CLEARWATER PAPER CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

May 8, 2025

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |||

(Name of registrant as specified in its charter) | ||||

(Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

CLEARWATER PAPER CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

May 8, 2025

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

| LETTER FROM OUR CEO |

| |

| Clearwater Paper Corporation 601 West Riverside, Suite 1100 Spokane, WA 99201 | ||

Dear Clearwater Paper stockholders and stakeholders,

2024 was a transformational year for us. We took significant strategic steps to become a premier independent paperboard packaging supplier focused on servicing North American converters.

The first step was the acquisition in May of the Augusta, Georgia, paperboard manufacturing facility from Graphic Packaging. Augusta is a great fit for our network, and we are continuing our efforts to successfully integrate the mill into our operations. We now have a national geographic footprint with our Lewiston, Idaho, mill covering the western part of the U.S., our Cypress Bend, Arkansas, mill covering the central part and our Augusta, Georgia mill covering the East. These mills have an annual capacity of approximately 1.4 million tons of SBS and can produce around 1.4 million tons of pulp per year. Consumer preferences for fiber-based packaging are creating significant growth potential, which will require us to continue to innovate and invest. We are partnering with our converter customers to develop new products and deliver innovative solutions that consumers are looking for – and to do this in the near term.

The second step was the sale of the tissue business in November. Thanks to the efforts of our team, the tissue business delivered excellent financial and operational results over the past couple of years. This outstanding performance enabled a $1.06 billion sale of the business to Sofidel America, and we used proceeds from the sale to significantly de-lever our balance sheet and position Clearwater Paper for future growth.

While we remain optimistic about the long-term prospect of paperboard packaging, the SBS industry was in a down-cycle in 2024, with supply exceeding demand, resulting in operating rates at around 85%. Under normal conditions based on historical results, our industry operating rates would be between 90 and 95%. Since we can’t predict the timing of an industry recovery, we have made tough but necessary decisions to reduce our fixed cost structure in 2025. This involved eliminating 10% of all positions across the company along with other cost reduction actions. We are aiming to reduce our fixed cost structure by approximately 10% in 2025, which is expected to deliver $40 to $50 million in annual run rate savings by the end of the year.

After taking the significant strategic steps to transform our business, and making the difficult decisions to reduce costs, we remain fully committed to our core values and to operating in sustainable ways. I want to point out a few 2024 highlights that demonstrate this commitment:

| • | We had one significant injury in 2024, a 75% reduction from 2023; however, our goal is always zero. |

| • | We reduced identified safety risks by more than 20% through our Aspects and Impacts process. |

| • | We were recognized by the Pulp & Paper Safety Association (PPSA) with The Safety Innovator and Safety Committee awards at the Annual PPSA Conference. |

| • | We received the Leadership in Sustainability award from the American Forest and Paper Association for our work driving transformative change in SBS sustainability, specifically tied to our NuVo® and ReMagine® products. |

| • | We partnered with The Water Council to improve our water stewardship performance and reporting. |

With our strong balance sheet and strategic clarity – and guided by our values – we believe that we are well positioned to weather the current SBS down-cycle and grow and diversify our business and products in partnership with our customers.

Thank you for the trust that you place in all of us at Clearwater Paper.

Sincerely,

Arsen S. Kitch

President and Chief Executive Officer

Clearwater Paper Corporation 2025

i

PROXY STATEMENT TABLE OF CONTENTS

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

1 | |||||

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS |

2024 PERFORMANCE HIGHLIGHTS | 2 | |||

| CORPORATE SOCIAL RESPONSIBILITY (CSR) AND ENVIRONMENTAL HIGHLIGHTS

|

3

| |||||

| 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS |

GOVERNANCE HIGHLIGHTS | 4 | |||

| BOARD OF DIRECTORS | 6 | |||||

| 7 | ||||||

| 7 | ||||||

| Nominees for Election at this Meeting for a Term Expiring in 2026 |

8 | |||||

| 9 | ||||||

| 10 | ||||||

| 11 | ||||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 12 | |||||

| CORPORATE GOVERNANCE | 14 | |||||

| Corporate Governance Guidelines; Code of Business Conduct and Ethics |

14 | |||||

| 14 | ||||||

| 14 | ||||||

| 15 | ||||||

| 16 | ||||||

| 16 | ||||||

| 17 | ||||||

| 19 | ||||||

| 20 | ||||||

| 21 | ||||||

| 21 | ||||||

| COMPENSATION OF DIRECTORS | 22 | |||||

| 22 | ||||||

| Director Stock Ownership Guidelines and Limitations on Securities Trading |

23 | |||||

| 3 | CORPORATE RESPONSIBILITY |

CORPORATE RESPONSIBILITY | 25 | |||

| 25 | ||||||

| 25 | ||||||

| 26 | ||||||

| 27 | ||||||

| 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES |

COMPENSATION COMMITTEE REPORT | 28 | |||

| EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS | 29 | |||||

| 30 | ||||||

| 30 | ||||||

| 31 | ||||||

| 32 | ||||||

| 35 | ||||||

| 38 | ||||||

| 39 | ||||||

Clearwater Paper Corporation 2025

ii

Clearwater Paper Corporation 2025

iii

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

Date: Thursday, May 8, 2025

Time: 9:00 a.m. Pacific

Place: Hyatt Regency Seattle

Via webcast: https://register.proxypush.com/CLW

Record Date: March 12, 2025

|

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Annual Meeting of Stockholders or Annual Meeting, we urge you to vote and submit your proxy in order to ensure the presence of a quorum. Each attendee must present the proper form of documentation (as described in the section “Annual Meeting Information”) to be admitted. | |||||||||||||||

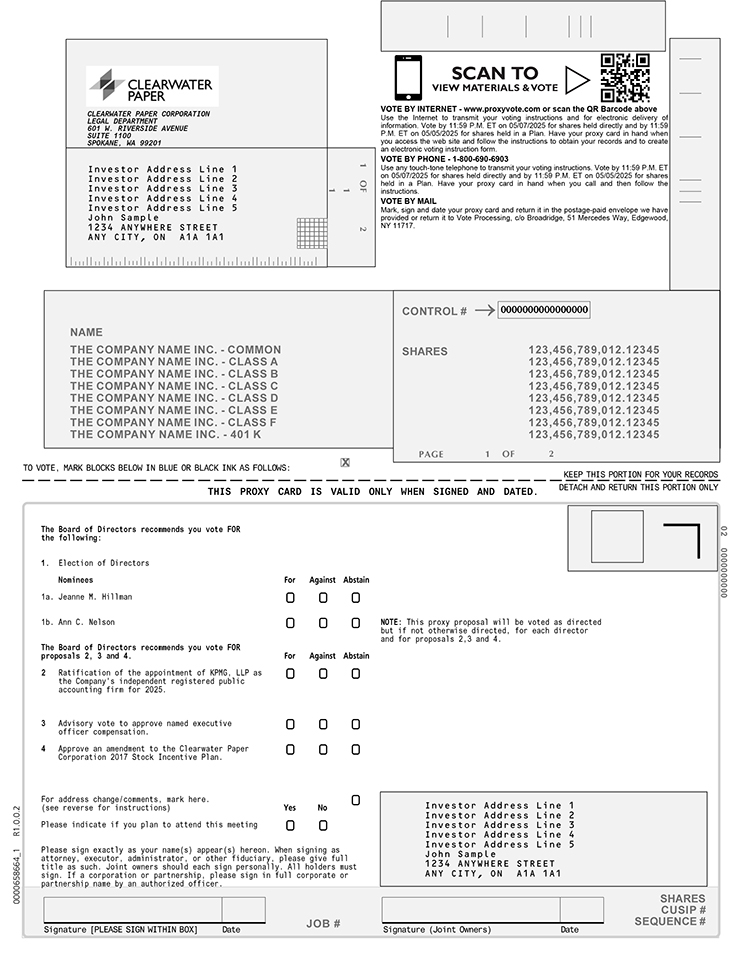

|

You may vote your shares in one of four ways:

|

||||||||||||||||

|

Return the proxy card by mail in the postage paid envelope |

INTERNET

go to www.proxyvote.com |

TELEPHONE

call the toll free number

1-800-690-6903 |

IN PERSON

Attend the Annual Meeting with your ID. | |||||||||||||

MEETING AGENDA / PROPOSALS

We are holding this meeting to:

| • | elect two directors to the Clearwater Paper Corporation Board of Directors; |

| • | ratify the appointment of our independent registered public accounting firm for 2025; |

| • | hold an advisory vote to approve the compensation of our named executive officers; |

| • | approve an amendment to the Clearwater Paper Corporation 2017 Stock Incentive Plan; and |

| • | transact any other business that properly comes before the meeting. |

Financial and other information concerning Clearwater Paper is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 2024. This proxy statement and our 2024 Annual Report to Stockholders are available on our website at www.clearwaterpaper.com by selecting “Investors,” “Financial Info” and then “Annual Reports.” Additionally, and in accordance with SEC rules, you may access our proxy materials at www.proxyvote.com which does not have “cookies” that identify visitors to the site.

| NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS | By Order of the Board of Directors, | |

|

On or about March 28, 2025, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to most of our stockholders containing instructions on how to access our 2025 Proxy Statement and 2024 Annual Report to Stockholders. Some of our stockholders, including stockholders that hold shares in one of our Clearwater Paper 401(k) Savings Plans, were not mailed the Notice and instead were mailed paper copies of our 2025 Proxy Statement and 2024 Annual Report on or about March 28, 2025. |

MARC D. ROME | |

| Corporate Secretary | ||

Clearwater Paper Corporation 2025

1

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

1. KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS

2024 PERFORMANCE HIGHLIGHTS

|

|

STRATEGIC

• Transformed our business into a focused and premier supplier of paperboard to North America converters.

