Please wait

SCHEDULE

14A

(RULE

14A-101)

SCHEDULE 14A

INFORMATION

PROXY STATEMENT

PURSUANT TO SECTION 14(A) OF

THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the

Registrant ☒

Filed by a party

other than the Registrant ☐

Check the

appropriate box:

☐ Preliminary

Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by

Rule14a-6(e)(2))

☒ Definitive

Proxy Statement

☐ Definitive

Additional Materials

☐ Soliciting

Material under Rule 14a-12

SCANDIUM

INTERNATIONAL MINING CORP.

(Name of

Registrant as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing

Fee (Check the appropriate box):

☒ No fee

required

☐ Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11

(1)

Title of each class

of securities to which transaction applies:

N/A

(2)

Aggregate number of

securities to which transaction applies:

N/A

(3)

Per unit price or

other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was determined):

N/A

(4)

Proposed maximum

aggregate value of transaction:

N/A

N/A

☐ Fee paid

previously with preliminary materials.

☐ Check box

if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its

filing.

(1)

Amount Previously

Paid:

N/A

(2)

Form, Schedule or

Registration Statement No.:

N/A

N/A

N/A

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TAKE NOTICE that

the annual general meeting of shareholders (the “Meeting”) of Scandium

International Mining Corp. (the “Company”) will be held at Suite

1200 – 750 West Pender Street, Vancouver, British Columbia,

V6C 2T8 on Thursday, June 4, 2020

at 10:00 a.m. (Pacific Standard Time) for the following

purposes:

1.

to receive the

audited financial statements of the Company for its fiscal year

ended December 31, 2019 and the report of the auditors

thereon;

2.

to fix the number

of directors at eight (8);

3.

to elect directors

of the Company for the ensuing year;

4.

to re-appoint

Davidson & Company LLP, Chartered Accountants, as auditors of

the Company for the ensuing year, and to authorize the directors to

fix the auditors’ remuneration; and

5.

to transact any

other business which may properly come before the Meeting, or any

adjournment thereof.

The Board of

Directors has fixed April 24, 2020 as the record date for

determining shareholders entitled to receive notice of, and to vote

at, the Meeting or any adjournment or postponement thereof. Only

shareholders of record at the close of business on that date will

be entitled to notice of and to vote at the Meeting.

All shareholders

are invited to attend the Meeting in person, but even if you expect

to be present at the Meeting, you are requested to mark, sign, date

and return the enclosed proxy card in accordance with the

instructions set out in the notes to the proxy and any accompanying

information from your intermediary as promptly as possible to

ensure your representation. All proxies must be received by our

transfer agent by no later than 48 hours prior to the time of the

Meeting in order to be counted.

DATED at Vancouver,

British Columbia, this ______ of April,

2020.

ON BEHALF OF THE

BOARD OF DIRECTORS

“George

Putnam”

PRESIDENT &

CEO

PROXY STATEMENT AND INFORMATION CIRCULAR

AS AT APRIL 24, 2020

ANNUAL GENERAL

MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE

4, 2020

In this Proxy Statement and Information Circular, all references to

“$” are references to United States dollars and all

references to “C$” are references to Canadian dollars.

As at April 24, 2020, one Canadian dollar was equal to approximately $0.71 in U.S.

Currency.

GENERAL

The enclosed proxy

is solicited by the Board of Directors (the “Board”) of Scandium International

Mining Corp., a British Columbia corporation (the

“Company” or

“SCY”), for use

at the Annual General Meeting of Shareholders (the

“Meeting”) of

SCY to be held at 10:00 a.m. (Pacific Standard Time) on Thursday,

June 4, 2020, at the offices of Morton Law LLP at Suite 1200 - 750

West Pender Street, Vancouver, British Columbia, V6C 2T8, and at

any adjournment or postponement thereof.

This Proxy

Statement and the accompanying proxy card are being mailed to our

shareholders on or about May 7, 2020.

The cost of

solicitation will be paid by the Company. The solicitation will be

made primarily by mail. Proxies may also be solicited personally or

by telephone by certain of the Company’s directors, officers

and regular employees, who will not receive additional

compensation, therefore. In addition, the Company will reimburse

brokerage firms, custodians, nominees and fiduciaries for their

expenses in forwarding solicitation materials to beneficial

owners.

Our administrative

offices are located at 1430 Greg Street, Suite 501, Sparks, Nevada,

89431.

APPOINTMENT

OF PROXYHOLDER

The persons named

as proxyholder in the accompanying form of proxy were designated by

the management of the Company (“Management Proxyholder”).

A shareholder desiring to appoint

some other person (“Alternate Proxyholder”) to

represent him at the Meeting may do so by inserting such other

person’s name in the space indicated or by completing another

proper form of proxy. A person appointed as

proxyholder need not be a shareholder of the Company. All completed

proxy forms must be deposited with Computershare Trust Company of

Canada (“Computershare”) not less than

forty-eight (48) hours, excluding Saturdays, Sundays, and holidays,

before the time of the Meeting or any adjournment of it unless the

chairman of the Meeting elects to exercise his discretion to accept

proxies received subsequently.

EXERCISE

OF DISCRETION BY PROXYHOLDER

The proxyholder

will vote for or against or withhold from voting the shares, as

directed by a shareholder on the proxy, on any ballot that may be

called for. In the absence of any

such direction, the Management Proxyholder will vote in favour of

matters described in the proxy. In the absence of any direction as

to how to vote the shares, an Alternate Proxyholder has discretion

to vote them as he or she chooses.

The enclosed form of proxy confers

discretionary authority upon the proxyholder with respect to amendments or

variations to matters

identified in the attached Notice of Meeting and other matters

which may properly come

before the Meeting. At present, Management of the Company

knows of no such amendments, variations or other

matters.

PROXY

VOTING

Registered

Shareholders

If you are a

registered shareholder, you may wish to vote by proxy whether or

not you attend the Meeting in person. Registered shareholders

electing to submit a proxy may do so by completing the enclosed

form of proxy (the “Proxy”) and returning it to the

Company’s transfer agent, Computershare, in accordance with

the instructions on the Proxy. In all cases you should ensure that

the Proxy is received at least 48 hours (excluding Saturdays,

Sundays and holidays) before the Meeting or the adjournment thereof

at which the Proxy is to be used.

Beneficial

Shareholders

The following

information is of significant importance to shareholders who do not

hold shares in their own name (referred to as “Beneficial Shareholders”).

Beneficial Shareholders should note that the only proxies that can

be recognized and acted upon at the Meeting are those deposited by

registered shareholders (those whose names appear on the records of

the Company as the registered holders of shares).

If shares are

listed in an account statement provided to a shareholder by a

broker, then in almost all cases those shares will not be

registered in the shareholder’s name on the records of the

Company. Such shares will more likely be registered under the names

of the shareholder’s broker or an agent of that broker (both

referred to as intermediaries). In the United States, the vast

majority of such shares are registered under the name of Cede &

Co. as nominee for The Depository Trust Company (which acts as

depositary for many U.S. brokerage firms and custodian banks), and

in Canada, under the name of CDS & Co. (the registration name

for The Canadian Depository for Securities Limited, which acts as

nominee for many Canadian brokerage firms).

Intermediaries are

required to seek voting instructions from Beneficial Shareholders

in advance of shareholders’ meetings. Every intermediary has

its own mailing procedures and provides its own return instructions

to clients.

