Fourth Quarter 2025 INVESTOR PRESENTATION COASTAL FINANCIAL CORPORATION

2 LEGAL INFORMATION AND DISCLAIMER Important note regarding forward-looking statements: Statements made in this presentation (or conveyed orally) which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding Coastal Financial Corporation's ("Coastal") plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “intend,” "target,” “outlook,” “project,” “guidance,” “forecast,” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include the prolonged U.S. government shutdown and those identified in the Company’s most recent Form 10-K and subsequent Form 10-Qs and other SEC filings, and such factors are incorporated herein by reference. If one or more events related to these or other risks or uncertainties materialize, or if Coastal’s underlying assumptions prove to be incorrect, actual results may differ materially from what Coastal anticipates. You are cautioned not to place undue reliance on forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made and Coastal undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding. Non-GAAP Financial Measures: This presentation includes certain non-GAAP financial measures. These non-GAAP financial measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP financial measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this presentation. This presentation includes non-GAAP financial measures to illustrate the impact of BaaS loan expense on net loan income and yield on CCBX loans, and net interest margin. Net BaaS loan income divided by average CCBX loans is a non-GAAP financial measure that includes the impact BaaS loan expense on net BaaS loan income and the yield on CCBX loans. The most directly comparable GAAP measure is yield on CCBX loans. Net interest income net of BaaS loan expense divided by average earning assets is a non-GAAP financial measure that includes the impact BaaS loan expense on net interest income. The most directly comparable GAAP measure is net interest income. Net interest margin, net of BaaS loan expense is a non-GAAP financial measure that includes the impact of BaaS loan expense on net interest margin. The most directly comparable GAAP measure is net interest margin. This presentation includes non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. Pre-tax, pre-provision net revenue ("PPNR") is presented to illustrate the impact of provision for income tax, provision for credit losses, BaaS credit and fraud indemnification income and BaaS loan expense have on net income. The most directly comparable GAAP measure is net income. Core expenses is presented to illustrate the impact of BaaS loan expense and BaaS fraud expenses and reimbursement of expenses (BaaS) have on noninterest expense. The most directly comparable GAAP measure is noninterest expense. Core net revenue is presented to illustrate the impact of BaaS credit enhancements, BaaS fraud enhancements, reimbursement of expenses (GAAP) and BaaS loan expense have on revenue. The most directly comparable GAAP measure is revenue. This presentation includes a non-GAAP financial measure to illustrate the impact of intangible assets on book value per share. We calculate tangible book value per share as total shareholders’ equity at the end of the relevant period, less goodwill and other intangible assets, divided by the outstanding number of our common shares at the end of each period. The most directly comparable GAAP financial measure is book value per share.

3 FOURTH QUARTER 2025 HIGHLIGHTS Note: Data as of the three months ended December 31, 2025 unless otherwise indicated (1)Core net revenue is a non-GAAP financial measure which includes net interest income and noninterest income, adjusted for BaaS credit enhancement, BaaS fraud enhancement, reimbursement of expenses (BaaS) and BaaS loan expense associated with the CCBX operating segment. This produces a figure which can be compared to revenue. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. Total loans receivable of $3.75 billion, an increase of $45.7 million, or 1.2%, from the prior quarter, reflecting continued growth across core lending categories _______________________________ Total deposits reached $4.14 billion, up $171.6 million, or 4.3%, over the prior quarter, supported by stable customer relationships and deposit inflows _______________________________ Core net revenue(1) grew 6.8% from the quarter ended September 30, 2025 Total revenue decreased 4.6% from the prior quarter, driven by lower credit enhancement revenue associated with lower provision for credit losses _______________________________ Sold $2.98 billion of loans during the quarter, $2.26 billion of which was activity on accounts that were previously sold credit card receivables ______________________________ Swept $843.6 million of deposits off balance-sheet for FDIC insurance and liquidity purposes generating $540,000 in noninterest income during the quarter ______________________________ Acquired the GreenFi climate-focused brand, enhancing Coastal's control over the brand as we evaluate strategic options, while continuing the existing partnership with Mission Financial Partners to support program continuity

4 ADVANCING FUTURE VALUE Note: Data as of the three months ended December 31, 2025 unless otherwise indicated Seven existing partner programs expanding to include new products such as lines of credit, deposit programs, credit cards, and other lending products ______________________________ Growth in CCBX deposit partners and products drove an increase of $182.9 million in CCBX deposits as of December 31, 2025, compared to September 30, 2025 _______________________________ We retain our portion of fee income on sold credit card receivables that continue generating ongoing fees, and off-balance sheet credit card accounts increased to 550,977 from 396,812 at September 30, 2025, a 39% quarter over quarter increase _______________________________ 8.7 million CCBX debit cards with fee-earning potential up from 7.1 million at September 30, 2025, reflecting strong partner and customer engagement _______________________________ Amid an evolving banking landscape, we remain confident in our platform and relationships, with ongoing technology investments supporting scalable, compliant, and differentiated solutions

5 ADVANCING TECHNOLOGY-ENABLED GROWTH Note: Data as of the three months ended December 31, 2025 unless otherwise indicated Implemented multiple artificial intelligence use cases to enhance operational efficiency, risk management, and customer experience ______________________________ Established a defined AI roadmap focused on responsibly scaling capabilities across platforms and processes ______________________________ Evaluating opportunities in digital assets and digital deposit solutions as part of longer- term innovation and growth initiatives ______________________________ Leveraging existing platform capabilities and regulatory framework to support future product development

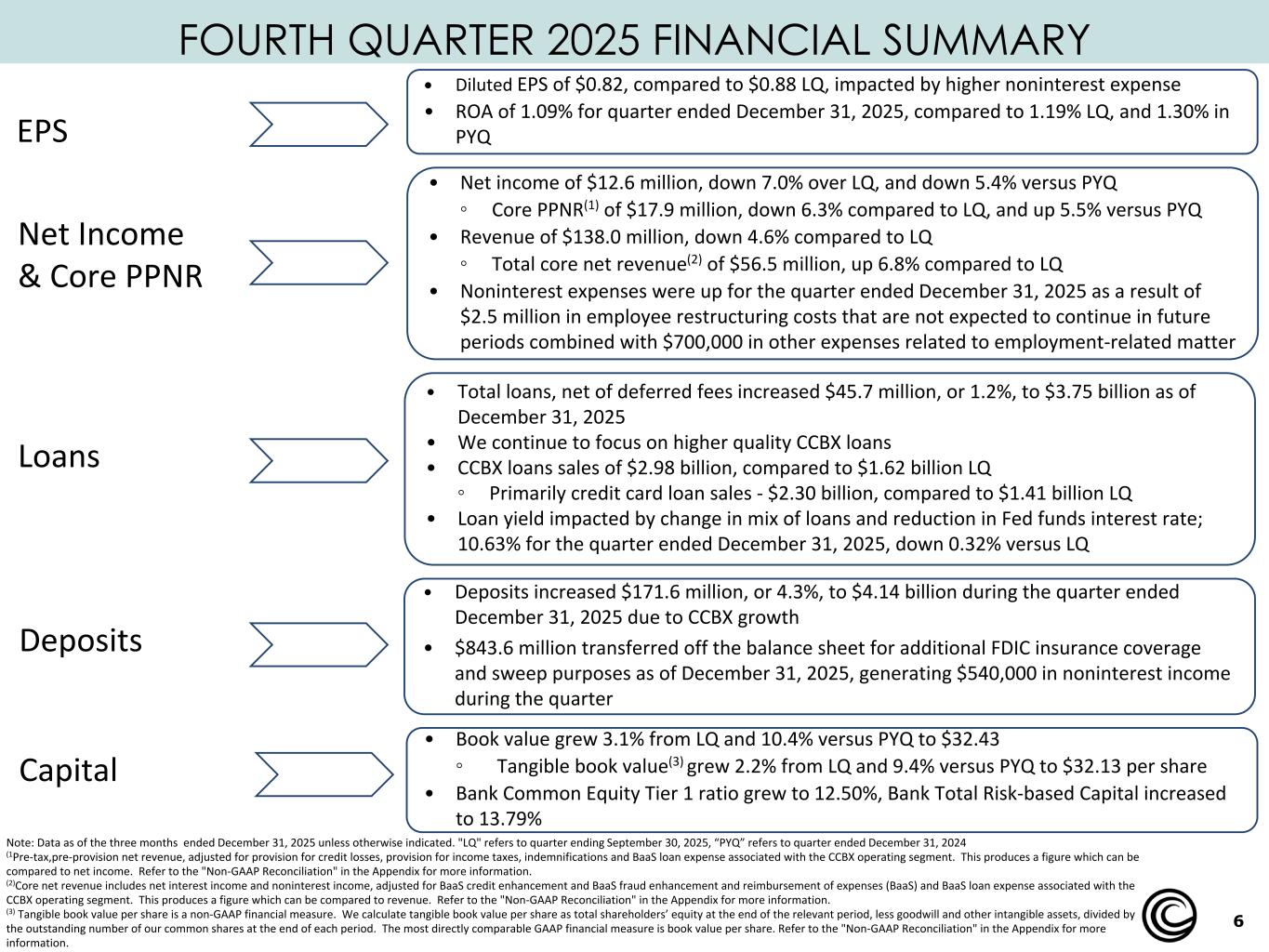

6 FOURTH QUARTER 2025 FINANCIAL SUMMARY • Diluted EPS of $0.82, compared to $0.88 LQ, impacted by higher noninterest expense • ROA of 1.09% for quarter ended December 31, 2025, compared to 1.19% LQ, and 1.30% in PYQ Note: Data as of the three months ended December 31, 2025 unless otherwise indicated. "LQ" refers to quarter ending September 30, 2025, “PYQ” refers to quarter ended December 31, 2024 (1Pre-tax,pre-provision net revenue, adjusted for provision for credit losses, provision for income taxes, indemnifications and BaaS loan expense associated with the CCBX operating segment. This produces a figure which can be compared to net income. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. (2)Core net revenue includes net interest income and noninterest income, adjusted for BaaS credit enhancement and BaaS fraud enhancement and reimbursement of expenses (BaaS) and BaaS loan expense associated with the CCBX operating segment. This produces a figure which can be compared to revenue. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. (3) Tangible book value per share is a non-GAAP financial measure. We calculate tangible book value per share as total shareholders’ equity at the end of the relevant period, less goodwill and other intangible assets, divided by the outstanding number of our common shares at the end of each period. The most directly comparable GAAP financial measure is book value per share. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. • Net income of $12.6 million, down 7.0% over LQ, and down 5.4% versus PYQ ◦ Core PPNR(1) of $17.9 million, down 6.3% compared to LQ, and up 5.5% versus PYQ • Revenue of $138.0 million, down 4.6% compared to LQ ◦ Total core net revenue(2) of $56.5 million, up 6.8% compared to LQ • Noninterest expenses were up for the quarter ended December 31, 2025 as a result of $2.5 million in employee restructuring costs that are not expected to continue in future periods combined with $700,000 in other expenses related to employment-related matter • Total loans, net of deferred fees increased $45.7 million, or 1.2%, to $3.75 billion as of December 31, 2025 • We continue to focus on higher quality CCBX loans • CCBX loans sales of $2.98 billion, compared to $1.62 billion LQ ◦ Primarily credit card loan sales - $2.30 billion, compared to $1.41 billion LQ • Loan yield impacted by change in mix of loans and reduction in Fed funds interest rate; 10.63% for the quarter ended December 31, 2025, down 0.32% versus LQ • Deposits increased $171.6 million, or 4.3%, to $4.14 billion during the quarter ended December 31, 2025 due to CCBX growth • $843.6 million transferred off the balance sheet for additional FDIC insurance coverage and sweep purposes as of December 31, 2025, generating $540,000 in noninterest income during the quarter EPS Capital Deposits Loans Net Income & Core PPNR • Book value grew 3.1% from LQ and 10.4% versus PYQ to $32.43 ◦ Tangible book value(3) grew 2.2% from LQ and 9.4% versus PYQ to $32.13 per share • Bank Common Equity Tier 1 ratio grew to 12.50%, Bank Total Risk-based Capital increased to 13.79%

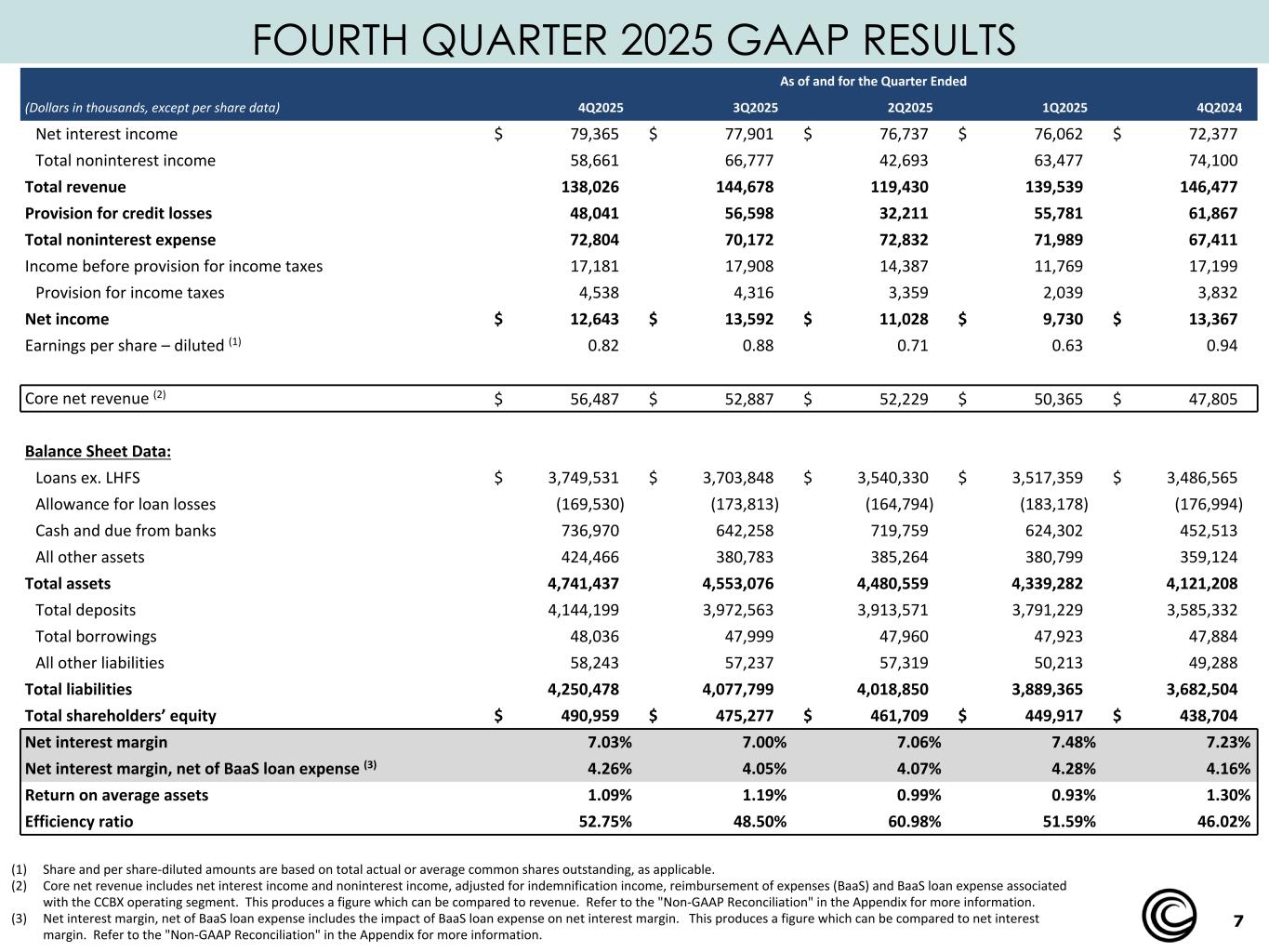

7 FOURTH QUARTER 2025 GAAP RESULTS (1) Share and per share-diluted amounts are based on total actual or average common shares outstanding, as applicable. (2) Core net revenue includes net interest income and noninterest income, adjusted for indemnification income, reimbursement of expenses (BaaS) and BaaS loan expense associated with the CCBX operating segment. This produces a figure which can be compared to revenue. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. (3) Net interest margin, net of BaaS loan expense includes the impact of BaaS loan expense on net interest margin. This produces a figure which can be compared to net interest margin. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. As of and for the Quarter Ended (Dollars in thousands, except per share data) 4Q2025 3Q2025 2Q2025 1Q2025 4Q2024 Net interest income $ 79,365 $ 77,901 $ 76,737 $ 76,062 $ 72,377 Total noninterest income 58,661 66,777 42,693 63,477 74,100 Total revenue 138,026 144,678 119,430 139,539 146,477 Provision for credit losses 48,041 56,598 32,211 55,781 61,867 Total noninterest expense 72,804 70,172 72,832 71,989 67,411 Income before provision for income taxes 17,181 17,908 14,387 11,769 17,199 Provision for income taxes 4,538 4,316 3,359 2,039 3,832 Net income $ 12,643 $ 13,592 $ 11,028 $ 9,730 $ 13,367 Earnings per share – diluted (1) 0.82 0.88 0.71 0.63 0.94 Core net revenue (2) $ 56,487 $ 52,887 $ 52,229 $ 50,365 $ 47,805 $ 47,805 Balance Sheet Data: Loans ex. LHFS $ 3,749,531 $ 3,703,848 $ 3,540,330 $ 3,517,359 $ 3,486,565 Allowance for loan losses (169,530) (173,813) (164,794) (183,178) (176,994) Cash and due from banks 736,970 642,258 719,759 624,302 452,513 All other assets 424,466 380,783 385,264 380,799 359,124 Total assets 4,741,437 4,553,076 4,480,559 4,339,282 4,121,208 Total deposits 4,144,199 3,972,563 3,913,571 3,791,229 3,585,332 Total borrowings 48,036 47,999 47,960 47,923 47,884 All other liabilities 58,243 57,237 57,319 50,213 49,288 Total liabilities 4,250,478 4,077,799 4,018,850 3,889,365 3,682,504 Total shareholders’ equity $ 490,959 $ 475,277 $ 461,709 $ 449,917 $ 438,704 Net interest margin 7.03% 7.00% 7.06% 7.48% 7.23% Net interest margin, net of BaaS loan expense (3) 4.26% 4.05% 4.07% 4.28% 4.16% Return on average assets 1.09% 1.19% 0.99% 0.93% 1.30% Efficiency ratio 52.75% 48.50% 60.98% 51.59% 46.02%

