Fiscal Year 2026 Third Quarter Results February 3, 2026

2Hamilton Lane | Global Leader in the Private Markets Today's Speakers Erik Hirsch Co-CEO Jeff Armbrister Chief Financial Officer John Oh Head of Shareholder Relations

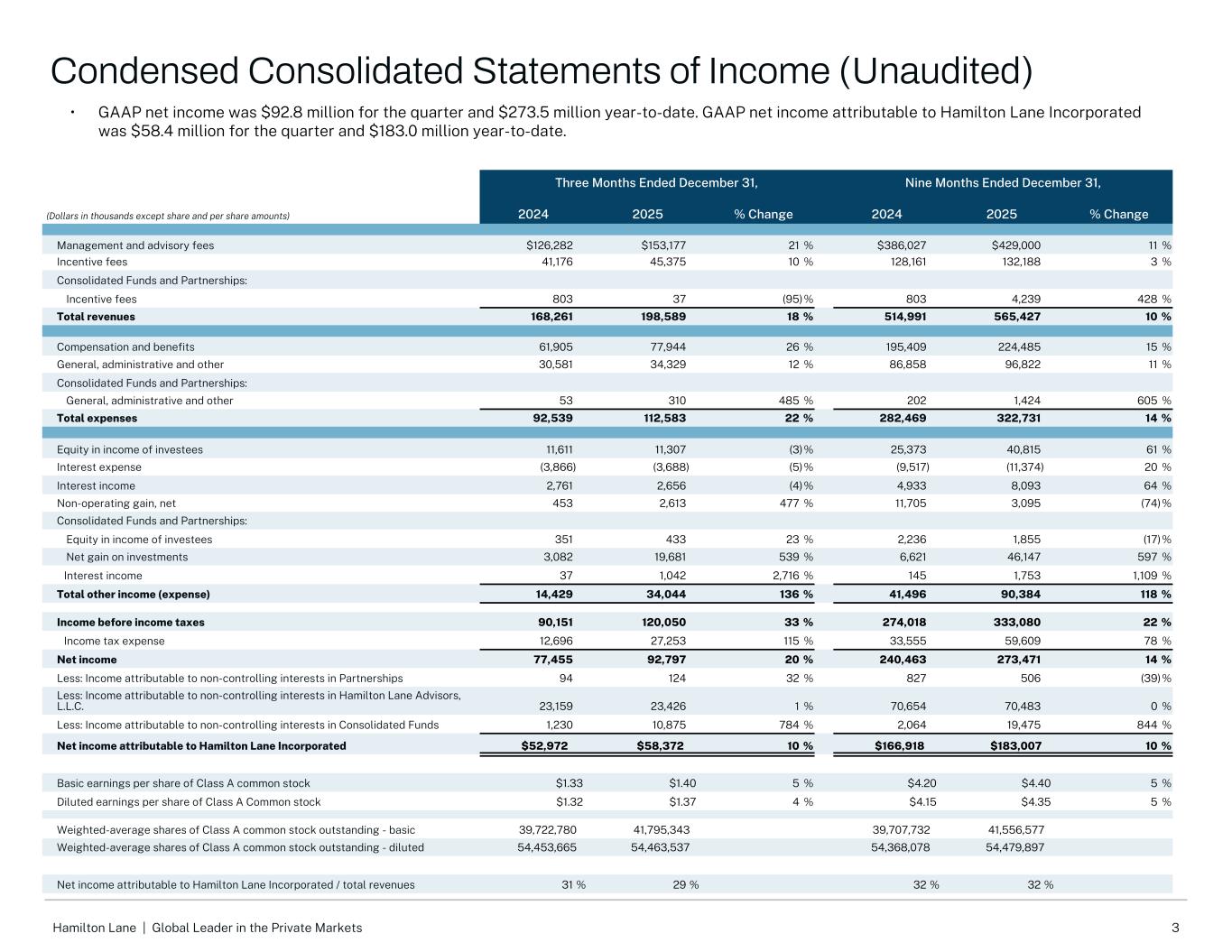

3Hamilton Lane | Global Leader in the Private Markets Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands except share and per share amounts) 2024 2025 % Change 2024 2025 % Change Management and advisory fees $126,282 $153,177 21 % $386,027 $429,000 11 % Incentive fees 41,176 45,375 10 % 128,161 132,188 3 % Consolidated Funds and Partnerships: Incentive fees 803 37 (95) % 803 4,239 428 % Total revenues 168,261 198,589 18 % 514,991 565,427 10 % Compensation and benefits 61,905 77,944 26 % 195,409 224,485 15 % General, administrative and other 30,581 34,329 12 % 86,858 96,822 11 % Consolidated Funds and Partnerships: General, administrative and other 53 310 485 % 202 1,424 605 % Total expenses 92,539 112,583 22 % 282,469 322,731 14 % Equity in income of investees 11,611 11,307 (3) % 25,373 40,815 61 % Interest expense (3,866) (3,688) (5) % (9,517) (11,374) 20 % Interest income 2,761 2,656 (4) % 4,933 8,093 64 % Non-operating gain, net 453 2,613 477 % 11,705 3,095 (74) % Consolidated Funds and Partnerships: Equity in income of investees 351 433 23 % 2,236 1,855 (17) % Net gain on investments 3,082 19,681 539 % 6,621 46,147 597 % Interest income 37 1,042 2,716 % 145 1,753 1,109 % Total other income (expense) 14,429 34,044 136 % 41,496 90,384 118 % Income before income taxes 90,151 120,050 33 % 274,018 333,080 22 % Income tax expense 12,696 27,253 115 % 33,555 59,609 78 % Net income 77,455 92,797 20 % 240,463 273,471 14 % Less: Income attributable to non-controlling interests in Partnerships 94 124 32 % 827 506 (39) % Less: Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 23,159 23,426 1 % 70,654 70,483 0 % Less: Income attributable to non-controlling interests in Consolidated Funds 1,230 10,875 784 % 2,064 19,475 844 % Net income attributable to Hamilton Lane Incorporated $52,972 $58,372 10 % $166,918 $183,007 10 % Basic earnings per share of Class A common stock $1.33 $1.40 5 % $4.20 $4.40 5 % Diluted earnings per share of Class A Common stock $1.32 $1.37 4 % $4.15 $4.35 5 % Weighted-average shares of Class A common stock outstanding - basic 39,722,780 41,795,343 39,707,732 41,556,577 Weighted-average shares of Class A common stock outstanding - diluted 54,453,665 54,463,537 54,368,078 54,479,897 Net income attributable to Hamilton Lane Incorporated / total revenues 31 % 29 % 32 % 32 % Condensed Consolidated Statements of Income (Unaudited) • GAAP net income was $92.8 million for the quarter and $273.5 million year-to-date. GAAP net income attributable to Hamilton Lane Incorporated was $58.4 million for the quarter and $183.0 million year-to-date.

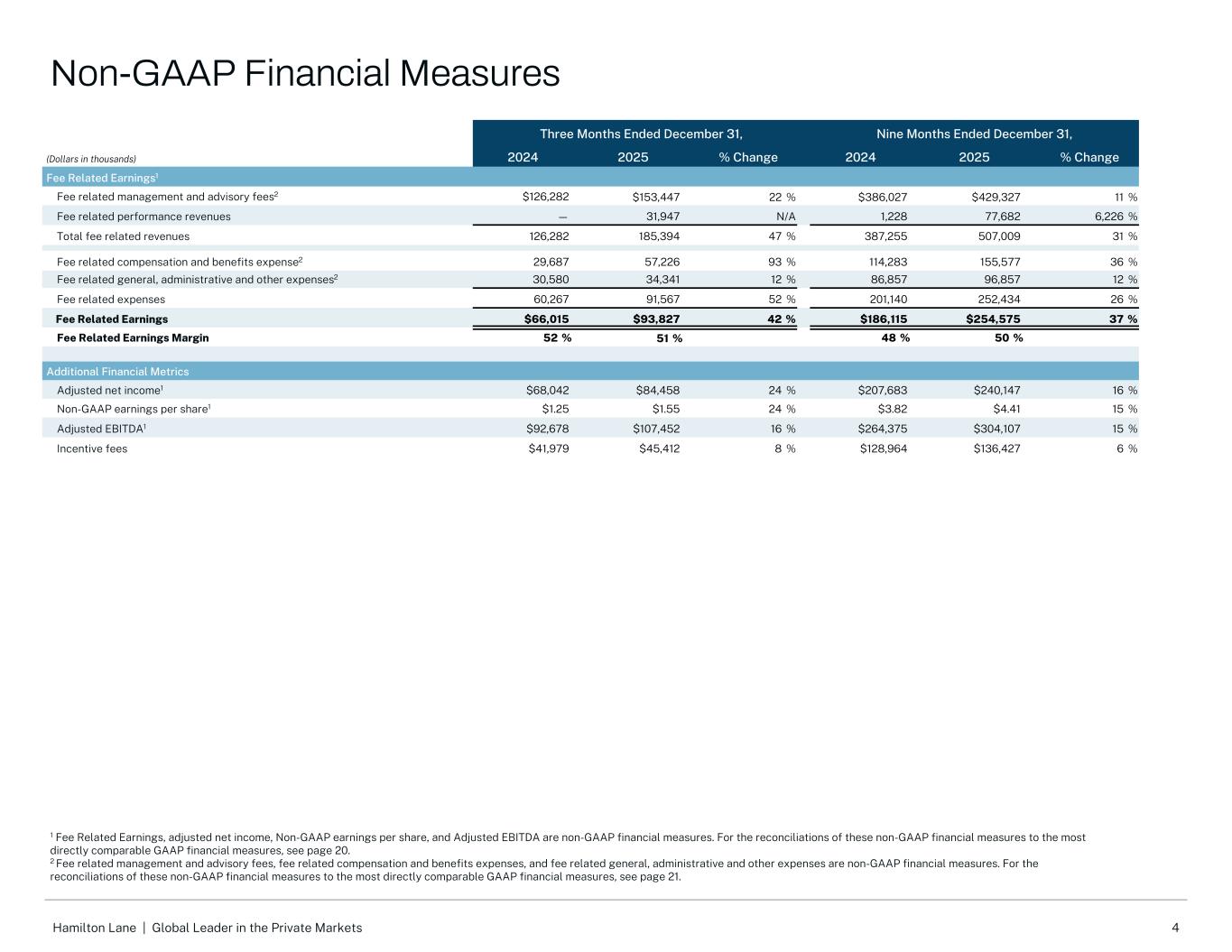

4Hamilton Lane | Global Leader in the Private Markets 1 Fee Related Earnings, adjusted net income, Non-GAAP earnings per share, and Adjusted EBITDA are non-GAAP financial measures. For the reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see page 20. 2 Fee related management and advisory fees, fee related compensation and benefits expenses, and fee related general, administrative and other expenses are non-GAAP financial measures. For the reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see page 21. Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands) 2024 2025 % Change 2024 2025 % Change Fee Related Earnings1 Fee related management and advisory fees2 $126,282 $153,447 22 % $386,027 $429,327 11 % Fee related performance revenues — 31,947 N/A 1,228 77,682 6,226 % Total fee related revenues 126,282 185,394 47 % 387,255 507,009 31 % Fee related compensation and benefits expense2 29,687 57,226 93 % 114,283 155,577 36 % Fee related general, administrative and other expenses2 30,580 34,341 12 % 86,857 96,857 12 % Fee related expenses 60,267 91,567 52 % 201,140 252,434 26 % Fee Related Earnings $66,015 $93,827 42 % $186,115 $254,575 37 % Fee Related Earnings Margin 52 % 51 % 48 % 50 % Additional Financial Metrics Adjusted net income1 $68,042 $84,458 24 % $207,683 $240,147 16 % Non-GAAP earnings per share1 $1.25 $1.55 24 % $3.82 $4.41 15 % Adjusted EBITDA1 $92,678 $107,452 16 % $264,375 $304,107 15 % Incentive fees $41,979 $45,412 8 % $128,964 $136,427 6 % Non-GAAP Financial Measures

