Execution Version BUSINESS.33520951.1 BUSINESS.33707975.1 THE SYMBOL “[***]” DENOTES PLACES WHERE CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS MORE (i) NOT MATERIAL, AND (ii) WOULD LIKELY CAUSE COMPETITIVE HARM TO THE COMPANY IF PUBLICLY DISCLOSED PURCHASE AND SALE AGREEMENT BY AND BETWEEN AQUESTIVE THERAPEUTICS, INC. AND 4010 ROYALTY INVESTMENTS ICAV, AN UMBRELLA IRISH COLLECTIVE ASSET- MANAGEMENT VEHICLE WITH SEGREGATED LIABILITY BETWEEN SUB-FUNDS, FOR AND ON BEHALF OF ITS SUB-FUND, 4010 ROYALTY INVESTMENTS FUND 1 DATED AS OF AUGUST 13, 2025

(i) BUSINESS.33520951.1 BUSINESS.33707975.1 TABLE OF CONTENTS Page ARTICLE 1 DEFINITIONS .........................................................................................................1 Section 1.1 Definitions ................................................................................................................... 1 Section 1.2 Certain Interpretations ............................................................................................... 17 ARTICLE 2 PURCHASE, SALE AND ASSIGNMENT OF THE REVENUE PARTICIPATION RIGHT ...............................................................................................18 Section 2.1 Purchase, Sale and Assignment ................................................................................. 18 Section 2.2 Purchase Price ............................................................................................................ 19 Section 2.3 No Assumed Obligations; Excluded Assets. .............................................................. 19 ARTICLE 3 CLOSING ..............................................................................................................20 Section 3.1 Closing ....................................................................................................................... 20 Section 3.2 Payment of Purchase Price ......................................................................................... 20 Section 3.3 Bill of Sale ................................................................................................................. 20 ARTICLE 4 REPRESENTATIONS AND WARRANTIES ......................................................20 Section 4.1 Seller’s Representations and Warranties .................................................................... 20 Section 4.2 Buyer’s Representations and Warranties ................................................................... 28 Section 4.3 No Implied Representations and Warranties .............................................................. 29 ARTICLE 5 CONDITIONS TO CLOSING...............................................................................29 Section 5.1 Effective Date Actions ............................................................................................... 29 Section 5.2 Conditions to the Buyer’s Obligations ....................................................................... 30 Section 5.3 Conditions to the Seller’s Obligations ....................................................................... 32 ARTICLE 6 COVENANTS .......................................................................................................33 Section 6.1 Reporting ................................................................................................................... 33 Section 6.2 Revenue Share Payments; Royalty Reports; Change of Control ............................... 34 Section 6.3 Disclosures ................................................................................................................. 36 Section 6.4 Inspections and Audits of the Seller .......................................................................... 36 Section 6.5 Intellectual Property Matters. ..................................................................................... 37 Section 6.6 In-Licenses ................................................................................................................. 38 Section 6.7 Out-Licenses. ............................................................................................................. 39 Section 6.8 Indebtedness............................................................................................................... 39 Section 6.9 Diligence .................................................................................................................... 40 Section 6.10 Efforts to Consummate Transactions ......................................................................... 40 Section 6.11 Further Assurances. ................................................................................................... 40 Section 6.12 No Impairment of Revenue Participation Right or Back-Up Security Interest .......... 41 Section 6.13 Certain Tax Matters. .................................................................................................. 41 ARTICLE 7 INDEMNIFICATION ............................................................................................42 Section 7.1 General Indemnity ..................................................................................................... 42 Section 7.2 Notice of Claims ........................................................................................................ 43 Section 7.3 Limitations on Liability ............................................................................................. 43 Section 7.4 Exclusive Remedy ..................................................................................................... 44 Section 7.5 Tax Treatment of Indemnification Payments ............................................................. 44 ARTICLE 8 CONFIDENTIALITY ............................................................................................44 Section 8.1 Confidentiality ........................................................................................................... 44 Section 8.2 Authorized Disclosure ............................................................................................... 45 ARTICLE 9 TERMINATION ....................................................................................................46 Section 9.1 Mutual Termination ................................................................................................... 46

(ii) BUSINESS.33520951.1 BUSINESS.33707975.1 Section 9.2 Buyer Termination Upon Failure to Achieve Closing Conditions ............................. 46 Section 9.3 Buyer Termination for [***] ...................................................................................... 46 Section 9.4 Automatic Termination .............................................................................................. 46 Section 9.5 Effect of Termination ................................................................................................. 46 Section 9.6 Survival ...................................................................................................................... 46 ARTICLE 10 EVENTS OF DEFAULT REMEDIES ................................................................46 Section 10.1 Remedies Upon Event of Default .............................................................................. 46 ARTICLE 11 MISCELLANEOUS ............................................................................................47 Section 11.1 Headings .................................................................................................................... 47 Section 11.2 Notices ....................................................................................................................... 47 Section 11.3 Expenses .................................................................................................................... 48 Section 11.4 Assignment ................................................................................................................ 49 Section 11.5 Amendment and Waiver. ........................................................................................... 49 Section 11.6 Entire Agreement ....................................................................................................... 49 Section 11.7 No Third-Party Beneficiaries ..................................................................................... 49 Section 11.8 Governing Law .......................................................................................................... 49 Section 11.9 Jurisdiction; Venue. ................................................................................................... 50 Section 11.10 Severability ................................................................................................................ 50 Section 11.11 Specific Performance ................................................................................................. 51 Section 11.12 Counterparts ............................................................................................................... 51 Section 11.13 Relationship of the Parties ......................................................................................... 51 Section 11.14 Limited Recourse and Non-Petition. .......................................................................... 51 Index of Exhibits, Schedules and Annexes Exhibit A: Description of Anaphylm Exhibit B: Bill of Sale

1 BUSINESS.33520951.1 BUSINESS.33707975.1 PURCHASE AND SALE AGREEMENT This PURCHASE AND SALE AGREEMENT, dated as of August 13, 2025 (this “Agreement”), is made and entered into by and between 4010 ROYALTY INVESTMENTS ICAV, AN UMBRELLA IRISH COLLECTIVE ASSET-MANAGEMENT VEHICLE WITH SEGREGATED LIABILITY BETWEEN SUB-FUNDS, FOR AND ON BEHALF OF ITS SUB-FUND, 4010 ROYALTY INVESTMENTS FUND 1 (the “Buyer”), and AQUESTIVE THERAPEUTICS, INC., a corporation incorporated in the State of Delaware (the “Seller”). RECITALS WHEREAS, the Seller is in the business of, among other things, developing and commercializing the Product; and WHEREAS, the Buyer desires to purchase the Revenue Participation Right from the Seller in exchange for payment of the Purchase Price, and the Seller desires to sell the Revenue Participation Right to the Buyer in exchange for the Buyer’s payment of the Purchase Price, in each case on the terms and conditions set forth in this Agreement. NOW THEREFORE, in consideration of the representations, warranties, covenants and agreements set forth herein and for good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Seller and the Buyer hereby agree as follows: ARTICLE 1 DEFINITIONS Section 1.1 Definitions. The following terms, as used herein, shall have the following meanings: “Affiliate” means, (a) with respect to any particular Person, any other Person directly or indirectly controlling, controlled by or under common control with such particular Person and (b) with respect to the Buyer, any Person now or hereafter existing that is managed or controlled by RTW Investments, LP or of which RTW Investments, LP serves as investment manager. For purposes of the foregoing sentence, the term “control” means direct or indirect ownership of (i) fifty percent (50%) or more, including ownership by trusts with substantially the same beneficial interests, of the voting and equity rights of such Person, firm, trust, corporation, partnership or other entity or combination thereof, or (ii) the power to direct the management of such person, firm, trust, corporation, partnership or other entity or combination thereof, by contract or otherwise. “Agreement” is defined in the preamble. “Anaphylm” means the sublingual film containing the prodrug dibutepinephrine referred to by the Seller as of the date hereof as Anaphylm or Anaphylm (dibutepinephrine) Sublingual Film, and as further described on Exhibit A.

