Proxy

Statement

2025

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to §240.14a-12 |

ý | No fee required. | |

¨ | Fee paid previously with preliminary materials. | |

¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| ||

Julie Iskow President & Chief Executive Officer | ||

By Order of the Board of Directors | ||

| ||

Brandon E. Ziegler Executive Vice President, Chief Legal and Administrative Officer and Corporate Secretary |

Questions and Answers .................................................................................................................... | ||

Proposal No. 1 - Election of Directors ........................................................................................... | ||

Corporate Governance ...................................................................................................................... | ||

Director Compensation ..................................................................................................................... | ||

Ownership of Common Stock ......................................................................................................... | ||

Executive Officers ............................................................................................................................... | ||

Executive Compensation .................................................................................................................. | ||

Compensation Discussion and Analysis ..................................................................................... | ||

Compensation Tables ........................................................................................................................ | ||

Potential Payments upon Termination or Change in Control ................................................. | ||

CEO Pay Ratio ..................................................................................................................................... | ||

Pay Versus Performance .................................................................................................................. | ||

Equity Compensation Plan Information ........................................................................................ | ||

Certain Relationships and Related-Party and Other Transactions ....................................... | ||

Executive Compensation ............................................................................................................................................... | ||

of Officers ............................................................................................................................................. | ||

Audit Committee Report ................................................................................................................... | ||

Accounting Firm .................................................................................................................................. | ||

Availability of Annual Report on Form 10-K ................................................................................ | ||

Other Business .................................................................................................................................... | ||

Inc. ........................................................................................................................................................... |

| Via the Internet: You may vote by proxy via the Internet by following the instructions found on the Proxy Card, Email or Notice of Availability of Proxy Materials that you received. |

| By Telephone: You may vote by proxy by calling the toll-free number found on the Proxy Card. |

| By Mail: You may vote by proxy by filling out the Proxy Card and returning it in the envelope provided. |

| At the Meeting: You may vote your shares electronically during the annual meeting by clicking on the “Vote” icon on the Meeting Center site. |

| Via the Internet: You may vote by proxy via the Internet by following the instructions on the voting instruction form provided to you by your broker, bank or other nominee. |

| By Telephone: You may vote by proxy by calling the toll-free number found on the voting instruction form provided to you by your broker, bank or other nominee. |

| By Mail: You may vote by proxy by filling out the voting instruction form and returning it in the envelope provided to you by your broker, bank or other nominee. |

| At the Meeting: If you obtained a legal proxy and registered with Computershare to receive your 15-digit control number from Computershare, you may vote your shares electronically during the annual meeting by clicking on the “Vote” icon on the Meeting Center site. |