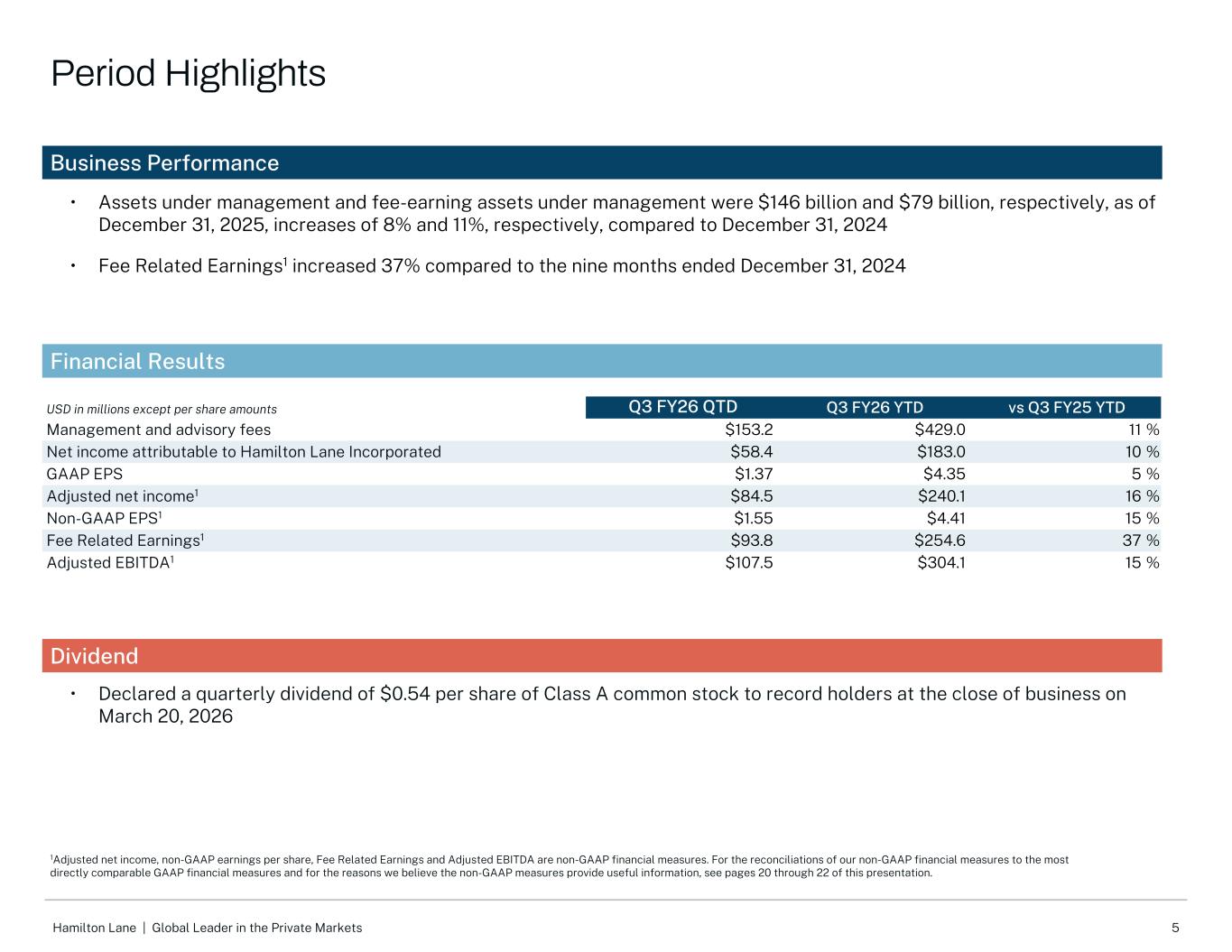

5Hamilton Lane | Global Leader in the Private Markets Business Performance Financial Results Dividend • Assets under management and fee-earning assets under management were $146 billion and $79 billion, respectively, as of December 31, 2025, increases of 8% and 11%, respectively, compared to December 31, 2024 • Fee Related Earnings1 increased 37% compared to the nine months ended December 31, 2024 USD in millions except per share amounts Q3 FY26 QTD Q3 FY26 YTD vs Q3 FY25 YTD Management and advisory fees $153.2 $429.0 11 % Net income attributable to Hamilton Lane Incorporated $58.4 $183.0 10 % GAAP EPS $1.37 $4.35 5 % Adjusted net income1 $84.5 $240.1 16 % Non-GAAP EPS1 $1.55 $4.41 15 % Fee Related Earnings1 $93.8 $254.6 37 % Adjusted EBITDA1 $107.5 $304.1 15 % • Declared a quarterly dividend of $0.54 per share of Class A common stock to record holders at the close of business on March 20, 2026 1Adjusted net income, non-GAAP earnings per share, Fee Related Earnings and Adjusted EBITDA are non-GAAP financial measures. For the reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see pages 20 through 22 of this presentation. Period Highlights

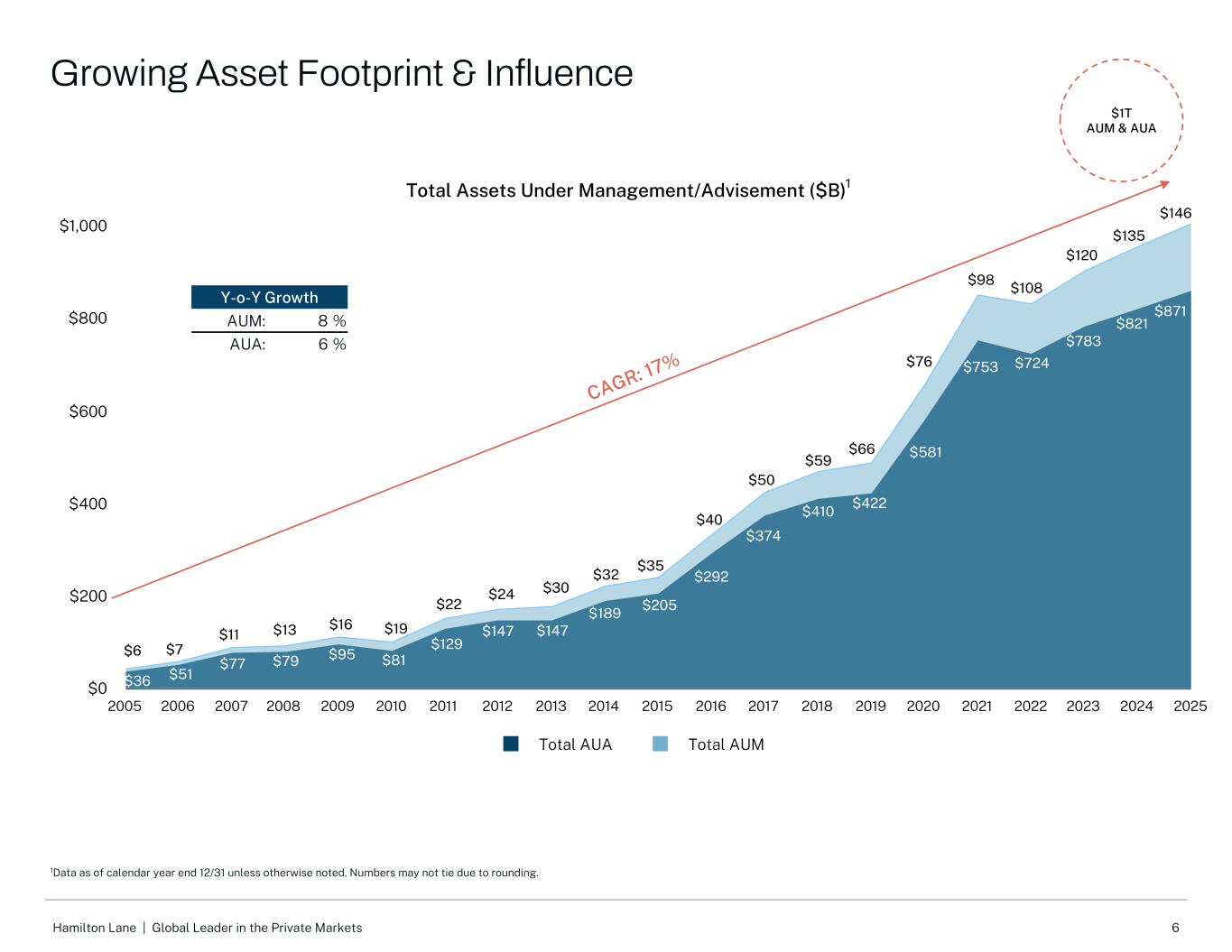

6Hamilton Lane | Global Leader in the Private Markets Total Assets Under Management/Advisement ($B) Total AUA Total AUM 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 $0 $200 $400 $600 $800 $1,000 Y-o-Y Growth AUM: 8 % AUA: 6 % $1T AUM & AUA 1 CAGR: 17% $6 $7 $11 $13 $16 $19 $22 $24 $30 $32 $35 $40 $50 $59 $66 $76 $98 $108 $36 $51 $77 $79 $95 $81 $129 $147 $147 $189 $205 $292 $374 $410 $422 $581 $753 $724 $783 $120 Growing Asset Footprint & Influence 1Data as of calendar year end 12/31 unless otherwise noted. Numbers may not tie due to rounding. $146 $871 $821 $135

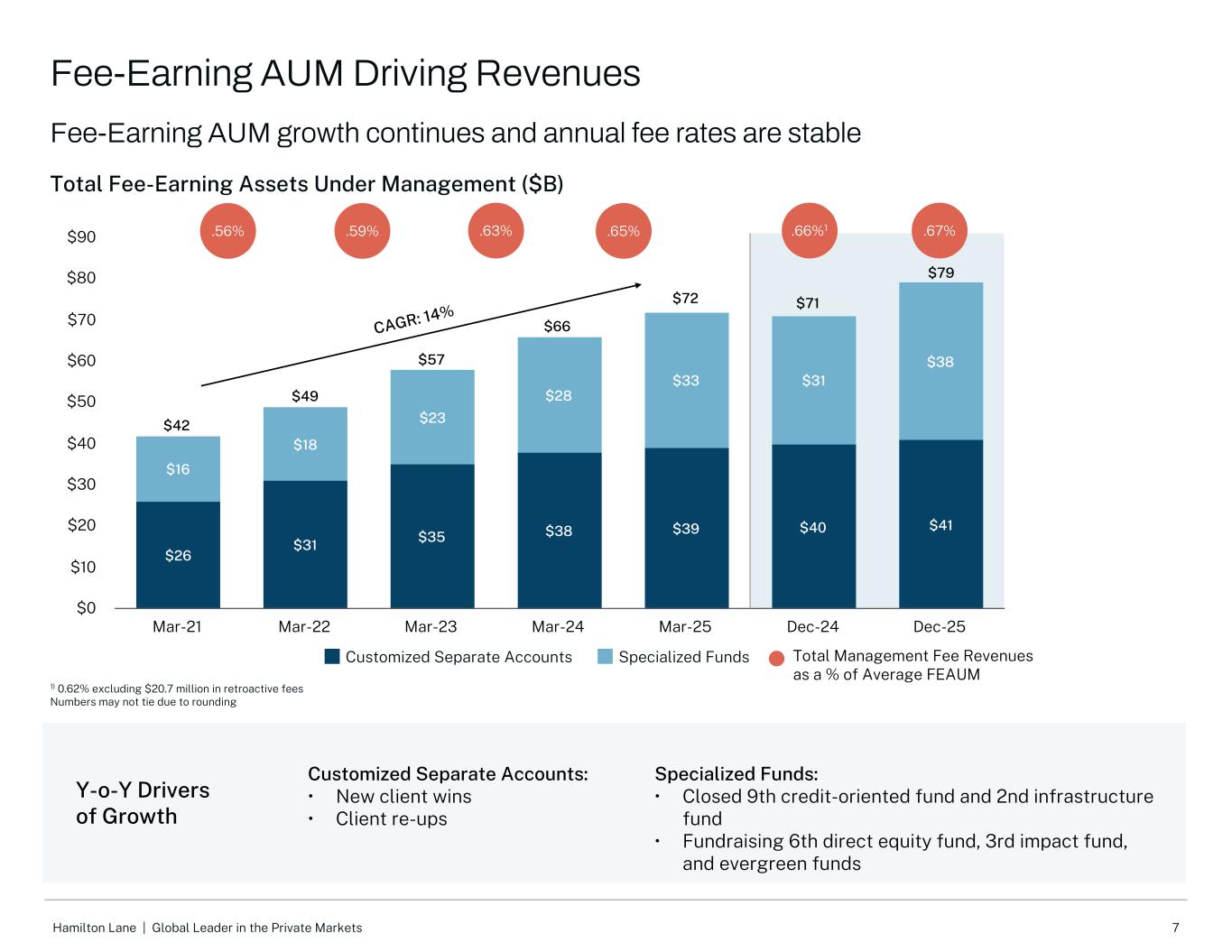

7Hamilton Lane | Global Leader in the Private Markets Y-o-Y Drivers of Growth Total Fee-Earning Assets Under Management ($B) $26 $31 $35 $38 $39 $40 $41 $16 $18 $23 $28 $33 $31 $38 Customized Separate Accounts Specialized Funds Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Dec-24 Dec-25 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 Fee-Earning AUM growth continues and annual fee rates are stable CAGR: 14% Total Management Fee Revenues as a % of Average FEAUM Customized Separate Accounts: • New client wins • Client re-ups Specialized Funds: • Closed 9th credit-oriented fund and 2nd infrastructure fund • Fundraising 6th direct equity fund, 3rd impact fund, and evergreen funds .56% $57 $71$72 $42 $49 $66 $79 Fee-Earning AUM Driving Revenues .59% .63% .65% .66%1 .67% 1) 0.62% excluding $20.7 million in retroactive fees Numbers may not tie due to rounding

