Booz Allen Hamilton Announces First Quarter Fiscal 2026 Results McLean, Virginia - July 25, 2025 - Booz Allen Hamilton Holding Corporation (NYSE: BAH), the parent company of advanced technology company Booz Allen Hamilton Inc., today announced results for the first quarter of fiscal 2026. The company delivered: Top and bottom-line performance in line with expectations, including growth in Adjusted Net Income1 and Adjusted EBITDA1 Strong performance across defense and intel markets Record Q1 backlog of $38 billion and quarterly book-to-bill ratio of 1.42x Repurchase of 1.1 percent of outstanding shares $200 million anticipated FY26 federal cash tax benefit from new S174 rules Continued strategic investments to accelerate technology transformation “Our first quarter delivered as expected. Booz Allen is winning work that enables us to bring tech into the administration’s mission priorities,” said Horacio Rozanski, Booz Allen Chairman, CEO and President. “We are accelerating our investments and partnerships across the tech ecosystem to continue delivering for our nation.” Q1 Highlights • Revenue declined 0.6 percent year-over-year to $2.9 billion • Adjusted Net Income1 of $184 million, a 2.2 percent increase • Adjusted EBITDA1 of $311 million, a 3.0 percent increase • Adjusted EBITDA Margin on Revenue1 increased by 30 basis points to 10.6 percent • Adjusted Diluted EPS1 of $1.48, a 7.2 percent increase • 1.42x quarterly book-to-bill ratio • Total backlog of $38 billion, a 10.7 percent increase • Free cash flow1 of $96 million, compared to $20 million in the prior year • $233 million in total capital deployment A regular quarterly dividend of $0.55 per share will be payable on August 29, 2025, to stockholders of record on August 14, 2025. 1 Due to the fiscal 2025 change in rounding presentation to millions, comparative period presentation within this release has been adjusted accordingly. 1 Revenue, Excluding Billable Expenses, Adjusted Net Income, Adjusted EBITDA, Adjusted Diluted EPS, Adjusted EBITDA Margin on Revenue, and Free Cash Flow are non- GAAP financial measures. See "Non-GAAP Financial Information" below for additional detail. Three Months Ended March 31, 2025 2024 % Change (unaudited) Revenue $2,924 $2,942 (0.6)% Revenue Ex. Billable Expenses $2,043 $1,997 2.3% Net Income $271 $165 64.2% Adjusted Net Income $184 $180 2.2% Diluted EPS $2.16 $1.27 70.1% Adjusted Diluted EPS $1.48 $1.38 7.2% EBITDA $297 $296 0.3% Adjusted EBITDA $311 $302 3.0% Adjusted EBITDA Margin on Revenue 10.6% 10.3% +30 bps Net Cash Provided by Operating Activities $119 $52 128.8% Free Cash Flow $96 $20 380.0% FINANCIAL SUMMARY

