3Q 2025 Investor Overview

Forward Looking Statements This earnings release contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. Any statements about our management’s expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” "optimistic," “intends” and similar words or phrases. Any or all of the forward-looking statements in this earnings release may turn out to be inaccurate. The inclusion of forward-looking information in this earnings release should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. We have based these forward- looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Our actual results could differ materially from those anticipated in such forward-looking statements. Accordingly, we caution you that any such forward-looking statements are not a guarantee of future performance and that actual results may prove to be materially different from the results expressed or implied by the forward-looking statements due to a number of factors. For details on some of the factors that could affect these expectations, see risk factors and other cautionary language included in the Company's Annual Report on Form 10-K and other periodic and current reports filed with the Securities and Exchange Commission. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: the strength of the United States (“U.S.”) economy in general and the strength of the local economies inwhich we conduct operations; geopolitical concerns, including acts or threats of terrorism and the ongoing wars in Ukraine and in the Middle East; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market, and monetary fluctuations; volatility and disruptions in global capital and credit markets; changes in U.S. trade policies, including the implementation of tariffs and other protectionist trade policies; the effects of federal government shutdowns, debt ceiling standoff, or other fiscal policy uncertainty; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services; the impact of changes in financial services policies, laws, and regulations, including those concerning taxes, banking, securities, and insurance, and the application thereof by regulatory bodies; cybersecurity threats and the cost of defending against them; climate change, and other catastrophic disasters; the effect of the IFH acquisition or any other acquisitions we have made or may make, including, without limitation, the failure to achieve the expected revenue growth and/or expense savings from such acquisitions, and/or the failure to effectively integrate an acquisition target into our operations, including the planned growth of Windsor AdvantageTM; and other factors that may affect our future results. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of Capital after the date hereof. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and that the sources from which it has been obtained are reliable. Capital cannot guarantee the accuracy of such information, however, and has not independently verified such information. While Capital is not aware of any misstatements regarding the industry data presented in this presentation, Capital's estimates involve risks and uncertainties and are subject to change based on various factors. Similarly, Capital believes that its internal research is reliable, even though such research has not been verified by independent sources. Non-U.S. GAAP Financial Measures This presentation may include certain non–U.S. generally accepted accounting principles ("GAAP") financial measures intended to supplement, not substitute for, comparable GAAP measures. These non-GAAP financial measures should not be considered in isolation, and should be considered as additions to, and not substitutes for or superior to, measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of the Company's non-GAAP financial measures as tools for comparison. If included in this presentation, see the Appendix to this presentation for a reconciliation of the non-GAAP financial measures used in (or conveyed orally during) this presentation to their most directly comparable GAAP financial measures. Core Financial Measures As used in this presentation, core net income, core fee revenue, core ROA, core ROE, ROTCE, core ROTCE, Commercial Bank NIM, Commercial Bank Loan Yield, Commercial Bank ACL Coverage Ratio, and Tangible Book Value are non-GAAP financial measures. These non-GAAP financial metrics exclude brokered time deposit call, merger-related expenses and other certain one-time non-recurring pre-tax adjustments and tax impacts of such adjustments. Reconciliations of these and other non-GAAP measures to their comparable GAAP measures are set forth in the Appendix to this presentation. 2

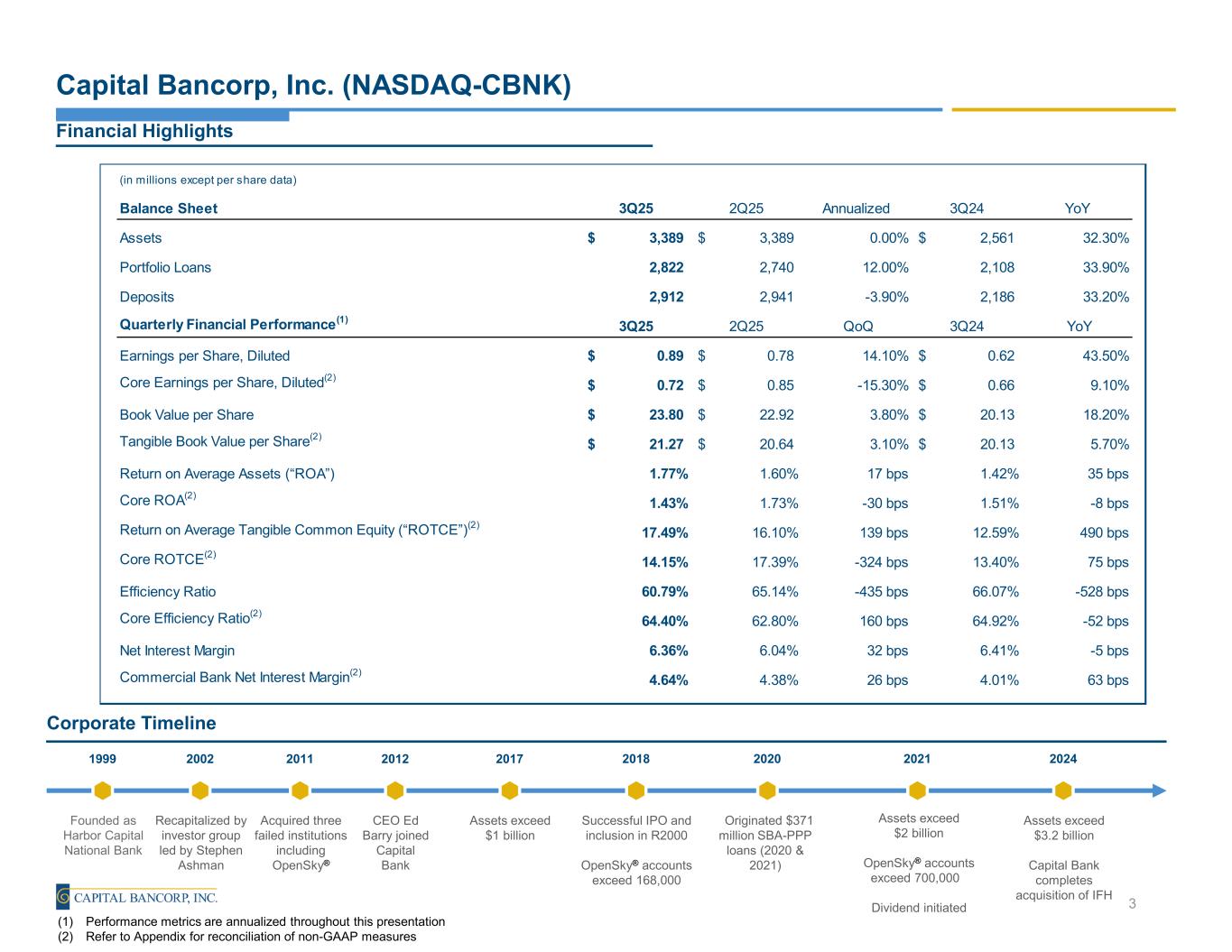

Capital Bancorp, Inc. (NASDAQ-CBNK) Financial Highlights Corporate Timeline Founded as Harbor Capital National Bank Recapitalized by investor group led by Stephen Ashman Acquired three failed institutions including OpenSky® CEO Ed Barry joined Capital Bank Assets exceed $1 billion Successful IPO and inclusion in R2000 OpenSky® accounts exceed 168,000 1999 2002 2011 2012 2017 2018 Originated $371 million SBA-PPP loans (2020 & 2021) 2020 Assets exceed $2 billion OpenSky® accounts exceed 700,000 Dividend initiated 2021 (1) Performance metrics are annualized throughout this presentation (2) Refer to Appendix for reconciliation of non-GAAP measures Assets exceed $3.2 billion Capital Bank completes acquisition of IFH 2024 3 (in millions except per share data) Balance Sheet 3Q25 2Q25 Annualized 3Q24 YoY Assets 3,389$ 3,389$ 0.00% 2,561$ 32.30% Portfolio Loans 2,822 2,740 12.00% 2,108 33.90% Deposits 2,912 2,941 -3.90% 2,186 33.20% Quarterly Financial Performance(1) 3Q25 2Q25 QoQ 3Q24 YoY Earnings per Share, Diluted 0.89$ 0.78$ 14.10% 0.62$ 43.50% Core Earnings per Share, Diluted(2) 0.72$ 0.85$ -15.30% 0.66$ 9.10% Book Value per Share 23.80$ 22.92$ 3.80% 20.13$ 18.20% Tangible Book Value per Share(2) 21.27$ 20.64$ 3.10% 20.13$ 5.70% Return on Average Assets (“ROA”) 1.77% 1.60% 17 bps 1.42% 35 bps Core ROA(2) 1.43% 1.73% -30 bps 1.51% -8 bps Return on Average Tangible Common Equity (“ROTCE”)(2) 17.49% 16.10% 139 bps 12.59% 490 bps Core ROTCE(2) 14.15% 17.39% -324 bps 13.40% 75 bps Efficiency Ratio 60.79% 65.14% -435 bps 66.07% -528 bps Core Efficiency Ratio(2) 64.40% 62.80% 160 bps 64.92% -52 bps Net Interest Margin 6.36% 6.04% 32 bps 6.41% -5 bps Commercial Bank Net Interest Margin(2) 4.64% 4.38% 26 bps 4.01% 63 bps