2 BUSINESS.33520951.1 BUSINESS.33707975.1 “Approved Indication” means the treatment of type I allergic reactions (including anaphylaxis) in adults and adolescent patients seven (7) years and older who weigh 30 kg or greater, which shall exclude any and all Blackbox Warnings. “Back-Up Security Interest” is defined in Section 2.1(b). “Bankruptcy Event” means the occurrence of any of the following in respect of a Person: (a) such Person shall generally not, shall be unable to, or an admission in writing by such Person of its inability to, pay its debts as they come due or a general assignment by such Person for the benefit of creditors; (b) the filing of any petition or answer by such Person seeking to adjudicate itself as bankrupt or insolvent, or seeking for itself any liquidation, winding-up, reorganization, arrangement, adjustment, protection, relief or composition of such Person or its debts under any applicable law relating to bankruptcy, insolvency, examinership, receivership, winding-up, liquidation, reorganization, examination, relief of debtors or other similar applicable law now or hereafter in effect, or seeking, consenting to or acquiescing in the entry of an order for relief in any case under any such applicable law, or the appointment of or taking possession by a receiver, trustee, custodian, liquidator, examiner, assignee, sequestrator or other similar official for such Person or for any substantial part of its property; (c) corporate or other entity action taken by such Person to authorize any of the actions set forth in clause (a) or clause (b) above; or (d) without the consent or acquiescence of such Person, the commencement of an action seeking entry of an order for relief or approval of a petition for relief or reorganization or any other petition seeking any reorganization, arrangement, composition, readjustment, liquidation, dissolution or other similar relief under any present or future bankruptcy, insolvency or similar applicable law, or the filing of any such petition against such Person, or, without the consent or acquiescence of such Person, the commencement of an action seeking entry of an order appointing a trustee, custodian, receiver or liquidator of such Person or of all or any substantial part of the property of such Person, in each case where such petition or order shall remain unstayed or shall not have been stayed or dismissed within [***] calendar days from entry thereof. “Bankruptcy Laws” means, collectively, bankruptcy, insolvency, reorganization, examinership, moratorium, fraudulent conveyance, fraudulent transfer or other similar laws affecting the enforcement of creditors’ rights generally. “Bill of Sale” is defined in Section 3.3. “Blackbox Warning” means any “black box warnings” as defined under 21 CFR 201.57(e) of the Code of Federal Regulations. “Business Day” means any day other than (a) a Saturday or Sunday or (b) a day on which banking institutions located in New York are permitted or required by applicable law or regulation to remain closed. “Buy-Back Option” is defined in Section 6.2(c)(i). “Buy-Back Requirement” is defined in Section 6.2(c)(i).

3 BUSINESS.33520951.1 BUSINESS.33707975.1 “Buyer” is defined in the preamble. “Buyer Indemnified Parties” is defined in Section 7.1(a). “Calendar Quarter” means, for the Calendar Quarter in which the Closing occurs, the period beginning on the first day of such Calendar Quarter and ending on the last day of such Calendar Quarter, and thereafter, in each case, each successive period of three (3) consecutive calendar months ending on March 31, June 30, September 30 or December 31; provided that the final Calendar Quarter of this Agreement shall end on the effective date of expiration or termination of this Agreement. “Calendar Year” means, for the Calendar Year in which the Closing occurs, the period beginning on the first day of such Calendar Year and ending on the last day of such Calendar Year, and thereafter, in each case, each respective period of twelve (12) consecutive months ending on December 31; provided that the final Calendar Year of this Agreement shall end on the effective date of expiration or termination of this Agreement. “Cap” means the amount equal to (a) on or prior to December 31, 2035, One Hundred Eighty-Seven Million, Five Hundred Thousand Dollars ($187,500,000) and (b) after December 31, 2035, Two Hundred and Twenty-Five Million Dollars ($225,000,000) (such amount in clause (b), the “Hard Cap”). “Change of Control” means the occurrence of any one or more of the following: (a) the acquisition, whether directly, indirectly, beneficially or of record, whether by merger, scheme of arrangement, consolidation, sale or other transfer of securities in a single transaction or series of related transactions, by any Person of any voting securities of the Seller, or if the percentage ownership of any Person in the voting securities of the Seller is increased through stock redemption, cancellation, or other recapitalization, and immediately after such acquisition or increase such Person is, directly or indirectly, the beneficial owner of voting securities representing fifty percent (50%) or more of the total voting power of all of the then outstanding voting securities of the Seller; (b) a merger, scheme of arrangement, consolidation, recapitalization, or reorganization of the Seller is consummated that would result in shareholders or equity holders of the Seller immediately prior to such transaction that did not own more than fifty percent (50%) of the outstanding voting securities of the Seller immediately prior to such transaction, owning more than fifty percent (50%) of the outstanding voting securities of the surviving entity (or its parent entity) immediately following such transaction; (c) the sale, lease, transfer, license or other disposition, in a single transaction or series of related transactions, by the Seller or any Subsidiary of the Seller of all or substantially all the assets of the Seller and its Subsidiaries taken as a whole, or the sale or disposition (whether by merger, consolidation or otherwise) of one or more Subsidiaries of the Seller if substantially all of the assets of the Seller and its Subsidiaries taken as a whole are held by such Subsidiary or Subsidiaries, except where such sale, lease, transfer, license or other disposition is to a wholly owned Subsidiary of the Seller; and (d) the sale, lease, transfer, license or other disposition, in a single transaction or series of related transactions, by the Seller or any Subsidiary of the Seller of all or substantially all the rights of the Seller and its Subsidiaries taken as a whole in and to the Product, or the sale or disposition (whether by merger, consolidation or otherwise) of one or more Subsidiaries of the Seller if substantially all of the assets of the Seller and its Subsidiaries taken as a whole in and to

4 BUSINESS.33520951.1 BUSINESS.33707975.1 the Product are held by such Subsidiary or Subsidiaries, except where such sale, lease, transfer, license or other disposition is to a wholly owned Subsidiary of the Seller. “Clinical Trial” means a clinical trial intended to support or maintain the Marketing Approval or Commercialization of the Product. “Clinical Updates” means (a) a summary of any material updates with respect to the Clinical Trials, including the number of patients currently enrolled in each such Clinical Trial, the number of sites conducting each such Clinical Trial, the material progress of each such Clinical Trial, any material modifications to each such Clinical Trial, any adverse events in the Clinical Trials, (b) written plans to start new Clinical Trials, and (c) investigator brochures for the Product. “Closing” means the closing of the sale, transfer, assignment and conveyance of the Revenue Participation Right hereunder. “Closing Date” means the date on which the Closing occurs pursuant to Section 3.1. “CMC” means chemistry, manufacturing and controls with respect to the Product. “CoC Agreement” is defined in Section 6.2(c)(i). “CoC Date” is defined in Section 6.2(c)(i). “CoC Payment” is defined in Section 6.2(c)(i). “Code” means the Internal Revenue Code of 1986, as amended. “Combination Product” means: (a) a single pharmaceutical formulation (whether co-formulated or administered together via the same administration route) containing as its active ingredients both the Product and one or more other therapeutically or prophylactically active pharmaceutical or biologic ingredients (each an “Other Component”), or (b) a combination therapy comprised of the Product and one or more Other Component(s), whether priced and sold in a single package containing such multiple products, packaged separately but sold together for a single price, or sold under separate price points but labeled for use together, in each case, including all dosage forms, formulations, presentations, and package configurations. Drug delivery vehicles, adjuvants and excipients will not be deemed to be “active ingredients”, except in the case where such delivery vehicle, adjuvant or excipient is recognized by the FDA as an active ingredient in accordance with 21 C.F.R. 210.3(b)(7). All references to Products in this Agreement shall be deemed to include Combination Products. “Commercial Updates” means a summary of material updates with respect to the Seller’s

