.2 Earnings Presentation NASDAQ: OCSL Fourth Quarter 2025

Forward Looking Statements & Legal Disclosures Some of the statements in this presentation constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation may include statements as to: our future operating results and distribution projections; the ability of Oaktree Fund Advisors, LLC (together with its affiliates, “Oaktree”) to implement Oaktree’s future plans with respect to our business and to achieve our investment objective; the ability of Oaktree and its affiliates to attract and retain highly talented professionals; our business prospects and the prospects of our portfolio companies; the impact of the investments that we expect to make; the ability of our portfolio companies to achieve their objectives; our expected financings and investments and additional leverage we may seek to incur in the future; the adequacy of our cash resources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; the cost or potential outcome of any litigation to which we may be a party; and the impact of current global economic conditions, including those caused by inflation, an elevated (but decreasing) interest rate environment and geopolitical events or all of the foregoing. In addition, words such as “anticipate,” “believe,” “expect,” “seek,” “plan,” “should,” “estimate,” “project” and “intend” indicate forward-looking statements, although not all forward-looking statements include these words. The forward-looking statements contained in this presentation involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in our annual report on Form 10-K for the fiscal year ended September 30, 2025. Other factors that could cause actual results to differ materially include: changes or potential disruptions in our operations, the economy, financial markets and political environment, including those caused by tariffs and trade disputes with other countries, inflation and an elevated interest rate environment; risks associated with possible disruption in our operations, the operations of our portfolio companies or the economy generally due to terrorism, war or other geopolitical conflict, natural disasters, pandemics or cybersecurity incidents; future changes in laws or regulations (including the interpretation of these laws and regulations by regulatory authorities) and conditions in our operating areas, particularly with respect to business development companies or regulated investment companies; and other considerations disclosed from time to time in our publicly disseminated documents and filings. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Calculation of Assets Under Management References to total assets under management or AUM represent assets managed by Oaktree, a proportionate amount of the AUM reported by DoubleLine Capital LP ( DoubleLine Capital ), and other minority corporate investments. Oaktree's methodology for calculating AUM includes (i) the net asset value (NAV) of assets managed directly by Oaktree, (ii) the leverage on which management fees are charged, (iii) undrawn capital that Oaktree is entitled to call from investors in Oaktree funds pursuant to their capital commitments, (iv) for collateralized loan obligation vehicles ( CLOs ), the aggregate par value of collateral assets and principal cash, (v) for publicly-traded business development companies, gross assets (including assets acquired with leverage), net of cash, and (vi) Oaktree's pro rata portion (20%) of the AUM reported by DoubleLine Capital and other minority corporate investments. This calculation of AUM is not based on the definitions of AUM that may be set forth in agreements governing the investment funds, vehicles or accounts managed and is not calculated pursuant to regulatory definitions. Unless otherwise indicated, data provided herein are as of September 30, 2025. Fourth Quarter 2025 Earnings Presentation NASDAQ: OCSL

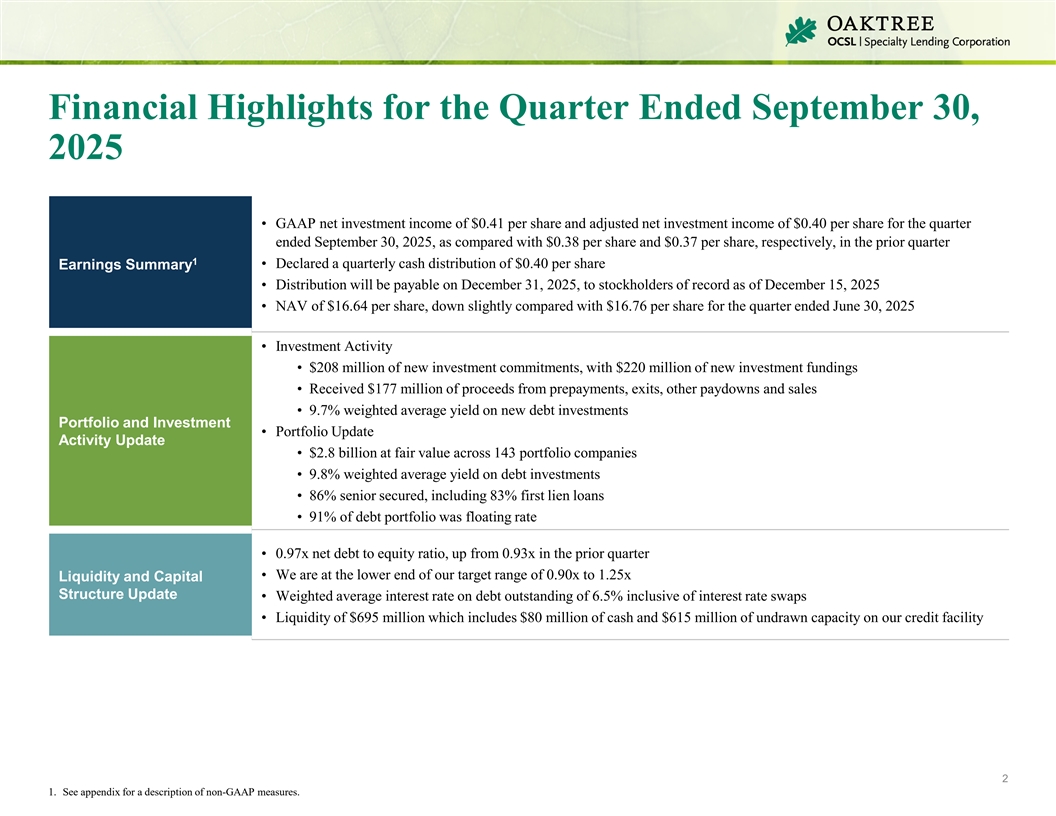

Financial Highlights for the Quarter Ended September 30, 2025 • GAAP net investment income of $0.41 per share and adjusted net investment income of $0.40 per share for the quarter ended September 30, 2025, as compared with $0.38 per share and $0.37 per share, respectively, in the prior quarter 1 • Declared a quarterly cash distribution of $0.40 per share Earnings Summary • Distribution will be payable on December 31, 2025, to stockholders of record as of December 15, 2025 • NAV of $16.64 per share, down slightly compared with $16.76 per share for the quarter ended June 30, 2025 • Investment Activity • $208 million of new investment commitments, with $220 million of new investment fundings • Received $177 million of proceeds from prepayments, exits, other paydowns and sales • 9.7% weighted average yield on new debt investments Portfolio and Investment • Portfolio Update Activity Update • $2.8 billion at fair value across 143 portfolio companies • 9.8% weighted average yield on debt investments • 86% senior secured, including 83% first lien loans • 91% of debt portfolio was floating rate • 0.97x net debt to equity ratio, up from 0.93x in the prior quarter • We are at the lower end of our target range of 0.90x to 1.25x Liquidity and Capital Structure Update • Weighted average interest rate on debt outstanding of 6.5% inclusive of interest rate swaps • Liquidity of $695 million which includes $80 million of cash and $615 million of undrawn capacity on our credit facility 2 1. See appendix for a description of non-GAAP measures.

