Investor Day Presentation December 2025 Broadstone Net Lease, Inc. | NYSE: BNL Redefining What’s Possible in Net Lease United Natural Foods (UNFI) Sarasota, FL

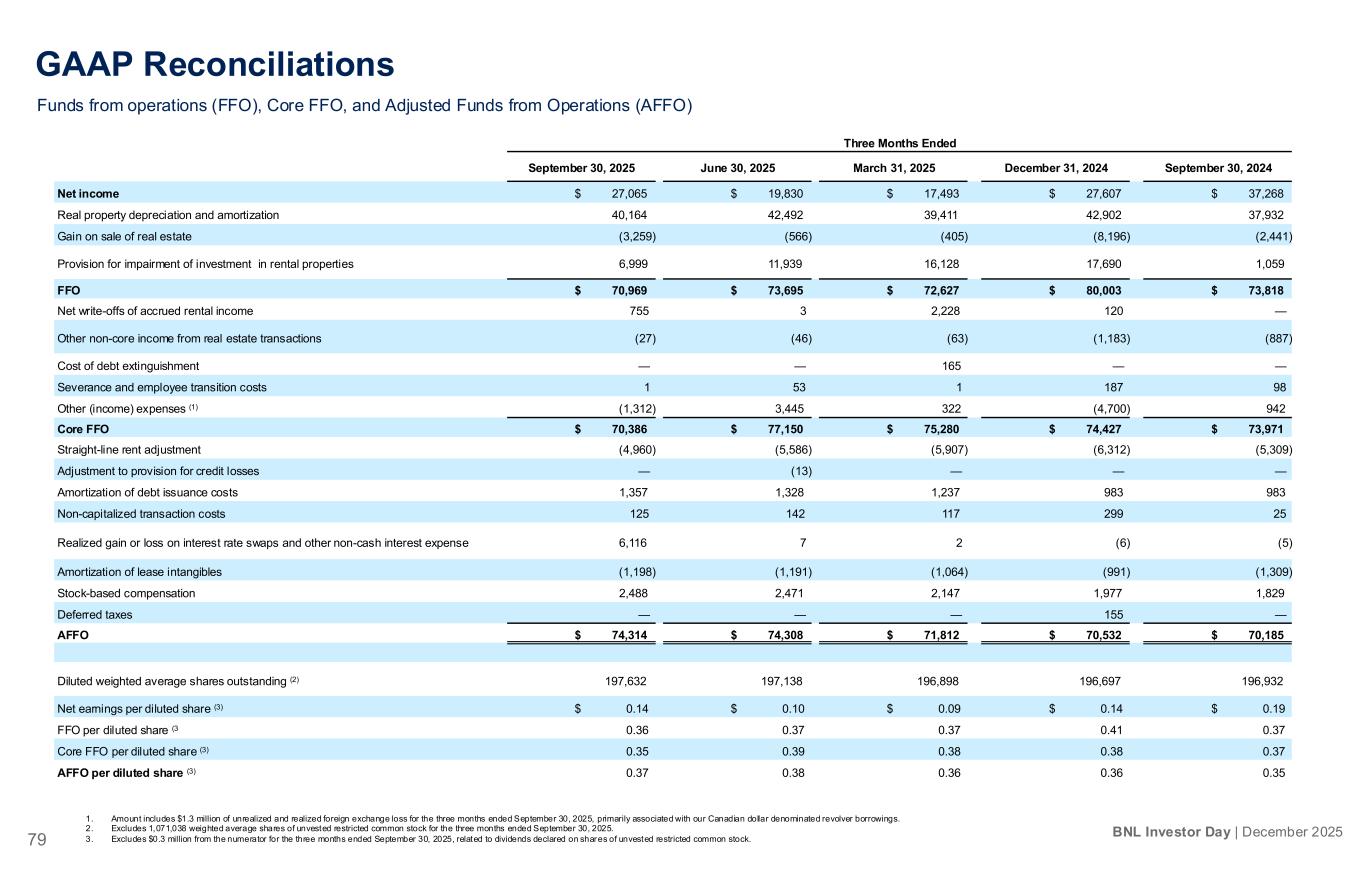

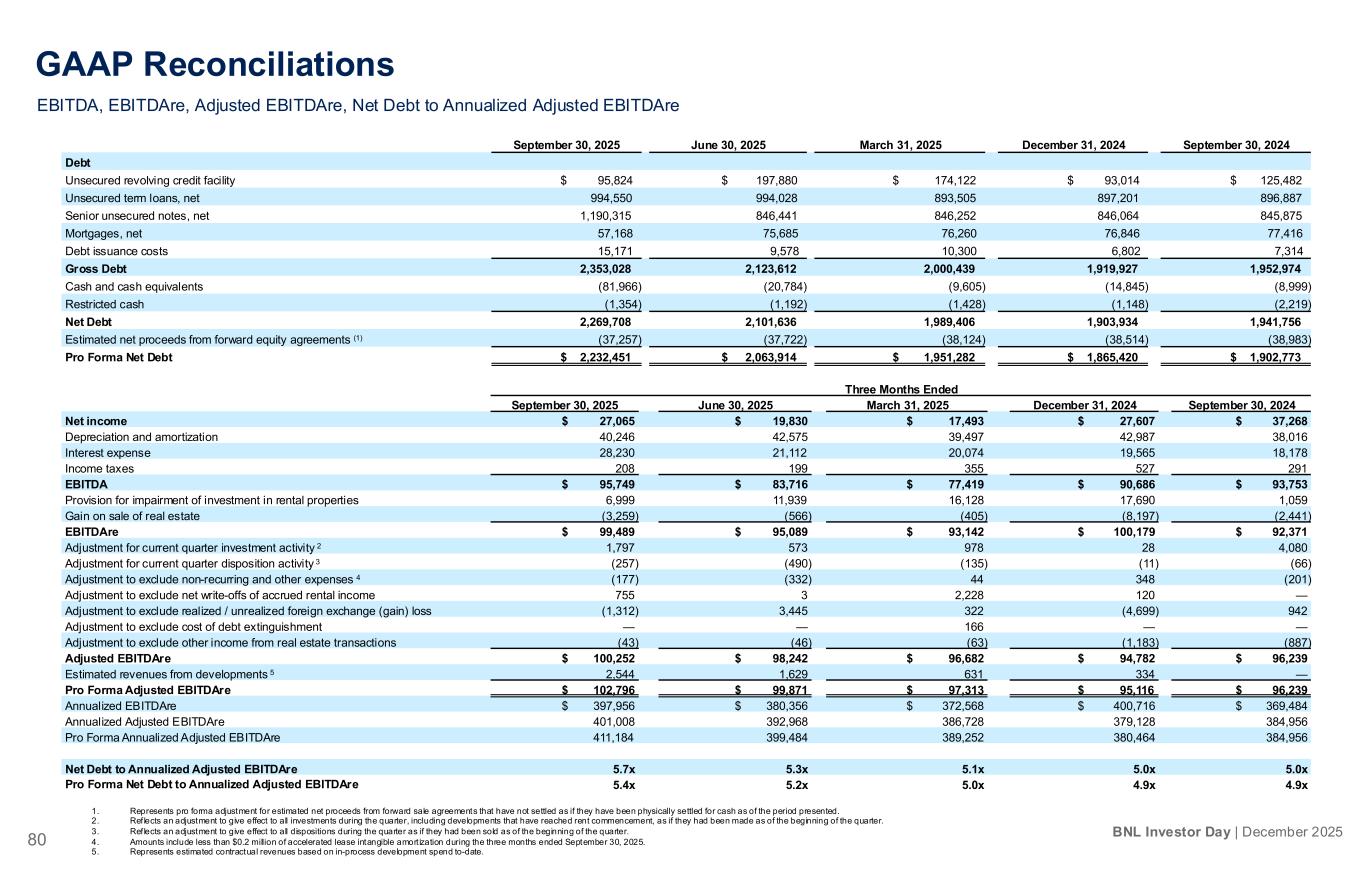

2 BNL Investor Day | December 2025 Disclaimers CAUTIONARY STATEMENTS CONCERNING FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, our plans, strategies, and prospects, both business and financial. Such forward- looking statements can generally be identified by our use of forward-looking terminology such as “outlook,” “potential,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “projects,” “predicts,” “expects,” “intends,” “anticipates,” “estimates,” “plans,” “would be,” “believes,” “continues,” or the negative version of these words or other comparable words. Forward-looking statements, including our 2025 and 2026 guidance, involve known and unknown risks and uncertainties, which may cause BNL’s actual future results to differ materially from expected results, including, without limitation, general econ omic conditions, including but not limited to increases in the rate of inflation and/or interest rates, local real estate conditions, tenant financial health, property acquisitions, and the timing and uncertainty of completing these acquisitions, potential delays and disruptions with respect to ongoing or planned development projects, and uncertainties regarding future distributions to our stockholders. These and other risks, assumptions, and uncertainties are described in Item 1A “Risk Facto rs” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 20, 2025, and Item 1A “Risk Factors” of the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, filed with the SEC on May 1, 2025, which you are encouraged to read, and are available on the SEC’s website at www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date they are made. The Company assumes no obligation to, and does not current ly intend to, update any forward- looking statements after the date of this presentation, whether as a result of new information, future events, changes in assumptions or otherwise. TRADEMARK DISCLAIMER This document contains references to copyrights, trademarks, trade names, and service marks that belong to other companies. Broadstone Net Lease is not affiliated or associated with, and is not endorsed by and does not endorse, such companies or their products or services. NON-GAAP FINANCIAL INFORMATION This presentation contains certain financial information that is not presented in conformity with accounting principles gener ally accepted in the United States of America (GAAP), including funds from operations (“FFO”), core funds from operations (“Core FFO”), adjusted funds from operations (“AFFO”), earnings before interest, taxes, depreciation and amortization (“EBITDA”), EBITDA further adjusted to exclude gains (losses) on sales of depr eciable property and provisions for impairment on investments in real estate (“EBITDAre”), Adjusted EBITDAre, Annualized Adjusted EBITDAre and Net Debt. We believe the use of FFO, Core FFO, and AFFO are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. We believe that EBITDA provides investors and analysts with a measure of our performance that includes our operating results unaffected by the differences in capital structures, capital investment cycles and useful life of related assets compared to other companies in our industry. We believe that the presentation of Net Debt to Annualized Adjusted EBITDAre is a useful measure of our ability to repay debt and a relative meas ure of leverage and is used in communications with our lenders and rating agencies regarding our credit rating. Such non-GAAP measures should not be considered in isolation or as an indicator of the Company's performance. Furthermore, they should not be seen as a substitute for metrics prepared in accordan ce with GAAP. Reconciliations of these measures to their most directly comparable GAAP measures for the periods that are presented in this presentation can be found in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Measures” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 20, 2025.

Welcome & Opening Remarks Speakers: Brent Maedl Time: 1:00 – 1:05 p.m. Sierra Nevada BTS Dayton, OH

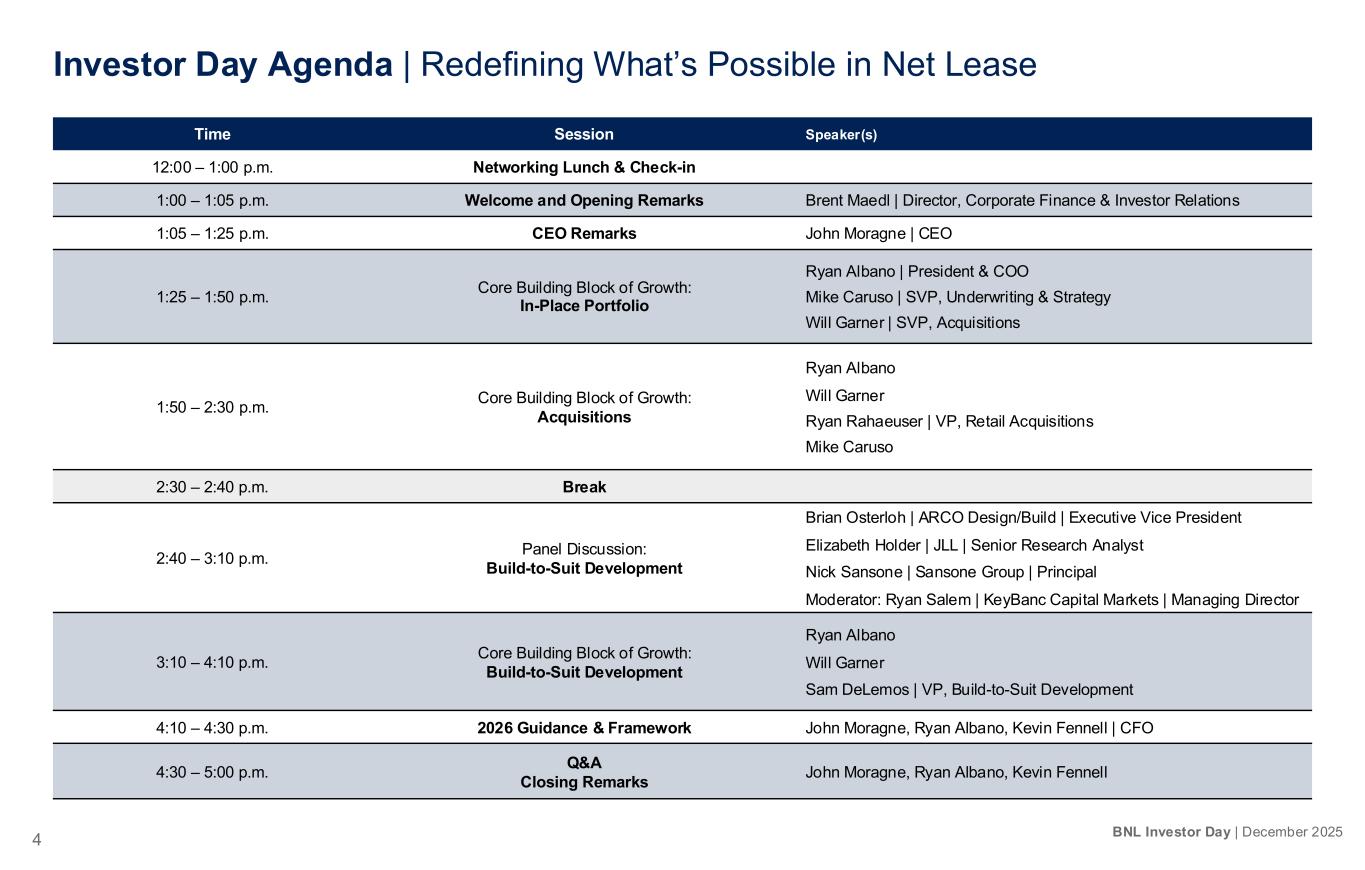

4 BNL Investor Day | December 2025 Time Session Speaker(s) 12:00 – 1:00 p.m. Networking Lunch & Check-in 1:00 – 1:05 p.m. Welcome and Opening Remarks Brent Maedl | Director, Corporate Finance & Investor Relations 1:05 – 1:25 p.m. CEO Remarks John Moragne | CEO 1:25 – 1:50 p.m. Core Building Block of Growth: In-Place Portfolio Ryan Albano | President & COO Mike Caruso | SVP, Underwriting & Strategy Will Garner | SVP, Acquisitions 1:50 – 2:30 p.m. Core Building Block of Growth: Acquisitions Ryan Albano Will Garner Ryan Rahaeuser | VP, Retail Acquisitions Mike Caruso 2:30 – 2:40 p.m. Break 2:40 – 3:10 p.m. Panel Discussion: Build-to-Suit Development Brian Osterloh | ARCO Design/Build | Executive Vice President Elizabeth Holder | JLL | Senior Research Analyst Nick Sansone | Sansone Group | Principal Moderator: Ryan Salem | KeyBanc Capital Markets | Managing Director 3:10 – 4:10 p.m. Core Building Block of Growth: Build-to-Suit Development Ryan Albano Will Garner Sam DeLemos | VP, Build-to-Suit Development 4:10 – 4:30 p.m. 2026 Guidance & Framework John Moragne, Ryan Albano, Kevin Fennell | CFO 4:30 – 5:00 p.m. Q&A Closing Remarks John Moragne, Ryan Albano, Kevin Fennell Investor Day Agenda | Redefining What’s Possible in Net Lease

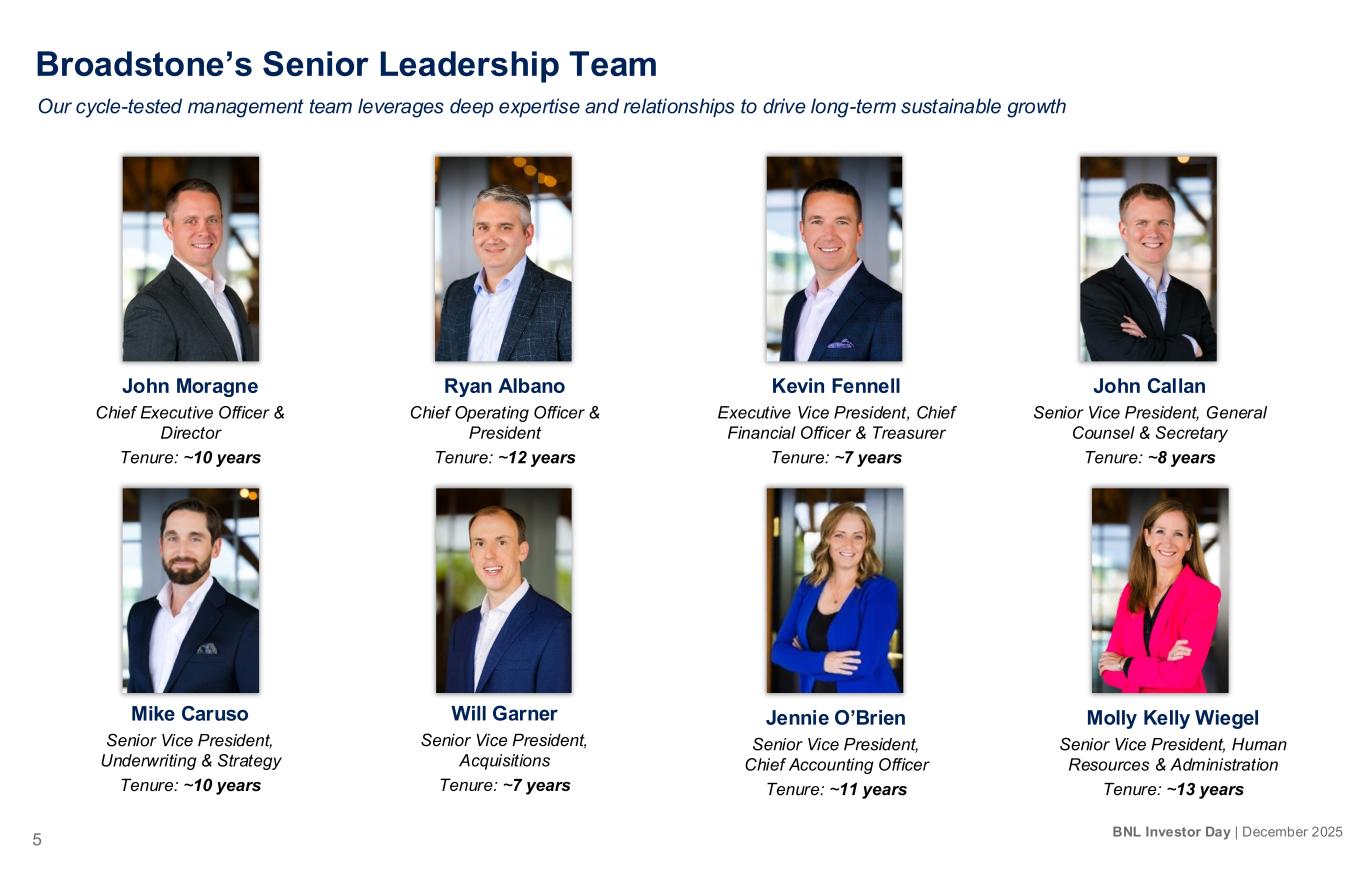

5 BNL Investor Day | December 2025 John Moragne Chief Executive Officer & Director Tenure: ~10 years Ryan Albano Chief Operating Officer & President Tenure: ~12 years Kevin Fennell Executive Vice President, Chief Financial Officer & Treasurer Tenure: ~7 years John Callan Senior Vice President, General Counsel & Secretary Tenure: ~8 years Mike Caruso Senior Vice President, Underwriting & Strategy Tenure: ~10 years Will Garner Senior Vice President, Acquisitions Tenure: ~7 years Jennie O’Brien Senior Vice President, Chief Accounting Officer Tenure: ~11 years Molly Kelly Wiegel Senior Vice President, Human Resources & Administration Tenure: ~13 years Broadstone’s Senior Leadership Team Our cycle-tested management team leverages deep expertise and relationships to drive long-term sustainable growth

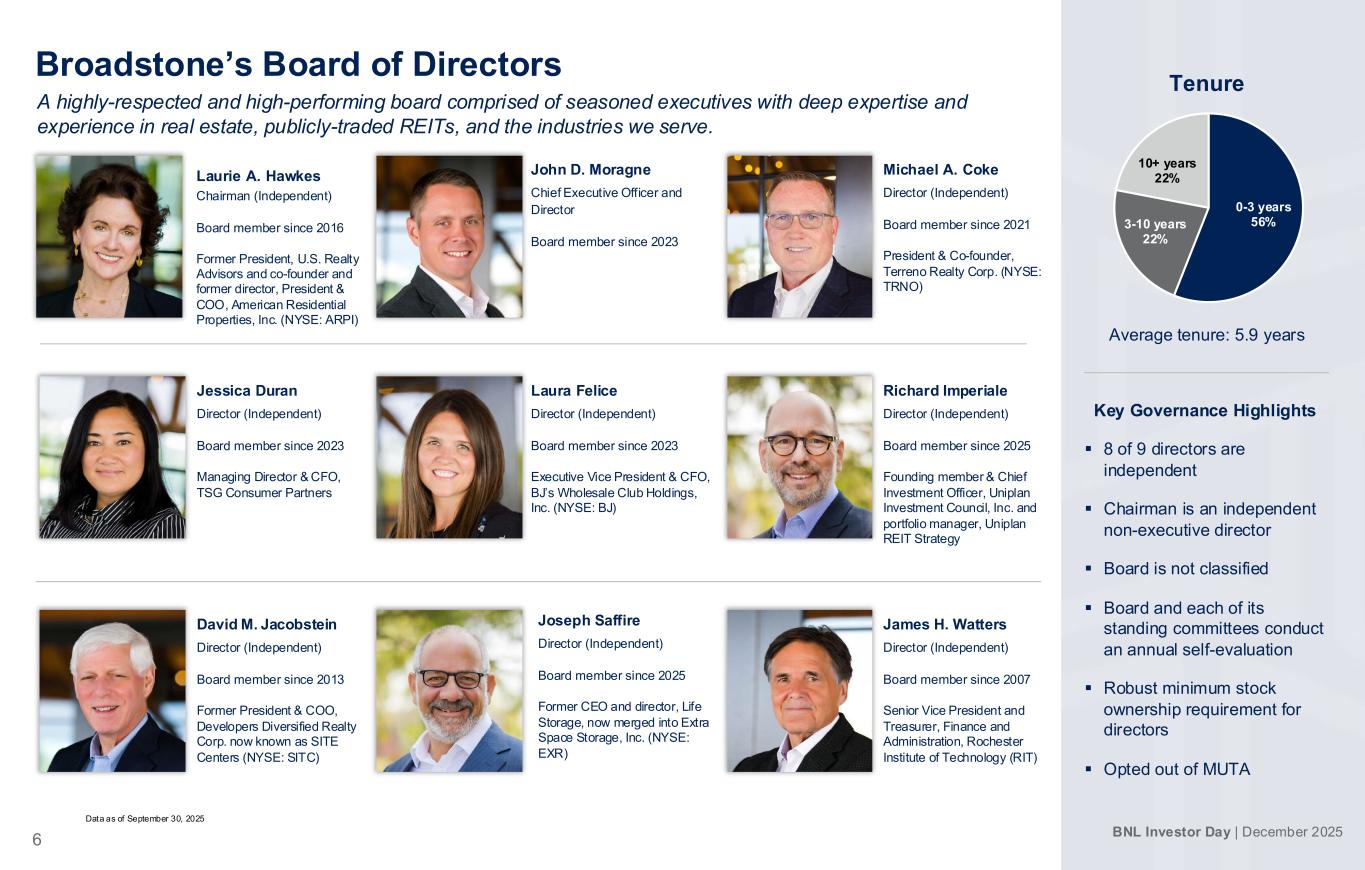

BNL Investor Day | December 2025 6 0-3 years 56%3-10 years 22% 10+ years 22% Data as of September 30, 2025 James H. Watters Director (Independent) Board member since 2007 Senior Vice President and Treasurer, Finance and Administration, Rochester Institute of Technology (RIT) Laurie A. Hawkes Chairman (Independent) Board member since 2016 Former President, U.S. Realty Advisors and co-founder and former director, President & COO, American Residential Properties, Inc. (NYSE: ARPI) John D. Moragne Chief Executive Officer and Director Board member since 2023 Michael A. Coke Director (Independent) Board member since 2021 President & Co-founder, Terreno Realty Corp. (NYSE: TRNO) Jessica Duran Director (Independent) Board member since 2023 Managing Director & CFO, TSG Consumer Partners Laura Felice Director (Independent) Board member since 2023 Executive Vice President & CFO, BJ’s Wholesale Club Holdings, Inc. (NYSE: BJ) Richard Imperiale Director (Independent) Board member since 2025 Founding member & Chief Investment Officer, Uniplan Investment Council, Inc. and portfolio manager, Uniplan REIT Strategy David M. Jacobstein Director (Independent) Board member since 2013 Former President & COO, Developers Diversified Realty Corp. now known as SITE Centers (NYSE: SITC) Joseph Saffire Director (Independent) Board member since 2025 Former CEO and director, Life Storage, now merged into Extra Space Storage, Inc. (NYSE: EXR) Tenure Broadstone’s Board of Directors A highly-respected and high-performing board comprised of seasoned executives with deep expertise and experience in real estate, publicly-traded REITs, and the industries we serve. Average tenure: 5.9 years Key Governance Highlights ▪ 8 of 9 directors are independent ▪ Chairman is an independent non-executive director ▪ Board is not classified ▪ Board and each of its standing committees conduct an annual self-evaluation ▪ Robust minimum stock ownership requirement for directors ▪ Opted out of MUTA

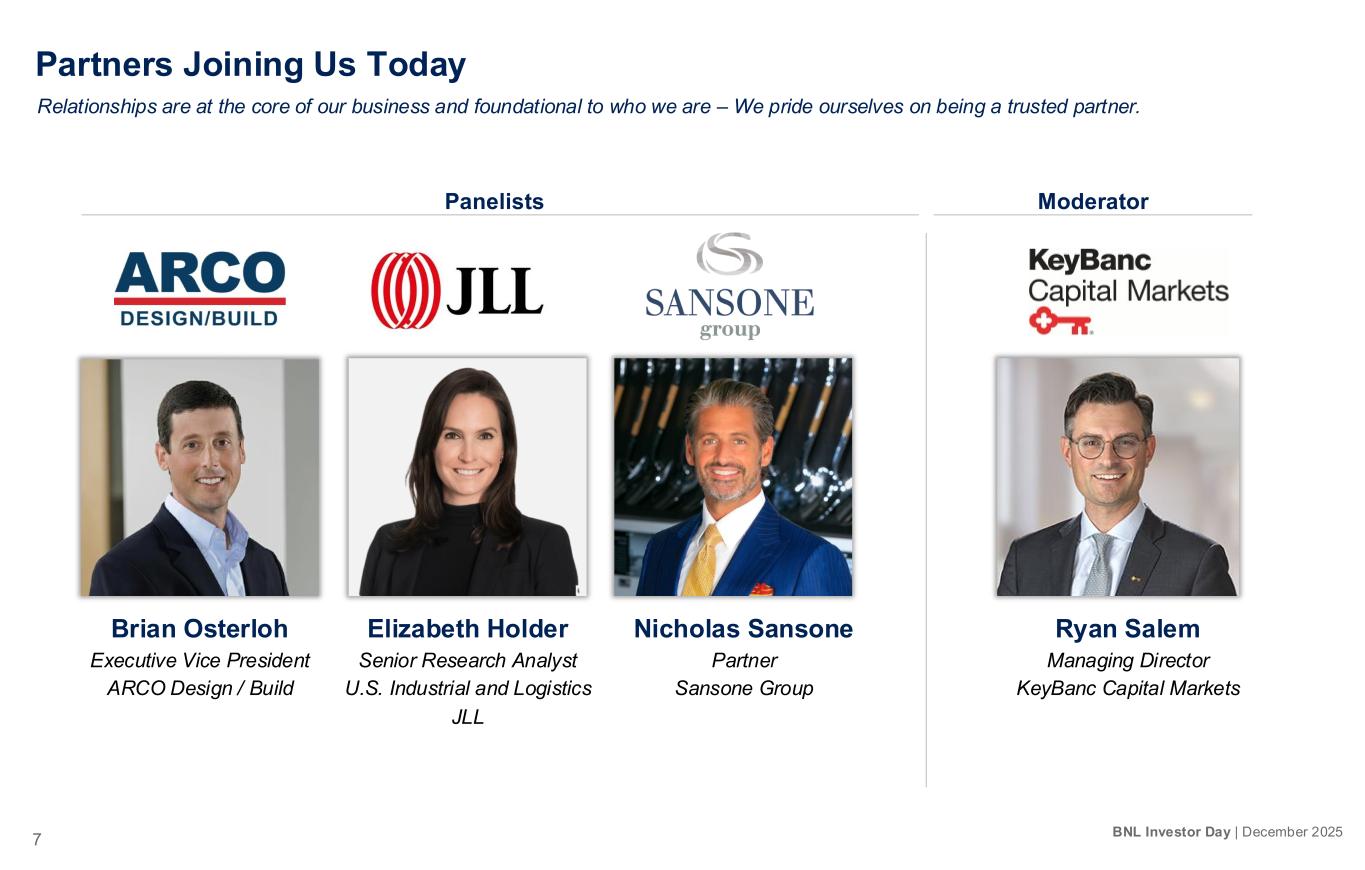

7 BNL Investor Day | December 2025 Partners Joining Us Today Relationships are at the core of our business and foundational to who we are – We pride ourselves on being a trusted partner. Nicholas Sansone Partner Sansone Group Elizabeth Holder Senior Research Analyst U.S. Industrial and Logistics JLL Brian Osterloh Executive Vice President ARCO Design / Build Ryan Salem Managing Director KeyBanc Capital Markets Panelists Moderator

CEO Remarks No Question Left Unanswered Speakers: John Moragne Time: 1:05 – 1:25 p.m. OUR MISSION To bring real estate to life and drive value through a relationship-based and innovative approach to net lease investing.

