Sept 17, 2025 Investor Day

Safe Harbor This presentation and the accompanying oral presentation have been prepared by MongoDB, Inc. (“MongoDB” or the “company”) for informational purposes only and not for any other purpose. Nothing contained in this presentation is, or should be construed as, a recommendation, promise or representation by the presenter or MongoDB or any officer, director, employee, agent or advisor of MongoDB. This presentation does not purport to be all-inclusive or to contain all of the information you may desire. Information provided in this presentation speaks only as of the date hereof, unless otherwise indicated. This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including but not limited to statements regarding our financial outlook, long-term financial targets, product development, business strategy and plans, market trends and market size and opportunities. These forward-looking statements include, but are not limited to, plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts and statements, and may be identified by words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “will,” “would” or the negative or plural of these words or similar expressions or variations. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. In particular, the development, release, and timing of any features or functionality described for MongoDB products remains at MongoDB s̓ sole discretion. Product roadmaps do not represent a commitment, promise or legal obligation to deliver any material, code, or functionality and you should not rely on them to make your purchase decisions. Furthermore, actual results may differ materially from those described in the forward-looking statements and are subject to a variety of assumptions, uncertainties, risks and factors that are beyond our control including, without limitation: the effects of the ongoing military conflict between Russia and Ukraine and Israel and Hamas on our business and future operating results; economic downturns and/or the effects of changes in trade policies, rising interest rates, inflation and volatility in the global economy and financial markets on our business and future operating results; our potential failure to meet publicly announced guidance or other expectations about our business and future operating results; our limited operating history; our history of losses; failure of our platform to satisfy customer demands; the effects of increased competition; our investments in new products and our ability to introduce new features, services or enhancements; social, ethical, regulatory and security issues relating to the use of new and evolving technologies, such as artificial intelligence, in our offerings or partnerships; our ability to effectively expand our sales and marketing organization; our ability to continue to build and maintain credibility with the developer community; our ability to add new customers or increase sales to our existing customers; our ability to maintain, protect, enforce and enhance our intellectual property; the growth and expansion of the market for database products and our ability to penetrate that market and increase market share; our ability to take advantage of market opportunities and drive growth and operating efficiency in new markets; our ability to increase Atlas consumption, expand operating margin, drive meaningful free cash flow and improve efficiency; our ability to integrate acquired businesses and technologies successfully or achieve the expected benefits of such acquisitions; our ability to maintain the security of our software and adequately address privacy concerns; our ability to manage our growth effectively and successfully recruit and retain additional highly-qualified personnel; and the price volatility of our common stock. These and other risks and uncertainties are more fully described in our filings with the Securities and Exchange Commission (“SEC”), including in the section entitled “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended July 31, 2025 and in other filings and reports we may file from time to time with the SEC. This presentation includes market and industry data and forecasts that the company has derived from independent consultant reports, publicly available information, various industry publications, other published industry sources, and its internal data and estimates. Independent consultant reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable. Although the company believes that these third-party sources are reliable, it does not guarantee the accuracy or completeness of this information, and the company has not independently verified this information. The company's internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which the company operates and management's understanding of industry conditions. Although the company believes that such information is reliable, it has not had this information verified by any independent sources. In addition, the information contained in this presentation is as of the date hereof (except where otherwise indicated), and the company has no obligation to update such information, including in the event that such information becomes inaccurate or if estimates change. Subsequent materials may be provided by or on behalf of the company in its discretion and such information may supplement, modify or supersede the information in these materials. Neither the company, nor any of its respective affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss or damage howsoever arising from any use of these materials or their contents or otherwise arising in connection with these materials. Except as required by law, we undertake no obligation to update any forward-looking statements included in this presentation as a result of new information, future events, changes in expectations or otherwise. Nothing in this presentation is, and should not be construed as, an offer to sell or a solicitation of an offer to buy, any securities.

Today’s Speakers Investor Day DEV ITTYCHERIA PRESIDENT & CEO JIM SCHARF CTO MIKE BERRY CFO MAY PETRY CMO FRED ROMA SVP, ATLAS DATA SERVICES

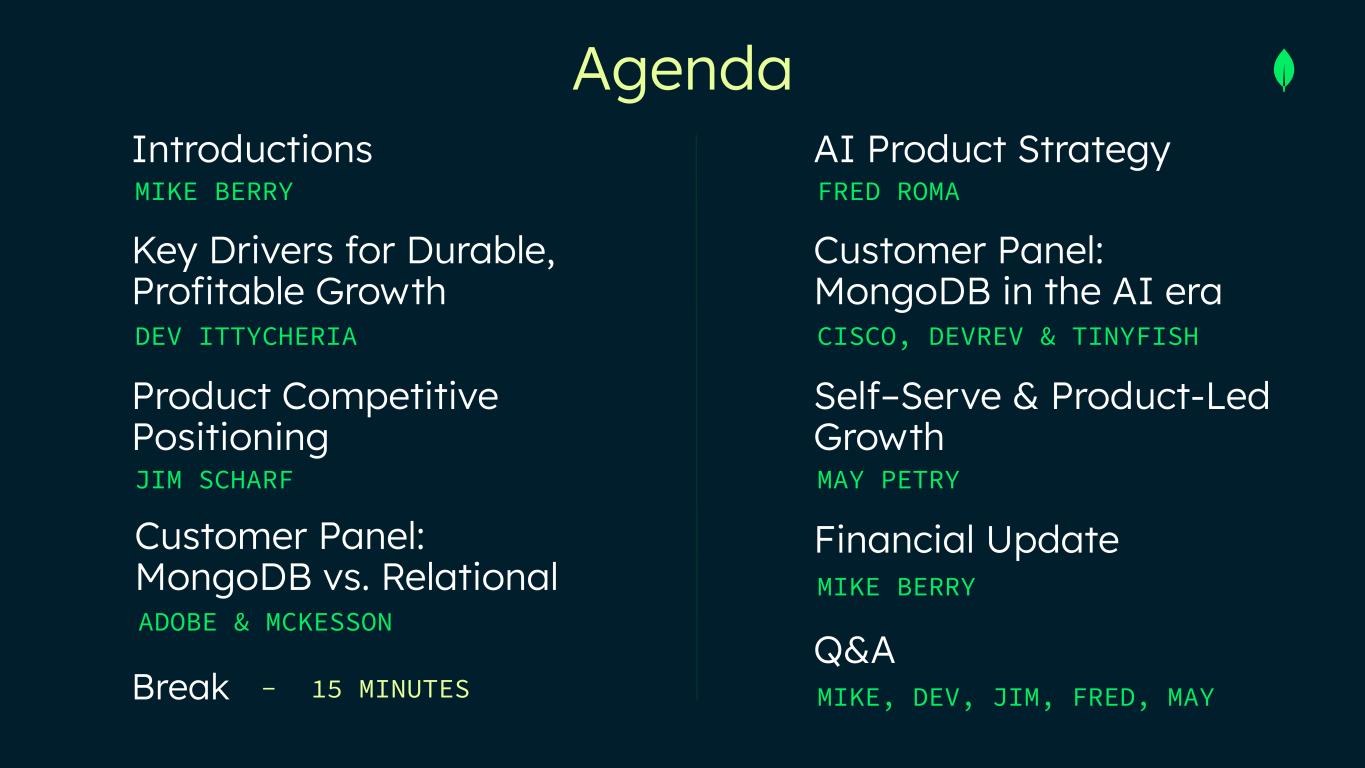

Customer Panel: MongoDB vs. Relational Key Drivers for Durable, Profitable Growth MIKE BERRY Agenda Introductions Break DEV ITTYCHERIA Product Competitive Positioning JIM SCHARF FRED ROMA AI Product Strategy Customer Panel: MongoDB in the AI era CISCO, DEVREV & TINYFISH Self–Serve & Product-Led Growth MAY PETRY Financial Update MIKE BERRY Q&A MIKE, DEV, JIM, FRED, MAY- 15 MINUTES ADOBE & MCKESSON

SEPTEMBER 2025 Key Drivers for Durable, Profitable Growth DEV ITTYCHERIA CHIEF EXECUTIVE OFFICER MONGODB

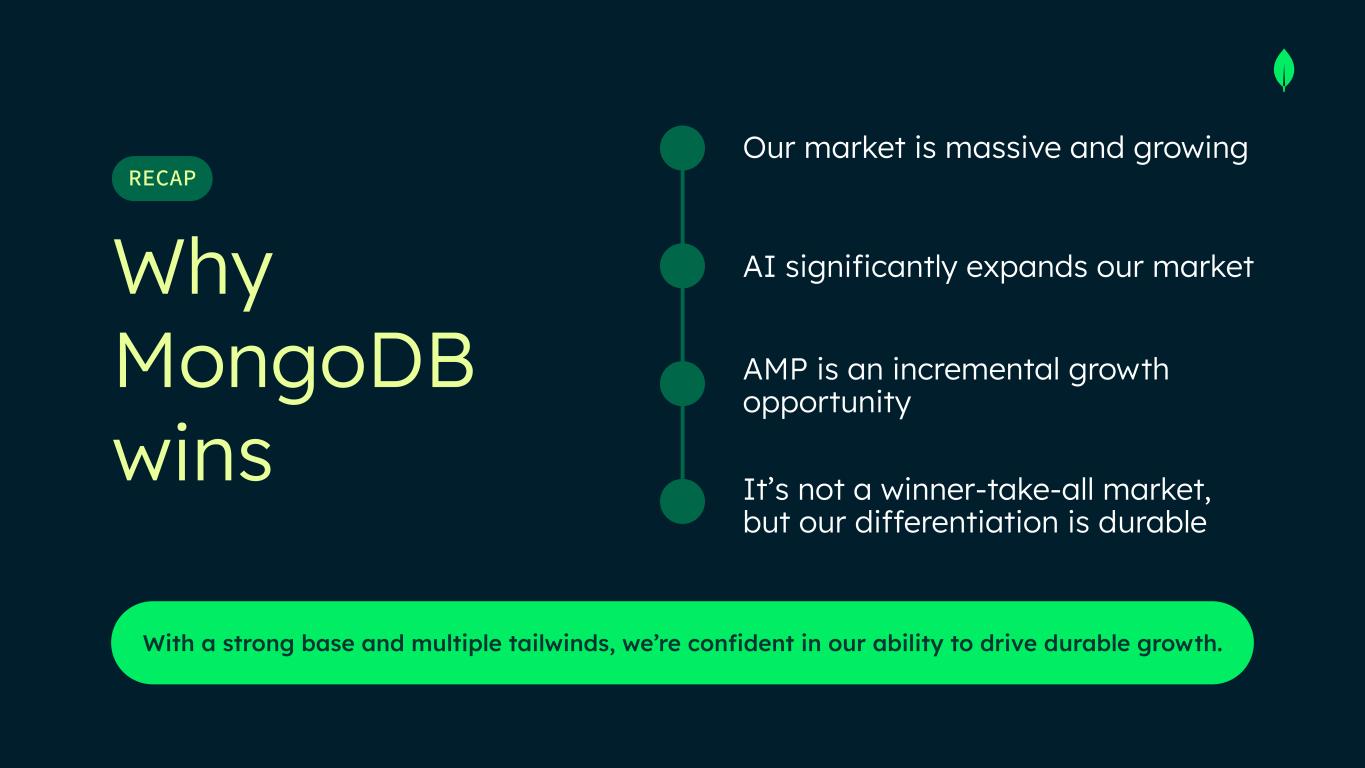

Our market is massive and growing What you’ll hear today & what you should take away AI significantly expands our market It’s not a winner-take-all market, but our differentiation is durable AMP is an incremental growth driver Multiple tailwinds will drive durable revenue growth

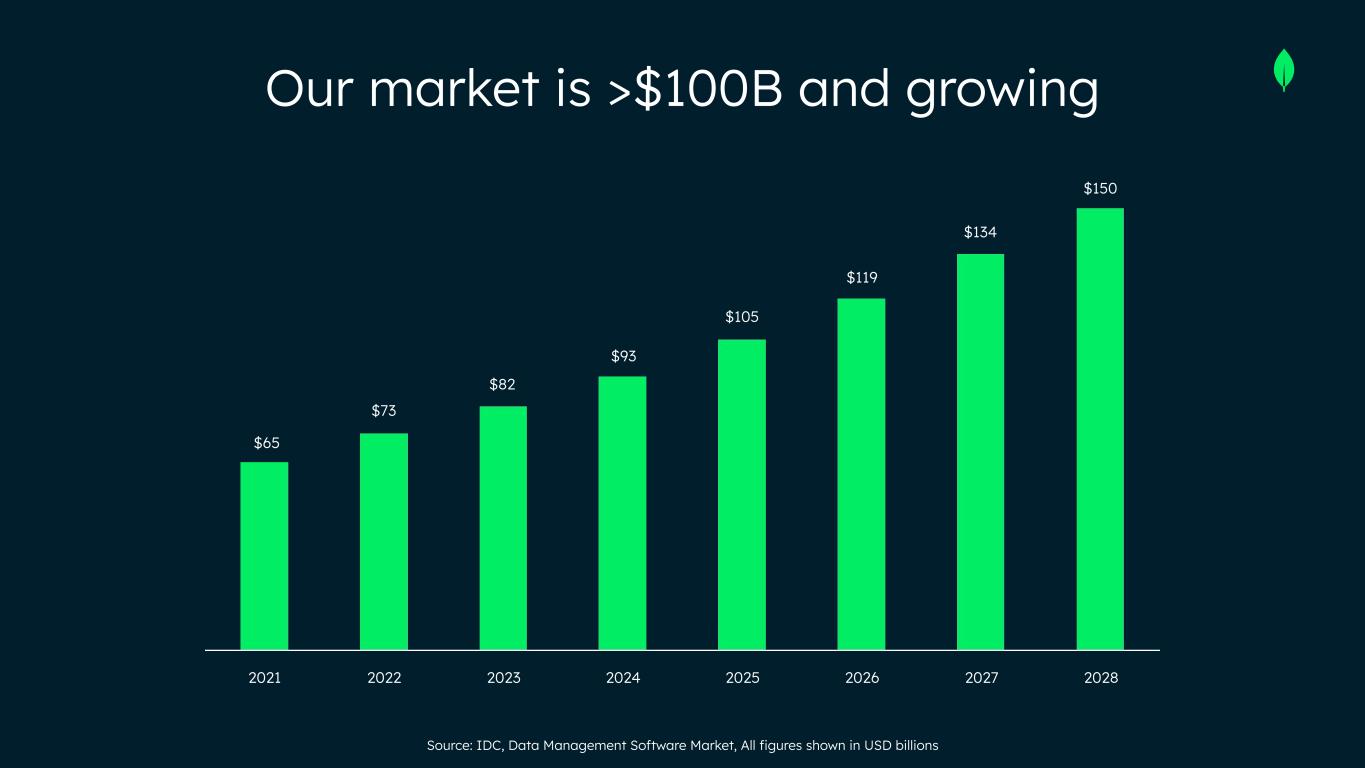

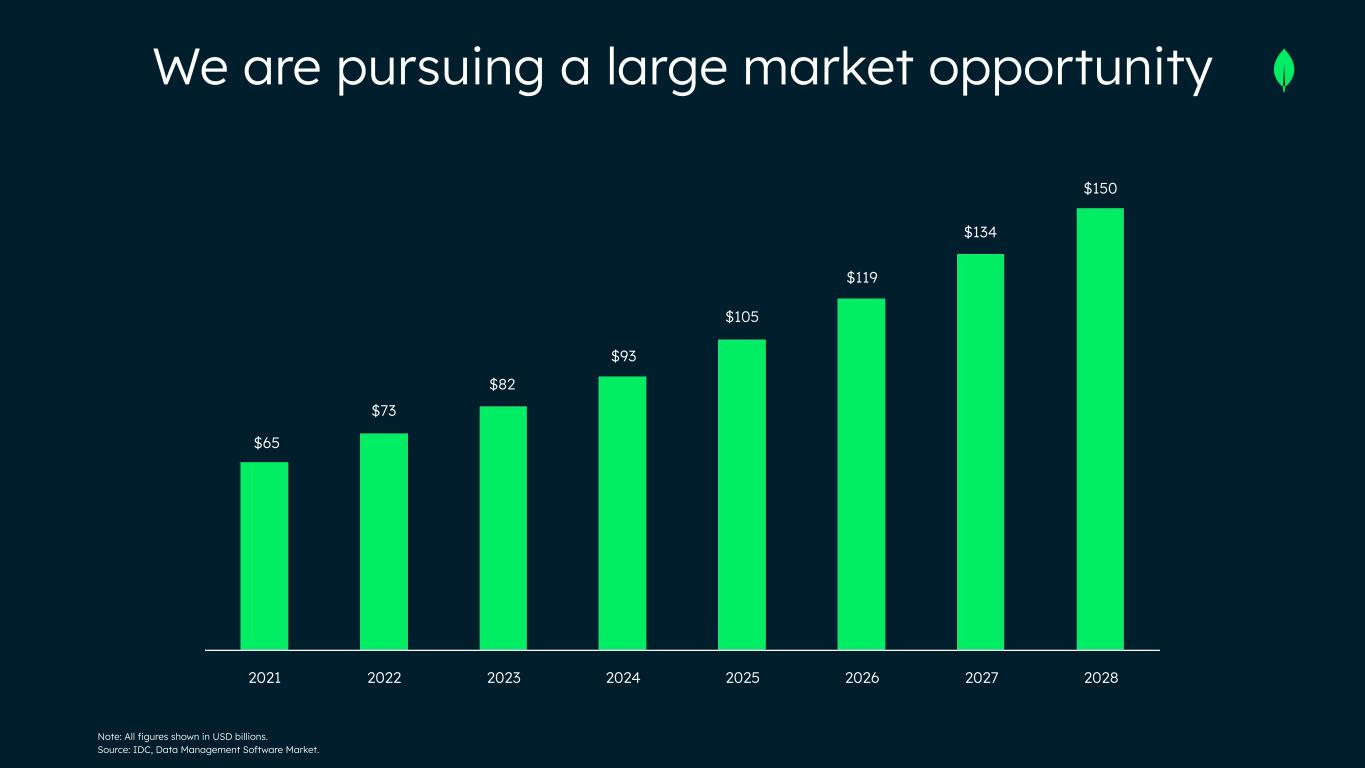

Source: IDC, Data Management Software Market, All figures shown in USD billions 2021 2022 2023 2024 2025 2026 2027 2028 $150 $134 $119 $105 $93 $82 $73 $65 Our market is >$100B and growing

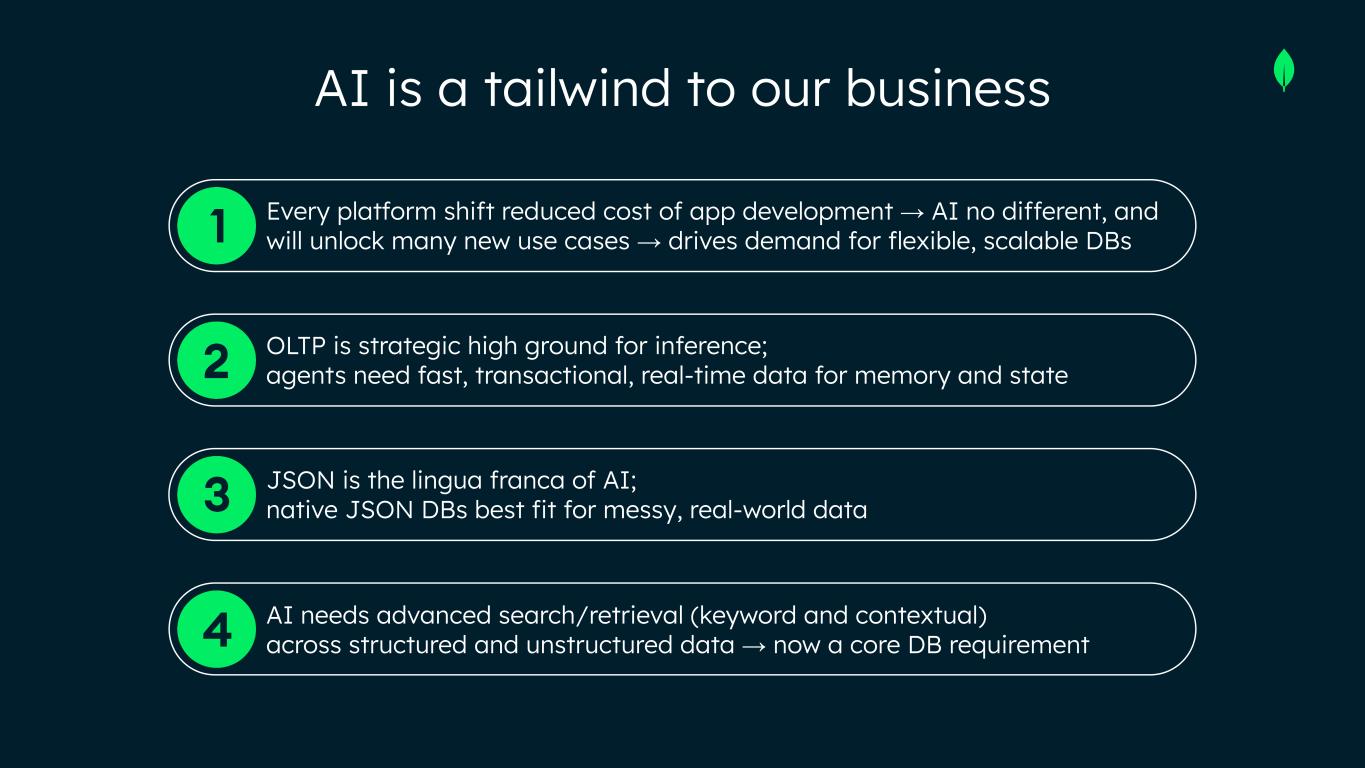

Every platform shift reduced cost of app development → AI no different, and will unlock many new use cases → drives demand for flexible, scalable DBs OLTP is strategic high ground for inference; agents need fast, transactional, real-time data for memory and state JSON is the lingua franca of AI; native JSON DBs best fit for messy, real-world data AI needs advanced search/retrieval (keyword and contextual) across structured and unstructured data → now a core DB requirement AI is a tailwind to our business

Before we talk about AI: how did we get to where we are today?

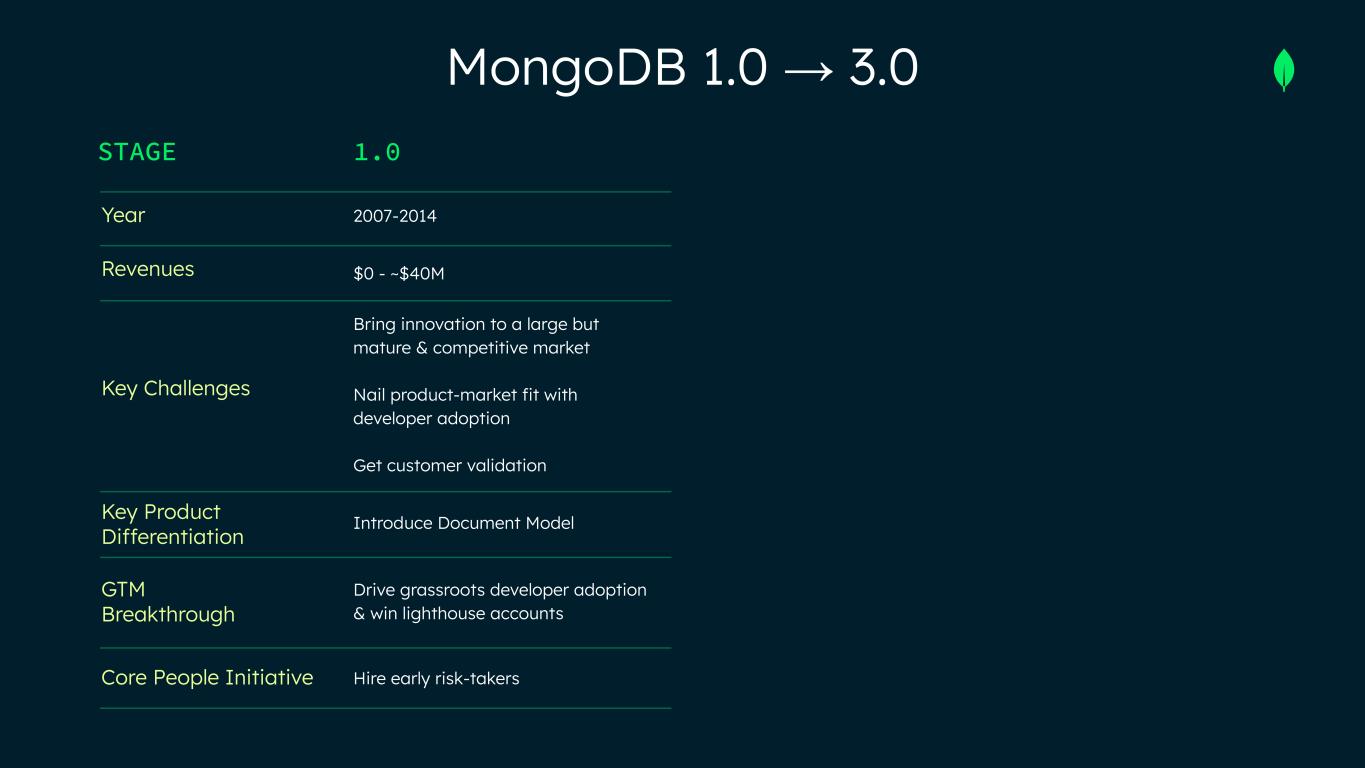

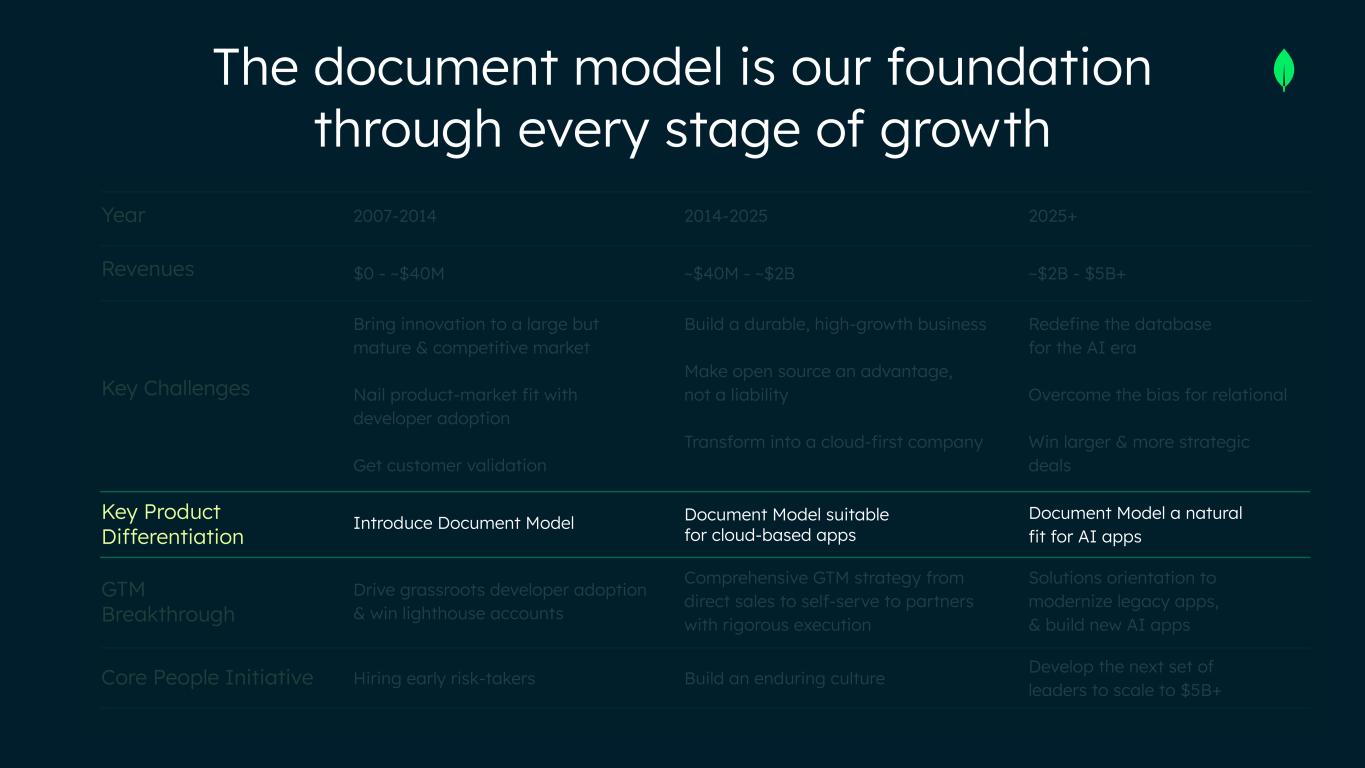

STAGE Year Revenues Key Challenges Key Product Differentiation GTM Breakthrough Core People Initiative MongoDB 1.0 → 3.0 1.0 2.0 3.0 2007-2014 $0 - ~$40M Bring innovation to a large but mature & competitive market Nail product-market fit with developer adoption Get customer validation Introduce Document Model Drive grassroots developer adoption & win lighthouse accounts Hire early risk-takers 2014-2025 ~$40M - ~$2B Build a durable, high-growth business Make open source an advantage, not a liability Transform into a cloud-first company Document Model suitable for cloud-based apps Comprehensive GTM strategy from direct sales to self-serve to partners with rigorous execution Build an enduring culture 2025+ ~$2B - $5B+ Redefine the database for the AI era Overcome the bias for relational Win larger & more strategic deals Document Model a natural fit for AI apps Solutions orientation to modernize legacy apps, & build new AI apps Develop the next set of leaders to scale to $5B+