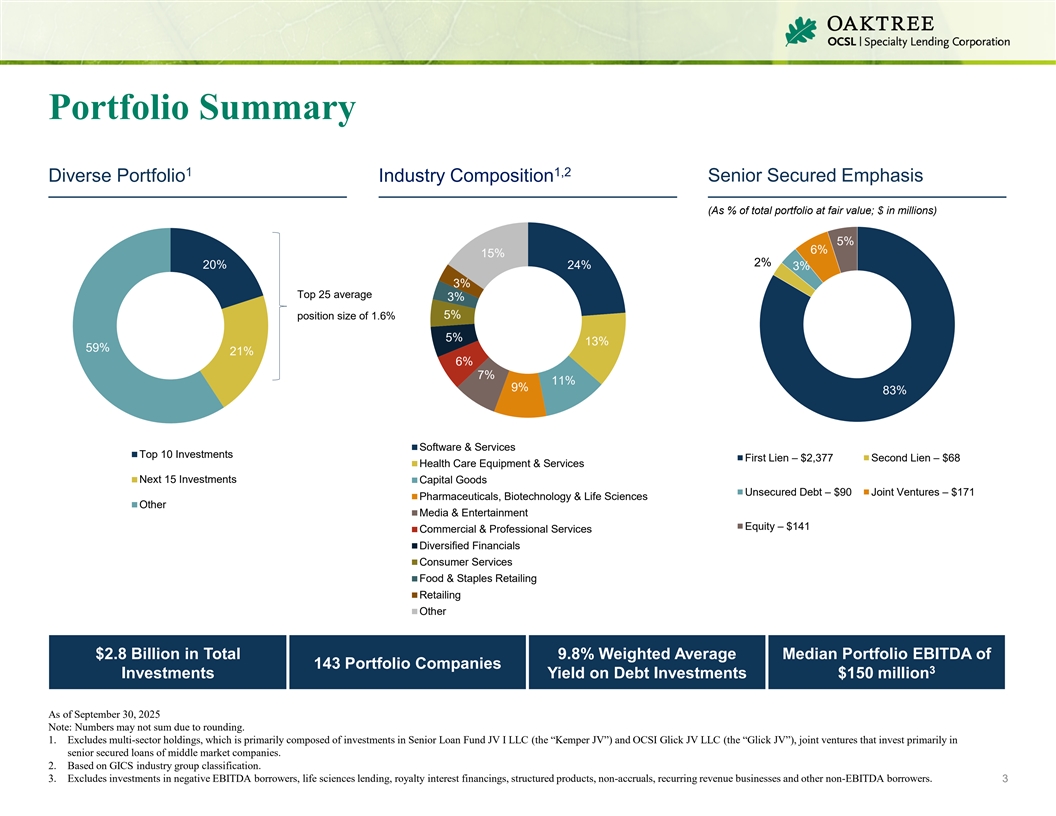

Portfolio Summary 1 1,2 Senior Secured Emphasis Diverse Portfolio Industry Composition (As % of total portfolio at fair value; $ in millions) 5% 6% 15% 2% 20% 24% 3% 3% Top 25 average 3% 5% position size of 1.6% 5% 13% 59% 21% 6% 7% 11% 9% 83% Software & Services Top 10 Investments First Lien – $2,377 Second Lien – $68 Health Care Equipment & Services Next 15 Investments Capital Goods Unsecured Debt – $90 Joint Ventures – $171 Pharmaceuticals, Biotechnology & Life Sciences Other Media & Entertainment Equity – $141 Commercial & Professional Services Diversified Financials Consumer Services Food & Staples Retailing Retailing Other $2.8 Billion in Total 9.8% Weighted Average Median Portfolio EBITDA of 143 Portfolio Companies 3 Investments Yield on Debt Investments $150 million As of September 30, 2025 Note: Numbers may not sum due to rounding. 1. Excludes multi-sector holdings, which is primarily composed of investments in Senior Loan Fund JV I LLC (the “Kemper JV”) and OCSI Glick JV LLC (the “Glick JV”), joint ventures that invest primarily in senior secured loans of middle market companies. 2. Based on GICS industry group classification. 3. Excludes investments in negative EBITDA borrowers, life sciences lending, royalty interest financings, structured products, non-accruals, recurring revenue businesses and other non-EBITDA borrowers. 3

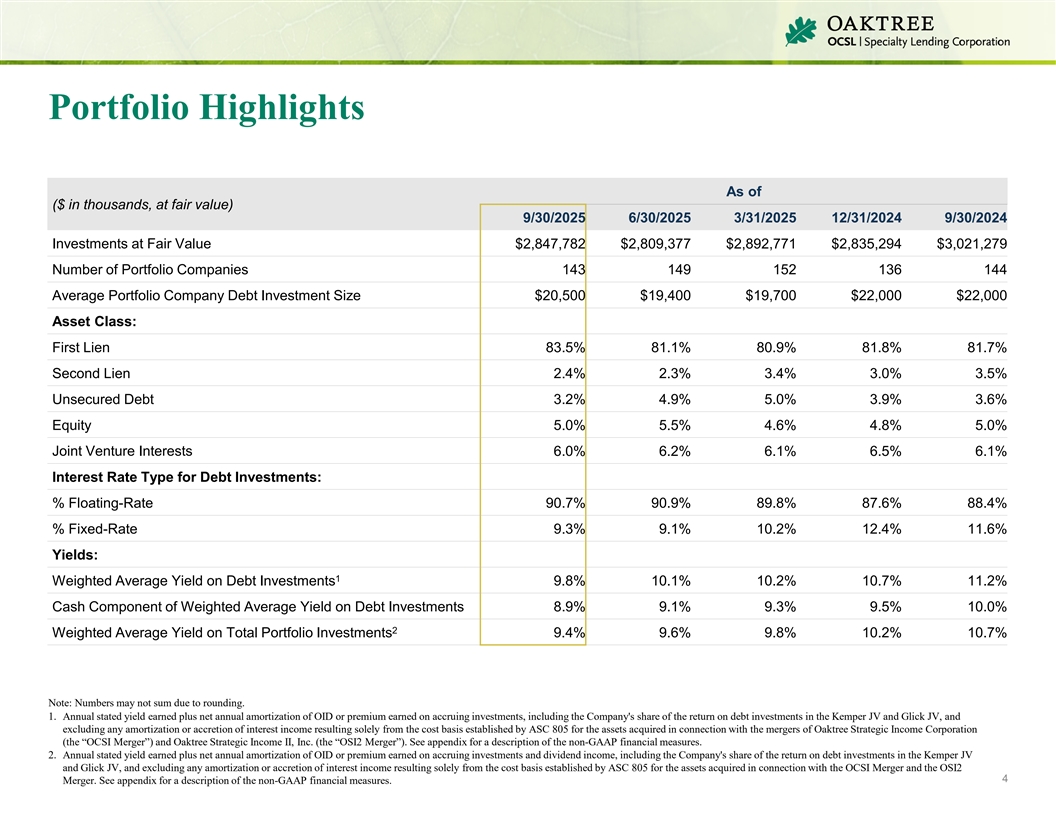

Portfolio Highlights As of ($ in thousands, at fair value) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Investments at Fair Value $2,847,782 $2,809,377 $2,892,771 $2,835,294 $3,021,279 Number of Portfolio Companies 143 149 152 136 144 Average Portfolio Company Debt Investment Size $20,500 $19,400 $19,700 $22,000 $22,000 Asset Class: First Lien 83.5% 81.1% 80.9% 81.8% 81.7% Second Lien 2.4% 2.3% 3.4% 3.0% 3.5% Unsecured Debt 3.2% 4.9% 5.0% 3.9% 3.6% Equity 5.0% 5.5% 4.6% 4.8% 5.0% Joint Venture Interests 6.0% 6.2% 6.1% 6.5% 6.1% Interest Rate Type for Debt Investments: % Floating-Rate 90.7% 90.9% 89.8% 87.6% 88.4% % Fixed-Rate 9.3% 9.1% 10.2% 12.4% 11.6% Yields: 1 Weighted Average Yield on Debt Investments 9.8% 10.1% 10.2% 10.7% 11.2% Cash Component of Weighted Average Yield on Debt Investments 8.9% 9.1% 9.3% 9.5% 10.0% 2 Weighted Average Yield on Total Portfolio Investments 9.4% 9.6% 9.8% 10.2% 10.7% Note: Numbers may not sum due to rounding. 1. Annual stated yield earned plus net annual amortization of OID or premium earned on accruing investments, including the Company's share of the return on debt investments in the Kemper JV and Glick JV, and excluding any amortization or accretion of interest income resulting solely from the cost basis established by ASC 805 for the assets acquired in connection with the mergers of Oaktree Strategic Income Corporation (the “OCSI Merger”) and Oaktree Strategic Income II, Inc. (the “OSI2 Merger”). See appendix for a description of the non-GAAP financial measures. 2. Annual stated yield earned plus net annual amortization of OID or premium earned on accruing investments and dividend income, including the Company's share of the return on debt investments in the Kemper JV and Glick JV, and excluding any amortization or accretion of interest income resulting solely from the cost basis established by ASC 805 for the assets acquired in connection with the OCSI Merger and the OSI2 4 Merger. See appendix for a description of the non-GAAP financial measures.

