Third Quarter Financial Results Presentation / November 3, 2025

Forward-looking statements disclosure This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "may," "will," "expect," "plan," "anticipate" and similar expressions (as well as other words or expressions referencing future events, progress, timing or circumstances) are intended to identify forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements regarding future operations, financial results and the financial condition of Syndax Pharmaceuticals, Inc. (“Syndax” or the “Company”), including financial position, strategy and plans, the progress, timing, clinical development and scope of clinical trials and the reporting of clinical data for Syndax’s product candidates, the progress of regulatory submissions and approvals and subsequent commercialization and the potential use of Syndax’s product candidates to treat various cancer indications and fibrotic diseases, and Syndax’s expectations for liquidity and future operations, are forward-looking statements. Many factors may cause differences between current expectations and actual results, including unexpected safety or efficacy data observed during preclinical studies or clinical trials, clinical site activation rates or clinical trial enrollment rates that are lower than expected; changes in expected or existing competition; the impact of macroeconomic conditions (the Russia-Ukraine war, inflation, among others) on Syndax’s business and that of the third parties on which Syndax depends, including delaying or otherwise disrupting Syndax’s clinical trials and preclinical studies, manufacturing and supply chain, or impairing employee productivity; failure of our collaborators to support or advance collaborations or product candidates and unexpected litigation or other disputes. Moreover, Syndax operates in a very competitive and rapidly changing environment. Other factors that may cause our actual results to differ from current expectations are discussed in Syndax’s filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” sections contained therein. New risks emerge from time to time. It is not possible for Syndax’s management to predict all risks, nor can Syndax assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied. Except as required by law, neither Syndax nor any other person assumes responsibility for the accuracy and completeness of the forward- looking statements. Syndax undertakes no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in Syndax’s expectations.

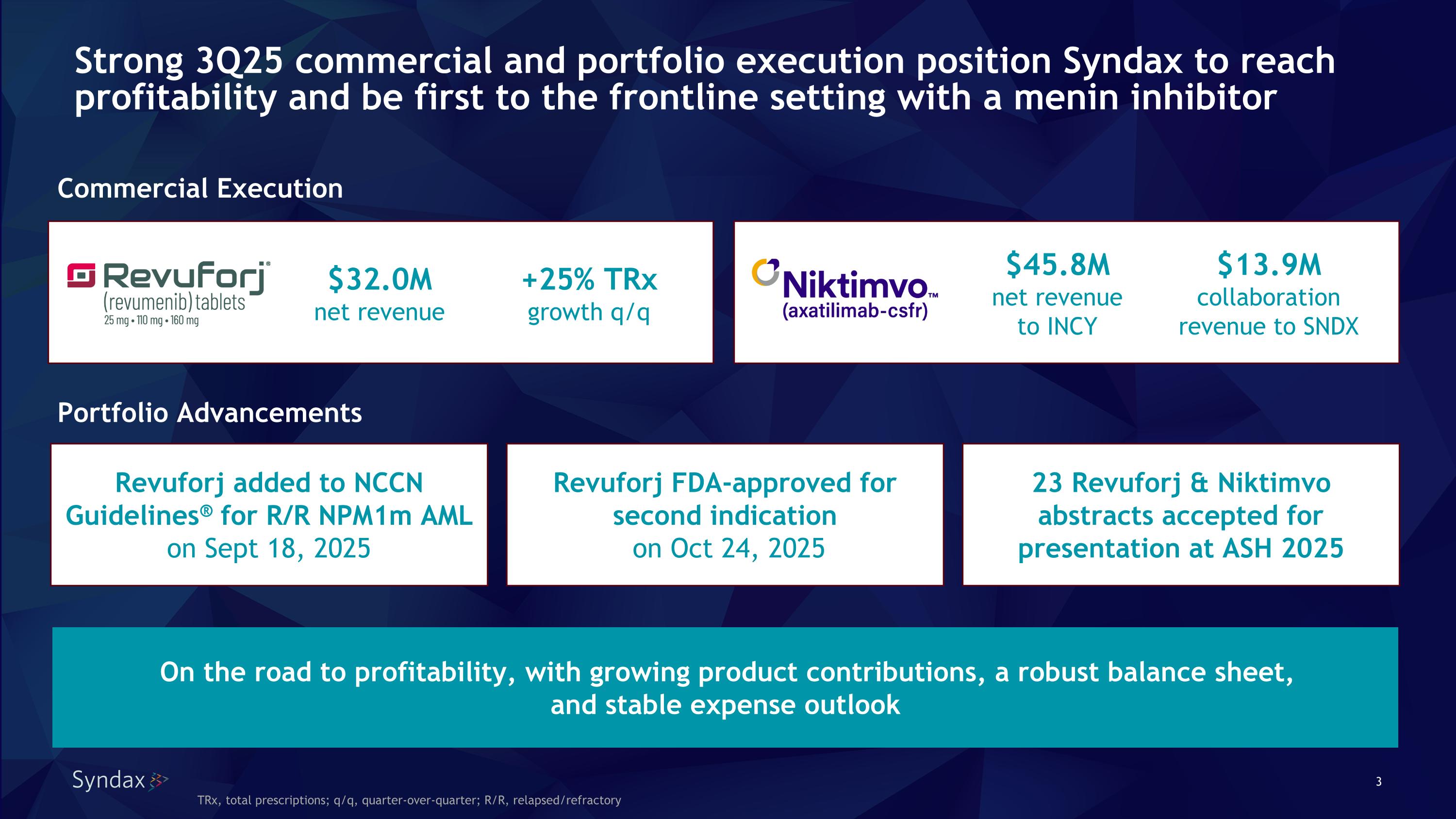

Strong 3Q25 commercial and portfolio execution position Syndax to reach profitability and be first to the frontline setting with a menin inhibitor Revuforj FDA-approved for second indication on Oct 24, 2025 Revuforj added to NCCN Guidelines® for R/R NPM1m AML on Sept 18, 2025 23 Revuforj & Niktimvo abstracts accepted for presentation at ASH 2025 Commercial Execution $32.0M net revenue $45.8M net revenue to INCY Portfolio Advancements On the road to profitability, with growing product contributions, a robust balance sheet, and stable expense outlook TRx, total prescriptions; q/q, quarter-over-quarter; R/R, relapsed/refractory $13.9M collaboration revenue to SNDX +25% TRx growth q/q