5 BUSINESS.33520951.1 BUSINESS.33707975.1 and its Affiliates’ and the Licensee’s sales and marketing activities and, if material, commercial manufacturing matters with respect to the Product. “Commercialization” means any and all activities directed to the distribution, marketing, detailing, promotion, selling and securing of reimbursement of the Product (including the using, importing, selling and offering for sale of the Product), and shall include post-Marketing Approval studies to the extent required by a Regulatory Authority, post-launch marketing, promoting, detailing, distributing, selling the Product, importing, exporting or transporting the Product for sale, and regulatory compliance with respect to the foregoing. When used as a verb, “Commercialize” shall mean to engage in Commercialization. Except with respect to post- Marketing Approval studies required by a Regulatory Authority, Commercialization shall not include any activities directed to the research or development (including pre-clinical and clinical development) or manufacture of the Product (and “Commercialize” shall be construed accordingly). “Commercially Reasonable Efforts” means the level of efforts and resources (measured as of the time that such efforts and resources are required to be used under this Agreement) that are commonly used by a commercial-stage public biotechnology company of similar size and resources to Seller (provided that, until the date that is two years prior to the date of Loss of Market Exclusivity, such size and resources shall not decrease below the size and resources of the Seller as of the Closing Date), to develop, manufacture or commercialize, as the case may be, a comparable product for a comparable clinical indication (with respect to market size and commercial opportunity) at a similar stage in its development or product life and of a similar market and potential to the Product, in each case taking into account safety and efficacy, the regulatory environment, patent coverage and regulatory exclusivity, competitive market conditions, and profitability and financial return (including Third Party costs and expenses), in each case as prevailing in the Territory and the relevant portion thereof at the time the obligations are carried out. For the avoidance of doubt, “Commercially Reasonable Efforts” shall be determined without regard to any payments owed by the Seller to the Buyer under this Agreement. “Confidential Information” is defined in Section 8.1. “Contract” means an agreement, instrument, arrangement, modification, waiver or understanding. “Disclosing Party” is defined in Section 8.1. “Disclosure Schedule” means the Disclosure Schedule, dated as of the date hereof, delivered to the Buyer by the Seller concurrently with the execution of this Agreement; provided, that the list of Existing Licenses under Schedule 4.1(h)(i) of the Disclosure Schedule and the list of Existing Patent Rights under Schedule 4.1(k)(i) of the Disclosure Schedule may be updated as of the Closing to the extent such updates would not be materially adverse to the Buyer’s interests under this Agreement. “Disqualified Person” means each of the Persons listed on Schedule 1.2 of the Disclosure Schedule.

6 BUSINESS.33520951.1 BUSINESS.33707975.1 “Distributor” means a Third Party that (a) purchases or has the option to purchase the Product in finished form from or at the direction of the Seller or any of its Affiliates, (b) has the right, option or obligation to distribute, market and sell the Product (with or without packaging rights) in one or more regions, (c) does not obtain a license or other rights to any Patent Rights, and (d) does not otherwise make any royalty, milestone, profit share or other similar payment to the Seller or its Affiliate based on such Third Party’s sale of the Product. The term “packaging rights” in this definition will mean the right for the Distributor to package or have packaged Products supplied in unpackaged bulk form into individual ready-for-sale packs. “EMA” means the European Medicines Agency, or any successor agency thereto. “Event of Default” means any of the events set forth below: (a) Non-Payment. The Seller fails to pay any amounts to the Buyer hereunder when and as the same shall become due and payable; provided that the Seller shall have the right to cure such failure within [***] Business Days of the date such amounts were originally due hereunder; (b) Covenants. If the Seller fails to perform or observe any covenant or agreement (not specified in subsection (a) above) contained in this Agreement on its part to be performed or observed, and, (i) in the case of any failure that is capable of cure, such failure continues unremedied for a period of [***] or more days, in all cases, following the date that is the earlier of (A) the date on which the Seller shall have received written notice thereof from the Buyer and (B) the date on which the Seller should have been aware of such failure; and (ii) such failure (without giving effect to any qualifications as to “materiality” “Material Adverse Effect” or any words of similar meaning) would reasonably be expected to have a Material Adverse Effect; (c) Representations and Warranties. If any representation or warranty made or deemed made by or on behalf of the Seller in or in connection with this Agreement or any amendment or modification hereof, including in any report, certificate, financial statement or other document furnished pursuant thereto, shall: (i)(A) prove to have been incorrect when made or deemed made to the extent that such representation or warranty contains any materiality or Material Adverse Effect qualifier; or (B) prove to have been incorrect in any material respect when made or deemed made to the extent that such representation or warranty does not otherwise contain any materiality or Material Adverse Effect qualifier; and (ii) such inaccuracy (without giving effect to any qualifications as to “materiality” “Material Adverse Effect” or any words of similar meaning) could reasonably be expected to have a Material Adverse Effect; (d) Bankruptcy Event. (i) the Seller or any of its Significant Subsidiaries shall commence a voluntary case or other proceeding seeking liquidation, reorganization or other relief with respect to the Seller, any Significant Subsidiaries or their respective debts under any bankruptcy, insolvency, examinership or other similar law now or hereafter in effect or seeking the appointment of a trustee,

7 BUSINESS.33520951.1 BUSINESS.33707975.1 receiver, examiner, liquidator, custodian or other similar official of the Seller or any Significant Subsidiary or any substantial part of its property, or shall consent to any such relief or to the appointment of or taking possession by any such official in an involuntary case or other proceeding commenced against it, or shall make a general assignment for the benefit of creditors, or shall fail generally to pay its debts as they become due; or (ii) an involuntary case or other proceeding shall be commenced against the Seller or any Significant Subsidiary seeking liquidation, reorganization or other relief with respect to the Seller or any Significant Subsidiary or its debts under any bankruptcy, insolvency, examinership or other similar law now or hereafter in effect or seeking the appointment of a trustee, receiver, examiner, liquidator, custodian or other similar official of the Seller or any Significant Subsidiary or any substantial part of its property, and such involuntary case or other proceeding shall remain undismissed and unstayed for a period of [***] calendar days; or (e) Indebtedness. Default by the Seller or any of its Subsidiaries with respect to any mortgage, agreement or other instrument under which there may be outstanding, or by which there may be secured or evidenced, any indebtedness for money borrowed in excess of [***] (or its foreign currency equivalent) in the aggregate of the Seller and its Subsidiaries, whether such indebtedness now exists or shall hereafter be created (i) resulting in such indebtedness becoming or being declared due and payable or (ii) constituting a failure to pay the principal of any such debt when due and payable (after the expiration of all applicable grace periods) at its stated maturity, upon required repurchase, upon declaration of acceleration or otherwise. (f) Judgment. A final judgment or judgments for the payment of [***] (or its foreign currency equivalent) or more (excluding from such [***] any amounts to be covered by insurance) in the aggregate rendered against the Seller or any of its Subsidiaries which judgment is not discharged, bonded, paid, waived or stayed within [***] days after (i) the date on which the right to appeal thereof has expired if no such appeal has commenced, or (ii) the date on which all rights to appeal have been extinguished. “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder. “Existing In-License” is defined in Section 4.1(h)(i). “Existing License” is defined in Section 4.1(h)(i). “Existing Out-License” is defined in Section 4.1(h)(i). “Existing Patent Rights” is defined in Section 4.1(k)(i). “FATCA” means sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official

8 BUSINESS.33520951.1 BUSINESS.33707975.1 interpretations thereof, any agreements entered into pursuant to section 1471(b)(1) of the Code and any fiscal or regulatory legislation, rules or practices adopted pursuant to any intergovernmental agreement, treaty or convention among Governmental Authorities and implementing such Sections of the Code. “FD&C Act” means the United States Federal Food, Drug, and Cosmetic Act, 21 U.S.C. § 301 et seq., and all regulations promulgated thereunder. “FDA” means the U.S. Food and Drug Administration, or any successor agency thereto. “FDA Application Integrity Policy” is defined in Section 4.1(g)(ii). “First Commercial Sale” means the first sale by the Seller or any of its Affiliates or Licensees to an end user or prescriber for use, consumption, or resale of the Product in the Territory following receipt of Marketing Approval for the Product in the Territory. Dispositions of the Product in clinical trials or other scientific testing, as free samples, or prior to receipt of such Marketing Approval under named patient use, compassionate use, patient assistance, charitable purposes, or other similar programs or studies shall not be considered a First Commercial Sale to the extent such dispositions are made at or below cost. “GAAP” means generally accepted accounting principles in the United States in effect from time to time. “Governmental Entity” means any: (a) nation, principality, republic, state, commonwealth, province, territory, county, municipality, district or other jurisdiction of any nature; (b) U.S. federal, state, local, municipal, foreign or other government; (c) governmental or quasi-governmental authority of any nature (including any governmental division, subdivision, department, agency, bureau, branch, office, commission, council, board, instrumentality, officer, official, representative, organization, unit, body or other entity and any court, arbitrator or other tribunal); (d) multi-national organization or body; or (e) individual, body or other entity exercising, or entitled to exercise, any executive, legislative, judicial, administrative, regulatory, police, military or taxing authority or power of any nature. “Gross Sales” is defined in the definition of “Net Sales”. “Hard Cap” is defined in the definition of “Cap”. “Improvements” means any improvement, invention or discovery relating to the Product (other than with respect to a new composition of matter), including the formulation, or the method of manufacture of the Product. “In-License” means any license, settlement agreement or other agreement or arrangement between the Seller or any of its Affiliates and any Third Party pursuant to which the Seller or any of its Affiliates obtains a license or a covenant not to sue or similar grant of rights to any Patents or other intellectual property rights of such Third Party that is necessary for or used in the research, development, manufacture, use or Commercialization of the Product. “Indebtedness” of any Person means any indebtedness for borrowed money, any

