Dennis J. Wilson, together with the other participants named herein, intends to file a proxy statement and accompanying GOLD universal proxy card with the U.S. Securities and Exchange Commission to be used to solicit proxies for the election of his slate of highly-qualified director candidates at the 2026 annual meeting of shareholders (including any other meeting of shareholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof, the “2026 Annual Meeting”) of lululemon athletica inc., and for the approval of a business proposal to be presented at the 2026 Annual Meeting.

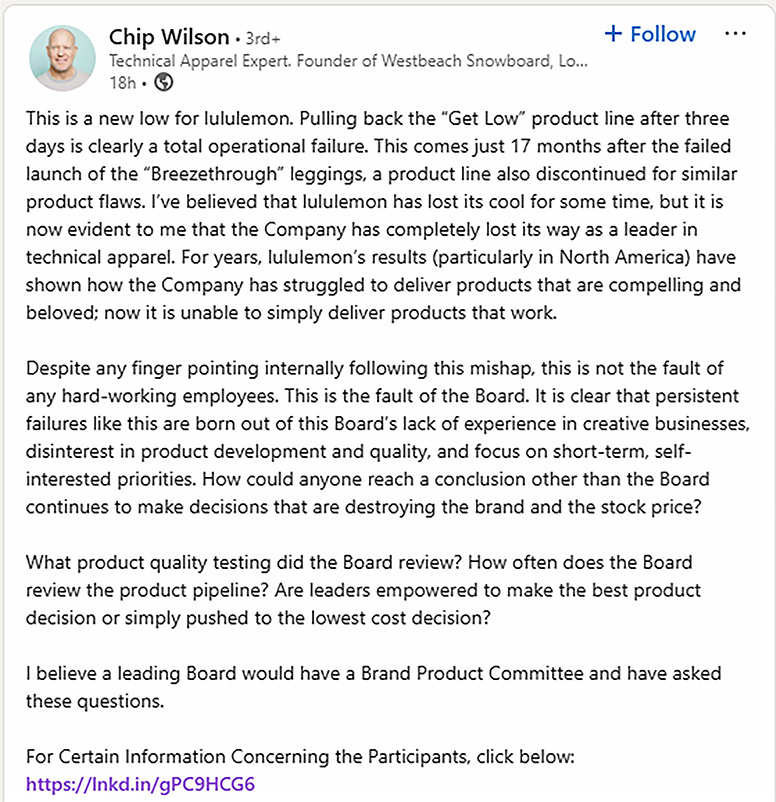

On January 21, 2026, Mr. Wilson posted the following material to LinkedIn:

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Dennis J. “Chip” Wilson, together with the other Participants (as defined below), intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A (the “Definitive Proxy Statement”) and accompanying GOLD Universal Proxy Card to be used to solicit proxies from the shareholders of the Company in connection with the 2026 Annual Meeting.

SHAREHOLDERS OF THE COMPANY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE PARTICIPANTS HAVE FILED OR WILL FILE WITH THE SEC BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION, INCLUDING ABOUT THE MATTERS TO BE VOTED ON AT THE ANNUAL MEETING AND ADDITIONAL INFORMATION RELATING TO THE PARTICIPANTS AND THEIR DIRECT OR INDIRECT INTERESTS, BY SECURITY HOLDINGS OR OTHERWISE.

The participants in the solicitation of proxies are Mr. Wilson, Anamered Investments Inc., LIPO Investments (USA), Inc., Wilson 5 Foundation, Wilson 5 Foundation Management Ltd., Five Boys Investments ULC, Shannon Wilson, Low Tide Properties Ltd., House of Wilson Ltd., Marc Maurer, Laura Gentile and Eric Hirshberg (collectively, the “Participants”).

The Definitive Proxy Statement and accompanying GOLD Universal Proxy Card will be furnished to some or all of the Company’s shareholders and will be, along with other relevant documents, available at no charge on the SEC’s website at https://www.sec.gov/.

Information about the Participants and a description of their direct or indirect interests, by security holdings or otherwise, is contained on an amendment to Schedule 13D filed by the Participants with the SEC on December 30, 2025, and is available here. By virtue of the relationship among the Participants as members in a Schedule 13(d) group, all the Participants, individually, are deemed to beneficially own the 9,904,856 shares of Common Stock (of which 5,115,961 are shares of the Company’s special voting stock paired with an equal number of exchangeable shares of Lulu Canadian Holding, Inc., on a fully-converted basis) owned in the aggregate by all of the Participants.