Third Quarter 2025 INVESTOR PRESENTATION COASTAL FINANCIAL CORPORATION

2 LEGAL INFORMATION AND DISCLAIMER Important note regarding forward-looking statements: Statements made in this presentation (or conveyed orally) which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding Coastal Financial Corporation's ("Coastal") plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “intend,” "target,” “outlook,” “project,” “guidance,” “forecast,” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include the prolonged U.S. government shutdown and those identified in the Company’s most recent Form 10-K and subsequent Form 10-Qs and other SEC filings, and such factors are incorporated herein by reference. If one or more events related to these or other risks or uncertainties materialize, or if Coastal’s underlying assumptions prove to be incorrect, actual results may differ materially from what Coastal anticipates. You are cautioned not to place undue reliance on forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made and Coastal undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding. Non-GAAP Measures: This presentation includes certain non-GAAP financial measures. These non-GAAP measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this presentation. This presentation includes non-GAAP financial measures to illustrate the impact of BaaS loan expense on net loan income and yield on CCBX loans, and net interest margin. Net BaaS loan income divided by average CCBX loans is a non-GAAP measure that includes the impact BaaS loan expense on net BaaS loan income and the yield on CCBX loans. The most directly comparable GAAP measure is yield on CCBX loans. Net interest income net of BaaS loan expense divided by average earning assets is a non-GAAP measure that includes the impact BaaS loan expense on net interest income. The most directly comparable GAAP measure is net interest income. Net interest margin, net of BaaS loan expense is a non-GAAP measure that includes the impact of BaaS loan expense on net interest margin. The most directly comparable GAAP measure is net interest margin. This presentation includes non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. Pre-tax, pre-provision net revenue ("PPNR") is presented to illustrate the impact of provision for income tax, provision for credit losses, BaaS credit and fraud indemnification income and BaaS loan expense have on net income. The most directly comparable GAAP measure is net income. Core expenses is presented to illustrate the impact of BaaS loan expense and BaaS fraud expenses and reimbursement of expenses (BaaS) have on noninterest expense. The most directly comparable GAAP measure is noninterest expense. Core net revenue is presented to illustrate the impact of BaaS credit enhancements, BaaS fraud enhancements, reimbursement of expenses (GAAP) and BaaS loan expense have on revenue. The most directly comparable GAAP measure is revenue. BaaS program income and transaction and interchange fees, net of nonrecurring revenue is presented to illustrate the impact of nonrecurring revenue related to CCBX partner interchange income on BaaS program income and transaction and interchange fees. This non-GAAP measure shows the portion of interchange fees that are not expected to recur and the impact that had on Baas program income and transaction and interchange fees for the periods presented. The most comparable GAAP measures are BaaS program income and transaction and interchange fees.

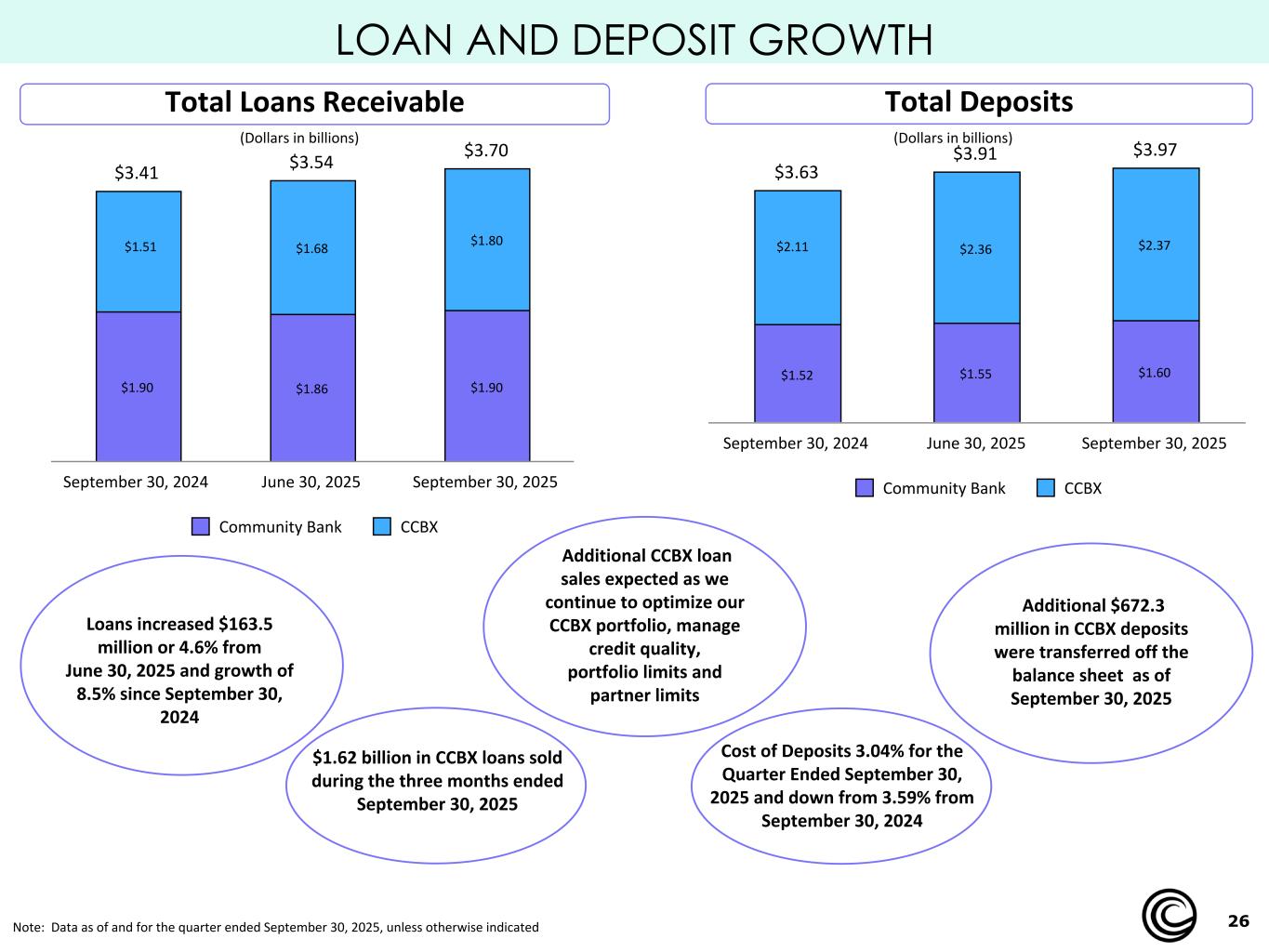

3 THIRD QUARTER 2025 HIGHLIGHTS Note: Data as of the three months ended September 30, 2025 unless otherwise indicated (1)Core net revenue is a non-GAAP measure which includes net interest income and noninterest income, adjusted for BaaS credit enhancement, BaaS fraud enhancement, reimbursement of expenses (BaaS) and BaaS loan expense associated with the CCBX operating segment. This produces a figure which can be compared to revenue. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. Total loans receivable increased by $163.5 million, or 4.6%, from the prior quarter, reflecting continued growth across core lending categories _______________________________ Total deposits reached $3.97 billion, up $59.0 million, or 1.5%, over the prior quarter, supported by stable customer relationships and deposit inflows _______________________________ Core net revenue(1) grew 1.3% from the quarter ended June 30, 2025 Total revenue increased 21.1% from the prior quarter, driven by higher credit enhancement revenue associated with increased provision for credit losses _______________________________ Sold $1.62 billion of loans during the quarter, $1.37 billion of which was activity on accounts with previously sold credit card receivables ______________________________ Swept $672.3 million of deposits off balance-sheet for FDIC insurance and liquidity purposes generating $311,000 in noninterest income during the quarter

4 ADVANCING FUTURE VALUE Note: Data as of the three months ended September 30, 2025 unless otherwise indicated Positive partner progression during the quarter, with one moving to active status and three moving to the implementation stage ______________________________ Six existing partner programs expanded to include new products such as lines of credit, deposit programs and credit cards ______________________________ Robinhood's deposit program is in testing and is expected to ramp up in the fourth quarter of 2025. The expansion of these and other partner initiatives is expected to drive higher partner revenue in upcoming periods _______________________________ Retaining our portion of fee income on sold credit card receivables Total of 396,812 off-balance sheet credit cards up from 313,827 at June 30, 2025 where receivables are sold on a recurring basis with continued fee earning potential _______________________________ 7.1 million CCBX debit cards with fee-earning potential up from 6.3 million at June 30, 2025, reflecting strong partner and customer engagement

5 THIRD QUARTER 2025 FINANCIAL SUMMARY • Diluted EPS of $0.88, compared to $0.71 LQ, impacted by lower noninterest expense • ROA of 1.19% in quarter ended September 30, 2025, compared to 0.99% LQ, and 1.34% in PYQ Note: Data as of the three months ended September 30, 2025 unless otherwise indicated. "LQ" refers to quarter ending June 30, 2025, “PYQ” refers to quarter ended September 30, 2024 (1Pre-tax,pre-provision net revenue, adjusted for provision for credit losses, provision for income taxes, indemnifications and BaaS loan expense associated with the CCBX operating segment. This produces a figure which can be compared to net income. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. (2)Core net revenue includes net interest income and noninterest income, adjusted for BaaS credit enhancement and BaaS fraud enhancement and reimbursement of expenses (BaaS) and BaaS loan expense associated with the CCBX operating segment. This produces a figure which can be compared to revenue. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. (3) Tangible equity to tangible assets is a non-GAAP measure. Since there is no goodwill or other intangible assets as of the date indicated, tangible equity to tangible assets is the same as total shareholders’ equity to total assets as of the date indicated. • Net income of $13.6 million, up 23.2% over LQ, and up 1.0% versus PYQ ◦ Core PPNR(1) of $19.1 million, up 24.6% compared to LQ, and up 15.5% versus PYQ • Revenue of $144.7 million, up 21.1% compared to LQ ◦ Total core net revenue(2) of $52.9 million, up 1.3% compared to LQ • Noninterest expenses improved for the quarter ended September 30, 2025, but we anticipate ongoing expense fluctuations due to new CCBX partners and product launches. • Total loans, net of deferred fees increased $163.5 million, or 4.6%, to $3.70 billion as of September 30, 2025 • We continue to focus on higher quality CCBX loans • CCBX loans sales of $1.62 billion, compared to $1.30 billion LQ ◦ Primarily credit card loan sales - $1.41 billion, compared to $996.7 million LQ • Loan yield impacted by change in mix of loans and recent reduction in Fed funds interest rate; 10.95% for the quarter ended September 30, 2025, down 0.16% versus PQ • Deposits increased $59.0 million, or 1.5%, to $3.97 billion during the quarter ended September 30, 2025 due to CCBX and community bank growth • $672.3 million transferred off the balance sheet for additional FDIC insurance coverage and sweep purposes as of September 30, 2025, generating $311,000 in noninterest income during the quarter EPS Capital Deposits Loans Net Income & Core PPNR • Tangible book value(3) grew 2.8% from LQ and 28.3% versus PYQ to $31.45 per share • Bank Common Equity Tier 1 ratio grew to 12.37%, Bank Total Risk-based Capital increased to 13.66%

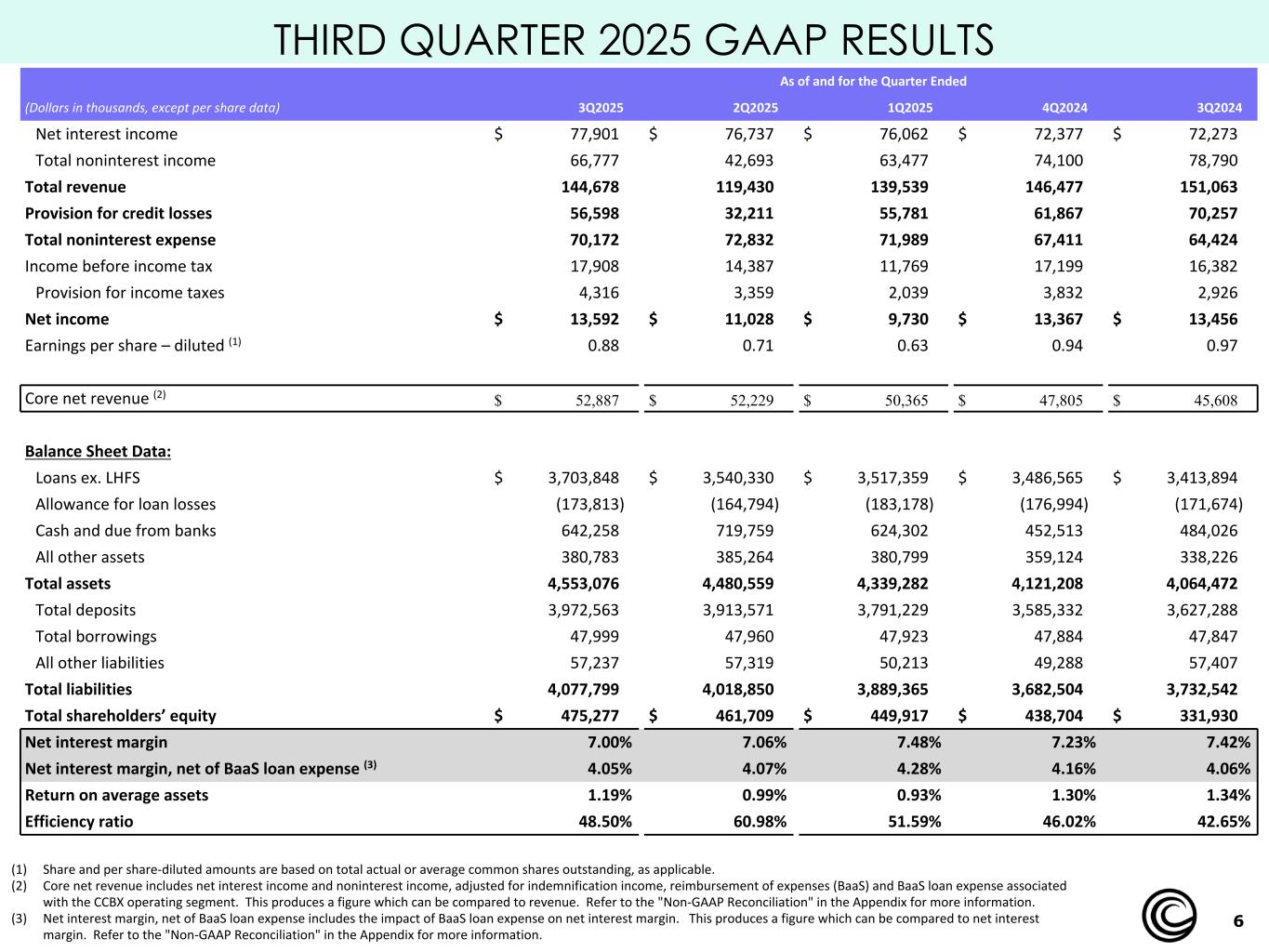

6 THIRD QUARTER 2025 GAAP RESULTS (1) Share and per share-diluted amounts are based on total actual or average common shares outstanding, as applicable. (2) Core net revenue includes net interest income and noninterest income, adjusted for indemnification income, reimbursement of expenses (BaaS) and BaaS loan expense associated with the CCBX operating segment. This produces a figure which can be compared to revenue. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. (3) Net interest margin, net of BaaS loan expense includes the impact of BaaS loan expense on net interest margin. This produces a figure which can be compared to net interest margin. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. As of and for the Quarter Ended (Dollars in thousands, except per share data) 3Q2025 2Q2025 1Q2025 4Q2024 3Q2024 Net interest income $ 77,901 $ 76,737 $ 76,062 $ 72,377 $ 72,273 Total noninterest income 66,777 42,693 63,477 74,100 78,790 Total revenue 144,678 119,430 139,539 146,477 151,063 Provision for credit losses 56,598 32,211 55,781 61,867 70,257 Total noninterest expense 70,172 72,832 71,989 67,411 64,424 Income before income tax 17,908 14,387 11,769 17,199 16,382 Provision for income taxes 4,316 3,359 2,039 3,832 2,926 Net income $ 13,592 $ 11,028 $ 9,730 $ 13,367 $ 13,456 Earnings per share – diluted (1) 0.88 0.71 0.63 0.94 0.97 Core net revenue (2) $ 52,887 $ 52,229 $ 50,365 $ 47,805 $ 45,608 $ 45,608 Balance Sheet Data: Loans ex. LHFS $ 3,703,848 $ 3,540,330 $ 3,517,359 $ 3,486,565 $ 3,413,894 Allowance for loan losses (173,813) (164,794) (183,178) (176,994) (171,674) Cash and due from banks 642,258 719,759 624,302 452,513 484,026 All other assets 380,783 385,264 380,799 359,124 338,226 Total assets 4,553,076 4,480,559 4,339,282 4,121,208 4,064,472 Total deposits 3,972,563 3,913,571 3,791,229 3,585,332 3,627,288 Total borrowings 47,999 47,960 47,923 47,884 47,847 All other liabilities 57,237 57,319 50,213 49,288 57,407 Total liabilities 4,077,799 4,018,850 3,889,365 3,682,504 3,732,542 Total shareholders’ equity $ 475,277 $ 461,709 $ 449,917 $ 438,704 $ 331,930 Net interest margin 7.00% 7.06% 7.48% 7.23% 7.42% Net interest margin, net of BaaS loan expense (3) 4.05% 4.07% 4.28% 4.16% 4.06% Return on average assets 1.19% 0.99% 0.93% 1.30% 1.34% Efficiency ratio 48.50% 60.98% 51.59% 46.02% 42.65%