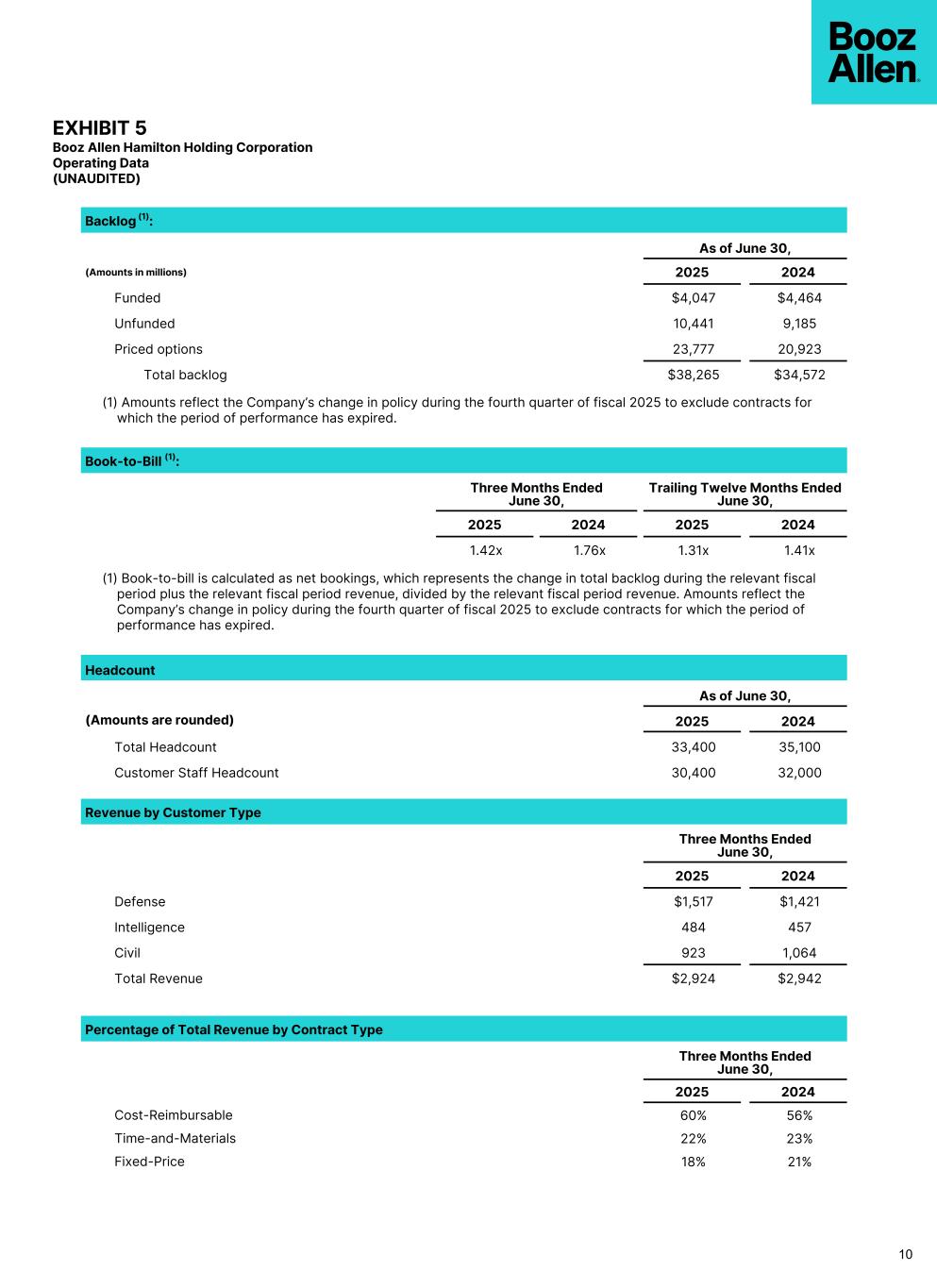

2 Reconciliations omitted in reliance on Item 10(e)(1)(i)(B) of Regulation S-K. See "Non-GAAP Financial Information." 3 Fiscal 2026 Guidance assumes an adjusted effective tax rate of 23–25% and average diluted shares outstanding of 123–125 million. 4 Fiscal 2026 Guidance assumes capital expenditures of approximately $110 million and $200 million cash tax benefit relative to initial guidance due to new S174 rules under the One Big Beautiful Bill. 2 OPERATING PERFORMANCE FISCAL YEAR 2026 GUIDANCE Revenue $12.0 - $12.5 billion Revenue Growth 0 - 4.0% Adjusted EBITDA $1,315 - $1,370 million Adjusted EBITDA Margin on Revenue ~11% Adjusted Diluted EPS3 $6.20 - $6.55 Free Cash Flow4 $900 - $1,000 million EARNINGS WEBCAST We will host a live conference call at 8 a.m. EDT on Friday, July 25, 2025, to discuss the financial results for our first quarter of fiscal year 2026. Analysts and institutional investors may participate on the call by registering online at investors.boozallen.com. The conference call will be webcast simultaneously to the public through a link at investors.boozallen.com. This press release, including the reconciliations of certain non-GAAP measures to their nearest comparable GAAP measures, is also available at investors.boozallen.com. A replay of the conference call will also be available on the site beginning at 11 a.m. EDT on Friday, July 25, 2025, and continuing for 12 months. ABOUT BOOZ ALLEN HAMILTON Booz Allen is an advanced technology company delivering outcomes with speed for America’s most critical defense, civil, and national security priorities. We build technology solutions using AI, cyber, and other cutting-edge technologies to advance and protect the nation and its citizens. By focusing on outcomes, we enable our people, clients, and their missions to succeed—accelerating the nation to realize our purpose: Empower People to Change the World®. With global headquarters in McLean, Virginia, our firm employs approximately 33,400 people globally as of June 30, 2025, and had revenue of $12.0 billion for the 12 months ended March 31, 2025. To learn more, visit www.boozallen.com. (NYSE: BAH) CONTACT INFORMATION Investor Relations Dustin Darensbourg Investor_Relations@bah.com Media Relations Jessica Klenk Klenk_Jessica@bah.com OUTLOOK2 For fiscal year 2026, we expect:

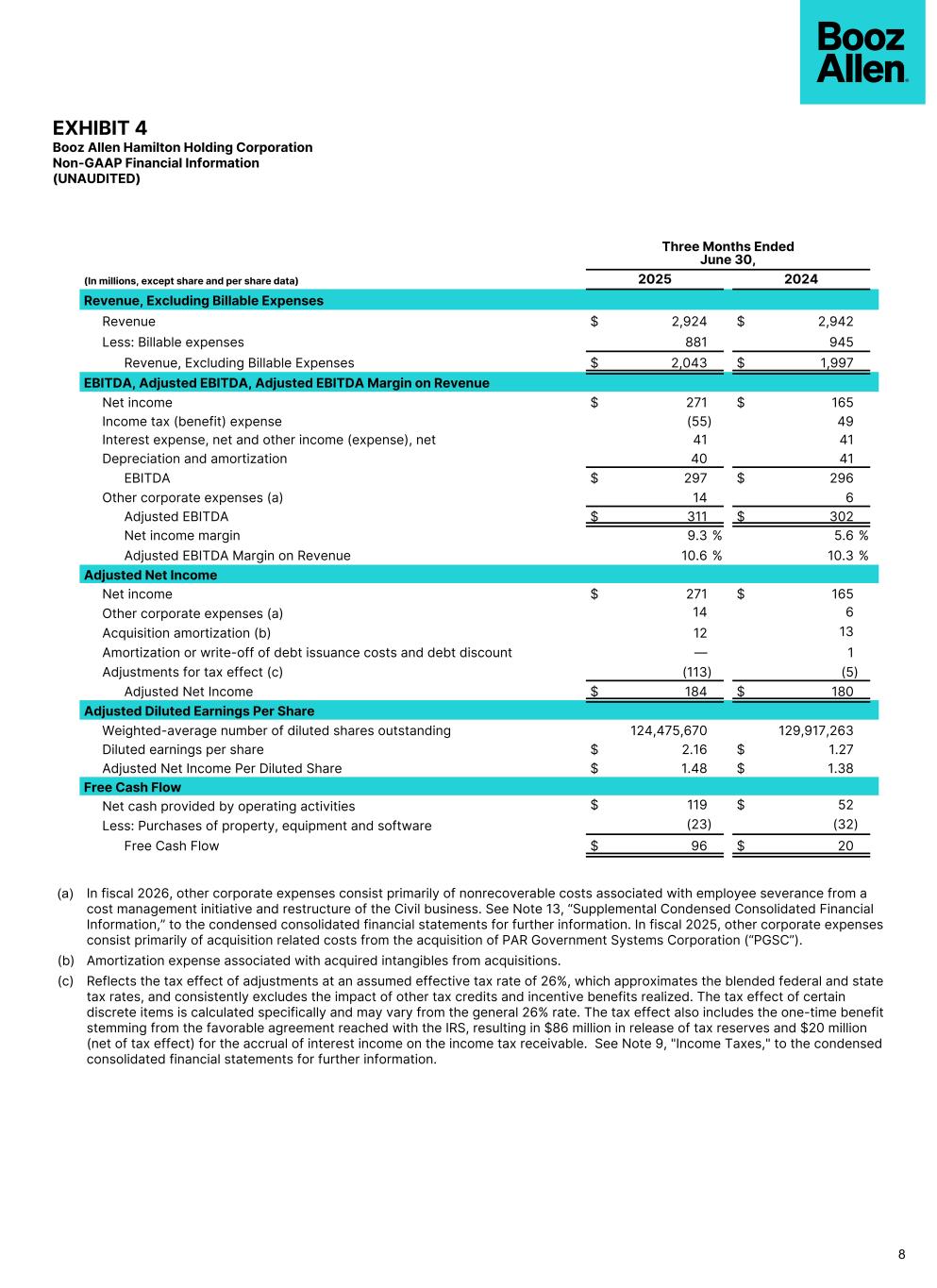

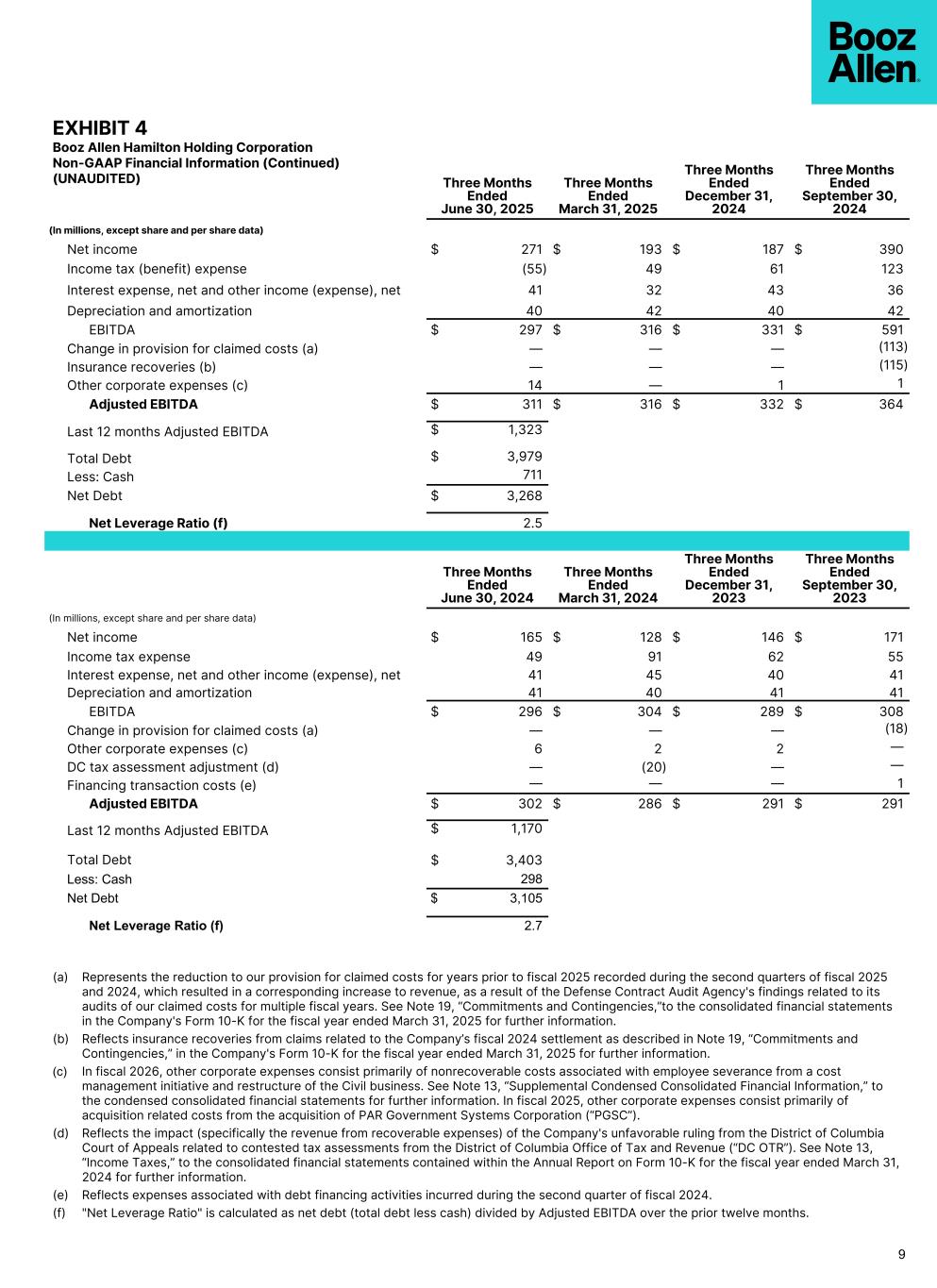

NON-GAAP FINANCIAL INFORMATION Booz Allen utilizes and discusses in this release Revenue, Excluding Billable Expenses, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow. While we believe that these non-GAAP financial measures may be useful in evaluating our financial information, they should be considered as supplemental in nature and not as a substitute for financial information prepared in accordance with GAAP. Reconciliations, definitions, and how we believe these measures are useful to management and investors are provided below. Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow exclude the impact of the items detailed in the supplemental exhibits, as these items are generally not operational in nature. These non-GAAP measures also provide another basis for comparing period to period results by excluding potential differences caused by non-operational and unusual or non-recurring items. “Revenue, Excluding Billable Expenses” represents revenue less billable expenses. Booz Allen uses Revenue, Excluding Billable Expenses because it provides management useful information about the Company’s operating performance by excluding the impact of costs such as subcontractor expenses, travel expenses, and other non-labor expenses incurred to perform on contracts. Billable expenses generally have lower margin and thus are less indicative of our profit generation capacity. "EBITDA” represents net income before income taxes, interest expense, net and other income (expense), net, and depreciation and amortization. “Adjusted EBITDA” represents net income before income tax expense, interest expense, net and other income (expense), net and depreciation and amortization and before certain other items, including the change in provision for claimed costs for historical rate years, other corporate expenses, financing transaction costs, DC tax assessment adjustment, and insurance recoveries. “Adjusted EBITDA Margin on Revenue” is calculated as Adjusted EBITDA divided by revenue. Booz Allen prepares Adjusted EBITDA and Adjusted EBITDA Margin on Revenue to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. “Adjusted Net Income” represents net income before: (i) other corporate expenses, (ii) acquisition amortization, and (iii) amortization or write-off of debt issuance costs and debt discount, in each case net of the tax effect where appropriate calculated using an assumed effective tax rate. Booz Allen prepares Adjusted Net Income to eliminate the impact of items, net of tax, it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. “Adjusted Diluted EPS” represents diluted EPS calculated using Adjusted Net Income as opposed to net income. Additionally, Adjusted Diluted EPS does not contemplate any adjustments to net income as required under the two- class method as disclosed in the footnotes to the consolidated financial statements of the Company's Form 10-K for the fiscal year ended March 31, 2025. "Free Cash Flow" represents the net cash generated from operating activities less the impact of purchases of property, equipment and software. Booz Allen presents these supplemental measures because it believes that these measures provide investors and securities analysts with important supplemental information with which to evaluate Booz Allen’s performance, long-term earnings potential, or liquidity, as applicable.These non-GAAP measurements may vary from and may not be comparable to similarly titled measures by other companies in Booz Allen’s industry. "Adjusted Effective Tax Rate" represents income tax expense (benefit) excluding the income tax effects of adjustments to net income, divided by adjusted earnings before income tax expense. "Net Leverage Ratio" is calculated as net debt (total debt less cash) divided by Adjusted EBITDA over the prior twelve months. Revenue, Excluding Billable Expenses, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, Adjusted Diluted EPS, Free Cash Flow, and Net Leverage Ratio are not recognized measurements under accounting principles generally accepted in the United States, or GAAP, and when analyzing Booz Allen’s performance or liquidity, as applicable, investors should (i) evaluate each adjustment in our reconciliation of revenue to Revenue, Excluding Billable Expenses, net income to Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, and Adjusted Diluted Earnings Per Share, net cash provided by operating activities to Free Cash Flow, and net debt to Net Leverage Ratio, (ii) use Revenue, Excluding Billable Expenses, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, and Adjusted Diluted EPS in addition to, and not as an alternative to, revenue, net income or diluted EPS as measures of operating results, each as defined under GAAP, (iii) use Free Cash Flow and Net Leverage Ratio, in addition to, and not as an alternative to, net cash provided by operating activities as a measure of liquidity, each as defined under GAAP, and (iv) use Net Leverage Ratio in addition to, and not as an alternative to, net debt as a measure of Booz Allen's debt leverage. Exhibit 4 includes a reconciliation of Revenue, Excluding Billable Expenses, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, Adjusted Diluted EPS, Free Cash Flow and Net Leverage Ratio to the most directly comparable financial measure calculated and presented in accordance with GAAP. With respect to our expectations under “Outlook” above, a reconciliation of Adjusted Diluted EPS guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward- looking basis due to our