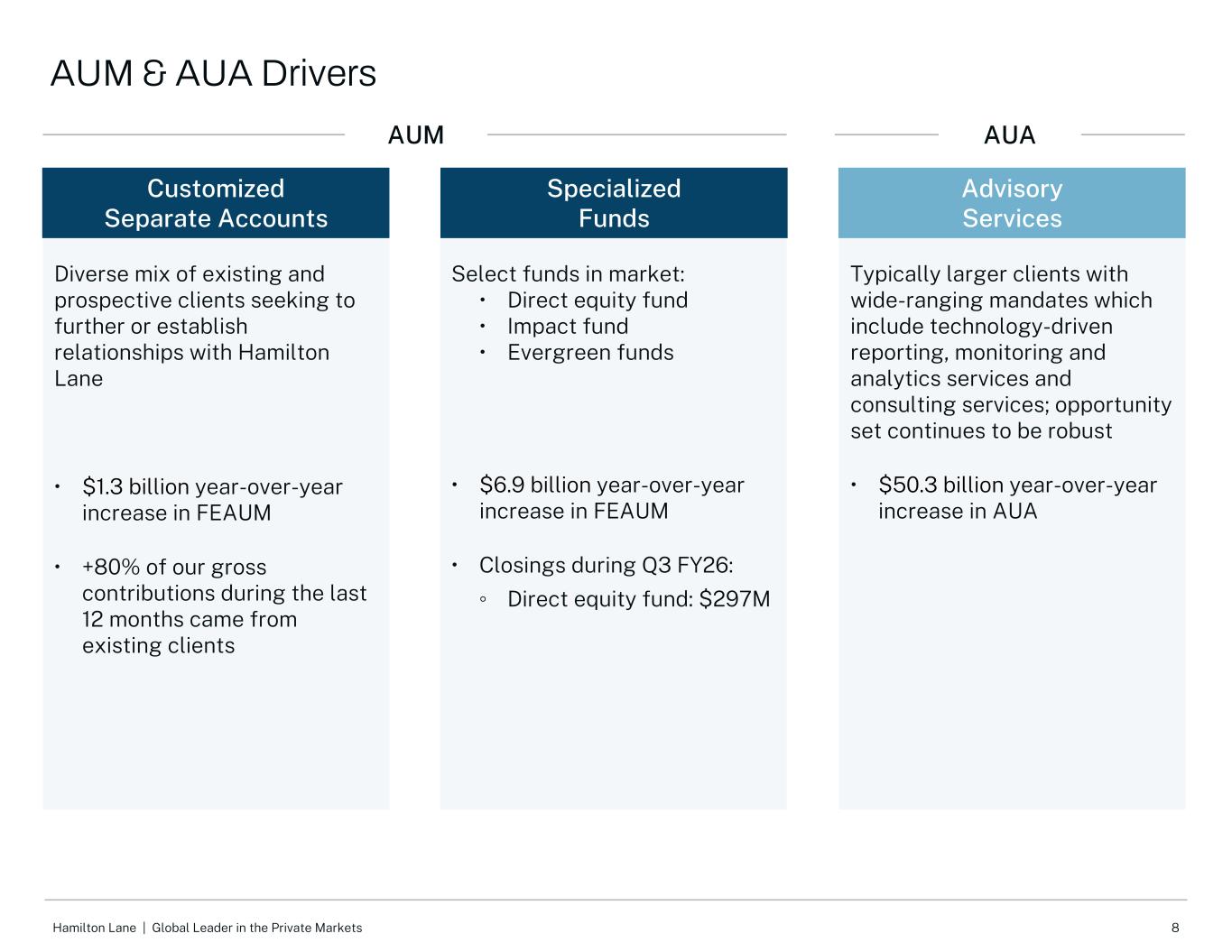

8Hamilton Lane | Global Leader in the Private Markets Customized Separate Accounts Specialized Funds Advisory Services Diverse mix of existing and prospective clients seeking to further or establish relationships with Hamilton Lane • $1.3 billion year-over-year increase in FEAUM • +80% of our gross contributions during the last 12 months came from existing clients AUM AUM & AUA Drivers AUA Select funds in market: • Direct equity fund • Impact fund • Evergreen funds • $6.9 billion year-over-year increase in FEAUM • Closings during Q3 FY26: ◦ Direct equity fund: $297M Typically larger clients with wide-ranging mandates which include technology-driven reporting, monitoring and analytics services and consulting services; opportunity set continues to be robust • $50.3 billion year-over-year increase in AUA

Financial Highlights

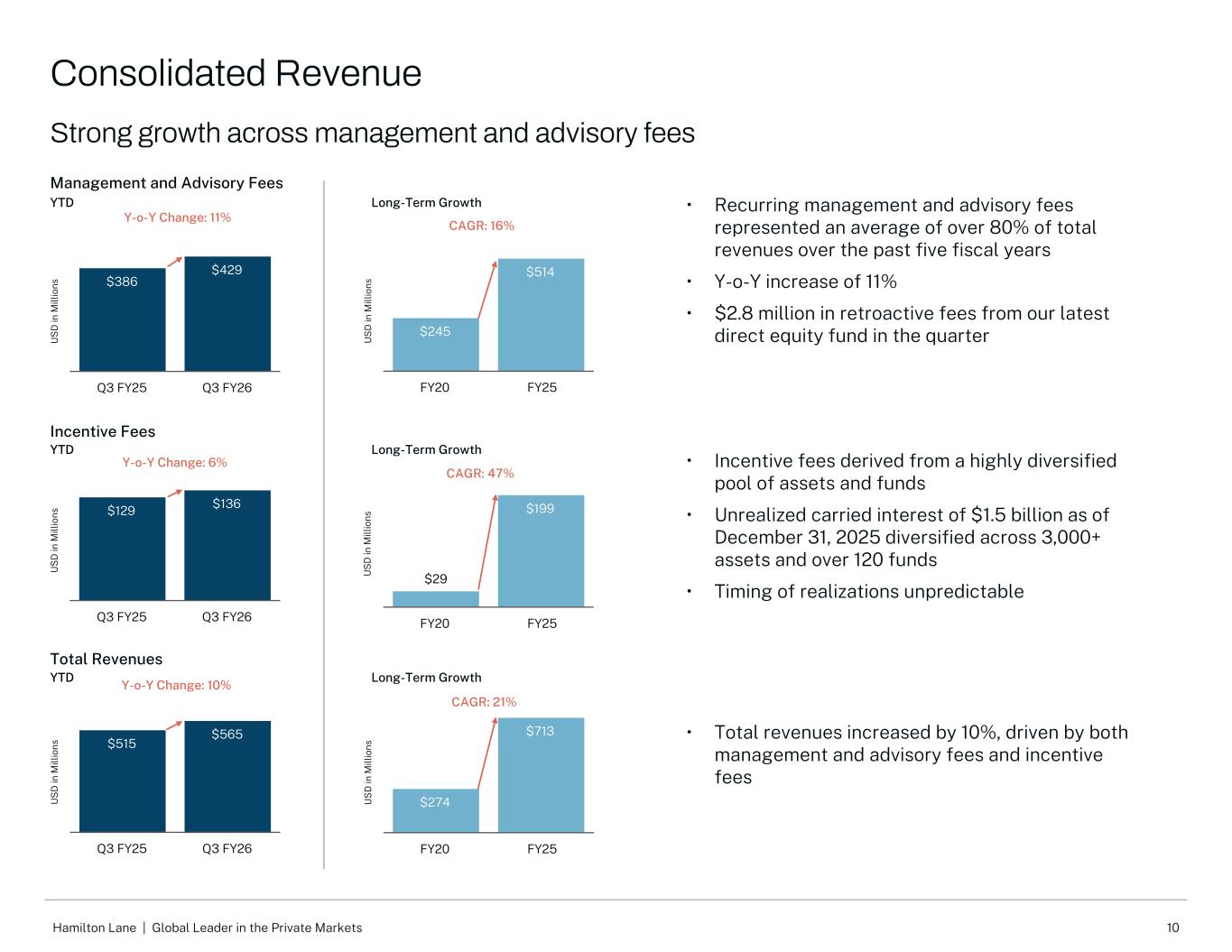

10Hamilton Lane | Global Leader in the Private Markets U S D in M ill io ns $515 $565 Q3 FY25 Q3 FY26 U S D in M ill io ns $129 $136 Q3 FY25 Q3 FY26 U S D in M ill io ns $386 $429 Q3 FY25 Q3 FY26 Management and Advisory Fees Incentive Fees Total Revenues YTD YTD Y-o-Y Change: 11% YTD Y-o-Y Change: 10% Y-o-Y Change: 6% • Recurring management and advisory fees represented an average of over 80% of total revenues over the past five fiscal years • Y-o-Y increase of 11% • $2.8 million in retroactive fees from our latest direct equity fund in the quarter • Incentive fees derived from a highly diversified pool of assets and funds • Unrealized carried interest of $1.5 billion as of December 31, 2025 diversified across 3,000+ assets and over 120 funds • Timing of realizations unpredictable • Total revenues increased by 10%, driven by both management and advisory fees and incentive fees Consolidated Revenue Strong growth across management and advisory fees U S D in M ill io ns $245 $514 FY20 FY25 Long-Term Growth U S D in M ill io ns $29 $199 FY20 FY25 Long-Term Growth CAGR: 16% U S D in M ill io ns $274 $713 FY20 FY25 Long-Term Growth CAGR: 21% CAGR: 47%