9 BNL Investor Day | December 2025 Why Are We Here Today? Provide an opportunity to meet and hear from members of the broader team, as well as several of our strategic partners Provide a definitive response to all outstanding questions regarding our performance since the executive management transition in 2023 Demonstrate the foundation laid for continued growth in 2026 and beyond Present a deep dive on our differentiated approach to net lease investing

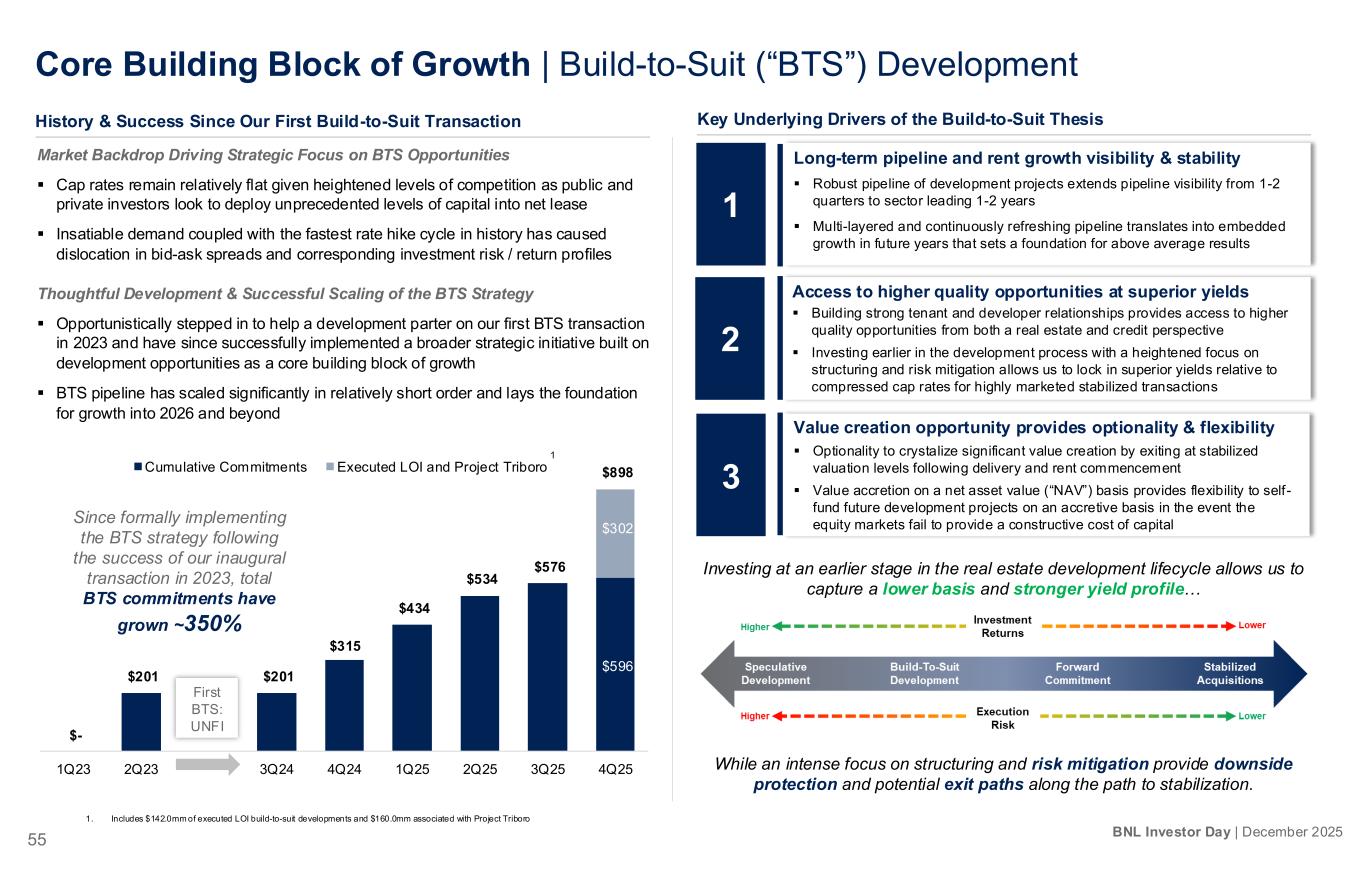

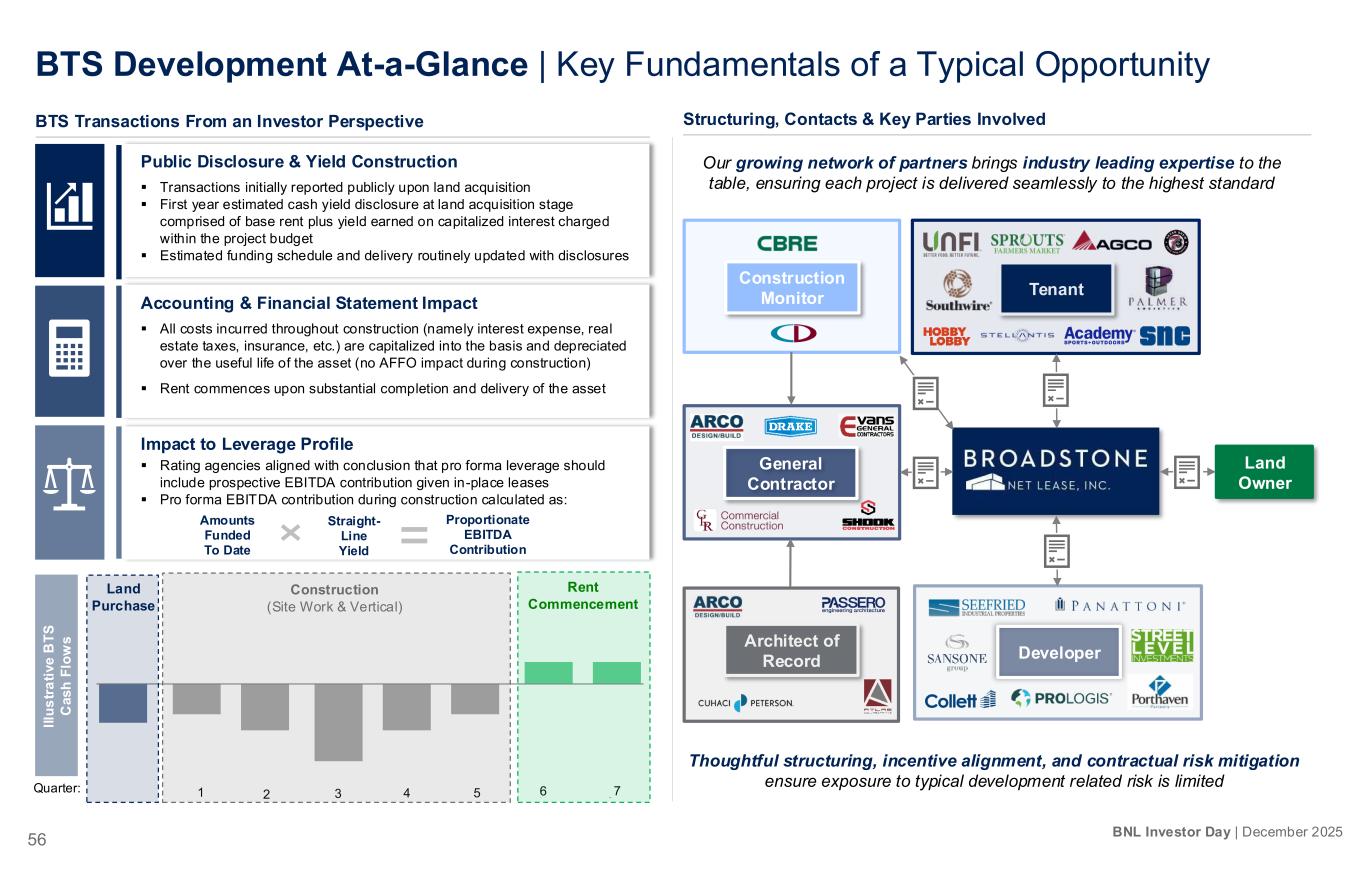

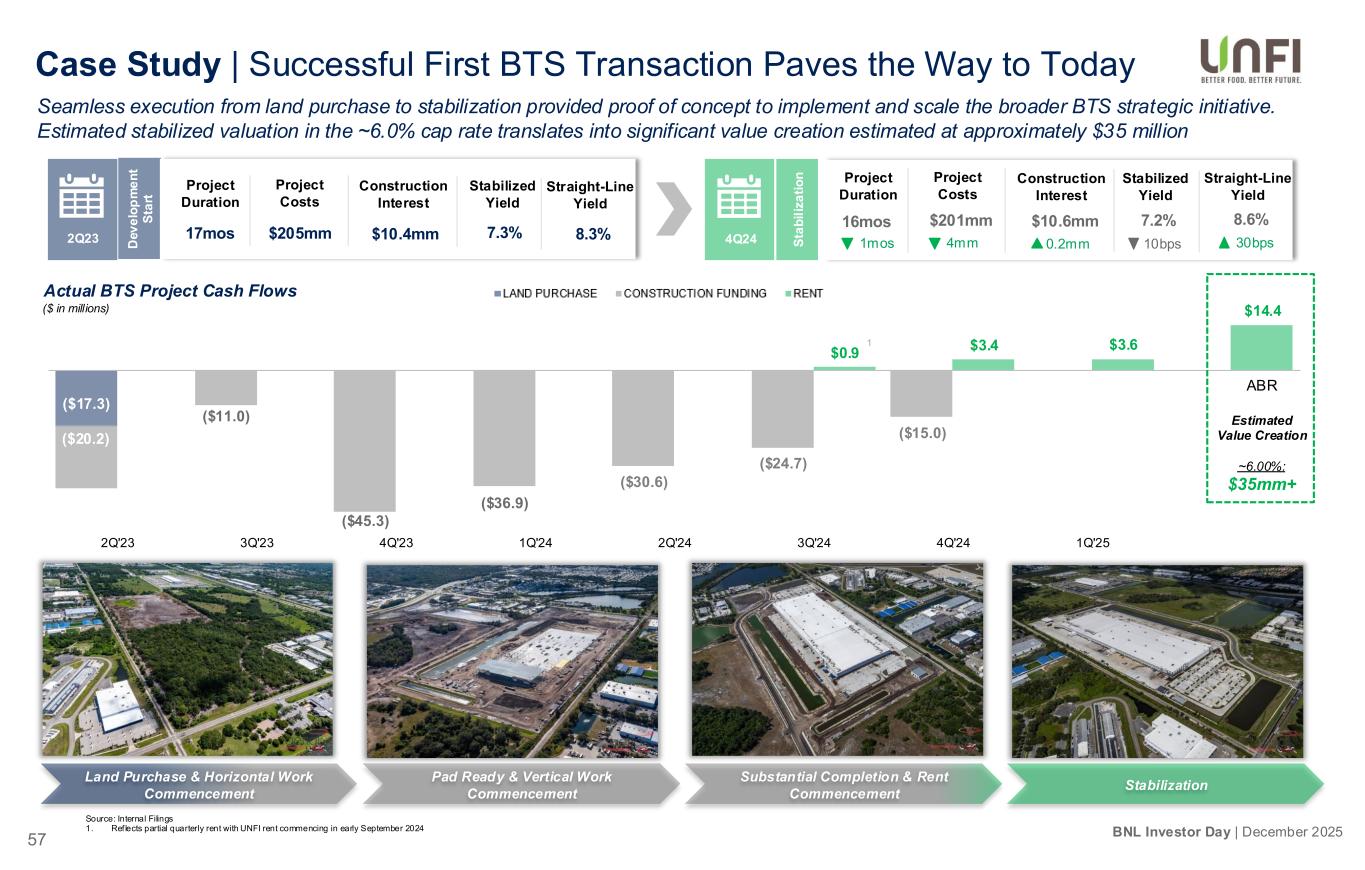

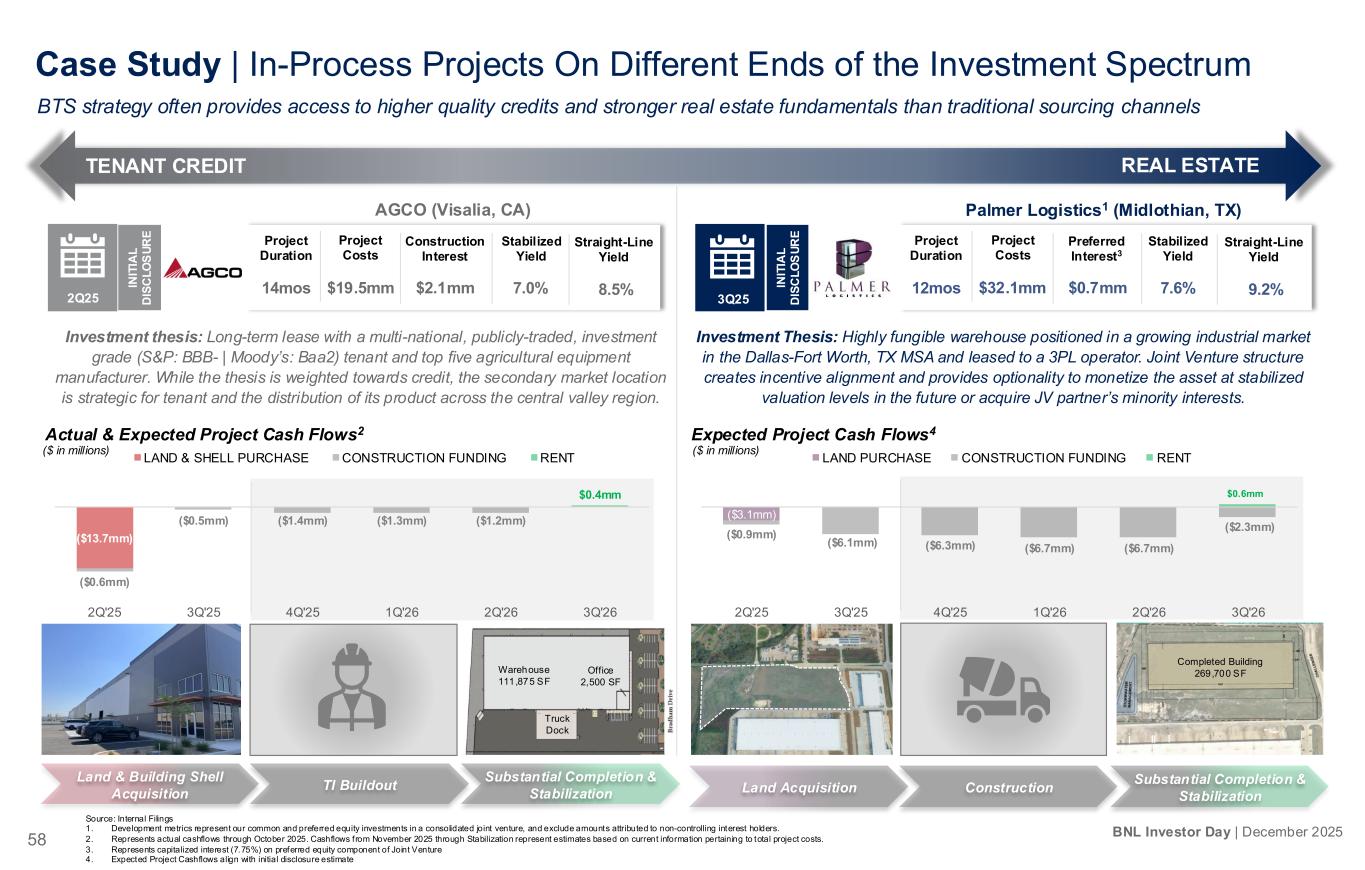

10 BNL Investor Day | December 2025 No Question Left Unanswered | Current Management Team’s Accomplishments Source: market data as of November 25, 2025, since January 1, 2023 1 Optimized organizational structure to further drive collaboration, operational efficiencies, and top-tier results ▪ Organizational restructuring in 2023 positioned BNL for success both in today’s dynamic environment and for years to come ▪ Operating model enhances collaboration across the organization through a data-driven decision-making process ▪ Continue to scale over expense base and have effectively managed core general & administrative expenses since the reorganizat ion Repositioned portfolio through a strategic wind-down of the clinical healthcare segment while continuing to grow earnings ▪ Reduced clinical healthcare exposure to 2.4% since announcing the healthcare simplification strategy at the beginning of 2024 ▪ Successfully sold 57 clinical healthcare assets for total proceeds of $352mm in 2024 ▪ Grew AFFO per share by 1.4% in 2024, a rarity for a REIT undertaking a portfolio repositioning 3 Developed and implemented a differentiated growth strategy built on three core building blocks ▪ Exceptional in-place portfolio performance via top tier same store rent growth and proactive asset management focused on delivering solutions ▪ Relationship-based approach to external growth, helping our partners grow their business while we grow ours ▪ Successfully launched and scaled a build-to-suit development strategy that has created compelling risk-adjusted opportunities 4 Generated a build-to-suit pipeline that will create consistent and predictable growth for several years to come ▪ Since launching the strategy, we have completed or committed $898mm to build-to-suit developments, including $583mm of commitments in 2025 ▪ This includes six projects under executed letter of intent, representing $142mm of these commitments ▪ Creating meaningful value through build-to-suit strategy with stabilized values ~75-100bps+ tighter than our initial cash yields 5 Returned significant relative value to shareholders while upholding the highest standard of transparency and disclosure ▪ 32.8% total shareholder return since beginning of 2023, outpacing the RMZ and placing BNL in the top two in the net lease space ▪ Despite year-to-date momentum and generating the second best TSR in net lease since 2023, we continue to trade at a discounted relative valuation ▪ Enhanced disclosures and upheld a high degree of transparency for our shareholders, priding ourselves on doing exactly what w e say we are going to 2

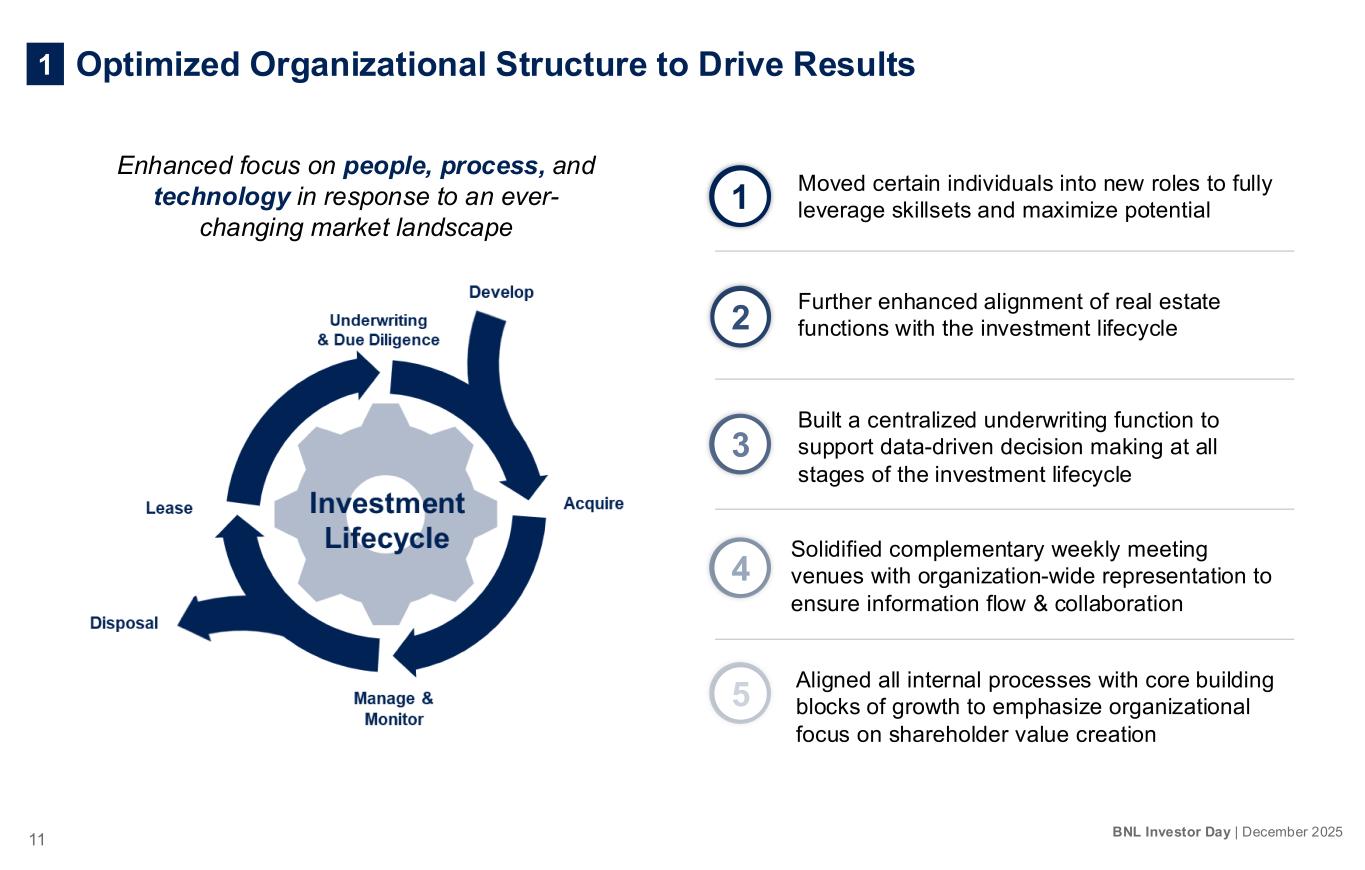

11 BNL Investor Day | December 2025 Optimized Organizational Structure to Drive Results 1 Moved certain individuals into new roles to fully leverage skillsets and maximize potential1 2 3 4 5 Further enhanced alignment of real estate functions with the investment lifecycle Built a centralized underwriting function to support data-driven decision making at all stages of the investment lifecycle Solidified complementary weekly meeting venues with organization-wide representation to ensure information flow & collaboration Aligned all internal processes with core building blocks of growth to emphasize organizational focus on shareholder value creation Enhanced focus on people, process, and technology in response to an ever- changing market landscape

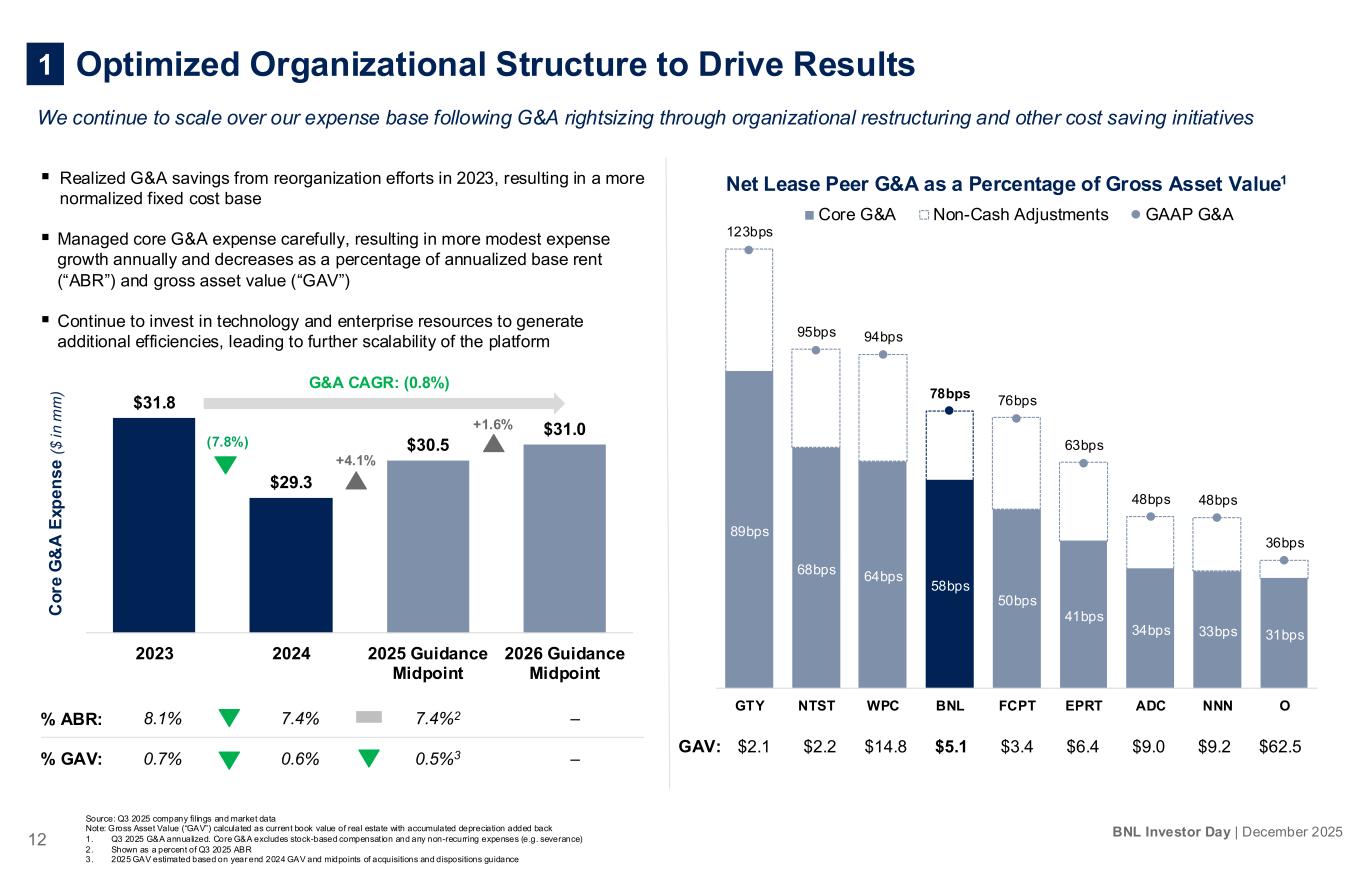

12 BNL Investor Day | December 2025 $31.8 $29.3 $30.5 $31.0 2023 2024 2025 Guidance Midpoint 2026 Guidance Midpoint Optimized Organizational Structure to Drive Results Source: Q3 2025 company filings and market data Note: Gross Asset Value (“GAV”) calculated as current book value of real estate with accumulated depreciation added back 1. Q3 2025 G&A annualized. Core G&A excludes stock-based compensat ion and any non-recurring expenses (e.g. severance) 2. Shown as a percent of Q3 2025 ABR 3. 2025 GAV estimated based on year end 2024 GAV and midpoints of acquisitions and dispositions guidance 1 +4.1% (7.8%) +1.6% ▪ Realized G&A savings from reorganization efforts in 2023, resulting in a more normalized fixed cost base ▪ Managed core G&A expense carefully, resulting in more modest expense growth annually and decreases as a percentage of annualized base rent (“ABR”) and gross asset value (“GAV”) ▪ Continue to invest in technology and enterprise resources to generate additional efficiencies, leading to further scalability of the platform 8.1% 7.4% 7.4%2 – 0.7% 0.6% 0.5%3 – % ABR: % GAV: C o re G & A E x p e n s e ( $ i n m m ) $2.1 $2.2 $14.8 $5.1 $3.4 $6.4 $9.0 $9.2 $62.5GAV: We continue to scale over our expense base following G&A rightsizing through organizational restructuring and other cost saving initiatives G&A CAGR: (0.8%) 89bps 68bps 64bps 58bps 50bps 41bps 34bps 33bps 31bps 123bps 95bps 94bps 78bps 76bps 63bps 48bps 48bps 36bps GTY NTST WPC BNL FCPT EPRT ADC NNN O Core G&A Non-Cash Adjustments GAAP G&A Net Lease Peer G&A as a Percentage of Gross Asset Value1