inability to predict our stock price, equity grants, and dividend declarations during the course of fiscal 2026. Projecting future stock price, equity grants, and the dividends to be declared would be necessary to accurately calculate the difference between Adjusted Diluted EPS and GAAP EPS as a result of the effects of the two-class method and related possible dilution used in the calculation of EPS. Consequently, any attempt to disclose such reconciliation would imply a degree of precision that could be confusing or misleading to investors. We expect the variability of the above charges to have an unpredictable, and potentially significant, impact on our future GAAP financial results. Accordingly, Booz Allen is relying on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude the reconciliation. In addition, our expectations for Adjusted EBITDA and Adjusted EBITDA Margin on Revenue for fiscal 2026 are presented under "Outlook" above and management may discuss its expectation for Adjusted EBITDA and Adjusted EBITDA Margin on Revenue for fiscal 2026 from time to time. A reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin on Revenue guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to our inability to predict specific quantification of the amounts that would be required to reconcile such measures. Consequently, any attempt to disclose such reconciliation would imply a degree of precision that could be confusing or misleading to investors. Accordingly, Booz Allen is relying on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude the reconciliation. 3

FORWARD LOOKING STATEMENTS Certain statements contained in this press release and in related comments by our management include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include information concerning Booz Allen’s preliminary financial results, financial outlook and guidance, including forecasted revenue, Diluted EPS, and Adjusted Diluted EPS, future quarterly dividends, and future improvements in operating margins, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks and other factors include: • any issue that compromises our relationships with the U.S. government or damages our professional reputation, including negative publicity concerning government contractors in general or us in particular; • changes in U.S. government spending, including a continuation of efforts by the U.S. government to reduce U.S. government spending, increased insourcing by certain U.S. government agencies, and shifts in expenditures away from agencies or programs that we support, as well as associated uncertainty around the timing, extent, nature and effect of such efforts; • U.S. government shutdowns as well as delayed long-term funding of our contracts; • failure to comply with new and existing U.S. and international laws and regulations; • our ability to compete effectively in the competitive bidding process and delays or losses of contract awards caused by competitors’ protests of major contract awards received by us; • the loss of U.S. government GSA Schedules or our position as prime contractor on government-wide acquisition contract vehicles (“GWACs”); • variable purchasing patterns under certain of our U.S. government contracts and changes in the mix of our contracts including our ability to accurately estimate or otherwise recover expenses, time, and resources for our contracts; • our ability to realize the full value of and replenish our backlog, generate revenue under certain of our contracts, and the timing of our receipt of revenue under contracts included in backlog; • internal system or service failures and security breaches, including, but not limited to, those resulting from external or internal threats, including cyber attacks on our network and internal systems or on our customers’ network or internal systems; • misconduct or other improper activities from our employees, subcontractors or suppliers, including the improper access, use or release of our or our customers’ sensitive or classified information; • failure to maintain strong relationships with other contractors, or the failure of contractors with which we have entered into a sub or prime-contractor relationship to meet their obligations to us or our customers; • inherent uncertainties and potential adverse developments in legal or regulatory proceedings, including litigation, audits, reviews, and investigations, which may result in materially adverse judgments, settlements, withheld payments, penalties, or other unfavorable outcomes including debarment, as well as disputes over the availability of insurance or indemnification; • risks related to a possible recession and volatility or instability of the global financial system, including the failures of financial institutions and the resulting impact on counterparties and business conditions generally; • risks related to a deterioration of economic conditions or weakening in credit or capital markets; • risks related to pending, completed, and future acquisitions and dispositions, including the ability to satisfy specified closing conditions for pending transactions, such as those related to receipt of regulatory approval or lack of regulatory intervention, and to realize the expected benefits from completed acquisitions and dispositions; • risks inherent in the government contracting environment; and • risks related to our indebtedness and credit facilities which contain financial and operating covenants. Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K filed with the SEC on May 23, 2025. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. 4

