1 U.S. Market & Product Assessment and Valuation of VT - 1953 for the Treatment of Symptoms of Malignant Fungating Wounds H1 2026

2 PROJECT OVERVIEW Destum Partners performed a U.S. market and product assessment, commercial forecast, and valuation for the use of VT - 1953 for the treatment of symptoms of Malignant Fungating Wounds (MFW) Commercial Forecast Market & Product Assessment ▪ Epidemiology ▪ Market Dynamics ▪ Target Product Profile ▪ Pricing & Reimbursement ▪ Competitive Landscape ▪ Development Strategy ▪ Strategic Positioning ▪ Relevant Development Expenses Valuation ▪ rNPV valuation ▪ Sensitivity and scenario analyses ▪ Model asset value change overtime, IRR, ROI, payback period & other financial metrics ▪ Patient - derived commercial forecast (units and revenue) ▪ Base scenario and sensitivity analyses ▪ Evaluation of overall business case

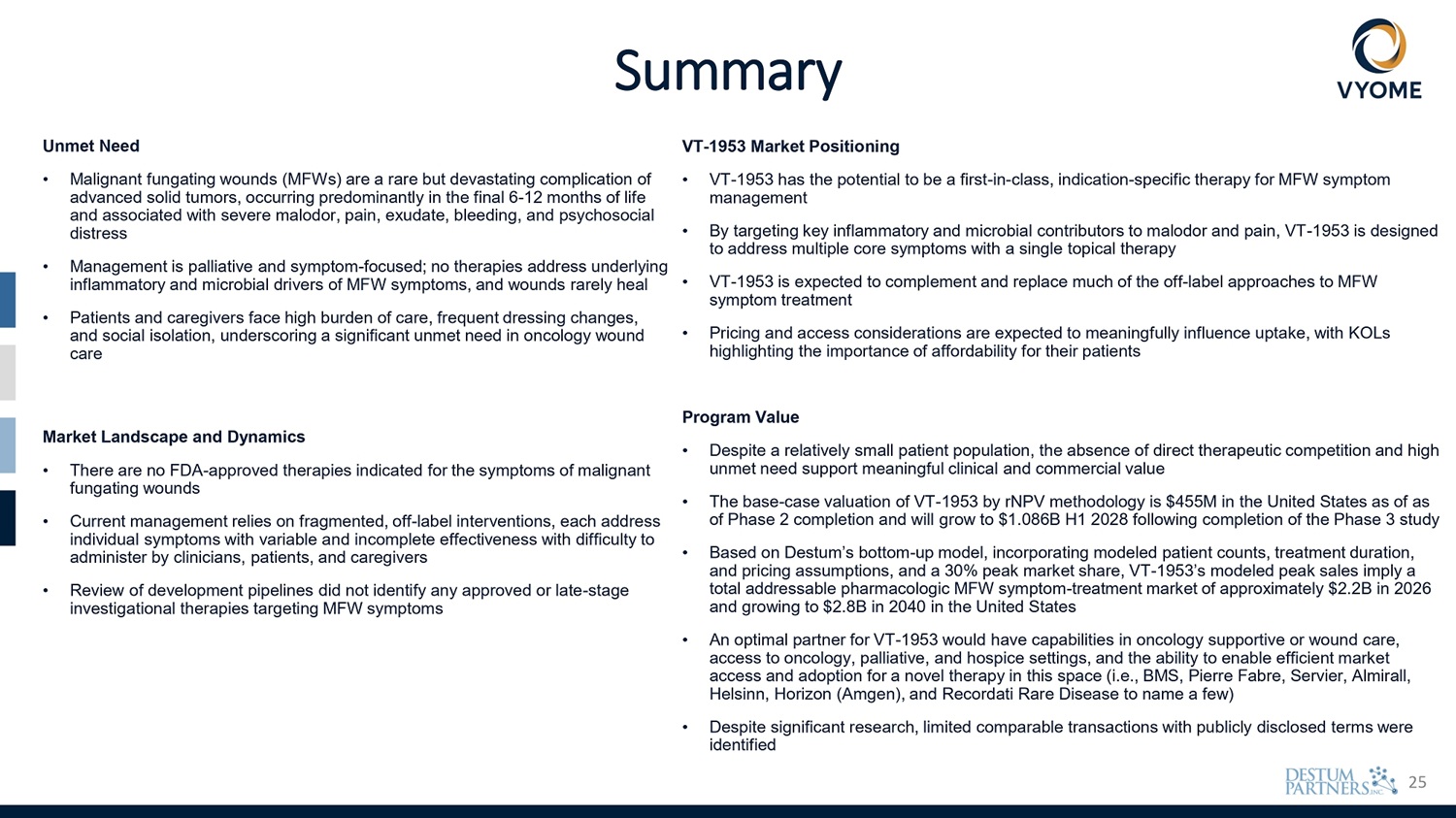

3 Summary Unmet Need • Malignant fungating wounds (MFWs) are a rare but devastating complication of advanced solid tumors, occurring predominantly in the final 6 - 12 months of life and associated with severe malodor, pain, exudate, bleeding, and psychosocial distress • Management is palliative and symptom - focused; no therapies address underlying inflammatory and microbial drivers of MFW symptoms, and wounds rarely heal • Patients and caregivers face high burden of care, frequent dressing changes, and social isolation, underscoring a significant unmet need in oncology wound care Market Landscape and Dynamics • There are no FDA - approved therapies indicated for the symptoms of malignant fungating wounds • Current management relies on fragmented, off - label interventions, each address individual symptoms with variable and incomplete effectiveness with difficulty to administer by clinicians, patients, and caregivers • Review of development pipelines did not identify any approved or late - stage investigational therapies targeting MFW symptoms VT - 1953 Market Positioning • VT - 1953 has the potential to be a first - in - class, indication - specific therapy for MFW symptom management • By targeting key inflammatory and microbial contributors to malodor and pain, VT - 1953 is designed to address multiple core symptoms with a single topical therapy • VT - 1953 is expected to complement and replace much of the off - label approaches to MFW symptom treatment • Pricing and access considerations are expected to meaningfully influence uptake, with KOLs highlighting the importance of affordability for their patients Program Value • Despite a relatively small patient population, the absence of direct therapeutic competition and high unmet need support meaningful clinical and commercial value • The base - case valuation of VT - 1953 by rNPV methodology is $455M in the United States as of as of Phase 2 completion and will grow to $1.086B H1 2028 following completion of the Phase 3 study • Based on Destum’s bottom - up model, incorporating modeled patient counts, treatment duration, and pricing assumptions, and a 30% peak market share, VT - 1953’s modeled peak sales imply a total addressable pharmacologic MFW symptom - treatment market of approximately $2.2B in 2026 and growing to $2.8B in 2040 in the United States • An optimal partner for VT - 1953 would have capabilities in oncology supportive or wound care, access to oncology, palliative, and hospice settings, and the ability to enable efficient market access and adoption for a novel therapy in this space (i.e., BMS, Pierre Fabre, Servier, Almirall, Helsinn, Horizon (Amgen), and Recordati Rare Disease to name a few) • Despite significant research, limited comparable transactions with publicly disclosed terms were identified