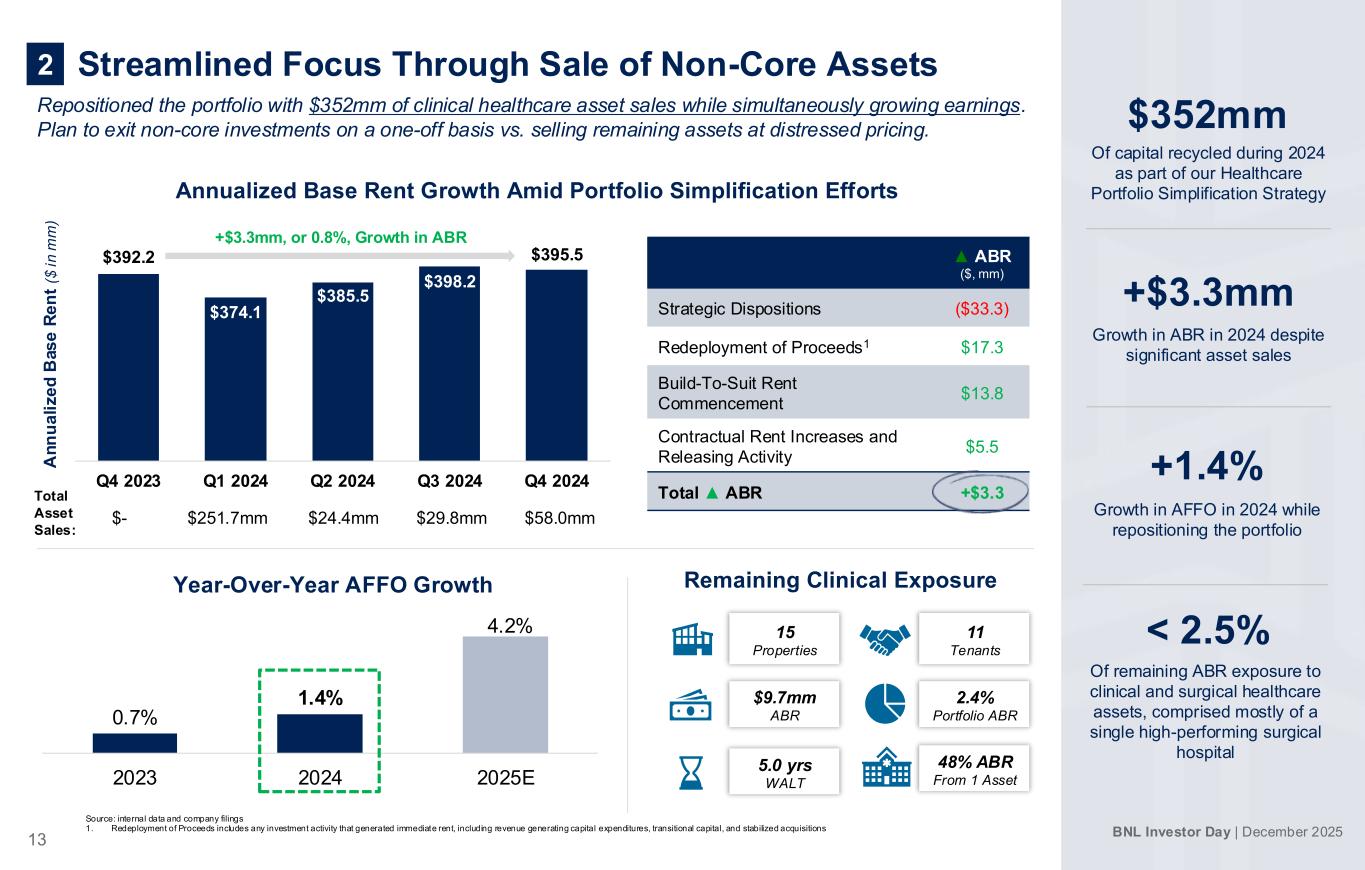

BNL Investor Day | December 2025 13 Source: internal data and company filings 1. Redeployment of Proceeds includes any investment activity that generated immediate rent, including revenue generating capital expenditures, transitional capital, and stabilized acquisitions Repositioned the portfolio with $352mm of clinical healthcare asset sales while simultaneously growing earnings. Plan to exit non-core investments on a one-off basis vs. selling remaining assets at distressed pricing. 0.7% 1.4% 4.2% 2023 2024 2025E $392.2 $374.1 $385.5 $398.2 $395.5 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Year-Over-Year AFFO Growth $352mm Of capital recycled during 2024 as part of our Healthcare Portfolio Simplification Strategy +1.4% Growth in AFFO in 2024 while repositioning the portfolio +$3.3mm Growth in ABR in 2024 despite significant asset sales < 2.5% Of remaining ABR exposure to clinical and surgical healthcare assets, comprised mostly of a single high-performing surgical hospital ▲ ABR ($, mm) Strategic Dispositions ($33.3) Redeployment of Proceeds1 $17.3 Build-To-Suit Rent Commencement $13.8 Contractual Rent Increases and Releasing Activity $5.5 Total ▲ ABR +$3.3 +$3.3mm, or 0.8%, Growth in ABR Streamlined Focus Through Sale of Non-Core Assets 2 Total Asset Sales: $- $251.7mm $24.4mm $29.8mm $58.0mm Annualized Base Rent Growth Amid Portfolio Simplification Efforts 15 Properties $9.7mm ABR Remaining Clinical Exposure 11 Tenants 2.4% Portfolio ABR 5.0 yrs WALT 48% ABR From 1 Asset A n n u a li z e d B a s e R e n t ($ i n m m )

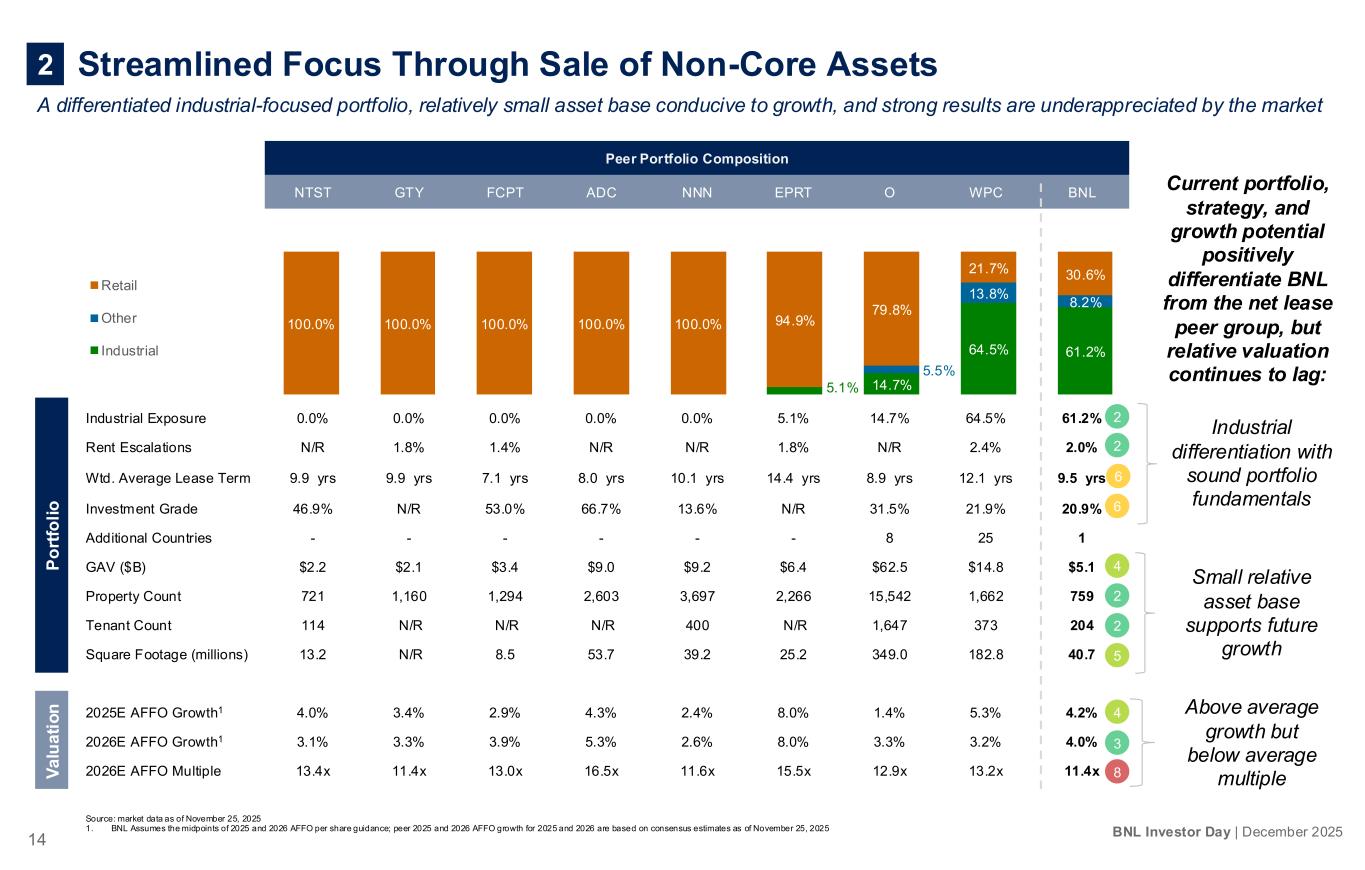

14 BNL Investor Day | December 2025 Source: market data as of November 25, 2025 1. BNL Assumes the midpoints of 2025 and 2026 AFFO per share guidance; peer 2025 and 2026 AFFO growth for 2025 and 2026 are based on consensus estimates as of November 25, 2025 Peer Portfolio Composition NTST GTY FCPT ADC NNN EPRT O WPC BNL Industrial Exposure 0.0% 0.0% 0.0% 0.0% 0.0% 5.1% 14.7% 64.5% 61.2% Rent Escalations N/R 1.8% 1.4% N/R N/R 1.8% N/R 2.4% 2.0% Wtd. Average Lease Term 9.9 yrs 9.9 yrs 7.1 yrs 8.0 yrs 10.1 yrs 14.4 yrs 8.9 yrs 12.1 yrs 9.5 yrs Investment Grade 46.9% N/R 53.0% 66.7% 13.6% N/R 31.5% 21.9% 20.9% Additional Countries - - - - - - 8 25 1 GAV ($B) $2.2 $2.1 $3.4 $9.0 $9.2 $6.4 $62.5 $14.8 $5.1 Property Count 721 1,160 1,294 2,603 3,697 2,266 15,542 1,662 759 Tenant Count 114 N/R N/R N/R 400 N/R 1,647 373 204 Square Footage (millions) 13.2 N/R 8.5 53.7 39.2 25.2 349.0 182.8 40.7 2025E AFFO Growth1 4.0% 3.4% 2.9% 4.3% 2.4% 8.0% 1.4% 5.3% 4.2% 2026E AFFO Growth1 3.1% 3.3% 3.9% 5.3% 2.6% 8.0% 3.3% 3.2% 4.0% 2026E AFFO Multiple 13.4x 11.4x 13.0x 16.5x 11.6x 15.5x 12.9x 13.2x 11.4x P o rt fo li o 2 2 6 6 2 2 5 4 3 8 5.1% 14.7% 64.5% 61.2% 5.5% 13.8% 8.2% 100.0% 100.0% 100.0% 100.0% 100.0% 94.9% 79.8% 21.7% 30.6% Retail Other Industrial Above average growth but below average multiple Small relative asset base supports future growth Industrial differentiation with sound portfolio fundamentals Current portfolio, strategy, and growth potential positively differentiate BNL from the net lease peer group, but relative valuation continues to lag: 4 Streamlined Focus Through Sale of Non-Core Assets 2 A differentiated industrial-focused portfolio, relatively small asset base conducive to growth, and strong results are underappreciated by the market V a lu a ti o n

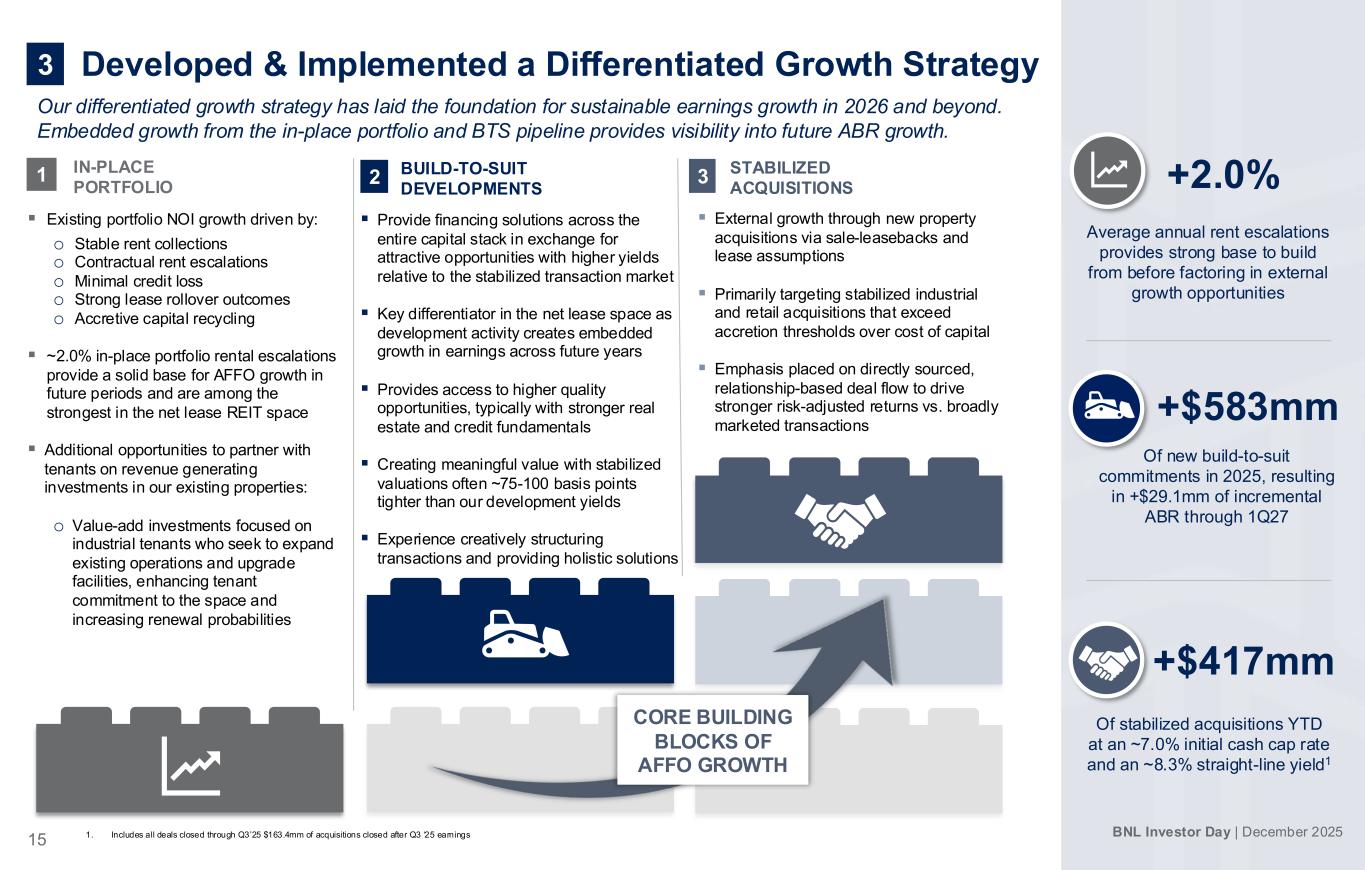

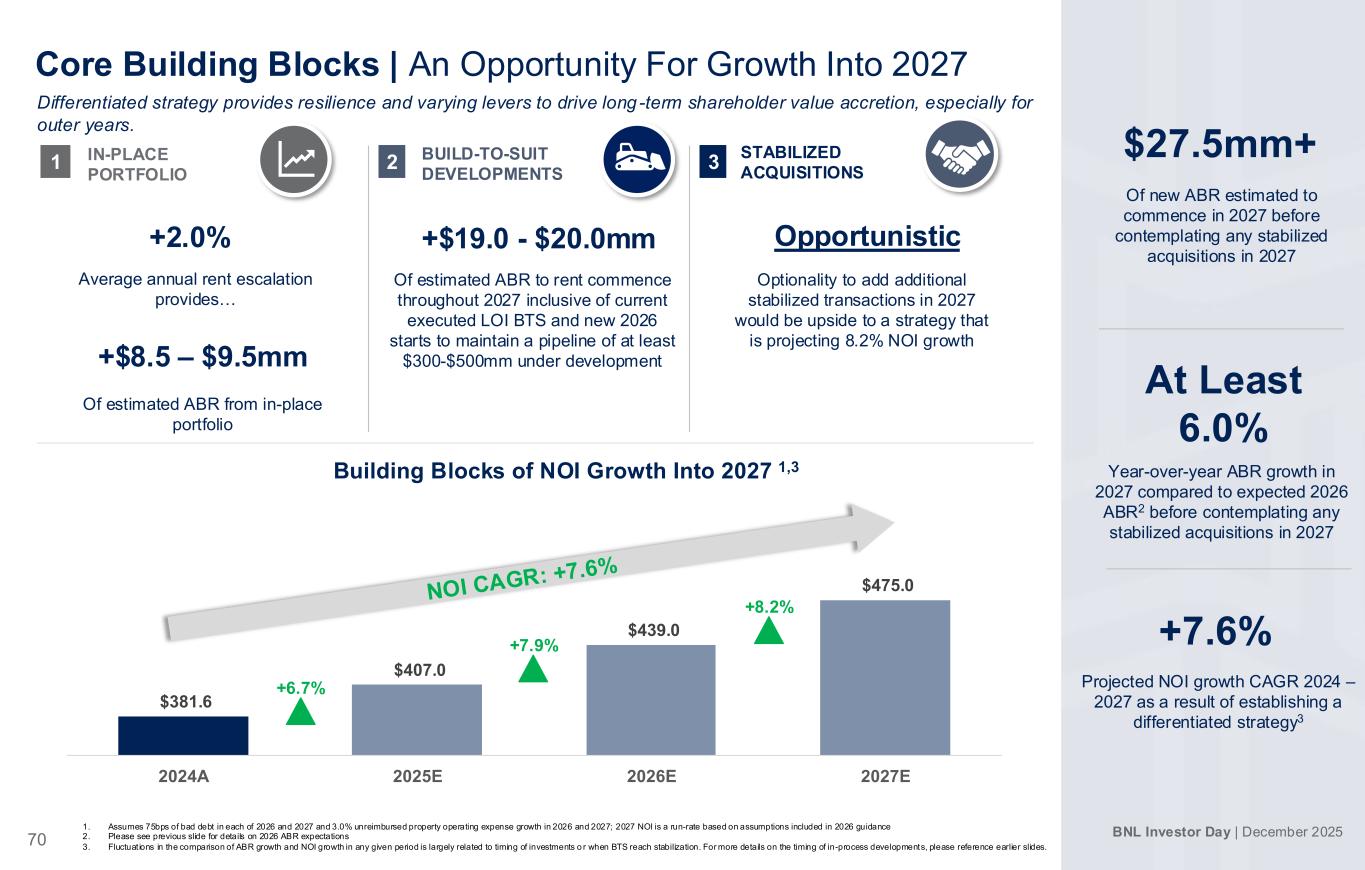

BNL Investor Day | December 2025 15 Our differentiated growth strategy has laid the foundation for sustainable earnings growth in 2026 and beyond. Embedded growth from the in-place portfolio and BTS pipeline provides visibility into future ABR growth. ▪ Existing portfolio NOI growth driven by: o Stable rent collections o Contractual rent escalations o Minimal credit loss o Strong lease rollover outcomes o Accretive capital recycling ▪ ~2.0% in-place portfolio rental escalations provide a solid base for AFFO growth in future periods and are among the strongest in the net lease REIT space ▪ Additional opportunities to partner with tenants on revenue generating investments in our existing properties: o Value-add investments focused on industrial tenants who seek to expand existing operations and upgrade facilities, enhancing tenant commitment to the space and increasing renewal probabilities 3 STABILIZED ACQUISITIONS 2 BUILD-TO-SUIT DEVELOPMENTS 1 IN-PLACE PORTFOLIO ▪ Provide financing solutions across the entire capital stack in exchange for attractive opportunities with higher yields relative to the stabilized transaction market ▪ Key differentiator in the net lease space as development activity creates embedded growth in earnings across future years ▪ Provides access to higher quality opportunities, typically with stronger real estate and credit fundamentals ▪ Creating meaningful value with stabilized valuations often ~75-100 basis points tighter than our development yields ▪ Experience creatively structuring transactions and providing holistic solutions ▪ External growth through new property acquisitions via sale-leasebacks and lease assumptions ▪ Primarily targeting stabilized industrial and retail acquisitions that exceed accretion thresholds over cost of capital ▪ Emphasis placed on directly sourced, relationship-based deal flow to drive stronger risk-adjusted returns vs. broadly marketed transactions CORE BUILDING BLOCKS OF AFFO GROWTH Developed & Implemented a Differentiated Growth Strategy3 +2.0% Average annual rent escalations provides strong base to build from before factoring in external growth opportunities +$417mm Of stabilized acquisitions YTD at an ~7.0% initial cash cap rate and an ~8.3% straight-line yield1 +$583mm Of new build-to-suit commitments in 2025, resulting in +$29.1mm of incremental ABR through 1Q27 1. Includes all deals closed through Q3’25 $163.4mm of acquisitions closed after Q3 ‘25 earnings

16 BNL Investor Day | December 2025 WHAT WE AVOID – SHORT-TERM THINKING WHERE WE ARE FOCUSED – LONG-TERM GROWTH Developed and Implemented a Differentiated Growth Strategy3 Treating investments like commodities, trading deeds and leases while passively collecting rent like a game of Monopoly Chasing broadly marketed transaction opportunities at pricing levels dislocated from the investment risk profile Selling non-core or distressed assets at distressed sale pricing solely to remove them from the portfolio and avoid headline risk Actively managing real estate with a willingness to “roll up our sleeves” to create value for our shareholders and partners. We are a real estate operator at heart, not solely a specialty finance lender Cultivating long-term, mutually beneficial relationships with our partners (tenants, developers, brokers, etc.) that build trust and helps our partners grow their businesses while we grow ours Employing innovative, forward-thinking solutions that create meaningful value beyond just collecting rent checks, redefining what’s possible for a net lease REIT Prioritizing predictable, durable, and attractive long-term growth over short-term gains and quarterly results Aggregating assets solely for the sake of growth and aggressively chasing high yields to boost short-term earnings. The “pie eating contest” model of net lease investing worked in the post-GFC low-interest rate environment, but we don’t believe it does anymore Allocating capital to the best opportunities with appropriately calibrated pricing based on the risk-return profile, taking a prudent and disciplined approach to capital deployment Binary thinking. Disciplined underwriting requires evaluating the full spectrum and balance between real estate fundaments and credit structuring / support 0 1

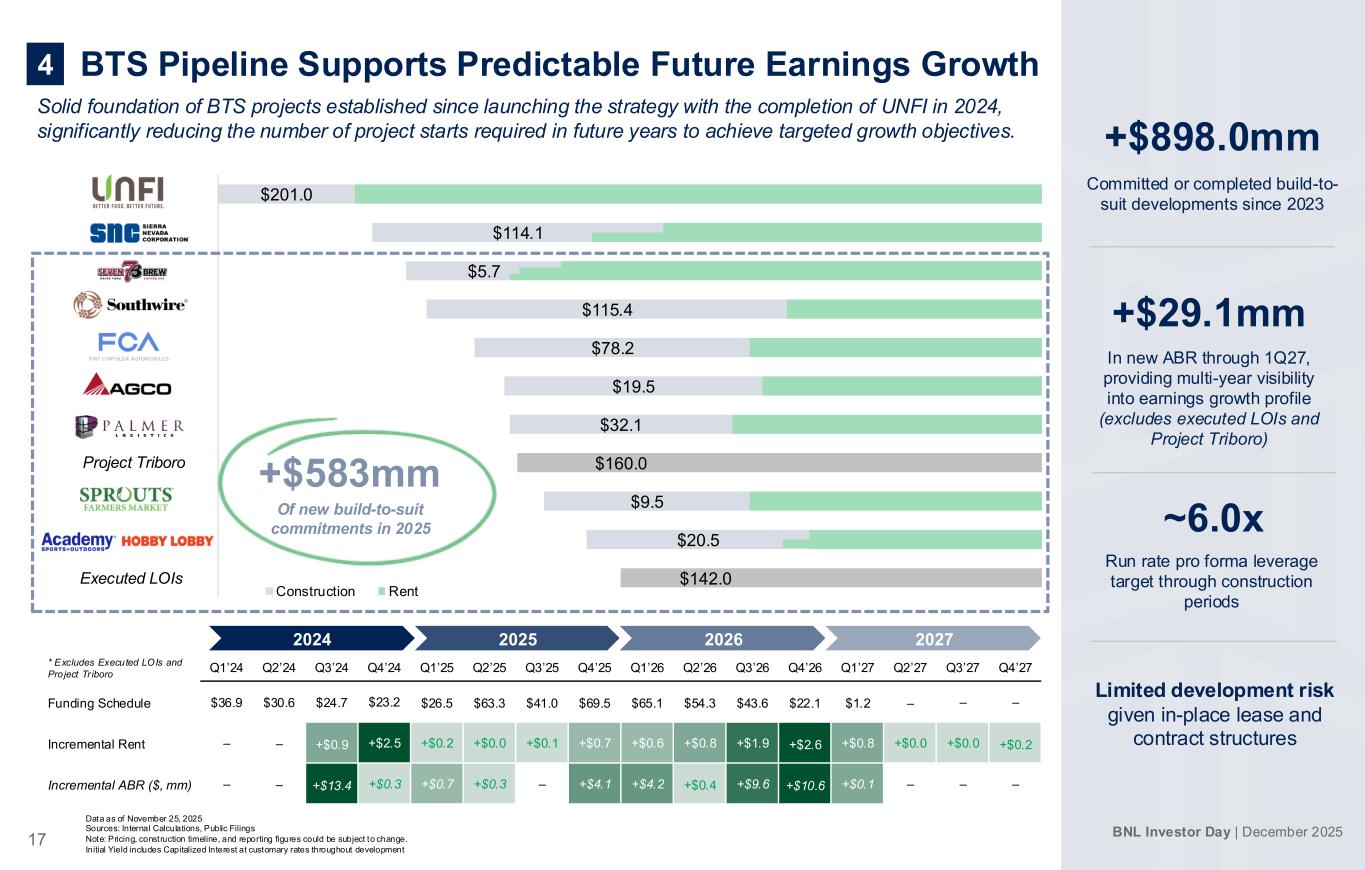

BNL Investor Day | December 2025 17 $201.0 $114.1 $5.7 $115.4 $78.2 $19.5 $32.1 $160.0 $9.5 $20.5 $142.0 UNFI Sierra Nevada 7 Brew Portfolio Southwire Fiat Chrysler AGCO Palmer Logistics Project Triboro Sprouts Hobby Lobby / Academy Sports Executed LOI Construction Rent Data as of November 25, 2025 Sources: Internal Calculations, Public Filings Note: Pricing, construction timeline, and reporting figures could be subject to change. Initial Yield includes Capitalized Interest at customary rates throughout development Solid foundation of BTS projects established since launching the strategy with the completion of UNFI in 2024, significantly reducing the number of project starts required in future years to achieve targeted growth objectives. 2024 2025 2026 2027 * Excludes Executed LOIs and Project Tr iboro Q1’24 Q2’24 Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 Q4’25 Q1’26 Q2’26 Q3’26 Q4’26 Q1’27 Q2’27 Q3’27 Q4’27 Funding Schedule $36.9 $30.6 $24.7 $23.2 $26.5 $63.3 $41.0 $69.5 $65.1 $54.3 $43.6 $22.1 $1.2 ‒ ‒ ‒ Incremental Rent ‒ ‒ +$0.9 +$2.5 +$0.2 +$0.0 +$0.1 +$0.7 +$0.6 +$0.8 +$1.9 +$2.6 +$0.8 +$0.0 +$0.0 +$0.2 Incremental ABR ($, mm) ‒ ‒ +$13.4 +$0.3 +$0.7 +$0.3 ‒ +$4.1 +$4.2 +$0.4 +$9.6 +$10.6 +$0.1 ‒ ‒ ‒ +$29.1mm In new ABR through 1Q27, providing multi-year visibility into earnings growth profile (excludes executed LOIs and Project Triboro) +$898.0mm Committed or completed build-to- suit developments since 2023 Limited development risk given in-place lease and contract structures ~6.0x Run rate pro forma leverage target through construction periods BTS Pipeline Supports Predictable Future Earnings Growth4 Executed LOIs Project Triboro +$583mm Of new build-to-suit commitments in 2025

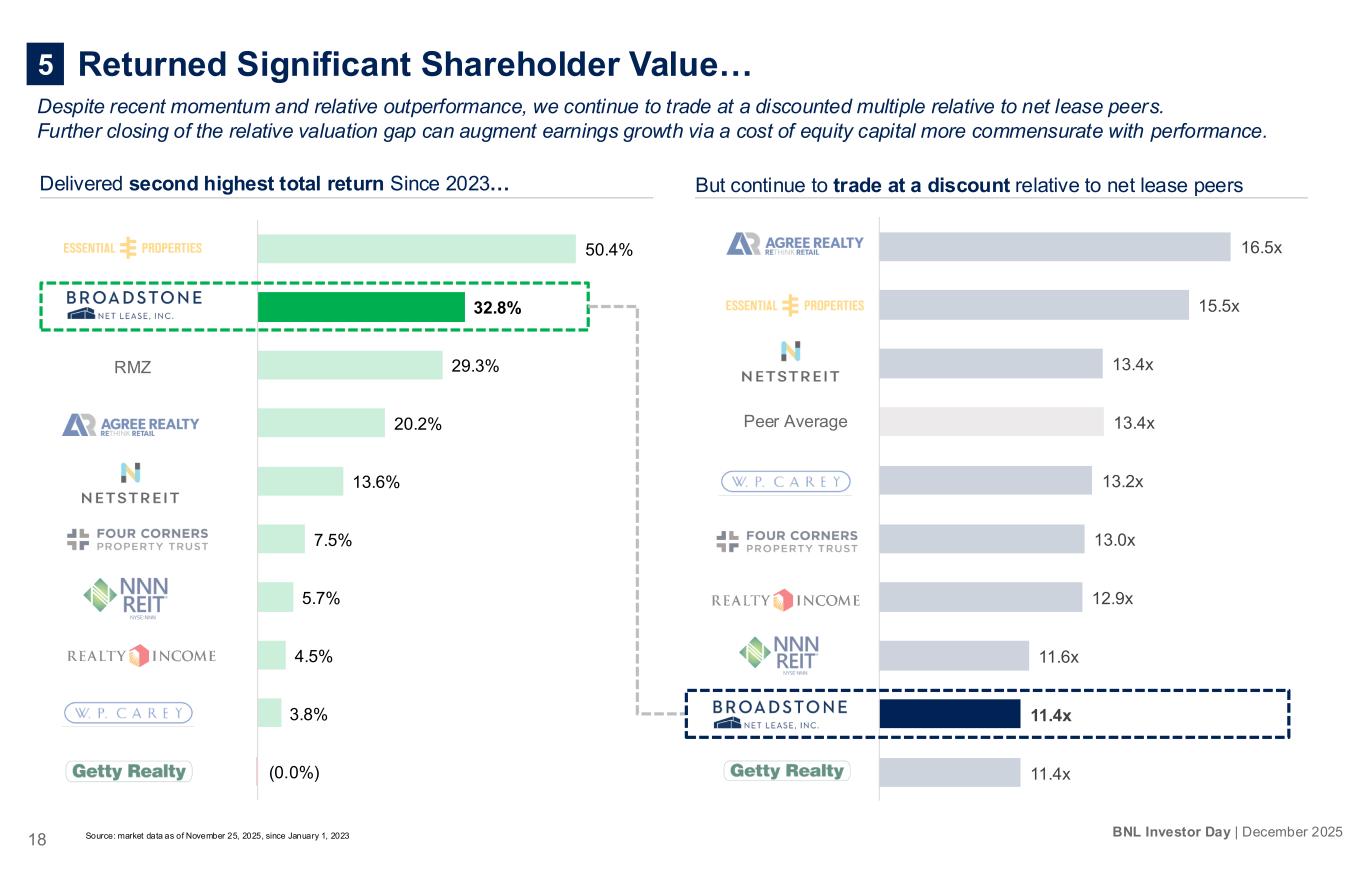

18 BNL Investor Day | December 2025 11.4x 11.4x 11.6x 12.9x 13.0x 13.2x 13.4x 13.4x 15.5x 16.5x GTY BNL NNN O FCPT WPC Peer Average NTST EPRT ADC (0.0%) 3.8% 4.5% 5.7% 7.5% 13.6% 20.2% 29.3% 32.8% 50.4% GTY WPC O NNN FCPT NTST ADC RMZ BNL EPRT Despite recent momentum and relative outperformance, we continue to trade at a discounted multiple relative to net lease peers. Further closing of the relative valuation gap can augment earnings growth via a cost of equity capital more commensurate with performance. 5 RMZ Returned Significant Shareholder Value… Delivered second highest total return Since 2023… But continue to trade at a discount relative to net lease peers Source: market data as of November 25, 2025, since January 1, 2023 Peer Av ag