STAGE Year Revenues Key Challenges Key Product Differentiation GTM Breakthrough Core People Initiative MongoDB 1.0 → 3.0 1.0 2.0 3.0 2007-2014 $0 - ~$40M Bring innovation to a large but mature & competitive market Nail product-market fit with developer adoption Get customer validation Introduce Document Model Drive grassroots developer adoption & win lighthouse accounts Hire early risk-takers 2014-2025 ~$40M - ~$2B Build a durable, high-growth business Make open source an advantage, not a liability Transform into a cloud-first company Document Model suitable for cloud-based apps Comprehensive GTM strategy from direct sales to self-serve to partners with rigorous execution Build an enduring culture 2025+ ~$2B - $5B+ Redefine the database for the AI era Overcome the bias for relational Win larger & more strategic deals Document Model a natural fit for AI apps Solutions orientation to modernize legacy apps, & build new AI apps Develop the next set of leaders to scale to $5B+

STAGE Year Revenues Key Challenges Key Product Differentiation GTM Breakthrough Core People Initiative MongoDB 1.0 → 3.0 1.0 2.0 3.0 2007-2014 $0 - ~$40M Bring innovation to a large but mature & competitive market Nail product-market fit with developer adoption Get customer validation Introduce Document Model Drive grassroots developer adoption & win lighthouse accounts Hire early risk-takers 2014-2025 ~$40M - ~$2B Build a durable, high-growth business Make open source an advantage, not a liability Transform into a cloud-first company Document Model suitable for cloud-based apps Comprehensive GTM strategy from direct sales to self-serve to partners with rigorous execution Build an enduring culture 2025+ ~$2B - $5B+ Redefine the database for the AI era Overcome the bias for relational Win larger & more strategic deals Document Model a natural fit for AI apps Solutions orientation to modernize legacy apps, & build new AI apps Develop the next set of leaders to scale to $5B+

Year Revenues Key Challenges GTM Breakthrough Core People Initiative The document model is our foundation through every stage of growth 2007-2014 $0 - ~$40M Bring innovation to a large but mature & competitive market Nail product-market fit with developer adoption Get customer validation Drive grassroots developer adoption & win lighthouse accounts Hiring early risk-takers 2014-2025 ~$40M - ~$2B Build a durable, high-growth business Make open source an advantage, not a liability Transform into a cloud-first company Comprehensive GTM strategy from direct sales to self-serve to partners with rigorous execution Build an enduring culture 2025+ ~$2B - $5B+ Redefine the database for the AI era Overcome the bias for relational Win larger & more strategic deals Solutions orientation to modernize legacy apps, & build new AI apps Develop the next set of leaders to scale to $5B+ Key Product Differentiation Introduce Document Model Document Model suitable for cloud-based apps Document Model a natural fit for AI apps

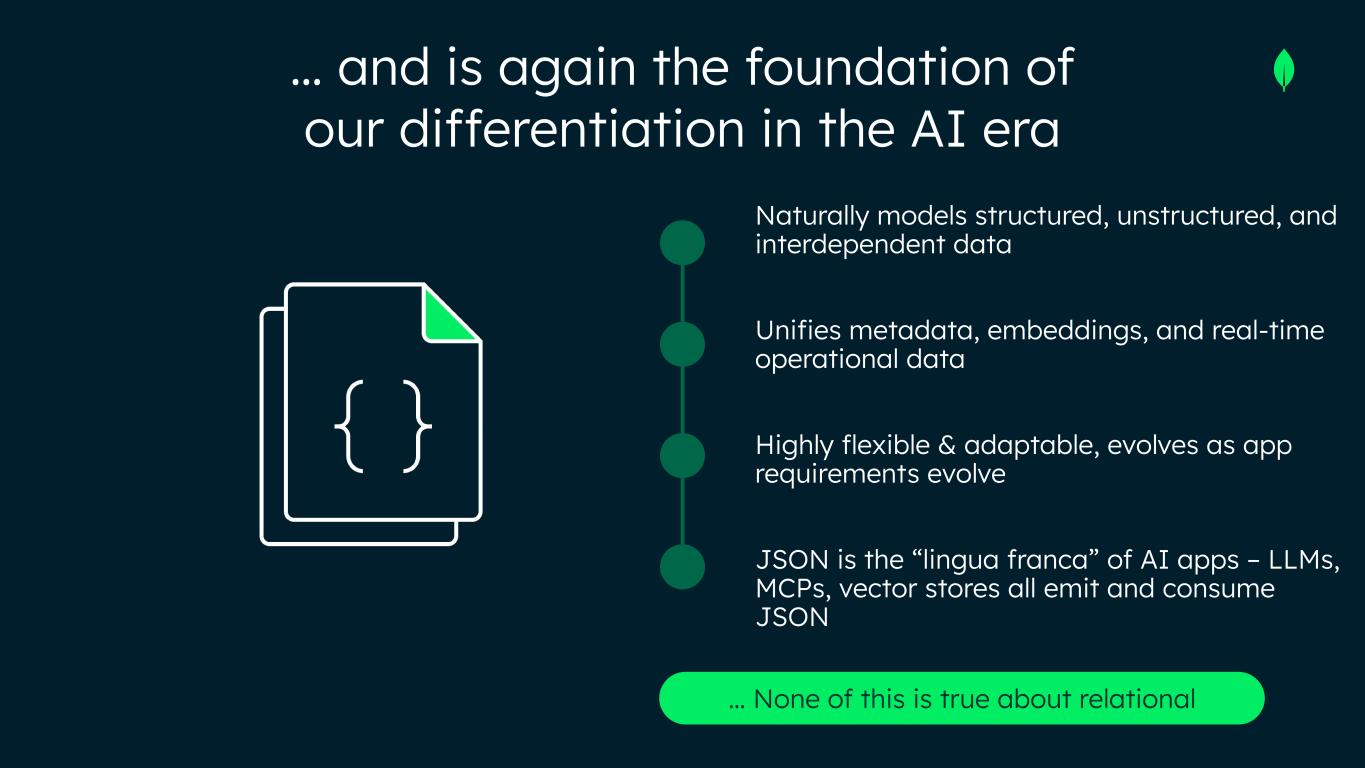

… and is again the foundation of our differentiation in the AI era Naturally models structured, unstructured, and interdependent data Unifies metadata, embeddings, and real-time operational data Highly flexible & adaptable, evolves as app requirements evolve JSON is the “lingua franca” of AI apps – LLMs, MCPs, vector stores all emit and consume JSON … None of this is true about relational

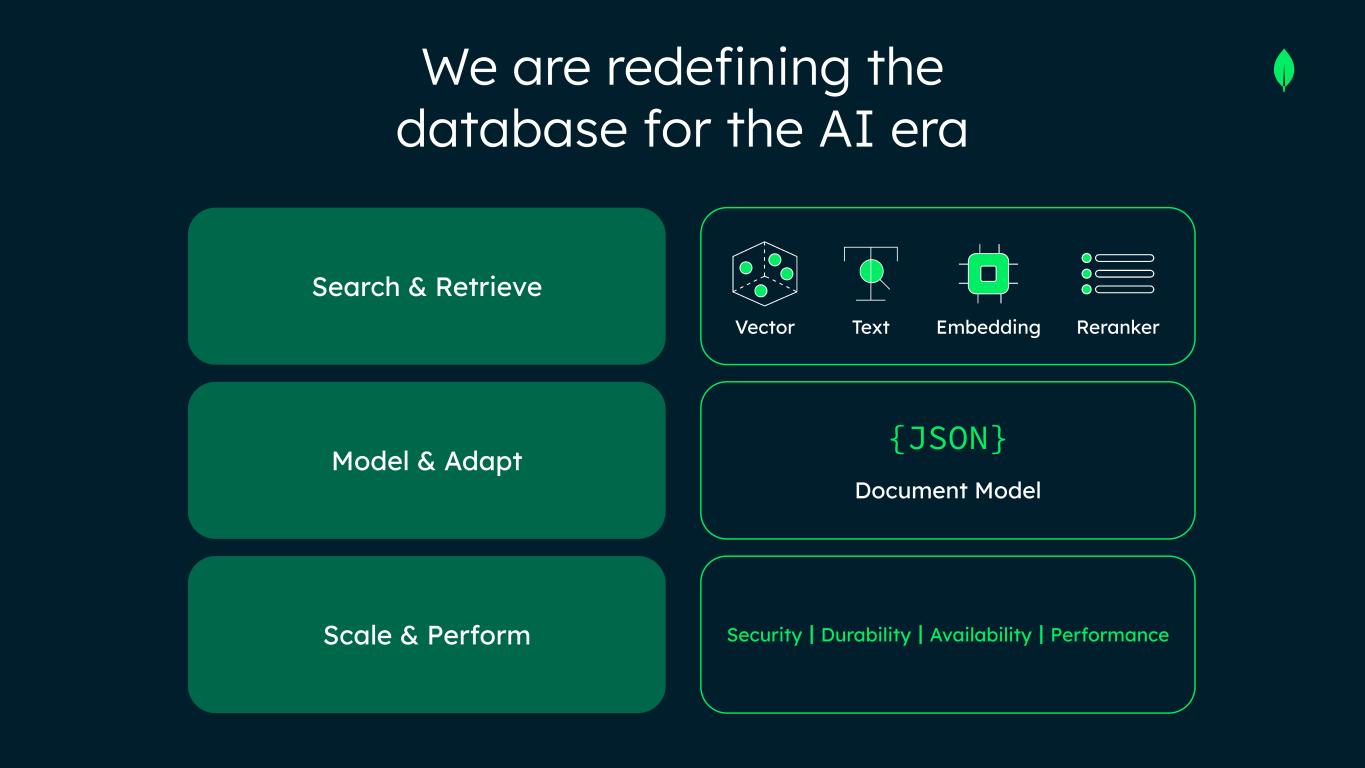

Search & Retrieve Model & Adapt Scale & Perform Security┃Durability┃Availability┃Performance {JSON} Document Model Vector Text Embedding Reranker We are redefining the database for the AI era

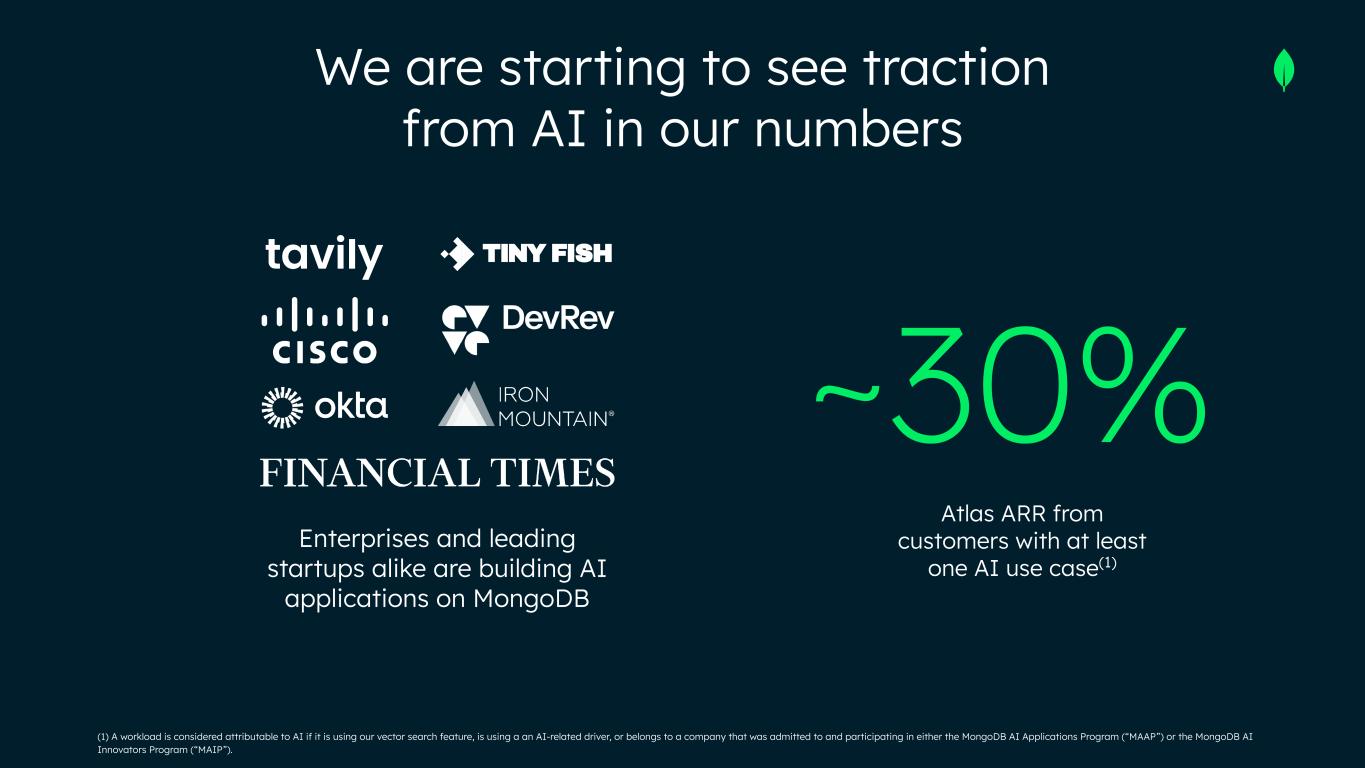

We are starting to see traction from AI in our numbers (1) A workload is considered attributable to AI if it is using our vector search feature, is using a an AI-related driver, or belongs to a company that was admitted to and participating in either the MongoDB AI Applications Program (“MAAP”) or the MongoDB AI Innovators Program (“MAIP”). ~30% Enterprises and leading startups alike are building AI applications on MongoDB Atlas ARR from customers with at least one AI use case(1)

Our core market remains large, but pursuing the legacy relational market is an incremental growth opportunity

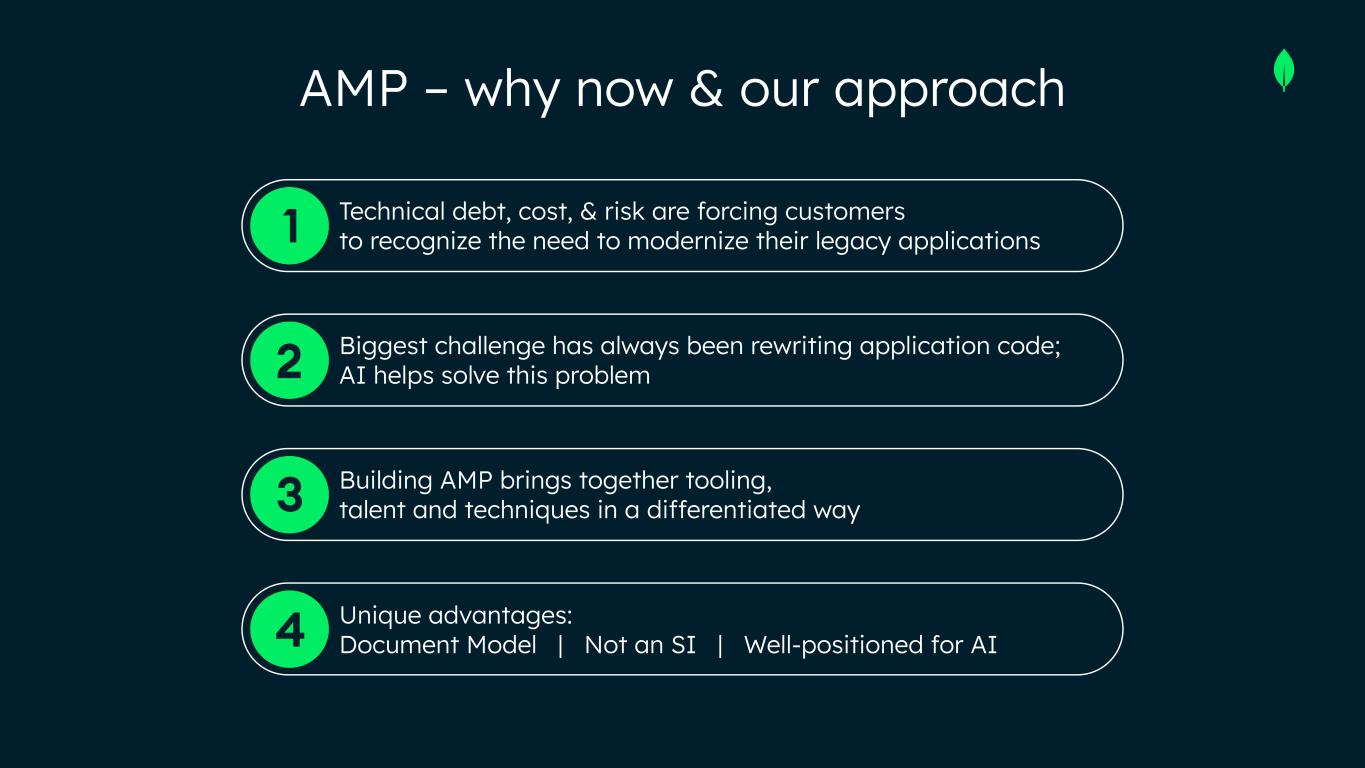

AMP – why now & our approach Technical debt, cost, & risk are forcing customers to recognize the need to modernize their legacy applications Biggest challenge has always been rewriting application code; AI helps solve this problem Building AMP brings together tooling, talent and techniques in a differentiated way Unique advantages: Document Model | Not an SI | Well-positioned for AI

We continue to win against the competition

We have a track record of winning against competition Stage 1.0 2.0 3.0 Year 2007-2014 2014-2025 2025+ “You’re just one of many niche NoSQL players – you’re not enterprise-ready” “You won’t be able to both partner and compete with the hyperscalers” “Postgres is emerging as a standard instead of MongoDB”

Our differentiation against relational is real & durable

We win due to the limitations of the architecture of relational databases Rigid schema Brittle Hard to adapt Difficult to scale

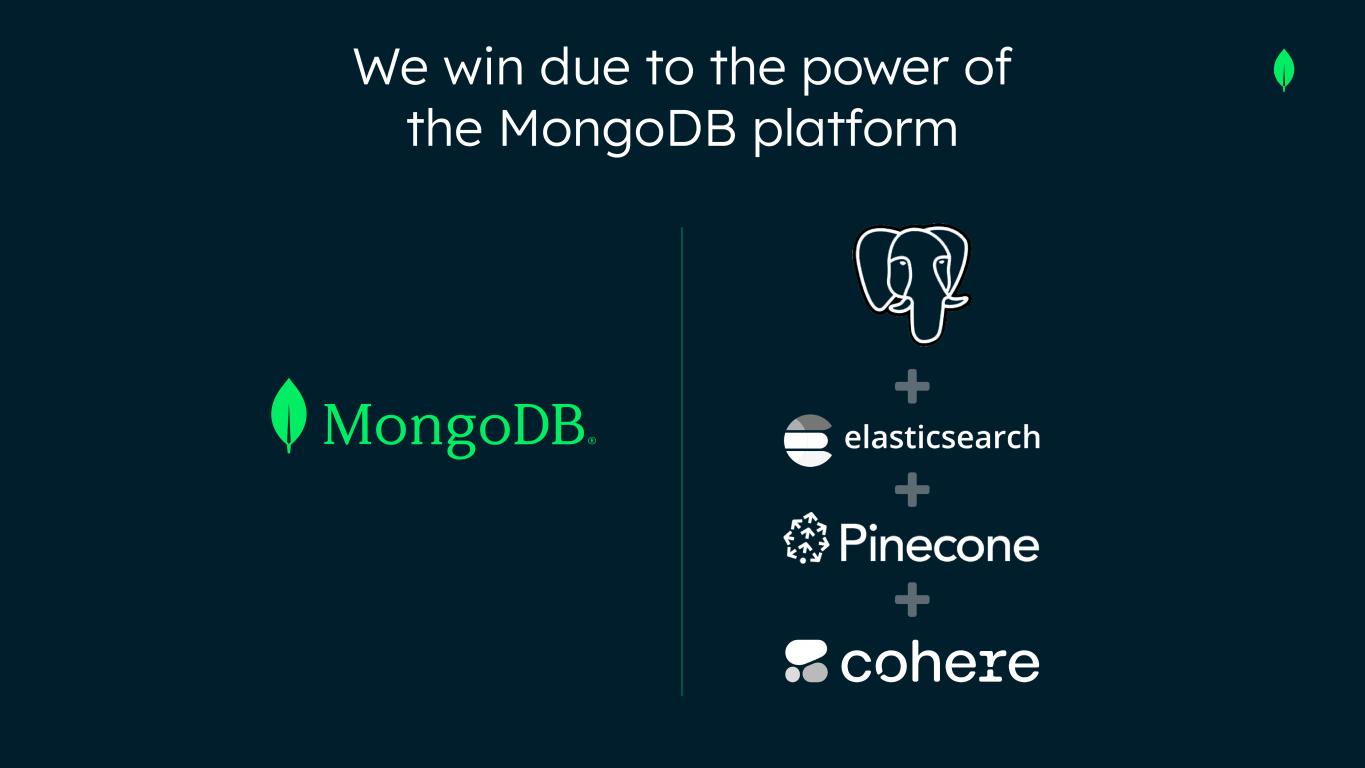

We win due to the power of the MongoDB platform

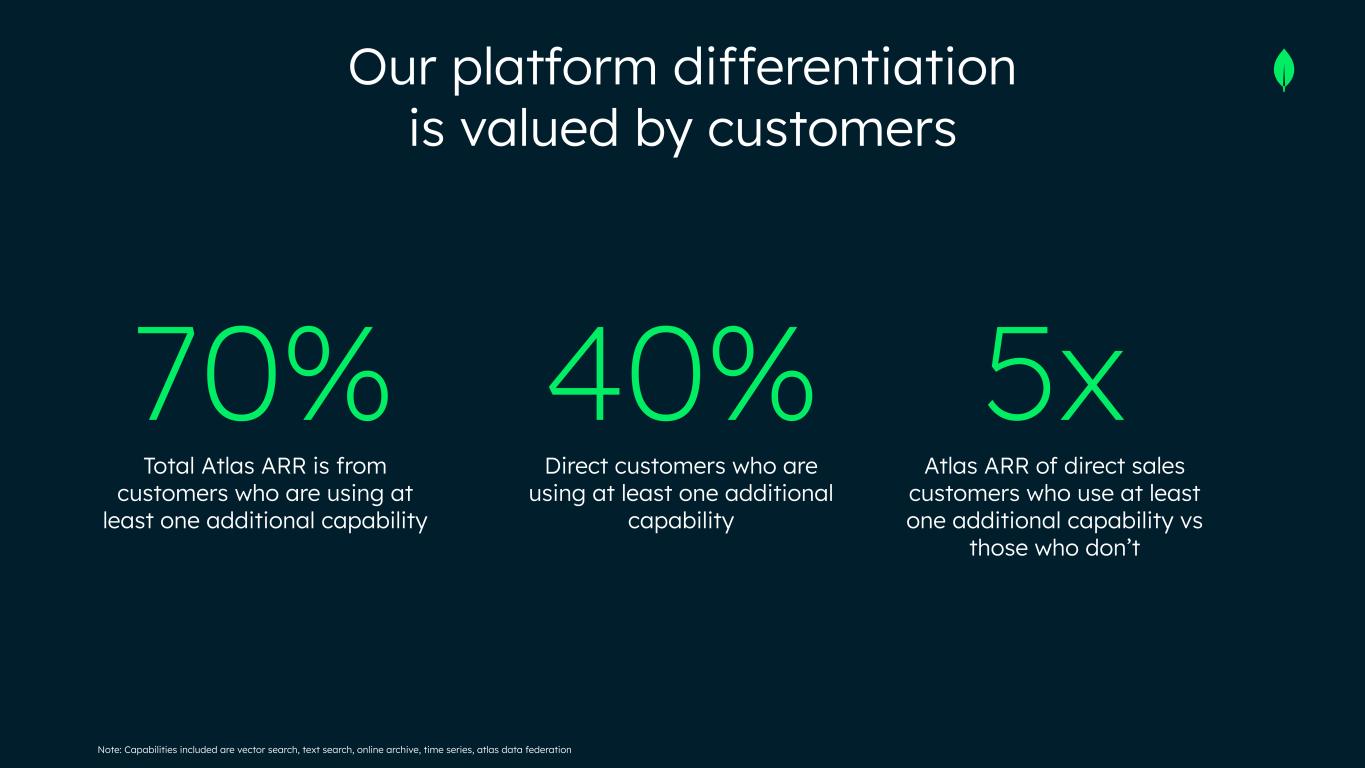

Note: Capabilities included are vector search, text search, online archive, time series, atlas data federation 70% Total Atlas ARR is from customers who are using at least one additional capability 5x Atlas ARR of direct sales customers who use at least one additional capability vs those who don’t 40% Direct customers who are using at least one additional capability Our platform differentiation is valued by customers

Driving sales productivity by allocating resources to the highest ROI channels Consistently releasing new capabilities to meet the needs of bleeding edge applications Increasing mindshare and education initiatives in the developer community We are working to both strengthen this differentiation and how we communicate it PRODUCT GTMMARKETING

Why MongoDB wins With a strong base and multiple tailwinds, we’re confident in our ability to drive durable growth. RECAP Our market is massive and growing AI significantly expands our market AMP is an incremental growth opportunity It’s not a winner-take-all market, but our differentiation is durable

Product Competitive Positioning SEPTEMBER 2025 JIM SCHARF CHIEF TECHNOLOGY OFFICER MONGODB

Agenda Foundation MongoDB 8.0 Queryable Encryption Horizontal Scaling Run Anywhere AMP

MongoDB Foundation Document Model

MongoDB Foundation Document Model Security Durability Availability Performance

MongoDB has unique foundational capabilities that position us well against relational and Postgres to win mission-critical, enterprise applications.