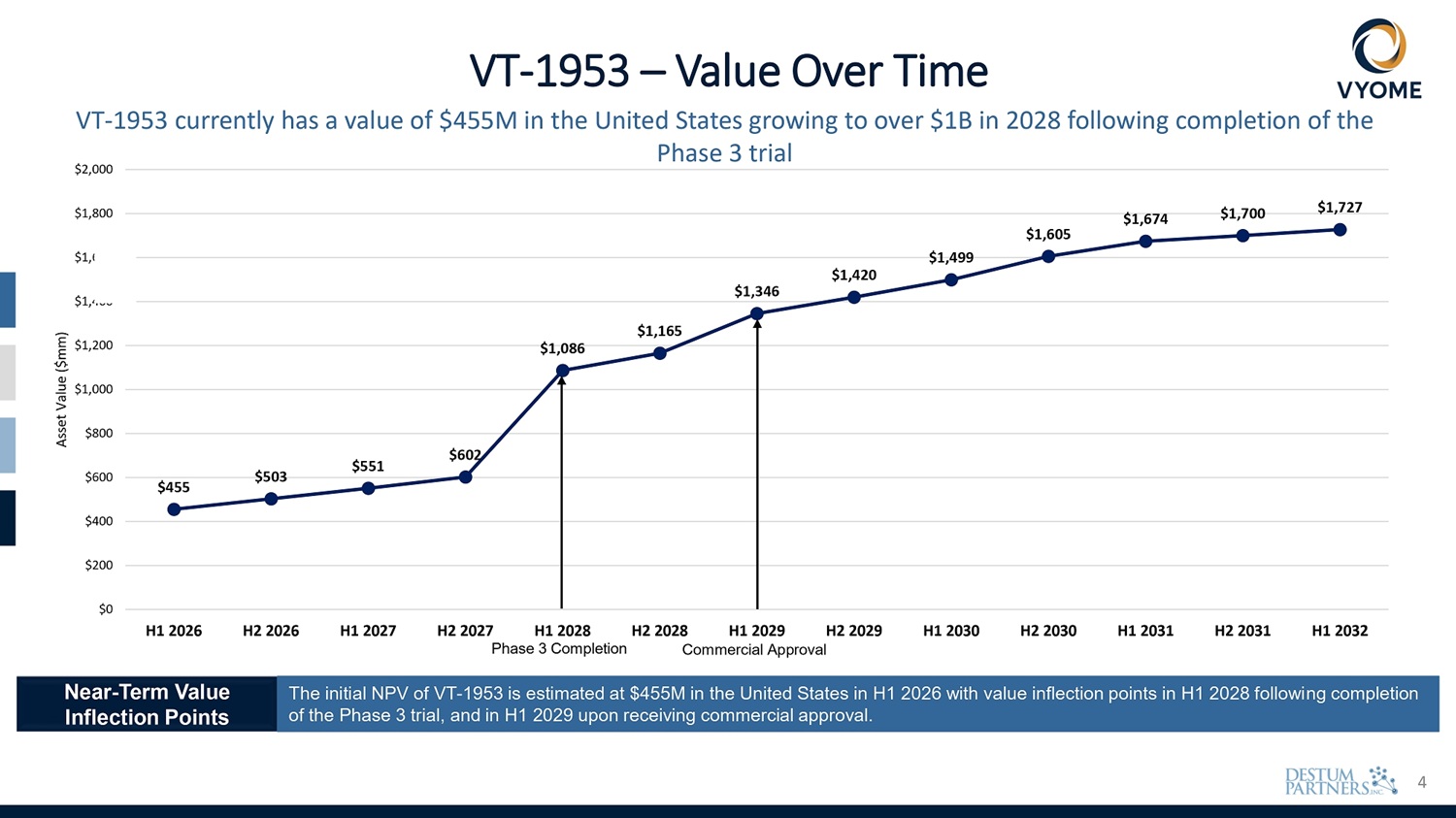

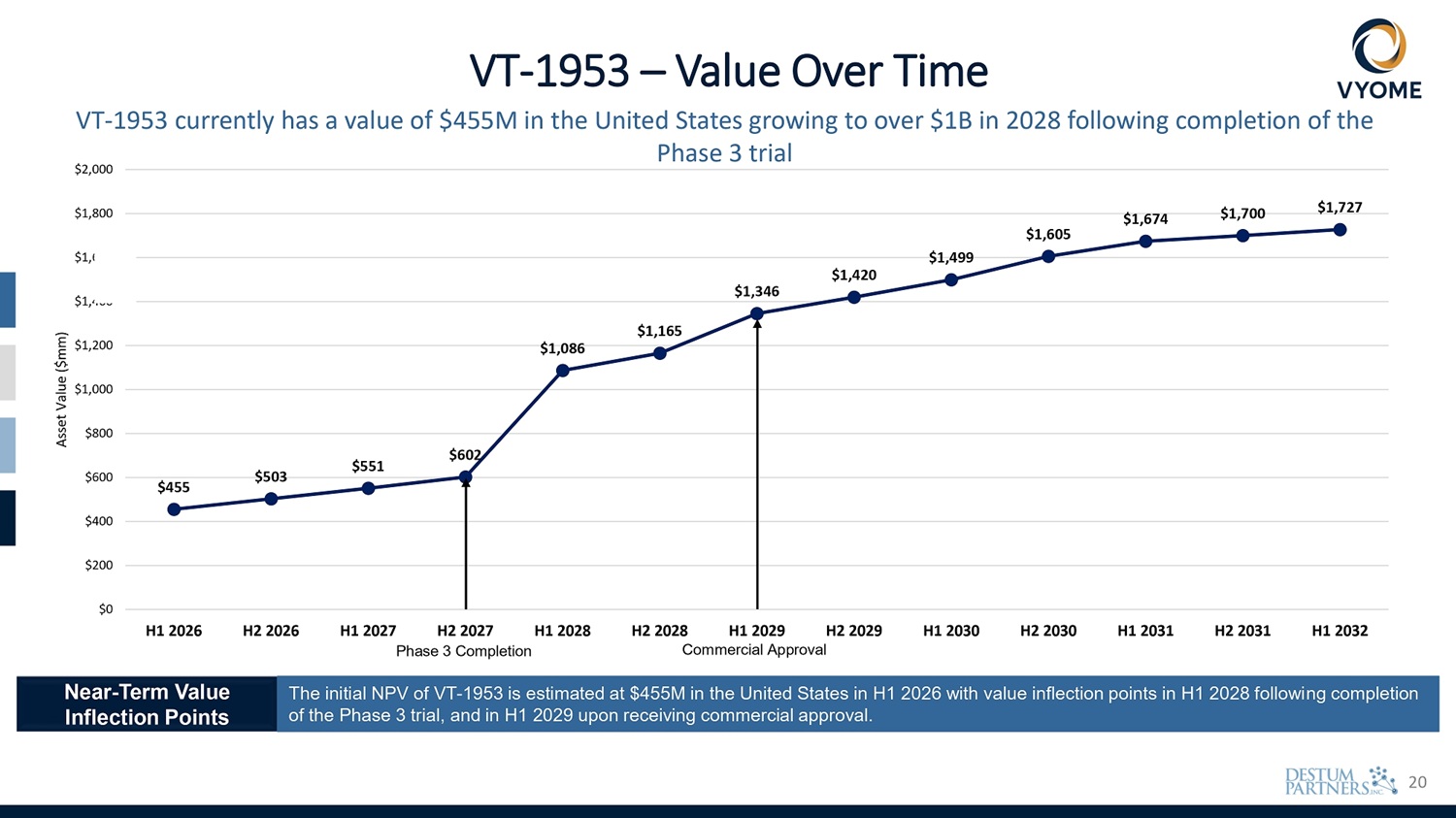

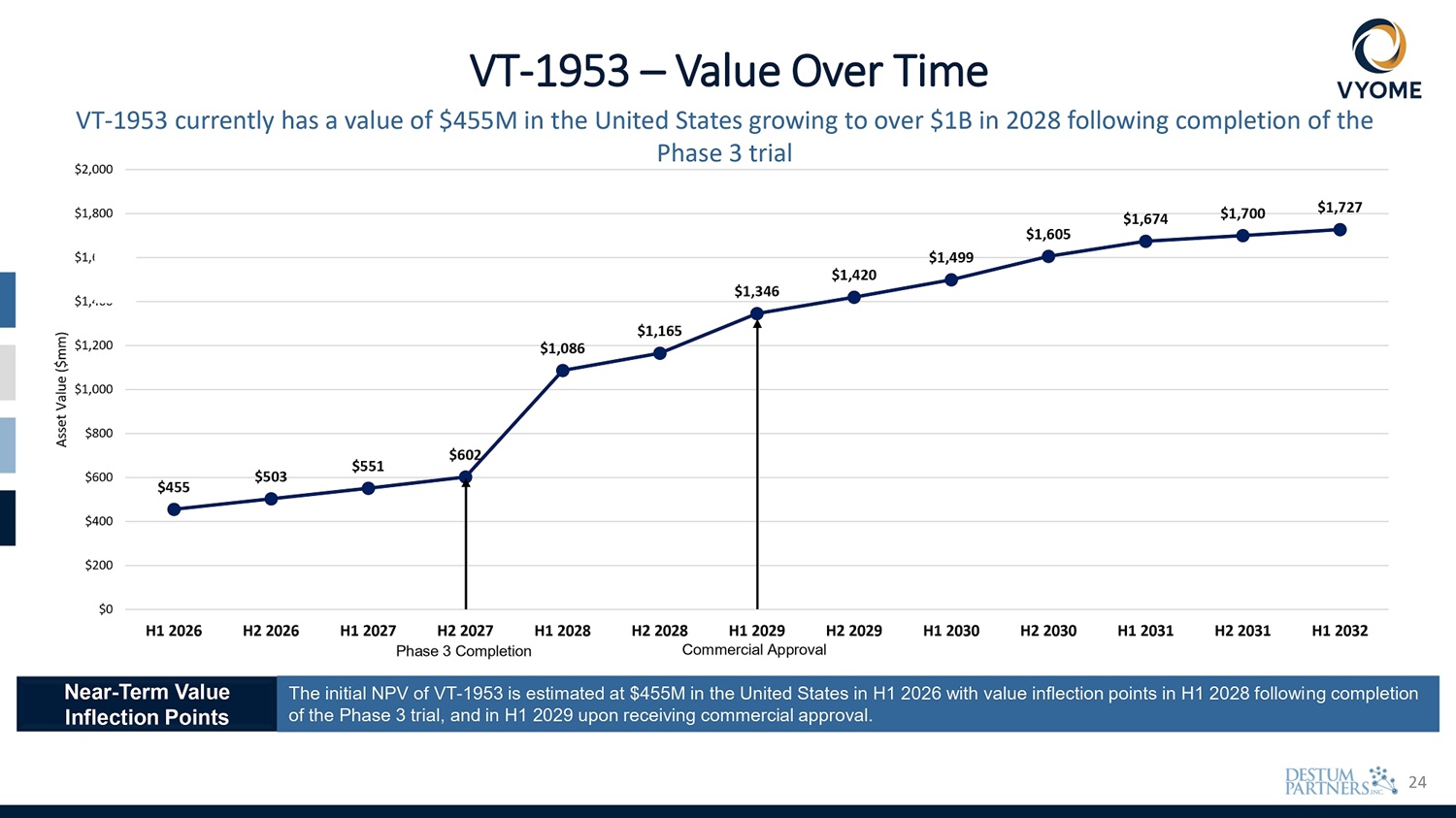

4 $455 $503 $551 $602 $1,086 $1,165 $1,346 $1,420 $1,499 $1,605 $1,674 $1,700 $1,727 $400 $200 $0 $600 $1,000 $800 $1,200 $1,400 600 $1, $1,800 $2,000 H1 2026 H2 2026 H1 2027 H2 2027 H1 2028 H2 2028 H1 2029 H2 2029 Phase 3 Completion Commercial Approval H1 2030 H2 2030 H1 2031 H2 2031 H1 2032 Asset Value ($mm) VT - 1953 – Value Over Time VT - 1953 currently has a value of $455M in the United States growing to over $1B in 2028 following completion of the Phase 3 trial Near - Term Value Inflection Points The initial NPV of VT - 1953 is estimated at $455M in the United States in H1 2026 with value inflection points in H1 2028 following completion of the Phase 3 trial, and in H1 2029 upon receiving commercial approval.

5 Table of Contents VT - 1953 for the Treatment of Symptoms of Malignant Fungating Wounds ▪ Background & Epidemiology ▪ Treatment Algorithm ▪ Competitive Landscape ▪ Total Treatable Patient Population ▪ Market Size & Potential ▪ Risk Assessments ▪ Forecast ▪ rNPV ▪ Summary