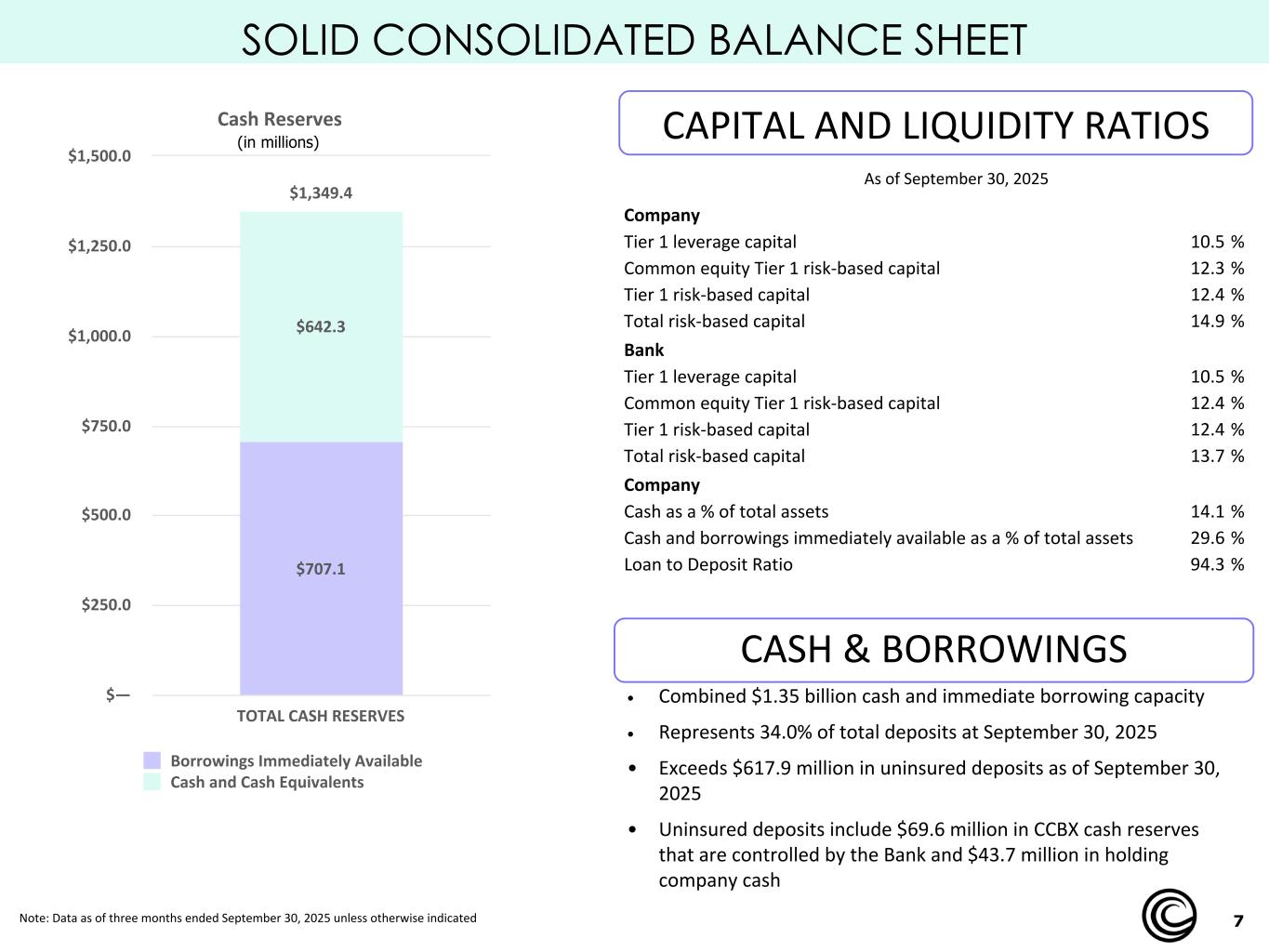

7 SOLID CONSOLIDATED BALANCE SHEET CAPITAL AND LIQUIDITY RATIOS Note: Data as of three months ended September 30, 2025 unless otherwise indicated (in millions) CASH & BORROWINGS • Combined $1.35 billion cash and immediate borrowing capacity • Represents 34.0% of total deposits at September 30, 2025 • Exceeds $617.9 million in uninsured deposits as of September 30, 2025 • Uninsured deposits include $69.6 million in CCBX cash reserves that are controlled by the Bank and $43.7 million in holding company cash Company Tier 1 leverage capital 10.5 % Common equity Tier 1 risk-based capital 12.3 % Tier 1 risk-based capital 12.4 % Total risk-based capital 14.9 % Bank Tier 1 leverage capital 10.5 % Common equity Tier 1 risk-based capital 12.4 % Tier 1 risk-based capital 12.4 % Total risk-based capital 13.7 % Company Cash as a % of total assets 14.1 % Cash and borrowings immediately available as a % of total assets 29.6 % Loan to Deposit Ratio 94.3 % As of September 30, 2025 Cash Reserves $1,349.4 $707.1 $642.3 Borrowings Immediately Available Cash and Cash Equivalents TOTAL CASH RESERVES $— $250.0 $500.0 $750.0 $1,000.0 $1,250.0 $1,500.0

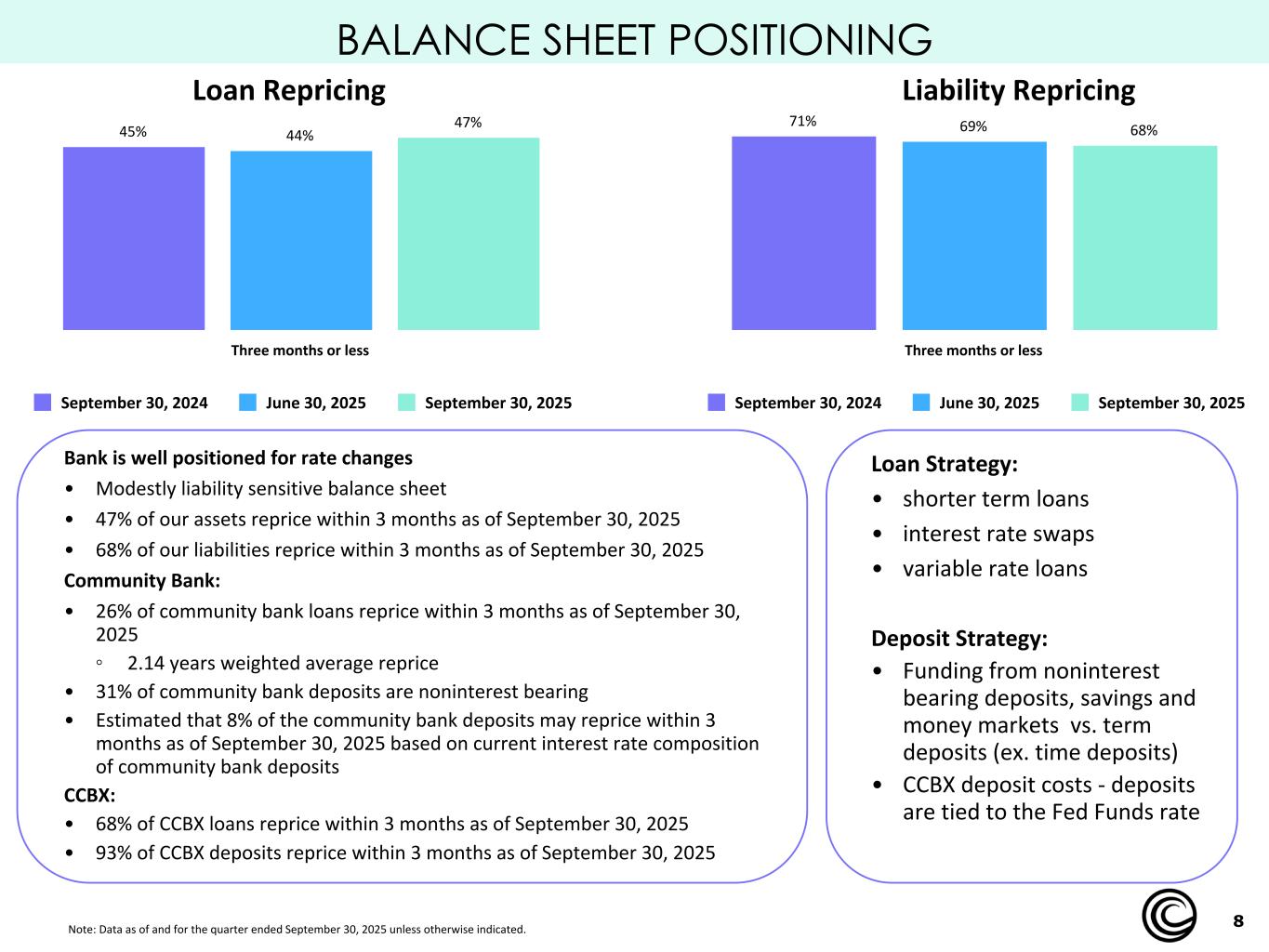

8 BALANCE SHEET POSITIONING Bank is well positioned for rate changes • Modestly liability sensitive balance sheet • 47% of our assets reprice within 3 months as of September 30, 2025 • 68% of our liabilities reprice within 3 months as of September 30, 2025 Community Bank: • 26% of community bank loans reprice within 3 months as of September 30, 2025 ◦ 2.14 years weighted average reprice • 31% of community bank deposits are noninterest bearing • Estimated that 8% of the community bank deposits may reprice within 3 months as of September 30, 2025 based on current interest rate composition of community bank deposits CCBX: • 68% of CCBX loans reprice within 3 months as of September 30, 2025 • 93% of CCBX deposits reprice within 3 months as of September 30, 2025 Loan Strategy: • shorter term loans • interest rate swaps • variable rate loans Deposit Strategy: • Funding from noninterest bearing deposits, savings and money markets vs. term deposits (ex. time deposits) • CCBX deposit costs - deposits are tied to the Fed Funds rate Note: Data as of and for the quarter ended September 30, 2025 unless otherwise indicated. 45% 44% 47% September 30, 2024 June 30, 2025 September 30, 2025 Three months or less 71% 69% 68% September 30, 2024 June 30, 2025 September 30, 2025 Three months or less Loan Repricing Liability Repricing

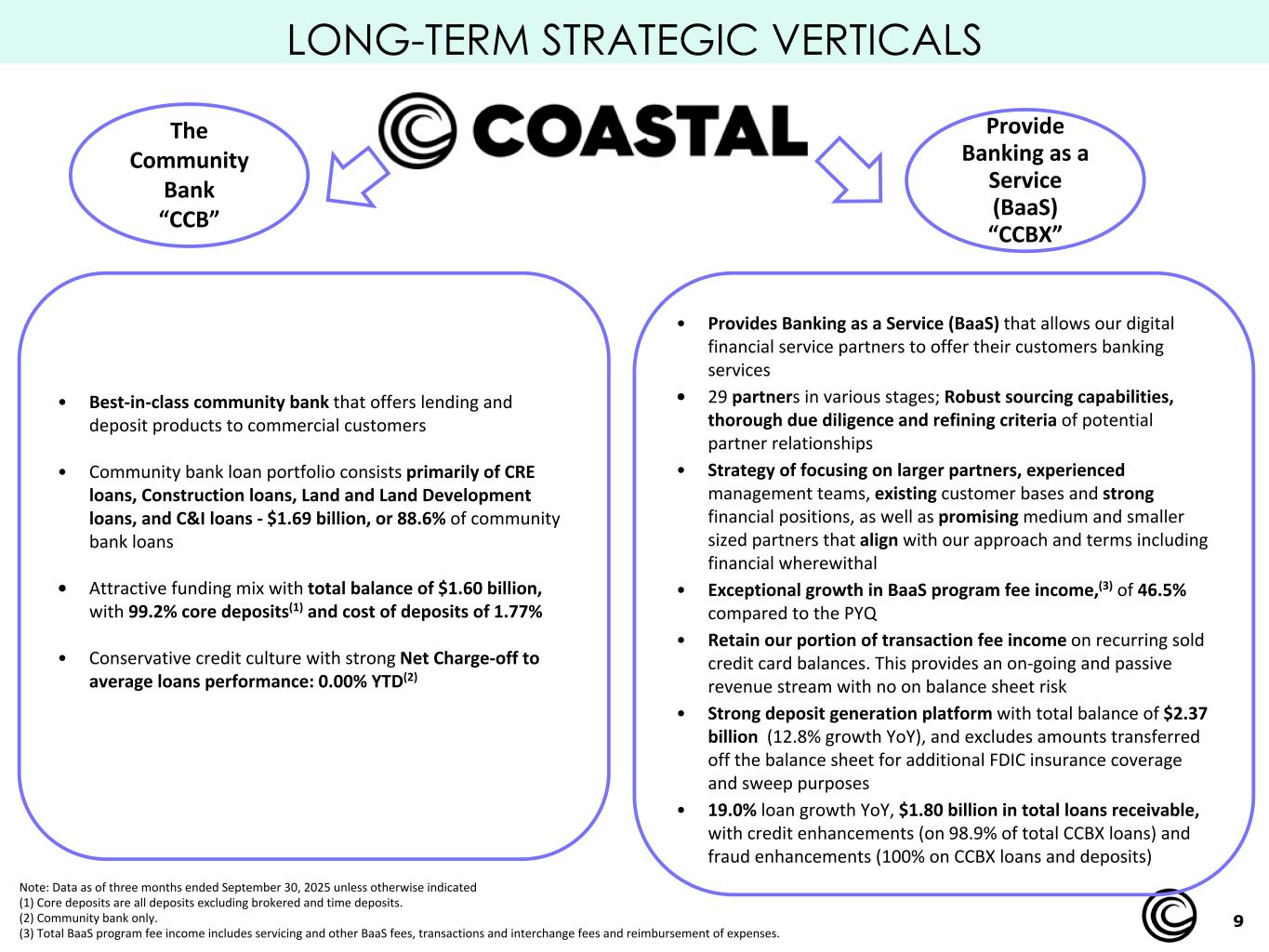

9 LONG-TERM STRATEGIC VERTICALS The Community Bank “CCB” Provide Banking as a Service (BaaS) “CCBX” • Best-in-class community bank that offers lending and deposit products to commercial customers • Community bank loan portfolio consists primarily of CRE loans, Construction loans, Land and Land Development loans, and C&I loans - $1.69 billion, or 88.6% of community bank loans • Attractive funding mix with total balance of $1.60 billion, with 99.2% core deposits(1) and cost of deposits of 1.77% • Conservative credit culture with strong Net Charge-off to average loans performance: 0.00% YTD(2) • Provides Banking as a Service (BaaS) that allows our digital financial service partners to offer their customers banking services • 29 partners in various stages; Robust sourcing capabilities, thorough due diligence and refining criteria of potential partner relationships • Strategy of focusing on larger partners, experienced management teams, existing customer bases and strong financial positions, as well as promising medium and smaller sized partners that align with our approach and terms including financial wherewithal • Exceptional growth in BaaS program fee income,(3) of 46.5% compared to the PYQ • Retain our portion of transaction fee income on recurring sold credit card balances. This provides an on-going and passive revenue stream with no on balance sheet risk • Strong deposit generation platform with total balance of $2.37 billion (12.8% growth YoY), and excludes amounts transferred off the balance sheet for additional FDIC insurance coverage and sweep purposes • 19.0% loan growth YoY, $1.80 billion in total loans receivable, with credit enhancements (on 98.9% of total CCBX loans) and fraud enhancements (100% on CCBX loans and deposits) Note: Data as of three months ended September 30, 2025 unless otherwise indicated (1) Core deposits are all deposits excluding brokered and time deposits. (2) Community bank only. (3) Total BaaS program fee income includes servicing and other BaaS fees, transactions and interchange fees and reimbursement of expenses.