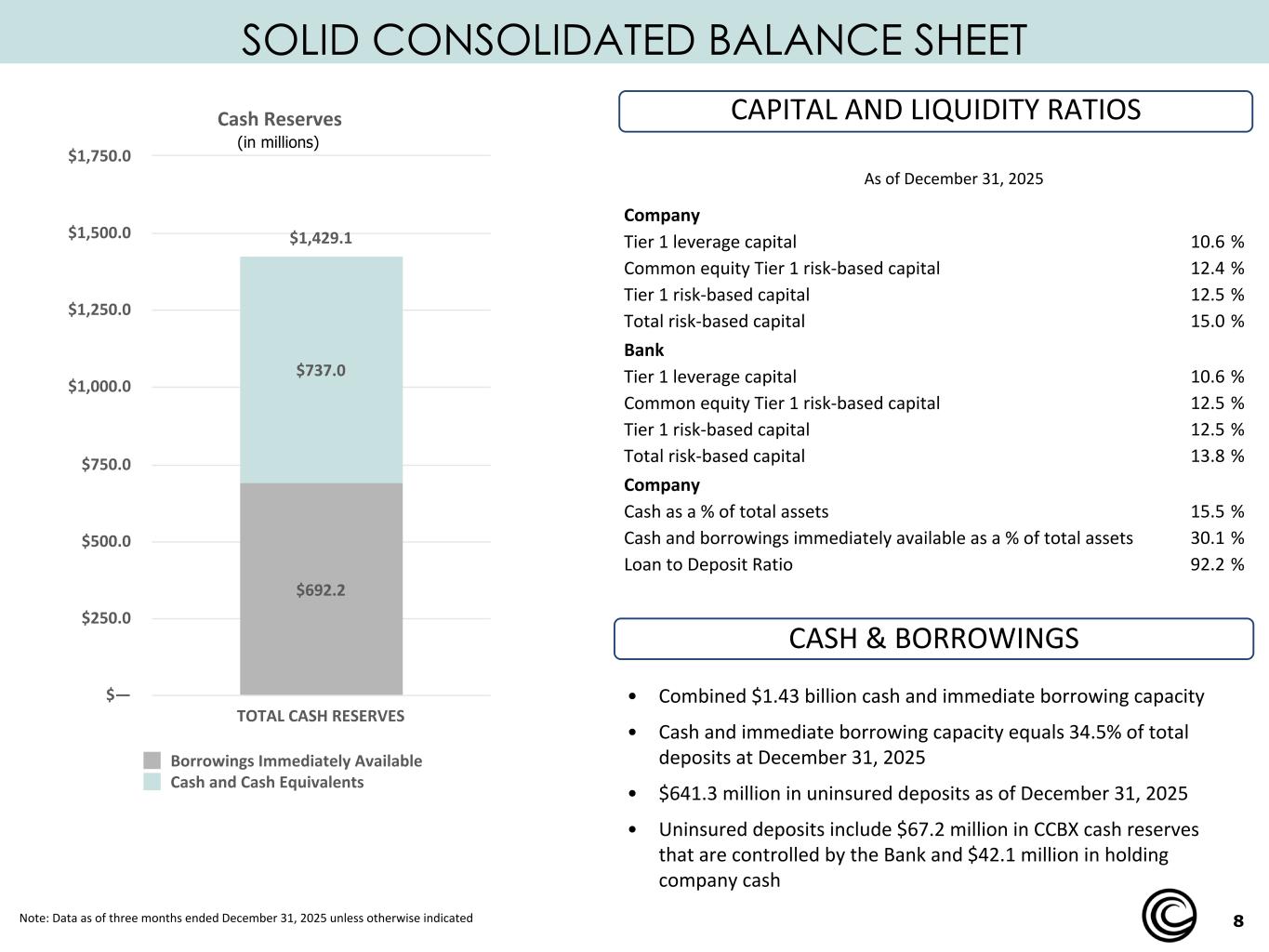

8 SOLID CONSOLIDATED BALANCE SHEET CAPITAL AND LIQUIDITY RATIOS Note: Data as of three months ended December 31, 2025 unless otherwise indicated (in millions) CASH & BORROWINGS • Combined $1.43 billion cash and immediate borrowing capacity • Cash and immediate borrowing capacity equals 34.5% of total deposits at December 31, 2025 • $641.3 million in uninsured deposits as of December 31, 2025 • Uninsured deposits include $67.2 million in CCBX cash reserves that are controlled by the Bank and $42.1 million in holding company cash Company Tier 1 leverage capital 10.6 % Common equity Tier 1 risk-based capital 12.4 % Tier 1 risk-based capital 12.5 % Total risk-based capital 15.0 % Bank Tier 1 leverage capital 10.6 % Common equity Tier 1 risk-based capital 12.5 % Tier 1 risk-based capital 12.5 % Total risk-based capital 13.8 % Company Cash as a % of total assets 15.5 % Cash and borrowings immediately available as a % of total assets 30.1 % Loan to Deposit Ratio 92.2 % As of December 31, 2025 Cash Reserves $1,429.1 $692.2 $737.0 Borrowings Immediately Available Cash and Cash Equivalents TOTAL CASH RESERVES $— $250.0 $500.0 $750.0 $1,000.0 $1,250.0 $1,500.0 $1,750.0

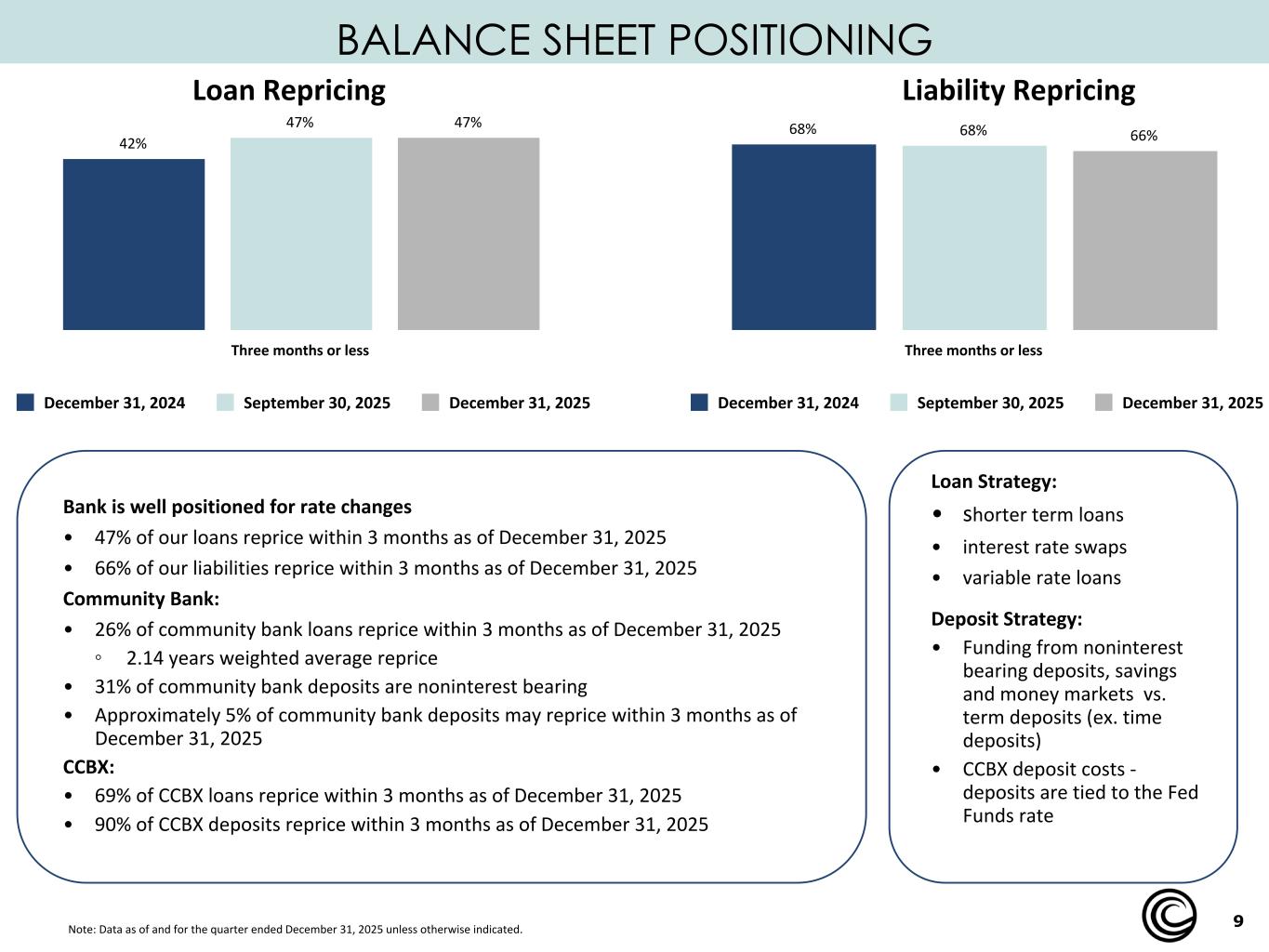

9 BALANCE SHEET POSITIONING Bank is well positioned for rate changes • 47% of our loans reprice within 3 months as of December 31, 2025 • 66% of our liabilities reprice within 3 months as of December 31, 2025 Community Bank: • 26% of community bank loans reprice within 3 months as of December 31, 2025 ◦ 2.14 years weighted average reprice • 31% of community bank deposits are noninterest bearing • Approximately 5% of community bank deposits may reprice within 3 months as of December 31, 2025 CCBX: • 69% of CCBX loans reprice within 3 months as of December 31, 2025 • 90% of CCBX deposits reprice within 3 months as of December 31, 2025 Loan Strategy: • shorter term loans • interest rate swaps • variable rate loans Deposit Strategy: • Funding from noninterest bearing deposits, savings and money markets vs. term deposits (ex. time deposits) • CCBX deposit costs - deposits are tied to the Fed Funds rate Note: Data as of and for the quarter ended December 31, 2025 unless otherwise indicated. 42% 47% 47% December 31, 2024 September 30, 2025 December 31, 2025 Three months or less 68% 68% 66% December 31, 2024 September 30, 2025 December 31, 2025 Three months or less Loan Repricing Liability Repricing

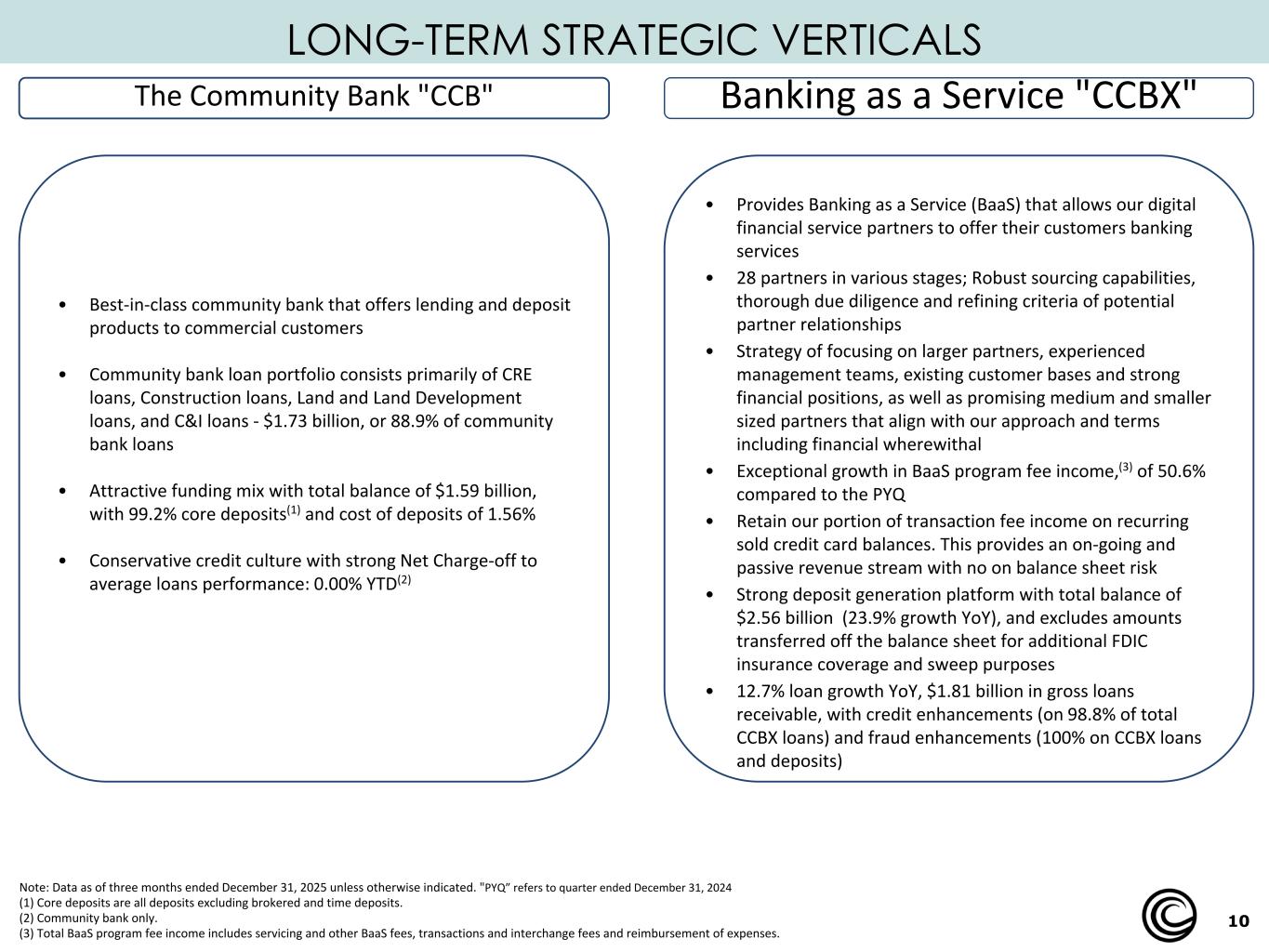

10 LONG-TERM STRATEGIC VERTICALS • Best-in-class community bank that offers lending and deposit products to commercial customers • Community bank loan portfolio consists primarily of CRE loans, Construction loans, Land and Land Development loans, and C&I loans - $1.73 billion, or 88.9% of community bank loans • Attractive funding mix with total balance of $1.59 billion, with 99.2% core deposits(1) and cost of deposits of 1.56% • Conservative credit culture with strong Net Charge-off to average loans performance: 0.00% YTD(2) • Provides Banking as a Service (BaaS) that allows our digital financial service partners to offer their customers banking services • 28 partners in various stages; Robust sourcing capabilities, thorough due diligence and refining criteria of potential partner relationships • Strategy of focusing on larger partners, experienced management teams, existing customer bases and strong financial positions, as well as promising medium and smaller sized partners that align with our approach and terms including financial wherewithal • Exceptional growth in BaaS program fee income,(3) of 50.6% compared to the PYQ • Retain our portion of transaction fee income on recurring sold credit card balances. This provides an on-going and passive revenue stream with no on balance sheet risk • Strong deposit generation platform with total balance of $2.56 billion (23.9% growth YoY), and excludes amounts transferred off the balance sheet for additional FDIC insurance coverage and sweep purposes • 12.7% loan growth YoY, $1.81 billion in gross loans receivable, with credit enhancements (on 98.8% of total CCBX loans) and fraud enhancements (100% on CCBX loans and deposits) Note: Data as of three months ended December 31, 2025 unless otherwise indicated. "PYQ” refers to quarter ended December 31, 2024 (1) Core deposits are all deposits excluding brokered and time deposits. (2) Community bank only. (3) Total BaaS program fee income includes servicing and other BaaS fees, transactions and interchange fees and reimbursement of expenses. The Community Bank "CCB" Banking as a Service "CCBX"