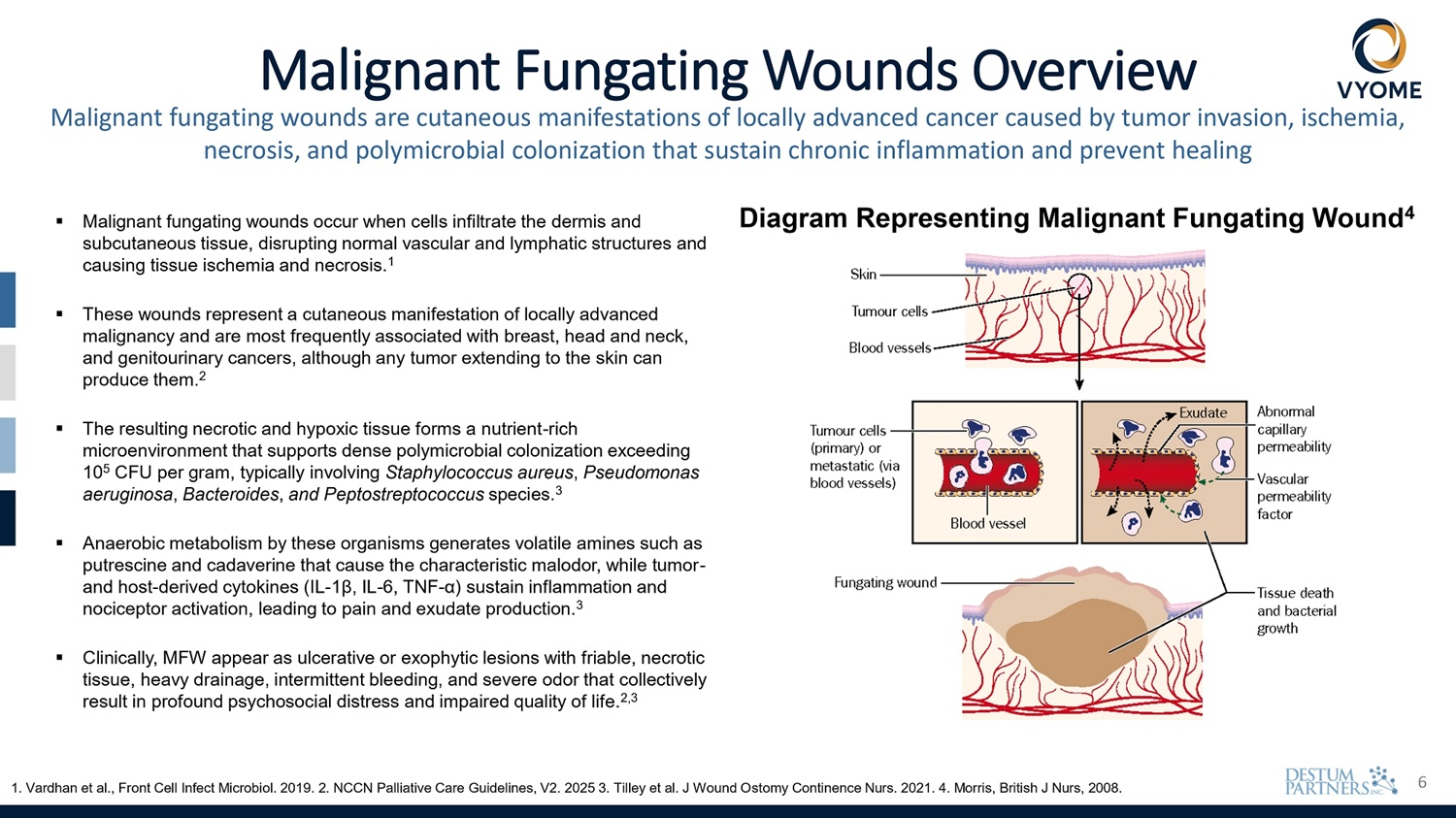

6 Malignant Fungating Wounds Overview Malignant fungating wounds are cutaneous manifestations of locally advanced cancer caused by tumor invasion, ischemia, necrosis, and polymicrobial colonization that sustain chronic inflammation and prevent healing ▪ Malignant fungating wounds occur when cells infiltrate the dermis and subcutaneous tissue, disrupting normal vascular and lymphatic structures and causing tissue ischemia and necrosis. 1 ▪ These wounds represent a cutaneous manifestation of locally advanced malignancy and are most frequently associated with breast, head and neck, and genitourinary cancers, although any tumor extending to the skin can produce them. 2 ▪ The resulting necrotic and hypoxic tissue forms a nutrient - rich microenvironment that supports dense polymicrobial colonization exceeding 10 5 CFU per gram, typically involving Staphylococcus aureus , Pseudomonas aeruginosa , Bacteroides , and Peptostreptococcus species. 3 ▪ Anaerobic metabolism by these organisms generates volatile amines such as putrescine and cadaverine that cause the characteristic malodor, while tumor - and host - derived cytokines (IL - 1β, IL - 6, TNF - α) sustain inflammation and nociceptor activation, leading to pain and exudate production. 3 ▪ Clinically, MFW appear as ulcerative or exophytic lesions with friable, necrotic tissue, heavy drainage, intermittent bleeding, and severe odor that collectively result in profound psychosocial distress and impaired quality of life . 2 , 3 1. Vardhan et al., Front Cell Infect Microbiol. 2019. 2. NCCN Palliative Care Guidelines, V2. 2025 3. Tilley et al. J Wound Ostomy Continence Nurs. 2021. 4. Morris, British J Nurs, 2008. Diagram Representing Malignant Fungating Wound 4

7 Malignant Fungating Wounds Epidemiology MFWs are an uncommon complication of advanced solid tumors concentrated near end of life ▪ MFWs occur almost exclusively in patients with advanced or uncontrolled solid tumors, most commonly breast cancer (~50 - 70%) and head & neck cancers, with smaller contributions from gynecologic, genitourinary, and other solid tumors. 1 ▪ Data on the incidence of MFWs is limited, though most authors agree that between 5 - 14% of advanced or terminal cancer patients will develop a MFW. 1 ▪ MFWs typically develop late in the disease course, most often during the final 6 - 12 months of life, and are considered a marker of terminal or near - terminal cancer. After reviewing 77 cases of cutaneous tumor metastases over 10 years, Saeed et al, reported that 28.6% of patients died within the first month following diagnosis, 66.23% had died within the first six months, and 75% within the first 12 months. 2 ▪ No reliable epidemiologic data quantifying the annual prevalence of advanced or terminal cancer patients with MFWs is available. Given the strong end - of - life clustering, Destum used annual U.S. cancer mortality as a proxy for the advanced cancer population at risk. The American cancer society estimates the number of cancer deaths in the U.S. continued to fall in 2025 to 618,120. 3 ▪ U.S. cancer incidence and mortality are projected to decline though 2040, reflecting earlier detection and improved therapeutics. From data published by Rahib et al, Destum calculated an annual rate of decrease of 1.5%. 4 ▪ For modeling purposes, Destum used the midpoint of published incidence estimates (9.5%) for the proportion of advanced or terminal cancer patients who develop an MFW. Applying this rate to ACS reported U.S. cancer mortality in 2025, yields an estimated 58,721 MFW cases in the United States in 2025. 1. Tilley et al. J Wound Ostomy Continence Nurs. 2021. 2. Alexander S, J Wound Care. 2009. 3. Siegel et al. CA Cancer J Clin. 2025. 4. Rahib et al. Oncology. 2021.

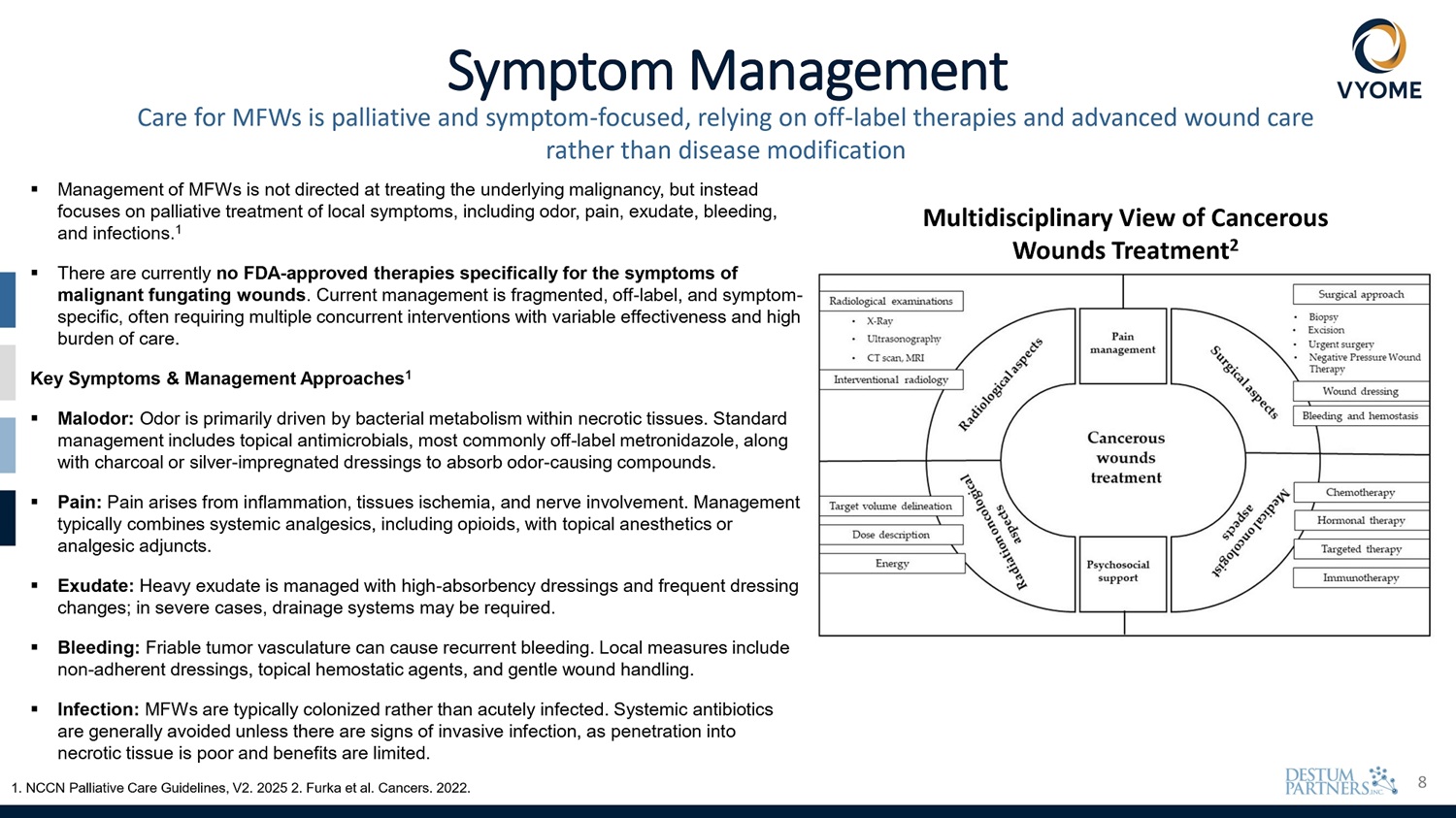

8 Symptom Management Care for MFWs is palliative and symptom - focused, relying on off - label therapies and advanced wound care rather than disease modification ▪ Management of MFWs is not directed at treating the underlying malignancy, but instead focuses on palliative treatment of local symptoms, including odor, pain, exudate, bleeding, ▪ Infection: MFWs are typically colonized rather than acutely infected. Systemic antibiotics are generally avoided unless there are signs of invasive infection, as penetration into necrotic tissue is poor and benefits are limited. 1. NCCN Palliative Care Guidelines, V2. 2025 2. Furka et al. Cancers. 2022. and infections. 1 ▪ There are currently no FDA - approved therapies specifically for the symptoms of malignant fungating wounds . Current management is fragmented, off - label, and symptom - specific, often requiring multiple concurrent interventions with variable effectiveness and high burden of care. Key Symptoms & Management Approaches 1 ▪ Malodor : Odor is primarily driven by bacterial metabolism within necrotic tissues . Standard management includes topical antimicrobials, most commonly off - label metronidazole, along with charcoal or silver - impregnated dressings to absorb odor - causing compounds . ▪ Pain: Pain arises from inflammation, tissues ischemia, and nerve involvement. Management typically combines systemic analgesics, including opioids, with topical anesthetics or analgesic adjuncts. ▪ Exudate: Heavy exudate is managed with high - absorbency dressings and frequent dressing changes; in severe cases, drainage systems may be required. ▪ Bleeding : Friable tumor vasculature can cause recurrent bleeding . Local measures include non - adherent dressings, topical hemostatic agents, and gentle wound handling . Multidisciplinary View of Cancerous Wounds Treatment 2

9 Table of Contents VT - 1953 for the Treatment of Symptoms of Malignant Fungating Wounds ▪ Background & Epidemiology ▪ Treatment Algorithm ▪ Competitive Landscape ▪ Total Treatable Patient Population ▪ Market Size & Potential ▪ Risk Assessments ▪ Forecast ▪ rNPV ▪ Summary