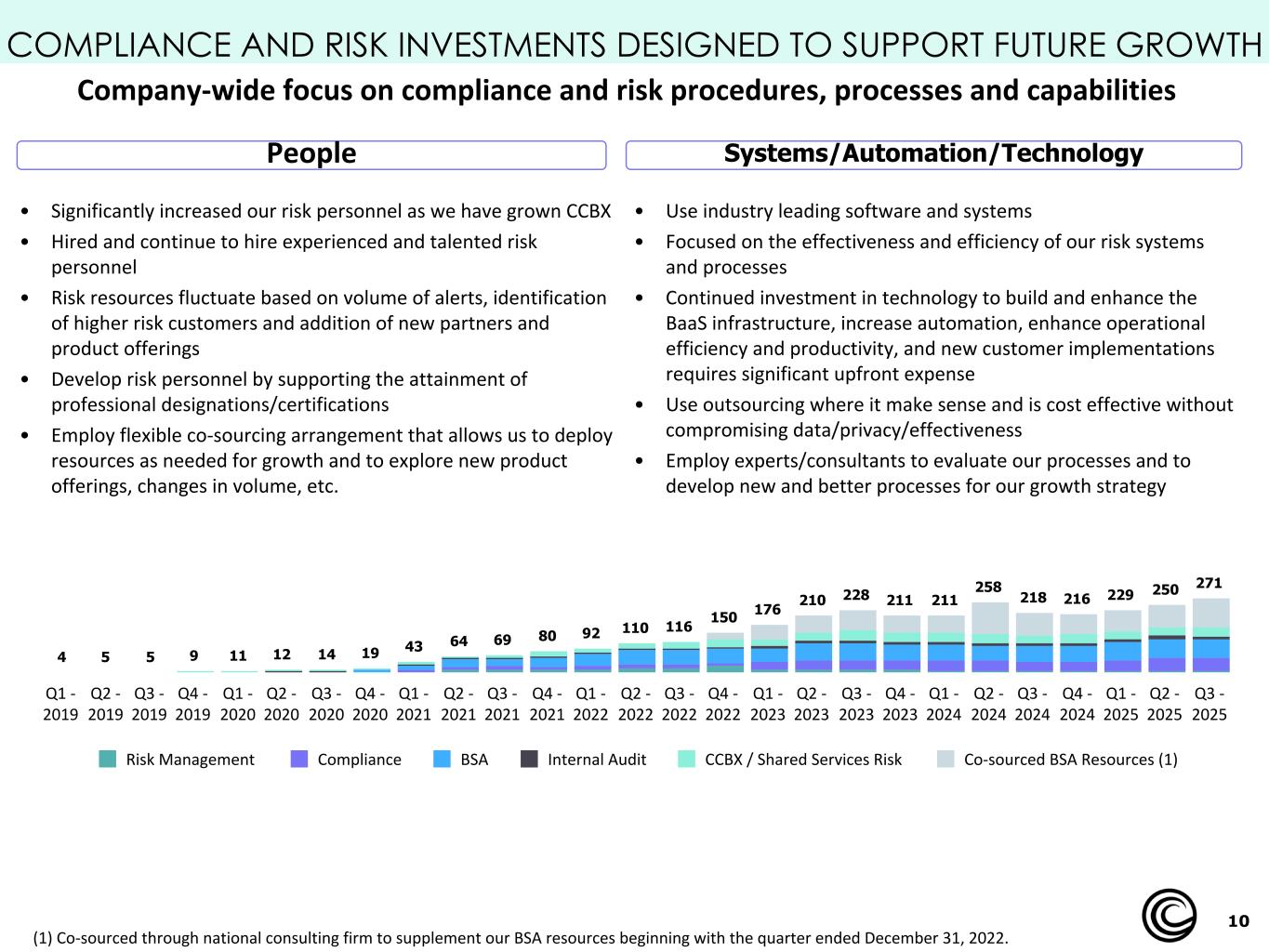

10 COMPLIANCE AND RISK INVESTMENTS DESIGNED TO SUPPORT FUTURE GROWTH 4 5 5 9 11 12 14 19 43 64 69 80 92 110 116 150 176 210 228 211 211 258 218 216 229 250 271 Risk Management Compliance BSA Internal Audit CCBX / Shared Services Risk Co-sourced BSA Resources (1) Q1 - 2019 Q2 - 2019 Q3 - 2019 Q4 - 2019 Q1 - 2020 Q2 - 2020 Q3 - 2020 Q4 - 2020 Q1 - 2021 Q2 - 2021 Q3 - 2021 Q4 - 2021 Q1 - 2022 Q2 - 2022 Q3 - 2022 Q4 - 2022 Q1 - 2023 Q2 - 2023 Q3 - 2023 Q4 - 2023 Q1 - 2024 Q2 - 2024 Q3 - 2024 Q4 - 2024 Q1 - 2025 Q2 - 2025 Q3 - 2025 People Systems/Automation/Technology • Significantly increased our risk personnel as we have grown CCBX • Hired and continue to hire experienced and talented risk personnel • Risk resources fluctuate based on volume of alerts, identification of higher risk customers and addition of new partners and product offerings • Develop risk personnel by supporting the attainment of professional designations/certifications • Employ flexible co-sourcing arrangement that allows us to deploy resources as needed for growth and to explore new product offerings, changes in volume, etc. • Use industry leading software and systems • Focused on the effectiveness and efficiency of our risk systems and processes • Continued investment in technology to build and enhance the BaaS infrastructure, increase automation, enhance operational efficiency and productivity, and new customer implementations requires significant upfront expense • Use outsourcing where it make sense and is cost effective without compromising data/privacy/effectiveness • Employ experts/consultants to evaluate our processes and to develop new and better processes for our growth strategy (1) Co-sourced through national consulting firm to supplement our BSA resources beginning with the quarter ended December 31, 2022. Company-wide focus on compliance and risk procedures, processes and capabilities

11 SEGMENT UPDATES: CCBX & COMMUNITY BANK

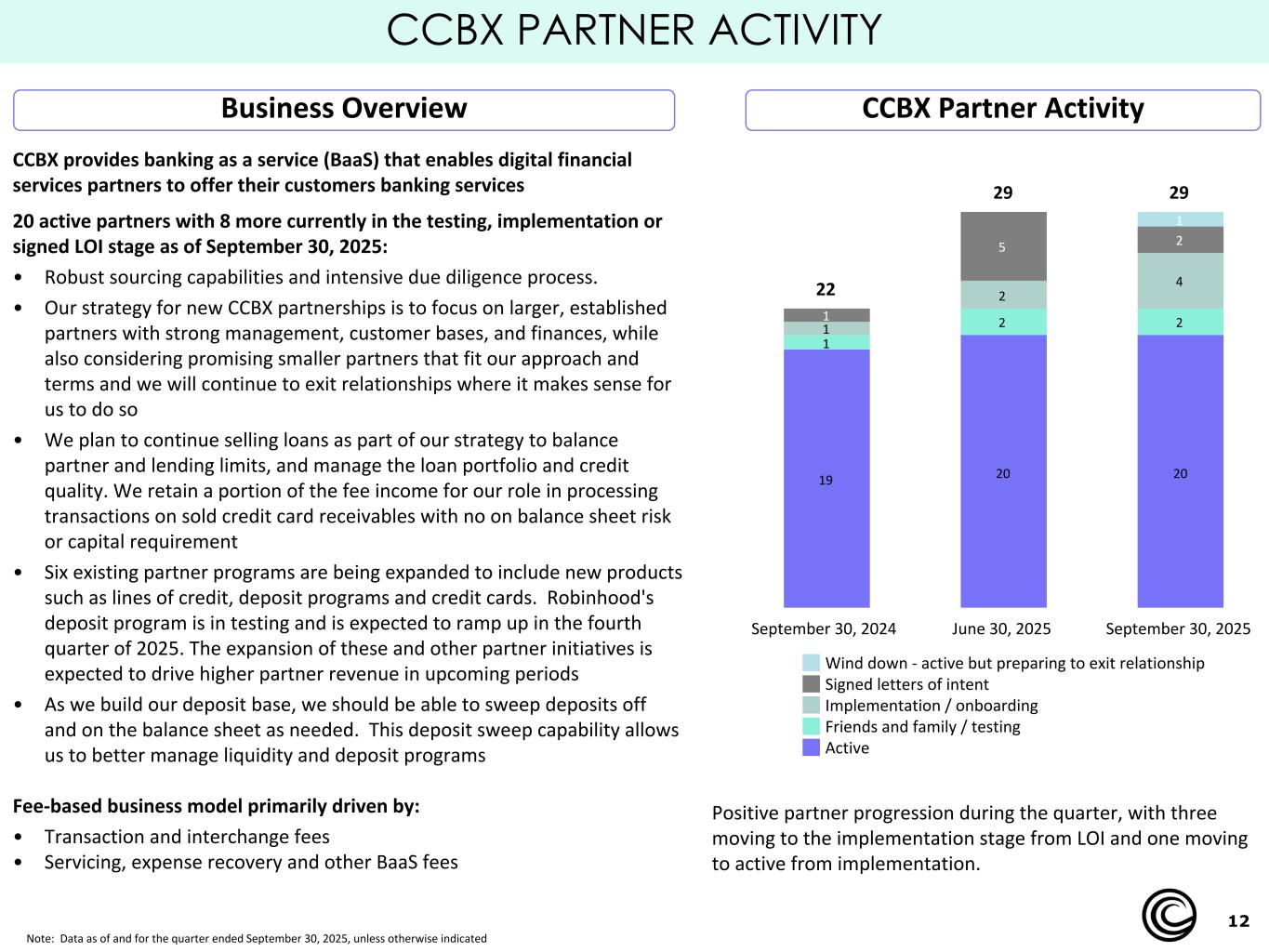

12 22 29 29 19 20 20 1 2 21 2 4 1 5 2 1 Wind down - active but preparing to exit relationship Signed letters of intent Implementation / onboarding Friends and family / testing Active September 30, 2024 June 30, 2025 September 30, 2025 CCBX provides banking as a service (BaaS) that enables digital financial services partners to offer their customers banking services 20 active partners with 8 more currently in the testing, implementation or signed LOI stage as of September 30, 2025: • Robust sourcing capabilities and intensive due diligence process. • Our strategy for new CCBX partnerships is to focus on larger, established partners with strong management, customer bases, and finances, while also considering promising smaller partners that fit our approach and terms and we will continue to exit relationships where it makes sense for us to do so • We plan to continue selling loans as part of our strategy to balance partner and lending limits, and manage the loan portfolio and credit quality. We retain a portion of the fee income for our role in processing transactions on sold credit card receivables with no on balance sheet risk or capital requirement • Six existing partner programs are being expanded to include new products such as lines of credit, deposit programs and credit cards. Robinhood's deposit program is in testing and is expected to ramp up in the fourth quarter of 2025. The expansion of these and other partner initiatives is expected to drive higher partner revenue in upcoming periods • As we build our deposit base, we should be able to sweep deposits off and on the balance sheet as needed. This deposit sweep capability allows us to better manage liquidity and deposit programs Fee-based business model primarily driven by: • Transaction and interchange fees • Servicing, expense recovery and other BaaS fees CCBX Partner Activity Note: Data as of and for the quarter ended September 30, 2025, unless otherwise indicated Business Overview CCBX PARTNER ACTIVITY Positive partner progression during the quarter, with three moving to the implementation stage from LOI and one moving to active from implementation.

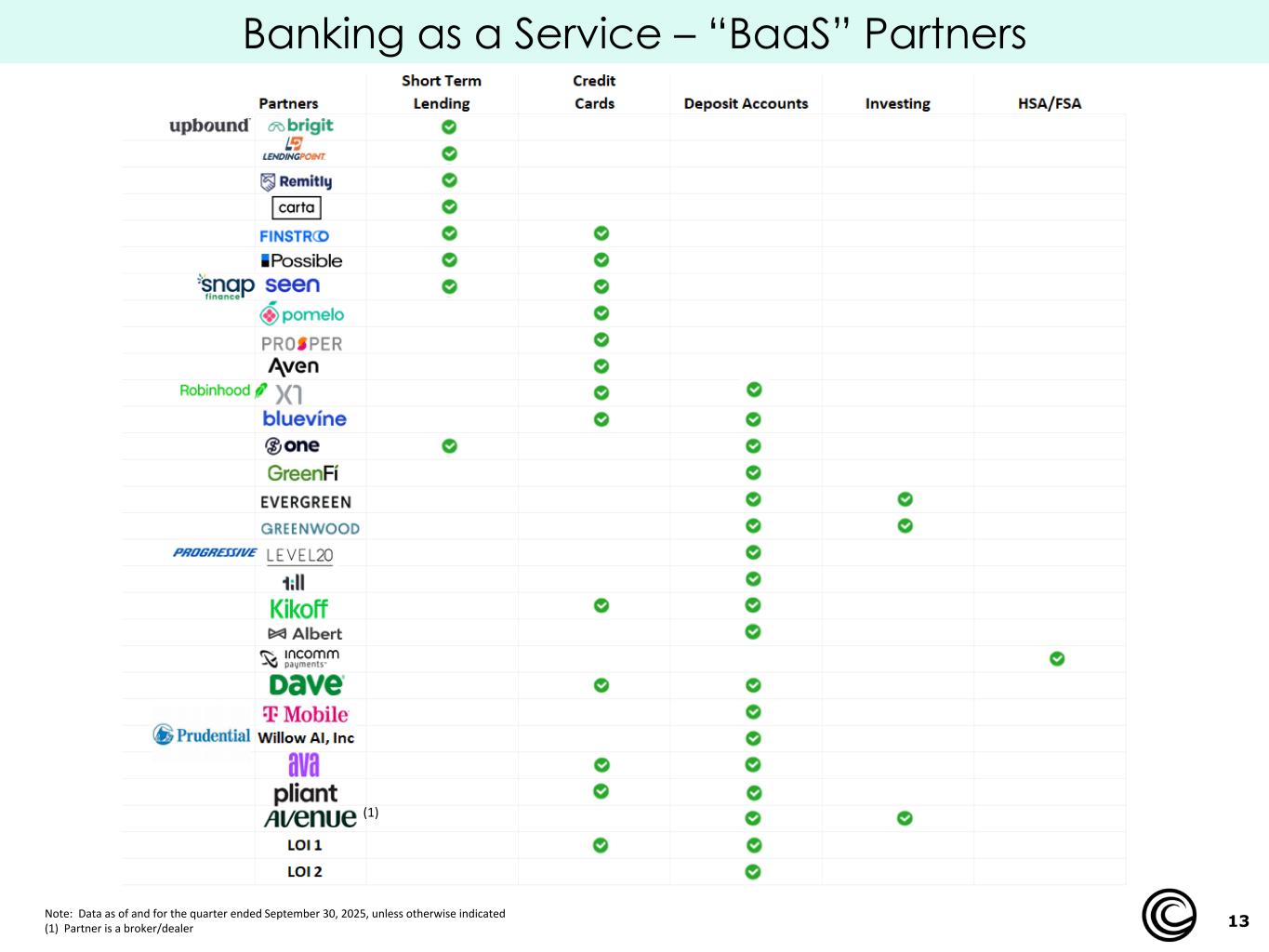

Banking as a Service – “BaaS” Partners 13Note: Data as of and for the quarter ended September 30, 2025, unless otherwise indicated (1) Partner is a broker/dealer (1)

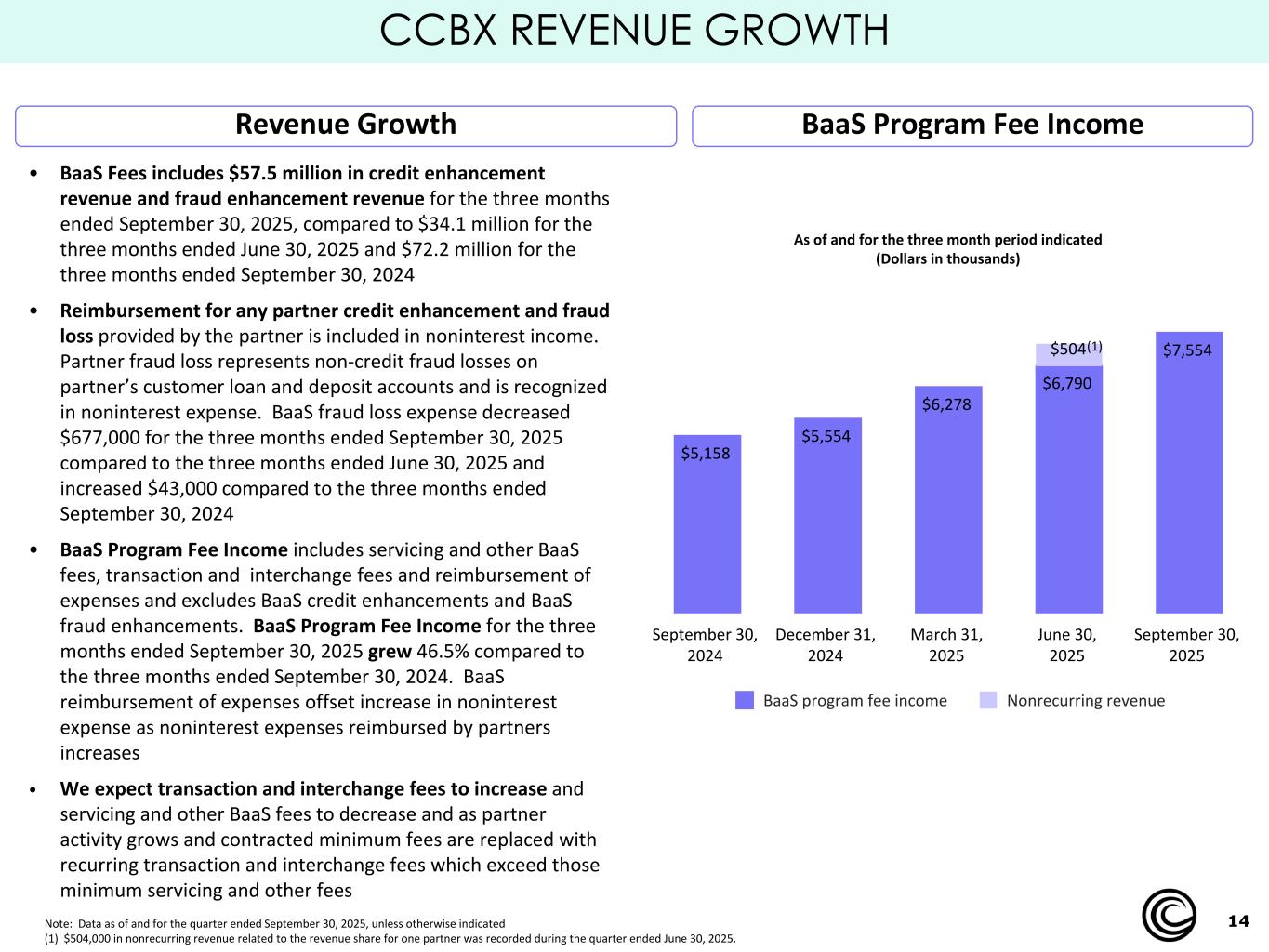

14 CCBX REVENUE GROWTH As of and for the three month period indicated (Dollars in thousands) $5,158 $5,554 $6,278 $6,790 $7,554$504 BaaS program fee income Nonrecurring revenue September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 BaaS Program Fee Income Note: Data as of and for the quarter ended September 30, 2025, unless otherwise indicated (1) $504,000 in nonrecurring revenue related to the revenue share for one partner was recorded during the quarter ended June 30, 2025. Revenue Growth • BaaS Fees includes $57.5 million in credit enhancement revenue and fraud enhancement revenue for the three months ended September 30, 2025, compared to $34.1 million for the three months ended June 30, 2025 and $72.2 million for the three months ended September 30, 2024 • Reimbursement for any partner credit enhancement and fraud loss provided by the partner is included in noninterest income. Partner fraud loss represents non-credit fraud losses on partner’s customer loan and deposit accounts and is recognized in noninterest expense. BaaS fraud loss expense decreased $677,000 for the three months ended September 30, 2025 compared to the three months ended June 30, 2025 and increased $43,000 compared to the three months ended September 30, 2024 • BaaS Program Fee Income includes servicing and other BaaS fees, transaction and interchange fees and reimbursement of expenses and excludes BaaS credit enhancements and BaaS fraud enhancements. BaaS Program Fee Income for the three months ended September 30, 2025 grew 46.5% compared to the three months ended September 30, 2024. BaaS reimbursement of expenses offset increase in noninterest expense as noninterest expenses reimbursed by partners increases • We expect transaction and interchange fees to increase and servicing and other BaaS fees to decrease and as partner activity grows and contracted minimum fees are replaced with recurring transaction and interchange fees which exceed those minimum servicing and other fees (1)