11 SEGMENT UPDATES: CCBX & COMMUNITY BANK

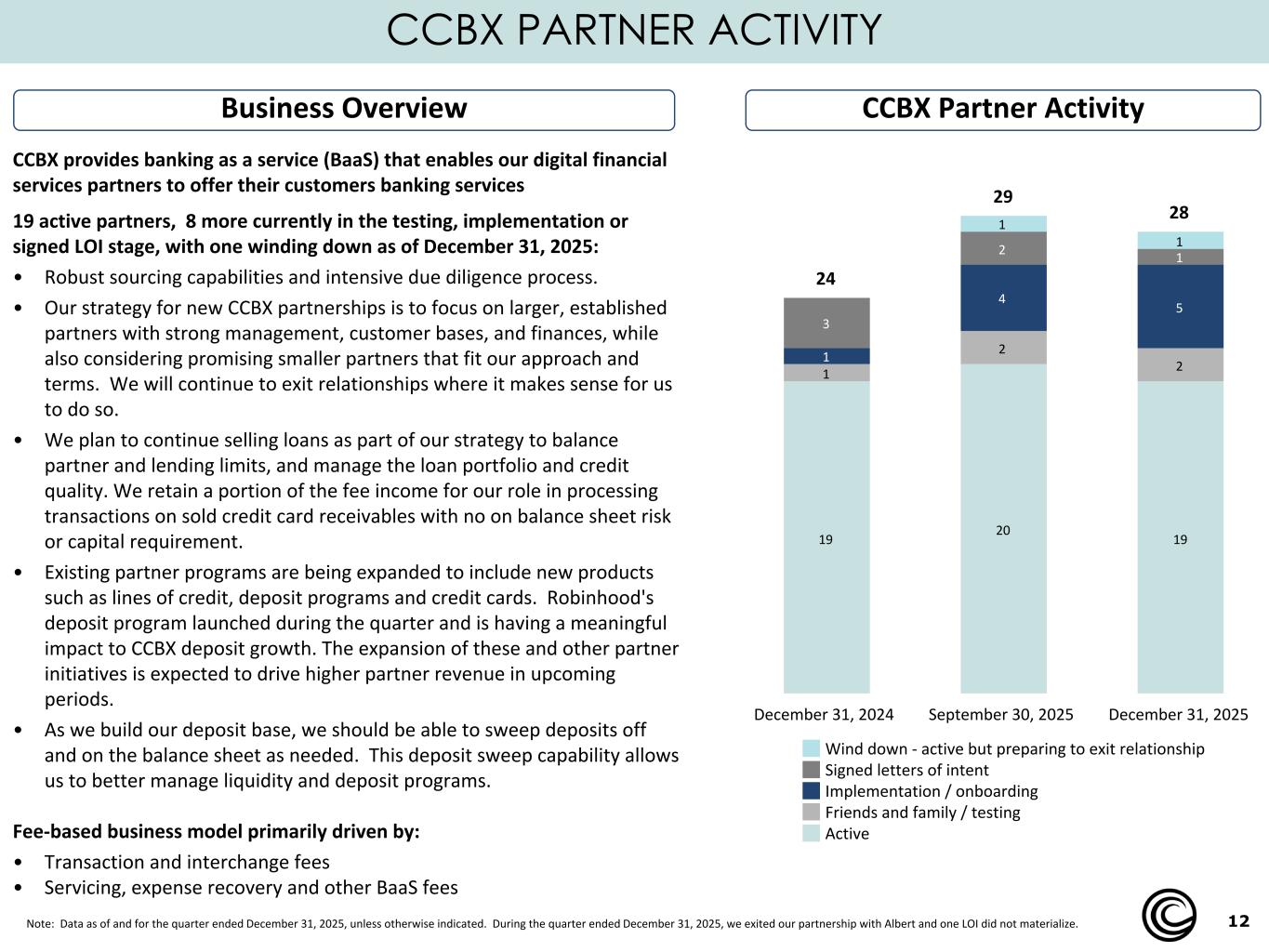

12 24 29 28 19 20 19 1 2 2 1 4 5 3 2 1 1 1 Wind down - active but preparing to exit relationship Signed letters of intent Implementation / onboarding Friends and family / testing Active December 31, 2024 September 30, 2025 December 31, 2025 CCBX provides banking as a service (BaaS) that enables our digital financial services partners to offer their customers banking services 19 active partners, 8 more currently in the testing, implementation or signed LOI stage, with one winding down as of December 31, 2025: • Robust sourcing capabilities and intensive due diligence process. • Our strategy for new CCBX partnerships is to focus on larger, established partners with strong management, customer bases, and finances, while also considering promising smaller partners that fit our approach and terms. We will continue to exit relationships where it makes sense for us to do so. • We plan to continue selling loans as part of our strategy to balance partner and lending limits, and manage the loan portfolio and credit quality. We retain a portion of the fee income for our role in processing transactions on sold credit card receivables with no on balance sheet risk or capital requirement. • Existing partner programs are being expanded to include new products such as lines of credit, deposit programs and credit cards. Robinhood's deposit program launched during the quarter and is having a meaningful impact to CCBX deposit growth. The expansion of these and other partner initiatives is expected to drive higher partner revenue in upcoming periods. • As we build our deposit base, we should be able to sweep deposits off and on the balance sheet as needed. This deposit sweep capability allows us to better manage liquidity and deposit programs. Fee-based business model primarily driven by: • Transaction and interchange fees • Servicing, expense recovery and other BaaS fees CCBX Partner Activity Note: Data as of and for the quarter ended December 31, 2025, unless otherwise indicated. During the quarter ended December 31, 2025, we exited our partnership with Albert and one LOI did not materialize. Business Overview CCBX PARTNER ACTIVITY

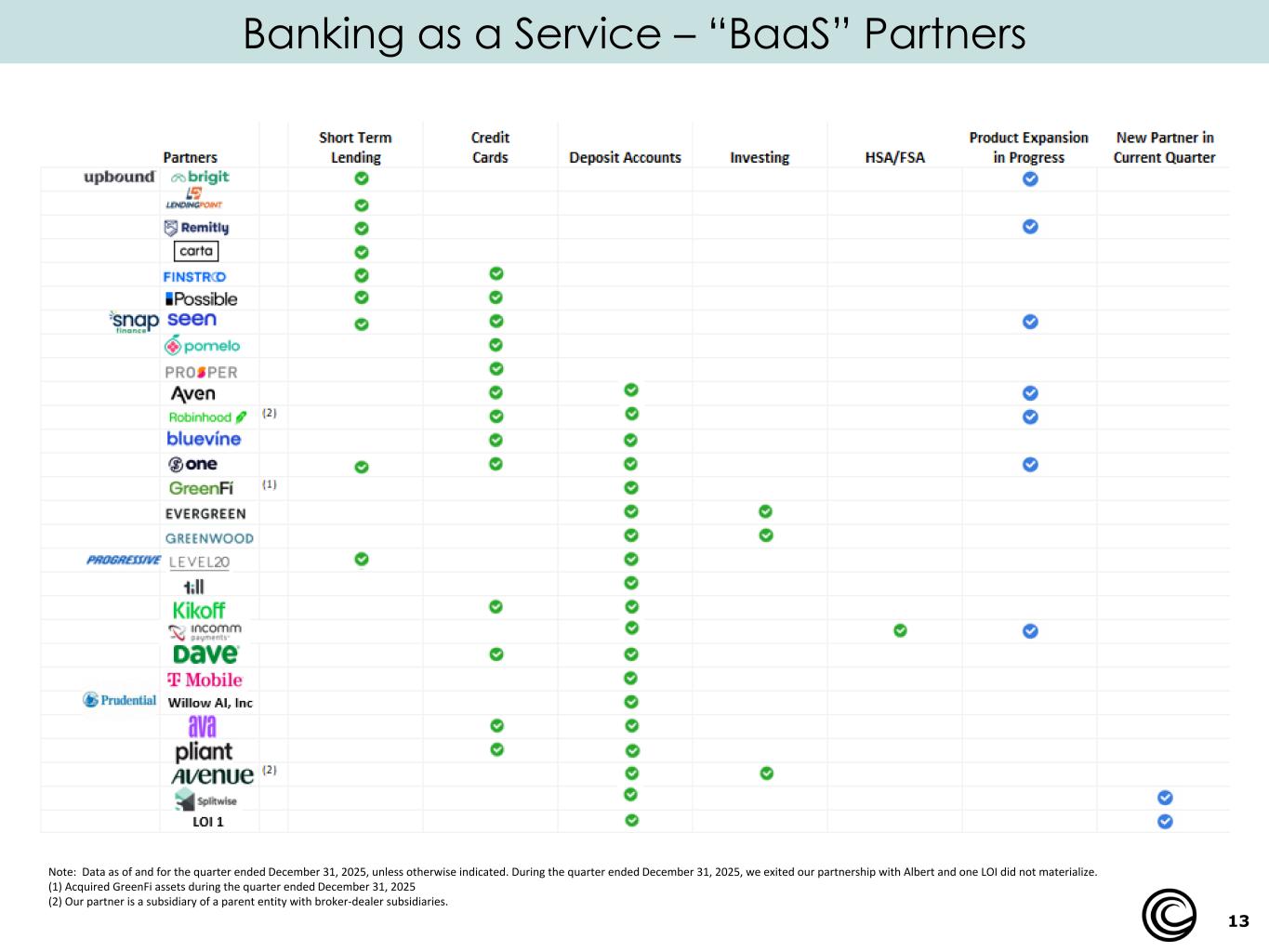

Banking as a Service – “BaaS” Partners 13 Note: Data as of and for the quarter ended December 31, 2025, unless otherwise indicated. During the quarter ended December 31, 2025, we exited our partnership with Albert and one LOI did not materialize. (1) Acquired GreenFi assets during the quarter ended December 31, 2025 (2) Our partner is a subsidiary of a parent entity with broker-dealer subsidiaries.

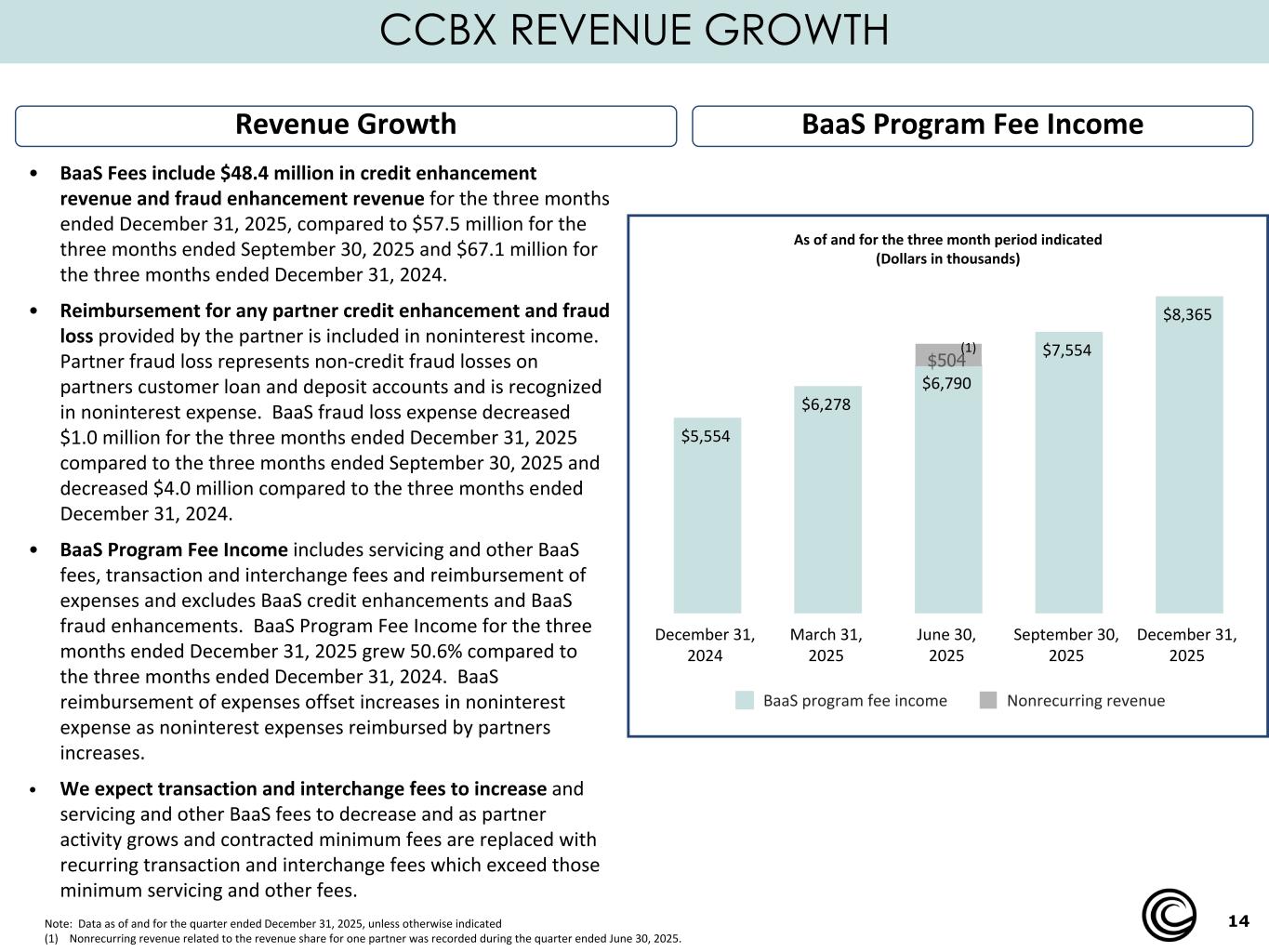

14 CCBX REVENUE GROWTH As of and for the three month period indicated (Dollars in thousands) $5,554 $6,278 $6,790 $7,554 $8,365 $504 BaaS program fee income Nonrecurring revenue December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 December 31, 2025 BaaS Program Fee Income Note: Data as of and for the quarter ended December 31, 2025, unless otherwise indicated (1) Nonrecurring revenue related to the revenue share for one partner was recorded during the quarter ended June 30, 2025. Revenue Growth • BaaS Fees include $48.4 million in credit enhancement revenue and fraud enhancement revenue for the three months ended December 31, 2025, compared to $57.5 million for the three months ended September 30, 2025 and $67.1 million for the three months ended December 31, 2024. • Reimbursement for any partner credit enhancement and fraud loss provided by the partner is included in noninterest income. Partner fraud loss represents non-credit fraud losses on partners customer loan and deposit accounts and is recognized in noninterest expense. BaaS fraud loss expense decreased $1.0 million for the three months ended December 31, 2025 compared to the three months ended September 30, 2025 and decreased $4.0 million compared to the three months ended December 31, 2024. • BaaS Program Fee Income includes servicing and other BaaS fees, transaction and interchange fees and reimbursement of expenses and excludes BaaS credit enhancements and BaaS fraud enhancements. BaaS Program Fee Income for the three months ended December 31, 2025 grew 50.6% compared to the three months ended December 31, 2024. BaaS reimbursement of expenses offset increases in noninterest expense as noninterest expenses reimbursed by partners increases. • We expect transaction and interchange fees to increase and servicing and other BaaS fees to decrease and as partner activity grows and contracted minimum fees are replaced with recurring transaction and interchange fees which exceed those minimum servicing and other fees. (1)

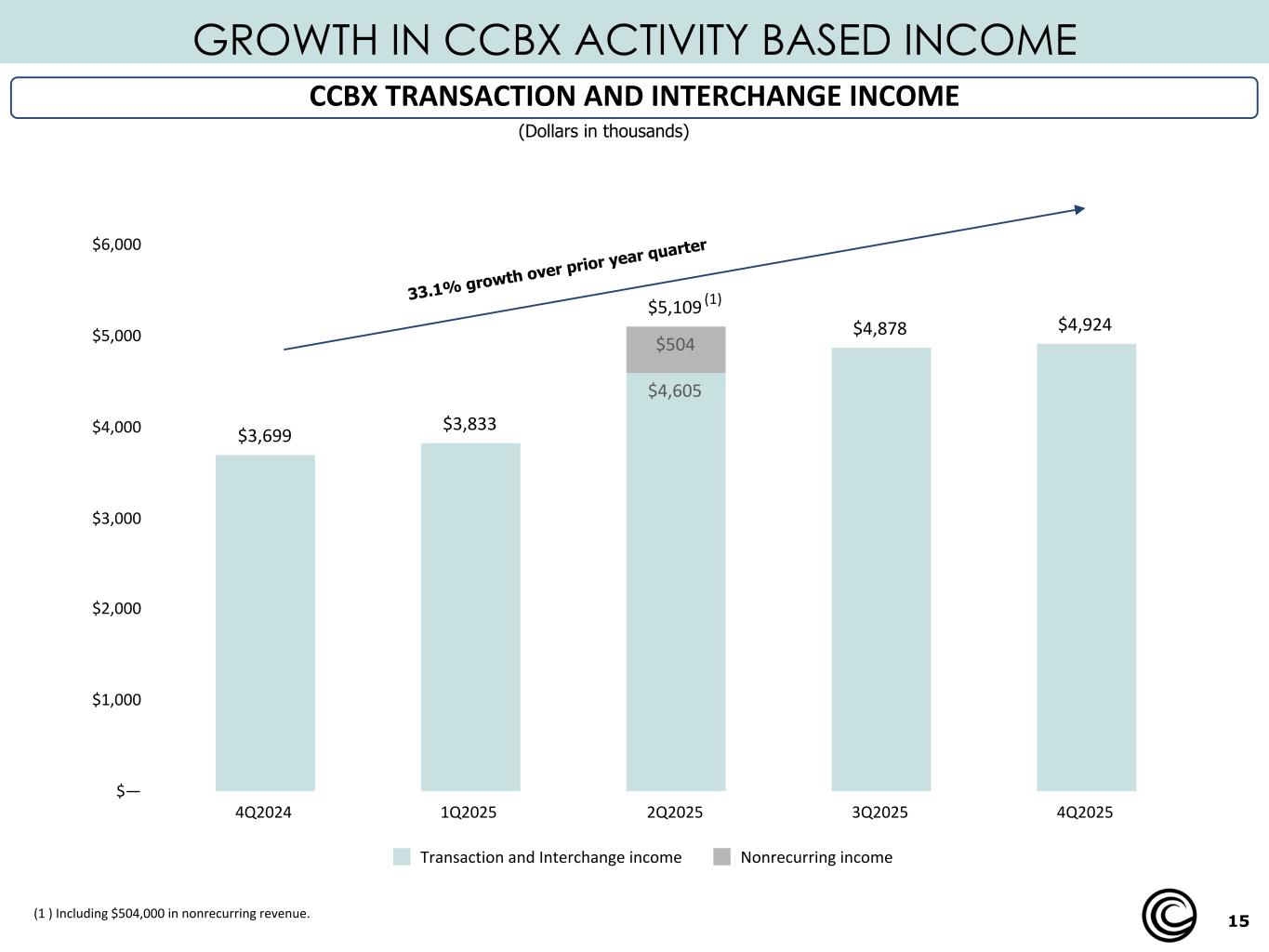

15 GROWTH IN CCBX ACTIVITY BASED INCOME CCBX TRANSACTION AND INTERCHANGE INCOME (Dollars in thousands) 33.1% growth over prior year quarter $3,699 $3,833 $5,109 $4,878 $4,924 $4,605 $504 Transaction and Interchange income Nonrecurring income 4Q2024 1Q2025 2Q2025 3Q2025 4Q2025 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 (1) (1 ) Including $504,000 in nonrecurring revenue.