If you are a Beneficial Shareholder:

You should

carefully follow the instructions of your broker or intermediary in

order to ensure that your shares are voted at the Meeting. The form

of proxy supplied to you by your broker will be similar to the

Proxy provided to registered shareholders by the Company. However,

its purpose is limited to instructing the intermediary on how to

vote on your behalf. Most brokers now delegate responsibility for

obtaining instructions from clients to Broadridge Investor

Communication Services (“Broadridge”) in the United States

and in Canada. Broadridge mails a voting instruction form in lieu

of a Proxy provided by the Company. The voting instruction form

will name the same persons as the Company’s Proxy to

represent you at the Meeting. You have the right to appoint a

person (who need not be a Beneficial Shareholder of the Company),

other than the persons designated in the voting instruction form,

to represent you at the Meeting. To exercise this right, you should

insert the name of the desired representative in the blank space

provided in the voting instruction form. The completed voting

instruction form must then be returned to Broadridge by mail or

facsimile or given to Broadridge by phone or over the internet, in

accordance with Broadridge’s instructions. Broadridge then

tabulates the results of all instructions received and provides

appropriate instructions respecting the voting of shares to be

represented at the Meeting. If you

receive a voting instruction form from Broadridge, you cannot use

it to vote shares directly at the Meeting - the voting instruction

form must be completed and returned to Broadridge, in accordance

with its instructions, well in advance of the Meeting in order to

have the shares voted.

Although as a

Beneficial Shareholder you may not be recognized directly at the

Meeting for the purposes of voting shares registered in the name of

your broker, you, or a person designated by you, may attend at the

Meeting as proxyholder for your broker and vote your shares in that

capacity. If you wish toattend the Meeting and indirectly vote your

shares as proxyholder for your broker, or have a person designated

by you do so, you should enter your own name, or the name of the

person you wish to designate, in the blank space on the voting

instruction form provided to you and return the same to your broker

in accordance with the instructions provided by such broker, well

in advance of the Meeting.

Alternatively, you

can request in writing that your broker send you a legal proxy

which would enable you, or a person designated by you, to attend at

the Meeting and vote your shares.

REVOCATION

OF PROXIES

In addition to

revocation in any other manner permitted by law, a registered

shareholder who has given a proxy may revoke it by:

(a)

executing a Proxy

bearing a later date or by executing a valid notice of revocation,

either of the foregoing to be executed by the registered

shareholder or the registered shareholder’s authorized

attorney in writing, or, if the shareholder is a corporation, under

its corporate seal by an officer or attorney duly authorized, and

by delivering the Proxy bearing a later date to Computershare at

any time up to and including the last business day that precedes

the day of the Meeting or, if the Meeting is adjourned, the last

business day that precedes any reconvening thereof, or to the

chairman of the Meeting on the day of the Meeting or any

reconvening thereof, or in any other manner provided by law;

or

(b)

personally

attending the Meeting and voting the registered shareholders’

shares.

A revocation of a

Proxy will not affect a matter on which a vote is taken before the

revocation.

Only

registered shareholders have the right to revoke a Proxy.

Non-Registered Holders who wish to change their vote must, at least

seven days before the Meeting, arrange for their respective

Intermediaries to revoke the Proxy on their behalf.

VOTING

PROCEDURE

A quorum for the

transaction of business at the Meeting is, subject to the special

rights and restrictions attached to the share of any class or

series of shares, one person who is a shareholder, or who is

otherwise permitted to vote shares of the Company at a meeting of

shareholders pursuant to its articles, present in person or by

proxy. Broker non-votes occur when a person holding shares through

a bank or brokerage account does not provide instructions as to how

his or her shares should be voted, and the broker does not exercise

discretion to vote those shares on a particular matter. Abstentions

and broker non-votes will be included in determining the presence

of a quorum at the Meeting. However, an abstention or broker

non-vote will not have any effect on the outcome for the election

of directors.

Shares for which

proxy cards are properly executed and returned will be voted at the

Meeting in accordance with the directions noted thereon or, in the

absence of directions, will be voted “FOR” fixing the number of

directors at eight (8), “FOR” the election of each of the

nominees to the Board named in this Proxy Statement,

“FOR” the

appointment of Davidson & Company LLP, Chartered Professional

Accountants, as independent auditors of the Company for the fiscal

year ended December 31, 2020 and to authorize the directors to fix

their remuneration. It is not expected that any matters other than

those referred to in this Proxy Statement will be brought before

the Meeting. If, however, other matters are properly presented, the

persons named as proxies will vote in accordance with their

discretion with respect to such matters.

To be effective,

each matter which is submitted to a vote of shareholders, other

than for the election of directors and the approval of auditors,

must be approved by a majority of the votes cast by the

shareholders voting in person or by proxy at the

Meeting.

VOTING

SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On April 24, 2020

(the “Record

Date”), there were 312,482,595 shares of common

stock in the capital of the Company (“Common Stock”) issued and

outstanding, each share carrying the right to one vote. Only

shareholders of record at the close of business on the Record Date

will be entitled to vote in person or by proxy at the Meeting or

any adjournment thereof.

To the knowledge of

the directors and executive officers of the Company, the beneficial

owners or persons exercising control or direction over Company

shares carrying more than 5% of the outstanding voting rights

are:

|

Name

and Address

|

Number

of Shares(1)

|

Nature

of Ownership

|

Approximate

% of Total Issued and Outstanding

|

|

Willem

Duyvesteyn

|

18,362,204(3)

|

Sole voting and

investment control

|

5.88%

|

|

Reno,

Nevada

|

9,518,693(2)(3)

|

Shared voting and

investment control

|

3.05%

|

|

Andrew

Greig

Teneriffe, QLD,

Australia

|

22,665,956(4)

|

Sole voting and

investment control

|

7.25%

|

|

Scandium

Investments LLC

Los Angeles,

California

|

66,268,694(5)(6)(7)

|

Shared voting and

investment control

|

21.21%

|

|

Peter

Evensen

|

66,268,694(5)(6)

|

Shared voting and

investment control

|

21.21%

|

|

Southport,

Connecticut

|

3,461,176(6)

|

Sole voting and

investment control

|

1.11%

|

|

R. Christian

Evensen

La Cañada

Flintridge, California

|

66,268,694(5)(7)

|

Shared voting and

investment control

|

21.21%

|

(1)

The information

relating to the above share ownership was obtained by the Company

from insider reports and beneficial ownership reports on Schedule

13D filed with the SEC or available at www.sedi.ca, or from the

shareholder.

(2)

9,518,693 of these common shares are

registered in the name of Irene Duyvesteyn, and Mr. Duyvesteyn has

voting and investment control over these common

shares.

(3)

This figure does

not include 3,400,000 common shares issuable pursuant to exercise

of stock options.

(4)

This figure does

not include 1,500,000 common shares issuable pursuant to exercise

of stock options.

(5)

Peter Evensen and

R. Christian Evensen hold voting and investment control of the

66,268,694 common shares registered in the name of Scandium

Investments LLC.

(6)

This figure does

not include 1,400,000 common shares issuable to Peter Evensen

pursuant to exercise of stock options.

(7)

This figure does

not include 1,200,000 common shares issuable to R. Christian

Evensen pursuant to exercise of stock options.

INTEREST

OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as disclosed

herein, no Person has any material interest, direct or indirect, by

way of beneficial ownership of securities or otherwise, in matters

to be acted upon at the Meeting other than the election of

directors and the appointment of auditors and as set out herein.

For the purpose of this paragraph, “Person” shall

include each person: (a) who has been a director, senior officer or

insider of the Company at any time since the commencement of the

Company’s last fiscal year; (b) who is a proposed nominee for

election as a director of the Company; or (c) who is an associate

or affiliate of a person included in subparagraphs (a) or

(b).