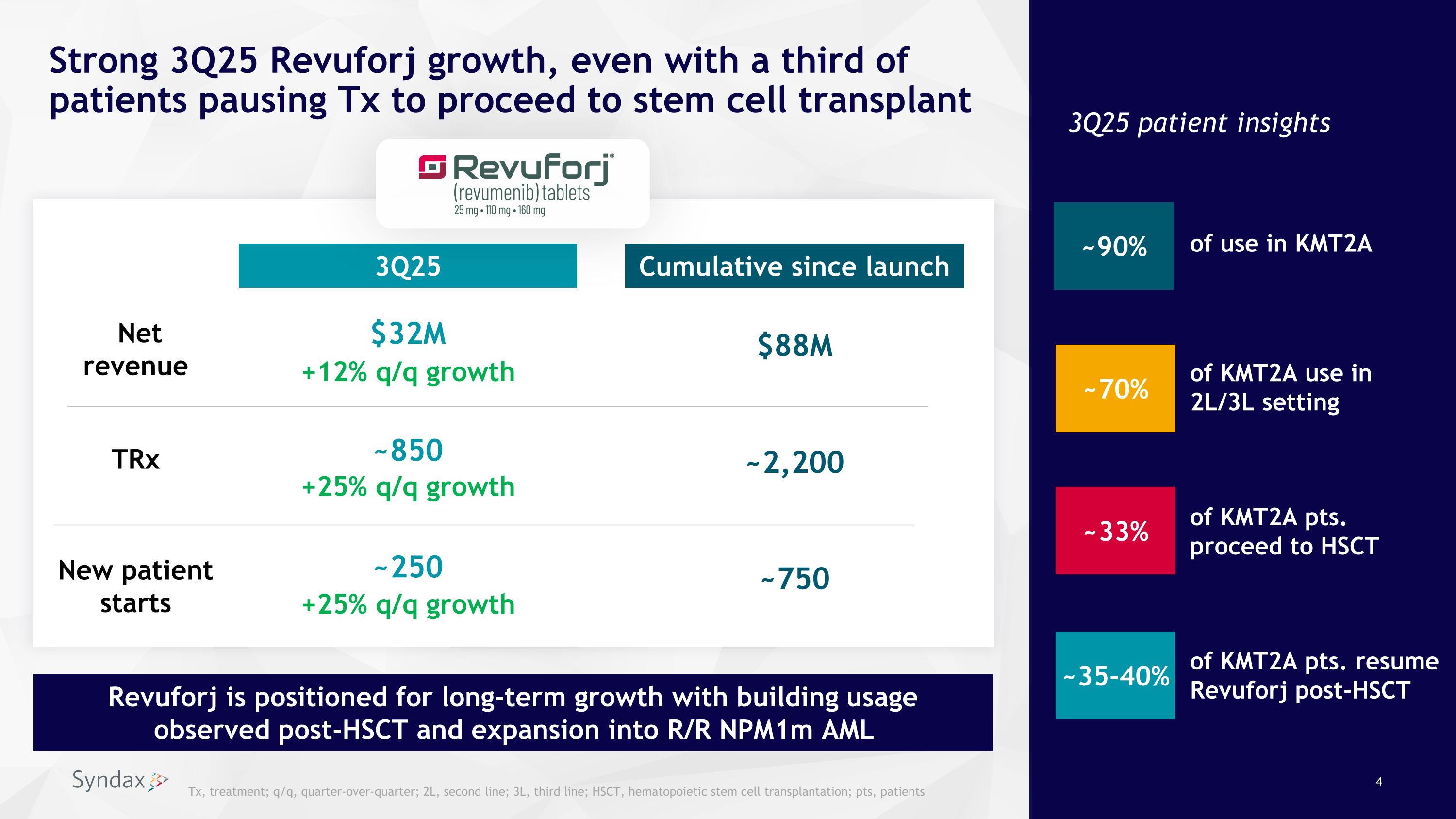

Strong 3Q25 Revuforj growth, even with a third of patients pausing Tx to proceed to stem cell transplant +12% q/q growth +25% q/q growth Cumulative since launch ~2,200 $32M 3Q25 3Q25 patient insights $88M ~850 Net revenue New patient starts ~750 ~250 TRx +25% q/q growth ~70% ~33% ~35-40% Revuforj is positioned for long-term growth with building usage observed post-HSCT and expansion into R/R NPM1m AML of use in KMT2A of KMT2A use in 2L/3L setting of KMT2A pts. proceed to HSCT of KMT2A pts. resume Revuforj post-HSCT ~90% Tx, treatment; q/q, quarter-over-quarter; 2L, second line; 3L, third line; HSCT, hematopoietic stem cell transplantation; pts, patients