AUGUSTA PAPERBOARD MILL

• $708 million purchase effective May 1, 2024.

• Increased SBS capacity to 1.4 million tons and was a critical factor in growing net sales of continuing operations by 22% year-over-year.

SALE OF CONSUMER PRODUCTS DIVISION

• $1.06 billion sale effective November 1, 2024, which generated $850 million in net proceeds.

|

|

CAPITAL STRUCTURE

• Continued to maintain strong financial flexibility.

• Reduced net debt by $199 million* and eliminated all but $275 million of 2028 notes with 4.75% interest rate.

• Repurchased $10 million of stock and launched new repurchase program with a $100 million repurchase authorization.

|

*In addition to disclosing financial results from continuing and discontinued operations calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), we disclose Adjusted EBITDA from total operations which includes both continuing and discontinued operations and our net debt reduction for 2024. The company discloses these measures because management believes these assist investors and analysts in comparing the company’s performance across reporting periods on a consistent basis by excluding items that the company does not believe are indicative of its core operating performance. In addition, the company uses Adjusted EBITDA from total operations: (i) as a factor in evaluating management’s performance when determining incentive compensation, (ii) to evaluate the effectiveness of the company’s business strategies, and (iii) because the company’s credit agreement and the indentures governing the company’s outstanding notes use metrics similar to Adjusted EBITDA from total operations to measure the company’s compliance with certain covenants. The company believes that Adjusted EBITDA from total operations, which excludes other operating credits and charges, net, interest expense, net, income tax (benefit) expense and depreciation and amortization, gain on sale of discontinued operations, and other non-operating items is a useful measure for evaluating our ability to generate earnings and that providing this measure will allow investors to more readily compare the earnings referred to in the Proxy Statement to the company’s earnings for past and future periods. It should be noted that other companies may present similarly-titled measures differently and, therefore, as presented by the company may not be comparable to similarly-titled measures reported by other companies. In addition, Adjusted EBITDA from total operations has material limitations as a performance measures because it excludes items that are actually incurred or experienced in connection with the operations of the company’s business. A reconciliation of Adjusted EBITDA and net debt reduction may be found under Appendix A to this Proxy Statement.

Clearwater Paper Corporation 2025

2

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

CORPORATE SOCIAL RESPONSIBILITY (CSR) AND ENVIRONMENTAL HIGHLIGHTS

Clearwater Paper is a values driven organization, and seeks to maximize our positive impact using our “Everyday Responsibility” sustainability framework, which integrates our three key sustainability priorities, namely resource stewardship, trusted products, and thriving people & communities.

Using this framework, our Board and management carefully consider the impact our decisions have beyond our bottom line. We believe that our commitment to the environment, the communities in which we do business, and the health, safety and equal opportunity for all of our employees is the foundation of our long-term success.

We continued to disclose our climate actions through the CDP (formerly the Carbon Disclosure Project), and work to invest in energy and resource efficiency projects such as our work with the Water Council to improve our water stewardship performance and reporting.

In 2024, the American Forest and Paper Association (AFPA) recognized Clearwater with a 2024 Leadership in Sustainability Award for our “Future is Fiber” initiative and our commitment to integrating post-consumer recycled materials into our Candesce®, NuVo® and ReMagine® product lines.

We also continued to make strides in reducing safety risks, including more than a 20% reduction in identified safety risks and a 75% reduction in significant injuries in 2024 as compared to 2023.

We are proud to highlight our sustainability commitments in the Corporate Responsibility section of this proxy and in our 2024 Sustainability Report, which can be found on our website at www.clearwaterpaper.com under “Sustainability.” The Sustainability Report includes our goals to reduce greenhouse gas emissions.

Clearwater Paper Corporation 2025

3

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

2. CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

GOVERNANCE HIGHLIGHTS

Commitment to Strong Governance Standards: We follow and abide by the following best practices:

Independence, Board Composition and Refreshment

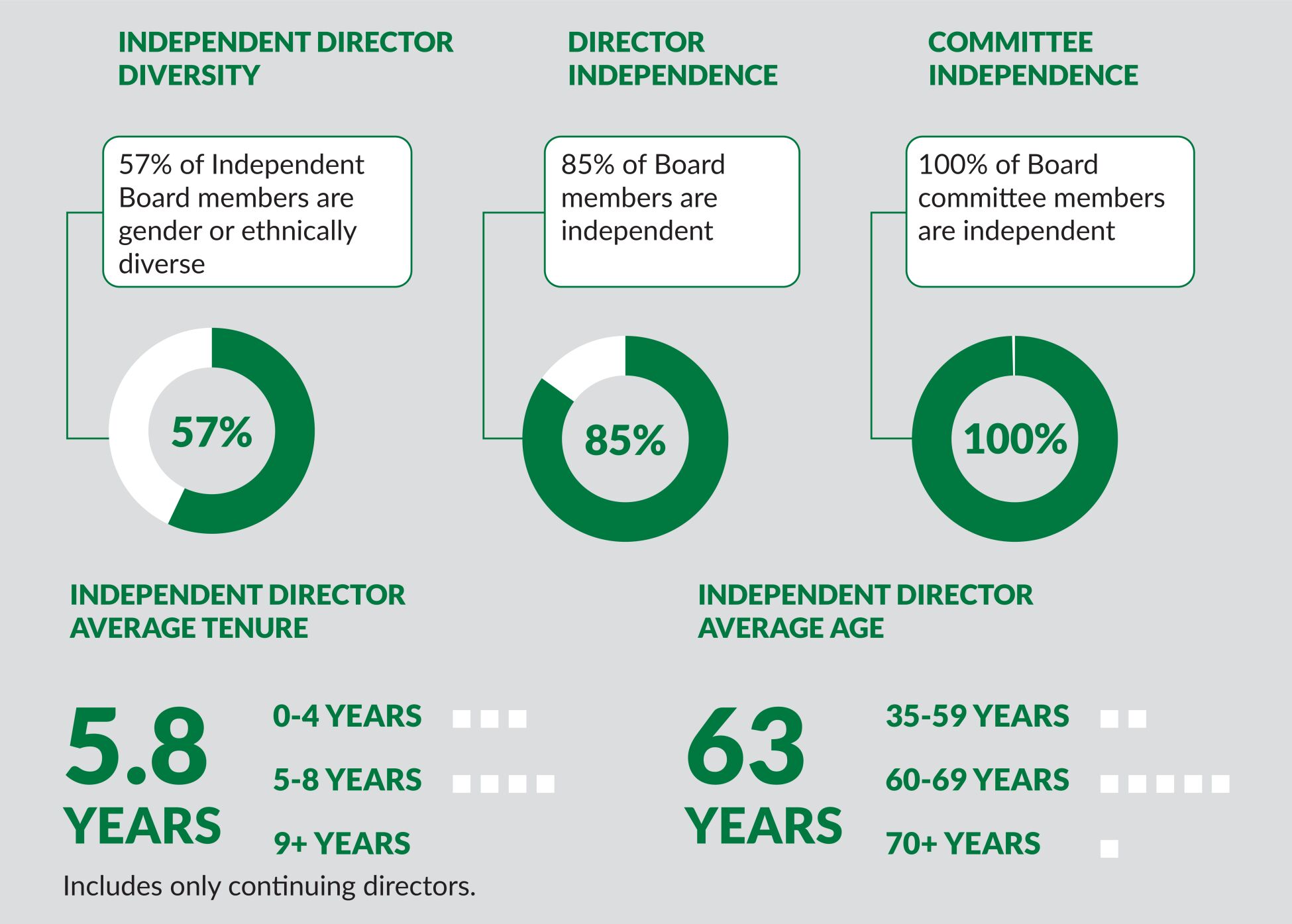

| • | As of the Annual Meeting the Board will have 8 members, 7 of whom are independent and 4 of whom reflect diversity in gender, ethnicity, or race. |

