Third Quarter Earnings Release Materials October 28, 2025 ARSEN KITCH President, Chief Executive Officer and Director SHERRI BAKER Senior Vice President and Chief Financial Officer

2 Forward Looking Statements Cautionary Statement Regarding Forward Looking Statements This presentation of supplemental information contains, in addition to historical information, certain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995 as amended, including statements as to: our expectations regarding capturing volume at the Augusta mill; our expectations regarding additional savings from our fixed cost reduction efforts; the Company’s strategic positioning to capitalize on the paperboard industry’s cyclical nature and deliver strong returns; product demand and industry trends; assumptions for Q4 2025 and full year 2025, including operational factors, capital, input costs, lower pricing and inflation; our capital allocation priorities; our strategy, including achieving target leverage ratio and maintaining liquidity; our focus on free cash flow generation through operational efficiencies and demand; our plans to explore avenues for strategic growth opportunities, particularly to expand our own product offerings and broaden such offerings to North American customers; continued investments into our assets to strengthen our competitive advantages and maintain our long-term performance; expectations regarding the paperboard market; inventory management; and our financial flexibility; and repurchases under the existing share buyback authorization. These forward-looking statements are based on management’s current expectations, estimates, assumptions and projections that are subject to change. Our actual results of operations may differ materially from those expressed or implied by the forward-looking statements contained in this presentation. Important factors that could cause or contribute to such differences include the risks and uncertainties described from time to time in the Company's public filings with the Securities and Exchange Commission, including but not limited to the following: there may be unexpected costs, charges or expenses resulting from the tissue business sale transaction; achievement of anticipated financial results and other benefits of the tissue business sale transaction; potential risks associated with operating without the tissue business, including less diversification in products offered; changes in our capital structure; risks relating to the achievement of anticipated financial results and other benefits of the Augusta, Georgia paperboard manufacturing facility acquisition, including from our integration efforts and the recovery of any losses related to the representation- and-warranty insurance claim; competitive pricing pressures for our products, including as a result of capacity additions, demand reduction and the impact of foreign currency fluctuations on the pricing of products globally; changes in the U.S. and international economies and in general economic conditions in the regions and industries in which we operate; increased regulation of retaliatory trade actions in response to announced or proposed U.S. tariffs, including potential impact on costs, structure, supply chains, or consumer demand; cyclical industry conditions; manufacturing or operating disruptions, including equipment malfunctions and damage to our manufacturing facilities; the loss of, changes in prices in regard to, or reduction in, orders from a significant customer; changes in the cost and availability of wood fiber and wood pulp; changes in energy, chemicals, packaging and transportation costs and disruptions in transportation services impacting our ability to receive inputs or ship products to customers; reliance on a limited number of third-party suppliers, vendors and service providers required for the production of our products and our operations; changes in customer product preferences and competitors’ product offerings; changes in labor contracts, including any related wage adjustments; labor disruptions; cyber-security risks; larger competitors having operational, financial and other advantages; consolidation and vertical integration of converting operations in the paperboard industry; our ability to execute on our growth and expansion strategies; our ability to successfully execute capital projects and other activities to operate our assets, including effective maintenance, implement our operational efficiencies and realize higher throughput or lower costs; IT system disruptions and IT system implementation failures; changes in expenses, required contributions and potential withdrawal costs associated with our pension plans; environmental liabilities or expenditures and climate change; risks and costs associated with new or ongoing environmental litigation, including PFAS related claims or regulatory actions affecting recently acquired facilities; our ability to attract, motivate, train and retain qualified and key personnel; our ability to service’ our debt obligations and restrictions on our business from debt covenants and terms; changes in our banking relations, or in our customer supply chain financing; negative changes in our credit agency ratings; and changes in laws, regulations or industry standards affecting our business. Forward-looking statements contained in this presentation present management’s views only as of the date of this presentation. We undertake no obligation to publicly update forward-looking statements or to retract future revisions of management's views based on events or circumstances occurring after the date of this presentation. Non-GAAP Financial Measures This presentation includes certain financial measures that are not calculated in accordance with GAAP, including Adjusted EBITDA from continuing operations. The Company’s management believes that the presentation of these financial measures provides useful information to investors because these measures are regularly used by management in assessing the Company’s performance. These financial measures should be considered in addition to results prepared in accordance with GAAP but should not be considered substitutes for or superior to GAAP results. In addition, these non-GAAP financial measures may not be comparable to similarly-titled measures utilized by other companies, since such other companies may not calculate such measure in the same manner as we do. A reconciliation of Adjusted EBITDA to the most relevant GAAP measure is available in the appendix of this presentation.