9 BUSINESS.33520951.1 BUSINESS.33707975.1 obligation evidenced by a note, bond, debenture or similar instrument, or any guarantee of any of the foregoing. “Indemnified Party” is defined in Section 7.2. “Indemnifying Party” is defined in Section 7.2. “Intellectual Property Rights” means any and all of the following: (a) the Patent Rights; and (b) rights in registered and unregistered trademarks, service marks, trade names, trade dress, logos, packaging design, slogans and Internet domain names, and registrations and applications for registration of any of the foregoing, in each case under clauses (a) and (b) in this paragraph, with respect to the Product. “Judgment” means any judgment, order, writ, injunction, citation, award or decree of any nature. “Knowledge of the Seller” means the actual knowledge of the individuals listed on Schedule 1.1 of the Disclosure Schedule, after reasonable due inquiry. “Licensee” means, with respect to the Product, a Third Party to whom the Seller or any Affiliate of the Seller has granted a license or sublicense to Commercialize the Product. For clarity, a Distributor shall not be deemed to be a “Licensee.” “Lien” means any mortgage, lien, pledge, participation interest, charge, adverse claim, security interest, encumbrance or restriction of any kind, including any restriction on use, transfer or exercise of any other attribute of ownership of any kind; provided that in no event shall an operating lease be deemed to constitute a Lien. “Loss” means any and all Judgments, damages, losses, claims, costs, liabilities and expenses, including reasonable fees and out-of-pocket expenses of counsel. “Loss of Market Exclusivity” shall mean the later to occur of: (a) the expiration of the last-to-expire Valid Claim of a Patent Right covering the Product in the Territory; and (b) the expiry of all Regulatory Exclusivity Periods for the Product in the Territory. “Major Stock Exchange” means the NYSE, NASDAQ, Tokyo Stock Exchange, Euronext, or the stock exchanges of Toronto, Frankfurt, or London. “Marketing Approval” means an NDA approved by the FDA or a Marketing Authorization Application approved by the EMA under the centralized European procedure. “Marketing Approval Deadline” means [***]. “Material Adverse Effect” means (a) a material adverse effect on (i) the Product, (ii) any of the Patent Rights, including the Seller’s of any of its Affiliate’s rights in or to such Patent Rights, (iii) any Marketing Approval of the Product in the Territory or the timing thereof, (iv) the legality, validity or enforceability of any provision of this Agreement, (v) the ability of the Seller to perform any of its obligations under this Agreement, (vi) the rights or remedies of the Buyer

10 BUSINESS.33520951.1 BUSINESS.33707975.1 under this Agreement, or (vii) the business of the Seller or its Affiliates or (b) an adverse effect in any material respect on (i) the timing, duration or amount of the Revenue Share Payments, or (ii) the Revenue Participation Right, the Product Collateral, or the Back-Up Security Interest. “NDA” means the New Drug Application submitted to the FDA in the United States in accordance with the FD&C Act with respect to the Product or any analogous application or submission with any Regulatory Authority outside of the United States. “Net Sales” means, with respect to the Product, the gross amount invoiced, billed or otherwise recorded for sales of the Product in the Territory by or on behalf of the Seller, its Affiliates, or any Licensee of the Seller or any of the Seller’s Affiliates (each of the foregoing Persons, for purposes of this definition, shall be considered a “Related Party”) to a Third Party in an arm’s length transaction (“Gross Sales”) less the following amounts, to the extent actually paid, incurred, allowed or accrued in accordance with GAAP consistently applied, and not reimbursed by such Third Party, provided that any given amount may be taken as a permitted deduction only once: (a) normal and customary rebates, chargebacks, quantity, trade and similar discounts, credits and allowances and other price reductions reasonably granted, allowed, incurred or paid in so far as they are applied to sales of the Product; (b) discounts (including cash, quantity, trade, governmental, and similar discounts), coupons, retroactive price reductions, charge back payments and rebates granted to wholesalers, Distributors, pharmacies and other retailers, managed care organizations, group purchasing organizations or other buying groups, pharmacy benefit management companies, health maintenance organizations, or to federal, state, provincial, local and other governments, or to their agencies, and any other providers of health insurance coverage, health care organizations or other health care institutions (including hospitals), health care administrators or patient assistance or other similar programs (including payments made under the new “Medicare Part D Coverage Gap Discount Program” and the “Annual Fee for Branded Pharmaceutical Manufacturers” specific to the Product), in each case, as applied to sales of the Product; (c) credits, adjustments, and allowances, including those granted on account of price adjustments, billing errors, and damage, Product otherwise not in saleable condition, and rejection, return or recall of the Product; (d) reasonable and customary freight and insurance costs incurred with respect to the shipment of the Product to customers, in each case if charged separately and invoiced to the customer; (e) sales, use, value-added, excise, turnover, inventory and other similar Taxes (excluding income or franchise Taxes of any kind), and that portion of annual fees due under Section 9008 of the United States Patient Protection and Affordable Care Act of 2010 (Pub. L. No. 111-48) and any other fee imposed by any equivalent applicable law, in each of the foregoing cases, that Seller allocates to sales of the

11 BUSINESS.33520951.1 BUSINESS.33707975.1 Product in accordance with Seller’s standard policies and procedures consistently applied across its products, as adjusted for rebates and refunds, imposed in connection with the sales of the Product to any Third Party, to the extent such Taxes are not paid by the Third Party; (f) actual copayment waiver amounts uncollected or uncollectible debt amounts with respect to sales of the Product, provided that if the debt is thereafter paid, the corresponding amount shall be added to the Net Sales of the period during which it is paid; (g) reasonable, customary and documented out of pocket amounts directly relating to co-pay programs, bridging programs or other similar patient assistance programs which may be implemented from time to time by the Seller; and (h) amounts previously included in Net Sales of the applicable Product that are adjusted or written-off by a Related Party as uncollectible in accordance with the standard practices of such Related Party for writing off uncollectible amounts consistently applied; provided that if any such written-off amounts are subsequently collected, then such collected amounts will be included in Net Sales in the period in which they are subsequently collected. For clarity, “Net Sales” will not include (i) sales or dispositions for charitable, promotional, pre-clinical, clinical, regulatory, compassionate use, named patient use or indigent or other similar programs, reasonable quantities of Product used as samples, and Product used in the development of the Product, (ii) sales or dispositions between any of the Related Parties (unless a Related Party is the final end-user of the Product), but will include subsequent sales or dispositions of Product to a non-Related Party, or (iii) payment obligations under any In- Licenses. Net Sales for any Combination Product shall be calculated by multiplying actual Net Sales of such Combination Product by the fraction A/(A+B) where “A” is the weighted average invoice price of the Product contained in such Combination Product when sold separately during the applicable accounting period in which the sales of the Combination Product were made, and “B” is the combined weighted average invoice prices of all of the Other Components contained in such Combination Product sold separately during such same accounting period. If A or B cannot be determined because invoice prices for the Product or the Other Component(s) are not available separately, the Seller and the Buyer shall determine Net Sales for the Product by mutual agreement based on the relative contribution of the Product and each such Other Component in such Combination Product in accordance with the above formula. “Orange Book” means the FDA publication “Approved Drug Products with Therapeutic Equivalence Evaluations,” as may be amended from time to time. “Orange Book Patent” means the Patents listed in the Orange Book by Seller, its Affiliates or Licensees in connection with the Product. “Other Component” is defined in the definition of “Combination Products”.