10 Competitive Landscape for VT - 1953 1. Destum Analysis No approved or late - stage therapies are in development for the symptoms of malignant fungating wounds • There are currently no FDA - approved drugs or late - stage clinical programs specifically indicated for malignant fungating wounds, positioning VT - 1953 as a potential first - in - class, indication - specific therapy • The current treatment landscape consists primarily of repurposed or off - label products used to manage individual symptoms rather than underlying inflammatory or microbial drivers of MFW symptoms • Review of current development pipelines did not identify any investigational therapies targeting MFW symptoms other than VT - 1953. • Primary market research and KOL interviews conducted by Destum Partners confirm that off - label metronidazole is widely used and is expected to remain part of standard of care, but is viewed as insufficient as a standalone solution due to limited symptom coverage and lack of approval • As a result, VT - 1953 is expected to enter a market with minimal direct therapeutic competition, with adoption driven by its ability to complement or replace fragmented off - label approaches

11 Market Share Estimation 1. Destum Analysis VT - 1953 enters a market where providers and patients are actively seeking new treatment options given the limited options currently available No current FDA approved topical treatments for malignant fungating wounds • Currently, there are no FDA approved topical treatments available to patients for malignant fungating wounds • As supported by Destum Partner’s primary market research, key opinion leaders (KOLs) state the need for new treatment options in this space for their patients No current viable competitors in development for malignant fungating wounds • Currently, there are no viable competitors in development for malignant fungating wounds leaving the door of opportunity open for VT - 1953 to become a competitive treatment option for patients in the space Effective topical treatments available in preferred formulations • Despite there being no current FDA approved topical treatments for patients with malignant fungating wounds and no viable competitors in development, KOLs emphasize the effectiveness of off label used products such a metronidazole for the treatment of malignant fungating wound symptoms. Nonetheless, significant administration burden of metronidazole (crushed oral tablets) exists for clinicians, patients, and caregivers Socioeconomic factors driving market share • As supported by Destum Partner’s research, majority of patients experiencing malignant fungating wounds fall into the Medicare / Medicaid insurance bucket and need affordable and accessible treatment options for their disease. Given the affordability and accessibility of comparable products such as StrataXRL®, Destum Partners assumed a 30% peak market share for VT - 1953

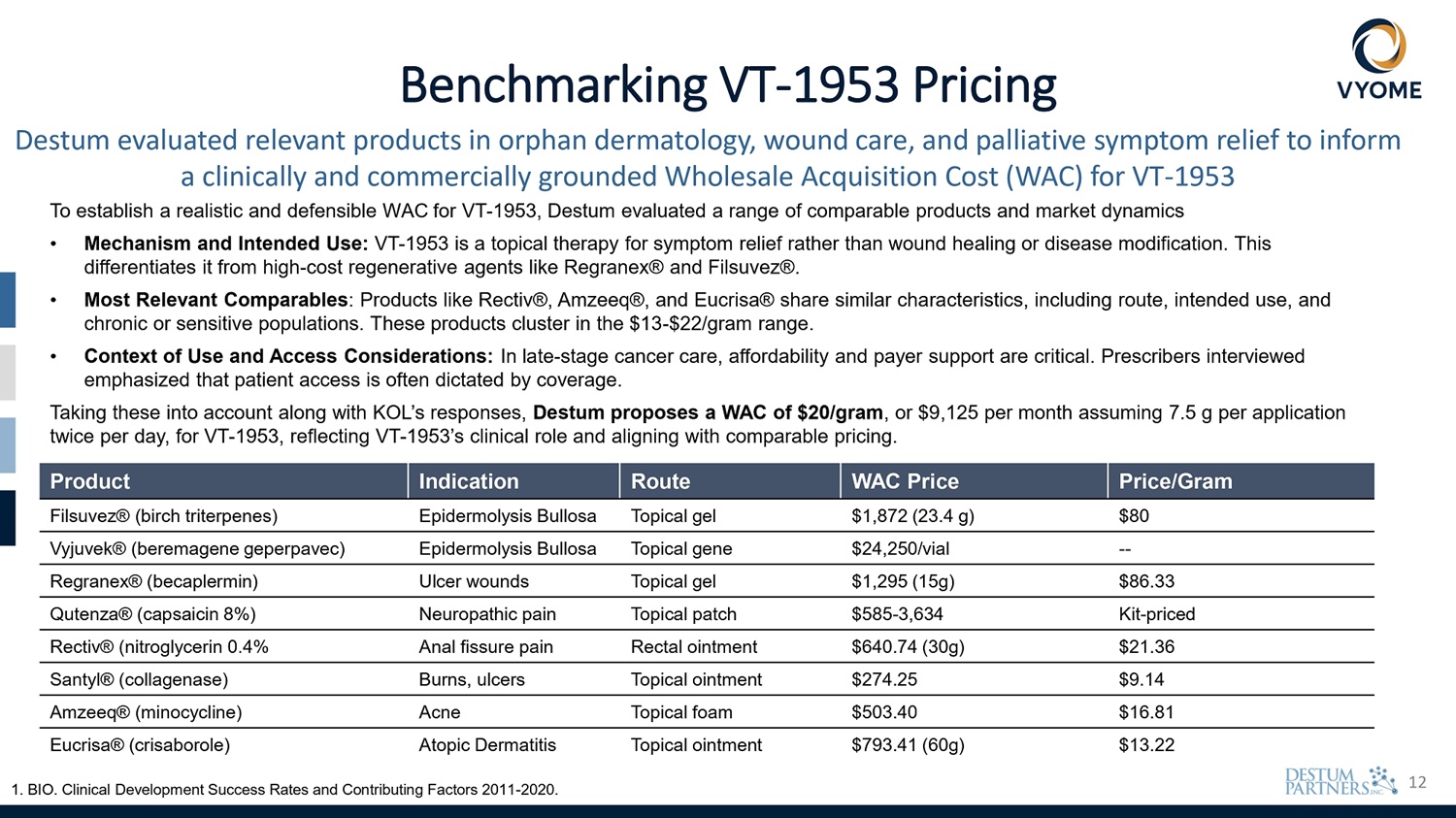

12 Benchmarking VT - 1953 Pricing Destum evaluated relevant products in orphan dermatology, wound care, and palliative symptom relief to inform a clinically and commercially grounded Wholesale Acquisition Cost (WAC) for VT - 1953 To establish a realistic and defensible WAC for VT - 1953, Destum evaluated a range of comparable products and market dynamics • Mechanism and Intended Use: VT - 1953 is a topical therapy for symptom relief rather than wound healing or disease modification. This differentiates it from high - cost regenerative agents like Regranex® and Filsuvez®. • Most Relevant Comparables : Products like Rectiv®, Amzeeq®, and Eucrisa® share similar characteristics, including route, intended use, and chronic or sensitive populations. These products cluster in the $13 - $22/gram range. • Context of Use and Access Considerations: In late - stage cancer care, affordability and payer support are critical. Prescribers interviewed emphasized that patient access is often dictated by coverage. Taking these into account along with KOL’s responses, Destum proposes a WAC of $20/gram , or $9,125 per month assuming 7.5 g per application twice per day, for VT - 1953, reflecting VT - 1953’s clinical role and aligning with comparable pricing. 1. BIO. Clinical Development Success Rates and Contributing Factors 2011 - 2020. Price/Gram WAC Price Route Indication Product $80 $1,872 (23.4 g) Topical gel Epidermolysis Bullosa Filsuvez® (birch triterpenes) - - $24,250/vial Topical gene Epidermolysis Bullosa Vyjuvek® (beremagene geperpavec) $86.33 $1,295 (15g) Topical gel Ulcer wounds Regranex® (becaplermin) Kit - priced $585 - 3,634 Topical patch Neuropathic pain Qutenza® (capsaicin 8%) $21.36 $640.74 (30g) Rectal ointment Anal fissure pain Rectiv® (nitroglycerin 0.4% $9.14 $274.25 Topical ointment Burns, ulcers Santyl® (collagenase) $16.81 $503.40 Topical foam Acne Amzeeq® (minocycline) $13.22 $793.41 (60g) Topical ointment Atopic Dermatitis Eucrisa® (crisaborole)