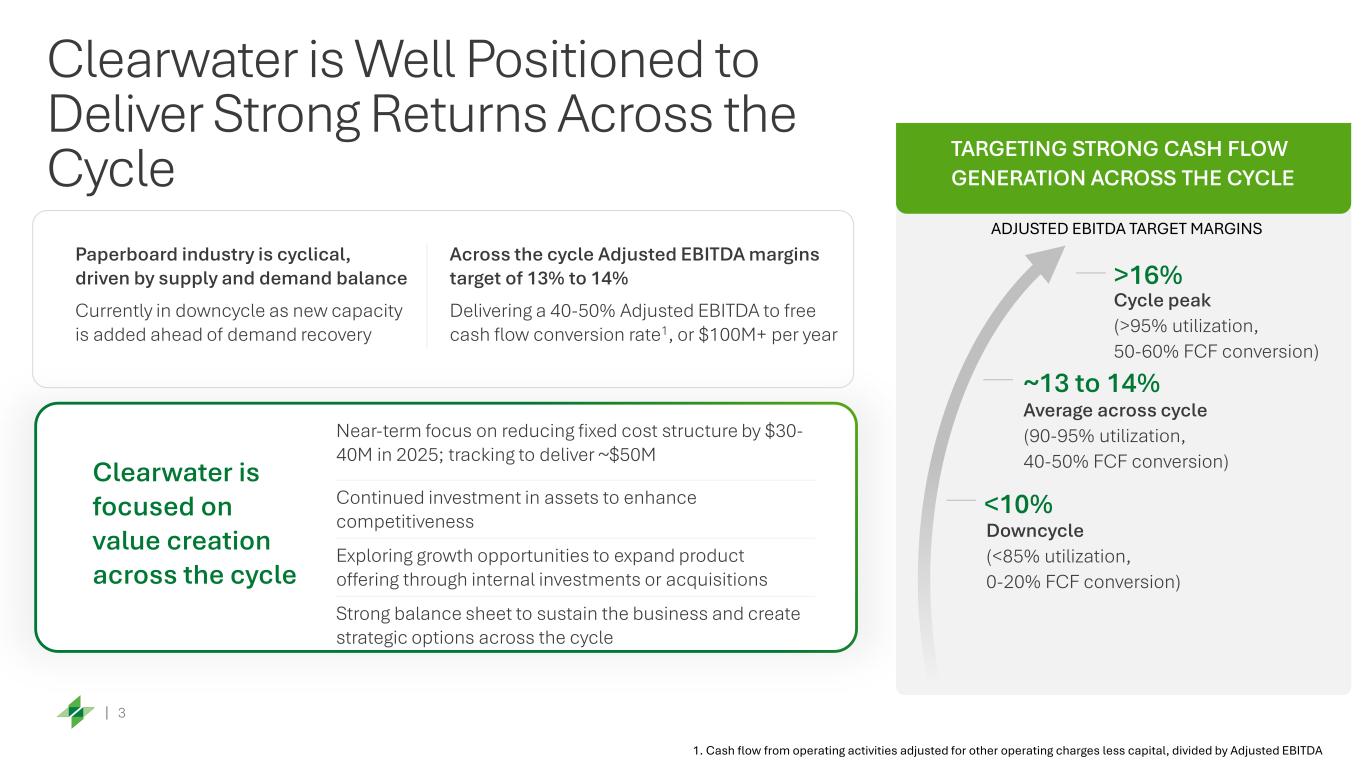

3 Clearwater is Well Positioned to Deliver Strong Returns Across the Cycle >16% Cycle peak (>95% utilization, 50-60% FCF conversion) Average across cycle (90-95% utilization, 40-50% FCF conversion) ~13 to 14% Downcycle (<85% utilization, 0-20% FCF conversion) <10% TARGETING STRONG CASH FLOW GENERATION ACROSS THE CYCLE Paperboard industry is cyclical, driven by supply and demand balance Currently in downcycle as new capacity is added ahead of demand recovery Across the cycle Adjusted EBITDA margins target of 13% to 14% Delivering a 40-50% Adjusted EBITDA to free cash flow conversion rate1, or $100M+ per year Near-term focus on reducing fixed cost structure by $30- 40M in 2025; tracking to deliver ~$50M Continued investment in assets to enhance competitiveness Exploring growth opportunities to expand product offering through internal investments or acquisitions Strong balance sheet to sustain the business and create strategic options across the cycle Clearwater is focused on value creation across the cycle 1. Cash flow from operating activities adjusted for other operating charges less capital, divided by Adjusted EBITDA ADJUSTED EBITDA TARGET MARGINS

4 Exploring Options to Expand Our Product Offering Post consumer recycled content Developed and in market Provide options for converter customers to service sustainability driven Consumer Packaged Goods (CPG) and Quick Service Restaurants (QSR) customers Compostable plate BPI certified at two locations Enable our plate converter customers to meet demands of leading domestic retailers Lightweight folding carton Developing and expected in market H1 2026 Offer alternatives to Folding Boxboard (FBB) imports with superior performance Poly-free coatings / barriers Continuing to develop options in addition to current offering Meet current and future needs of sustainability driven cup converters looking for a poly-free offering Unbleached paperboard grade (CUK) Technical feasibility and market opportunity near completion; decision on hold Enable independent converters to better compete with large integrated incumbents Recycled paperboard grade (CRB) Open to evaluating M&A Options Provide a more complete paperboard offering to existing Solid Bleached Sulfate (SBS) customers Initiative Status Objective