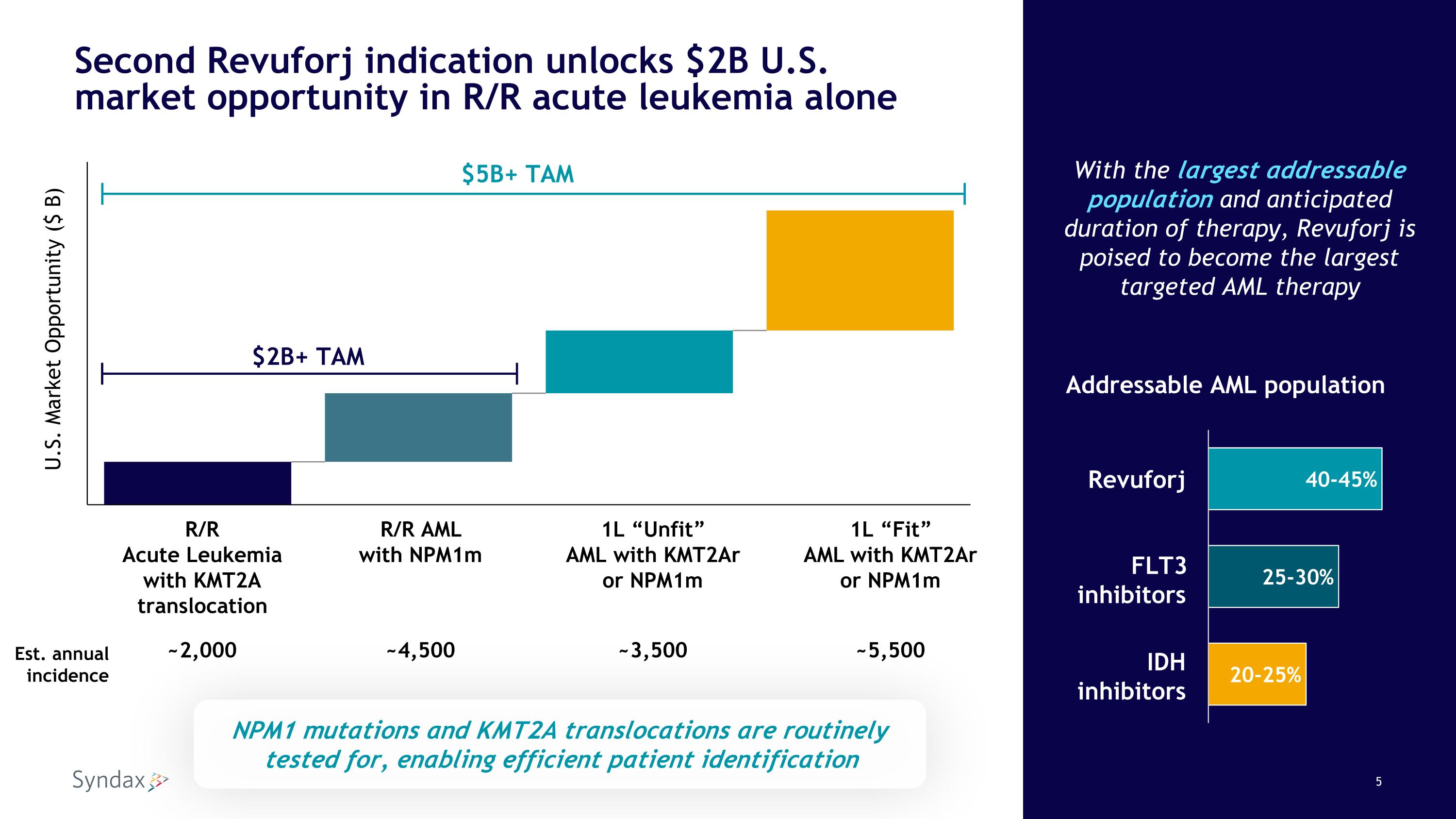

Second Revuforj indication unlocks $2B U.S. market opportunity in R/R acute leukemia alone With the largest addressable population and anticipated duration of therapy, Revuforj is poised to become the largest targeted AML therapy R/R Acute Leukemia with KMT2A translocation R/R AML with NPM1m 1L “Unfit” AML with KMT2Ar or NPM1m 1L “Fit” AML with KMT2Ar or NPM1m Est. annual incidence ~2,000 ~4,500 ~3,500 ~5,500 U.S. Market Opportunity ($ B) $5B+ TAM $2B+ TAM Addressable AML population Revuforj FLT3 inhibitors IDH inhibitors NPM1 mutations and KMT2A translocations are routinely tested for, enabling efficient patient identification

Revuforj expansion into R/R NPM1m AML is well underway, leveraging solid foundation Unmatched efficacy data across multiple patient subtypes Strong prescriber base & HCP familiarity Excellent payer support & reimbursement Proven track record of delivering for patients Competitive advantages

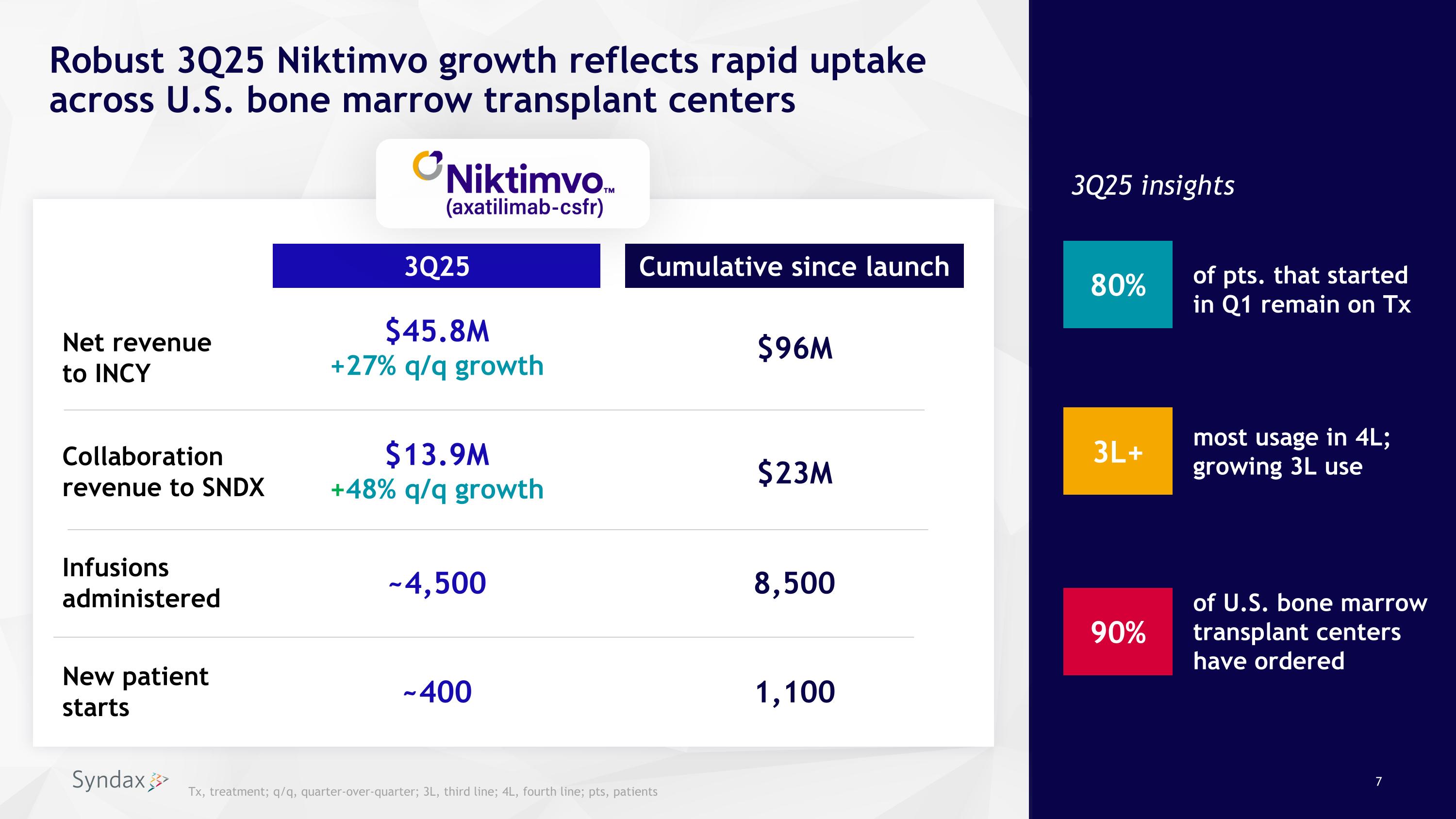

Robust 3Q25 Niktimvo growth reflects rapid uptake across U.S. bone marrow transplant centers Cumulative since launch 8,500 $45.8M +27% q/q growth 3Q25 3Q25 insights $96M ~4,500 Net revenue to INCY New patient starts 1,100 ~400 Infusions administered 3L+ 90% of pts. that started in Q1 remain on Tx most usage in 4L; growing 3L use of U.S. bone marrow transplant centers have ordered 80% Collaboration revenue to SNDX $13.9M +48% q/q growth $23M Tx, treatment; q/q, quarter-over-quarter; 3L, third line; 4L, fourth line; pts, patients