12 BUSINESS.33520951.1 BUSINESS.33707975.1 “Out-License” means each license or other agreement between the Seller or any of its Affiliates and any Third Party (other than Distributors) pursuant to which the Seller or any of its Affiliates grants a license, sublicense, or other rights to practice any Patents or other intellectual property rights to research, develop, manufacture, use, or Commercialize the Product. “Out-License Date” is defined in Section 6.7(a). “Patent Rights” means any and all Patents, as well as any Patents covering any Improvements, owned or in-licensed by the Seller or any of its Affiliates or under which the Seller or any of its Affiliates is or may become empowered to grant licenses necessary for or used in the research, development, manufacture, use, or Commercialization of the Product, including the Patents listed on Schedule 4.1(k)(i). “Patent Rights Updates” means an updated list of the Patent Rights, including any new Patents issued or filed, amended or supplemented, or any abandonments or other termination of prosecution with respect to any of the Patent Rights, and any other material information or developments with respect to the Patent Rights. “Patents” means any and all patents and patent applications existing as of the date of this Agreement and all patent applications filed hereafter, including any continuation, continuation- in-part, division, provisional or any substitute applications, any patent issued with respect to any of the foregoing patent applications, any certificate, reissue, reexamination, renewal or patent term extension or adjustment (including any supplementary protection certificate) of any such patent or other governmental actions which extend any of the subject matter of a patent, and any substitution patent, confirmation patent or registration patent or patent of addition based on any such patent, and all foreign counterparts of any of the foregoing. “Permit” is defined in Section 4.1(g)(viii). “Permitted Indebtedness” means: (a) true sales of royalties or revenue interests (in each instance including via a monetization) entered into after [***] that contain no financial covenants or other provisions typically found in loan agreements, and in connection with such true sale Seller or its Affiliates do not grant any Lien on any assets of Seller or its Affiliates, other than a back-up security interest to perfect the true sale; and (b) subject to the prior written consent of the Buyer, secured Indebtedness, so long as (x) the holders of such secured Indebtedness or any agent, representative or trustee acting on behalf of such holders have entered into an intercreditor agreement with the Buyer in form and substance consistent with current industry standards and reasonably satisfactory to the Buyer and (y) the lien supporting such secured Indebtedness does not extend to the Revenue Participation Right; provided, that the principal amount of any secured Indebtedness incurred pursuant to this clause (ii) (together with the aggregate outstanding principal amount of all Indebtedness previously incurred by the Seller, including with respect to the refinancing of the Seller’s existing Indebtedness) does not at the time of incurring such Indebtedness

13 BUSINESS.33520951.1 BUSINESS.33707975.1 exceed (A) [***], (B) after the Marketing Approval, $[***] or (C) so long as the Seller has (I) a market capitalization greater [***] measured as of the time such secured Indebtedness is incurred, and (II) Net Sales in excess of [***]) for the trailing twelve-month period ending the last full month prior to the incurrence of such secured Indebtedness, then an amount equal to [***] of the Seller’s market capitalization, measured as of the time such secured Indebtedness is incurred. “Permitted License” is defined in Section 6.7(a). “Permitted Liens” means any lien granted in connection with Permitted Indebtedness. “Person” means any individual, firm, corporation, company, partnership, limited liability company, trust, joint venture, association, estate, trust, Governmental Entity or other entity, enterprise, association or organization. “Prime Rate” means the prime rate published by The Wall Street Journal, from time to time, as the prime rate. “Product” means all current and future pharmaceutical products developed or to be developed by the Seller or any of its Affiliates, for the treatment of type I allergic reactions, including anaphylaxis, containing or comprising individually and collectively, (a) Anaphylm; (b) [***], and (c) [***]. “Product Collateral” means the Seller’s or any of its Affiliate’s rights, title and interests in any and all of the following as they exist in the Territory: (a) the Revenue Share Payments; (b) the Product Rights owned, licensed or otherwise held by the Seller, and (c) any proceeds from either (a) or (b) above, including all accounts receivable and general intangibles of Seller or its Affiliates resulting from the sale, license or other disposition of the Product in the Territory by the Seller, its Affiliates, or its Licensees. “Product Rights” means any and all of the following: (a) Intellectual Property Rights, (b) regulatory filings, submissions and approvals, including Marketing Approvals, with or from any Regulatory Authorities with respect to the Product, (c) In-Licenses and (d) Out-Licenses. “Purchase Price” is defined in Section 2.2. “Qualified Person” means any pharmaceutical company that is a Third Party with (a) a market capitalization greater than [***] for [***] consecutive trading days on a Major Stock Exchange or (b) annual net revenue, in accordance with GAAP, in excess of [***] in each case ((a) and (b)), measured as of the date the definitive agreement for the applicable Change of Control or Permitted License is executed. “Ratchet” is defined in the definition of “Revenue Share Rate”. “Ratchet Cure” is defined in the definition of “Revenue Share Rate”. “Ratchet Threshold” is defined in the definition of “Revenue Share Rate”.