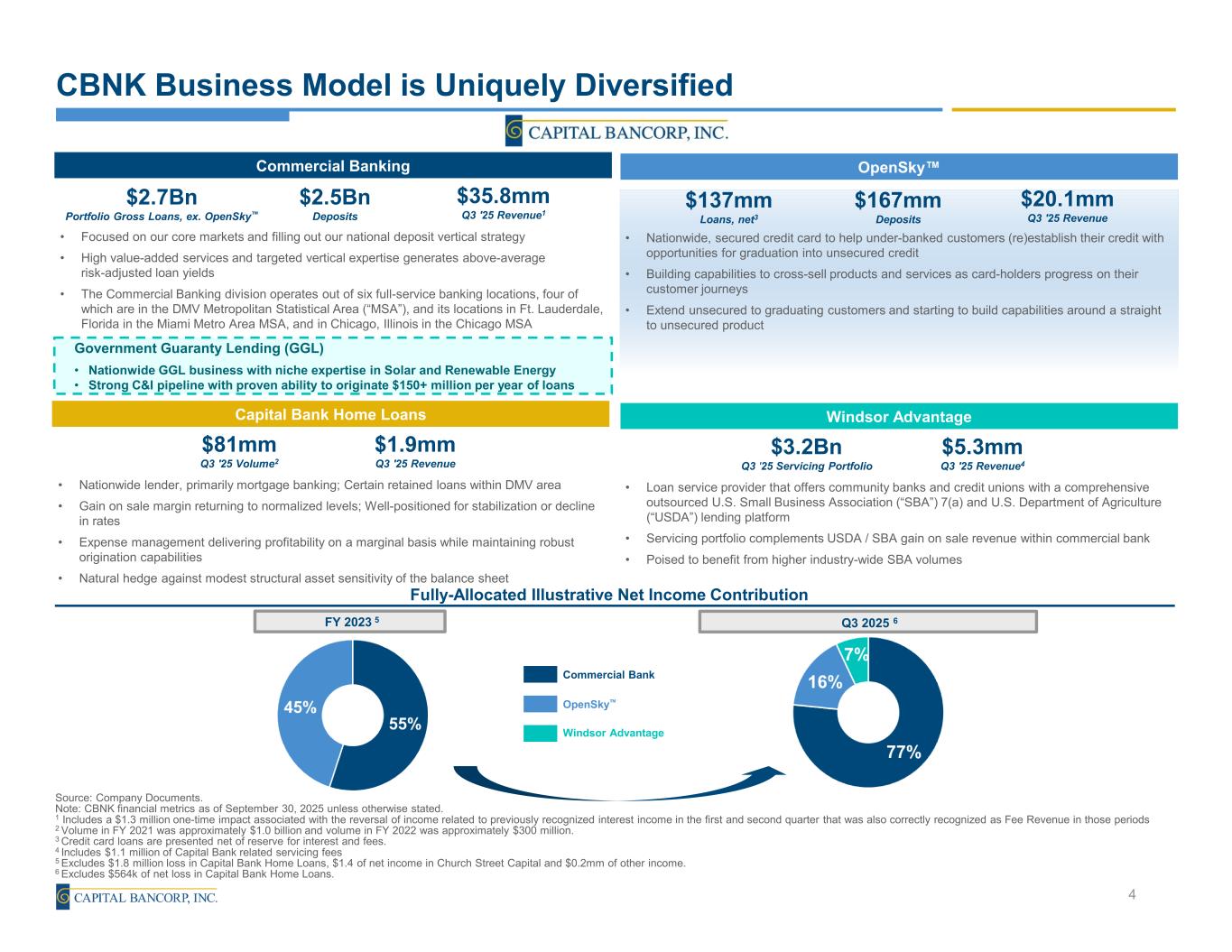

$3.2Bn Q3 '25 Servicing Portfolio $5.3mm Q3 '25 Revenue4 • Loan service provider that offers community banks and credit unions with a comprehensive outsourced U.S. Small Business Association (“SBA”) 7(a) and U.S. Department of Agriculture (“USDA”) lending platform • Servicing portfolio complements USDA / SBA gain on sale revenue within commercial bank • Poised to benefit from higher industry-wide SBA volumes Q3 2025 6 CBNK Business Model is Uniquely Diversified Source: Company Documents. Note: CBNK financial metrics as of September 30, 2025 unless otherwise stated. 1 Includes a $1.3 million one-time impact associated with the reversal of income related to previously recognized interest income in the first and second quarter that was also correctly recognized as Fee Revenue in those periods 2 Volume in FY 2021 was approximately $1.0 billion and volume in FY 2022 was approximately $300 million. 3 Credit card loans are presented net of reserve for interest and fees. 4 Includes $1.1 million of Capital Bank related servicing fees 5 Excludes $1.8 million loss in Capital Bank Home Loans, $1.4 of net income in Church Street Capital and $0.2mm of other income. 6 Excludes $564k of net loss in Capital Bank Home Loans. Commercial Bank OpenSky Windsor Advantage Commercial Banking Government Guaranty Lending (GGL) • Nationwide GGL business with niche expertise in Solar and Renewable Energy • Strong C&I pipeline with proven ability to originate $150+ million per year of loans $2.7Bn Portfolio Gross Loans, ex. OpenSky $2.5Bn Deposits • Focused on our core markets and filling out our national deposit vertical strategy • High value-added services and targeted vertical expertise generates above-average risk-adjusted loan yields • The Commercial Banking division operates out of six full-service banking locations, four of which are in the DMV Metropolitan Statistical Area (“MSA”), and its locations in Ft. Lauderdale, Florida in the Miami Metro Area MSA, and in Chicago, Illinois in the Chicago MSA $35.8mm Q3 '25 Revenue1 Fully-Allocated Illustrative Net Income Contribution 4 $81mm Q3 '25 Volume2 $1.9mm Q3 '25 Revenue • Nationwide lender, primarily mortgage banking; Certain retained loans within DMV area • Gain on sale margin returning to normalized levels; Well-positioned for stabilization or decline in rates • Expense management delivering profitability on a marginal basis while maintaining robust origination capabilities • Natural hedge against modest structural asset sensitivity of the balance sheet $167mm Deposits $137mm Loans, net3 • Nationwide, secured credit card to help under-banked customers (re)establish their credit with opportunities for graduation into unsecured credit • Building capabilities to cross-sell products and services as card-holders progress on their customer journeys • Extend unsecured to graduating customers and starting to build capabilities around a straight to unsecured product $20.1mm Q3 '25 Revenue Capital Bank Home Loans OpenSky Windsor Advantage FY 2023 5

Financial Information

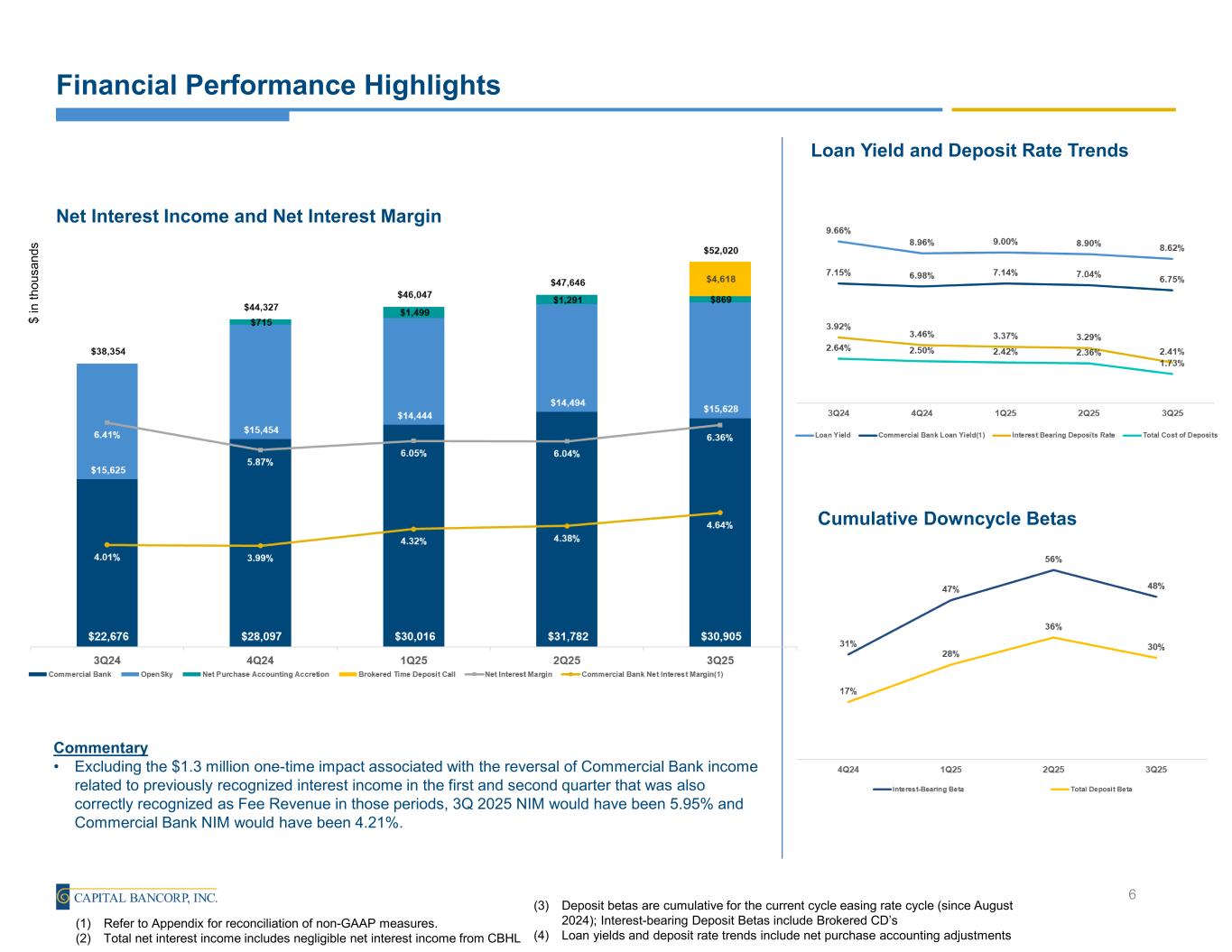

Financial Performance Highlights $ in th ou sa nd s 6 (1) Refer to Appendix for reconciliation of non-GAAP measures. (2) Total net interest income includes negligible net interest income from CBHL Net Interest Income and Net Interest Margin Loan Yield and Deposit Rate Trends Cumulative Downcycle Betas (3) Deposit betas are cumulative for the current cycle easing rate cycle (since August 2024); Interest-bearing Deposit Betas include Brokered CD’s (4) Loan yields and deposit rate trends include net purchase accounting adjustments Commentary • Excluding the $1.3 million one-time impact associated with the reversal of Commercial Bank income related to previously recognized interest income in the first and second quarter that was also correctly recognized as Fee Revenue in those periods, 3Q 2025 NIM would have been 5.95% and Commercial Bank NIM would have been 4.21%.

