Long-Term Compensation

Typically, long-term awards comprise the single biggest component of target total direct compensation for our NEOs. This approach aligns our executive team with our stockholders’ long-term interests, attracts executives of the highest caliber and retains them for the long term. In granting annual long-term awards, the Compensation Committee considers, among other things, the executive officer’s base compensation and bonus opportunity, the need to create a meaningful opportunity for reward predicated on the creation of long-term stockholder value, our financial results, market conditions and an evaluation of the expected and actual responsibilities and performance.

Based on the results of our internal research and guidance from FW Cook with respect to the practices of our peer group, the recommendations of Mr. Sanborn (who did not participate in approval discussions regarding his own compensation) and the individual performance of each of the NEOs, the Compensation Committee granted long-term awards in Q1 2024 to each of our NEOs as part of our Company-wide annual long-term award program.

In 2024, we adopted a program whereby all long-term awards, including those granted to our NEOs, are bifurcated into an equity portion (e.g., PBRSU and/or RSU) and a fixed value cash-based portion (“Cash Award”). The Cash Award vests over 3 years, like the equity portion. This program was implemented in response to stockholder feedback to reduce the dilution from our equity programs. Specifically, it permits for decreased equity utilization, while keeping target compensation levels intact and providing the Company another multi-year retention feature in its compensation program. We believe this program was the best available solution to balance reducing dilution, rewarding and retaining employees, and managing compensation expense.

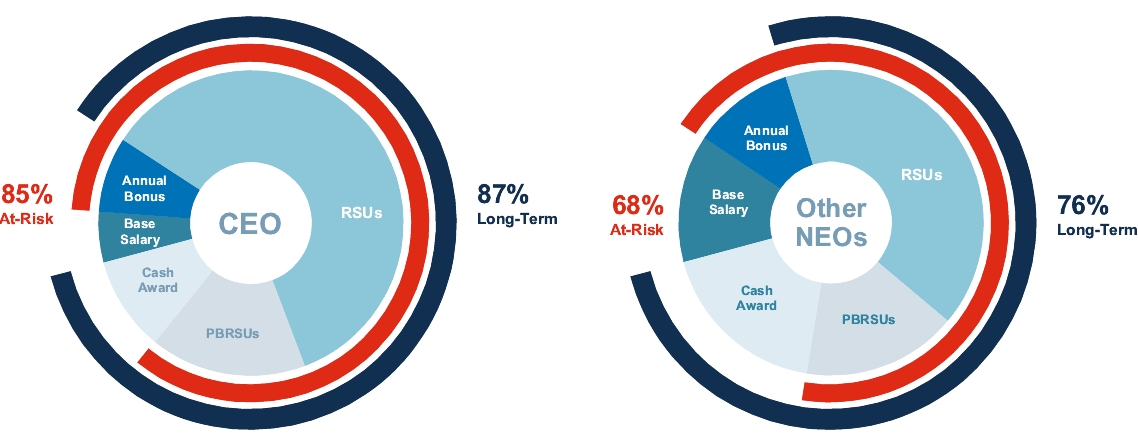

The aggregate intended target value of the 2024 refresh long-term awards granted to NEOs were allocated as follows: (i) 25% in the form of a Cash Award and (ii) 75% in the form of equity awards (i.e., RSUs and PBRSUs), with allocation between RSU and PBRSU being 45/55 for our CEO and 30/70 for our other NEOs.

Refresh Restricted Stock Units

In 2024, all Company employees that were granted RSUs were provided with an intended target value of the RSU award and the number of RSUs subject to the award was determined by dividing the intended target value of the RSU award by our trailing 30-day average stock price ending on the date preceding the date of grant.

On March 21, 2024, the Compensation Committee granted 157,809 RSUs to Mr. Sanborn, 147,289 RSUs to Mr. LaBenne, 106,375 RSUs to Ms. Armstrong, 68,735 RSUs to Mr. Cheng and 147,289 RSUs to Mr. Momen, reflecting intended target values of $1,265,625, $1,181,250, $853,125, $551,250 and $1,181,250, respectively. These RSUs vest over three years, with 1/12th of the RSUs vesting in quarterly installments starting on May 25, 2024, subject to continued service.

Refresh Performance-Based Restricted Stock Units

In 2024, all Company employees that were granted PBRSUs were provided with an intended target value of the PBRSU award and the number of target PBRSUs subject to the award was determined by dividing the intended target value of the PBRSU award by the per unit grant date fair value.

On March 21, 2024, the Compensation Committee granted 179,980 target PBRSUs to Mr. Sanborn, 58,903 target PBRSUs to Mr. LaBenne, 42,541 target PBRSUs to Ms. Armstrong, 27,488 target PBRSUs to Mr. Cheng and 58,903 target PBRSUs to Mr. Momen, reflecting intended target values of $1,546,875, $506,250, $365,625, $236,250 and $506,250, respectively.

These awards are structured so that the PBRSUs become earned only to the extent that pre-established performance targets are met over the three-year performance period. For 2024, the Compensation Committee diversified the PBRSU program by introducing an ambitious, but attainable, multi-year operating metric. This change