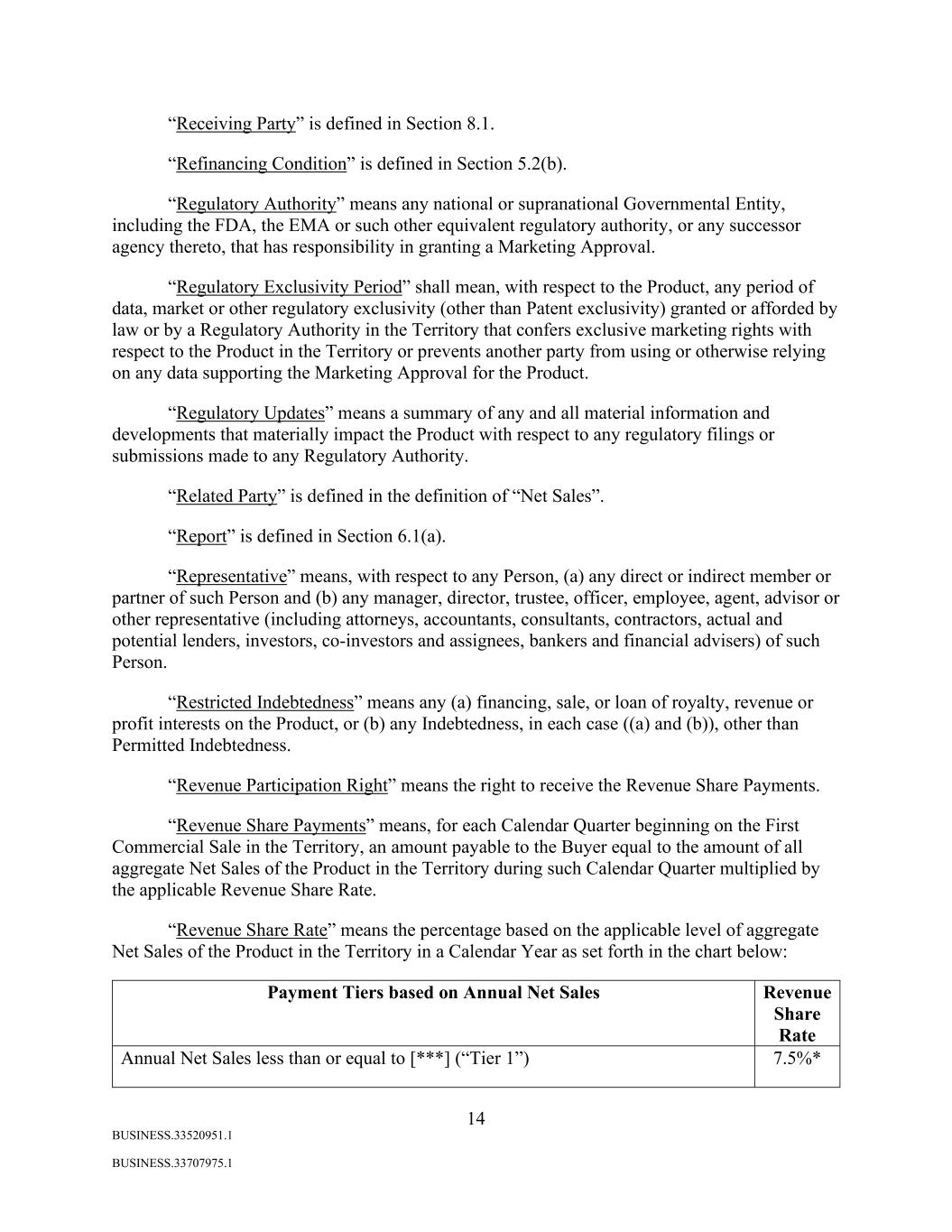

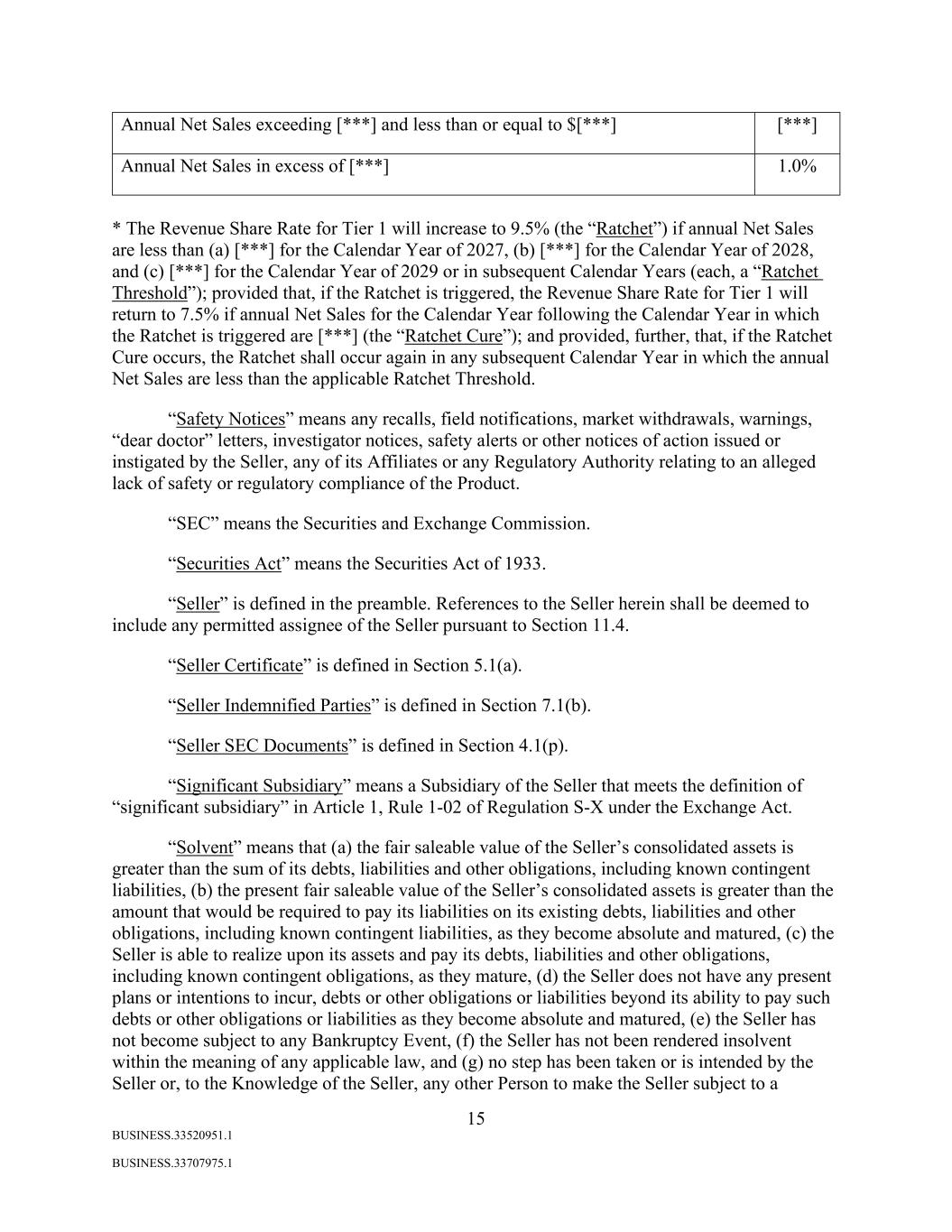

14 BUSINESS.33520951.1 BUSINESS.33707975.1 “Receiving Party” is defined in Section 8.1. “Refinancing Condition” is defined in Section 5.2(b). “Regulatory Authority” means any national or supranational Governmental Entity, including the FDA, the EMA or such other equivalent regulatory authority, or any successor agency thereto, that has responsibility in granting a Marketing Approval. “Regulatory Exclusivity Period” shall mean, with respect to the Product, any period of data, market or other regulatory exclusivity (other than Patent exclusivity) granted or afforded by law or by a Regulatory Authority in the Territory that confers exclusive marketing rights with respect to the Product in the Territory or prevents another party from using or otherwise relying on any data supporting the Marketing Approval for the Product. “Regulatory Updates” means a summary of any and all material information and developments that materially impact the Product with respect to any regulatory filings or submissions made to any Regulatory Authority. “Related Party” is defined in the definition of “Net Sales”. “Report” is defined in Section 6.1(a). “Representative” means, with respect to any Person, (a) any direct or indirect member or partner of such Person and (b) any manager, director, trustee, officer, employee, agent, advisor or other representative (including attorneys, accountants, consultants, contractors, actual and potential lenders, investors, co-investors and assignees, bankers and financial advisers) of such Person. “Restricted Indebtedness” means any (a) financing, sale, or loan of royalty, revenue or profit interests on the Product, or (b) any Indebtedness, in each case ((a) and (b)), other than Permitted Indebtedness. “Revenue Participation Right” means the right to receive the Revenue Share Payments. “Revenue Share Payments” means, for each Calendar Quarter beginning on the First Commercial Sale in the Territory, an amount payable to the Buyer equal to the amount of all aggregate Net Sales of the Product in the Territory during such Calendar Quarter multiplied by the applicable Revenue Share Rate. “Revenue Share Rate” means the percentage based on the applicable level of aggregate Net Sales of the Product in the Territory in a Calendar Year as set forth in the chart below: Payment Tiers based on Annual Net Sales Revenue Share Rate Annual Net Sales less than or equal to [***] (“Tier 1”) 7.5%*

15 BUSINESS.33520951.1 BUSINESS.33707975.1 Annual Net Sales exceeding [***] and less than or equal to $[***] [***] Annual Net Sales in excess of [***] 1.0% * The Revenue Share Rate for Tier 1 will increase to 9.5% (the “Ratchet”) if annual Net Sales are less than (a) [***] for the Calendar Year of 2027, (b) [***] for the Calendar Year of 2028, and (c) [***] for the Calendar Year of 2029 or in subsequent Calendar Years (each, a “Ratchet Threshold”); provided that, if the Ratchet is triggered, the Revenue Share Rate for Tier 1 will return to 7.5% if annual Net Sales for the Calendar Year following the Calendar Year in which the Ratchet is triggered are [***] (the “Ratchet Cure”); and provided, further, that, if the Ratchet Cure occurs, the Ratchet shall occur again in any subsequent Calendar Year in which the annual Net Sales are less than the applicable Ratchet Threshold. “Safety Notices” means any recalls, field notifications, market withdrawals, warnings, “dear doctor” letters, investigator notices, safety alerts or other notices of action issued or instigated by the Seller, any of its Affiliates or any Regulatory Authority relating to an alleged lack of safety or regulatory compliance of the Product. “SEC” means the Securities and Exchange Commission. “Securities Act” means the Securities Act of 1933. “Seller” is defined in the preamble. References to the Seller herein shall be deemed to include any permitted assignee of the Seller pursuant to Section 11.4. “Seller Certificate” is defined in Section 5.1(a). “Seller Indemnified Parties” is defined in Section 7.1(b). “Seller SEC Documents” is defined in Section 4.1(p). “Significant Subsidiary” means a Subsidiary of the Seller that meets the definition of “significant subsidiary” in Article 1, Rule 1-02 of Regulation S-X under the Exchange Act. “Solvent” means that (a) the fair saleable value of the Seller’s consolidated assets is greater than the sum of its debts, liabilities and other obligations, including known contingent liabilities, (b) the present fair saleable value of the Seller’s consolidated assets is greater than the amount that would be required to pay its liabilities on its existing debts, liabilities and other obligations, including known contingent liabilities, as they become absolute and matured, (c) the Seller is able to realize upon its assets and pay its debts, liabilities and other obligations, including known contingent obligations, as they mature, (d) the Seller does not have any present plans or intentions to incur, debts or other obligations or liabilities beyond its ability to pay such debts or other obligations or liabilities as they become absolute and matured, (e) the Seller has not become subject to any Bankruptcy Event, (f) the Seller has not been rendered insolvent within the meaning of any applicable law, and (g) no step has been taken or is intended by the Seller or, to the Knowledge of the Seller, any other Person to make the Seller subject to a