PROPOSAL

1

ELECTION

OF DIRECTORS

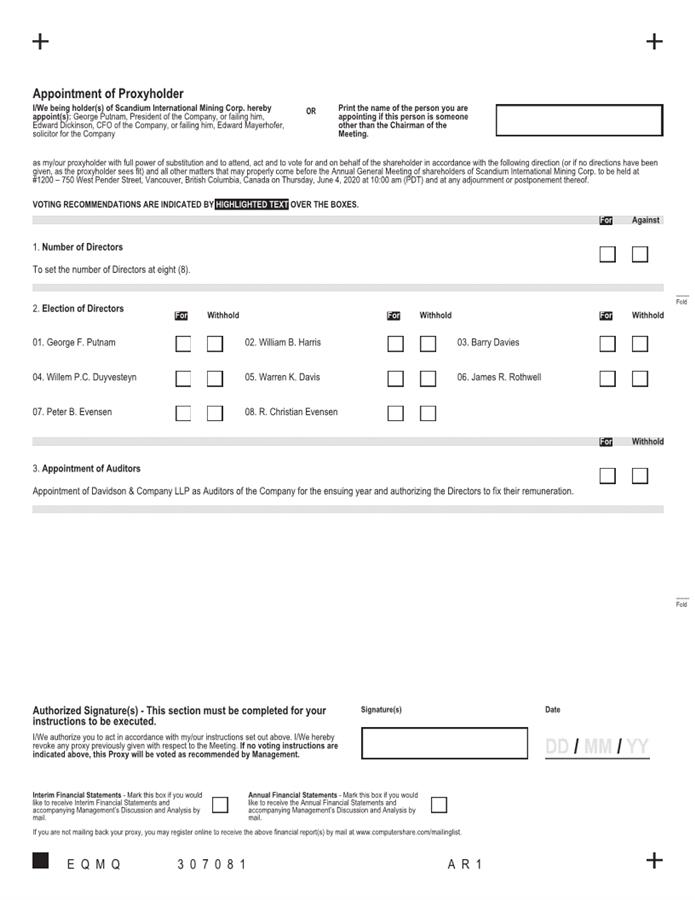

The Board proposes

to fix the number of directors of the Company at eight (8) and that

the following eight nominees be elected as directors at the

Meeting, each of whom will hold office until the expiration of

their term or until his or her successor shall have been duly

appointed or elected and qualified: George Putnam, William Harris,

Barry Davies, Willem Duyvesteyn, Warren Davis, James Rothwell,

Peter Evensen and R. Christian Evensen.

Unless otherwise

instructed, it is the intention of the persons named as proxies on

the accompanying proxy card to vote shares represented by properly

executed proxies for the election of such nominees. Although the

Board anticipates that the eight nominees will be available to

serve as directors of SCY, if any of them should be unwilling or

unable to serve, it is intended that the proxies will be voted for

the election of such substitute nominee or nominees as may be

designated by the Board.

THE

BOARD RECOMMENDS A VOTE “FOR” FIXING THE TOTAL NUMBER OF DIRECTORS

AT EIGHT AND “FOR” THE ELECTION OF EACH OF THE EIGHT

NOMINEES.

As part of its

ongoing review of corporate governance policies, on September 2,

2014, the Board adopted a policy providing that in an uncontested

election of directors, any nominee who receives a greater number of

votes “withheld” than votes “for” will

tender his or her resignation to the Chairman of the Board promptly

following the shareholders’ meeting. The Board will consider

the offer of resignation and will make a decision whether or not to

accept it. In considering whether or not to accept the resignation,

the Board will consider all factors deemed relevant by the members

of the Board. The Board will be expected to accept the resignation

except in situations where the considerations would warrant the

applicable director continuing to serve on the Board. The Board

will make its final decision and announce it in a press release

within 90 days following the shareholders’ meeting. A

director who tenders his or her resignation pursuant to this policy

will not participate in any meeting of the Board at which the

resignation is considered.

The following table

sets out the names of the nominees, their positions and offices in

the Company, principal occupations, the period of time that they

have been directors of the Company, and the number of shares of the

Company which each beneficially owns or over which control or

direction is exercised.

|

Name,

Residence and Present Position with the Company

|

Director

Since

|

#

of Shares Beneficially Owned, Directly or Indirectly, or Over Which

Control or Direction is Exercised (1)

|

Principal

Occupation (1)

|

|

George

F. Putnam

California,

USA

Director, President and Chief Executive Officer

|

May 3,

2010

|

4,775,360(5)

|

President and Chief

Executive Officer of Scandium International Mining

Corp.

|

|

William B. Harris (2)(3)Florida,

USA

Director (Chairman of the Board)

|

June 5,

2007

|

657,778(5)

|

Partner of Solo

Management Group, LLC, an investment management and financial

consulting company.

|

|

Barry

T. Davies

Kowloon, Hong

Kong

Director

|

January 20,

2010

|

7,341,778(5)

|

President of

Rudgear Holdings Ltd., a private investment company, since March

2006.

|

|

Willem P.C. Duyvesteyn (4)

Nevada,

USA

Director, Chief Technology Officer

|

January 20,

2010

|

27,880,897(5)(6)

|

Chief Technology

Officer of Scandium International Mining Corp. and President,

Technology and Resource Development Inc., a company involved in the development and commercialization

of various mineral and energy related processes and

projects.

|

|

Warren K. Davis (2) (3)

California,

USA

Director

|

May 30,

2012

|

2,211,307(5)

|

Consultant to

Energy and Power Industry clients who are developing new projects

with both conventional and advanced technology.

|

|

James R. Rothwell (2)

Washington,

USA

Director

|

July 16,

2014

|

1,645,682(5)

|

Consultant to

mining and metals industry companies.

|

|

Peter B. Evensen (3)

Connecticut,

USA

Director

|

October 10,

2017

|

69,729,870(5)(7)

|

CEO of Evensen

Enterprises LLC, a shipping management company and CEO and Board

Member of General Ore International Corporation, a private shipping

company.

|

|

R.

Christian Evensen

California,

USA

Director

|

October 10,

2017

|

66,268,694(5)(7)

|

Managing Partner of

Flintridge Capital Investments, LLC.

|

(1)

The information as

to principal occupation, business or employment and shares

beneficially owned or controlled is not within the knowledge of the

management of the Company and has been furnished by the respective

nominees. Unless otherwise stated, any nominees named above have

held the principal occupation or employment indicated for at least

five years.

(2)

Member of the Audit

Committee.

(3)

Member of the

Compensation Committee.

(4)

Nominee of Willem

Duyvesteyn and Irene Duyvesteyn. In connection with the acquisition

of The Technology Store, Inc. by the Company, Willem Duyvesteyn and

Irene Duyvesteyn have the right to nominate one director to the

Board.

(5)

These figures do

not include the number of common shares issuable pursuant to

exercise of stock options as follows;8,550,000 shares issuable to

George Putnam, 2,900,000 shares issuable to William Harris,

2,400,000 shares issuable to Barry Davies; 3,400,000 shares

issuable to Willem Duyvesteyn, 1,900,000 shares issuable to Warren

Davis, 2,200,000 shares issuable to James Rothwell, 1,400,000

shares issuable to Peter Evensen and 1,200,000 shares issuable to

R. Christian Evensen.

(6)

9,518,693 of these common shares are

registered in the name of Irene Duyvesteyn, and Mr. Duyvesteyn has

voting and investment control over these common

shares.

(7)

Peter Evensen and

R. Christian Evensen hold voting and investment control of the

66,268,694 common shares registered in the name of Scandium

Investments LLC.