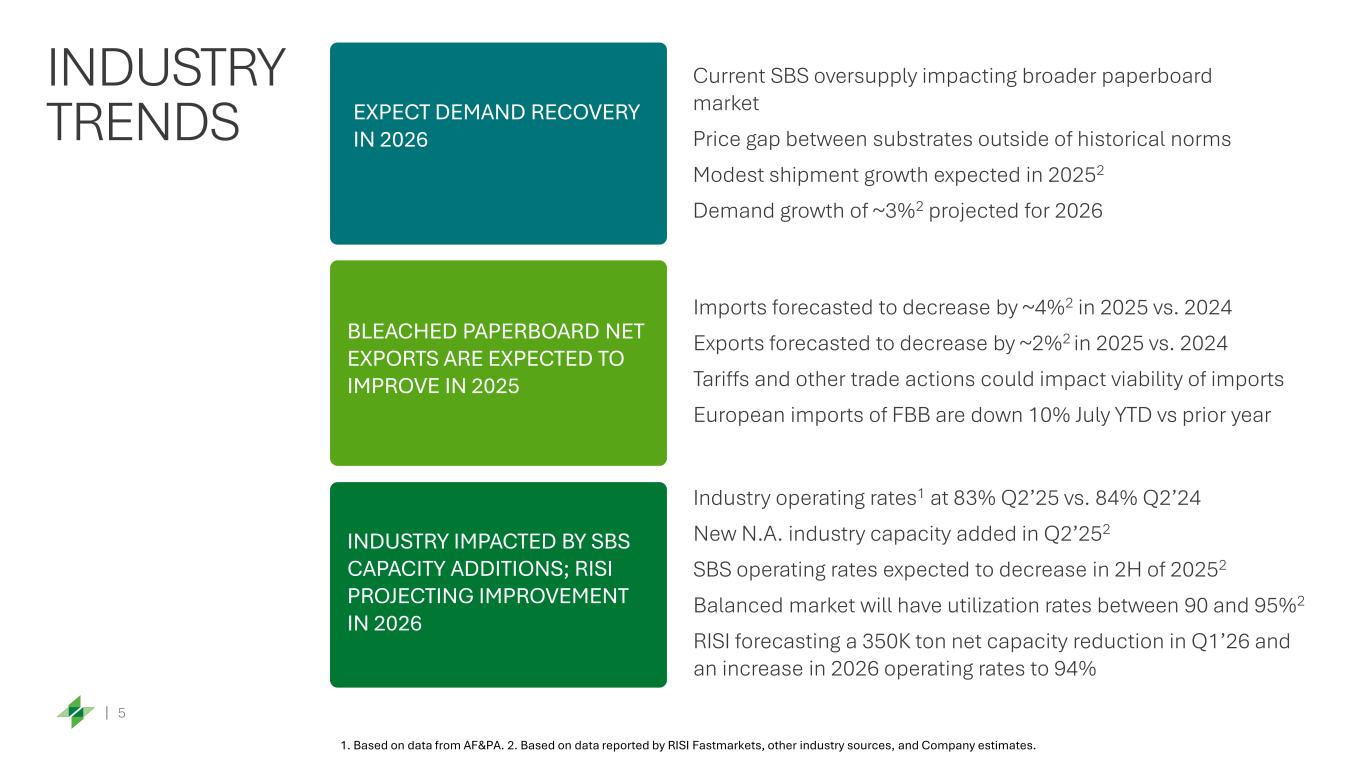

5 INDUSTRY TRENDS 1. Based on data from AF&PA. 2. Based on data reported by RISI Fastmarkets, other industry sources, and Company estimates. EXPECT DEMAND RECOVERY IN 2026 Current SBS oversupply impacting broader paperboard market Price gap between substrates outside of historical norms Modest shipment growth expected in 20252 Demand growth of ~3%2 projected for 2026 INDUSTRY IMPACTED BY SBS CAPACITY ADDITIONS; RISI PROJECTING IMPROVEMENT IN 2026 Industry operating rates1 at 83% Q2’25 vs. 84% Q2’24 New N.A. industry capacity added in Q2’252 SBS operating rates expected to decrease in 2H of 20252 Balanced market will have utilization rates between 90 and 95%2 RISI forecasting a 350K ton net capacity reduction in Q1’26 and an increase in 2026 operating rates to 94% BLEACHED PAPERBOARD NET EXPORTS ARE EXPECTED TO IMPROVE IN 2025 Imports forecasted to decrease by ~4%2 in 2025 vs. 2024 Exports forecasted to decrease by ~2%2 in 2025 vs. 2024 Tariffs and other trade actions could impact viability of imports European imports of FBB are down 10% July YTD vs prior year

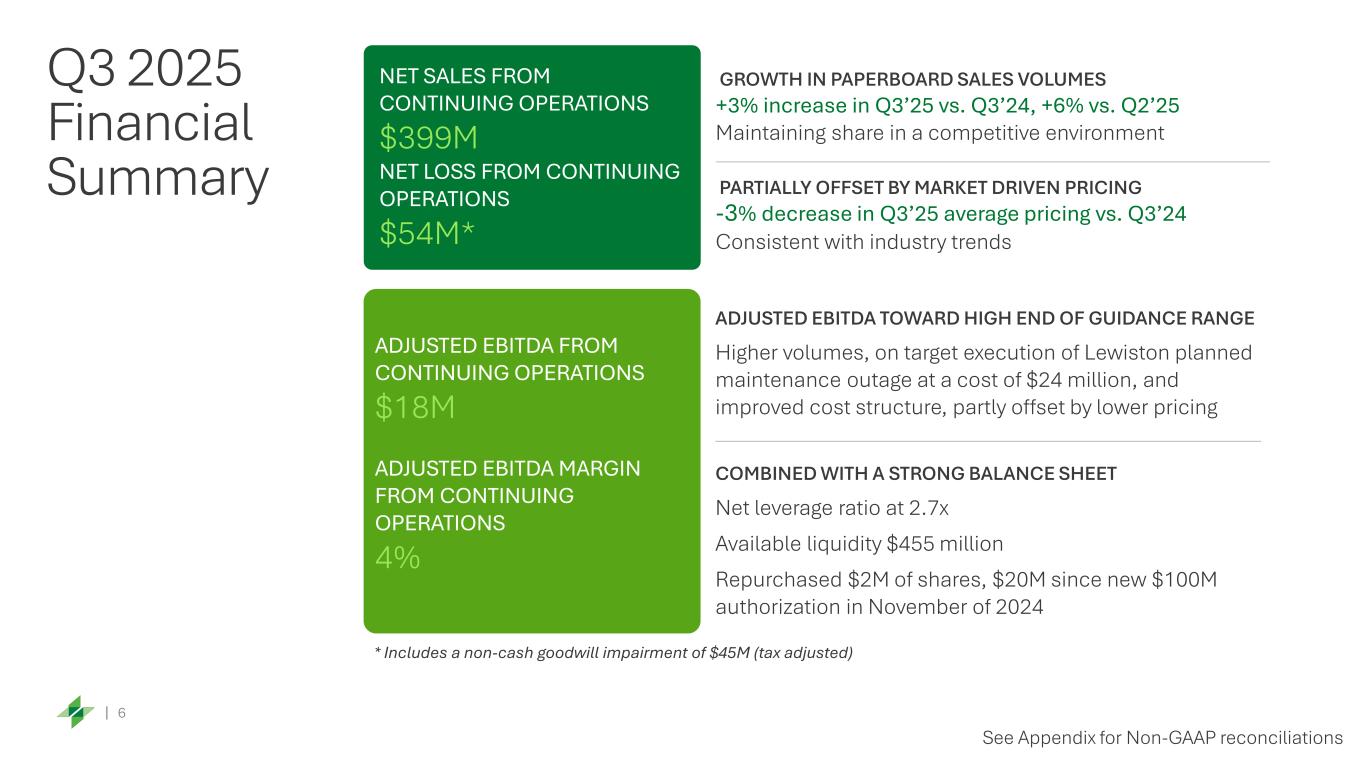

6 +3% increase in Q3’25 vs. Q3’24, +6% vs. Q2’25 Maintaining share in a competitive environment -3% decrease in Q3’25 average pricing vs. Q3’24 Consistent with industry trends Q3 2025 Financial Summary NET SALES FROM CONTINUING OPERATIONS $399M NET LOSS FROM CONTINUING OPERATIONS $54M* PARTIALLY OFFSET BY MARKET DRIVEN PRICING ADJUSTED EBITDA FROM CONTINUING OPERATIONS $18M ADJUSTED EBITDA MARGIN FROM CONTINUING OPERATIONS 4% ADJUSTED EBITDA TOWARD HIGH END OF GUIDANCE RANGE Higher volumes, on target execution of Lewiston planned maintenance outage at a cost of $24 million, and improved cost structure, partly offset by lower pricing COMBINED WITH A STRONG BALANCE SHEET Net leverage ratio at 2.7x Available liquidity $455 million Repurchased $2M of shares, $20M since new $100M authorization in November of 2024 GROWTH IN PAPERBOARD SALES VOLUMES See Appendix for Non-GAAP reconciliations * Includes a non-cash goodwill impairment of $45M (tax adjusted)