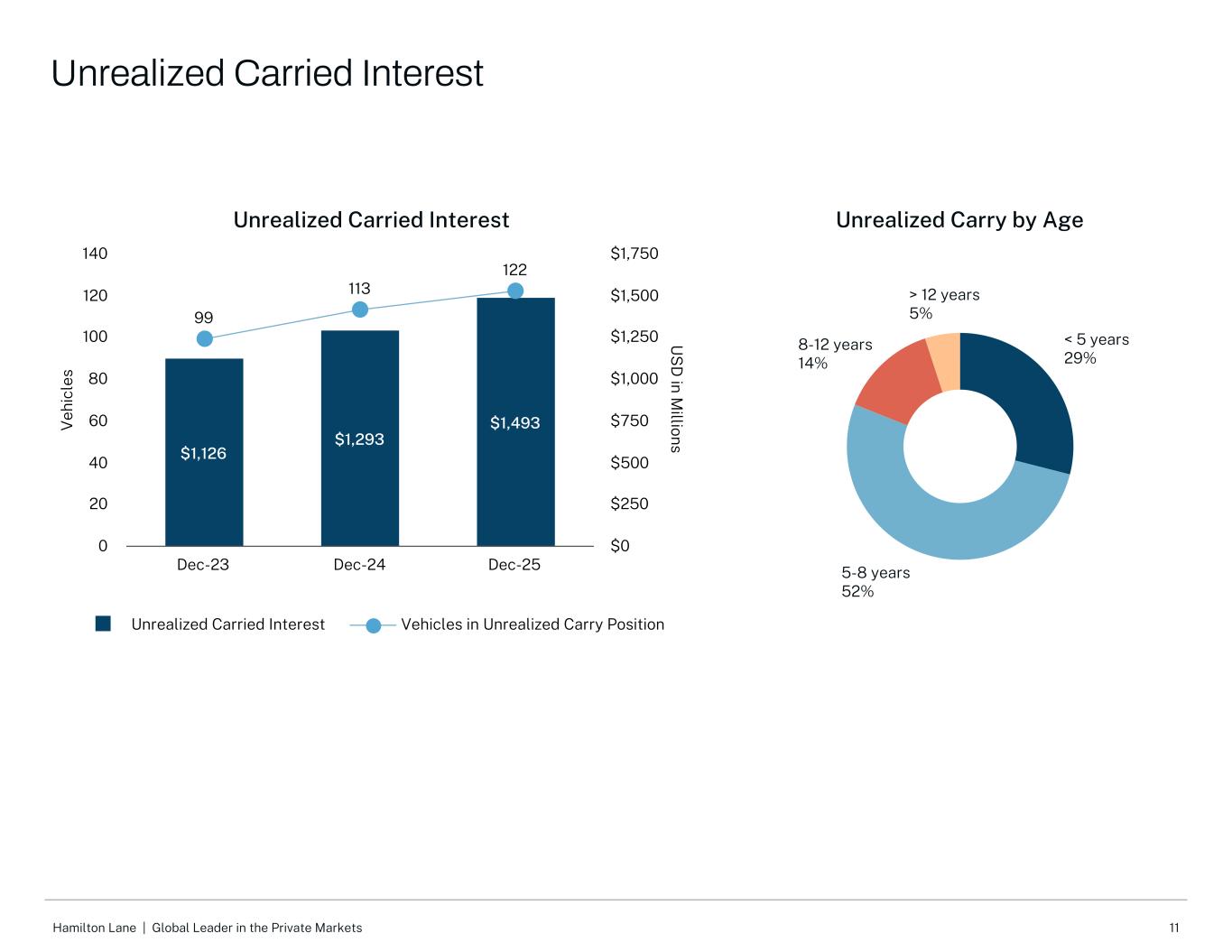

11Hamilton Lane | Global Leader in the Private Markets Period Ending V eh ic le s U S D in M illions Unrealized Carried Interest $1,126 $1,293 $1,493 99 113 122 Unrealized Carried Interest Vehicles in Unrealized Carry Position Dec-23 Dec-24 Dec-25 0 20 40 60 80 100 120 140 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 Unrealized Carry by Age < 5 years 29% 5-8 years 52% 8-12 years 14% > 12 years 5% Unrealized Carried Interest

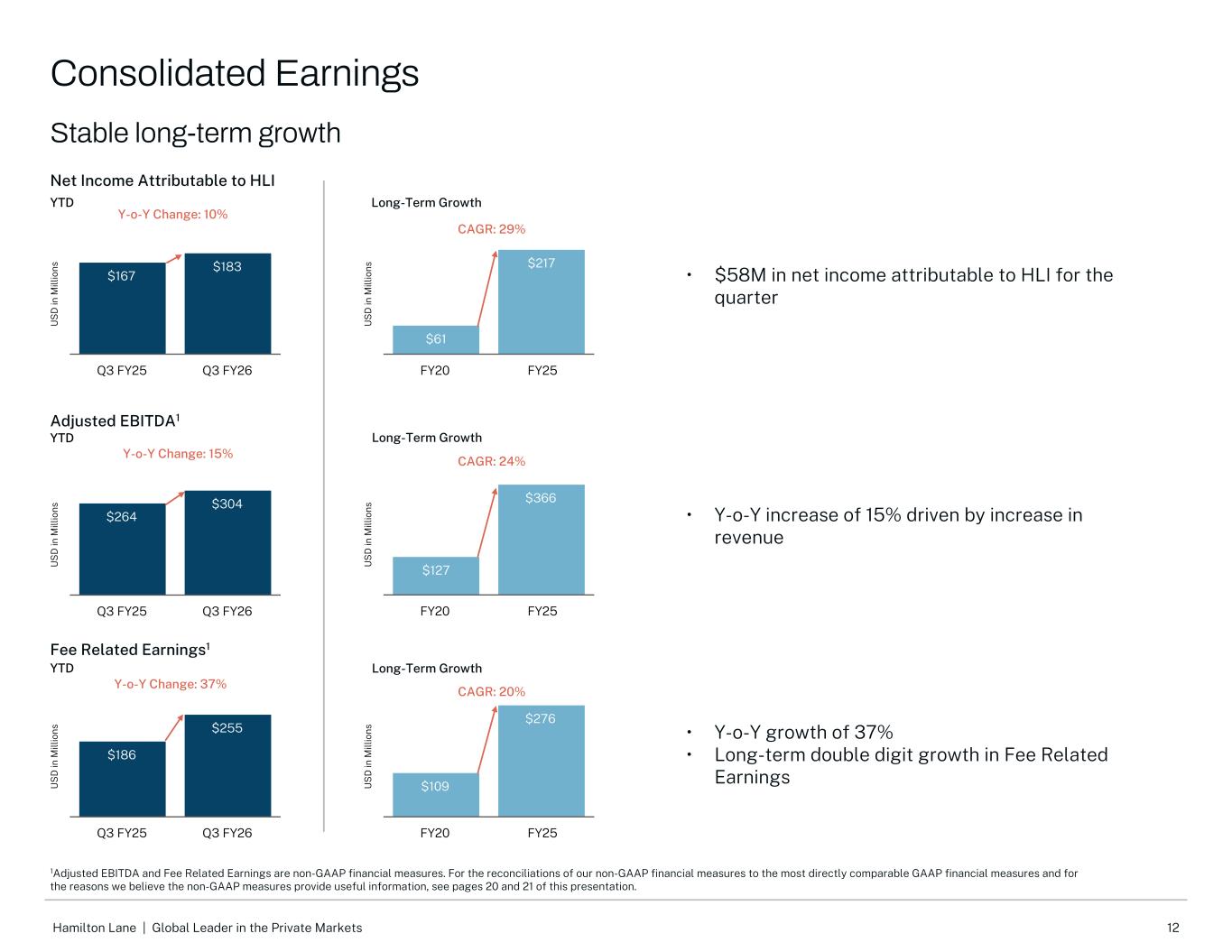

12Hamilton Lane | Global Leader in the Private Markets Net Income Attributable to HLI Adjusted EBITDA1 Fee Related Earnings1 U S D in M ill io ns $264 $304 Q3 FY25 Q3 FY26 U S D in M ill io ns $167 $183 Q3 FY25 Q3 FY26 U S D in M ill io ns $186 $255 Q3 FY25 Q3 FY26 Y-o-Y Change: 10% 1Adjusted EBITDA and Fee Related Earnings are non-GAAP financial measures. For the reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see pages 20 and 21 of this presentation. Y-o-Y Change: 15% Y-o-Y Change: 37% Consolidated Earnings Stable long-term growth YTD YTD YTD • $58M in net income attributable to HLI for the quarter • Y-o-Y increase of 15% driven by increase in revenue • Y-o-Y growth of 37% • Long-term double digit growth in Fee Related Earnings U S D in M ill io ns $61 $217 FY20 FY25 U S D in M ill io ns $127 $366 FY20 FY25 U S D in M ill io ns $109 $276 FY20 FY25 CAGR: 20% CAGR: 24% Long-Term Growth Long-Term Growth Long-Term Growth CAGR: 29%

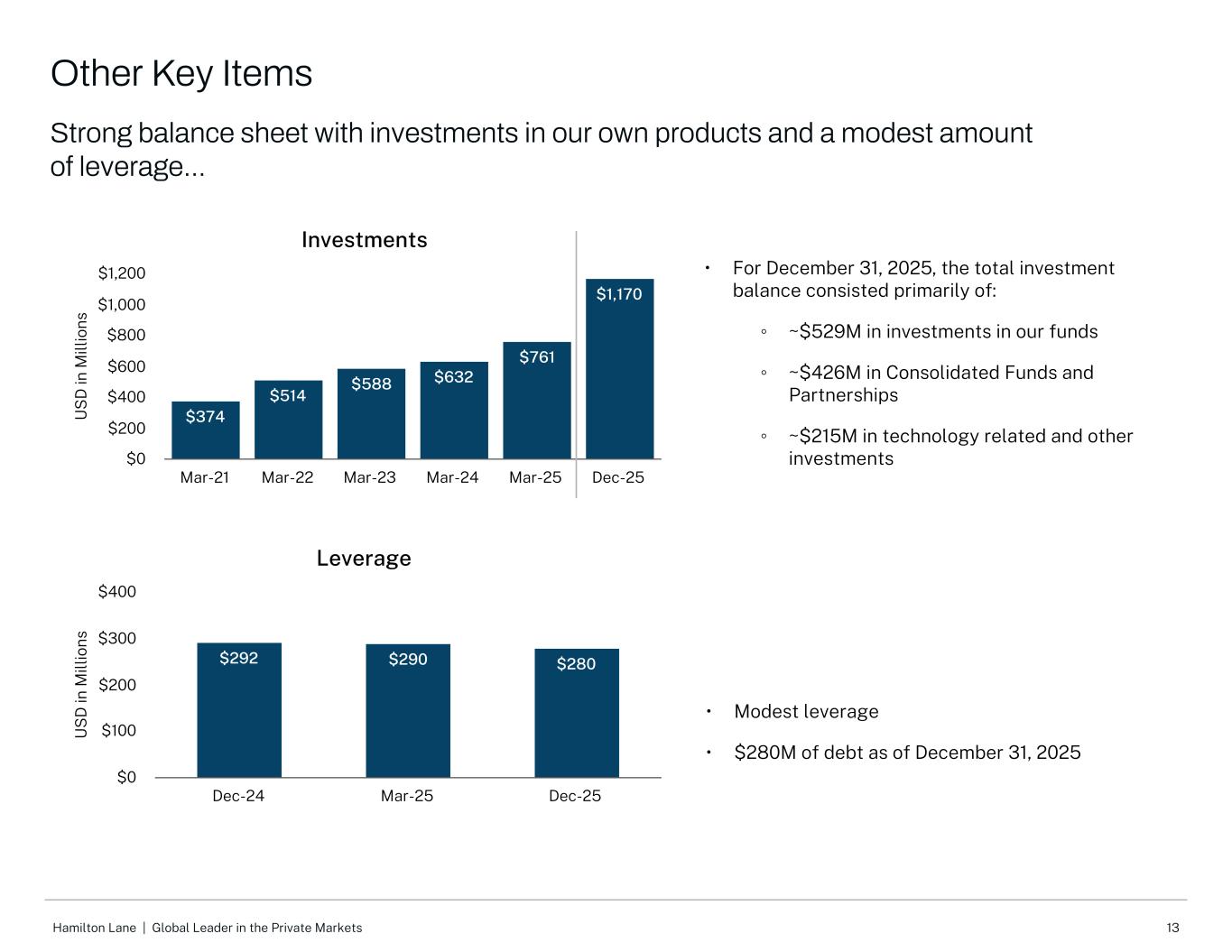

13Hamilton Lane | Global Leader in the Private Markets U S D in M ill io ns Investments $374 $514 $588 $632 $761 $1,170 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Dec-25 $0 $200 $400 $600 $800 $1,000 $1,200 • For December 31, 2025, the total investment balance consisted primarily of: ◦ ~$529M in investments in our funds ◦ ~$426M in Consolidated Funds and Partnerships ◦ ~$215M in technology related and other investments • Modest leverage • $280M of debt as of December 31, 2025 U S D in M ill io ns Leverage $292 $290 $280 Dec-24 Mar-25 Dec-25 $0 $100 $200 $300 $400 Other Key Items Strong balance sheet with investments in our own products and a modest amount of leverage...