George Putnam has extensive mining

industry experience, having worked for over 20 years for BHP (now

BHP-Billiton) and GE/Utah International. Mr. Putnam also served for

three years as CFO of QGX Ltd., a TSX-listed mineral exploration

and development company. Mr. Putnam holds a BA (Economics) from

Gettysburg College, and an MBA (Finance) from Duke University. The

Board believes that Mr. Putnam’s expertise and experience in

the mining industry is valuable to the Board.

William Harris has more than 35 years of

experience in financial and executive management with public

companies. Mr. Harris is also a board member of EnCore Energy Corp,

Golden Predator Mining Corp, and the former President and CEO of

Hoechst Fibers Worldwide, the global acetate and polyester business

of Hoechst AG. Mr. Harris holds a BA in English from Harvard

College and an MBA in finance from Columbia University Graduate

School of Business. Mr. Harris’ expertise and experience make

him a valuable member of the Board.

Barry Davies is a mining engineer with

more than 35 years' experience in mineral exploration, mine

development, operations and corporate management. During more than

20 years with the BHP Group and predecessor companies he held

senior management positions with responsibility for exploration and

mine development projects in Australia, Southeast Asia and Southern

Africa. Mr Davies is a graduate in mining engineering from the

Camborne School of Mines in the United Kingdom. Mr Davies'

experience and his independence from management make him a valuable

member of the Board.

Willem Duyvesteyn has 40 years’

experience in the mining, mineral and energy industries. Mr.

Duyvesteyn was Vice President and General Manager Minerals

Technology for BHP for more than 10 years. Prior to BHP he served

with AMAX as Director of Laterite Nickel projects. Mr. Duyvesteyn

has an ingenieurs degree in mining engineering and extractive

metallurgy from Delft University of Technology. Mr.

Duyvesteyn’s extensive experience make him a valuable member

of the Board.

Warren Davis has held numerous senior

roles in both minerals and electric power industries, with a focus

on energy project development, project marketing and business

strategy. Mr. Davis currently provides consulting services for

several power plant contractors and electric power technology

clients. His previous positions include roles with Black &

Veatch (15 years), Bechtel Power Corp (three years), and The

General Electric Company (10 years). Mr. Davis worked for Utah

International Inc. (seven years) in the minerals industry,

specifically in exploration, acquisitions and strategy. He was

founder and president of Golden Bear Energy Services, a start-up

energy company, and has worked in numerous entrepreneurial energy

development roles. Mr. Davis holds a BS in Mechanical Engineering

from UC Berkeley and an MBA from Stanford University. Mr.

Davis’ experience and his independence from management make

him a valuable member of the Board.

James Rothwell has held numerous senior

management roles and board positions in Canadian public mining

companies, including Chairman of Shore Gold Inc. and Kensington

Resources Ltd., Board Director for Motapa Diamonds Inc. and

President, CEO and Director of Inca Pacific Resources and Dia Met

Minerals Ltd. Prior to these Canadian company positions, he served

for 27 years with Utah International and BHP in a number of

business roles in the US, Canada, Brazil and Australia. With BHP,

Mr. Rothwell’s operational experience included thermal coal,

iron ore, coking coal, manganese, diamonds, and the leadership of

the BHP Minerals marketing effort worldwide. He has served on

minerals industry associations in Australia, the USA and Canada.

Mr. Rothwell has a BA (Economics) and an MBA (Finance/Accounting)

from Stanford University. Mr. Rothwell’s experience and his

independence from management make him a valuable member of the

Board.

Peter Evensen is a consultant in the

international shipping and offshore industry through Evensen

Enterprises LLC, an entity he established after he retired as

President and Chief Executive Officer of Teekay Corporation in

January 2017 after joining Teekay in 2003 as Senior Vice President,

Treasurer and Chief Financial Officer. Mr. Evensen has over 30

years of experience in banking and shipping finance. Prior to

joining Teekay, Mr. Evensen was Managing Director and Head of

Global Shipping at J.P. Morgan Securities Inc. and worked in other

senior positions for its predecessor firms for over 20 years. His

international industry experience includes positions in Vancouver,

New York, London and Oslo. Mr. Evensen holds a B.A. in Economics

and Political Science and attended the Tuck Advanced Management

Program at Dartmouth. Mr. Evensen’s experience and his

independence from management make him a valuable member of the

Board.

R. Christian Evensen is the founding

partner of Flintridge Capital Investments. He has spent his career

structuring and managing corporate, derivative and real estate

investments and their underlying financing of these investments.

Prior to the formation of Flintridge in 2006, Mr. Evensen was a

founder (in 1990) and Managing Partner of Canyon Capital Advisors

LLC and Canyon Capital Realty Advisors LLC both SEC registered

investment advisors. He was also President of Canyon Partners

Incorporated, a NASD broker-dealer. During the 1980s, Mr. Evensen

was a Senior Vice President and Director of the Senior Debt and

International Markets Groups in the High Yield Bond Department of

Drexel Burnham Lambert. Prior to working for Drexel, Mr. Evensen

was a Vice President of the Currency and Interest Rate Derivatives

Group at Merrill Lynch. Mr. Evensen began his career at The Bank of

New York and First Interstate Bank. Mr. Evensen holds a B.A. in

Economics from Williams College. Mr. Evensen’s experience and

his independence from management make him a valuable member of the

Board.

Executive

Officers

The following sets

forth certain information regarding executive officers of the

Company. Information pertaining to Mr. Putnam and Mr. Duyvesteyn,

each of whom are a director and executive officer of the Company,

may be found in the section entitled

“Directors”.

|

Name

|

Position

with the Company

|

Age

as of the Annual Meeting

|

|

Edward

Dickinson

|

Chief Financial

Officer

|

73

|

|

John

Thompson

|

Vice President,

General Manager - Australia

|

72

|

Edward Dickinson, Chief Financial

Officer, joined the Company in September 2011. Prior to joining the

Company Mr. Dickinson was employed by Altair Nanotechnologies Inc.

from August 1996 to August 2011 where he held several senior

management positions including Chief Financial Officer, Director of

Finance, Corporate Secretary and Senior Director – Program

and Contract management. From 1994 to 1996, Mr. Dickinson was

employed by the Southern California Edison Company as a negotiator

of non-utility power generation contracts. Mr. Dickinson was Vice

President and Director of GeoLectric Power Company during 1993 and

1994, and from 1987 through 1992 was the Director of Finance and

Administration for OESI Power Corporation. Prior to 1987, Mr.

Dickinson served in various financial and program management

positions at the U.S. Department of Energy. Mr. Dickinson, who is a

certified public accountant, obtained a Master’s degree in

Accounting from California State University,

Northridge.

John Thompson, Vice President, General

Manager - Australia, joined the Company in May 2011. Mr.

Thompson’s mining career spans 41 years in senior management

roles with Utah Development Company, BHP (now BHP Billiton),

Newcrest Mining and QGX Ltd., managing and developing mineral

projects in Australia, New Zealand, Mongolia and the United States.

He has held numerous other leadership roles in the mining industry,

including four Mine/General Manager roles in coking coal, gold and

titanium/iron sands operations and a General Manager position at

Newcrest overseeing five operating gold businesses in Australia.

Mr. Thompson has a Bachelor of Science degree in Mining and

Petroleum Engineering from the University of Queensland and is a

Fellow of the Australian Institute of Mining and

Metallurgy.

