Exhibit 99.1

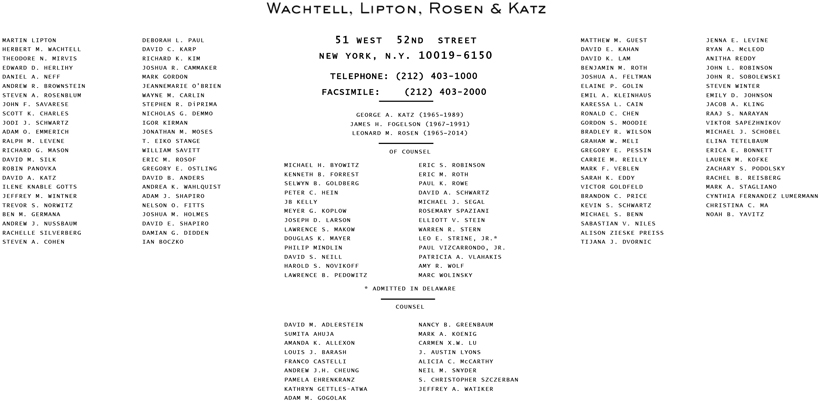

Wachtell, Lipton, Rosen & Katz 51 WEST 52ND STREETNEW YORK, N.Y. 10019-6150TELEPHONE: (212) 403-1000FACSIMILE: (212) 403-2000GEORGE A. KATZ (19651989) JAMES H. FOGELSON (19671991) LEONARD M. ROSEN (19652014)OF COUNSELMARTIN LIPTONHERBERT M. WACHTELLTHEODORE N. MIRVISEDWARD D. HERLIHYDANIEL A. NEFFANDREW R. BROWNSTEINSTEVEN A. ROSENBLUMJOHN F. SAVARESESCOTT K. CHARLESJODI J. SCHWARTZADAM O. EMMERICHRALPH M. LEVENERICHARD G. MASONDAVID M. SILKROBIN PANOVKADAVID A. KATZILENE KNABLE GOTTSJEFFREY M. WINTNERTREVOR S. NORWITZBEN M. GERMANAANDREW J. NUSSBAUMRACHELLE SILVERBERGSTEVEN A. COHENDEBORAH L. PAULDAVID C. KARPRICHARD K. KIMJOSHUA R. CAMMAKERMARK GORDONJEANNEMARIE OBRIENWAYNE M. CARLINSTEPHEN R. DiPRIMANICHOLAS G. DEMMOIGOR KIRMANJONATHAN M. MOSEST. EIKO STANGEWILLIAM SAVITTERIC M. ROSOFGREGORY E. OSTLINGDAVID B. ANDERSANDREA K. WAHLQUISTADAM J. SHAPIRONELSON O. FITTSJOSHUA M. HOLMESDAVID E. SHAPIRODAMIAN G. DIDDENIAN BOCZKOMICHAEL H. BYOWITZKENNETH B. FORRESTSELWYN B. GOLDBERGPETER C. HEINJB KELLYMEYER G. KOPLOWJOSEPH D. LARSONLAWRENCE S. MAKOWDOUGLAS K. MAYERPHILIP MINDLINDAVID S. NEILLHAROLD S. NOVIKOFFLAWRENCE B. PEDOWITZERIC S. ROBINSONERIC M. ROTHPAUL K. ROWEDAVID A. SCHWARTZMICHAEL J. SEGALROSEMARY SPAZIANIELLIOTT V. STEINWARREN R. STERNLEO E. STRINE, JR.*PAUL VIZCARRONDO, JR.PATRICIA A. VLAHAKISAMY R. WOLFMARC WOLINSKY* ADMITTED IN DELAWARE COUNSELDAVID M. ADLERSTEINSUMITA AHUJAAMANDA K. ALLEXONLOUIS J. BARASHFRANCO CASTELLIANDREW J.H. CHEUNGPAMELA EHRENKRANZKATHRYN GETTLES-ATWAADAM M. GOGOLAKNANCY B. GREENBAUMMARK A. KOENIGCARMEN X.W. LUJ. AUSTIN LYONSALICIA C. McCARTHYNEIL M. SNYDERS. CHRISTOPHER SZCZERBANJEFFREY A. WATIKERMATTHEW M. GUESTDAVID E. KAHANDAVID K. LAMBENJAMIN M. ROTHJOSHUA A. FELTMANELAINE P. GOLINEMIL A. KLEINHAUSKARESSA L. CAINRONALD C. CHENGORDON S. MOODIEBRADLEY R. WILSON GRAHAM W. MELIGREGORY E. PESSINCARRIE M. REILLYMARK F. VEBLENSARAH K. EDDYVICTOR GOLDFELDBRANDON C. PRICEKEVIN S. SCHWARTZMICHAEL S. BENNSABASTIAN V. NILESALISON ZIESKE PREISSTIJANA J. DVORNICJENNA E. LEVINERYAN A. McLEODANITHA REDDYJOHN L. ROBINSONJOHN R. SOBOLEWSKISTEVEN WINTEREMILY D. JOHNSONJACOB A. KLINGRAAJ S. NARAYANVIKTOR SAPEZHNIKOVMICHAEL J. SCHOBELELINA TETELBAUMERICA E. BONNETTLAUREN M. KOFKEZACHARY S. PODOLSKYRACHEL B. REISBERGMARK A. STAGLIANOCYNTHIA FERNANDEZ LUMERMANNCHRISTINA C. MANOAH B. YAVITZ

September 12, 2022

By E-mail

Skadden, Arps, Slate, Meagher & Flom LLP

525 University Avenue, Suite 1400

Palo Alto, California 94301

| Attention: |

Mike Ringler | |

| Sonia K. Nijjar | ||

| Dohyun Kim | ||

| Re: |

Third Purported Termination of Agreement and Plan of Merger | |

Dear Mr. Ringler:

This letter is sent on behalf of Twitter, Inc. (“Twitter” or “the Company”) in response to your September 9, 2022 letter, in which X Holdings I, Inc., for the third time, purports to terminate the Agreement and Plan of Merger (the “Agreement”) by and among Twitter, X Holdings I, Inc. (“Parent”), X Holdings II, Inc. (“Acquisition Sub”), and Elon R. Musk (together with Parent and Acquisition Sub, the “Musk Parties”). Capitalized terms used here and not otherwise defined have the meanings ascribed to them in the Agreement.

As was the case with both your July 8, 2022 and August 29, 2022 purported notices of termination, the purported termination set forth in your September 9, 2022 letter is invalid and wrongful under the Agreement, including under Section 8.1(d) thereof. Twitter has breached none of its representations or obligations under the Agreement, and following the receipt of the approval of Twitter’s stockholders at its September 13, 2022 special meeting, all of the conditions precedent