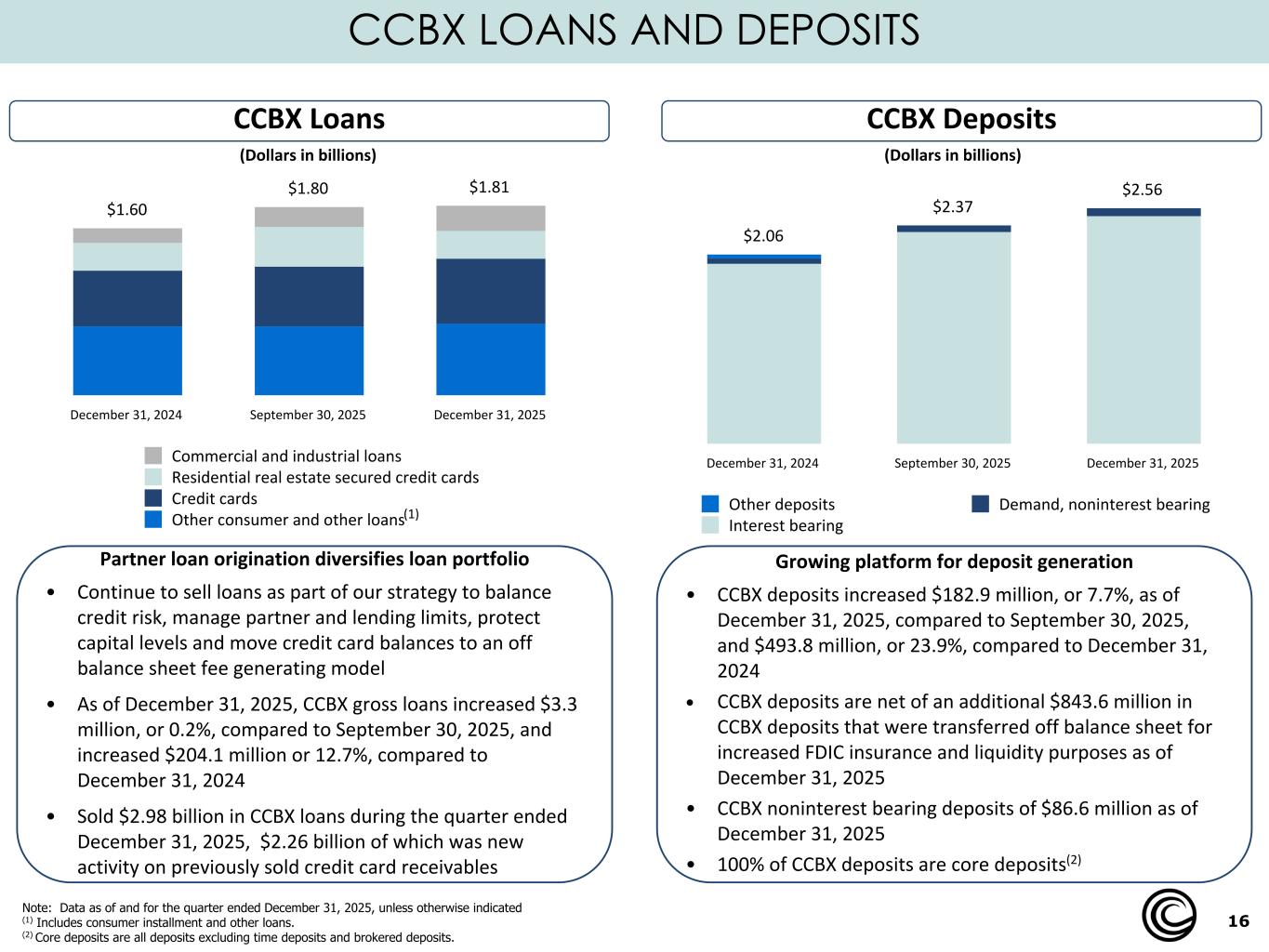

16 CCBX LOANS AND DEPOSITS (Dollars in billions) $2.06 $2.37 $2.56 Other deposits Demand, noninterest bearing Interest bearing December 31, 2024 September 30, 2025 December 31, 2025 (Dollars in billions) $1.60 $1.80 $1.81 Commercial and industrial loans Residential real estate secured credit cards Credit cards Other consumer and other loans December 31, 2024 September 30, 2025 December 31, 2025 CCBX Loans CCBX Deposits Note: Data as of and for the quarter ended December 31, 2025, unless otherwise indicated (1) Includes consumer installment and other loans. (2) Core deposits are all deposits excluding time deposits and brokered deposits. Growing platform for deposit generation • CCBX deposits increased $182.9 million, or 7.7%, as of December 31, 2025, compared to September 30, 2025, and $493.8 million, or 23.9%, compared to December 31, 2024 • CCBX deposits are net of an additional $843.6 million in CCBX deposits that were transferred off balance sheet for increased FDIC insurance and liquidity purposes as of December 31, 2025 • CCBX noninterest bearing deposits of $86.6 million as of December 31, 2025 • 100% of CCBX deposits are core deposits(2) Partner loan origination diversifies loan portfolio • Continue to sell loans as part of our strategy to balance credit risk, manage partner and lending limits, protect capital levels and move credit card balances to an off balance sheet fee generating model • As of December 31, 2025, CCBX gross loans increased $3.3 million, or 0.2%, compared to September 30, 2025, and increased $204.1 million or 12.7%, compared to December 31, 2024 • Sold $2.98 billion in CCBX loans during the quarter ended December 31, 2025, $2.26 billion of which was new activity on previously sold credit card receivables (1)

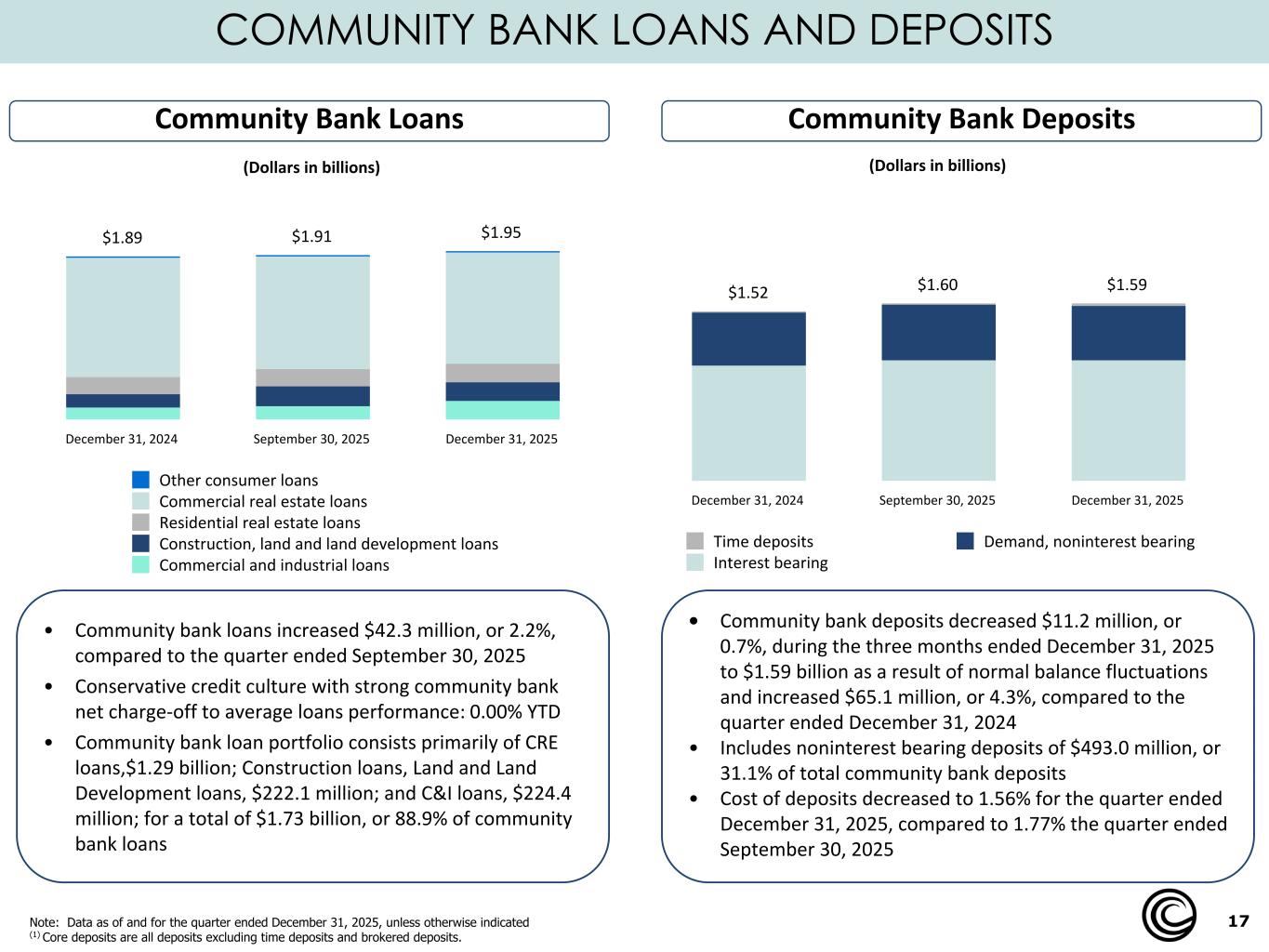

17 COMMUNITY BANK LOANS AND DEPOSITS (Dollars in billions) $1.52 $1.60 $1.59 Time deposits Demand, noninterest bearing Interest bearing December 31, 2024 September 30, 2025 December 31, 2025 Community Bank Loans Community Bank Deposits Note: Data as of and for the quarter ended December 31, 2025, unless otherwise indicated (1) Core deposits are all deposits excluding time deposits and brokered deposits. • Community bank loans increased $42.3 million, or 2.2%, compared to the quarter ended September 30, 2025 • Conservative credit culture with strong community bank net charge-off to average loans performance: 0.00% YTD • Community bank loan portfolio consists primarily of CRE loans,$1.29 billion; Construction loans, Land and Land Development loans, $222.1 million; and C&I loans, $224.4 million; for a total of $1.73 billion, or 88.9% of community bank loans • Community bank deposits decreased $11.2 million, or 0.7%, during the three months ended December 31, 2025 to $1.59 billion as a result of normal balance fluctuations and increased $65.1 million, or 4.3%, compared to the quarter ended December 31, 2024 • Includes noninterest bearing deposits of $493.0 million, or 31.1% of total community bank deposits • Cost of deposits decreased to 1.56% for the quarter ended December 31, 2025, compared to 1.77% the quarter ended September 30, 2025 (Dollars in billions) $1.89 $1.91 $1.95 Other consumer loans Commercial real estate loans Residential real estate loans Construction, land and land development loans Commercial and industrial loans December 31, 2024 September 30, 2025 December 31, 2025

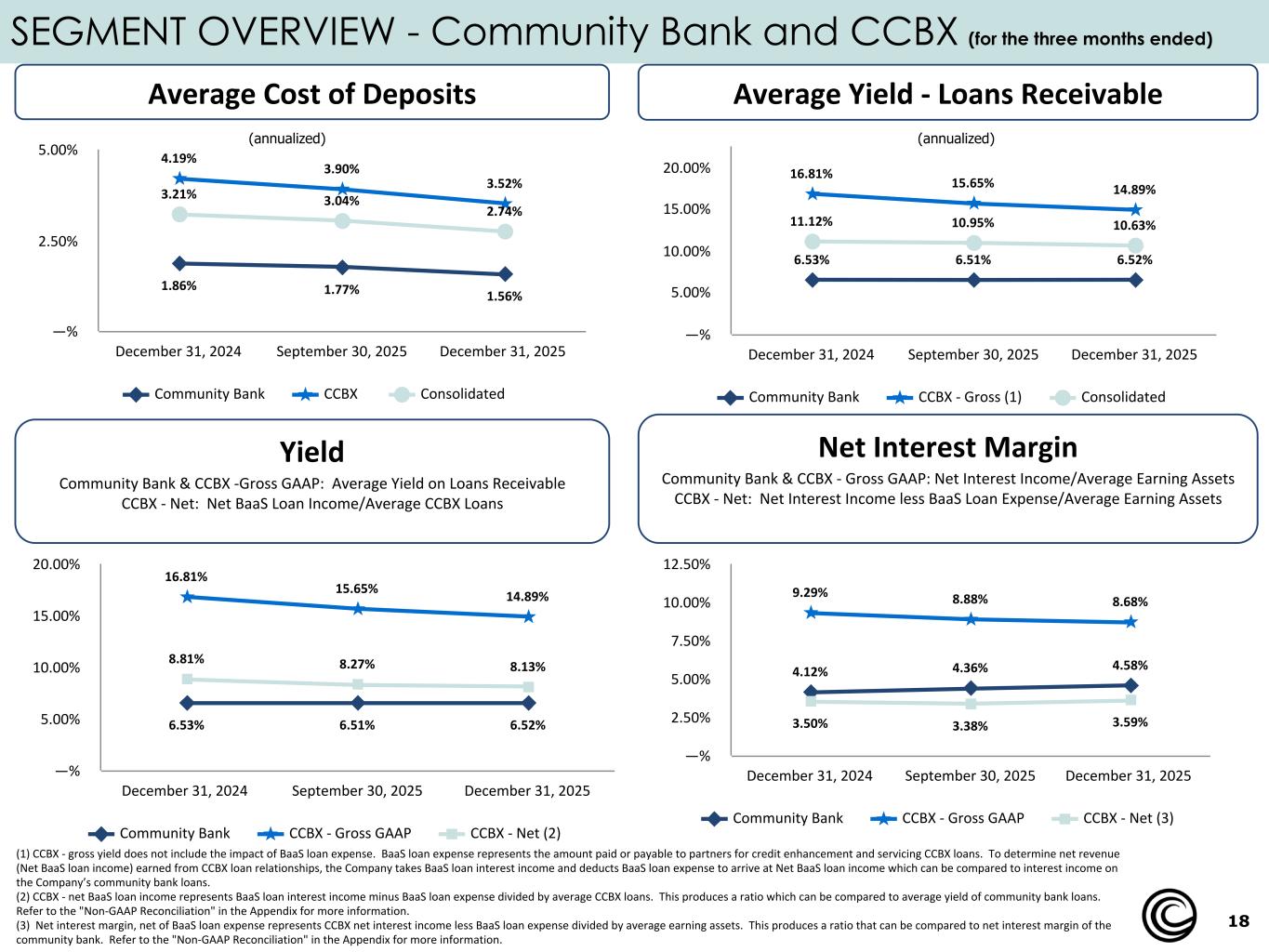

18 SEGMENT OVERVIEW - Community Bank and CCBX (for the three months ended) 1.86% 1.77% 1.56% 4.19% 3.90% 3.52% 3.21% 3.04% 2.74% Community Bank CCBX Consolidated December 31, 2024 September 30, 2025 December 31, 2025 —% 2.50% 5.00% Average Cost of Deposits (annualized) 6.53% 6.51% 6.52% 16.81% 15.65% 14.89% 11.12% 10.95% 10.63% Community Bank CCBX - Gross (1) Consolidated December 31, 2024 September 30, 2025 December 31, 2025 —% 5.00% 10.00% 15.00% 20.00% Average Yield - Loans Receivable (annualized) Yield Community Bank & CCBX -Gross GAAP: Average Yield on Loans Receivable CCBX - Net: Net BaaS Loan Income/Average CCBX Loans 6.53% 6.51% 6.52% 16.81% 15.65% 14.89% 8.81% 8.27% 8.13% Community Bank CCBX - Gross GAAP CCBX - Net (2) December 31, 2024 September 30, 2025 December 31, 2025 —% 5.00% 10.00% 15.00% 20.00% 4.12% 4.36% 4.58% 9.29% 8.88% 8.68% 3.50% 3.38% 3.59% Community Bank CCBX - Gross GAAP CCBX - Net (3) December 31, 2024 September 30, 2025 December 31, 2025 —% 2.50% 5.00% 7.50% 10.00% 12.50% Net Interest Margin Community Bank & CCBX - Gross GAAP: Net Interest Income/Average Earning Assets CCBX - Net: Net Interest Income less BaaS Loan Expense/Average Earning Assets (1) CCBX - gross yield does not include the impact of BaaS loan expense. BaaS loan expense represents the amount paid or payable to partners for credit enhancement and servicing CCBX loans. To determine net revenue (Net BaaS loan income) earned from CCBX loan relationships, the Company takes BaaS loan interest income and deducts BaaS loan expense to arrive at Net BaaS loan income which can be compared to interest income on the Company’s community bank loans. (2) CCBX - net BaaS loan income represents BaaS loan interest income minus BaaS loan expense divided by average CCBX loans. This produces a ratio which can be compared to average yield of community bank loans. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information. (3) Net interest margin, net of BaaS loan expense represents CCBX net interest income less BaaS loan expense divided by average earning assets. This produces a ratio that can be compared to net interest margin of the community bank. Refer to the "Non-GAAP Reconciliation" in the Appendix for more information.

