Advancing medicines. Solving problems. Improving lives. September 2024 H.C. Wainwright 27th Annual Global Investment Conference September 8, 2025

© 2025 Aquestive Therapeutics, Inc. 2 Disclaimer This presentation and the accompanying oral commentary have been prepared by Aquestive Therapeutics, Inc. (“Aquestive”, the “Company”, “our” or “us”) and contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “may,” “will,” or the negative of those terms, and similar expressions, are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the advancement and related timing of our product candidate Anaphylm (dibutepinephrine) Sublingual Film through clinical development and approval by the U.S. Food and Drug Administration (FDA); timing of regulatory approval submissions outside of the U.S. for Anaphylm; pre-launch activities and commercial launch of Anaphylm, if approved by the FDA including plans for marketing, market access and patient services; that the results of the Company’s clinical studies and data for Anaphylm are sufficient to support submission of the NDA for approval of Anaphylm by the FDA; that Anaphylm will be the first and only oral administration of epinephrine and accepted as an alternative to existing standards of care, if Anaphylm is approved by the FDA; the expected growth of the U.S. epinephrine market including in value and the opportunity such growth presents to the Company should Anaphylm be approved by the FDA; the advancement, growth and related timing of our Adrenaverse pipeline epinephrine prodrug product candidates, including AQST-108 (epinephrine) Topical Gel; through clinical development including design and timing of clinical studies including those necessary to support the targeted indication of moderate and severe alopecia areata for AQST- 108, if approved by the FDA; plans and timing to submit the IND for AQST-108 and initiation of a Phase 2a clinical trial for AQST-108 for the treatment of patients with alopecia areata; following launch of AQST-108, if approved by the FDA; the launch of Libervant® (diazepam) Buccal Film, if approved by the FDA for U.S. market access for ARS epilepsy patients; the commercial opportunity of Libervant, Anaphylm, and AQST-108, including potential market growth and revenues (including projected peak annual sales) generated for the Company from commercialization of these products and product candidates should Anaphylm and AQST-108 be approved by the FDA and Libervant gain U.S. market access; the potential benefits our products and product candidates could bring to patients and acceptance by patients, prescribers and payors of our product candidates as an alternative to existing standards of care for the targeted medical indication of these product candidates; and business strategies, market opportunities, cash runway projections and other statements that are not historical facts. These forward-looking statements are based on our current expectations and beliefs and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Such risks and uncertainties include, but are not limited to, risks associated with our development work, including any delays or changes to the timing, cost and success of our product development activities and clinical trials and plans, including those relating to Anaphylm, AQST- 108, and our other product candidates, or failure to receive regulatory approval at all for these and other product candidates; risk of delays in advancement of the regulatory approval process through the FDA of our product candidates, including the acceptance of the NDA for Anaphylm; the risk of whether the Company’s clinical data is sufficient for approval of Anaphylm, including with respect to our pharmacokinetic (PK) and pharmacodynamic (PD) comparability submission for FDA approval of Anaphylm; risks associated our ability to address the FDA’s comments on our clinical trials and other concerns identified in the FDA Type C meeting minutes for Anaphylm, including the risk that the FDA may require additional clinical studies for approval of Anaphylm; risk of U.S. market access for Libervant upon expiration of the seven year orphan drug market exclusivity granted by the FDA for an approved nasal spray product of another company, which is scheduled to occur in January 2027, or for other reasons; risks associated with the success of any competing products, including generics; risks and uncertainties inherent in commercializing a new product (including technology risks, financial risks, market risks and implementation risks and regulatory limitations); risk of development of a market access, sales and marketing capability for commercialization of our product candidates, including Libervant, Anaphylm and AQST-108; risks associated with the potential impact on the value of the Company of the sale or outlicensing of our product and product candidates, including Libervant and Anaphylm and other product candidates; risk of sufficient capital and cash resources, including sufficient access to available debt and equity financing, including under our ATM facility, and revenues from operations, to satisfy all of our short- term and longer-term liquidity and cash requirements and other cash needs, at the times and in the amounts needed, including to commence principal payments on our 13.5% Notes in 2026 and to fund future clinical development and commercial activities for our product candidates, including Anaphylm and AQST-108, should these product candidates be approved by the FDA, and for the launch of Libervant upon expiration of the orphan drug marketing exclusivity period of the nasal spray product, if granted by the FDA; risk that our manufacturing capabilities will be sufficient to support demand in the U.S. and abroad for our product candidates, including Anaphylm, if approved by the FDA and regulatory authorities abroad, and for Libervant should Libervant receive U.S. market access from the FDA, and for demand for our licensed products in the U.S. and abroad; risk of eroding market share for Suboxone® as a sunsetting product, which accounts for the substantial part of our current operating revenue; risk of default of our debt instruments; risks related to the outsourcing of certain sales, marketing and other operational and staff functions to third parties; risks associated with the rate and degree of market acceptance in the U.S. and abroad of our product candidates, including Libervant and Anaphylm, if approved by the FDA and regulatory authorities outside the U.S.; risk of the rate and degree of market acceptance in the U.S. and abroad of our licensed products; risk associated with the size and growth of our product markets; risks associated with our failure to comply with all FDA and other governmental and customer requirements for our manufacturing facilities; risks associated with intellectual property rights and infringement claims relating to our products; risk that our patent applications for our product candidates, including for Anaphylm, will not be timely issued, or issued at all, by the United States Patent and Trademark Office; risk of unexpected patent developments; risk of legislation and regulatory actions and changes in laws or regulations affecting our business including relating to our products and product candidates and product pricing, reimbursement or access therefor; risk of loss of significant customers; risks related to claims and legal proceedings against us including patent infringement, securities, business torts, investigative, product safety or efficacy and antitrust litigation matters; risk of product recalls and withdrawals; risks related to any disruptions in our information technology networks and systems, including the impact of cybersecurity attacks; risk of increased cybersecurity attacks and data accessibility disruptions due to remote working arrangements; risk of adverse developments affecting the financial services industry; risks related to inflation and rising interest rates; risks related to the impact of pandemic diseases on our business; risks and uncertainties related to general economic, political (including the Ukraine and Israel wars and other acts of war and terrorism), business, industry, regulatory, financial and market conditions and other unusual items, including a potential recession; risks related to uncertainty about U.S. government initiatives and their impact on our business, including imposition of tariffs and other trade restrictions; and other uncertainties affecting us including those described in the "Risk Factors" section and in other sections included in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the U.S. Securities and Exchange Commission. Given those uncertainties, you should not place undue reliance on these forward-looking statements, which speak only as of the date made. All subsequent forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by this cautionary statement. The Company assumes no obligation to update forward-looking statements or outlook or guidance after the date of this presentation whether as a result of new information, future events or otherwise, except as may be required by applicable law. We obtained the industry, market and competitive position data used throughout this presentation from our own internal estimates and research, as well as from industry and general publications, and research, surveys and studies conducted by third parties. Internal estimates are derived from publicly available information released by industry analysts and third-party sources, our internal research and our industry experience, and are based on assumptions made by us based on such data and our knowledge of the industry and market, which we believe to be reasonable. In addition, while we believe the industry, market and competitive position data included in this presentation is reliable and based on reasonable assumptions, we have not independently verified any third-party information, and all such data involve risks and uncertainties are subject to change based on various factors. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any of the Company’s securities, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction. PharmFilm®, Libervant® and the Aquestive logo are registered trademarks of Aquestive Therapeutics, Inc. The trade name “Anaphylm” for AQST-109 has been conditionally approved by the FDA. Final approval of the Anaphylm proprietary name is conditioned on FDA approval of the product candidate, AQST-109. All other registered trademarks referenced herein are the property of their respective owners.