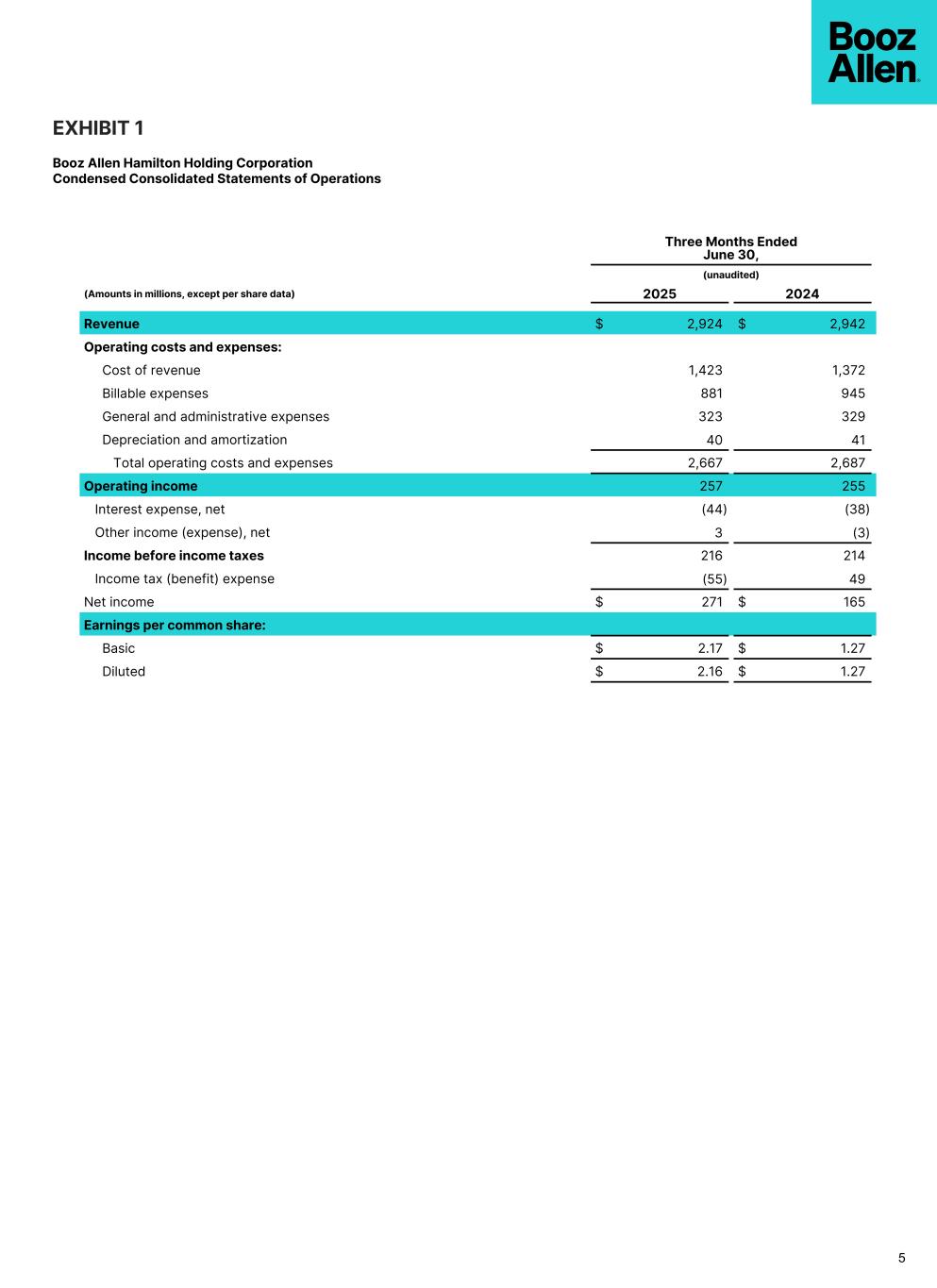

EXHIBIT 1 Booz Allen Hamilton Holding Corporation Condensed Consolidated Statements of Operations 5 Three Months Ended June 30, (unaudited) (Amounts in millions, except per share data) 2025 2024 Revenue $ 2,924 $ 2,942 Operating costs and expenses: Cost of revenue 1,423 1,372 Billable expenses 881 945 General and administrative expenses 323 329 Depreciation and amortization 40 41 Total operating costs and expenses 2,667 2,687 Operating income 257 255 Interest expense, net (44) (38) Other income (expense), net 3 (3) Income before income taxes 216 214 Income tax (benefit) expense (55) 49 Net income $ 271 $ 165 Earnings per common share: Basic $ 2.17 $ 1.27 Diluted $ 2.16 $ 1.27