INVOLVEMENT

IN CERTAIN LEGAL PROCEEDINGS

During the past ten

years, none of the persons currently serving as executive officers

and/or directors of the Company has been the subject matter of any

of the following legal proceedings that are required to be

disclosed pursuant to Item 401(f) of Regulation S-K including: (a)

any bankruptcy petition filed by or against any business of which

such person was a general partner or executive officer either at

the time of the bankruptcy or within two years prior to that time;

(b) any criminal convictions; (c)any order, judgment, or decree

permanently or temporarily enjoining, barring, suspending or

otherwise limiting his involvement in any type of business,

securities or banking activities; (d) any finding by a court, the

SEC or the CFTC to have violated a federal or state securities or

commodities law, any law or regulation respecting financial

institutions or insurance companies, or any law or regulation

prohibiting mail or wire fraud; (e) any sanction or order of any

self-regulatory organization or registered entity or equivalent

exchange, association or entity; or (f) any material proceedings in

which such person is a party adverse to SCY or any of its

subsidiaries or has a material interest adverse to SCY or any of

its subsidiaries. Further, no such legal proceedings are believed

to be contemplated by governmental authorities against any

director, executive officer or affiliate of SCY, any owner of

record or beneficially of more than five percent of the

Company’s Common Stock, or any associate of such director,

executive officer, affiliate of SCY, or security

holder.

SECURITY

OWNERSHIP OF MANAGEMENT

The following table

sets forth certain information regarding the beneficial ownership

of the Company’s Common Stock as of April 24, 2020

by:

(i)

each director of

SCY;

(ii)

each of the Named

Executive Officers of SCY; and

(iii)

all directors and

executive officers as a group.

Except as noted

below, SCY believes that the beneficial owners of the Common Stock

listed below, based on information furnished by such owners, have

sole voting and investment power with respect to such

shares.

|

Name of

Beneficial Owner

|

Shares

Beneficially Owned[1]

|

Percentage of Shares

Beneficially Owned[1]

|

|

George

Putnam

|

4,775,360

|

1.53%

|

|

William

Harris

|

657,778

|

0.21%

|

|

Barry

Davies

|

7,341,778

|

2.35%

|

|

Willem

Duyvesteyn

|

27,880,897(2)

|

8.92%

|

|

Warren

Davis

|

2,211,307

|

0.71%

|

|

James

Rothwell

|

1,645,682

|

0.53%

|

|

Peter

Evensen

|

69,729,870(3)

|

22.31%

|

|

R. Christian

Evensen

|

Nil(3)

|

0.00%

|

|

John

Thompson

|

3,886,200

|

1.24%

|

|

Edward

Dickinson

|

640,708

|

0.21%

|

|

All

officers and directors (11) persons

|

140,735,536

|

38.01%

|

(1)

These amounts

exclude beneficial ownership of securities not currently

outstanding but which are reserved for immediate issuance on

exercise of stock options as follows;8,550,000 shares issuable to

George Putnam, 2,900,000 shares issuable to William Harris,

2,400,000 shares issuable to Barry Davies;3,400,000 shares issuable

to Willem Duyvesteyn, 1,900,000 shares issuable to Warren Davis,

2,200,000 shares issuable to James Rothwell, 1,400,000

issuable to Peter Evensen, 1,200,000 issuable to R. Christian

Evensen, 1,750,000 shares issuable to John Thompson, and 1,800,000

shares issuable to Edward Dickinson.

(2)

9,518,693 of these Common Shares are

registered in the name of Irene Duyvesteyn, and Mr. Duyvesteyn has

voting and investment control over these Common

Shares.

(3)

Peter Evensen and

R. Christian Evensen hold voting and investment control of the

66,268,694 Common Shares registered in the name of Scandium

Investments LLC. For the purposes of this table, these Common

Shares have been allocated to Peter Evensen.

SECTION

16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of

the Securities Exchange Act of 1934, as amended

(“Exchange

Act”), requires SCY’s directors, executive

officers and persons who own more than 10% of a registered class of

SCY’s securities to file with the Securities and Exchange

Commission (“SEC”) initial reports of ownership

and reports of changes in ownership of Common Stock and other

equity securities of SCY. Directors, executive officers and greater

than 10% shareholders are required by SEC regulation to furnish SCY

with copies of all Section 16(a) reports they file.

To SCY’s

knowledge, based solely on a review of Forms 3 and 4, as amended,

furnished to it during its most recent fiscal year, and Form 5, as

amended, furnished to it with respect to such year, SCY believes

that during the year ended December 31, 2019, its directors,

executive officers and greater than 10% shareholders complied with

all Section 16(a) filing requirements of the Exchange

Act.

DIRECTORS

AND EXECUTIVE OFFICERS

The following table

contains information regarding the members and nominees of the

Board and the Executive Officers of SCY as of the Record

Date:

|

Name

|

Age

|

Position

|

Position

Held Since

|

|

George

Putnam

|

66

|

Director,

President, CEO

|

May 3,

2010

|

|

William

Harris

|

73

|

Director

Chairman

|

June 5,

2007

April 2,

2010

|

|

Barry

Davies

|

70

|

Director

|

January 20,

2010

|

|

Willem

Duyvesteyn

|

75

|

Director

CTO

|

January 20,

2010

October 28,

2015

|

|

Warren

Davis

|

75

|

Director

|

May 30,

2012

|

|

James

Rothwell

|

71

|

Director

|

July 16,

2014

|

|

Peter

Evensen

|

61

|

Director

|

October 10,

2017

|

|

R. Christian

Evensen

|

63

|

Director

|

October 10,

2017

|

|

Edward

Dickinson

|

73

|

CFO

|

August

15,2011

|

|

John

Thompson

|

72

|

Vice President

Project Development

|

March 8,

2011

|

All of the officers

identified above serve at the discretion of the Board and have

consented to act as officers of the Company.

RELATIONSHIPS

AMONG DIRECTORS OR EXECUTIVE OFFICERS

Peter Evensen and

R. Christian Evensen are brothers and they both serve as directors

of SCY. Other than as disclosed herein, there are no family

relationships among any of the existing directors or executive

officers of SCY.

COMPENSATION

COMMITTEE

The Company’s

compensation policies and programs are designed to be competitive

with similar mining companies and to recognize and reward executive

performance consistent with the success of the Company’s

business. These policies and programs are intended to attract and

retain capable and experienced people. The role and philosophy of

the compensation committee (“Compensation Committee”) is to

ensure that the Company’s compensation goals and objectives,

as applied to the actual compensation paid to the Company’s

Chief Executive Officer and other executive officers, are aligned

with the Company’s overall business objectives and with

shareholder interests.

In addition to

industry comparables, the Compensation Committee considers a

variety of factors when determining both compensation policies and

programs and individual compensation levels. These factors include

the long-range interests of the Company and its shareholders,

overall financial and operating performance of the Company and the

Compensation Committee’s assessment of each executive’s

individual performance and contribution toward meeting corporate

objectives.

The current members

of the Compensation Committee are Peter Evensen, Warren Davis and

William Harris. Warren Davis and William Harris are both

independent directors. Peter Evensen is relying on a temporary

exemption from the requirement to be an independent member of the

Compensation Committee. The direct or indirect “material

relationship” between Peter Evensen and the Company is based

solely on his shared voting and investment control of over more

than 10% of the Company’s common shares. The Board determined

in its reasonable judgement that (i) Peter Evensen is able to

exercise the impartial judgement necessary for Mr. Evensen to

fulfill his responsibilities as a Compensation Committee member,

and (ii) the appointment of Mr. Evensen is required by the best

interests of the Company and its shareholders of the

Company.

The function of the

Compensation Committee is to assist the Board in fulfilling its

responsibilities relating to the compensation practices of the

executive officers of the Company. The Compensation Committee has

been empowered to review the compensation levels of the executive

officers of the Company and to report thereon to the Board; to

review the strategic objectives of the stock option and other

stock-based compensation plans of the Company and to set stock

based compensation; and to consider any other matters which, in the

Compensation Committee’s judgment, should be taken into

account in reaching the recommendation to the Board concerning the

compensation levels of the Company’s executive

officers.