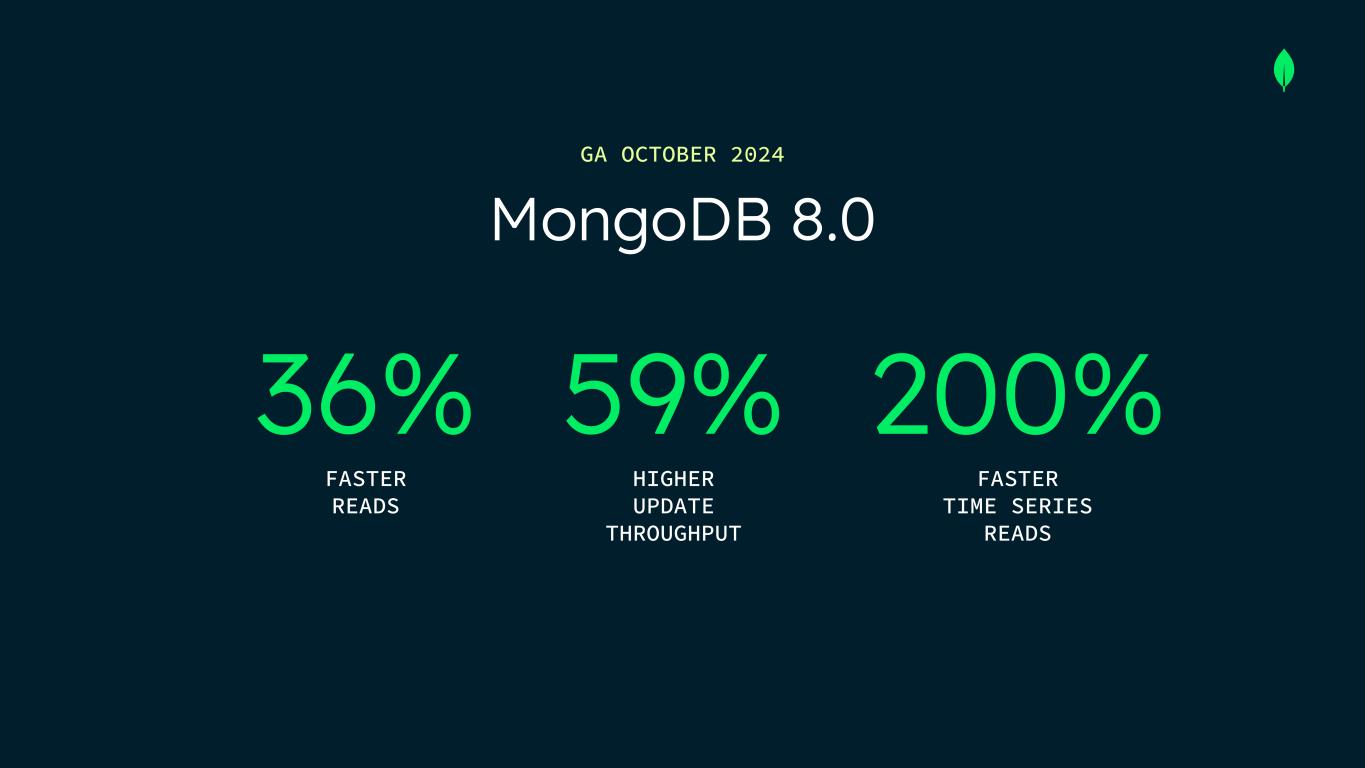

MongoDB 8.0

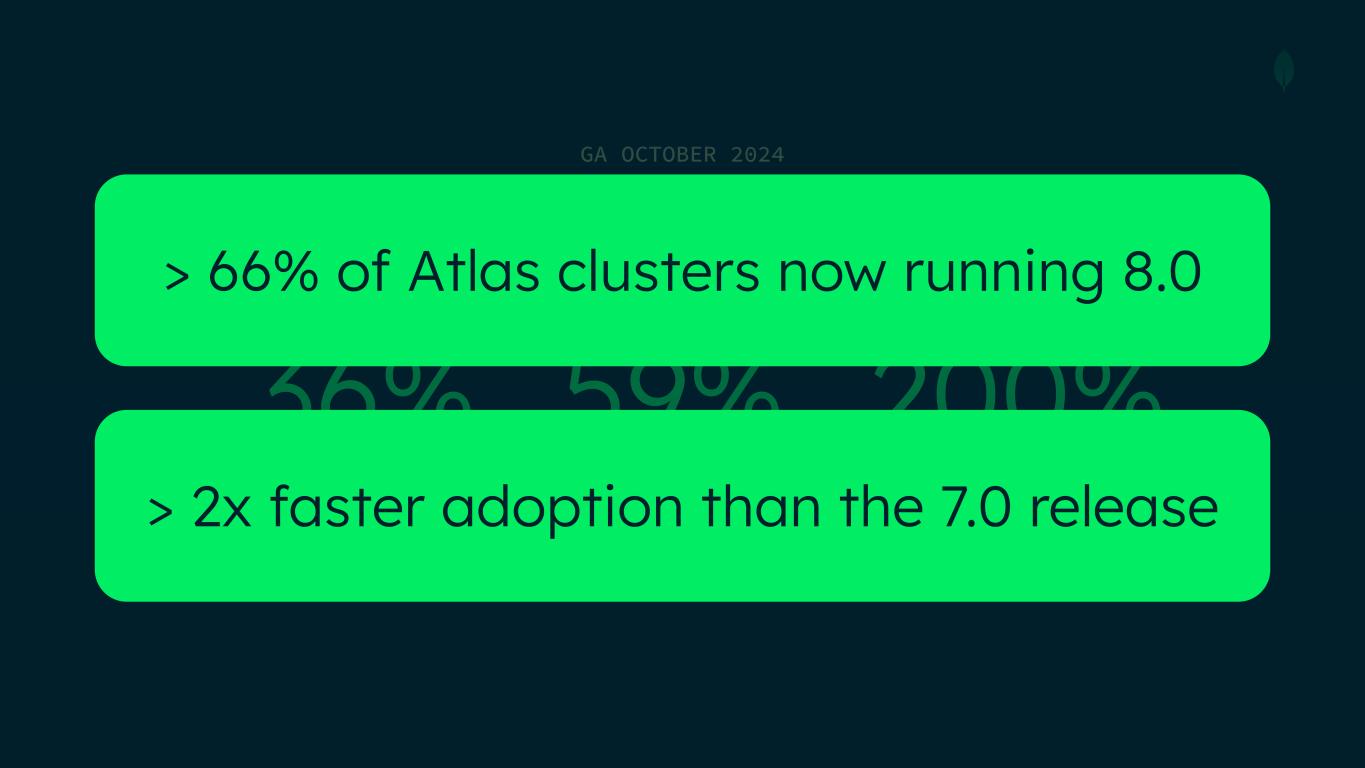

HIGHER UPDATE THROUGHPUT FASTER READS MongoDB 8.0 59%36% GA OCTOBER 2024 FASTER TIME SERIES READS 200%

HIGHER UPDATE THROUGHPUT FASTER READS MongoDB 8.0 59%36% GA OCTOBER 2024 FASTER TIME SERIES READS 200% > 66% of Atlas clusters now running 8.0 > 2x faster adoption than the 7.0 release

MongoDB 8.2 NEW

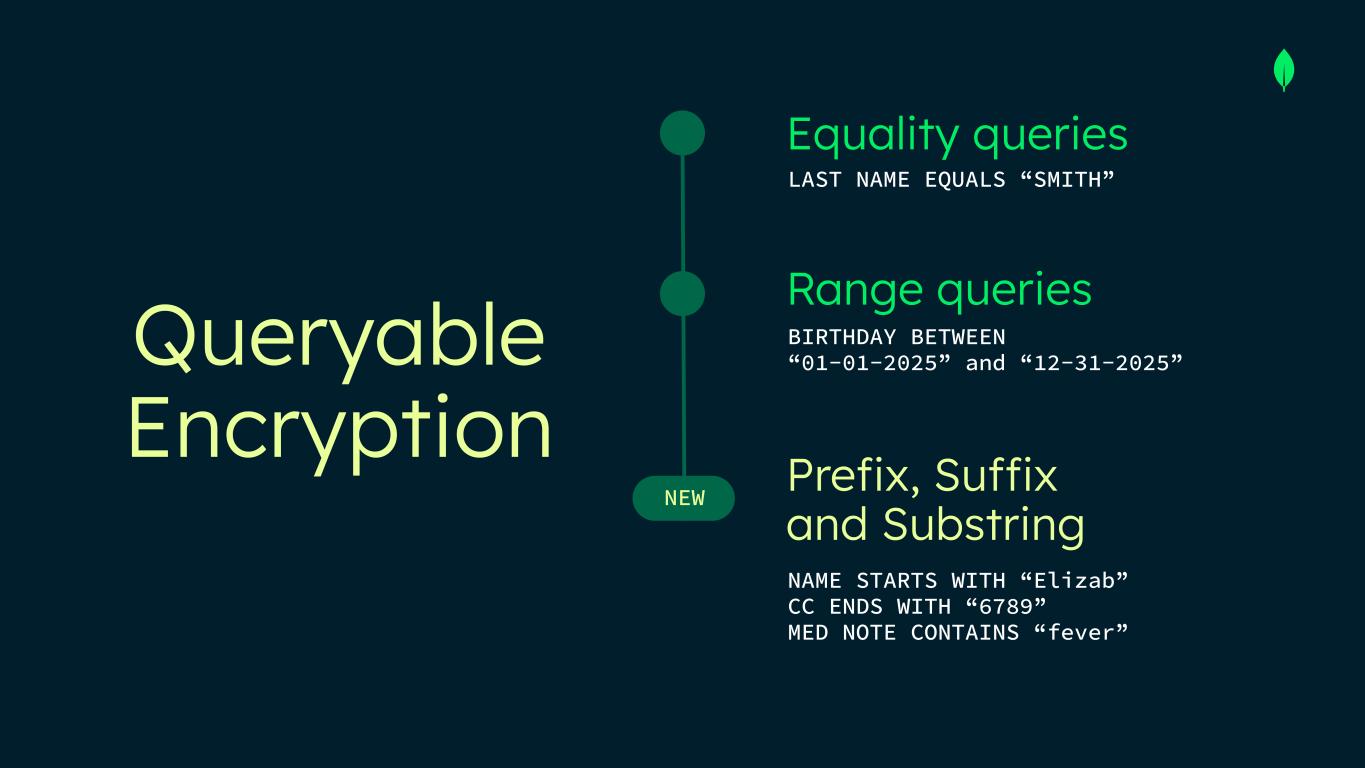

Queryable Encryption Equality queries NEW LAST NAME EQUALS “SMITH” BIRTHDAY BETWEEN “01-01-2025” and “12-31-2025” NAME STARTS WITH “Elizab” CC ENDS WITH “6789” MED NOTE CONTAINS “fever” Range queries Prefix, Suffix and Substring

QE makes MongoDB suitable for applications with sensitive data in across a range of industries HEALTH & BENEFITS TELECOMMUNICATIONSGOVERNMENTTECHNOLOGY

Horizontal Scaling

VERTICAL SCALING $ $

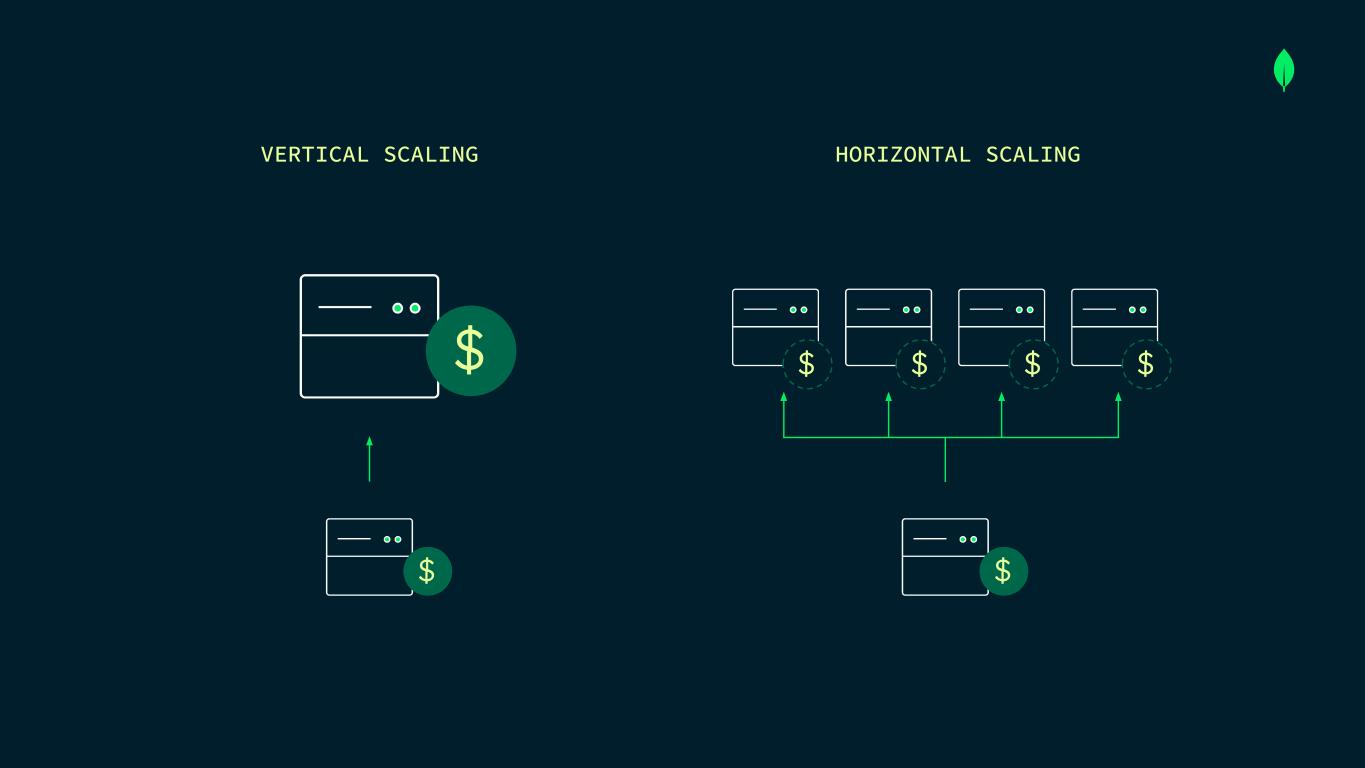

VERTICAL SCALING HORIZONTAL SCALING $ $ $ $ $ $$

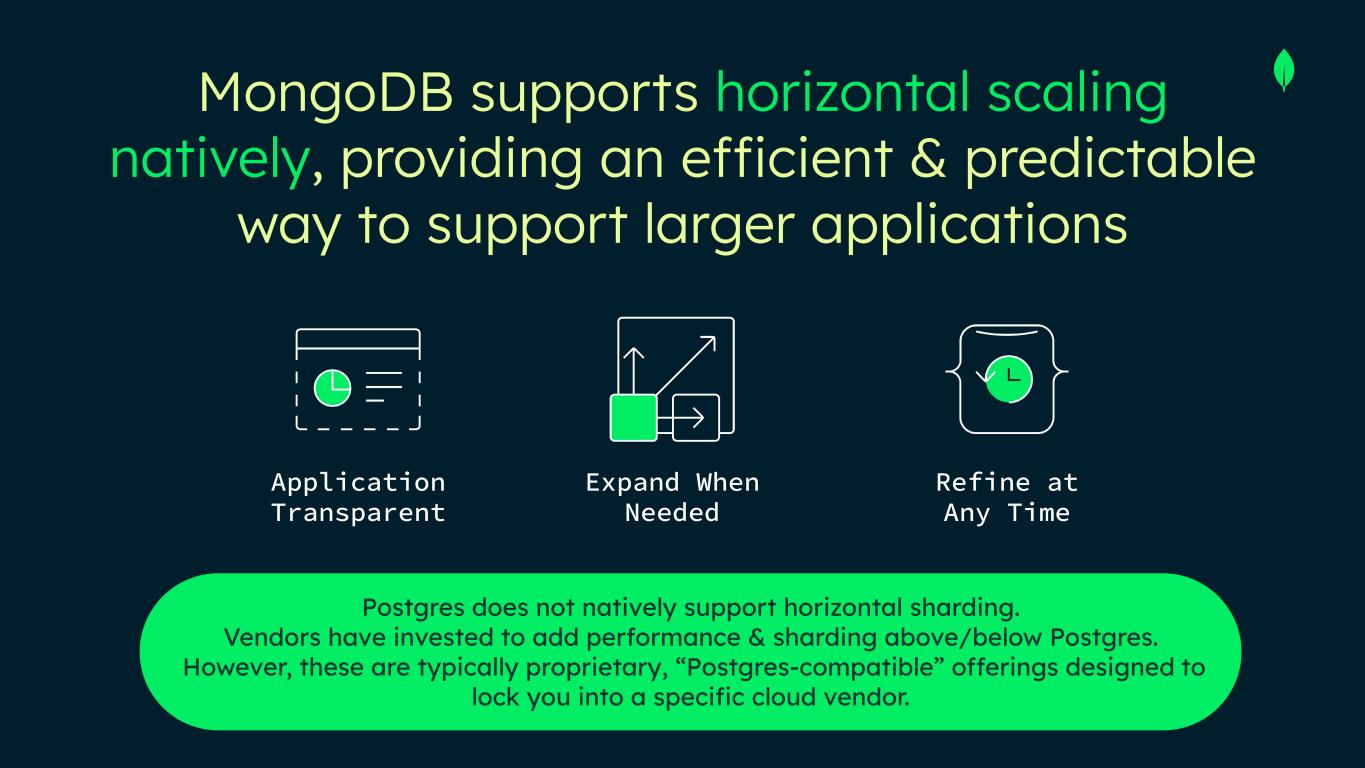

Postgres does not natively support horizontal sharding. Vendors have invested to add performance & sharding above/below Postgres. However, these are typically proprietary, “Postgres-compatible” offerings designed to lock you into a specific cloud vendor. MongoDB supports horizontal scaling natively, providing an efficient & predictable way to support larger applications Application Transparent Expand When Needed Refine at Any Time

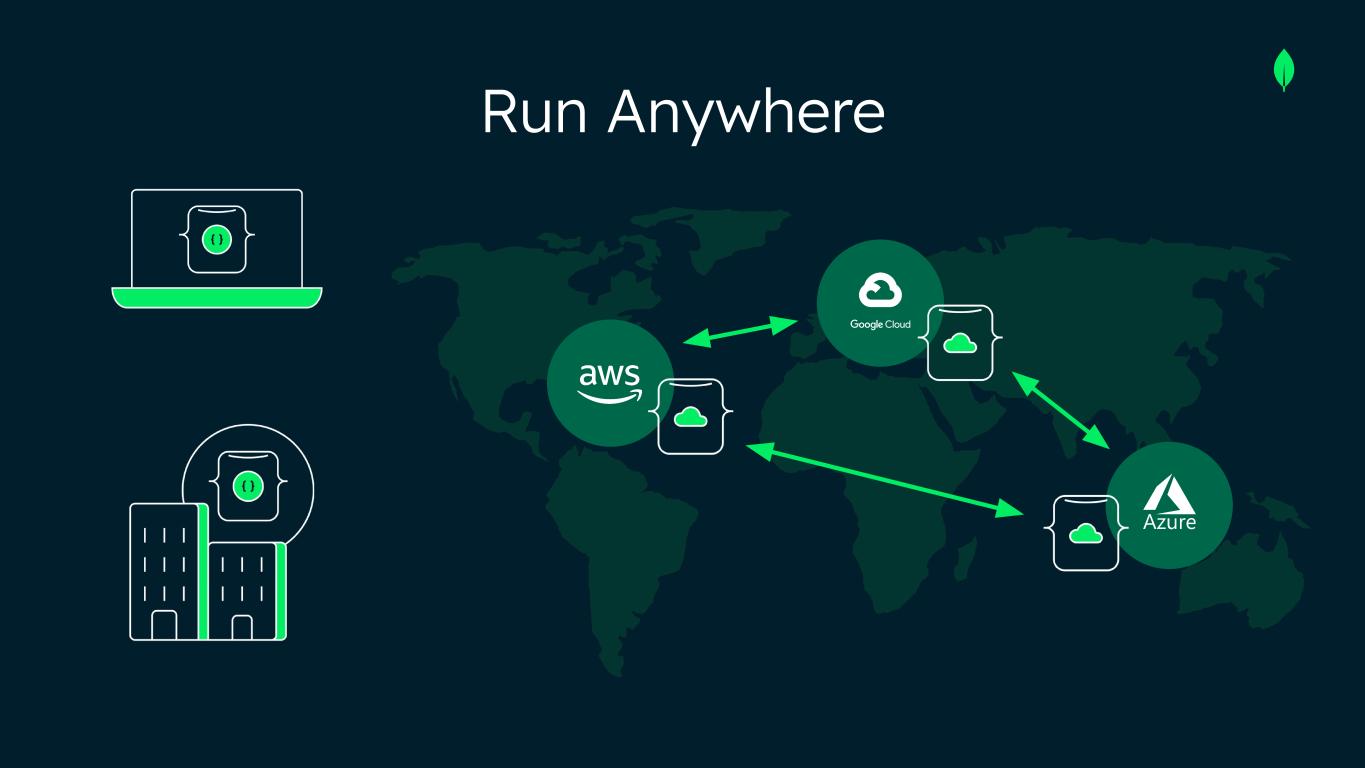

Run Anywhere

Run Anywhere

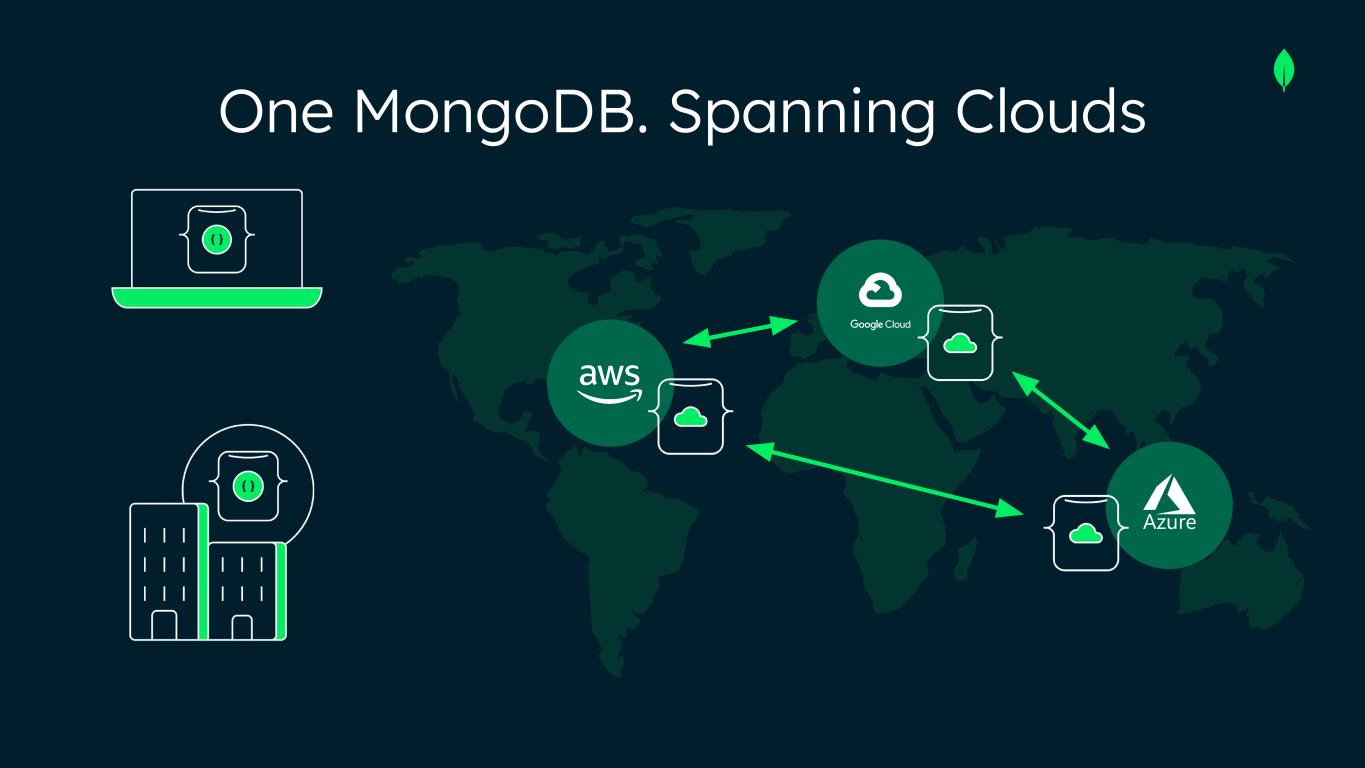

One MongoDB. Spanning Clouds

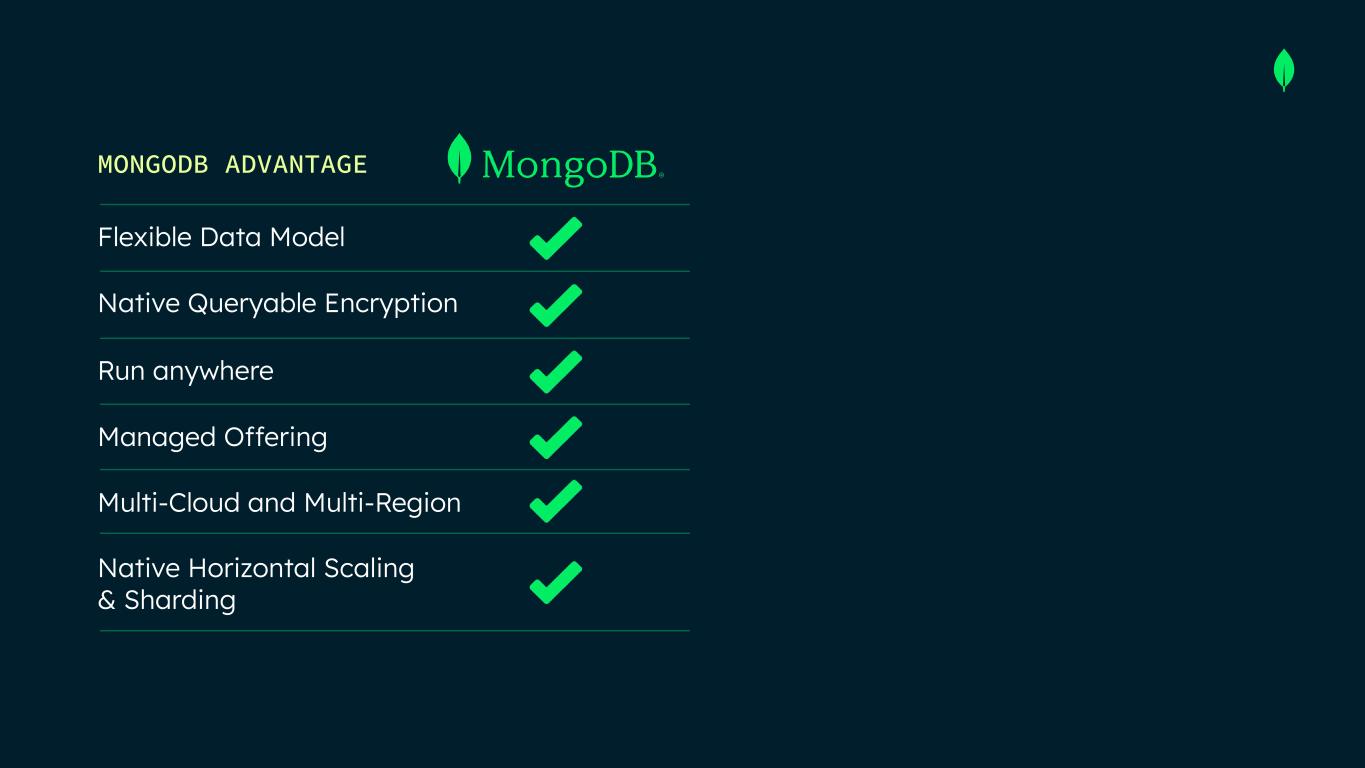

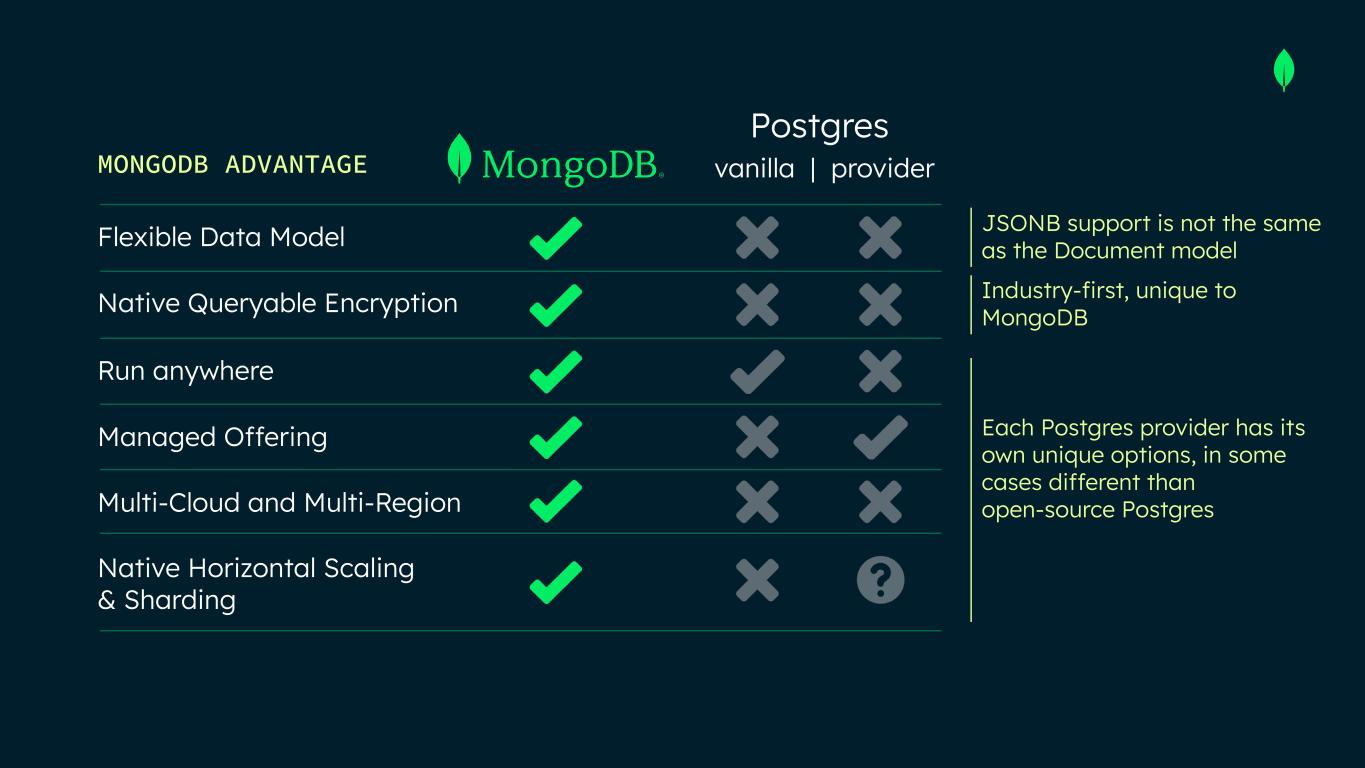

MONGODB ADVANTAGE Flexible Data Model Native Queryable Encryption Run anywhere Managed Offering Multi-Cloud and Multi-Region Native Horizontal Scaling & Sharding