Appendix

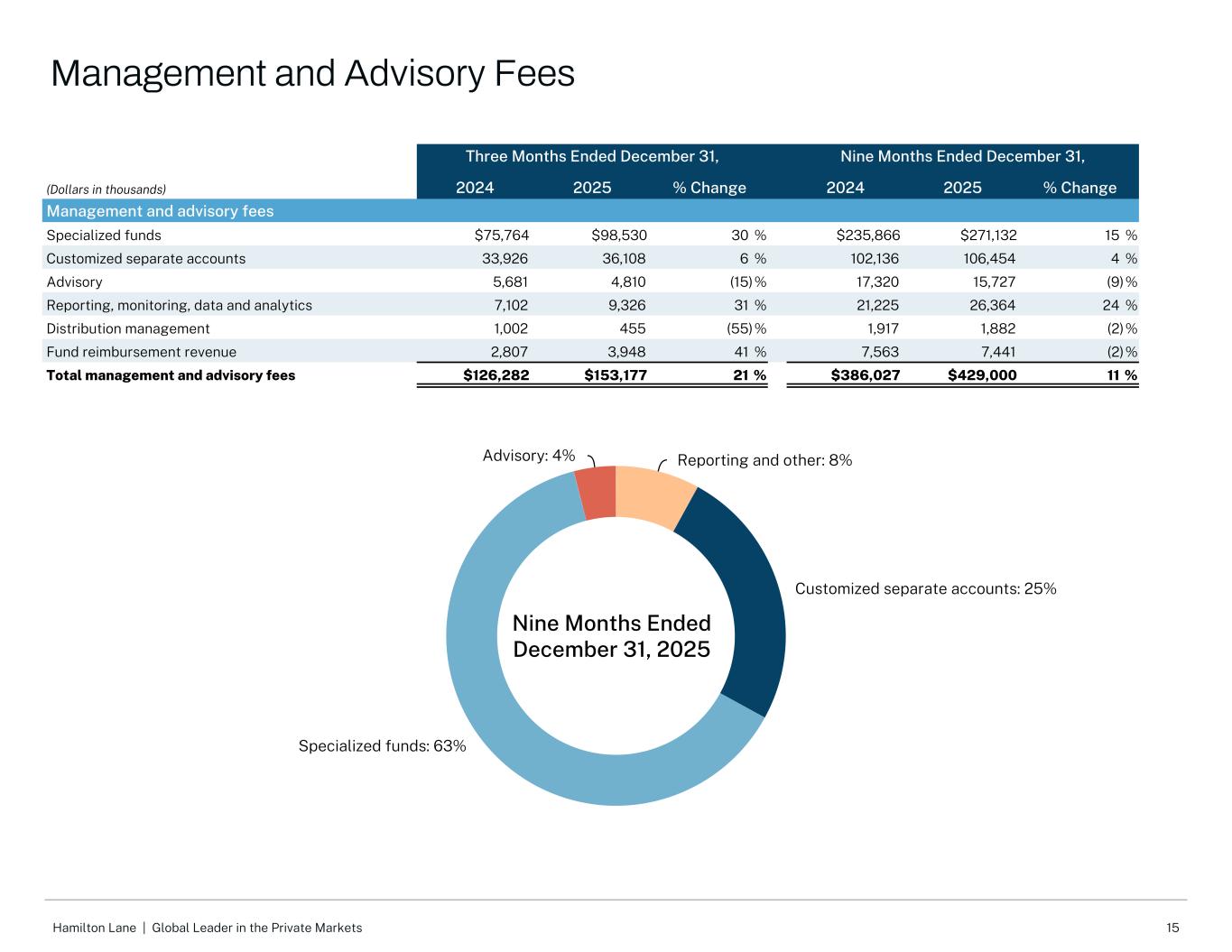

15Hamilton Lane | Global Leader in the Private Markets Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands) 2024 2025 % Change 2024 2025 % Change Management and advisory fees Specialized funds $75,764 $98,530 30 % $235,866 $271,132 15 % Customized separate accounts 33,926 36,108 6 % 102,136 106,454 4 % Advisory 5,681 4,810 (15) % 17,320 15,727 (9) % Reporting, monitoring, data and analytics 7,102 9,326 31 % 21,225 26,364 24 % Distribution management 1,002 455 (55) % 1,917 1,882 (2) % Fund reimbursement revenue 2,807 3,948 41 % 7,563 7,441 (2) % Total management and advisory fees $126,282 $153,177 21 % $386,027 $429,000 11 % Reporting and other: 8% Customized separate accounts: 25% Specialized funds: 63% Advisory: 4% Nine Months Ended December 31, 2025 Management and Advisory Fees

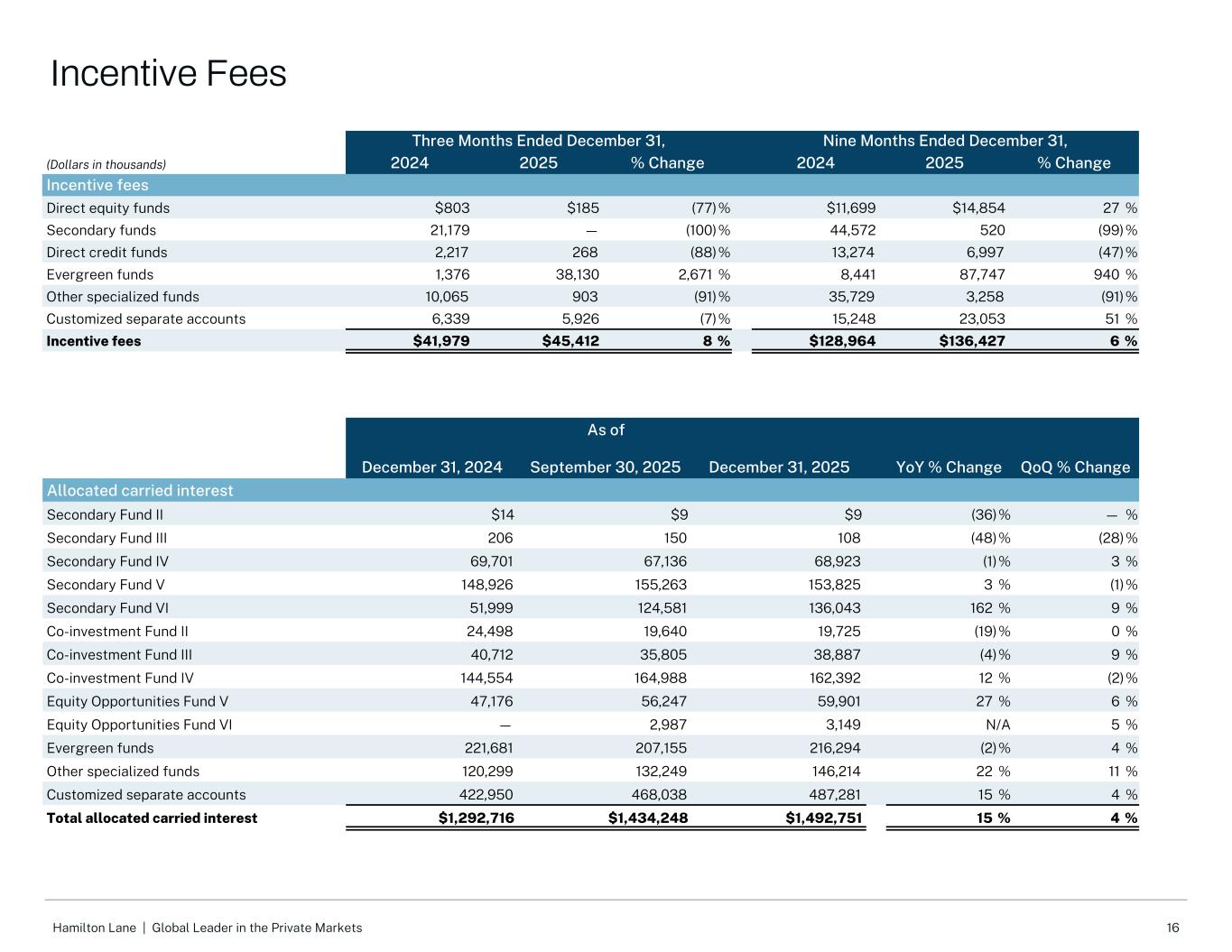

16Hamilton Lane | Global Leader in the Private Markets Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands) 2024 2025 % Change 2024 2025 % Change Incentive fees Direct equity funds $803 $185 (77) % $11,699 $14,854 27 % Secondary funds 21,179 — (100) % 44,572 520 (99) % Direct credit funds 2,217 268 (88) % 13,274 6,997 (47) % Evergreen funds 1,376 38,130 2,671 % 8,441 87,747 940 % Other specialized funds 10,065 903 (91) % 35,729 3,258 (91) % Customized separate accounts 6,339 5,926 (7) % 15,248 23,053 51 % Incentive fees $41,979 $45,412 8 % $128,964 $136,427 6 % As of December 31, 2024 September 30, 2025 December 31, 2025 YoY % Change QoQ % Change Allocated carried interest Secondary Fund II $14 $9 $9 (36) % — % Secondary Fund III 206 150 108 (48) % (28) % Secondary Fund IV 69,701 67,136 68,923 (1) % 3 % Secondary Fund V 148,926 155,263 153,825 3 % (1) % Secondary Fund VI 51,999 124,581 136,043 162 % 9 % Co-investment Fund II 24,498 19,640 19,725 (19) % 0 % Co-investment Fund III 40,712 35,805 38,887 (4) % 9 % Co-investment Fund IV 144,554 164,988 162,392 12 % (2) % Equity Opportunities Fund V 47,176 56,247 59,901 27 % 6 % Equity Opportunities Fund VI — 2,987 3,149 N/A 5 % Evergreen funds 221,681 207,155 216,294 (2) % 4 % Other specialized funds 120,299 132,249 146,214 22 % 11 % Customized separate accounts 422,950 468,038 487,281 15 % 4 % Total allocated carried interest $1,292,716 $1,434,248 $1,492,751 15 % 4 % Incentive Fees

