| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant ☑

|

| |

Filed by a Party other than the Registrant ☐

|

|

Check the appropriate box:

|

|||

|

☐

|

| |

Preliminary Proxy Statement

|

|

☐

|

| |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☑

|

| |

Definitive Proxy Statement

|

|

☐

|

| |

Definitive Additional Materials

|

|

☐

|

| |

Soliciting Material under §240.14a-12

|

|

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check all boxes that apply):

|

||||||

|

☑

|

| |

No fee required

|

| ||

|

☐

|

| |

Fee paid previously with preliminary materials

|

| ||

|

☐

|

| |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11

|

| ||

Proto Labs, Inc.

5540 Pioneer Creek Drive

Maple Plain, Minnesota 55359

(763) 479-3680

Fax: (763) 479-2679

April 4, 2023

Dear Fellow Shareholder:

The Board of Directors of Proto Labs, Inc. cordially invites you to join our 2023 Annual

Meeting of Shareholders (the “Annual Meeting”) on Wednesday, May 17, 2023 at 8:30 a.m. Central Time. Our Annual Meeting will be a “virtual meeting” of shareholders, which will be conducted exclusively online via live webcast.

We will be using the “Notice and Access” method of furnishing proxy materials via the

Internet to our shareholders. We believe that this process will provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to reduce the environmental impact of our Annual Meeting and the

costs of printing and distributing the proxy materials. On or about April 4, 2023, we will mail to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement

and Annual Report on Form 10-K and vote electronically via the Internet. The Notice also contains instructions on how to receive a paper copy of your proxy materials.

It is important that your shares be represented at the Annual Meeting, whether or not you

plan to participate. Please vote electronically via the Internet or, if you receive a paper copy of the proxy card by mail, you may vote by Internet, telephone or by returning your signed proxy card in the envelope provided. If you do

participate in the Annual Meeting and desire to vote at that time, you may do so as described in the Proxy Statement.

We hope that you will be able to participate in the Annual Meeting.

Very truly yours,

Archie C. Black

Chairman of the Board

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 17, 2023

| |

Proto Labs, Inc. will hold its 2023 Annual Meeting of Shareholders online via live

webcast on Wednesday, May 17, 2023 at http://www.virtualshareholdermeeting.com/PRLB2023. The Annual Meeting will begin at 8:30 a.m. Central Time. The proxy materials were made available to you via the Internet or mailed to you beginning

on or about April 4, 2023.

|

| ||||||

| |

TIME AND DATE:

|

| |

8:30 a.m. Central Time, on Wednesday, May 17, 2023

|

| |||

| |

ITEM OF BUSINESS:

|

| |

At the Annual Meeting, our shareholders will:

|

| |||

| | | |

1.

|

| |

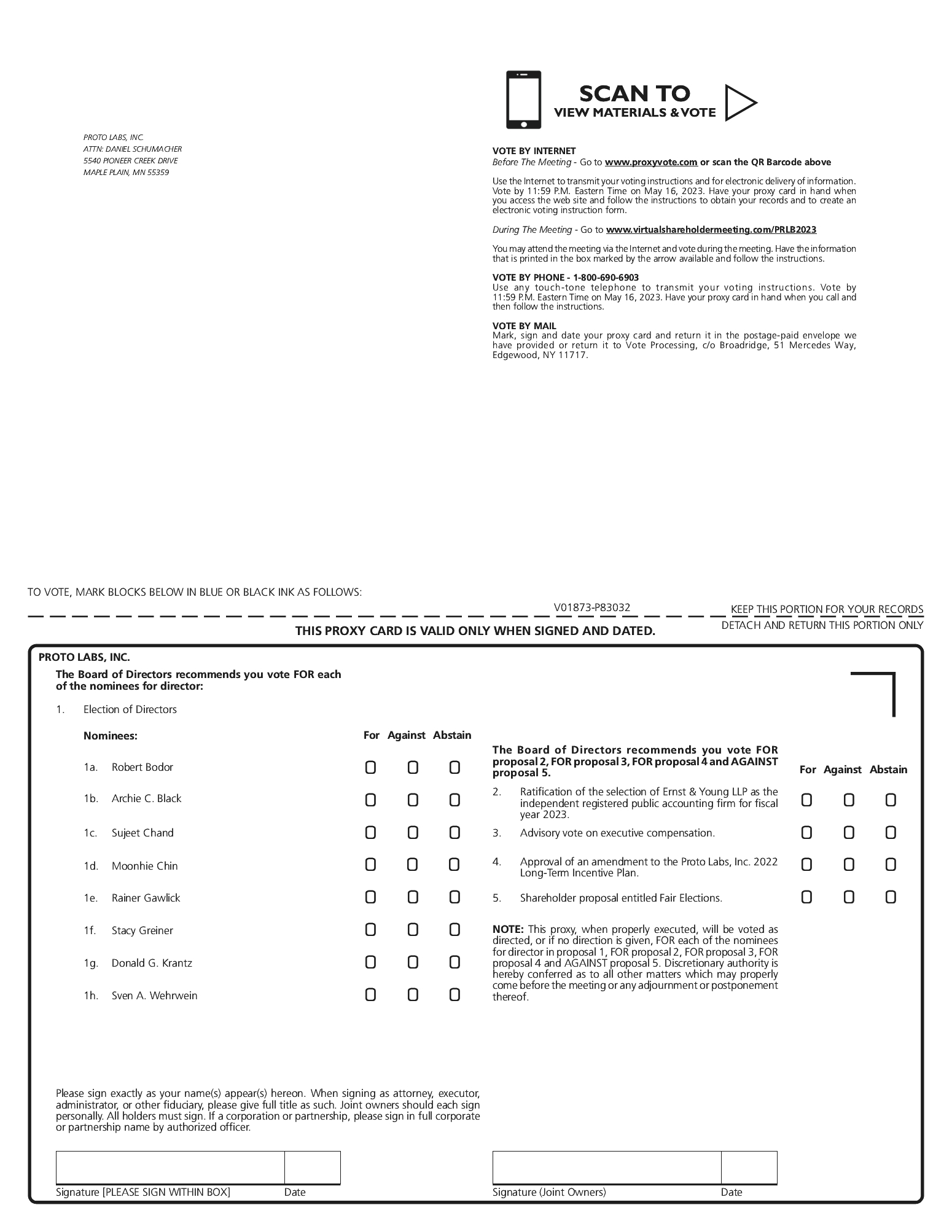

Elect eight directors to hold office until the next Annual Meeting of Shareholders

or until their successors are duly elected.

|

| |

| | | |

2.

|

| |

Vote on the ratification of the selection of Ernst & Young LLP as our

independent registered public accounting firm for fiscal 2023.

|

| |

| | | |

3.

|

| |

Vote on an advisory basis to approve the compensation of the officers disclosed in

the accompanying Proxy Statement, which we refer to as a “say-on-pay” vote.

|

| |

| | | |

4.

|

| |

Vote on the approval of an amendment to the Proto Labs, Inc. 2022 Long-Term

Incentive Plan.

|

| |

| | | |

5.

|

| |

Vote on the shareholder proposal entitled Fair Elections, if properly presented at

the Annual Meeting.

|

| |

| | | |

6.

|

| |

Act on any other matters that may properly come before the Annual Meeting, or any

adjournment or postponement thereof.

|

| |

| |

RECOMMENDATION:

|

| |

The board of directors recommends that shareholders vote FOR each of the following:

|

| |||

| | | |

•

|

| |

Each of the director nominees named in the accompanying Proxy Statement.

|

| |

| | | |

•

|

| |

The ratification of the selection of Ernst & Young LLP as our independent

registered public accounting firm for fiscal 2023.

|

| |

| | | |

•

|

| |

The approval of the say-on-pay proposal.

|

| |

| | | |

•

|

| |

The approval of an amendment to the Proto Labs, Inc. 2022 Long-Term Incentive

Plan.

|

| |

| | | |

The board of directors recommends that shareholders vote AGAINST the shareholder proposal entitled Fair Elections, if properly presented at the Annual Meeting.

|

| ||||

| |

Only shareholders of record at the close of business on

March 22, 2023 may vote at the Annual Meeting or any adjournment or postponement thereof.

|

| ||||||

| | | |

|

| |

By Order of the Board of Directors

|

| |

| | | |

|

| |

|

| |

| | | |

|

| |

Jason Frankman

Secretary

|

| |

YOUR VOTE IS IMPORTANT

Whether or not you plan to join the Annual Meeting, we urge you to vote as soon as

possible. If you received the Notice of Internet Availability of Proxy Materials (the “Notice”), you may vote via the Internet as described in the Notice. If you received a copy of the proxy card by mail, you may vote by Internet or telephone

as instructed on the proxy card, or you may sign, date and mail the proxy card in the envelope provided.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2023 ANNUAL

MEETING OF SHAREHOLDERS TO BE HELD ON MAY 17, 2023.