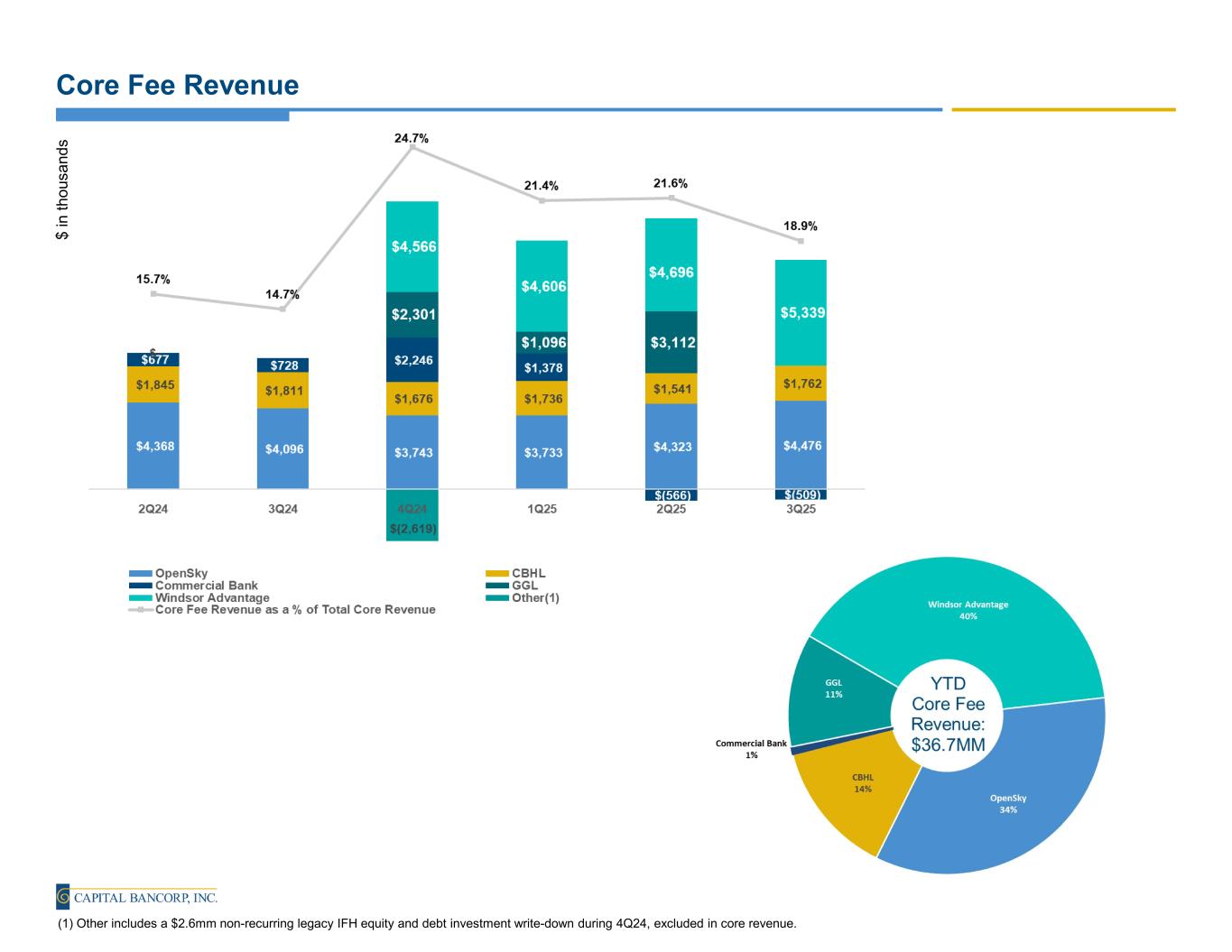

Core Fee Revenue $ in th ou sa nd s 7 (1) Other includes a $2.6mm non-recurring legacy IFH equity and debt investment write-down during 4Q24, excluded in core revenue.

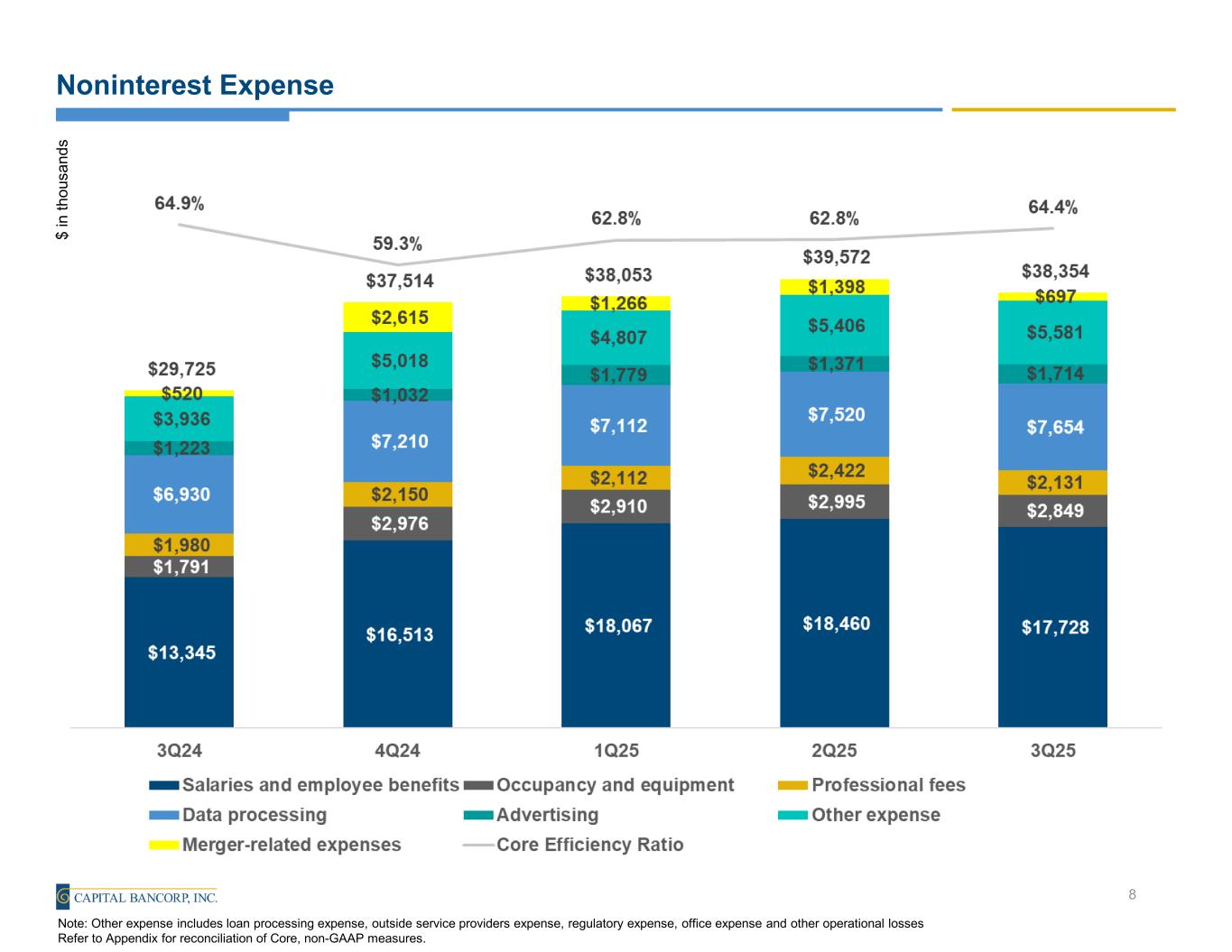

Noninterest Expense $ in th ou sa nd s 8 Note: Other expense includes loan processing expense, outside service providers expense, regulatory expense, office expense and other operational losses Refer to Appendix for reconciliation of Core, non-GAAP measures.