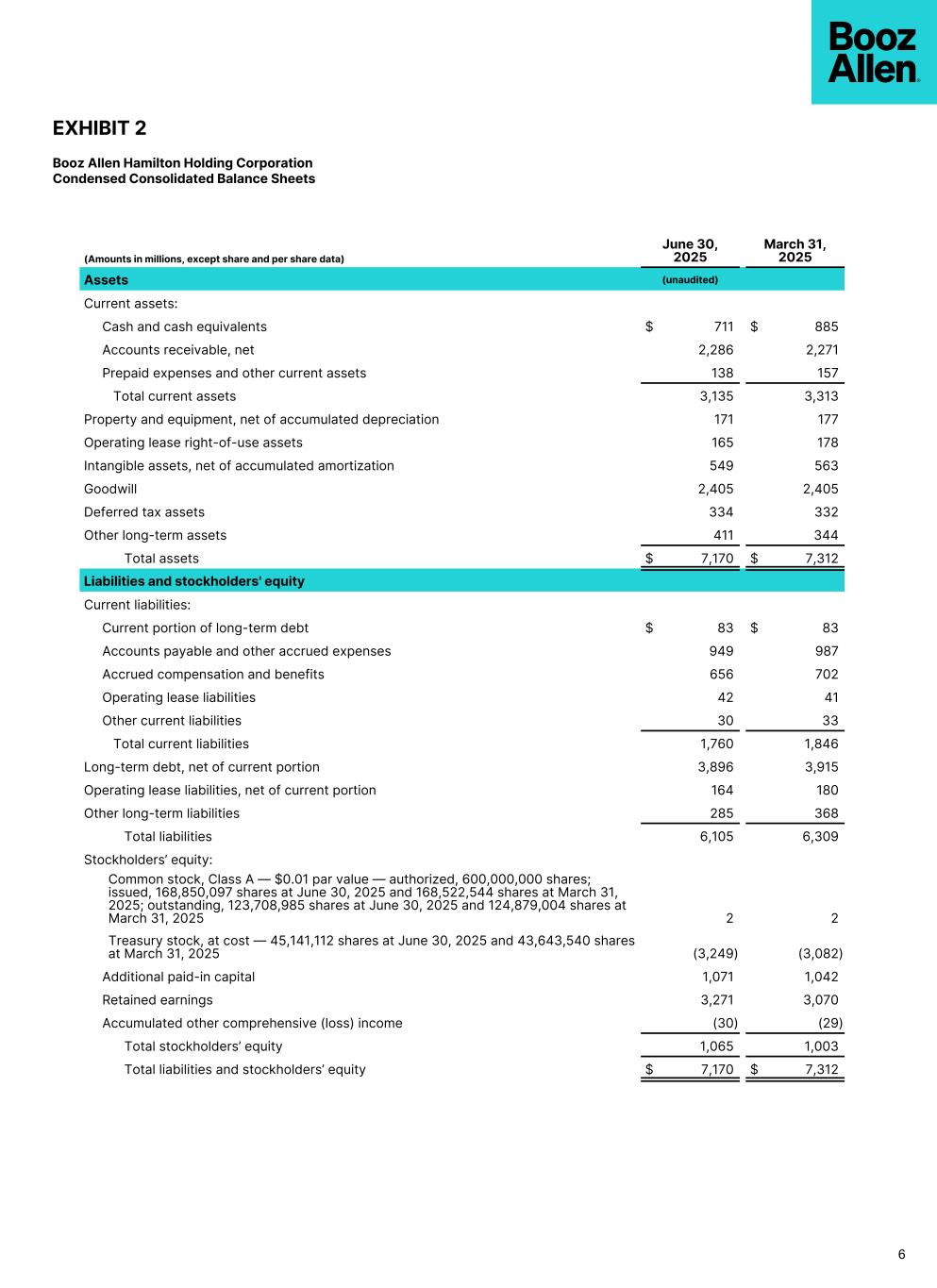

EXHIBIT 2 Booz Allen Hamilton Holding Corporation Condensed Consolidated Balance Sheets (Amounts in millions, except share and per share data) June 30, 2025 March 31, 2025 Assets (unaudited) Current assets: Cash and cash equivalents $ 711 $ 885 Accounts receivable, net 2,286 2,271 Prepaid expenses and other current assets 138 157 Total current assets 3,135 3,313 Property and equipment, net of accumulated depreciation 171 177 Operating lease right-of-use assets 165 178 Intangible assets, net of accumulated amortization 549 563 Goodwill 2,405 2,405 Deferred tax assets 334 332 Other long-term assets 411 344 Total assets $ 7,170 $ 7,312 Liabilities and stockholders' equity Current liabilities: Current portion of long-term debt $ 83 $ 83 Accounts payable and other accrued expenses 949 987 Accrued compensation and benefits 656 702 Operating lease liabilities 42 41 Other current liabilities 30 33 Total current liabilities 1,760 1,846 Long-term debt, net of current portion 3,896 3,915 Operating lease liabilities, net of current portion 164 180 Other long-term liabilities 285 368 Total liabilities 6,105 6,309 Stockholders’ equity: Common stock, Class A — $0.01 par value — authorized, 600,000,000 shares; issued, 168,850,097 shares at June 30, 2025 and 168,522,544 shares at March 31, 2025; outstanding, 123,708,985 shares at June 30, 2025 and 124,879,004 shares at March 31, 2025 2 2 Treasury stock, at cost — 45,141,112 shares at June 30, 2025 and 43,643,540 shares at March 31, 2025 (3,249) (3,082) Additional paid-in capital 1,071 1,042 Retained earnings 3,271 3,070 Accumulated other comprehensive (loss) income (30) (29) Total stockholders’ equity 1,065 1,003 Total liabilities and stockholders’ equity $ 7,170 $ 7,312 6

