1 Q4 | 2025 Q4 2025 Earnings February 18, 2026

2 Q4 | 2025 Forward-Looking Statements Certain statements contained in this presentation include, and OPENLANE may make related oral, "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, statements made that are not historical facts (including but not limited to expectations, estimates, assumptions, projections and/or financial guidance) may be forward-looking statements. Words such as "should," "may," "will," "would," "anticipate," "expect," "project," "intend,“ “contemplate,” "plan," "believe," "seek," "estimate," "assume," “can,” "could," "continue,” "outlook," “target” and similar expressions identify forward-looking statements. Such statements are based on management's current assumptions, expectations and/or beliefs, are not guarantees of future performance and are subject to substantial risks, uncertainties and changes that could cause actual results to differ materially from the results projected, expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section entitled "Risk Factors" in OPENLANE’s annual and quarterly periodic reports, and in OPENLANE’s other filings and reports filed with the Securities and Exchange Commission. Many of these risk factors are outside of our control, and as such, they involve risks which are not currently known that could cause actual results to differ materially from those discussed or implied herein. The forward-looking statements are made as of the date of this presentation. OPENLANE undertakes no obligation to update any forward-looking statements. Non-GAAP Financial Measures In addition to the financial measures contained in this presentation that are prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), this presentation also includes certain non-GAAP financial measures. EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Adjusted Free Cash Flow, Adjusted Free Cash Flow Conversion, Operating Adjusted Income from Continuing Operations (or “Operating adjusted income”), and Operating Adjusted Income from Continuing Operations per diluted share (or “Operating Adjusted EPS”) as presented herein are supplemental measures of our performance and liquidity that are not required by, or presented in accordance with GAAP. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Management believes that these measures provide investors additional meaningful methods to evaluate certain aspects of OPENLANE’s results period over period and for the other reasons set forth below. These non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. Reconciliations of each non-GAAP financial measure to its most comparable GAAP financial measure are provided in the Appendix. EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in our senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by our creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate our performance. Adjusted EBITDA Margin represents Adjusted EBITDA divided by revenue. Free Cash Flow (or “FCF”) is defined as net cash provided by operating activities, less purchases of property, equipment and computer software. Adjusted Free Cash Flow is Free Cash Flow adjusted for the cash portion of EBITDA addbacks to calculate Adjusted EBITDA, the net change in finance receivables held for investment and the net change in obligations collateralized by finance receivables. Management uses Adjusted Free Cash Flow to measure the funds generated in a given period that are available for capital allocation. Adjusted Free Cash Flow Conversion represents Adjusted Free Cash Flow divided by Adjusted EBITDA. Operating Adjusted Income from Continuing Operations is defined as income from continuing operations adjusted for acquired amortization expense, gains/losses on sale of property or businesses, impairments to goodwill or other intangible assets and certain other non-recurring items. Amortization expense associated with acquired intangible assets is not representative of ongoing capital expenditures but has a continuing effect on our reported results. Management believes Operating Adjusted Income from Continuing Operations provides comparability to other companies that may not have incurred these types of non-cash expenses or that report a similar measure. Operating Adjusted EPS represents Operating Adjusted Income from Continuing Operations divided by weighted average diluted shares, including the assumed conversion of preferred shares.

3 Q3 | 20254 Letter to Stockholders Peter Kelly, CEO At the start of 2025, I challenged the OPENLANE team to achieve four key objectives: 1) grow our customer base; 2) grow vehicle transaction volumes; 3) improve our financial performance; and 4) position OPENLANE for long-term success. I am very pleased to report we exceeded our expectations on each of our goals. On a full-year basis, OPENLANE sold nearly 1.5 million vehicles and generated $1.9 billion in total revenue, $333 million in Adjusted EBITDA, and $392 million in cash flow from operations. These results were driven by particularly strong performance in our US dealer-to-dealer business which continued to accelerate in 2025, outpacing the industry and taking market share. These results are compelling proof points to the strength of OPENLANE’s strategy. As we continue to execute our strategy with focus and conviction, we are making wholesale easy for our customers, compounding our growth and further differentiating OPENLANE in the market. Looking ahead, OPENLANE begins 2026 with positive momentum and remains well positioned to capture additional market share as the industry continues its migration toward digital and the inflection of off-lease supply beginning in the first quarter of 2026. Our results, coupled with our positive outlook for 2026, fuels our confidence in OPENLANE’s ability to deliver long-term growth and shareholder value.

Q4 | 2025 4 We connect the leading automotive manufacturers, dealers, rental companies, fleet operators, captive finance and lending institutions as buyers and sellers to create the most advanced digital marketplace for wholesale used vehicles. Marketplace Segment About Our Company Two Business Segments Finance Segment Best Marketplace Best Experience Best Technology Strategic Differentiators Our Purpose We make wholesale easy so our customers can be more successful.

Q4 | 2025 5 total vehicles sold average listings per month gross merchandise value 1.5M 200K+ $29B Commercial 40+ exclusive OEM & financial institution customers Marketplace Segment: OPENLANE Digital Marketplace Leader With Deep Strength in Dealer & Commercial Vehicles Dealer 50K active buyers and sellers in the marketplace

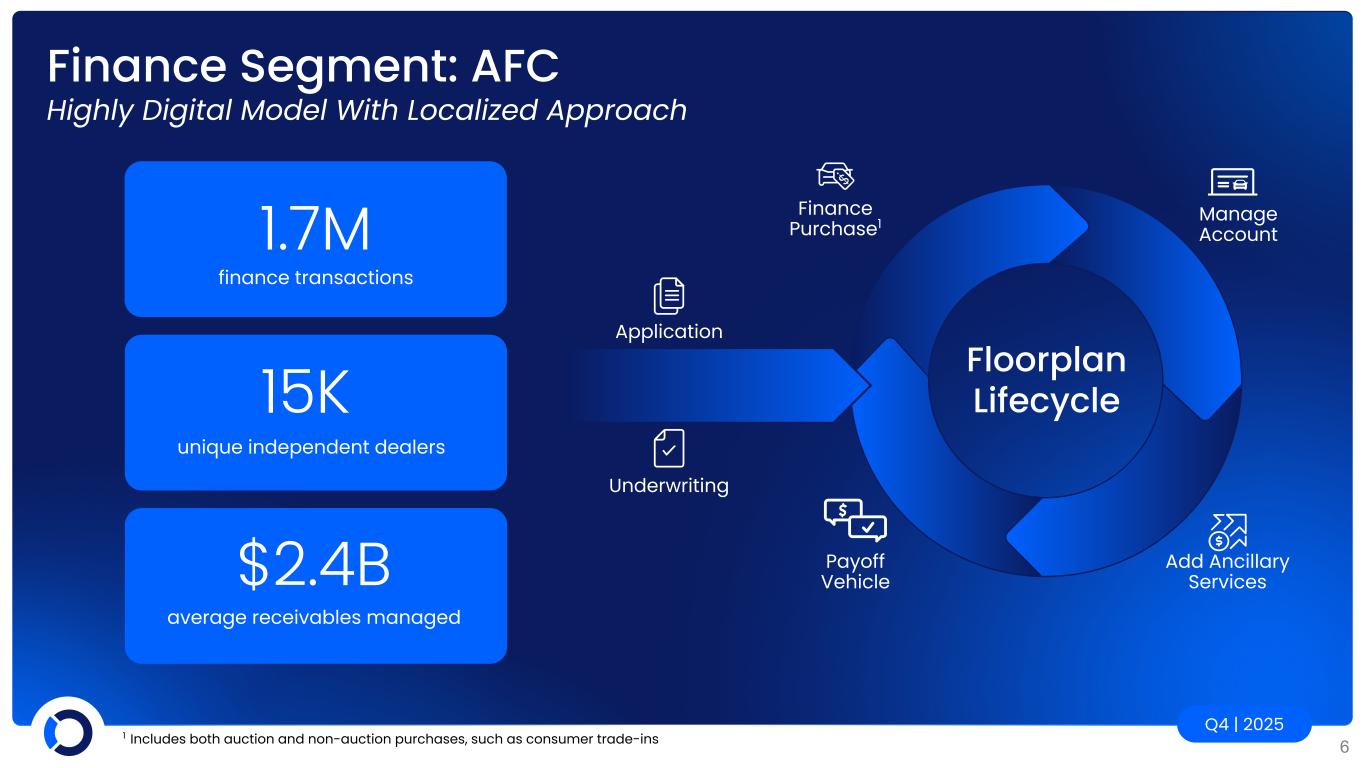

Q4 | 2025 6 Floorplan Lifecycle Finance Segment: AFC Highly Digital Model With Localized Approach Finance Purchase1 Manage Account Add Ancillary Services Payoff Vehicle Application Underwriting finance transactions 1.7M 1.5-2% 15K unique independent dealers $2.4B average receivables managed 1 Includes both auction and non-auction purchases, such as consumer trade-ins