| • | Since 2019, 5 new Board members have been added to the Board. |

| • | Kevin Hunt will retire this year in line with our age limit guidelines for directors. |

| • | There are 3 standing committees, each made up entirely of independent directors. |

| • | The independent directors meet regularly without management present. |

Board Practices

| • | The Board and its committees each perform a self-evaluation on an annual basis. |

| • | The Board imposes age limits on independent directors. |

Clearwater Paper Corporation 2025

4

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

| • | Each standing committee operates under a committee charter. |

| • | The Board oversees risk management practices. The Board and the Audit Committee are responsible for data privacy oversight. |

| • | The Board oversees our sustainability practices: the Nominating and Governance Committee, or Nominating Committee, assists the Board with respect to the overall oversight and implementation of our sustainability practices, including environmental initiatives; the Compensation Committee oversees human capital management, and the Audit Committee assists with the oversight of the public reporting of sustainability data. |

| • | The Board regularly receives information concerning, and provides input on, succession planning. |

| • | The Board and its committees met 36 times in 2024. |

| • | The Compensation Committee annually reviews the performance of our Chief Executive Officer, with the participation of all of our independent directors. |

| • | The Nominating Committee performs an annual performance evaluation of the Chair of the Board. |

| • | We have adopted a Code of Business Conduct and Ethics, which outlines our insider trading, anti-corruption and anti-bribery policies, and a Code of Ethics for Senior Officers, which outlines additional responsibilities for those individuals. We also have adopted Corporate Governance Guidelines, and a Human Rights Policy, each of which is available on our website at www.clearwaterpaper.com under “Investors” then “Governance.” |

| • | We do not have a “poison pill” in place. |

| • | We adopted a clawback policy in compliance with the Dodd-Frank Act. |

Leadership Structure

| • | The Chair of the Board and the CEO are separate. |

Voting and Nominating

| • | There is a majority voting requirement in uncontested director elections. |

| • | Each share of Clearwater Paper is entitled to only one vote. |

| • | At the 2024 annual meeting of stockholders, the stockholders approved the restated certificate of incorporation to declassify the Board. In accordance with those changes, our Board’s class terms will be eliminated over a three-year period commencing with this 2025 Annual Meeting and we will provide for an annual election of all directors commencing with the 2027 annual meeting of stockholders. |

Clearwater Paper Corporation 2025

5

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

BOARD OF DIRECTORS

|

|

Arsen S. Kitch, 43 President and Chief Executive Officer | |

| Tenure: 4.9 years | Other Public Boards: 0

|

|

|

Alexander Toeldte, 65 Independent Chair of the Board CEO and Director of Boise, Inc (retired)

| |

| Tenure: 9 years | Other Public Boards: 0

|

| 5 | new independent directors added over the past six years. |

|

|

Jeanne M. Hillman, 65 Independent Vice President of Enterprise Technology and Governance of Weyerhaeuser Company (retired) | |

| Tenure: 2.4 years | Other Public Boards: 0

| ||

|

|

Ann C. Nelson, 65 Independent Lead Audit Partner of KPMG (retired) | |

| Tenure: 4.8 years | Other Public Boards: 1

| ||

|

|

John J. Corkrean, 59 Independent Audit Chair EVP and CFO of H.B. Fuller Company | |

| Tenure: 5.9 years | Other Public Boards: 0

| ||

|

|

Christine M. Vickers Tucker, 57 Independent Vice President and General Manager of The Clorox Professional Products Company (retired) | |

| Tenure: 3.8 years | Other Public Boards: 0

| ||

|

|

Joe W. Laymon, 72 Independent Vice President, Human Resources and Corporate Services of Chevron Corporation (retired) | |

| Tenure: 5.9 years | Other Public Boards: 1

| ||

|

|

John P. O’Donnell, 64 Independent Nomination & Governance Chair CEO, president and a director of Neenah, Inc. (retired) | |

| Tenure: 9 years | Other Public Boards: 0

|

|

|

Kevin J. Hunt, 73 Independent Compensation Chair Former CEO, president and a director of Ralcorp Holdings, Inc. (retired) | |

| Tenure: 12.2 years | Other Public Boards: 1 Mr. Hunt will retire prior to the 2025 Annual Meeting.

|

| COMMITTEE PARTICIPATION: |

Chair | Member |

Audit – Audit committee Compensation – Compensation committee Nom. & Gov. – Nominating and Governance committee

Clearwater Paper Corporation 2025

6

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

BOARD SKILLS SUMMARY

| Our Board of Directors possesses diverse experience and perspectives in various areas critical to our business. The Board’s collective knowledge ensures appropriate management and risk oversight and supports our goal of creating long-term sustainable stockholder value. |

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||

| Senior Executive/Strategic Leadership: Senior leadership experience in complex public and private organizations as an officer or board member | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||

| Sustainable Manufacturing/Supply Chain: Experience and responsibility for managing or overseeing sustainable manufacturing operations and/or supply chain logistics of a company | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||

| Strategy/M&A: Strategic planning, merger and acquisition and/or divestiture experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||

| Paper/Tissue Industry: Experience with the pulp, tissue and paperboard industry or consumer products | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||

| Human Capital Management & Executive Compensation: Experience in human resources, diversity and inclusion, leadership development, talent management, executive compensation issues, and/or health and safety | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||

| Audit/Accounting/Finances: Experience preparing, auditing, analyzing, or evaluating financings and financial statements for a complex business. | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||

| Other Board Experience: Corporate governance experience gained as a director of a publicly listed company or other complex organization | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||

| Cybersecurity: Experience with cybersecurity risk management | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Sustainability: Experience with implementation of sustainability practices | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||

| Risk Management: Experience with financial and/or operational risk management. | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||

DIRECTOR NOMINEES

This table provides a summary of information regarding our two director nominees.

| Current Committee Memberships | ||||||||||||||||

| Name |

Age | Director Since |

Current Principal Occupation |

Independent | Audit | Compensation | Nominating and Corporate Governance |

Other Public Boards | ||||||||

| Jeanne M. Hillman |

65 | 2022 | Retired VP | Yes | * | * | 0 | |||||||||

| Ann C. Nelson |

65 | 2020 | Retired Partner | Yes | * | * | 1 | |||||||||

Our Board of Directors currently is divided into three classes serving staggered three-year terms. The average tenure of our continuing independent directors is 5.8 years. At the Annual Meeting, our stockholders will be asked to elect two individuals to serve as directors until the 2026 annual meeting of stockholders. See “Proposal No. 1—Election of Directors.” Our Bylaws

Clearwater Paper Corporation 2025

7

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

require our directors to be elected by a majority vote of the shares of common stock present or represented by proxy and entitled to vote at the Annual Meeting. At the 2024 annual meeting of stockholders, the stockholders approved the amended and restated certificate of incorporation to declassify the Board. In accordance with those changes, our Board’s class terms will be eliminated over a three-year period commencing with this 2025 Annual Meeting and we will hold annual elections of all directors commencing with the 2027 annual meeting of stockholders. The directors elected this year will be elected on an annual basis going forward.

Below are the names and ages of our nine directors as of the date of this proxy statement, the year each became a director, each director’s principal occupation or employment for at least the past five years, and other public company directorships held by each director during the past five years. Unless authority is withheld, the persons named as proxies in the voting materials made available to you or in the accompanying proxy will vote for the election of the nominees listed below. We have no reason to believe that any of these nominees will be unable to serve as a director. If any of the nominees becomes unavailable to serve, the persons named as proxies will have discretionary authority to vote for a substitute nominee.

NOMINEES FOR ELECTION AT THIS MEETING FOR A TERM EXPIRING IN 2026

Jeanne M. Hillman

Biography: Ms. Hillman (age 65) has been a director since October 2022. Ms. Hillman served as the vice president, enterprise technology and governance, at Weyerhaeuser (NYSE:WY), a timber, wood products and real estate company from May 2019 until her retirement in March 2020. Prior to that, Ms. Hillman served as Weyerhaeuser’s vice president, chief accounting officer from August 2013 to May 2019 and April 2006 to October 2010. From October 2010 to August 2013, she served as Weyerhaeuser’s vice president, finance operations for a wood products business improvement initiative. She has also served in senior financial roles which included accountability for strategic planning, capital investment, and multiple acquisitions and divestitures from 2002 through 2016. Ms. Hillman has held various financial and information technology roles since May 1984.

