| Blackstone Reports Third Quarter 2025 Results |

New York, October 23, 2025: Blackstone (NYSE:BX) today reported its third quarter 2025 results.

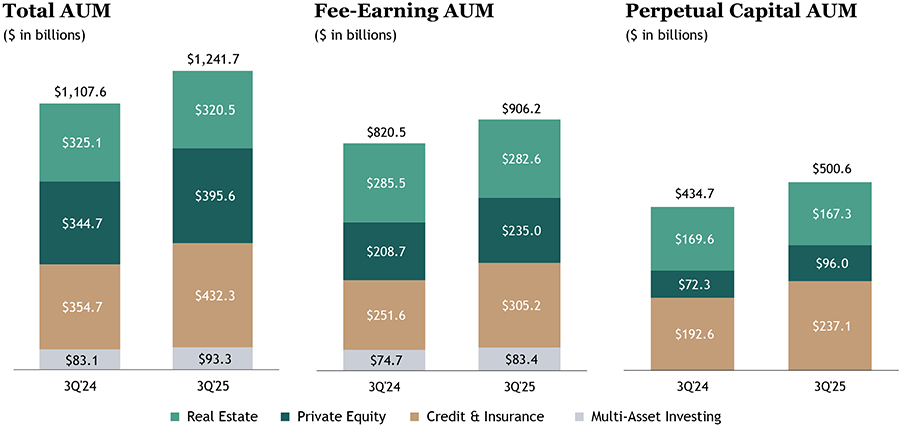

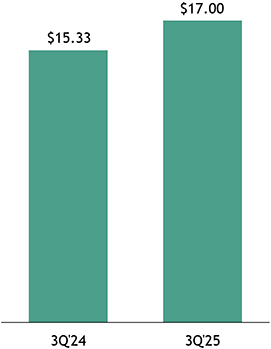

Stephen A. Schwarzman, Chairman and Chief Executive Officer, said, “Blackstone reported an exceptional third

quarter, highlighted by outstanding financial results and robust fund-raising momentum across our three major

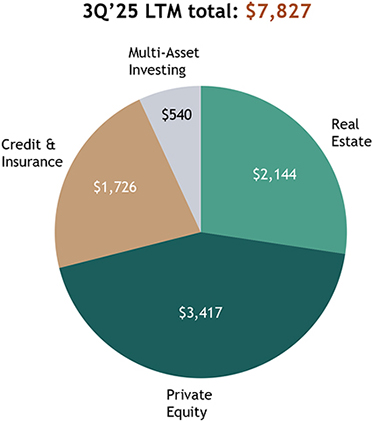

channels—institutions, insurance and individuals. Inflows reached $54 billion in the quarter and $225 billion over

the last twelve months. The leading platforms we’ve established in key growth areas, such as digital and energy

infrastructure, are helping power investment performance for our clients and position us extraordinarily well for

the future.”

Blackstone issued a full detailed presentation of its third quarter 2025 results, which can be viewed at

www.blackstone.com.

Dividend

Blackstone has declared a quarterly dividend of $1.29 per share to record holders of common stock at the close of

business on November 3, 2025. This dividend will be paid on November 10, 2025.

Quarterly Investor Call Details

Blackstone will host its third quarter 2025 investor conference via public webcast on October 23, 2025 at

9:00 a.m. ET. To register, please use the following link:

https://event.webcasts.com/starthere.jsp?ei=1735590&tp_key=f891a18007. For those unable to listen to the live

Blackstone

345 Park Avenue, New York, NY 10154

T 212 583 5000

www.blackstone.com