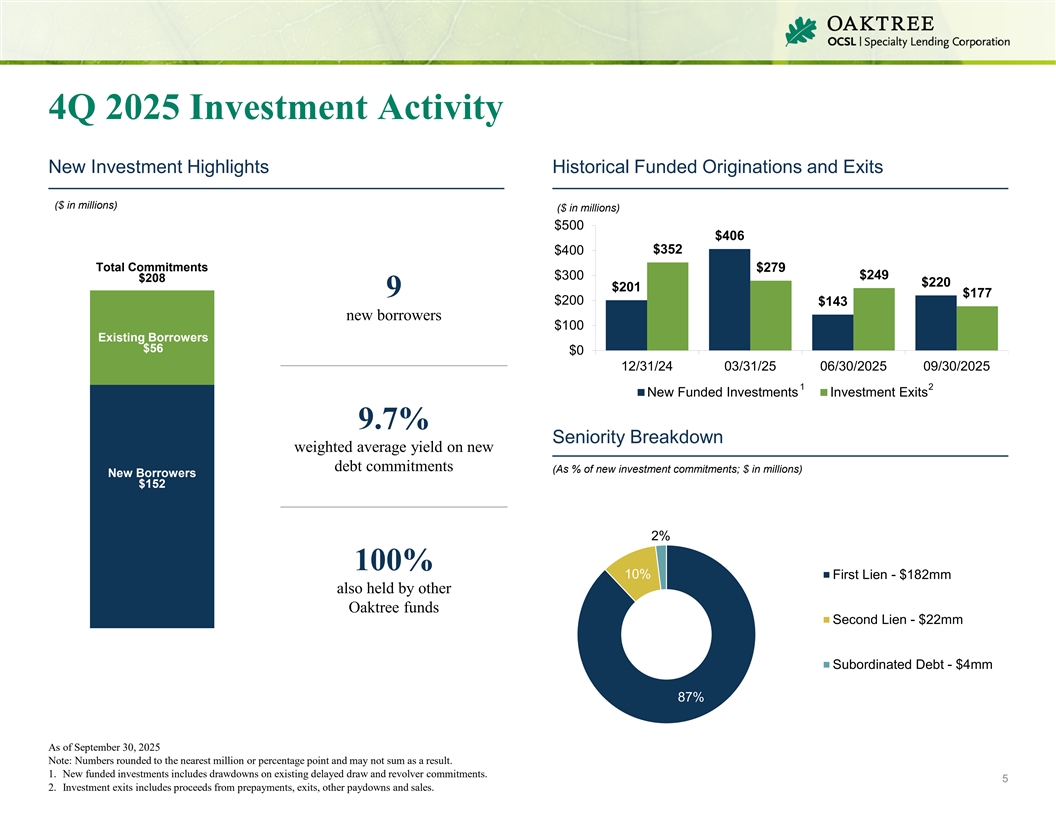

4Q 2025 Investment Activity New Investment Highlights Historical Funded Originations and Exits ($ in millions) ($ in millions) $500 $406 $352 $400 Total Commitments $279 $300 $249 $208 $220 $201 9 $177 $200 $143 new borrowers $100 Existing Borrowers $56 $0 12/31/24 03/31/25 06/30/2025 09/30/2025 1 2 New Funded Investments Investment Exits 9.7% Seniority Breakdown weighted average yield on new debt commitments (As % of new investment commitments; $ in millions) New Borrowers $152 2% 100% 10% First Lien - $182mm also held by other Oaktree funds Second Lien - $22mm Subordinated Debt - $4mm 87% As of September 30, 2025 Note: Numbers rounded to the nearest million or percentage point and may not sum as a result. 1. New funded investments includes drawdowns on existing delayed draw and revolver commitments. 5 2. Investment exits includes proceeds from prepayments, exits, other paydowns and sales.

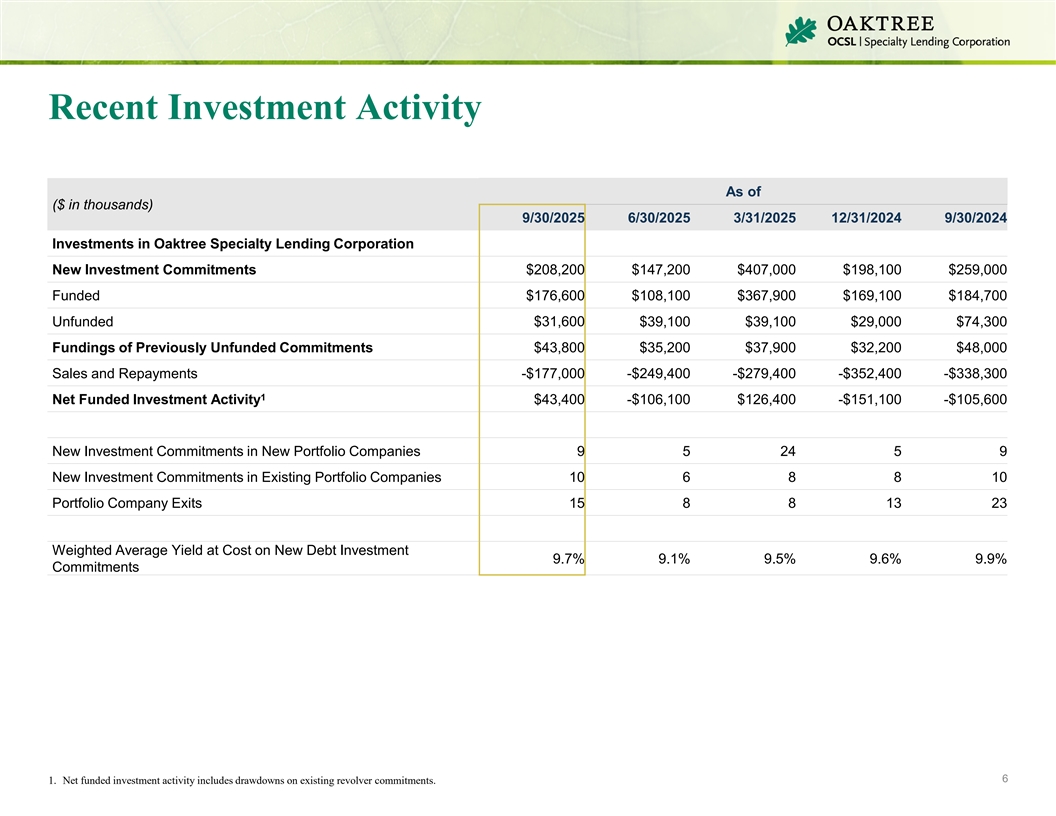

Recent Investment Activity As of ($ in thousands) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Investments in Oaktree Specialty Lending Corporation New Investment Commitments $208,200 $147,200 $407,000 $198,100 $259,000 Funded $176,600 $108,100 $367,900 $169,100 $184,700 Unfunded $31,600 $39,100 $39,100 $29,000 $74,300 Fundings of Previously Unfunded Commitments $43,800 $35,200 $37,900 $32,200 $48,000 Sales and Repayments -$177,000 -$249,400 -$279,400 -$352,400 -$338,300 1 Net Funded Investment Activity $43,400 -$106,100 $126,400 -$151,100 -$105,600 New Investment Commitments in New Portfolio Companies 9 5 24 5 9 New Investment Commitments in Existing Portfolio Companies 10 6 8 8 10 Portfolio Company Exits 15 8 8 13 23 Weighted Average Yield at Cost on New Debt Investment 9.7% 9.1% 9.5% 9.6% 9.9% Commitments 6 1. Net funded investment activity includes drawdowns on existing revolver commitments. I n v e s t o r P r e s e n ta