Qualifications: Our Nominating Committee believes Ms. Hillman’s experience in the wood products industry, financial expertise, governance, information technology, M&A, business operations, strategic planning and executive management experience make her an asset to our Board.

Ann C. Nelson

Biography: Ms. Nelson (age 65) has been a director since May 2020. Ms. Nelson served as a lead audit partner of KPMG, LLP, an audit services firm, from May 1994 until her retirement in September 2019. Prior to that, starting in August 1982, she served in various positions with KPMG including lead client partner on a variety of accounts in the forest products and paper industries.

Current Public Directorships: Ms. Nelson has served as a director and chair of the audit committee of Rayonier, Inc. (NYSE: RYN), a timber REIT, since 2020 and is a member of the compensation and management development committee.

Qualifications: Our Nominating Committee believes Ms. Nelson’s leadership capabilities, knowledge of the paper industry as well as experience with cybersecurity, and human capital management, expertise in accounting and financial reporting, and experience as a chair of the audit committee of another public company make her an asset to our Board.

Clearwater Paper Corporation 2025

8

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

DIRECTORS CONTINUING IN OFFICE UNTIL 2026

Joe W. Laymon

Biography: Mr. Laymon (age 72) has been a director since May 2019. Mr. Laymon served as vice president, human resources and corporate services at Chevron Corporation (NYSE:CVX), a leading global integrated energy company from 2008 until his retirement in 2017.

Current Public Directorships: Mr. Laymon has served on the board of directors for Peabody Energy (NYSE:BTU), a global coal company, since 2017 and serves as the chair of the compensation committee as well as a member of the health, safety, security & environmental committee.

Qualifications: Our Nominating Committee believes Mr. Laymon’s leadership and executive compensation, diversity and inclusion, sustainability, cybersecurity, and human capital management experience and experience as a chair of the compensation committee of another public company make him an asset to our Board.

John P. O’Donnell

Biography: Mr. O’Donnell (age 64) has been a director since April 2016, including chair of our Nominating Committee since May 2020. Mr. O’Donnell served as president and CEO of Neenah, Inc. (NYSE: NP), a global specialty materials company, from May 2011 and as a director from November 2010 until his retirement in July 2020. He served as Neenah Inc.’s COO from June 2010 to May 2011 and as president, fine paper from 2007 to June 2010. Mr. O’Donnell was employed by Georgia-Pacific Corporation from 1985 until 2007 and held increasingly senior management positions in the consumer products division where he served as president of the north american retail business from 2004 through 2007, and as president of the north american commercial tissue business from 2002 through 2004.

Qualifications: Our Nominating Committee believes Mr. O’Donnell’s leadership, strategic planning, human capital management, M&A, supply chain and consumer product paper industry experience make him an asset to our Board.

Christine M. Vickers Tucker

Biography: Ms. Vickers Tucker (age 57) has been a director since May 2021. Ms. Vickers Tucker served as the vice president and general manager, The Clorox Professional Products Company, a business unit of The Clorox Company, (NYSE:CLX), a leading manufacturer and marketer of consumer and professional products, from April 2020 until her retirement in October 2021. Prior to that she was the vice president and general manager of The Clorox Professional Products Company & Retail Laundry Division from September 2018 to April 2020, and vice president and general manager, The Clorox Professional Products Company from October 2014 through August 2018, and vice president and general manager of The Clorox Company of Canada from October 2012 through October 2014. Previously she held various managerial, sales and marketing positions within The Clorox Company beginning with Associate Marketing Manager at Hidden Valley, Clorox Bleach, Pine-Sol Brands starting in August 1995.

Qualifications: Our Nominating Committee believes Ms. Vickers Tucker’s knowledge of and experience with human capital management, professional and consumer products, strategic planning, business-to-business sales and marketing and manufacturing operations make her an asset to our Board.

Clearwater Paper Corporation 2025

9

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

DIRECTORS CONTINUING IN OFFICE UNTIL 2027

John J. Corkrean

Biography: Mr. Corkrean (age 59) has been a director since May 2019, serving as chair of our Audit Committee since September 2019. Mr. Corkrean currently serves as executive vice president and chief financial officer for H.B. Fuller Company (NYSE:FUL), a global adhesive, sealants and chemical products manufacturer, a position he has held since 2016. Prior to that he was employed by Ecolab for 17 years in a series of financial leadership roles including from 2014 through 2016 as senior vice president, finance for the global energy service division.

Qualifications: Our Nominating Committee believes Mr. Corkrean’s financial, cybersecurity, executive compensation, public company expertise and leadership background make him an asset to our Board.

Arsen S. Kitch

Biography: Mr. Kitch (age 43) has been a director since April 1, 2020. He has served as the company’s president and CEO since April 1, 2020. He served as the company’s senior vice president, general manager, consumer products division from May 2018 to April 2020 and served as vice president, general manager, consumer products division from January 2018 to May 2018. He served as the company’s vice president, finance and vice president financial planning and analysis from January 2015 through December 2017, and served as senior director, strategy and planning from August 2013 through December 2014.

Qualifications: Our Nominating Committee believes, as the CEO, Mr. Kitch’s knowledge of our day-to-day operations and the effectiveness of our business strategies provides a valuable perspective to the Board. Additionally, Mr. Kitch’s experience, knowledge, skills and expertise acquired having served as CEO, Senior Vice President of a major division, and Vice President in the financial and strategical planning aspects of the company, M&A, human capital management, and sustainability experience make him an asset to our Board.

Alexander Toeldte

Biography: Mr. Toeldte (age 65) has been a director since April 2016, serving as Chair of the Board since September 2018 including as Independent Executive Chair from March 2020 to May 2022. Mr. Toeldte served as the chairman of Jitasa, Inc., a privately held provider of accounting and financial management services for not-for-profit organizations from 2014 to 2022. He served as a director of Xerium Technologies, Inc. (NYSE:XRM), a global provider of industrial products and services from 2016 until the company’s sale in 2018 and was a member of its compensation and governance committees. He served as an operating director at Paine & Partners, LLC, a private equity firm until 2016. Mr. Toeldte served as president, CEO and a director of Boise Inc., a paper manufacturer, from February 2008 to 2013 and at Boise Cascade as its executive vice president, paper and packaging from October 2005 to 2008. Mr. Toeldte’s previous experience includes serving as executive vice president of Fonterra Co-operative Group, a New Zealand based global dairy company, and CEO of Fonterra Enterprises. Previously, Mr. Toeldte served in various capacities with Fletcher Challenge Limited Group, a New Zealand based natural resources conglomerate, including as Group CFO as well as CEO of publicly traded Fletcher Challenge Building and Fletcher Challenge Paper. He also served as chair of the board of publicly traded Fletcher Challenge Canada. Mr. Toeldte was a member of the board of the American Forest & Paper Association, which he chaired in 2012, from 2008 to 2013 and from 2020 to 2022. Before his executive career Mr. Toeldte was a partner at McKinsey in Canada and Sweden.

Qualifications: Our Nominating Committee believes Mr. Toeldte’s global experience in the consumer products and paper industries, along with experience in other related industries, executive compensation, financial expertise, M&A, and leadership and board experience make him an asset to our Board.

Clearwater Paper Corporation 2025

10

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

DIRECTOR RETIRING IN 2025

Kevin J. Hunt

Biography: Mr. Hunt (age 72) has been a director since January 2013, including as Chair of the Compensation Committee since May 2016. From January 2013 to January 2014, he served as a consultant to ConAgra Foods, Inc., which acquired Ralcorp Holdings Inc. in January 2013. Mr. Hunt served as president, CEO and as a director of Ralcorp Holdings Inc., a producer of private-brand foods and food service products from January 2012 to January 2013. He served as co-CEO and president of Ralcorp from 2003 until 2012 and as a director from 2004 until the company’s acquisition in 2013. Prior to that period, Mr. Hunt was corporate vice president and president of Bremner Food Group.

Current Public Directorships: Mr. Hunt has served as a director of Energizer Holdings, Inc. (NYSE: ENR), a manufacturer of primary batteries, automotive care and portable lighting products since its spin-off from Edgewell Personal Care Company (NYSE: EPC) in July 2015. He is a member of Energizer’s human capital committee and serves as chairman of its finance and oversight committee.

Qualifications: Our Nominating Committee believes Mr. Hunt’s experience with private label consumer product companies, human capital management, M&A, business operations, financial expertise, strategic planning and both executive management and board experience make him an asset to our Board.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF THE TWO NOMINEES FOR DIRECTOR.