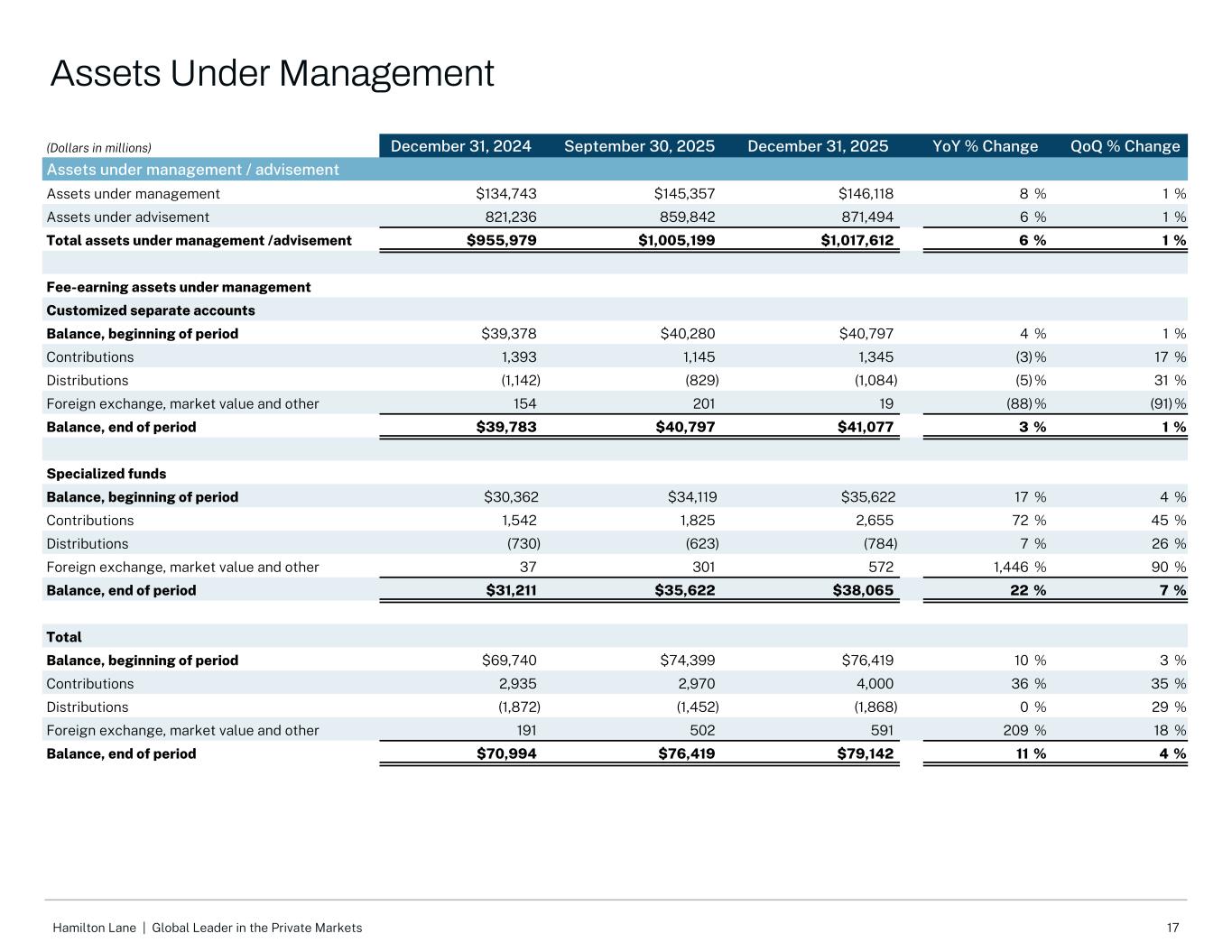

17Hamilton Lane | Global Leader in the Private Markets (Dollars in millions) December 31, 2024 September 30, 2025 December 31, 2025 YoY % Change QoQ % Change Assets under management / advisement Assets under management $134,743 $145,357 $146,118 8 % 1 % Assets under advisement 821,236 859,842 871,494 6 % 1 % Total assets under management /advisement $955,979 $1,005,199 $1,017,612 6 % 1 % Fee-earning assets under management Customized separate accounts Balance, beginning of period $39,378 $40,280 $40,797 4 % 1 % Contributions 1,393 1,145 1,345 (3) % 17 % Distributions (1,142) (829) (1,084) (5) % 31 % Foreign exchange, market value and other 154 201 19 (88) % (91) % Balance, end of period $39,783 $40,797 $41,077 3 % 1 % Specialized funds Balance, beginning of period $30,362 $34,119 $35,622 17 % 4 % Contributions 1,542 1,825 2,655 72 % 45 % Distributions (730) (623) (784) 7 % 26 % Foreign exchange, market value and other 37 301 572 1,446 % 90 % Balance, end of period $31,211 $35,622 $38,065 22 % 7 % Total Balance, beginning of period $69,740 $74,399 $76,419 10 % 3 % Contributions 2,935 2,970 4,000 36 % 35 % Distributions (1,872) (1,452) (1,868) 0 % 29 % Foreign exchange, market value and other 191 502 591 209 % 18 % Balance, end of period $70,994 $76,419 $79,142 11 % 4 % Assets Under Management

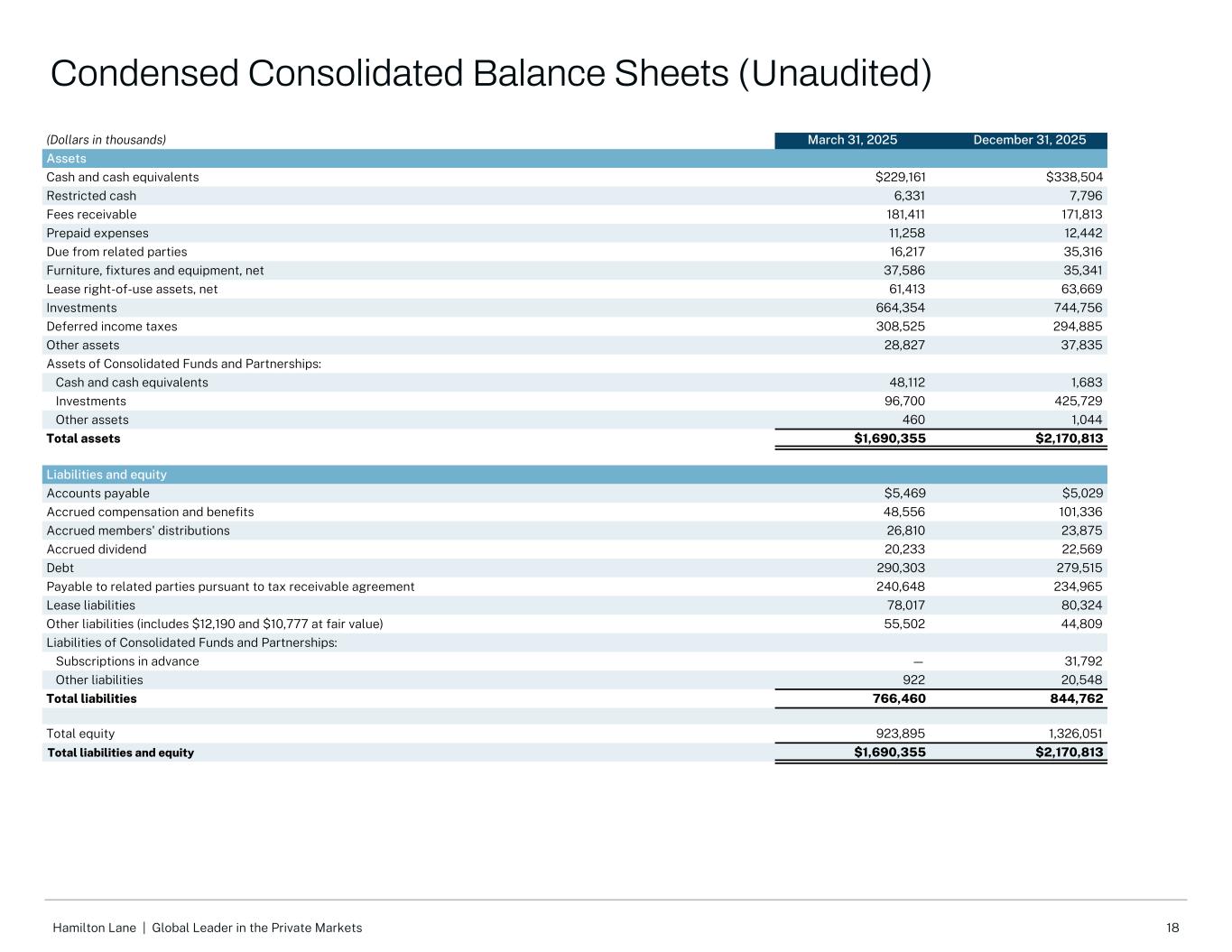

18Hamilton Lane | Global Leader in the Private Markets (Dollars in thousands) March 31, 2025 December 31, 2025 Assets Cash and cash equivalents $229,161 $338,504 Restricted cash 6,331 7,796 Fees receivable 181,411 171,813 Prepaid expenses 11,258 12,442 Due from related parties 16,217 35,316 Furniture, fixtures and equipment, net 37,586 35,341 Lease right-of-use assets, net 61,413 63,669 Investments 664,354 744,756 Deferred income taxes 308,525 294,885 Other assets 28,827 37,835 Assets of Consolidated Funds and Partnerships: Cash and cash equivalents 48,112 1,683 Investments 96,700 425,729 Other assets 460 1,044 Total assets $1,690,355 $2,170,813 Liabilities and equity Accounts payable $5,469 $5,029 Accrued compensation and benefits 48,556 101,336 Accrued members' distributions 26,810 23,875 Accrued dividend 20,233 22,569 Debt 290,303 279,515 Payable to related parties pursuant to tax receivable agreement 240,648 234,965 Lease liabilities 78,017 80,324 Other liabilities (includes $12,190 and $10,777 at fair value) 55,502 44,809 Liabilities of Consolidated Funds and Partnerships: Subscriptions in advance — 31,792 Other liabilities 922 20,548 Total liabilities 766,460 844,762 Total equity 923,895 1,326,051 Total liabilities and equity $1,690,355 $2,170,813 Condensed Consolidated Balance Sheets (Unaudited)

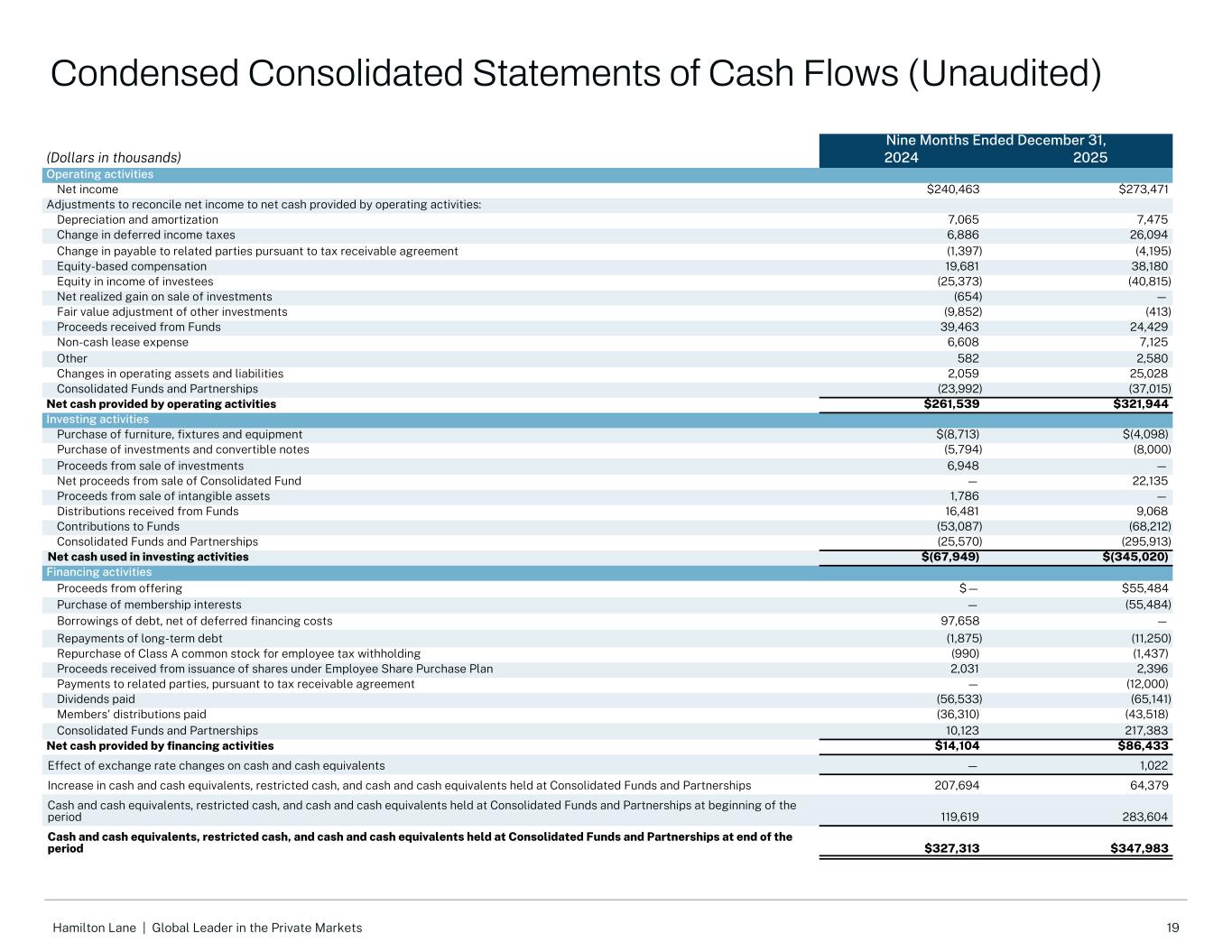

19Hamilton Lane | Global Leader in the Private Markets Nine Months Ended December 31, (Dollars in thousands) 2024 2025 Operating activities Net income $240,463 $273,471 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 7,065 7,475 Change in deferred income taxes 6,886 26,094 Change in payable to related parties pursuant to tax receivable agreement (1,397) (4,195) Equity-based compensation 19,681 38,180 Equity in income of investees (25,373) (40,815) Net realized gain on sale of investments (654) — Fair value adjustment of other investments (9,852) (413) Proceeds received from Funds 39,463 24,429 Non-cash lease expense 6,608 7,125 Other 582 2,580 Changes in operating assets and liabilities 2,059 25,028 Consolidated Funds and Partnerships (23,992) (37,015) Net cash provided by operating activities $261,539 $321,944 Investing activities Purchase of furniture, fixtures and equipment $(8,713) $(4,098) Purchase of investments and convertible notes (5,794) (8,000) Proceeds from sale of investments 6,948 — Net proceeds from sale of Consolidated Fund — 22,135 Proceeds from sale of intangible assets 1,786 — Distributions received from Funds 16,481 9,068 Contributions to Funds (53,087) (68,212) Consolidated Funds and Partnerships (25,570) (295,913) Net cash used in investing activities $(67,949) $(345,020) Financing activities Proceeds from offering $— $55,484 Purchase of membership interests — (55,484) Borrowings of debt, net of deferred financing costs 97,658 — Repayments of long-term debt (1,875) (11,250) Repurchase of Class A common stock for employee tax withholding (990) (1,437) Proceeds received from issuance of shares under Employee Share Purchase Plan 2,031 2,396 Payments to related parties, pursuant to tax receivable agreement — (12,000) Dividends paid (56,533) (65,141) Members' distributions paid (36,310) (43,518) Consolidated Funds and Partnerships 10,123 217,383 Net cash provided by financing activities $14,104 $86,433 Effect of exchange rate changes on cash and cash equivalents — 1,022 Increase in cash and cash equivalents, restricted cash, and cash and cash equivalents held at Consolidated Funds and Partnerships 207,694 64,379 Cash and cash equivalents, restricted cash, and cash and cash equivalents held at Consolidated Funds and Partnerships at beginning of the period 119,619 283,604 Cash and cash equivalents, restricted cash, and cash and cash equivalents held at Consolidated Funds and Partnerships at end of the period $327,313 $347,983 Condensed Consolidated Statements of Cash Flows (Unaudited)

