Exhibit 7.2

| |||

1. OBJECTIVE | |

This Policy is intended for overseeing compliance with applicable norms by Directors and Officials of Ecopetrol S.A. (“Ecopetrol” or the “Company”) who, in performance of their duties, have access to privileged information and negotiate the Company’s Securities, pursuant to article 404 of the Commercial Code and literal a) of article 2.11.4.2.1 of Decree 2555 of 2010, rule 10b5-1 of the Exchange Act, the Insider Trading and Securities Fraud Enforcement Act, and the sections of the Exchange Act that have been amended or added by virtue thereof, and other regulations that modify, complement and/or repeal them.

Ecopetrol has implemented this policy to promote compliance with applicable securities laws and regulations, mainly those that prohibit and sanction performing operations based on insider information in the jurisdictions where the Company lists its Securities, including its Bonds, Ordinary Shares, and American Depositary Receipts (ADR). A copy of this Policy will be included as annex to Form 20-F that must be published annually in the Securities and Exchange Commission de los Estados Unidos de América (la “SEC”).

2. GLOSSARY | |

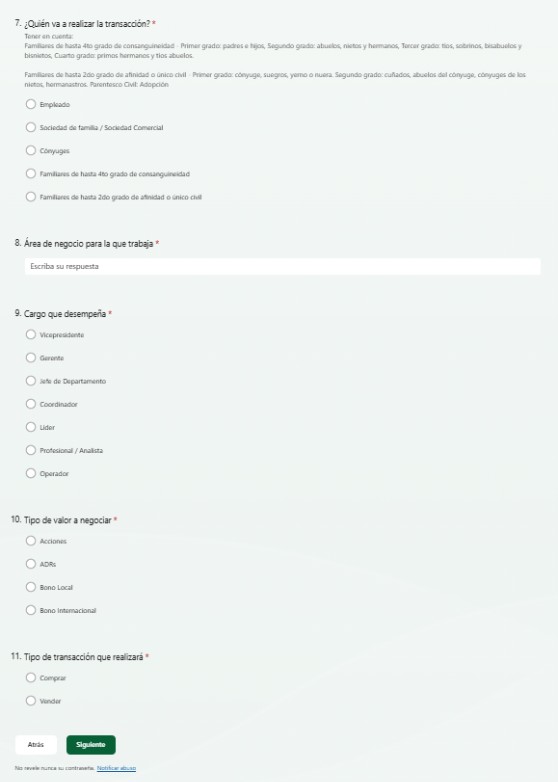

Ordinary shares: Negotiable property titles, representing an aliquot part of a company’s assets, which grant their holders political and economic rights that can be exercised be it collectively or individually, in accordance with the provisions of the respective corporate statutes. For the purposes of this Policy, the notion of “Ordinary Shares” will also include the American Depositary Receipts.

Administrators: In accordance with article 22 of Law 222 of 1995 and the regulations that complement, modify or repeal it, the directors, the legal representative, the liquidator, the factor, the members of boards or governing councils of the entity and those who, in accordance with the statutes, exercise or hold these functions.

American Depositary Receipts: An American Depositary Receipt is a negotiable certificate evidencing holding in the shares of a non-US company that have been deposited in a US bank. Such ADRs are negotiated in US Dollars, through the settlement system of the United States, which allows the ADR holders to not making transactions in a foreign currency.

Beneficial owner: The beneficial owner is understood to be any person or group of persons who, be it directly or indirectly, by themselves or through an Interposed Person, by virtue of contract, agreement or in any other way, has, with respect to a share or any holding in a company, the faculty or power to vote in the election of directors or representatives or, to direct, guide, and control said vote, as well as that of disposing or ordering the disposal of or encumbrance of the share or holding.

For the purposes of this definition, spouses or permanent couple and relatives within the second degree of consanguinity, second degree of affinity, and only civil relationship constitute the same beneficial owner, unless it is demonstrated that they act with independent economic interests, a circumstance that may be declared by means of oath before the Financial Superintendency of Colombia for exclusively evidentiary purposes.

Bonds: Negotiable fixed income securities, representing an aliquot part of a collective credit established by the Company.

Material changes: Information relating to a change in the Company’s business, operations, or capital that would be expected to have a significant effect on the market price or value of the Company’s assets (e.g. Business Mergers or Acquisitions, Disposals, Issuance of Shares or Bonds to the market).

Hedging and Derivatives: Hedging refers to a number of financial strategies designed for protection against losses or risks. Derivatives are financial instruments or future contracts whose value is based on the price of an underlying asset-shares, exchange rates, among others - characterized by defining a future