Q4 | 2025 7 Highly Synergistic Business Model Marketplace Segment Finance Segment Cross-pollination of dealer recruitment & engagement Dealer credit drives transactions & wallet-share Bundled products, services & promotions Cash generation for investment in innovation

8 Q3 | 20254 Financial Highlights

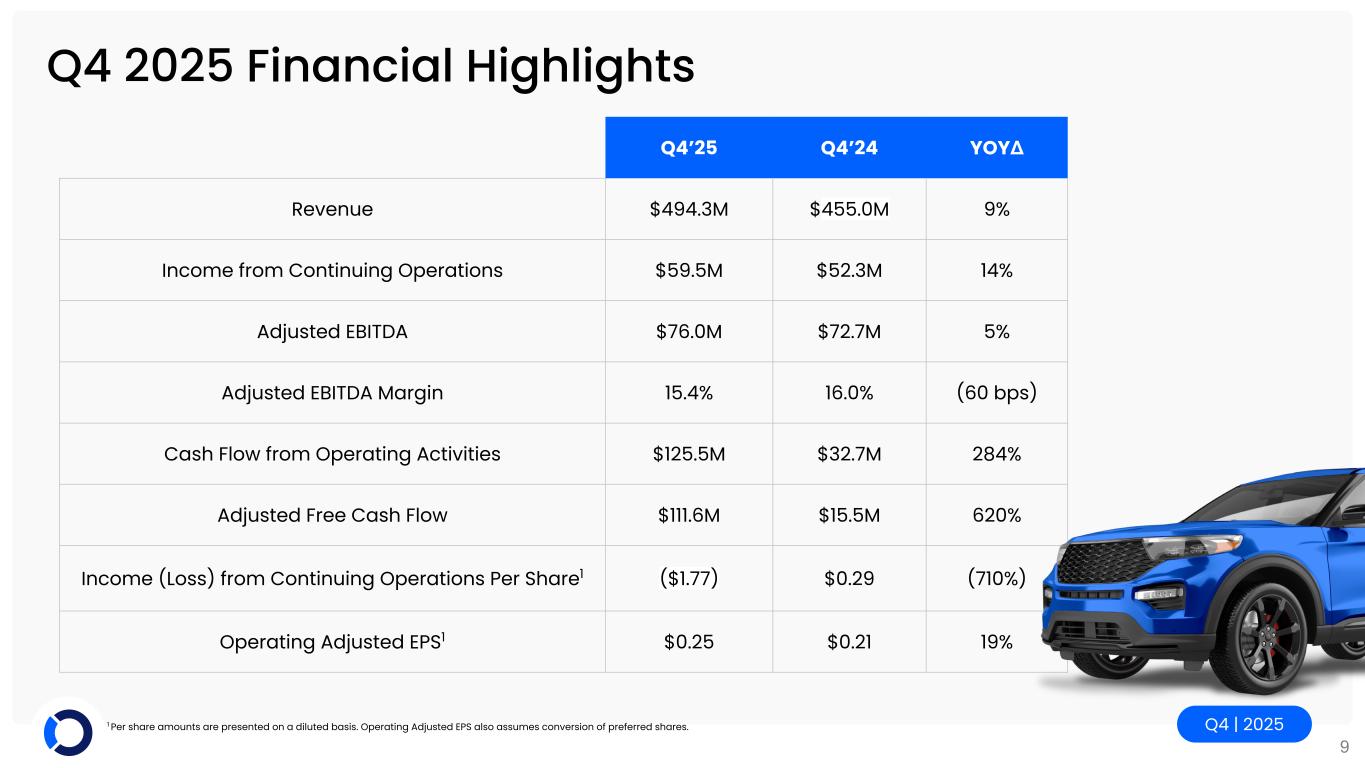

Q4 | 2025 9 Q4 2025 Financial Highlights Q4’25 Q4’24 YOYΔ Revenue $494.3M $455.0M 9% Income from Continuing Operations $59.5M $52.3M 14% Adjusted EBITDA $76.0M $72.7M 5% Adjusted EBITDA Margin 15.4% 16.0% (60 bps) Cash Flow from Operating Activities $125.5M $32.7M 284% Adjusted Free Cash Flow $111.6M $15.5M 620% Income (Loss) from Continuing Operations Per Share1 ($1.77) $0.29 (710%) Operating Adjusted EPS1 $0.25 $0.21 19% 1 Per share amounts are presented on a diluted basis. Operating Adjusted EPS also assumes conversion of preferred shares.

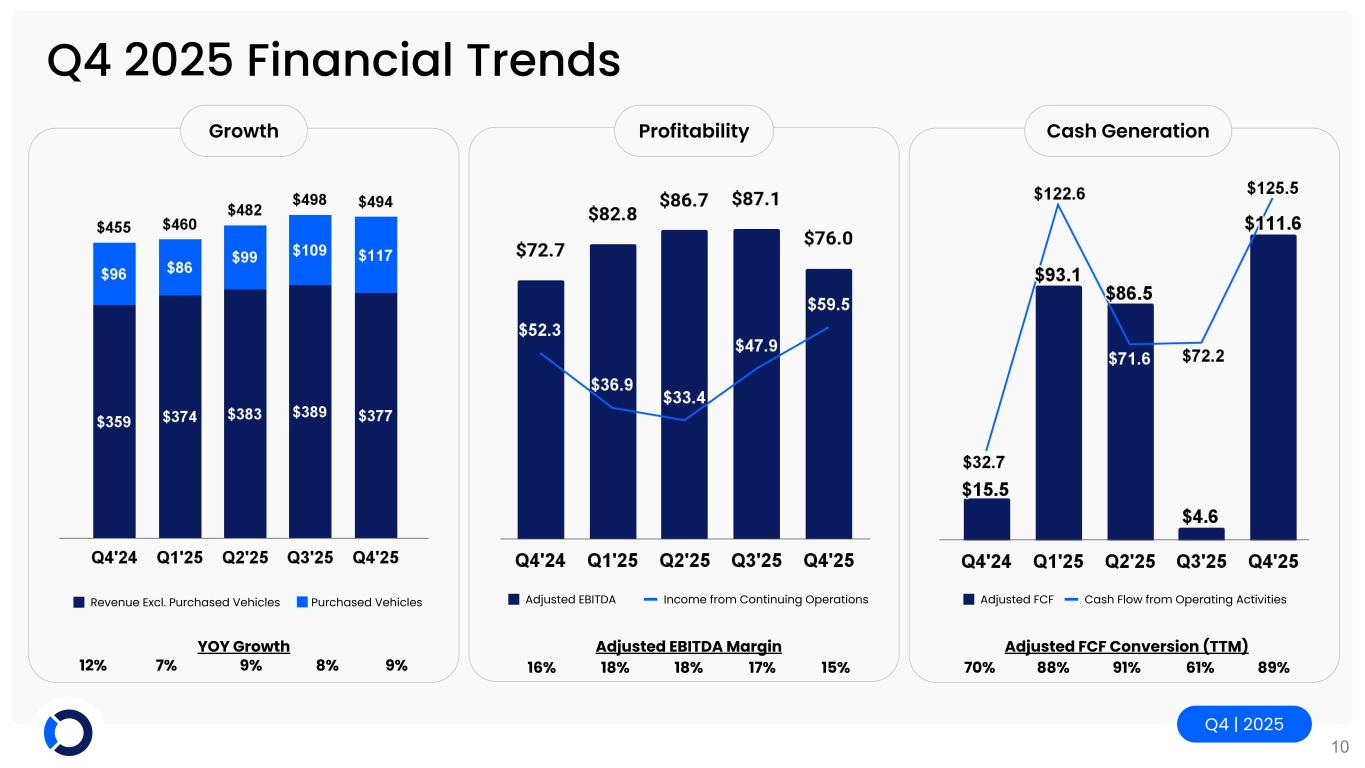

Q4 | 2025 10 Growth Q4 2025 Financial Trends Profitability Cash Generation YOY Growth 12% 7% 9% 8% 9% Adjusted EBITDA Margin 16% 18% 18% 17% 15% Adjusted EBITDA Income from Continuing OperationsRevenue Excl. Purchased Vehicles Adjusted FCF Cash Flow from Operating ActivitiesPurchased Vehicles Adjusted FCF Conversion (TTM) 70% 88% 91% 61% 89%