Our Proxy Statement for the 2023 Annual Meeting of Shareholders and our

Annual Report on Form 10-K for the fiscal year ended December 31, 2022 are available at www.proxyvote.com.

TABLE OF CONTENTS

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | |

| |

PROXY SUMMARY

|

|

This Proxy Summary provides general information about Proto Labs, Inc. (the “Company”)

and highlights certain information contained elsewhere in this Proxy Statement. As it is only a summary, please refer to the entire Proxy Statement and the Annual Report on Form 10-K for the year ended December 31, 2022 before you vote. The

Proxy Statement and accompanying materials were first provided to shareholders on or about April 4, 2023.

2022 HIGHLIGHTS

Like many companies, Proto Labs faced internal and external disruptions to our business

in 2022. Throughout the year, we worked to overcome these challenges, and we achieved our strategic goals to enable us to drive future growth. Despite the obstacles of the macroeconomic environment and internal challenges, our business

strategy and market opportunity remain strong. 2022 was highlighted by low double digit organic revenue growth in our CNC machining and 3D printing services and we generated $48.5 million in revenue from our Hubs business. In 2022, we also

made significant progress on the integrated Proto Labs and Hubs offer, allowing our customers to realize the benefits of a unique integrated CNC offer. We established an important platform that will allow us to prove the value of our

comprehensive offer strategy.

DIRECTOR NOMINEES

| |

Name

|

| |

Age

|

| |

Director

Since

|

| |

Independent

|

| |

Audit

Committee

|

| |

Compensation

Committee

|

| |

Nominating

and

Governance

Committee

|

|

| |

Robert Bodor

|

| |

50

|

| |

2021

|

| |

No

|

| | | | | | | |||

| |

Archie C. Black

|

| |

61

|

| |

2016

|

| |

Yes

|

| | | | | |

|

| ||

| |

Sujeet Chand

|

| |

65

|

| |

2017

|

| |

Yes

|

| | | | | |

|

| ||

| |

Moonhie Chin

|

| |

65

|

| |

2019

|

| |

Yes

|

| | | |

|

| | | ||

| |

Rainer Gawlick

|

| |

55

|

| |

2008

|

| |

Yes

|

| |

|

| |

|

| | | |

| |

Stacy Greiner

|

| |

49

|

| |

2021

|

| |

Yes

|

| |

|

| | | | | ||

| |

Donald G. Krantz

|

| |

68

|

| |

2017

|

| |

Yes

|

| | | |

|

| | | ||

| |

Sven A. Wehrwein

|

| |

72

|

| |

2011

|

| |

Yes

|

| |

|

| | | |

|

|

|

| |

Chairperson

|

|

|

| |

Member

|

|

| 1

CORPORATE GOVERNANCE HIGHLIGHTS

|

•

|

Separate Board Chairperson and CEO

|

|

•

|

Risk oversight by full Board and Committees

|

|

•

|

Majority voting standard for uncontested director elections

|

|

•

|

Annual election of directors

|

|

•

|

Bylaws provide for Proxy Access by shareholders

|

|

•

|

Annual advisory say-on-pay vote

|

CORPORATE RESPONSIBILITY AND SUSTAINABILITY HIGHLIGHTS

Our corporate responsibility and sustainability practices are built on a foundation of

shared fundamental values of teamwork, trust and achievement, and help us to deliver strong financial results that create value for our Company and our shareholders in a way that respects our communities and the environments in which we

operate. The Company's three core values are embodied in everything we do.

|

•

|

Teamwork – We are dedicated to the idea that a diversity of minds is better than one. Through open communication, we strive to

collaborate with and include all of our colleagues to maximize our creativity and to make our good ideas great. We respect each other’s opinions. We help colleagues who are struggling to improve, so our success is everyone’s success.

|

|

•

|

Trust – Our integrity is built on honest answers to our customers and colleagues. It is okay to make mistakes if we use them to

learn. We navigate difficult situations with compassion. The success of our Company depends on the success of our people.

|

|

•

|

Achievement – Speed and innovation are the cornerstones of our success. We are committed to being a solution for getting things

done quickly and sustainably and a catalyst for great ideas for our shareholders, customers, the environment and each other. We are responsible for our performance, our results and our future.

|

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

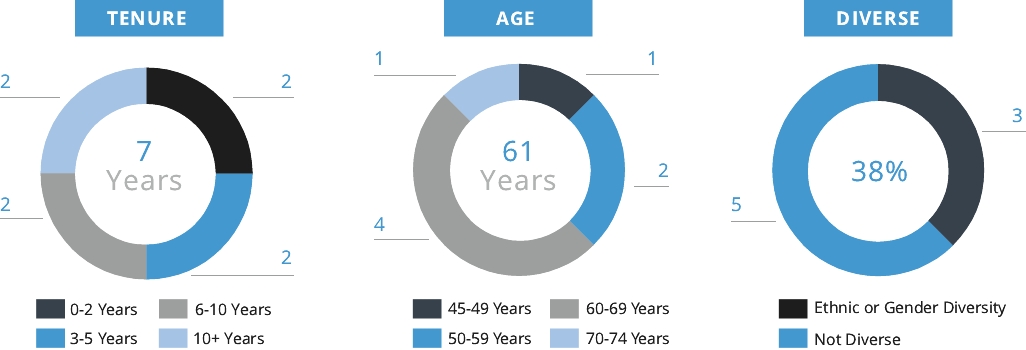

In 2021, our board of directors, executives and leaders throughout the organization

focused to identify our top environmental, social and governance (ESG) priorities for 2022 and beyond. In 2022, for each of our top priorities, we focused on: (1) identifying data, measures and metrics, (2) assessing our current performance,

(3) setting both short- and long-term goals for each of our top priorities, and (4) beginning to execute on our plans for each of these areas. The figure below shows the results of our ESG priority setting initiative in terms of both

importance to stakeholders and our Company’s success.

| 3

Our environmental key priorities include:

|

•

|

Environmental compliance

|

|

•

|

Energy use reduction

|

|

•

|

Waste management/recycling

|

In 2022, one of our environmental objectives was to define our key priorities and focus

areas. Once our key priorities were defined, we implemented cross functional teams to begin collecting base data related to energy use and waste management/recycling.

Our social key priorities include:

|

•

|

Ethics and integrity

|

|

•

|

Employee health and well being

|

|

•

|

Diversity, equity and inclusion

|

In 2022, we defined our key priorities and focus areas. We established goals and

initiatives specific to each key area, determined whether goals were global or regional in nature and established action plans to drive improvement.