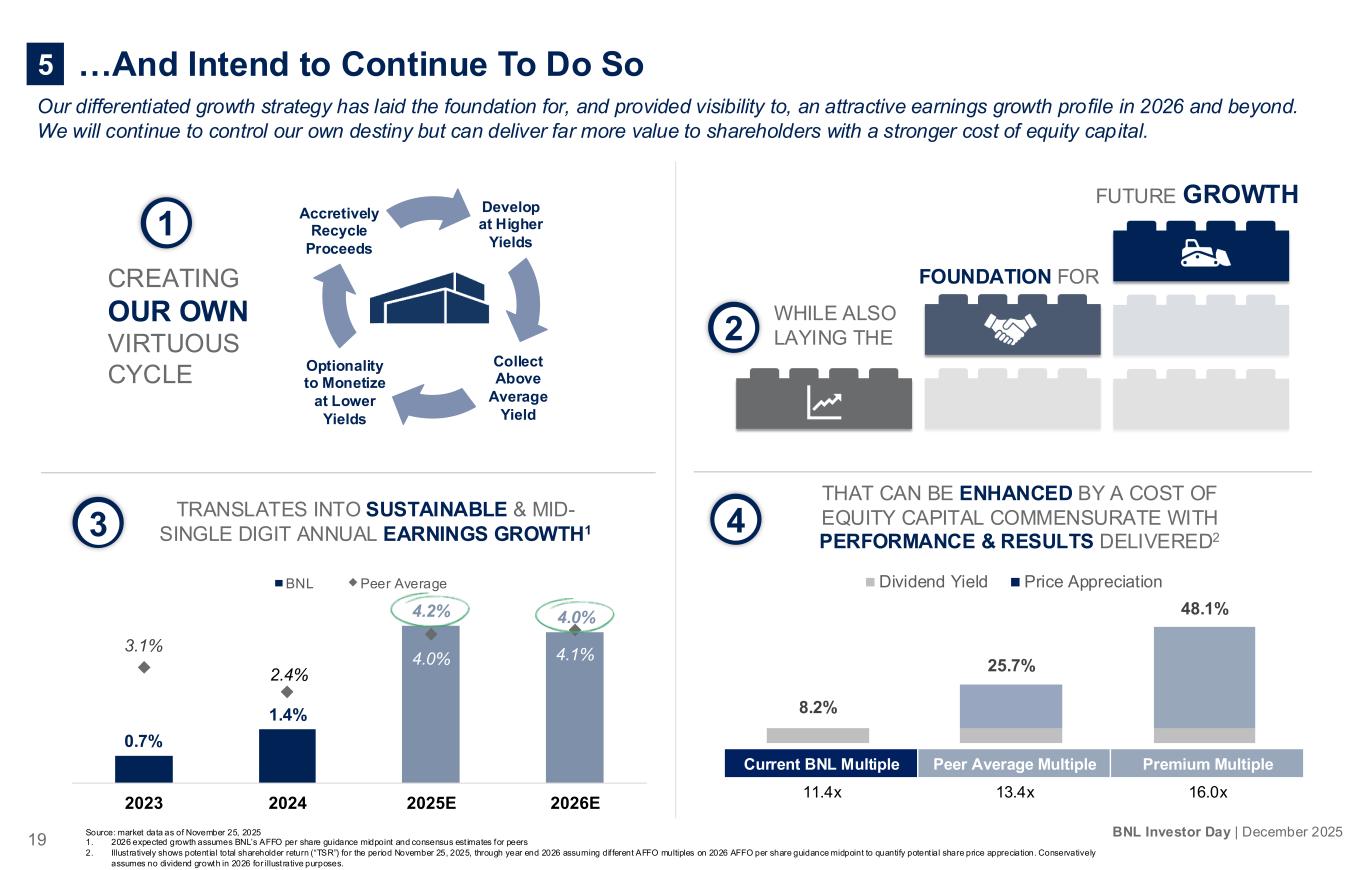

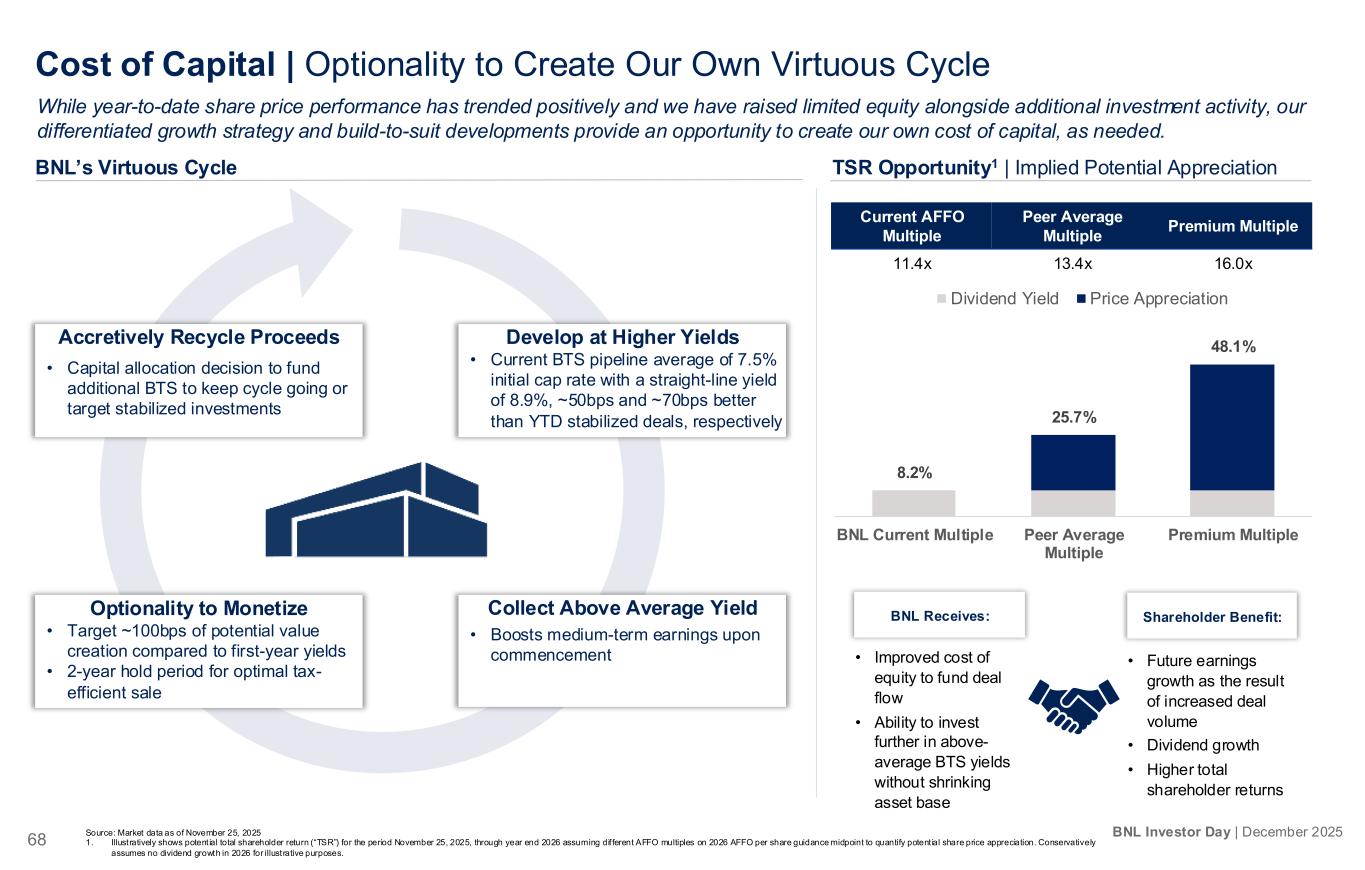

19 BNL Investor Day | December 2025 5 …And Intend to Continue To Do So Accretively Recycle Proceeds Develop at Higher Yields Optionality to Monetize at Lower Yields Collect Above Average Yield CREATING OUR OWN VIRTUOUS CYCLE WHILE ALSO LAYING THE FOUNDATION FOR FUTURE GROWTH 1 Our differentiated growth strategy has laid the foundation for, and provided visibility to, an attractive earnings growth profile in 2026 and beyond. We will continue to control our own destiny but can deliver far more value to shareholders with a stronger cost of equity capital. 0.7% 1.4% 4.2% 4.0% 3.1% 2.4% 4.0% 4.1% 2023 2024 2025E 2026E BNL Peer Average TRANSLATES INTO SUSTAINABLE & MID- SINGLE DIGIT ANNUAL EARNINGS GROWTH1 2 3 THAT CAN BE ENHANCED BY A COST OF EQUITY CAPITAL COMMENSURATE WITH PERFORMANCE & RESULTS DELIVERED2 4 8.2% 25.7% 48.1% Dividend Yield Price Appreciation Current BNL Multiple Peer Average Multiple Premium Multiple 11.4x 13.4x 16.0x Source: market data as of November 25, 2025 1. 2026 expected growth assumes BNL’s AFFO per share guidance midpoint and consensus est imates for peers 2. Illustratively shows potent ial total shareholder return (“TSR”) for the period November 25, 2025, through year end 2026 assuming dif ferent AFFO multiples on 2026 AFFO per share guidance midpoint to quantify potent ial share price appreciation. Conservatively assumes no dividend growth in 2026 for illustrative purposes.

20 BNL Investor Day | December 2025 Broadstone’s Vision for the Future Generate a robust and resilient pipeline of build-to-suit developments, creating unique value in the net lease space and providing sector-leading multi-year visibility into a compelling growth profile Help our clients and partners grow their businesses while we grow ours Accretively and opportunistically acquire stabilized acquisitions at attractive spreads as a core part of our growth model, primarily through our relationship- based approach and deep network Provide transparency through sector-leading disclosure and frequent shareholder engagement Drive long-term shareholder value through mid-single digit year-over-year AFFO per share growth, translating into dividend growth and potential share price appreciation

Speakers: Ryan Albano, Mike Caruso & Will Garner Time: 1:25 – 1:50 p.m. Core Building Block: In-Place Portfolio The Hess Collection American Canyon, CA

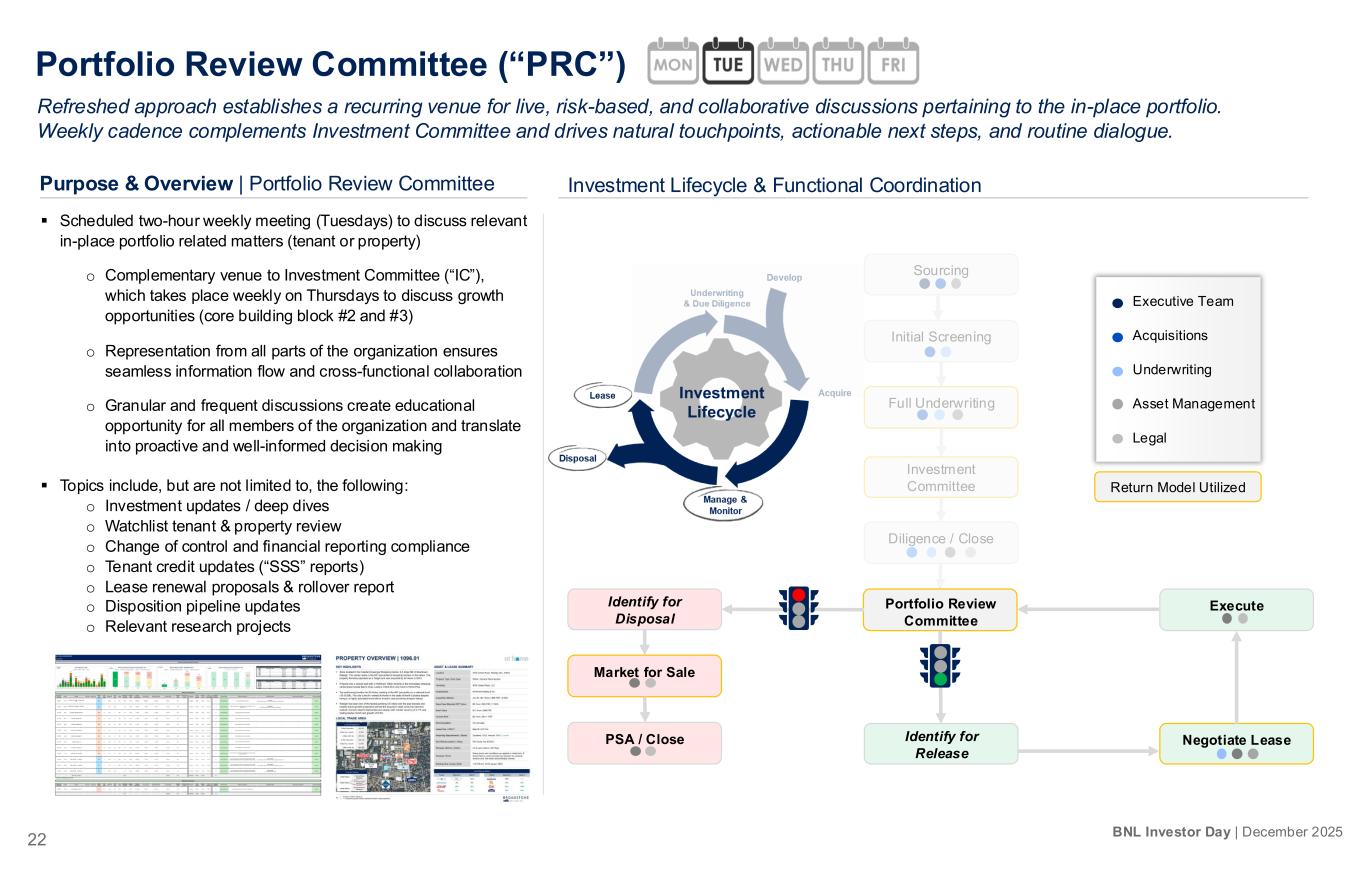

22 BNL Investor Day | December 2025 Portfolio Review Committee (“PRC”) Refreshed approach establishes a recurring venue for live, risk-based, and collaborative discussions pertaining to the in-place portfolio. Weekly cadence complements Investment Committee and drives natural touchpoints, actionable next steps, and routine dialogue. Sourcing Executive Team Acquisitions Underwriting Asset Management Legal Initial Screening Full Underwriting Investment Committee Portfolio Review Committee Identify for Disposal Market for Sale PSA / Close Identify for Release Negotiate Lease Execute Diligence / Close Return Model Utilized ▪ Scheduled two-hour weekly meeting (Tuesdays) to discuss relevant in-place portfolio related matters (tenant or property) o Complementary venue to Investment Committee (“IC”), which takes place weekly on Thursdays to discuss growth opportunities (core building block #2 and #3) o Representation from all parts of the organization ensures seamless information flow and cross-functional collaboration o Granular and frequent discussions create educational opportunity for all members of the organization and translate into proactive and well-informed decision making ▪ Topics include, but are not limited to, the following: o Investment updates / deep dives o Watchlist tenant & property review o Change of control and financial reporting compliance o Tenant credit updates (“SSS” reports) o Lease renewal proposals & rollover report o Disposition pipeline updates o Relevant research projects Purpose & Overview | Portfolio Review Committee Investment Lifecycle & Functional Coordination

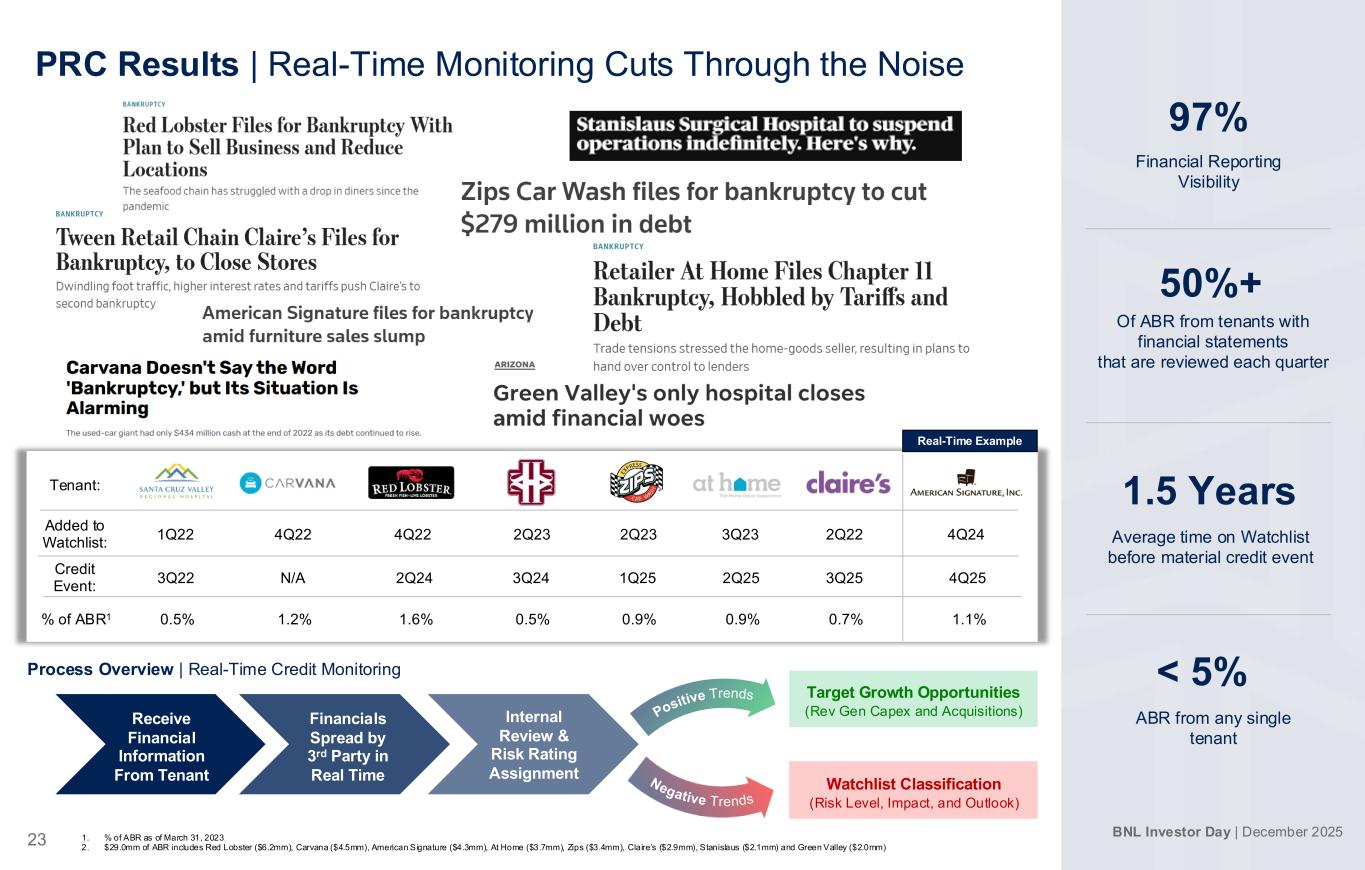

BNL Investor Day | December 2025 23 PRC Results | Real-Time Monitoring Cuts Through the Noise N/A3Q22 3Q252Q24 1. % of ABR as of March 31, 2023 2. $29.0mm of ABR includes Red Lobster ($6.2mm), Carvana ($4.5mm), American Signature ($4.3mm), At Home ($3.7mm), Zips ($3.4mm), Claire’s ($2.9mm), Stanislaus ($2.1mm) and Green Valley ($2.0mm) 97% Financial Reporting Visibility < 5% ABR from any single tenant 1.5 Years Average time on Watchlist before material credit event Tenant: Added to Watchlist: Credit Event: Receive Financial Information From Tenant Financials Spread by 3rd Party in Real Time Internal Review & Risk Rating Assignment Process Overview | Real-Time Credit Monitoring Watchlist Classification (Risk Level, Impact, and Outlook) Target Growth Opportunities (Rev Gen Capex and Acquisitions) Positive Trends Negative Trends 2Q253Q24 1Q25 4Q221Q22 2Q224Q22 3Q232Q23 2Q23 22 136 85 7 Quarters on Watchlist before credit event 4Q24 4Q25 Real-Time Example 1.2%0.5% 0.7%1.6%% of ABR1 0.9%0.5% 0.9% 1.1% 50%+ Of ABR from tenants with financial statements that are reviewed each quarter

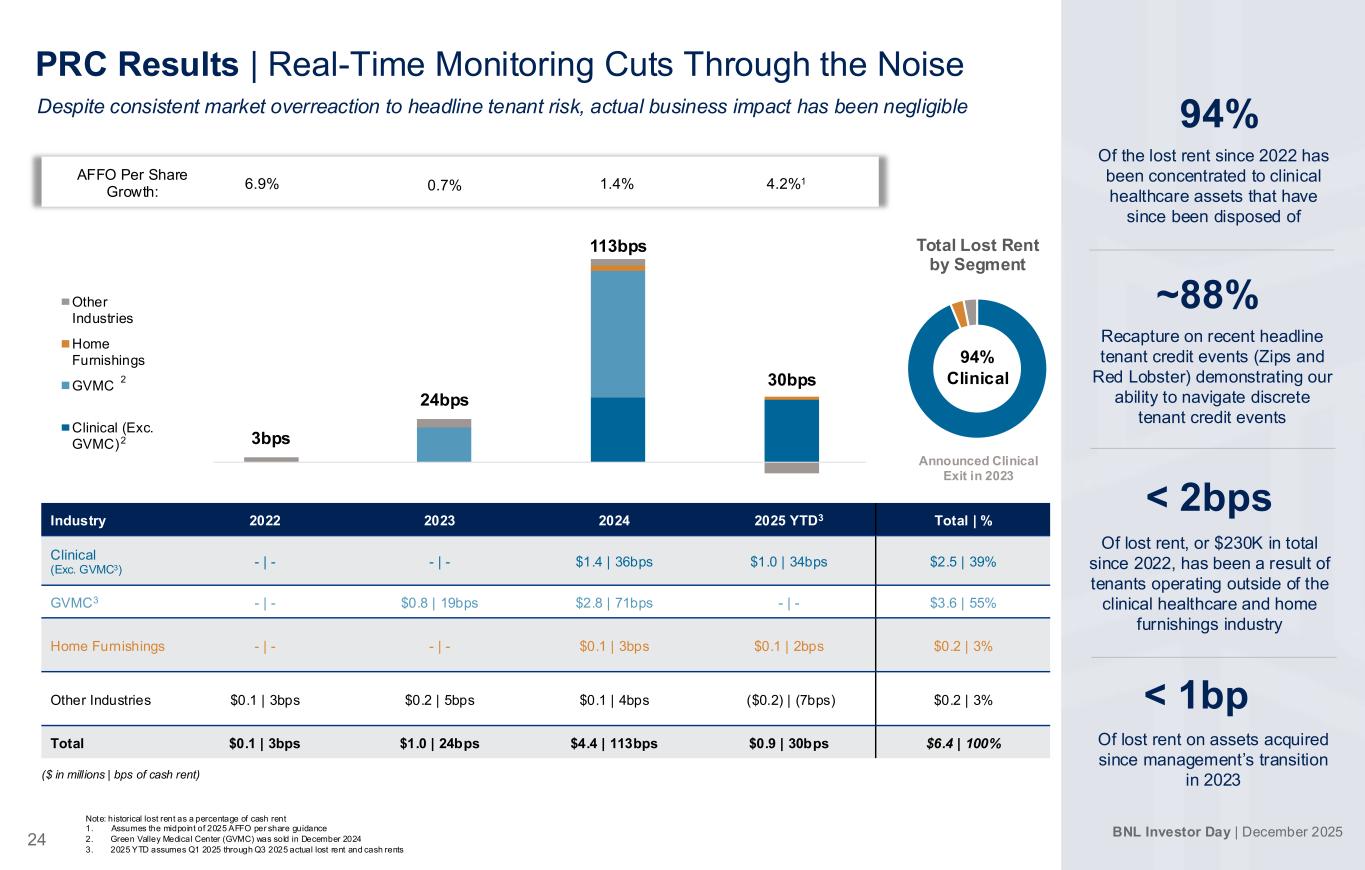

BNL Investor Day | December 2025 24 3bps 24bps 113bps 30bps Other Industries Home Furnishings GVMC Clinical (Exc. GVMC) Note: historical lost rent as a percentage of cash rent 1. Assumes the midpoint of 2025 AFFO per share guidance 2. Green Valley Medical Center (GVMC) was sold in December 2024 3. 2025 YTD assumes Q1 2025 through Q3 2025 actual lost rent and cash rents Despite consistent market overreaction to headline tenant risk, actual business impact has been negligible 2 ($ in millions | bps of cash rent) Industry 2022 2023 2024 2025 YTD3 Total | % Clinical (Exc. GVMC3) - | - - | - $1.4 | 36bps $1.0 | 34bps $2.5 | 39% GVMC3 - | - $0.8 | 19bps $2.8 | 71bps - | - $3.6 | 55% Home Furnishings - | - - | - $0.1 | 3bps $0.1 | 2bps $0.2 | 3% Other Industries $0.1 | 3bps $0.2 | 5bps $0.1 | 4bps ($0.2) | (7bps) $0.2 | 3% Total $0.1 | 3bps $1.0 | 24bps $4.4 | 113bps $0.9 | 30bps $6.4 | 100% 2 94% Of the lost rent since 2022 has been concentrated to clinical healthcare assets that have since been disposed of ~88% Recapture on recent headline tenant credit events (Zips and Red Lobster) demonstrating our ability to navigate discrete tenant credit events < 1bp Of lost rent on assets acquired since management’s transition in 2023 PRC Results | Real-Time Monitoring Cuts Through the Noise Total Lost Rent by Segment 94% Clinical Announced Clinical Exit in 2023 Of lost rent, or $230K in total since 2022, has been a result of tenants operating outside of the clinical healthcare and home furnishings industry < 2bps 6.9% AFFO Per Share Growth: 4.2%10.7% 1.4%