Report on Executive Compensation

This report on

executive compensation has been authorized by the Compensation

Committee. The Board assumes responsibility for reviewing and

monitoring the long-range compensation strategy for the senior

management of the Company although the Compensation Committee

guides it in this role. The Board determines the type and amount of

compensation for the President and CEO. The Board also reviews the

compensation of the Company’s senior executives. The

Compensation Committee has not considered the implications of the

risks associated with the Company’s compensation policies and

practices.

The Compensation

Committee makes the final determination on compensation for

directors and senior executives of the Company. The Compensation

Committee will take recommendations from the CEO as to what

appropriate levels of compensation should be for senior executives.

The Compensation Committee does not delegate the authority to

determine compensation for directors and senior officers to other

persons.

Philosophy and Objectives

The compensation

program for the senior management of the Company is designed to

ensure that the level and form of compensation achieves certain

objectives, including:

(a)

attracting and

retaining talented, qualified and effective

executives;

(b)

motivating the

short and long-term performance of these executives;

and

(c)

better aligning

their interests with those of the Company’s

shareholders.

In compensating its

senior management, the Company has employed a combination of base

salary and equity participation through its stock option plan. The

Company’s Named Executive Officers or NEOs, as that term is

defined in Form 51-102F6, and directors are not permitted to

purchase financial instruments, including, for greater certainty,

prepaid variable forward contracts, equity swaps, collars or units

of exchange funds, that are designed to hedge or offset a decrease

in market value of equity securities granted as compensation or

held, directly or indirectly, by the NEO or director.

Elements of the Compensation Program

The significant

elements of compensation awarded to the Named Executive Officers

(as defined below) are a cash salary and stock options. The Company

does not presently have a long-term incentive plan for its Named

Executive Officers. There is no policy or target regarding

allocation between cash and non-cash elements of the

Company’s compensation program. The Compensation Committee

reviews annually the total compensation package of each of the

Company’s executives on an individual basis, against the

backdrop of the compensation goals and objectives described above

and makes recommendations to the Board concerning the individual

components of their compensation.

Cash Salary

As a general rule,

the Company seeks to offer its Named Executive Officers a

compensation package that is in line with that offered by other

companies in our industry, and as an immediate means of rewarding

the Named Executive Officers for efforts expended on behalf of the

Company.

Equity Participation

The Company

believes that encouraging its executives and employees to become

shareholders is the best way of aligning their interests with those

of its shareholders. Equity participation is accomplished through

the Company’s stock option plan. Stock options are granted to

senior executives taking into account a number of factors,

including the amount and term of options previously granted, base

salary and bonuses and competitive factors. Options are generally

granted to senior executives which vest on terms established by the

Board.

Perquisites and Other Personal Benefits

The Company’s

Named Executive Officers are not generally entitled to significant

perquisites or other personal benefits not offered to the

Company’s other employees.

EXECUTIVE

COMPENSATION

Summary

Compensation Table

The following table

sets forth all information concerning the total compensation of the

Company’s president, chief executive officer, chief financial

officer, and the two other most highly compensated officers during

the last fiscal year (the “Named Executive Officers”) during

the last two completed fiscal years for services rendered to the

Company in all capacities.

|

Name

and Principal

Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards(1) ($)

|

Non-Equity

Incentive Plan Compensation

($)

|

Nonqualified

Deferred Compensation Earnings

($)

|

All

Other Compensation

($)

|

Total ($)

|

|

George

Putnam,

|

2019

|

$200,000

|

$Nil

|

$Nil

|

$39,263

|

$Nil

|

$Nil

|

$Nil

|

$239,263

|

|

President,

CEO and Director

|

2018

|

$200,000

|

$Nil

|

$Nil

|

$154,273

|

$Nil

|

$Nil

|

$Nil

|

$354,273

|

|

|

2017

|

$200,000

|

$Nil

|

$Nil

|

$198,127

|

$Nil

|

$Nil

|

$Nil

|

$398,127

|

|

Edward Dickinson,

|

2019

|

$90,000

|

$Nil

|

$Nil

|

$15,705

|

$Nil

|

$Nil

|

$Nil

|

$105,705

|

|

CFO

|

2018

|

$90,000

|

$Nil

|

$Nil

|

$46,282

|

$Nil

|

$Nil

|

$Nil

|

$136,282

|

|

|

2017

|

$90,000

|

$Nil

|

$Nil

|

$74,298

|

$Nil

|

$Nil

|

$Nil

|

$164,298

|

|

John Thompson,

V.P.

|

2019

|

$62,638

|

$Nil

|

$Nil

|

$11,779

|

$Nil

|

$Nil

|

$Nil

|

$74,417

|

|

General

Manager, Australia

|

2018

|

$66,991

|

$Nil

|

$Nil

|

$46,282

|

$Nil

|

$Nil

|

$Nil

|

$113,273

|

|

|

2017

|

$69,224

|

$Nil

|

$Nil

|

$74,298

|

$Nil

|

$Nil

|

$Nil

|

$143,522

|

|

Willem

Duyvesteyn

|

2019

|

$102,000

|

$Nil

|

$Nil

|

$31,410

|

$Nil

|

$Nil

|

$Nil

|

$133,410

|

|

CTO

and Director

|

2018

|

$102,000

|

$Nil

|

$Nil

|

$77,137

|

$Nil

|

$Nil

|

$Nil

|

$179,137

|

|

|

2017

|

$102,000

|

$Nil

|

$Nil

|

$123,829

|

$Nil

|

$Nil

|

$Nil

|

$225,829

|

(1) The

determination of the value of option awards is based upon the

Black-Scholes Option pricing model, details and assumptions of

which are set out in Note 6 to the Company’s consolidated

financial statements for the fiscal year ended December 31,

2019.

DIRECTOR

COMPENSATION

No cash

compensation was paid to any director of the Company for the

director’s services as a director during the financial year

ended December 31, 2019, other than the reimbursement of

out-of-pocket expenses.

The Company has no standard arrangement pursuant

to which directors are compensated by the Company for their

services in their capacity as directors except for the granting

from time to time of incentive stock options in accordance with the

policies of the Toronto Stock Exchange (“TSX”). During the most recently

completed financial year, no incentive stock options were granted

to directors, including directors who are Named Executive

Officers.

AGGREGATED

STOCK OPTION EXERCISES DURING THE MOST RECENTLY COMPLETED FISCAL

YEAR AND FISCAL YEAR-END OPTION VALUES

During the

Company’s fiscal year ended December 31, 2019, three

directors exercised a total of 1,000,000 options to purchase common

shares.

