Takeda Pharmaceutical Company Limited Business Report: The 149th Interim Period

Page 2 Table of Contents CEO Message 3 Feature: Six Late-Stage Pipeline Programs with the Potential to Deliver Significant Value 4 FY2025 H1 Financial Highlights 7 COMMERCIAL UPDATES ACROSS SIX KEY BUSINESS AREAS 7 FY2025 Forecast and Management Guidance 8 Reference 9 Important Notice 10

Page 3 CEO Message Dear Takeda Shareholders, Fiscal year 2025 is a pivotal year for Takeda, as we advance our late-stage pipeline and prepare to launch new products that will be future drivers of our sustainable growth. In the first half of the fiscal year, we presented very positive Phase 3 data for two assets in our late-stage pipeline. First was rusfertide, a treatment for polycythemia vera, a rare blood cancer that increases the risk of life-threatening cardiovascular and thrombotic events. Then came oveporexton, a treatment for narcolepsy type 1, a neurological disorder that causes excessive daytime sleepiness and disrupted nighttime sleep. Both pipeline assets are scheduled for regulatory submission by the end of this fiscal year and, if approved, they have the potential to provide new treatment options for patients. Additionally, for our oral allosteric tyrosine kinase 2 (TYK2) inhibitor zasocitinib, we anticipate readouts for two Phase 3 studies in psoriasis before the end of this fiscal year. Preparations for launch and commercialization are already under way for rusfertide, oveporexton and zasocitinib, which are among six late-stage pipeline programs that collectively represent peak revenue potential of between USD 10 and 20 billion, signifying huge prospects for our business. We also remain committed to expanding and diversifying our R&D pipeline through internal and external innovation. This commitment is highlighted by our recently announced global strategic partnership with Innovent Biologics for two highly promising late-stage oncology assets and an exclusive option for an early-stage program. These advances reinforce our long-term growth trajectory and our commitment to delivering life-transforming treatments. We’re entering the second half of fiscal year 2025 with a laser focus on execution and are confident in our ability to deliver on our financial targets and the potential of our late-stage pipeline—creating meaningful value for patients and shareholders. We also continue to advance our leadership transition as planned, with Julie Kim preparing to take over as CEO when I retire from the company next June. Our collaborative transition is providing continuity that will ultimately enable us to accelerate for the future. On behalf of Takeda, I want to thank you for your continued engagement. We very much appreciate your support. Warm regards, Christophe Weber, President & CEO Takeda Pharmaceutical Company Limited

Page 4 Feature: Six Late-Stage Pipeline Programs with the Potential to Deliver Significant Value Fiscal year 2025 is a year of transformation, as we drive innovation at an unprecedented speed and scale. To bring new treatment options to patients around the world, we are focusing on the advancement of six late-stage pipeline programs and accelerating investments in preparation for their launch. We have a robust portfolio of promising late-stage assets approaching commercialization. Regulatory filings for rusfertide and oveporexton are expected in the second half of the fiscal year, as well as Phase 3 results for zasocitinib. This progress enables us to potentially deliver new, innovative treatments to patients and serves as a cornerstone of Takeda’s growth strategy, reflecting our dedication to advancing the future of health care. Each of the six late-stage programs holds the potential to transform patients’ lives. With our deep expertise in understanding disease biology and our commitment to addressing unmet medical needs, we aim to redefine the standard of care. Below, we introduce our late-stage pipeline programs. *These programs are currently investigational and have not been approved anywhere in the world. oveporexton Indication being studied: Narcolepsy Type 1 (NT1) Unmet needs - NT1 is a chronic, rare neurological disorder caused by a significant loss of orexin neurons. - Current treatments do not address the root cause of NT1 and provide only partial improvements with >80% of survey respondents reported experiencing residual symptoms1. - The orexin neuropeptide is essential to sleep-wake and other disorders where orexin signaling is implicated. - NT1 is characterized by excessive daytime sleepiness, disrupted nighttime sleep, hallucinations, sleep paralysis and cataplexy (sudden loss of muscle tone) 2. Characteristics - Takeda is the world’s leader in orexin science with the most comprehensive development program. - Oveporexton, discovered in our labs in Shonan, Japan, is an investigative oral orexin receptor 2-selective agonist designed to address the root cause of NT1. - Both Phase 3 studies met all primary and secondary endpoints, demonstrating statistically significant improvements compared to placebo across a broad range of symptoms at all dose levels at week 12. - Consistent with all oveporexton studies to date, no serious treatment-related adverse events