Postgres Each Postgres provider has its own unique options, in some cases different than open-source Postgres JSONB support is not the same as the Document model MONGODB ADVANTAGE Flexible Data Model Native Queryable Encryption Run anywhere Managed Offering Multi-Cloud and Multi-Region Native Horizontal Scaling & Sharding vanilla | provider Industry-first, unique to MongoDB

Application Modernization Platform MongoDBNEW

Application Modernization Platform MongoDBNEW Partnered with our enterprise customers over recent years

Application Modernization Platform MongoDBNEW Partnered with our enterprise customers over recent years Developed AI-powered Tools and are combining with modernization Techniques & Expertise

Application Modernization Platform Partnered with our enterprise customers over recent yearsMongoDBNEW Initial target is Java & Oracle applications Developed AI-powered Tools and are combining with modernization Techniques & Expertise

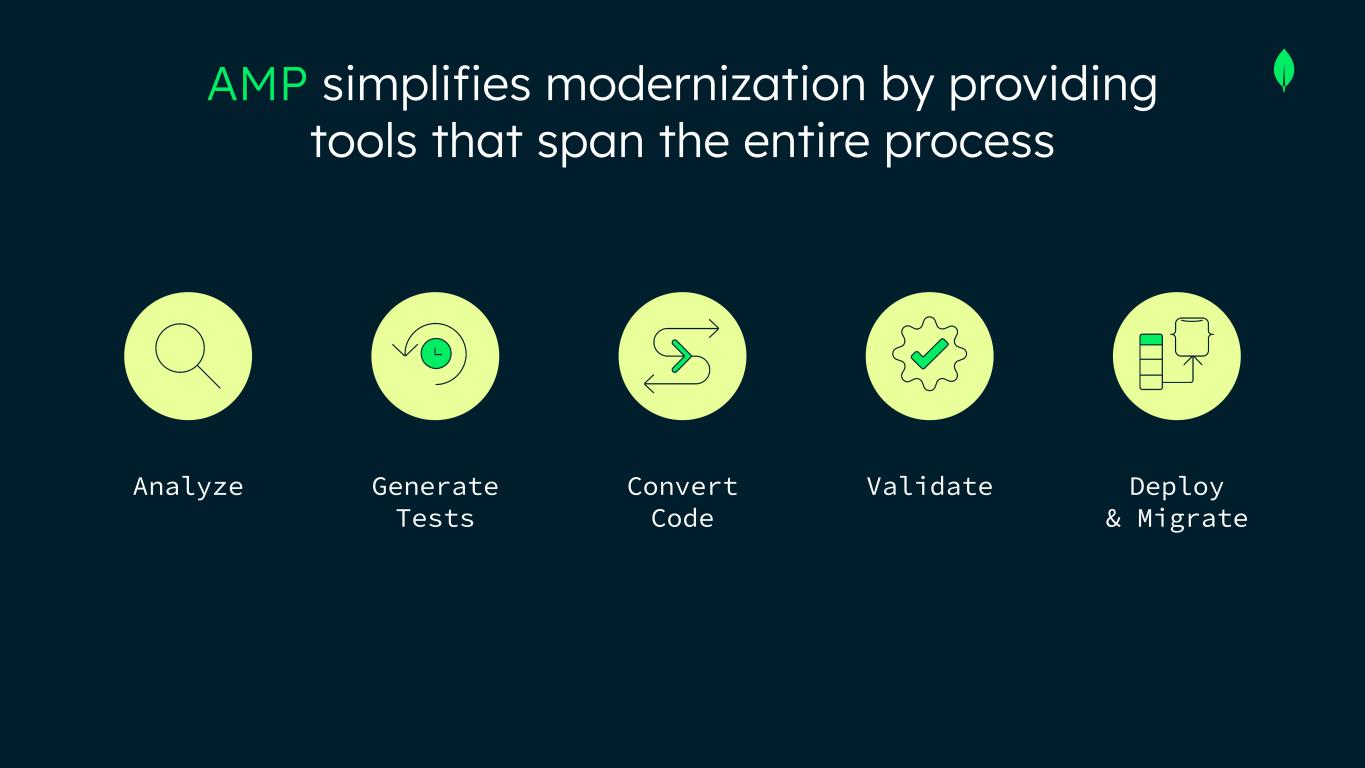

AMP simplifies modernization by providing tools that span the entire process Analyze Generate Tests Convert Code Validate Deploy & Migrate

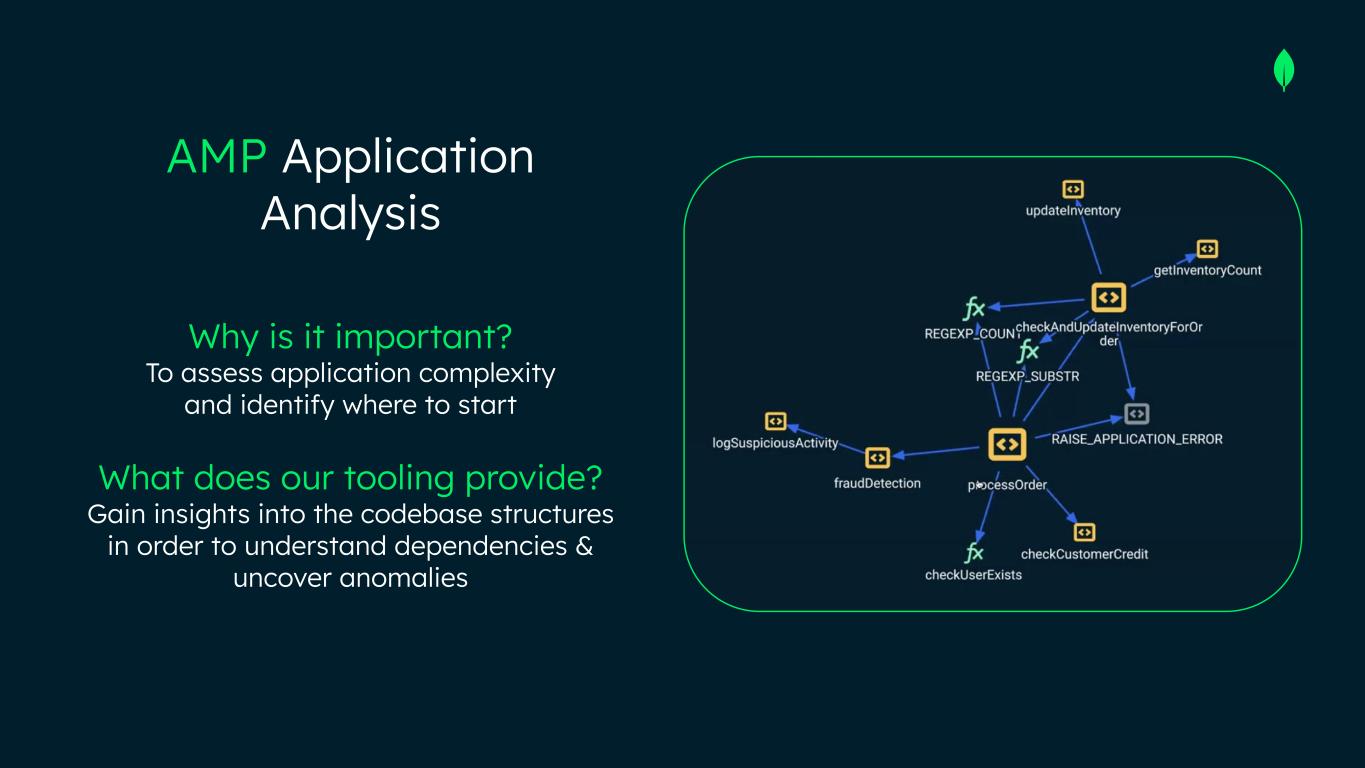

Why is it important? To assess application complexity and identify where to start What does our tooling provide? Gain insights into the codebase structures in order to understand dependencies & uncover anomalies AMP Application Analysis

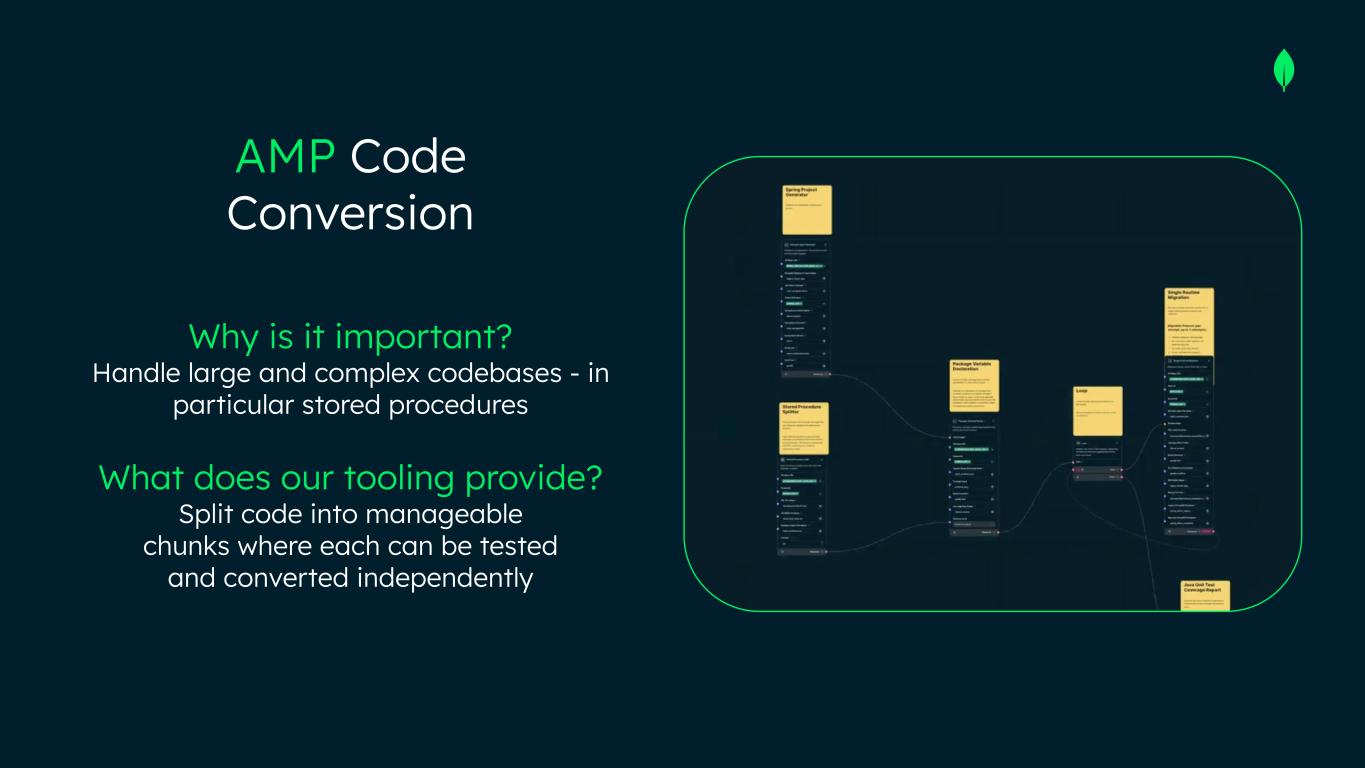

Why is it important? Handle large and complex codebases - in particular stored procedures What does our tooling provide? Split code into manageable chunks where each can be tested and converted independently AMP Code Conversion

AMP in Action FASTER DEVELOPMENT 200% REDUCTION IN MIGRATION TIME 90% FASTER MIGRATION >50x

CO-FOUNDER & CEO Investor Day Customer Testimonial: MongoDB vs. Relational DIMITRI SIROTA

Customer Panel: MongoDB vs. Relational Investor Day TOM VALLETTA ENTERPRISE ARCHITECT AT ADOBE WORKFRONT SCOTT MOONEY VP DISTRIBUTION OPERATIONS

Break / Lunch 15 MINUTE

SEPTEMBER 2025 AI Product Strategy FRED ROMA SVP, ATLAS DATA SERVICES MONGODB

The Journey from Pilot to Production Operating & Scaling

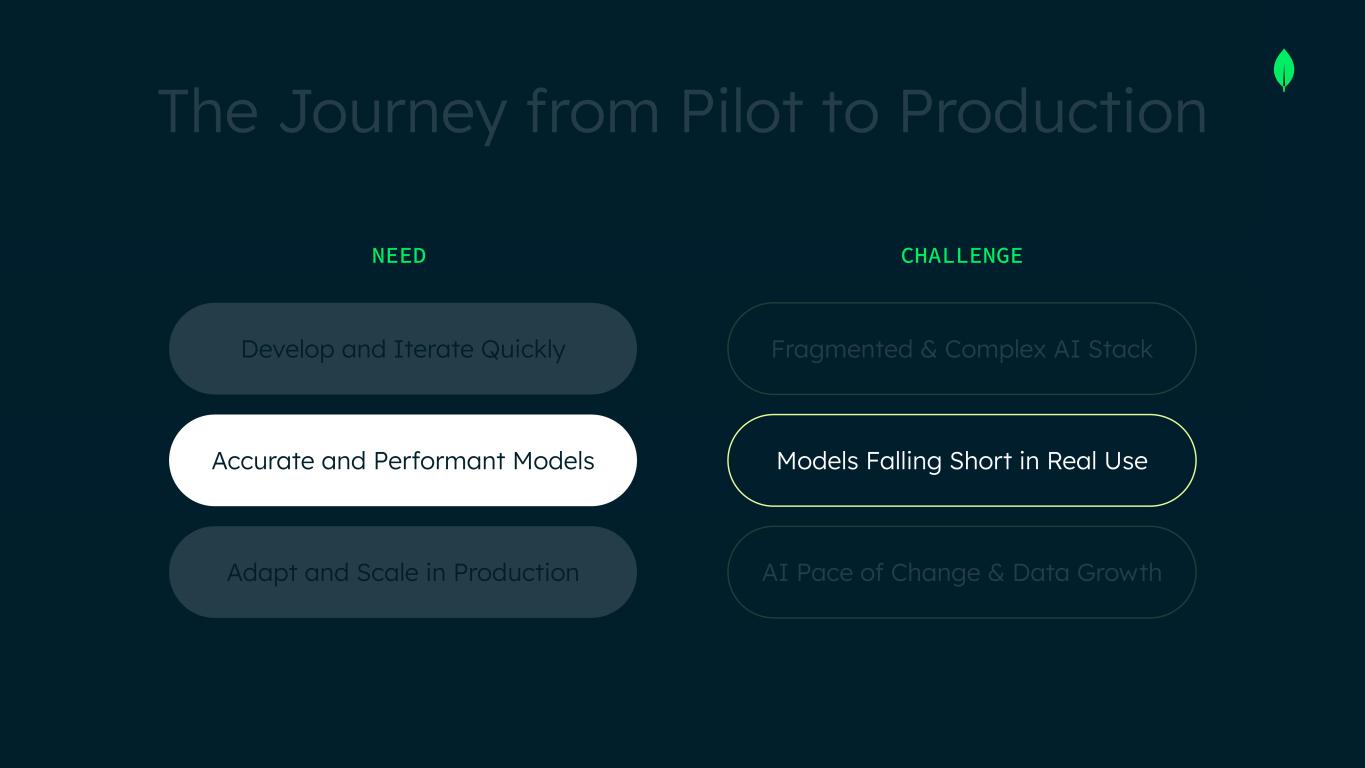

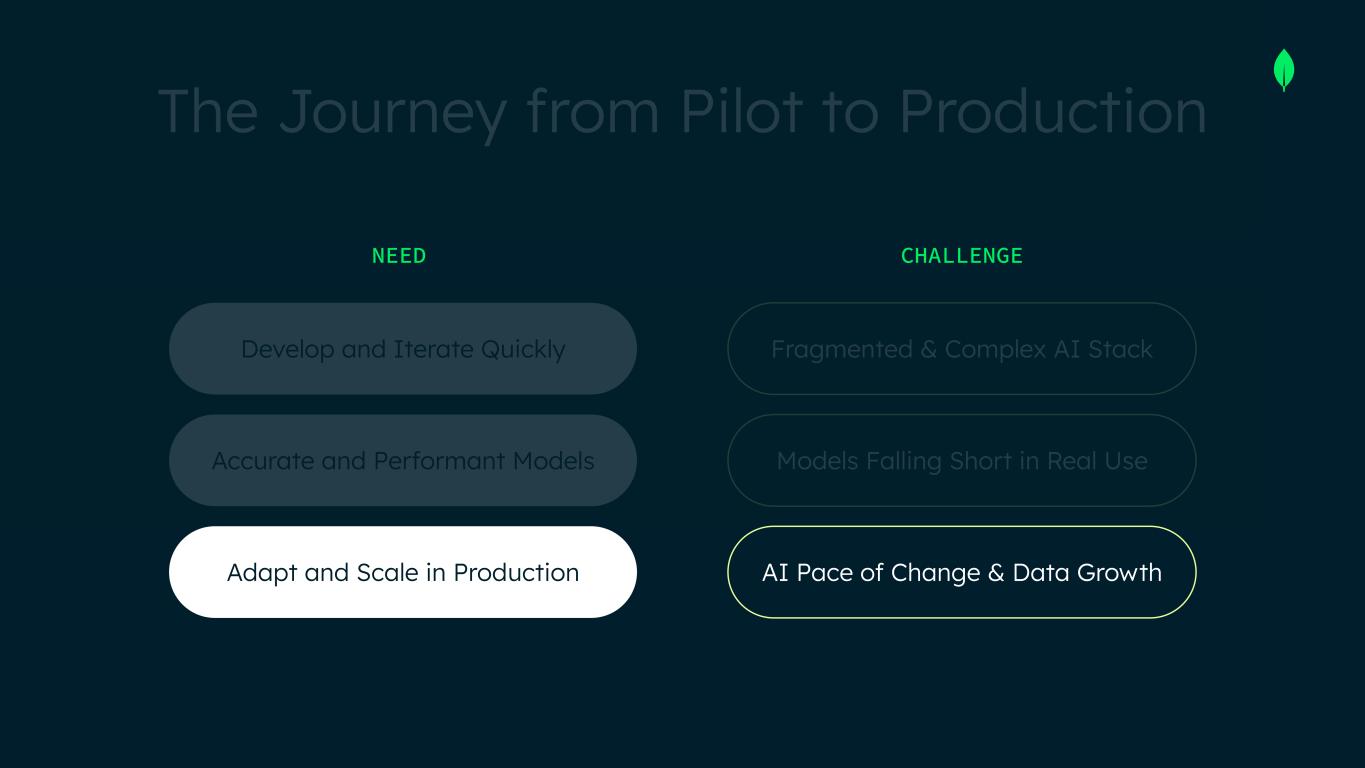

The Journey from Pilot to Production NEED Develop and Iterate Quickly CHALLENGE Fragmented & Complex AI Stack

The Journey from Pilot to Production NEED Develop and Iterate Quickly Accurate and Performant Models CHALLENGE Fragmented & Complex AI Stack Models Falling Short in Real Use

The Journey from Pilot to Production NEED CHALLENGE Develop and Iterate Quickly Accurate and Performant Models Adapt and Scale in Production Fragmented & Complex AI Stack Models Falling Short in Real Use AI Pace of Change & Data Growth

MongoDB delivers unique advantages and simplifies every stage of the journey

The Journey from Pilot to Production NEED CHALLENGE Develop and Iterate Quickly Accurate and Performant Models Adapt and Scale in Production Fragmented & Complex AI Stack Models Falling Short in Real Use AI Pace of Change & Data Growth

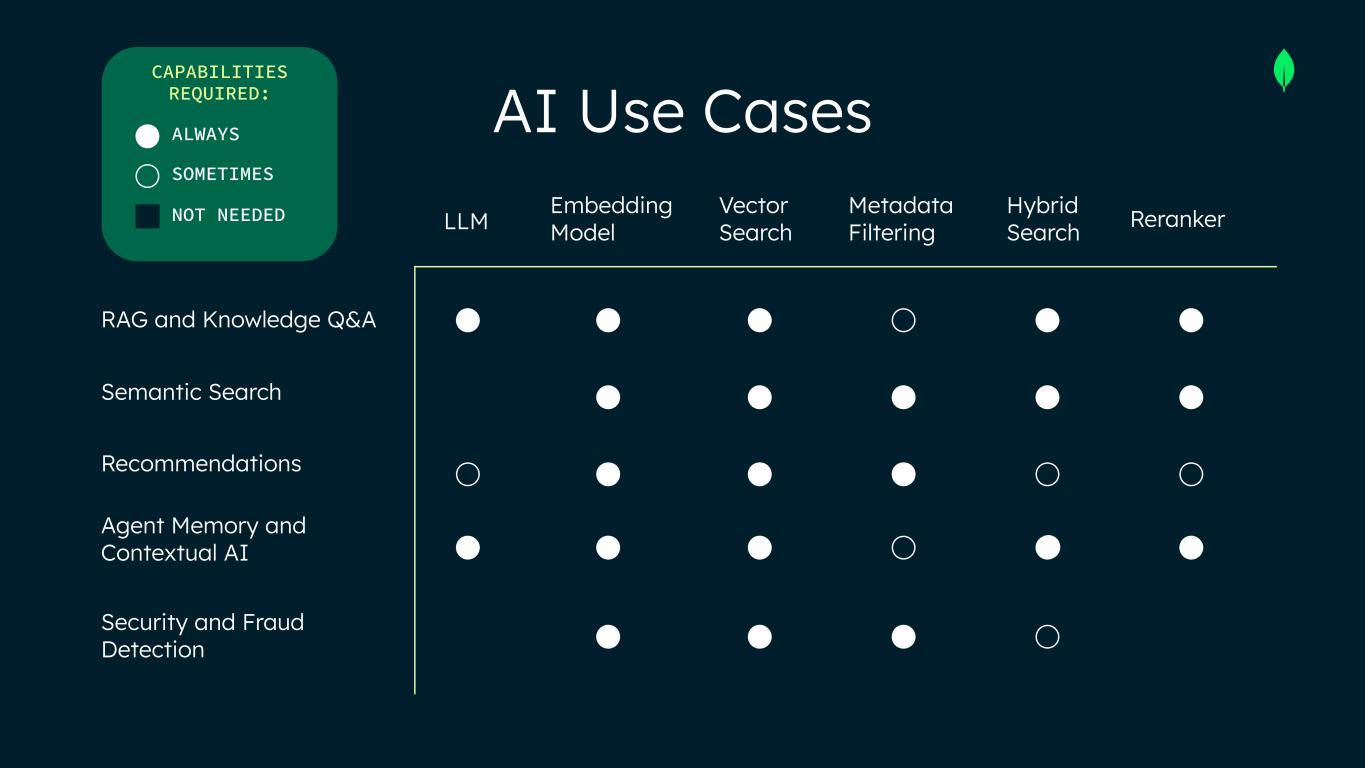

AI Use Cases RAG and Knowledge Q&A Semantic Search Recommendations Agent Memory and Contextual AI Security and Fraud Detection

AI Use Cases RAG and Knowledge Q&A Semantic Search Recommendations Agent Memory and Contextual AI Security and Fraud Detection LLM Embedding Model Vector Search Metadata Filtering Hybrid Search Reranker ALWAYS SOMETIMES NOT NEEDED CAPABILITIES REQUIRED:

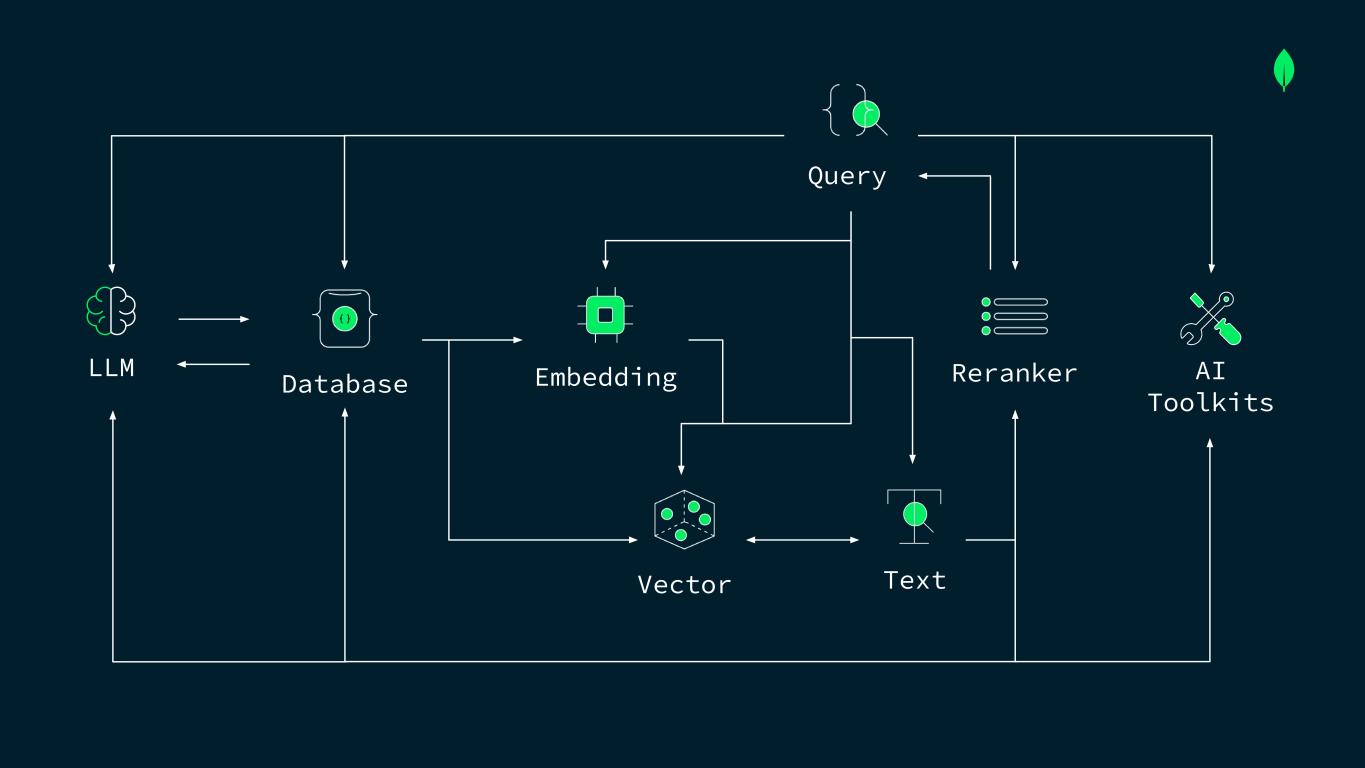

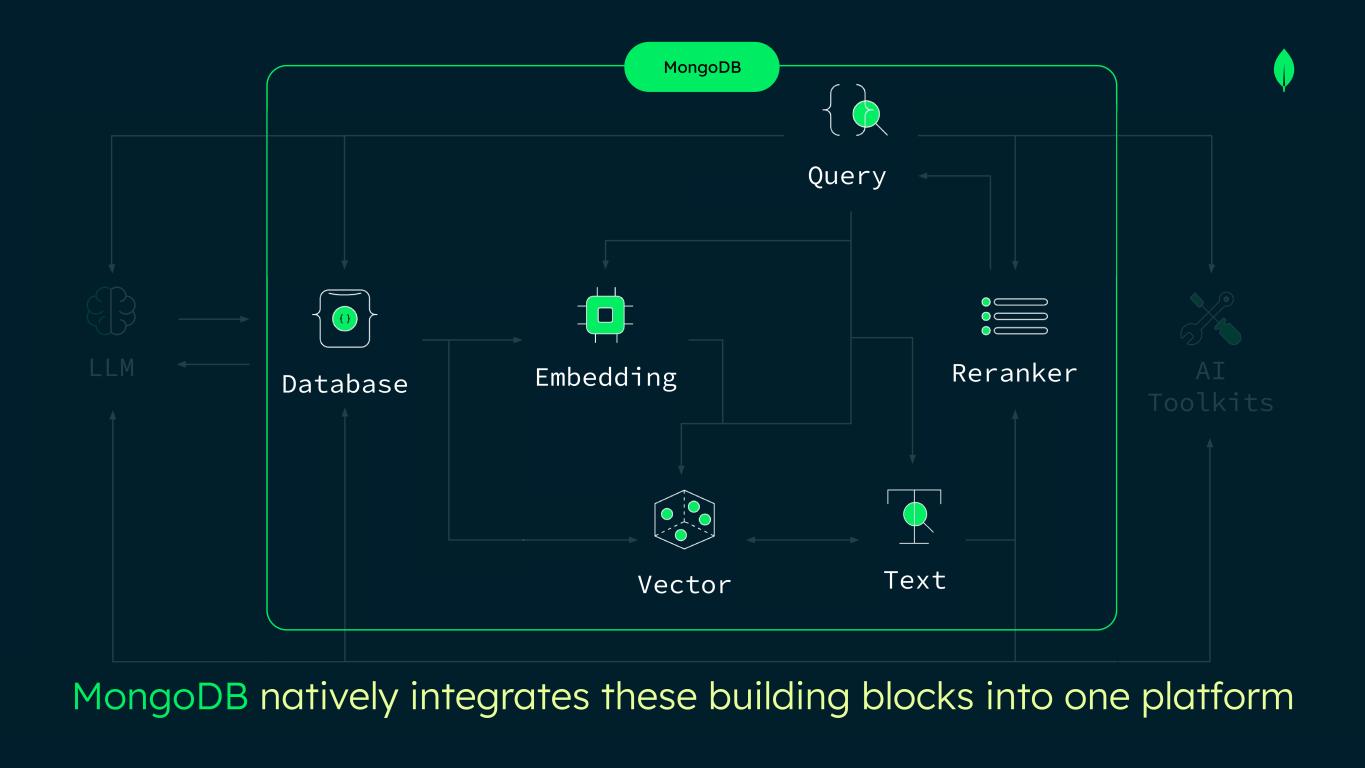

Vector Database Embedding Text RerankerLLM Query AI Toolkits

Vector Database Embedding Text RerankerLLM Query AI Toolkits MongoDB natively integrates these building blocks into one platform MongoDB