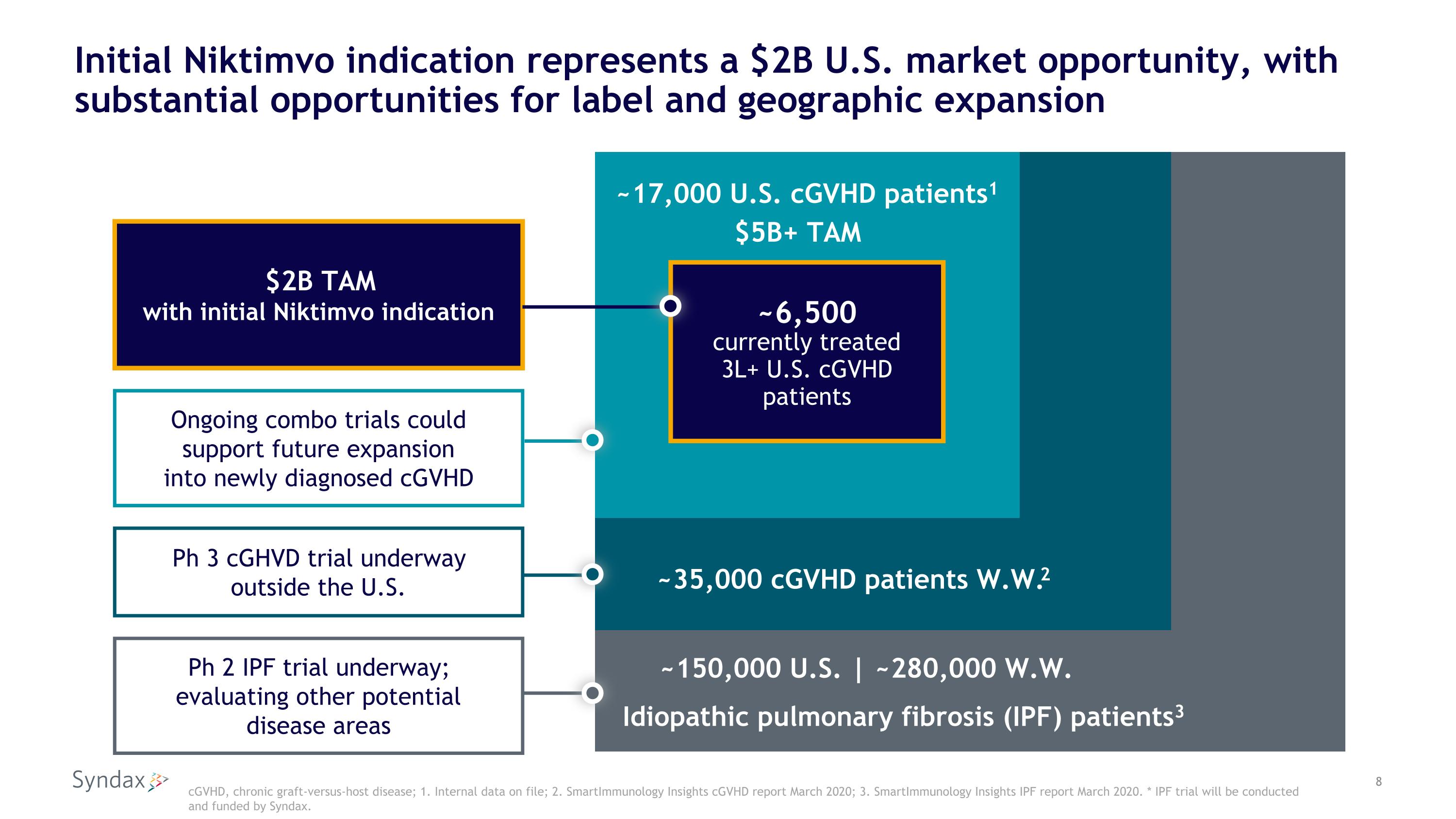

Initial Niktimvo indication represents a $2B U.S. market opportunity, with substantial opportunities for label and geographic expansion cGVHD, chronic graft-versus-host disease; 1. Internal data on file; 2. SmartImmunology Insights cGVHD report March 2020; 3. SmartImmunology Insights IPF report March 2020. * IPF trial will be conducted and funded by Syndax. ~17,000 U.S. cGVHD patients1 ~6,500 currently treated 3L+ U.S. cGVHD patients ~35,000 cGVHD patients W.W.2 Idiopathic pulmonary fibrosis (IPF) patients3 ~150,000 U.S. | ~280,000 W.W. $2B TAM with initial Niktimvo indication Ongoing combo trials could support future expansion into newly diagnosed cGVHD Ph 2 IPF trial underway; evaluating other potential disease areas Ph 3 cGHVD trial underway outside the U.S. $5B+ TAM

