UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement. | |

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). | |

| ¨ | Definitive Proxy Statement. | |

| x | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12. | |

YuMe, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

On May 16, 2016, YuMe, Inc. issued the following press release:

YUME SENDS LETTER TO STOCKHOLDERS

Cites Strong Support from Wall Street Analysts

Addresses and Corrects VIEX’s Misleading and False Claims

Urges Stockholders to Vote FOR its Experienced, Independent

Director Nominees on the WHITE Proxy Card Today

Redwood City, Calif. – May 16, 2016 – YuMe, Inc. (NYSE: YUME) (the “Company”), the global audience technology company powered by data-driven insights and multi-platform expertise, today sent a letter to stockholders in connection with the Company’s 2016 Annual Meeting on May 27, 2016. YuMe’s stockholders of record as of the close of business on March 31, 2016 will be entitled to vote at the Annual Meeting.

The letter cites strong support from Wall Street analysts, including references to YuMe’s solid first quarter 2016 performance and announced increase of second quarter guidance, which reflect the Company’s significant progress and momentum in executing on its value-creating strategic plan. The letter also addresses and corrects misleading and false claims made by VIEX Opportunities Fund, LP (“VIEX”), which has nominated two inexperienced and unqualified candidates for election at the Annual Meeting.

Stockholders are urged to vote “FOR” on the WHITE proxy card in support of YuMe’s experienced, independent director nominees, Craig Forman and Derek Harrar, to ensure YuMe continues to improve profitability, drive growth and enhance stockholder value.

The letter to YuMe stockholders is set forth below:

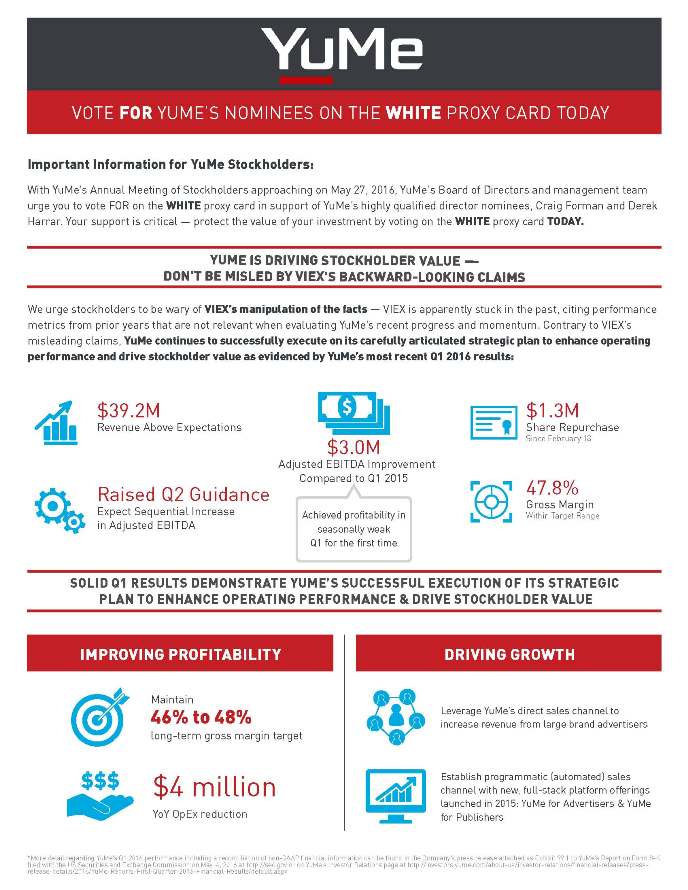

VOTE FOR YUME’S NOMINEES ON THE WHITE PROXY CARD TODAY Important Information for YuMe Stockholders: With YuMe’s Annual Meeting of Stockholders approaching on May 27, 2016, YuMe’s Board of Directors and management team urge you to vote FOR on the WHITE proxy card in support of YuMe’s highly qualified director nominees, Craig Forman and Derek Harrar. Your support is critical — protect the value of your investment by voting on the WHITE proxy card TODAY. YUME IS DRIVING STOCKHOLDER VALUE — DON’T BE MISLED BY VIEX’S BACKWARD-LOOKING CLAIMS We urge stockholders to be wary of VIEX’s manipulation of the facts — VIEX is apparently stuck in the past, citing performance metrics from prior years that are not relevant when evaluating YuMe’s recent progress and momentum. Contrary to VIEX’s misleading claims, YuMe continues to successfully execute on its carefully articulated strategic plan to enhance operating performance and drive stockholder value as evidenced by YuMe’s most recent Q1 2016 results: $39.2M $1.3M Revenue Above Expectations Share Repurchase $3.0M Since February 18 Adjusted EBITDA Improvement Q2 Guidance Compared to Q1 2015 47.8% Raised Gross Margin Expect Sequential Increase Achieved profitability in Within Target Range in Adjusted EBITDA seasonally weak Q1 for the first time SOLID Q1 RESULTS DEMONSTRATE YUME’S SUCCESSFUL EXECUTION OF ITS STRATEGIC PLAN TO ENHANCE OPERATING PERFORMANCE & DRIVE STOCKHOLDER VALUE IMPROVING PROFITABILITY DRIVING GROWTH Maintain 46% 48% Leverage YuMe’s direct sales channel to to increase revenue from large brand advertisers long-term gross margin target $$$ Establish programmatic (automated) sales $4 million channel with new, full-stack platform offerings YoY OpEx reduction launched in 2015: YuMe for Advertisers & YuMe for Publishers filed *More with detail the regarding US Securities YuMe’s and Q1 Exchange 2016 performance Commission including on May a4, reconciliation 2016 at http://sec of non .gov -GAAP or on financial YuMe’s information Investor Relations can be page found at in http://investors the Company’s .yume press .com/about release attached -us/investor as Exhibit -relations/financial 99.1 to YuMe’s- Report releases/press on Form - 8-K release-details/2016/YuMe-Reports-First-Quarter-2016-Financial-Results/default.aspx