6 of revenue in 2024 150+ 20+ years since the company was founded Products available in6 continents Over $1.5 billion1 in potential peak annual net sales from pipeline assets drug approvals 1.Aquestive Therapeutics data on file. 2.5 billion $57M+ PharmFilm® doses shipped worldwide More than employees based in Indiana and New Jersey expected in the U.S. by 2027 if approved by the FDA 2 product launches 3

4 Our Technologies AdrenaVerseTM platform contains a library of over 20 epinephrine prodrugs that demonstrate control of absorption and conversion rates across a variety of dosage forms including lotions, creams, and ointments (LCOs) and delivery sites. The AdrenaVerse platform enables us to pursue a variety of allergy and dermatological indications. PharmFilm® PharmFilm® is a unique and versatile technology for high-performance drug delivery. Aquestive scientists combine the customizable features of PharmFilm® with patented formulation and engineering processes to optimize the delivery of active pharmaceutical ingredients (APIs). TM

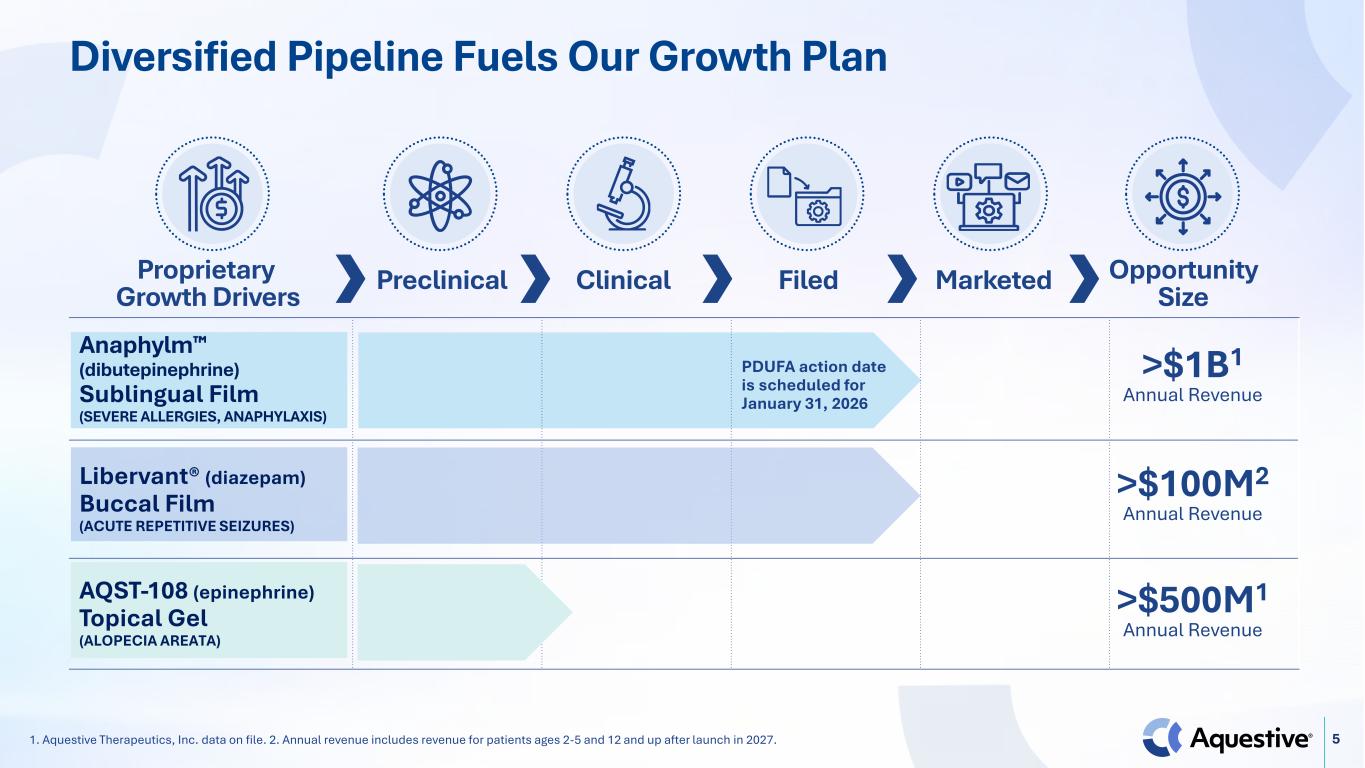

5 Anaphylm (dibutepinephrine) Sublingual Film (SEVERE ALLERGIES, ANAPHYLAXIS) PDUFA action date is scheduled for January 31, 2026 Libervant® (diazepam) Buccal Film (ACUTE REPETITIVE SEIZURES) AQST-108 (epinephrine) Topical Gel (ALOPECIA AREATA) Diversified Pipeline Fuels Our Growth Plan 1. Aquestive Therapeutics, Inc. data on file. 2. Annual revenue includes revenue for patients ages 2-5 and 12 and up after launch in 2027. Proprietary Growth Drivers Preclinical Clinical Filed Marketed Opportunity Size >$500M1 Annual Revenue >$1B1 Annual Revenue >$100M2 Annual Revenue

6 Cassie Jung Chief Operating Officer Dedicated and Experienced Leadership Team Daniel Barber President, CEO & Director Lori J. Braender Chief Legal Officer, Chief Compliance Officer, Corporate Secretary Ernie Toth Chief Financial Officer Peter Boyd SVP, HR & IT Melina Cioffi SVP, Regulatory Affairs Carl Kraus Chief Medical Officer Sherry Korczynski Chief Commercial Officer