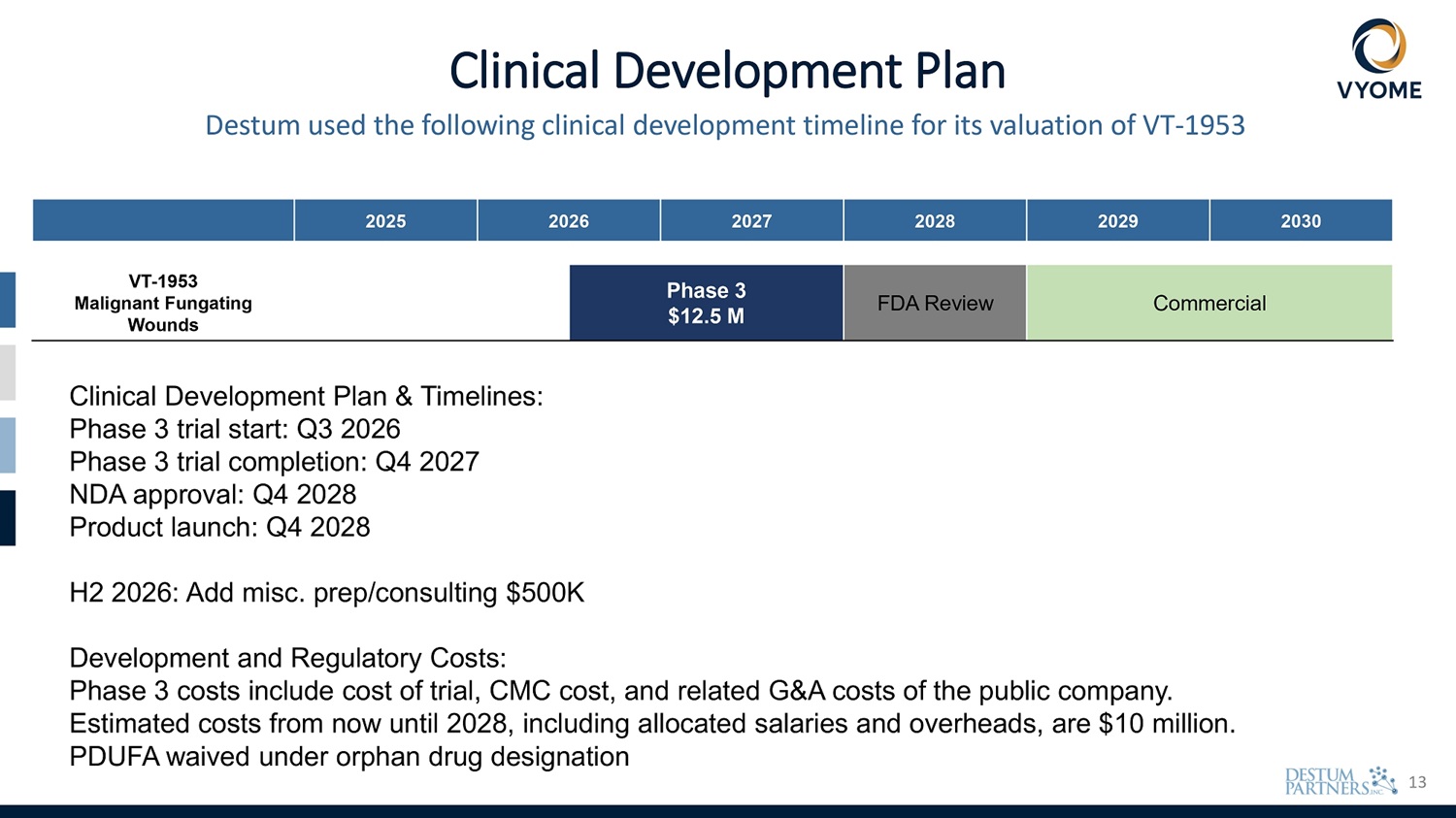

13 Clinical Development Plan Destum used the following clinical development timeline for its valuation of VT - 1953 2030 2029 2028 2027 2026 2025 Commercial FDA Review Phase 3 $12.5 M VT - 1953 Malignant Fungating Wounds Clinical Development Plan & Timelines: Phase 3 trial start: Q3 2026 Phase 3 trial completion: Q4 2027 NDA approval: Q4 2028 Product launch: Q4 2028 H2 2026: Add misc. prep/consulting $500K Development and Regulatory Costs: Phase 3 costs include cost of trial, CMC cost, and related G&A costs of the public company. Estimated costs from now until 2028, including allocated salaries and overheads, are $10 million. PDUFA waived under orphan drug designation

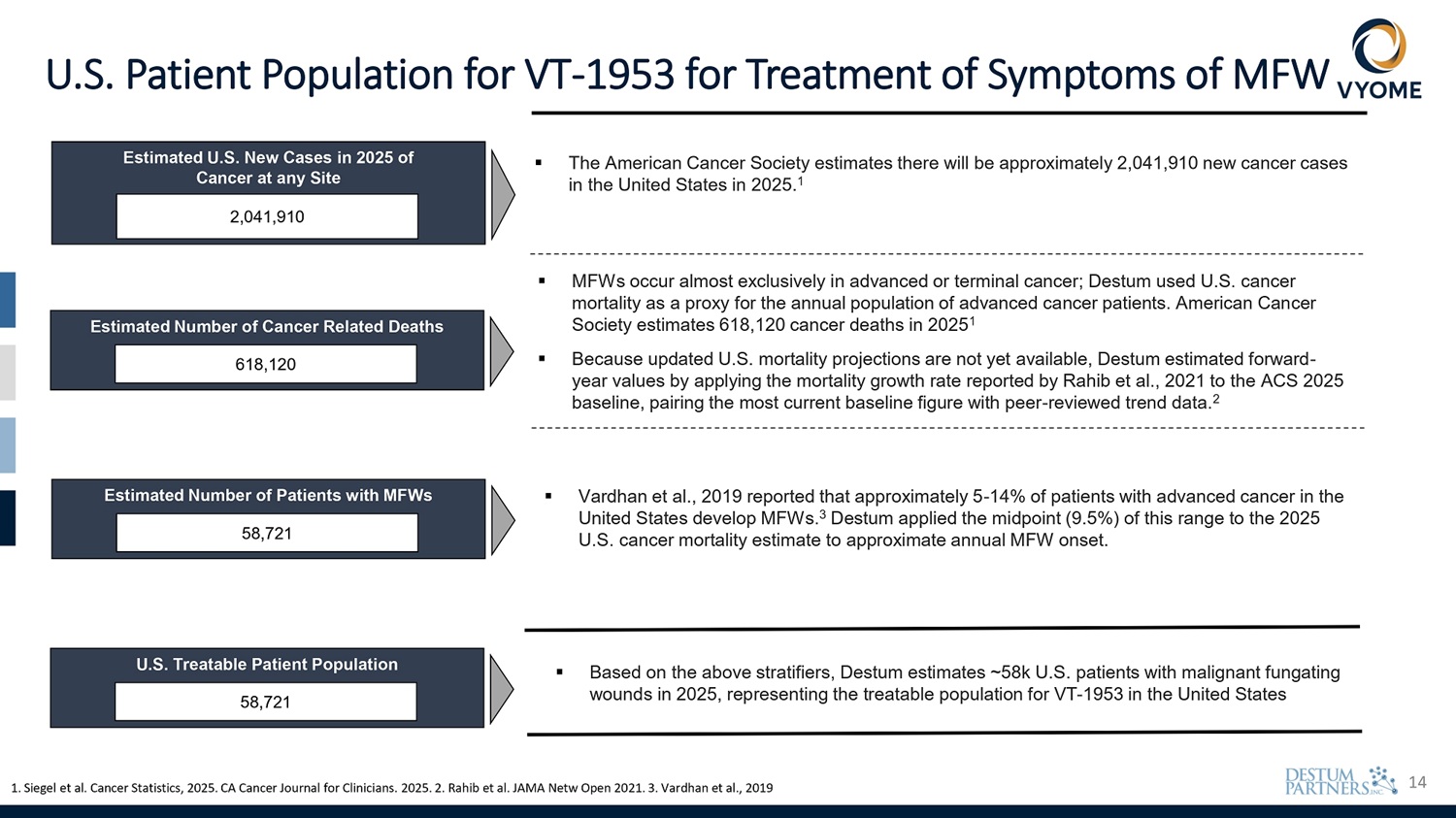

14 U.S. Patient Population for VT - 1953 for Treatment of Symptoms of MFW Estimated U.S. New Cases in 2025 of Cancer at any Site 2,041,910 Estimated Number of Patients with MFWs 58,721 U.S. Treatable Patient Population 58,721 ▪ The American Cancer Society estimates there will be approximately 2,041,910 new cancer cases in the United States in 2025. 1 Estimated Number of Cancer Related Deaths 618,120 1. Siegel et al. Cancer Statistics, 2025. CA Cancer Journal for Clinicians. 2025. 2. Rahib et al. JAMA Netw Open 2021. 3. Vardhan et al., 2019 ▪ Vardhan et al., 2019 reported that approximately 5 - 14% of patients with advanced cancer in the United States develop MFWs. 3 Destum applied the midpoint (9.5%) of this range to the 2025 U.S. cancer mortality estimate to approximate annual MFW onset. ▪ MFWs occur almost exclusively in advanced or terminal cancer; Destum used U.S. cancer mortality as a proxy for the annual population of advanced cancer patients. American Cancer Society estimates 618,120 cancer deaths in 2025 1 ▪ Because updated U.S. mortality projections are not yet available, Destum estimated forward - year values by applying the mortality growth rate reported by Rahib et al., 2021 to the ACS 2025 baseline, pairing the most current baseline figure with peer - reviewed trend data. 2 ▪ Based on the above stratifiers, Destum estimates ~58k U.S. patients with malignant fungating wounds in 2025, representing the treatable population for VT - 1953 in the United States

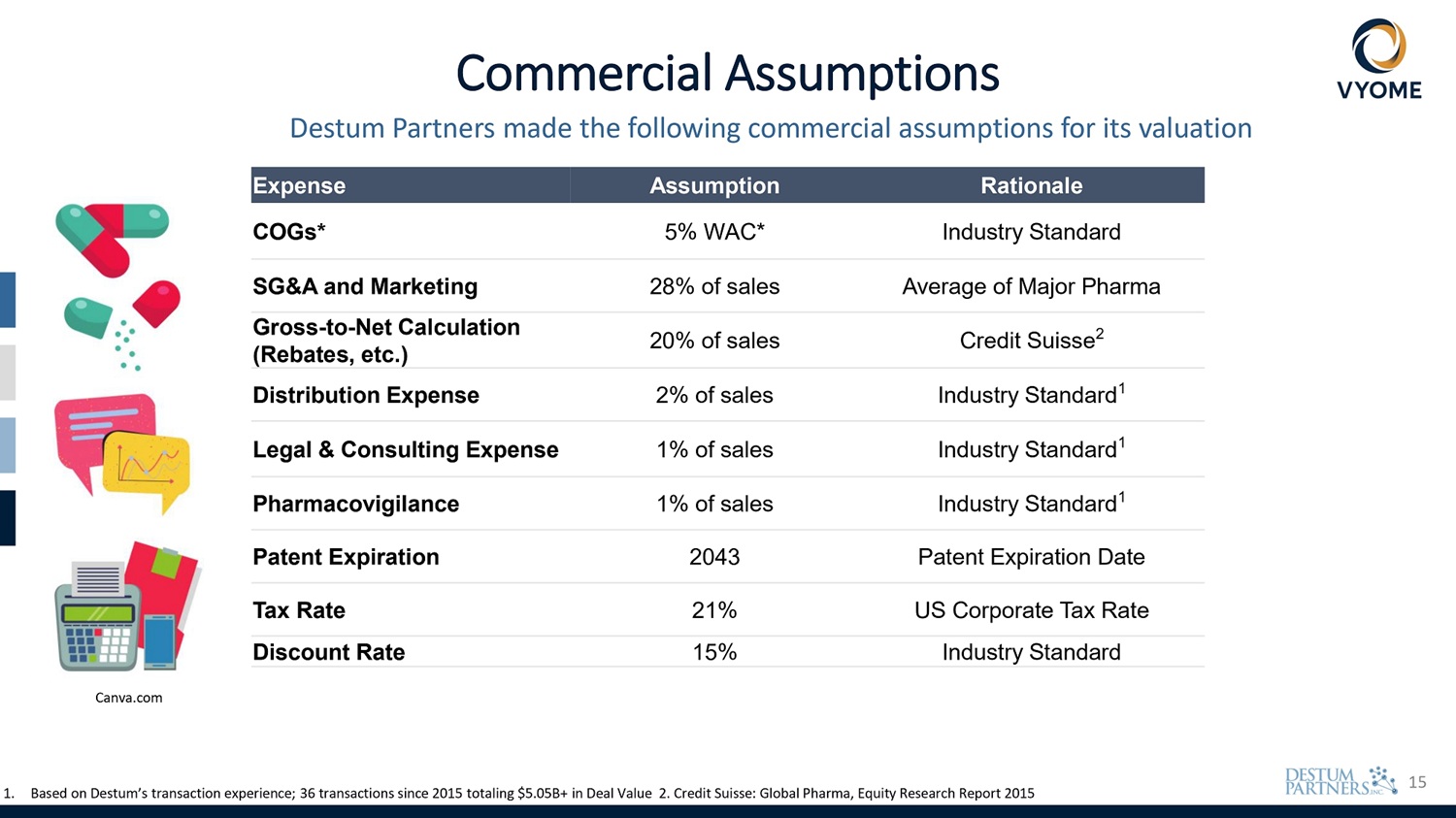

15 Commercial Assumptions Destum Partners made the following commercial assumptions for its valuation Rationale Assumption Expense Industry Standard 5% WAC* COGs* Average of Major Pharma 28% of sales SG&A and Marketing Credit Suisse 2 20% of sales Gross - to - Net Calculation (Rebates, etc.) Industry Standard 1 2% of sales Distribution Expense Industry Standard 1 1% of sales Legal & Consulting Expense Industry Standard 1 1% of sales Pharmacovigilance Patent Expiration Date 2043 Patent Expiration US Corporate Tax Rate 21% Tax Rate Industry Standard 15% Discount Rate 1. Based on Destum’s transaction experience; 36 transactions since 2015 totaling $5.05B+ in Deal Value 2. Credit Suisse: Global Pharma, Equity Research Report 2015 Canva.com