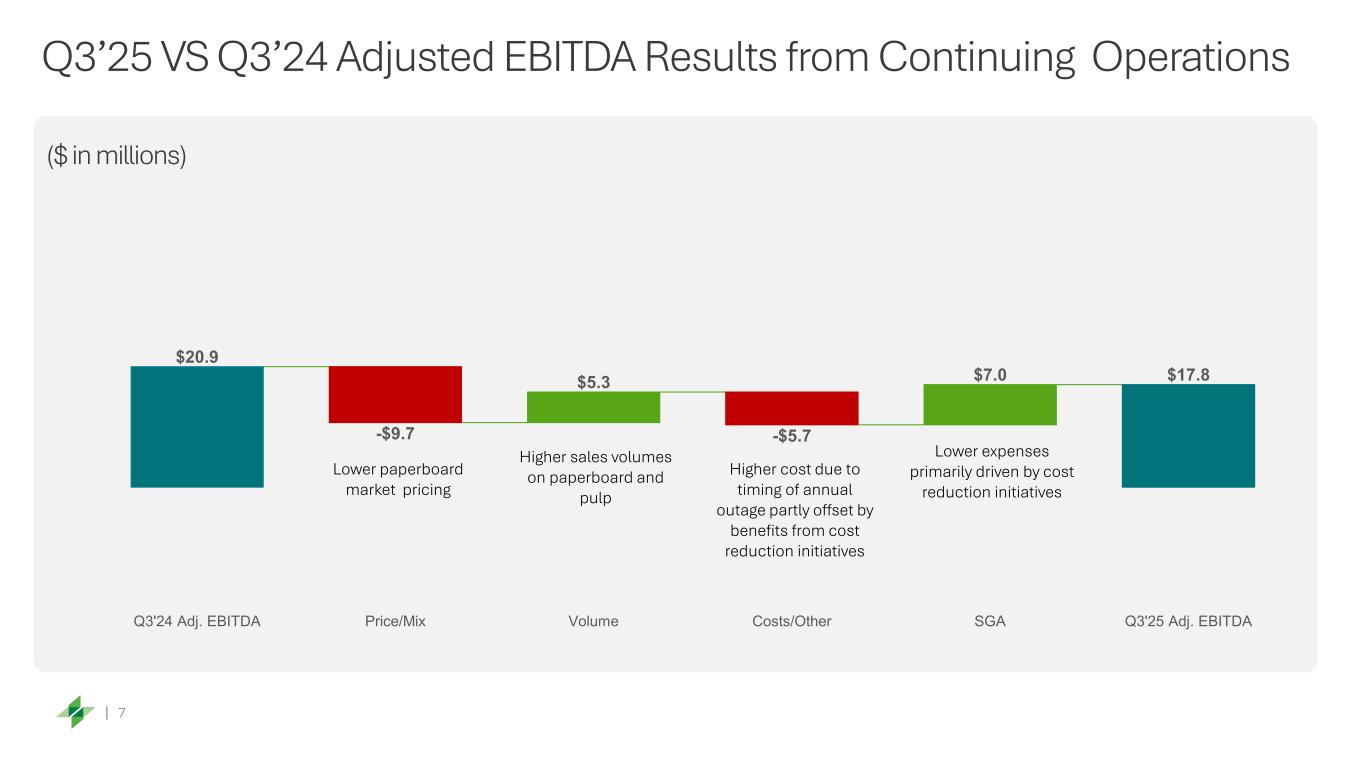

7 Q3’25 VS Q3’24 Adjusted EBITDA Results from Continuing Operations ($ in millions) $20.9 -$5.7 $7.0 $17.8 -$9.7 $5.3 Q3'24 Adj. EBITDA Price/Mix Volume Costs/Other SGA Q3'25 Adj. EBITDA Lower paperboard market pricing Higher sales volumes on paperboard and pulp Higher cost due to timing of annual outage partly offset by benefits from cost reduction initiatives Lower expenses primarily driven by cost reduction initiatives