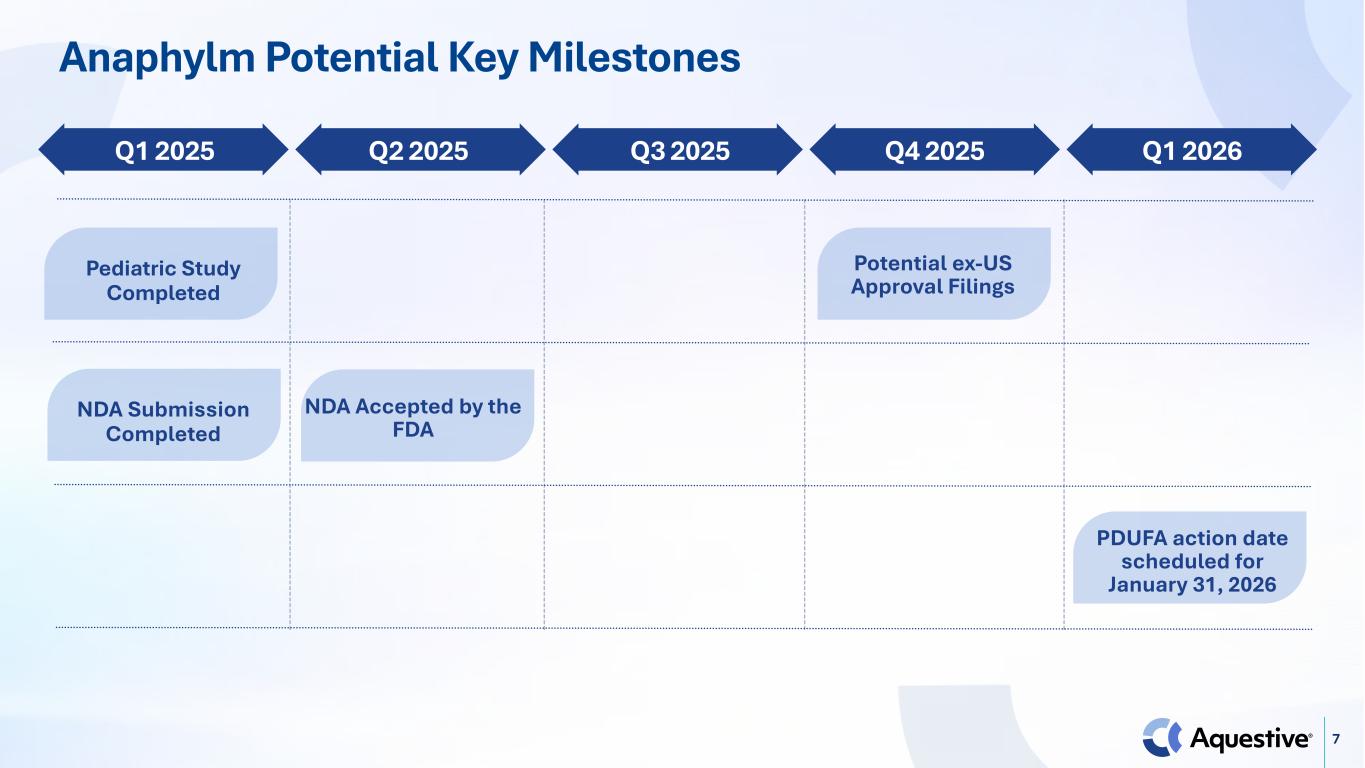

7 Anaphylm Potential Key Milestones Pediatric Study Completed Q1 2025 NDA Submission Completed NDA Accepted by the FDA Potential ex-US Approval Filings Q2 2025 Q3 2025 Q4 2025 Q1 2026 PDUFA action date scheduled for January 31, 2026

