value per Common Unit $6.08 $7.49 DCF Surplus / (Shortfall) $17.5 $27.8 Add: Annual Distributions 0.16 0.16 LP Coverage Ratio 3.5x 5.0x Equity Value per Common Unit (12/31/22) $6.24 $7.65 2 PV of Equity Value per Common Unit $5.64 $6.93 BKEP / EVR Model Sensitivities – Unit Value as 12/31/22 | PV of Value per Common Unit 2022E 2022E Net Debt Multiple of 2023E Cash Flow Net Debt Multiple of 2023E Adjusted Cash Flow 9.0x 10.0x 11.0x 12.0x 12.5x 9.0x 10.0x 11.0x 12.0x 12.5x $77 $2.50 | $2.27 $3.70 | $3.35 $4.90 | $4.43 $6.10 | $5.52 $6.69 | $6.06 $160 $3.32 | $3.01 $4.82 | $4.36 $6.32 | $5.72 $7.82 | $7.07 $8.57 | $7.75 87 2.28 | 2.06 3.47 | 3.14 4.67 | 4.23 5.87 | 5.31 6.47 | 5.85 180 2.86 | 2.59 4.36 | 3.95 5.86 | 5.31 7.36 | 6.66 8.11 | 7.34 97 2.05 | 1.85 3.24 | 2.94 4.44 | 4.02 5.64 | 5.10 6.24 | 5.64 200 2.41 | 2.18 3.91 | 3.54 5.41 | 4.89 6.90 | 6.25 7.65 | 6.93 107 1.82 | 1.65 3.02 | 2.73 4.21 | 3.81 5.41 | 4.90 6.01 | 5.44 220 1.95 | 1.77 3.45 | 3.12 4.95 | 4.48 6.45 | 5.83 7.20 | 6.51 117 1.59 | 1.44 2.79 | 2.52 3.98 | 3.61 5.18 | 4.69 5.78 | 5.23 240 1.49 | 1.35 2.99 | 2.71 4.49 | 4.06 5.99 | 5.42 6.74 | 6.10 Implied Implied EBITDA 7.9x 8.8x 9.6x 10.5x 11.0x EBITDA 7.9x 8.8x 9.7x 10.6x 11.0x Multiple Multiple Source: DG email dated December 16, 2021 Note: DG Capital’s analysis does not incorporate the additional dilution from GP preferred units Current Peer Group Trading BKEP Current Trading Area 1. Projections based on DG Capital assumptions 2. Discounted one year utilizing a 10.5% cost of equity and assuming multiples are one-year forward multiples 1

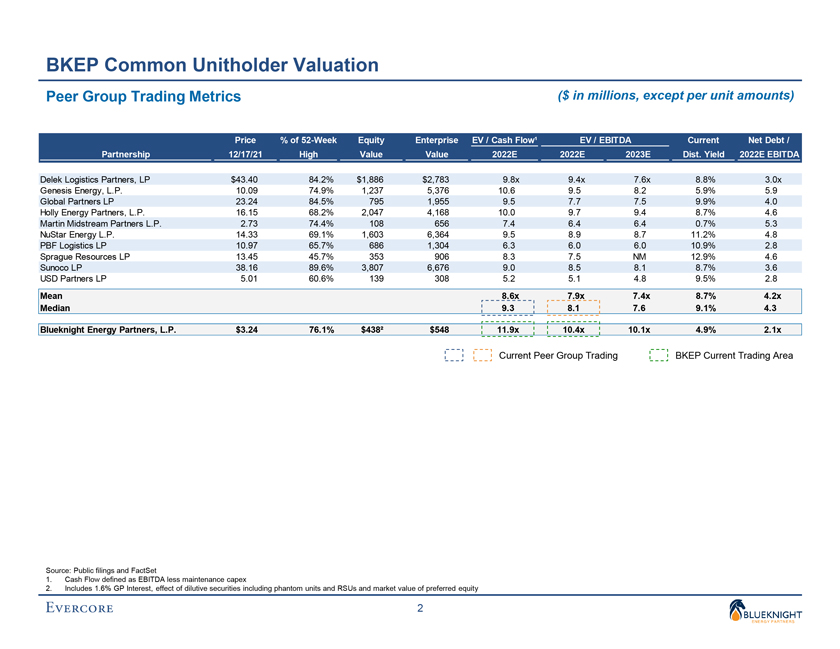

Preliminary Draft – Confidential BKEP Common Unitholder Valuation Peer Group Trading Metrics ($ in millions, except per unit amounts) Delek Logistics Partners, LP $43.40 84.2% $1,886 $2,783 9.8x 9.4x 7.6x 8.8% 3.0x Genesis Energy, L.P. 10.09 74.9% 1,237 5,376 10.6 9.5 8.2 5.9% 5.9 Global Partners LP 23.24 84.5% 795 1,955 9.5 7.7 7.5 9.9% 4.0 Holly Energy Partners, L.P. 16.15 68.2% 2,047 4,168 10.0 9.7 9.4 8.7% 4.6 Martin Midstream Partners L.P. 2.73 74.4% 108 656 7.4 6.4 6.4 0.7% 5.3 NuStar Energy L.P. 14.33 69.1% 1,603 6,364 9.5 8.9 8.7 11.2% 4.8 PBF Logistics LP 10.97 65.7% 686 1,304 6.3 6.0 6.0 10.9% 2.8 Sprague Resources LP 13.45 45.7% 353 906 8.3 7.5 NM 12.9% 4.6 Sunoco LP 38.16 89.6% 3,807 6,676 9.0 8.5 8.1 8.7% 3.6 USD Partners LP 5.01 60.6% 139 308 5.2 5.1 4.8 9.5% 2.8 Mean 8.6x 7.9x 7.4x 8.7% 4.2x Median 9.3 8.1 7.6 9.1% 4.3 Blueknight Energy Partners, L.P. $3.24 76.1% $438Ë› $548 11.9x 10.4x 10.1x 4.9% 2.1x Current Peer Group Trading BKEP Current Trading Area Source: Public filings and FactSet 1. Cash Flow defined as EBITDA less maintenance capex 2. Includes 1.6% GP Interest, effect of dilutive securities including phantom units and RSUs and market value of preferred equity 2