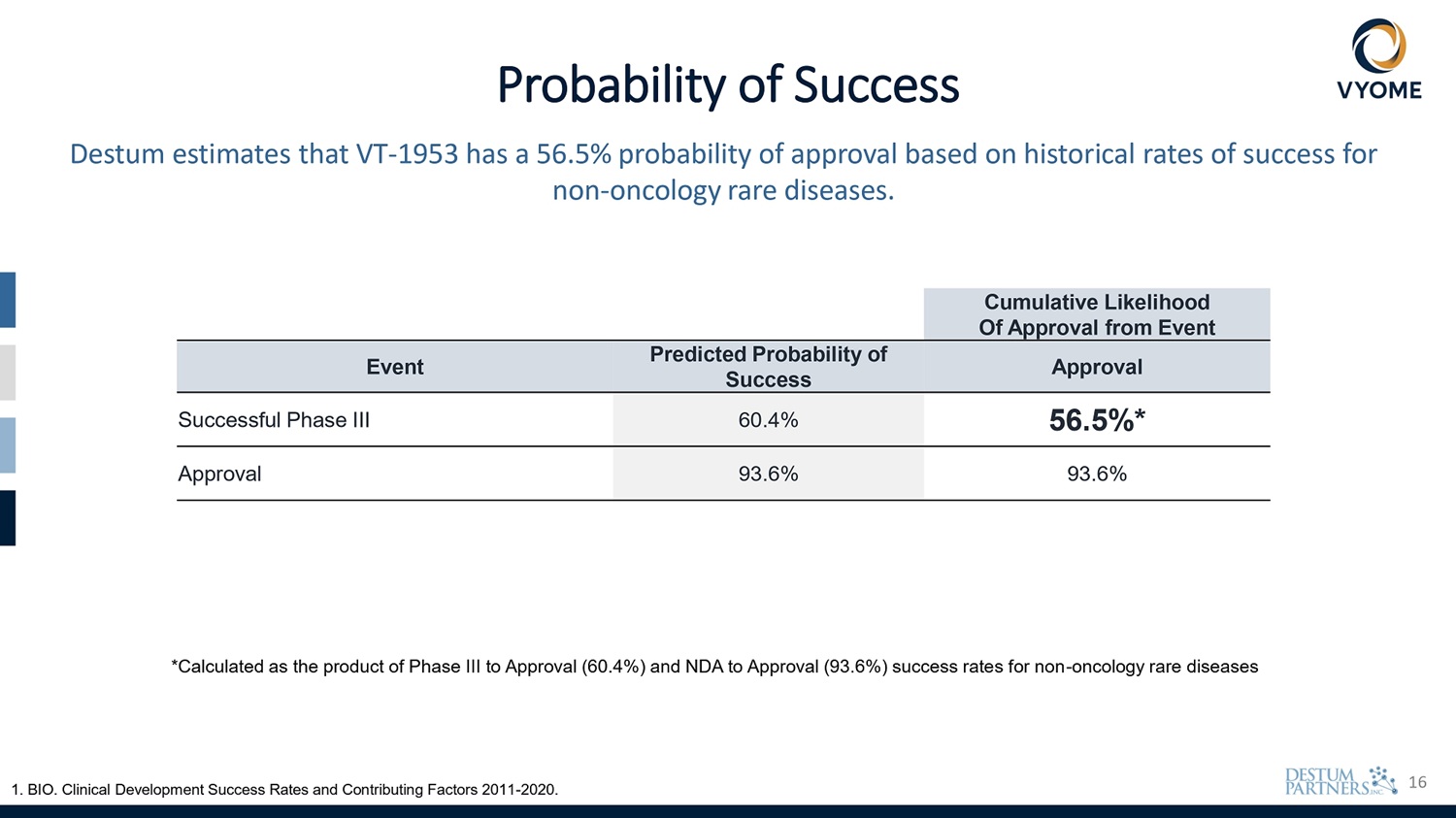

16 Probability of Success Destum estimates that VT - 1953 has a 56.5% probability of approval based on historical rates of success for non - oncology rare diseases. Cumulative Likelihood Of Approval from Event Approval Predicted Probability of Success Event 56.5%* 60.4% Successful Phase III 93.6% 93.6% Approval 1. BIO. Clinical Development Success Rates and Contributing Factors 2011 - 2020. *Calculated as the product of Phase III to Approval (60.4%) and NDA to Approval (93.6%) success rates for non - oncology rare diseases

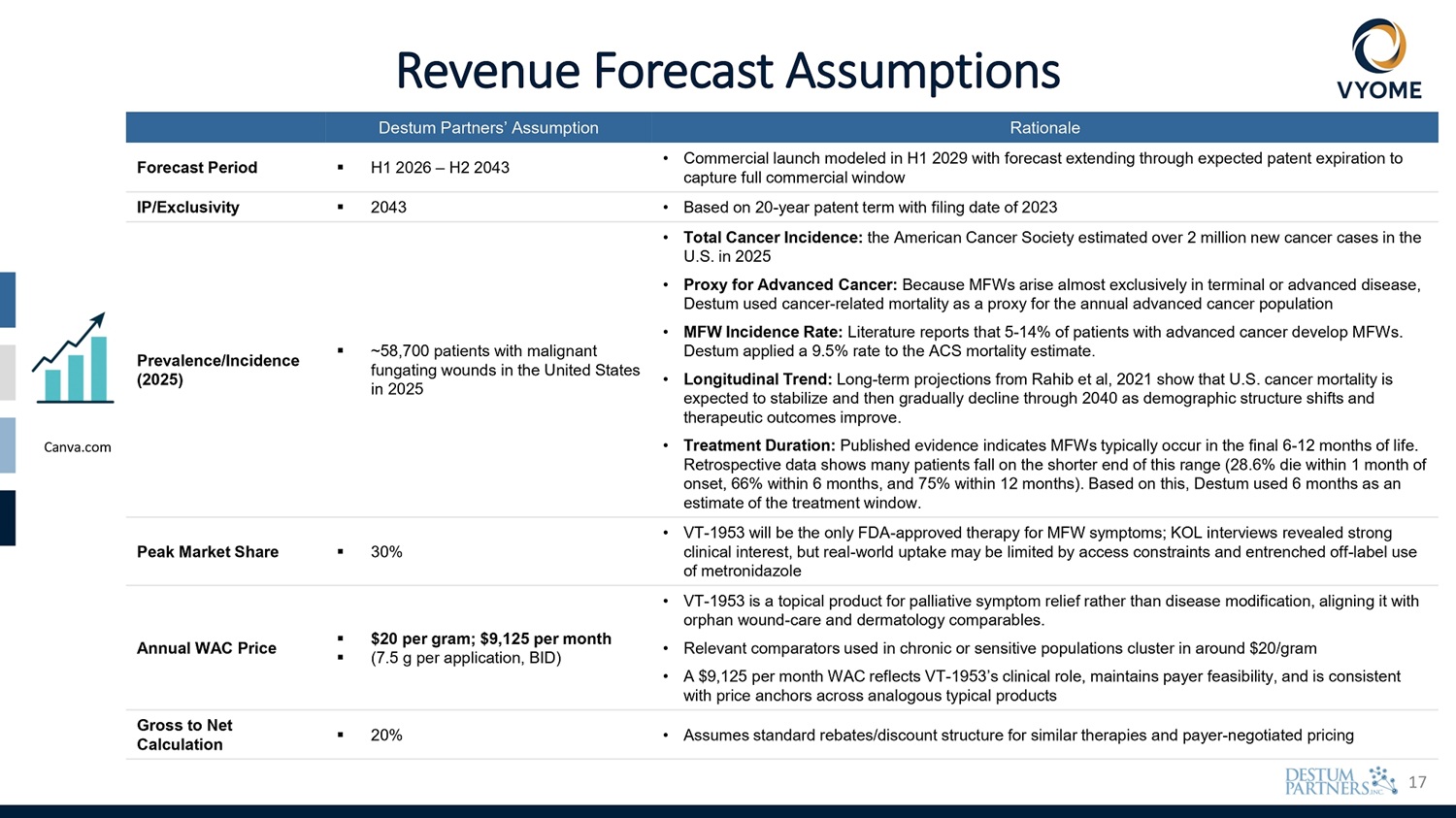

17 Revenue Forecast Assumptions Rationale Destum Partners’ Assumption • Commercial launch modeled in H1 2029 with forecast extending through expected patent expiration to capture full commercial window ▪ H1 2026 – H2 2043 Forecast Period • Based on 20 - year patent term with filing date of 2023 ▪ 2043 IP/Exclusivity • Total Cancer Incidence: the American Cancer Society estimated over 2 million new cancer cases in the U.S. in 2025 • Proxy for Advanced Cancer: Because MFWs arise almost exclusively in terminal or advanced disease, Destum used cancer - related mortality as a proxy for the annual advanced cancer population • MFW Incidence Rate: Literature reports that 5 - 14% of patients with advanced cancer develop MFWs. Destum applied a 9.5% rate to the ACS mortality estimate. • Longitudinal Trend: Long - term projections from Rahib et al, 2021 show that U.S. cancer mortality is expected to stabilize and then gradually decline through 2040 as demographic structure shifts and therapeutic outcomes improve. • Treatment Duration: Published evidence indicates MFWs typically occur in the final 6 - 12 months of life. Retrospective data shows many patients fall on the shorter end of this range (28.6% die within 1 month of onset, 66% within 6 months, and 75% within 12 months). Based on this, Destum used 6 months as an estimate of the treatment window. ▪ ~58,700 patients with malignant fungating wounds in the United States in 2025 Prevalence/Incidence (2025) • VT - 1953 will be the only FDA - approved therapy for MFW symptoms; KOL interviews revealed strong clinical interest, but real - world uptake may be limited by access constraints and entrenched off - label use of metronidazole ▪ 30% Peak Market Share • VT - 1953 is a topical product for palliative symptom relief rather than disease modification, aligning it with orphan wound - care and dermatology comparables. • Relevant comparators used in chronic or sensitive populations cluster in around $20/gram • A $9,125 per month WAC reflects VT - 1953’s clinical role, maintains payer feasibility, and is consistent with price anchors across analogous typical products ▪ $20 per gram; $9,125 per month ▪ (7.5 g per application, BID) Annual WAC Price • Assumes standard rebates/discount structure for similar therapies and payer - negotiated pricing ▪ 20% Gross to Net Calculation Canva.com

