Project Ibiza: Employee All-Hands Exhibit (i)

Safe Harbor Notice to Investors/Important Additional Information Filed with the U.S. Securities and Exchange Commission This presentation is not a recommendation, an offer to purchase or a solicitation of an offer to sell shares of Immune Design Corp. (“Immune Design”) stock. Cascade Merger Sub Inc. (“Purchaser”) has not commenced the tender offer described in this presentation (the “Offer”). Upon commencement of the Offer, Merck Sharp & Dohme Corp. (“Merck”) and Purchaser will file with the U.S. Securities and Exchange Commission (the “SEC”) a tender offer statement on Schedule TO and related exhibits, including an offer to purchase, letter of transmittal, and other related documents. Following commencement of the Offer, Immune Design will file with the SEC a solicitation/recommendation statement on Schedule 14D-9. Stockholders should read the offer to purchase and solicitation/recommendation statement and the tender offer statement on Schedule TO and related exhibits when such documents are filed and become available, as they will contain important information about the Offer. Stockholders can obtain these documents when they are filed and become available free of charge from the SEC’s website at www.sec.gov or by contacting the investor relations department of Immune Design at the email addresses included below. Contact: Sylvia Wheeler & Katalin Janos sylvia.wheeler@immunedesign.com katalin.janos@immunedesign.com In addition to the solicitation/recommendation statement, Immune Design files annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements or other information filed by Immune Design at the SEC public reference room at 100 F Street, N.E., Washington, DC 201549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Immune Design’s filings with the SEC are also available to the public from commercial document-retrieval services and the SEC’s website at www.sec.gov.

Safe Harbor Forward-Looking Statements This presentation may contain certain forward-looking statements regarding Immune Design, including without limitation with respect to its business, the proposed tender offer and merger, the expected timetable for completing the transaction, the parties’ ability to satisfy the conditions to the Offer and the other conditions set forth in the definitive merger agreement among Immune Design, Merck and Purchaser (the “Merger Agreement”), and the possibility of any termination of the Merger Agreement. Completion of the Offer and merger contemplated by the Merger Agreement (the “Merger”) are subject to conditions, including satisfaction of a minimum tender condition and required regulatory approvals, and there can be no assurance that those conditions can be satisfied or that the transactions described in this presentation (the “Transactions”) will be completed or will be completed when expected. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements. These factors include, but are not limited to, the risk that not all conditions of the Offer or the Merger will be satisfied or waived; uncertainties regarding the two companies’ ability to successfully develop and market both new and existing products; uncertainties relating to the anticipated timing of filings and approvals relating to the Transactions; uncertainties as to the timing of the Offer and Merger; uncertainties as to how many of Immune Design’s stockholders will tender their stock in the Offer; the possibility that competing offers will be made; the failure to complete the Offer or the Merger in the timeframe expected by the parties or at all; the outcome of legal proceedings that may be instituted against Immune Design and/or others relating to the Transactions; Immune Design’s ability to maintain relationships with employees or vendors; domestic and global economic and business conditions; and other risk factors described in Immune Design’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the SEC. The reader is cautioned not to unduly rely on these forward-looking statements. Any forward-looking statements in this presentation are based on information known to Immune Design on the date of this presentation. Immune Design does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Meeting Agenda Announcement Transaction Details Common Questions “Do’s & Don’ts” Closing Confidential

Transaction Announcement This morning, Merck and IMDZ jointly announced that IMDZ will be acquired by Merck Confidential “Scientists at Immune Design have established a unique portfolio of approaches to cancer immunization and adjuvant systems designed to enhance the ability of a vaccine to protect against infection, which could meaningfully improve vaccine development. This acquisition builds upon Merck’s industry-leading programs that harness the power of the immune system to prevent and treat disease disease.” - Dr. Roger M. Perlmutter, president, Merck Research Laboratories “Merck has a rich history of discovery and innovation and a strong track record of developing meaningful therapeutics and vaccines. We believe this agreement creates shareholder value by positioning our technologies and capabilities for long-term success with a leading, research-driven biopharmaceutical company company.” - Dr. Carlos V. Paya, president and ceo, Immune Design