Clearwater Paper Corporation 2025

11

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

This table shows the number of shares of common stock beneficially owned, by each owner of more than 5% of our common stock, each of our directors, each executive officer for whom compensation is reported in this proxy statement, and all directors and executive officers as a group. Except for our 5% holders, the table shows beneficial ownership as of February 28, 2025. The number of shares reported is based on data provided to us by the beneficial owners of the shares. The percentage ownership data is based on 16,239,929 shares of common stock issued and outstanding as of February 28, 2025. Under SEC rules, beneficial ownership includes shares over which the person or entity exercises voting or investment power and any shares that the person or entity has the right to acquire within 60 days of February 28, 2025. Except as noted, and subject to applicable community property laws, each owner has sole voting and investment power over the shares shown in this table.

|

Amount and Nature of Common

|

||||||||||||||

|

Number of |

Percent of Class |

Common Stock Units (1) |

||||||||||||

| Stockholders Owning More Than 5% |

||||||||||||||

| BlackRock, Inc. 50 Hudson Yards New York, NY 10001 |

1,668,972 | (2) | 10.28 | % | ||||||||||

| Dimensional Fund Advisors LP 6300 Bee Cave Road, Building One Austin, TX 78746 |

1,407,064 | (3) | 8.66 | % | ||||||||||

| The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 |

1,201,708 | (4) | 7.40 | % | ||||||||||

| Directors and Named Executive Officers |

||||||||||||||

| John J. Corkrean |

- | * | 19,896 | |||||||||||

| Jeanne M. Hillman |

* | 10,995 | ||||||||||||

| Kevin J. Hunt |

- | * | 33,203 | |||||||||||

| Arsen S. Kitch |

275,910 | (5) | 1.69 | % | - | |||||||||

| Joe W. Laymon |

- | * | 19,896 | |||||||||||

| Ann C. Nelson |

3,000 | * | 14,671 | |||||||||||

| John P. O’Donnell |

- | * | 27,652 | |||||||||||

| Alexander Toeldte |

- | * | 30,934 | |||||||||||

| Christine M. Vickers Tucker |

- | * | 10,617 | |||||||||||

| Sherri J. Baker |

2,101 | (6) | * | |||||||||||

| Steve M. Bowden |

67,489 | (7) | * | |||||||||||

| Michael S. Gadd |

111,701 | (8) | * | |||||||||||

| Michael J. Urlick |

25,418 | (9) | * | |||||||||||

| Directors and Executive Officers as a Group |

||||||||||||||

| (15 persons) |

581,447 | (10) | 3.55 | % | 167,864 | |||||||||

| * | Less than 1% |

| (1) | Represents vested common stock units as of February 28, 2025 and common stock units for directors that will vest within 60 days of February 28, 2025. |

Clearwater Paper Corporation 2025

12

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

| (2) | Based on the stockholders’ Schedule 13G/A filed on December 6, 2024, with the SEC, the stockholder serves as a parent holding company registered under the Investment Advisors Act, with sole dispositive power over all of these shares and sole voting power over 1,639,710 of these shares of common stock as of November 30, 2024. The Schedule indicates that sole dispositive power over all these shares is held as of November 30, 2024, by the following subsidiaries of Blackrock, Inc.: BlackRock Advisors, LLC; Aperio Group, LLC; BlackRock Fund Advisors; BlackRock Institutional Trust Company, National Association; BlackRock Asset Management Ireland Limited; BlackRock Financial Management, Inc.; BlackRock Asset Management Schweiz AG; BlackRock Investment Management, LLC; BlackRock Investment Management (UK) Limited; SpiderRock Advisors, LLC; BlackRock Asset Management Canada Limited; BlackRock Investment Management (Australia) Limited; and Blackrock Fund Managers Ltd. BlackRock Fund Advisors beneficially owns 5% or more of the total shares owned by BlackRock, Inc. |

| (3) | Based on the stockholder’s Schedule 13G/A filed on February 9, 2024 with the SEC, the stockholder serves as an investment advisor registered under the Investment Advisors Act, with sole dispositive power over all of these shares, and sole voting power over 1,387,893 of these shares as of December 29, 2023 (subject to the provisions of Note 1 of such 13G/A), however, Dimensional Fund Advisors LP disclaims beneficial owner of such securities. |

| (4) | Based on the stockholders’ Schedule 13G/A filed on February 13, 2024 with the SEC, the stockholder serves as an investment advisor registered under the Investment Advisors Act, with sole dispositive power over 1,156,659 of these shares, shared dispositive power over 45,049 of these shares, and shared voting power over 29,994 of these shares as of December 29, 2023. |

| (5) | Mr. Kitch’s shares include (i) 16,605 shares of common stock exercisable under vested stock options and (ii) 31,781 restricted stock units that will vest within 60 days of February 28, 2025. |

| (6) | Ms. Baker’s shares include 2,101 restricted stock units that will vest within 60 days of February 28, 2025. |

| (7) | Mr. Bowden’s shares include 5,357 restricted stock units that will vest within 60 days of February 28, 2025. |

| (8) | Mr. Gadd’s shares include (i) 28 shares of common stock held in Mr. Gadd’s individual account under our 401(k) employee savings plan, (ii) 28,728 shares of common stock exercisable under vested stock options, and (iii) 6,088 restricted stock units that will vest within 60 days of February 28, 2025. |

| (9) | Mr. Urlick’s shares include (i) 3,513 shares of common stock exercisable under vested stock options and (ii) 4,678 restricted stock units that will vest within 60 days of February 28, 2025. |

| (10) | The group’s shares include 126,637 restricted stock units that will vest within 60 days of February 28, 2025. |

Clearwater Paper Corporation 2025

13

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE GUIDELINES; CODE OF BUSINESS CONDUCT AND ETHICS

We have established a corporate governance program to help guide our company and our employees, officers and directors in carrying out their responsibilities and duties as well as to set standards for their professional conduct. Our Board has adopted Corporate Governance Guidelines, or Governance Guidelines, which provide standards and practices of corporate governance that we have designed to help contribute to our success and to assure public confidence in our company. Our Governance Guidelines may be found on our website at www.clearwaterpaper.com under “Investors,” then “Governance.” In addition, all standing committees of the Board operate under charters that describe the responsibilities and practices of that committee.

We have adopted a Code of Business Conduct and Ethics, or Ethics Code, which provides ethical standards and corporate policies that apply to all our directors, officers and employees. Our Ethics Code requires, among other things, that our directors, officers and employees act with integrity and the highest ethical standards, comply with laws and other legal requirements, engage in fair competition, avoid conflicts of interest, and otherwise act in our best interests. We have also adopted a Code of Ethics for Senior Officers that applies to senior management and provides for accurate, full, fair and timely financial reporting and the reporting of information related to significant deficiencies in internal controls, fraud and legal compliance.

We have established procedures for confidentially and anonymously reporting concerns and potential violations regarding accounting, internal controls and auditing matters, as well as concerns regarding, or potential violations of, our ethics codes and other matters.

DIRECTOR INDEPENDENCE

The role of our Board is to oversee and provide policy guidance on our business and affairs. The Board believes that it will best serve our stockholders if the majority of its members are independent. As of March 28, 2025, our Board had nine members, eight of whom are outside (non-employee) directors. As of May 8, 2025, our Board will have eight members, seven of whom are outside directors. The Chair of our Board, Alexander Toeldte, is an outside director. With the exception of Arsen S. Kitch, our President and Chief Executive Officer, the Board has determined that none of our directors or their immediate family members have a material relationship with the company (either directly or as a partner, stockholder or officer of an organization that has a relationship with us), and none of our directors or their immediate family members are employees of our independent registered public accounting firm, KPMG LLP. All our outside directors are independent within the meaning of the New York Stock Exchange, or NYSE, listing standards and our Director Independence Policy.

Our Board meets regularly in executive session, during their scheduled meetings, without members of management present and as the Board or its individual members deem necessary. Mr. Toeldte, as the Chair, presides over these sessions. Each standing committee of the Board, during their scheduled meetings, also regularly meets in executive session and as the committee or its individual members deem necessary. Our directors are also invited to attend the meetings of committees of which they are not members and regularly do so.

BOARD AND COMMITTEE MEETINGS

Our Board and its committees met a total of 36 times in 2024. All directors serving in 2024 attended all Board meetings and all Board committee meetings for which they were a committee member during 2024. The Board does not have a policy requiring director attendance at annual meetings of our stockholders. However, all our directors attended our 2024 annual meeting of stockholders and we anticipate that all will attend our 2025 Annual Meeting.