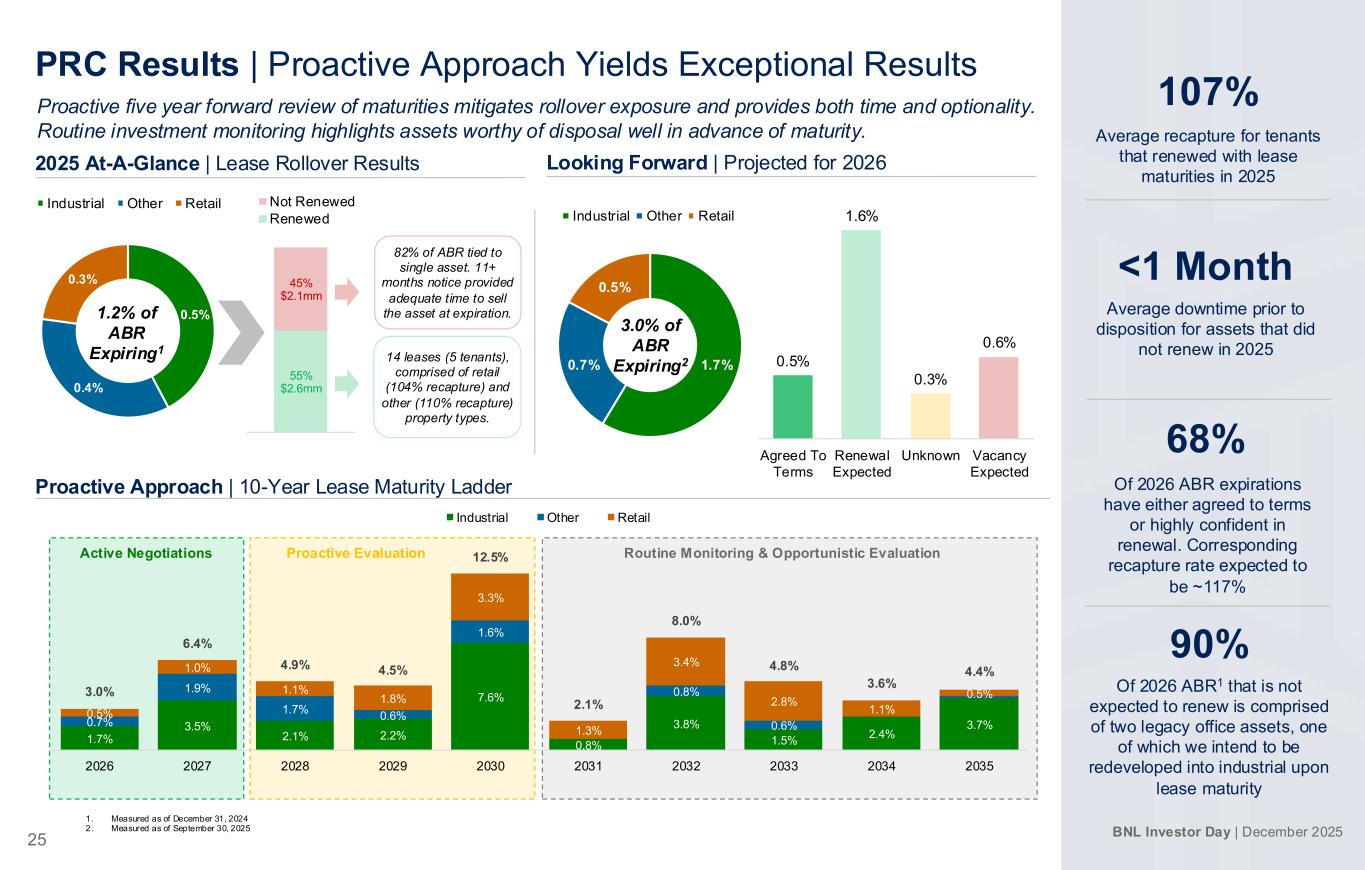

BNL Investor Day | December 2025 25 1. Measured as of December 31, 2024 2. Measured as of September 30, 2025 PRC Results | Proactive Approach Yields Exceptional Results Active Negotiations Proactive Evaluation Routine Monitoring & Opportunistic Evaluation Proactive Approach | 10-Year Lease Maturity Ladder 2025 At-A-Glance | Lease Rollover Results Proactive five year forward review of maturities mitigates rollover exposure and provides both time and optionality. Routine investment monitoring highlights assets worthy of disposal well in advance of maturity. Looking Forward | Projected for 2026 1.7%0.7% 0.5% Industrial Other Retail 3.0% of ABR Expiring2 0.5% 1.6% 0.3% 0.6% Agreed To Terms Renewal Expected Unknown Vacancy Expected 55% $2.6mm 45% $2.1mm Not Renewed Renewed 0.5% 0.4% 0.3% Industrial Other Retail 1.2% of ABR Expiring1 107% Average recapture for tenants that renewed with lease maturities in 2025 90% Of 2026 ABR1 that is not expected to renew is comprised of two legacy office assets, one of which we intend to be redeveloped into industrial upon lease maturity Of 2026 ABR expirations have either agreed to terms or highly confident in renewal. Corresponding recapture rate expected to be ~117% 68% <1 Month Average downtime prior to disposition for assets that did not renew in 2025 14 leases (5 tenants), comprised of retail (104% recapture) and other (110% recapture) property types. 82% of ABR tied to single asset. 11+ months notice provided adequate time to sell the asset at expiration. 1.7% 3.5% 2.1% 2.2% 7.6% 0.8% 3.8% 1.5% 2.4% 3.7%0.7% 1.9% 1.7% 0.6% 1.6% 0.8% 0.6% 0.5% 1.0% 1.1% 1.8% 3.3% 1.3% 3.4% 2.8% 1.1% 0.5%3.0% 6.4% 4.9% 4.5% 12.5% 2.1% 8.0% 4.8% 3.6% 4.4% 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Industrial Other Retail

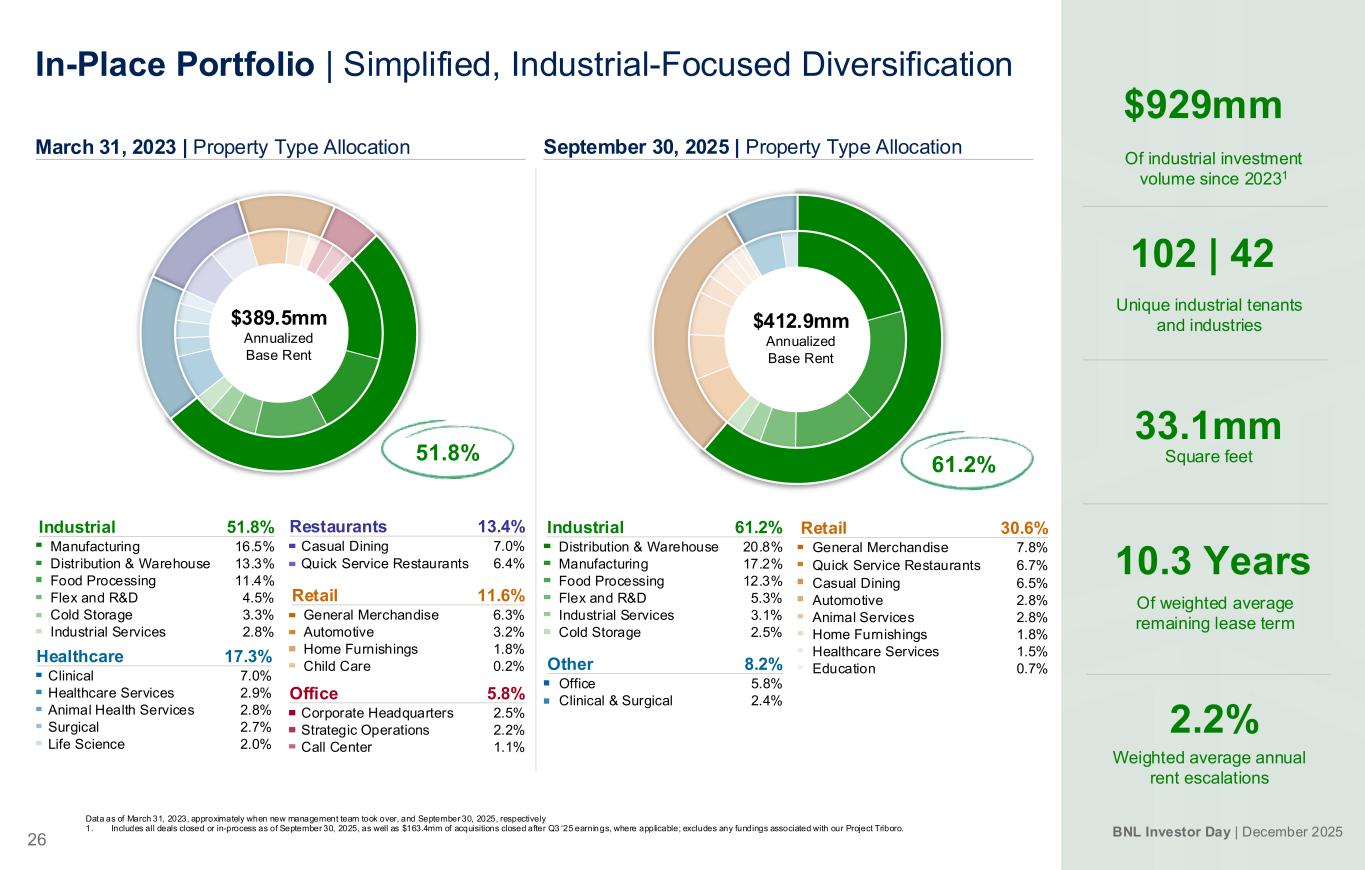

BNL Investor Day | December 2025 26 Data as of March 31, 2023, approximately when new management team took over, and September 30, 2025, respectively 1. Includes all deals closed or in-process as of September 30, 2025, as well as $163.4mm of acquisitions closed after Q3 ‘25 earnings, where applicable; excludes any fundings associated with our Project Triboro. In-Place Portfolio | Simplified, Industrial-Focused Diversification Industrial 61.2% Distribution & Warehouse 20.8% Manufacturing 17.2% Food Processing 12.3% Flex and R&D 5.3% Industrial Services 3.1% Cold Storage 2.5% Other 8.2% Office 5.8% Clinical & Surgical 2.4% Retail 30.6% General Merchandise 7.8% Quick Service Restaurants 6.7% Casual Dining 6.5% Automotive 2.8% Animal Services 2.8% Home Furnishings 1.8% Healthcare Services 1.5% Education 0.7% $412.9mm Annualized Base Rent Industrial 51.8% Manufacturing 16.5% Distribution & Warehouse 13.3% Food Processing 11.4% Flex and R&D 4.5% Cold Storage 3.3% Industrial Services 2.8% Healthcare 17.3% Clinical 7.0% Healthcare Services 2.9% Animal Health Services 2.8% Surgical 2.7% Life Science 2.0% Office 5.8% Corporate Headquarters 2.5% Strategic Operations 2.2% Call Center 1.1% Restaurants 13.4% Casual Dining 7.0% Quick Service Restaurants 6.4% Retail 11.6% General Merchandise 6.3% Automotive 3.2% Home Furnishings 1.8% Child Care 0.2% $389.5mm Annualized Base Rent March 31, 2023 | Property Type Allocation 51.8% 61.2% September 30, 2025 | Property Type Allocation 102 | 42 Unique industrial tenants and industries 33.1mm Square feet 10.3 Years Of weighted average remaining lease term 2.2% Weighted average annual rent escalations $929mm Of industrial investment volume since 20231

27 BNL Investor Day | December 2025 Core Asset Class Outlook | Industrial E-commerce demand remains a tailwind, creating a steady and growing need for more distribution and logistics space Nearshoring and reshoring continue to gain momentum, resulting in increased manufacturing space demand and needs for conveniently located logistics spaces Build-to-suit projects are often located in attractive markets with solid growth prospects, resulting in higher annual rental escalations relative to the in-place portfolio average and potential mark-to-market opportunities at lease rollover Users continue optimizing supply chain footprints into newer, higher-quality assets, providing a tailwind for our larger industrial build-to-suit pipeline

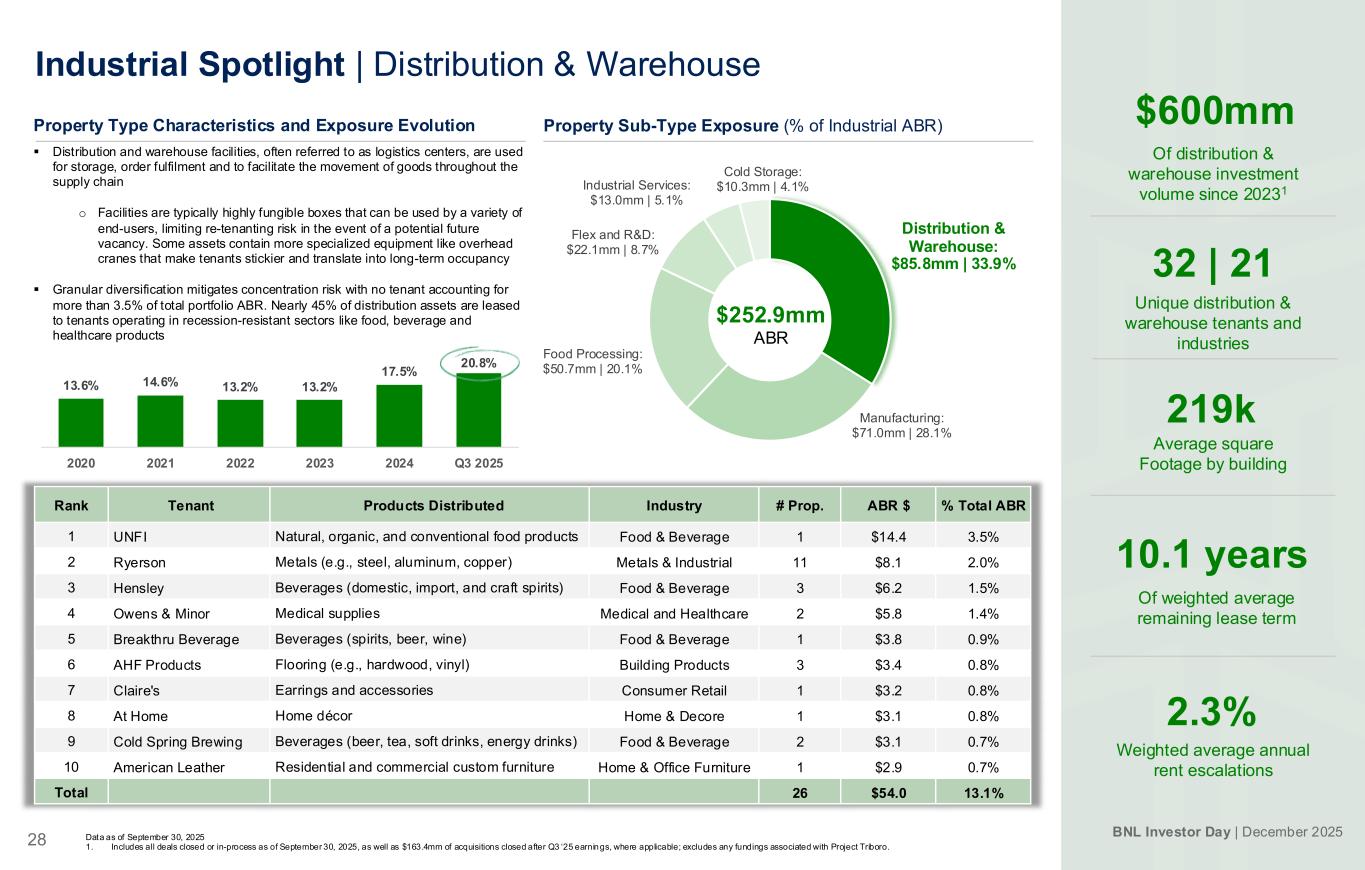

BNL Investor Day | December 2025 28 Data as of September 30, 2025 1. Includes all deals closed or in-process as of September 30, 2025, as well as $163.4mm of acquisitions closed after Q3 ‘25 earnings, where applicable; excludes any fundings associated with Project Triboro. Industrial Spotlight | Distribution & Warehouse Rank Tenant Products Distributed Industry # Prop. ABR $ % Total ABR 1 UNFI Natural, organic, and conventional food products Food & Beverage 1 $14.4 3.5% 2 Ryerson Metals (e.g., steel, aluminum, copper) Metals & Industrial 11 $8.1 2.0% 3 Hensley Beverages (domestic, import, and craft spirits) Food & Beverage 3 $6.2 1.5% 4 Owens & Minor Medical supplies Medical and Healthcare 2 $5.8 1.4% 5 Breakthru Beverage Beverages (spirits, beer, wine) Food & Beverage 1 $3.8 0.9% 6 AHF Products Flooring (e.g., hardwood, vinyl) Building Products 3 $3.4 0.8% 7 Claire's Earrings and accessories Consumer Retail 1 $3.2 0.8% 8 At Home Home décor Home & Decore 1 $3.1 0.8% 9 Cold Spring Brewing Beverages (beer, tea, soft drinks, energy drinks) Food & Beverage 2 $3.1 0.7% 10 American Leather Residential and commercial custom furniture Home & Office Furniture 1 $2.9 0.7% Total 26 $54.0 13.1% 32 | 21 Unique distribution & warehouse tenants and industries 10.1 years Of weighted average remaining lease term 2.3% Weighted average annual rent escalations 219k Average square Footage by building ▪ Distribution and warehouse facilities, often referred to as logistics centers, are used for storage, order fulfilment and to facilitate the movement of goods throughout the supply chain o Facilities are typically highly fungible boxes that can be used by a variety of end-users, limiting re-tenanting risk in the event of a potential future vacancy. Some assets contain more specialized equipment like overhead cranes that make tenants stickier and translate into long-term occupancy ▪ Granular diversification mitigates concentration risk with no tenant accounting for more than 3.5% of total portfolio ABR. Nearly 45% of distribution assets are leased to tenants operating in recession-resistant sectors like food, beverage and healthcare products Property Type Characteristics and Exposure Evolution Distribution & Warehouse: $85.8mm | 33.9% Manufacturing: $71.0mm | 28.1% Food Processing: $50.7mm | 20.1% Flex and R&D: $22.1mm | 8.7% Industrial Services: $13.0mm | 5.1% Cold Storage: $10.3mm | 4.1% $252.9mm ABR Property Sub-Type Exposure (% of Industrial ABR) $600mm Of distribution & warehouse investment volume since 20231 13.6% 14.6% 13.2% 13.2% 17.5% 20.8% 2020 2021 2022 2023 2024 Q3 2025

29 BNL Investor Day | December 2025 Source: Internal Filings Data as of September 30, 2025 1. Source: CoStar Case Study | Strong Real Estate Fundamentals Mitigate Downside Risk A thesis centered around strong real estate fundamentals provides confidence in our investment positioning in the event of bankruptcy. Mission-critical real estate located in attractive markets with below-market rents and basis translates into significant leverage during negotiations. Low basis and strong fundamentals provide optionality amid bankruptcy Mission critical real estate in desirable market provide leverage amid bankruptcy Headquarters & Sole North American DC (528K SF) Lease assumed by Claire’s Essentials, LLC. Structured amendment to provide optionality and additional time to find a resolution. Currently listed for sale or lease. A low basis, below market rent, and strong market provide downside protection. #40 Tenant 0.8% ABR #30 Tenant 0.9% ABR Headquarters and Primary DC (592K SF) & Retail Site (116K SF) Both leases assumed without change. Retail location is one of the top performing sites systemwide. Mission-critical DC centrally located and serving most retail locations coupled with a below market rent and strong Dallas market provided significant leverage that wasn’t ultimately used. #11 in Industrial TTM Sales Volume $2.1bn #2 in Industrial Inventory 1.2bn SF #1 in Industrial TTM Net Absorption +22.3mm SF #1 in Industrial Inventory 1.4bn SF #4 in Industrial TTM Sales Volume $4.4bn #21 in Industrial TTM Net Absorption +2.7mm SF Market Strengths1 Market Strengths1Investment Strengths Investment Strengths Location Strengths Proximity to I-90 and O’Hare Airport. Located at a 4-way interchange in a business-friendly county. Below Market Basis1 Acquisition price estimated 20% below market providing optionality to pursue several different paths forward. Below Market Rents1 Rent estimated 15% - 25% below estimated market, representing potential for ABR upside if backfilled. Location Strength Plano site located in dense industrial infill. Raleigh site located in a retail corridor with high foot traffic metrics. Below Market Basis1 Acquisition prices both screen below market, translating to value creation in a potential future stabilized disposition Below Market Rents1 At Home’s rents estimated well below market, translating to significant ABR upside in a re-tenanting scenario. Hoffman Estates, IL Plano, TX Raleigh, NC

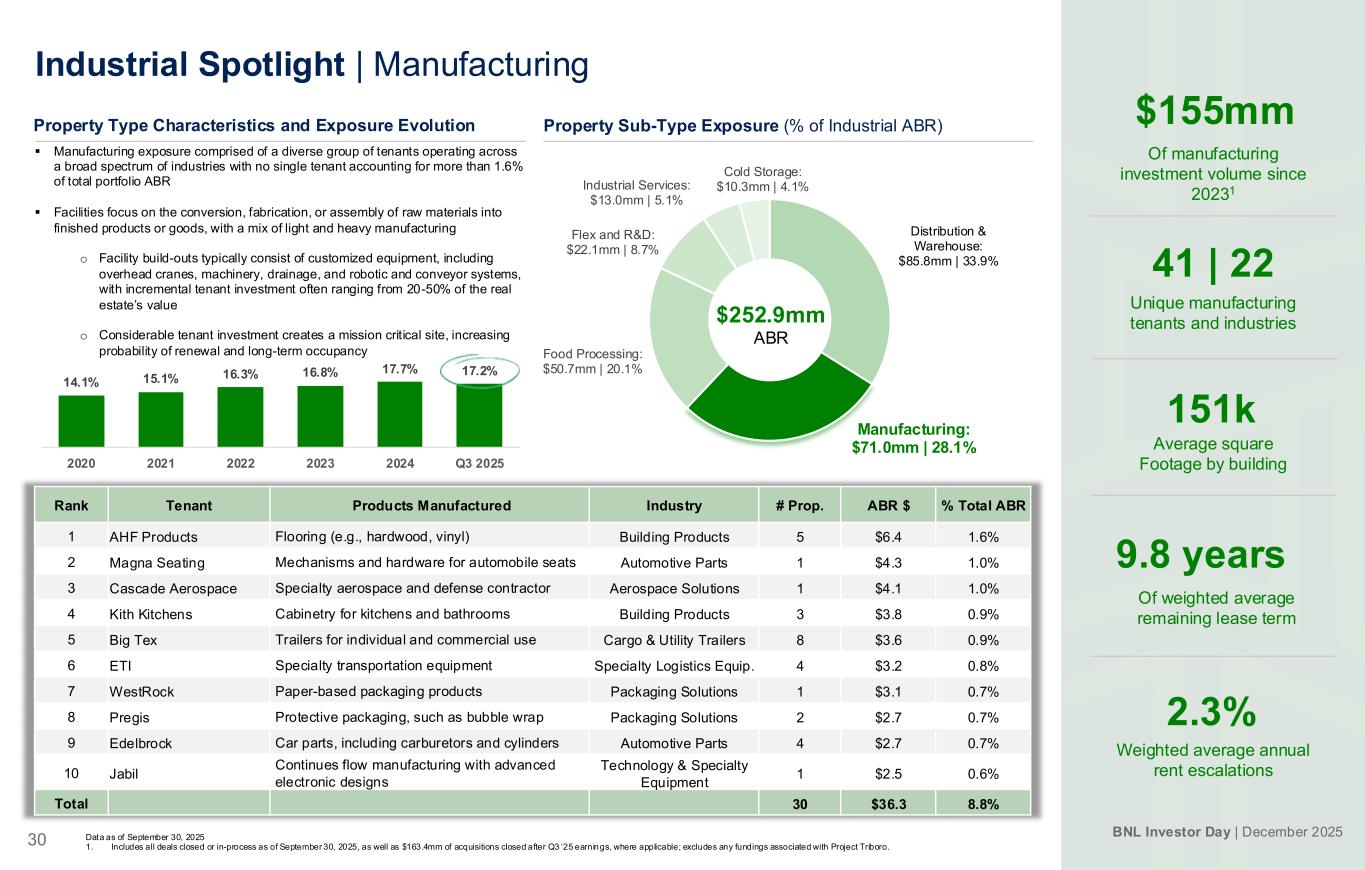

BNL Investor Day | December 2025 30 Data as of September 30, 2025 1. Includes all deals closed or in-process as of September 30, 2025, as well as $163.4mm of acquisitions closed after Q3 ‘25 earnings, where applicable; excludes any fundings associated with Project Triboro. Industrial Spotlight | Manufacturing Rank Tenant Products Manufactured Industry # Prop. ABR $ % Total ABR 1 AHF Products Flooring (e.g., hardwood, vinyl) Building Products 5 $6.4 1.6% 2 Magna Seating Mechanisms and hardware for automobile seats Automotive Parts 1 $4.3 1.0% 3 Cascade Aerospace Specialty aerospace and defense contractor Aerospace Solutions 1 $4.1 1.0% 4 Kith Kitchens Cabinetry for kitchens and bathrooms Building Products 3 $3.8 0.9% 5 Big Tex Trailers for individual and commercial use Cargo & Utility Trailers 8 $3.6 0.9% 6 ETI Specialty transportation equipment Specialty Logistics Equip. 4 $3.2 0.8% 7 WestRock Paper-based packaging products Packaging Solutions 1 $3.1 0.7% 8 Pregis Protective packaging, such as bubble wrap Packaging Solutions 2 $2.7 0.7% 9 Edelbrock Car parts, including carburetors and cylinders Automotive Parts 4 $2.7 0.7% 10 Jabil Continues flow manufacturing with advanced electronic designs Technology & Specialty Equipment 1 $2.5 0.6% Total 30 $36.3 8.8% 41 | 22 Unique manufacturing tenants and industries 9.8 years Of weighted average remaining lease term 2.3% Weighted average annual rent escalations 151k Average square Footage by building ▪ Manufacturing exposure comprised of a diverse group of tenants operating across a broad spectrum of industries with no single tenant accounting for more than 1.6% of total portfolio ABR ▪ Facilities focus on the conversion, fabrication, or assembly of raw materials into finished products or goods, with a mix of light and heavy manufacturing o Facility build-outs typically consist of customized equipment, including overhead cranes, machinery, drainage, and robotic and conveyor systems, with incremental tenant investment often ranging from 20-50% of the real estate’s value o Considerable tenant investment creates a mission critical site, increasing probability of renewal and long-term occupancy Property Type Characteristics and Exposure Evolution Distribution & Warehouse: $85.8mm | 33.9% Manufacturing: $71.0mm | 28.1% Food Processing: $50.7mm | 20.1% Flex and R&D: $22.1mm | 8.7% Industrial Services: $13.0mm | 5.1% Cold Storage: $10.3mm | 4.1% $252.9mm ABR Property Sub-Type Exposure (% of Industrial ABR) $155mm Of manufacturing investment volume since 20231 14.1% 15.1% 16.3% 16.8% 17.7% 17.2% 2020 2021 2022 2023 2024 Q3 2025

31 BNL Investor Day | December 2025 Source: Internal Filings Data as of September 30, 2025 Sources: CoStar, WestRock Case Study | Specialization & Tenant Investment Incentivize Long-Term Occupancy Mission-critical manufacturing facility with significant tenant investment provides confidence in underlying long-term occupancy thesis. Renewal negotiations underway and expected to substantiate the original investment thesis centered around tenant “stickiness”. Specialized facility with significant tenant investment translates to occupancy Manufacturing & Production Facility (351K SF) Corrugated cardboard manufacturing facility with a specialized build-out that includes heavy equipment throughout. Tenant has been in the site for 20+ years and has invested significant amounts of capital into the facility. Operational longevity expected to be confirmed with renewal. #45 Tenant 0.7% ABR Low basis provides opportunity for additional investment alongside tenant Investment thesis expected to be confirmed with a high probability of renewal Continued Tenant Investment Recent tenant investment of $17mm+ on new line machinery and HVAC upgrades provides further confidence in long-term occupancy Below-Market Basis Basis estimated to be 10% below market - provides flexibility to make further investment alongside tenant in exchange for additional term Below-Market Rents Rent calibrated to market at acquisition, providing room to for revenue generating capex at renewal to push rents higher and remain in-line with market Long-Term Occupancy Expected to Continue Tenant has operated for over two decades at this facility and is expected to continue to well into the future, proving out the original long-term occupancy investment thesis Offering Revenue Generating CapEx Offering capital to address tenant desired building improvements that are amortized at an attractive yield over the course of the renewal term Renewal Discussions Underway Currently in active discussions with tenant regarding a long-term renewal and feel confident in our ability to reach a mutually beneficial outcome Investment Strengths ▪ Significant power & rail access ▪ Ample outdoor storage ▪ Mission critical nature of site and proximity to end users of product mix ▪ Longevity of operations at the facility (20+ years) ▪ Significant investment in equipment ($100mm+) ▪ Below-market rent and basis ▪ Investment grade parent guaranty Fresno, CA