Our governance key priorities include:

|

•

|

Ethics, compliance and transparency

|

|

•

|

Regulatory management

|

|

•

|

Risk and crisis management

|

In 2022, we evolved our formal enterprise risk management program, which included input

from our board of directors and various levels of company leadership. Our program includes annual formal enterprise and fraud risk assessments with continuous feedback throughout the year as we evaluate the operating environment. The results

of the enterprise risk management program will be used to drive governance key priorities and company strategy in 2023 and beyond. In addition, we set regulatory management goals around International Traffic in Arms Regulation and global

export compliance and established enhanced decision authority and signatory matrices to drive governance oversight and compliance.

Environmental

|

•

|

Digital Manufacturing Drives Sustainability

|

As a digital manufacturer, we are able to assist our customers as they focus on

materials management, operational productivity and on-demand solutions. Digital manufacturing is a solution our customers can deploy to reduce product waste by iterating part designs virtually, on a digital twin model, before any actual

production begins. With on-demand production of parts, there is also reduced reliance on storage facilities since inventory is virtual – the parts you need, when you need them. Our on-demand manufacturing model also helps customers with

end-of-life planning for products, reducing the need for ordering excess parts with shifting market demand.

When paired with a robust e-commerce platform, digital manufacturing can also increase

efficiencies in material selection and usage, the procurement process, and accelerating innovation. Furthermore, reducing scrap rate requires monitoring systems that enable automated process cycle sheet generation, ensuring run-to-run

repeatability and reducing operator error. This kind of monitoring system can improve consistency in part production and reduce scrap costs, especially in injection molding. We believe sustainability in product development, and in

manufacturing, is the future and we will continue to support our customers in their own sustainability journeys.

|

•

|

Environmental Initiatives

|

We are committed to having a positive impact on the environment. In 2022, we hosted

InspirON in Europe, an online knowledge sharing event to focus on what design engineers need to consider when developing sustainable products for manufacturing. The event was designed to provide insight into designing more sustainable

products and to explore how design can help make the manufacturing process greener and more efficient. The event covered topics ranging from: sustainable material selection, to the role that digital manufacturing and industry 4.0 will play,

to how to develop and optimize a sustainable supply chain.

4 |

In 2021, we were awarded a Manufacturing Leadership Award from the National Association

of Manufacturers (NAM) in the Sustainability Leadership category. This category recognizes companies embracing manufacturing processes that are non-polluting, conserve energy and natural resources, and are economically sound and safe for

employees, communities, and consumers. In 2020, we installed nearly 1,900 solar panels on the roof of our facility in Plymouth, MN, one of our larger manufacturing facilities. The solar array covers nearly 20 percent of our energy use in

Plymouth, MN and offsets the equivalent of 1.3 million pounds of CO2 and preserves 775 acres of forest annually.

We strive to maximize recycling in both our manufacturing and office facilities. In our

manufacturing facilities, we recycle metal, plastic and water used throughout the manufacturing processes. Finally, the Green Team, an employee-led organization, educates our employees on how they can positively impact the environment, both

at work and at home. The Green Team also provides opportunities for employees to positively impact the environment, including activities like roadside cleanup and tree planting.

Social

|

•

|

Diversity, Equity and Inclusion

|

At Proto Labs, diversity, equity and inclusion matters. We are committed to nurturing a

culture where we celebrate diversity, equity and inclusivity as a way of life. Our diversity and inclusion efforts start at the top with our board regularly reviewing initiatives. Our Diversity, Equity and Inclusion (DEI) Leadership Council

was established to promote honest conversations, influence best practices and educate our employees. Our DEI Leadership Council members are employee representatives chosen from various functions and locations to work directly with our

leadership team to drive change in our work environment. We also require certain employees to participate in annual unconscious bias training to further foster a work environment of fairness and sensitivity. As we continue to grow, we will

continue to emphasize employee safety and having an inclusive work environment as top priorities. Our goal is to build diverse teams throughout the global organization and be a role model for the communities where we work and live. Uniqueness

defines us as a company, from our custom products to our employees. Our pledge is to promote a global culture that invites, recognizes and embraces each individuals contributions to make a stronger “US”.

|

•

|

Workforce Demographics

|

As of December 31, 2022, we had 2,568 full-time employees, including 1,787 full-time

employees in the United States, 777 full-time employees in Europe and 4 full-time employees in Japan. We also regularly use independent contractors and other temporary employees across the organization to augment our regular staff. We believe

that our future success will depend in part on our continued ability to attract, hire and retain qualified, diverse and inclusive personnel.

We are an equal opportunity employer, and we believe that a diverse workforce made up of

people with different ideas, strengths, interests and cultural backgrounds drives employee and business success. Our workforce is composed of a diverse group of engineers, technicians and business professionals from around the world and every

walk of life.

We believe our employees are critical to our success and continually seek employee

feedback to enhance employee engagement. In 2022, our attrition rates were higher than in previous years. Our attrition rates were 21.8% and 23.1% in the United States and Europe, respectively.

|

•

|

Compensation and Benefits

|

We believe our success depends in large measure on our ability to attract, retain and

motivate a broad range of employees to be successful in a dynamic and changing business environment, and that a competitive compensation program is essential. In determining employee compensation, our executive leadership team reviews and

considers several factors, including individual and corporate performance, input from managers, competitor market data from third party compensation surveys, our compensation philosophy and key principles, and the leadership’s collective

experience and knowledge. Annually, our executive leadership team reviews input from managers throughout our organization, including recommendations as to compensation levels that the managers believe are commensurate with an individual’s job

performance, skills, experience, qualifications, criticality to our Company and development/career opportunities. We also award long-term equity-based compensation to high performing employees and managers who have the greatest impact on the

creation of shareholder value to further align the interests of our employees and shareholders.

| 5

We provide employee benefits that meet or exceed the requirements of local law. We are

committed to providing comprehensive benefits plans including, but not limited to, paid leave, retirement savings, health benefits, dental benefits, parental leave, family care leave, and childcare benefits. All overtime is performed and

compensated in accordance with the law and the individual’s employment contract or other applicable contract or collective agreement.

|

•

|

Education

|

We firmly believe that investing in the education of our employees is critical to our

success. Our employees are provided access to a robust learning management system that offers hundreds of courses on various topics ranging from compliance to leadership and for job-specific skills. In 2022 and 2021, employees spent an

average of 36 and 14 hours, respectively, per employee in training sessions. We provide an Educational Assistance Program for employees, which offers financial assistance for both professional and personal development to inspire employees to

continuously enhance their skills and knowledge. We have a customized leadership development program designed for current and aspiring managers in search of developing their leadership skills. The program provides training on topics that are

aligned with our Leadership Principles and our Core Values. In 2022, we launched a pilot mentorship program to provide opportunity for mentors and mentees to accelerate their personal and professional development through a one-on-one guided

relationship.

In order to ensure our industry remains robust, we are committed to supporting Science,

Technology, Engineering and Mathematics (STEM) programs in the cities where we have facilities. Through the Proto Labs Foundation, we provide STEM education grants to eligible organizations. In addition, we partner with schools, colleges and

universities to provide various outreach opportunities and sponsorships.

|

•

|

Health, Safety and Wellness

|

We are committed to providing a work environment that minimizes health and safety risks.

Our processes support accident prevention and prioritizes the health and safety of all of our employees and all others affected by their activities. We provide and require our employees to use personal protective equipment at all times. To

ensure our employees understand the importance of safety, we provide regular, mandatory training.

We strive to continuously improve our employees’ health, safety and wellness. Our “I Am”

safety program teaches that safety is the responsibility of every individual in our organization. We believe this program is the basis for our excellent safety compliance record. We believe that our employees are our most valuable asset, and

their safety and health is among our top priorities.