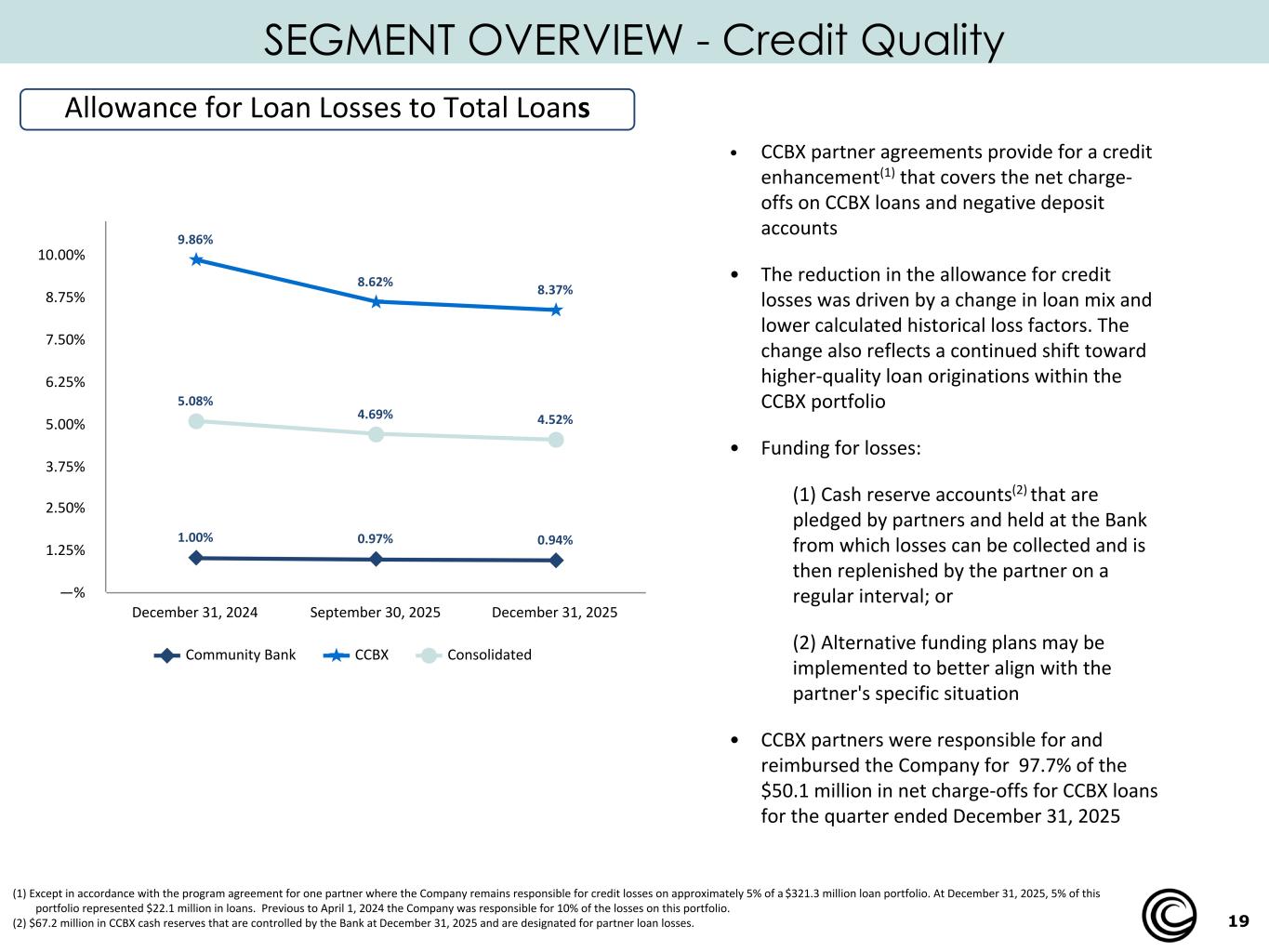

19 SEGMENT OVERVIEW - Credit Quality 1.00% 0.97% 0.94% 9.86% 8.62% 8.37% 5.08% 4.69% 4.52% Community Bank CCBX Consolidated December 31, 2024 September 30, 2025 December 31, 2025 —% 1.25% 2.50% 3.75% 5.00% 6.25% 7.50% 8.75% 10.00% Allowance for Loan Losses to Total Loans (1) Except in accordance with the program agreement for one partner where the Company remains responsible for credit losses on approximately 5% of a $321.3 million loan portfolio. At December 31, 2025, 5% of this portfolio represented $22.1 million in loans. Previous to April 1, 2024 the Company was responsible for 10% of the losses on this portfolio. (2) $67.2 million in CCBX cash reserves that are controlled by the Bank at December 31, 2025 and are designated for partner loan losses. • CCBX partner agreements provide for a credit enhancement(1) that covers the net charge- offs on CCBX loans and negative deposit accounts • The reduction in the allowance for credit losses was driven by a change in loan mix and lower calculated historical loss factors. The change also reflects a continued shift toward higher-quality loan originations within the CCBX portfolio • Funding for losses: (1) Cash reserve accounts(2) that are pledged by partners and held at the Bank from which losses can be collected and is then replenished by the partner on a regular interval; or (2) Alternative funding plans may be implemented to better align with the partner's specific situation • CCBX partners were responsible for and reimbursed the Company for 97.7% of the $50.1 million in net charge-offs for CCBX loans for the quarter ended December 31, 2025

20 APPENDIX

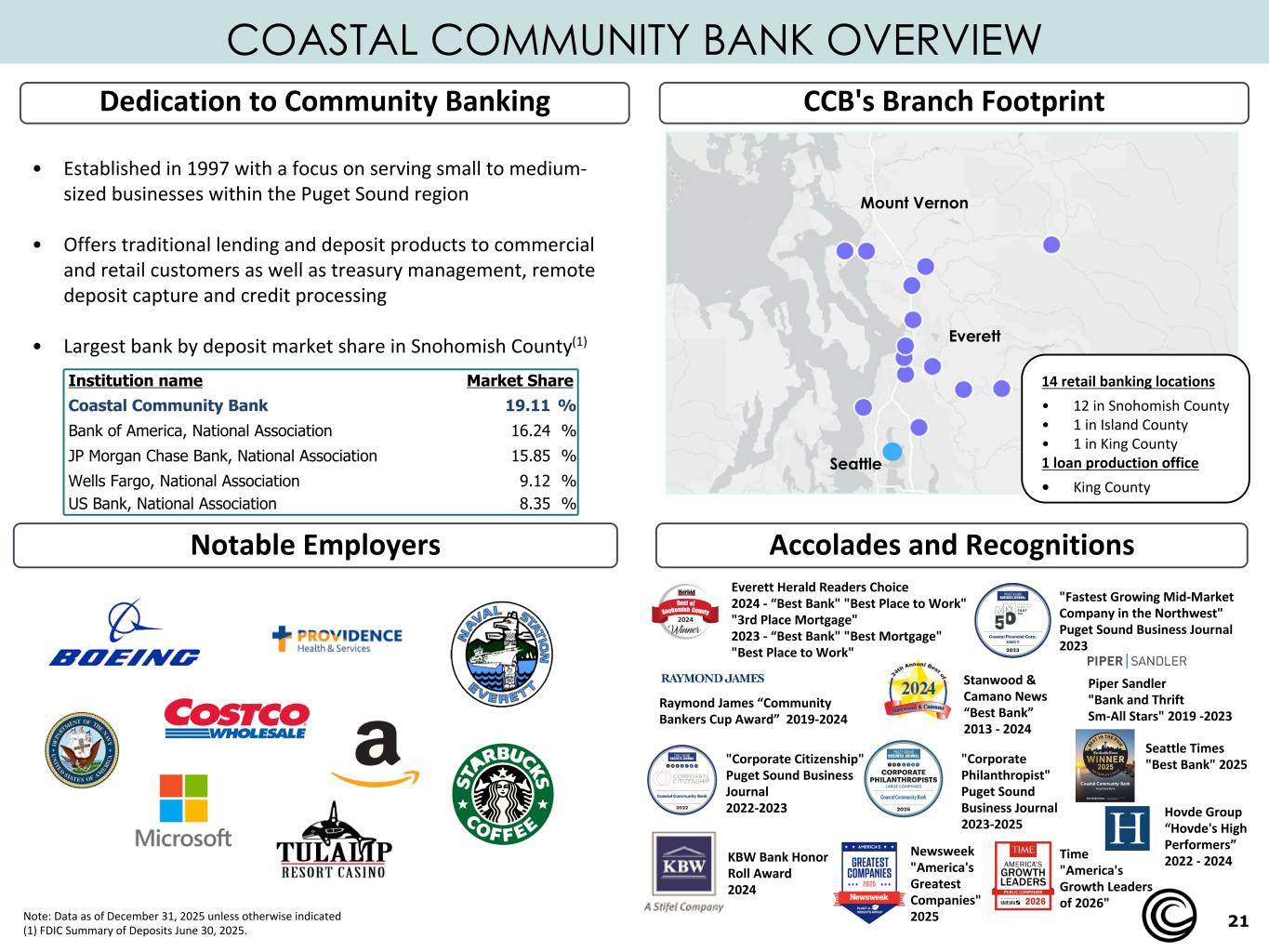

21 • Established in 1997 with a focus on serving small to medium- sized businesses within the Puget Sound region • Offers traditional lending and deposit products to commercial and retail customers as well as treasury management, remote deposit capture and credit processing • Largest bank by deposit market share in Snohomish County(1) Accolades and Recognitions Stanwood & Camano News “Best Bank” 2013 - 2024 COASTAL COMMUNITY BANK OVERVIEW Note: Data as of December 31, 2025 unless otherwise indicated (1) FDIC Summary of Deposits June 30, 2025. Raymond James “Community Bankers Cup Award” 2019-2024 Piper Sandler "Bank and Thrift Sm-All Stars" 2019 -2023 Dedication to Community Banking CCB's Branch Footprint "Corporate Citizenship" Puget Sound Business Journal 2022-2023 Everett Herald Readers Choice 2024 - “Best Bank" "Best Place to Work" "3rd Place Mortgage" 2023 - “Best Bank" "Best Mortgage" "Best Place to Work" Institution name Market Share Coastal Community Bank 19.11 % Bank of America, National Association 16.24 % JP Morgan Chase Bank, National Association 15.85 % Wells Fargo, National Association 9.12 % US Bank, National Association 8.35 % Hovde Group “Hovde's High Performers” 2022 - 2024 Notable Employers "Corporate Philanthropist" Puget Sound Business Journal 2023-2025 "Fastest Growing Mid-Market Company in the Northwest" Puget Sound Business Journal 2023 Mount Vernon Everett Seattle 14 retail banking locations • 12 in Snohomish County • 1 in Island County • 1 in King County 1 loan production office • King County KBW Bank Honor Roll Award 2024 Newsweek "America's Greatest Companies" 2025 Seattle Times "Best Bank" 2025 Time "America's Growth Leaders of 2026"

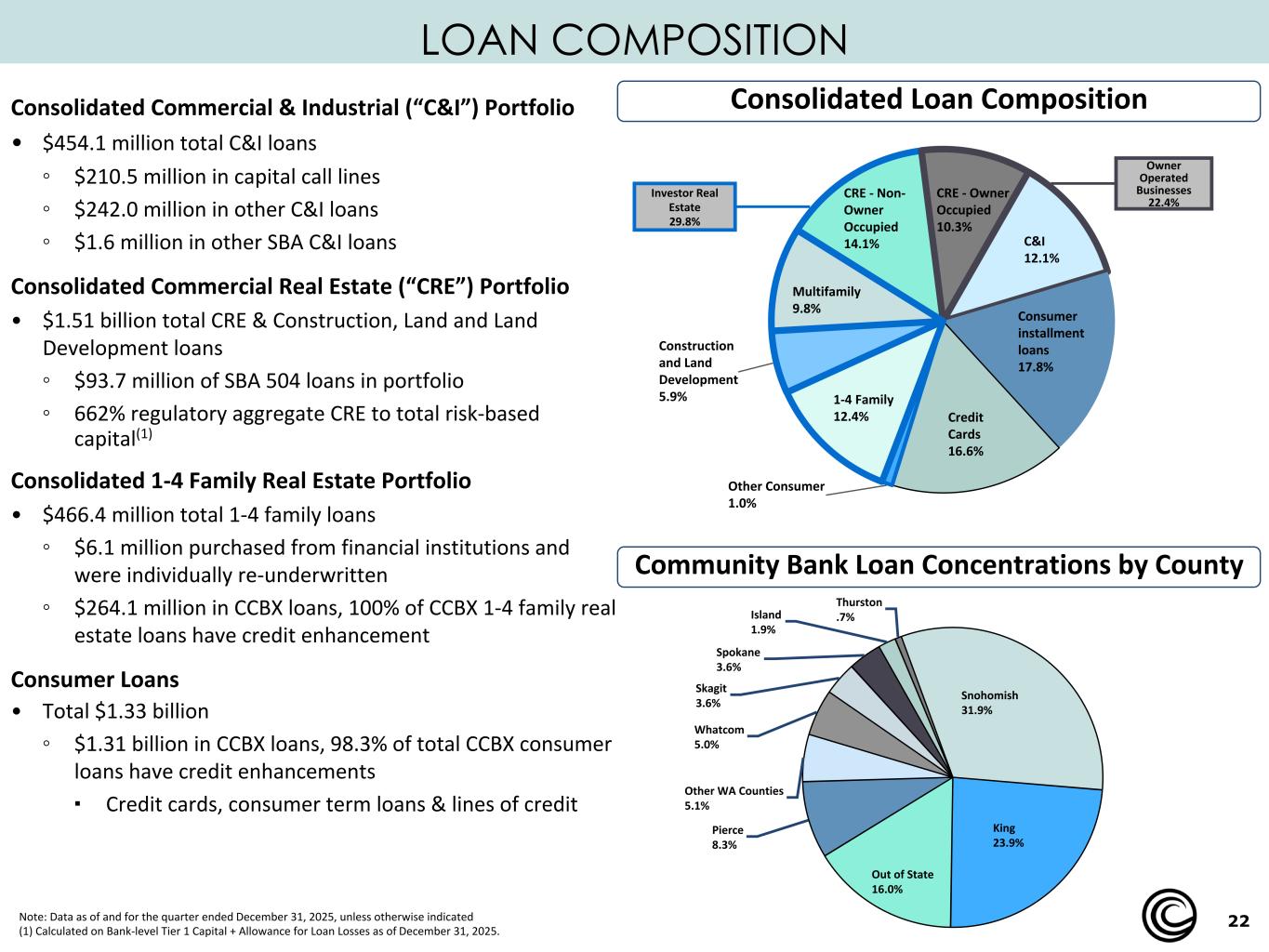

22 CRE - Non- Owner Occupied 14.1% CRE - Owner Occupied 10.3% C&I 12.1% Consumer installment loans 17.8% Credit Cards 16.6% Other Consumer 1.0% 1-4 Family 12.4% Construction and Land Development 5.9% Multifamily 9.8% LOAN COMPOSITION Consolidated Loan Composition Community Bank Loan Concentrations by County Consolidated Commercial & Industrial (“C&I”) Portfolio • $454.1 million total C&I loans ◦ $210.5 million in capital call lines ◦ $242.0 million in other C&I loans ◦ $1.6 million in other SBA C&I loans Consolidated Commercial Real Estate (“CRE”) Portfolio • $1.51 billion total CRE & Construction, Land and Land Development loans ◦ $93.7 million of SBA 504 loans in portfolio ◦ 662% regulatory aggregate CRE to total risk-based capital(1) Consolidated 1-4 Family Real Estate Portfolio • $466.4 million total 1-4 family loans ◦ $6.1 million purchased from financial institutions and were individually re-underwritten ◦ $264.1 million in CCBX loans, 100% of CCBX 1-4 family real estate loans have credit enhancement Consumer Loans • Total $1.33 billion ◦ $1.31 billion in CCBX loans, 98.3% of total CCBX consumer loans have credit enhancements ▪ Credit cards, consumer term loans & lines of credit Note: Data as of and for the quarter ended December 31, 2025, unless otherwise indicated (1) Calculated on Bank-level Tier 1 Capital + Allowance for Loan Losses as of December 31, 2025. Investor Real Estate 29.8% Owner Operated Businesses 22.4% Snohomish 31.9% King 23.9% Out of State 16.0% Pierce 8.3% Other WA Counties 5.1% Whatcom 5.0% Skagit 3.6% Spokane 3.6% Island 1.9% Thurston .7%