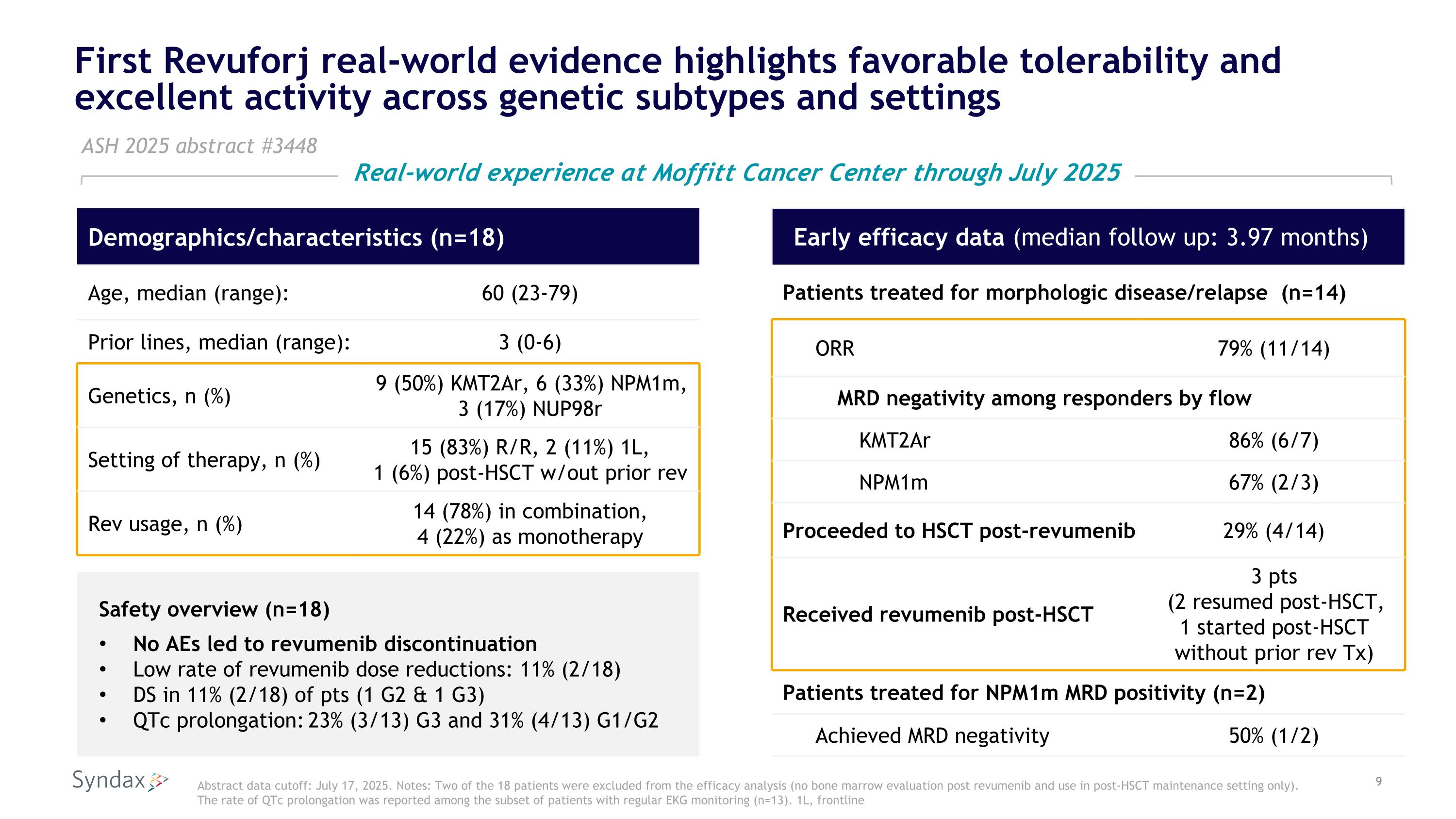

First Revuforj real-world evidence highlights favorable tolerability and excellent activity across genetic subtypes and settings Early efficacy data (median follow up: 3.97 months) Patients treated for morphologic disease/relapse (n=14) ORR 79% (11/14) MRD negativity among responders by flow KMT2Ar 86% (6/7) NPM1m 67% (2/3) Proceeded to HSCT post-revumenib 29% (4/14) Received revumenib post-HSCT 3 pts (2 resumed post-HSCT, 1 started post-HSCT without prior rev Tx) Patients treated for NPM1m MRD positivity (n=2) Achieved MRD negativity 50% (1/2) ASH 2025 abstract #3448 Safety overview (n=18) No AEs led to revumenib discontinuation Low rate of revumenib dose reductions: 11% (2/18) DS in 11% (2/18) of pts (1 G2 & 1 G3) QTc prolongation: 23% (3/13) G3 and 31% (4/13) G1/G2 Demographics/characteristics (n=18) Age, median (range): 60 (23-79) Prior lines, median (range): 3 (0-6) Genetics, n (%) 9 (50%) KMT2Ar, 6 (33%) NPM1m, 3 (17%) NUP98r Setting of therapy, n (%) 15 (83%) R/R, 2 (11%) 1L, 1 (6%) post-HSCT w/out prior rev Rev usage, n (%) 14 (78%) in combination, 4 (22%) as monotherapy Abstract data cutoff: July 17, 2025. Notes: Two of the 18 patients were excluded from the efficacy analysis (no bone marrow evaluation post revumenib and use in post-HSCT maintenance setting only). The rate of QTc prolongation was reported among the subset of patients with regular EKG monitoring (n=13). 1L, frontline Real-world experience at Moffitt Cancer Center through July 2025

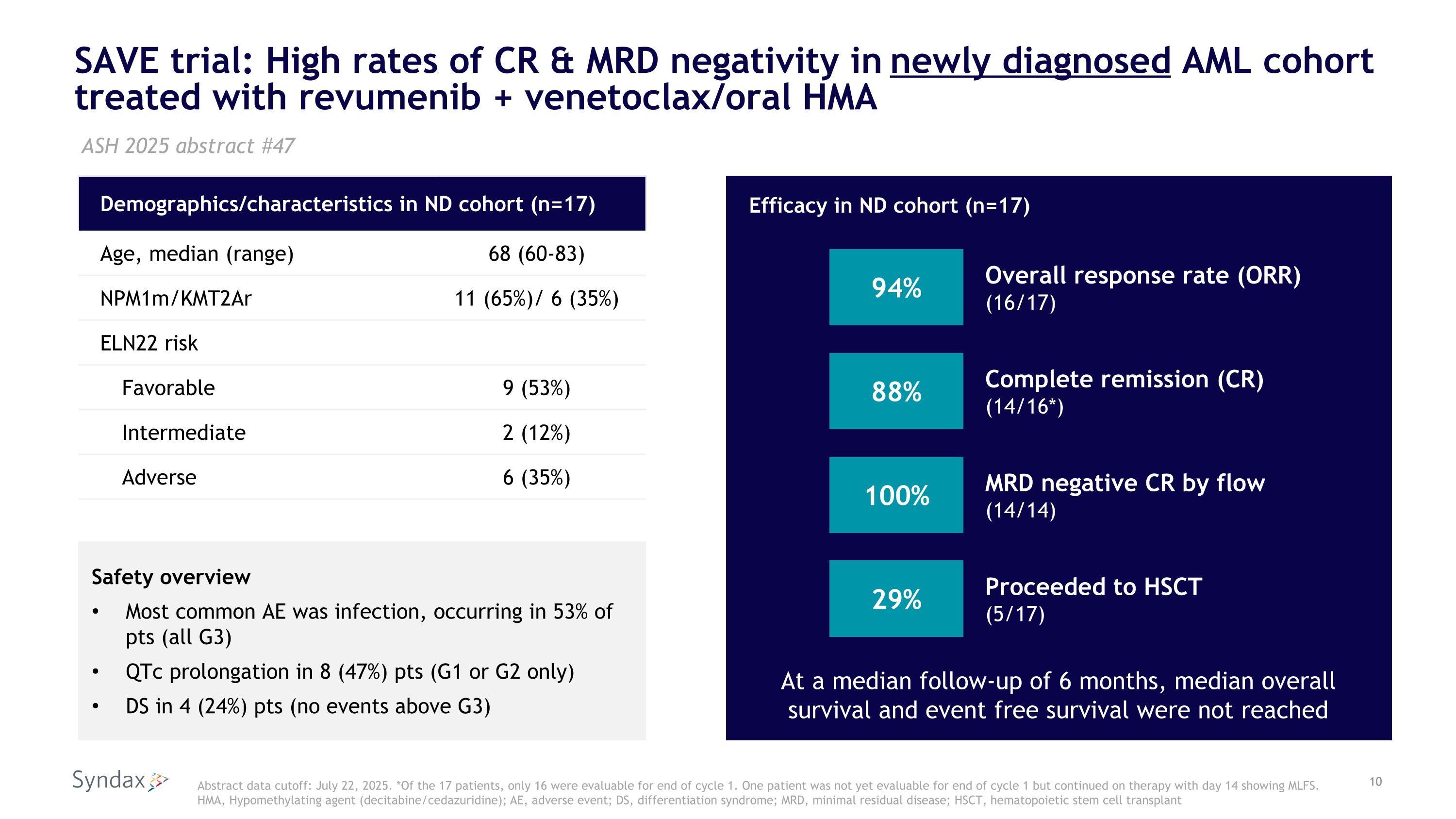

SAVE trial: High rates of CR & MRD negativity in newly diagnosed AML cohort treated with revumenib + venetoclax/oral HMA Demographics/characteristics in ND cohort (n=17) Age, median (range) 68 (60-83) NPM1m/KMT2Ar 11 (65%)/ 6 (35%) ELN22 risk Favorable 9 (53%) Intermediate 2 (12%) Adverse 6 (35%) ASH 2025 abstract #47 Abstract data cutoff: July 22, 2025. *Of the 17 patients, only 16 were evaluable for end of cycle 1. One patient was not yet evaluable for end of cycle 1 but continued on therapy with day 14 showing MLFS. HMA, Hypomethylating agent (decitabine/cedazuridine); AE, adverse event; DS, differentiation syndrome; MRD, minimal residual disease; HSCT, hematopoietic stem cell transplant Safety overview Most common AE was infection, occurring in 53% of pts (all G3) QTc prolongation in 8 (47%) pts (G1 or G2 only) DS in 4 (24%) pts (no events above G3) 94% Overall response rate (ORR) (16/17) Efficacy in ND cohort (n=17) 88% Complete remission (CR) (14/16*) 100% MRD negative CR by flow (14/14) At a median follow-up of 6 months, median overall survival and event free survival were not reached 29% Proceeded to HSCT (5/17)