Page 5 were reported. - These results reinforce the potential of oveporexton to unlock a new era of care in NT1. rusfertide Indication being studied: Polycythemia Vera(PV) Unmet needs - For patients with PV, a rare blood cancer, it’s recommended that hematocrit (HCT), which reflects the number of circulating red blood cells, is maintained below 45%. Exceeding this threshold is associated with a fourfold increase in the risk of death from thromboembolic or cardiovascular events3. However, real-world data indicates that 78% of PV patients have uncontrolled HCT4. - PV patients also commonly suffer from iron deficiency, which significantly impacts their daily life and productivity5. Characteristics - Rusfertide was shown to deliver rapid, consistent and sustained HCT control below 45% and is expected to be used at multiple steps of the PV treatment landscape both as monotherapy and in combination with existing options. - The Verify Phase 3 study met the primary and secondary endpoint and showed rusfertide’s tolerable safety profile. zasocitinib Indications being studied: Plaque Psoriasis & Psoriatic Arthritis, Ulcerative Colitis & Crohn’s Disease, Vitiligo and Hidradenitis Suppurativa Unmet needs - Psoriasis, the initial indication under investigation, is an often debilitating skin disease with great physical and psychosocial burden and has the potential to affect all aspects of a person's life6,7. - Chronic inflammation seen in psoriatic arthritis may result in irreversible structural damage if not managed appropriately, and substantial physical disability (associated with progressive disease), which can impact a patient’s quality of life8,9,10. - Despite the availability of multiple treatment options for psoriasis and psoriatic arthritis, there remains an unmet need for highly effective, well-tolerated, and convenient oral therapy. Characteristics - Zasocitinib is an investigational next-generation, highly selective, oral TYK2 inhibitor that maintains 24-hour inhibition of IL-23 plus other core disease-driving immune pathways11,12,13. - The results of the Phase 2b studies in plaque psoriasis and active psoriatic arthritis reported positive efficacy results with a favorable benefit-risk profile, which strengthened the growing body of clinical evidence for zasocitinib12,14.

Page 6 mezagitamab Indications being studied: IgA Nephropathy (IgAN) and Immune Thrombocytopenia(ITP) Unmet needs - Despite recent therapeutic advances, most approved treatments for IgAN do not directly target the underlying pathogenic mechanisms of the disease, and many patients remain at risk for progressive kidney function decline15. - In ITP many patients continue to experience disease burden despite available therapies, with limited durable responses and quality-of-life improvements highlighting a persistent unmet need for more effective and tolerable treatment options16. Characteristics - Mezagitamab has a potential to deliver a transformative profile, by addressing the root cause in auto-immune diseases while maintaining favorable safety and tolerability. - Continue expanding the asset potential beyond IgAN and ITP by prioritizing the most relevant indications to mezagitamab. elritercept Indication being studied: Anemia Associated Myelodysplastic Syndrome (MDS) Unmet needs - MDS is characterized by inadequate blood cell production, often leading to severe anemia that significantly impacts patient health and quality of life. - 40% of patients will not respond to ESA* in 1L and will progress within a year, and majority of patients in later lines have high transfusion 17. Characteristics - By impacting early and late stages of blood cell development, elritercept has the potential to treat a broad set of low risk MDS patients18. - It also has a potential best-in-class profile, including prolonged and sustained efficacy across a broad set of patients and a generally well tolerated safety profile. * erythropoiesis-stimulating agents fazirsiran Indication being studied: Alpha-1 Antitrypsin Deficiency-Associated Liver Disease(AATD-LD) Unmet needs - There is currently no approved pharmacologic treatment for AATD-LD, a rare inherited condition that can lead to fibrosis, cirrhosis and hepatocellular carcinoma. The only disease management options for patients are lifestyle modifications and liver transplant, which is