18 Table of Contents VT - 1953 for the Treatment of Symptoms of Malignant Fungating Wounds ▪ Background & Epidemiology ▪ Treatment Algorithm ▪ Competitive Landscape ▪ Total Treatable Patient Population ▪ Market Size & Potential ▪ Risk Assessments ▪ Forecast ▪ rNPV ▪ Summary

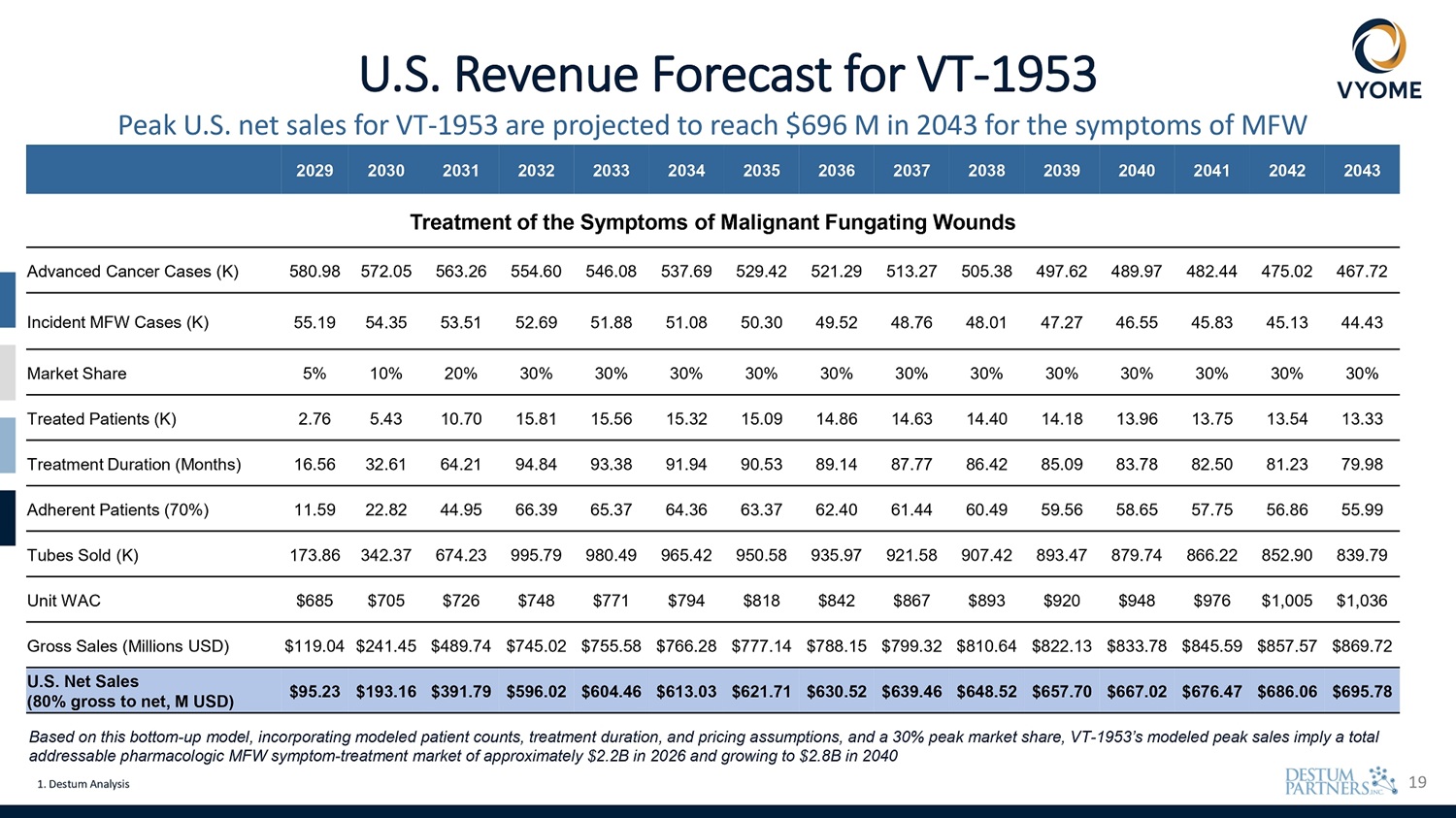

19 U.S. Revenue Forecast for VT - 1953 Peak U.S. net sales for VT - 1953 are projected to reach $696 M in 2043 for the symptoms of MFW Based on this bottom - up model, incorporating modeled patient counts, treatment duration, and pricing assumptions, and a 30% peak market share, VT - 1953’s modeled peak sales imply a total addressable pharmacologic MFW symptom - treatment market of approximately $2.2B in 2026 and growing to $2.8B in 2040 1. Destum Analysis 2043 2042 2041 2040 2039 2038 2037 2036 2035 2034 2033 2032 2031 2030 2029 Treatment of the Symptoms of Malignant Fungating Wounds 467.72 475.02 482.44 489.97 497.62 505.38 513.27 521.29 529.42 537.69 546.08 554.60 563.26 572.05 580.98 Advanced Cancer Cases (K) 44.43 45.13 45.83 46.55 47.27 48.01 48.76 49.52 50.30 51.08 51.88 52.69 53.51 54.35 55.19 Incident MFW Cases (K) 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 20% 10% 5% Market Share 13.33 13.54 13.75 13.96 14.18 14.40 14.63 14.86 15.09 15.32 15.56 15.81 10.70 5.43 2.76 Treated Patients (K) 79.98 81.23 82.50 83.78 85.09 86.42 87.77 89.14 90.53 91.94 93.38 94.84 64.21 32.61 16.56 Treatment Duration (Months) 55.99 56.86 57.75 58.65 59.56 60.49 61.44 62.40 63.37 64.36 65.37 66.39 44.95 22.82 11.59 Adherent Patients (70%) 839.79 852.90 866.22 879.74 893.47 907.42 921.58 935.97 950.58 965.42 980.49 995.79 674.23 342.37 173.86 Tubes Sold (K) $1,036 $1,005 $976 $948 $920 $893 $867 $842 $818 $794 $771 $748 $726 $705 $685 Unit WAC $869.72 $857.57 $845.59 $833.78 $822.13 $810.64 $799.32 $788.15 $777.14 $766.28 $755.58 $745.02 $489.74 $241.45 $119.04 Gross Sales (Millions USD) $695.78 $686.06 $676.47 $667.02 $657.70 $648.52 $639.46 $630.52 $621.71 $613.03 $604.46 $596.02 $391.79 $193.16 $95.23 U.S. Net Sales (80% gross to net, M USD)

20 $455 $503 $551 $602 $1,086 $1,165 $1,346 $1,420 $1,499 $1,605 $1,674 $1,700 $1,727 $400 $200 $0 $600 $1,000 $800 $1,200 $1,400 600 $1, $1,800 $2,000 H1 2026 H2 2026 H1 2027 H2 2027 H1 2028 H2 2028 H1 2029 H2 2029 Phase 3 Completion Commercial Approval H1 2030 H2 2030 H1 2031 H2 2031 H1 2032 Asset Value ($mm) VT - 1953 – Value Over Time VT - 1953 currently has a value of $455M in the United States growing to over $1B in 2028 following completion of the Phase 3 trial Near - Term Value Inflection Points The initial NPV of VT - 1953 is estimated at $455M in the United States in H1 2026 with value inflection points in H1 2028 following completion of the Phase 3 trial, and in H1 2029 upon receiving commercial approval.

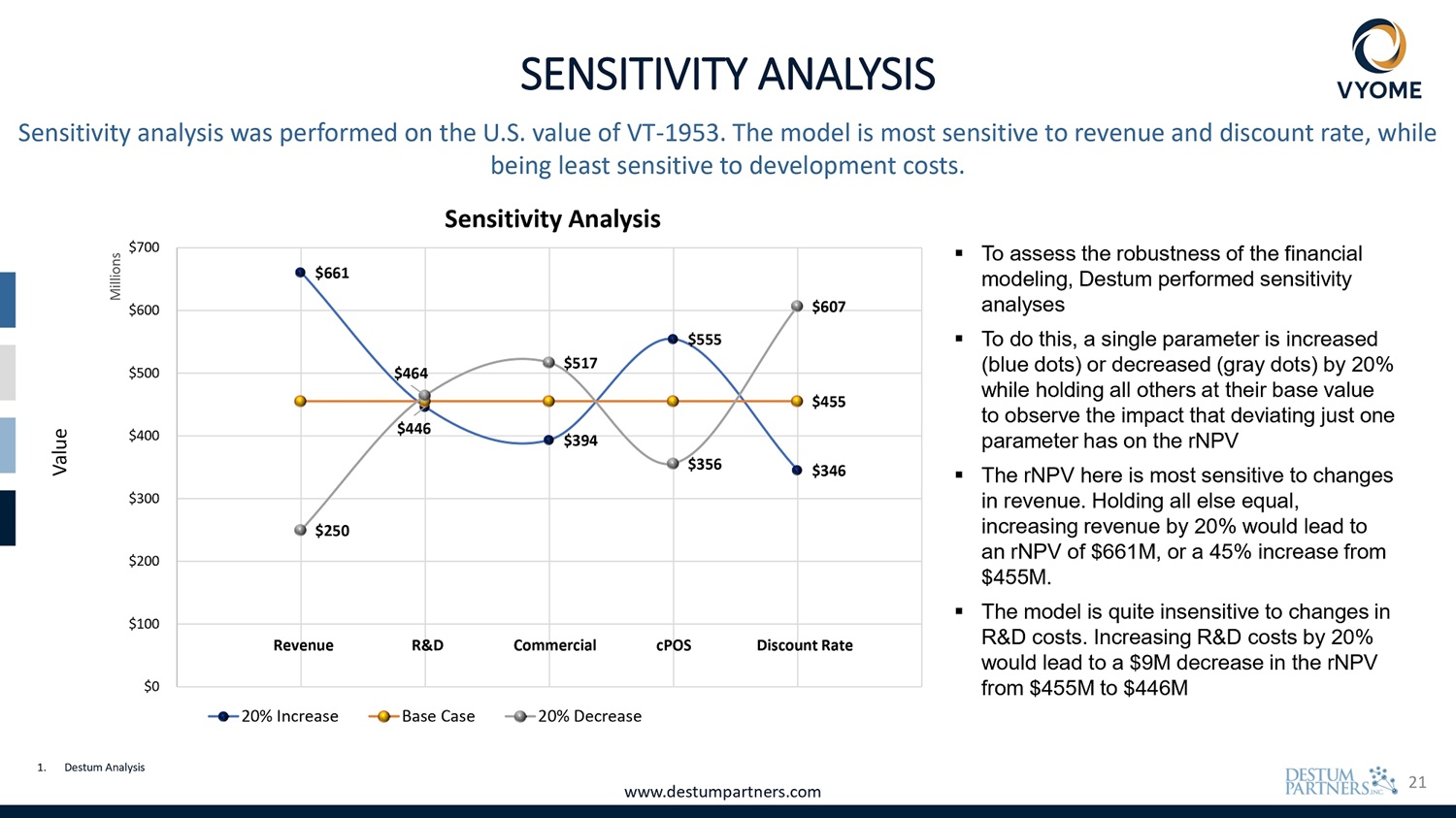

21 $607 $661 $555 $517 $464 $455 $446 $346 $356 $394 $250 unt Rate S Disco ercial cPO D Comm enue R& Rev $0 $100 $200 $300 $400 $500 $600 $700 Value Millions Sensitivity analysis was performed on the U.S. value of VT - 1953. The model is most sensitive to revenue and discount rate, while being least sensitive to development costs. Sensitivity Analysis 20% Increase Base Case 20% Decrease SENSITIVITY ANALYSIS 1. Destum Analysis www.destumpartners.com ▪ To assess the robustness of the financial modeling, Destum performed sensitivity analyses ▪ To do this, a single parameter is increased (blue dots) or decreased (gray dots) by 20% while holding all others at their base value to observe the impact that deviating just one parameter has on the rNPV ▪ The rNPV here is most sensitive to changes in revenue. Holding all else equal, increasing revenue by 20% would lead to an rNPV of $661M, or a 45% increase from $455M. ▪ The model is quite insensitive to changes in R&D costs. Increasing R&D costs by 20% would lead to a $9M decrease in the rNPV from $455M to $446M