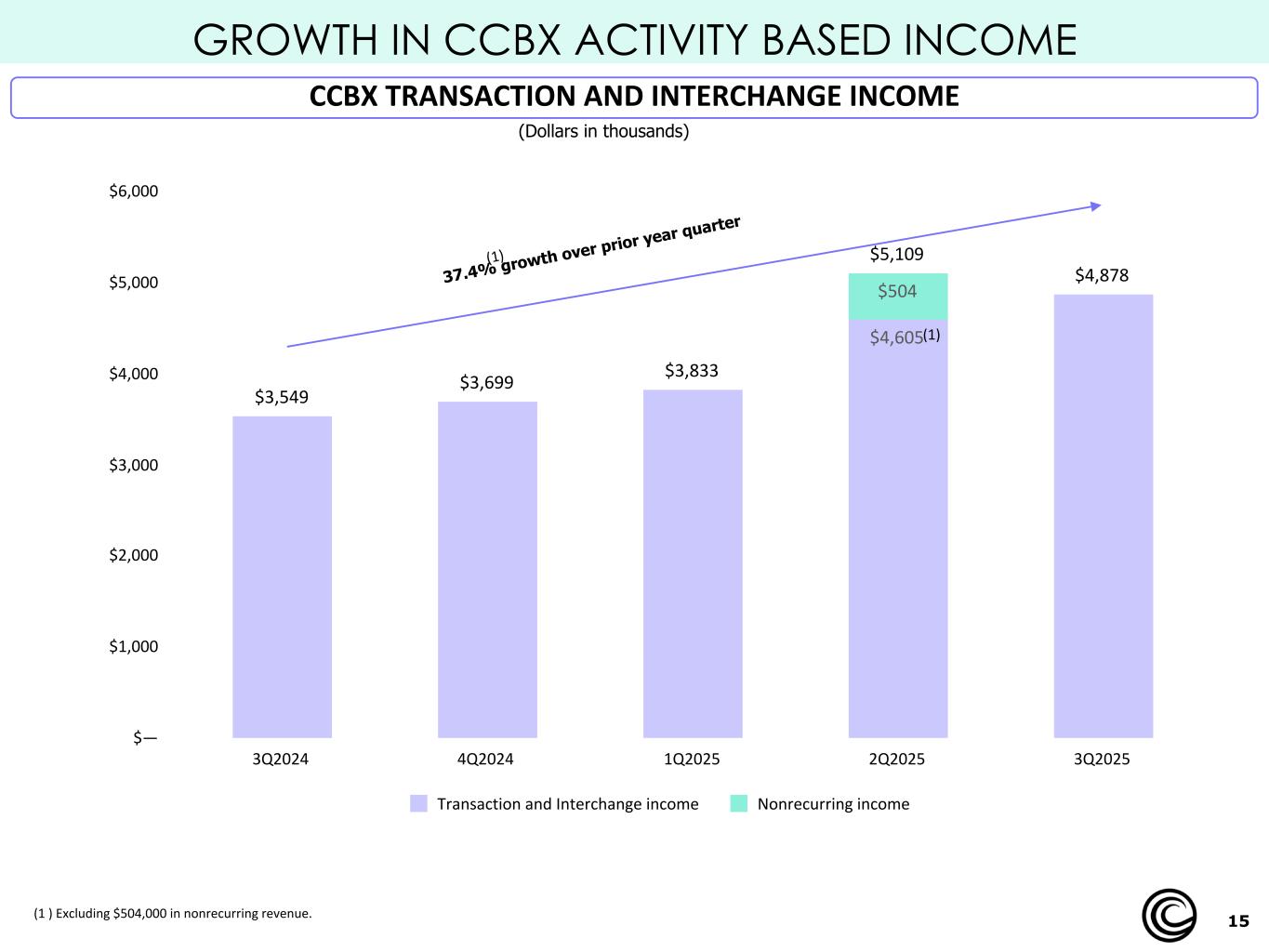

15 GROWTH IN CCBX ACTIVITY BASED INCOME CCBX TRANSACTION AND INTERCHANGE INCOME (Dollars in thousands) 37.4% growth over prior year quarter $3,549 $3,699 $3,833 $5,109 $4,878 $4,605 $504 Transaction and Interchange income Nonrecurring income 3Q2024 4Q2024 1Q2025 2Q2025 3Q2025 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 (1) (1 ) Excluding $504,000 in nonrecurring revenue. (1)

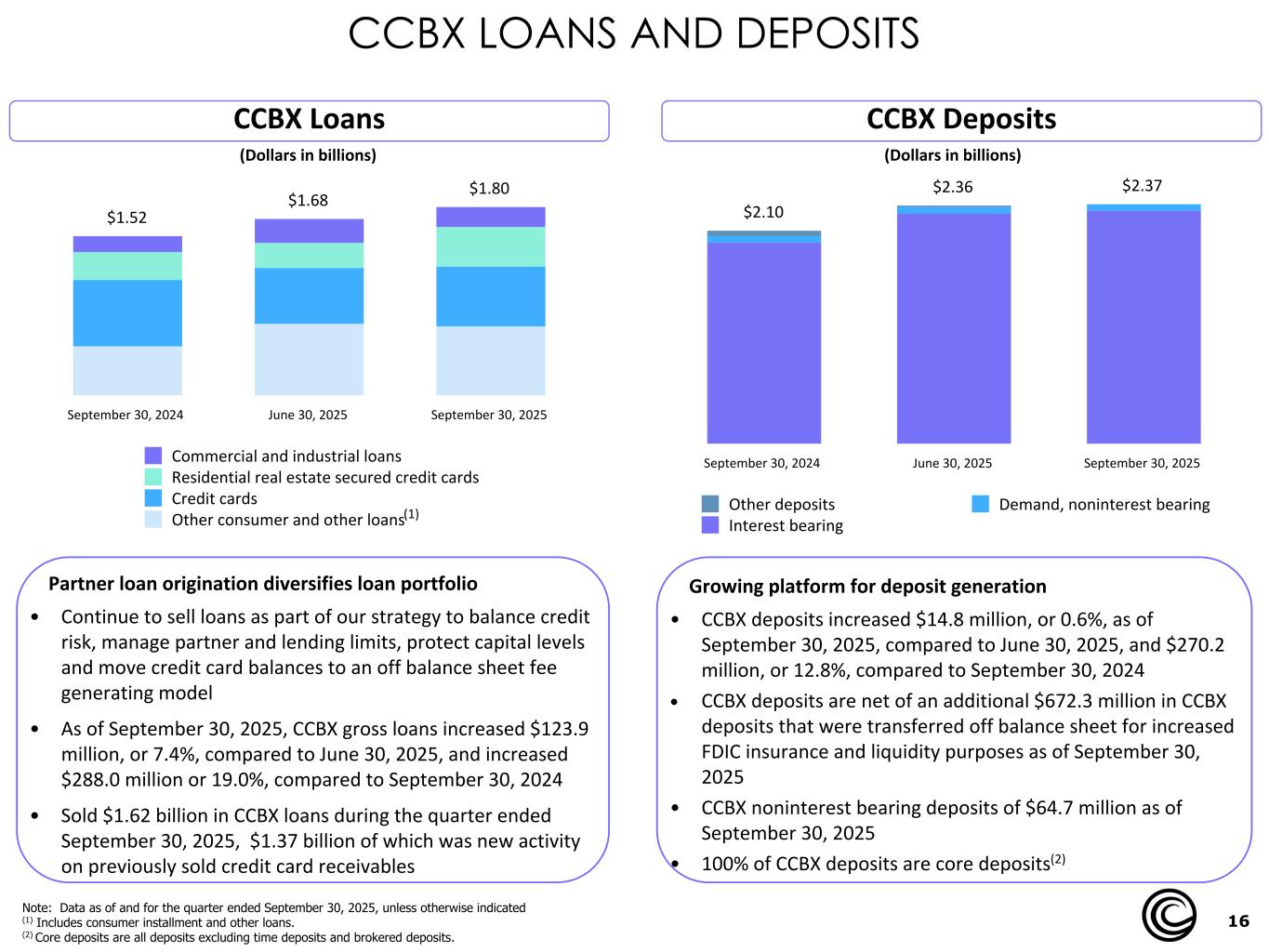

16 CCBX LOANS AND DEPOSITS (Dollars in billions) $2.10 $2.36 $2.37 Other deposits Demand, noninterest bearing Interest bearing September 30, 2024 June 30, 2025 September 30, 2025 (Dollars in billions) $1.52 $1.68 $1.80 Commercial and industrial loans Residential real estate secured credit cards Credit cards Other consumer and other loans September 30, 2024 June 30, 2025 September 30, 2025 Growing platform for deposit generation • CCBX deposits increased $14.8 million, or 0.6%, as of September 30, 2025, compared to June 30, 2025, and $270.2 million, or 12.8%, compared to September 30, 2024 • CCBX deposits are net of an additional $672.3 million in CCBX deposits that were transferred off balance sheet for increased FDIC insurance and liquidity purposes as of September 30, 2025 • CCBX noninterest bearing deposits of $64.7 million as of September 30, 2025 • 100% of CCBX deposits are core deposits(2) Partner loan origination diversifies loan portfolio • Continue to sell loans as part of our strategy to balance credit risk, manage partner and lending limits, protect capital levels and move credit card balances to an off balance sheet fee generating model • As of September 30, 2025, CCBX gross loans increased $123.9 million, or 7.4%, compared to June 30, 2025, and increased $288.0 million or 19.0%, compared to September 30, 2024 • Sold $1.62 billion in CCBX loans during the quarter ended September 30, 2025, $1.37 billion of which was new activity on previously sold credit card receivables CCBX Loans CCBX Deposits Note: Data as of and for the quarter ended September 30, 2025, unless otherwise indicated (1) Includes consumer installment and other loans. (2) Core deposits are all deposits excluding time deposits and brokered deposits. (1)

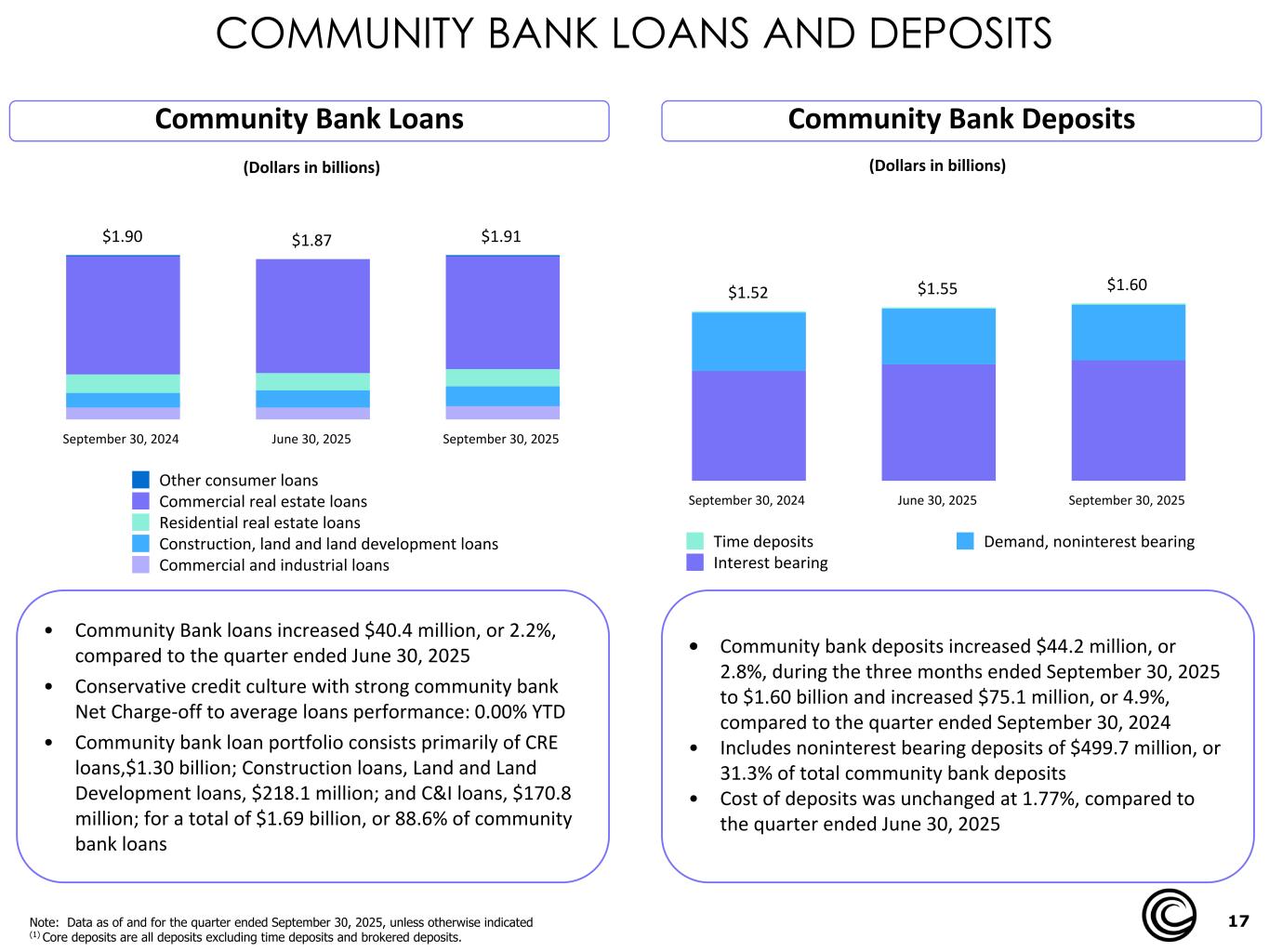

17 COMMUNITY BANK LOANS AND DEPOSITS (Dollars in billions) $1.52 $1.55 $1.60 Time deposits Demand, noninterest bearing Interest bearing September 30, 2024 June 30, 2025 September 30, 2025 Community Bank Loans Community Bank Deposits Note: Data as of and for the quarter ended September 30, 2025, unless otherwise indicated (1) Core deposits are all deposits excluding time deposits and brokered deposits. • Community Bank loans increased $40.4 million, or 2.2%, compared to the quarter ended June 30, 2025 • Conservative credit culture with strong community bank Net Charge-off to average loans performance: 0.00% YTD • Community bank loan portfolio consists primarily of CRE loans,$1.30 billion; Construction loans, Land and Land Development loans, $218.1 million; and C&I loans, $170.8 million; for a total of $1.69 billion, or 88.6% of community bank loans • Community bank deposits increased $44.2 million, or 2.8%, during the three months ended September 30, 2025 to $1.60 billion and increased $75.1 million, or 4.9%, compared to the quarter ended September 30, 2024 • Includes noninterest bearing deposits of $499.7 million, or 31.3% of total community bank deposits • Cost of deposits was unchanged at 1.77%, compared to the quarter ended June 30, 2025 (Dollars in billions) $1.90 $1.87 $1.91 Other consumer loans Commercial real estate loans Residential real estate loans Construction, land and land development loans Commercial and industrial loans September 30, 2024 June 30, 2025 September 30, 2025