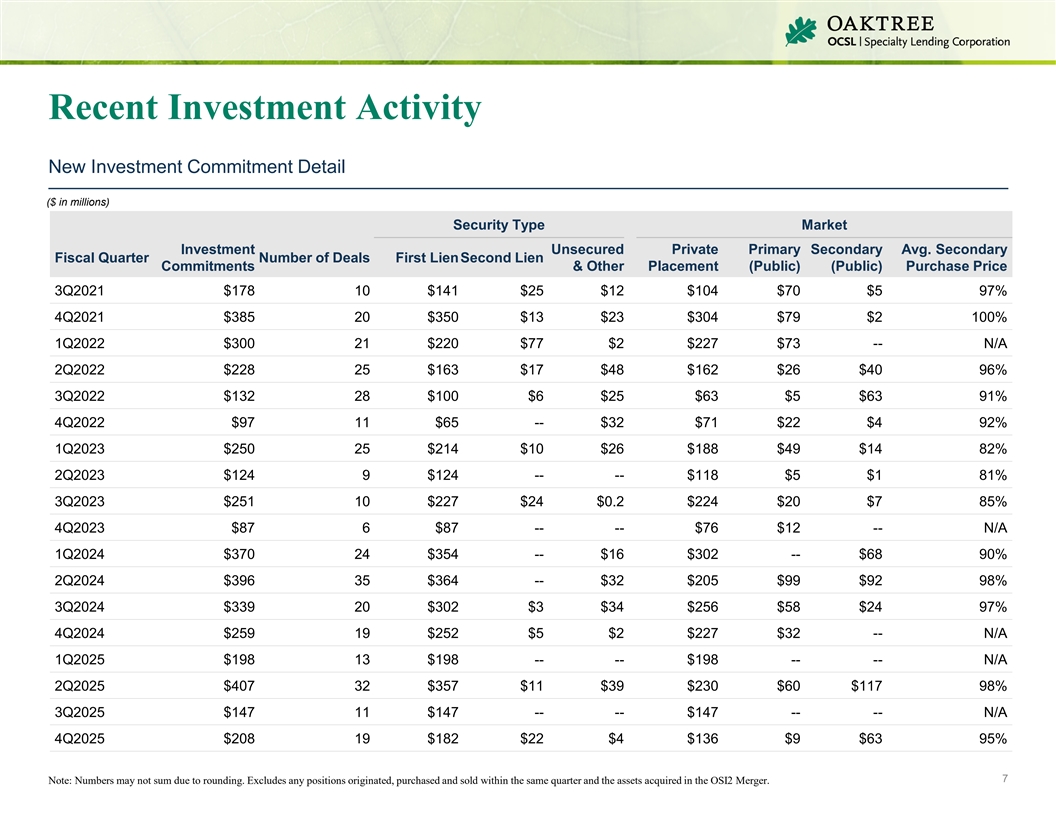

Recent Investment Activity New Investment Commitment Detail ($ in millions) Security Type Market Investment Unsecured Private Primary Secondary Avg. Secondary Fiscal Quarter Number of Deals First LienSecond Lien Commitments & Other Placement (Public) (Public) Purchase Price 3Q2021 $178 10 $141 $25 $12 $104 $70 $5 97% 4Q2021 $385 20 $350 $13 $23 $304 $79 $2 100% 1Q2022 $300 21 $220 $77 $2 $227 $73 -- N/A 2Q2022 $228 25 $163 $17 $48 $162 $26 $40 96% 3Q2022 $132 28 $100 $6 $25 $63 $5 $63 91% 4Q2022 $97 11 $65 -- $32 $71 $22 $4 92% 1Q2023 $250 25 $214 $10 $26 $188 $49 $14 82% 2Q2023 $124 9 $124 -- -- $118 $5 $1 81% 3Q2023 $251 10 $227 $24 $0.2 $224 $20 $7 85% 4Q2023 $87 6 $87 -- -- $76 $12 -- N/A 1Q2024 $370 24 $354 -- $16 $302 -- $68 90% 2Q2024 $396 35 $364 -- $32 $205 $99 $92 98% 3Q2024 $339 20 $302 $3 $34 $256 $58 $24 97% 4Q2024 $259 19 $252 $5 $2 $227 $32 -- N/A 1Q2025 $198 13 $198 -- -- $198 -- -- N/A 2Q2025 $407 32 $357 $11 $39 $230 $60 $117 98% 3Q2025 $147 11 $147 -- -- $147 -- -- N/A 4Q2025 $208 19 $182 $22 $4 $136 $9 $63 95% 7 Note: Numbers may not sum due to rounding. Excludes any positions originated, purchased and sold within the same quarter and the assets acquired in the OSI2 Merger.

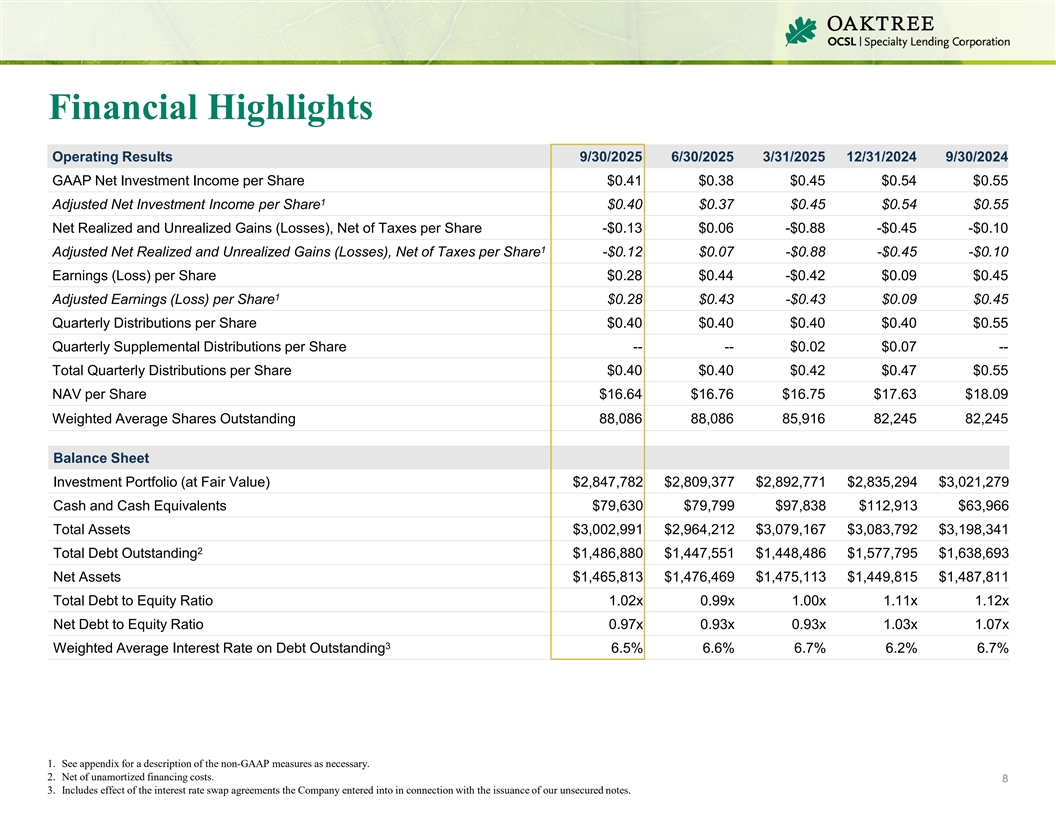

Financial Highlights Operating Results 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 GAAP Net Investment Income per Share $0.41 $0.38 $0.45 $0.54 $0.55 1 Adjusted Net Investment Income per Share $0.40 $0.37 $0.45 $0.54 $0.55 Net Realized and Unrealized Gains (Losses), Net of Taxes per Share -$0.13 $0.06 -$0.88 -$0.45 -$0.10 1 Adjusted Net Realized and Unrealized Gains (Losses), Net of Taxes per Share -$0.12 $0.07 -$0.88 -$0.45 -$0.10 Earnings (Loss) per Share $0.28 $0.44 -$0.42 $0.09 $0.45 1 Adjusted Earnings (Loss) per Share $0.28 $0.43 -$0.43 $0.09 $0.45 Quarterly Distributions per Share $0.40 $0.40 $0.40 $0.40 $0.55 Quarterly Supplemental Distributions per Share -- -- $0.02 $0.07 -- Total Quarterly Distributions per Share $0.40 $0.40 $0.42 $0.47 $0.55 NAV per Share $16.64 $16.76 $16.75 $17.63 $18.09 Weighted Average Shares Outstanding 88,086 88,086 85,916 82,245 82,245 Balance Sheet Investment Portfolio (at Fair Value) $2,847,782 $2,809,377 $2,892,771 $2,835,294 $3,021,279 Cash and Cash Equivalents $79,630 $79,799 $97,838 $112,913 $63,966 Total Assets $3,002,991 $2,964,212 $3,079,167 $3,083,792 $3,198,341 2 Total Debt Outstanding $1,486,880 $1,447,551 $1,448,486 $1,577,795 $1,638,693 Net Assets $1,465,813 $1,476,469 $1,475,113 $1,449,815 $1,487,811 Total Debt to Equity Ratio 1.02x 0.99x 1.00x 1.11x 1.12x Net Debt to Equity Ratio 0.97x 0.93x 0.93x 1.03x 1.07x 3 Weighted Average Interest Rate on Debt Outstanding 6.5% 6.6% 6.7% 6.2% 6.7% 1. See appendix for a description of the non-GAAP measures as necessary. 2. Net of unamortized financing costs. 8 I n 3. Includes effect of the interest rate swap agreements the Company entered into in connection with the issuance of our unsecured notes. v e s t o r P r e s e n a t