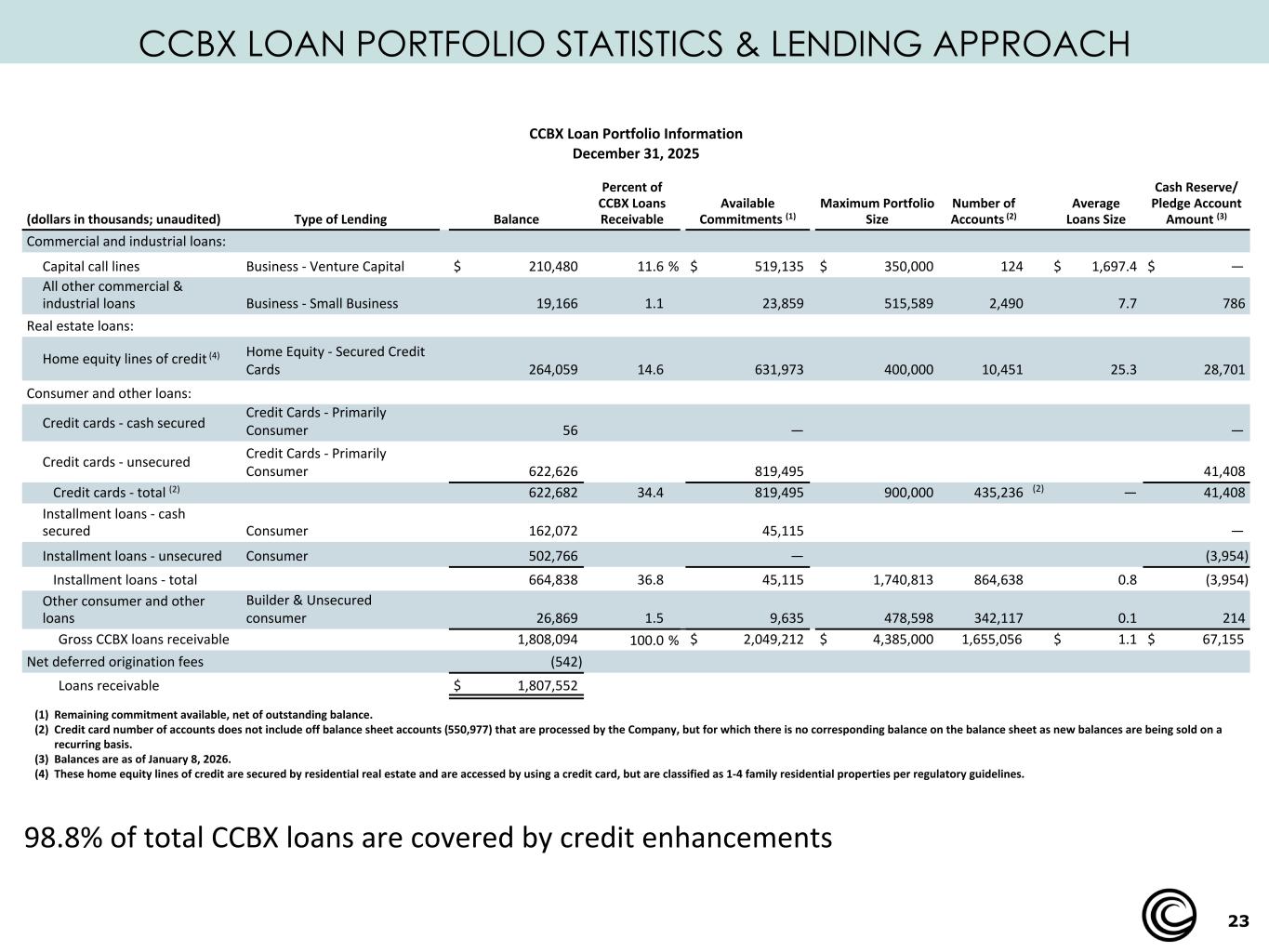

23 CCBX LOAN PORTFOLIO STATISTICS & LENDING APPROACH CCBX Loan Portfolio Information December 31, 2025 (dollars in thousands; unaudited) Type of Lending Balance Percent of CCBX Loans Receivable Available Commitments (1) Maximum Portfolio Size Number of Accounts (2) Average Loans Size Cash Reserve/ Pledge Account Amount (3) Commercial and industrial loans: Capital call lines Business - Venture Capital $ 210,480 11.6 % $ 519,135 $ 350,000 124 $ 1,697.4 $ — All other commercial & industrial loans Business - Small Business 19,166 1.1 23,859 515,589 2,490 7.7 786 Real estate loans: Home equity lines of credit (4) Home Equity - Secured Credit Cards 264,059 14.6 631,973 400,000 10,451 25.3 28,701 Consumer and other loans: Credit cards - cash secured Credit Cards - Primarily Consumer 56 — — Credit cards - unsecured Credit Cards - Primarily Consumer 622,626 819,495 41,408 Credit cards - total (2) 622,682 34.4 819,495 900,000 435,236 (2) — 41,408 Installment loans - cash secured Consumer 162,072 45,115 — Installment loans - unsecured Consumer 502,766 — (3,954) Installment loans - total 664,838 36.8 45,115 1,740,813 864,638 0.8 (3,954) Other consumer and other loans Builder & Unsecured consumer 26,869 1.5 9,635 478,598 342,117 0.1 214 Gross CCBX loans receivable 1,808,094 100.0 % $ 2,049,212 $ 4,385,000 1,655,056 $ 1.1 $ 67,155 Net deferred origination fees (542) Loans receivable $ 1,807,552 (1) Remaining commitment available, net of outstanding balance. (2) Credit card number of accounts does not include off balance sheet accounts (550,977) that are processed by the Company, but for which there is no corresponding balance on the balance sheet as new balances are being sold on a recurring basis. (3) Balances are as of January 8, 2026. (4) These home equity lines of credit are secured by residential real estate and are accessed by using a credit card, but are classified as 1-4 family residential properties per regulatory guidelines. 98.8% of total CCBX loans are covered by credit enhancements

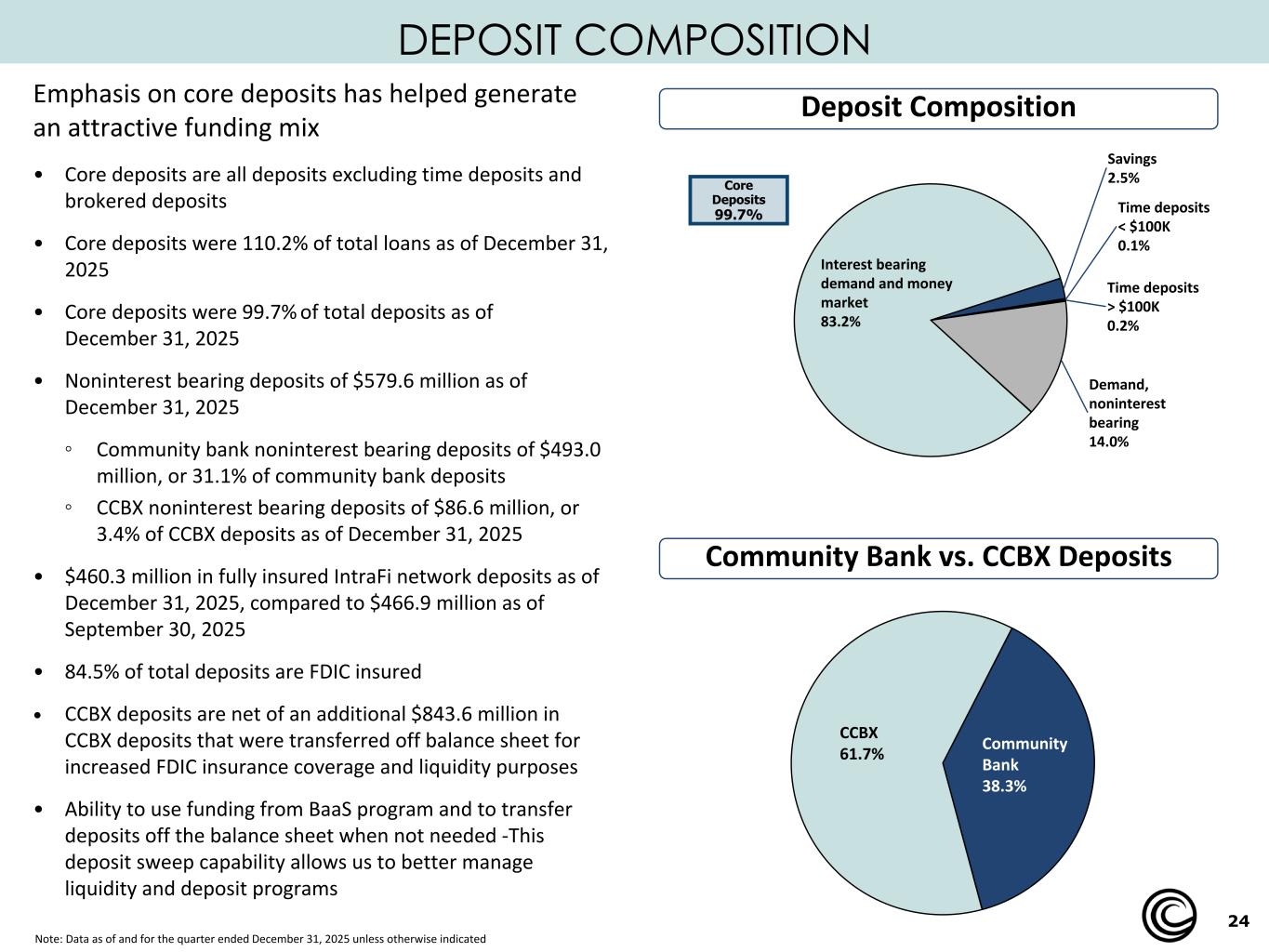

24 Demand, noninterest bearing 14.0% Interest bearing demand and money market 83.2% Savings 2.5% Time deposits < $100K 0.1% Time deposits > $100K 0.2% DEPOSIT COMPOSITION Deposit CompositionEmphasis on core deposits has helped generate an attractive funding mix • Core deposits are all deposits excluding time deposits and brokered deposits • Core deposits were 110.2% of total loans as of December 31, 2025 • Core deposits were 99.7% of total deposits as of December 31, 2025 • Noninterest bearing deposits of $579.6 million as of December 31, 2025 ◦ Community bank noninterest bearing deposits of $493.0 million, or 31.1% of community bank deposits ◦ CCBX noninterest bearing deposits of $86.6 million, or 3.4% of CCBX deposits as of December 31, 2025 • $460.3 million in fully insured IntraFi network deposits as of December 31, 2025, compared to $466.9 million as of September 30, 2025 • 84.5% of total deposits are FDIC insured • CCBX deposits are net of an additional $843.6 million in CCBX deposits that were transferred off balance sheet for increased FDIC insurance coverage and liquidity purposes • Ability to use funding from BaaS program and to transfer deposits off the balance sheet when not needed -This deposit sweep capability allows us to better manage liquidity and deposit programs Note: Data as of and for the quarter ended December 31, 2025 unless otherwise indicated Core Deposits 99.7% Community Bank vs. CCBX Deposits CCBX 61.7% Community Bank 38.3%

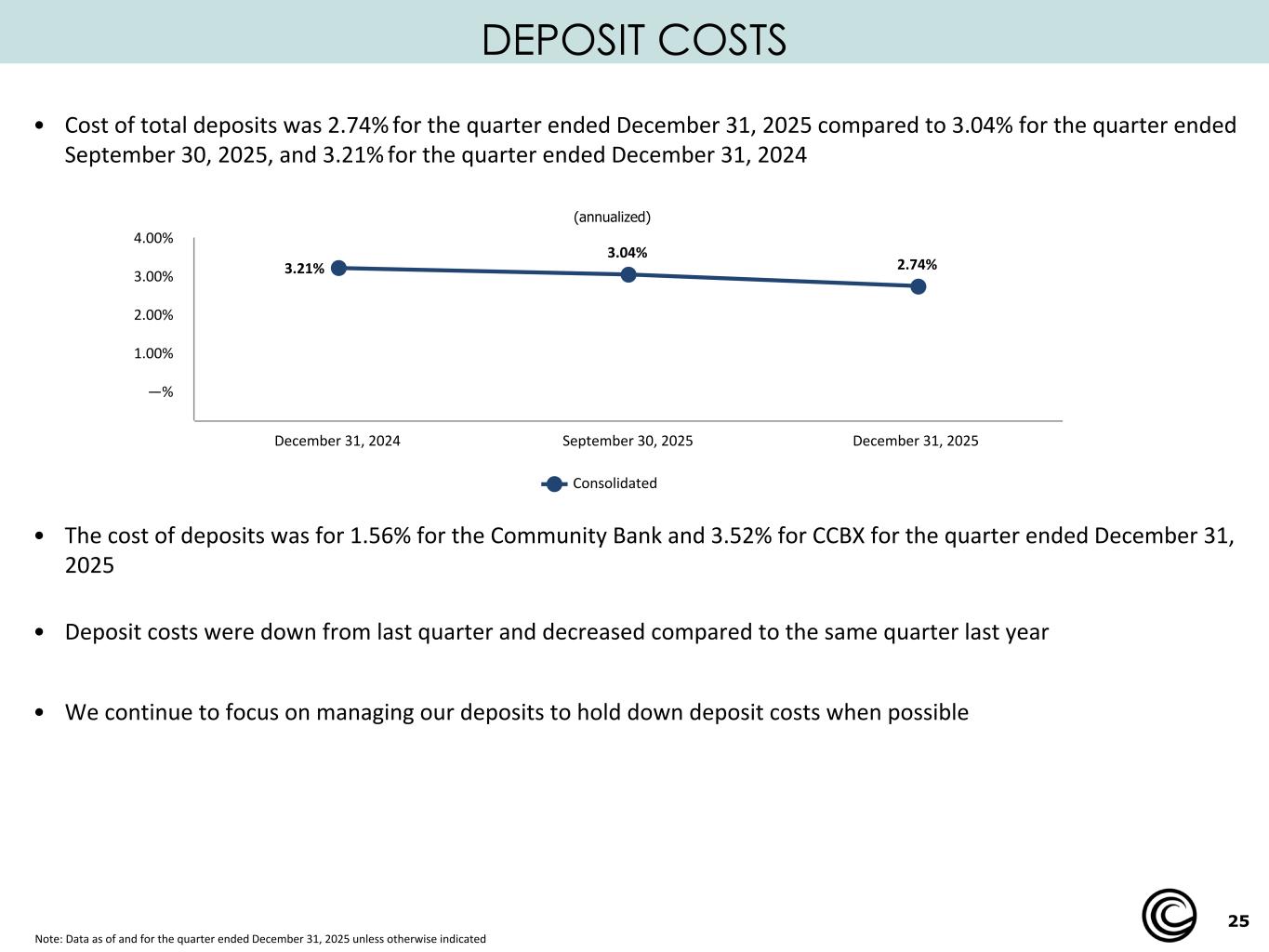

25 DEPOSIT COSTS • Cost of total deposits was 2.74% for the quarter ended December 31, 2025 compared to 3.04% for the quarter ended September 30, 2025, and 3.21% for the quarter ended December 31, 2024 • The cost of deposits was for 1.56% for the Community Bank and 3.52% for CCBX for the quarter ended December 31, 2025 • Deposit costs were down from last quarter and decreased compared to the same quarter last year • We continue to focus on managing our deposits to hold down deposit costs when possible Note: Data as of and for the quarter ended December 31, 2025 unless otherwise indicated 3.21% 3.04% 2.74% Consolidated December 31, 2024 September 30, 2025 December 31, 2025 —% 1.00% 2.00% 3.00% 4.00% (annualized)