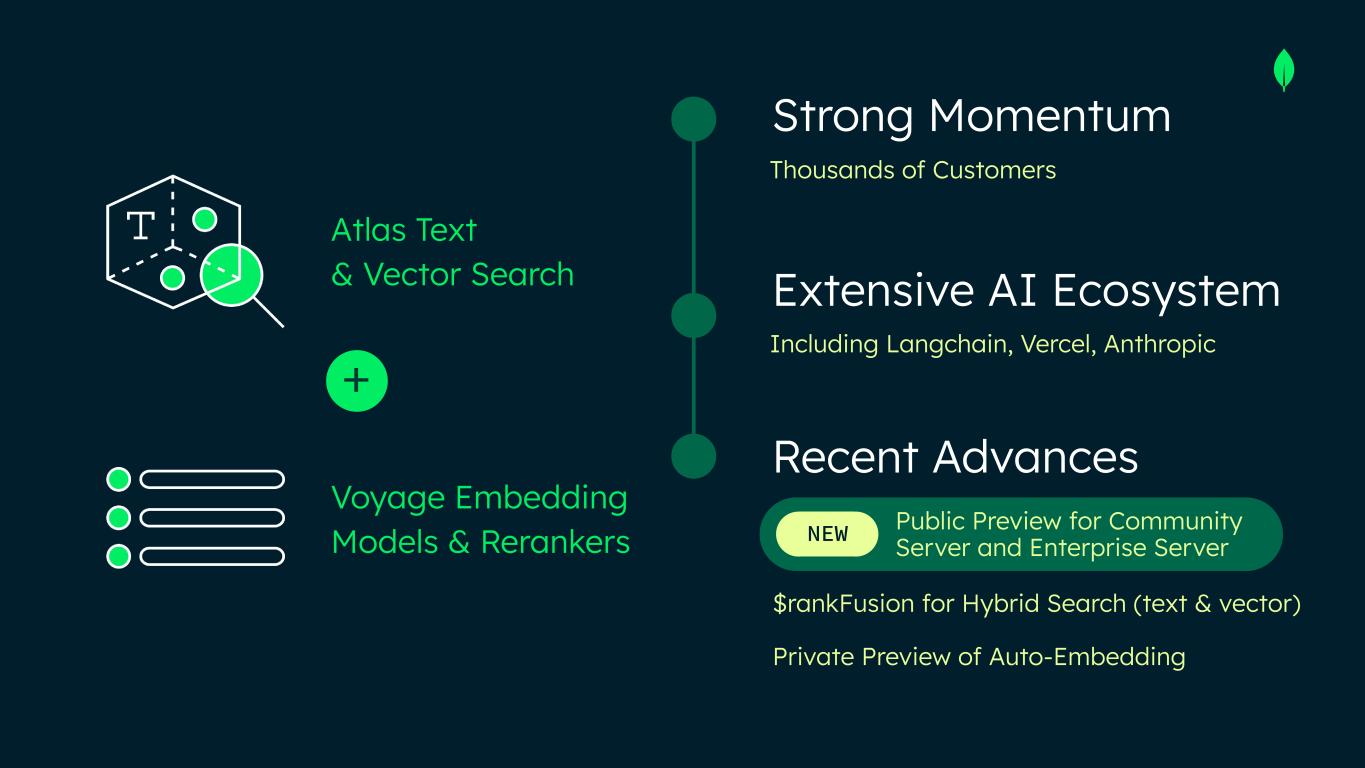

Strong Momentum Extensive AI Ecosystem Recent Advances Thousands of Customers Including Langchain, Vercel, Anthropic $rankFusion for Hybrid Search (text & vector) Private Preview of Auto-Embedding Atlas Text & Vector Search Voyage Embedding Models & Rerankers + NEW Public Preview for Community Server and Enterprise Server

The Journey from Pilot to Production NEED CHALLENGE Develop and Iterate Quickly Accurate and Performant Models Adapt and Scale in Production Fragmented & Complex AI Stack Models Falling Short in Real Use AI Pace of Change & Data Growth

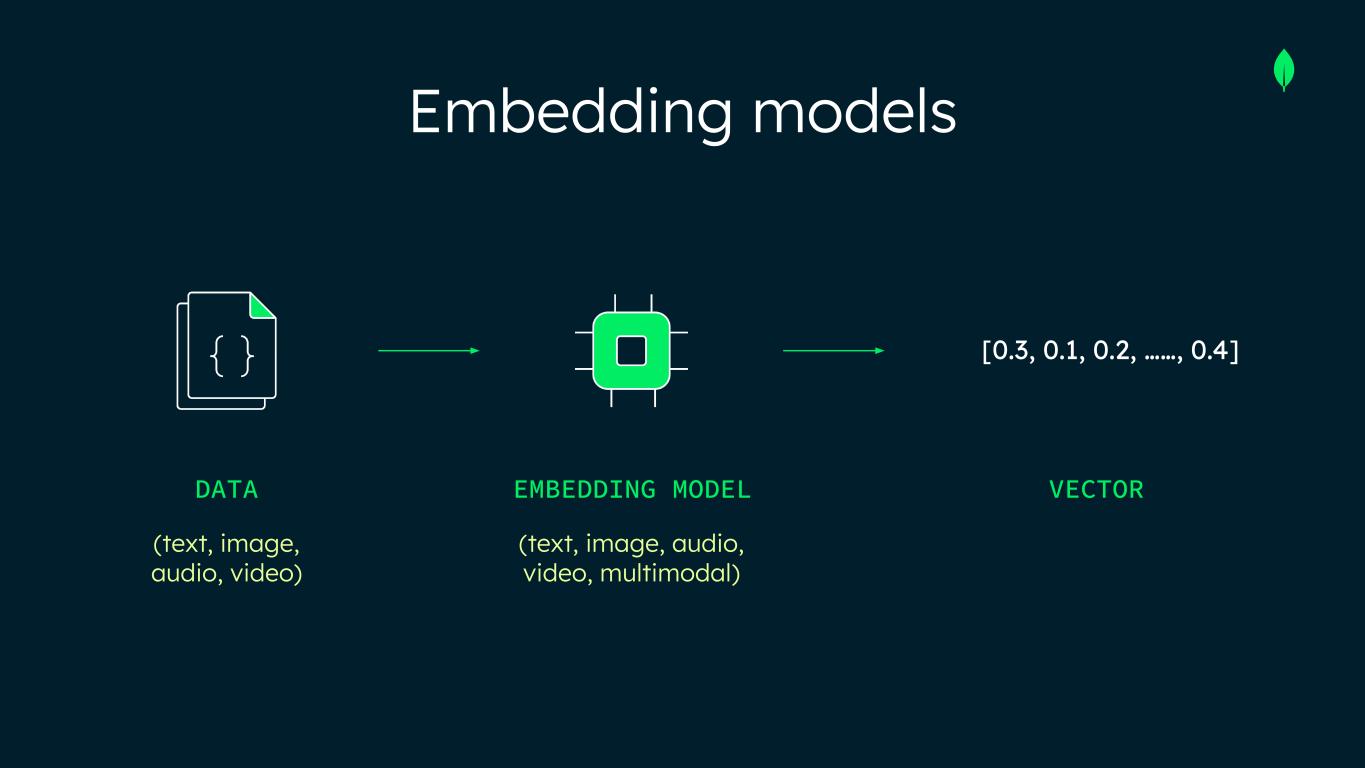

Embedding models [0.3, 0.1, 0.2, ……, 0.4] DATA (text, image, audio, video) EMBEDDING MODEL (text, image, audio, video, multimodal) VECTOR

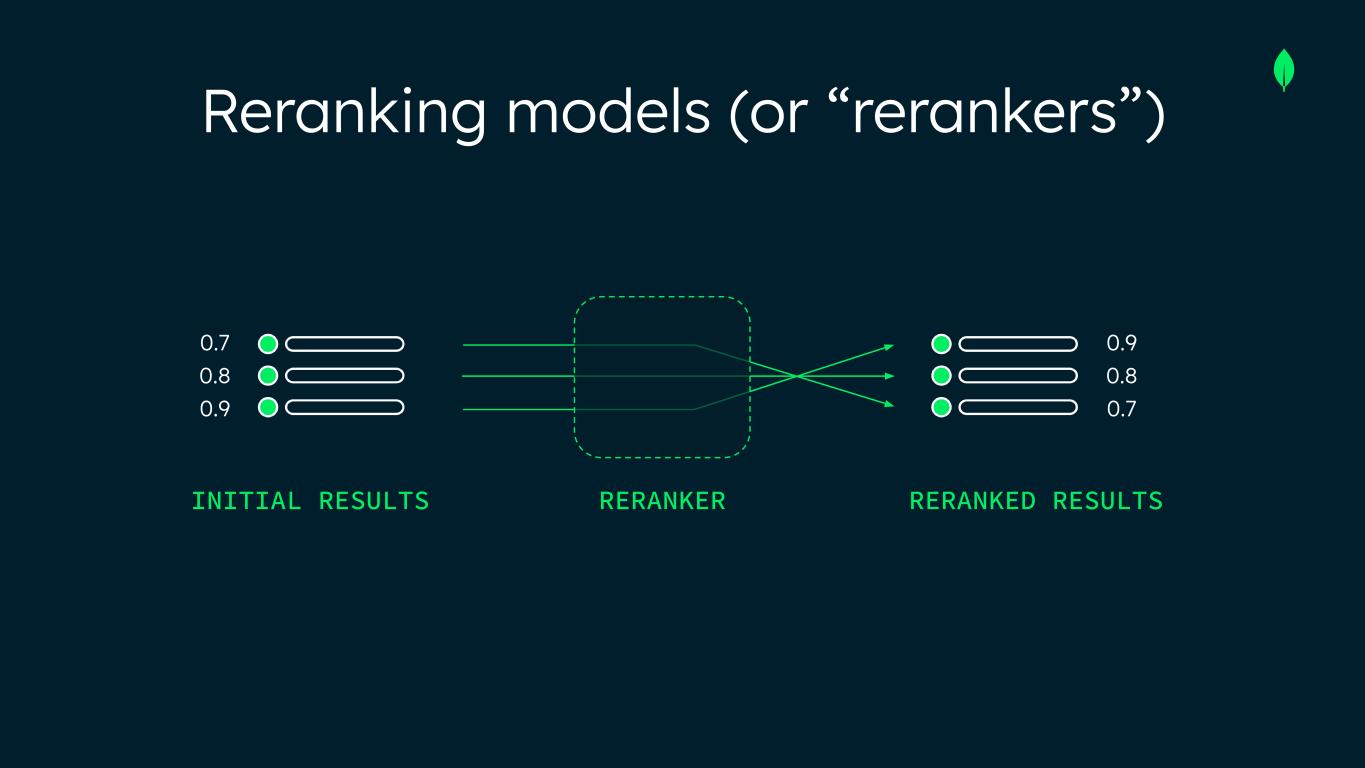

Reranking models (or “rerankers”) INITIAL RESULTS RERANKED RESULTS 0.9 0.8 0.7 0.7 0.8 0.9 RERANKER

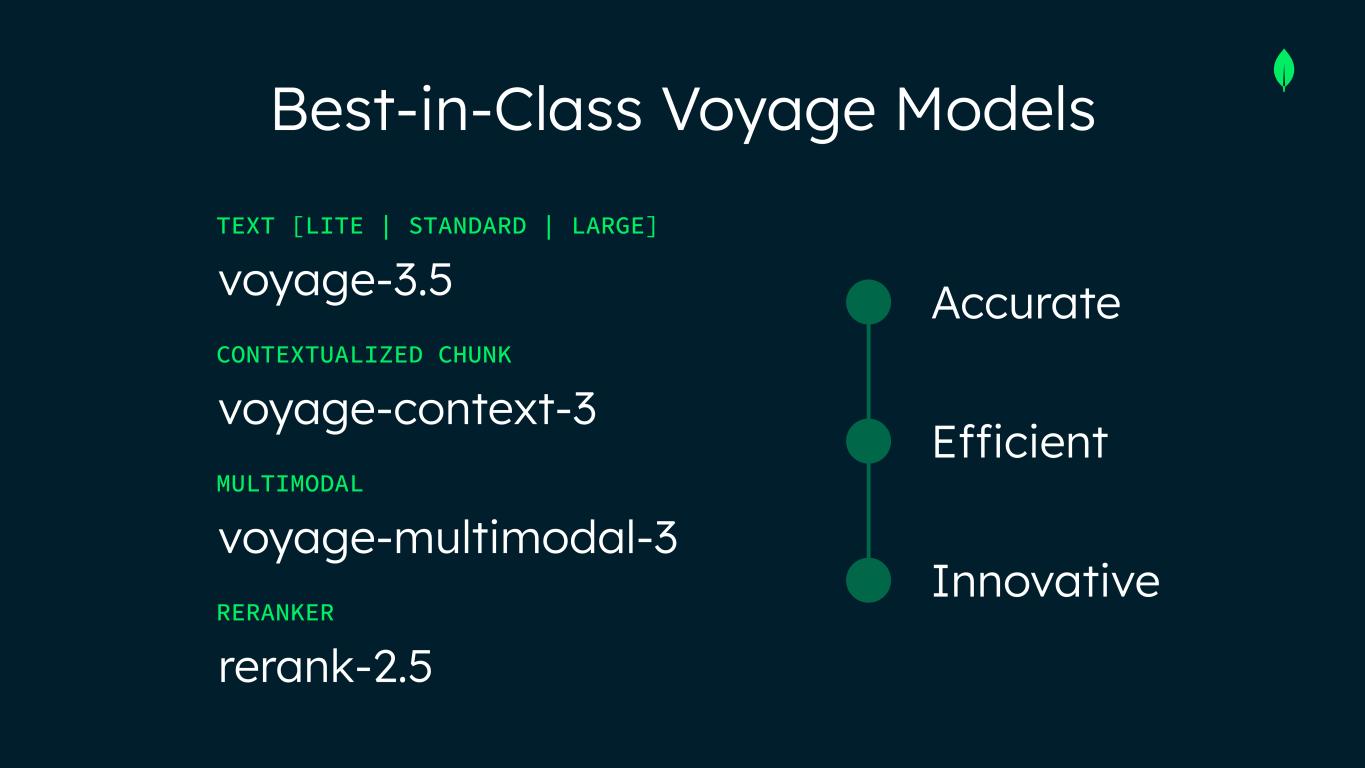

voyage-3.5 TEXT [LITE | STANDARD | LARGE] voyage-context-3 CONTEXTUALIZED CHUNK voyage-multimodal-3 MULTIMODAL rerank-2.5 RERANKER Best-in-Class Voyage Models Accurate Efficient Innovative

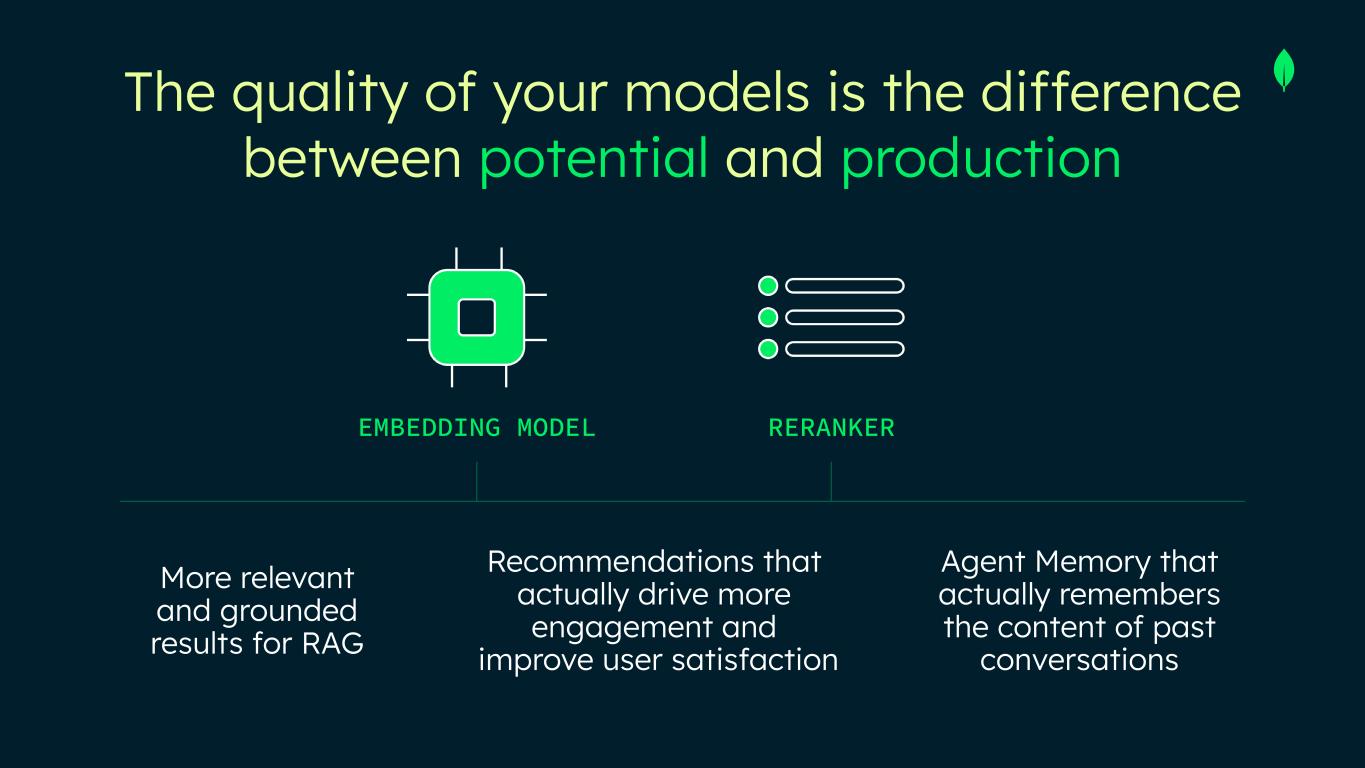

The quality of your models is the difference between potential and production EMBEDDING MODEL RERANKER More relevant and grounded results for RAG Recommendations that actually drive more engagement and improve user satisfaction Agent Memory that actually remembers the content of past conversations

The Journey from Pilot to Production NEED CHALLENGE Develop and Iterate Quickly Accurate and Performant Models Adapt and Scale in Production Fragmented & Complex AI Stack Models Falling Short in Real Use AI Pace of Change & Data Growth

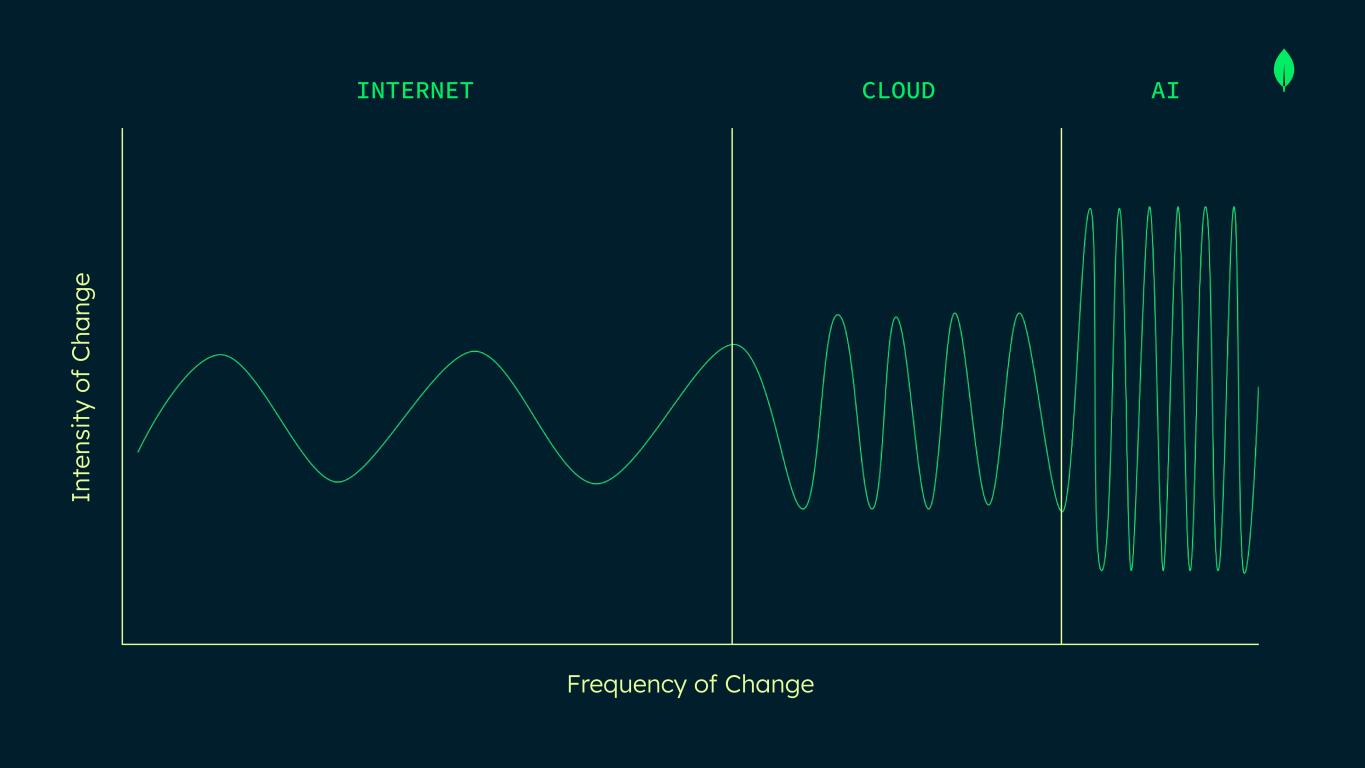

In te ns ity o f C ha ng e Frequency of Change INTERNET CLOUD AI

Document Model MongoDB’s core strengths are adaptability and scalability by design. With AI, those strengths are more relevant than ever. Horizontal Scalability+

Document Model MongoDB’s core strengths are adaptability and scalability by design. With AI, those strengths are more relevant than ever. Horizontal Scalability One Data Platform+ +

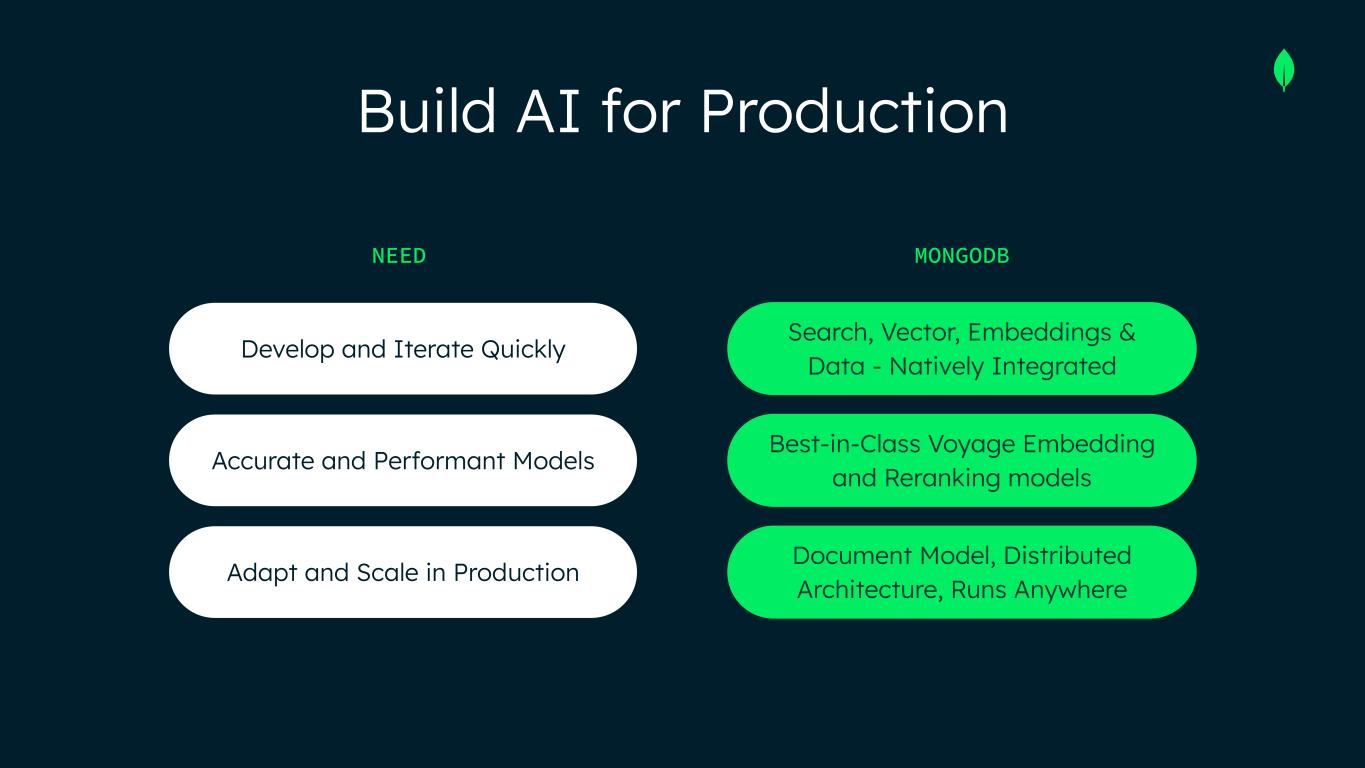

Build AI for Production NEED MONGODB Develop and Iterate Quickly Accurate and Performant Models Adapt and Scale in Production Search, Vector, Embeddings & Data - Natively Integrated Best-in-Class Voyage Embedding and Reranking models Document Model, Distributed Architecture, Runs Anywhere