11 Q3 | 20254 Appendix

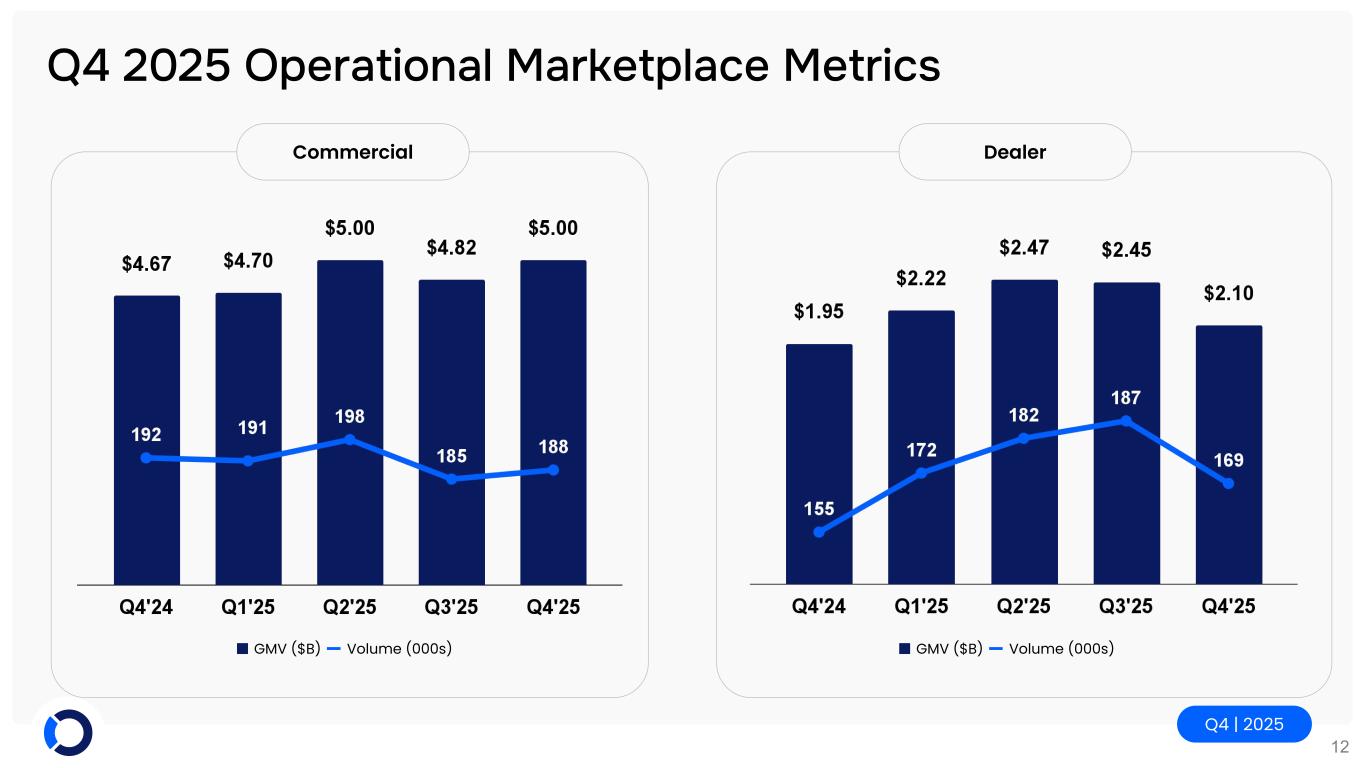

Q4 | 2025 12 Dealer Q4 2025 Operational Marketplace Metrics Commercial GMV ($B) Volume (000s)GMV ($B) Volume (000s)

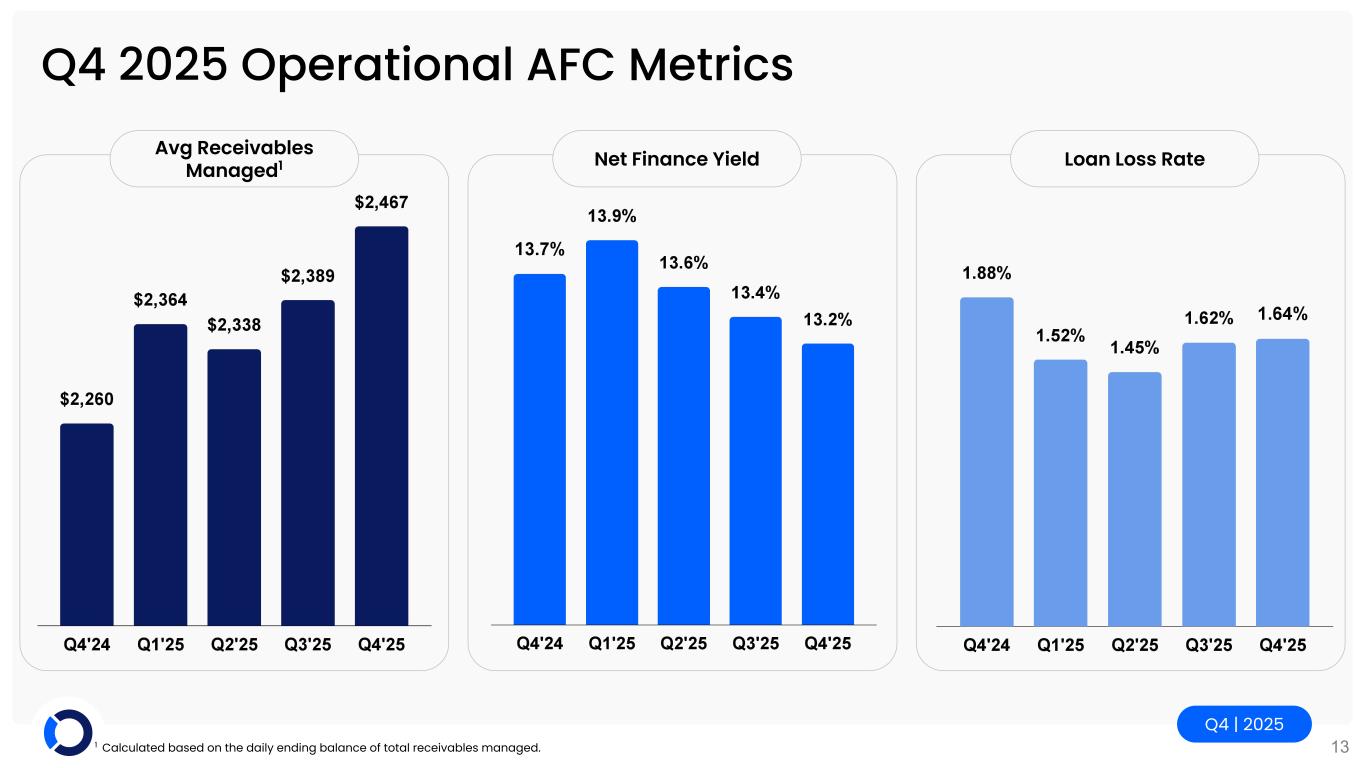

Q4 | 2025 13 Q4 2025 Operational AFC Metrics Net Finance Yield Loan Loss Rate 1 Calculated based on the daily ending balance of total receivables managed. Avg Receivables Managed1