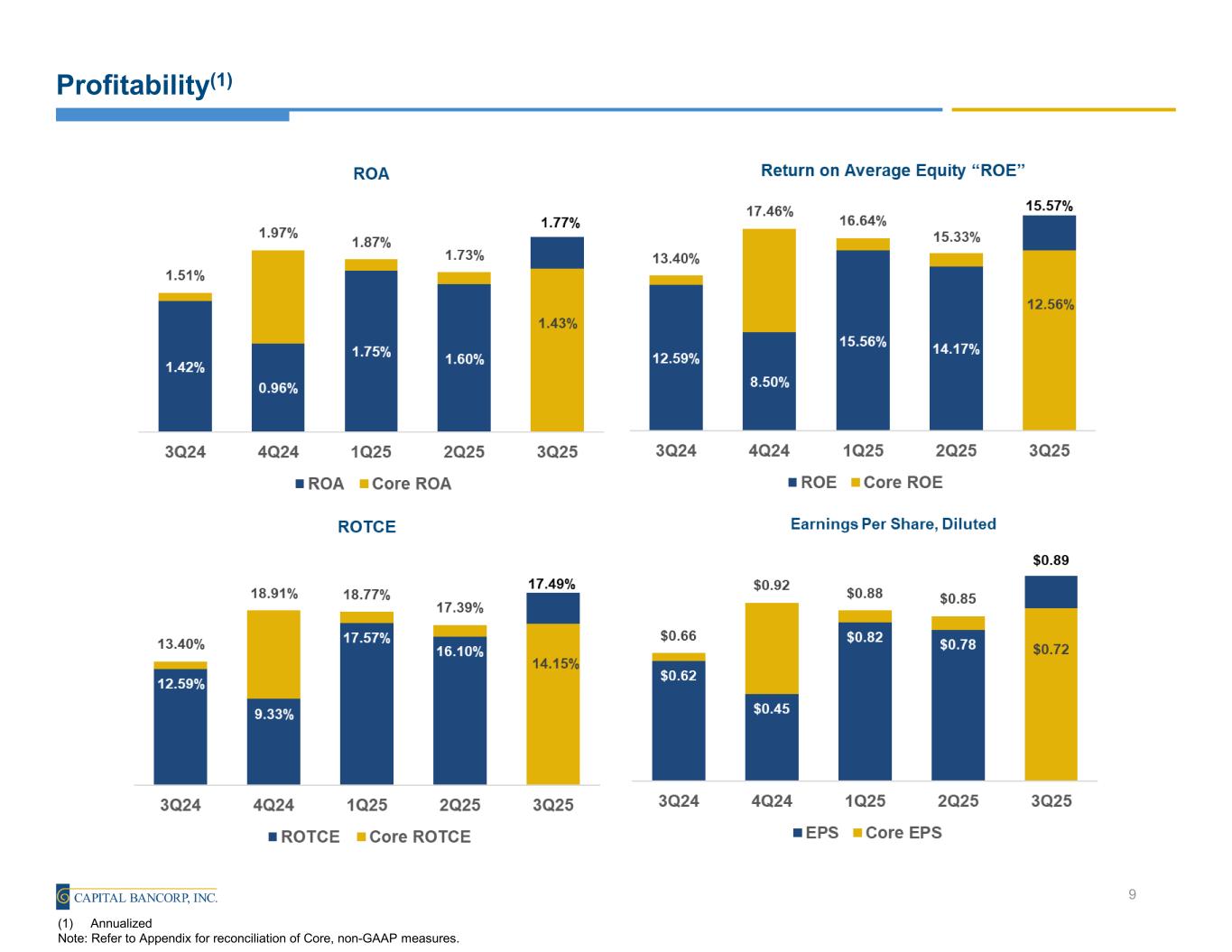

Profitability(1) 9 (1) Annualized Note: Refer to Appendix for reconciliation of Core, non-GAAP measures.

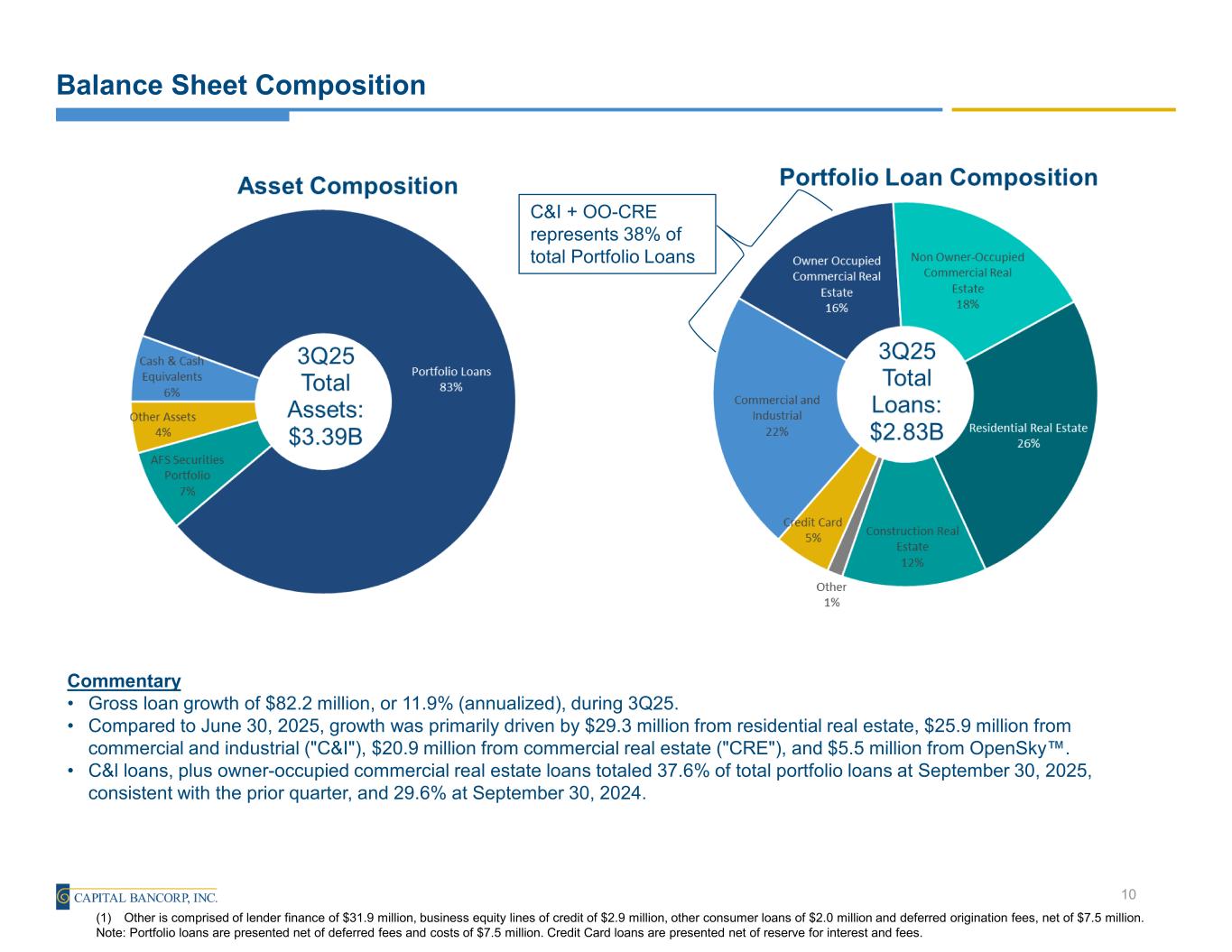

Balance Sheet Composition Commentary • Gross loan growth of $82.2 million, or 11.9% (annualized), during 3Q25. • Compared to June 30, 2025, growth was primarily driven by $29.3 million from residential real estate, $25.9 million from commercial and industrial ("C&I"), $20.9 million from commercial real estate ("CRE"), and $5.5 million from OpenSky . • C&l loans, plus owner-occupied commercial real estate loans totaled 37.6% of total portfolio loans at September 30, 2025, consistent with the prior quarter, and 29.6% at September 30, 2024. 10 (1) Other is comprised of lender finance of $31.9 million, business equity lines of credit of $2.9 million, other consumer loans of $2.0 million and deferred origination fees, net of $7.5 million. Note: Portfolio loans are presented net of deferred fees and costs of $7.5 million. Credit Card loans are presented net of reserve for interest and fees. C&I + OO-CRE represents 38% of total Portfolio Loans

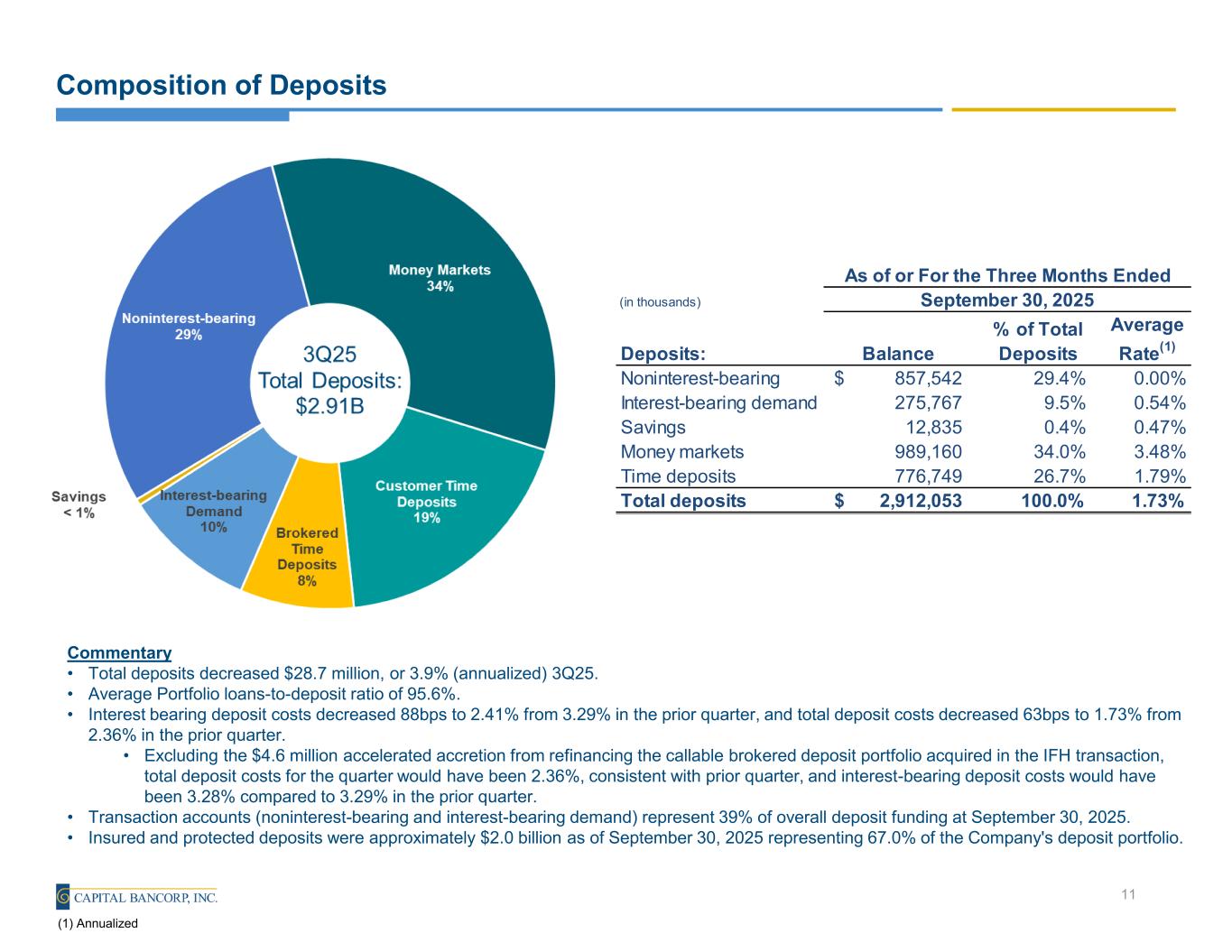

Composition of Deposits Commentary • Total deposits decreased $28.7 million, or 3.9% (annualized) 3Q25. • Average Portfolio loans-to-deposit ratio of 95.6%. • Interest bearing deposit costs decreased 88bps to 2.41% from 3.29% in the prior quarter, and total deposit costs decreased 63bps to 1.73% from 2.36% in the prior quarter. • Excluding the $4.6 million accelerated accretion from refinancing the callable brokered deposit portfolio acquired in the IFH transaction, total deposit costs for the quarter would have been 2.36%, consistent with prior quarter, and interest-bearing deposit costs would have been 3.28% compared to 3.29% in the prior quarter. • Transaction accounts (noninterest-bearing and interest-bearing demand) represent 39% of overall deposit funding at September 30, 2025. • Insured and protected deposits were approximately $2.0 billion as of September 30, 2025 representing 67.0% of the Company's deposit portfolio. 11 (1) Annualized (in thousands) Deposits: Balance % of Total Deposits Average Rate(1) Noninterest-bearing 857,542$ 29.4% 0.00% Interest-bearing demand 275,767 9.5% 0.54% Savings 12,835 0.4% 0.47% Money markets 989,160 34.0% 3.48% Time deposits 776,749 26.7% 1.79% Total deposits 2,912,053$ 100.0% 1.73% As of or For the Three Months Ended September 30, 2025