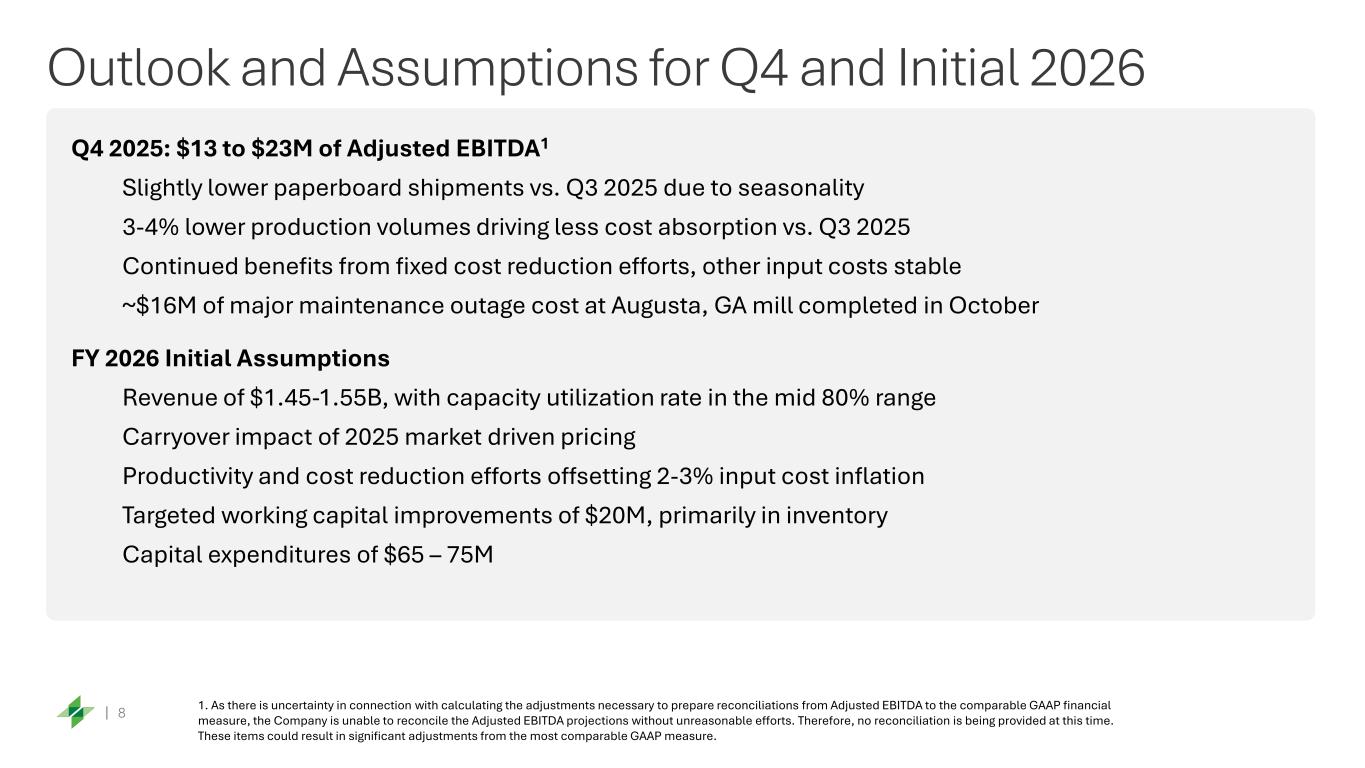

8 Outlook and Assumptions for Q4 and Initial 2026 Q4 2025: $13 to $23M of Adjusted EBITDA1 Slightly lower paperboard shipments vs. Q3 2025 due to seasonality 3-4% lower production volumes driving less cost absorption vs. Q3 2025 Continued benefits from fixed cost reduction efforts, other input costs stable ~$16M of major maintenance outage cost at Augusta, GA mill completed in October FY 2026 Initial Assumptions Revenue of $1.45-1.55B, with capacity utilization rate in the mid 80% range Carryover impact of 2025 market driven pricing Productivity and cost reduction efforts offsetting 2-3% input cost inflation Targeted working capital improvements of $20M, primarily in inventory Capital expenditures of $65 – 75M 1. As there is uncertainty in connection with calculating the adjustments necessary to prepare reconciliations from Adjusted EBITDA to the comparable GAAP financial measure, the Company is unable to reconcile the Adjusted EBITDA projections without unreasonable efforts. Therefore, no reconciliation is being provided at this time. These items could result in significant adjustments from the most comparable GAAP measure.