OUTSTANDING

EQUITY AWARDS AT THE MOST RECENTLY COMPLETED FISCAL

YEAR

|

|

Option-based

Awards

|

Share-based

Awards

|

|

Name

|

Number

of

securities

underlying unexercised options

(#)

|

Option

exercise

price

(C$)

|

Option

expiration

date

|

Value

of

Unexercised in-the money

options(US$)(1)(2)

(1)

|

Number

of

shares

or units of shares that have not vested

(#)

|

Market

or payout value of

share

based awards that have not vested ($)

|

|

|

400,000

|

$0.14

|

Apr. 17,

2020

|

$Nil

|

N/A

|

N/A

|

|

|

800,000

|

$0.10

|

Nov. 5,

2020

|

$Nil

|

|

|

|

|

300,000

|

$0.13

|

Feb. 8,

2021

|

$Nil

|

|

|

|

|

400,000

|

$0.37

|

Feb. 21,

2022

|

$Nil

|

|

|

|

|

400,000

|

$0.225

|

Jan. 19,

2023

|

$Nil

|

|

|

|

|

500,000

|

$0.15

|

May 9,

2024

|

$Nil

|

|

|

|

Barry

Davies

|

400,000

|

$0.14

|

Apr. 17,

2020

|

$Nil

|

N/A

|

N/A

|

|

|

500,000

|

$0.10

|

Nov. 5,

2020

|

$Nil

|

|

|

|

|

300,000

|

$0.13

|

Feb. 8,

2021

|

$Nil

|

|

|

|

|

400,000

|

$0.37

|

Feb. 21,

2022

|

$Nil

|

|

|

|

|

400,000

|

$0.225

|

Jan. 19,

2023

|

$Nil

|

|

|

|

|

400,000

|

$0.15

|

May 9,

2024

|

$Nil

|

|

|

|

Willem

Duyvesteyn

|

400,000

|

$0.14

|

Apr. 17,

2020

|

$Nil

|

N/A

|

N/A

|

|

|

500,000

|

$0.10

|

Nov. 5,

2020

|

$Nil

|

|

|

|

|

500,000

|

$0.13

|

Feb. 8,

2021

|

$Nil

|

|

|

|

|

500,000

|

$0.37

|

Feb. 21,

2022

|

$Nil

|

|

|

|

|

500,000

|

$0.225

|

Jan. 19,

2023

|

$Nil

|

|

|

|

|

400,000

|

$0.15

|

May 9,

2024

|

$Nil

|

|

|

|

George

Putnam

|

400,000

|

$0.14

|

Apr. 17,

2020

|

$Nil

|

N/A

|

N/A

|

|

|

2,500,000

|

$0.10

|

Nov. 5,

2020

|

$Nil

|

|

|

|

|

750,000

|

$0.13

|

Feb. 8,

2021

|

$Nil

|

|

|

|

|

800,000

|

$0.37

|

Feb. 21,

2022

|

$Nil

|

|

|

|

|

1,000,000

|

$0.225

|

Jan 19,

2023

|

$Nil

|

|

|

|

|

500,000

|

$0.15

|

May 9,

2024

|

$Nil

|

|

|

|

Warren

Davis

|

400,000

|

$0.14

|

Apr. 17,

2020

|

$Nil

|

N/A

|

N/A

|

|

|

300,000

|

$0.13

|

Feb. 8,

2021

|

$Nil

|

|

|

|

|

400,000

|

$0.37

|

Feb. 21,

2022

|

$Nil

|

|

|

|

|

400,000

|

$0.225

|

Jan. 19,

2023

|

$Nil

|

|

|

|

|

400,000

|

$0.15

|

May 9,

2024

|

$Nil

|

|

|

|

James

Rothwell

|

400,000

|

$0.14

|

Apr. 17,

2020

|

$Nil

|

N/A

|

N/A

|

|

|

300,000

|

$0.13

|

Feb. 8,

2021

|

$Nil

|

|

|

|

|

500,000

|

$0.37

|

Feb. 21,

2022

|

$Nil

|

|

|

|

|

500,000

|

$0.225

|

Jan. 19,

2023

|

$Nil

|

|

|

|

|

500,000

|

$0.15

|

May 9,

2024

|

$Nil

|

|

|

|

Peter

Evensen

|

500,000

|

$0.225

|

Jan. 19,

2023

|

$Nil

|

N/A

|

N/A

|

|

|

500,000

|

$0.15

|

May 9,

2024

|

$Nil

|

|

|

|

Christian

Evensen

|

400,000

|

$0.225

|

Jan. 19,

2023

|

$Nil

|

N/A

|

N/A

|

|

|

400,000

|

$0.15

|

May 9,

2024

|

$Nil

|

|

|

(1)

“Value of

unexercised in-the-money options” is calculated by

determining the difference between the market value of the

securities underlying the options at the date referred to and the

exercise price of the options and is not necessarily indicative of

the value (i.e. loss or gain) that will actually be realized by the

directors.

(2)

“in-the-money

options” means the excess of the market value of the

Company’s shares on December 31, 2019 over the exercise price

of the options.

SECURITIES

AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION

PLANS

The following table

sets out information as of the end of the fiscal year ended

December 31, 2019 with respect to compensation plans under which

equity securities of the Company are authorized for

issuance.

|

Plan

Category

|

Number

of securities to be issued upon exercise of outstanding options,

warrants and rights(a)

|

Weighted-average

exercise price of outstanding options, warrants and

rights(b)

|

Number

of securities remaining available for future issuances under equity

compensation plan [excluding securities reflected in column

(a)](c)

|

|

Equity compensation

plans approved by security holders

|

34,610,000

|

$0.19

|

12,262,389

|

|

Equity compensation

plans not

approved by

security holders

|

Nil

|

Nil

|

Nil

|

|

Total:

|

34,610,000

|

$0.19

|

12,262,389

|

TERMINATION

AND CHANGE OF CONTROL BENEFITS

The following

contracts, agreements, plans, and arrangements provide for payments

to the applicable Named Executive Officers following or in

connection with any termination (whether voluntary, involuntary or

constructive), resignation, retirement, a change in control of the

company or a change in such Named Executive Officers’

responsibilities:

George Putnam - the Company entered

into a letter agreement effective May 1, 2010 with George Putnam,

pursuant to which Mr. Putnam agreed to act as President and CEO of

the Company. Mr. Putnam receives a base salary of $200,000 per

year. The Compensation Committee has discretion to award an annual

bonus and will review Mr. Putnam’s base salary on an annual

basis. Mr. Putnam received an initial grant of 2,000,000 stock

options, 25% of which vested immediately, and the remainder of

which vested in three equal installments every six months

thereafter. Mr. Putnam is entitled to termination payments in the

amount of six months’ base salary if he is terminated without

cause in his first year of employment, and six months’ base

salary plus one month salary for each year of full service to a

maximum of twenty-four months, if terminated after the first year

of employment. If Mr. Putnam is terminated pursuant to a change in

control, he is entitled to a termination payment equivalent to

three times his base salary.

Edward Dickinson – the Company

entered into a letter agreement effective September 1, 2011 with

Edward Dickinson, pursuant to which Mr. Dickinson agreed to act as

chief financial officer of the Company and its subsidiaries. Mr.

Dickinson receives a base salary of $75,000 per year, reflecting a

50% time commitment to the Company. If the job content and demands

exceed a 50% time commitment then the Company may consider

expanding Mr. Dickinson’s role and adjusting this

compensation accordingly to reflect additional time and work

commitment. Mr. Dickinson received an initial grant of 300,000

stock options, 20% of which vested immediately, and the remainder

of which vested in four equal instalments every six months

thereafter. Mr. Dickinson is entitled to participate in the

Company’s stock option plan. If Mr. Dickinson is terminated

pursuant to a change in control, he is entitled to a termination

payment equal to one year’s base salary.

John D. Thompson – the Company

entered into a letter agreement effective February 8, 2011 with

John D. Thompson, pursuant to which Mr. Thompson agreed to act as

VP, Project Development of the Company and its subsidiaries. Mr.

Thompson receives a base salary of A$90,000 per year, reflecting

his support to the Company on a 50% basis. If the position and job

requirements expand to a full time commitment, the Company may

discuss with Mr. Thompson on appropriate compensation changes. Mr.