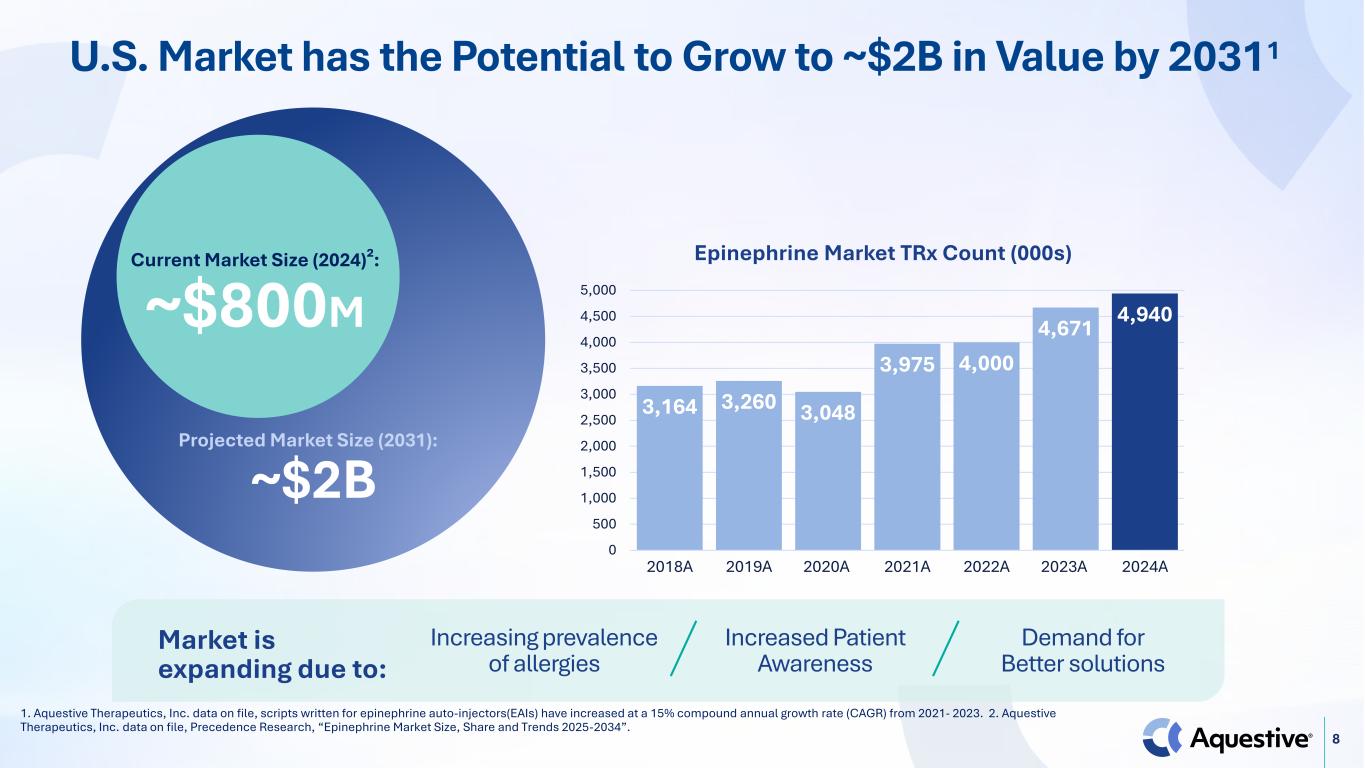

8 U.S. Market has the Potential to Grow to ~$2B in Value by 20311 Current Market Size (2024)²: ~$800M Projected Market Size (2031): ~$2B 3,164 3,260 3,048 3,975 4,000 4,671 4,940 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 2018A 2019A 2020A 2021A 2022A 2023A 2024A Epinephrine Market TRx Count (000s) 1. Aquestive Therapeutics, Inc. data on file, scripts written for epinephrine auto-injectors(EAIs) have increased at a 15% compound annual growth rate (CAGR) from 2021- 2023. 2. Aquestive Therapeutics, Inc. data on file, Precedence Research, “Epinephrine Market Size, Share and Trends 2025-2034”. Market is expanding due to: Increasing prevalence of allergies Increased Patient Awareness Demand for Better solutions

9 Recent capital raise activities validate the belief in the commercial promise of Anaphylm On August 14, 2025, we completed an equity raise of $85 million We further bolstered our balance sheet with a strategic funding with RTW Investments, LP Equity raise and strategic funding provide cash runway into 2027 We have significantly strengthened our balance sheet