In addition to concentrating on employee safety in the workplace, we also focus on the

overall wellbeing of our employees. We continue to invest in a variety of employee health and wellness programs, including gym membership discounts, on-site yoga classes at certain facilities, wellness newsletters and learning sessions, and

providing various Employee Assistance Programs.

|

•

|

Charitable Giving

|

We pride ourselves in being a responsible corporate citizen through our Proto Labs

Foundation. We support several charitable causes with our Employee Matching, Cool Ideas, and Major Gifts Programs. The Foundation’s efforts serve as a sustaining investment in the future of the communities where our employees live and work,

and also a commitment to build talent to support the future employment needs of the manufacturing industry. ProtoGivers, our employee led community involvement team, organizes a wide variety of charitable activities, including blood drives,

working for Habitat for Humanity projects, volunteering for Feed My Starving Children, and making financial contributions to charitable causes, many of which are matched through the Proto Labs Foundation Employee Giving Program. Our financial

support and our community outreach programs are intended to improve the quality of life in the communities where we have facilities.

|

•

|

Human Rights

|

We recognize our responsibility to protect human rights and we are committed to

fostering an organizational culture which promotes support for internationally recognized human rights and labor standards. We strive to respect and promote human rights in accordance with the UN Guiding Principles on Business and Human

Rights in our relationship with our employees, customers and suppliers. We have established a Human Rights Policy which is available on the Investor Relations section of our website.

6 |

|

•

|

Supply Chain

|

We are committed to conducting our business in accordance with the highest ethical

standards and in compliance with all applicable laws, rules and regulations. We expect our suppliers to share our principles and uphold our standards and for each to develop policies and programs, as appropriate, to ensure that all workers

understand and adhere to these standards. We have established a Vendor Code of Conduct Policy, including guidance on anti-bribery, privacy and data protection, responsible sourcing of materials, environmental standards, labor and human

rights, and anti-tax evasion. Our full policy is available on the Investor Relations section of our website.

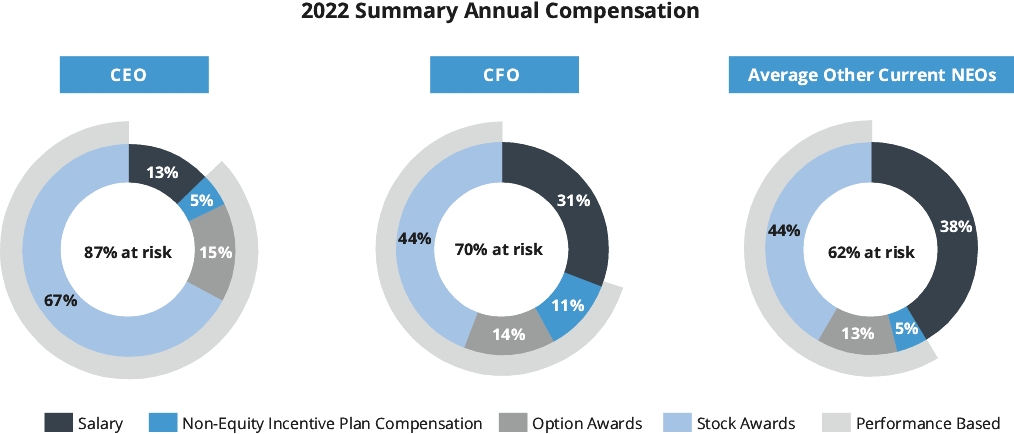

OUR COMPENSATION APPROACH

We believe our success depends in large measure on our ability to attract, retain and

motivate a talented senior management team to effectively lead our Company in a dynamic and changing business environment, and that a competitive executive compensation program is essential to that effort. We believe that our executive

compensation program should support our short- and long-term strategic and operational objectives, and reward corporate and individual performance that contributes to creating value for our shareholders.

Consistent with this philosophy, and past practice, the majority of our named executive

officers’ 2022 summary annual compensation is considered "at risk".

AGENDA ITEMS AND BOARD RECOMMENDATIONS

Unless you give other instructions on your proxy card, the persons named as proxy holders

on the proxy card will vote in accordance with the recommendations of our board of directors. Each of the below proposals are described in more detail in this Proxy Statement:

| |

|

| |

Proposal

|

| |

Board's Voting

Recommendation

|

|

| |

1.

|

| |

Election of the eight director nominees named in this Proxy Statement to serve

for one-year terms.

|

| |

For

|

|

| |

2.

|

| |

Ratification of the selection of Ernst & Young LLP as our independent

registered public accounting firm for fiscal 2023.

|

| |

For

|

|

| |

3.

|

| |

Advisory vote to approve the executive officer compensation disclosed in this

Proxy Statement (“say-on-pay”).

|

| |

For

|

|

| |

4.

|

| |

Approval of an amendment to the Proto Labs, Inc. 2022 Long-Term Incentive Plan

|

| |

For

|

|

| |

5.

|

| |

Shareholder proposal entitled Fair Elections, if properly presented at the Annual

Meeting.

|

| |

Against

|

|

| 7

PROXY STATEMENT

The board of directors of Proto Labs, Inc. is soliciting proxies for use at the Annual

Meeting to be held on May 17, 2023, and at any adjournment or postponement of the meeting.

|

Q:

|

Who can vote?

|

|

A:

|

You can vote if you were a shareholder at the close of business on the record date of March 22, 2023 (the “Record Date”). There were

a total of 26,202,723 shares of our common stock outstanding on the Record Date. The Notice of Internet Availability of Proxy Materials (the “Notice”), notice of Annual Meeting, this Proxy Statement and accompanying proxy card and the

Annual Report on Form 10-K for 2022 were first mailed or made available to you beginning on or about April 4, 2023. This Proxy Statement summarizes the information you need to vote at the Annual Meeting.

|

|

Q:

|

Who can attend the Annual Meeting?

|

|

A:

|

This year, the 2023 Annual Meeting will once again be conducted exclusively virtually via live webcast at

www.virtualshareholdermeeting.com/PRLB2023 (the “Annual Meeting Website”). All shareholders, regardless of size, resources or physical location, eligible to attend the Annual Meeting will be able to participate via webcast and will be

able to communicate with us and ask questions before and during the Annual Meeting. All shareholders as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting. If you hold your shares in street name, then you

must request a legal proxy from your broker or nominee to attend and vote at the Annual Meeting.

|

|

Q:

|

What am I voting on?

|

|

A:

|

You are voting on:

|

|

•

|

Election of eight nominees as directors to hold office until the next Annual Meeting of Shareholders or until their successors are

duly elected.

|

|

•

|

Ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2023.

|

|

•

|

Approval on an advisory basis of the compensation of our officers disclosed in this Proxy Statement, which we refer to as a

“say-on-pay” vote.

|

|

•

|

Approval of an amendment to the Proto Labs, Inc. 2022 Long-Term Incentive Plan.

|

|

•

|

A shareholder proposal entitled Fair Elections, if properly presented at the Annual Meeting.

|

|

Q:

|

How does the board of directors recommend I vote on the proposals?

|

|

A:

|

The board is soliciting your proxy and recommends you vote:

|

|

•

|

FOR each of the director nominees;

|

|

•

|

FOR the ratification of the selection of Ernst & Young LLP as our

independent registered public accounting firm for fiscal 2023;

|

|

•

|

FOR the say-on-pay proposal;

|

|

•

|

FOR the approval of an amendment to the Proto Labs, Inc. 2022 Long-Term

Incentive Plan; and

|

|

•

|

AGAINST the shareholder proposal entitled Fair Elections, if properly

presented at the Annual Meeting.

|

|

Q:

|

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a paper

copy of the proxy materials?

|

|

A:

|

“Notice and Access” rules adopted by the United States Securities and Exchange Commission (the “SEC”) permit us to furnish proxy

materials, including this Proxy Statement and our Annual Report on Form 10-K for 2022, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Shareholders will not receive printed

copies of the proxy materials unless they request them. Instead, the Notice instructs as to how you may access and review all of the proxy materials on the Internet.

|

8 |

The Notice also instructs as to how you may submit your proxy via the Internet. If you

would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice. Any request to receive proxy materials by mail will remain in effect until you revoke it.

|

Q:

|

How many shares must be voted to approve each proposal?

|

|

A:

|

Quorum. A majority of the shares entitled to vote, represented in person or by proxy, is

necessary to constitute a quorum for the transaction of business at the Annual Meeting. As of the Record Date, 26,202,723 shares of our common stock were issued and outstanding. A majority of those shares will constitute a quorum for

the purpose of electing directors and adopting proposals at the Annual Meeting. If you submit a valid proxy or attend the Annual Meeting, your shares will be counted to determine whether there is a quorum.

|

Vote Required. Generally, directors

are elected by a majority of the votes cast with respect to the director, meaning that the votes cast “for” a director must exceed the votes cast “against” the director. However, in a contested election of directors in which the number of

nominees exceeds the number of directors to be elected, the directors are elected by a plurality of the votes present in person or by proxy at the meeting. The election of directors at the Annual Meeting will be an uncontested election, and

therefore directors will be elected by a majority of the votes cast with respect to the director.