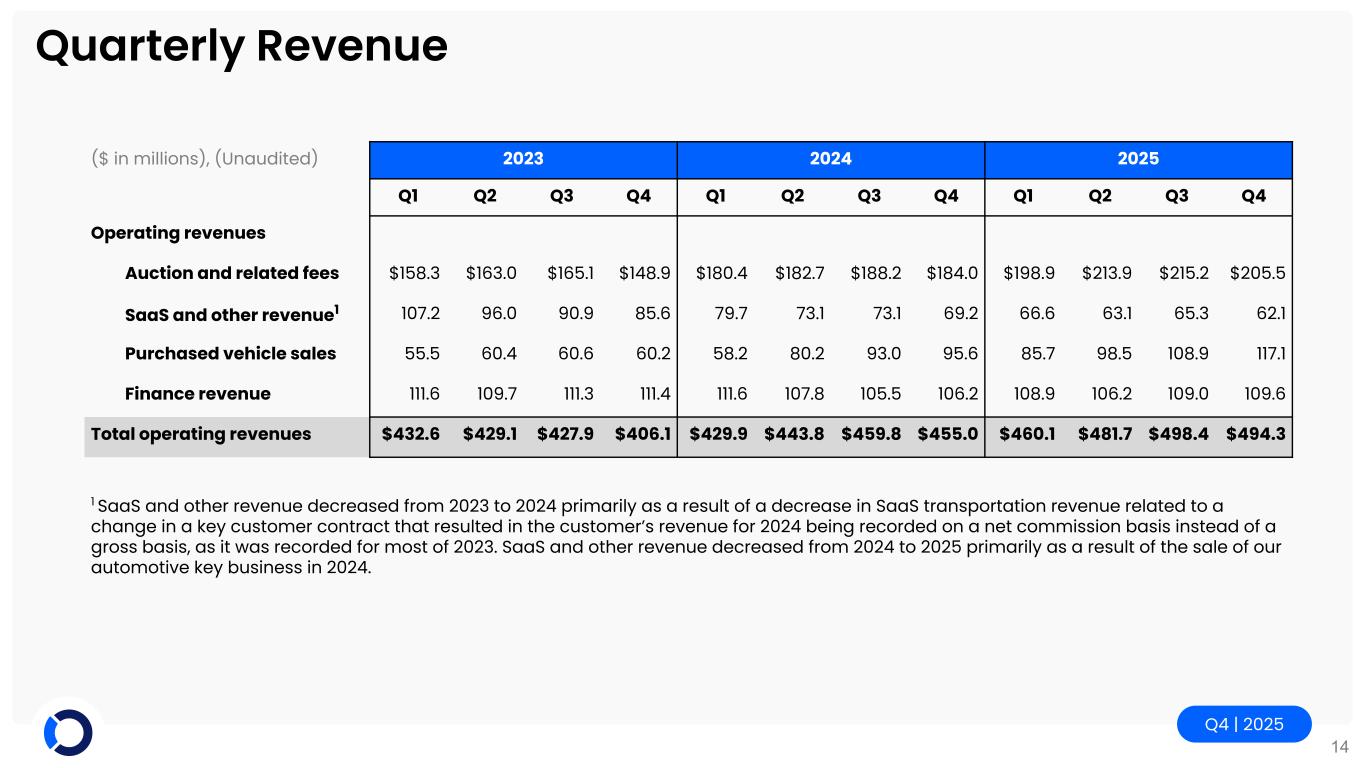

Q4 | 2025 14 Quarterly Revenue ($ in millions), (Unaudited) 2023 2024 2025 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Operating revenues Auction and related fees $158.3 $163.0 $165.1 $148.9 $180.4 $182.7 $188.2 $184.0 $198.9 $213.9 $215.2 $205.5 SaaS and other revenue1 107.2 96.0 90.9 85.6 79.7 73.1 73.1 69.2 66.6 63.1 65.3 62.1 Purchased vehicle sales 55.5 60.4 60.6 60.2 58.2 80.2 93.0 95.6 85.7 98.5 108.9 117.1 Finance revenue 111.6 109.7 111.3 111.4 111.6 107.8 105.5 106.2 108.9 106.2 109.0 109.6 Total operating revenues $432.6 $429.1 $427.9 $406.1 $429.9 $443.8 $459.8 $455.0 $460.1 $481.7 $498.4 $494.3 1 SaaS and other revenue decreased from 2023 to 2024 primarily as a result of a decrease in SaaS transportation revenue related to a change in a key customer contract that resulted in the customer’s revenue for 2024 being recorded on a net commission basis instead of a gross basis, as it was recorded for most of 2023. SaaS and other revenue decreased from 2024 to 2025 primarily as a result of the sale of our automotive key business in 2024.