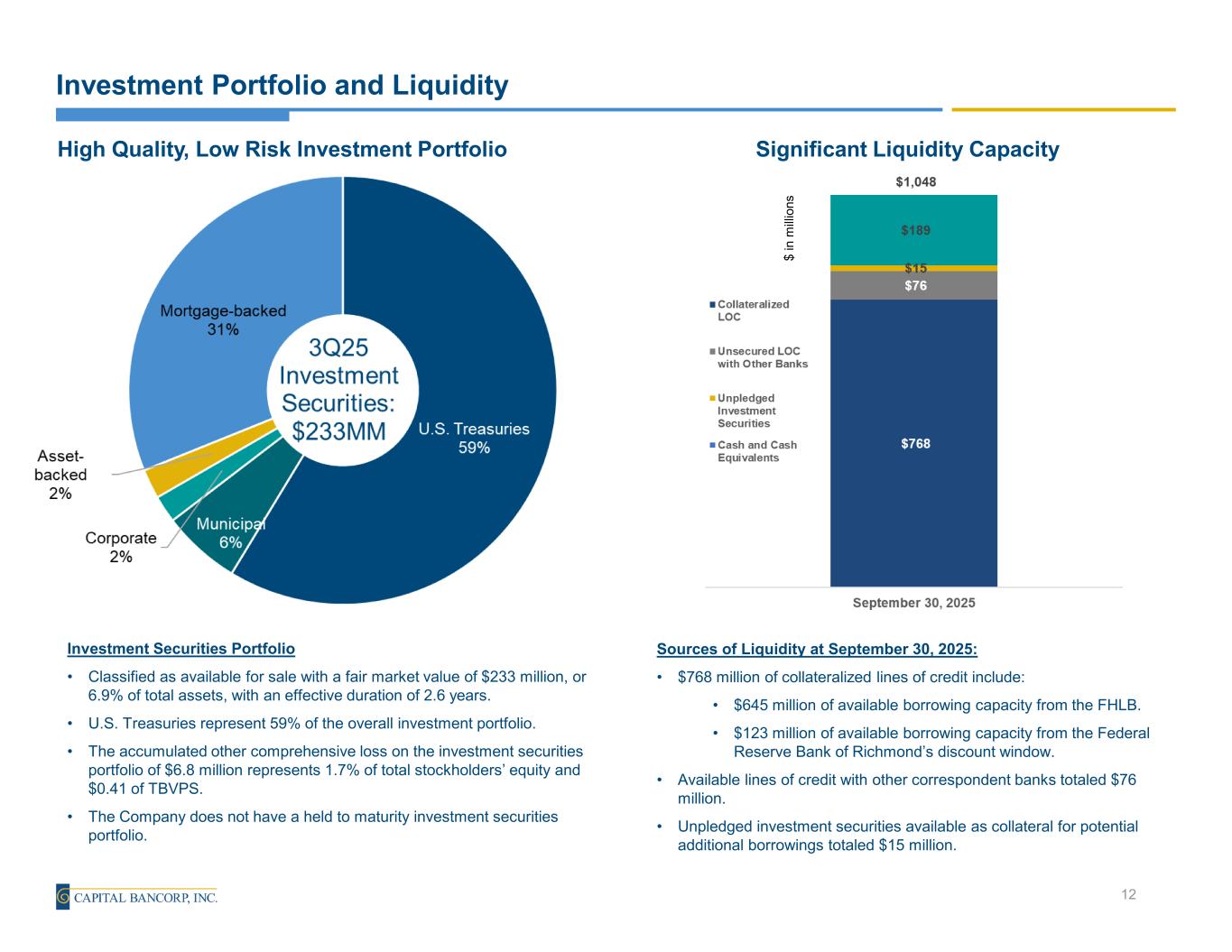

Investment Portfolio and Liquidity Investment Securities Portfolio • Classified as available for sale with a fair market value of $233 million, or 6.9% of total assets, with an effective duration of 2.6 years. • U.S. Treasuries represent 59% of the overall investment portfolio. • The accumulated other comprehensive loss on the investment securities portfolio of $6.8 million represents 1.7% of total stockholders’ equity and $0.41 of TBVPS. • The Company does not have a held to maturity investment securities portfolio. 12 High Quality, Low Risk Investment Portfolio Sources of Liquidity at September 30, 2025: • $768 million of collateralized lines of credit include: • $645 million of available borrowing capacity from the FHLB. • $123 million of available borrowing capacity from the Federal Reserve Bank of Richmond’s discount window. • Available lines of credit with other correspondent banks totaled $76 million. • Unpledged investment securities available as collateral for potential additional borrowings totaled $15 million. Significant Liquidity Capacity $ in m illi on s

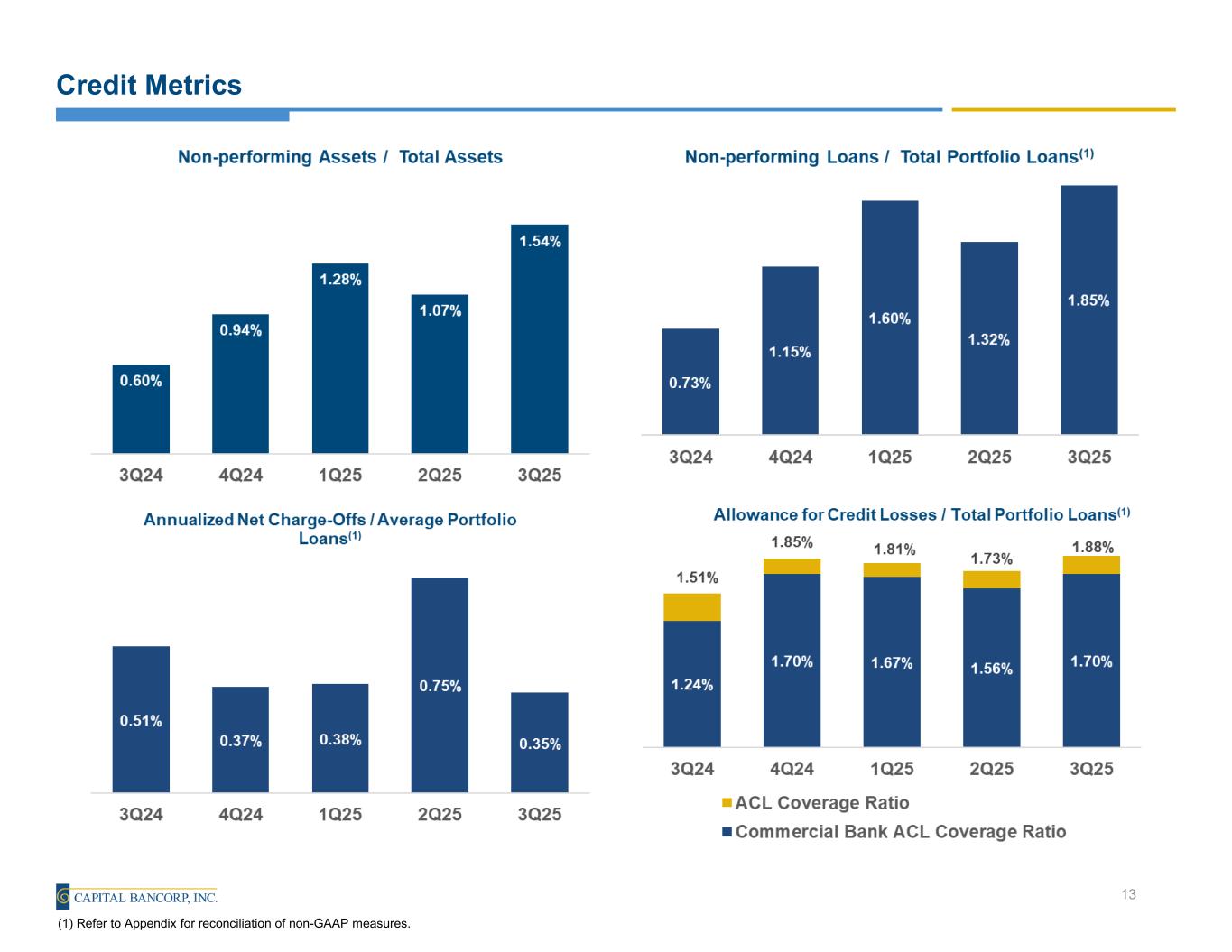

Credit Metrics 13 (1) Refer to Appendix for reconciliation of non-GAAP measures.