The proposal to ratify the selection of our independent registered public accounting firm

must be approved by the affirmative vote of the greater of (a) a majority of the shares of our common stock present online or by proxy at the Annual Meeting and entitled to vote or (b) a majority of the minimum number of shares of common stock

entitled to vote that would constitute a quorum. For the advisory say-on-pay vote, there is no minimum approval necessary since it is advisory. However, if the advisory say-on-pay resolution in this Proxy Statement receives more votes “for”

than “against,” then it will be deemed to be approved. The say-on-pay vote is advisory and is not binding on the board of directors. The proposal to approve an amendment to the Proto Labs, Inc. 2022 Long-Term Incentive Plan must be approved by

the affirmative vote of the greater of (a) a majority of the shares of our common stock present online or by proxy at the Annual Meeting and entitled to vote or (b) a majority of the minimum number of shares of common stock entitled to vote

that would constitute a quorum. For the shareholder proposal, if properly presented at the Annual Meeting, it must be approved by the affirmative vote of the greater of (a) a majority of the shares of our common stock present online or by proxy

at the Annual Meeting and entitled to vote or (b) a majority of the minimum number of shares of common stock entitled to vote that would constitute a quorum.

|

Q:

|

What is the effect of broker non-votes and abstentions?

|

|

A:

|

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the

nominee does not have or does not exercise discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. If a broker returns a “non-vote” proxy indicating a lack of authority to

vote on a proposal, then the shares covered by such a “non-vote” proxy will be deemed present at the Annual Meeting for purposes of determining a quorum, but not present for purposes of calculating the vote with respect to any

non-discretionary proposals. Nominees will not have discretionary voting power with respect to any matter to be voted upon at the Annual Meeting, other than the ratification of the selection of our independent registered public

accounting firm. Broker non-votes will have no effect on any of the proposals.

|

A properly executed proxy marked “ABSTAIN” with respect to a proposal will be counted for

purposes of determining whether there is a quorum and will be considered present in person or by proxy and entitled to vote, but will not be deemed to have been voted in favor of such proposal. Abstentions will have no effect on the voting for

the election of directors or approval of the advisory say-on-pay resolution. Abstentions will have the same effect as voting against the proposal to ratify the selection of our independent registered public accounting firm, the proposal to

approve an amendment to the Proto Labs, Inc. 2022 Long-Term Incentive Plan, the shareholder proposal entitled Fair Elections, and any other item properly presented at the Annual Meeting or any adjournments or postponements thereof.

|

Q:

|

How will the proxies vote on any other business brought up at the Annual Meeting?

|

|

A:

|

By submitting your proxy, you authorize the proxies to use their judgment to determine how to vote on any other matter brought

before the Annual Meeting, or any adjournments or postponements thereof. We do not know of any other business to be considered at the Annual Meeting. The proxies’ authority to vote according to their judgment applies only to shares you

own as the shareholder of record.

|

| 9

|

Q:

|

How do I cast my vote?

|

|

A:

|

If you are a shareholder whose shares are registered in your name, you may vote using any of the following methods:

|

|

•

|

Internet. You may vote by going to the web address www.proxyvote.com 24-hours a day, seven

days a week, until 11:59 p.m. Eastern Time on May 16, 2023 and following the instructions for Internet voting shown on your Notice or proxy card.

|

|

•

|

Telephone. If you requested printed proxy materials and you received a paper copy of the

proxy card, you may vote by dialing 1-800-690-6903 24-hours a day, seven days a week, until 11:59 p.m. Eastern Time on May 16, 2023 and following the instructions for telephone voting shown on your proxy card.

|

|

•

|

Mail. If you requested printed proxy materials and you receive a paper copy of the proxy

card, then you may vote by completing, signing, dating and mailing the proxy card in the envelope provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. If you vote by Internet or telephone,

please do not mail your proxy card.

|

|

•

|

Virtually at the Annual Meeting Website. If you are a shareholder whose shares are

registered in your name, you may vote virtually via live webcast during the Annual Meeting.

|

If your shares are held on account at a brokerage firm, bank or similar organization, you

will receive voting instructions from your bank, broker or other nominee describing how to vote your shares. You must follow those instructions to vote your shares. You will receive the Notice that instructs how to access our proxy materials on

the Internet and vote your shares via the Internet. It also instructs how to request a paper copy of our proxy materials. If you hold your shares in street name and want to vote virtually during the Annual Meeting, then you must obtain a legal

proxy from your broker or nominee.

Proxies that are voted via the Internet or by telephone in accordance with the voting

instructions provided, and proxy cards that are properly signed, dated and returned, will be voted in the manner specified.

|

Q:

|

Can I vote my shares by filling out and returning the Notice?

|

|

A:

|

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning

it. The Notice provides instructions on how to vote by Internet, by requesting and returning a paper proxy card or voting instruction card, or by voting at the Annual Meeting.

|

|

Q:

|

Can I revoke or change my vote?

|

|

A:

|

You can revoke your proxy at any time before it is voted at the Annual Meeting by:

|

|

•

|

submitting a new proxy with a more recent date than that of the prior proxy given before 11:59 p.m. Eastern Time on May 16, 2023 by

(1) following the Internet voting instructions or (2) following the telephone voting instructions;

|

|

•

|

completing, signing, dating and returning a new proxy card to us, which must be received by us before the time of the Annual

Meeting; or

|

|

•

|

participating in the virtual Annual Meeting and revoking the proxy by voting those shares when joining the meeting.

|

Joining the Annual Meeting will not by itself revoke a previously granted proxy. Unless

you decide to vote your shares virtually at the Annual Meeting, you should revoke your prior proxy in the same way you initially submitted it—that is, by Internet, telephone or mail.

|

Q:

|

Who will count the votes?

|

|

A:

|

Broadridge Financial Solutions, Inc., our independent proxy tabulator, will count the votes. Daniel Schumacher, our Chief Financial

Officer, will act as inspector of election for the Annual Meeting.

|

|

Q:

|

Is my vote confidential?

|

|

A:

|

All proxies and all vote tabulations that identify an individual shareholder are confidential. Your vote will not be disclosed

except:

|

|

•

|

to allow Broadridge Financial Solutions, Inc. to tabulate the vote;

|

|

•

|

to allow Daniel Schumacher to certify the results of the vote; and

|

|

•

|

to meet applicable legal requirements.

|

10 |

|

Q:

|

What shares are included on my proxy?

|

|

A:

|

Your proxy will represent all shares registered to your account.

|

|

Q:

|

What happens if I don’t vote shares that I own?

|

|

A:

|

For shares registered in your name. If you do not vote shares that are registered in your

name by voting online at the Annual Meeting or by proxy through the Internet, telephone or mail, your shares will not be counted in determining the presence of a quorum or in determining the

outcome of the vote on the proposals presented at the Annual Meeting.