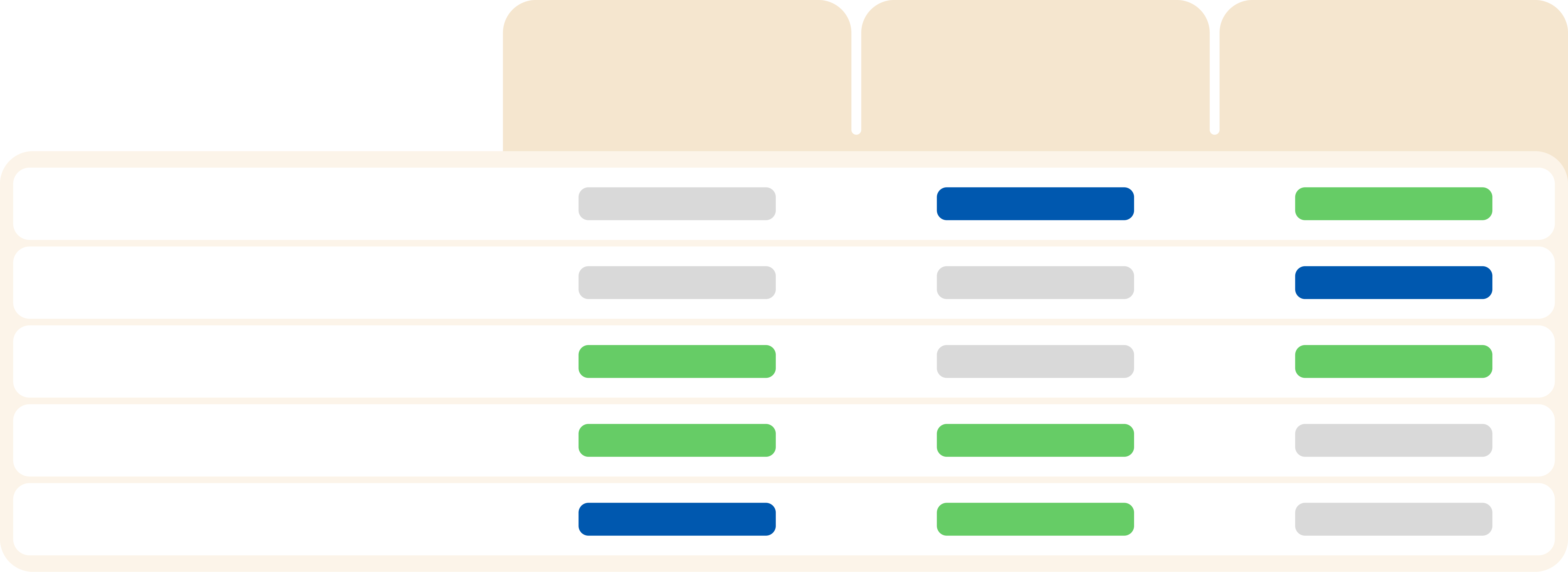

Proposal | Voting Options | Votes Required to Adopt Proposal | Effect of Abstentions and Withhold Votes | Broker Discretionary Voting Allowed? | |||||

Election of directors | For or withhold on each nominee | Plurality of votes cast | No effect | No | |||||

Advisory approval* of the compensation of our named executive officers | For, against, or abstain | Majority of votes cast | No effect | No | |||||

Advisory vote* on the frequency of stockholder advisory votes on executive compensation | One year, two years, three years, or abstain | Plurality of votes cast | No effect | No | |||||

Approval of the amendment of our Certificate of Incorporation to allow for the exculpation of officers | For, against, or abstain | Two thirds of outstanding shares entitled to vote | Same as "Against" | No | |||||

Ratification of appointment of independent registered public accounting firm | For, against, or abstain | Majority of votes cast | No effect | Yes |

Role | Key Responsibilities and Duties | |||

Non-Executive Chair | Preside at all Board meetings, annual stockholder meetings and special stockholder meetings. Set the agenda for any Board meetings and guide discussions at any Board meetings. Foster open and collegial discussion amongst all Board members. Monitor the Board’s receipt of accurate, timely, relevant and clear information from Board committees and management. Act as a source of institutional knowledge to both the Board and management. | |||

Organizes and directs the work of the Board, providing leadership, direction and strategic vision for the Company. | ||||

Chief Executive Officer | Lead the development of value-creating and sustainable strategies, both short and long-term for the Company. Set meaningful and measurable operating and strategic goals for the Company. Build and guide a highly capable and dynamic management team and establish a strong performance management culture. Serve as a primary interface between management and the Board, providing regular updates and information to the Board on key issues and business developments. Anticipate and mitigate potential risks to the Company and its businesses, helping to ensure that they are identified, monitored and reported to the Board or applicable Board committee, as appropriate. Represent the face of the Company to its stockholders. | |||

Leads the day-to-day business and operations, directing management to implement the strategy developed with the Board. | ||||

Lead Independent Director | Preside at all Board meetings at which the Chair is not present, including executive sessions of the independent directors. Act as a liaison among the Chair, the CEO and the independent directors. Have the authority to call meetings of the Board and of the independent directors, when necessary. Consult with the Chair and CEO and approve the schedules, agendas and information provided to the Board for each meeting. Communicate Board member feedback to the Chair and CEO after each Board meeting. Consult with inside and outside counsel and other advisors as he or she deems appropriate in fulfilling the Lead Independent Director role. Be available for consultation and direct communication with major stockholders, as appropriate. | |||

Provides strong, independent leadership and oversight of management. | ||||

Audit Committee | Compensation Committee | Nominating and Governance Committee | ||||

Chair | $20,000 | $15,000 | $10,000 | |||

Each other member | $10,000 | $7,500 | $5,000 | |||

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | All Other Compensation ($) | Total ($) | ||||