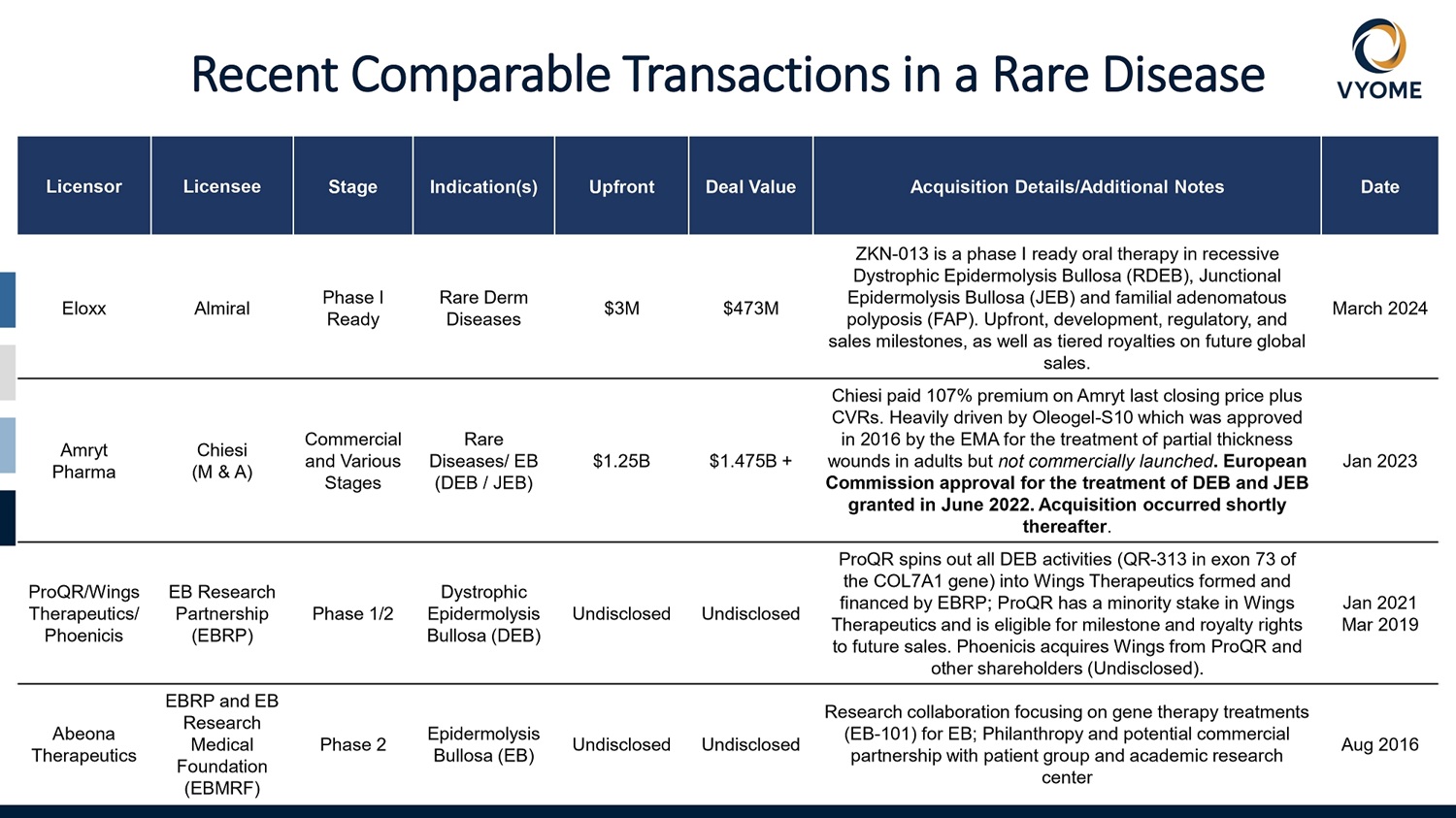

22 Date Acquisition Details/Additional Notes Deal Value Upfront Indication(s) Stage Licensee Licensor March 2024 ZKN - 013 is a phase I ready oral therapy in recessive Dystrophic Epidermolysis Bullosa (RDEB), Junctional Epidermolysis Bullosa (JEB) and familial adenomatous polyposis (FAP). Upfront, development, regulatory, and sales milestones, as well as tiered royalties on future global sales. $473M $3M Rare Derm Diseases Phase I Ready Almiral Eloxx Jan 2023 Chiesi paid 107% premium on Amryt last closing price plus CVRs. Heavily driven by Oleogel - S10 which was approved in 2016 by the EMA for the treatment of partial thickness wounds in adults but not commercially launched . European Commission approval for the treatment of DEB and JEB granted in June 2022. Acquisition occurred shortly thereafter . $1.475B + $1.25B Rare Diseases/ EB (DEB / JEB) Commercial and Various Stages Chiesi (M & A) Amryt Pharma Jan 2021 Mar 2019 ProQR spins out all DEB activities (QR - 313 in exon 73 of the COL7A1 gene) into Wings Therapeutics formed and financed by EBRP; ProQR has a minority stake in Wings Therapeutics and is eligible for milestone and royalty rights to future sales. Phoenicis acquires Wings from ProQR and other shareholders (Undisclosed). Undisclosed Undisclosed Dystrophic Epidermolysis Bullosa (DEB) Phase 1/2 EB Research Partnership (EBRP) ProQR/Wings Therapeutics/ Phoenicis Aug 2016 Research collaboration focusing on gene therapy treatments (EB - 101) for EB; Philanthropy and potential commercial partnership with patient group and academic research center Undisclosed Undisclosed Epidermolysis Bullosa (EB) Phase 2 EBRP and EB Research Medical Foundation (EBMRF) Abeona Therapeutics Recent Comparable Transactions in a Rare Disease

23 Table of Contents VT - 1953 for the Treatment of Symptoms of Malignant Fungating Wounds ▪ Background & Epidemiology ▪ Treatment Algorithm ▪ Competitive Landscape ▪ Total Treatable Patient Population ▪ Market Size & Potential ▪ Risk Assessments ▪ Forecast ▪ rNPV ▪ Summary

24 $455 $503 $551 $602 $1,086 $1,165 $1,346 $1,420 $1,499 $1,605 $1,674 $1,700 $1,727 $400 $200 $0 $600 $1,000 $800 $1,200 $1,400 600 $1, $1,800 $2,000 H1 2026 H2 2026 H1 2027 H2 2027 H1 2028 H2 2028 H1 2029 H2 2029 Phase 3 Completion Commercial Approval H1 2030 H2 2030 H1 2031 H2 2031 H1 2032 Asset Value ($mm) VT - 1953 – Value Over Time VT - 1953 currently has a value of $455M in the United States growing to over $1B in 2028 following completion of the Phase 3 trial Near - Term Value Inflection Points The initial NPV of VT - 1953 is estimated at $455M in the United States in H1 2026 with value inflection points in H1 2028 following completion of the Phase 3 trial, and in H1 2029 upon receiving commercial approval.

25 Summary Unmet Need • Malignant fungating wounds (MFWs) are a rare but devastating complication of advanced solid tumors, occurring predominantly in the final 6 - 12 months of life and associated with severe malodor, pain, exudate, bleeding, and psychosocial distress • Management is palliative and symptom - focused; no therapies address underlying inflammatory and microbial drivers of MFW symptoms, and wounds rarely heal • Patients and caregivers face high burden of care, frequent dressing changes, and social isolation, underscoring a significant unmet need in oncology wound care Market Landscape and Dynamics • There are no FDA - approved therapies indicated for the symptoms of malignant fungating wounds • Current management relies on fragmented, off - label interventions, each address individual symptoms with variable and incomplete effectiveness with difficulty to administer by clinicians, patients, and caregivers • Review of development pipelines did not identify any approved or late - stage investigational therapies targeting MFW symptoms VT - 1953 Market Positioning • VT - 1953 has the potential to be a first - in - class, indication - specific therapy for MFW symptom management • By targeting key inflammatory and microbial contributors to malodor and pain, VT - 1953 is designed to address multiple core symptoms with a single topical therapy • VT - 1953 is expected to complement and replace much of the off - label approaches to MFW symptom treatment • Pricing and access considerations are expected to meaningfully influence uptake, with KOLs highlighting the importance of affordability for their patients Program Value • Despite a relatively small patient population, the absence of direct therapeutic competition and high unmet need support meaningful clinical and commercial value • The base - case valuation of VT - 1953 by rNPV methodology is $455M in the United States as of as of Phase 2 completion and will grow to $1.086B H1 2028 following completion of the Phase 3 study • Based on Destum’s bottom - up model, incorporating modeled patient counts, treatment duration, and pricing assumptions, and a 30% peak market share, VT - 1953’s modeled peak sales imply a total addressable pharmacologic MFW symptom - treatment market of approximately $2.2B in 2026 and growing to $2.8B in 2040 in the United States • An optimal partner for VT - 1953 would have capabilities in oncology supportive or wound care, access to oncology, palliative, and hospice settings, and the ability to enable efficient market access and adoption for a novel therapy in this space (i.e., BMS, Pierre Fabre, Servier, Almirall, Helsinn, Horizon (Amgen), and Recordati Rare Disease to name a few) • Despite significant research, limited comparable transactions with publicly disclosed terms were identified

26 Thank You Tom Filipczak Managing Director and Partner tfilipczak@destumpartners.com Ryan Zahn, MSPH MBA Senior Associate rzahn@destumpartners.com Kate Hutchinson, Ph.D. Associate khutchinson@destumpartners.com www.destumpartners.com