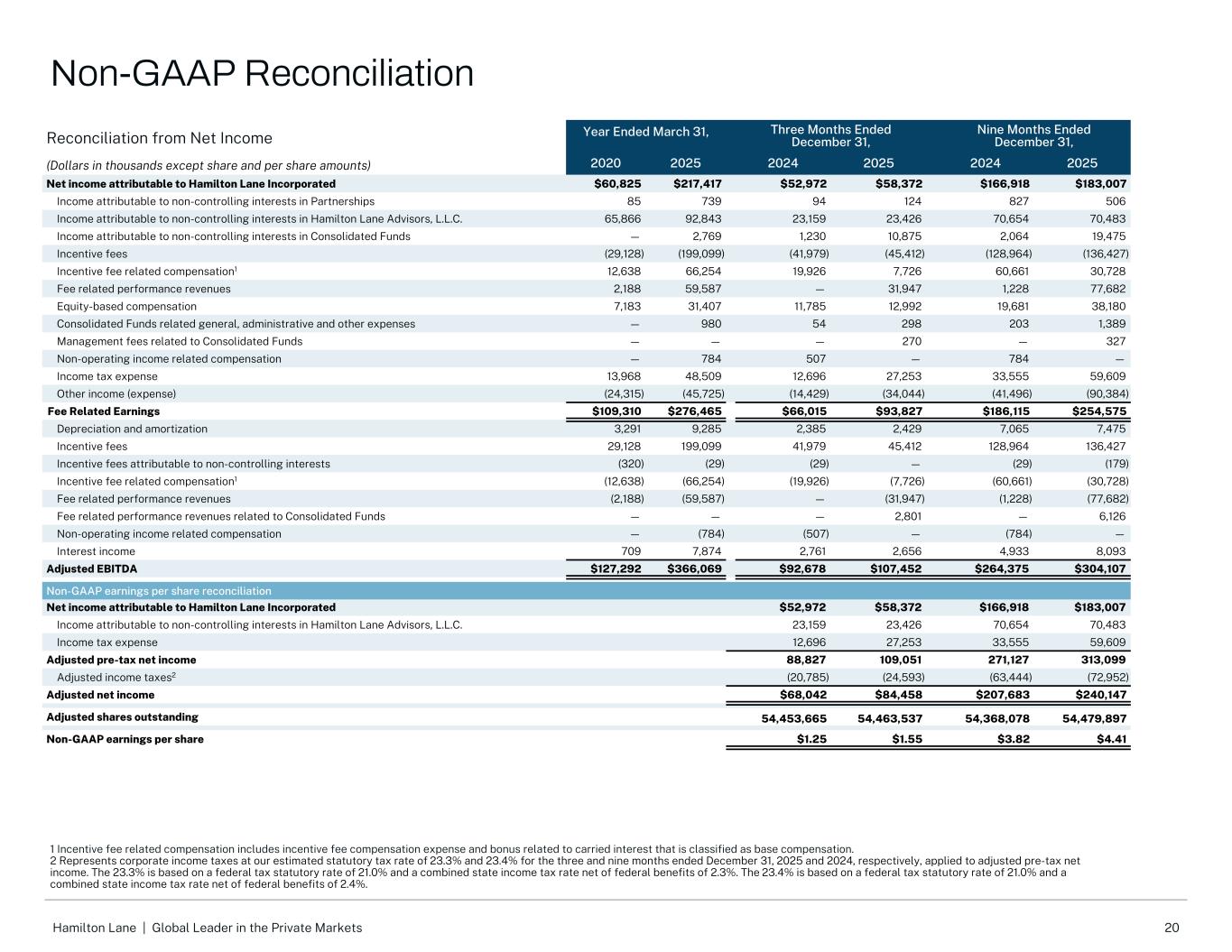

20Hamilton Lane | Global Leader in the Private Markets Reconciliation from Net Income Year Ended March 31, Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands except share and per share amounts) 2020 2025 2024 2025 2024 2025 Net income attributable to Hamilton Lane Incorporated $60,825 $217,417 $52,972 $58,372 $166,918 $183,007 Income attributable to non-controlling interests in Partnerships 85 739 94 124 827 506 Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 65,866 92,843 23,159 23,426 70,654 70,483 Income attributable to non-controlling interests in Consolidated Funds — 2,769 1,230 10,875 2,064 19,475 Incentive fees (29,128) (199,099) (41,979) (45,412) (128,964) (136,427) Incentive fee related compensation1 12,638 66,254 19,926 7,726 60,661 30,728 Fee related performance revenues 2,188 59,587 — 31,947 1,228 77,682 Equity-based compensation 7,183 31,407 11,785 12,992 19,681 38,180 Consolidated Funds related general, administrative and other expenses — 980 54 298 203 1,389 Management fees related to Consolidated Funds — — — 270 — 327 Non-operating income related compensation — 784 507 — 784 — Income tax expense 13,968 48,509 12,696 27,253 33,555 59,609 Other income (expense) (24,315) (45,725) (14,429) (34,044) (41,496) (90,384) Fee Related Earnings $109,310 $276,465 $66,015 $93,827 $186,115 $254,575 Depreciation and amortization 3,291 9,285 2,385 2,429 7,065 7,475 Incentive fees 29,128 199,099 41,979 45,412 128,964 136,427 Incentive fees attributable to non-controlling interests (320) (29) (29) — (29) (179) Incentive fee related compensation1 (12,638) (66,254) (19,926) (7,726) (60,661) (30,728) Fee related performance revenues (2,188) (59,587) — (31,947) (1,228) (77,682) Fee related performance revenues related to Consolidated Funds — — — 2,801 — 6,126 Non-operating income related compensation — (784) (507) — (784) — Interest income 709 7,874 2,761 2,656 4,933 8,093 Adjusted EBITDA $127,292 $366,069 $92,678 $107,452 $264,375 $304,107 Non-GAAP earnings per share reconciliation Net income attributable to Hamilton Lane Incorporated $52,972 $58,372 $166,918 $183,007 Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 23,159 23,426 70,654 70,483 Income tax expense 12,696 27,253 33,555 59,609 Adjusted pre-tax net income 88,827 109,051 271,127 313,099 Adjusted income taxes2 (20,785) (24,593) (63,444) (72,952) Adjusted net income $68,042 $84,458 $207,683 $240,147 Adjusted shares outstanding 54,453,665 54,463,537 54,368,078 54,479,897 Non-GAAP earnings per share $1.25 $1.55 $3.82 $4.41 1 Incentive fee related compensation includes incentive fee compensation expense and bonus related to carried interest that is classified as base compensation. 2 Represents corporate income taxes at our estimated statutory tax rate of 23.3% and 23.4% for the three and nine months ended December 31, 2025 and 2024, respectively, applied to adjusted pre-tax net income. The 23.3% is based on a federal tax statutory rate of 21.0% and a combined state income tax rate net of federal benefits of 2.3%. The 23.4% is based on a federal tax statutory rate of 21.0% and a combined state income tax rate net of federal benefits of 2.4%. Non-GAAP Reconciliation

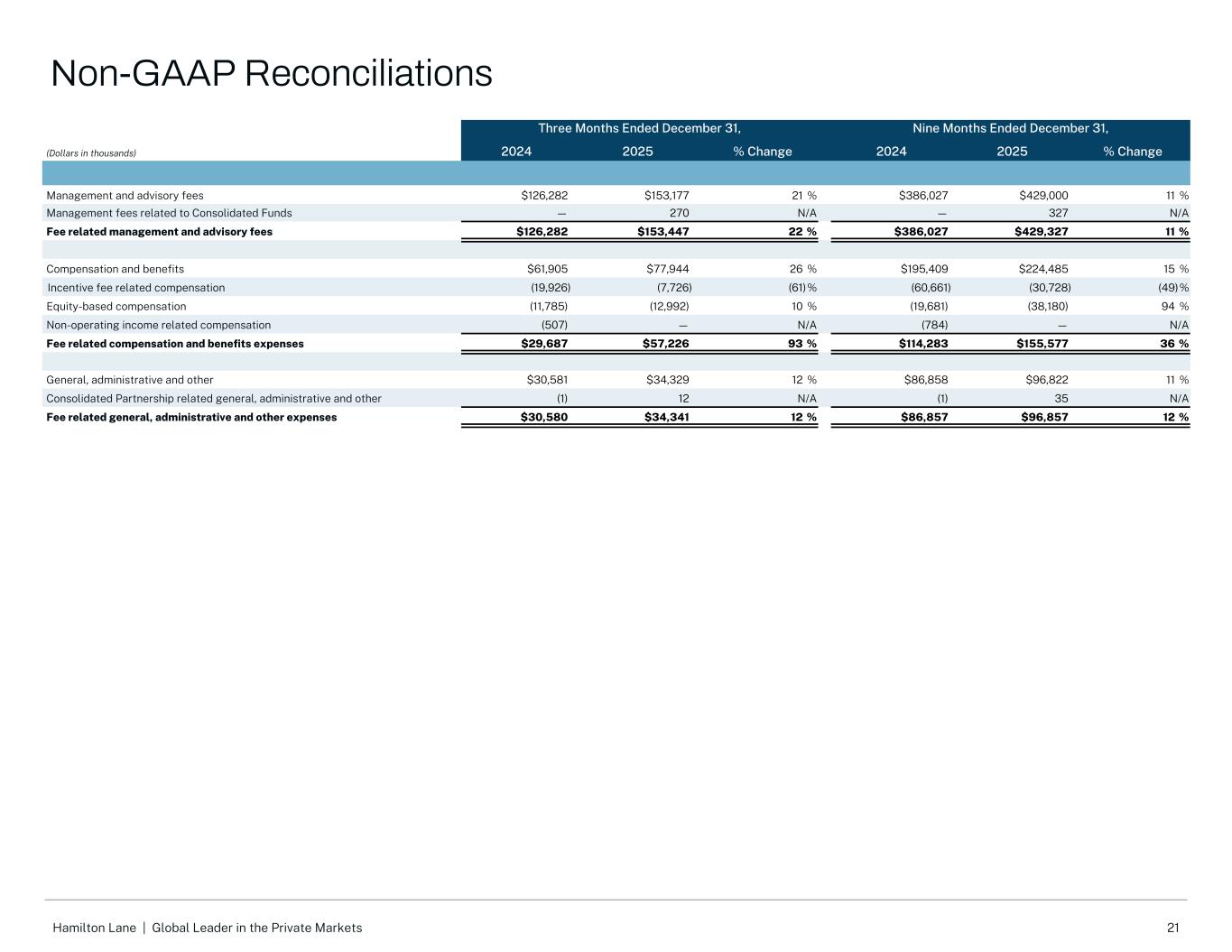

21Hamilton Lane | Global Leader in the Private Markets Non-GAAP Reconciliations Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands) 2024 2025 % Change 2024 2025 % Change Management and advisory fees $126,282 $153,177 21 % $386,027 $429,000 11 % Management fees related to Consolidated Funds — 270 N/A — 327 N/A Fee related management and advisory fees $126,282 $153,447 22 % $386,027 $429,327 11 % Compensation and benefits $61,905 $77,944 26 % $195,409 $224,485 15 % Incentive fee related compensation (19,926) (7,726) (61) % (60,661) (30,728) (49) % Equity-based compensation (11,785) (12,992) 10 % (19,681) (38,180) 94 % Non-operating income related compensation (507) — N/A (784) — N/A Fee related compensation and benefits expenses $29,687 $57,226 93 % $114,283 $155,577 36 % General, administrative and other $30,581 $34,329 12 % $86,858 $96,822 11 % Consolidated Partnership related general, administrative and other (1) 12 N/A (1) 35 N/A Fee related general, administrative and other expenses $30,580 $34,341 12 % $86,857 $96,857 12 %