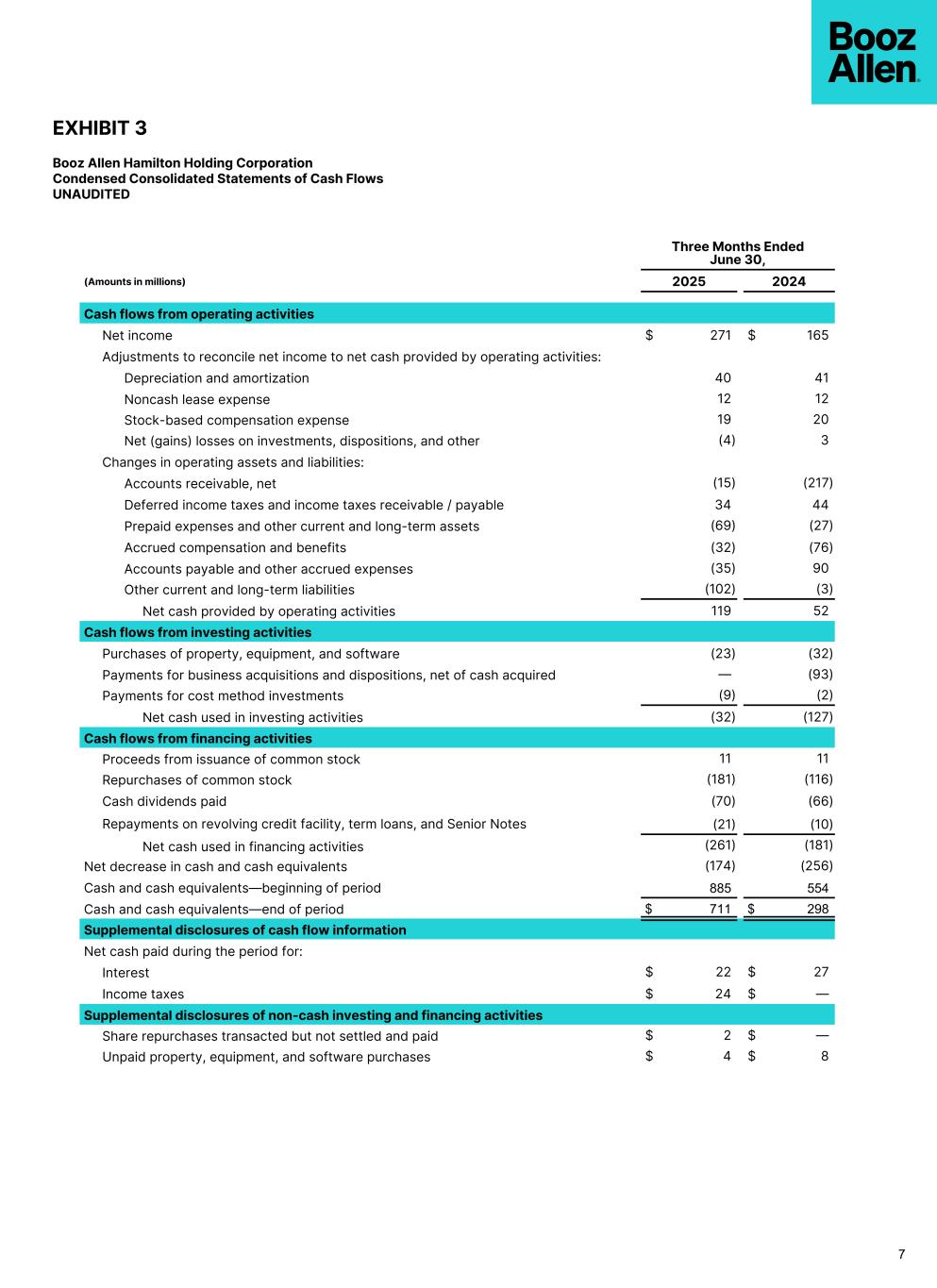

EXHIBIT 3 Booz Allen Hamilton Holding Corporation Condensed Consolidated Statements of Cash Flows UNAUDITED Three Months Ended June 30, (Amounts in millions) 2025 2024 Cash flows from operating activities Net income $ 271 $ 165 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 40 41 Noncash lease expense 12 12 Stock-based compensation expense 19 20 Net (gains) losses on investments, dispositions, and other (4) 3 Changes in operating assets and liabilities: Accounts receivable, net (15) (217) Deferred income taxes and income taxes receivable / payable 34 44 Prepaid expenses and other current and long-term assets (69) (27) Accrued compensation and benefits (32) (76) Accounts payable and other accrued expenses (35) 90 Other current and long-term liabilities (102) (3) Net cash provided by operating activities 119 52 Cash flows from investing activities Purchases of property, equipment, and software (23) (32) Payments for business acquisitions and dispositions, net of cash acquired — (93) Payments for cost method investments (9) (2) Net cash used in investing activities (32) (127) Cash flows from financing activities Proceeds from issuance of common stock 11 11 Repurchases of common stock (181) (116) Cash dividends paid (70) (66) Repayments on revolving credit facility, term loans, and Senior Notes (21) (10) Net cash used in financing activities (261) (181) Net decrease in cash and cash equivalents (174) (256) Cash and cash equivalents––beginning of period 885 554 Cash and cash equivalents––end of period $ 711 $ 298 Supplemental disclosures of cash flow information Net cash paid during the period for: Interest $ 22 $ 27 Income taxes $ 24 $ — Supplemental disclosures of non-cash investing and financing activities Share repurchases transacted but not settled and paid $ 2 $ — Unpaid property, equipment, and software purchases $ 4 $ 8 7

EXHIBIT 4 Booz Allen Hamilton Holding Corporation Non-GAAP Financial Information (UNAUDITED) Three Months Ended June 30, (In millions, except share and per share data) 2025 2024 Revenue, Excluding Billable Expenses Revenue $ 2,924 $ 2,942 Less: Billable expenses 881 945 Revenue, Excluding Billable Expenses $ 2,043 $ 1,997 EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue Net income $ 271 $ 165 Income tax (benefit) expense (55) 49 Interest expense, net and other income (expense), net 41 41 Depreciation and amortization 40 41 EBITDA $ 297 $ 296 Other corporate expenses (a) 14 6 Adjusted EBITDA $ 311 $ 302 Net income margin 9.3 % 5.6 % Adjusted EBITDA Margin on Revenue 10.6 % 10.3 % Adjusted Net Income Net income $ 271 $ 165 Other corporate expenses (a) 14 6 Acquisition amortization (b) 12 13 Amortization or write-off of debt issuance costs and debt discount — 1 Adjustments for tax effect (c) (113) (5) Adjusted Net Income $ 184 $ 180 Adjusted Diluted Earnings Per Share Weighted-average number of diluted shares outstanding 124,475,670 129,917,263 Diluted earnings per share $ 2.16 $ 1.27 Adjusted Net Income Per Diluted Share $ 1.48 $ 1.38 Free Cash Flow Net cash provided by operating activities $ 119 $ 52 Less: Purchases of property, equipment and software (23) (32) Free Cash Flow $ 96 $ 20 8 (a) In fiscal 2026, other corporate expenses consist primarily of nonrecoverable costs associated with employee severance from a cost management initiative and restructure of the Civil business. See Note 13, “Supplemental Condensed Consolidated Financial Information,” to the condensed consolidated financial statements for further information. In fiscal 2025, other corporate expenses consist primarily of acquisition related costs from the acquisition of PAR Government Systems Corporation (“PGSC”). (b) Amortization expense associated with acquired intangibles from acquisitions. (c) Reflects the tax effect of adjustments at an assumed effective tax rate of 26%, which approximates the blended federal and state tax rates, and consistently excludes the impact of other tax credits and incentive benefits realized. The tax effect of certain discrete items is calculated specifically and may vary from the general 26% rate. The tax effect also includes the one-time benefit stemming from the favorable agreement reached with the IRS, resulting in $86 million in release of tax reserves and $20 million (net of tax effect) for the accrual of interest income on the income tax receivable. See Note 9, "Income Taxes," to the condensed consolidated financial statements for further information.