10 Lead Asset Anaphylm (dibutepinephrine) Sublingual Film

11 A Novel Approach to Epinephrine Delivery First and only non-device based, orally delivered epinephrine product candidate Needle-Free Easy to Use Designed to Work Quickly1 Device-Free Easy to Carry + + Anaphylm (dibutepinephrine) Sublingual Film 1. Aquestive Therapeutics, Inc. data on file.

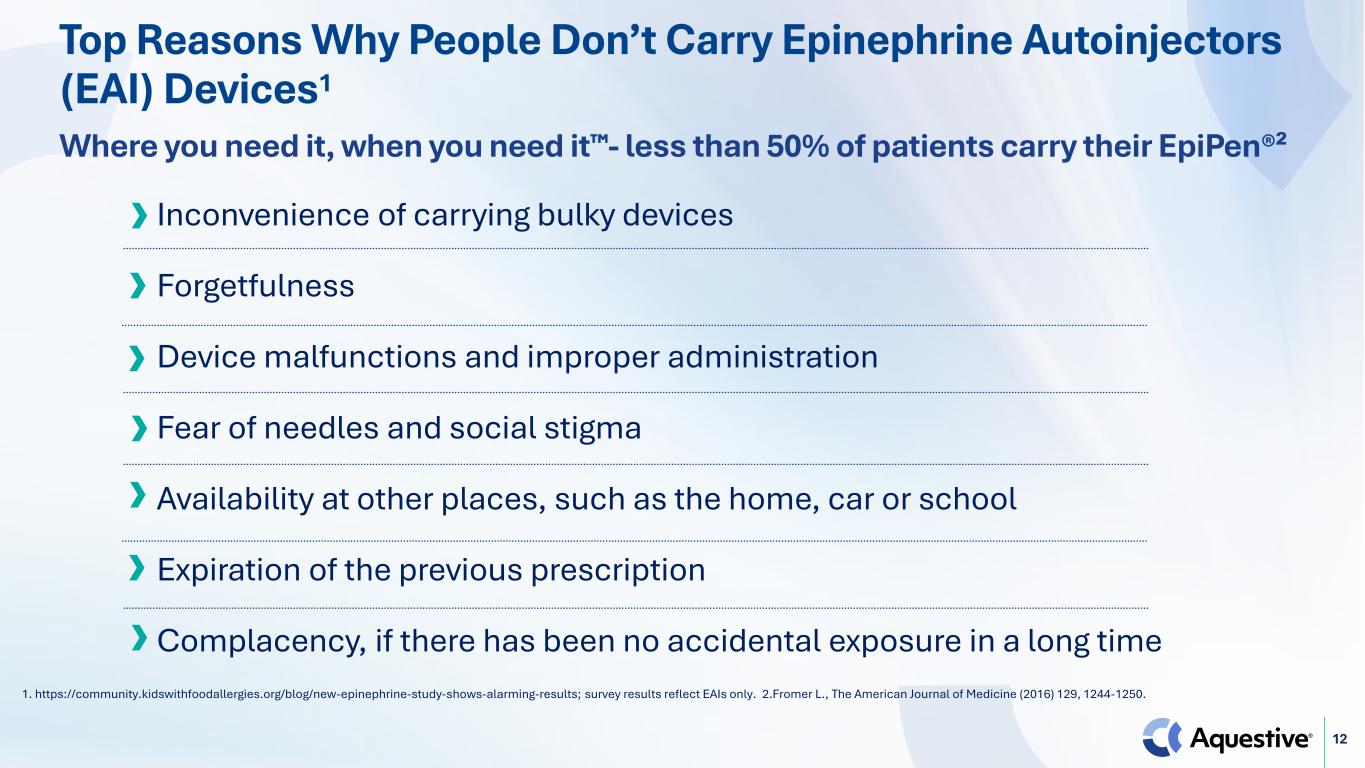

12 Top Reasons Why People Don’t Carry Epinephrine Autoinjectors (EAI) Devices1 1. https://community.kidswithfoodallergies.org/blog/new-epinephrine-study-shows-alarming-results; survey results reflect EAIs only. 2.Fromer L., The American Journal of Medicine (2016) 129, 1244-1250. Inconvenience of carrying bulky devices Forgetfulness Device malfunctions and improper administration Fear of needles and social stigma Availability at other places, such as the home, car or school Expiration of the previous prescription Complacency, if there has been no accidental exposure in a long time Where you need it, when you need it - less than 50% of patients carry their EpiPen®²