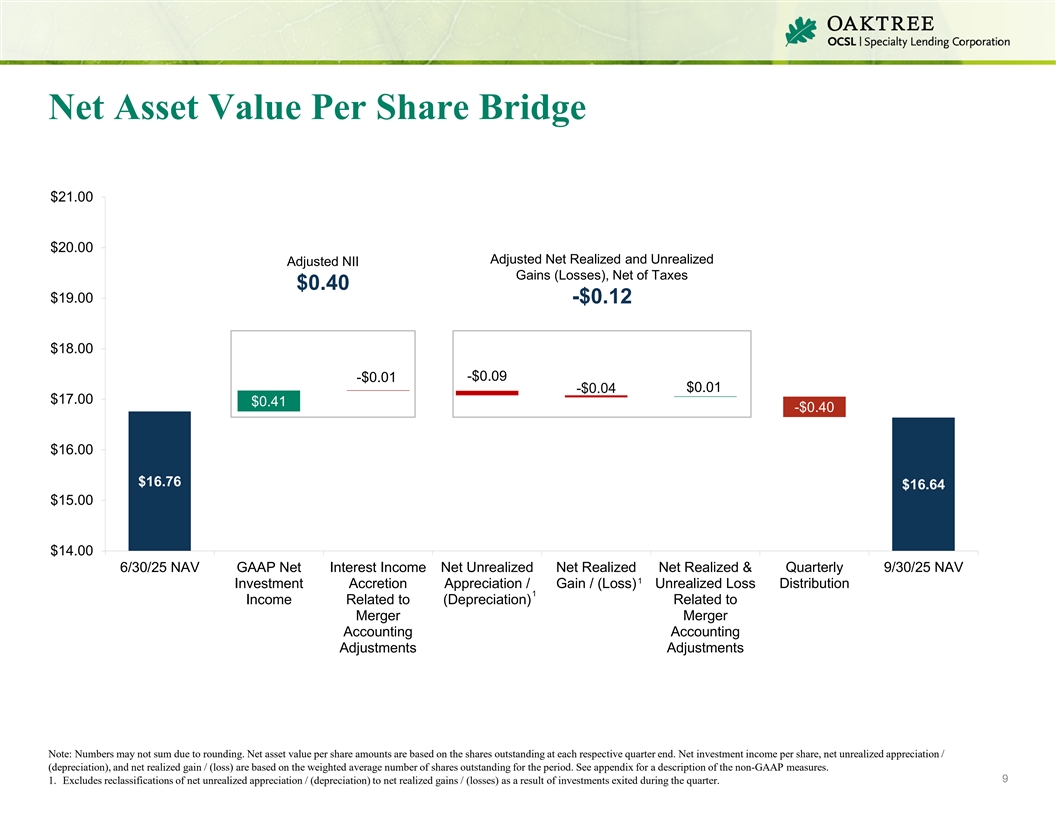

Net Asset Value Per Share Bridge $21.00 $20.00 Adjusted Net Realized and Unrealized Adjusted NII Gains (Losses), Net of Taxes $0.40 $19.00 -$0.12 $18.00 -$0.09 -$0.01 $0.01 -$0.04 $17.00 $0.41 -$0.40 $16.00 $16.76 $16.64 $15.00 $14.00 6/30/25 NAV GAAP Net Interest Income Net Unrealized Net Realized Net Realized & Quarterly 9/30/25 NAV 1 Investment Accretion Appreciation / Gain / (Loss) Unrealized Loss Distribution 1 Income Related to (Depreciation) Related to Merger Merger Accounting Accounting Adjustments Adjustments Note: Numbers may not sum due to rounding. Net asset value per share amounts are based on the shares outstanding at each respective quarter end. Net investment income per share, net unrealized appreciation / (depreciation), and net realized gain / (loss) are based on the weighted average number of shares outstanding for the period. See appendix for a description of the non-GAAP measures. 9 1. Excludes reclassifications of net unrealized appreciation / (depreciation) to net realized gains / (losses) as a result of investments exited during the quarter. I n v e s t o r P r e s e n a t

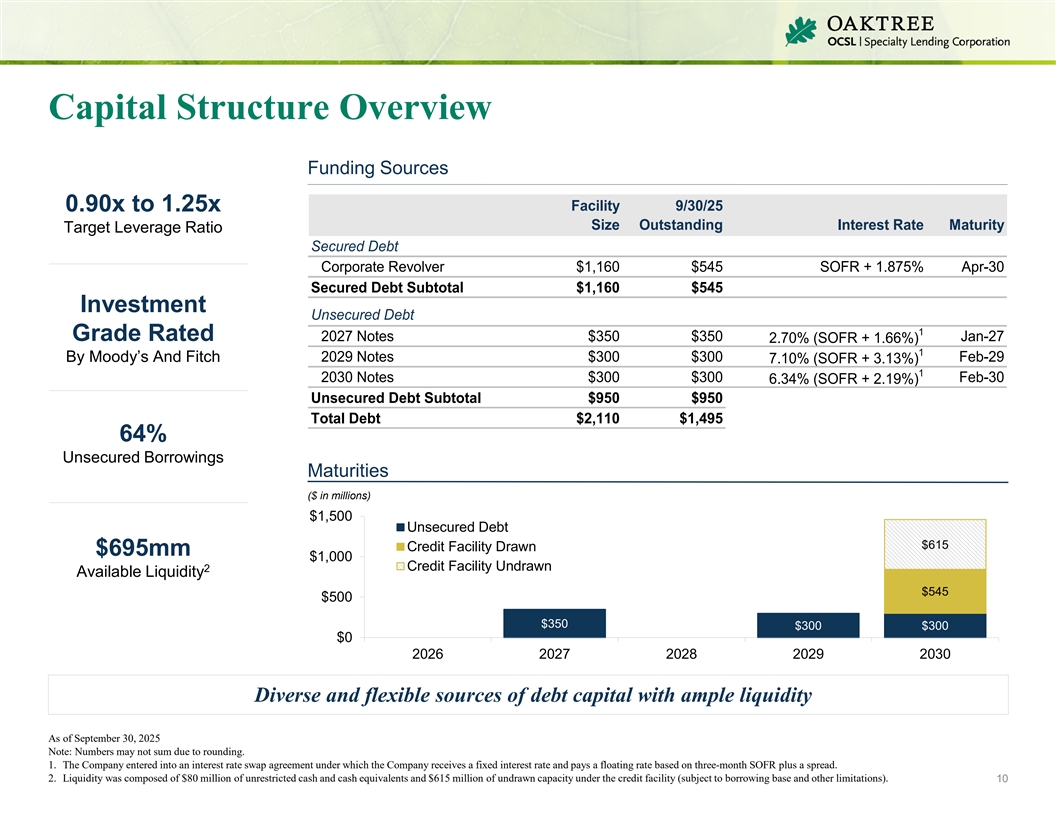

Capital Structure Overview Funding Sources Facility 9/30/25 0.90x to 1.25x Size Outstanding Interest Rate Maturity Target Leverage Ratio Secured Debt Corporate Revolver $1,160 $545 SOFR + 1.875% Apr-30 Secured Debt Subtotal $1,160 $545 Investment Unsecured Debt 1 Grade Rated 2027 Notes $350 $350 Jan-27 2.70% (SOFR + 1.66%) 1 2029 Notes $300 $300 Feb-29 By Moody’s And Fitch 7.10% (SOFR + 3.13%) 1 2030 Notes $300 $300 Feb-30 6.34% (SOFR + 2.19%) Unsecured Debt Subtotal $950 $950 Total Debt $2,110 $1,495 64% Unsecured Borrowings Maturities ($ in millions) $1,500 Unsecured Debt $615 Credit Facility Drawn $695mm $1,000 Credit Facility Undrawn 2 Available Liquidity $545 $500 $350 $300 $300 $0 2026 2027 2028 2029 2030 Diverse and flexible sources of debt capital with ample liquidity As of September 30, 2025 Note: Numbers may not sum due to rounding. 1. The Company entered into an interest rate swap agreement under which the Company receives a fixed interest rate and pays a floating rate based on three-month SOFR plus a spread. 2. Liquidity was composed of $80 million of unrestricted cash and cash equivalents and $615 million of undrawn capacity under the credit facility (subject to borrowing base and other limitations). 10