|

For shares held in street name. If

you hold shares through a broker, you will receive voting instructions from your broker. If you do not submit voting instructions to your broker and your broker does not have discretion to vote your shares on a particular matter, then your

shares will not be counted in determining the outcome of the vote on that matter at the Annual Meeting. See “What is the effect of broker non-votes and abstentions?” as described above. Your broker

will not have discretion to vote your shares for any matter to be voted upon at the Annual Meeting other than the ratification of the selection of our independent registered public accounting firm. Accordingly, it is important that you

provide voting instructions to your broker for the matters to be voted upon at the Annual Meeting.

|

Q:

|

What if I do not specify how I want my shares voted?

|

|

A:

|

If you are a registered shareholder and submit a signed proxy card or submit your proxy by Internet or telephone but do not specify

how you want to vote your shares on a particular matter, we will vote your shares as follows:

|

|

•

|

FOR each of the director nominees;

|

|

•

|

FOR the ratification of the selection of Ernst & Young LLP as our

independent registered public accounting firm for fiscal 2023;

|

|

•

|

FOR the say-on-pay proposal;

|

|

•

|

FOR the approval of an amendment to the Proto Labs, Inc. 2022 Long-Term

Incentive Plan; and

|

|

•

|

AGAINST the shareholder proposal entitled Fair Elections, if properly

presented at the Annual Meeting.

|

If any matters not described in this Proxy Statement are properly presented at the Annual

Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned or postponed, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your

proxy instructions, as described under “Can I revoke or change my vote?”

If you hold shares through a broker, please see above under “What happens if I don’t

vote shares that I own?”

|

Q:

|

What does it mean if I get more than one Notice or proxy card?

|

|

A:

|

Your shares are probably registered in more than one account. You should provide voting instructions for all Notices and proxy cards

you receive.

|

|

Q:

|

How many votes can I cast?

|

|

A:

|

You are entitled to one vote per share on all matters presented at the Annual Meeting or any adjournment or postponement thereof.

There is no cumulative voting.

|

|

Q:

|

When are shareholder proposals and nominees due for the 2024 Annual Meeting of Shareholders?

|

|

A:

|

If you want to submit a shareholder proposal or nominee for the 2024 Annual Meeting of Shareholders, you must submit the proposal in

writing to our Secretary, Proto Labs, Inc., 5540 Pioneer Creek Drive, Maple Plain, Minnesota 55359, so it is received by the relevant dates set forth below under “Submission of Shareholder Proposals and Nominations.”

|

| 11

|

Q:

|

What is “householding”?

|

|

A:

|

We may send a single Notice, as well as other shareholder communications, to any household at which two or more shareholders reside

unless we receive other instruction from you. This practice, known as “householding,” is designed to reduce duplicate mailings and printing and postage costs, and conserve natural resources. If your Notice is being householded and you

wish to receive multiple copies of the Notice, or if you are receiving multiple copies and would like to receive a single copy, or if you would like to opt out of this practice for future mailings, you may contact:

|

Broadridge Financial Solutions, Inc.

Householding Department

51 Mercedes Way

Edgewood, New York 11717

1-800-542-1061

Broadridge will deliver the requested documents to you promptly upon receipt of your

request.

|

Q:

|

How is this proxy solicitation being conducted?

|

|

A:

|

We will pay for the cost of soliciting proxies and we will reimburse brokerage houses and other custodians, nominees and fiduciaries

for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our shareholders. In addition, some of our employees may solicit proxies. We may solicit proxies in person, via the Internet, by telephone

and by mail. Our employees will not receive special compensation for these services, which the employees will perform as part of their regular duties.

|

12 |

The following table sets forth information as of March 22, 2023 regarding the beneficial

ownership of our common stock by:

|

•

|

each person or group who is known by us to own beneficially more than 5% of our outstanding shares of common stock;

|

|

•

|

each of our named executive officers named in the Summary Compensation Table below;

|

|

•

|

each of our directors and each director nominee; and

|

|

•

|

all of our current executive officers, directors and director nominees as a group.

|

The percentage of beneficial ownership is based on 26,202,723 shares of common stock

outstanding as of March 22, 2023. Except as disclosed in the footnotes to this table and subject to applicable community property laws, we believe that each shareholder identified in the table possesses sole voting and investment power over all

shares of common stock shown as beneficially owned by the shareholder. Unless otherwise indicated in the table or footnotes below, the address for each beneficial owner is c/o Proto Labs, Inc., 5540 Pioneer Creek Drive, Maple Plain, Minnesota

55359.

| |

Name and Address of Beneficial Owner

|

| |

Beneficial Ownership on March 22, 2023

|

| |||

| |

|

| |

Number

|

| |

Percent

|

|

| |

Greater than 5% shareholders:

|

| | | | | ||

| | | | | | | |||

| |

BlackRock, Inc.

|

| | | | | ||

| |

55 East 52nd Street

|

| | | | | ||

| |

New York, NY 10055

|

| |

4,854,359(1)

|

| |

18.5%

|

|

| | | | | | | |||

| |

The Vanguard Group

|

| | | | | ||

| |

100 Vanguard Blvd.

|

| | | | | ||

| |

Malvern, PA 19355

|

| |

3,044,564(2)

|

| |

11.6%

|

|

| | | | | | | |||

| |

Disciplined Growth Investors, Inc.

|

| | | | | ||

| |

150 South Fifth Street, Suite 2550

|

| | | | | ||

| |

Minneapolis, MN 55402

|

| |

2,121,891(3)

|

| |

8.1%

|

|

| | | | | | | |||

| |

Directors and named executive officers:

|

| | | | | ||

| |

Archie C. Black

|

| |

13,065(4)

|

| |

*

|

|

| |

Sujeet Chand

|

| |

11,500(5)

|

| |

*

|

|

| |

Moonhie Chin

|

| |

6,943(6)

|

| |

*

|

|

| |

Rainer Gawlick

|

| |

33,070(7)

|

| |

*

|

|

| |

Stacy Greiner

|

| |

6,491(8)

|

| |

*

|

|

| |

Donald Krantz

|

| |

11,500(9)

|

| |

*

|

|

| |

Sven A. Wehrwein

|

| |

25,197(10)

|

| |

*

|

|

| |

Robert Bodor

|

| |

54,689(11)

|

| |

*

|

|

| |

Daniel Schumacher

|

| |

10,771(12)

|

| |

*

|

|

| |

Michael R. Kenison

|

| |

13,927(13)

|

| |

*

|

|

| |

Bjoern Klaas

|

| |

12,780(14)

|

| |

*

|

|

| |

Oleg Ryaboy

|

| |

3,075(15)

|

| |

*

|

|

| |

Arthur R. Baker III

|

| |

24,224

|

| |

*

|

|

| |

All directors and executive officers as a group (12 persons)

|

| |

203,008(16)

|

| |

*

|

|

|

*

|

Represents beneficial ownership of less than one percent

|

|

(1)

|

Information is based on a Schedule 13G/A filed with the SEC by BlackRock, Inc. (“BlackRock”) on January 23, 2023. BlackRock has sole

voting power over 4,795,935 shares of our common stock and sole dispositive power over 4,854,359 shares of our common stock.

|

|

(2)

|

Information is based on a Schedule 13G/A filed with the SEC by Vanguard Group Inc. (“Vanguard”) on February 9, 2023. Vanguard has

shared voting power over 22,683 shares of our common stock, sole dispositive power over 2,996,199 shares of our common stock and shared dispositive power over 48,365 shares of our common stock.

|

|

(3)

|

Information is based on a Schedule 13G/A filed with the SEC by Disciplined Growth Investors, Inc. (“DGI”) on February 14, 2023. DGI

has sole voting power over 1,841,607 shares of our common stock and sole dispositive power over 2,121,891 shares of our common stock.

|

|

(4)

|

Includes 3,236 shares of deferred stock units that vest on May 17, 2023 and will be settled after separation from service on the

board of directors.