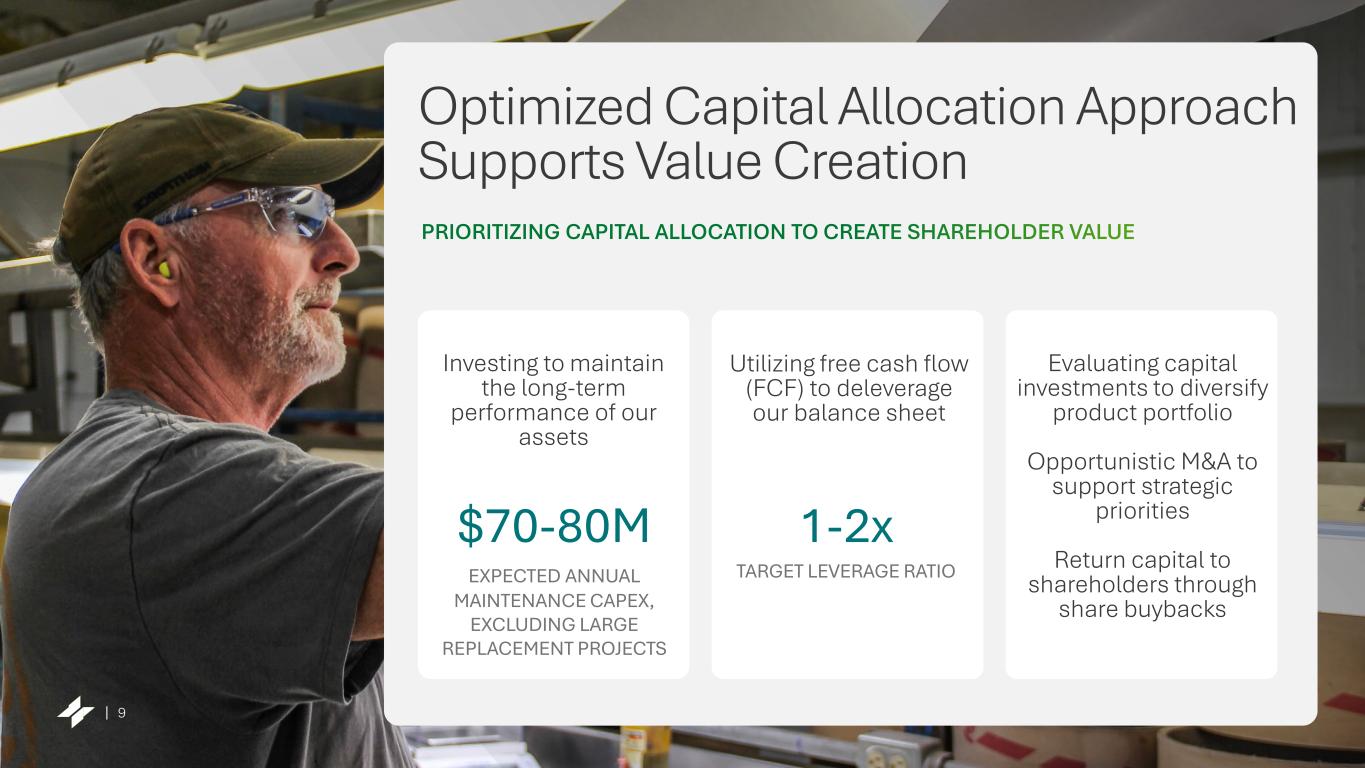

9 Optimized Capital Allocation Approach Supports Value Creation $70-80M EXPECTED ANNUAL MAINTENANCE CAPEX, EXCLUDING LARGE REPLACEMENT PROJECTS 1-2x TARGET LEVERAGE RATIO Investing to maintain the long-term performance of our assets Evaluating capital investments to diversify product portfolio Opportunistic M&A to support strategic priorities Return capital to shareholders through share buybacks Utilizing free cash flow (FCF) to deleverage our balance sheet

10 Optimistic About Long-Term Value Creation Sharp focus on improving and growing our paperboard business • De-levered balance sheet with proceeds from tissue sale • Focus on growing our position as a premier independent paperboard packaging supplier to North American converters Well invested asset base to support future growth • High quality paperboard assets well positioned across the U.S. to efficiently service North American converters • Strong legacy of prioritizing sustainability • Focused on expanding product portfolio through internal investment and opportunistic M&A Focused on optimizing business to deliver free cash flows • Driving improvement in operational performance • Consistently investing to maintain competitiveness of our assets • Strategically deploy capital to create long-term shareholder value

11 Appendix

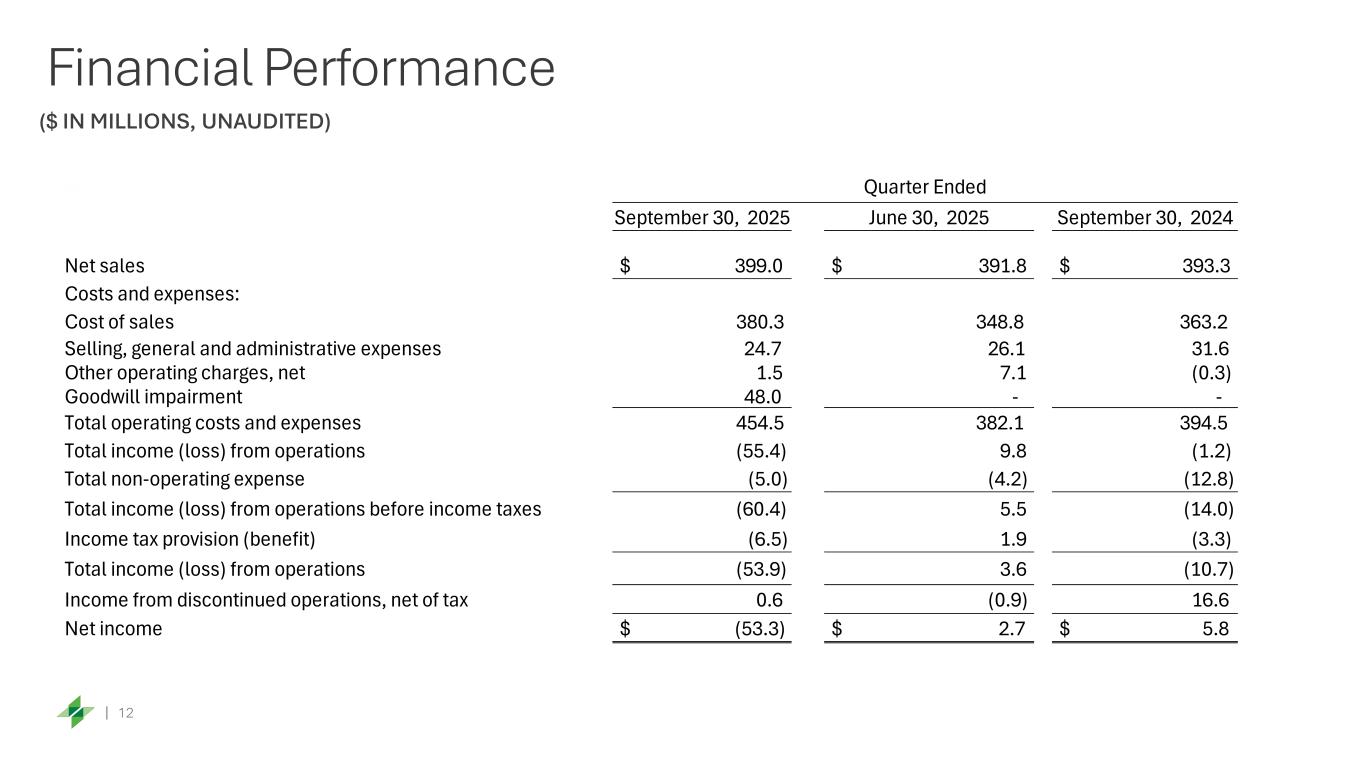

12 Financial Performance ($ IN MILLIONS, UNAUDITED) September 30, 2025 June 30, 2025 September 30, 2024 Net sales $ 399.0 $ 391.8 $ 393.3 Costs and expenses: Cost of sales 380.3 348.8 363.2 Selling, general and administrative expenses 24.7 26.1 31.6 Other operating charges, net 1.5 7.1 (0.3) Goodwill impairment 48.0 - - Total operating costs and expenses 454.5 382.1 394.5 Total income (loss) from operations (55.4) 9.8 (1.2) Total non-operating expense (5.0) (4.2) (12.8) Total income (loss) from operations before income taxes (60.4) 5.5 (14.0) Income tax provision (benefit) (6.5) 1.9 (3.3) Total income (loss) from operations (53.9) 3.6 (10.7) Income from discontinued operations, net of tax 0.6 (0.9) 16.6 Net income $ (53.3) $ 2.7 $ 5.8 Quarter Ended