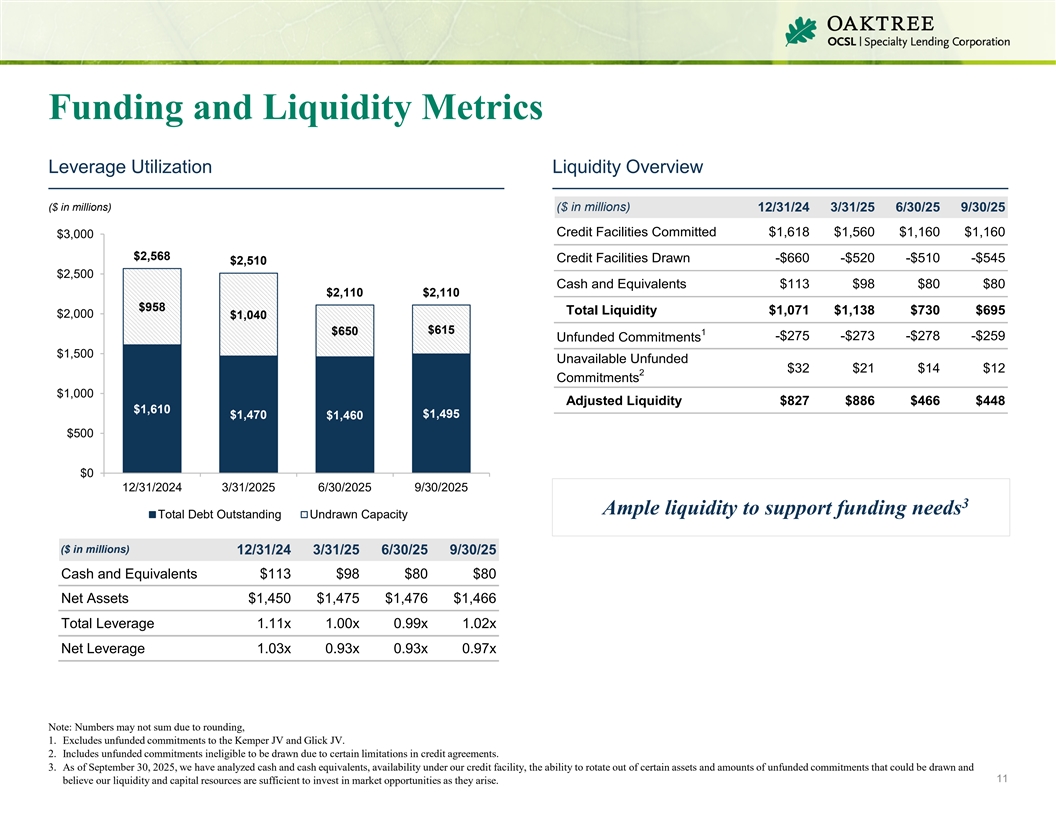

Funding and Liquidity Metrics Leverage Utilization Liquidity Overview ($ in millions) ($ in millions) 12/31/24 3/31/25 6/30/25 9/30/25 Credit Facilities Committed $1,618 $1,560 $1,160 $1,160 $3,000 $2,568 Credit Facilities Drawn -$660 -$520 -$510 -$545 $2,510 $2,500 Cash and Equivalents $113 $98 $80 $80 $2,110 $2,110 $958 Total Liquidity $1,071 $1,138 $730 $695 $2,000 $1,040 $615 1 $650 -$275 -$273 -$278 -$259 Unfunded Commitments $1,500 Unavailable Unfunded $32 $21 $14 $12 2 Commitments $1,000 Adjusted Liquidity $827 $886 $466 $448 $1,610 $1,470 $1,495 $1,460 $500 $0 12/31/2024 3/31/2025 6/30/2025 9/30/2025 3 Ample liquidity to support funding needs Total Debt Outstanding Undrawn Capacity ($ in millions) 12/31/24 3/31/25 6/30/25 9/30/25 Cash and Equivalents $113 $98 $80 $80 Net Assets $1,450 $1,475 $1,476 $1,466 Total Leverage 1.11x 1.00x 0.99x 1.02x Net Leverage 1.03x 0.93x 0.93x 0.97x Note: Numbers may not sum due to rounding, 1. Excludes unfunded commitments to the Kemper JV and Glick JV. 2. Includes unfunded commitments ineligible to be drawn due to certain limitations in credit agreements. 3. As of September 30, 2025, we have analyzed cash and cash equivalents, availability under our credit facility, the ability to rotate out of certain assets and amounts of unfunded commitments that could be drawn and 11 believe our liquidity and capital resources are sufficient to invest in market opportunities as they arise.

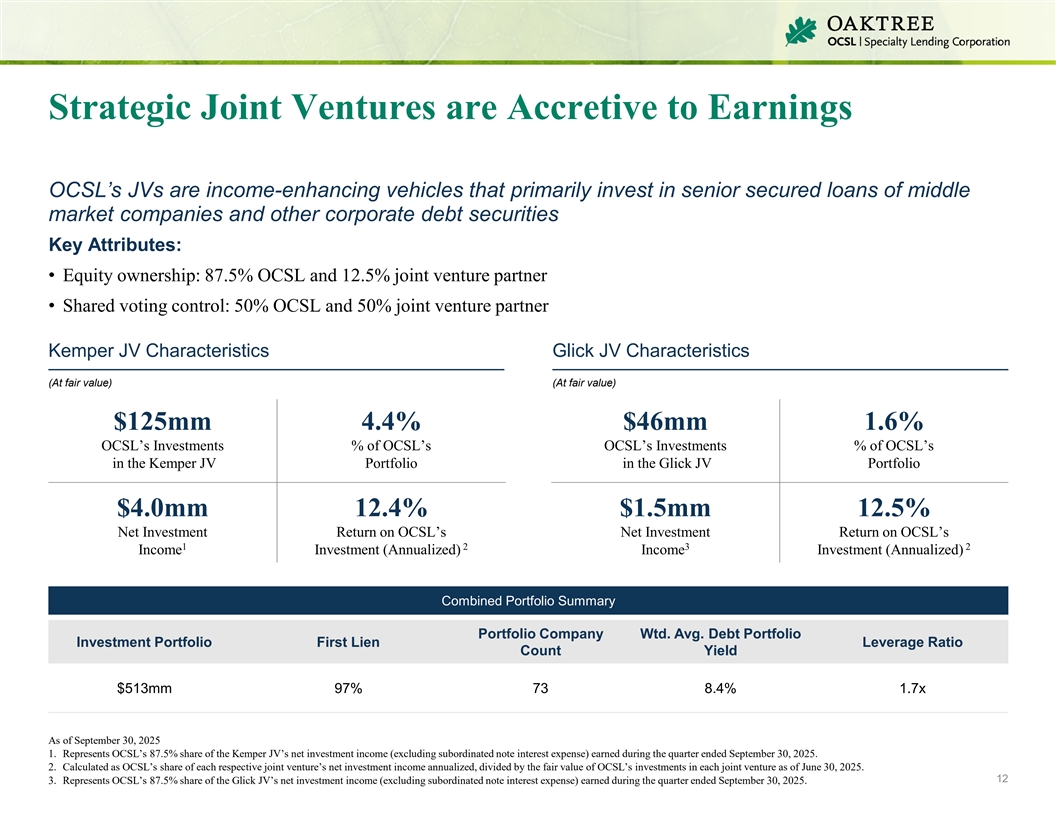

Strategic Joint Ventures are Accretive to Earnings OCSL’s JVs are income-enhancing vehicles that primarily invest in senior secured loans of middle market companies and other corporate debt securities Key Attributes: • Equity ownership: 87.5% OCSL and 12.5% joint venture partner • Shared voting control: 50% OCSL and 50% joint venture partner Kemper JV Characteristics Glick JV Characteristics (At fair value) (At fair value) $125mm 4.4% $46mm 1.6% OCSL’s Investments % of OCSL’s OCSL’s Investments % of OCSL’s in the Kemper JV Portfolio in the Glick JV Portfolio $4.0mm 12.4% $1.5mm 12.5% Net Investment Return on OCSL’s Net Investment Return on OCSL’s 1 2 3 2 Income Investment (Annualized) Income Investment (Annualized) Combined Portfolio Summary Portfolio Company Wtd. Avg. Debt Portfolio Investment Portfolio First Lien Leverage Ratio Count Yield $513mm 97% 73 8.4% 1.7x As of September 30, 2025 1. Represents OCSL’s 87.5% share of the Kemper JV’s net investment income (excluding subordinated note interest expense) earned during the quarter ended September 30, 2025. 2. Calculated as OCSL’s share of each respective joint venture’s net investment income annualized, divided by the fair value of OCSL’s investments in each joint venture as of June 30, 2025. 12 3. Represents OCSL’s 87.5% share of the Glick JV’s net investment income (excluding subordinated note interest expense) earned during the quarter ended September 30, 2025.