Clearwater Paper Corporation 2025

14

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

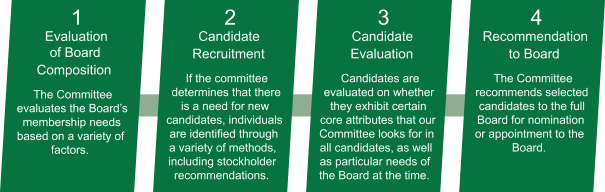

NOMINEES FOR DIRECTOR

Our Nominating Committee is responsible for identifying, evaluating, recruiting and recommending qualified candidates to our Board for nomination or election. The Board nominates directors for election at each Annual Meeting of Stockholders and elects new directors to fill vacancies if they occur.

Our Board strives to find directors who are experienced and dedicated individuals with diverse backgrounds, perspectives and skills. Our Governance Guidelines contain membership criteria that call for candidates to be selected for their character, judgment, diversity of experience, business acumen and ability to act on behalf of and in the best interest of all stockholders. While we do not have a formal policy or requirement with respect to director diversity, we value members who represent diverse backgrounds and viewpoints and strive towards a board composition that encompasses such diversity. Each of the last three independent directors to join our board have been female. The Nominating Committee will continue to review all measurable objectives for achieving diversity on the Board and recommend them to the Board for consideration. In addition, we expect each director to be committed to enhancing stockholder value and to have sufficient time to effectively carry out his or her duties as a director. Our Nominating Committee seeks to ensure that a majority of our directors are independent under NYSE rules as well as our policies, and that one or more of our directors is an “Audit Committee Financial Expert” under SEC rules.

Prior to our Annual Meeting of Stockholders, our Nominating Committee identifies director nominees by first evaluating the current directors whose terms will expire at the Annual Meeting and who are willing to continue in service. These candidates are evaluated based on the criteria described above, the candidate’s prior service as a director, and the needs of the Board for any particular talents and experience. If a director no longer wishes to continue in service, if the Nominating Committee decides not to re-nominate a director, or if a vacancy is created on the Board because of a resignation or an increase in the size of the Board or other event, then the committee considers whether to replace such director or to decrease the size of the Board. If the decision is to replace a director, then the Nominating Committee considers various candidates for Board membership, including those suggested by committee members, by other Board members, a director search firm engaged by the committee, or our stockholders. Prospective nominees are evaluated by the Nominating Committee based on the membership criteria described above and set forth in our Governance Guidelines.

A stockholder who wishes to recommend a prospective nominee to the Board for consideration by the Nominating Committee must notify our Corporate Secretary in writing at our principal executive office located at 601 West Riverside Avenue, Suite 1100, Spokane, WA 99201. Each notice must include the information about the prospective nominee as would be required under our Amended and Restated Bylaws, or Bylaws. Such notice must be delivered to our offices by the deadline relating to stockholder proposals to be considered for inclusion in our proxy materials, as described under “General Information—Stockholder Proposals for 2026” in this proxy statement.

Each notice delivered by a stockholder who wishes to recommend a prospective nominee to the Board for consideration by the Nominating Committee generally must include the following information about the prospective nominee:

| • | the name, age, business address and residence address of the person; |

| • | the principal occupation of the person; |

| • | the number of shares of Clearwater Paper common stock owned by the person; |

| • | a statement whether the person, if elected, intends to tender an irrevocable resignation effective upon (i) such person’s failure to receive the required vote for re-election and (ii) acceptance of such resignation by the Board; |

| • | a description of all compensation and other relationships during the past three years between the stockholder and the person; |

| • | any other information relating to the person required to be disclosed pursuant to Section 14 of the Securities Exchange Act; and |

Clearwater Paper Corporation 2025

15

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

| • | the person’s written consent to serve as a director if elected. |

The Nominating Committee may require any prospective nominee recommended by a stockholder to furnish such other information as the Nominating Committee may reasonably require to determine the eligibility of such person to serve as an independent director or that could be material to a stockholder’s understanding of the independence, or lack thereof, of such person.

The foregoing is only a summary of the detailed requirements set forth in our Bylaws regarding director nominations by stockholders that would apply when a stockholder wishes to recommend a prospective nominee to the Board for consideration by the Nominating Committee. A more detailed description of the information that must be provided as to a prospective nominee is set forth in Article 3 of our Bylaws, which are available on our website at www.clearwaterpaper.com by selecting “Investors” and then “Governance.”

BOARD SUCCESSION PLANNING AND RECRUITMENT

Identifying and recommending qualified individuals for appointment or election to our Board with an evaluation based on the requirements in our Bylaws and Corporate Governance Guidelines is a core responsibility of the Nominating Committee. The committee carries out this responsibility through a year-round process described below

Evaluation of Board Composition

Each year the Nominating Committee evaluates the size and composition of the Board to assess whether they are appropriate in light of the company’s evolving needs. In making this evaluation, the committee considers the company’s strategic direction, current director qualifications, the results of Board and committee self-assessments, and legal and investor relations review.

BOARD LEADERSHIP STRUCTURE

Traditionally, the Board has elected to appoint one of its independent members to serve as Chair. In that role, Alexander Toeldte acts as the lead independent director and, among other responsibilities, provides an independent contact to allow the other directors to communicate their views and concerns to management as well as presides over non-management executive sessions of Board meetings. Our Board believes that an independent Chair with prior corporate governance experience combined with a President and CEO who manages the day-to-day operations of our company while also serving as a director, provides our Board with an optimal balance in terms of leadership structure at this point in time.

In the future, the Board may elect to have the role of Board Chair and CEO performed by the same person, as other companies in our industry do. If we were to adopt that structure, the Board would appoint one of its independent members to serve as Vice Chair, who would act as the lead independent director and, among other responsibilities, provide an

Clearwater Paper Corporation 2025

16

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

independent contact to allow the other directors to communicate their views and concerns to management as well as preside over non-management executive sessions of Board meetings.

BOARD COMMITTEES

Our Board currently has three standing committees, as described below. The current charters of each of these committees are available on our website at www.clearwaterpaper.com by selecting “Investors” and then “Governance.”

| Audit Committee

|

Description and Key Responsibilities

| |

| Members: • John J. Corkrean* (Chair) (since May 2019 and • Jeanne M. Hillman* (since October 2022) • Kevin J. Hunt* (since September 2018) • Ann C. Nelson* (since May 2020) • John P. O’Donnell* (since May 2020)

* Audit Committee financial expert as defined by

Meetings in 2024: 8

Average Attendance in 2024: 100%

Independence: 100% |

• Assists the Board in its oversight of our accounting, financial reporting, and internal accounting control matters. • Reviews the quarterly and audited annual financial statements (as more fully described in its charter). • Exercises sole authority to select, compensate and terminate our independent registered public accounting firm as well as the committee’s own consultants and advisors. • Oversees the appointment, compensation and replacement of our head of internal audit. • Reviews our Related Person Transactions Policy and considers any related person transactions. See “Transactions with Related Persons.” • Pre-approves the independent registered public accounting firm’s audit fees and non-audit services and fees in accordance with criteria adopted by the committee. • Review the company’s policies and programs for addressing data protection as it relates to the committee’s oversight of financial risk, including both privacy and security. • Assists the Board in its oversight of the cybersecurity programs of the company. | |

Clearwater Paper Corporation 2025

17

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

| Compensation Committee

|

Description and Key Responsibilities

| |

| Members: • Kevin J. Hunt (Chair) (since January 2013 and • John J. Corkrean (since May 2020) • Joe W. Laymon (since May 2019) • Alexander Toeldte (since May 2017) • Christine M. Vickers Tucker (since May 2021)

Meetings in 2024: 5

Average Attendance in 2024: 100%

Independence: 100% |

• Oversees our executive compensation and benefits programs, including establishing the performance measurements and targets for executive officers’ incentive pay. • Annually reviews and approves executive compensation. • Coordinates with our Board Chair the annual performance review of our Chief Executive Officer. • Reviews the “Executive Compensation Discussion and Analysis” contained in this proxy statement and recommends its inclusion to the full Board for approval. • Exercises sole authority to select, compensate and terminate its own compensation consultants or other advisors. • Reviews the development and implementation of the company’s practices, strategies, and policies used for recruiting, managing, and developing employees (i.e., human capital management) and for focusing on diversity and inclusion, workplace environment and safety, and corporate culture. | |

| Nominating & Governance Committee

|

Description and Key Responsibilities

| |

| Members: • John P. O’Donnell (Chair) (since May 2018 and Chair since May 2020) • Joe W. Laymon (since May 2019) • Ann C. Nelson (since May 2020) • Alexander Toeldte (since April 2016 and Chair from September 2018 to May 2020) • Christine M. Vickers Tucker (since May 2022)