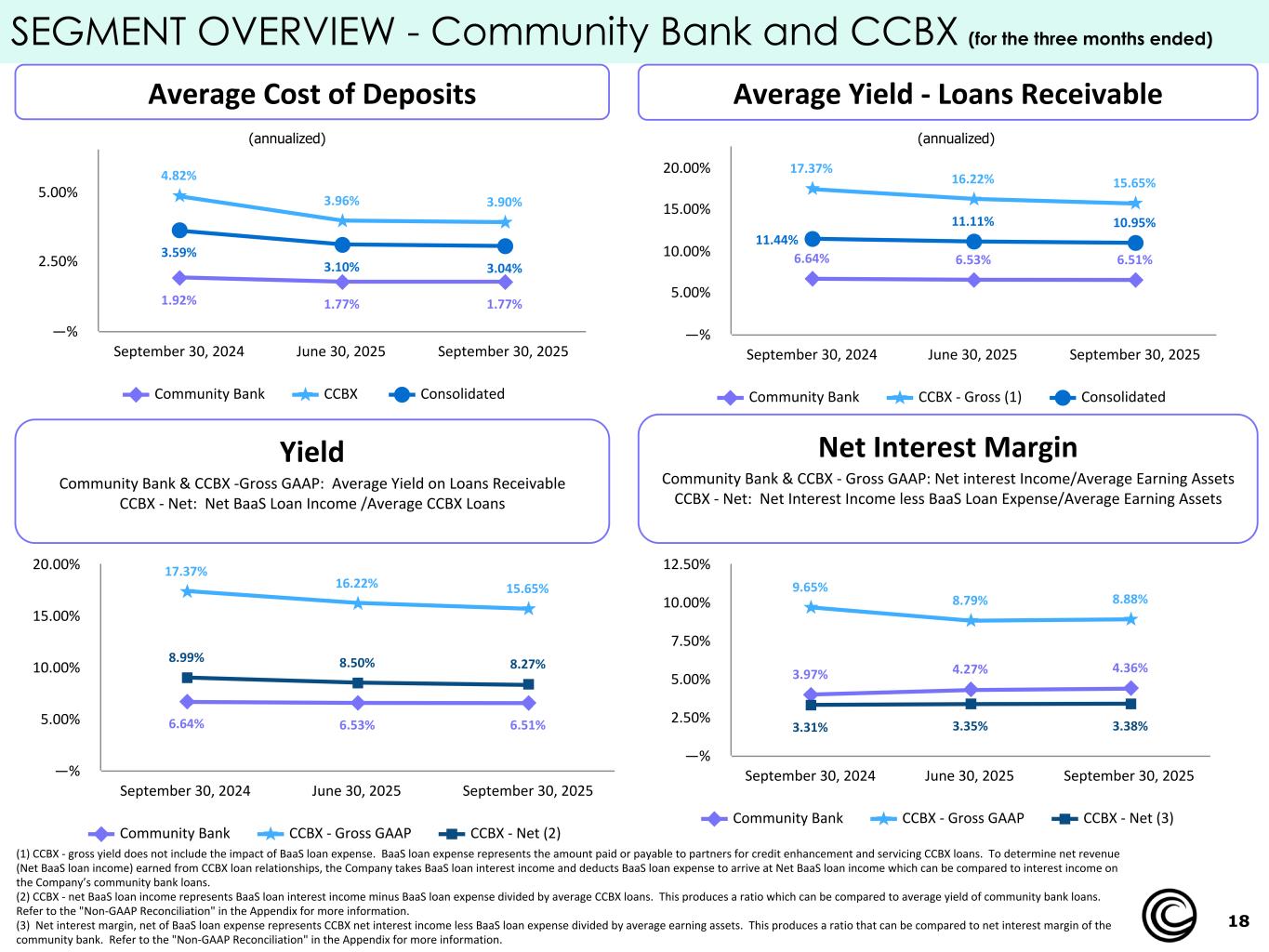

18 SEGMENT OVERVIEW - Community Bank and CCBX (for the three months ended) 1.92% 1.77% 1.77% 4.82% 3.96% 3.90% 3.59% 3.10% 3.04% Community Bank CCBX Consolidated September 30, 2024 June 30, 2025 September 30, 2025 —% 2.50% 5.00% Average Cost of Deposits (annualized) 6.64% 6.53% 6.51% 17.37% 16.22% 15.65% 11.44% 11.11% 10.95% Community Bank CCBX - Gross (1) Consolidated September 30, 2024 June 30, 2025 September 30, 2025 —% 5.00% 10.00% 15.00% 20.00% Average Yield - Loans Receivable (annualized) Yield Community Bank & CCBX -Gross GAAP: Average Yield on Loans Receivable CCBX - Net: Net BaaS Loan Income /Average CCBX Loans 6.64% 6.53% 6.51% 17.37% 16.22% 15.65% 8.99% 8.50% 8.27% Community Bank CCBX - Gross GAAP CCBX - Net (2) September 30, 2024 June 30, 2025 September 30, 2025 —% 5.00% 10.00% 15.00% 20.00% 3.97% 4.27% 4.36% 9.65% 8.79% 8.88% 3.31% 3.35% 3.38% Community Bank CCBX - Gross GAAP CCBX - Net (3) September 30, 2024 June 30, 2025 September 30, 2025 —% 2.50% 5.00% 7.50% 10.00% 12.50% Net Interest Margin Community Bank & CCBX - Gross GAAP: Net interest Income/Average Earning Assets CCBX - Net: Net Interest Income less BaaS Loan Expense/Average Earning Assets (1) CCBX - gross yield does not include the impact of BaaS loan expense. BaaS loan expense represents the amount paid or payable to partners for credit enhancement and servicing CCBX loans. To determine net revenue (Net BaaS loan income) earned from CCBX loan relationships, the Company takes BaaS loan interest income and deducts BaaS loan expense to arrive at Net BaaS loan income which can be compared to interest income on the Company’s community bank loans. (2) CCBX - net BaaS loan income represents BaaS loan interest income minus BaaS loan expense divided by average CCBX loans. This produces a ratio which can be compared to average yield of community bank loans. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. (3) Net interest margin, net of BaaS loan expense represents CCBX net interest income less BaaS loan expense divided by average earning assets. This produces a ratio that can be compared to net interest margin of the community bank. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information.

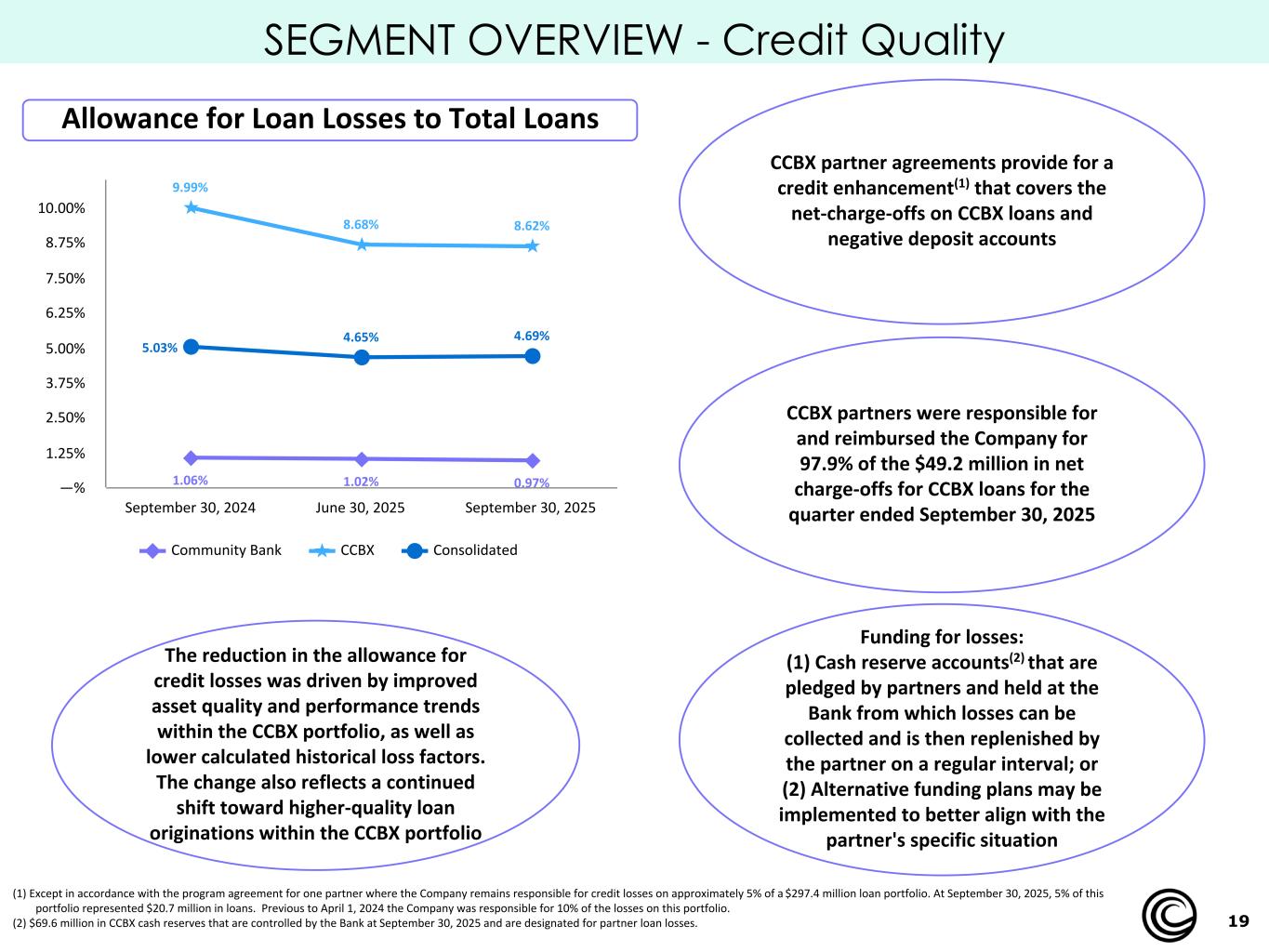

19 SEGMENT OVERVIEW - Credit Quality 1.06% 1.02% 0.97% 9.99% 8.68% 8.62% 5.03% 4.65% 4.69% Community Bank CCBX Consolidated September 30, 2024 June 30, 2025 September 30, 2025 —% 1.25% 2.50% 3.75% 5.00% 6.25% 7.50% 8.75% 10.00% Allowance for Loan Losses to Total Loans CCBX partner agreements provide for a credit enhancement(1) that covers the net-charge-offs on CCBX loans and negative deposit accounts CCBX partners were responsible for and reimbursed the Company for 97.9% of the $49.2 million in net charge-offs for CCBX loans for the quarter ended September 30, 2025 Funding for losses: (1) Cash reserve accounts(2) that are pledged by partners and held at the Bank from which losses can be collected and is then replenished by the partner on a regular interval; or (2) Alternative funding plans may be implemented to better align with the partner's specific situation (1) Except in accordance with the program agreement for one partner where the Company remains responsible for credit losses on approximately 5% of a $297.4 million loan portfolio. At September 30, 2025, 5% of this portfolio represented $20.7 million in loans. Previous to April 1, 2024 the Company was responsible for 10% of the losses on this portfolio. (2) $69.6 million in CCBX cash reserves that are controlled by the Bank at September 30, 2025 and are designated for partner loan losses. The reduction in the allowance for credit losses was driven by improved asset quality and performance trends within the CCBX portfolio, as well as lower calculated historical loss factors. The change also reflects a continued shift toward higher-quality loan originations within the CCBX portfolio

20 APPENDIX

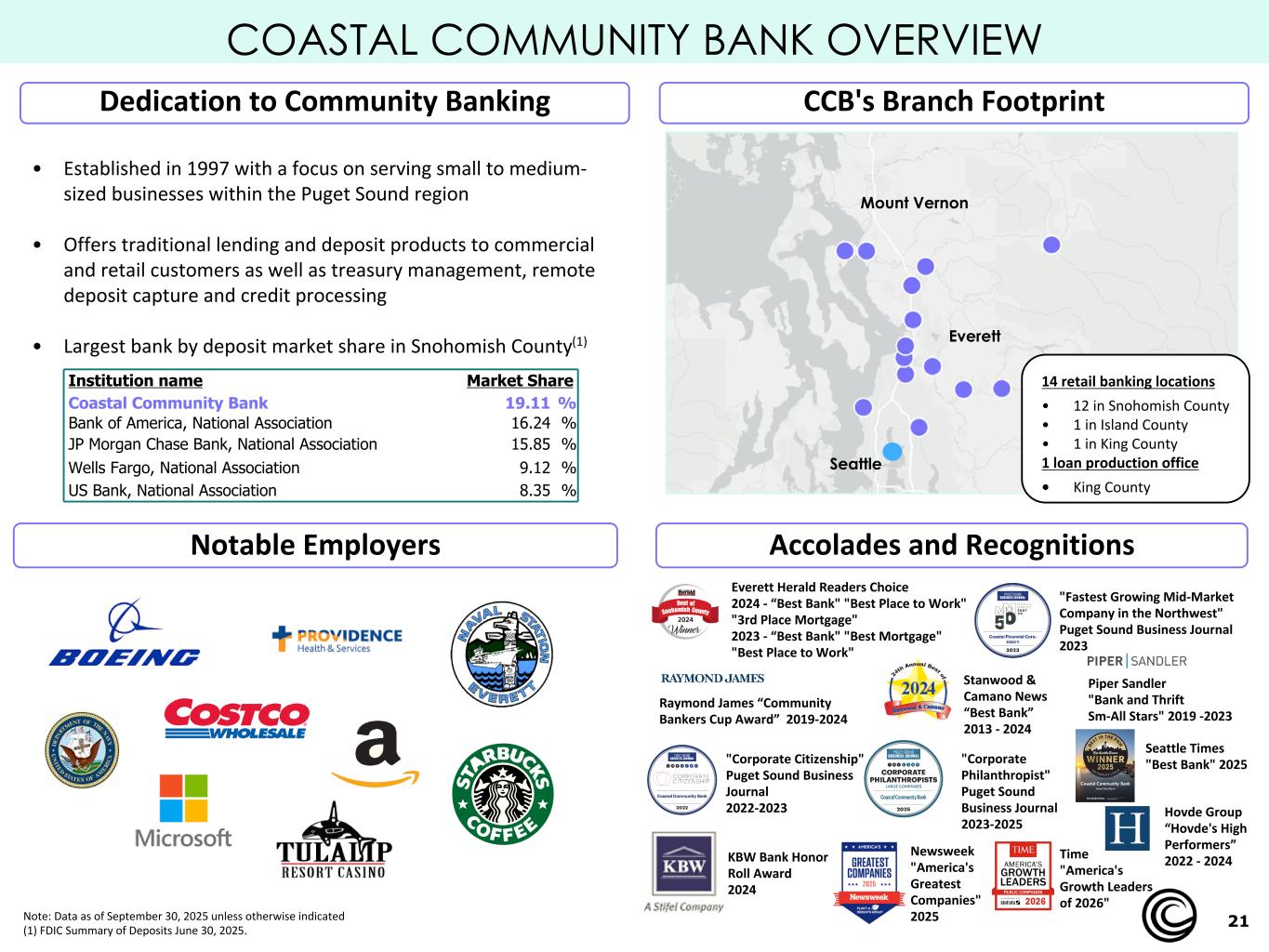

21 • Established in 1997 with a focus on serving small to medium- sized businesses within the Puget Sound region • Offers traditional lending and deposit products to commercial and retail customers as well as treasury management, remote deposit capture and credit processing • Largest bank by deposit market share in Snohomish County(1) Accolades and Recognitions Stanwood & Camano News “Best Bank” 2013 - 2024 COASTAL COMMUNITY BANK OVERVIEW Note: Data as of September 30, 2025 unless otherwise indicated (1) FDIC Summary of Deposits June 30, 2025. Raymond James “Community Bankers Cup Award” 2019-2024 Piper Sandler "Bank and Thrift Sm-All Stars" 2019 -2023 Dedication to Community Banking CCB's Branch Footprint "Corporate Citizenship" Puget Sound Business Journal 2022-2023 Everett Herald Readers Choice 2024 - “Best Bank" "Best Place to Work" "3rd Place Mortgage" 2023 - “Best Bank" "Best Mortgage" "Best Place to Work" Institution name Market Share Coastal Community Bank 19.11 % Bank of America, National Association 16.24 % JP Morgan Chase Bank, National Association 15.85 % Wells Fargo, National Association 9.12 % US Bank, National Association 8.35 % Hovde Group “Hovde's High Performers” 2022 - 2024 Notable Employers "Corporate Philanthropist" Puget Sound Business Journal 2023-2025 "Fastest Growing Mid-Market Company in the Northwest" Puget Sound Business Journal 2023 Mount Vernon Everett Seattle 14 retail banking locations • 12 in Snohomish County • 1 in Island County • 1 in King County 1 loan production office • King County KBW Bank Honor Roll Award 2024 Newsweek "America's Greatest Companies" 2025 Seattle Times "Best Bank" 2025 Time "America's Growth Leaders of 2026"