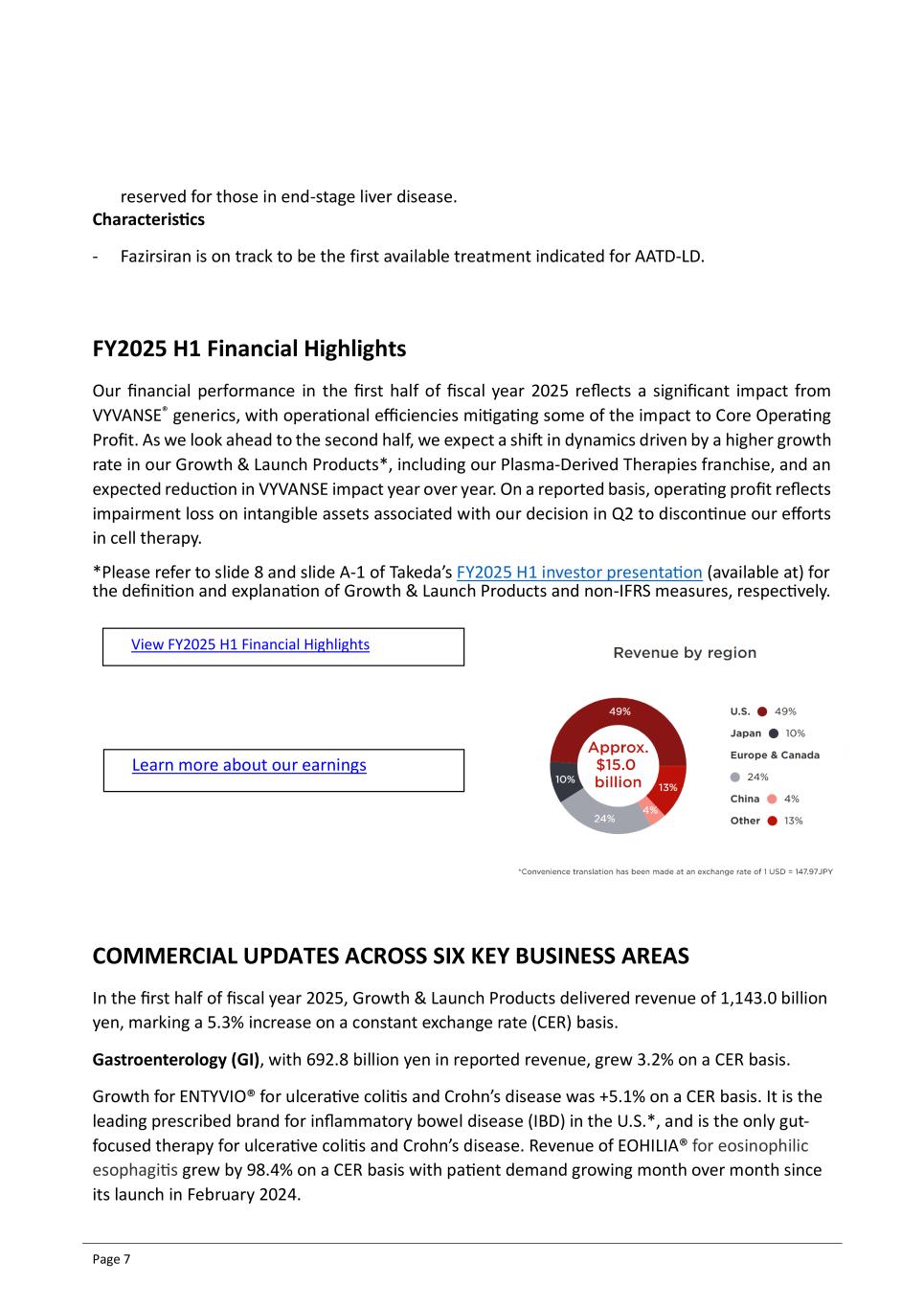

Page 7 reserved for those in end-stage liver disease. Characteristics - Fazirsiran is on track to be the first available treatment indicated for AATD-LD. FY2025 H1 Financial Highlights Our financial performance in the first half of fiscal year 2025 reflects a significant impact from VYVANSE® generics, with operational efficiencies mitigating some of the impact to Core Operating Profit. As we look ahead to the second half, we expect a shift in dynamics driven by a higher growth rate in our Growth & Launch Products*, including our Plasma-Derived Therapies franchise, and an expected reduction in VYVANSE impact year over year. On a reported basis, operating profit reflects impairment loss on intangible assets associated with our decision in Q2 to discontinue our efforts in cell therapy. *Please refer to slide 8 and slide A-1 of Takeda’s FY2025 H1 investor presentation (available at) for the definition and explanation of Growth & Launch Products and non-IFRS measures, respectively. COMMERCIAL UPDATES ACROSS SIX KEY BUSINESS AREAS In the first half of fiscal year 2025, Growth & Launch Products delivered revenue of 1,143.0 billion yen, marking a 5.3% increase on a constant exchange rate (CER) basis. Gastroenterology (GI), with 692.8 billion yen in reported revenue, grew 3.2% on a CER basis. Growth for ENTYVIO® for ulcerative colitis and Crohn’s disease was +5.1% on a CER basis. It is the leading prescribed brand for inflammatory bowel disease (IBD) in the U.S.*, and is the only gut- focused therapy for ulcerative colitis and Crohn’s disease. Revenue of EOHILIA® for eosinophilic esophagitis grew by 98.4% on a CER basis with patient demand growing month over month since its launch in February 2024. View FY2025 H1 Financial Highlights Learn more about our earnings

Page 8 * US Patient Share – IQVIA Rare Diseases, with 380.5 billion yen in reported revenue, grew 0.7% on a CER basis. Hereditary angioedema treatment TAKHZYRO®, which grew by 5.9% on a CER basis, continues to deliver sustained global growth with approximately 6,700 patients treated worldwide. LIVTENCITY® for post-transplant CMV infection, which grew by 47.7% at CER, is