Meetings in 2024: 4

Average Attendance in 2024: 100%

Independence: 100% |

• Identifies, evaluates, recruits and recommends to the Board nominees for election as directors. • Develops and recommends to the Board corporate governance principles. • Oversees the evaluation of the Board and assists in the evaluation of management. • Director succession planning is also a focus of the Nominating Committee with striking a balance between Board refreshment and the need for new or additional skill sets with maintaining the institutional knowledge about our business and operating history. • Exercises sole authority to select, compensate and terminate its own consultants and advisors. • Assists the Board in its review of the development, oversight, and implementation of the company’s sustainability policies, programs, and practices, and discusses with management such matters, including environmental protection, community and social responsibility, and human rights. | |

Clearwater Paper Corporation 2025

18

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

BOARD AND RISK OVERSIGHT

|

BOARD OF DIRECTORS

| ||||

| • Responsible for overseeing company-wide risk management both directly and through its three standing committees | ||||

| Audit Committee | Nominating and Governance Committee | Compensation Committee | ||

| • Oversees internal audit function which provides ongoing assessment of risk management processes

• Material financial risk oversight, and management risk assessment process

• Cybersecurity

|

• Corporate governance structure and succession planning

• Sustainability efforts |

• Compensation program and policy related risk

• Human capital management and strategies, with related risks | ||

| MANAGEMENT |

| • Responsible for day-to-day management of risk

• Reports to the Board and the committees of the Board regarding risk and mitigation efforts

• Coordinates risk management activity via its Risk Management Committee staffed with subject matter experts from across the organization

|

Board of Directors

One of the responsibilities of our Board is to provide oversight of our risk management practices in order to ensure appropriate risk management systems are employed throughout the company. Management, which is responsible for the day-to-day assessment and mitigation of our risks, utilizes an enterprise risk management, or ERM, program, which is an enterprise-wide program designed to enable effective and efficient identification and management of critical enterprise risks and to facilitate the incorporation of risk considerations into decision making. To assist and strengthen management’s risk assessment and mitigation efforts, we have a Risk Management Committee whose management members represent a company-wide perspective and provide subject matter expertise as part of our ERM process. Through the ERM process, management identifies, monitors, and mitigates risks and regularly reports to the Board or a committee of the Board as to the assessment and management of those risks.

The Board’s standing committees support the Board by regularly addressing various issues within their respective areas of oversight. Each of the committee chairs, as appropriate, reports to the full Board at regular meetings concerning the activities of the committee, any significant issues it has discussed, and the actions taken by the committee.

The Board’s role in risk oversight is consistent with its leadership structure. We believe that our Board’s leadership structure facilitates its oversight of our risk management practices by combining the day-to-day knowledge of our business possessed by our President and CEO as a member of the Board, with the independence provided by our Independent Chair and independent Board committees.

Clearwater Paper Corporation 2025

19

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

Audit Committee

The Audit Committee’s responsibilities include reviewing and overseeing major financial risk and cybersecurity exposures and the steps management has taken to monitor and control these exposures. As sustainability matters have become a part of regular public company reporting obligations, the Audit Committee is involved in the oversight of such reporting and any related and required controls. Our Audit Committee also reviews with our independent auditors the adequacy and effectiveness of our internal controls over financial reporting. Additionally, our head of Internal Audit provides the Audit Committee with regular updates on our systems of internal controls over financial reporting, and our General Counsel reviews with the committee significant litigation, claims and regulatory and legal compliance matters.

Compensation Committee

The Compensation Committee assists the Board in fulfilling its risk management oversight responsibilities associated with risks arising from our compensation policies and programs. Each year management and the Compensation Committee review whether risks arising from our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on the company. The Compensation Committee is also responsible for overseeing and reviewing development and implementation of company practices, strategies and policies with respect to human capital management.

Nominating and Governance Committee

The Nominating Committee assists the Board in fulfilling its risk management oversight responsibilities associated with risks related to corporate governance structures and processes. In addition to Board-related duties, the Nominating Committee is responsible for overseeing and reviewing sustainability efforts with senior management across various company functions.

Cybersecurity

A critical aspect of our risk mitigation is cybersecurity, which we prioritize across our enterprise and regularly review with our Board. We use a risk assessment methodology derived from industry standards to identify, rank, and remediate cybersecurity risks. We also model our security policies on National Institute of Standards and Technology (NIST) standards and employ a cybersecurity architecture that relies on defensive, in-depth strategies to protect the company against continually evolving security threats.

Our comprehensive security framework spans IT and OT systems, incorporating advanced concepts such as Secure Access Service Edge (SASE), Zero Trust Architecture, Threat Intelligence, and AI-driven anomaly detection. Key components of our approach include Secure Identity and Privileged Access Management, Adaptive Multi-Factor Authentication, System Hardening, and robust system logging.

Clearwater Paper’s IT security is managed by a dedicated 24x7 security operations center that reviews security threats using an AI and machine-learning-enabled SIEM system that collects and collates events and logs from infrastructure devices and business applications. In addition, we reinforce our back-end security practices with required annual security awareness training for system users and periodic phishing and other security simulations to reinforce security concepts. Training content is provided and updated periodically by a leading security training company. We experienced no security breaches during 2024.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

John J. Corkrean, Kevin J. Hunt, Joe W. Laymon, Alexander Toeldte and Christine M. Vickers Tucker each served as a member of our Compensation Committee during 2024. All are outside directors, and none of our named executive officers served as a director or as a member of a compensation committee of any business entity employing any of our directors during 2024.

Clearwater Paper Corporation 2025

20

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

COMMUNICATIONS WITH DIRECTORS

Stockholders and interested parties may contact our directors to provide comments, to report concerns, or to ask a question, by mail at the following address:

Corporate Secretary

Clearwater Paper Corporation

601 West Riverside Ave., Suite 1100

Spokane, Washington 99201

Stockholders and interested parties may also communicate with our directors as a group by using the form on our website at www.clearwaterpaper.com, by selecting “Investors,” then “Governance” and “Contact the Board.”

All communications received will be processed by our Corporate Secretary. We forward all communications, other than those that are unrelated to the duties and responsibilities of the Board, to the intended director(s).

Our Audit Committee has established procedures to address concerns and reports of potential irregularities or violations regarding accounting, internal controls and auditing matters. Reports may be made on a confidential and anonymous basis. All such reports are directed through an independent, third-party hotline provider and are routed directly to the Chair of the Audit Committee. The procedures and hotline number are available by going to our public website at www.clearwaterpaper.com, and selecting “Investors,” then “Governance,” and “Procedures for the Reporting of Questionable Accounting and Auditing Matters.” Reports may also be made via the hotline provider’s website that is accessed through our intranet website.

TRANSACTIONS WITH RELATED PERSONS

Securities laws require us to disclose certain business transactions that are considered related person transactions. In order to comply with these requirements, our Board has adopted a Related Person Transactions Policy that applies to our directors and executive officers, any beneficial owner of more than 5% of our voting stock, any immediate family member of any of the foregoing persons, and any entity that employs any of the foregoing persons, or in which any of the foregoing persons is a general partner, principal or 10% or greater beneficial owner. Transactions covered by this policy are those in which (a) we or any of our subsidiaries participate, (b) the amount involved exceeds $120,000, and (c) any related person had, has, or will have a direct or indirect material interest, as defined in the policy.

Any proposed related person transaction is reviewed by our Audit Committee at its next regularly scheduled meeting, unless our Corporate Secretary or General Counsel determines that it is not practicable or desirable to wait until the next scheduled meeting for a particular transaction, in which case the Chair of the Audit Committee has the authority to review and consider the proposed transaction. Only those transactions determined to be fair and in the company’s best interests are approved, after taking into account all factors deemed relevant by the Audit Committee, or its Chair, as the case may be. If the Chair approves any related person transaction, then that approval is reported to the Audit Committee at its next regularly scheduled meeting.

We did not conduct any transactions with related persons in 2024 that would require disclosure in this proxy statement or that required approval by the Audit Committee pursuant to the policy described above.

Clearwater Paper Corporation 2025

21

| 1 | KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | CORPORATE RESPONSIBILITY | 4 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 | AUDIT COMMITTEE REPORT |

6 | ANNUAL MEETING INFORMATION |

7 | PROPOSALS | |||||||||||||

COMPENSATION OF DIRECTORS

Our Nominating Committee reviews and makes recommendations to our Board concerning independent director compensation. Similar to our philosophy regarding executive compensation, our philosophy regarding director compensation is to provide our directors a fair compensation package that is tied to the services they perform as well as to the performance of the company, with the objective of recruiting and retaining an outstanding group of directors.