Investor Day Customer Testimonial: MongoDB in the AI era ENO REYES CTO & CO-FOUNDER

Investor Day SUDHEESH NAIR CEO & CO-FOUNDER SHAUN ROBERTS DISTINGUISHED ENGINEER STEVEN POITRAS FOUNDING ARCHITECT Customer Panel: MongoDB in the AI era

Self–Serve & Product-Led Growth MAY PETRY CHIEF MARKETING OFFICER MONGODB SEPTEMBER 2025

Product-led Growth: The Engine Driving Scalable, Durable Growth

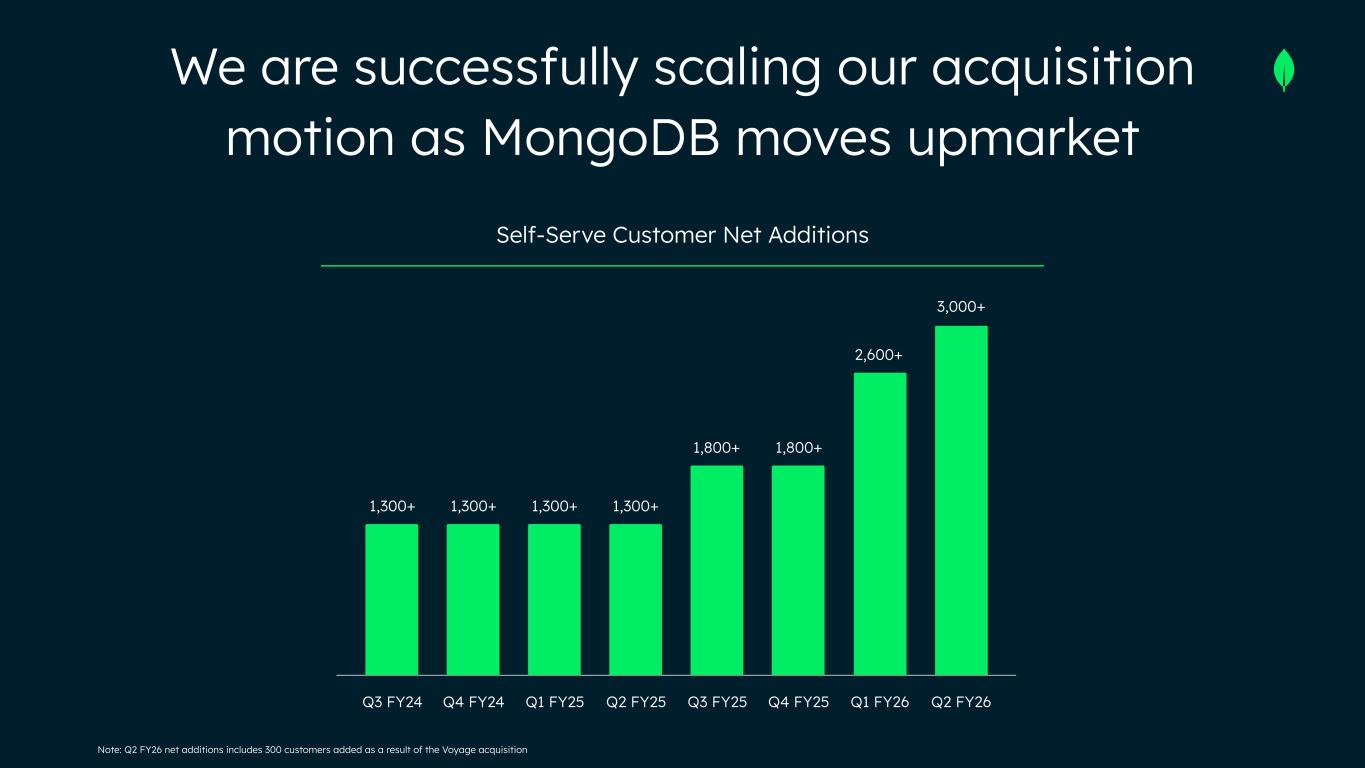

Note: Q2 FY26 net additions includes 300 customers added as a result of the Voyage acquisition We are successfully scaling our acquisition motion as MongoDB moves upmarket Self-Serve Customer Net Additions Q3 FY24 Q4 FY24 Q1 FY25 Q2 FY25 Q3 FY25 Q4 FY25 Q1 FY26 Q2 FY26 1,300+ 1,300+ 1,300+ 1,300+ 1,800+ 1,800+ 2,600+ 3,000+

25% Of customers with >$1M ARR were originally sourced through the self-serve channel 15% Faster time to $1M in ARR for customers sourced from the self-serve channel Self-serve creates warm opportunities for our sales team, increasing productivity

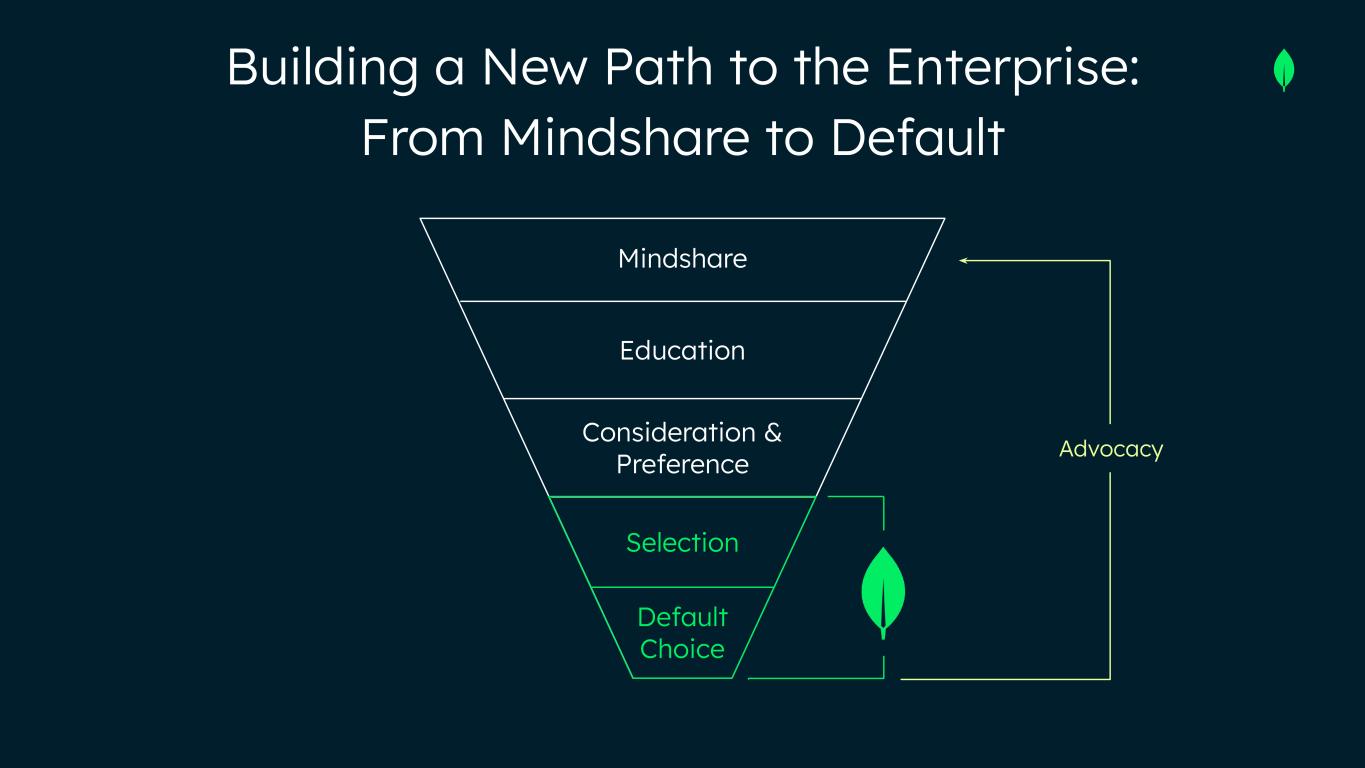

Building a New Path to the Enterprise: From Mindshare to Default Mindshare Education Consideration & Preference Selection Default Choice Advocacy

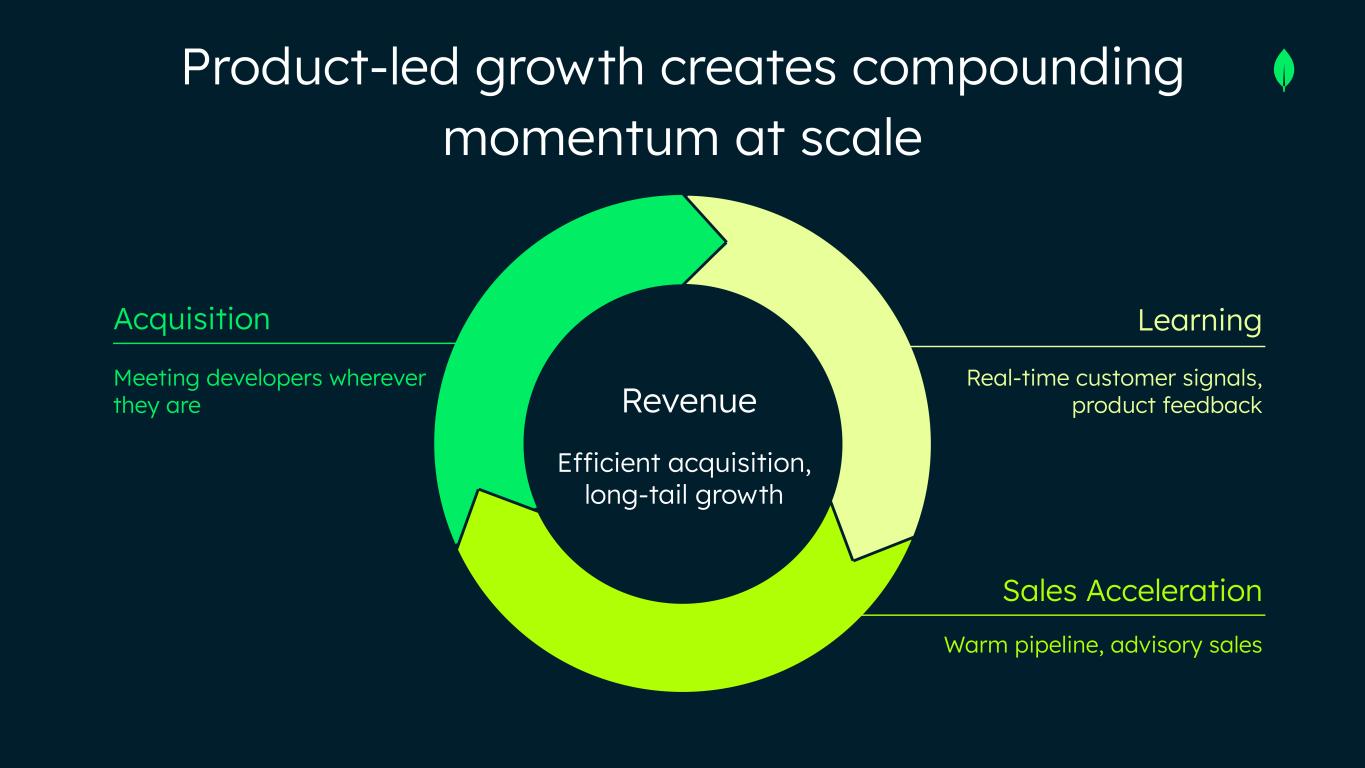

Learning Sales Acceleration Acquisition Revenue Efficient acquisition, long-tail growth Real-time customer signals, product feedback Warm pipeline, advisory sales Product-led growth creates compounding momentum at scale Meeting developers wherever they are

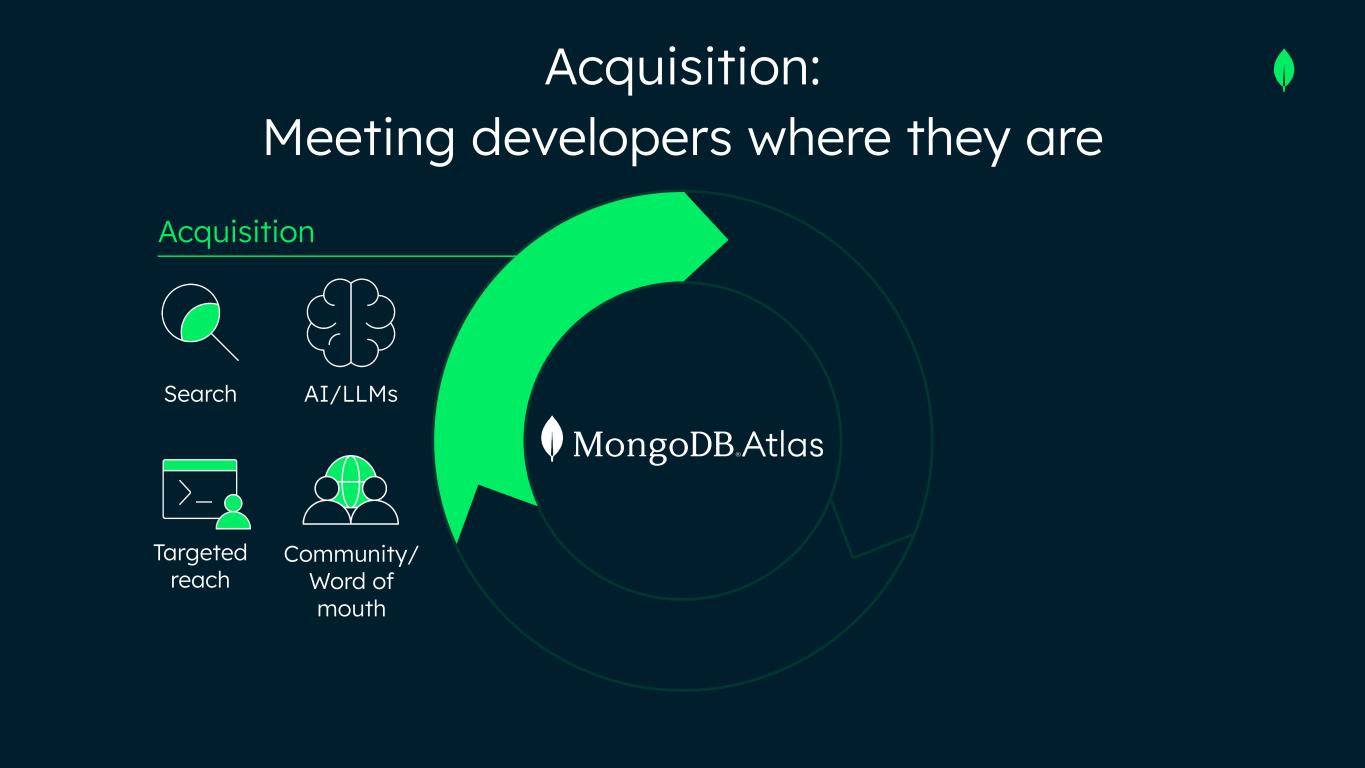

Acquisition Acquisition: Meeting developers where they are Search AI/LLMs Targeted reach Community/ Word of mouth

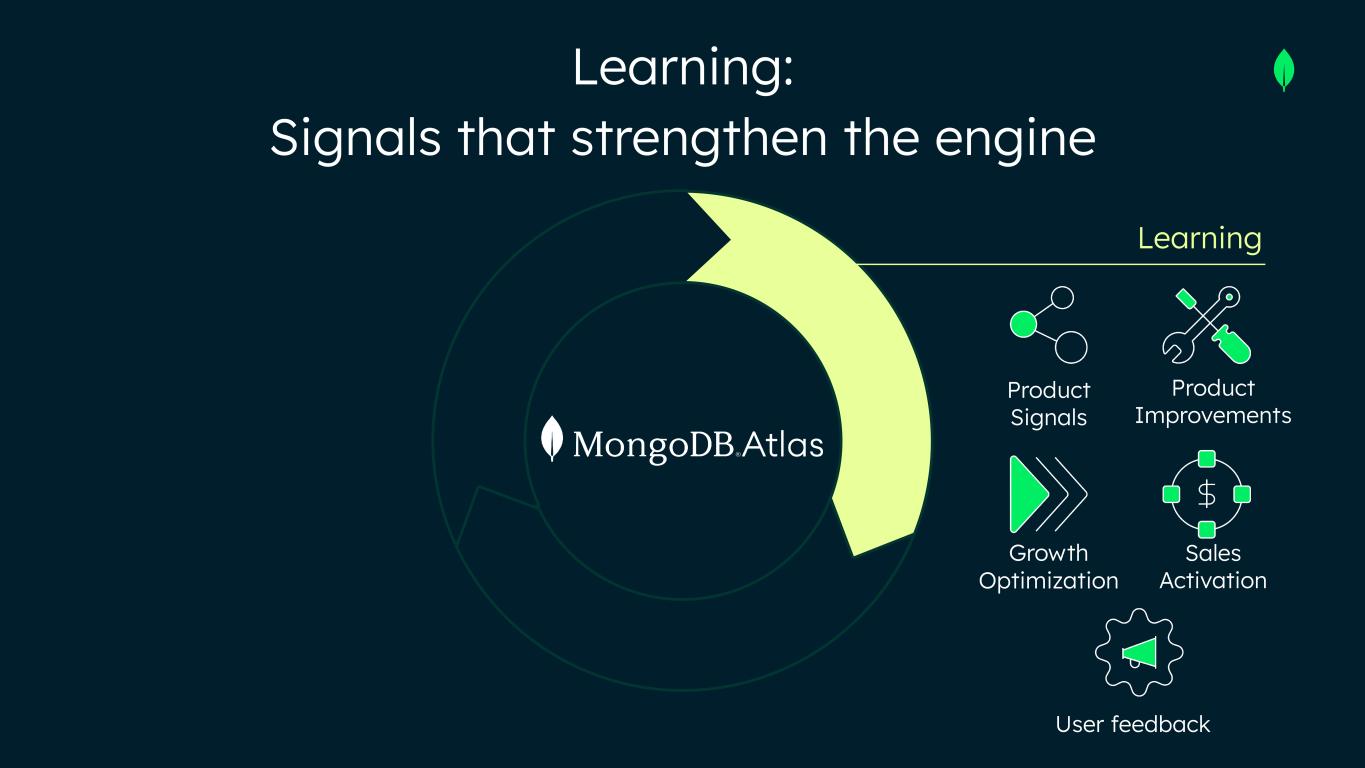

Learning: Signals that strengthen the engine Learning Product Signals Product Improvements Growth Optimization Sales Activation User feedback

Sales Acceleration Sales acceleration: Turning adoption into warm demand Signal Product usage Real-time account insights Expand Enterprise adoption Sales field by warm demand Land Self-serve use Hands-on value

From PLG to Enterprise Scale: Our Durable Growth Engine GLOBAL CRYPTO PLATFORM FORTUNE 500 BROKERAGE & WEALTH MANAGER GLOBAL DESIGN & COLLABORATION PLATFORM

Acquire our next best customer efficiently Turn user signals into better GTM Drive operating leverage through automation Product-Led Growth: Powering MongoDB’s Next Stage of Growth

SEPTEMBER 2025 Financial Update MIKE BERRY CHIEF FINANCIAL OFFICER MONGODB

Strong track record in a large, growing market Durable business model to drive profitable growth Revenue growth with expanding operating margin Long-term financial targets Themes of the discussion today

Q2 Performance Recap

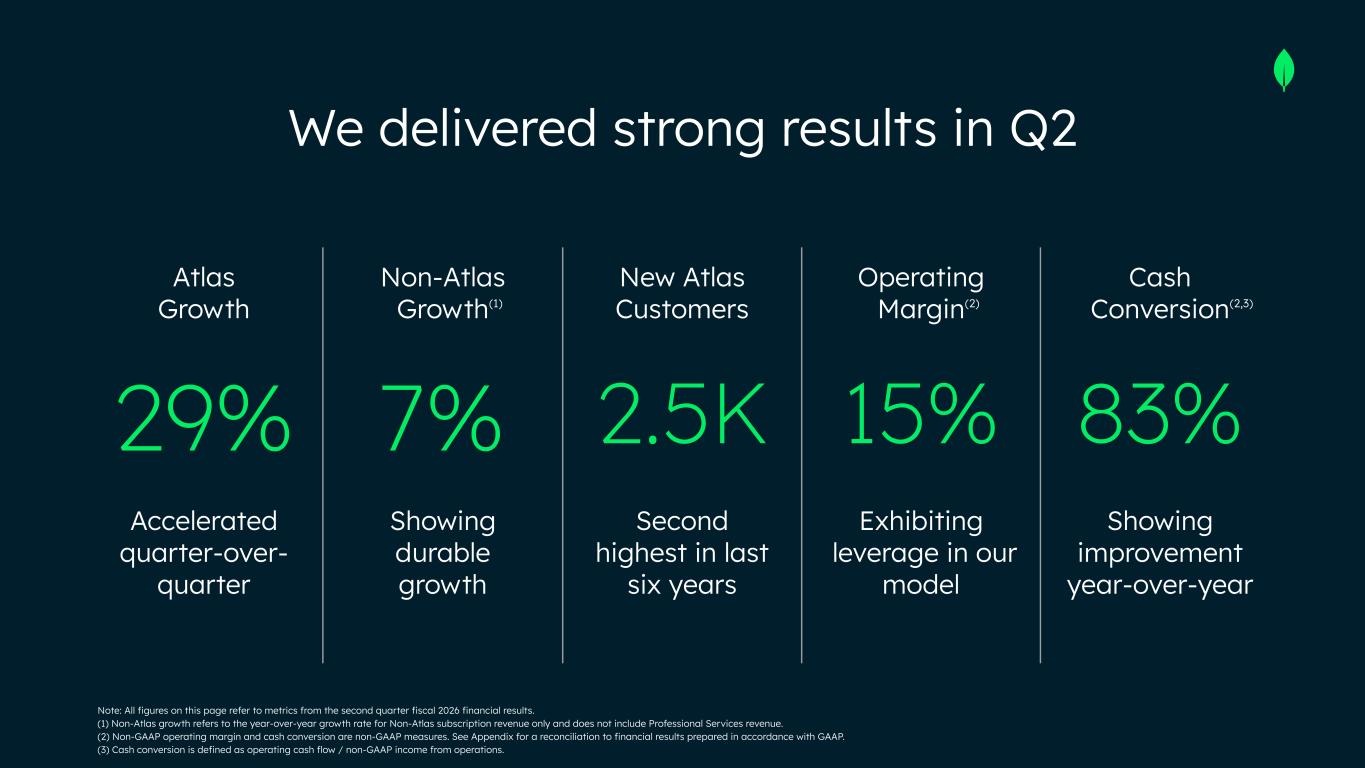

Atlas Growth Non-Atlas Growth New Atlas Customers Operating Margin Cash Conversion 29% 7% 2.5K 15% 83% Accelerated quarter-over- quarter Showing durable growth Second highest in last six years Exhibiting leverage in our model Showing improvement year-over-year Note: All figures on this page refer to metrics from the second quarter fiscal 2026 financial results. (1) Non-Atlas growth refers to the year-over-year growth rate for Non-Atlas subscription revenue only and does not include Professional Services revenue. (2) Non-GAAP operating margin and cash conversion are non-GAAP measures. See Appendix for a reconciliation to financial results prepared in accordance with GAAP. (3) Cash conversion is defined as operating cash flow / non-GAAP income from operations. (1) (2,3)(2) We delivered strong results in Q2

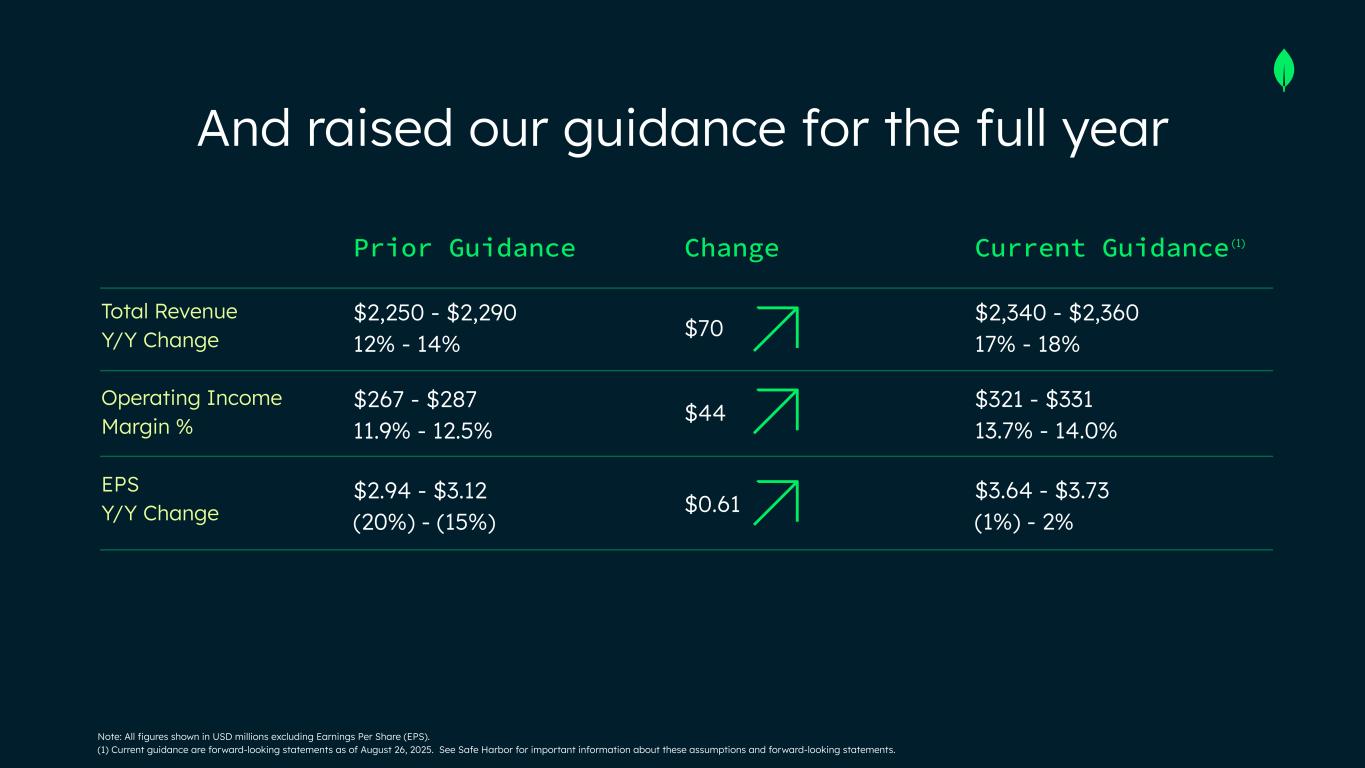

Note: All figures shown in USD millions excluding Earnings Per Share (EPS). (1) Current guidance are forward-looking statements as of August 26, 2025. See Safe Harbor for important information about these assumptions and forward-looking statements. Total Revenue Y/Y Change Operating Income Margin % EPS Y/Y Change Prior Guidance Change Current Guidance $2,250 - $2,290 12% - 14% $267 - $287 11.9% - 12.5% $70 $44 $2,340 - $2,360 17% - 18% $321 - $331 13.7% - 14.0% $2.94 - $3.12 (20%) - (15%) $0.61 $3.64 - $3.73 (1%) - 2% (1) And raised our guidance for the full year

Market Opportunity

2021 2022 2023 2024 2025 2026 2027 2028 $150 $134 $119 $105 $93 $82 $73 $65 Note: All figures shown in USD billions. Source: IDC, Data Management Software Market. We are pursuing a large market opportunity