demonstrating strong U.S. market penetration and rapid geographic expansion with the recent launch in Japan and national reimbursement inclusion in China. Plasma-Derived Therapies (PDT), with 517.4 billion yen in reported revenue, grew 0.4% on a CER basis. Immunoglobulin grew 3.1% and Albumin declined 2.4% at CER, impacted by shipment timing and quarterly phasing. Demand remains strong, and we confirm our full year guidance of mid-single digit growth at CER for the PDT portfolio. Oncology, with 287.8 billion yen in reported revenue, grew 3.4% on a CER basis. The Oncology portfolio delivered steady growth across key brands, including FRUZAQLA®, which has been approved or launched in more than 30 countries to date. Key drivers for FRUZAQLA include the need for new non-chemotherapy treatment option in metastatic colorectal cancer. ADCETRIS® growth (+11.5% at CER) is primary driven by continued increased use in first-line Hodgkin lymphoma. Vaccines, with 31.7 billion yen in reported revenue, declined 16.8% on a CER basis. Global demand for QDENGA®, for the prevention of dengue, remains strong, with the vaccine now available in 31 countries, driving additional growth through increasing breadth and depth in these markets and further geographic expansion. Sales of other vaccines declined primarily due to reduced supply of COVID-19 vaccines in Japan. Neuroscience, with 206.1 billion yen in reported revenue, declined 32.1% on a CER basis. Revenue decline was mainly due to loss of exclusivity of VYVANSE® in the U.S. in August 2023. U.S. revenue declined 57.7% at CER in first half of fiscal year 2025, reflecting broader availability of generic supply. Outside the U.S., major markets where VYVANSE has experienced loss of exclusivity to date are Canada, Brazil and Germany. FY2025 Forecast and Management Guidance We have revised our full year forecast, as well as Management Guidance for Core Operating Profit and Core EPS. Our updates to our forecast reflect a reduction in sales forecasts for products including ENTYVIO and VYVANSE, impairment losses on intangible assets and transactional FX headwinds as well as a higher tax rate, partially offset by savings from OPEX management efforts.