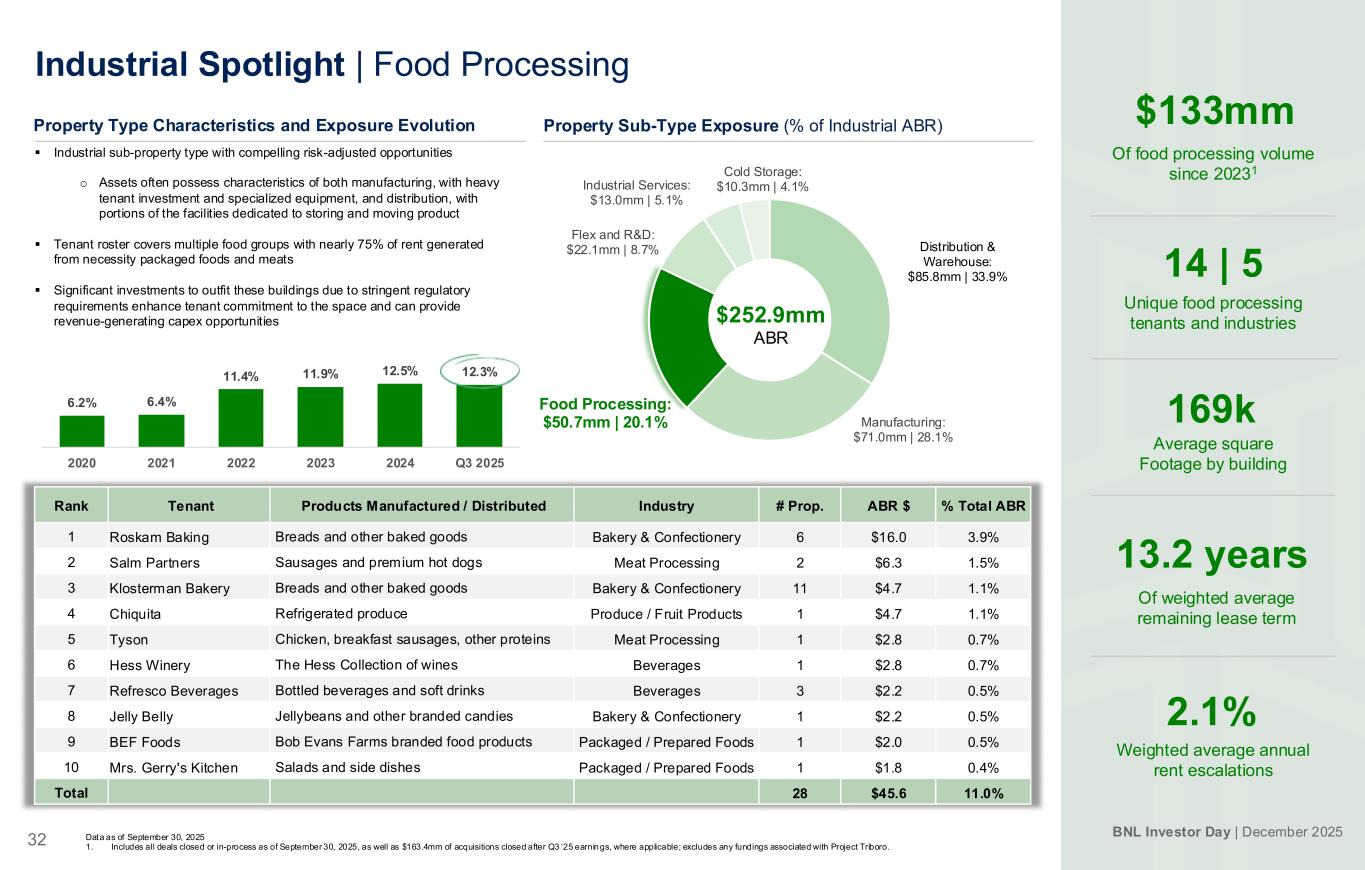

BNL Investor Day | December 2025 32 6.2% 6.4% 11.4% 11.9% 12.5% 12.3% 2020 2021 2022 2023 2024 Q3 2025 Data as of September 30, 2025 1. Includes all deals closed or in-process as of September 30, 2025, as well as $163.4mm of acquisitions closed after Q3 ‘25 earnings, where applicable; excludes any fundings associated with Project Triboro. Industrial Spotlight | Food Processing Rank Tenant Products Manufactured / Distributed Industry # Prop. ABR $ % Total ABR 1 Roskam Baking Breads and other baked goods Bakery & Confectionery 6 $16.0 3.9% 2 Salm Partners Sausages and premium hot dogs Meat Processing 2 $6.3 1.5% 3 Klosterman Bakery Breads and other baked goods Bakery & Confectionery 11 $4.7 1.1% 4 Chiquita Refrigerated produce Produce / Fruit Products 1 $4.7 1.1% 5 Tyson Chicken, breakfast sausages, other proteins Meat Processing 1 $2.8 0.7% 6 Hess Winery The Hess Collection of wines Beverages 1 $2.8 0.7% 7 Refresco Beverages Bottled beverages and soft drinks Beverages 3 $2.2 0.5% 8 Jelly Belly Jellybeans and other branded candies Bakery & Confectionery 1 $2.2 0.5% 9 BEF Foods Bob Evans Farms branded food products Packaged / Prepared Foods 1 $2.0 0.5% 10 Mrs. Gerry's Kitchen Salads and side dishes Packaged / Prepared Foods 1 $1.8 0.4% Total 28 $45.6 11.0% 14 | 5 Unique food processing tenants and industries 13.2 years Of weighted average remaining lease term 2.1% Weighted average annual rent escalations 169k Average square Footage by building ▪ Industrial sub-property type with compelling risk-adjusted opportunities o Assets often possess characteristics of both manufacturing, with heavy tenant investment and specialized equipment, and distribution, with portions of the facilities dedicated to storing and moving product ▪ Tenant roster covers multiple food groups with nearly 75% of rent generated from necessity packaged foods and meats ▪ Significant investments to outfit these buildings due to stringent regulatory requirements enhance tenant commitment to the space and can provide revenue-generating capex opportunities Property Type Characteristics and Exposure Evolution Distribution & Warehouse: $85.8mm | 33.9% Manufacturing: $71.0mm | 28.1% Food Processing: $50.7mm | 20.1% Flex and R&D: $22.1mm | 8.7% Industrial Services: $13.0mm | 5.1% Cold Storage: $10.3mm | 4.1% $252.9mm ABR Property Sub-Type Exposure (% of Industrial ABR) $133mm Of food processing volume since 20231

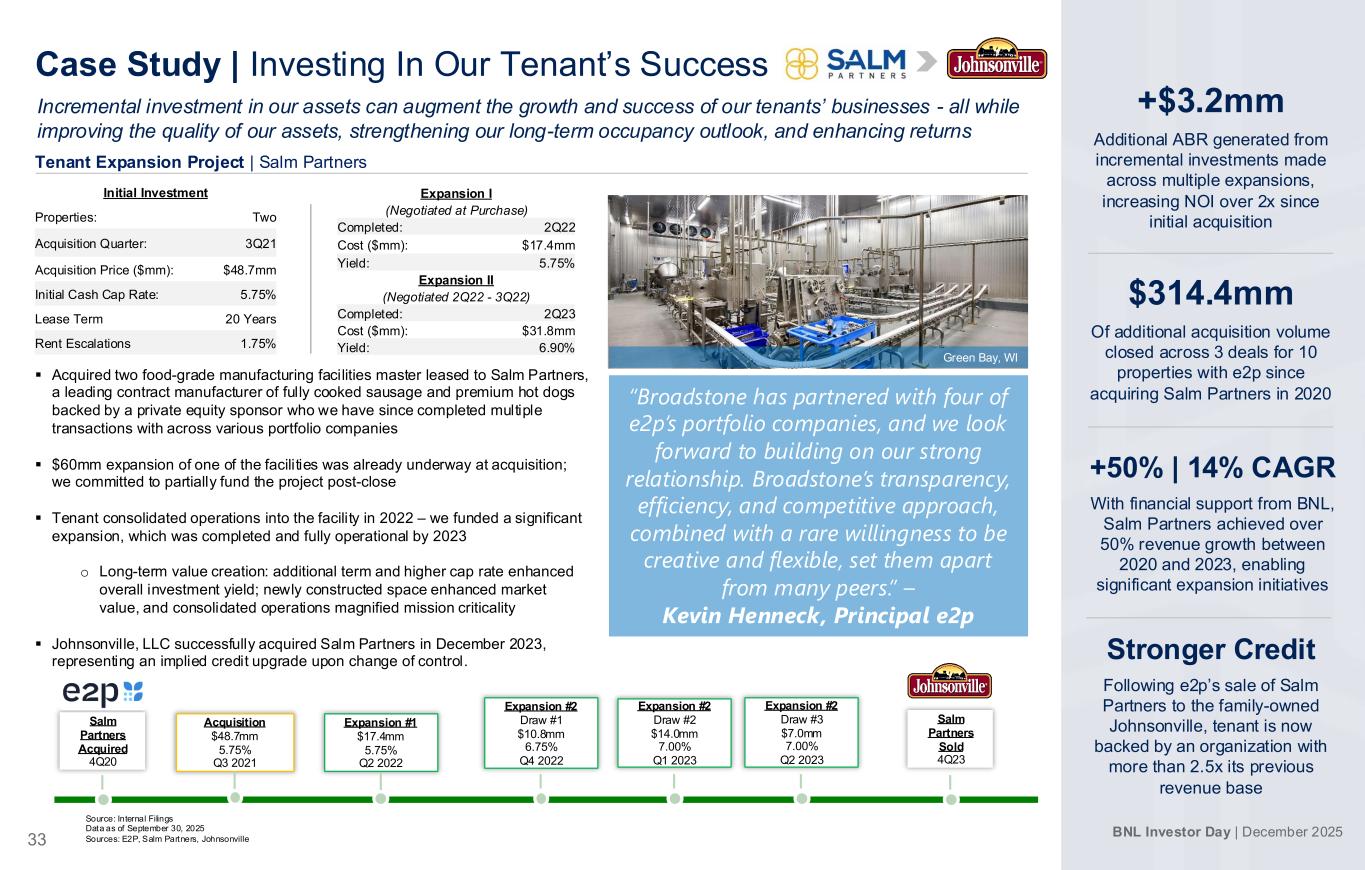

BNL Investor Day | December 2025 33 “Broadstone has partnered with four of e2p’s portfolio companies, and we look forward to building on our strong relationship. Broadstone’s transparency, efficiency, and competitive approach, combined with a rare willingness to be creative and flexible, set them apart from many peers.” – Kevin Henneck, Principal e2p Source: Internal Filings Data as of September 30, 2025 Sources: E2P, Salm Partners, Johnsonville Case Study | Investing In Our Tenant’s Success Incremental investment in our assets can augment the growth and success of our tenants’ businesses - all while improving the quality of our assets, strengthening our long-term occupancy outlook, and enhancing returns Tenant Expansion Project | Salm Partners Initial Investment Properties: Two Acquisition Quarter: 3Q21 Acquisition Price ($mm): $48.7mm Initial Cash Cap Rate: 5.75% Lease Term 20 Years Rent Escalations 1.75% Expansion I (Negotiated at Purchase) Completed: 2Q22 Cost ($mm): $17.4mm Yield: 5.75% Expansion II (Negotiated 2Q22 - 3Q22) Completed: 2Q23 Cost ($mm): $31.8mm Yield: 6.90% ▪ Acquired two food-grade manufacturing facilities master leased to Salm Partners, a leading contract manufacturer of fully cooked sausage and premium hot dogs backed by a private equity sponsor who we have since completed multiple transactions with across various portfolio companies ▪ $60mm expansion of one of the facilities was already underway at acquisition; we committed to partially fund the project post-close ▪ Tenant consolidated operations into the facility in 2022 – we funded a significant expansion, which was completed and fully operational by 2023 o Long-term value creation: additional term and higher cap rate enhanced overall investment yield; newly constructed space enhanced market value, and consolidated operations magnified mission criticality ▪ Johnsonville, LLC successfully acquired Salm Partners in December 2023, representing an implied credit upgrade upon change of control. Acquisition $48.7mm 5.75% Q3 2021 Expansion #1 $17.4mm 5.75% Q2 2022 Expansion #2 Draw #1 $10.8mm 6.75% Q4 2022 Expansion #2 Draw #2 $14.0mm 7.00% Q1 2023 Expansion #2 Draw #3 $7.0mm 7.00% Q2 2023 +$3.2mm Additional ABR generated from incremental investments made across multiple expansions, increasing NOI over 2x since initial acquisition $314.4mm Of additional acquisition volume closed across 3 deals for 10 properties with e2p since acquiring Salm Partners in 2020 Salm Partners Sold 4Q23 Salm Partners Acquired 4Q20 +50% | 14% CAGR With financial support from BNL, Salm Partners achieved over 50% revenue growth between 2020 and 2023, enabling significant expansion initiatives Stronger Credit Following e2p’s sale of Salm Partners to the family-owned Johnsonville, tenant is now backed by an organization with more than 2.5x its previous revenue base Green Bay, WI

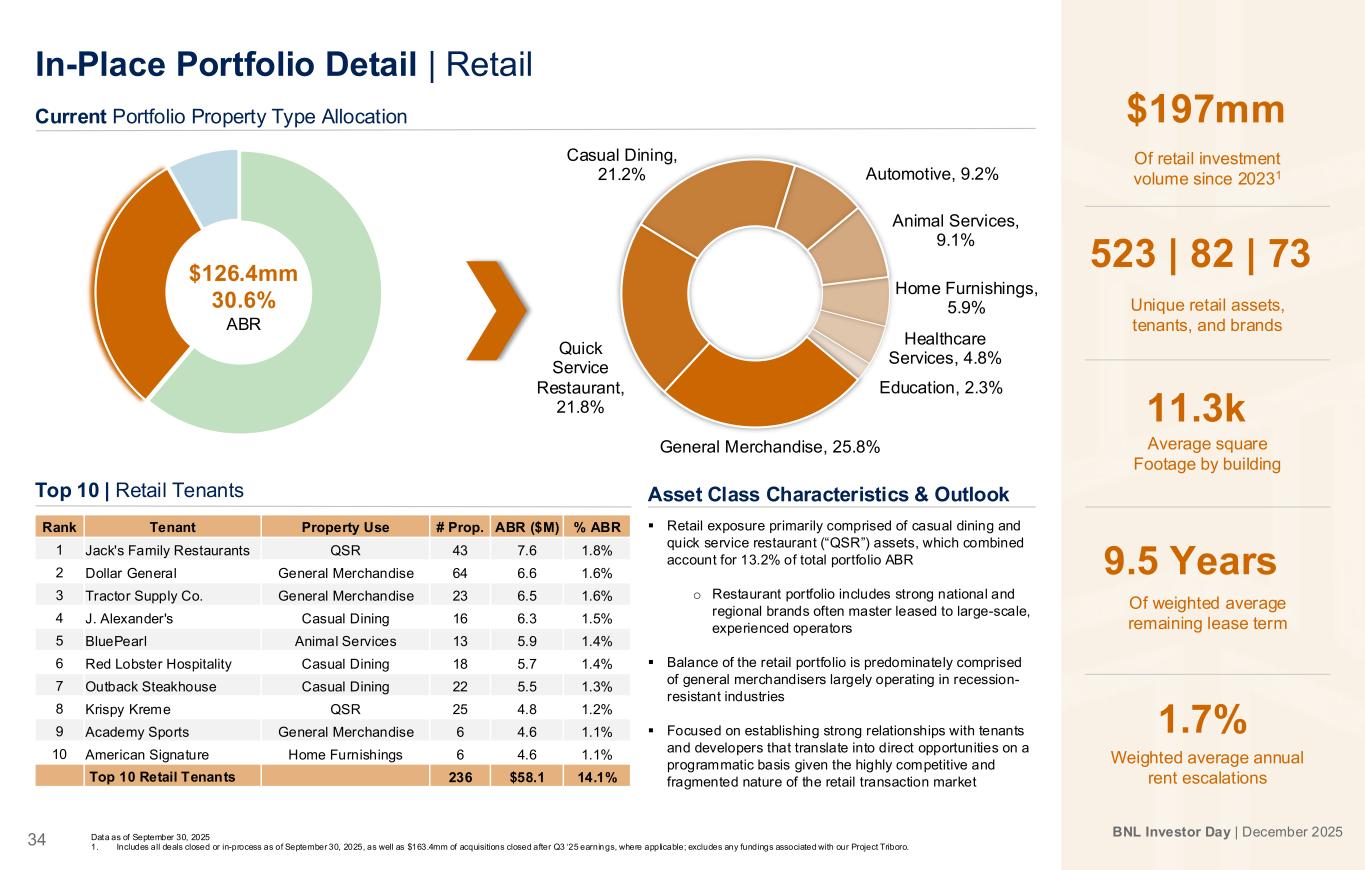

BNL Investor Day | December 2025 34 Data as of September 30, 2025 1. Includes all deals closed or in-process as of September 30, 2025, as well as $163.4mm of acquisitions closed after Q3 ‘25 earnings, where applicable; excludes any fundings associated with our Project Triboro. $126.4mm 30.6% ABR General Merchandise, 25.8% Quick Service Restaurant, 21.8% Casual Dining, 21.2% Automotive, 9.2% Animal Services, 9.1% Home Furnishings, 5.9% Healthcare Services, 4.8% Education, 2.3% Rank Tenant Property Use # Prop. ABR ($M) % ABR 1 Jack's Family Restaurants QSR 43 7.6 1.8% 2 Dollar General General Merchandise 64 6.6 1.6% 3 Tractor Supply Co. General Merchandise 23 6.5 1.6% 4 J. Alexander's Casual Dining 16 6.3 1.5% 5 BluePearl Animal Services 13 5.9 1.4% 6 Red Lobster Hospitality Casual Dining 18 5.7 1.4% 7 Outback Steakhouse Casual Dining 22 5.5 1.3% 8 Krispy Kreme QSR 25 4.8 1.2% 9 Academy Sports General Merchandise 6 4.6 1.1% 10 American Signature Home Furnishings 6 4.6 1.1% Top 10 Retail Tenants 236 $58.1 14.1% Current Portfolio Property Type Allocation In-Place Portfolio Detail | Retail 523 | 82 | 73 Unique retail assets, tenants, and brands 9.5 Years Of weighted average remaining lease term 1.7% Weighted average annual rent escalations $197mm Of retail investment volume since 20231 11.3k Average square Footage by building Top 10 | Retail Tenants Asset Class Characteristics & Outlook ▪ Retail exposure primarily comprised of casual dining and quick service restaurant (“QSR”) assets, which combined account for 13.2% of total portfolio ABR o Restaurant portfolio includes strong national and regional brands often master leased to large-scale, experienced operators ▪ Balance of the retail portfolio is predominately comprised of general merchandisers largely operating in recession- resistant industries ▪ Focused on establishing strong relationships with tenants and developers that translate into direct opportunities on a programmatic basis given the highly competitive and fragmented nature of the retail transaction market

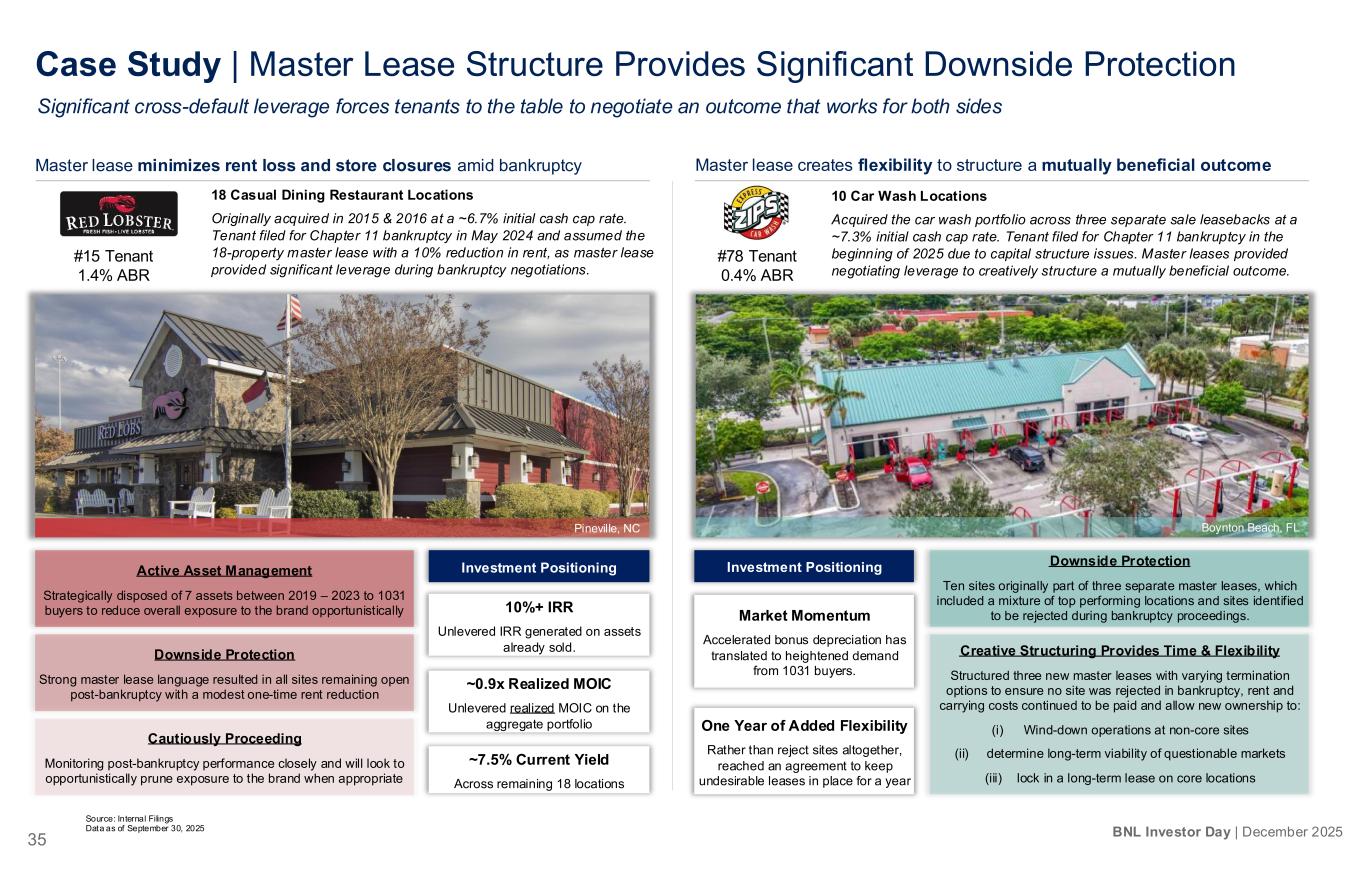

35 BNL Investor Day | December 2025 Case Study | Master Lease Structure Provides Significant Downside Protection Significant cross-default leverage forces tenants to the table to negotiate an outcome that works for both sides Master lease minimizes rent loss and store closures amid bankruptcy Master lease creates flexibility to structure a mutually beneficial outcome Source: Internal Filings Data as of September 30, 2025 Pineville, NC Boynton Beach, FL 18 Casual Dining Restaurant Locations Originally acquired in 2015 & 2016 at a ~6.7% initial cash cap rate. Tenant filed for Chapter 11 bankruptcy in May 2024 and assumed the 18-property master lease with a 10% reduction in rent, as master lease provided significant leverage during bankruptcy negotiations. #15 Tenant 1.4% ABR #78 Tenant 0.4% ABR 10 Car Wash Locations Acquired the car wash portfolio across three separate sale leasebacks at a ~7.3% initial cash cap rate. Tenant filed for Chapter 11 bankruptcy in the beginning of 2025 due to capital structure issues. Master leases provided negotiating leverage to creatively structure a mutually beneficial outcome. Active Asset Management Strategically disposed of 7 assets between 2019 – 2023 to 1031 buyers to reduce overall exposure to the brand opportunistically Downside Protection Strong master lease language resulted in all sites remaining open post-bankruptcy with a modest one-time rent reduction Cautiously Proceeding Monitoring post-bankruptcy performance closely and will look to opportunistically prune exposure to the brand when appropriate Downside Protection Ten sites originally part of three separate master leases, which included a mixture of top performing locations and sites identified to be rejected during bankruptcy proceedings. Creative Structuring Provides Time & Flexibility Structured three new master leases with varying termination options to ensure no site was rejected in bankruptcy, rent and carrying costs continued to be paid and allow new ownership to: (i) Wind-down operations at non-core sites (ii) determine long-term viability of questionable markets (iii) lock in a long-term lease on core locations Investment Positioning 10%+ IRR Unlevered IRR generated on assets already sold. ~0.9x Realized MOIC Unlevered realized MOIC on the aggregate portfolio ~7.5% Current Yield Across remaining 18 locations Investment Positioning One Year of Added Flexibility Rather than reject sites altogether, reached an agreement to keep undesirable leases in place for a year Market Momentum Accelerated bonus depreciation has translated to heightened demand from 1031 buyers.

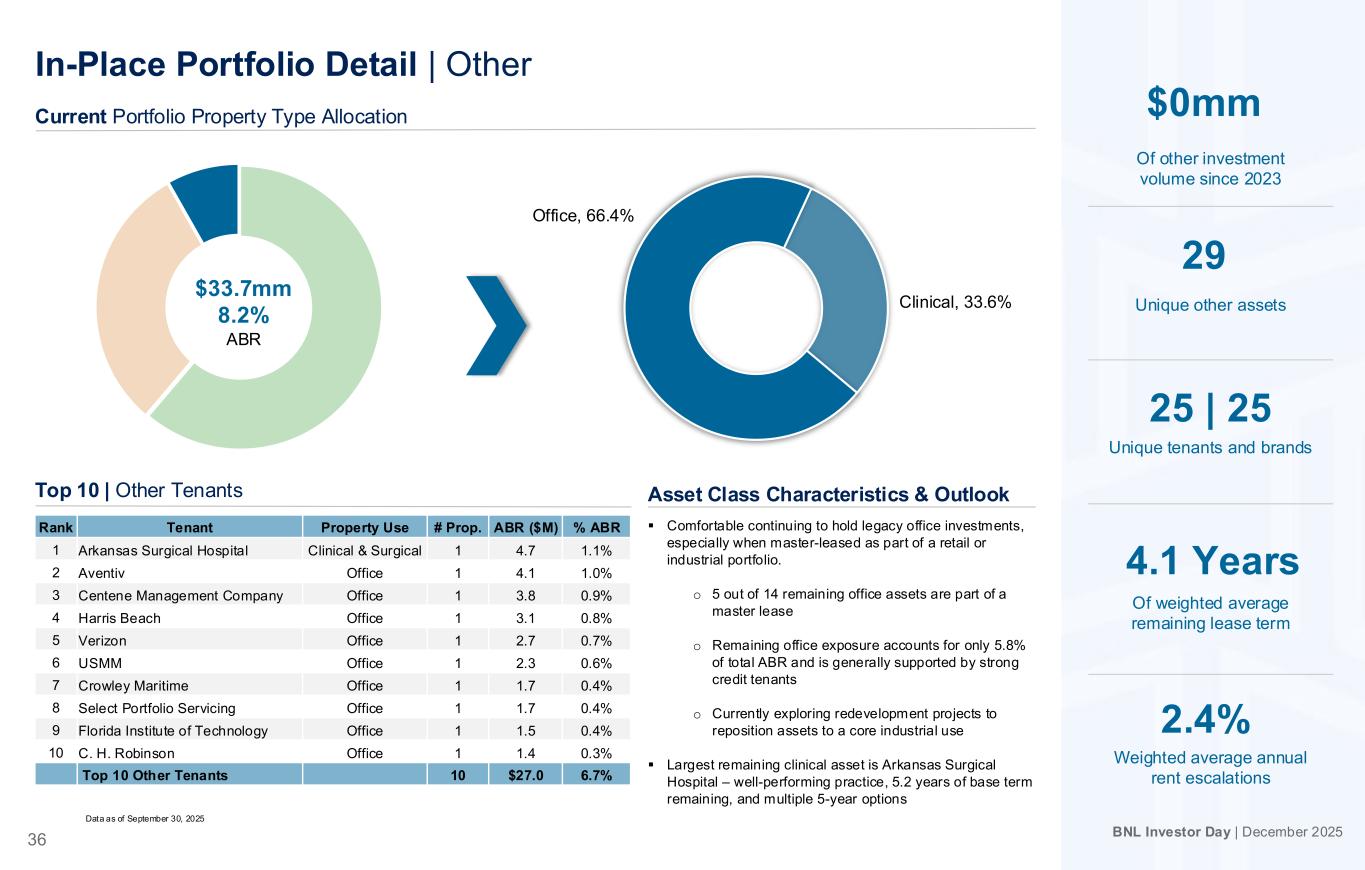

BNL Investor Day | December 2025 36 Rank Tenant Property Use # Prop. ABR ($M) % ABR 1 Arkansas Surgical Hospital Clinical & Surgical 1 4.7 1.1% 2 Aventiv Office 1 4.1 1.0% 3 Centene Management Company Office 1 3.8 0.9% 4 Harris Beach Office 1 3.1 0.8% 5 Verizon Office 1 2.7 0.7% 6 USMM Office 1 2.3 0.6% 7 Crowley Maritime Office 1 1.7 0.4% 8 Select Portfolio Servicing Office 1 1.7 0.4% 9 Florida Institute of Technology Office 1 1.5 0.4% 10 C. H. Robinson Office 1 1.4 0.3% Top 10 Other Tenants 10 $27.0 6.7% Data as of September 30, 2025 $33.7mm 8.2% ABR Office, 66.4% Clinical, 33.6% In-Place Portfolio Detail | Other 29 Unique other assets 4.1 Years Of weighted average remaining lease term 2.4% Weighted average annual rent escalations $0mm Of other investment volume since 2023 25 | 25 Unique tenants and brands Top 10 | Other Tenants Asset Class Characteristics & Outlook ▪ Comfortable continuing to hold legacy office investments, especially when master-leased as part of a retail or industrial portfolio. o 5 out of 14 remaining office assets are part of a master lease o Remaining office exposure accounts for only 5.8% of total ABR and is generally supported by strong credit tenants o Currently exploring redevelopment projects to reposition assets to a core industrial use ▪ Largest remaining clinical asset is Arkansas Surgical Hospital – well-performing practice, 5.2 years of base term remaining, and multiple 5-year options Current Portfolio Property Type Allocation