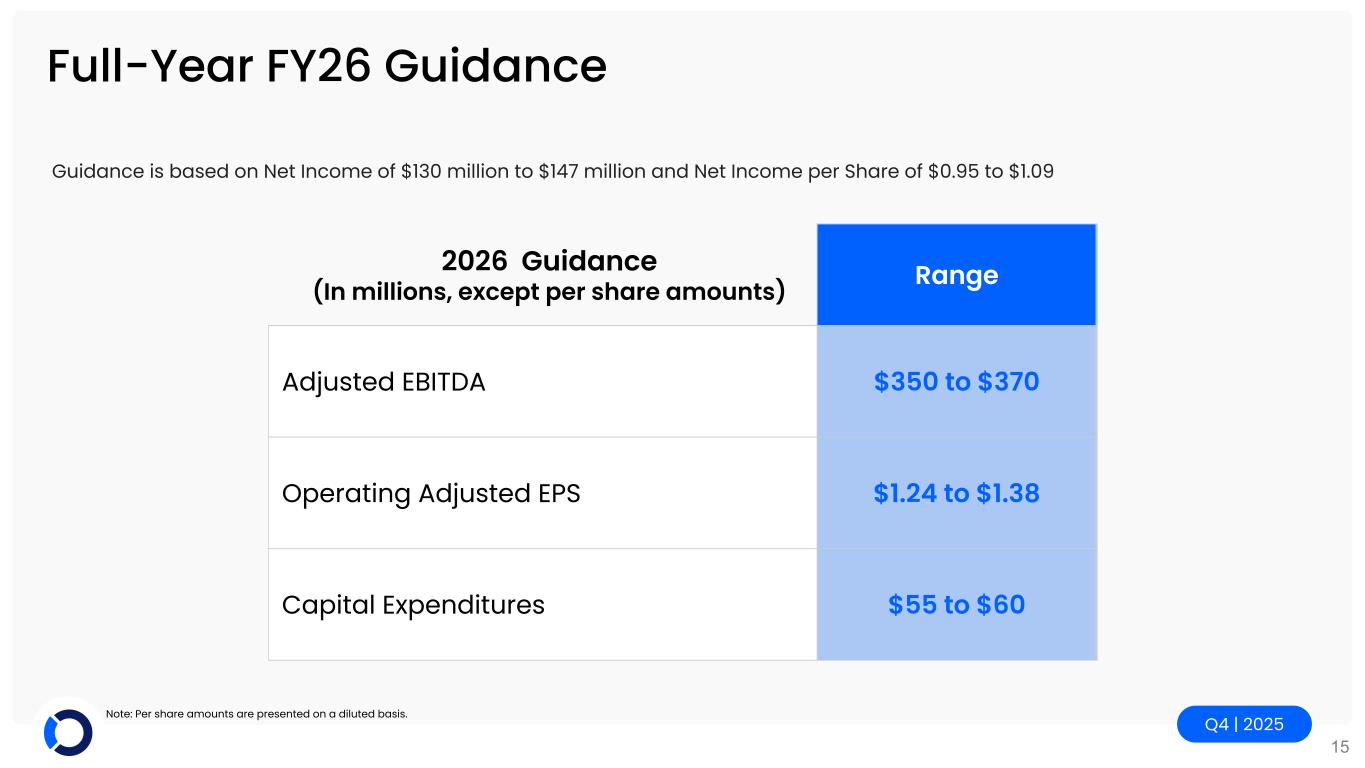

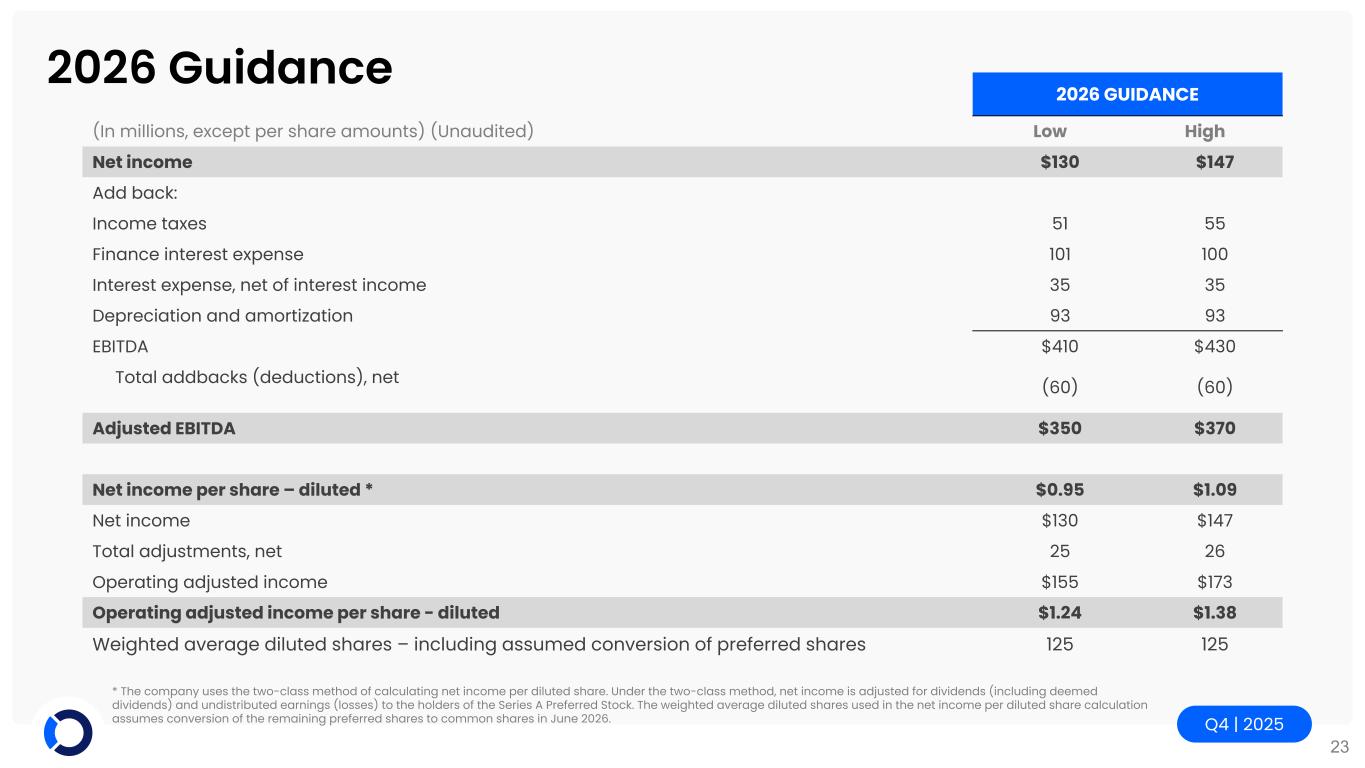

Q4 | 2025 15 Full-Year FY26 Guidance 2026 Guidance (In millions, except per share amounts) Range Adjusted EBITDA $350 to $370 Operating Adjusted EPS $1.24 to $1.38 Capital Expenditures $55 to $60 Note: Per share amounts are presented on a diluted basis. Guidance is based on Net Income of $130 million to $147 million and Net Income per Share of $0.95 to $1.09

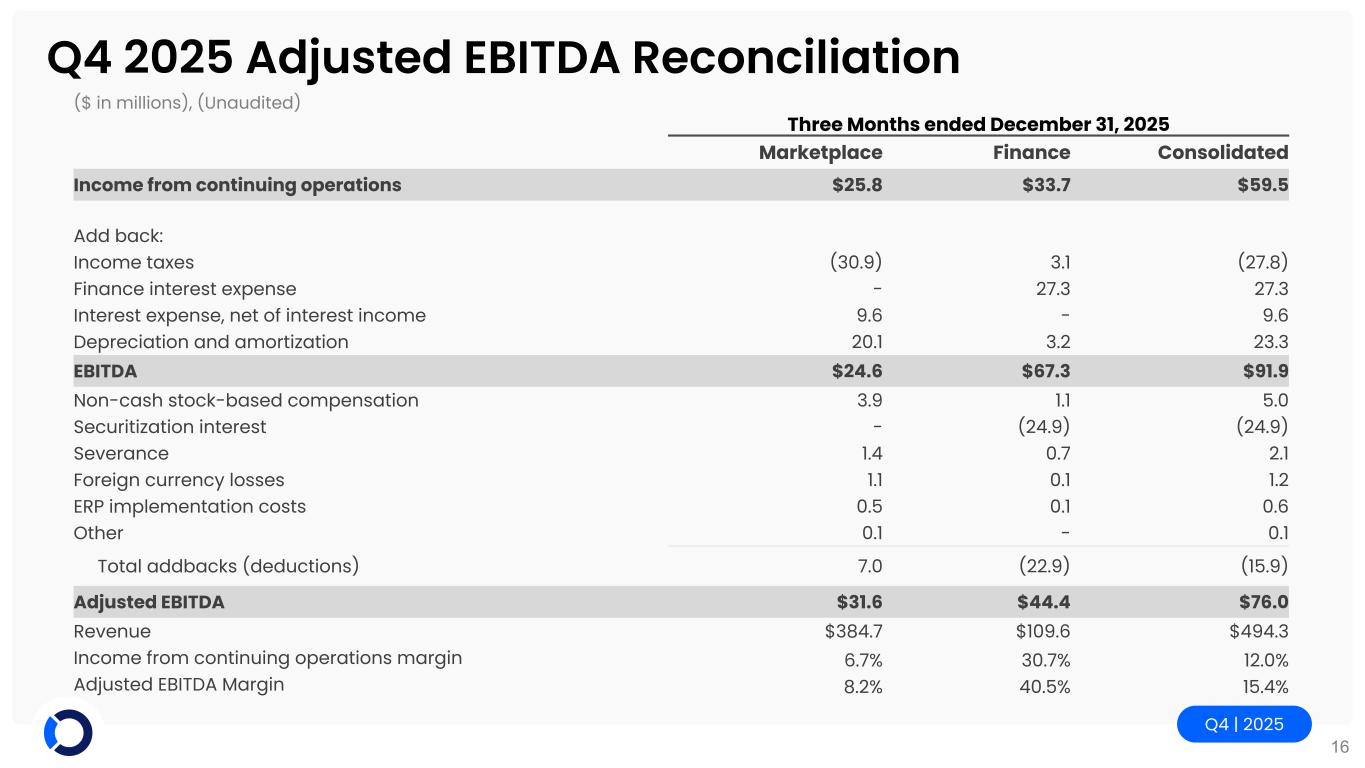

Q4 | 2025 16 Q4 2025 Adjusted EBITDA Reconciliation ($ in millions), (Unaudited) Three Months ended December 31, 2025 Marketplace Finance Consolidated Income from continuing operations $25.8 $33.7 $59.5 Add back: Income taxes (30.9) 3.1 (27.8) Finance interest expense - 27.3 27.3 Interest expense, net of interest income 9.6 - 9.6 Depreciation and amortization 20.1 3.2 23.3 EBITDA $24.6 $67.3 $91.9 Non-cash stock-based compensation 3.9 1.1 5.0 Securitization interest - (24.9) (24.9) Severance 1.4 0.7 2.1 Foreign currency losses 1.1 0.1 1.2 ERP implementation costs 0.5 0.1 0.6 Other 0.1 - 0.1 Total addbacks (deductions) 7.0 (22.9) (15.9) Adjusted EBITDA $31.6 $44.4 $76.0 Revenue $384.7 $109.6 $494.3 Income from continuing operations margin 6.7% 30.7% 12.0% Adjusted EBITDA Margin 8.2% 40.5% 15.4%