Page 9 Our updates to our Management Guidance primarily reflect transactional FX headwinds with higher OPEX savings expected to fully mitigate unfavorable change in product mix. Reference 1. Y. Dauvilliers et al, Burden of Illness Study Among Patients with Central Disorders of Hypersomnolence, EAN, 2024 2. Maski K, et al. J Clin Sleep Med. 2017;13(3):419-425. doi: 10.5664/jcsm.6494; US FDA. Narcolepsy & Idiopathic Hypersomnia FDA Patient-Led Listening Session Summary Report 3. Verstovsek S, et al. Ann Hematol 2023 Mar;102(3):571-581 4. Kaifie A, et al. J Hematol Oncol 2016;9:18. 5. Mesa R, et al. BMC Cancer 2016;16,167. 6. Strober B, Greenberg JD, Karki C, et al. Impact of psoriasis severity on patient-reported clinical symptoms, health-related quality of life and work productivity among US patients: real-world data from the Corrona Psoriasis Registry. BMJ Open. 2019 April 20; 9(4):e027535. doi: 10.1136/bmjopen-2018-027535. 7. AlQassimi S, AlBrashdi S, Galadari H, et al. Global burden of psoriasis - comparison of regional and global epidemiology, 1990 to 2017. Intl J Dermatol. 2020 May; 59(5):566-571. doi: 10.1111/ijd.14864. 8. American College of Rheumatology. Psoriatic arthritis. Available at: https://rheumatology.org/patients/psoriatic-arthritis. 9. Mease P, Strand V, Gladman D. Functional impairment measurement in psoriatic arthritis: Importance and challenges. Semin Arthritis Rheum. 2018;48(3):436- 448. doi: 10.1016/j. semarthrit.2018.05.010. 10. Merola JF, Ogdie A, Gottlieb AB, et al. Patient and physician perceptions of psoriatic disease in the United States: Results from the UPLIFT survey. Dermatol Ther (Heidelb). 2023;13(6):1329-1346. doi: 10.1007/s13555-023-00929-9. 11. Mehrotra S, Sano Y, Halkowycz P, et al. Pharmacological Characterization of Zasocitinib (TAK-279): An Oral, Highly Selective and Potent Allosteric TYK2 Inhibitor. J Invest Dermatol. 2025 May 27:S0022- 202X(25)00531-7. doi: 10.1016/j.jid.2025.05.014. 12. Armstrong AW, Gooderham M, Lynde C, et al. Tyrosine Kinase 2 Inhibition With Zasocitinib (TAK-279) in Psoriasis: A Randomized Clinical Trial. JAMA Dermatol. 2024 Oct 1;160(10):1066-1074. doi: 10.1001/jamadermatol.2024.2701. 13. Leit S, J, Greenwood Carriero S, et al. Discovery of a potent and selective tyrosine kinase 2 inhibitor: TAK-279. J Medicinal Chemistry. 2023 Aug 10;66(15):10473-10496. doi: 10.1021/acs.jmedchem.3c00600 14. Kivitz A, Baraliakos X, Muensterman ET, et al. Highly selective tyrosine kinase 2 inhibition with zasocitinib (TAK-279) improves outcomes in patients with active psoriatic arthritis: a randomized phase 2b study. Ann Rheum Dis. 2025 Oct;84(10):1660-1674. doi: 10.1016/j.ard.2025.05.023 View FY2025 Management Guidance View FY2025 Reported and Core Forecasts