Appendix

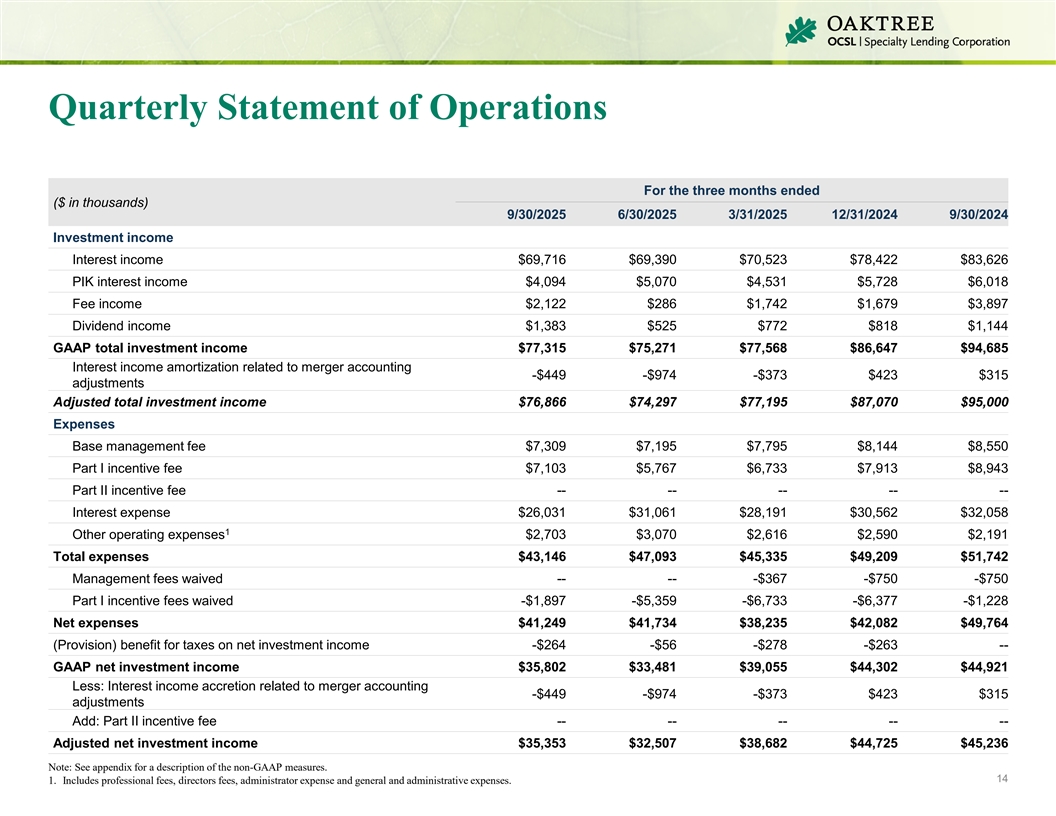

Quarterly Statement of Operations For the three months ended ($ in thousands) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Investment income Interest income $69,716 $69,390 $70,523 $78,422 $83,626 PIK interest income $4,094 $5,070 $4,531 $5,728 $6,018 Fee income $2,122 $286 $1,742 $1,679 $3,897 Dividend income $1,383 $525 $772 $818 $1,144 GAAP total investment income $77,315 $75,271 $77,568 $86,647 $94,685 Interest income amortization related to merger accounting -$449 -$974 -$373 $423 $315 adjustments Adjusted total investment income $76,866 $74,297 $77,195 $87,070 $95,000 Expenses Base management fee $7,309 $7,195 $7,795 $8,144 $8,550 Part I incentive fee $7,103 $5,767 $6,733 $7,913 $8,943 Part II incentive fee -- -- -- -- -- Interest expense $26,031 $31,061 $28,191 $30,562 $32,058 1 Other operating expenses $2,703 $3,070 $2,616 $2,590 $2,191 Total expenses $43,146 $47,093 $45,335 $49,209 $51,742 Management fees waived -- -- -$367 -$750 -$750 Part I incentive fees waived -$1,897 -$5,359 -$6,733 -$6,377 -$1,228 Net expenses $41,249 $41,734 $38,235 $42,082 $49,764 (Provision) benefit for taxes on net investment income -$264 -$56 -$278 -$263 -- GAAP net investment income $35,802 $33,481 $39,055 $44,302 $44,921 Less: Interest income accretion related to merger accounting -$449 -$974 -$373 $423 $315 adjustments Add: Part II incentive fee -- -- -- -- -- Adjusted net investment income $35,353 $32,507 $38,682 $44,725 $45,236 Note: See appendix for a description of the non-GAAP measures. 14 1. Includes professional fees, directors fees, administrator expense and general and administrative expenses. I n v e s t o r P r e s e n a t