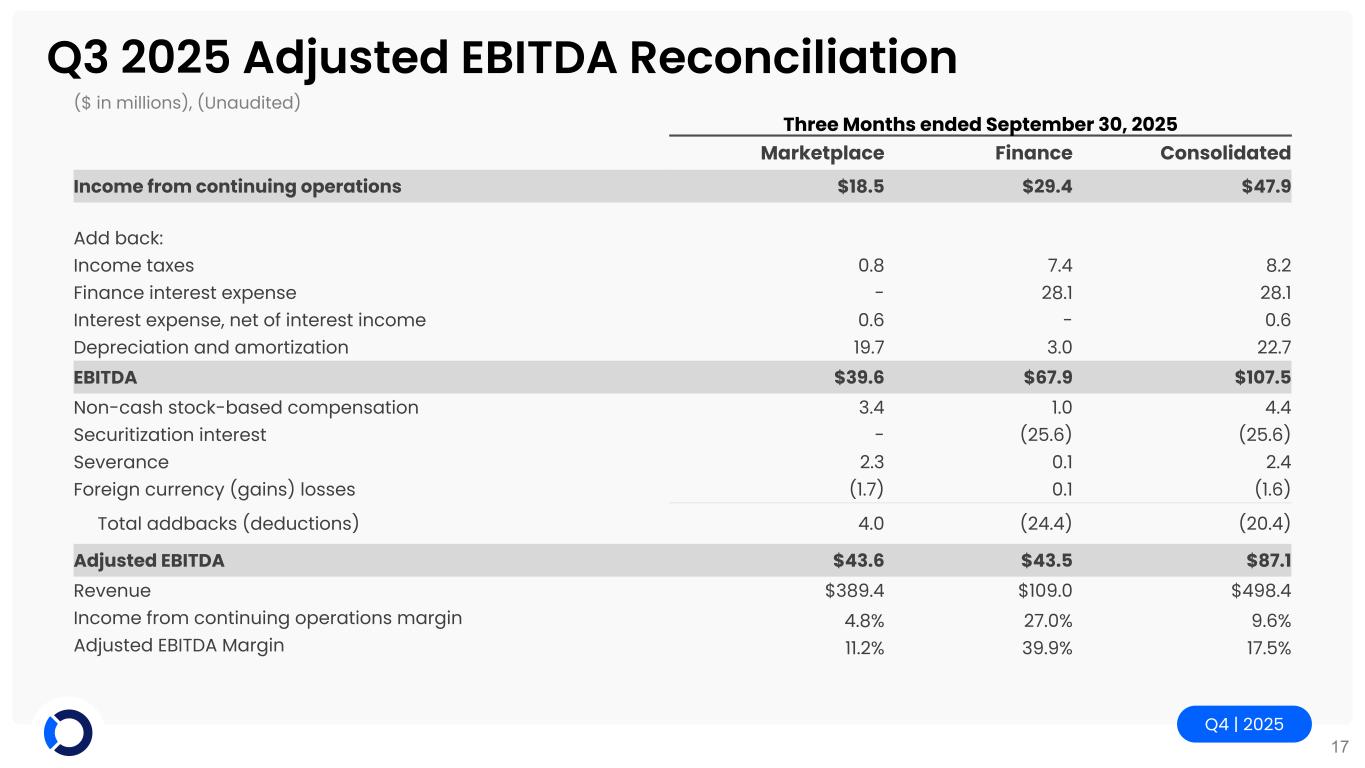

Q4 | 2025 17 Q3 2025 Adjusted EBITDA Reconciliation ($ in millions), (Unaudited) Three Months ended September 30, 2025 Marketplace Finance Consolidated Income from continuing operations $18.5 $29.4 $47.9 Add back: Income taxes 0.8 7.4 8.2 Finance interest expense - 28.1 28.1 Interest expense, net of interest income 0.6 - 0.6 Depreciation and amortization 19.7 3.0 22.7 EBITDA $39.6 $67.9 $107.5 Non-cash stock-based compensation 3.4 1.0 4.4 Securitization interest - (25.6) (25.6) Severance 2.3 0.1 2.4 Foreign currency (gains) losses (1.7) 0.1 (1.6) Total addbacks (deductions) 4.0 (24.4) (20.4) Adjusted EBITDA $43.6 $43.5 $87.1 Revenue $389.4 $109.0 $498.4 Income from continuing operations margin 4.8% 27.0% 9.6% Adjusted EBITDA Margin 11.2% 39.9% 17.5%

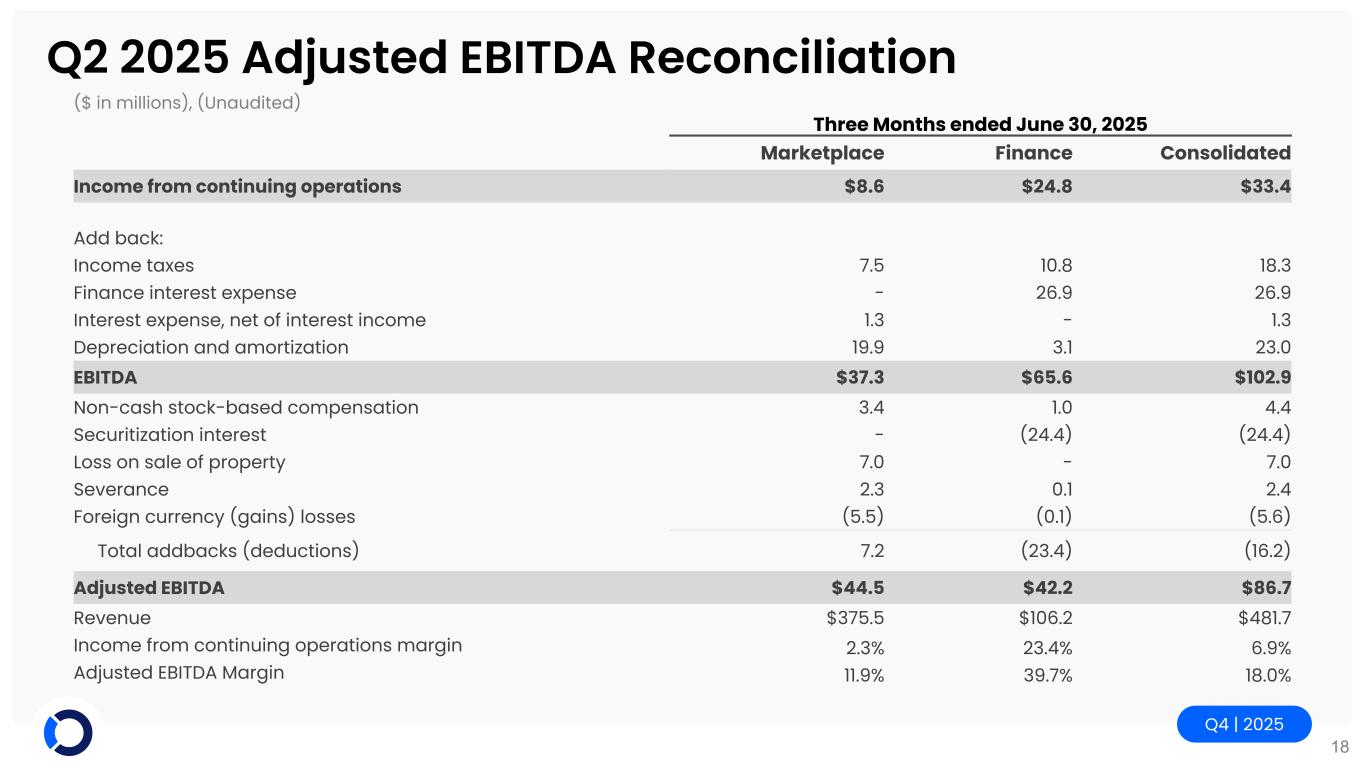

Q4 | 2025 18 Q2 2025 Adjusted EBITDA Reconciliation ($ in millions), (Unaudited) Three Months ended June 30, 2025 Marketplace Finance Consolidated Income from continuing operations $8.6 $24.8 $33.4 Add back: Income taxes 7.5 10.8 18.3 Finance interest expense - 26.9 26.9 Interest expense, net of interest income 1.3 - 1.3 Depreciation and amortization 19.9 3.1 23.0 EBITDA $37.3 $65.6 $102.9 Non-cash stock-based compensation 3.4 1.0 4.4 Securitization interest - (24.4) (24.4) Loss on sale of property 7.0 - 7.0 Severance 2.3 0.1 2.4 Foreign currency (gains) losses (5.5) (0.1) (5.6) Total addbacks (deductions) 7.2 (23.4) (16.2) Adjusted EBITDA $44.5 $42.2 $86.7 Revenue $375.5 $106.2 $481.7 Income from continuing operations margin 2.3% 23.4% 6.9% Adjusted EBITDA Margin 11.9% 39.7% 18.0%