EXHIBIT 4 Booz Allen Hamilton Holding Corporation Non-GAAP Financial Information (Continued) (UNAUDITED) Three Months Ended June 30, 2025 Three Months Ended March 31, 2025 Three Months Ended December 31, 2024 Three Months Ended September 30, 2024 (In millions, except share and per share data) Net income $ 271 $ 193 $ 187 $ 390 Income tax (benefit) expense (55) 49 61 123 Interest expense, net and other income (expense), net 41 32 43 36 Depreciation and amortization 40 42 40 42 EBITDA $ 297 $ 316 $ 331 $ 591 Change in provision for claimed costs (a) — — — (113) Insurance recoveries (b) — — — (115) Other corporate expenses (c) 14 — 1 1 Adjusted EBITDA $ 311 $ 316 $ 332 $ 364 Last 12 months Adjusted EBITDA $ 1,323 Total Debt $ 3,979 Less: Cash 711 Net Debt $ 3,268 Net Leverage Ratio (f) 2.5 Three Months Ended June 30, 2024 Three Months Ended March 31, 2024 Three Months Ended December 31, 2023 Three Months Ended September 30, 2023 (In millions, except share and per share data) Net income $ 165 $ 128 $ 146 $ 171 Income tax expense 49 91 62 55 Interest expense, net and other income (expense), net 41 45 40 41 Depreciation and amortization 41 40 41 41 EBITDA $ 296 $ 304 $ 289 $ 308 Change in provision for claimed costs (a) — — — (18) Other corporate expenses (c) 6 2 2 — DC tax assessment adjustment (d) — (20) — — Financing transaction costs (e) — — — 1 Adjusted EBITDA $ 302 $ 286 $ 291 $ 291 Last 12 months Adjusted EBITDA $ 1,170 Total Debt $ 3,403 Less: Cash 298 Net Debt $ 3,105 Net Leverage Ratio (f) 2.7 9 (a) Represents the reduction to our provision for claimed costs for years prior to fiscal 2025 recorded during the second quarters of fiscal 2025 and 2024, which resulted in a corresponding increase to revenue, as a result of the Defense Contract Audit Agency's findings related to its audits of our claimed costs for multiple fiscal years. See Note 19, “Commitments and Contingencies,”to the consolidated financial statements in the Company's Form 10-K for the fiscal year ended March 31, 2025 for further information. (b) Reflects insurance recoveries from claims related to the Company’s fiscal 2024 settlement as described in Note 19, “Commitments and Contingencies,” in the Company's Form 10-K for the fiscal year ended March 31, 2025 for further information. (c) In fiscal 2026, other corporate expenses consist primarily of nonrecoverable costs associated with employee severance from a cost management initiative and restructure of the Civil business. See Note 13, “Supplemental Condensed Consolidated Financial Information,” to the condensed consolidated financial statements for further information. In fiscal 2025, other corporate expenses consist primarily of acquisition related costs from the acquisition of PAR Government Systems Corporation (“PGSC”). (d) Reflects the impact (specifically the revenue from recoverable expenses) of the Company's unfavorable ruling from the District of Columbia Court of Appeals related to contested tax assessments from the District of Columbia Office of Tax and Revenue (“DC OTR”). See Note 13, “Income Taxes,” to the consolidated financial statements contained within the Annual Report on Form 10-K for the fiscal year ended March 31, 2024 for further information. (e) Reflects expenses associated with debt financing activities incurred during the second quarter of fiscal 2024. (f) "Net Leverage Ratio" is calculated as net debt (total debt less cash) divided by Adjusted EBITDA over the prior twelve months.

EXHIBIT 5 Booz Allen Hamilton Holding Corporation Operating Data (UNAUDITED) Backlog (1): As of June 30, (Amounts in millions) 2025 2024 Funded $4,047 $4,464 Unfunded 10,441 9,185 Priced options 23,777 20,923 Total backlog $38,265 $34,572 (1) Amounts reflect the Company’s change in policy during the fourth quarter of fiscal 2025 to exclude contracts for which the period of performance has expired. Book-to-Bill (1): Three Months Ended June 30, Trailing Twelve Months Ended June 30, 2025 2024 2025 2024 1.42x 1.76x 1.31x 1.41x (1) Book-to-bill is calculated as net bookings, which represents the change in total backlog during the relevant fiscal period plus the relevant fiscal period revenue, divided by the relevant fiscal period revenue. Amounts reflect the Company’s change in policy during the fourth quarter of fiscal 2025 to exclude contracts for which the period of performance has expired. Headcount As of June 30, (Amounts are rounded) 2025 2024 Total Headcount 33,400 35,100 Customer Staff Headcount 30,400 32,000 Revenue by Customer Type Three Months Ended June 30, 2025 2024 Defense $1,517 $1,421 Intelligence 484 457 Civil 923 1,064 Total Revenue $2,924 $2,942 Percentage of Total Revenue by Contract Type Three Months Ended June 30, 2025 2024 Cost-Reimbursable 60% 56% Time-and-Materials 22% 23% Fixed-Price 18% 21% 10