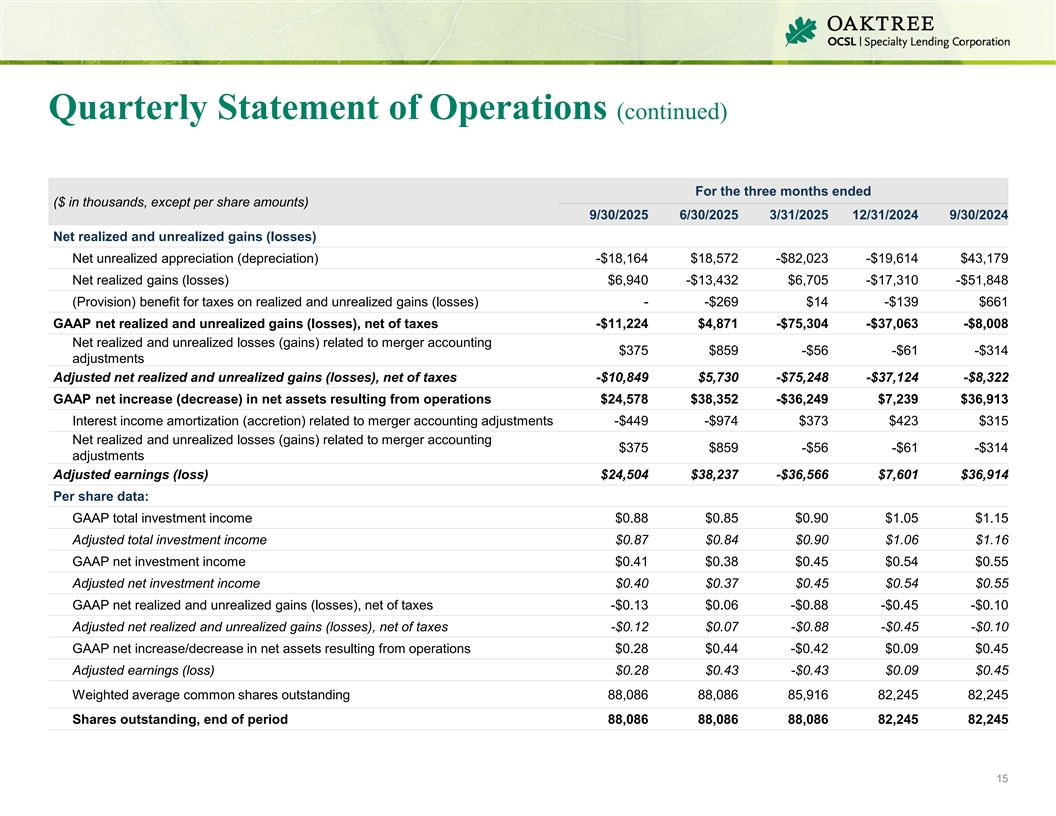

Quarterly Statement of Operations (continued) For the three months ended ($ in thousands, except per share amounts) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Net realized and unrealized gains (losses) Net unrealized appreciation (depreciation) -$18,164 $18,572 -$82,023 -$19,614 $43,179 Net realized gains (losses) $6,940 -$13,432 $6,705 -$17,310 -$51,848 (Provision) benefit for taxes on realized and unrealized gains (losses) - -$269 $14 -$139 $661 GAAP net realized and unrealized gains (losses), net of taxes -$11,224 $4,871 -$75,304 -$37,063 -$8,008 Net realized and unrealized losses (gains) related to merger accounting $375 $859 -$56 -$61 -$314 adjustments Adjusted net realized and unrealized gains (losses), net of taxes -$10,849 $5,730 -$75,248 -$37,124 -$8,322 GAAP net increase (decrease) in net assets resulting from operations $24,578 $38,352 -$36,249 $7,239 $36,913 Interest income amortization (accretion) related to merger accounting adjustments -$449 -$974 $373 $423 $315 Net realized and unrealized losses (gains) related to merger accounting $375 $859 -$56 -$61 -$314 adjustments Adjusted earnings (loss) $24,504 $38,237 -$36,566 $7,601 $36,914 Per share data: GAAP total investment income $0.88 $0.85 $0.90 $1.05 $1.15 Adjusted total investment income $0.87 $0.84 $0.90 $1.06 $1.16 GAAP net investment income $0.41 $0.38 $0.45 $0.54 $0.55 Adjusted net investment income $0.40 $0.37 $0.45 $0.54 $0.55 GAAP net realized and unrealized gains (losses), net of taxes -$0.13 $0.06 -$0.88 -$0.45 -$0.10 Adjusted net realized and unrealized gains (losses), net of taxes -$0.12 $0.07 -$0.88 -$0.45 -$0.10 GAAP net increase/decrease in net assets resulting from operations $0.28 $0.44 -$0.42 $0.09 $0.45 Adjusted earnings (loss) $0.28 $0.43 -$0.43 $0.09 $0.45 Weighted average common shares outstanding 88,086 88,086 85,916 82,245 82,245 Shares outstanding, end of period 88,086 88,086 88,086 82,245 82,245 15 I n v e s t o r P r e s e n a t

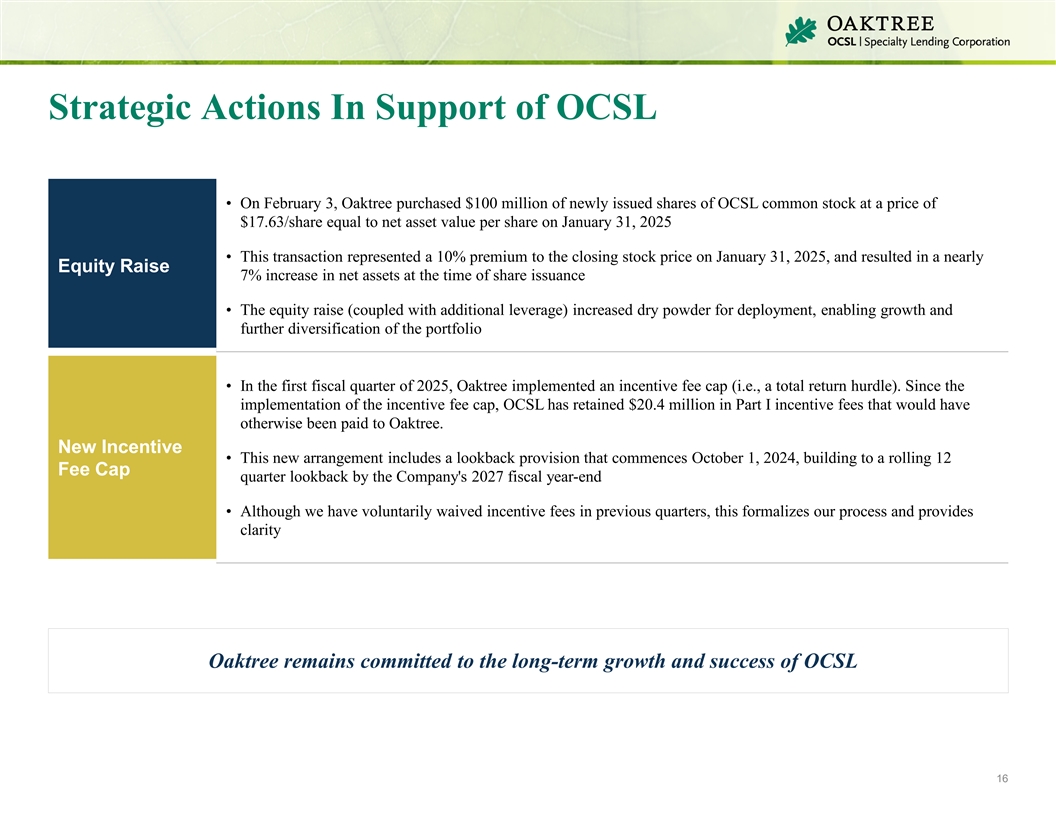

Strategic Actions In Support of OCSL • On February 3, Oaktree purchased $100 million of newly issued shares of OCSL common stock at a price of $17.63/share equal to net asset value per share on January 31, 2025 • This transaction represented a 10% premium to the closing stock price on January 31, 2025, and resulted in a nearly Equity Raise 7% increase in net assets at the time of share issuance • The equity raise (coupled with additional leverage) increased dry powder for deployment, enabling growth and further diversification of the portfolio • In the first fiscal quarter of 2025, Oaktree implemented an incentive fee cap (i.e., a total return hurdle). Since the implementation of the incentive fee cap, OCSL has retained $20.4 million in Part I incentive fees that would have otherwise been paid to Oaktree. New Incentive • This new arrangement includes a lookback provision that commences October 1, 2024, building to a rolling 12 Fee Cap quarter lookback by the Company's 2027 fiscal year-end • Although we have voluntarily waived incentive fees in previous quarters, this formalizes our process and provides clarity Oaktree remains committed to the long-term growth and success of OCSL 16

Non-GAAP Disclosures The OCSI Merger and the OSI2 Merger (the “Mergers”) were accounted for as asset acquisitions in accordance with the asset acquisition method of accounting as detailed in ASC 805-50, Business Combinations—Related Issues ( ASC 805 ). The consideration paid to each of the stockholders of OCSI and OSI2 were allocated to the individual assets acquired and liabilities assumed based on the relative fair values of the net identifiable assets acquired other than non-qualifying assets, which established a new cost basis for the acquired investments under ASC 805 that, in aggregate, was different than the historical cost basis of the acquired investments prior to the OCSI Merger or OSI2 Merger, as applicable. Additionally, immediately following the completion of the Mergers, the acquired investments were marked to their respective fair values under ASC 820, Fair Value Measurements, which resulted in unrealized appreciation / depreciation. The new cost basis established by ASC 805 on debt investments acquired will accrete / amortize over the life of each respective debt investment through interest income, with a corresponding adjustment recorded to unrealized appreciation / depreciation on such investment acquired through its ultimate disposition. The new cost basis established by ASC 805 on equity investments acquired will not accrete / amortize over the life of such investments through interest income and, assuming no subsequent change to the fair value of the equity investments acquired and disposition of such equity investments at fair value, the Company will recognize a realized gain / loss with a corresponding reversal of the unrealized appreciation / depreciation on disposition of such equity investments acquired. The Company’s management uses the non-GAAP financial measures described above internally to analyze and evaluate financial results and performance and to compare its financial results with those of other business development companies that have not adjusted the cost basis of certain investments pursuant to ASC 805. The Company’s management believes Adjusted Total Investment Income , Adjusted Total Investment Income Per Share , Adjusted Net Investment Income and Adjusted Net Investment Income Per Share are useful to investors as an additional tool to evaluate ongoing results and trends for the Company without giving effect to the accretion income resulting from the new cost basis of the investments acquired in the Mergers because these amounts do not impact the fees payable to Oaktree under its fourth amended and restated investment advisory agreement (the “A&R Advisory Agreement”), and specifically as its relates to Adjusted Net Investment Income and Adjusted Net Investment Income Per Share , without giving effect to Part II incentive fees. In addition, the Company’s management believes that “Adjusted Net Realized and Unrealized Gains (Losses), Net of Taxes”, “Adjusted Net Realized and Unrealized Gains (Losses), Net of Taxes Per Share”, “Adjusted Earnings (Loss)” and “Adjusted Earnings (Loss) Per Share” are useful to investors as they exclude the non-cash income/gain resulting from the Mergers and used by management to evaluate the economic earnings of its investment portfolio. Moreover, these metrics align the Company's key financial measures with the calculation of incentive fees payable to Oaktree under with the A&R Advisory Agreement (i.e., excluding amounts resulting solely from the lower cost basis of the acquired investments established by ASC 805 that would have been to the benefit of Oaktree absent such exclusion). 17 I n v e s t o r P r e s e n a t

oaktreespecialtylending.com