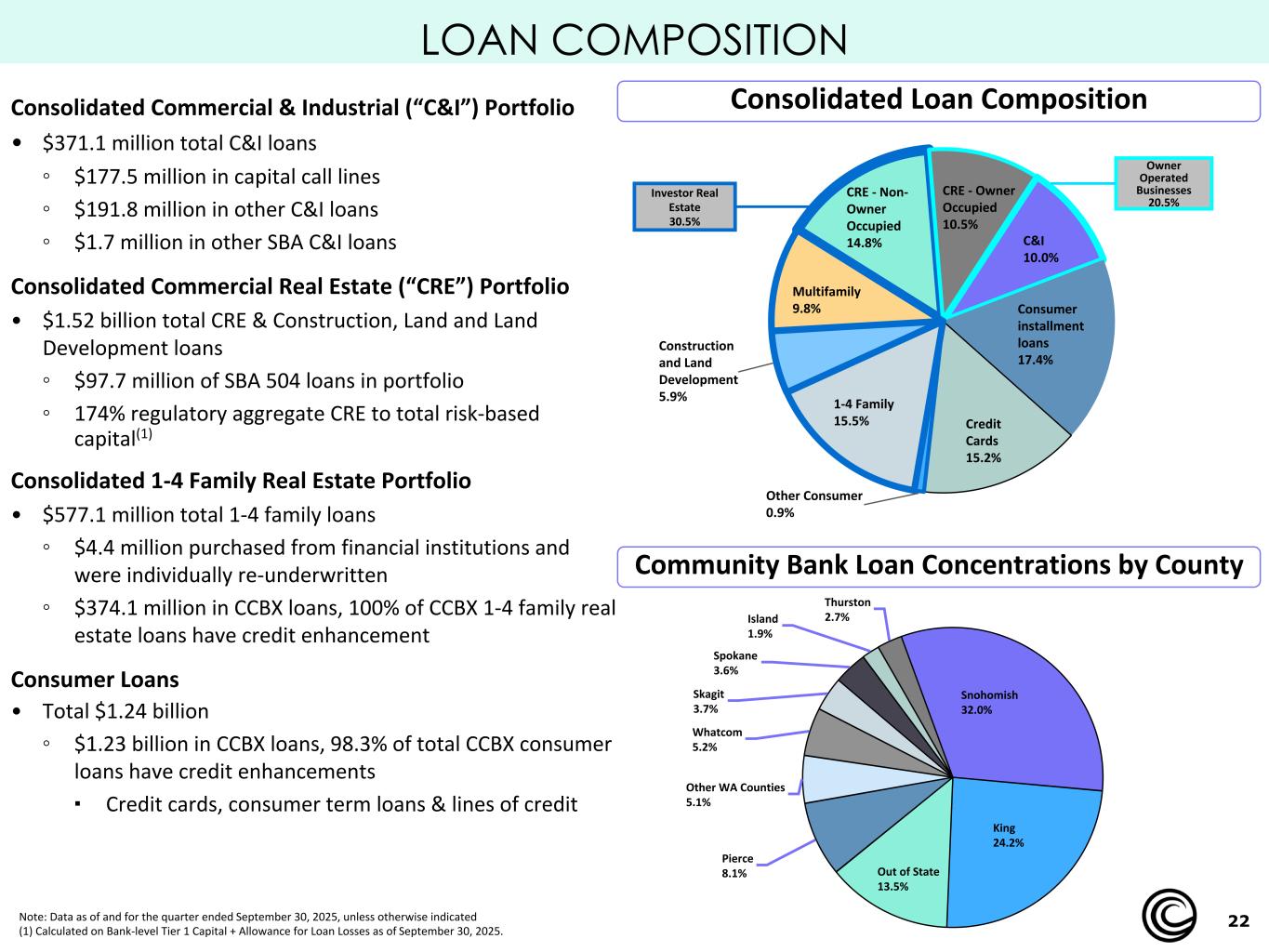

22 CRE - Non- Owner Occupied 14.8% CRE - Owner Occupied 10.5% C&I 10.0% Consumer installment loans 17.4% Credit Cards 15.2% Other Consumer 0.9% 1-4 Family 15.5% Construction and Land Development 5.9% Multifamily 9.8% LOAN COMPOSITION Consolidated Loan Composition Community Bank Loan Concentrations by County Consolidated Commercial & Industrial (“C&I”) Portfolio • $371.1 million total C&I loans ◦ $177.5 million in capital call lines ◦ $191.8 million in other C&I loans ◦ $1.7 million in other SBA C&I loans Consolidated Commercial Real Estate (“CRE”) Portfolio • $1.52 billion total CRE & Construction, Land and Land Development loans ◦ $97.7 million of SBA 504 loans in portfolio ◦ 174% regulatory aggregate CRE to total risk-based capital(1) Consolidated 1-4 Family Real Estate Portfolio • $577.1 million total 1-4 family loans ◦ $4.4 million purchased from financial institutions and were individually re-underwritten ◦ $374.1 million in CCBX loans, 100% of CCBX 1-4 family real estate loans have credit enhancement Consumer Loans • Total $1.24 billion ◦ $1.23 billion in CCBX loans, 98.3% of total CCBX consumer loans have credit enhancements ▪ Credit cards, consumer term loans & lines of credit Note: Data as of and for the quarter ended September 30, 2025, unless otherwise indicated (1) Calculated on Bank-level Tier 1 Capital + Allowance for Loan Losses as of September 30, 2025. Investor Real Estate 30.5% Owner Operated Businesses 20.5% Snohomish 32.0% King 24.2% Out of State 13.5% Pierce 8.1% Other WA Counties 5.1% Whatcom 5.2% Skagit 3.7% Spokane 3.6% Island 1.9% Thurston 2.7%

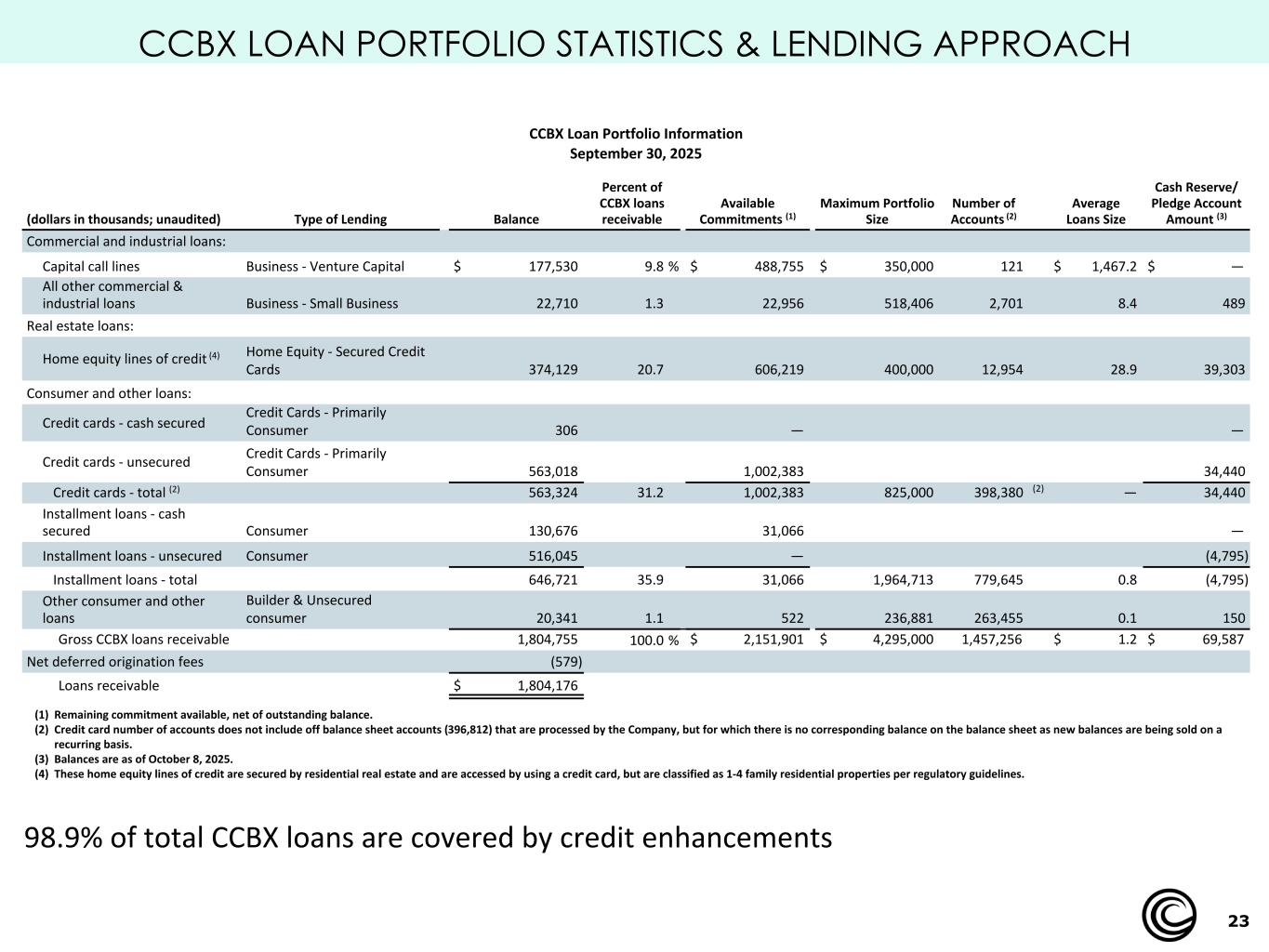

23 CCBX LOAN PORTFOLIO STATISTICS & LENDING APPROACH CCBX Loan Portfolio Information September 30, 2025 (dollars in thousands; unaudited) Type of Lending Balance Percent of CCBX loans receivable Available Commitments (1) Maximum Portfolio Size Number of Accounts (2) Average Loans Size Cash Reserve/ Pledge Account Amount (3) Commercial and industrial loans: Capital call lines Business - Venture Capital $ 177,530 9.8 % $ 488,755 $ 350,000 121 $ 1,467.2 $ — All other commercial & industrial loans Business - Small Business 22,710 1.3 22,956 518,406 2,701 8.4 489 Real estate loans: Home equity lines of credit (4) Home Equity - Secured Credit Cards 374,129 20.7 606,219 400,000 12,954 28.9 39,303 Consumer and other loans: Credit cards - cash secured Credit Cards - Primarily Consumer 306 — — Credit cards - unsecured Credit Cards - Primarily Consumer 563,018 1,002,383 34,440 Credit cards - total (2) 563,324 31.2 1,002,383 825,000 398,380 (2) — 34,440 Installment loans - cash secured Consumer 130,676 31,066 — Installment loans - unsecured Consumer 516,045 — (4,795) Installment loans - total 646,721 35.9 31,066 1,964,713 779,645 0.8 (4,795) Other consumer and other loans Builder & Unsecured consumer 20,341 1.1 522 236,881 263,455 0.1 150 Gross CCBX loans receivable 1,804,755 100.0 % $ 2,151,901 $ 4,295,000 1,457,256 $ 1.2 $ 69,587 Net deferred origination fees (579) Loans receivable $ 1,804,176 (1) Remaining commitment available, net of outstanding balance. (2) Credit card number of accounts does not include off balance sheet accounts (396,812) that are processed by the Company, but for which there is no corresponding balance on the balance sheet as new balances are being sold on a recurring basis. (3) Balances are as of October 8, 2025. (4) These home equity lines of credit are secured by residential real estate and are accessed by using a credit card, but are classified as 1-4 family residential properties per regulatory guidelines. 98.9% of total CCBX loans are covered by credit enhancements

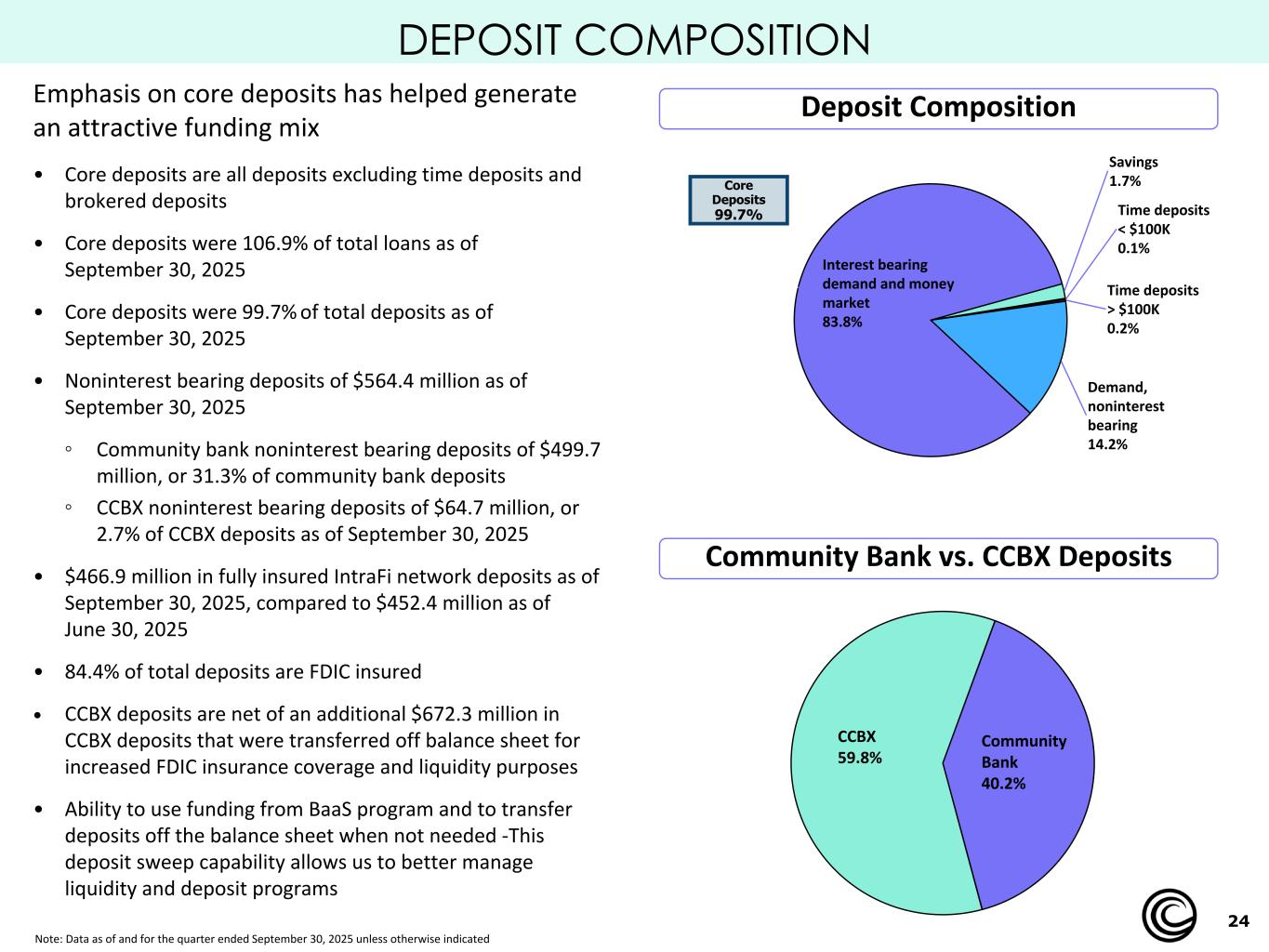

24 Demand, noninterest bearing 14.2% Interest bearing demand and money market 83.8% Savings 1.7% Time deposits < $100K 0.1% Time deposits > $100K 0.2% DEPOSIT COMPOSITION Deposit CompositionEmphasis on core deposits has helped generate an attractive funding mix • Core deposits are all deposits excluding time deposits and brokered deposits • Core deposits were 106.9% of total loans as of September 30, 2025 • Core deposits were 99.7% of total deposits as of September 30, 2025 • Noninterest bearing deposits of $564.4 million as of September 30, 2025 ◦ Community bank noninterest bearing deposits of $499.7 million, or 31.3% of community bank deposits ◦ CCBX noninterest bearing deposits of $64.7 million, or 2.7% of CCBX deposits as of September 30, 2025 • $466.9 million in fully insured IntraFi network deposits as of September 30, 2025, compared to $452.4 million as of June 30, 2025 • 84.4% of total deposits are FDIC insured • CCBX deposits are net of an additional $672.3 million in CCBX deposits that were transferred off balance sheet for increased FDIC insurance coverage and liquidity purposes • Ability to use funding from BaaS program and to transfer deposits off the balance sheet when not needed -This deposit sweep capability allows us to better manage liquidity and deposit programs Note: Data as of and for the quarter ended September 30, 2025 unless otherwise indicated Core Deposits 99.7% Community Bank vs. CCBX Deposits CCBX 59.8% Community Bank 40.2%

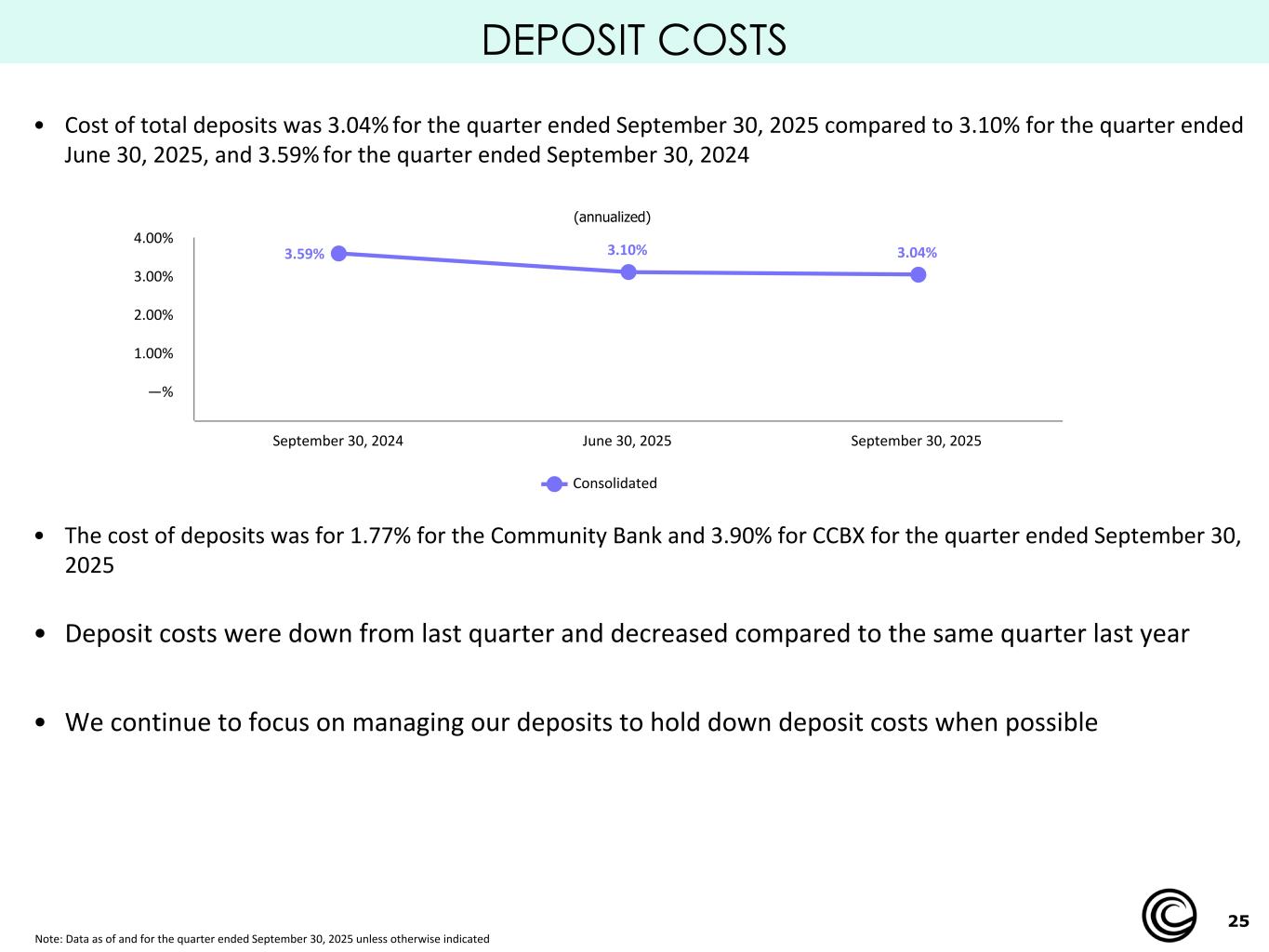

25 DEPOSIT COSTS • Cost of total deposits was 3.04% for the quarter ended September 30, 2025 compared to 3.10% for the quarter ended June 30, 2025, and 3.59% for the quarter ended September 30, 2024 • The cost of deposits was for 1.77% for the Community Bank and 3.90% for CCBX for the quarter ended September 30, 2025 • Deposit costs were down from last quarter and decreased compared to the same quarter last year • We continue to focus on managing our deposits to hold down deposit costs when possible Note: Data as of and for the quarter ended September 30, 2025 unless otherwise indicated 3.59% 3.10% 3.04% Consolidated September 30, 2024 June 30, 2025 September 30, 2025 —% 1.00% 2.00% 3.00% 4.00% (annualized)