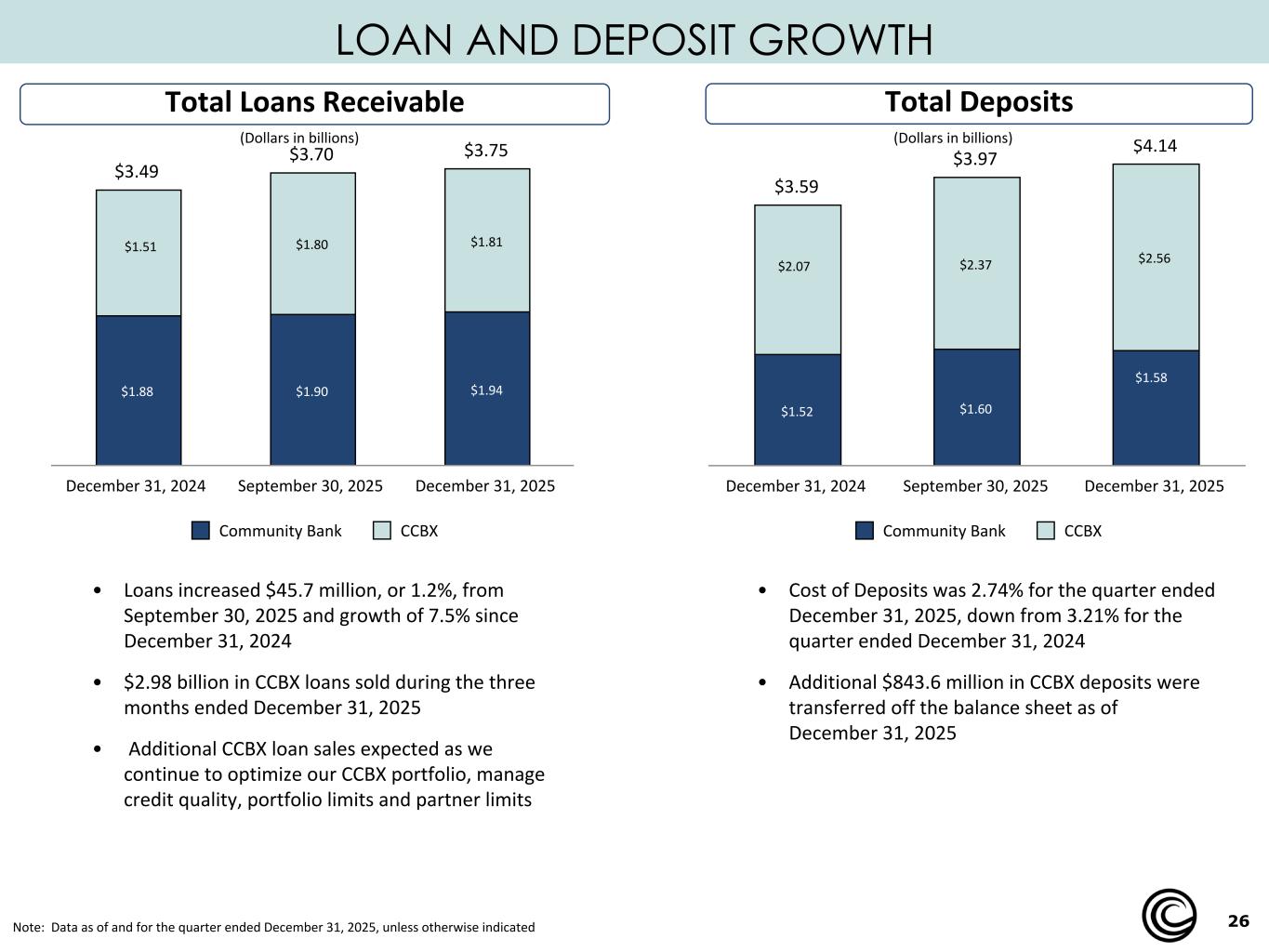

26 LOAN AND DEPOSIT GROWTH $3.49 $3.70 $3.75 $1.88 $1.90 $1.94 $1.80 $1.81 Community Bank CCBX December 31, 2024 September 30, 2025 December 31, 2025 • Loans increased $45.7 million, or 1.2%, from September 30, 2025 and growth of 7.5% since December 31, 2024 • $2.98 billion in CCBX loans sold during the three months ended December 31, 2025 • Additional CCBX loan sales expected as we continue to optimize our CCBX portfolio, manage credit quality, portfolio limits and partner limits $3.59 $3.97 $4.14 $1.52 $1.60 $2.37 $2.56 Community Bank CCBX December 31, 2024 September 30, 2025 December 31, 2025 (Dollars in billions) (Dollars in billions) • Cost of Deposits was 2.74% for the quarter ended December 31, 2025, down from 3.21% for the quarter ended December 31, 2024 • Additional $843.6 million in CCBX deposits were transferred off the balance sheet as of December 31, 2025 Total DepositsTotal Loans Receivable Note: Data as of and for the quarter ended December 31, 2025, unless otherwise indicated $1.51 $2.07 $1.58

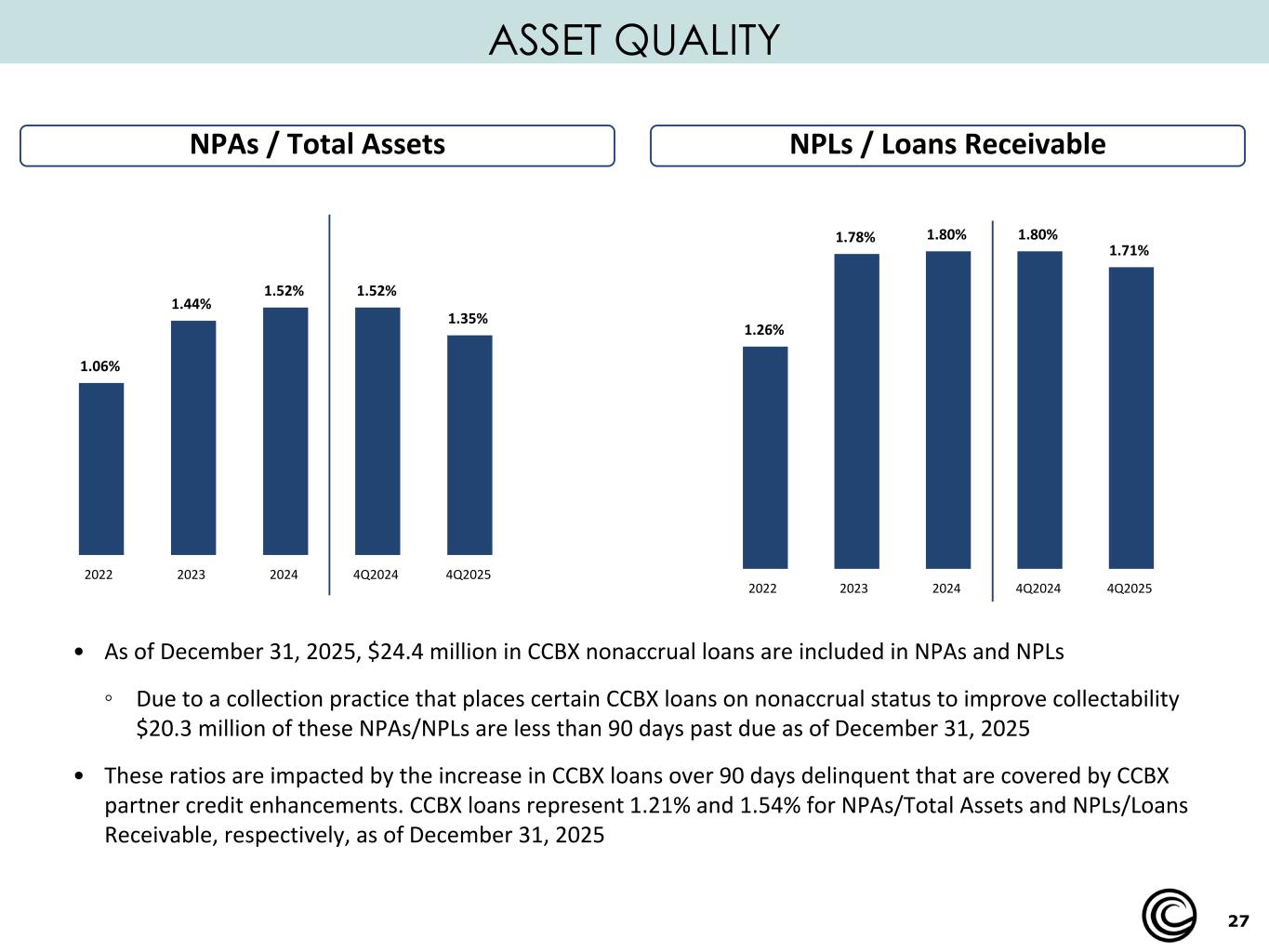

27 ASSET QUALITY NPAs / Total Assets NPLs / Loans Receivable 1.06% 1.44% 1.52% 1.52% 1.35% 2022 2023 2024 4Q2024 4Q2025 1.26% 1.78% 1.80% 1.80% 1.71% 2022 2023 2024 4Q2024 4Q2025 • As of December 31, 2025, $24.4 million in CCBX nonaccrual loans are included in NPAs and NPLs ◦ Due to a collection practice that places certain CCBX loans on nonaccrual status to improve collectability $20.3 million of these NPAs/NPLs are less than 90 days past due as of December 31, 2025 • These ratios are impacted by the increase in CCBX loans over 90 days delinquent that are covered by CCBX partner credit enhancements. CCBX loans represent 1.21% and 1.54% for NPAs/Total Assets and NPLs/Loans Receivable, respectively, as of December 31, 2025

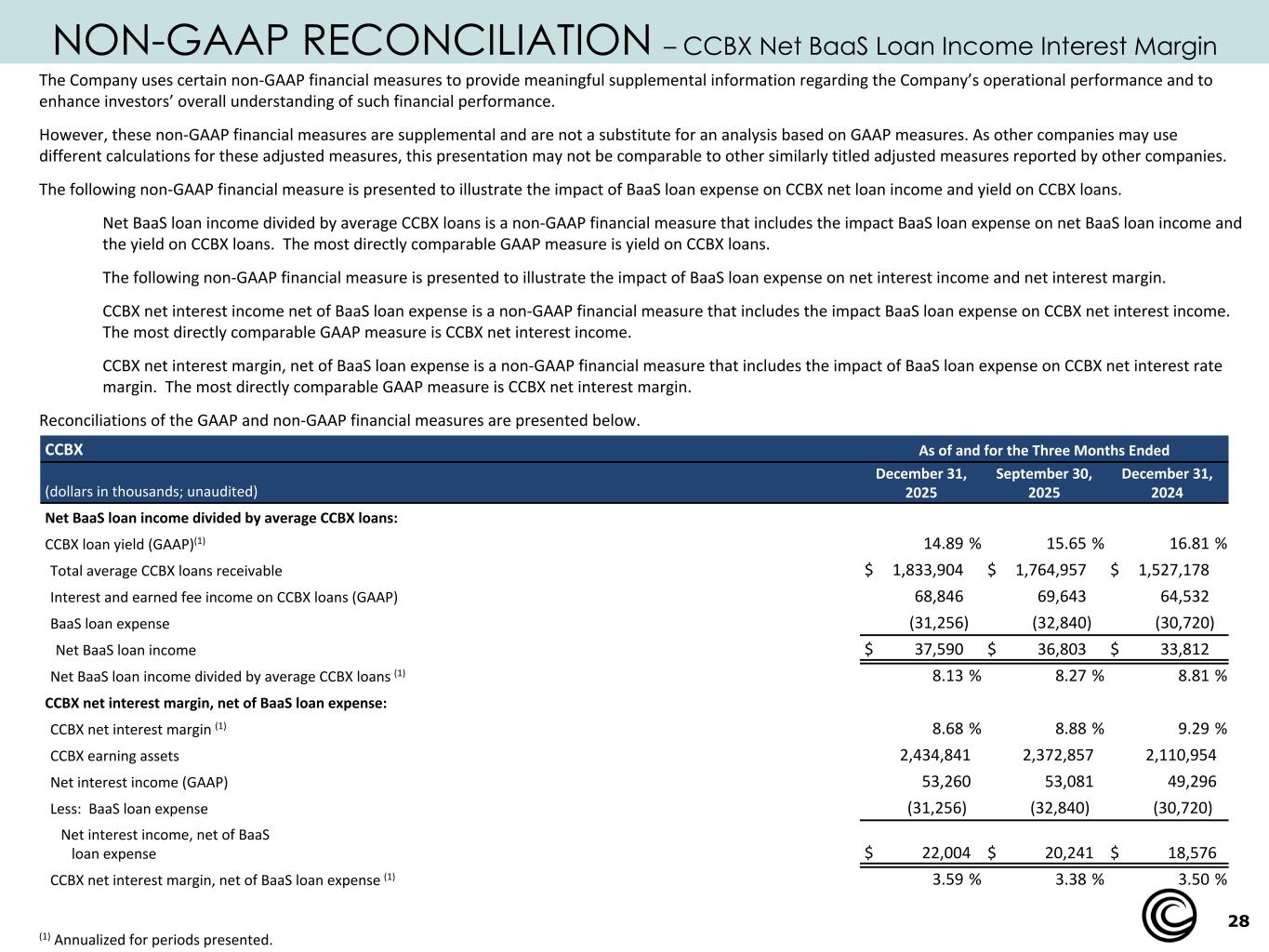

28 NON-GAAP RECONCILIATION – CCBX Net BaaS Loan Income Interest Margin The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. The following non-GAAP financial measure is presented to illustrate the impact of BaaS loan expense on CCBX net loan income and yield on CCBX loans. Net BaaS loan income divided by average CCBX loans is a non-GAAP financial measure that includes the impact BaaS loan expense on net BaaS loan income and the yield on CCBX loans. The most directly comparable GAAP measure is yield on CCBX loans. The following non-GAAP financial measure is presented to illustrate the impact of BaaS loan expense on net interest income and net interest margin. CCBX net interest income net of BaaS loan expense is a non-GAAP financial measure that includes the impact BaaS loan expense on CCBX net interest income. The most directly comparable GAAP measure is CCBX net interest income. CCBX net interest margin, net of BaaS loan expense is a non-GAAP financial measure that includes the impact of BaaS loan expense on CCBX net interest rate margin. The most directly comparable GAAP measure is CCBX net interest margin. Reconciliations of the GAAP and non-GAAP financial measures are presented below. CCBX As of and for the Three Months Ended (dollars in thousands; unaudited) December 31, 2025 September 30, 2025 December 31, 2024 Net BaaS loan income divided by average CCBX loans: CCBX loan yield (GAAP)(1) 14.89 % 15.65 % 16.81 % Total average CCBX loans receivable $ 1,833,904 $ 1,764,957 $ 1,527,178 Interest and earned fee income on CCBX loans (GAAP) 68,846 69,643 64,532 BaaS loan expense (31,256) (32,840) (30,720) Net BaaS loan income $ 37,590 $ 36,803 $ 33,812 Net BaaS loan income divided by average CCBX loans (1) 8.13 % 8.27 % 8.81 % CCBX net interest margin, net of BaaS loan expense: CCBX net interest margin (1) 8.68 % 8.88 % 9.29 % CCBX earning assets 2,434,841 2,372,857 2,110,954 Net interest income (GAAP) 53,260 53,081 49,296 Less: BaaS loan expense (31,256) (32,840) (30,720) Net interest income, net of BaaS loan expense $ 22,004 $ 20,241 $ 18,576 CCBX net interest margin, net of BaaS loan expense (1) 3.59 % 3.38 % 3.50 % (1) Annualized for periods presented.

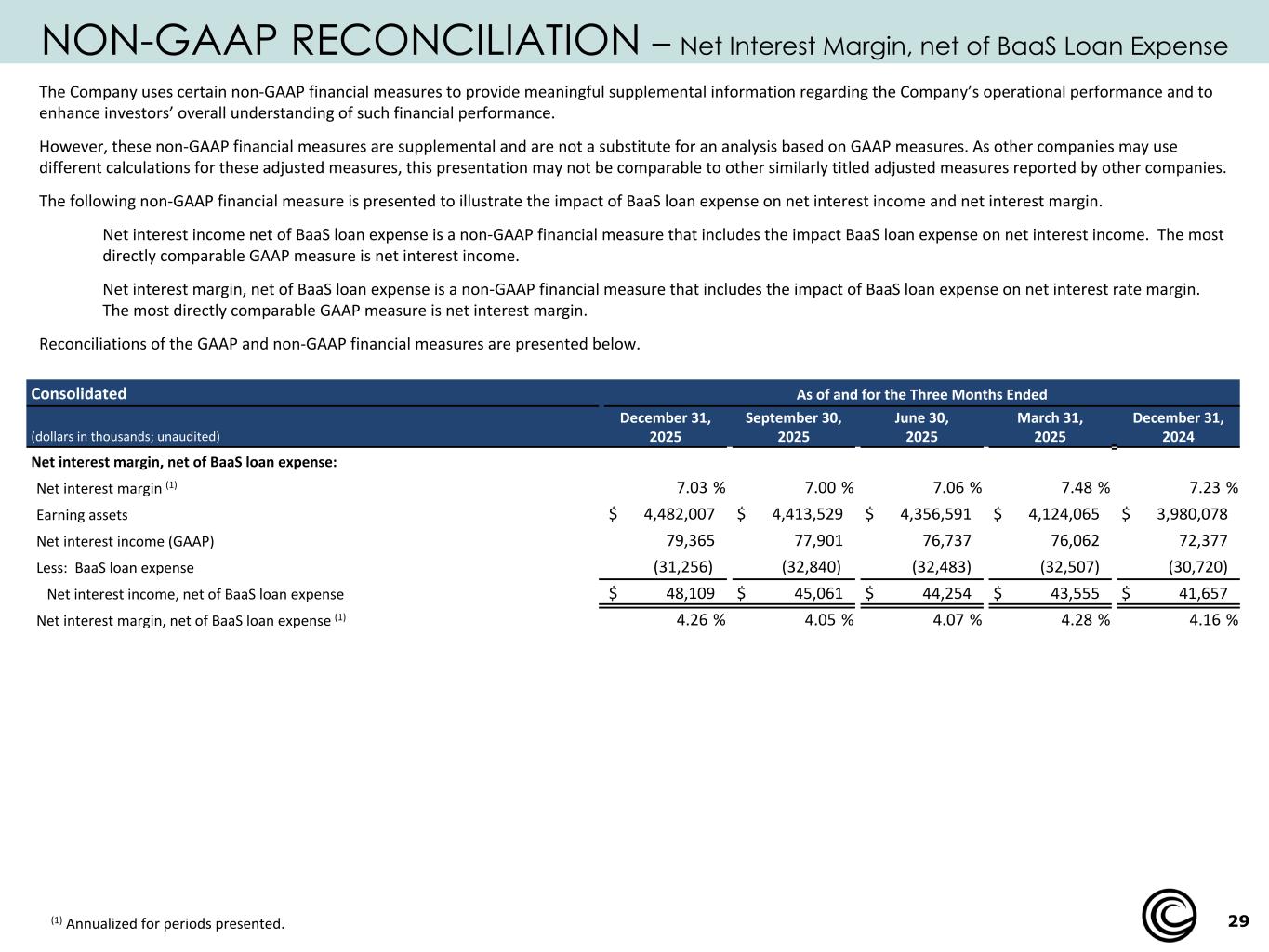

29 NON-GAAP RECONCILIATION – Net Interest Margin, net of BaaS Loan Expense The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. The following non-GAAP financial measure is presented to illustrate the impact of BaaS loan expense on net interest income and net interest margin. Net interest income net of BaaS loan expense is a non-GAAP financial measure that includes the impact BaaS loan expense on net interest income. The most directly comparable GAAP measure is net interest income. Net interest margin, net of BaaS loan expense is a non-GAAP financial measure that includes the impact of BaaS loan expense on net interest rate margin. The most directly comparable GAAP measure is net interest margin. Reconciliations of the GAAP and non-GAAP financial measures are presented below. Consolidated As of and for the Three Months Ended (dollars in thousands; unaudited) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 Net interest margin, net of BaaS loan expense: Net interest margin (1) 7.03 % 7.00 % 7.06 % 7.48 % 7.23 % Earning assets $ 4,482,007 $ 4,413,529 $ 4,356,591 $ 4,124,065 $ 3,980,078 Net interest income (GAAP) 79,365 77,901 76,737 76,062 72,377 Less: BaaS loan expense (31,256) (32,840) (32,483) (32,507) (30,720) Net interest income, net of BaaS loan expense $ 48,109 $ 45,061 $ 44,254 $ 43,555 $ 41,657 Net interest margin, net of BaaS loan expense (1) 4.26 % 4.05 % 4.07 % 4.28 % 4.16 % (1) Annualized for periods presented.