Page 10 15. Disease, Kidney, et al. "KDIGO 2025 Clinical Practice Guideline for the Management of Immunoglobulin A Nephropathy (IgAN) and Immunoglobulin A Vasculitis (IgAV)." Kidney International 108.4 (2025): S1- S71. 16. Bussel, James B., et al. "The Lack of Tolerable Treatments Options That Can Induce Durable Responses without Fear of Relapse after Discontinuation Represents a Significant Unmet Need for Patients (Pts) with Immune Thrombocytopenia (ITP): Results from the ITP World Impact Survey (I-WISh) 2.0." Blood 142 (2023): 1212. 17. Internal estimates based on exhaustive Literature review 18. Diez-Campelo,et al/ ASH. 2023 Important Notice This report and any materials distributed in connection with this report may contain forward-looking statements, beliefs or opinions regarding Takeda’s future business, future position and results of operations, including estimates, forecasts, targets and plans for Takeda. Without limitation, forward- looking statements often include words such as “targets”, “plans”, “believes”, “hopes”, “continues”, “expects”, “aims”, “intends”, “ensures”, “will”, “may”, “should”, “would”, “could”, “anticipates”, “estimates”, “projects”, “forecasts”, “outlook” or similar expressions or the negative thereof. These forward-looking statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those expressed or implied by the forward-looking statements: the economic circumstances surrounding Takeda’s global business, including general economic conditions in Japan and the United States and with respect to international trade relations; competitive pressures and developments; changes to applicable laws and regulations, including tax, tariff and other trade-related rules; challenges inherent in new product development, including uncertainty of clinical success and decisions of regulatory authorities and the timing thereof; uncertainty of commercial success for new and existing products; manufacturing difficulties or delays; fluctuations in interest and currency exchange rates; claims or concerns regarding the safety or efficacy of marketed products or product candidates; the impact of health crises, like the novel coronavirus pandemic; the success of our environmental sustainability efforts, in enabling us to reduce our greenhouse gas emissions or meet our other environmental goals; the extent to which our efforts to increase efficiency, productivity or cost- savings, such as the integration of digital technologies, including artificial intelligence, in our business or other initiatives to restructure our operations will lead to the expected benefits; and other factors identified in Takeda’s most recent Annual Report on Form 20-F and Takeda’s other reports filed with the U.S. Securities and Exchange Commission, available on Takeda’s website at: https://www.takeda.com/investors/sec-filings-and-security-reports/ or at www.sec.gov. Takeda does not undertake to update any of the forward-looking statements contained in this report or any other forward- looking statements it may make, except as required by law or stock exchange rule. Past performance is not an indicator of future results and the results or statements of Takeda in this report may not be indicative of, and are not an estimate, forecast, guarantee or projection of Takeda’s future results. Financial Information and Non-IFRS Measures Takeda’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”).

Page 11 This report and materials distributed in connection with this report include certain financial measures not presented in accordance with IFRS, such as Core Revenue, Core Operating Profit, Core Net Profit for the year attributable to owners of the Company, Core EPS, Constant Exchange Rate (“CER”) change, Net Debt, Adjusted Net Debt, EBITDA, Adjusted EBITDA, Free Cash Flow and Adjusted Free Cash Flow. Takeda’s management evaluates results and makes operating and investment decisions using both IFRS and non- IFRS measures included in this report. These non-IFRS measures exclude certain income, cost and cash flow items which are included in, or are calculated differently from, the most closely comparable measures presented in accordance with IFRS. Takeda’s non-IFRS measures are not prepared in accordance with IFRS and such non-IFRS measures should be considered a supplement to, and not a substitute for, measures prepared in accordance with IFRS (which we sometimes refer to as “reported” measures). Investors are encouraged to review the definitions and reconciliations of non-IFRS measures to their most directly comparable IFRS measures, which are in the Financial Appendix appearing at the end of Takeda’s FY2025 H1 investor presentation. Peak Revenue Potential References in this report to peak revenue ranges are estimates that have not been adjusted for probability of technical and regulatory success (PTRS) and should not be considered a forecast or target. These peak revenue ranges represent Takeda’s assessments of various possible future commercial scenarios that may or may not occur. Medical information This report contains information about products that may not be available in all countries, or may be available under different trademarks, for different indications, in different dosages, or in different strengths. Nothing contained herein should be considered a solicitation, promotion or advertisement for any prescription drugs including the ones under development. License and Collaboration Agreement with Innovent Biologics This transaction is subject to customary closing conditions, including regulatory approvals. Takeda does not have rights to the two late-stage assets until the transaction closes and additionally would not have rights to the early-stage program until the option exercise.