|

| 13

|

(5)

|

Includes 3,236 shares of deferred stock units that vest on May 17, 2023 and will be settled after separation from service on the

board of directors.

|

|

(6)

|

Includes 3,236 shares of deferred stock units that vest on May 17, 2023 and will be settled after separation from service on the

board of directors.

|

|

(7)

|

Includes 4,055 shares that Dr. Gawlick has the right to acquire from us within 60 days of the date of the table pursuant to the

exercise of stock options and 3,236 shares of deferred stock units that vest on May 17, 2023 and will be settled after separation from service on the board of directors.

|

|

(8)

|

Includes 3,236 shares of deferred stock units that vest on May 17, 2023 and will be settled after separation from service on the

board of directors.

|

|

(9)

|

Includes 3,236 shares of restricted stock units that vest on May 17, 2023.

|

|

(10)

|

Includes 6,055 shares that Mr. Wehrwein has the right to acquire from us within 60 days of the date of the table pursuant to the

exercise of stock options and 3,236 shares of deferred stock units that vest on May 17, 2023 and will be settled after separation from service on the board of directors.

|

|

(11)

|

Includes 36,096 shares that Dr. Bodor has the right to acquire from us within 60 days of the date of the table pursuant to the

exercise of stock options.

|

|

(12)

|

Includes 1,362 shares of restricted stock units that vest on May 20, 2023 and 4,605 shares that Mr. Schumacher has the right to

acquire from us within 60 days of the date of the table pursuant to the exercise of stock options.

|

|

(13)

|

Includes 1,558 shares of restricted stock units that vest on May 20, 2023 and 6,102 shares that Mr. Kenison has the right to acquire

from us within 60 days of the date of the table pursuant to the exercise of stock options.

|

|

(14)

|

Includes 5,891 shares that Mr. Klaas has the right to acquire from us within 60 days of the date of the table pursuant to the

exercise of stock options.

|

|

(15)

|

Includes 1,576 shares that Mr. Ryaboy has the right to acquire from us within 60 days of the date of the table pursuant to the

exercise of stock options.

|

|

(16)

|

Includes 64,380 shares held by our executive officers and directors, in the aggregate, that can be acquired from us within 60 days

of the date of the table pursuant to the exercise of stock options, 19,416 shares of deferred stock units, in the aggregate, that vest on May 17, 2023 and will be settled after separation from service on the board of directors, 3,236

shares of restricted stock units that vest on May 17, 2023 and 2,920 shares of restricted stock units that vest on May 20, 2023.

|

14 |

Archie Black leads our board of directors in his role as Chairman. Our board of directors

believes that its leadership structure is appropriate for our Company in light of the importance of maintaining independent board leadership and engagement.

As Chairman, Mr. Black:

|

•

|

presides at all meetings of the board of directors, including executive sessions of the independent directors;

|

|

•

|

conducts the annual performance review of the Chief Executive Officer, with input from the other independent directors;

|

|

•

|

sets the board agenda and frequency of meetings, in consultation with the committee chairs as applicable; and

|

|

•

|

has the authority to convene meetings of the independent directors at every meeting.

|

Our management is responsible for defining the various risks facing our Company,

formulating risk management policies and procedures, and managing our risk exposures on a day-to-day basis. The board’s responsibility is to monitor our risk management processes by using board meetings, management presentations and other

opportunities to educate itself concerning our material risks and evaluating whether management has reasonable controls in place to address the material risks; the board is not responsible, however, for defining or managing our various risks.

The full board is responsible for monitoring management’s responsibility in the area of risk oversight. In addition, the audit committee and compensation committee have risk oversight responsibilities in their respective areas of focus, on

which they report to the full board. Management reports from time to time to the full board, audit committee and compensation committee on risk management. The board focuses on the material risks facing our Company, including operational,

credit, liquidity, legal and cybersecurity risks, to assess whether management has reasonable controls in place to address these risks.

In consultation with other members of the board of directors, the nominating and governance

committee is responsible for identifying individuals who it considers qualified to become board members. The nominating and governance committee will screen potential director candidates, including those recommended by shareholders, and

recommend to the board of directors suitable nominees for the election to the board of directors. The nominating and governance committee uses a variety of methods for identifying and evaluating nominees for directors. The nominating and

governance committee regularly assesses the appropriate size and composition of the board of directors, the needs of the board of directors and the respective committees of the board of directors, and the qualifications of candidates in light

of these needs. Candidates may come to the attention of the nominating and governance committee through shareholders, management, current members of the board of directors, or search firms. The evaluation of these candidates may be based solely

upon information provided to the committee or may include discussions with persons familiar with the candidate, an interview of the candidate or other actions the committee deems appropriate, including the use of third parties to review

candidates.

In considering whether to recommend an individual for election to the board, the nominating

and governance committee considers, as required by the corporate governance guidelines and its charter, the board’s overall balance of diversity of perspectives, backgrounds, and experiences, although it does not have a formal policy regarding

the consideration of diversity of board members. The nominating and governance committee views diversity expansively and considers, among other things, breadth and depth of relevant business and board skills and experiences, educational

background, employment experience and leadership performance as well as those intangible factors that it deems appropriate to develop a heterogeneous and cohesive board, such as integrity, achievements, judgment, intelligence, personal

character, the interplay of the candidate’s relevant experience with the experience of other board members, the willingness of the candidate to devote sufficient time to board duties, and likelihood that he or she will be willing and able to

serve on the board for an extended period of time.

The nominating and governance committee will consider a recommendation by a shareholder of

a candidate for election as a Proto Labs director. Shareholders who wish to recommend individuals for consideration by the nominating and governance committee to become nominees for election to the board may do so by submitting a written

recommendation to our Secretary. Recommendations must be received by the Secretary within the timelines specified in our Bylaws to be considered by the nominating and governance committee for possible

| 15

nomination at our Annual Meeting of Shareholders the following year. Our Bylaws provide

that such notice should be received no less than 90 days prior to the first anniversary of the preceding year’s Annual Meeting, except in certain circumstances. All recommendations must contain the information required in our Bylaws and

corporate governance guidelines, including, among other things, the identification of the nominee, a written consent by the recommended individual to agree to be named in our proxy statement and to serve as director if elected, and the name and

address of the shareholder submitting the nomination. Shareholders may also have the opportunity to include nominees in our proxy statement by complying with the requirements set forth in Section 2.17 of our Bylaws. Recommendations must be

received by the Secretary within the timeframes noted under “Submission of Shareholder Proposals and Nominations.”

Our Bylaws include a “proxy access” provision for director nominations under which eligible

shareholders may nominate candidates for election to our board and inclusion in our proxy statement. The “proxy access” provision permits an eligible shareholder, or an eligible group of up to 20 shareholders, owning continuously for at least

three years shares of our Company representing an aggregate of at least three percent of the voting power entitled to vote in the election of directors, to nominate and include in our annual meeting proxy materials director nominees not to

exceed the greater of (i) two or (ii) 25 percent of the number of directors then serving on our board, or, if such amount is not a whole number, the closest whole number below 25 percent, but not less than two. Such nominations are subject to

certain eligibility, procedural, and disclosure requirements set forth in section 2.17 of our Bylaws, including the requirement that our Company must receive notice of such nominations not less than 120 calendar days prior to the anniversary

date of the prior year’s annual proxy materials mailing, except as otherwise provided in section 2.17 of our Bylaws. Section 2.17 of our Bylaws provides the exclusive method for a shareholder to include nominees for election to the board of

directors in the Company’s proxy materials, other than with respect to Rule 14a-19 to the extent applicable with respect to the form of proxies.

Our board of directors has reviewed the materiality of any relationship that each of our

directors has with us, either directly or indirectly. Based on this review, our board has determined that, with the exception of Dr. Robert Bodor, our Chief Executive Officer, all of the directors and director nominees are “independent

directors” as defined by Section 303A.02 of the New York Stock Exchange Listed Company Manual.