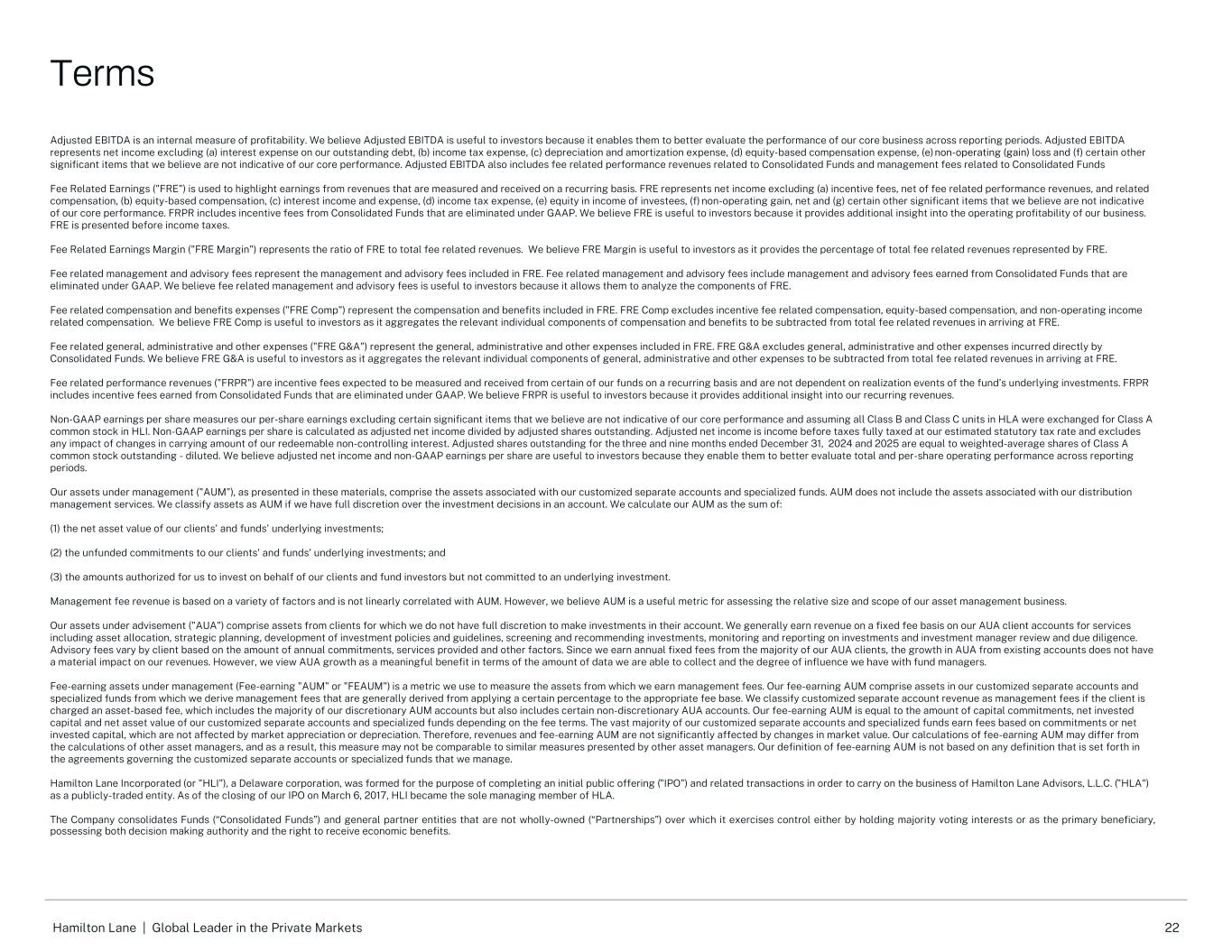

22Hamilton Lane | Global Leader in the Private Markets Adjusted EBITDA is an internal measure of profitability. We believe Adjusted EBITDA is useful to investors because it enables them to better evaluate the performance of our core business across reporting periods. Adjusted EBITDA represents net income excluding (a) interest expense on our outstanding debt, (b) income tax expense, (c) depreciation and amortization expense, (d) equity-based compensation expense, (e) non-operating (gain) loss and (f) certain other significant items that we believe are not indicative of our core performance. Adjusted EBITDA also includes fee related performance revenues related to Consolidated Funds and management fees related to Consolidated Funds Fee Related Earnings ("FRE") is used to highlight earnings from revenues that are measured and received on a recurring basis. FRE represents net income excluding (a) incentive fees, net of fee related performance revenues, and related compensation, (b) equity-based compensation, (c) interest income and expense, (d) income tax expense, (e) equity in income of investees, (f) non-operating gain, net and (g) certain other significant items that we believe are not indicative of our core performance. FRPR includes incentive fees from Consolidated Funds that are eliminated under GAAP. We believe FRE is useful to investors because it provides additional insight into the operating profitability of our business. FRE is presented before income taxes. Fee Related Earnings Margin ("FRE Margin") represents the ratio of FRE to total fee related revenues. We believe FRE Margin is useful to investors as it provides the percentage of total fee related revenues represented by FRE. Fee related management and advisory fees represent the management and advisory fees included in FRE. Fee related management and advisory fees include management and advisory fees earned from Consolidated Funds that are eliminated under GAAP. We believe fee related management and advisory fees is useful to investors because it allows them to analyze the components of FRE. Fee related compensation and benefits expenses ("FRE Comp") represent the compensation and benefits included in FRE. FRE Comp excludes incentive fee related compensation, equity-based compensation, and non-operating income related compensation. We believe FRE Comp is useful to investors as it aggregates the relevant individual components of compensation and benefits to be subtracted from total fee related revenues in arriving at FRE. Fee related general, administrative and other expenses ("FRE G&A") represent the general, administrative and other expenses included in FRE. FRE G&A excludes general, administrative and other expenses incurred directly by Consolidated Funds. We believe FRE G&A is useful to investors as it aggregates the relevant individual components of general, administrative and other expenses to be subtracted from total fee related revenues in arriving at FRE. Fee related performance revenues ("FRPR") are incentive fees expected to be measured and received from certain of our funds on a recurring basis and are not dependent on realization events of the fund’s underlying investments. FRPR includes incentive fees earned from Consolidated Funds that are eliminated under GAAP. We believe FRPR is useful to investors because it provides additional insight into our recurring revenues. Non-GAAP earnings per share measures our per-share earnings excluding certain significant items that we believe are not indicative of our core performance and assuming all Class B and Class C units in HLA were exchanged for Class A common stock in HLI. Non-GAAP earnings per share is calculated as adjusted net income divided by adjusted shares outstanding. Adjusted net income is income before taxes fully taxed at our estimated statutory tax rate and excludes any impact of changes in carrying amount of our redeemable non-controlling interest. Adjusted shares outstanding for the three and nine months ended December 31, 2024 and 2025 are equal to weighted-average shares of Class A common stock outstanding - diluted. We believe adjusted net income and non-GAAP earnings per share are useful to investors because they enable them to better evaluate total and per-share operating performance across reporting periods. Our assets under management ("AUM"), as presented in these materials, comprise the assets associated with our customized separate accounts and specialized funds. AUM does not include the assets associated with our distribution management services. We classify assets as AUM if we have full discretion over the investment decisions in an account. We calculate our AUM as the sum of: (1) the net asset value of our clients' and funds' underlying investments; (2) the unfunded commitments to our clients' and funds' underlying investments; and (3) the amounts authorized for us to invest on behalf of our clients and fund investors but not committed to an underlying investment. Management fee revenue is based on a variety of factors and is not linearly correlated with AUM. However, we believe AUM is a useful metric for assessing the relative size and scope of our asset management business. Our assets under advisement ("AUA") comprise assets from clients for which we do not have full discretion to make investments in their account. We generally earn revenue on a fixed fee basis on our AUA client accounts for services including asset allocation, strategic planning, development of investment policies and guidelines, screening and recommending investments, monitoring and reporting on investments and investment manager review and due diligence. Advisory fees vary by client based on the amount of annual commitments, services provided and other factors. Since we earn annual fixed fees from the majority of our AUA clients, the growth in AUA from existing accounts does not have a material impact on our revenues. However, we view AUA growth as a meaningful benefit in terms of the amount of data we are able to collect and the degree of influence we have with fund managers. Fee-earning assets under management (Fee-earning "AUM" or "FEAUM") is a metric we use to measure the assets from which we earn management fees. Our fee-earning AUM comprise assets in our customized separate accounts and specialized funds from which we derive management fees that are generally derived from applying a certain percentage to the appropriate fee base. We classify customized separate account revenue as management fees if the client is charged an asset-based fee, which includes the majority of our discretionary AUM accounts but also includes certain non-discretionary AUA accounts. Our fee-earning AUM is equal to the amount of capital commitments, net invested capital and net asset value of our customized separate accounts and specialized funds depending on the fee terms. The vast majority of our customized separate accounts and specialized funds earn fees based on commitments or net invested capital, which are not affected by market appreciation or depreciation. Therefore, revenues and fee-earning AUM are not significantly affected by changes in market value. Our calculations of fee-earning AUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Our definition of fee-earning AUM is not based on any definition that is set forth in the agreements governing the customized separate accounts or specialized funds that we manage. Hamilton Lane Incorporated (or "HLI"), a Delaware corporation, was formed for the purpose of completing an initial public offering ("IPO") and related transactions in order to carry on the business of Hamilton Lane Advisors, L.L.C. ("HLA") as a publicly-traded entity. As of the closing of our IPO on March 6, 2017, HLI became the sole managing member of HLA. The Company consolidates Funds (“Consolidated Funds”) and general partner entities that are not wholly-owned (“Partnerships”) over which it exercises control either by holding majority voting interests or as the primary beneficiary, possessing both decision making authority and the right to receive economic benefits. Terms

23Hamilton Lane | Global Leader in the Private Markets Some of the statements in this presentation may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe,” “estimate,” “continue,” “anticipate,” “intend,” “plan” and similar expressions, or the negative version of these words or other comparable words, are intended to identify these forward-looking statements. Forward-looking statements discuss management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including, risks relating to: the historical performance of our investments may not be indicative of future results or future returns on our Class A common stock; our ability to identify available and suitable investment opportunities for our clients; intense competition in our industry, including for access to investments and for customized separate account and advisory clients; customized separate account and advisory account fee revenue is not a long-term contracted source of revenue; our ability to appropriately deal with conflicts of interest; our ability to retain our senior management team and attract additional qualified investment professionals; our ability to expand our business and formulate new business strategies; our ability to manage our obligations under our debt agreements; volatile market, economic and geopolitical conditions, which can adversely affect our business and the investments made by our funds or accounts; defaults by clients and third-party investors on their obligations to fund commitments; our ability to comply with the investment guidelines set by our clients; the exercise of redemption or repurchase rights by investors in certain of our funds; extensive government regulation, compliance failures and changes in law or regulation could adversely affect us; our ability to maintain our desired fee structure; failure to maintain the security of our information technology networks, or those of our third-party service providers, or data security breaches; our only material asset is our interest in Hamilton Lane Advisors, L.L.C., and we are accordingly dependent upon distributions from such entity to pay dividends, taxes and other expenses. The foregoing list of factors is not exhaustive and should be read in conjunction with the other cautionary statements that are included in our filings with the Securities and Exchange Commission (the “SEC”). For more information regarding these risks and uncertainties as well as additional risks we face, you should refer to the “Risk Factors” detailed in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2025 and in our subsequent reports filed from time to time with the SEC, which are accessible on the SEC’s website at www.sec.gov. The forward-looking statements included in this presentation are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law. Values appearing in this presentation that are whole numbers are rounded approximations. As of February 3, 2026 Disclosures