Thompson received an initial grant of 500,000 stock options

exercisable for a term of 5 years, 20% which vested immediately,

and the remainder of which vested in four equal instalments every

six months thereafter. Mr. Thompson is entitled to a termination

payment equal to six months’ base salary plus one additional

month of salary for each full year of services, to a maximum of

twenty-four months. If Mr. Thompson is terminated pursuant to a

change of control, he is entitled to a termination payment equal to

two times his base salary.

Other than the

agreements described above, the Company and its subsidiaries are

not parties to any contracts, and have not entered into any plans

or arrangements which require compensation to be paid to any of the

Named Executive Officers in the event of:

(a)

resignation,

retirement or any other termination of employment with the Company

or one of its subsidiaries;

(b)

a change of control

of the Company or one of its subsidiaries; or

(c)

a change in the

director, officer or employee’s responsibilities following a

change of control of the Company.

BOARD

OF DIRECTORS MEETINGS AND COMMITTEES

During the fiscal

year ended December 31, 2019, the Board held four directors’

meetings. All other matters which required Board approval were

consented to in writing by all of the Company’s

directors.

The Board has

established an Audit Committee and a Compensation Committee. The

Board has no standing nominating committee. Each of the Audit

Committee and the Compensation Committee is responsible to the full

Board. The functions performed by these committees are summarized

below:

Audit Committee. The Board has an Audit Committee composed of three

directors, William Harris (Chair), Warren Davis, and James

Rothwell. Prior to October 28, 2015, Barry Davies served on the

Audit Committee. All members of the Audit Committee are

“independent” and “financially literate” in

accordance with Multilateral Instrument 52-110 Audit Committees

(“NI 52-110”). The Audit Committee reviews all

financial statements of the Company prior to their publication,

reviews audits or communications, recommends the appointment of

independent auditors, reviews and approves the professional

services to be rendered by independent auditors and reviews fees

for audit services. The Audit Committee meets both separately with

auditors (without management present) as well as with management

present. The meetings with the auditors discuss the various aspects

of the Company’s financial presentation in the areas of audit

risk and Canadian generally accepted accounting principles.

Specifically, the audit committee has:

(a)

reviewed

and discussed the audited financial statements with

management;

(b)

discussed

with the independent auditors the matters required to be discussed

by the statement on Auditing Standards No. 61, as amended;

and

(c)

received

the written disclosures and the letter from the independent

accountant required by applicable requirements of the Public

Company Accounting Oversight Board regarding the independent

accountant’s communications with the Audit Committee

concerning independence, and has discussed with the independent

accountant the independent accountant’s

independence.

A copy of the text of the Company’s audit

committee charter can be found on the Company’s website

at www.scandiummining.com.

Based on the

foregoing review and discussions, the audit committee recommended

to the Board that the audited financial statements should be

included in our Annual Report on Form 10-K for the year ended

December 31, 2017 filed with the SEC.

Submitted by the

Audit Committee.

William Harris,

Chair

Warren Davis,

Member

James Rothwell,

Member

Compensation Committee. The Compensation

Committee reviews and approves the compensation of SCY’s

officers, reviews and administers SCY’s stock option plan and

makes recommendations to the Board regarding such matters. The

members of the Compensation Committee are William Harris, Warren

Davis, and Peter Evensen. William Harris and Warren Davis are both

independent directors. Peter Evensen is relying on a temporary

exemption from the requirement to be an independent member of the

Compensation Committee. The direct or indirect “material

relationship” between Peter Evensen and the Company is based

solely on his shared voting and investment control of over more

than 10% of the Company’s common shares. The Board determined

in its reasonable judgement that (i) Peter Evensen is able to

exercise the impartial judgement necessary for Mr. Evensen to

fulfill his responsibilities as a Compensation Committee member,

and (ii) the appointment of Mr. Evensen is required by the best

interests of the Company and its shareholders of the Company. The

Board has adopted a written charter for the Compensation Committee,

a copy of which can be found on the Company’s website at

www.scandiumminingcom.

Nominating Committee. No Nominating

Committee has been appointed. Nominations of directors are made by

the Board. The Board is of the view that the present management

structure does not warrant the appointment of a Nominating

Committee.

In its

deliberations for selecting candidates for nominees as director,

the Board considers the candidate’s knowledge of the mineral

exploration industry and involvement in community, business and

civic affairs. Any nominee for director made by the Board must be

highly qualified with regard to some or all these attributes. In

searching for qualified director candidates to fill vacancies on

the Board, the Board solicits its current Board for names of

potentially qualified candidates. The Board would then consider the

potential pool of director candidates, select the candidate the

Board believes best meets the then-current needs of the Board, and

conduct a thorough investigation of the proposed candidate’s

background to ensure there is no past history, potential conflict

of interest or regulatory issue that would cause the candidate not

to be qualified to serve as a director of SCY. Additionally, the

Board annually reviews the Board’s size, structure,

composition and functioning, to ensure an appropriate blend and

balance of diverse skills and experience.

MANAGEMENT

CONTRACTS

The Company is not

a party to a management contract with anyone other than directors

or Named Executive Officers of the Company.

INDEBTEDNESS

OF DIRECTORS AND EXECUTIVE OFFICERS

None of the current

or former directors, executive officers, employees, and proposed

nominees for election as directors or their associates is or has

since the beginning of the last completed financial year, been

indebted to the Company or any of its subsidiaries or indebted to

another entity where such indebtedness is or was the subject of a

guarantee, support agreement, letter of credit or other similar

instrument or understanding provided by the Company or any of its

subsidiaries.

INTEREST

OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as disclosed

herein, since the commencement of the Company’s most recently

completed financial year, no informed person of the Company,

nominee for director or any associate or affiliate of an informed

person or nominee, had any material interest, direct or indirect,

in any transaction or any proposed transaction which has materially

affected or would materially affect the Company or any of its

subsidiaries.

An “informed

person” means: (a) a director or executive officer of the

Company; (b) a director or executive officer of a person or company

that is itself an informed person or subsidiary of the Company; (c)

any person or company who beneficially owns, directly or

indirectly, voting securities of the company or who exercises

control or director over voting securities of the Company or a

combination of both carrying more than 10% of the voting rights

other than voting securities held by the person or company as

underwriter in the course of a distribution; and (d) the Company

itself, if and for so long as it has purchased, redeemed or

otherwise acquired any of its shares.

REPORT

OF CORPORATE GOVERNANCE

The British

Columbia Securities Commission has issued guidelines on corporate

governance disclosure for non-venture issuers as set out in

National Instrument 58-101 (the “Policy”). The Policy addresses

matters relating to constitution and independence of directors, the

functions to be performed by the directors of a company and their

committees and effectiveness and evaluation of proposed corporate

governance guidelines and best practices specified by the Canadian

securities regulators. The Company’s approach to corporate

governance in the context of the specific issues outlined in Form

58-101F1 is set out below.

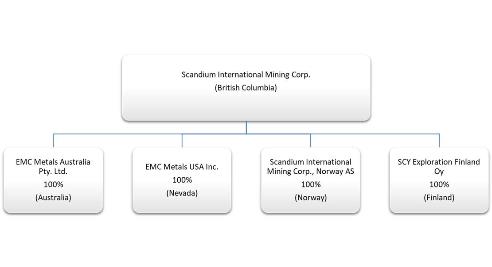

Board of Directors

The Board currently

consists of eight directors, and it is proposed that all eight be

nominated at the Meeting. Of the eight proposed directors, a

majority of individuals qualify as independent directors. A

director is independent if he or she has no direct or indirect

“material relationship” with the Company. A

“material relationship” is a relationship which could,

in the view of the Board, be reasonably expected to interfere with

the exercise of the director’s independent judgment. The

following table outlines the Company’s independent and