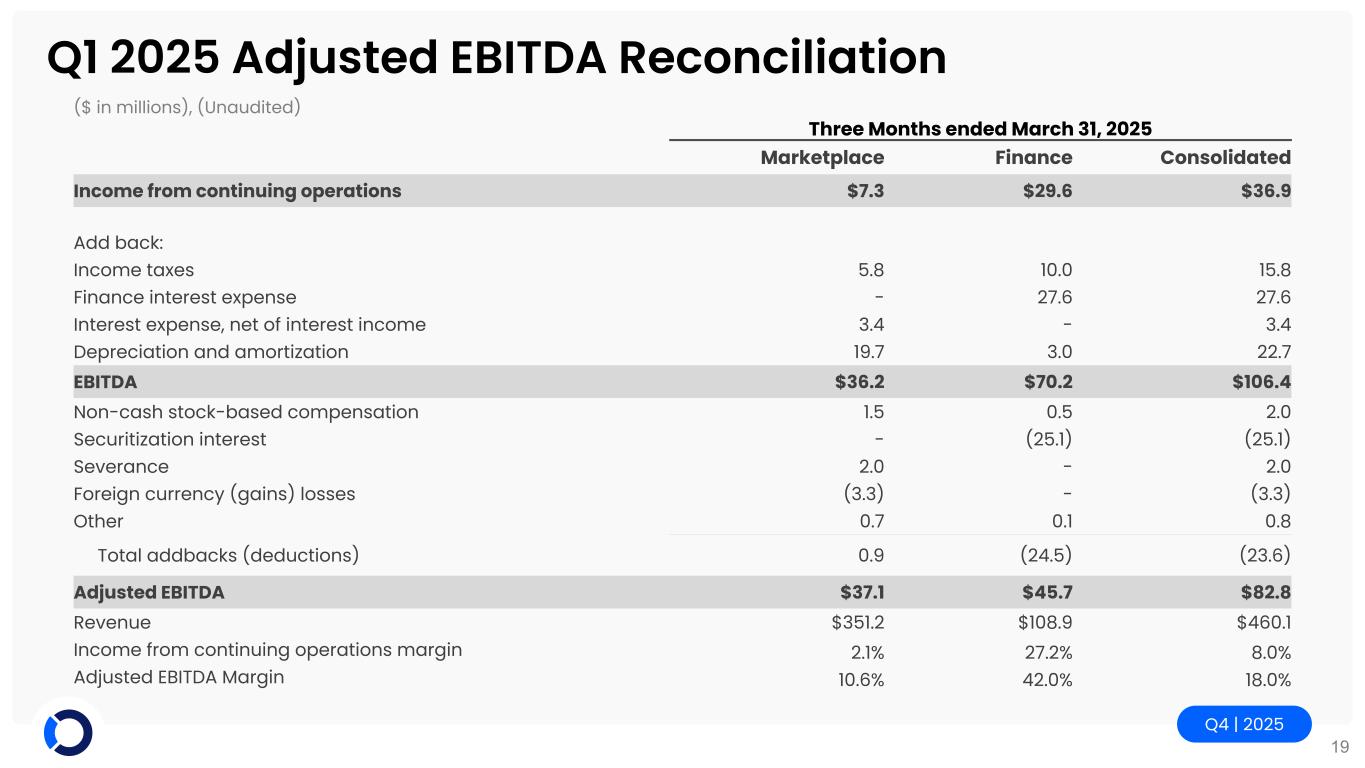

Q4 | 2025 19 Q1 2025 Adjusted EBITDA Reconciliation ($ in millions), (Unaudited) Three Months ended March 31, 2025 Marketplace Finance Consolidated Income from continuing operations $7.3 $29.6 $36.9 Add back: Income taxes 5.8 10.0 15.8 Finance interest expense - 27.6 27.6 Interest expense, net of interest income 3.4 - 3.4 Depreciation and amortization 19.7 3.0 22.7 EBITDA $36.2 $70.2 $106.4 Non-cash stock-based compensation 1.5 0.5 2.0 Securitization interest - (25.1) (25.1) Severance 2.0 - 2.0 Foreign currency (gains) losses (3.3) - (3.3) Other 0.7 0.1 0.8 Total addbacks (deductions) 0.9 (24.5) (23.6) Adjusted EBITDA $37.1 $45.7 $82.8 Revenue $351.2 $108.9 $460.1 Income from continuing operations margin 2.1% 27.2% 8.0% Adjusted EBITDA Margin 10.6% 42.0% 18.0%

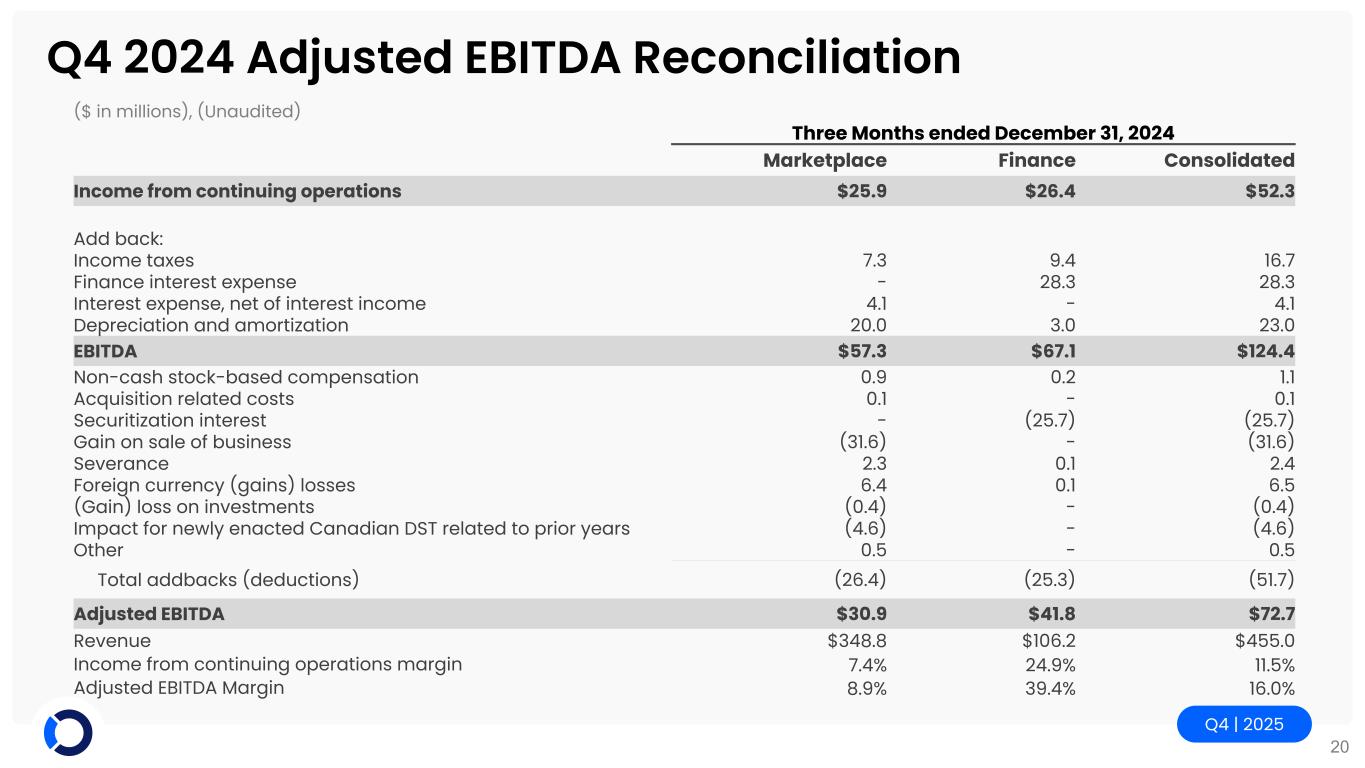

Q4 | 2025 20 Q4 2024 Adjusted EBITDA Reconciliation ($ in millions), (Unaudited) Three Months ended December 31, 2024 Marketplace Finance Consolidated Income from continuing operations $25.9 $26.4 $52.3 Add back: Income taxes 7.3 9.4 16.7 Finance interest expense - 28.3 28.3 Interest expense, net of interest income 4.1 - 4.1 Depreciation and amortization 20.0 3.0 23.0 EBITDA $57.3 $67.1 $124.4 Non-cash stock-based compensation 0.9 0.2 1.1 Acquisition related costs 0.1 - 0.1 Securitization interest - (25.7) (25.7) Gain on sale of business (31.6) - (31.6) Severance 2.3 0.1 2.4 Foreign currency (gains) losses 6.4 0.1 6.5 (Gain) loss on investments (0.4) - (0.4) Impact for newly enacted Canadian DST related to prior years (4.6) - (4.6) Other 0.5 - 0.5 Total addbacks (deductions) (26.4) (25.3) (51.7) Adjusted EBITDA $30.9 $41.8 $72.7 Revenue $348.8 $106.2 $455.0 Income from continuing operations margin 7.4% 24.9% 11.5% Adjusted EBITDA Margin 8.9% 39.4% 16.0%