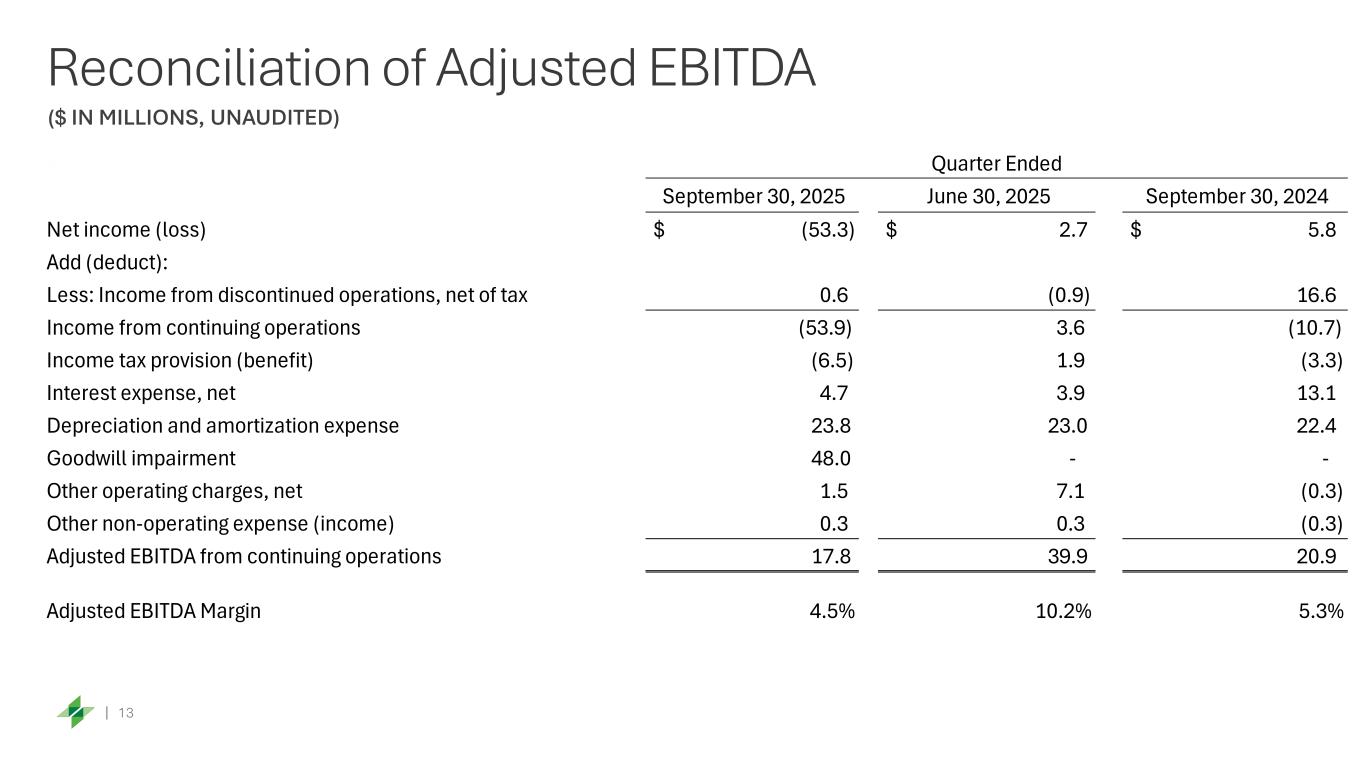

13 Reconciliation of Adjusted EBITDA ($ IN MILLIONS, UNAUDITED) September 30, 2025 June 30, 2025 September 30, 2024 Net income (loss) $ (53.3) $ 2.7 $ 5.8 Add (deduct): Less: Income from discontinued operations, net of tax 0.6 (0.9) 16.6 Income from continuing operations (53.9) 3.6 (10.7) Income tax provision (benefit) (6.5) 1.9 (3.3) Interest expense, net 4.7 3.9 13.1 Depreciation and amortization expense 23.8 23.0 22.4 Goodwill impairment 48.0 - - Other operating charges, net 1.5 7.1 (0.3) Other non-operating expense (income) 0.3 0.3 (0.3) Adjusted EBITDA from continuing operations 17.8 39.9 20.9 Adjusted EBITDA Margin 4.5% 10.2% 5.3% Quarter Ended