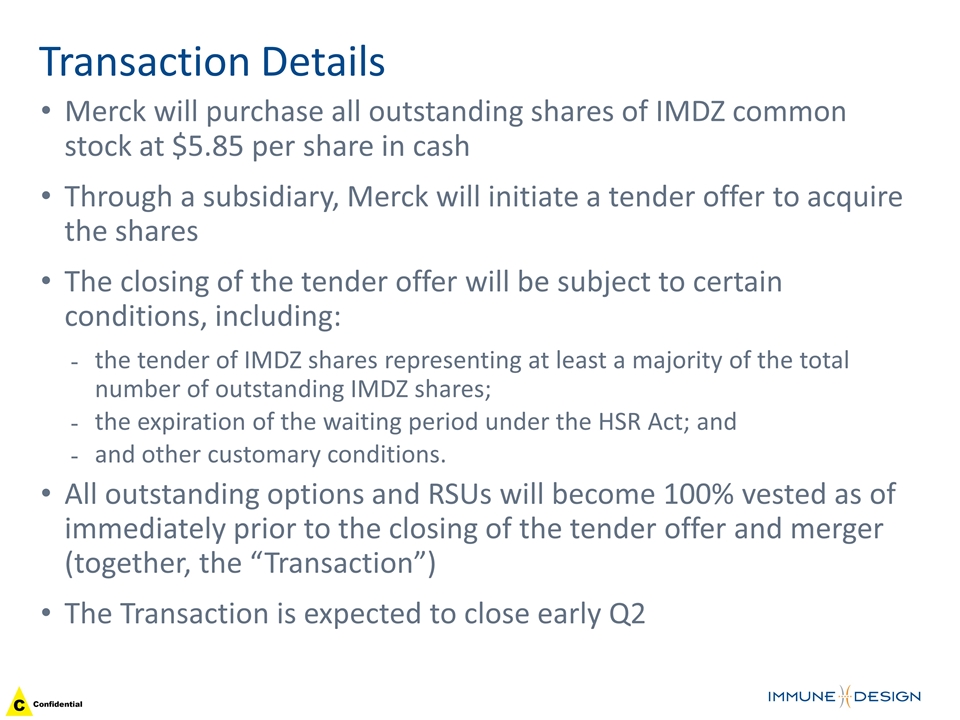

Transaction Details Merck will purchase all outstanding shares of IMDZ common stock at $5.85 per share in cash Through a subsidiary, Merck will initiate a tender offer to acquire the shares The closing of the tender offer will be subject to certain conditions, including: the tender of IMDZ shares representing at least a majority of the total number of outstanding IMDZ shares; the expiration of the waiting period under the HSR Act; and and other customary conditions. All outstanding options and RSUs will become 100% vested as of immediately prior to the closing of the tender offer and merger (together, the “Transaction”) The Transaction is expected to close early Q2

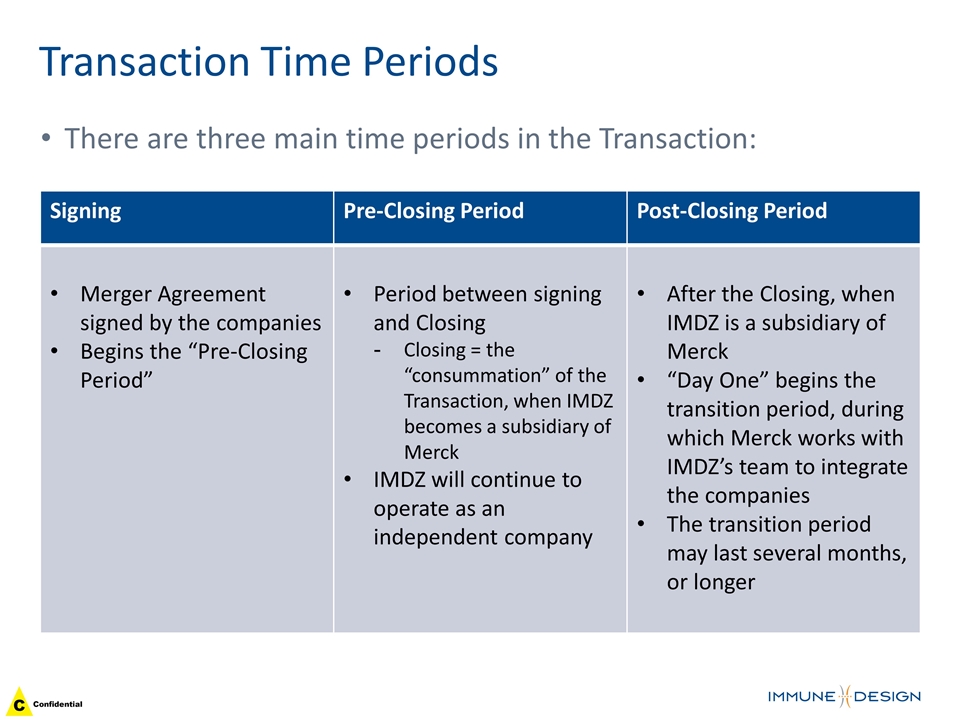

Transaction Time Periods Signing Pre-Closing Period Post-Closing Period Merger Agreement signed by the companies Begins the “Pre-Closing Period” Period between signing and Closing Closing = the “consummation” of the Transaction, when IMDZ becomes a subsidiary of Merck IMDZ will continue to operate as an independent company After the Closing, when IMDZ is a subsidiary of Merck “Day One” begins the transition period, during which Merck works with IMDZ’s team to integrate the companies The transition period may last several months, or longer There are three main time periods in the Transaction:

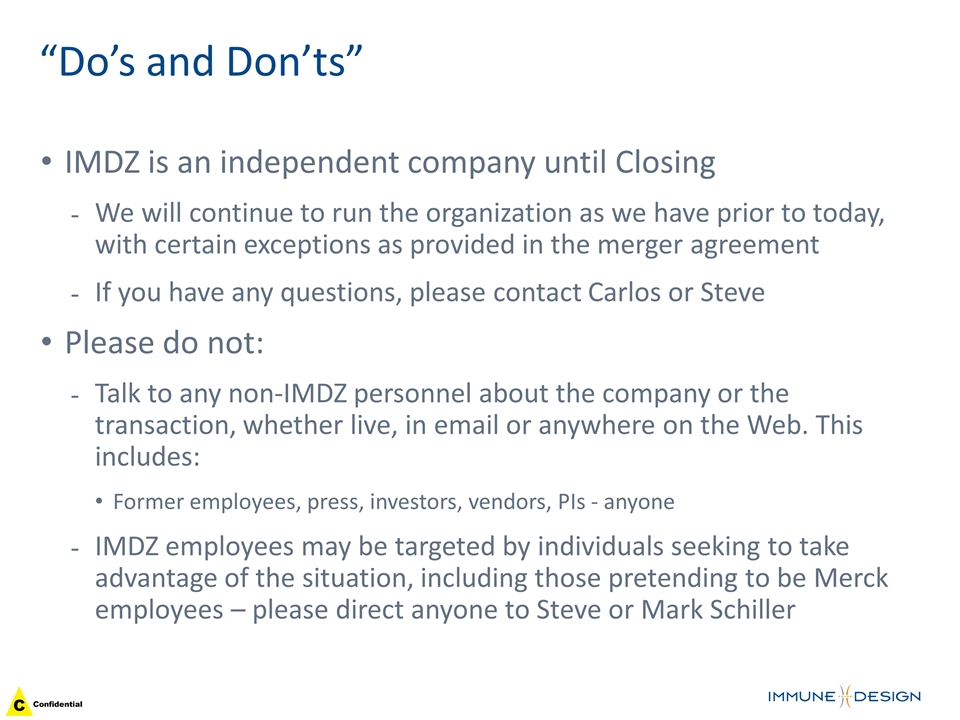

“Do’s and Don’ts” IMDZ is an independent company until Closing We will continue to run the organization as we have prior to today, with certain exceptions as provided in the merger agreement If you have any questions, please contact Carlos or Steve Please do not: Talk to any non-IMDZ personnel about the company or the transaction, whether live, in email or anywhere on the Web. This includes: Former employees, press, investors, vendors, PIs - anyone IMDZ employees may be targeted by individuals seeking to take advantage of the situation, including those pretending to be Merck employees – please direct anyone to Steve or Mark Schiller

Common Questions What about our ongoing activities? We will continue to manage ongoing activities as originally planned, including all committed studies within budget. For example: G142 Parts 4 and 5 will continue to enroll Closure of CMB305 will continue Merck has the right to review and consent to certain activities between sign and close Research programs and ISTs would continue as planned

Common Questions (continued) What about my job? Is Merck going to keep our employees and offices? As a reminder, IMDZ is still an independent company, so it’s too early to have definitive plans regarding all our employees. Over the coming weeks, Merck leadership, along with the IMDZ leadership, will work closely together to determine a people strategy for the near and long term future. Does Merck have a severance plan for employees? Merck does have a Severance Benefits Program in place that would apply to IMDZ employees after the closing. In addition, Merck has committed to work closely with us to provide peace of mind as we work through the integration and enable all of us to continue focusing on business as usual. Of course, when we have more details, we will share them with you.

Common Questions (continued) & Closing Where can I find more information? Within 10 business days, Merck will file a tender offer statement on Schedule TO and IMDZ will file a solicitation/recommendation statement on Schedule 14D-9 with the Securities and Exchange Commission, each of which will have more information about the Transaction. Closing