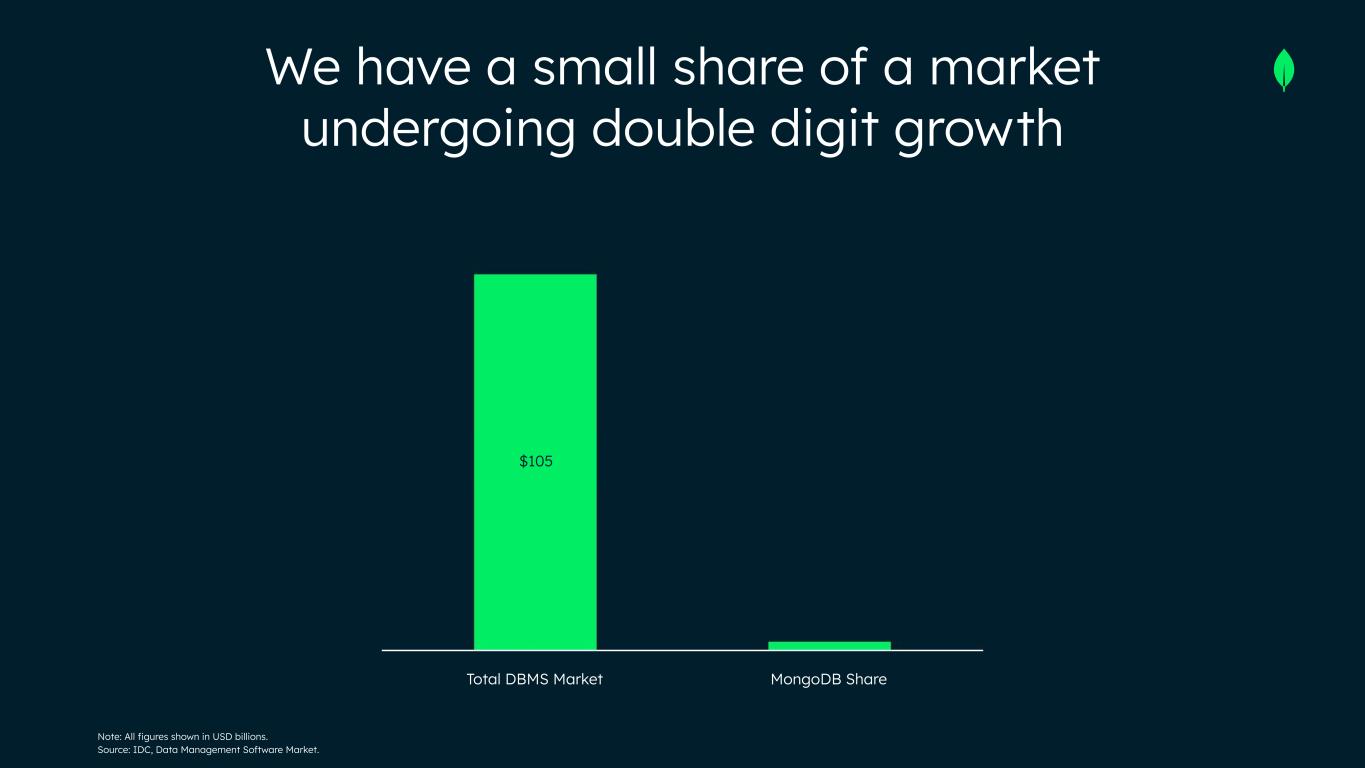

Note: All figures shown in USD billions. Source: IDC, Data Management Software Market. We have a small share of a market undergoing double digit growth Total DBMS Market MongoDB Share $105

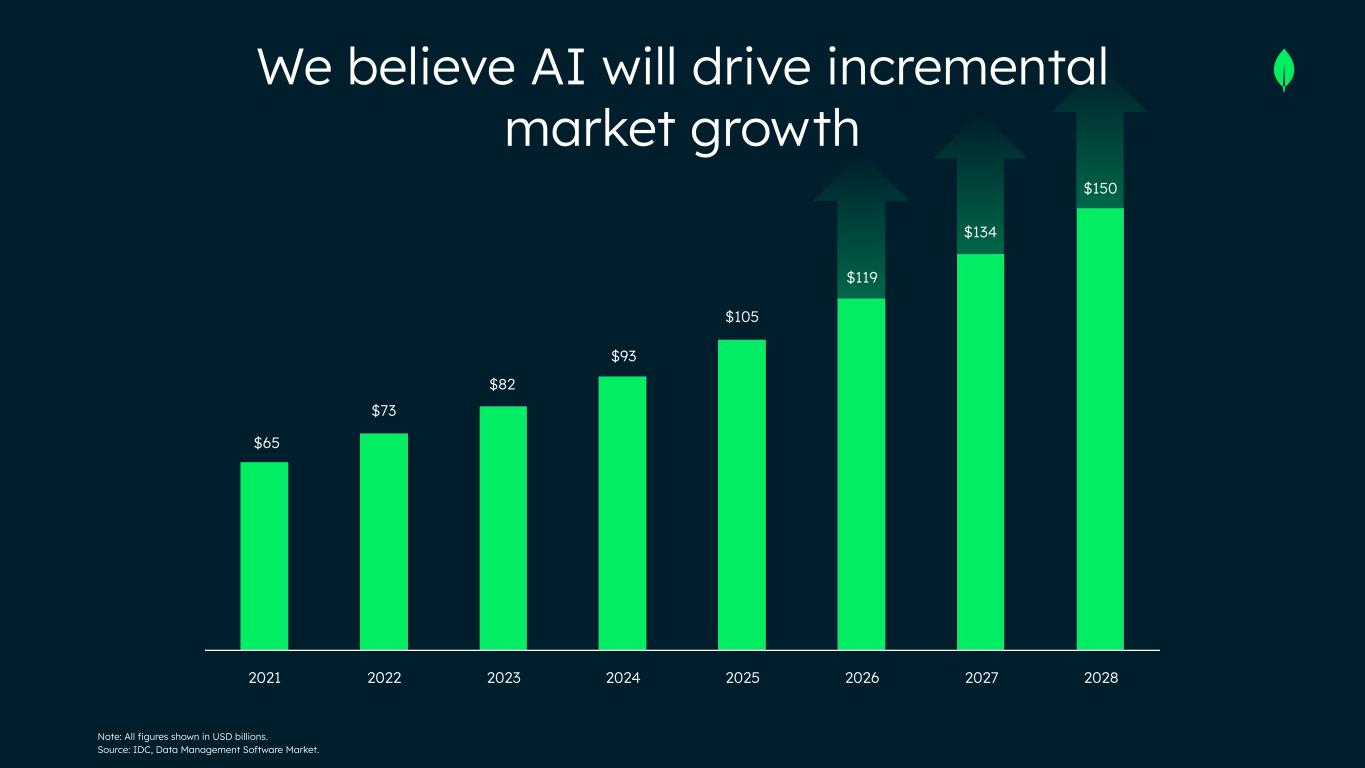

$150 $134 $119 $105 $93 $82 $73 $65 2021 2022 2023 2024 2025 2026 2027 2028 We believe AI will drive incremental market growth Note: All figures shown in USD billions. Source: IDC, Data Management Software Market.

We are targeting the OLTP market, a strategic high ground for AI workloads ● We are going after a massive market; few companies have this large of a market opportunity ● With $2B+ in revenue, we still have only ~2% market share ● The opportunity for our core database is still huge ● This large market is expected to grow at a ~13% CAGR ○ This is before accounting for incremental growth from AI application development…

MongoDB Performance

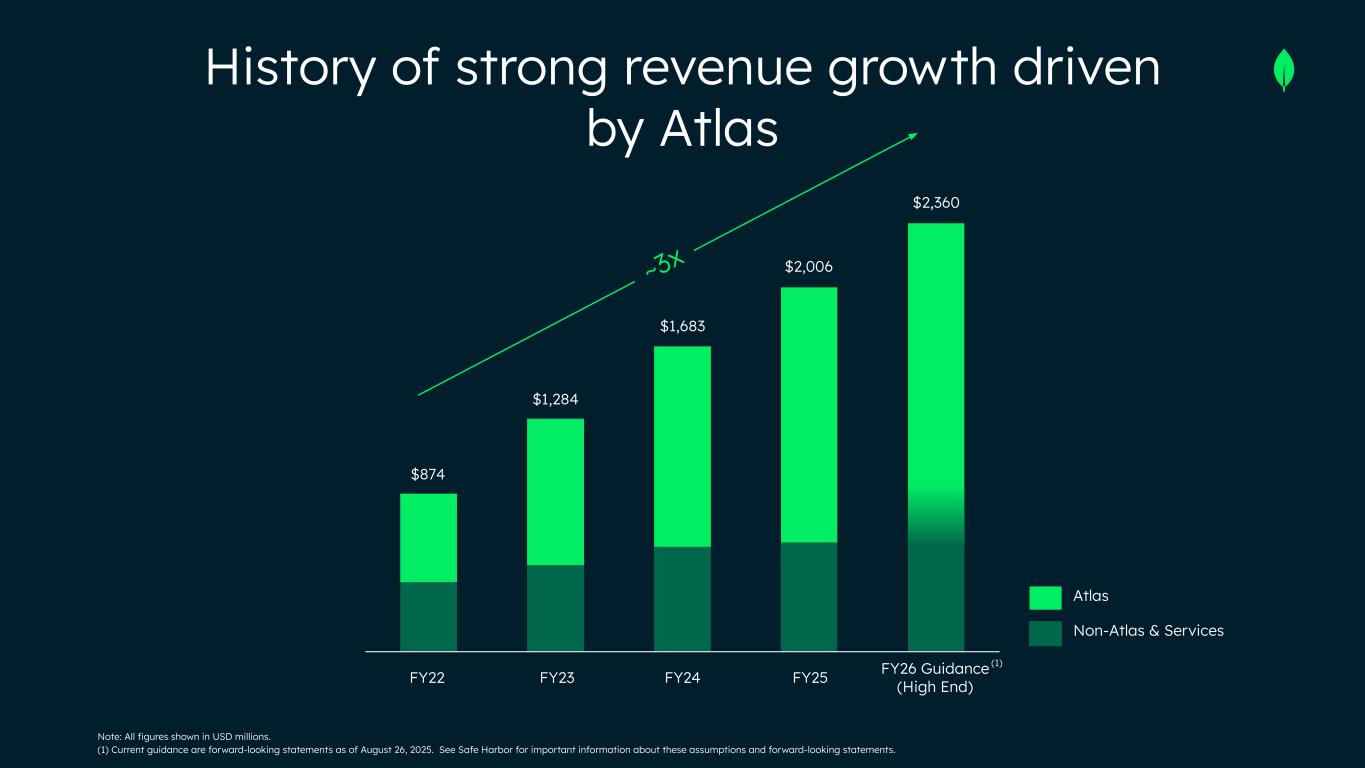

~3x FY22 FY23 FY24 FY25 FY26 Guidance (High End) $874 $1,284 $1,683 $2,006 $2,360 Atlas Non-Atlas & Services Note: All figures shown in USD millions. (1) Current guidance are forward-looking statements as of August 26, 2025. See Safe Harbor for important information about these assumptions and forward-looking statements. (1) History of strong revenue growth driven by Atlas

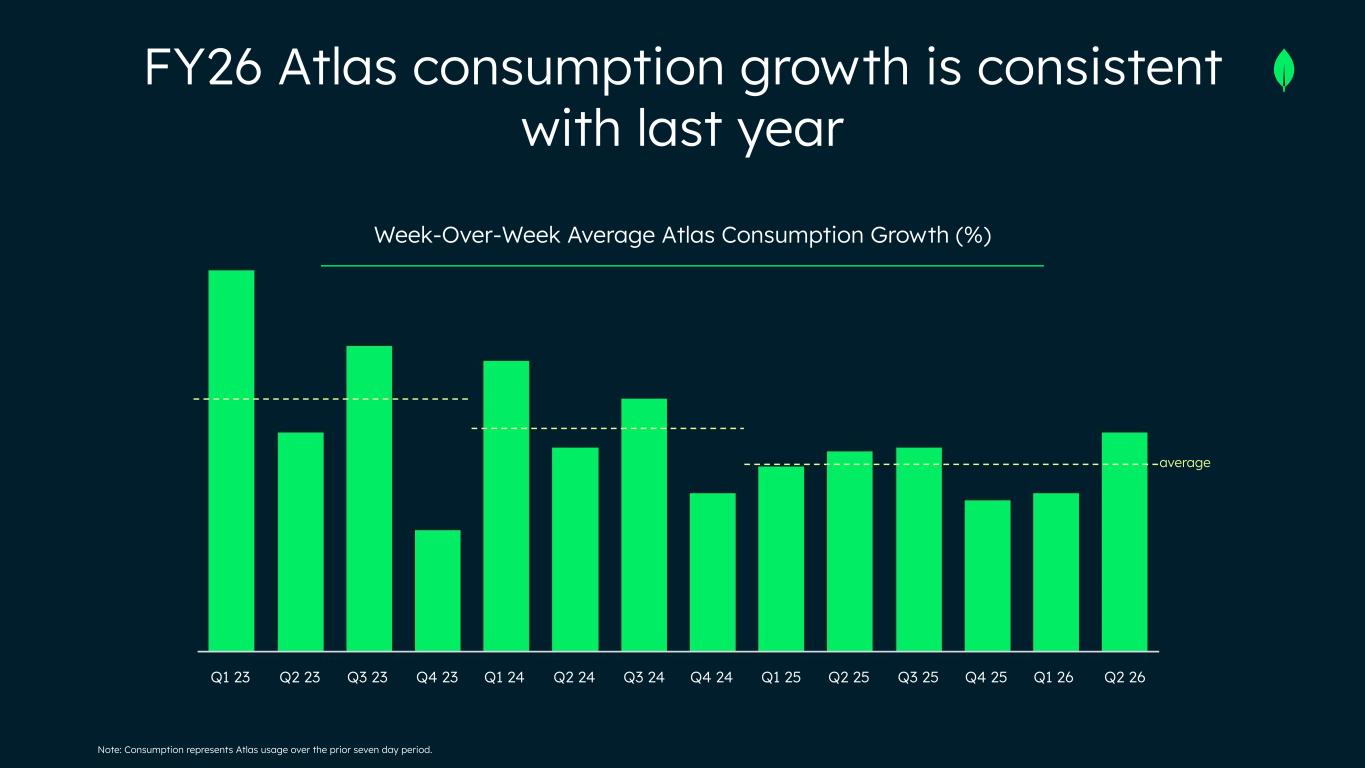

Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Q1 26 Q2 26 average Week-Over-Week Average Atlas Consumption Growth (%) Note: Consumption represents Atlas usage over the prior seven day period. FY26 Atlas consumption growth is consistent with last year

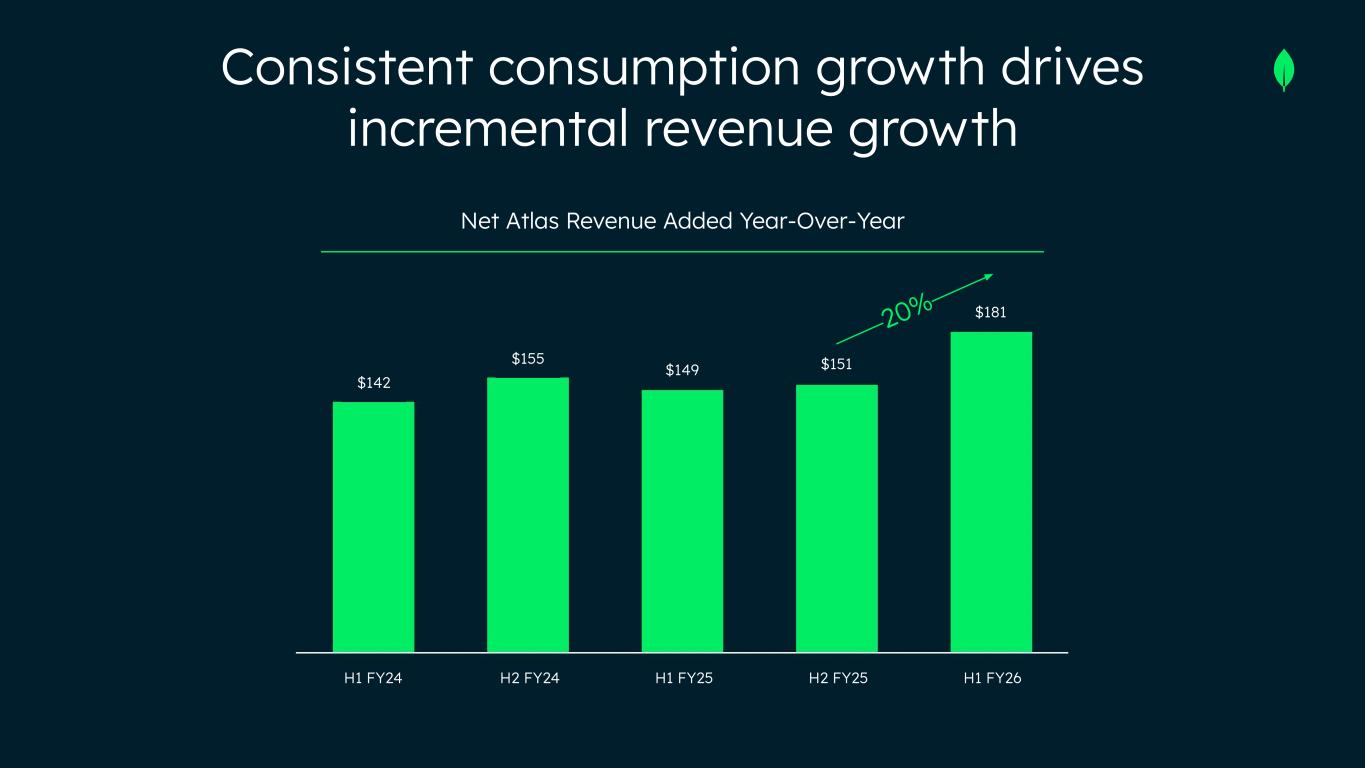

Net Atlas Revenue Added Year-Over-Year H1 FY24 H2 FY24 H1 FY25 H2 FY25 H1 FY26 $142 $155 $149 $151 $181 Consistent consumption growth drives incremental revenue growth 20%

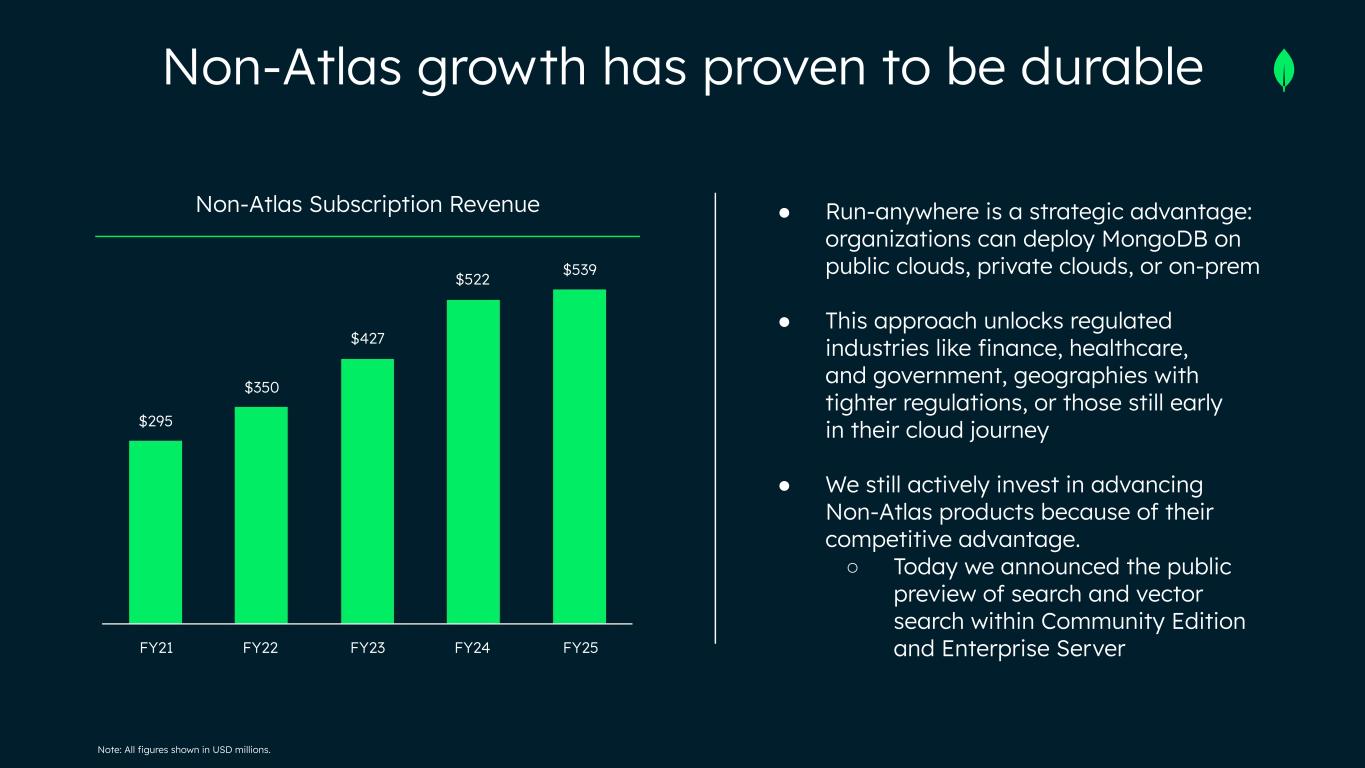

Note: All figures shown in USD millions. ● Run-anywhere is a strategic advantage: organizations can deploy MongoDB on public clouds, private clouds, or on-prem ● This approach unlocks regulated industries like finance, healthcare, and government, geographies with tighter regulations, or those still early in their cloud journey ● We still actively invest in advancing Non-Atlas products because of their competitive advantage. ○ Today we announced the public preview of search and vector search within Community Edition and Enterprise Server Non-Atlas Subscription Revenue $295 $350 $427 $522 $539 FY21 FY22 FY23 FY24 FY25 Non-Atlas growth has proven to be durable

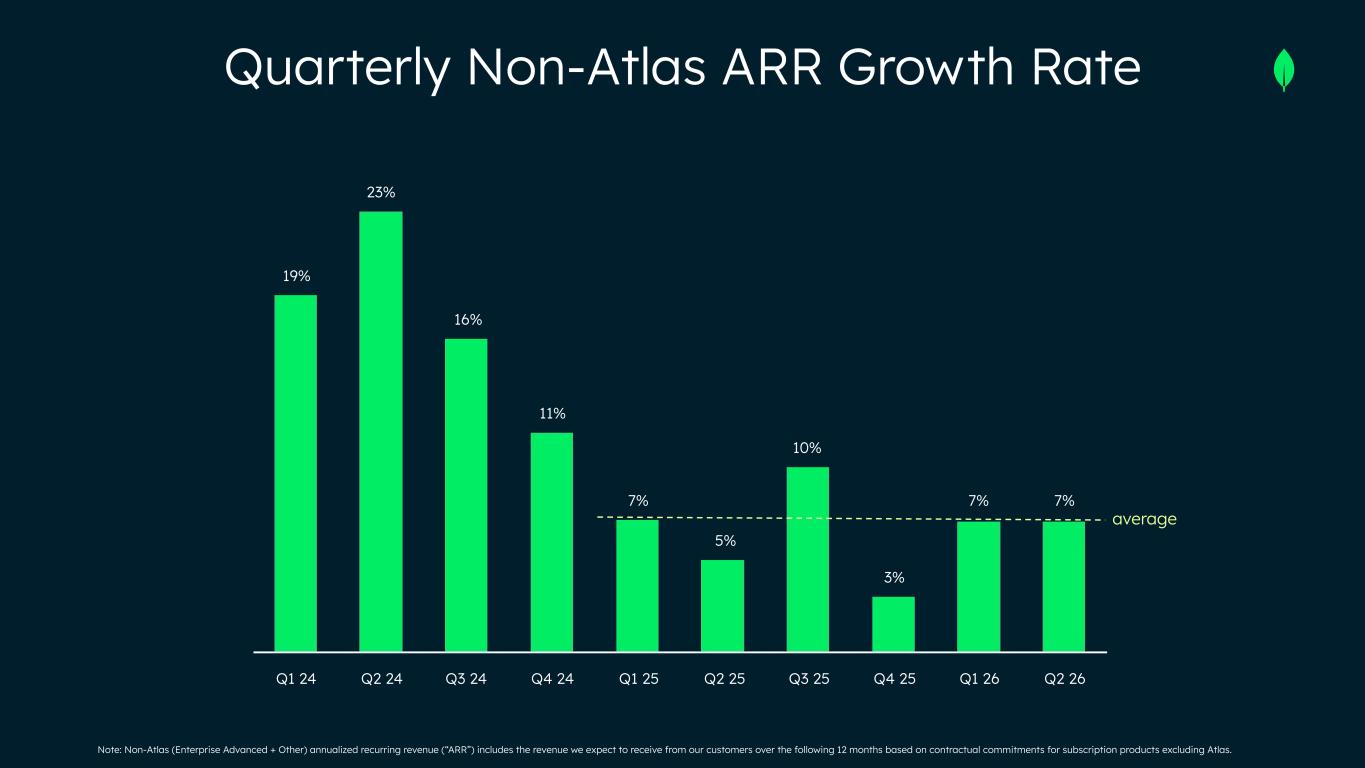

Note: Non-Atlas (Enterprise Advanced + Other) annualized recurring revenue (“ARR”) includes the revenue we expect to receive from our customers over the following 12 months based on contractual commitments for subscription products excluding Atlas. average Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Q1 26 Q2 26 19% 23% 16% 11% 7% 5% 10% 3% 7% 7% Quarterly Non-Atlas ARR Growth Rate

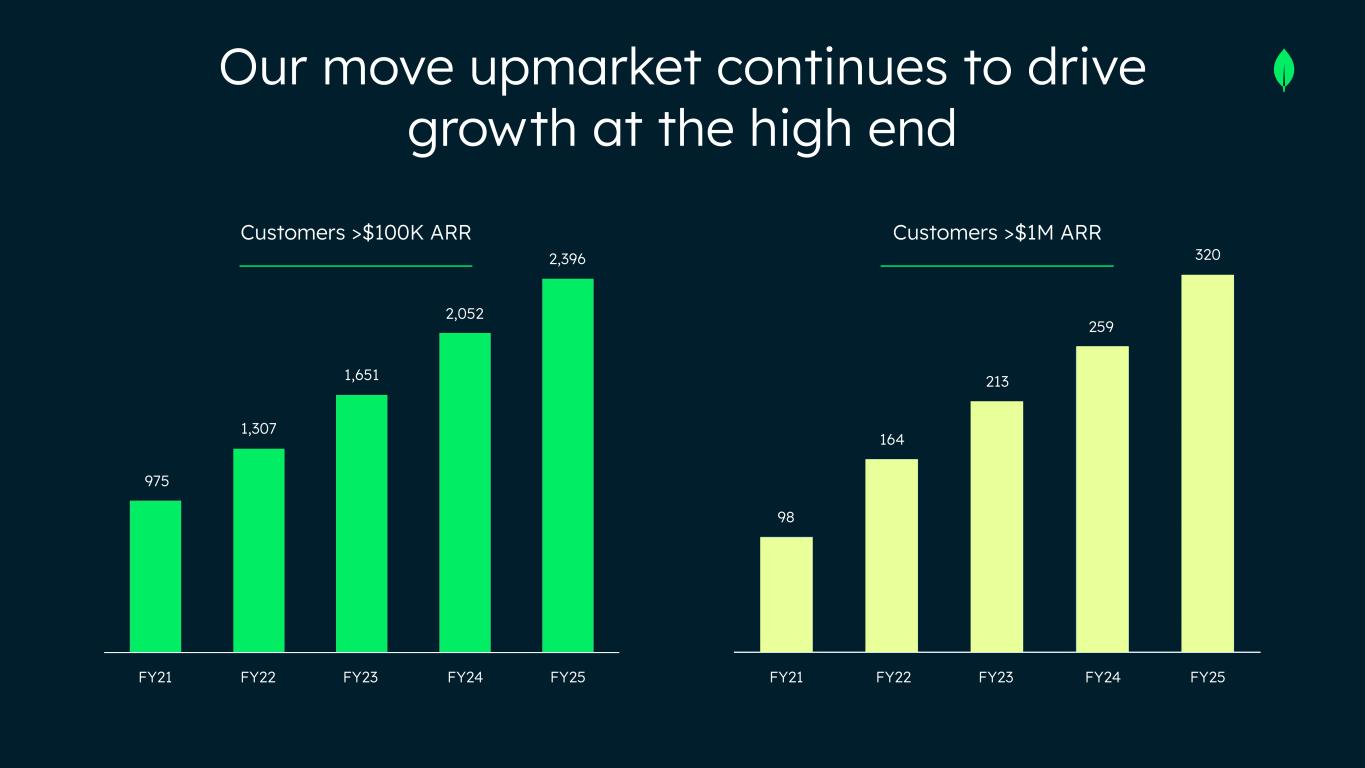

Customers >$100K ARR Customers >$1M ARR 975 1,307 1,651 2,052 2,396 98 164 213 259 320 FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25 Our move upmarket continues to drive growth at the high end