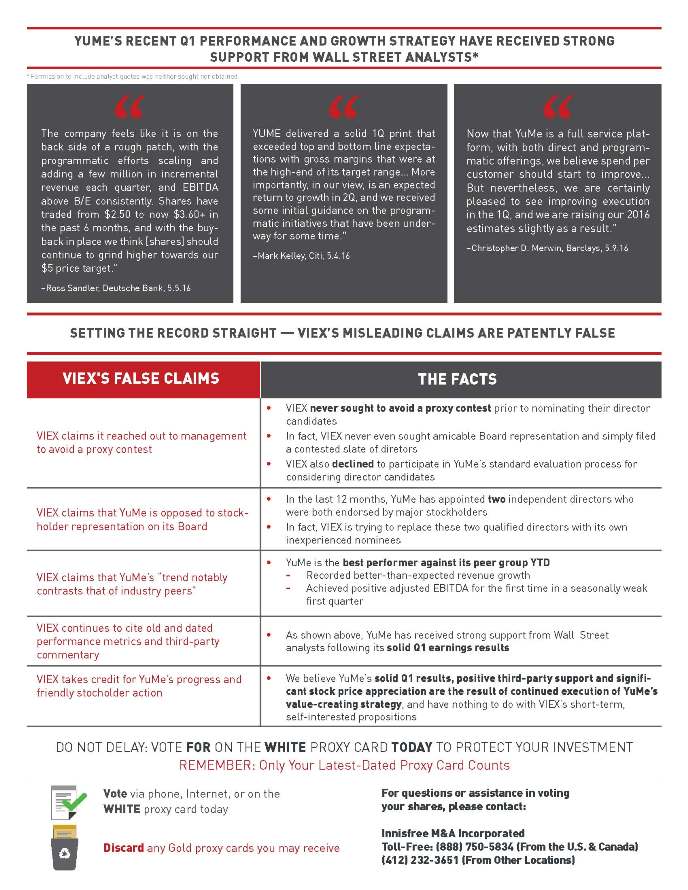

YUME’S RECENT Q1 PERFORMANCE AND GROWTH STRATEGY HAVE RECEIVED STRONG SUPPORT FROM WALL STREET ANALYSTS* *Permission to include analyst quotes was neither sought nor obtained. The company feels like it is on the YUME delivered a solid 1Q print that Now that YuMe is a full service plat-back side of a rough patch, with the exceeded top and bottom line expecta- form, with both direct and program-programmatic efforts scaling and tions with gross margins that were at matic offerings, we believe spend per adding a few million in incremental the high-end of its target range… More customer should start to improve revenue each quarter, and EBITDA importantly, in our view, is an expected But nevertheless, we are certainly above B/E consistently. Shares have return to growth in 2Q, and we received pleased to see improving execution traded from $2.50 to now $3.60+ in some initial guidance on the program- in the 1Q, and we are raising our 2016 the past 6 months, and with the buy- matic initiatives that have been under- estimates slightly as a result.” way for some time.” back in place we think [shares] should –Christopher D. Merwin, Barclays, 5.9.16 continue to grind higher towards our –Mark Kelley, Citi, 5.4.16 $5 price target.” –Ross Sandler, Deutsche Bank, 5.5.16 SETTING THE RECORD STRAIGHT — VIEX’S MISLEADING CLAIMS ARE PATENTLY FALSE VIEX’S FALSE CLAIMS THE FACTS • VIEX never sought to avoid a proxy contest prior to nominating their director candidates VIEX claims it reached out to management • In fact, VIEX never even sought amicable Board representation and simply filed to avoid a proxy contest a contested slate of diretors • VIEX also declined to participate in YuMe’s standard evaluation process for considering director candidates • In the last 12 months, YuMe has appointed two independent directors who VIEX claims that YuMe is opposed to stock- were both endorsed by major stockholders holder representation on its Board • In fact, VIEX is trying to replace these two qualified directors with its own inexperienced nominees • YuMe is the best performer against its peer group YTD VIEX claims that YuMe’s “trend notably - Recorded better-than-expected revenue growth contrasts that of industry peers” - Achieved positive adjusted EBITDA for the first time in a seasonally weak first quarter VIEX continues to cite old and dated • As shown above, YuMe has received strong support from Wall Street performance metrics and third-party analysts following its solid Q1 earnings results commentary VIEX takes credit for YuMe’s progress and • We believe YuMe’s solid Q1 results, positive third-party support and signifi-friendly stocholder action cant stock price appreciation are the result of continued execution of YuMe’s value-creating strategy, and have nothing to do with VIEX’s short-term, self-interested propositions DO NOT DELAY: VOTE FOR ON THE WHITE PROXY CARD TODAY TO PROTECT YOUR INVESTMENT REMEMBER: Only Your Latest-Dated Proxy Card Counts Vote via phone, Internet, or on the For questions or assistance in voting WHITE proxy card today your shares, please contact: Innisfree M&A Incorporated Discard any Gold proxy cards you may receive Toll-Free: (888) 750-5834 (From the U.S. & Canada) (412) 232-3651 (From Other Locations)