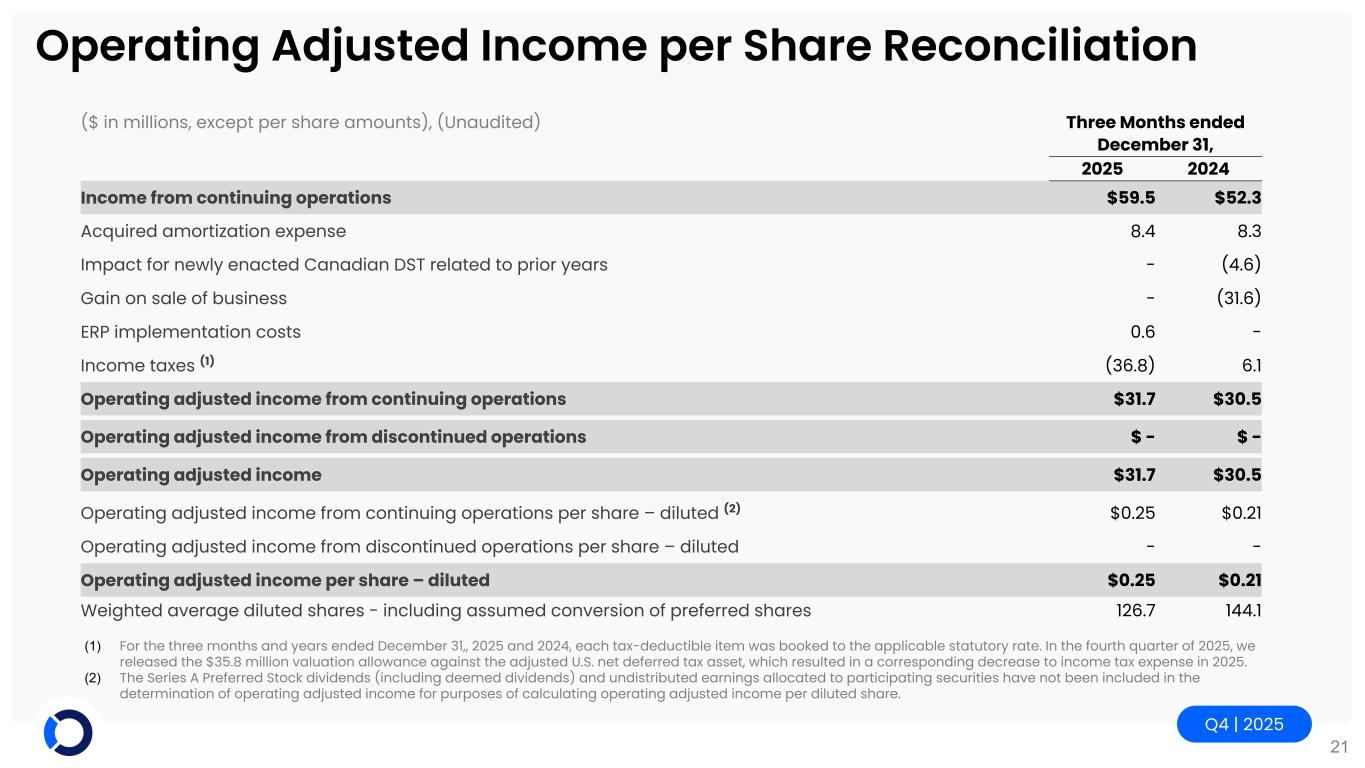

Q4 | 2025 21 Operating Adjusted Income per Share Reconciliation ($ in millions, except per share amounts), (Unaudited) Three Months ended December 31, 2025 2024 Income from continuing operations $59.5 $52.3 Acquired amortization expense 8.4 8.3 Impact for newly enacted Canadian DST related to prior years - (4.6) Gain on sale of business - (31.6) ERP implementation costs 0.6 - Income taxes (1) (36.8) 6.1 Operating adjusted income from continuing operations $31.7 $30.5 Operating adjusted income from discontinued operations $ - $ - Operating adjusted income $31.7 $30.5 Operating adjusted income from continuing operations per share – diluted (2) $0.25 $0.21 Operating adjusted income from discontinued operations per share – diluted - - Operating adjusted income per share – diluted $0.25 $0.21 Weighted average diluted shares - including assumed conversion of preferred shares 126.7 144.1 (1) For the three months and years ended December 31,, 2025 and 2024, each tax-deductible item was booked to the applicable statutory rate. In the fourth quarter of 2025, we released the $35.8 million valuation allowance against the adjusted U.S. net deferred tax asset, which resulted in a corresponding decrease to income tax expense in 2025. (2) The Series A Preferred Stock dividends (including deemed dividends) and undistributed earnings allocated to participating securities have not been included in the determination of operating adjusted income for purposes of calculating operating adjusted income per diluted share.

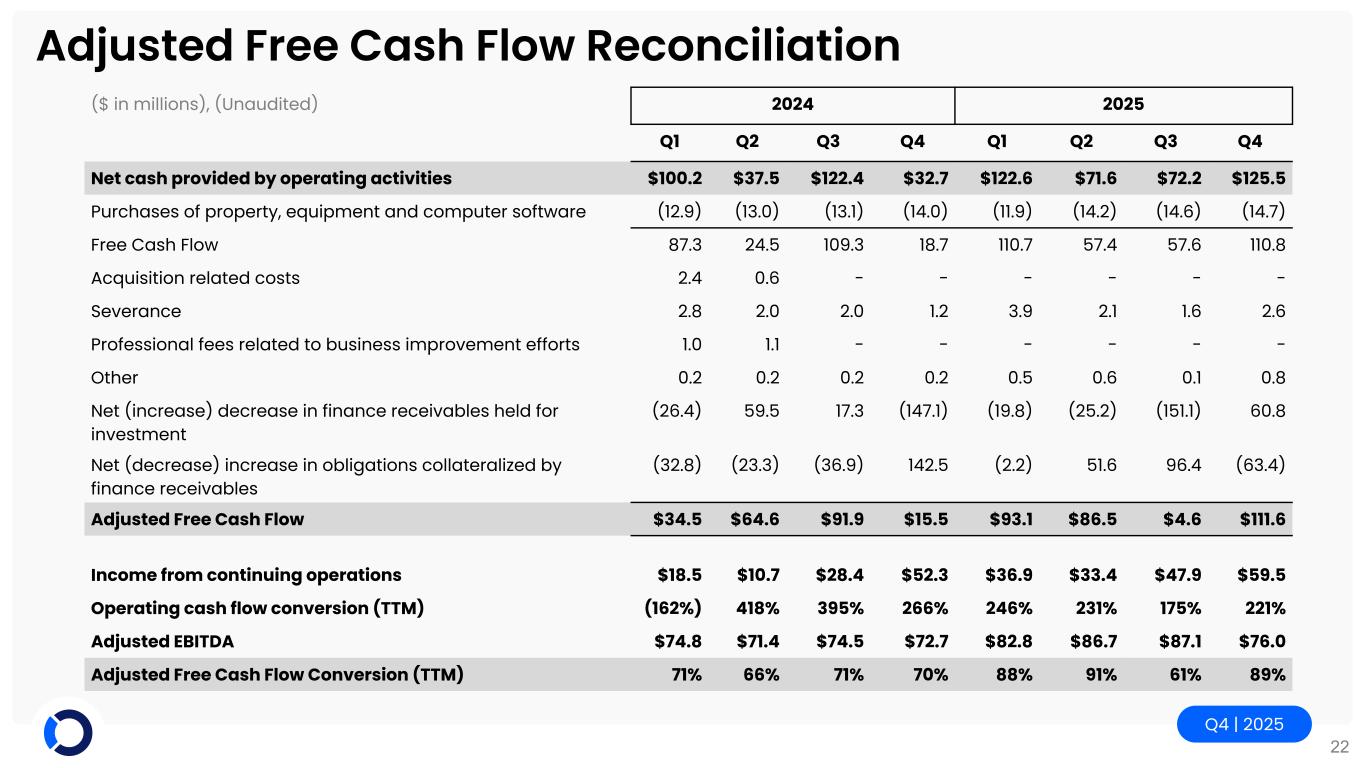

Q4 | 2025 22 Adjusted Free Cash Flow Reconciliation ($ in millions), (Unaudited) 2024 2025 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net cash provided by operating activities $100.2 $37.5 $122.4 $32.7 $122.6 $71.6 $72.2 $125.5 Purchases of property, equipment and computer software (12.9) (13.0) (13.1) (14.0) (11.9) (14.2) (14.6) (14.7) Free Cash Flow 87.3 24.5 109.3 18.7 110.7 57.4 57.6 110.8 Acquisition related costs 2.4 0.6 - - - - - - Severance 2.8 2.0 2.0 1.2 3.9 2.1 1.6 2.6 Professional fees related to business improvement efforts 1.0 1.1 - - - - - - Other 0.2 0.2 0.2 0.2 0.5 0.6 0.1 0.8 Net (increase) decrease in finance receivables held for investment (26.4) 59.5 17.3 (147.1) (19.8) (25.2) (151.1) 60.8 Net (decrease) increase in obligations collateralized by finance receivables (32.8) (23.3) (36.9) 142.5 (2.2) 51.6 96.4 (63.4) Adjusted Free Cash Flow $34.5 $64.6 $91.9 $15.5 $93.1 $86.5 $4.6 $111.6 Income from continuing operations $18.5 $10.7 $28.4 $52.3 $36.9 $33.4 $47.9 $59.5 Operating cash flow conversion (TTM) (162%) 418% 395% 266% 246% 231% 175% 221% Adjusted EBITDA $74.8 $71.4 $74.5 $72.7 $82.8 $86.7 $87.1 $76.0 Adjusted Free Cash Flow Conversion (TTM) 71% 66% 71% 70% 88% 91% 61% 89%

Q4 | 2025 23 2026 Guidance 2026 GUIDANCE (In millions, except per share amounts) (Unaudited) Low High Net income $130 $147 Add back: Income taxes 51 55 Finance interest expense 101 100 Interest expense, net of interest income 35 35 Depreciation and amortization 93 93 EBITDA $410 $430 Total addbacks (deductions), net (60) (60) Adjusted EBITDA $350 $370 Net income per share – diluted * $0.95 $1.09 Net income $130 $147 Total adjustments, net 25 26 Operating adjusted income $155 $173 Operating adjusted income per share - diluted $1.24 $1.38 Weighted average diluted shares – including assumed conversion of preferred shares 125 125 * The company uses the two-class method of calculating net income per diluted share. Under the two-class method, net income is adjusted for dividends (including deemed dividends) and undistributed earnings (losses) to the holders of the Series A Preferred Stock. The weighted average diluted shares used in the net income per diluted share calculation assumes conversion of the remaining preferred shares to common shares in June 2026.