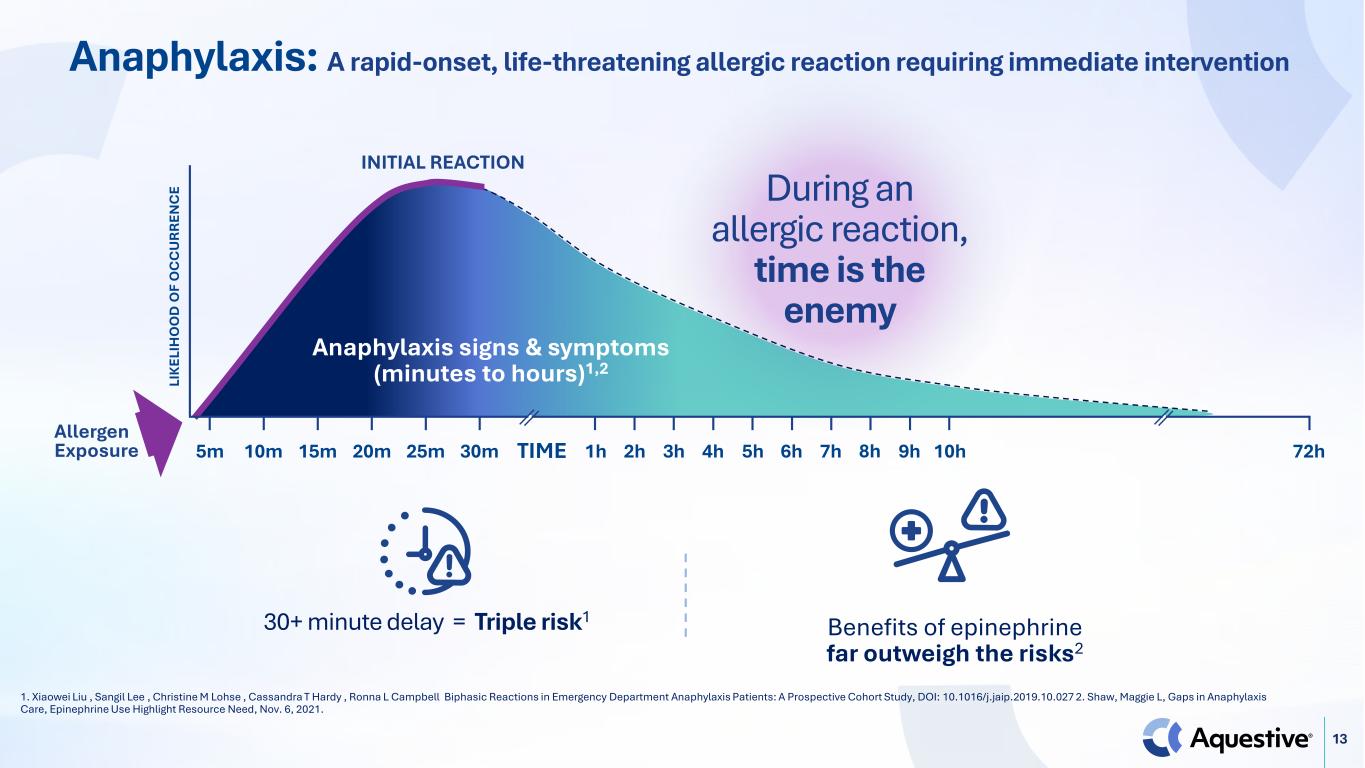

13 Anaphylaxis: A rapid-onset, life-threatening allergic reaction requiring immediate intervention 1. Xiaowei Liu , Sangil Lee , Christine M Lohse , Cassandra T Hardy , Ronna L Campbell Biphasic Reactions in Emergency Department Anaphylaxis Patients: A Prospective Cohort Study, DOI: 10.1016/j.jaip.2019.10.027 2. Shaw, Maggie L, Gaps in Anaphylaxis Care, Epinephrine Use Highlight Resource Need, Nov. 6, 2021. Anaphylaxis signs & symptoms (minutes to hours)1,2 Allergen Exposure LI K EL IH O O D O F O C C U R R EN C E INITIAL REACTION 5m 10m 15m 20m 25m 30m 1h 8h 72h2h 3h 4h 5h 6h 7h 9h 10hTIME During an allergic reaction, time is the enemy 30+ minute delay = Triple risk1 Benefits of epinephrine far outweigh the risks2

14 Rapid Relief Needed When It Matters Most1 Anaphylm reaches peak absorption in just 12 minutes Observed to achieve therapeutic blood concentrations in as little as 5 minutes (over 100 pg/ml) Observed to deliver a median Tmax of 12 minutes 1. Aquestive Therapeutics, Inc. data results on file, excluding Tmax data results for Neffy®, which can be found in the prescribing information located in the approved product label; no head-to-head comparison studies have been conducted with Anaphylm and Neffy®.