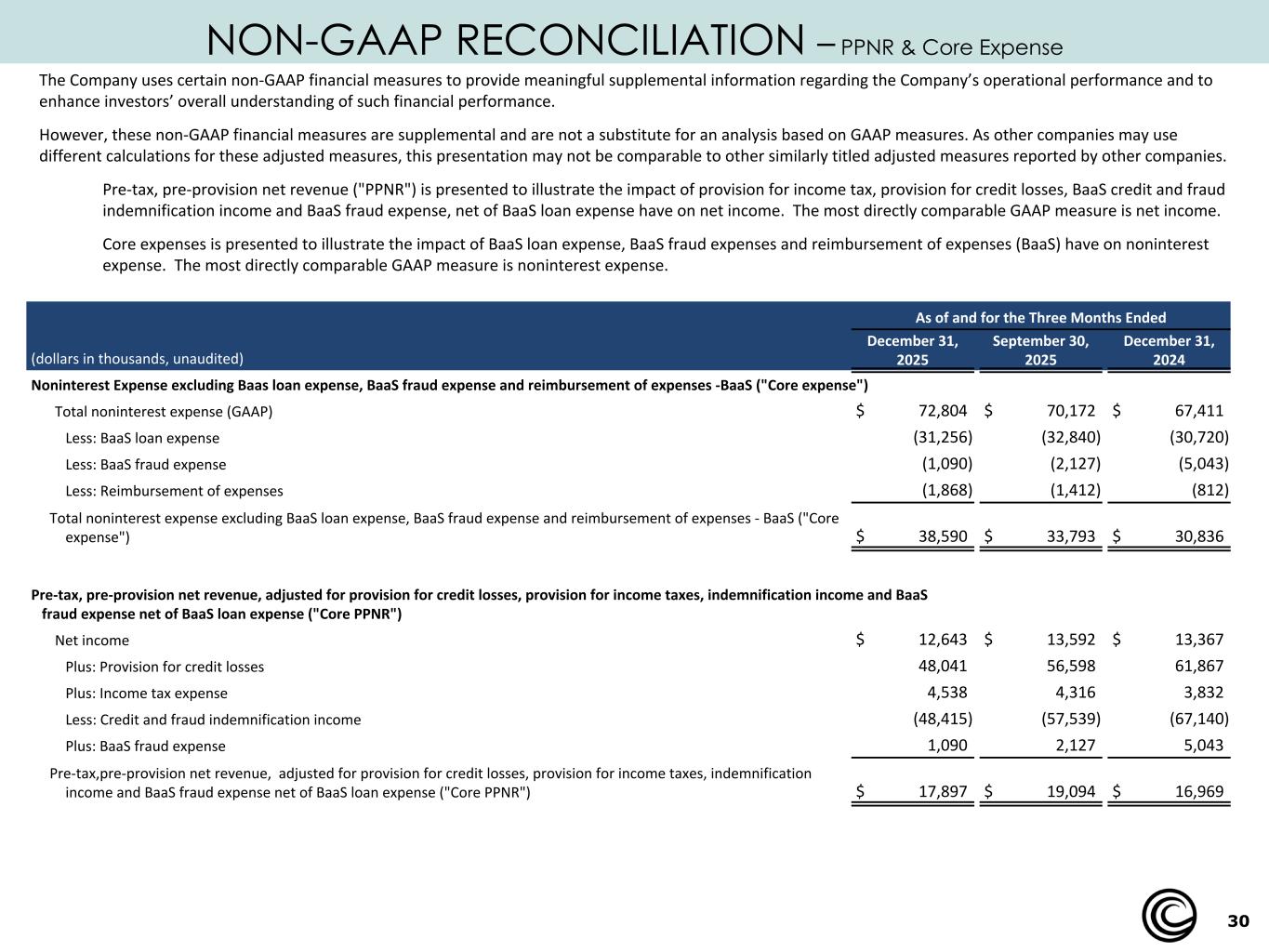

30 NON-GAAP RECONCILIATION – PPNR & Core Expense The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. Pre-tax, pre-provision net revenue ("PPNR") is presented to illustrate the impact of provision for income tax, provision for credit losses, BaaS credit and fraud indemnification income and BaaS fraud expense, net of BaaS loan expense have on net income. The most directly comparable GAAP measure is net income. Core expenses is presented to illustrate the impact of BaaS loan expense, BaaS fraud expenses and reimbursement of expenses (BaaS) have on noninterest expense. The most directly comparable GAAP measure is noninterest expense. As of and for the Three Months Ended (dollars in thousands, unaudited) December 31, 2025 September 30, 2025 December 31, 2024 Noninterest Expense excluding Baas loan expense, BaaS fraud expense and reimbursement of expenses -BaaS ("Core expense") Total noninterest expense (GAAP) $ 72,804 $ 70,172 $ 67,411 Less: BaaS loan expense (31,256) (32,840) (30,720) Less: BaaS fraud expense (1,090) (2,127) (5,043) Less: Reimbursement of expenses (1,868) (1,412) (812) Total noninterest expense excluding BaaS loan expense, BaaS fraud expense and reimbursement of expenses - BaaS ("Core expense") $ 38,590 $ 33,793 $ 30,836 Pre-tax, pre-provision net revenue, adjusted for provision for credit losses, provision for income taxes, indemnification income and BaaS fraud expense net of BaaS loan expense ("Core PPNR") Net income $ 12,643 $ 13,592 $ 13,367 Plus: Provision for credit losses 48,041 56,598 61,867 Plus: Income tax expense 4,538 4,316 3,832 Less: Credit and fraud indemnification income (48,415) (57,539) (67,140) Plus: BaaS fraud expense 1,090 2,127 5,043 Pre-tax,pre-provision net revenue, adjusted for provision for credit losses, provision for income taxes, indemnification income and BaaS fraud expense net of BaaS loan expense ("Core PPNR") $ 17,897 $ 19,094 $ 16,969

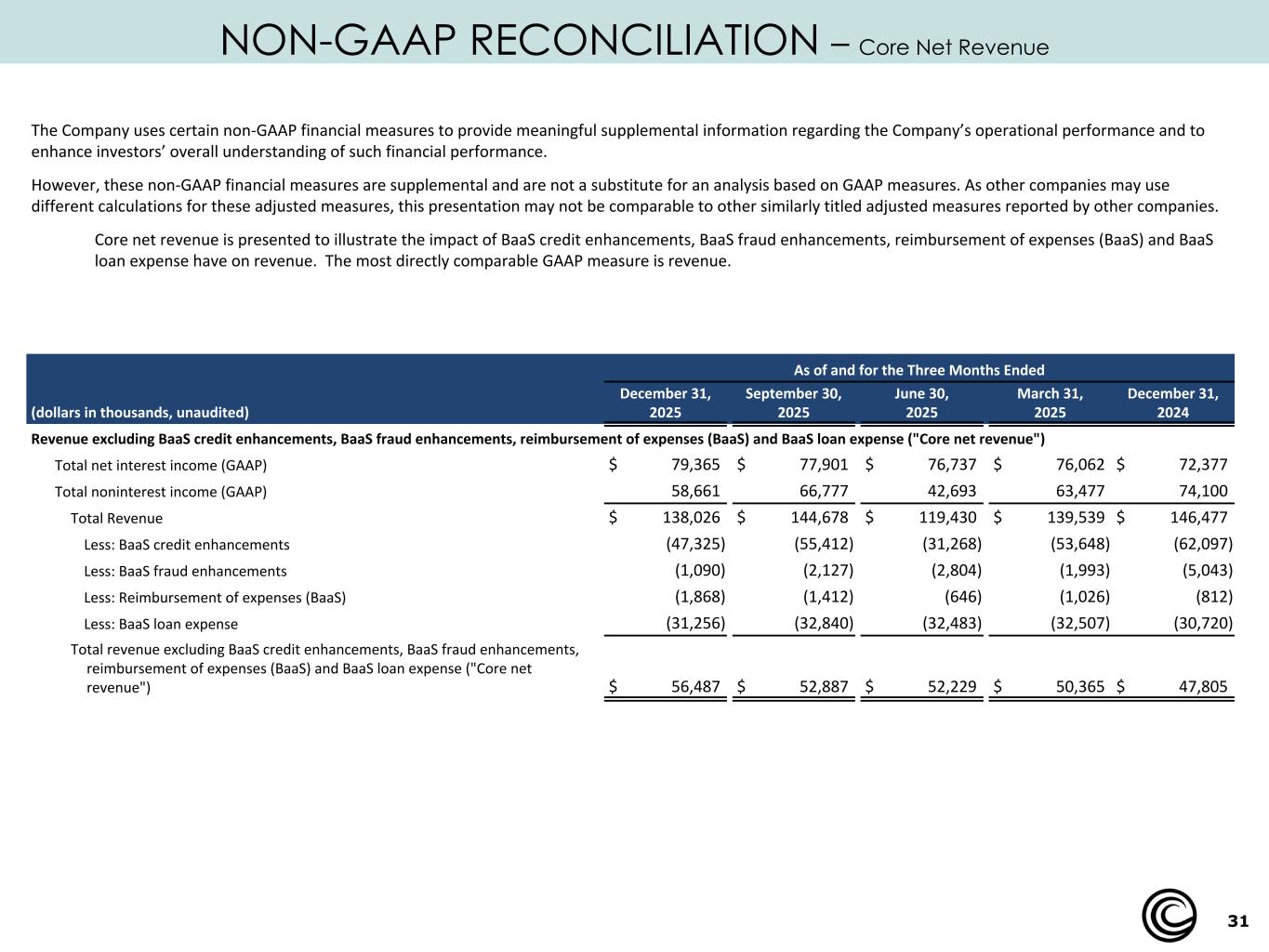

31 NON-GAAP RECONCILIATION – Core Net Revenue The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. Core net revenue is presented to illustrate the impact of BaaS credit enhancements, BaaS fraud enhancements, reimbursement of expenses (BaaS) and BaaS loan expense have on revenue. The most directly comparable GAAP measure is revenue. As of and for the Three Months Ended (dollars in thousands, unaudited) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 Revenue excluding BaaS credit enhancements, BaaS fraud enhancements, reimbursement of expenses (BaaS) and BaaS loan expense ("Core net revenue") Total net interest income (GAAP) $ 79,365 $ 77,901 $ 76,737 $ 76,062 $ 72,377 Total noninterest income (GAAP) 58,661 66,777 42,693 63,477 74,100 Total Revenue $ 138,026 $ 144,678 $ 119,430 $ 139,539 $ 146,477 Less: BaaS credit enhancements (47,325) (55,412) (31,268) (53,648) (62,097) Less: BaaS fraud enhancements (1,090) (2,127) (2,804) (1,993) (5,043) Less: Reimbursement of expenses (BaaS) (1,868) (1,412) (646) (1,026) (812) Less: BaaS loan expense (31,256) (32,840) (32,483) (32,507) (30,720) Total revenue excluding BaaS credit enhancements, BaaS fraud enhancements, reimbursement of expenses (BaaS) and BaaS loan expense ("Core net revenue") $ 56,487 $ 52,887 $ 52,229 $ 50,365 $ 47,805

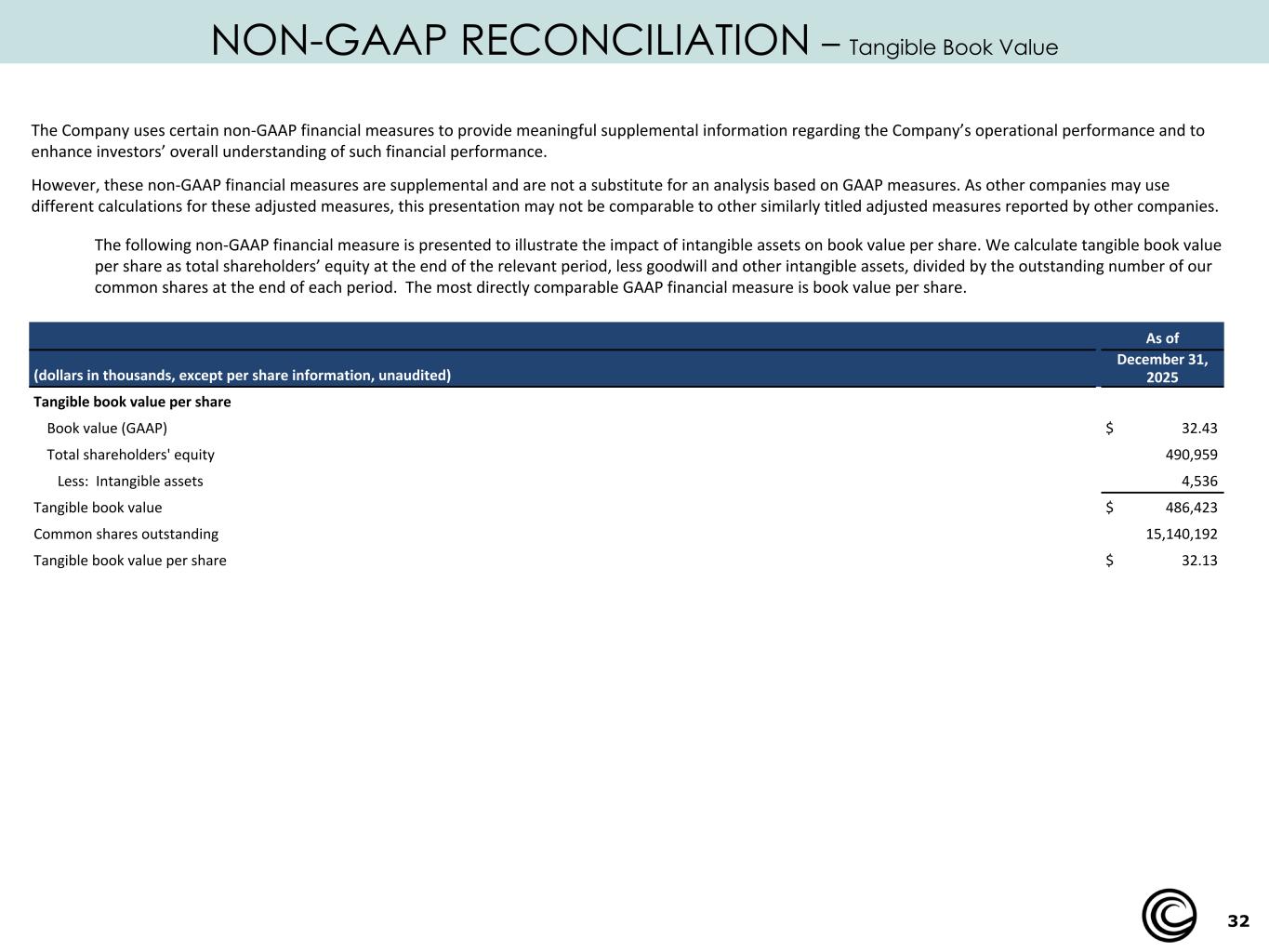

32 NON-GAAP RECONCILIATION – Tangible Book Value The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. The following non-GAAP financial measure is presented to illustrate the impact of intangible assets on book value per share. We calculate tangible book value per share as total shareholders’ equity at the end of the relevant period, less goodwill and other intangible assets, divided by the outstanding number of our common shares at the end of each period. The most directly comparable GAAP financial measure is book value per share. As of (dollars in thousands, except per share information, unaudited) December 31, 2025 Tangible book value per share Book value (GAAP) $ 32.43 Total shareholders' equity 490,959 Less: Intangible assets 4,536 Tangible book value $ 486,423 Common shares outstanding 15,140,192 Tangible book value per share $ 32.13