The stockholder letter can also be viewed at YuMe’s 2016 Annual Meeting website, www.YuMeStockholderValue.com.

If you have questions or need assistance voting your WHITE proxy card,

please contact:

Innisfree M&A Incorporated

Stockholders in the U.S. and Canada may call toll-free: (888) 750-5834

Stockholders in other locations may call: + (412) 232-3651

Banks and Brokers may call collect: (212) 750-5833

About YuMe

YuMe, Inc. (YUME) is a leading provider of global audience technologies, curating relationships between brand advertisers and consumers of premium video content across a growing range of connected devices. Combining data-driven technologies with deep insight into audience behavior, YuMe offers brand advertisers end-to-end marketing software that establishes greater brand resonance with engaged consumers. It is the evolution of brand advertising for an ever-expanding video ecosystem. YuMe is headquartered in Redwood City, California, United States offices worldwide. For more information, visit YuMe.com/pr, follow @YuMeVideo and like YuMe on Facebook.

Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve risks and uncertainties. These forward-looking statements include but are not limited to statements regarding the proposed director nominees and YuMe’s future financial results. Actual results may differ materially from those anticipated in these forward-looking statements. Factors that might contribute to such differences include, among others, that historical growth rates and results may not be indicative of future growth rates and results; economic downturns and the general state of the economy; our ability to expand our customer base and increase sales to existing customers; unforeseen difficulties executing on our strategic activities; our ability to retain and hire necessary employees; the impact of seasonality on our business; our ability to successfully sell, integrate or maintain our programmatic solution; whether sufficient advertising customers or digital media property owners adopt our programmatic solution; our ability to develop innovative, new products and services on a timely and cost-effective basis; client acceptance of our products and services; unforeseen changes in expense levels; competition and the pricing strategies of our competitors, which could lead to pricing pressure; and the effect the announcement of the stockholder proposal and nominations may have on YuMe’s relationships with its stockholders and other constituencies and on our ongoing business operations. For more information regarding the risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements, as well as risks relating to our business in general, we refer you to the “Risk Factors” section of YuMe’s most recent Quarterly Report on Form 10-Q and YuMe’s other filings, which are available on the Securities and Exchange Commission (“SEC”) Web site at www.sec.gov. These forward-looking statements are based on current expectations and YuMe assumes no obligation to update this information.

Important Additional Information

YuMe filed a proxy statement with SEC in connection with the solicitation of proxies for the 2016 Annual Meeting (the “Proxy Statement”) on April 14, 2016. YuMe, its directors and certain of its executive officers will be participants in the solicitation of proxies from stockholders in respect of the 2016 Annual Meeting. Information regarding the names of YuMe’s directors and executive officers and their respective interests in YuMe by security holdings or otherwise is set forth in the Proxy Statement. To the extent holdings of such participants in YuMe’s securities have or will change following the Proxy Statement, such changes will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information can also be found in YuMe’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the SEC on March 10, 2016, and its Quarterly Report on Form 10-K for the period ended March 31, 2016, filed with the SEC on May 6, 2016. Details concerning the nominees of YuMe’s Board of Directors for election at the 2016 Annual Meeting are included in the Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND STOCKHOLDERS OF YUME ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders will be able to obtain a copy of the definitive proxy statement and other documents filed by YuMe free of charge from the SEC’s website, www.sec.gov. YuMe stockholders will also be able to obtain, without charge, a copy of the definitive Proxy Statement and other relevant filed documents by directing a request by mail to Secretary, YuMe, Inc., 1204 Middlefield Road, Redwood City, 94063.

Contacts

Investor Relations

YuMe, Inc.

Gary J. Fuges, CFA, 650-503-7875

ir@yume.com

Innisfree M&A Incorporated

Larry Miller / Jennifer Shotwell, 212-750-5833

Media Relations

Sard Verbinnen & Co

John Christiansen / Meghan Gavigan, 415-618-8750

jchristiansen@sardverb.com / mgavigan@sardverb.com