We have adopted a code of ethics and business conduct relating to the conduct of our

business by our employees, officers and directors, which is posted on our website at www.protolabs.com under the investor relations section. Annually, our employees are required to complete code of

conduct and business ethics training. We plan to post to our website at the address described above any future amendments or waivers to our code of ethics and business conduct.

Under our Corporate Governance Guidelines, a process has been established by which

shareholders and other interested parties may communicate with members of the board of directors. Any shareholder or other interested party who desires to communicate with the board, individually or as a group, may do so by writing to the

intended member or members of the board, c/o Secretary, Proto Labs, Inc., 5540 Pioneer Creek Drive, Maple Plain, Minnesota 55359. A copy of our Corporate Governance Guidelines is available at www.protolabs.com

under the investor relations section.

All communications received in accordance with these procedures will initially be received

and processed by the office of our Secretary to determine that the communication is a message to one or more of our directors and will be relayed to the appropriate director or directors. The director or directors who receive any such

communication will have discretion to determine whether the subject matter of the communication should be brought to the attention of the full board or one or more of its committees and whether any response to the person sending the

communication is appropriate.

During 2022, the full board of directors met five times in person and held seven meetings

via videoconference. Five of the meetings were preceded and/or followed by an executive session of the independent directors, chaired by Mr. Black or the acting chair of the meeting. Each of our then-serving directors attended at least 75%

percent of the meetings of the board and any committee on which they served in 2022. We do not maintain a formal policy regarding the board’s attendance at annual shareholder meetings; however, board members are expected to regularly attend all

board meetings and meetings of the committees on which they serve and are encouraged to make every effort to attend the Annual Meeting of Shareholders. All of our then-serving directors attended the 2022 Annual Meeting of Shareholders.

16 |

Our board of directors has established an audit committee, a compensation committee and a

nominating and governance committee. The charters of these committees are posted on our website at www.protolabs.com under the investor relations section.

The current composition and responsibilities of each committee, as well as the number of

times it met during 2022, are described below.

| |

Audit Committee

|

| |

Compensation Committee

|

| |

Nominating and

Governance Committee

|

|

| |

Sven A.Wehrwein (chair)

|

| |

Rainer Gawlick (chair)

|

| |

Sujeet Chand (chair)

|

|

| |

Rainer Gawlick

|

| |

Moonhie Chin

|

| |

Archie C. Black

|

|

| |

Stacy Greiner

|

| |

Donald G. Krantz

|

| |

Sven A. Wehrwein

|

|

Effective May 17, 2023, the composition of each committee will be as follows:

| |

Audit Committee

|

| |

Compensation Committee

|

| |

Nominating and

Governance Committee

|

|

| |

Sven A.Wehrwein (chair)

|

| |

Moonhie Chin (chair)

|

| |

Sujeet Chand (chair)

|

|

| |

Rainer Gawlick

|

| |

Archie C. Black

|

| |

Archie C. Black

|

|

| |

Stacy Greiner

|

| |

Donald G. Krantz

|

| |

Sven A. Wehrwein

|

|

Audit Committee

Among other matters, our audit committee:

|

•

|

oversees management’s processes for ensuring the quality and integrity of our consolidated financial statements, our accounting and

financial reporting processes, and other financial information provided by us to any governmental body or to the public;

|

|

•

|

evaluates the qualifications, independence and performance of our independent auditor and internal audit function;

|

|

•

|

oversees the resolution of any disagreements between management and the auditors regarding financial reporting;

|

|

•

|

oversees our investment and cash management policies; and

|

|

•

|

supervises management’s processes for ensuring our compliance with legal, ethical and regulatory requirements as set forth in

policies established by our board of directors.

|

Each of the members of our audit committee meets the requirements for independence and

financial literacy under the applicable rules and regulations of the SEC and the New York Stock Exchange (“NYSE”). Our board of directors has determined that Sven A. Wehrwein is an audit committee financial expert, as defined under the

applicable rules of the SEC. The audit committee met seven times in 2022.

Nominating and Governance Committee

Among other matters, our nominating and governance committee:

|

•

|

identifies qualified individuals to become board members, consistent with criteria approved by the board;

|

|

•

|

selects director nominees for the next Annual Meeting of Shareholders;

|

|

•

|

determines the composition of the board’s committees and evaluates and enhances the effectiveness of the board and individual

directors and officers;

|

|

•

|

develops and implements the corporate governance guidelines for our Company; and

|

|

•

|

ensures that succession planning takes place for critical senior management positions.

|

Each member of our nominating and governance committee satisfies the NYSE independence

standards. The nominating and governance committee met five times in 2022.

| 17

Compensation Committee

Among other matters, our compensation committee:

|

•

|

reviews and approves compensation programs, awards and employment arrangements for executive officers;

|

|

•

|

administers compensation plans for employees;

|

|

•

|

reviews our programs and practices relating to leadership development and continuity; and

|

|

•

|

determines the compensation of non-employee directors.

|

In addition, the compensation committee has the authority to select, retain and compensate

compensation consulting firms and other experts as it deems necessary to carry out its responsibilities.

Each member of our compensation committee satisfies the NYSE independence standards and is

a “non-employee director” as that term is defined in Rule 16b-3 under the Securities Exchange Act of 1934. The compensation committee met eight times in 2022.

Related Person Transaction Approval Policy

Our board of directors has adopted a written statement of policy regarding transactions

with related persons, which we refer to as our related person policy. Subject to the exceptions described below, our related person policy requires our audit committee to review and approve any proposed related person transaction and all

material facts with respect thereto. In reviewing a transaction, our audit committee will consider all relevant facts and circumstances, including (1) whether the terms are fair to us, (2) whether the transaction is material to us, (3) the role

the related person played in arranging the transaction, (4) the structure of the transaction, (5) the interests of all related persons in the transaction, and (6) whether the transaction has the potential to influence the exercise of business

judgment by the related person or others. Our audit committee will not approve or ratify a related person transaction unless it determines that, upon consideration of all relevant information, the transaction is beneficial to us and our

shareholders and the terms of the transaction are fair to us. No related person transaction will be consummated without the approval or ratification of our audit committee. Under our related person policy, a related person includes any of our

directors, director nominees, executive officers, any beneficial owner of more than 5% of our common stock and any immediate family member of any of the foregoing. Related party transactions exempt from our policy include payment of

compensation by us to a related person for the related person’s service to us as an employee, director or executive officer, transactions available to all of our employees and shareholders on the same terms and transactions between us and the

related person that, when aggregated with the amount of all other transactions between us and the related person or its affiliates, involve $120,000 or less in a year.

Since the beginning of 2022, we have not engaged in any related party transactions as

defined above.

18 |

Eight directors will be elected at the Annual Meeting. Upon the recommendation of the

nominating and governance committee, the board of directors has nominated for election the eight persons named below. Each has consented to being named a nominee and will, if elected, serve until the next Annual Meeting of Shareholders or until

a successor is duly elected. There are no family relationships between any director and any executive officer. Each nominee listed below is currently a director of Proto Labs and has been duly elected by shareholders.

The names of the nominees and other information are set forth below:

| |

Robert Bodor –

Age 50

Director since 2021

|

Dr. Bodor has

served as our President and Chief Executive Officer since March 2021. Dr. Bodor previously served as our Vice President and General Manager – Americas from January 2015 to March 2021. From July 2013 to January 2015, Dr. Bodor served

as our Chief Technology Officer. From December 2012 to June 2013, Dr. Bodor served as our Director of Business Development. Prior to joining Proto Labs, from January 2011 to December 2012, Dr. Bodor held several roles at Honeywell,

most recently leading SaaS business offerings for Honeywell’s Life Safety Division.

Skills and Qualifications

Dr. Bodor’s