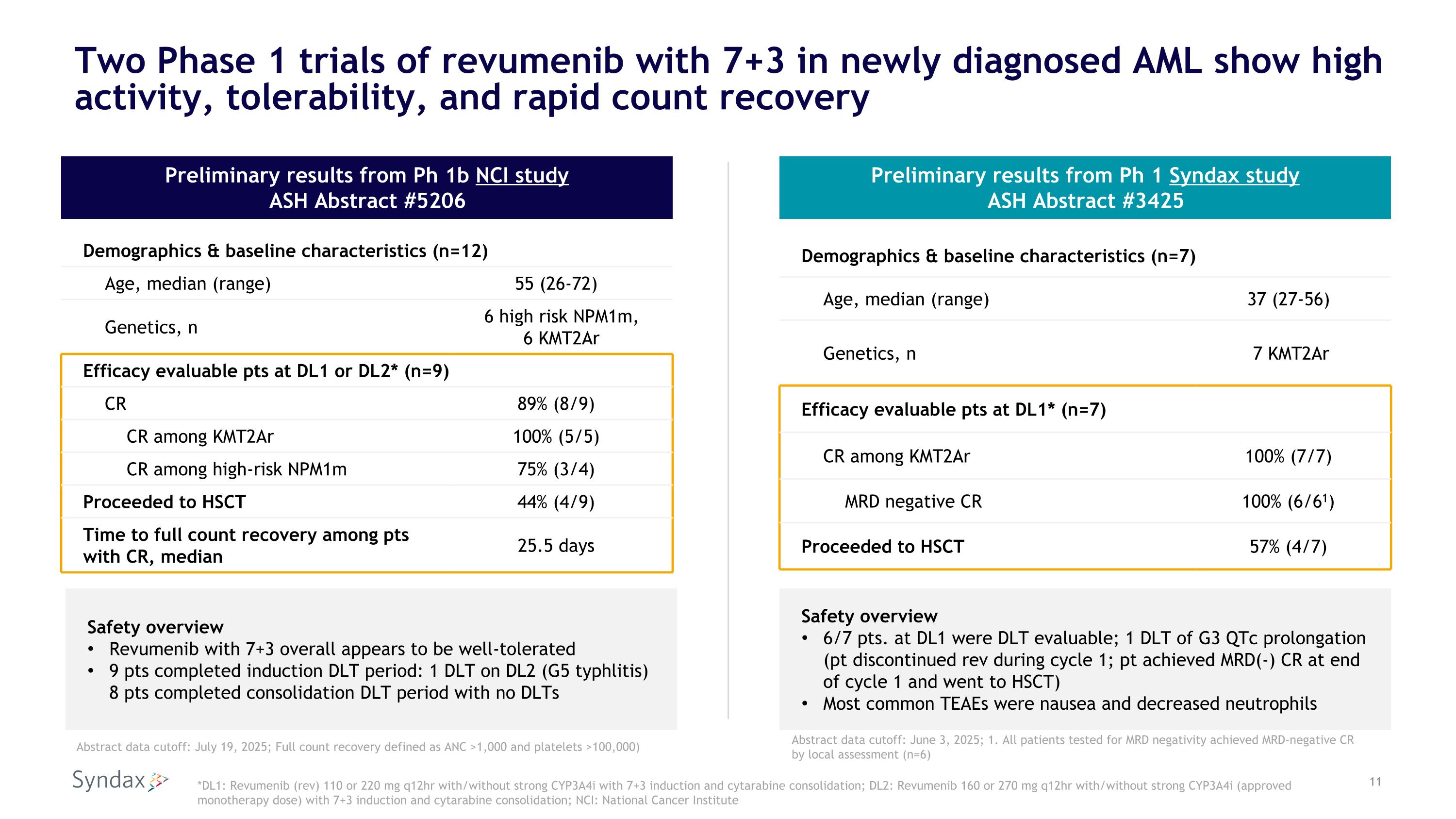

Two Phase 1 trials of revumenib with 7+3 in newly diagnosed AML show high activity, tolerability, and rapid count recovery Demographics & baseline characteristics (n=12) Age, median (range) 55 (26-72) Genetics, n 6 high risk NPM1m, 6 KMT2Ar Efficacy evaluable pts at DL1 or DL2* (n=9) CR 89% (8/9) CR among KMT2Ar 100% (5/5) CR among high-risk NPM1m 75% (3/4) Proceeded to HSCT 44% (4/9) Time to full count recovery among pts with CR, median 25.5 days Safety overview Revumenib with 7+3 overall appears to be well-tolerated 9 pts completed induction DLT period: 1 DLT on DL2 (G5 typhlitis) 8 pts completed consolidation DLT period with no DLTs Preliminary results from Ph 1b NCI study ASH Abstract #5206 Preliminary results from Ph 1 Syndax study ASH Abstract #3425 Demographics & baseline characteristics (n=7) Age, median (range) 37 (27-56) Genetics, n 7 KMT2Ar Efficacy evaluable pts at DL1* (n=7) CR among KMT2Ar 100% (7/7) MRD negative CR 100% (6/61) Proceeded to HSCT 57% (4/7) Safety overview 6/7 pts. at DL1 were DLT evaluable; 1 DLT of G3 QTc prolongation (pt discontinued rev during cycle 1; pt achieved MRD(-) CR at end of cycle 1 and went to HSCT) Most common TEAEs were nausea and decreased neutrophils *DL1: Revumenib (rev) 110 or 220 mg q12hr with/without strong CYP3A4i with 7+3 induction and cytarabine consolidation; DL2: Revumenib 160 or 270 mg q12hr with/without strong CYP3A4i (approved monotherapy dose) with 7+3 induction and cytarabine consolidation; NCI: National Cancer Institute Abstract data cutoff: July 19, 2025; Full count recovery defined as ANC >1,000 and platelets >100,000) Abstract data cutoff: June 3, 2025; 1. All patients tested for MRD negativity achieved MRD-negative CR by local assessment (n=6)