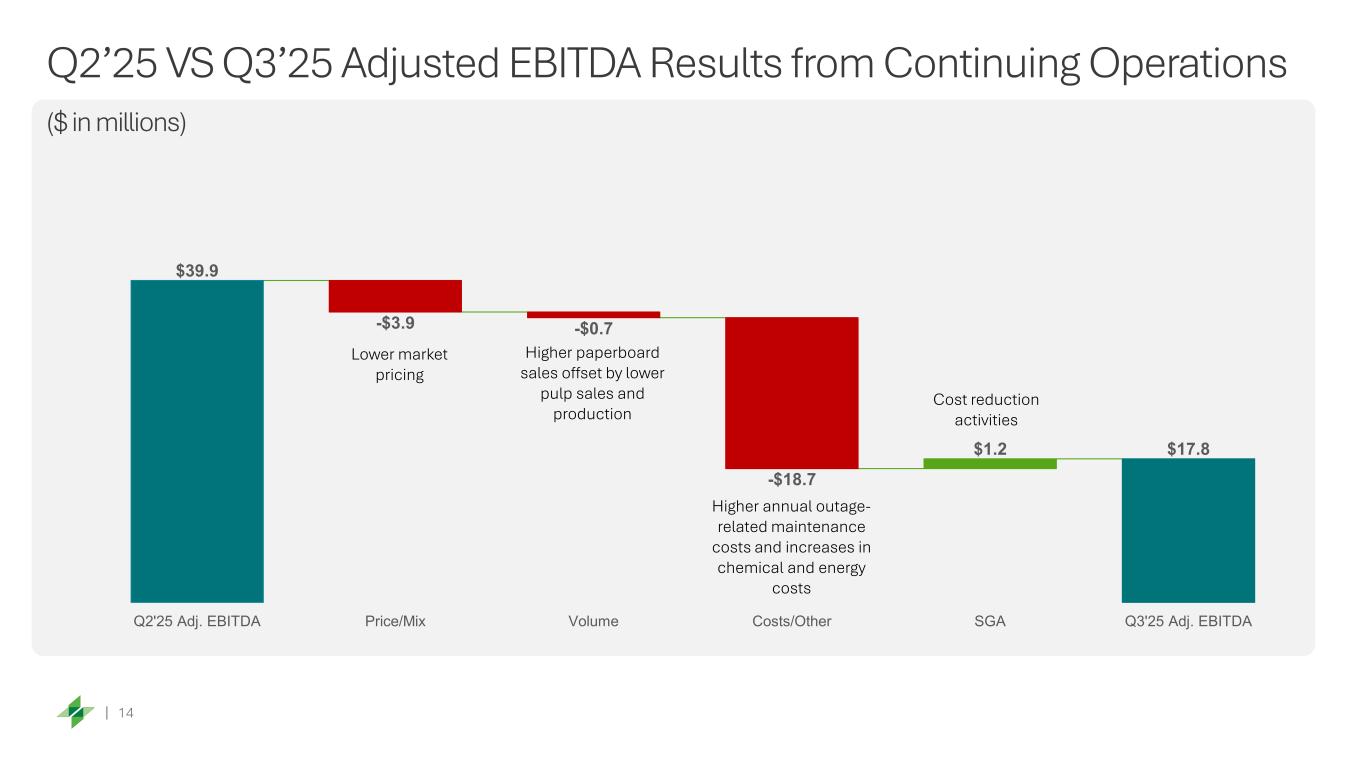

14 Q2’25 VS Q3’25 Adjusted EBITDA Results from Continuing Operations ($ in millions) $39.9 -$18.7 $1.2 $17.8 -$3.9 -$0.7 Q2'25 Adj. EBITDA Price/Mix Volume Costs/Other SGA Q3'25 Adj. EBITDA Higher paperboard sales offset by lower pulp sales and production Higher annual outage- related maintenance costs and increases in chemical and energy costs Cost reduction activities Lower market pricing

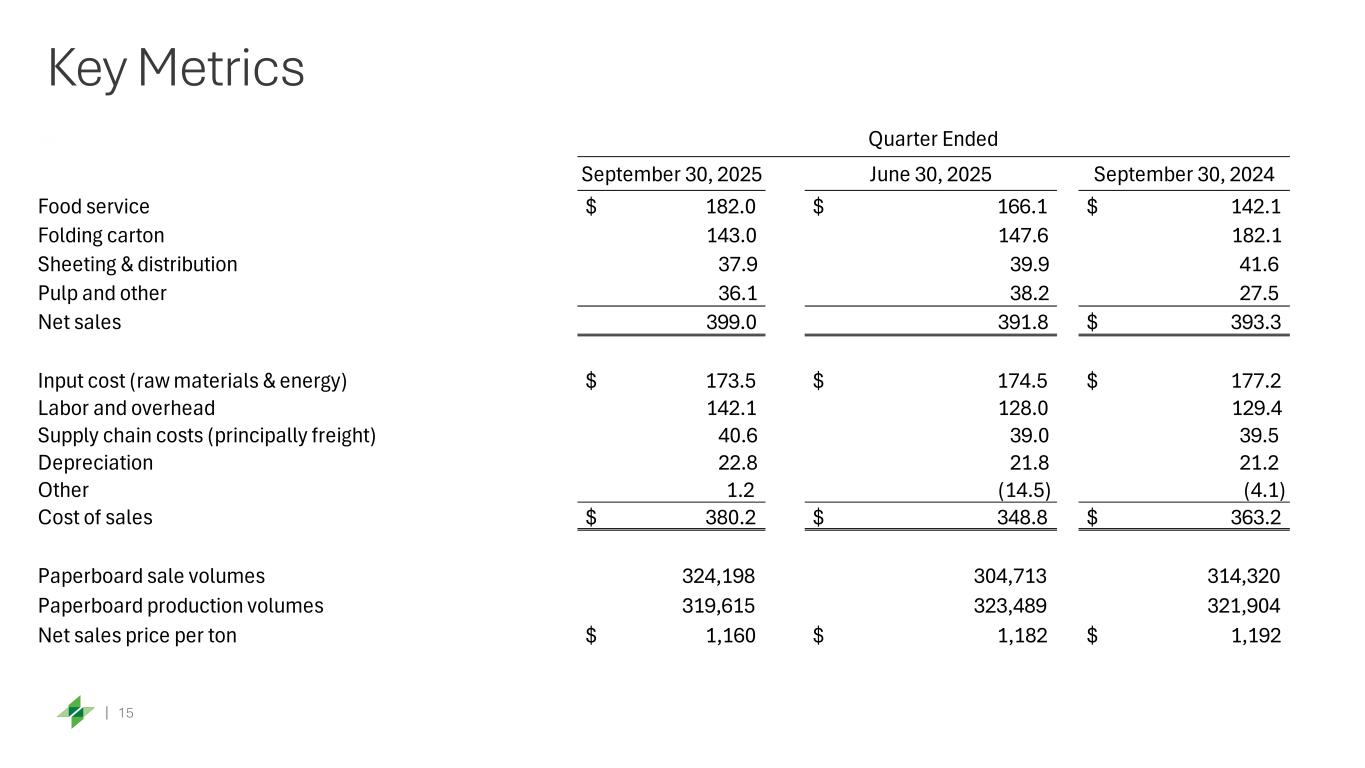

15 Key Metrics September 30, 2025 June 30, 2025 September 30, 2024 Food service $ 182.0 $ 166.1 $ 142.1 Folding carton 143.0 147.6 182.1 Sheeting & distribution 37.9 39.9 41.6 Pulp and other 36.1 38.2 27.5 Net sales 399.0 391.8 $ 393.3 Input cost (raw materials & energy) $ 173.5 $ 174.5 $ 177.2 Labor and overhead 142.1 128.0 129.4 Supply chain costs (principally freight) 40.6 39.0 39.5 Depreciation 22.8 21.8 21.2 Other 1.2 (14.5) (4.1) Cost of sales $ 380.2 $ 348.8 $ 363.2 Paperboard sale volumes 324,198 304,713 314,320 Paperboard production volumes 319,615 323,489 321,904 Net sales price per ton $ 1,160 $ 1,182 $ 1,192 Quarter Ended