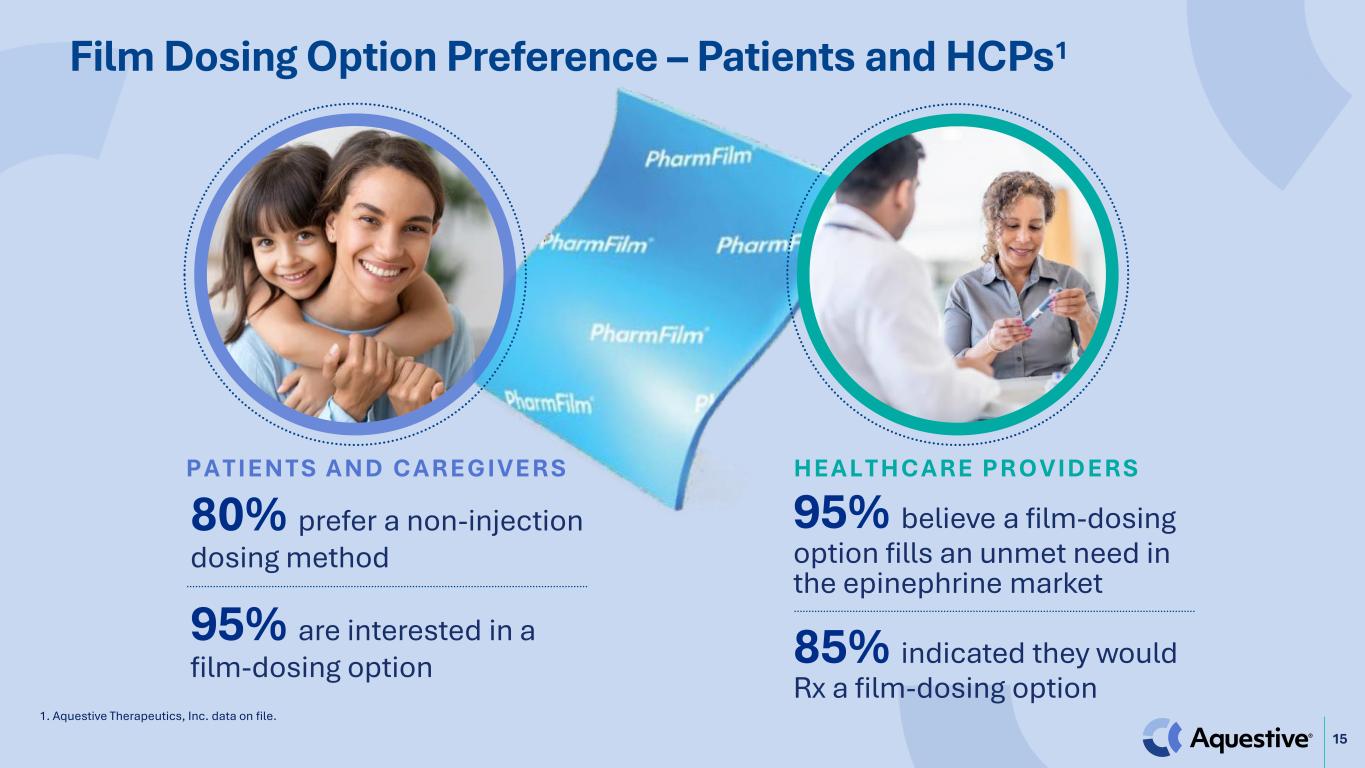

15 Film Dosing Option Preference – Patients and HCPs1 80% prefer a non-injection dosing method 95% are interested in a film-dosing option P A T I E N T S A N D C A R E G I V E R S 95% believe a film-dosing option fills an unmet need in the epinephrine market 85% indicated they would Rx a film-dosing option H E A L T H C A R E P R O V I D E R S 1. Aquestive Therapeutics, Inc. data on file.