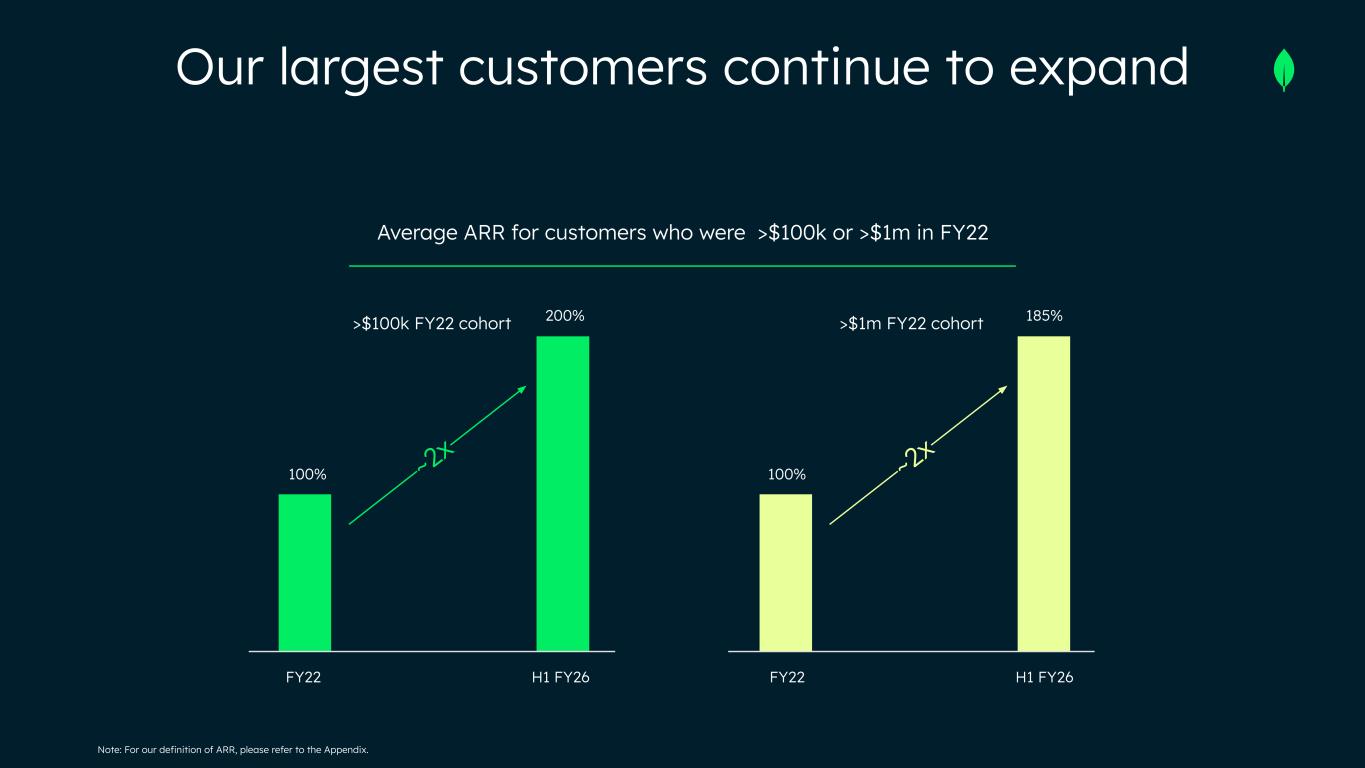

Average ARR for customers who were >$100k or >$1m in FY22 >$1m FY22 cohort ~2x FY22 H1 FY26 >$100k FY22 cohort ~2x FY22 H1 FY26 100% 200% 100% 185% Note: For our definition of ARR, please refer to the Appendix. Our largest customers continue to expand

Invest to Drive Growth

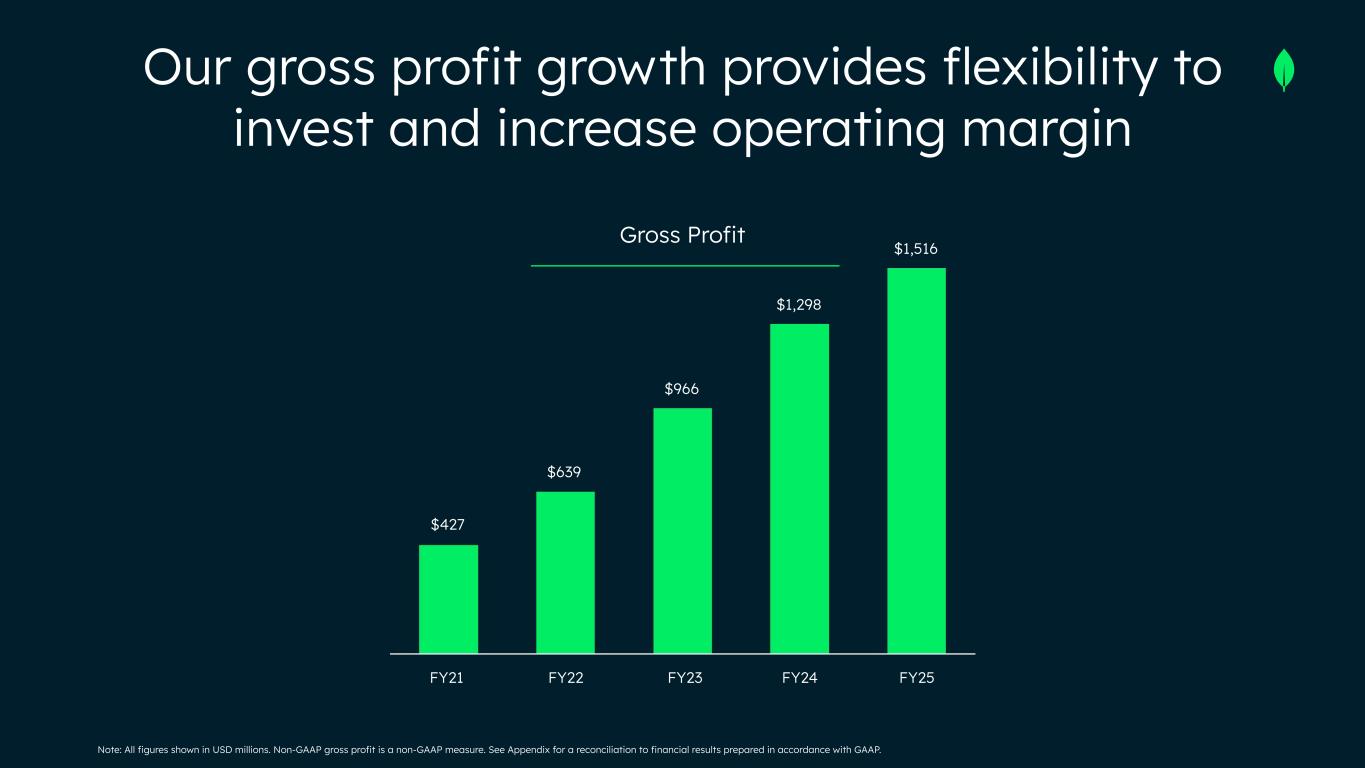

Note: All figures shown in USD millions. Non-GAAP gross profit is a non-GAAP measure. See Appendix for a reconciliation to financial results prepared in accordance with GAAP. Gross Profit FY21 FY22 FY23 FY24 FY25 $427 $639 $966 $1,298 $1,516 Our gross profit growth provides flexibility to invest and increase operating margin

Via live and self-serve programs, we’ve trained 180K+ skilled users year-to-date YTD we’ve hosted 165 hands-on workshops with attendees in over 30 countries We are investing in Developer Awareness as we still have a limited footprint compared to our opportunity

Invest in features for AI workloads and to integrate AI into our products Deepening our competitive advantage in our core database offering We are investing in Research and Development as we execute against our ambitious product roadmap

Expanding our partner ecosystem Hiring enterprise reps to fuel the move upmarket We are investing in Sales as we have a significant opportunity to capture AI workloads. Investing in PLG / self- serve for long-term growth Building teams of forward- deployed engineers to solution with customers Using AI and tools to automate work

Areas of focus to increase efficiency Revenue growth drives gross profit Scale efficiencies Incremental/Variable investments Reallocation Productivity

Capital Structure

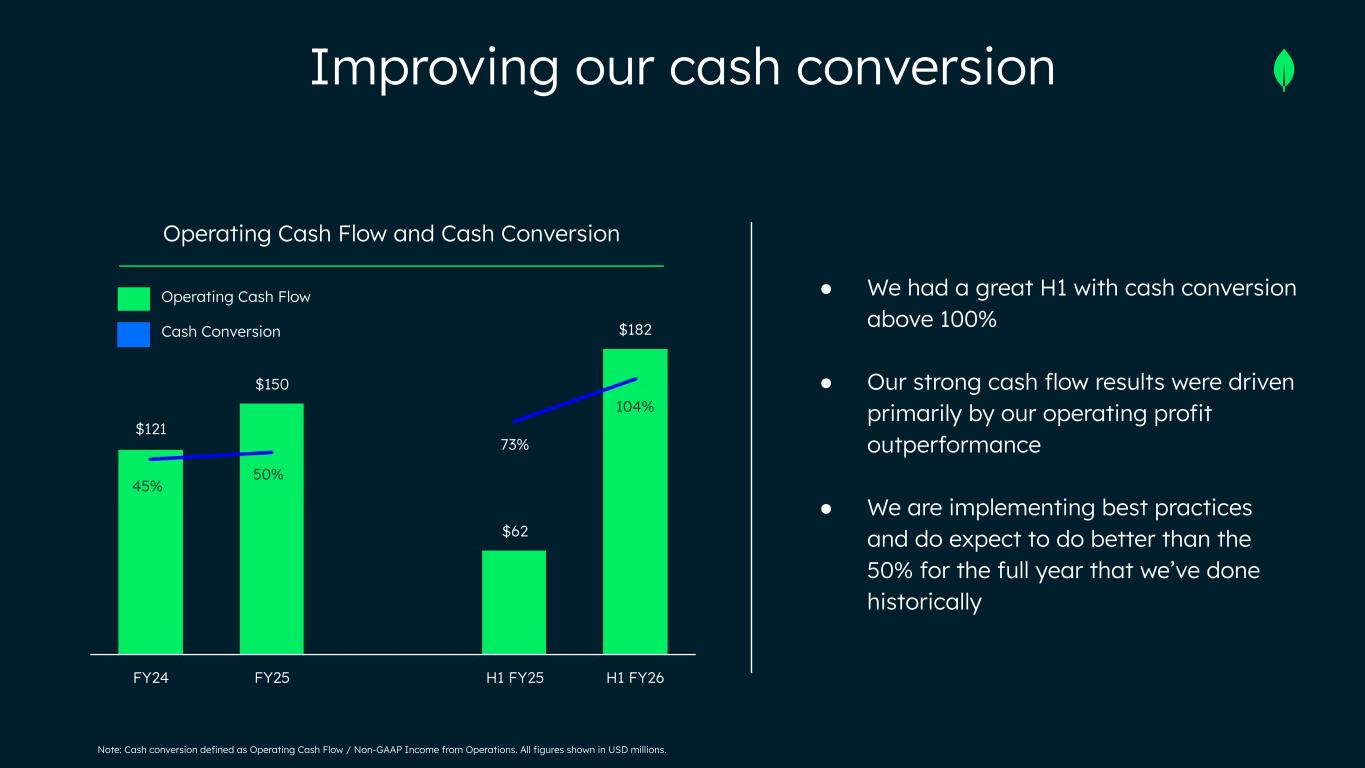

Operating Cash Flow and Cash Conversion ● We had a great H1 with cash conversion above 100% ● Our strong cash flow results were driven primarily by our operating profit outperformance ● We are implementing best practices and do expect to do better than the 50% for the full year that we’ve done historically Improving our cash conversion Operating Cash Flow Cash Conversion 45% 50% 104% $121 $150 $62 $182 73% FY24 FY25 H1 FY25 H1 FY26 Note: Cash conversion defined as Operating Cash Flow / Non-GAAP Income from Operations. All figures shown in USD millions.

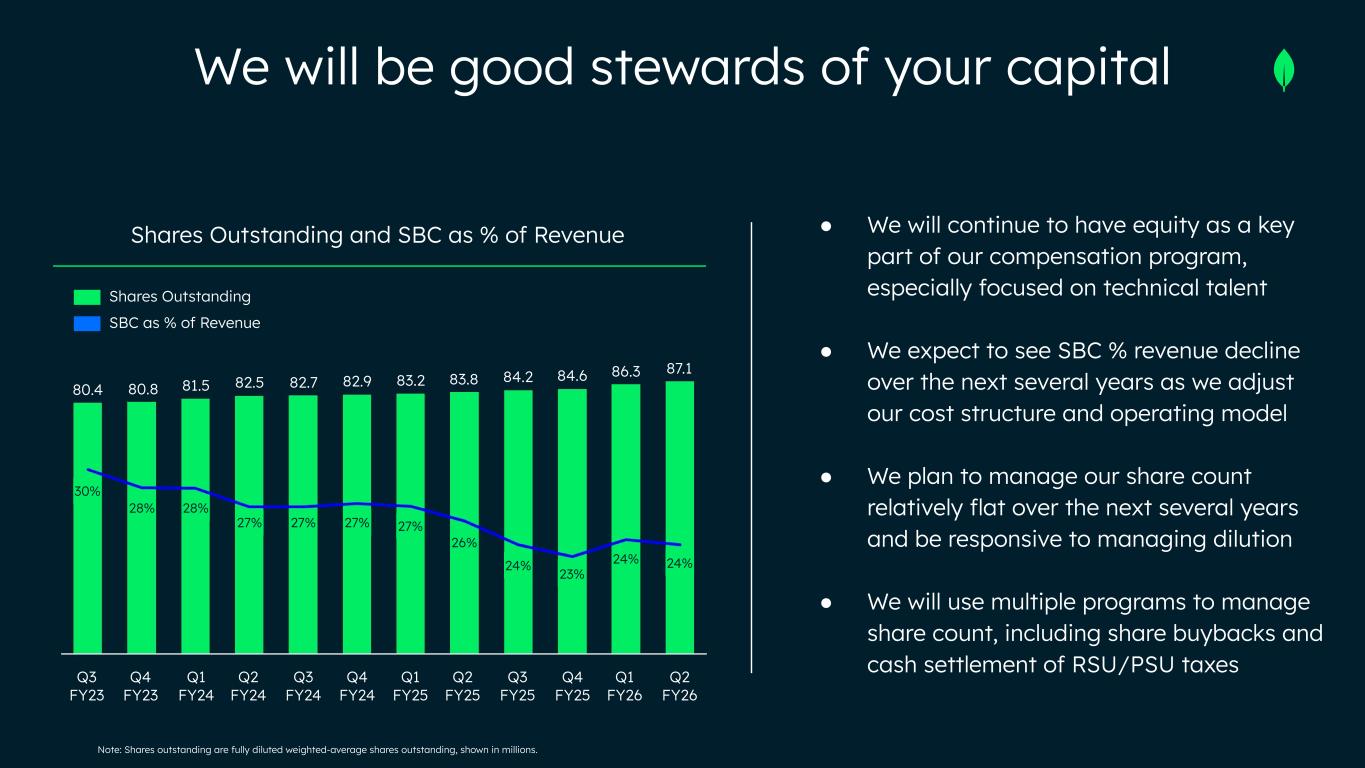

Shares Outstanding and SBC as % of Revenue Shares Outstanding SBC as % of Revenue ● We will continue to have equity as a key part of our compensation program, especially focused on technical talent ● We expect to see SBC % revenue decline over the next several years as we adjust our cost structure and operating model ● We plan to manage our share count relatively flat over the next several years and be responsive to managing dilution ● We will use multiple programs to manage share count, including share buybacks and cash settlement of RSU/PSU taxesQ3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Q3 FY24 Q4 FY24 Q1 FY25 Q2 FY25 Q3 FY25 Q4 FY25 Q1 FY26 Q2 FY26 24%24% 23%24% 26% 27%27%27%27% 28%28% 30% 80.4 80.8 81.5 82.5 82.7 82.9 83.2 83.8 84.2 84.6 86.3 87.1 Note: Shares outstanding are fully diluted weighted-average shares outstanding, shown in millions. We will be good stewards of your capital

Long-term financial targets as we drive towards the Rule of 40

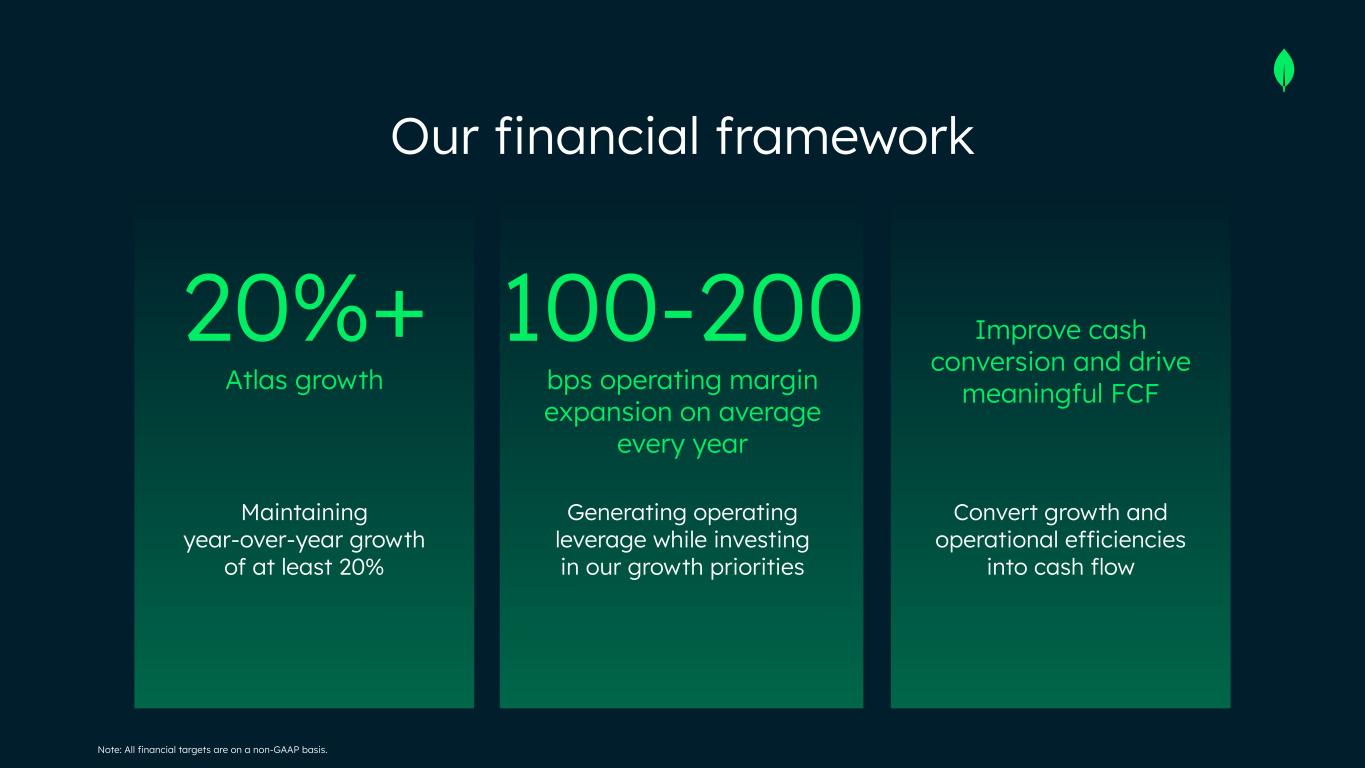

Note: All financial targets are on a non-GAAP basis. 100-200 bps operating margin expansion on average every year 20%+ Atlas growth Improve cash conversion and drive meaningful FCF Maintaining year-over-year growth of at least 20% Generating operating leverage while investing in our growth priorities Convert growth and operational efficiencies into cash flow Our financial framework

Long-term financial targets Note: All financial targets are on a non-GAAP basis. Revenue: High teens average growth Operating Margin: 20%+ In the time frame of the long-term model FCF Conversion: 80%+ 3-5 YEARS

Our Growth Drivers KEY TAKEAWAYS

We have a huge market opportunity with double digit growth Our Growth Drivers KEY TAKEAWAYS

We have a huge market opportunity with double digit growth Our platform is differentiated with the document model Our Growth Drivers KEY TAKEAWAYS

We have a huge market opportunity with double digit growth Our platform is differentiated with the document model Our Growth Drivers KEY TAKEAWAYS We expect AI will be an incremental growth driver

We have a huge market opportunity with double digit growth Our platform is differentiated with the document model We expect AI will be an incremental growth driver We expect AMP will be an incremental growth driver Our Growth Drivers KEY TAKEAWAYS

We plan to drive durable growth and margin expansion We have a huge market opportunity with double digit growth Our platform is differentiated with the document model We expect AI will be an incremental growth driver We expect AMP will be an incremental growth driver Our Growth Drivers KEY TAKEAWAYS

We plan to drive durable growth and margin expansion We have a huge market opportunity with double digit growth Our platform is differentiated with the document model We expect AI will be an incremental growth driver We expect AMP will be an incremental growth driver Our Growth Drivers KEY TAKEAWAYS

Q&A

Why MongoDB wins With a strong base and multiple tailwinds, we’re confident in our ability to drive durable growth. RECAP Our market is massive and growing AI grows our market significantly It’s not a winner-take-all market, but our differentiation is durable AMP is an incremental growth driver

Appendix

Non-GAAP Financial Measures This presentation includes the following financial measures defined as non-GAAP financial measures by the SEC: non-GAAP gross profit, non-GAAP income from operations, non-GAAP operating margin, cash conversion, free cash flow and free cash flow conversion. Non-GAAP gross profit excludes expenses associated with stock-based compensation. Non-GAAP income from operations and non-GAAP operating margin exclude expenses associated with stock-based compensation including employer payroll taxes upon the vesting and exercising of stock-based awards and expenses related to stock appreciation rights previously issued to our employees in China, amortization of intangible assets for the acquired technology and acquired customer relationships associated with prior acquisitions, certain acquisition-related costs and other, including due diligence costs, professional fees in connection with an acquisition and certain integration-related expenses, and restructuring costs associated with a formal restructuring plan that are primarily related to workforce reductions. The Company excludes these expenses because they are not reflective of ordinary course ongoing business and operating results. Free cash flow represents net cash from/used in operating activities, less capital expenditures, principal payments of finance lease liabilities and capitalized software development costs, if any. MongoDB uses free cash flow to understand and evaluate its liquidity and to generate future operating plans. The exclusion of capital expenditures, principal payments of finance lease liabilities and amounts capitalized for software development facilitates comparisons of MongoDB’s liquidity on a period-to-period basis and excludes items that it does not consider to be indicative of its liquidity. MongoDB believes that free cash flow is a measure of liquidity that provides useful information to investors in understanding and evaluating the strength of its liquidity and future ability to generate cash that can be used for strategic opportunities or investing in its business in the same manner as MongoDB’s management and board of directors. Cash conversion is defined as operating cash flow divided by non-GAAP income from operations. Free cash flow conversion is defined as free cash flow divided by non-GAAP income from operations. MongoDB uses these non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating MongoDB’s ongoing operational performance. MongoDB believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing its financial results with other companies in MongoDB’s industry, many of which may present similar non-GAAP financial measures to investors. Non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. In particular, other companies may report non-GAAP gross profit, non-GAAP income from operations, non-GAAP operating margin and free cash flow or similarly titled measures but calculate them differently, which reduces their usefulness as comparative measures. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, as presented below. Operating margin and free cash flow conversion are non-GAAP and reconciliations of non-GAAP operating margin and non-GAAP free cash flow conversion to the most directly comparable GAAP measures are not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures and the lack of a timeline for the achievement of said long-term financial model. This presentation and any future presentations containing such non-GAAP reconciliations can also be found on the Investor Relations page of MongoDB’s website at https://investors.mongodb.com.

Definitions We calculate annualized recurring revenue (“ARR”) and annualized monthly recurring revenue (“MRR”) to help us measure our subscription revenue performance. ARR includes the revenue we expect to receive from our customers over the following 12 months based on contractual commitments and, in the case of Direct Sales Customers of MongoDB Atlas, by annualizing the prior 90 days of their actual usage of MongoDB Atlas, assuming no increases or reductions in their subscriptions or usage. For all other customers of our self-serve products, we calculate annualized MRR by annualizing the prior 30 days of their actual usage of such products, assuming no increases or reductions in usage. ARR and annualized MRR exclude professional services. When we refer to ARR in this presentation, we are referring to the combination of annualized recurring revenue (“ARR”) and annualized monthly recurring revenue (“MRR”) unless otherwise noted. Non-Atlas (Enterprise Advanced + Other) annualized recurring revenue (“ARR”) includes the revenue we expect to receive from our customers over the following 12 months based on contractual commitments for subscription products excluding Atlas.

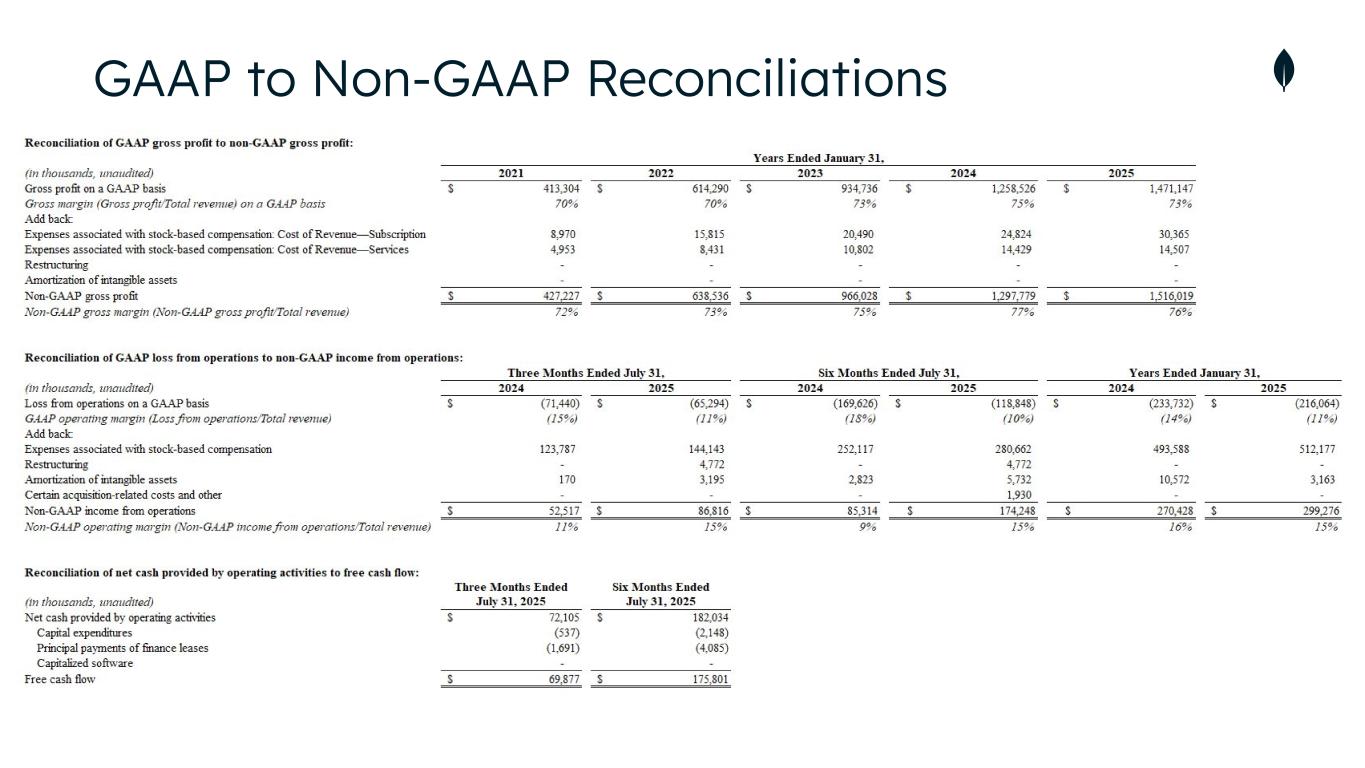

GAAP to Non-GAAP Reconciliations