26 LOAN AND DEPOSIT GROWTH $3.41 $3.54 $3.70 $1.90 $1.86 $1.90 $1.68 $1.80 Community Bank CCBX September 30, 2024 June 30, 2025 September 30, 2025 Loans increased $163.5 million or 4.6% from June 30, 2025 and growth of 8.5% since September 30, 2024 Additional $672.3 million in CCBX deposits were transferred off the balance sheet as of September 30, 2025 $3.63 $3.91 $3.97 $1.52 $1.55 $1.60 $2.36 $2.37 Community Bank CCBX September 30, 2024 June 30, 2025 September 30, 2025 (Dollars in billions) (Dollars in billions) Cost of Deposits 3.04% for the Quarter Ended September 30, 2025 and down from 3.59% from September 30, 2024 Total DepositsTotal Loans Receivable Note: Data as of and for the quarter ended September 30, 2025, unless otherwise indicated Additional CCBX loan sales expected as we continue to optimize our CCBX portfolio, manage credit quality, portfolio limits and partner limits $1.62 billion in CCBX loans sold during the three months ended September 30, 2025 $1.51 $2.11

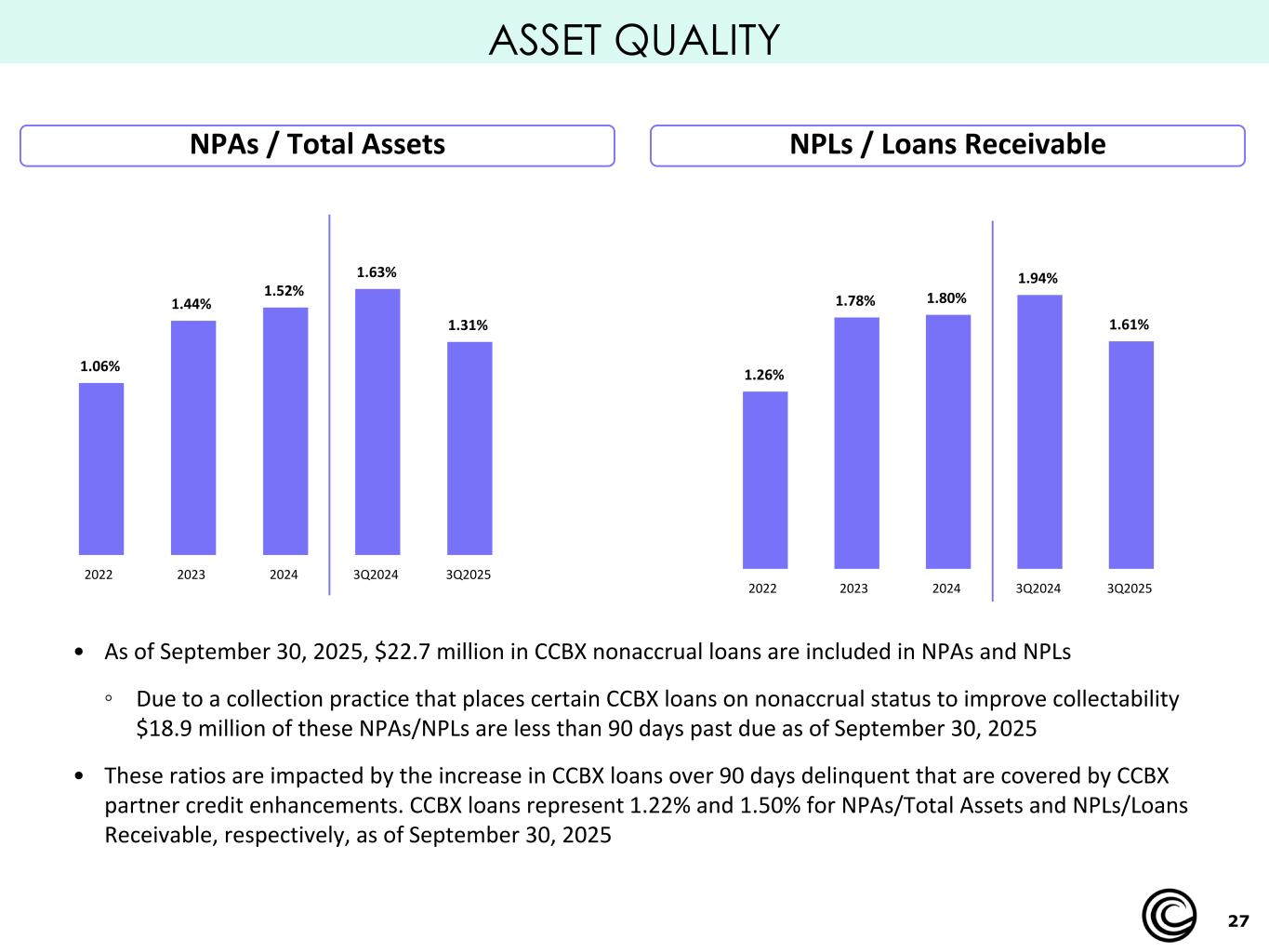

27 ASSET QUALITY NPAs / Total Assets NPLs / Loans Receivable 1.06% 1.44% 1.52% 1.63% 1.31% 2022 2023 2024 3Q2024 3Q2025 1.26% 1.78% 1.80% 1.94% 1.61% 2022 2023 2024 3Q2024 3Q2025 • As of September 30, 2025, $22.7 million in CCBX nonaccrual loans are included in NPAs and NPLs ◦ Due to a collection practice that places certain CCBX loans on nonaccrual status to improve collectability $18.9 million of these NPAs/NPLs are less than 90 days past due as of September 30, 2025 • These ratios are impacted by the increase in CCBX loans over 90 days delinquent that are covered by CCBX partner credit enhancements. CCBX loans represent 1.22% and 1.50% for NPAs/Total Assets and NPLs/Loans Receivable, respectively, as of September 30, 2025

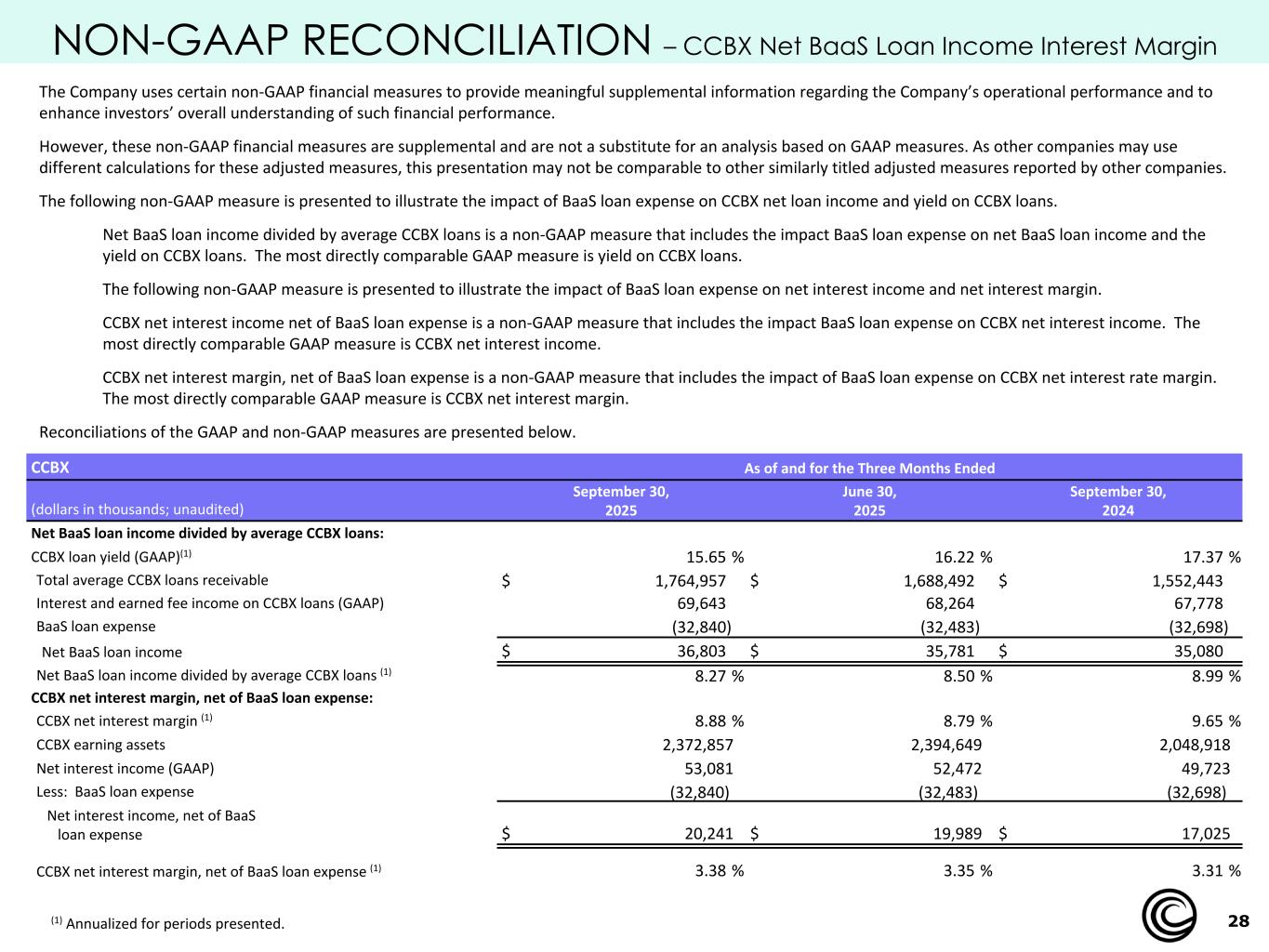

28 NON-GAAP RECONCILIATION – CCBX Net BaaS Loan Income Interest Margin The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. The following non-GAAP measure is presented to illustrate the impact of BaaS loan expense on CCBX net loan income and yield on CCBX loans. Net BaaS loan income divided by average CCBX loans is a non-GAAP measure that includes the impact BaaS loan expense on net BaaS loan income and the yield on CCBX loans. The most directly comparable GAAP measure is yield on CCBX loans. The following non-GAAP measure is presented to illustrate the impact of BaaS loan expense on net interest income and net interest margin. CCBX net interest income net of BaaS loan expense is a non-GAAP measure that includes the impact BaaS loan expense on CCBX net interest income. The most directly comparable GAAP measure is CCBX net interest income. CCBX net interest margin, net of BaaS loan expense is a non-GAAP measure that includes the impact of BaaS loan expense on CCBX net interest rate margin. The most directly comparable GAAP measure is CCBX net interest margin. Reconciliations of the GAAP and non-GAAP measures are presented below. CCBX As of and for the Three Months Ended (dollars in thousands; unaudited) September 30, 2025 June 30, 2025 September 30, 2024 Net BaaS loan income divided by average CCBX loans: CCBX loan yield (GAAP)(1) 15.65 % 16.22 % 17.37 % Total average CCBX loans receivable $ 1,764,957 $ 1,688,492 $ 1,552,443 Interest and earned fee income on CCBX loans (GAAP) 69,643 68,264 67,778 BaaS loan expense (32,840) (32,483) (32,698) Net BaaS loan income $ 36,803 $ 35,781 $ 35,080 Net BaaS loan income divided by average CCBX loans (1) 8.27 % 8.50 % 8.99 % CCBX net interest margin, net of BaaS loan expense: CCBX net interest margin (1) 8.88 % 8.79 % 9.65 % CCBX earning assets 2,372,857 2,394,649 2,048,918 Net interest income (GAAP) 53,081 52,472 49,723 Less: BaaS loan expense (32,840) (32,483) (32,698) Net interest income, net of BaaS loan expense $ 20,241 $ 19,989 $ 17,025 CCBX net interest margin, net of BaaS loan expense (1) 3.38 % 3.35 % 3.31 % (1) Annualized for periods presented.

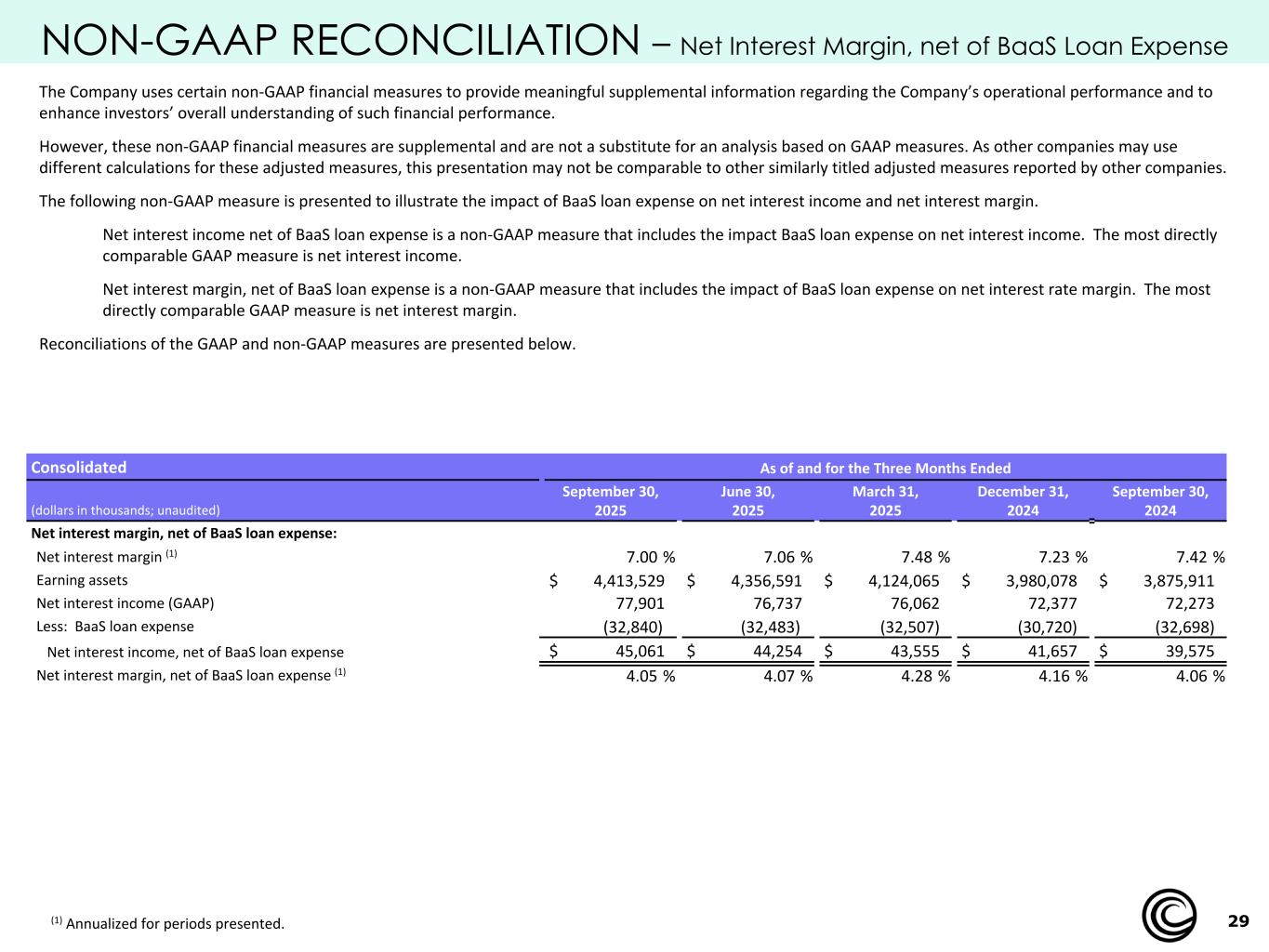

29 NON-GAAP RECONCILIATION – Net Interest Margin, net of BaaS Loan Expense The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. The following non-GAAP measure is presented to illustrate the impact of BaaS loan expense on net interest income and net interest margin. Net interest income net of BaaS loan expense is a non-GAAP measure that includes the impact BaaS loan expense on net interest income. The most directly comparable GAAP measure is net interest income. Net interest margin, net of BaaS loan expense is a non-GAAP measure that includes the impact of BaaS loan expense on net interest rate margin. The most directly comparable GAAP measure is net interest margin. Reconciliations of the GAAP and non-GAAP measures are presented below. Consolidated As of and for the Three Months Ended (dollars in thousands; unaudited) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net interest margin, net of BaaS loan expense: Net interest margin (1) 7.00 % 7.06 % 7.48 % 7.23 % 7.42 % Earning assets $ 4,413,529 $ 4,356,591 $ 4,124,065 $ 3,980,078 $ 3,875,911 Net interest income (GAAP) 77,901 76,737 76,062 72,377 72,273 Less: BaaS loan expense (32,840) (32,483) (32,507) (30,720) (32,698) Net interest income, net of BaaS loan expense $ 45,061 $ 44,254 $ 43,555 $ 41,657 $ 39,575 Net interest margin, net of BaaS loan expense (1) 4.05 % 4.07 % 4.28 % 4.16 % 4.06 % (1) Annualized for periods presented.