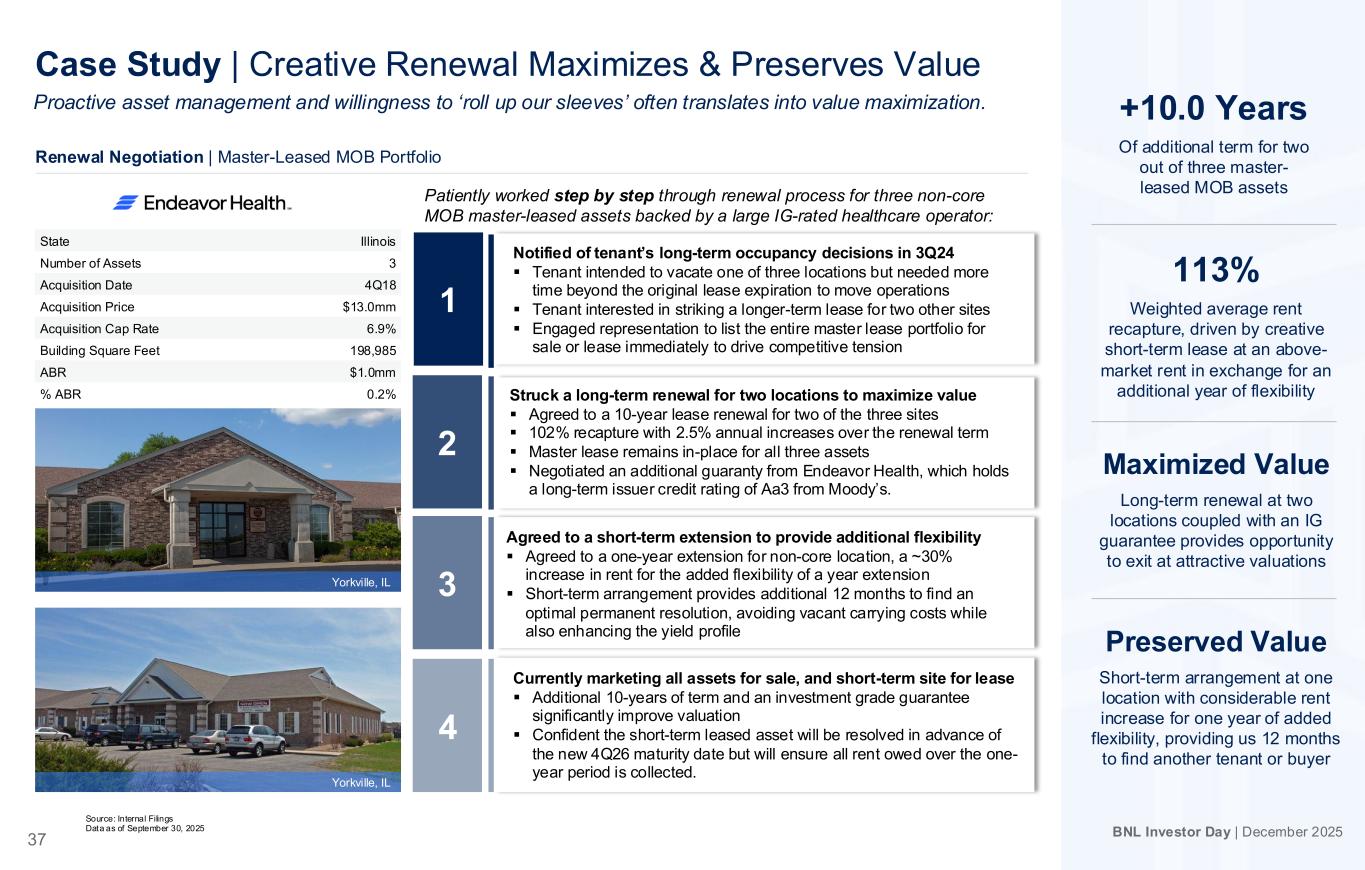

BNL Investor Day | December 2025 37 Source: Internal Filings Data as of September 30, 2025 Case Study | Creative Renewal Maximizes & Preserves Value Proactive asset management and willingness to ‘roll up our sleeves’ often translates into value maximization. +10.0 Years Of additional term for two out of three master- leased MOB assets 113% Weighted average rent recapture, driven by creative short-term lease at an above- market rent in exchange for an additional year of flexibility Maximized Value Long-term renewal at two locations coupled with an IG guarantee provides opportunity to exit at attractive valuations Preserved Value Short-term arrangement at one location with considerable rent increase for one year of added flexibility, providing us 12 months to find another tenant or buyer Renewal Negotiation | Master-Leased MOB Portfolio 1 2 3 4 Patiently worked step by step through renewal process for three non-core MOB master-leased assets backed by a large IG-rated healthcare operator: Notified of tenant’s long-term occupancy decisions in 3Q24 ▪ Tenant intended to vacate one of three locations but needed more time beyond the original lease expiration to move operations ▪ Tenant interested in striking a longer-term lease for two other sites ▪ Engaged representation to list the entire master lease portfolio for sale or lease immediately to drive competitive tension Struck a long-term renewal for two locations to maximize value ▪ Agreed to a 10-year lease renewal for two of the three sites ▪ 102% recapture with 2.5% annual increases over the renewal term ▪ Master lease remains in-place for all three assets ▪ Negotiated an additional guaranty from Endeavor Health, which holds a long-term issuer credit rating of Aa3 from Moody’s. Currently marketing all assets for sale, and short-term site for lease ▪ Additional 10-years of term and an investment grade guarantee significantly improve valuation ▪ Confident the short-term leased asset will be resolved in advance of the new 4Q26 maturity date but will ensure all rent owed over the one- year period is collected. State Illinois Number of Assets 3 Acquisition Date 4Q18 Acquisition Price $13.0mm Acquisition Cap Rate 6.9% Building Square Feet 198,985 ABR $1.0mm % ABR 0.2% Agreed to a short-term extension to provide additional flexibility ▪ Agreed to a one-year extension for non-core location, a ~30% increase in rent for the added flexibility of a year extension ▪ Short-term arrangement provides additional 12 months to find an optimal permanent resolution, avoiding vacant carrying costs while also enhancing the yield profile Yorkville, IL Yorkville, IL

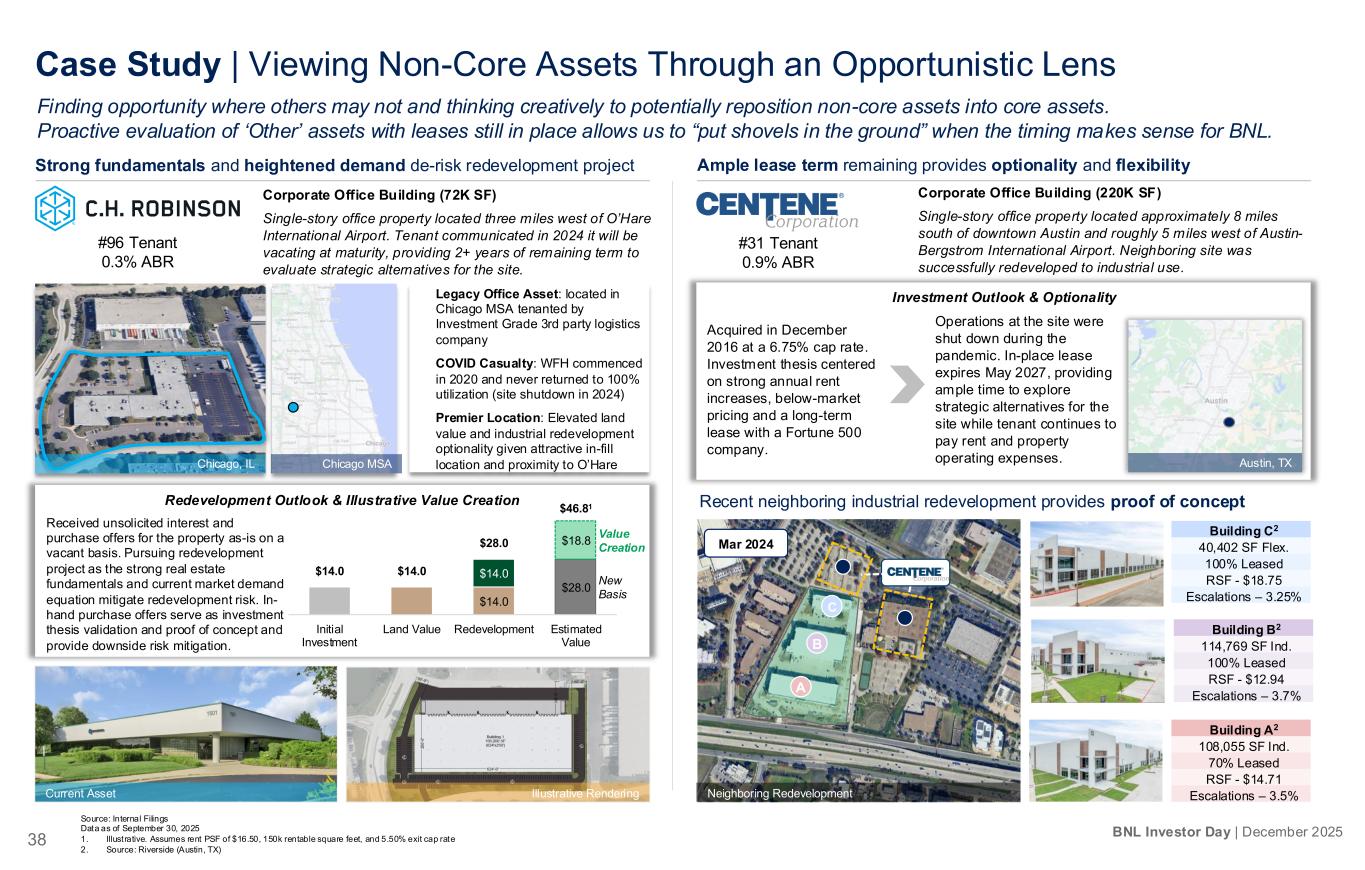

38 BNL Investor Day | December 2025 Legacy Office Asset: located in Chicago MSA tenanted by Investment Grade 3rd party logistics company COVID Casualty: WFH commenced in 2020 and never returned to 100% utilization (site shutdown in 2024) Premier Location: Elevated land value and industrial redevelopment optionality given attractive in-fill location and proximity to O’Hare Case Study | Viewing Non-Core Assets Through an Opportunistic Lens Finding opportunity where others may not and thinking creatively to potentially reposition non-core assets into core assets. Proactive evaluation of ‘Other’ assets with leases still in place allows us to “put shovels in the ground” when the timing makes sense for BNL. Strong fundamentals and heightened demand de-risk redevelopment project Ample lease term remaining provides optionality and flexibility Source: Internal Filings Data as of September 30, 2025 1. Illustrative. Assumes rent PSF of $16.50, 150k rentable square feet, and 5.50% exit cap rate 2. Source: Riverside (Austin, TX) Corporate Office Building (72K SF) Single-story office property located three miles west of O’Hare International Airport. Tenant communicated in 2024 it will be vacating at maturity, providing 2+ years of remaining term to evaluate strategic alternatives for the site. #96 Tenant 0.3% ABR Chicago, IL Current Asset Illustrative Rendering Redevelopment Outlook & Illustrative Value Creation $14.0 $28.0 $14.0 $18.8 $14.0 $14.0 $28.0 $46.81 Initial Investment Land Value Redevelopment Estimated Value New Basis Value Creation Received unsolicited interest and purchase offers for the property as-is on a vacant basis. Pursuing redevelopment project as the strong real estate fundamentals and current market demand equation mitigate redevelopment risk. In- hand purchase offers serve as investment thesis validation and proof of concept and provide downside risk mitigation. Corporate Office Building (220K SF) Single-story office property located approximately 8 miles south of downtown Austin and roughly 5 miles west of Austin- Bergstrom International Airport. Neighboring site was successfully redeveloped to industrial use. #31 Tenant 0.9% ABR Building C2 40,402 SF Flex. 100% Leased RSF - $18.75 Escalations – 3.25% Building B2 114,769 SF Ind. 100% Leased RSF - $12.94 Escalations – 3.7% Building A2 108,055 SF Ind. 70% Leased RSF - $14.71 Escalations – 3.5% Mar 2024 A B C Neighboring Redevelopment Investment Outlook & Optionality Acquired in December 2016 at a 6.75% cap rate. Investment thesis centered on strong annual rent increases, below-market pricing and a long-term lease with a Fortune 500 company. Austin, TX Operations at the site were shut down during the pandemic. In-place lease expires May 2027, providing ample time to explore strategic alternatives for the site while tenant continues to pay rent and property operating expenses. Recent neighboring industrial redevelopment provides proof of concept Chicago MSA

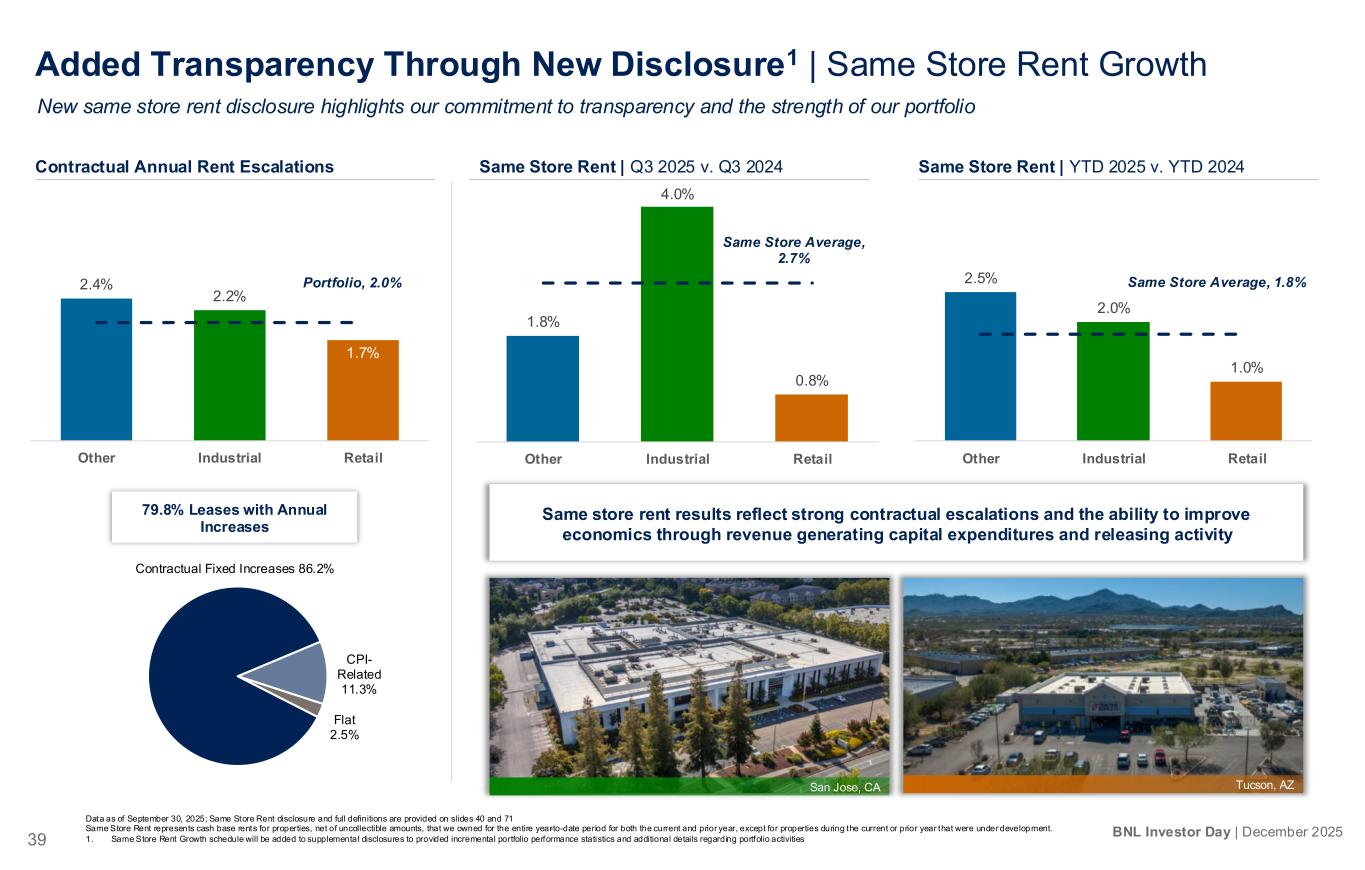

39 BNL Investor Day | December 2025 Added Transparency Through New Disclosure1 | Same Store Rent Growth Data as of September 30, 2025; Same Store Rent disclosure and full definitions are provided on slides 40 and 71 Same Store Rent represents cash base rents for properties, net of uncollectible amounts, that we owned for the entire year-to-date period for both the current and prior year, except for properties during the current or prior year that were under development. 1. Same Store Rent Growth schedule will be added to supplemental disclosures to provided incremental portfolio performance statistics and additional details regarding portfolio activities Contractual Annual Rent Escalations Same Store Rent | Q3 2025 v. Q3 2024 Same Store Rent | YTD 2025 v. YTD 2024 2.4% 2.2% 1.7% Portfolio, 2.0% Other Industrial Retail 2.5% 2.0% 1.0% Same Store Average, 1.8% Other Industrial Retail 1.8% 4.0% 0.8% Same Store Average, 2.7% Other Industrial Retail New same store rent disclosure highlights our commitment to transparency and the strength of our portfolio Contractual Fixed Increases 86.2% CPI- Related 11.3% Flat 2.5% 79.8% Leases with Annual Increases Picture Same store rent results reflect strong contractual escalations and the ability to improve economics through revenue generating capital expenditures and releasing activity San Jose, CA Tucson, AZ

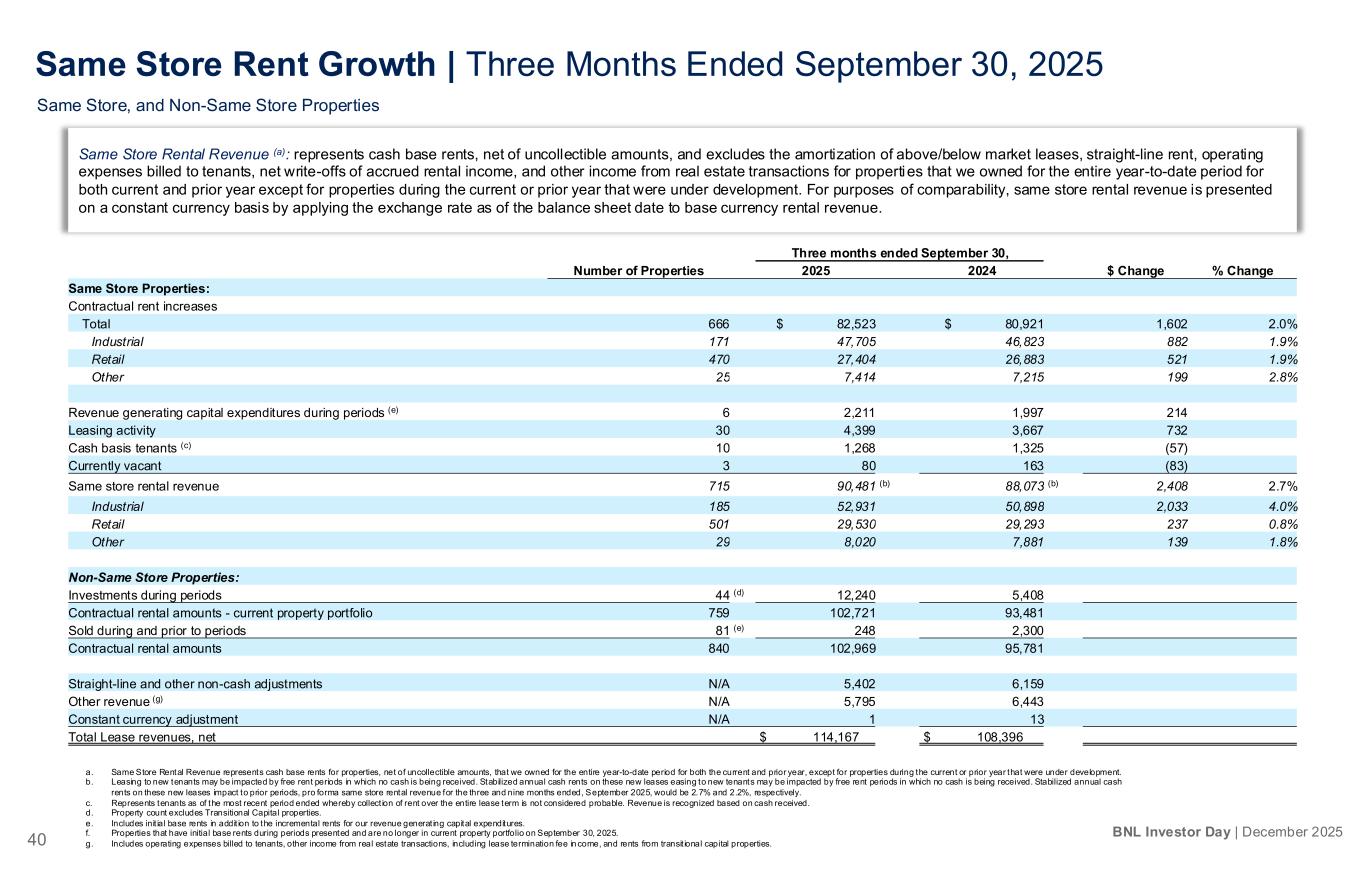

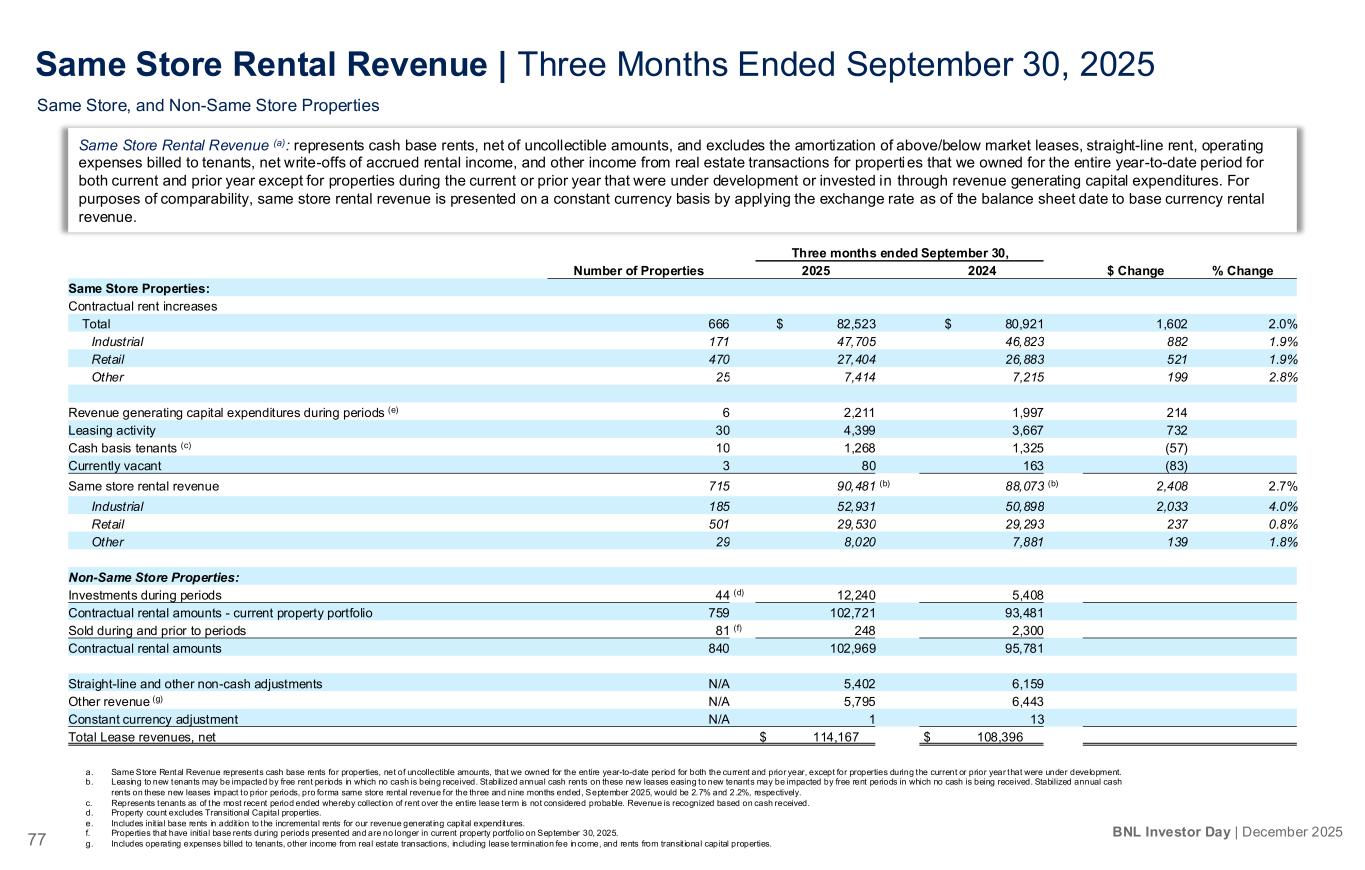

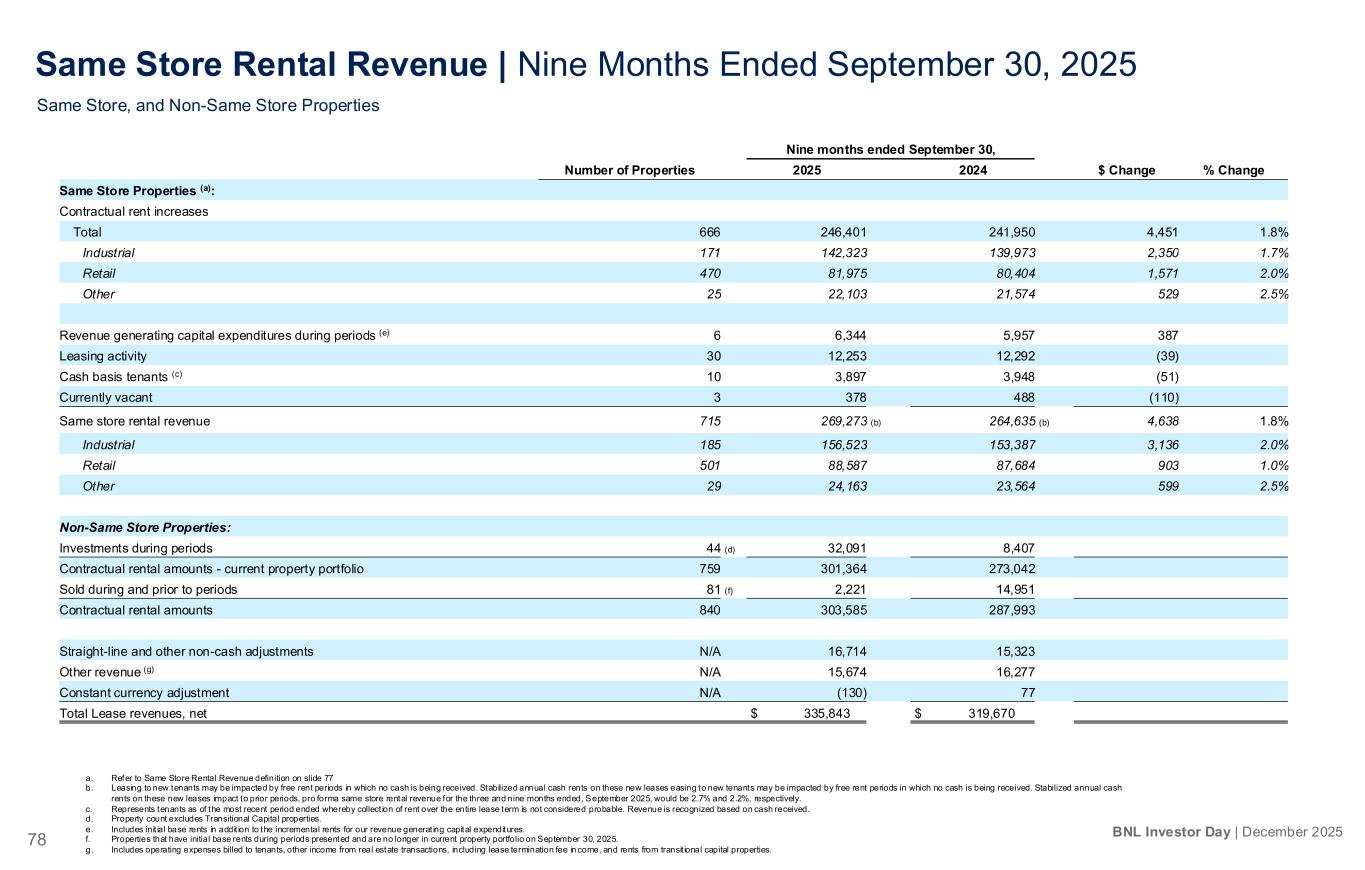

40 BNL Investor Day | December 2025 a. Same Store Rental Revenue represents cash base rents for properties, net of uncollectible amounts, that we owned for the entire year-to-date period for both the current and prior year, except for properties during the current or prior year that were under development. b. Leasing to new tenants may be impacted by free rent periods in which no cash is being received. Stabilized annual cash rents on these new leases easing to new tenants may be impacted by free rent periods in which no cash is being received. Stabilized annual cash rents on these new leases impact to prior periods, pro forma same store rental revenue for the three and nine months ended, September 2025, would be 2.7% and 2.2%, respectively. c. Represents tenants as of the most recent period ended whereby collect ion of rent over the entire lease term is not considered probable. Revenue is recognized based on cash received. d. Property count excludes Transitional Capital properties. e. Includes init ial base rents in addit ion to the incremental rents for our revenue generat ing capital expenditures. f. Properties that have initial base rents during periods presented and are no longer in current property portfolio on September 30, 2025. g. Includes operating expenses billed to tenants, other income from real estate transactions, including lease termination fee in come, and rents from transit ional capital properties. Three months ended September 30, Number of Properties 2025 2024 $ Change % Change Same Store Properties: Contractual rent increases Total 666 $ 82,523 $ 80,921 1,602 2.0% Industrial 171 47,705 46,823 882 1.9% Retail 470 27,404 26,883 521 1.9% Other 25 7,414 7,215 199 2.8% Revenue generating capital expenditures during periods (e) 6 2,211 1,997 214 Leasing activity 30 4,399 3,667 732 Cash basis tenants (c) 10 1,268 1,325 (57) Currently vacant 3 80 163 (83) Same store rental revenue 715 90,481 (b) 88,073 (b) 2,408 2.7% Industrial 185 52,931 50,898 2,033 4.0% Retail 501 29,530 29,293 237 0.8% Other 29 8,020 7,881 139 1.8% Non-Same Store Properties: Investments during periods 44 (d) 12,240 5,408 Contractual rental amounts - current property portfolio 759 102,721 93,481 Sold during and prior to periods 81 (e) 248 2,300 Contractual rental amounts 840 102,969 95,781 Straight-line and other non-cash adjustments N/A 5,402 6,159 Other revenue (g) N/A 5,795 6,443 Constant currency adjustment N/A 1 13 Total Lease revenues, net $ 114,167 $ 108,396 Same Store, and Non-Same Store Properties Same Store Rent Growth | Three Months Ended September 30, 2025 Same Store Rental Revenue (a): represents cash base rents, net of uncollectible amounts, and excludes the amortization of above/below market leases, straight-line rent, operating expenses billed to tenants, net write-offs of accrued rental income, and other income from real estate transactions for properties that we owned for the entire year-to-date period for both current and prior year except for properties during the current or prior year that were under development. For purposes of comparability, same store rental revenue is presented on a constant currency basis by applying the exchange rate as of the balance sheet date to base currency rental revenue.