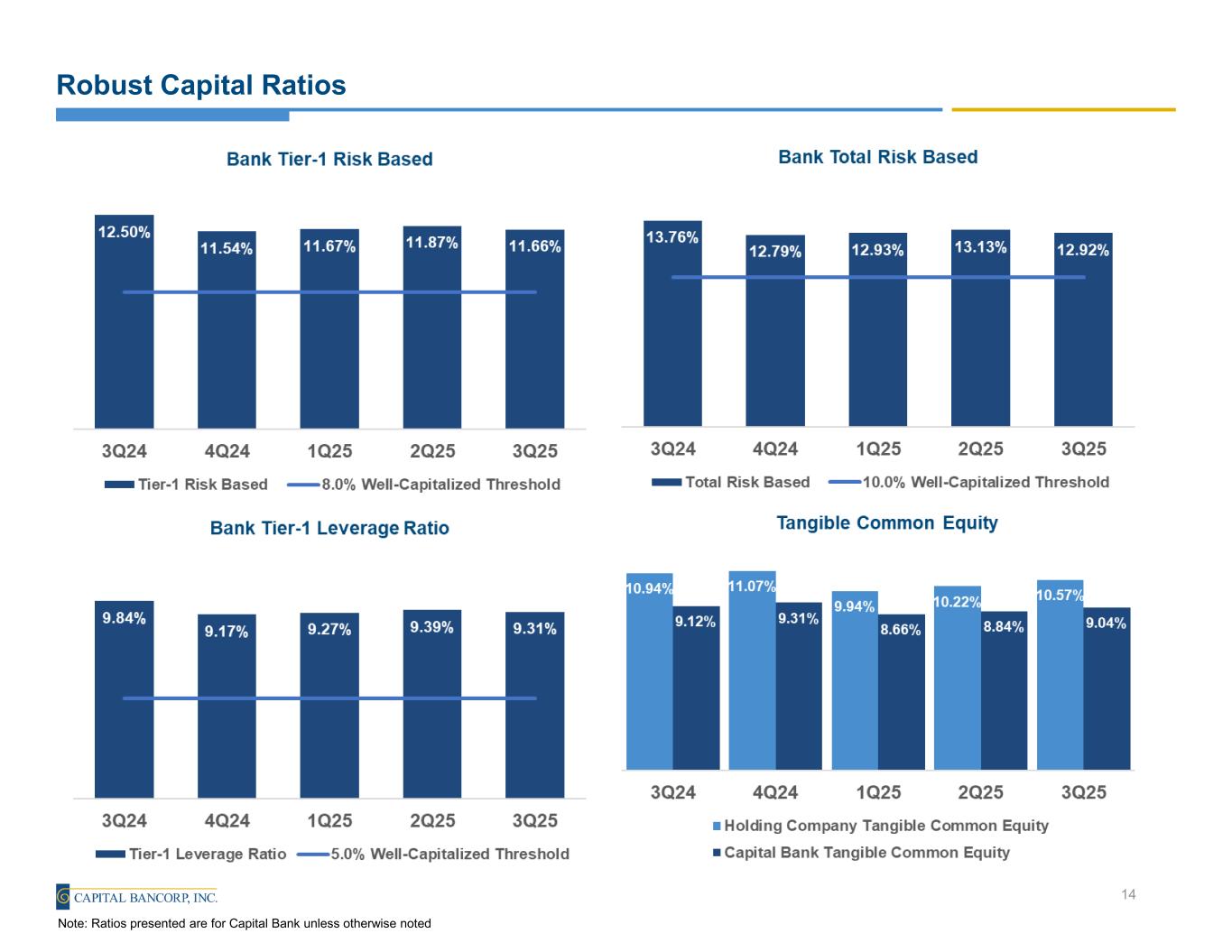

Robust Capital Ratios 14 Note: Ratios presented are for Capital Bank unless otherwise noted

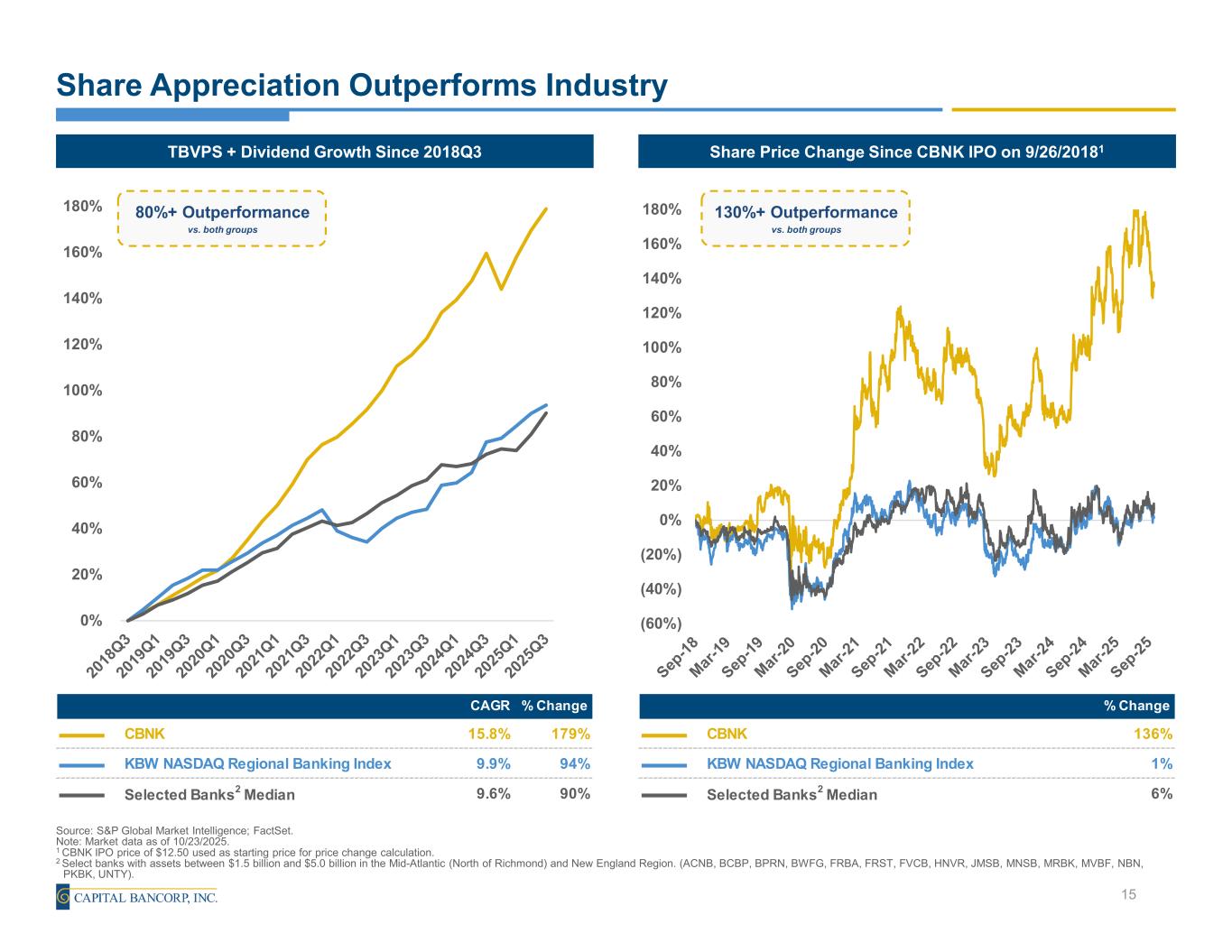

% Change CBNK 136% KBW NASDAQ Regional Banking Index 1% Selected Banks2 Median 6% 58.48% (60%) (40%) (20%) 0% 20% 40% 60% 80% 100% 120% 140% 160% 180% Share Appreciation Outperforms Industry Source: S&P Global Market Intelligence; FactSet. Note: Market data as of 10/23/2025. 1 CBNK IPO price of $12.50 used as starting price for price change calculation. 2 Select banks with assets between $1.5 billion and $5.0 billion in the Mid-Atlantic (North of Richmond) and New England Region. (ACNB, BCBP, BPRN, BWFG, FRBA, FRST, FVCB, HNVR, JMSB, MNSB, MRBK, MVBF, NBN, PKBK, UNTY). 15 Share Price Change Since CBNK IPO on 9/26/20181TBVPS + Dividend Growth Since 2018Q3 80%+ Outperformance vs. both groups 130%+ Outperformance vs. both groups CAGR % Change CBNK 15.8% 179% KBW NASDAQ Regional Banking Index 9.9% 94% Selected Banks2 Median 9.6% 90% 0% 20% 40% 60% 80% 100% 120% 140% 160% 180%