16 Anaphylm Commercial Opportunity and Readiness

17 2024 2025 2026 Anaphylm completed and planned go-to market activities Strategic Foundations • Key opinion leader engagement • Market research with >1,000 HCPs, patients, caregivers, and payors • Partnering with epinephrine- experienced promotional agencies and commercial consultants Launch Readiness • Unbranded medical education • Talent acquisition • Continue to execute our go- to-market plan driving awareness oKnown epinephrine prescribers/specialties oWork with payers to raise awareness oEngagement with advocacy groups oCongress attendance oPublications Preparedness for Commercial Launch • Facilitate access with payers • Focus on key prescribers in the initial launch • Leverage Anaphylm’s unique product attributes to engage HCPs, patients, caregivers, and advocacy groups • Optimize marketing mix that works smarter, is more focused to enable us to effectively compete in the epinephrine delivery market

18 Reminder: Planned Anaphylm launch strategy Focus on driving awareness among allergists and pediatricians1 2 3 4 Launch into the “warm weather” volume increase Price within the range of existing standards of care Leverage our existing commercial know-how

19 Epinephrine prescribers: an addressable market opportunity1 • Allergists are the most productive segment by far, averaging ~200 prescriptions per year • Pediatricians are the second most productive segment, averaging ~16 prescriptions per year 1. Aquestive Therapeutics, Inc. data on file.

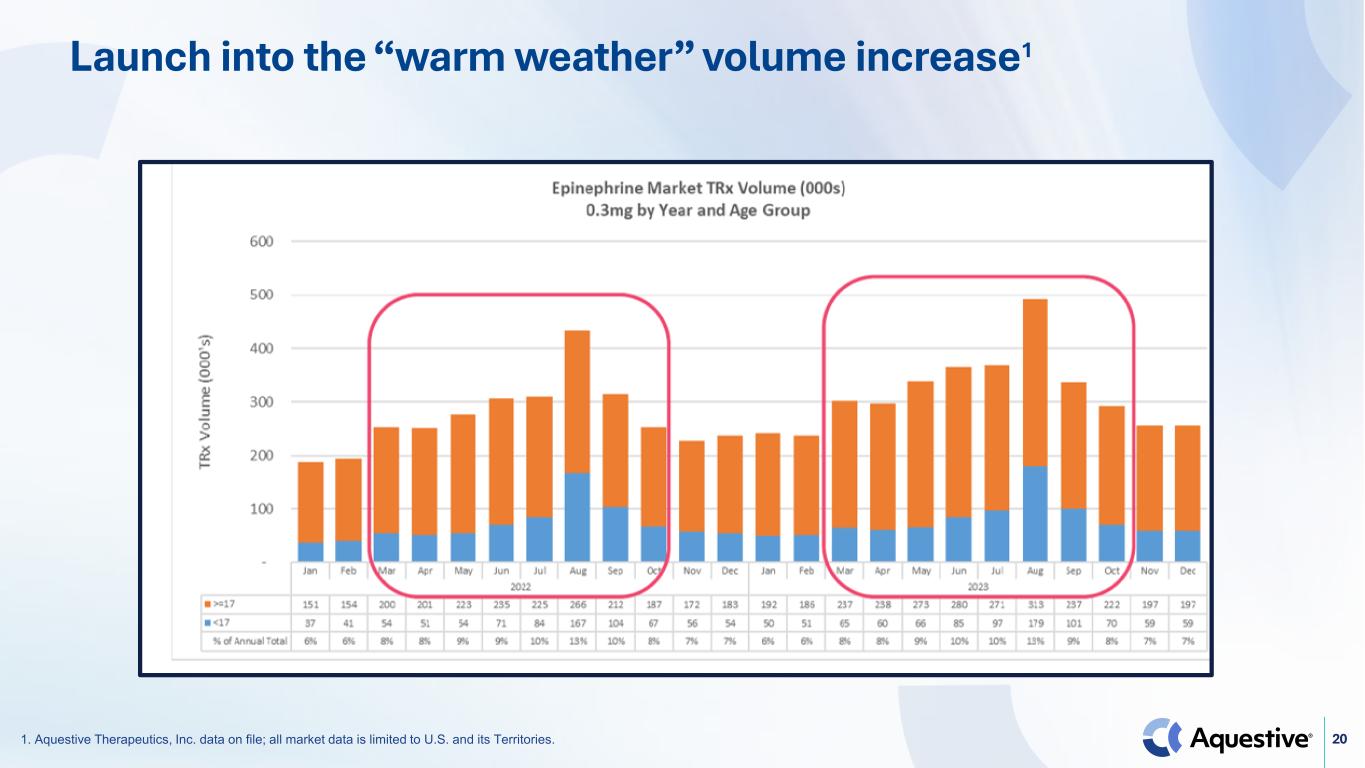

20 Launch into the “warm weather” volume increase1 1. Aquestive Therapeutics, Inc. data on file; all market data is limited to U.S. and its Territories.

21 Bridging from Awareness to Filled Prescriptions

22 Market Access: the foundation to a successful Anaphylm launch Strictly Confidential. Do Not Distribute. Current areas of Aquestive diligence and focus

23 Trade & Distribution Strategy • Vertically integrated operations with supply chain infrastructure prepared for launch and scalable growth • Strategic distribution relationships secured through established wholesaler agreements and third-party logistics contracts • Multi-channel distribution strategy in development, evaluating cash-pay models, telehealth platforms, and specialty pharmacy networks to maximize market reach Strictly Confidential. Do Not Distribute.

24 Patient Services Strategy Strictly Confidential. Do Not Distribute. • Best-in-class patient services deployment • Access and affordability optimization • Patient and provider support • Scalable solutions

25 Thank You