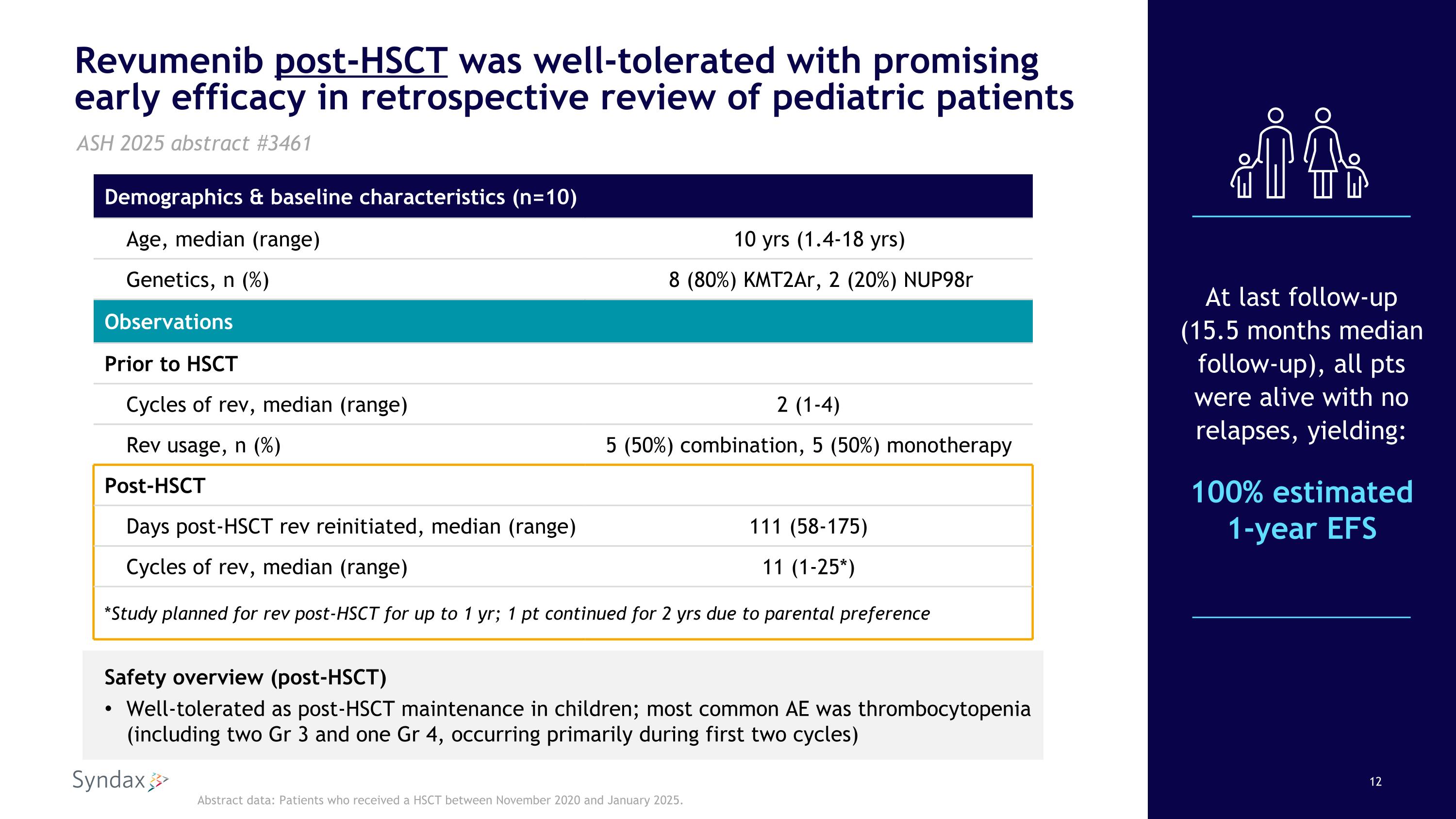

Revumenib post-HSCT was well-tolerated with promising early efficacy in retrospective review of pediatric patients Safety overview (post-HSCT) Well-tolerated as post-HSCT maintenance in children; most common AE was thrombocytopenia (including two Gr 3 and one Gr 4, occurring primarily during first two cycles) At last follow-up (15.5 months median follow-up), all pts were alive with no relapses, yielding: 100% estimated 1-year EFS ASH 2025 abstract #3461 Abstract data: Patients who received a HSCT between November 2020 and January 2025. Demographics & baseline characteristics (n=10) Age, median (range) 10 yrs (1.4-18 yrs) Genetics, n (%) 8 (80%) KMT2Ar, 2 (20%) NUP98r Observations Prior to HSCT Cycles of rev, median (range) 2 (1-4) Rev usage, n (%) 5 (50%) combination, 5 (50%) monotherapy Post-HSCT Days post-HSCT rev reinitiated, median (range) 111 (58-175) Cycles of rev, median (range) 11 (1-25*) *Study planned for rev post-HSCT for up to 1 yr; 1 pt continued for 2 yrs due to parental preference