Ed Barry Chief Executive Officer (240) 283-1912 NASDAQ: CBNK

Non-U.S. GAAP Financial Measures

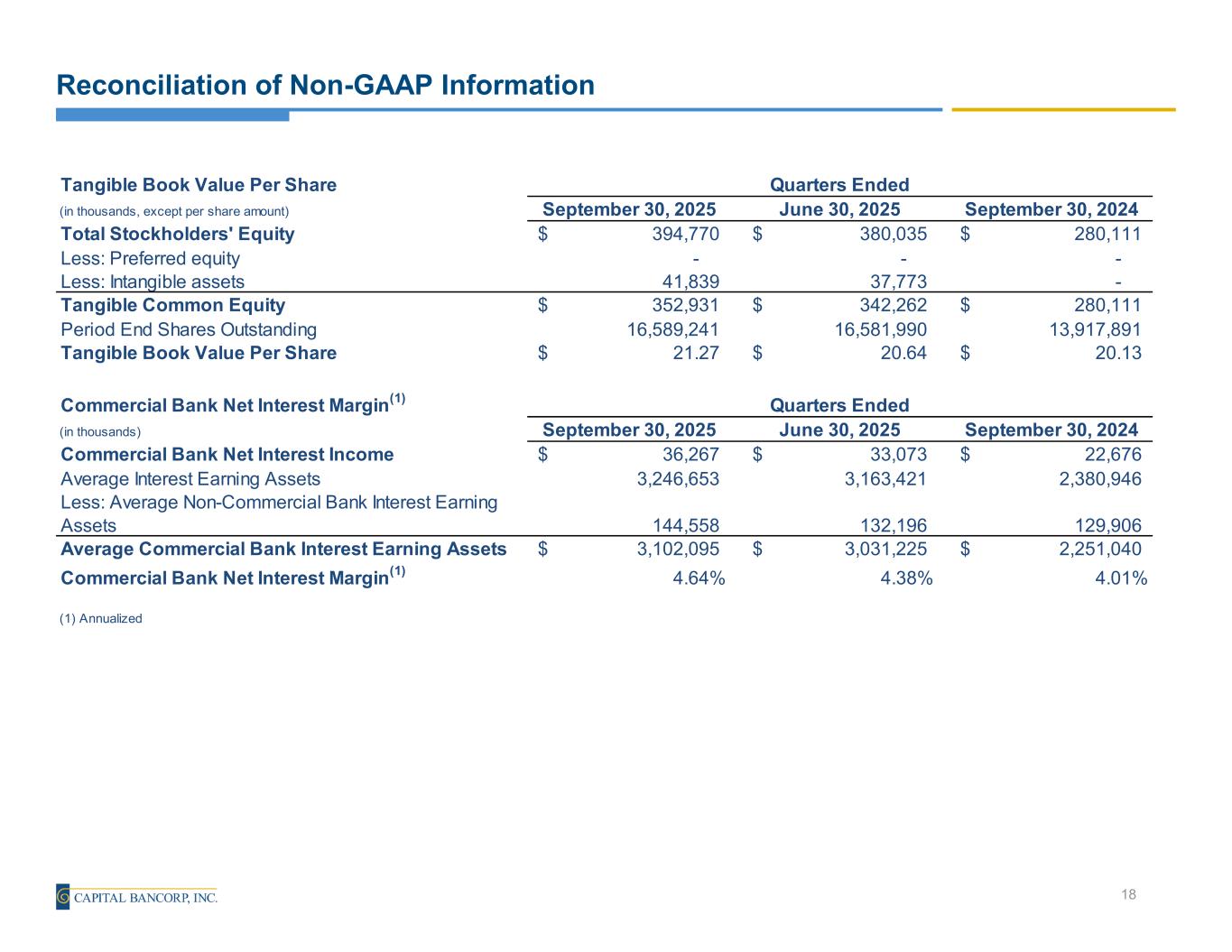

Reconciliation of Non-GAAP Information 18 Tangible Book Value Per Share (in thousands, except per share amount) September 30, 2025 June 30, 2025 September 30, 2024 Total Stockholders' Equity 394,770$ 380,035$ 280,111$ Less: Preferred equity - - - Less: Intangible assets 41,839 37,773 - Tangible Common Equity 352,931$ 342,262$ 280,111$ Period End Shares Outstanding 16,589,241 16,581,990 13,917,891 Tangible Book Value Per Share 21.27$ 20.64$ 20.13$ Commercial Bank Net Interest Margin(1) (in thousands) September 30, 2025 June 30, 2025 September 30, 2024 Commercial Bank Net Interest Income 36,267$ 33,073$ 22,676$ Average Interest Earning Assets 3,246,653 3,163,421 2,380,946 Less: Average Non-Commercial Bank Interest Earning Assets 144,558 132,196 129,906 Average Commercial Bank Interest Earning Assets 3,102,095$ 3,031,225$ 2,251,040$ Commercial Bank Net Interest Margin(1) 4.64% 4.38% 4.01% (1) Annualized Quarters Ended Quarters Ended

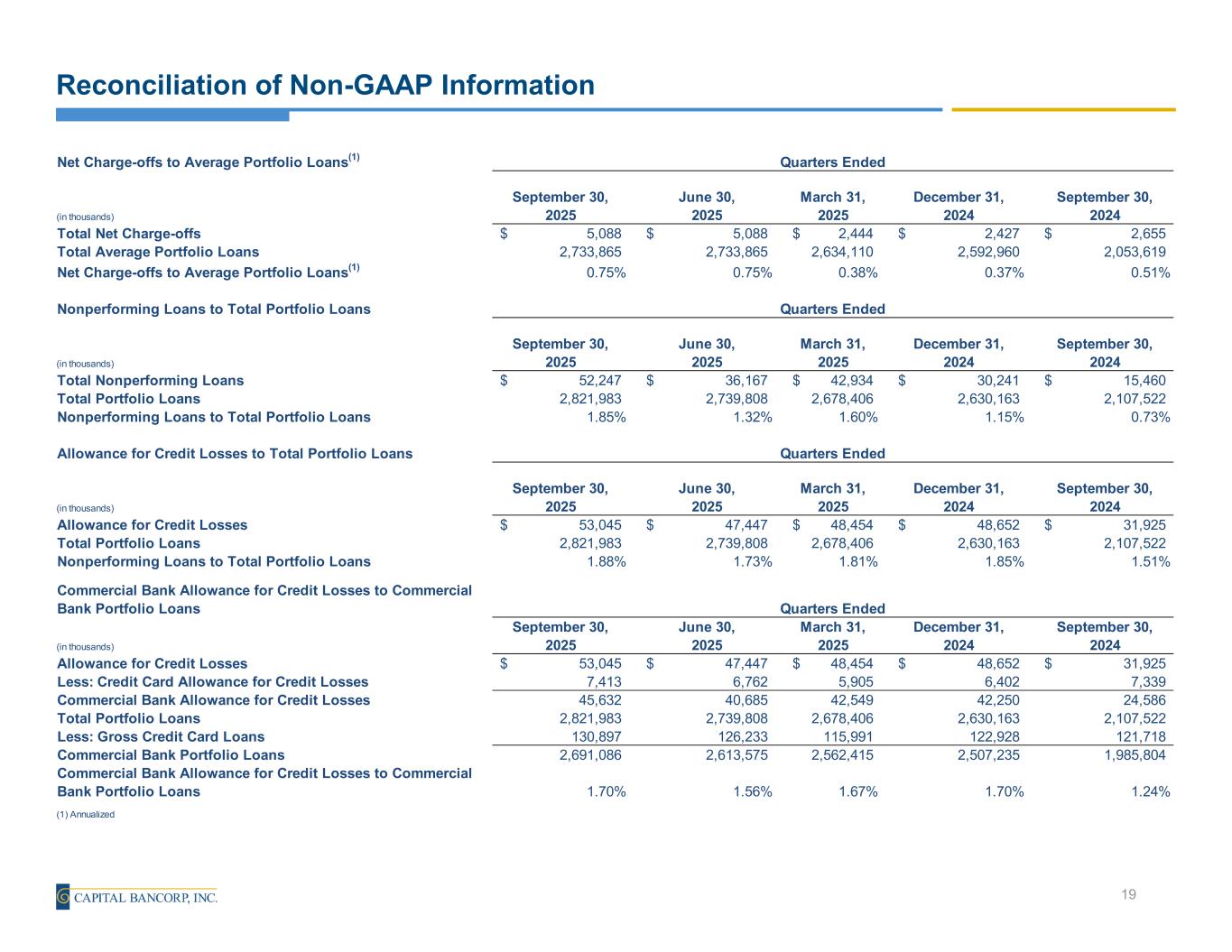

Reconciliation of Non-GAAP Information 19 Net Charge-offs to Average Portfolio Loans(1) (in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Total Net Charge-offs 5,088$ 5,088$ 2,444$ 2,427$ 2,655$ Total Average Portfolio Loans 2,733,865 2,733,865 2,634,110 2,592,960 2,053,619 Net Charge-offs to Average Portfolio Loans(1) 0.75% 0.75% 0.38% 0.37% 0.51% Nonperforming Loans to Total Portfolio Loans (in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Total Nonperforming Loans 52,247$ 36,167$ 42,934$ 30,241$ 15,460$ Total Portfolio Loans 2,821,983 2,739,808 2,678,406 2,630,163 2,107,522 Nonperforming Loans to Total Portfolio Loans 1.85% 1.32% 1.60% 1.15% 0.73% Allowance for Credit Losses to Total Portfolio Loans (in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Allowance for Credit Losses 53,045$ 47,447$ 48,454$ 48,652$ 31,925$ Total Portfolio Loans 2,821,983 2,739,808 2,678,406 2,630,163 2,107,522 Nonperforming Loans to Total Portfolio Loans 1.88% 1.73% 1.81% 1.85% 1.51% Commercial Bank Allowance for Credit Losses to Commercial Bank Portfolio Loans (in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Allowance for Credit Losses 53,045$ 47,447$ 48,454$ 48,652$ 31,925$ Less: Credit Card Allowance for Credit Losses 7,413 6,762 5,905 6,402 7,339 Commercial Bank Allowance for Credit Losses 45,632 40,685 42,549 42,250 24,586 Total Portfolio Loans 2,821,983 2,739,808 2,678,406 2,630,163 2,107,522 Less: Gross Credit Card Loans 130,897 126,233 115,991 122,928 121,718 Commercial Bank Portfolio Loans 2,691,086 2,613,575 2,562,415 2,507,235 1,985,804 Commercial Bank Allowance for Credit Losses to Commercial Bank Portfolio Loans 1.70% 1.56% 1.67% 1.70% 1.24% (1) Annualized Quarters Ended Quarters Ended Quarters Ended Quarters Ended