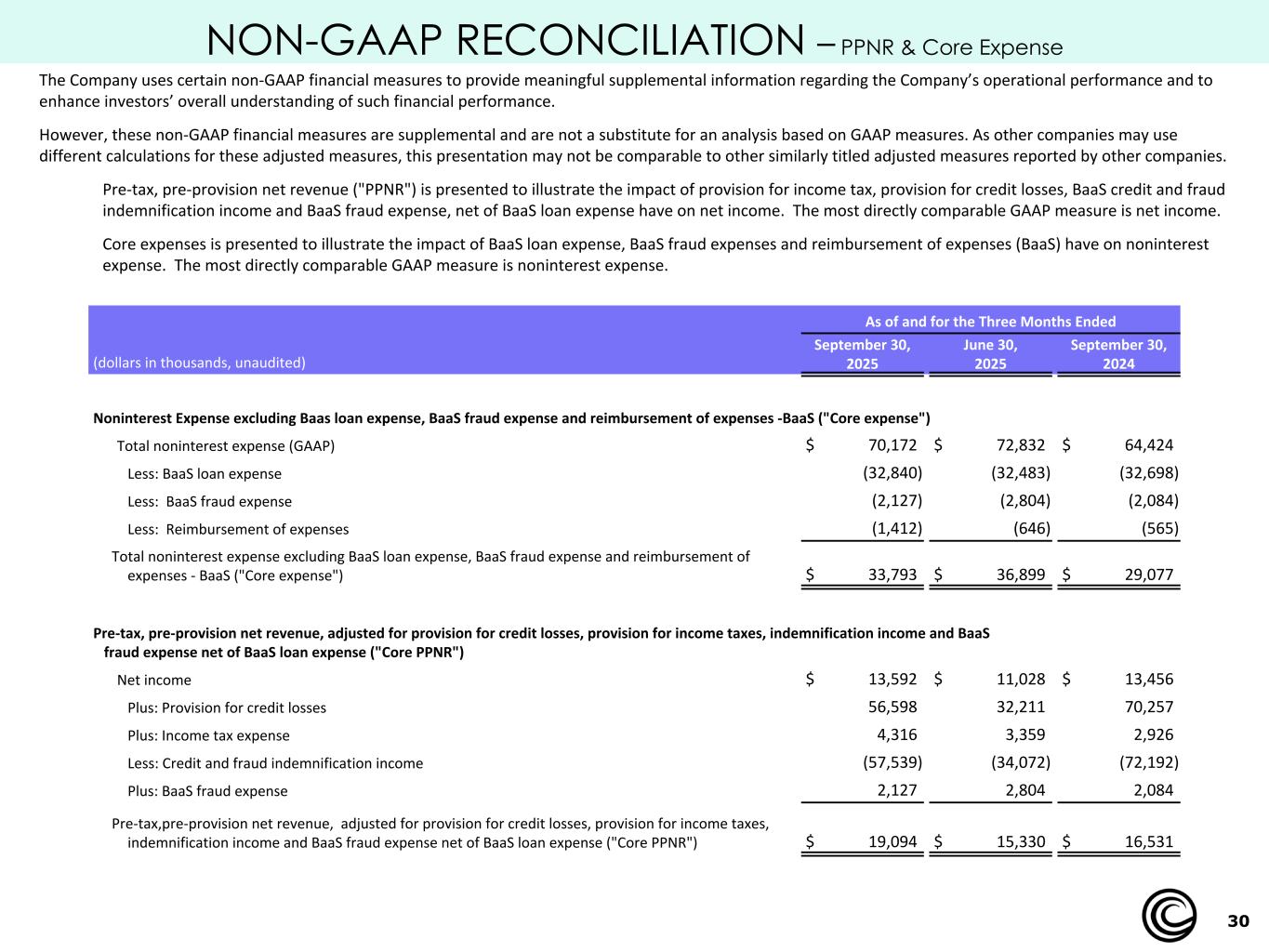

30 NON-GAAP RECONCILIATION – PPNR & Core Expense The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. Pre-tax, pre-provision net revenue ("PPNR") is presented to illustrate the impact of provision for income tax, provision for credit losses, BaaS credit and fraud indemnification income and BaaS fraud expense, net of BaaS loan expense have on net income. The most directly comparable GAAP measure is net income. Core expenses is presented to illustrate the impact of BaaS loan expense, BaaS fraud expenses and reimbursement of expenses (BaaS) have on noninterest expense. The most directly comparable GAAP measure is noninterest expense. As of and for the Three Months Ended (dollars in thousands, unaudited) September 30, 2025 June 30, 2025 September 30, 2024 Noninterest Expense excluding Baas loan expense, BaaS fraud expense and reimbursement of expenses -BaaS ("Core expense") Total noninterest expense (GAAP) $ 70,172 $ 72,832 $ 64,424 Less: BaaS loan expense (32,840) (32,483) (32,698) Less: BaaS fraud expense (2,127) (2,804) (2,084) Less: Reimbursement of expenses (1,412) (646) (565) Total noninterest expense excluding BaaS loan expense, BaaS fraud expense and reimbursement of expenses - BaaS ("Core expense") $ 33,793 $ 36,899 $ 29,077 Pre-tax, pre-provision net revenue, adjusted for provision for credit losses, provision for income taxes, indemnification income and BaaS fraud expense net of BaaS loan expense ("Core PPNR") Net income $ 13,592 $ 11,028 $ 13,456 Plus: Provision for credit losses 56,598 32,211 70,257 Plus: Income tax expense 4,316 3,359 2,926 Less: Credit and fraud indemnification income (57,539) (34,072) (72,192) Plus: BaaS fraud expense 2,127 2,804 2,084 Pre-tax,pre-provision net revenue, adjusted for provision for credit losses, provision for income taxes, indemnification income and BaaS fraud expense net of BaaS loan expense ("Core PPNR") $ 19,094 $ 15,330 $ 16,531

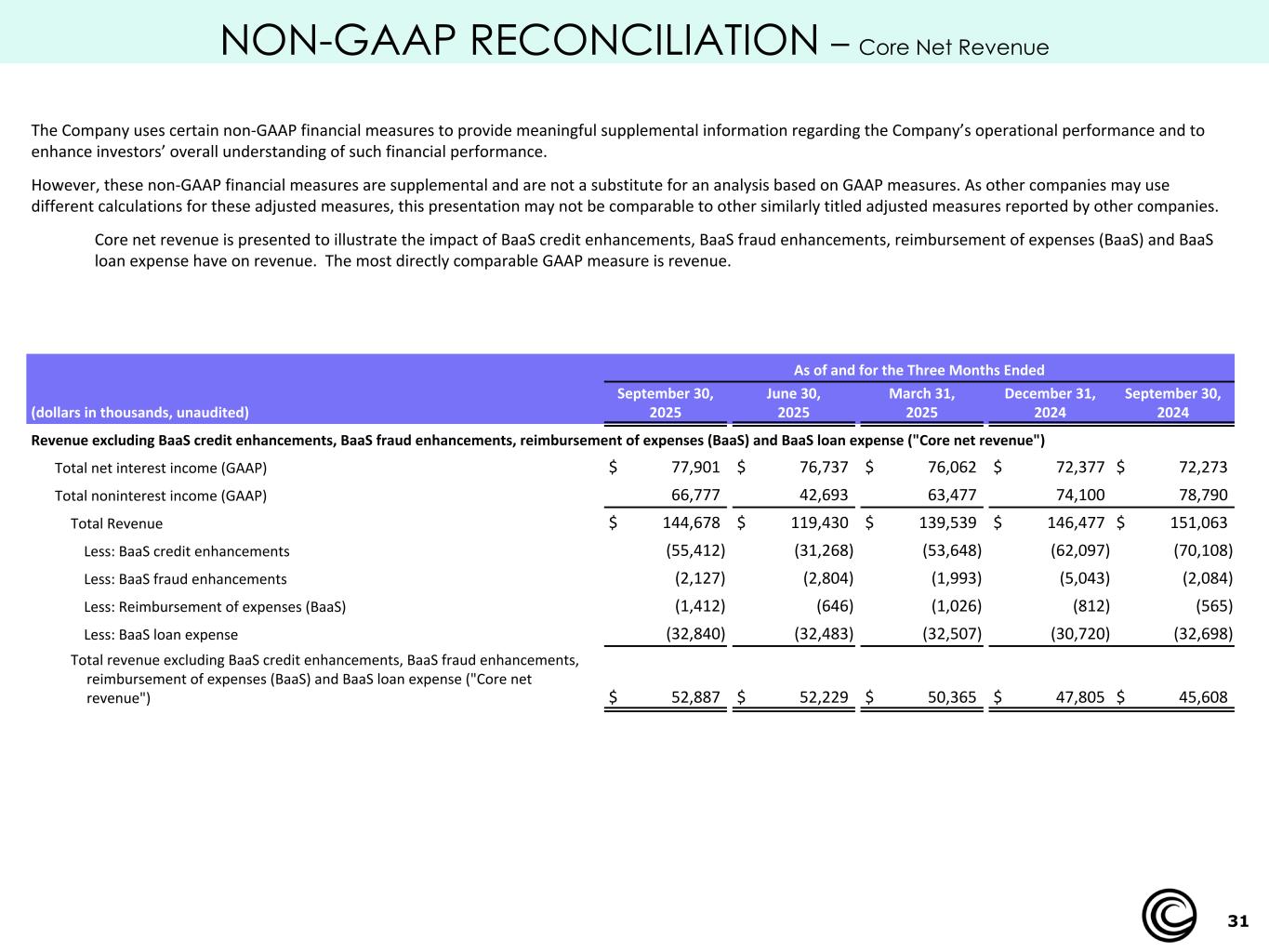

31 NON-GAAP RECONCILIATION – Core Net Revenue The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. Core net revenue is presented to illustrate the impact of BaaS credit enhancements, BaaS fraud enhancements, reimbursement of expenses (BaaS) and BaaS loan expense have on revenue. The most directly comparable GAAP measure is revenue. As of and for the Three Months Ended (dollars in thousands, unaudited) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Revenue excluding BaaS credit enhancements, BaaS fraud enhancements, reimbursement of expenses (BaaS) and BaaS loan expense ("Core net revenue") Total net interest income (GAAP) $ 77,901 $ 76,737 $ 76,062 $ 72,377 $ 72,273 Total noninterest income (GAAP) 66,777 42,693 63,477 74,100 78,790 Total Revenue $ 144,678 $ 119,430 $ 139,539 $ 146,477 $ 151,063 Less: BaaS credit enhancements (55,412) (31,268) (53,648) (62,097) (70,108) Less: BaaS fraud enhancements (2,127) (2,804) (1,993) (5,043) (2,084) Less: Reimbursement of expenses (BaaS) (1,412) (646) (1,026) (812) (565) Less: BaaS loan expense (32,840) (32,483) (32,507) (30,720) (32,698) Total revenue excluding BaaS credit enhancements, BaaS fraud enhancements, reimbursement of expenses (BaaS) and BaaS loan expense ("Core net revenue") $ 52,887 $ 52,229 $ 50,365 $ 47,805 $ 45,608

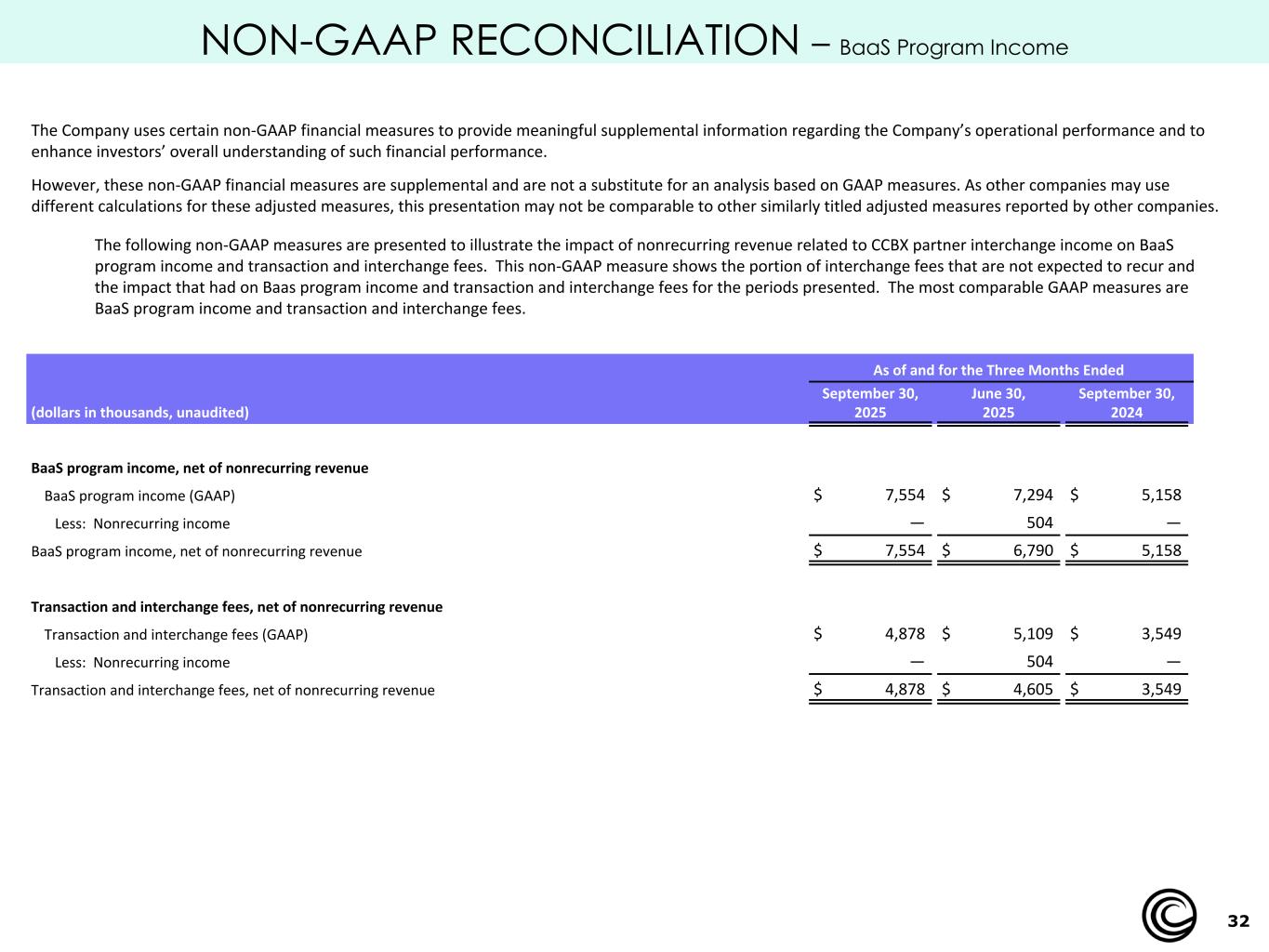

32 NON-GAAP RECONCILIATION – BaaS Program Income The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. The following non-GAAP measures are presented to illustrate the impact of nonrecurring revenue related to CCBX partner interchange income on BaaS program income and transaction and interchange fees. This non-GAAP measure shows the portion of interchange fees that are not expected to recur and the impact that had on Baas program income and transaction and interchange fees for the periods presented. The most comparable GAAP measures are BaaS program income and transaction and interchange fees. As of and for the Three Months Ended (dollars in thousands, unaudited) September 30, 2025 June 30, 2025 September 30, 2024 BaaS program income, net of nonrecurring revenue BaaS program income (GAAP) $ 7,554 $ 7,294 $ 5,158 Less: Nonrecurring income — 504 — BaaS program income, net of nonrecurring revenue $ 7,554 $ 6,790 $ 5,158 Transaction and interchange fees, net of nonrecurring revenue Transaction and interchange fees (GAAP) $ 4,878 $ 5,109 $ 3,549 Less: Nonrecurring income — 504 — Transaction and interchange fees, net of nonrecurring revenue $ 4,878 $ 4,605 $ 3,549