16 BUSINESS.33520951.1 BUSINESS.33707975.1 Bankruptcy Event. For purposes of this definition, the amount of contingent liabilities at any time shall be computed as the amount that, in light of all the facts and circumstances existing at such time, represents the amount that can reasonably be expected to become an actual or matured liability. “Subsidiary” means any and all corporations, partnerships, limited liability companies, joint ventures, associations and other entities controlled (by contract or otherwise) by the Seller directly or indirectly through one or more intermediaries. For purposes hereof, the Seller shall be deemed to control a partnership, limited liability company, association or other business entity if the Seller, directly or indirectly through one or more intermediaries, shall be allocated a majority of partnership, limited liability company, association or other business entity gains or losses or shall be or control the managing director or general partner of such partnership, limited liability company, association or other business entity. “Tax” or “Taxes” means any U.S. federal, state, local or foreign income, gross receipts, license, payroll, employment, excise, severance, occupation, premium, windfall profits, environmental, customs duties, capital stock, franchise, profits, withholding, social security, unemployment, disability, real property, personal property, abandoned property, value added, alternative or add-on minimum, estimated or other tax of any kind whatsoever, including any interest, penalty or addition thereto, whether disputed or not. “Territory” means the United States of America, its fifty (50) states, the District of Columbia, Puerto Rico and any other jurisdiction within the United States of America. “Third Party” means any Person that is not the Seller or the Seller’s Affiliates. “Tier 1” is defined in the definition of “Revenue Share Rate”. “Transaction Documents” means this Agreement, the Bill of Sale, and any other agreement, instrument or document entered into from time to time in connection herewith or therewith, in each case, as amended, supplemented or otherwise modified from time to time. “Transaction Expenses” means the aggregate amount of any and all reasonable and documented out-of-pocket fees and expenses reasonably incurred by or on behalf of, or paid directly by, the Buyer in connection with the transactions contemplated hereby, including diligence and the negotiation, preparation, and execution of the Transaction Documents, and the consummation of the transactions contemplated hereby, subject to a cap of [***] “UCC” means the Uniform Commercial Code as in effect from time to time in the State of New York; provided that, if, with respect to any financing statement or by reason of any provisions of applicable law, the perfection or the effect of perfection or non-perfection of the back-up security interest or any portion thereof granted pursuant to Section 2.1(b) is governed by the Uniform Commercial Code as in effect in a jurisdiction of the United States other than the State of New York, then “UCC” means the Uniform Commercial Code as in effect from time to time in such other jurisdiction for purposes of the provisions of this Agreement and any financing statement relating to such perfection or effect of perfection or non-perfection.

17 BUSINESS.33520951.1 BUSINESS.33707975.1 “U.S.-Ireland Treaty” is defined in Section 6.13(a). “U.S. Marketing Approval” is defined in Section 5.2(a). “Valid Claim” shall mean: (a) any claim of an issued and unexpired Patent included within the Patent Rights, that shall not have been withdrawn, lapsed, abandoned, revoked, canceled or disclaimed, or held invalid or unenforceable by a court, Governmental Entity, national or regional patent office or other appropriate body that has competent jurisdiction in a decision being final and unappealable or unappealed within the time allowed for appeal; and (b) a claim of a pending Patent application included within the Patent Rights that is filed and being prosecuted in good faith and that has not been finally abandoned or finally rejected. Section 1.2 Certain Interpretations. Except where expressly stated otherwise in this Agreement, the following rules of interpretation apply to this Agreement: (a) unless otherwise defined, all terms that are defined in the UCC shall have the meanings stated in the UCC; (b) words of the masculine, feminine or neuter gender shall mean and include the correlative words of other genders; (c) “either” and “or” are not exclusive and “include,” “includes” and “including” are not limiting and shall be deemed to be followed by the words “without limitation;” (d) “extent” in the phrase “to the extent” means the degree to which a subject or other thing extends, and such phrase does not mean simply “if;” (e) “hereof,” “hereto,” “herein” and “hereunder” and words of similar import when used in this Agreement refer to this Agreement as a whole and not to any particular provision of this Agreement; (f) references to a Person are also to its permitted successors and assigns (subject to any restrictions on assignment, transfer or delegation set forth herein), and any reference to a Person in a particular capacity excludes such Person in other capacities; (g) the word “will” shall be construed to have the same meaning and effect as the word “shall”; (h) definitions are applicable to the singular as well as the plural forms of such terms; (i) unless otherwise indicated, references to an “Article”, “Section” or “Exhibit” refer to an Article or Section of, or an Exhibit to, this Agreement, and references to a “Schedule” refer to the corresponding part of the Disclosure Schedule; (j) in the computation of a period of time from a specified date to a later specified date, the word “from” means “from and including”;

18 BUSINESS.33520951.1 BUSINESS.33707975.1 (k) references to “$” or otherwise to dollar amounts refer to the lawful currency of the United States; (l) where any payment is to be made, any funds are to be applied or any calculation is to be made under this Agreement on a day that is not a Business Day, unless this Agreement otherwise provides, such payment shall be made, such funds shall be applied and such calculation shall be made on the succeeding Business Day, and payments shall be adjusted accordingly; (m) provisions referring to matters that would or could have, or would or could reasonably be expected to have, or similar phrases, shall be deemed to have such result or expectation with or without the giving of notice or the passage of time, or both; (n) for covenants that are to be undertaken “reasonably,” such actions (or inactions) shall take into account Buyer’s and Seller’s relative economic interests in the matter and the relative economic impact of the applicable action (or inaction) on such interests; (o) references to this Agreement include the Bill of Sale, the Disclosure Schedule; and (p) references to a law include any amendment or modification to such law and any rules and regulations issued thereunder, whether such amendment or modification is made, or issuance of such rules and regulations occurs, before or after the date of this Agreement. ARTICLE 2 PURCHASE, SALE AND ASSIGNMENT OF THE REVENUE PARTICIPATION RIGHT Section 2.1 Purchase, Sale and Assignment. (a) At the Closing and upon the terms and subject to the conditions of this Agreement, the Seller shall sell, transfer, assign and convey to the Buyer, without recourse (except as expressly provided herein), and the Buyer shall purchase, acquire and accept from the Seller, the Revenue Participation Right, free and clear of all Liens. Immediately upon the sale to the Buyer by the Seller of the Revenue Participation Right pursuant to this Section 2.1(a), all of the Seller’s right, title and interest in and to the Revenue Participation Right shall terminate, and all such right, title and interest shall vest in the Buyer free and clear of all Liens. (b) It is the intention of the parties hereto that the transfer of the Revenue Participation Right as provided in Section 2.1(a) be, and be construed as, a true sale and a true, complete, absolute and irrevocable transfer, assignment and conveyance, without recourse, of all of the Seller’s right, title and interest in and to the Revenue Participation Right from the Seller to the Buyer. Neither the Seller nor the Buyer intends the transactions contemplated by this Agreement to be, or for any purpose characterized as, a loan from the Buyer to the Seller or a pledge, a security interest, a financing transaction or a borrowing. Each of the Seller and the Buyer agree to treat the transfer of the Revenue Participation Right for all purposes (including

19 BUSINESS.33520951.1 BUSINESS.33707975.1 tax and financial accounting purposes) as a sale on all relevant books, records, tax returns, financial statements and other applicable documents. It is the intention of the parties hereto that the beneficial interest in and title to the Revenue Participation Right and any “proceeds” (as such term is defined in the UCC) thereof shall not be part of the Seller’s estate in the event of the filing of a petition by or against the Seller under any Bankruptcy Laws. The Seller hereby waives, to the maximum extent permitted by applicable law, any right to contest or otherwise assert that this Agreement does not constitute a true, complete, absolute and irrevocable sale, transfer, assignment and conveyance by the Seller to the Buyer of all of the Seller’s right, title and interest in and to the Revenue Participation Right under applicable law, which waiver shall, to the maximum extent permitted by applicable law, be enforceable against the Seller in any bankruptcy or insolvency proceeding relating to the Seller. Accordingly, each of the Seller and the Buyer shall treat the sale, transfer, assignment and conveyance of the Revenue Participation Right as a sale of “accounts” or “payment intangibles” (as appropriate) in accordance with the UCC, and the Seller hereby authorizes the Buyer to file financing statements (and continuation statements with respect to such financing statements when applicable) naming the Seller as the debtor/seller and the Buyer as the secured party/buyer in respect to the Revenue Participation Right. In the event that, notwithstanding the intent of the parties hereto, the sale, transfer, assignment and conveyance contemplated hereby is hereafter held not to be a sale, (i) the Seller hereby (A) grants to the Buyer, as security for all of the Seller’s obligations hereunder (including the payment of the Revenue Share Payments), a first priority security interest in and to all right, title and interest in, to and under the Revenue Participation Right, the Revenue Share Payments, the Product Collateral, and any “proceeds” (as defined in the UCC) thereof, (B) agrees that this Agreement shall constitute a security agreement under applicable law, and (C) that this Agreement shall be deemed to be a “security agreement” within the meaning of Article 9 of the UCC and the Seller hereby grants to the Buyer a “security interest” within the meaning of Article 9 of the UCC in all of the Seller’s right, title and interest in, to and under the Revenue Participation Right, the Revenue Share Payments, the Product Collateral, and any “proceeds” (as defined in the UCC), now existing and hereafter created, to secure a loan in an amount equal to the Purchase Price and each of the Seller’s other payment obligations under this Agreement and (ii) each of the Seller and the Buyer hereby represents and warrants as to itself only that each remittance of any amounts with respect to the Revenue Participation Right to the Buyer under this Agreement, will have been in payment of a debt incurred by the Seller in the ordinary course of business or financial affairs of the Seller and the Buyer (collectively, the “Back-Up Security Interest”). The Seller authorizes the Buyer, from and after the Closing, to file such security filings and financing statements (and continuation statements with respect to such financing statements when applicable) in such manner and such jurisdictions as are necessary or appropriate to perfect the Back-Up Security Interest. Section 2.2 Purchase Price. At the Closing and upon the terms and subject to the conditions of this Agreement, the purchase price to be paid as consideration to the Seller for the sale, transfer, assignment and conveyance of the Revenue Participation Right to the Buyer is Seventy-Five Million Dollars ($75,000,000) in cash (the “Purchase Price”) less any Transaction Expenses that have not been reimbursed to the Buyer hereunder prior to the Closing. Section 2.3 No Assumed Obligations; Excluded Assets. Notwithstanding any provision in this Agreement to the contrary, the Buyer is only agreeing, on the terms and