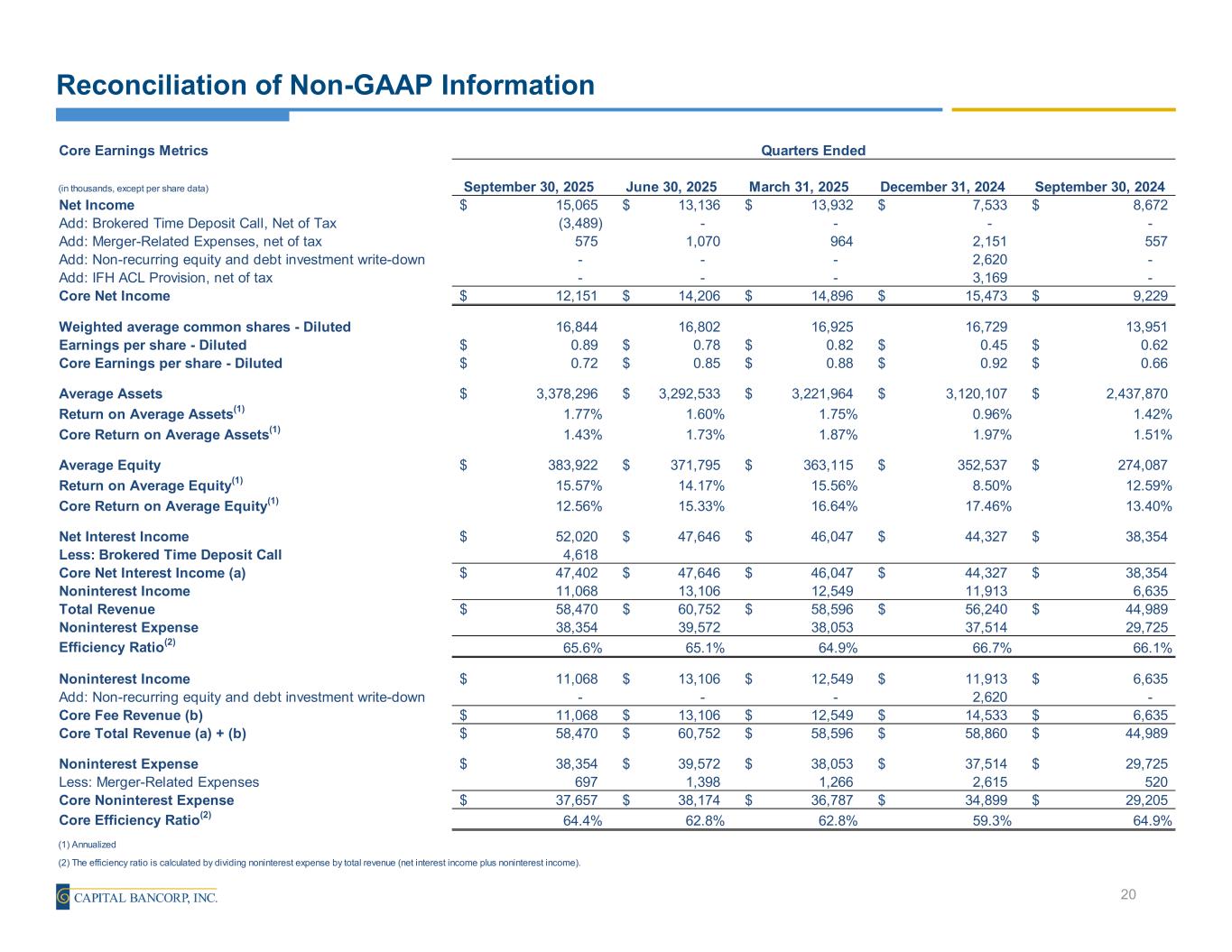

Reconciliation of Non-GAAP Information 20 Core Earnings Metrics (in thousands, except per share data) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net Income 15,065$ 13,136$ 13,932$ 7,533$ 8,672$ Add: Brokered Time Deposit Call, Net of Tax (3,489) - - - - Add: Merger-Related Expenses, net of tax 575 1,070 964 2,151 557 Add: Non-recurring equity and debt investment write-down - - - 2,620 - Add: IFH ACL Provision, net of tax - - - 3,169 - Core Net Income 12,151$ 14,206$ 14,896$ 15,473$ 9,229$ Weighted average common shares - Diluted 16,844 16,802 16,925 16,729 13,951 Earnings per share - Diluted 0.89$ 0.78$ 0.82$ 0.45$ 0.62$ Core Earnings per share - Diluted 0.72$ 0.85$ 0.88$ 0.92$ 0.66$ Average Assets 3,378,296$ 3,292,533$ 3,221,964$ 3,120,107$ 2,437,870$ Return on Average Assets(1) 1.77% 1.60% 1.75% 0.96% 1.42% Core Return on Average Assets(1) 1.43% 1.73% 1.87% 1.97% 1.51% Average Equity 383,922$ 371,795$ 363,115$ 352,537$ 274,087$ Return on Average Equity(1) 15.57% 14.17% 15.56% 8.50% 12.59% Core Return on Average Equity(1) 12.56% 15.33% 16.64% 17.46% 13.40% Net Interest Income 52,020$ 47,646$ 46,047$ 44,327$ 38,354$ Less: Brokered Time Deposit Call 4,618 Core Net Interest Income (a) 47,402$ 47,646$ 46,047$ 44,327$ 38,354$ Noninterest Income 11,068 13,106 12,549 11,913 6,635 Total Revenue 58,470$ 60,752$ 58,596$ 56,240$ 44,989$ Noninterest Expense 38,354 39,572 38,053 37,514 29,725 Efficiency Ratio(2) 65.6% 65.1% 64.9% 66.7% 66.1% Noninterest Income 11,068$ 13,106$ 12,549$ 11,913$ 6,635$ Add: Non-recurring equity and debt investment write-down - - - 2,620 - Core Fee Revenue (b) 11,068$ 13,106$ 12,549$ 14,533$ 6,635$ Core Total Revenue (a) + (b) 58,470$ 60,752$ 58,596$ 58,860$ 44,989$ Noninterest Expense 38,354$ 39,572$ 38,053$ 37,514$ 29,725$ Less: Merger-Related Expenses 697 1,398 1,266 2,615 520 Core Noninterest Expense 37,657$ 38,174$ 36,787$ 34,899$ 29,205$ Core Efficiency Ratio(2) 64.4% 62.8% 62.8% 59.3% 64.9% (1) Annualized (2) The efficiency ratio is calculated by dividing noninterest expense by total revenue (net interest income plus noninterest income). Quarters Ended

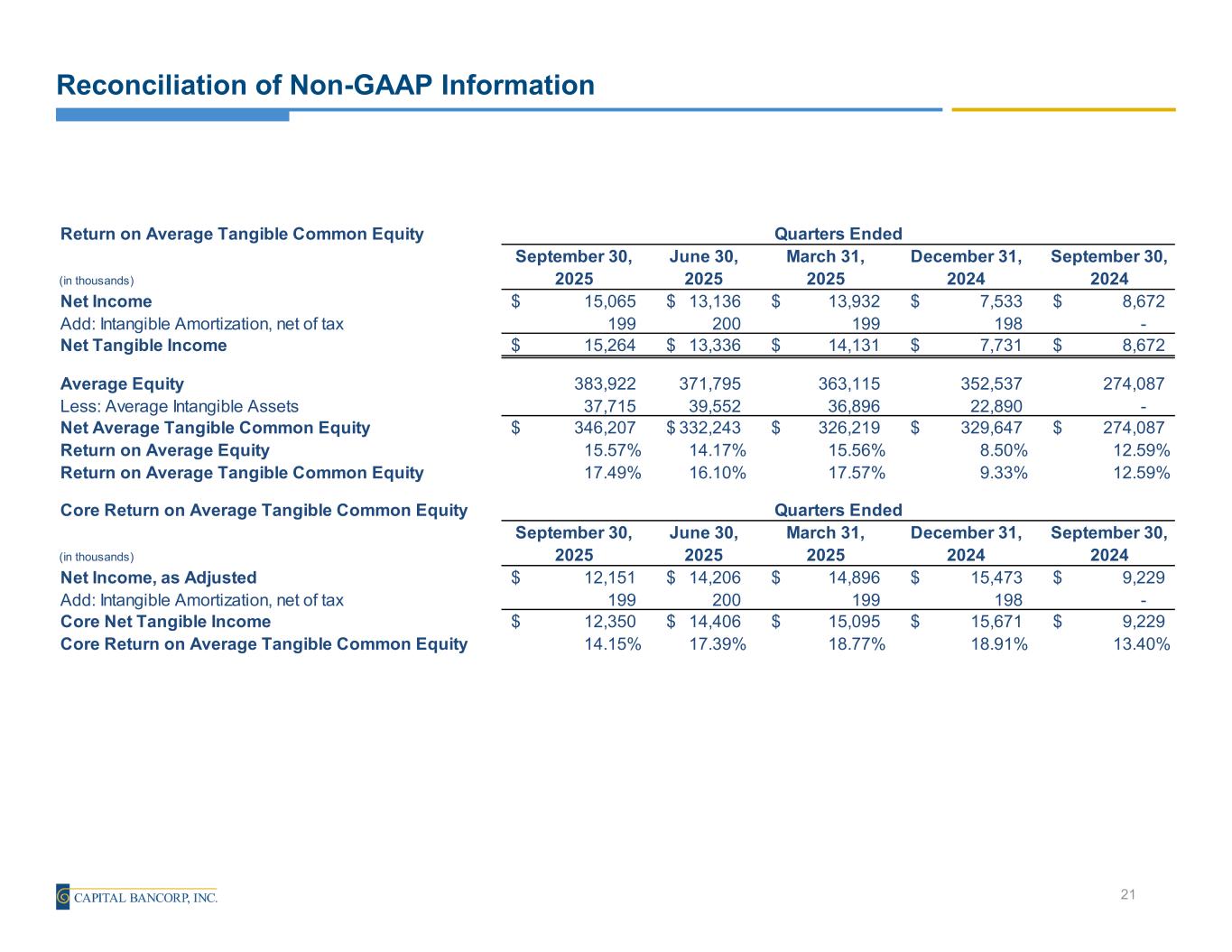

Reconciliation of Non-GAAP Information 21 Return on Average Tangible Common Equity (in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net Income 15,065$ 13,136$ 13,932$ 7,533$ 8,672$ Add: Intangible Amortization, net of tax 199 200 199 198 - Net Tangible Income 15,264$ 13,336$ 14,131$ 7,731$ 8,672$ Average Equity 383,922 371,795 363,115 352,537 274,087 Less: Average Intangible Assets 37,715 39,552 36,896 22,890 - Net Average Tangible Common Equity 346,207$ 332,243$ 326,219$ 329,647$ 274,087$ Return on Average Equity 15.57% 14.17% 15.56% 8.50% 12.59% Return on Average Tangible Common Equity 17.49% 16.10% 17.57% 9.33% 12.59% Core Return on Average Tangible Common Equity (in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net Income, as Adjusted 12,151$ 14,206$ 14,896$ 15,473$ 9,229$ Add: Intangible Amortization, net of tax 199 200 199 198 - Core Net Tangible Income 12,350$ 14,406$ 15,095$ 15,671$ 9,229$ Core Return on Average Tangible Common Equity 14.15% 17.39% 18.77% 18.91% 13.40% Quarters Ended Quarters Ended