41 Investor Day | December 2025 Key Takeaways 1 2 3 Thoughtful portfolio construction and capital allocation decision making has produced an industrial-focused diversified portfolio of net lease real estate. Sound portfolio fundamentals translate into stable and predictable growth and provide downside protection from discrete tenant issues Newly disclosed same store growth of 2.7% (3Q25 vs. 3Q24), is the culmination of our top-tier annual rent escalations of 2.0% and a differentiated approach to active real estate management Proactive management of our real estate portfolio and a willingness to “roll up our sleeves” to create value for our shareholders and partners has translated into a strong foundation of organic growth to build upon

Speakers: Ryan Albano, Will Garner, Ryan Rahaeuser & Mike Caruso Time: 1:50 – 2:30 p.m. Core Building Block: Stabilized Acquisitions Nestlé USA Little Chute, WI

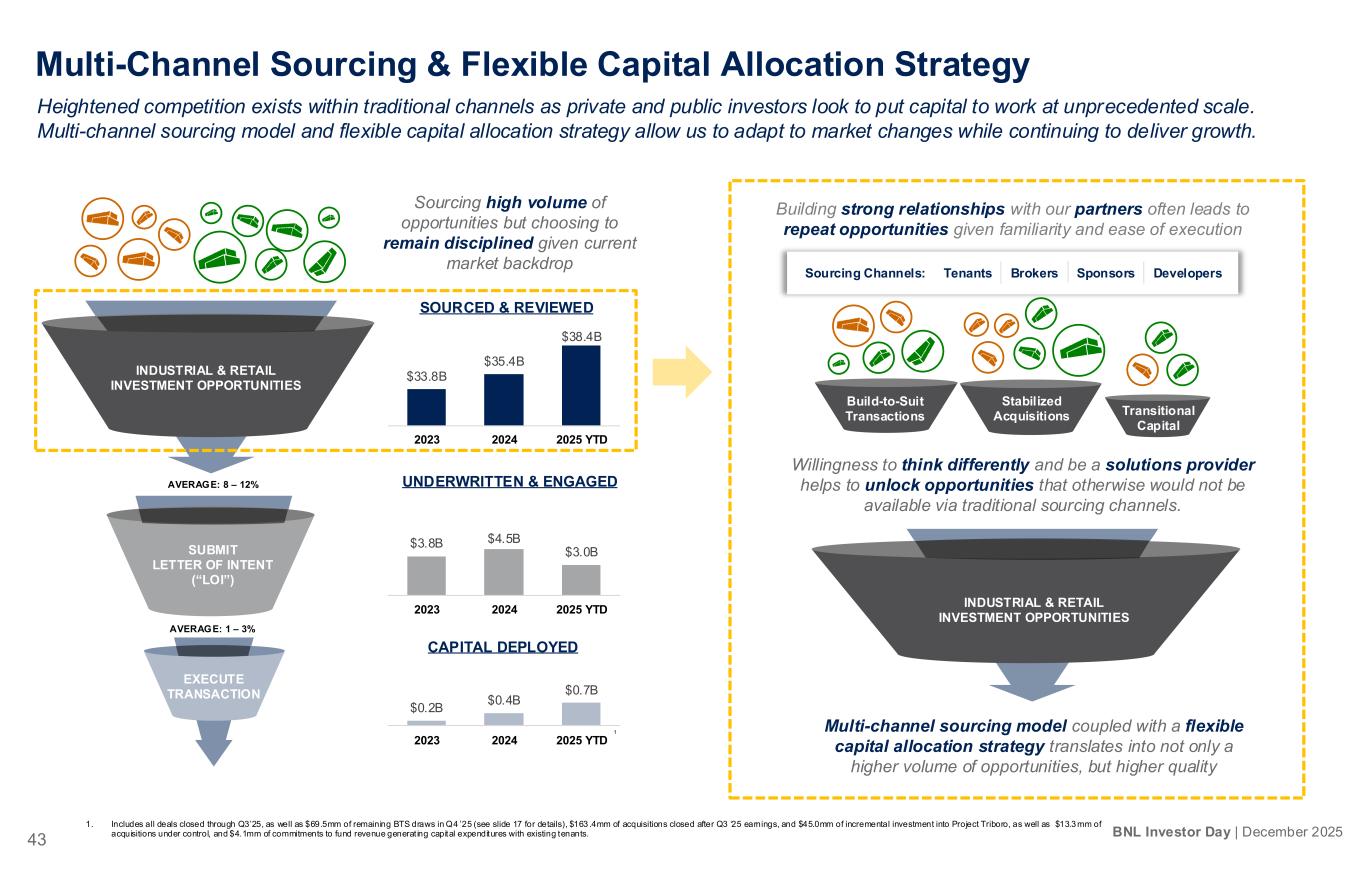

43 BNL Investor Day | December 2025 Multi-Channel Sourcing & Flexible Capital Allocation Strategy 1. Includes all deals closed through Q3’25, as well as $69.5mm of remaining BTS draws in Q4 ’25 (see slide 17 for details), $163 .4mm of acquisitions closed after Q3 ‘25 earnings, and $45.0mm of incremental investment into Project Triboro, as well as $13.3 mm of acquisitions under control, and $4.1mm of commitments to fund revenue generat ing capital expenditures with existing tenants. Heightened competition exists within traditional channels as private and public investors look to put capital to work at unprecedented scale. Multi-channel sourcing model and flexible capital allocation strategy allow us to adapt to market changes while continuing to deliver growth. SUBMIT LETTER OF INTENT (“LOI”) AVERAGE: 8 – 12% EXECUTE TRANSACTION AVERAGE: 1 – 3% SOURCED & REVIEWED UNDERWRITTEN & ENGAGED CAPITAL DEPLOYED $33.8B $35.4B $38.4B 2023 2024 2025 YTD $3.8B $4.5B $3.0B 2023 2024 2025 YTD $0.2B $0.4B $0.7B 2023 2024 2025 YTD Sourcing high volume of opportunities but choosing to remain disciplined given current market backdrop Build-to-Suit Transactions INDUSTRIAL & RETAIL INVESTMENT OPPORTUNITIES INDUSTRIAL & RETAIL INVESTMENT OPPORTUNITIES Sourcing Channels: Tenants Brokers Sponsors Developers Building strong relationships with our partners often leads to repeat opportunities given familiarity and ease of execution Willingness to think differently and be a solutions provider helps to unlock opportunities that otherwise would not be available via traditional sourcing channels. Multi-channel sourcing model coupled with a flexible capital allocation strategy translates into not only a higher volume of opportunities, but higher quality Stabilized Acquisitions Transitional Capital 1

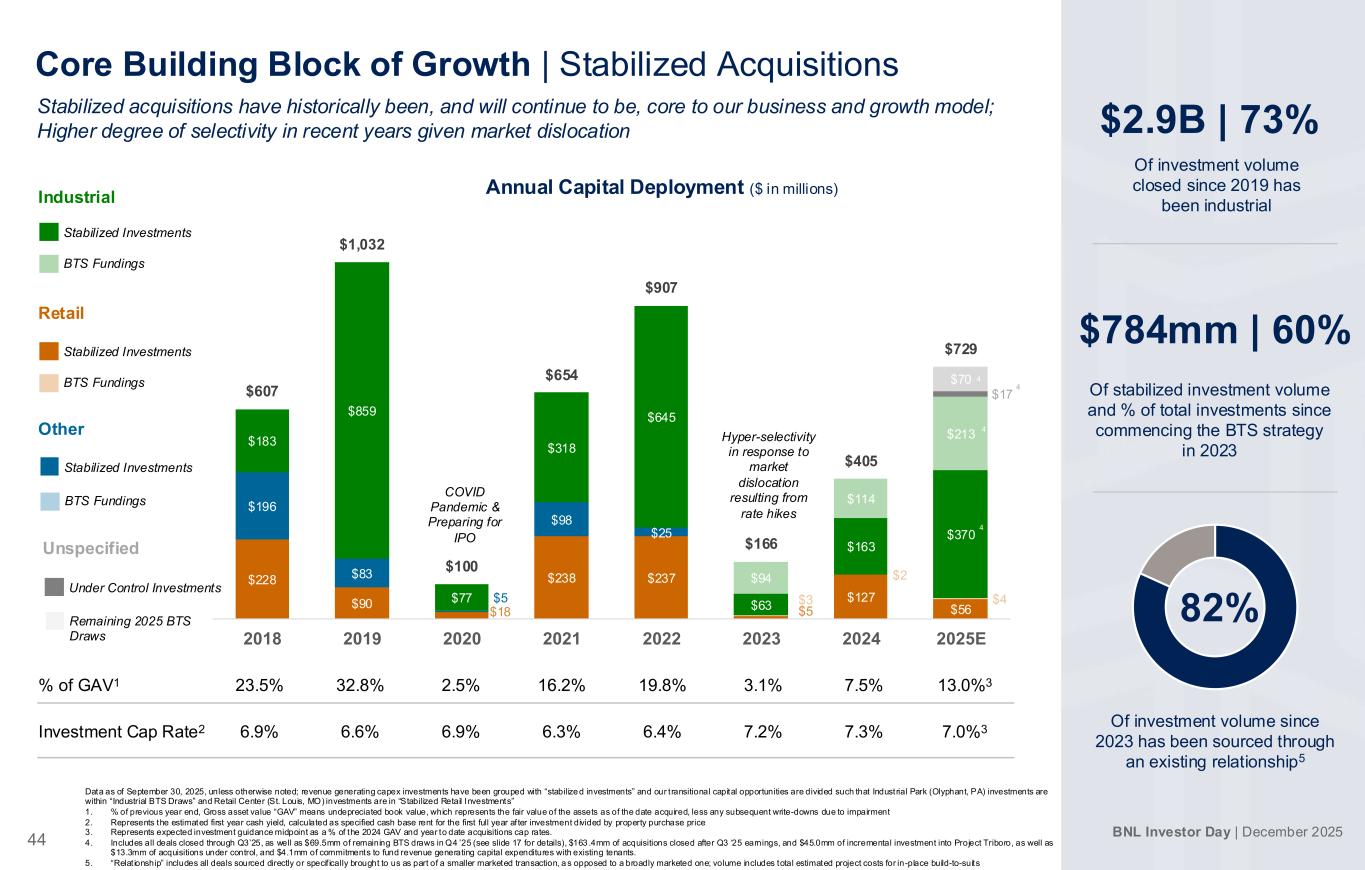

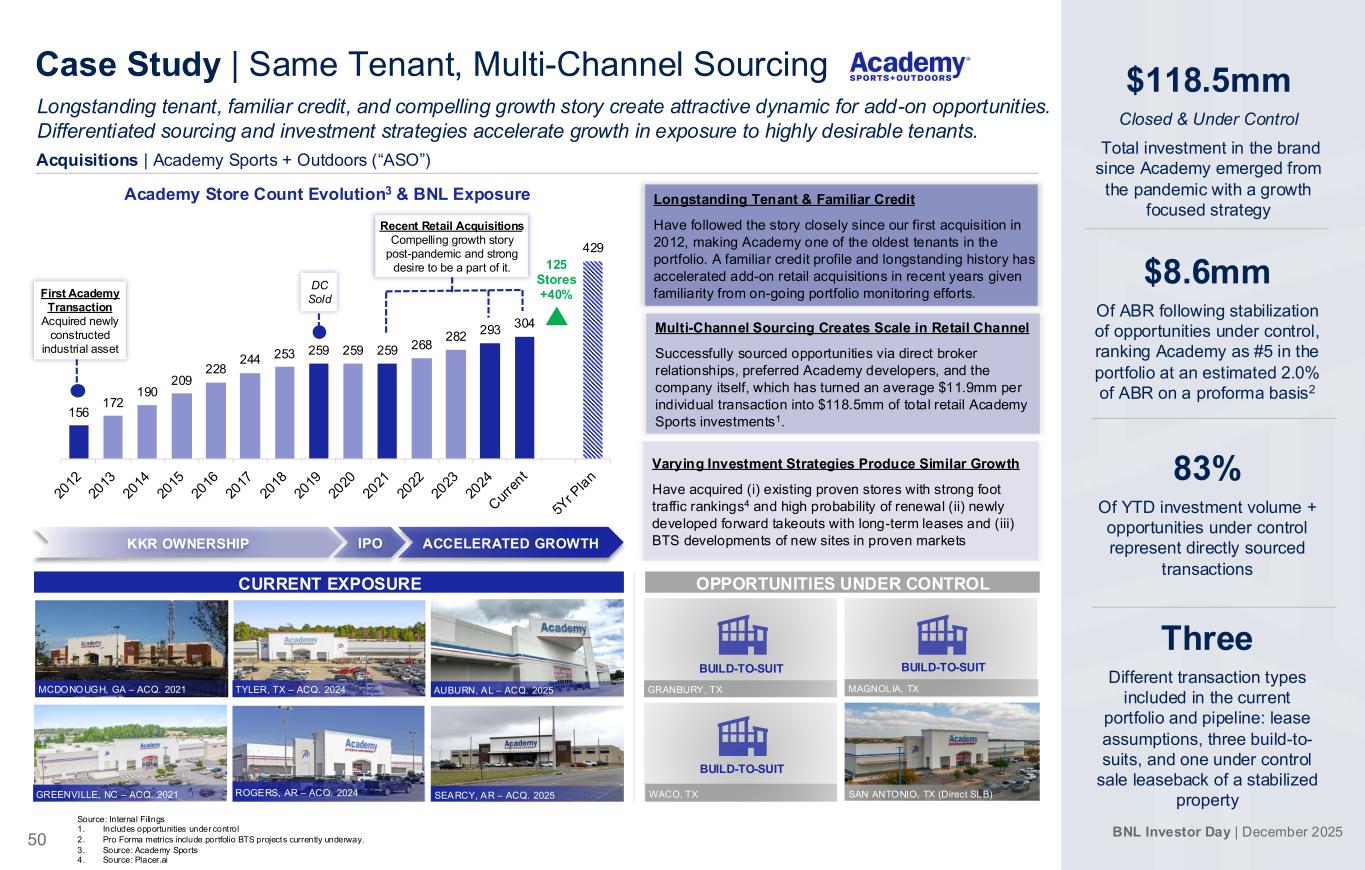

BNL Investor Day | December 2025 44 $228 $90 $18 $238 $237 $5 $127 $56 $3 $2 $4 $196 $83 $5 $98 $25 $183 $859 $77 $318 $645 $63 $163 $370 $94 $114 $213 $17 $70 $607 $1,032 $100 $654 $907 $166 $405 $729 2018 2019 2020 2021 2022 2023 2024 2025E Data as of September 30, 2025, unless otherwise noted; revenue generating capex investments have been grouped with “stabilize d investments” and our transitional capital opportunities are divided such that Industrial Park (Olyphant, PA) investments are within “Industrial BTS Draws” and Retail Center (St. Louis, MO) investments are in “Stabilized Retail Investments” 1. % of previous year end, Gross asset value “GAV” means undepreciated book value, which represents the fair value of the assets as of the date acquired, less any subsequent write-downs due to impairment 2. Represents the estimated first year cash yield, calculated as specified cash base rent for the first full year after investment divided by property purchase price 3. Represents expected investment guidance midpoint as a % of the 2024 GAV and year to date acquisitions cap rates. 4. Includes all deals closed through Q3’25, as well as $69.5mm of remaining BTS draws in Q4 ’25 (see slide 17 for details), $163 .4mm of acquisitions closed after Q3 ‘25 earnings, and $45.0mm of incremental investment into Project Triboro, as well as $13.3mm of acquisitions under control, and $4.1mm of commitments to fund revenue generating capital expenditures with existing tenants. 5. “Relat ionship” includes all deals sourced directly or specif ically brought to us as part of a smaller marketed transaction, a s opposed to a broadly marketed one; volume includes total estimated project costs for in-place build-to-suits Core Building Block of Growth | Stabilized Acquisitions Stabilized acquisitions have historically been, and will continue to be, core to our business and growth model; Higher degree of selectivity in recent years given market dislocation % of GAV1 23.5% 32.8% 2.5% 16.2% 19.8% 3.1% 7.5% 13.0%3 Investment Cap Rate2 6.9% 6.6% 6.9% 6.3% 6.4% 7.2% 7.3% 7.0%3 4 $2.9B | 73% Of investment volume closed since 2019 has been industrial 4 Stabilized Investments BTS Fundings Industrial Retail Other COVID Pandemic & Preparing for IPO Hyper-selectivity in response to market dislocation resulting from rate hikes Stabilized Investments BTS Fundings Stabilized Investments BTS Fundings $784mm | 60% Of stabilized investment volume and % of total investments since commencing the BTS strategy in 2023 82% Of investment volume since 2023 has been sourced through an existing relationship5 4 4 Unspecified Under Control Investments Remaining 2025 BTS Draws Annual Capital Deployment ($ in millions)

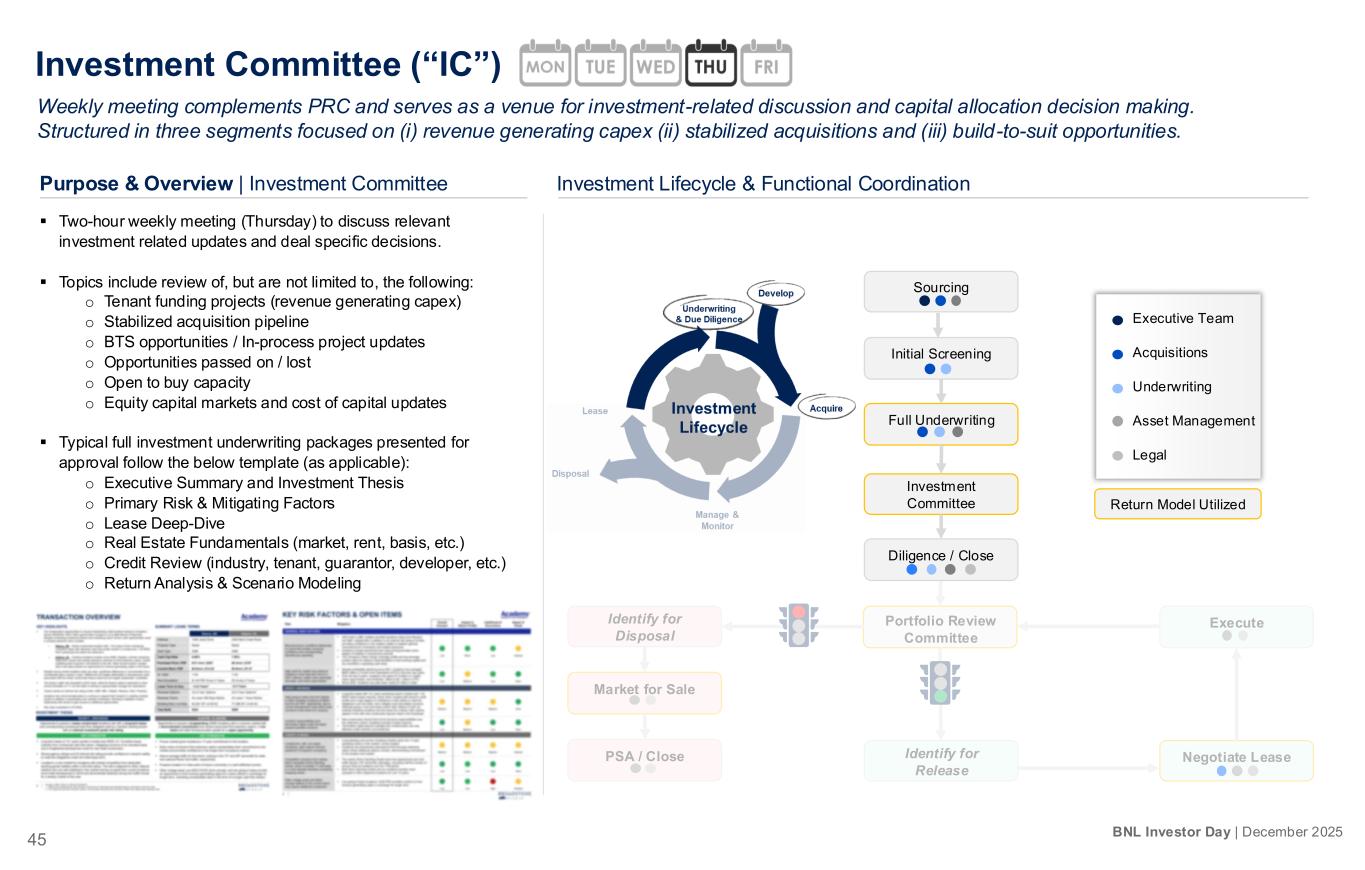

45 BNL Investor Day | December 2025 Investment Committee (“IC”) Weekly meeting complements PRC and serves as a venue for investment-related discussion and capital allocation decision making. Structured in three segments focused on (i) revenue generating capex (ii) stabilized acquisitions and (iii) build-to-suit opportunities. Sourcing Executive Team Acquisitions Underwriting Asset Management Legal Initial Screening Full Underwriting Investment Committee Portfolio Review Committee Identify for Disposal Market for Sale PSA / Close Identify for Release Negotiate Lease Execute Return Model Utilized Purpose & Overview | Investment Committee Investment Lifecycle & Functional Coordination Diligence / Close ▪ Two-hour weekly meeting (Thursday) to discuss relevant investment related updates and deal specific decisions. ▪ Topics include review of, but are not limited to, the following: o Tenant funding projects (revenue generating capex) o Stabilized acquisition pipeline o BTS opportunities / In-process project updates o Opportunities passed on / lost o Open to buy capacity o Equity capital markets and cost of capital updates ▪ Typical full investment underwriting packages presented for approval follow the below template (as applicable): o Executive Summary and Investment Thesis o Primary Risk & Mitigating Factors o Lease Deep-Dive o Real Estate Fundamentals (market, rent, basis, etc.) o Credit Review (industry, tenant, guarantor, developer, etc.) o Return Analysis & Scenario Modeling

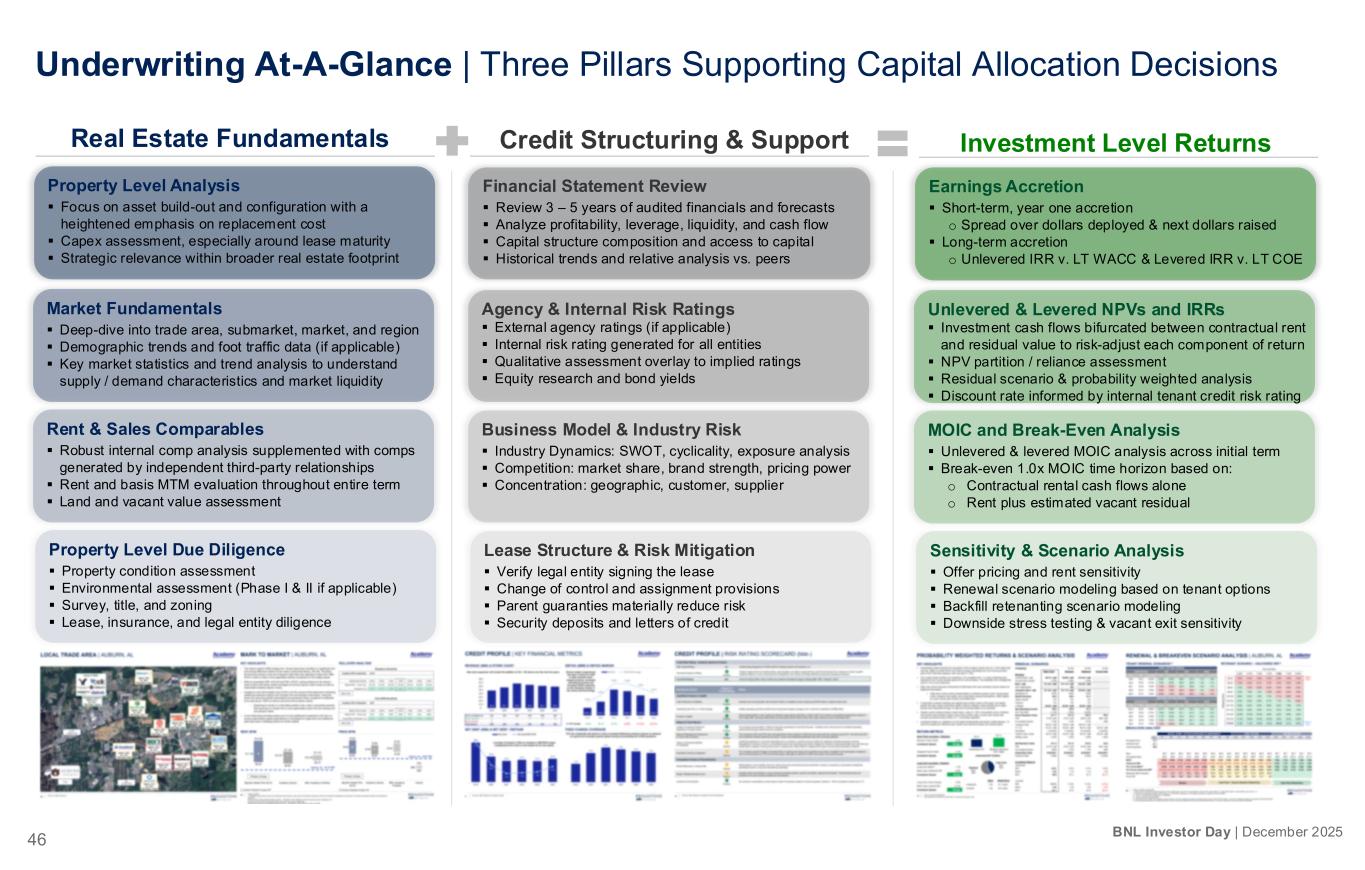

46 BNL Investor Day | December 2025 Underwriting At-A-Glance | Three Pillars Supporting Capital Allocation Decisions Real Estate Fundamentals Credit Structuring & Support Investment Level Returns Market Fundamentals ▪ Deep-dive into trade area, submarket, market, and region ▪ Demographic trends and foot traffic data (if applicable) ▪ Key market statistics and trend analysis to understand supply / demand characteristics and market liquidity Property Level Analysis ▪ Focus on asset build-out and configuration with a heightened emphasis on replacement cost ▪ Capex assessment, especially around lease maturity ▪ Strategic relevance within broader real estate footprint Rent & Sales Comparables ▪ Robust internal comp analysis supplemented with comps generated by independent third-party relationships ▪ Rent and basis MTM evaluation throughout entire term ▪ Land and vacant value assessment Property Level Due Diligence ▪ Property condition assessment ▪ Environmental assessment (Phase I & II if applicable) ▪ Survey, title, and zoning ▪ Lease, insurance, and legal entity diligence Agency & Internal Risk Ratings ▪ External agency ratings (if applicable) ▪ Internal risk rating generated for all entities ▪ Qualitative assessment overlay to implied ratings ▪ Equity research and bond yields Financial Statement Review ▪ Review 3 – 5 years of audited financials and forecasts ▪ Analyze profitability, leverage, liquidity, and cash flow ▪ Capital structure composition and access to capital ▪ Historical trends and relative analysis vs. peers Business Model & Industry Risk ▪ Industry Dynamics: SWOT, cyclicality, exposure analysis ▪ Competition: market share, brand strength, pricing power ▪ Concentration: geographic, customer, supplier Lease Structure & Risk Mitigation ▪ Verify legal entity signing the lease ▪ Change of control and assignment provisions ▪ Parent guaranties materially reduce risk ▪ Security deposits and letters of credit Unlevered & Levered NPVs and IRRs ▪ Investment cash flows bifurcated between contractual rent and residual value to risk-adjust each component of return ▪ NPV partition / reliance assessment ▪ Residual scenario & probability weighted analysis ▪ Discount rate informed by internal tenant credit risk rating Earnings Accretion ▪ Short-term, year one accretion o Spread over dollars deployed & next dollars raised ▪ Long-term accretion o Unlevered IRR v. LT WACC & Levered IRR v. LT COE MOIC and Break-Even Analysis ▪ Unlevered & levered MOIC analysis across initial term ▪ Break-even 1.0x MOIC time horizon based on: o Contractual rental cash flows alone o Rent plus estimated vacant residual Sensitivity & Scenario Analysis ▪ Offer pricing and rent sensitivity ▪ Renewal scenario modeling based on tenant options ▪ Backfill retenanting scenario modeling ▪ Downside stress testing & vacant exit sensitivity

47 BNL Investor Day | December 2025 Underwriting At-A-Glance | A Spectrum of Opportunity Multi-dimensional approach to underwriting combats binary thinking and a “one size fits all” investment mandate TENANT CREDIT REAL ESTATE Tractor Supply | Monroe, WA Investment thesis reliant on Tenant Credit Investment thesis reliant on Real Estate ▪ Strong tenant or guarantor credit, often with an investment grade rating ▪ Long-term leases given confidence in tenant’s ability to meet the obligations of the lease over the initial term ▪ NPV reliance heavily weighted towards contractual rental cash flows that are discounted at a lower rate given the underlying strength of credit profile ▪ 1.0x MOIC break-even reached inside of original lease term, reducing reliance on renewal or vacant residual value ▪ Strong real estate fundamentals, typically located in attractive markets ▪ Below market rents and basis provide a mark-to-market opportunity in the event of a downside future vacancy scenario ▪ Attractive market supply and demand characteristics reduce downtime and increase confidence in releasability in the event of a future tenant vacancy ▪ NPV reliance heavily weighted towards real estate residual given potential value creation generated upon exit ▪ Development basis vs. stabilized value creates flexibility and optionality Sprouts Farmers Market | Dallas-Forth Worth, TX MSAAvera Health | Sioux Falls, SD Southwire | Atlanta, GA MSA BTS strategy provides access to higher quality credits and stronger real estate fundamentals All investments viewed on a sliding scale from tenant credit to real estate fundamentals - Underwriting focus and supporting analysis shift depending on each investment’s underlying thesis on the investment reliance on each factor