The Nominating Committee, pursuant to the authority granted under its charter, engaged Semler Brossy to advise it on director compensation matters for 2024. Semler Brossy’s assessment was taken into consideration in establishing our current director compensation, which is targeted to be at the median of compensation paid by comparable companies.

2024 COMPENSATION OF NON-EMPLOYEE DIRECTORS

| Name | Fees Earned or Paid in Cash ($)(1) |

Stock Awards ($)(2) |

All Other ($) |

Total ($) |

||||||||||||||||

| John J. Corkrean |

$ | 132,500 | $ | 134,328 | - | $ | 266,828 | |||||||||||||

| Jeanne M. Hillman |

$ | 105,000 | (3) | $ | 134,328 | - | $ | 239,328 | ||||||||||||

| Kevin J. Hunt |

$ | 127,500 | $ | 134,328 | - | $ | 261,828 | |||||||||||||

| Joe L. Laymon |

$ | 105,000 | (4) | $ | 134,328 | - | $ | 239,328 | ||||||||||||

| Ann C. Nelson |

$ | 112,500 | $ | 134,328 | - | $ | 246,828 | |||||||||||||

| John P. O’Donnell |

$ | 122,500 | $ | 134,328 | - | $ | 256,828 | |||||||||||||

| Alexander Toeldte |

$ | 215,000 | $ | 134,328 | - | $ | 349,328 | |||||||||||||

| Christine M. Vickers Tucker |

$ | 118,499 | $ | 134,328 | $1,533 | (5) | $ | 254,360 | ||||||||||||

| (1) | Represents annual retainers for 2024, as well as any amounts earned for service as Chair or committee Chair as well as committee membership retainers. |

| (2) | This column shows the aggregate grant date fair value, computed in accordance with FASB ASC Topic 718, of stock units granted in 2024. In accordance with FASB ASC Topic 718, the grant date fair value reported for all stock units was computed by multiplying the number of stock units by the closing price of our stock on the grant date. The aggregate number of vested and unvested phantom common stock units credited for service and deferred fees as a director outstanding as of December 31, 2024 for each non-employee director was as follows: Mr. Corkrean— 22,683 units; Ms. Hillman—13,056 units; Mr. Hunt—35,990 units; Mr. Laymon— 27,038 units; Ms. Nelson— 17,458 units; Mr. O’Donnell—30,439 units; Mr. Toeldte—33,721 units; and Ms. Vickers Tucker—13,405 units. |

| (3) | In 2024, Ms. Hillman elected to defer receipt of a portion of her cash retainers and fees, which will be paid out according to her election under the Clearwater Paper Corporation Deferred Compensation Plan for Directors. Of the $105,000 reported here, Ms. Hillman received $21,000 in cash and the rest was deferred into phantom stock units per her deferral election. In connection with these deferrals, we credited 2,260 stock units to Ms. Hillman’s account for fees deferred in 2024. Such amounts were determined separately for each fee payment, which included pro-rata payments of the director’s annual retainer fee, by dividing the fee amount by the appropriate closing stock price pursuant to the plan. These stock units are included in Ms. Hillman’s aggregate number of phantom common stock units described in footnote 2. |

| (4) | In 2024, Mr. Laymon elected to defer receipt of his cash retainers and fees, which will be paid out according to his election under the Clearwater Paper Corporation Deferred Compensation Plan for Directors. Of the $105,000 reported here, Mr. Laymon received no cash and all fees were deferred into phantom stock units per his deferral election. In connection with these deferrals, we credited 2,826 stock units to Mr. Laymon’s account for fees deferred in 2024. Such amounts were determined separately for each fee payment, which include pro-rata payments of the director’s annual retainer fee, by dividing the amount due by the appropriate per share closing stock price pursuant to the plan. These stock units are included in Mr. Laymon’s aggregate number of phantom common stock units described in footnote 2. |

| (5) | Ms. Vickers Tucker elected to defer receipt of her fees in 2021 and 2022. In 2024 she began receiving payments according to her election under the Clearwater Paper Corporation Deferred Compensation Plan for Directors. |

Clearwater Paper Corporation 2025

22

1 |

KEY PERFORMANCE, CSR AND ENVIRONMENTAL HIGHLIGHTS | 2 |

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS |

3 |

CORPORATE RESPONSIBILITY | 4 |

EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 5 |

AUDIT COMMITTEE REPORT |

6 |

ANNUAL MEETING INFORMATION |

7 |

PROPOSALS | |||||||||||||

Annual retainer fee |

$90,000 | |||

Annual retainer fee for Audit Committee membership |

$15,000 | |||

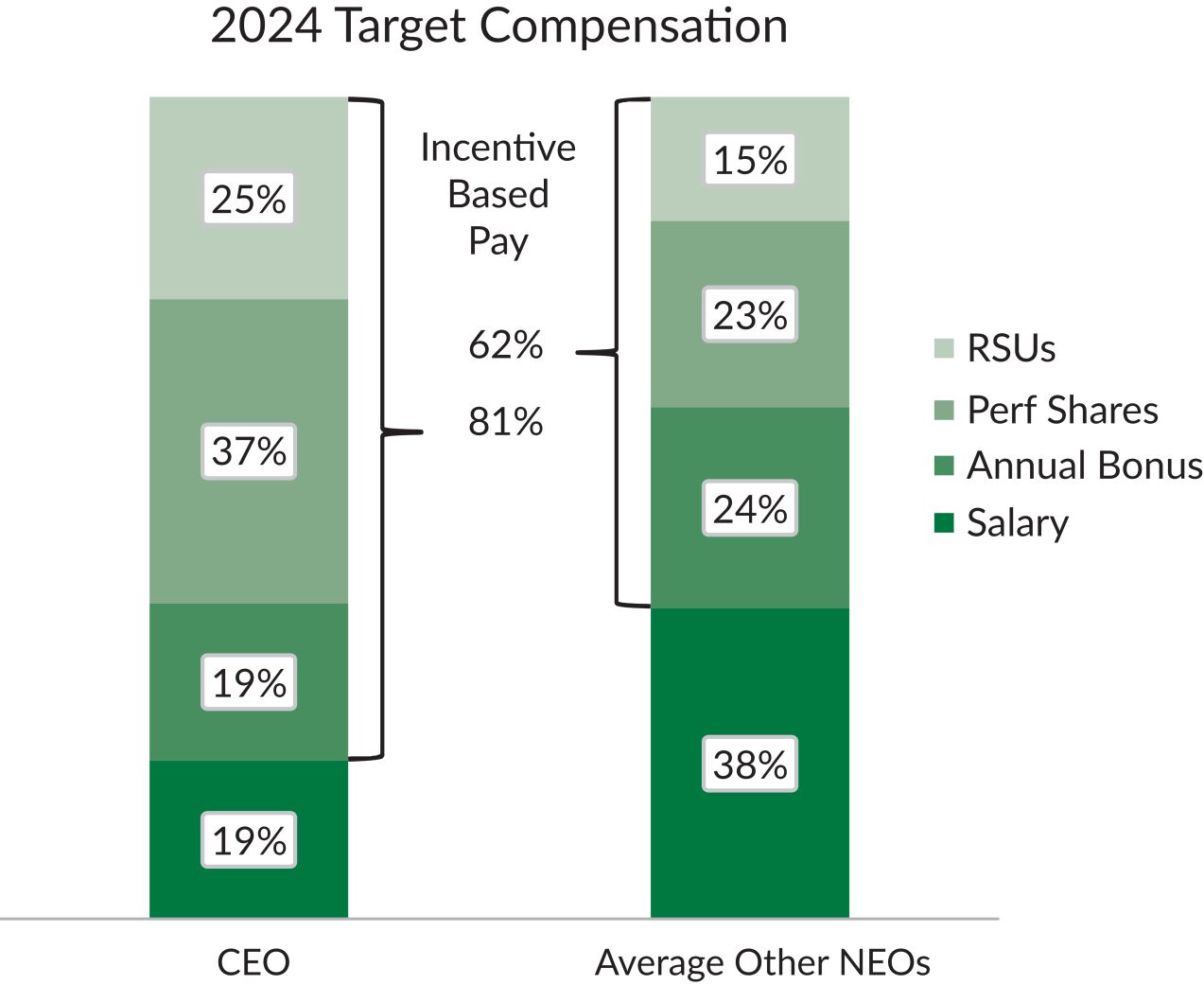

Annual retainer fee for Compensation Committee membership |