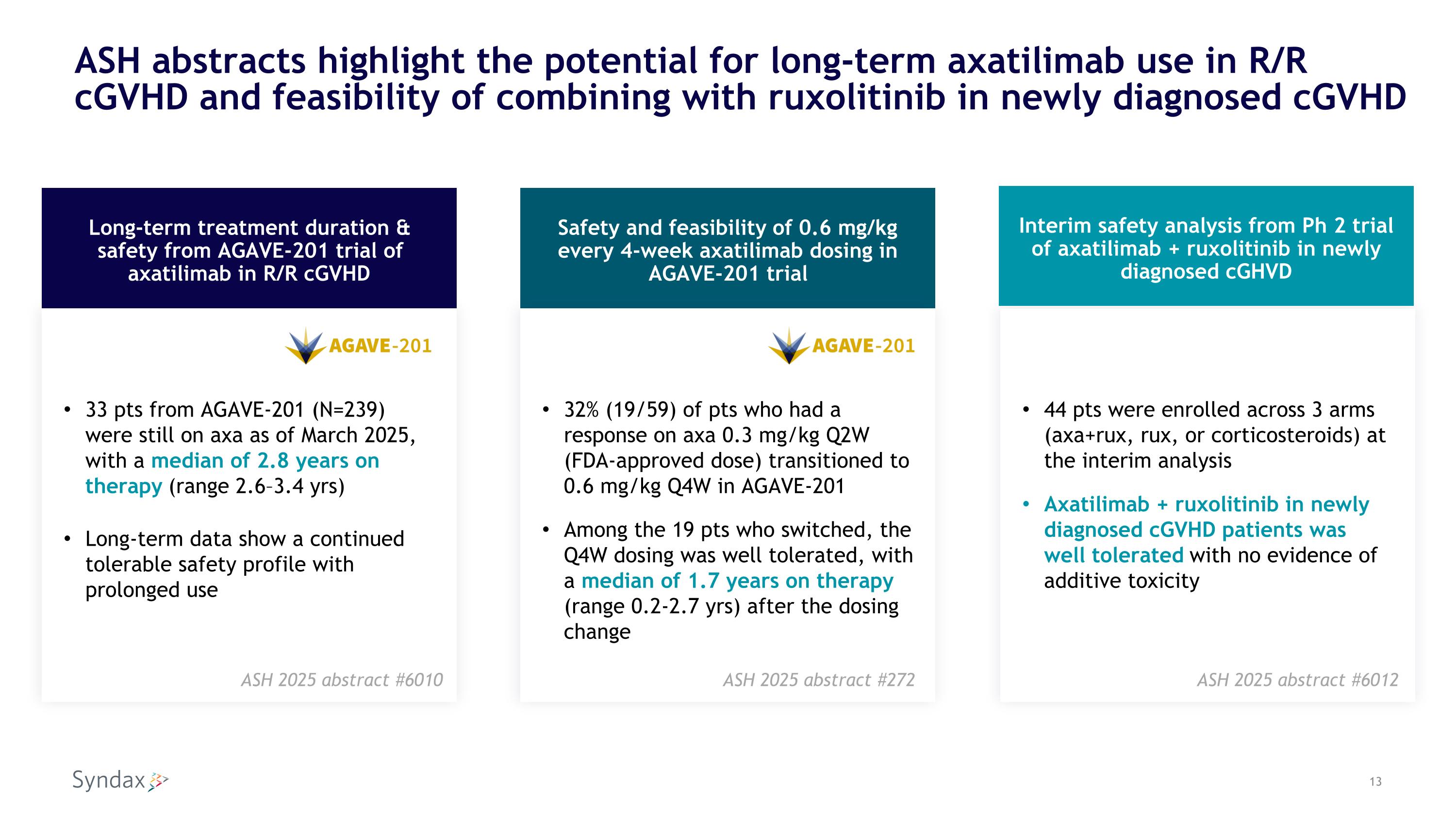

ASH abstracts highlight the potential for long-term axatilimab use in R/R cGVHD and feasibility of combining with ruxolitinib in newly diagnosed cGVHD 44 pts were enrolled across 3 arms (axa+rux, rux, or corticosteroids) at the interim analysis Axatilimab + ruxolitinib in newly diagnosed cGVHD patients was well tolerated with no evidence of additive toxicity Long-term treatment duration & safety from AGAVE-201 trial of axatilimab in R/R cGVHD Interim safety analysis from Ph 2 trial of axatilimab + ruxolitinib in newly diagnosed cGHVD Safety and feasibility of 0.6 mg/kg every 4-week axatilimab dosing in AGAVE-201 trial 33 pts from AGAVE-201 (N=239) were still on axa as of March 2025, with a median of 2.8 years on therapy (range 2.6–3.4 yrs) Long-term data show a continued tolerable safety profile with prolonged use 32% (19/59) of pts who had a response on axa 0.3 mg/kg Q2W (FDA-approved dose) transitioned to 0.6 mg/kg Q4W in AGAVE-201 Among the 19 pts who switched, the Q4W dosing was well tolerated, with a median of 1.7 years on therapy (range 0.2-2.7 yrs) after the dosing change ASH 2025 abstract #6010 ASH 2025 abstract #6012 ASH 2025 abstract #272

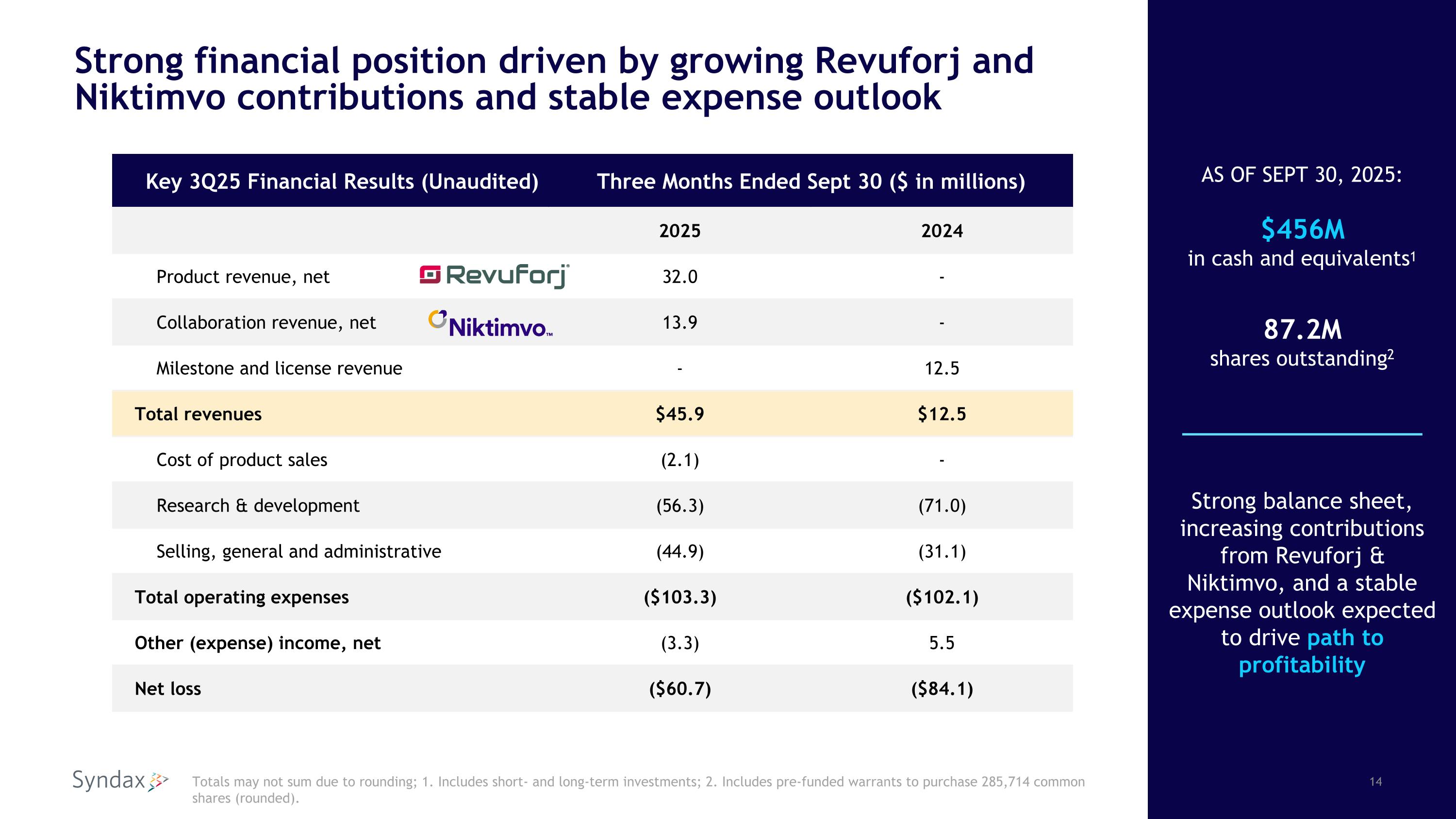

Strong financial position driven by growing Revuforj and Niktimvo contributions and stable expense outlook Key 3Q25 Financial Results (Unaudited) Three Months Ended Sept 30 ($ in millions) 2025 2024 Product revenue, net 32.0 - Collaboration revenue, net 13.9 - Milestone and license revenue - 12.5 Total revenues $45.9 $12.5 Cost of product sales (2.1) - Research & development (56.3) (71.0) Selling, general and administrative (44.9) (31.1) Total operating expenses ($103.3) ($102.1) Other (expense) income, net (3.3) 5.5 Net loss ($60.7) ($84.1) Totals may not sum due to rounding; 1. Includes short- and long-term investments; 2. Includes pre-funded warrants to purchase 285,714 common shares (rounded). Strong balance sheet, increasing contributions from Revuforj & Niktimvo, and a stable expense outlook expected to drive path to profitability AS OF SEPT 30, 2025: $456M in cash and equivalents1 87.2M shares outstanding2

15 Two first- & best-in-class drugs $5B+ TAM $5B+ TAM Two exceptional product launches Syndax is on the road to profitability with two medicines with multi-billion-dollar potential

Lilah, diagnosed with R/R AML FUELED BY A PASSION FOR PATIENTS