20 BUSINESS.33520951.1 BUSINESS.33707975.1 conditions set forth in this Agreement, to purchase, acquire and accept the Revenue Participation Right and is not assuming any liability or obligation of the Seller or any of its Affiliates of whatever nature, whether presently in existence or arising or asserted hereafter. Except as specifically set forth herein in respect of the Revenue Participation Right purchased, acquired and accepted hereunder, the Buyer does not, by such purchase, acquisition and acceptance, acquire any other assets of the Seller or its Affiliates. ARTICLE 3 CLOSING Section 3.1 Closing. The Closing shall take place remotely via the exchange of documents and signatures on the [***] Business Day, or such period as mutually agreed upon in writing by the parties hereto, after the date on which the conditions set forth in ARTICLE 5 are satisfied or waived by both parties in writing. Each of the Buyer and the Seller will confirm in writing that the conditions set forth in ARTICLE 5 are satisfied or waived, other than the payment of Purchase Price, no later than [***] Business Days after the date on which such conditions are satisfied or waived by both parties in writing. Section 3.2 Payment of Purchase Price. At the Closing, the Buyer shall deliver (or cause to be delivered) payment of the Purchase Price to the Seller by electronic funds transfer or wire transfer of immediately available funds to one or more accounts specified by the Seller. Section 3.3 Bill of Sale. At the Closing, upon confirmation of the receipt of the Purchase Price, the Seller shall deliver to the Buyer a duly executed bill of sale evidencing the sale, transfer, assignment and conveyance of the Revenue Participation Right in substantially the form attached hereto as Exhibit B (the “Bill of Sale”). ARTICLE 4 REPRESENTATIONS AND WARRANTIES Section 4.1 Seller’s Representations and Warranties. Except as set forth on the Disclosure Schedule attached hereto (provided, the list of Existing Licenses under Schedule 4.1(h)(i) of the Disclosure Schedule and the list of Existing Patent Rights under Schedule 4.1(k)(i) of the Disclosure Schedule may be updated as of the Closing to the extent such updates would not have a material adverse effect on the Product, any Product Rights or the Revenue Participation Right), the Seller represents and warrants to the Buyer that as of the date hereof and as of the Closing Date: (a) Existence; Good Standing. The Seller is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Delaware. The Seller is duly licensed or qualified to do business and is in corporate good standing in each jurisdiction in which the nature of the business conducted by it or the character or location of the properties and assets owned, leased or operated by it makes such licensing or qualification necessary, except where the failure to be so licensed or qualified and in corporate good standing has not and would

21 BUSINESS.33520951.1 BUSINESS.33707975.1 not reasonably be expected to have, either individually or in the aggregate, a Material Adverse Effect. (b) Authorization. The Seller has all requisite corporate power and authority to execute, deliver and perform its obligations under this Agreement. The execution, delivery and performance of this Agreement, and the consummation of the transactions contemplated hereby, have been duly authorized by all necessary corporate action on the part of the Seller. (c) Enforceability. This Agreement has been duly executed and delivered by an authorized officer of the Seller and constitutes the valid and binding obligation of the Seller, enforceable against the Seller in accordance with its terms, except as may be limited by applicable Bankruptcy Laws or by general principles of equity (whether considered in a proceeding in equity or at law). (d) No Conflicts. The execution, delivery and performance by the Seller of this Agreement and the consummation of the transactions contemplated hereby and thereby do not and will not (i) contravene or conflict with the certificate of incorporation or bylaws of the Seller, (ii) contravene or conflict with or constitute a material default under any law binding upon or applicable to the Seller or the Revenue Participation Right or (iii) contravene or conflict with or constitute a material default under any material Contract or Judgment binding upon or applicable to the Seller or the Revenue Participation Right. (e) Consents. Except for the UCC financing statements contemplated by Section 2.1(b), or any filings required by U.S. federal securities laws or stock exchange rules, no consent, approval, license, order, authorization, registration, declaration or filing with or of any Governmental Entity or other Person is required to be done or obtained by the Seller in connection with (i) the execution and delivery by the Seller of this Agreement, (ii) the performance by the Seller of its obligations under this Agreement or (iii) the consummation by the Seller of any of the transactions contemplated by this Agreement. (f) No Litigation. Other than as disclosed on the Seller’s Form 10-Q or Form 10-K, as applicable, either the Seller nor any of its Subsidiaries is a party to, and has not received any written notice of, any action, suit, investigation or proceeding pending before any Governmental Entity and, to the Knowledge of the Seller, no such action, suit, investigation or proceeding has been threatened against the Seller, that, individually or in the aggregate, has had or would, if determined adversely, reasonably be expected to have a Material Adverse Effect. (g) Compliance. (i) All applications, submissions, information and data related to the Product submitted or utilized as the basis for any request to any Regulatory Authority by or on behalf of the Seller were true and correct in all material respects as of the date of such submission or request, and, to the Knowledge of the Seller any material updates, changes, corrections or modification to such applications, submissions, information or data required under applicable laws or regulations have been submitted to the necessary Regulatory Authorities.

22 BUSINESS.33520951.1 BUSINESS.33707975.1 (ii) Neither the Seller nor any of its Subsidiaries has committed any act, made any statement or failed to make any statement that would reasonably be expected to provide a basis for the FDA or, to the extent such activities outside the Territory would reasonably have a material adverse effect on any Product or any Product Rights in the Territory, the EMA, to invoke its policy with respect to “Fraud, Untrue Statements of Material Facts, Bribery, and Illegal Gratuities”, 56 Fed. Reg. 46191 (September 10, 1991) (the “FDA Application Integrity Policy”) and any amendments thereto, or any similar policies by FDA or any other Regulatory Authority, set forth in any applicable laws or regulations. Neither the Seller nor, to the Knowledge of the Seller, any of its officers, employees, contractors or agents is the subject of any pending or, to the Knowledge of the Seller, threatened investigation by the FDA or, to the extent such activities would reasonably have a material adverse effect on any Product or any Product Rights in the Territory, any other Regulatory Authority that would reasonably result in the invocation of the FDA Application Integrity Policy or any similar policy by any Regulatory Authority. (iii) The Seller has provided to the Buyer prior to the date hereof in a data room available to the Buyer or delivered directly (including via email) to the Buyer true and correct copies or summaries of all material written communications sent or received by the Seller and any of its Affiliates to or from any Regulatory Authorities that (A) relate to the Product since [***], or (B) would indicate that such Regulatory Authority (A) is likely to reject, condition, or delay any application for Marketing Approval, or (B) is likely to pursue any material compliance actions against the Seller. (iv) As of (A) the date hereof, Anaphylm has not been the subject of a prior Marketing Approval in the Territory, other than with respect to the U.S. Marketing Approval if and when approved by the FDA, and, (B) the Closing Date, Anaphylm has not been the subject of a prior Marketing Approval in the Territory, other than the U.S. Marketing Approval. (v) None of the Seller, any of its Subsidiaries and, to the Knowledge of the Seller, any Third Party manufacturer of the Product, has received from the FDA a “Warning Letter”, Form FDA-483, “Untitled Letter,” or similar material written correspondence or, since [***], received from the FDA any notice alleging violations of applicable laws and regulations enforced by the FDA, or, to the extent such correspondence or notice would reasonably have a material adverse effect on the Product or any Product Rights in the Territory, any comparable material written correspondence from any other Regulatory Authority with regard to the Product or the manufacture, processing, packaging or holding thereof, the subject of which communication is unresolved and, if determined adversely to the Seller or such Subsidiary, would, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect. (vi) Since [***], (A) there have been no Safety Notices, (B) to the Knowledge of the Seller, there are no unresolved material product complaints