Brigid A. Bonner | 70,000 | 215,000 | — | 285,000 | ||||

Michael M. Crow, Ph.D. | 60,000 | 215,000 | — | 275,000 | ||||

Robert H. Herz | 65,000 | 215,000 | — | 280,000 | ||||

David S. Mulcahy | 105,000 | 215,000 | — | 320,000 | ||||

Suku Radia | 77,500 | 215,000 | — | 292,500 | ||||

Martin J. Vanderploeg, Ph.D. | 127,500 | 215,000 | — | 342,500 |

Shares Beneficially Owned | % of total voting power | |||||||||

Class A Common Stock | Class B Common Stock | |||||||||

Name of Beneficial Owner | Number | % | Number | % | ||||||

Named Executive Officers, Directors and Nominees: | ||||||||||

Julie Iskow | 175,452 | * | — | * | * | |||||

Jill Klindt(1) | 81,062 | * | — | * | * | |||||

Brandon Ziegler | 51,212 | * | — | * | * | |||||

Michael Hawkins | — | * | — | * | * | |||||

Martin J. Vanderploeg, Ph.D.(2) | 694,043 | 1.3 | 890,802 | 23.2 | 10.6 | |||||

Brigid A. Bonner(3) | 18,097 | * | — | * | * | |||||

Michael M. Crow, Ph.D.(4) | 46,332 | * | — | * | * | |||||

Robert H. Herz(5) | 68,076 | * | — | * | * | |||||

David S. Mulcahy(6) | 203,127 | * | — | * | * | |||||

Suku Radia(7) | 28,154 | * | — | * | * | |||||

Astha Malik | — | * | — | * | * | |||||

All executive officers, directors and nominees as a group (10 persons)(8) | 1,365,555 | 2.6 | 890,802 | 23.2 | 11.3 | |||||

5% Stockholders: | ||||||||||

The Vanguard Group(9) | 5,729,254 | 11.0 | — | * | 6.3 | |||||

BlackRock, Inc.(10) | 5,176,217 | 10.0 | — | * | 5.7 | |||||

FMR, LLC (11) | 3,242,497 | 6.2 | — | * | 3.6 | |||||

Matthew M. Rizai, Ph.D.(12) | 946,100 | 1.8 | 2,135,109 | 55.5 | 24.6 | |||||

Jeffrey Trom, Ph.D.(13) | 132,981 | * | 819,672 | 21.3 | 9.2 | |||||

Name | Age | Position | ||||

| Julie Iskow | 63 | President, Chief Executive Officer and Director | |||

| Jill Klindt | 48 | Executive Vice President, Chief Financial Officer and Treasurer | |||

| Brandon E. Ziegler | 52 | Executive Vice President, Chief Legal and Administrative Officer and Corporate Secretary | |||

| Michael D. Hawkins | 49 | Executive Vice President, Chief Sales Officer |

Name | Title | |||

Julie Iskow | President and Chief Executive Officer ("CEO") | |||

Jill Klindt | Executive Vice President, Chief Financial Officer ("CFO") and Treasurer | |||

Brandon Ziegler | Executive Vice President, Chief Legal and Administrative Officer and Corporate Secretary | |||

Michael Hawkins | Executive Vice President, Chief Sales Officer |

Altair Engineering, Inc. (ALTR) | HubSpot, Inc. (HUBS) | Rapid7, Inc. (RPD) | ||

AppFolio, Inc. (APPF) | MicroStrategy Inc. (MSTR) | RingCentral, Inc. (RNG) | ||

Aspen Technology, Inc. (AZPN) | Okta, Inc. (OKTA) | Smartsheet, Inc. (SMAR) | ||

BlackLine, Inc. (BL) | PagerDuty, Inc. (PD) | SPS Commerce, Inc. (SPSC) | ||

Five9, Inc. (FIVN) | Qualys, Inc. (QLYS) |

Named Executive Officer | 2024 Base Salary (Annualized) ($) | 2023 Base Salary (Annualized) ($) | Year over Year Difference (%) | |||

Julie Iskow | 610,000 | 610,000 | — | |||

Jill Klindt | 412,000 | 400,000 | 3% | |||

Brandon Ziegler | 412,000 | 400,000 | 3% | |||

Michael Hawkins | 420,000 | 400,000 | 5% |

Performance Metric | Target | Weighting | ||

Revenue Growth | 14.7% | 60% | ||

Non-GAAP Operating Income | $14,900 | 20% | ||

Operating Cash Flow | $80,000 | 20% |

Named Executive Officer | 2024 Target Bonus | |

Julie Iskow | 125% | |

Jill Klindt | 75% | |

Brandon Ziegler | 75% | |

Michael Hawkins | 90% |

Threshold | Target | Maximum | |||||

Performance | <80% | 80% | 100% | >120% | |||

Payout | —% | 50% | 100% | 150% |

Performance Metric | Target | Actual Results | Achievement of Target | |||

Revenue Growth | 14.7% | 17.2% | 117.0% | |||

Non-GAAP Operating Income | $14,900 | $32,045 | 215.1% | |||

Operating Cash Flow | $80,000 | $87,706 | 109.6% |

Executive | 2024 Base Salary ($) | 2024 Target Bonus ($) | 2024 Target Bonus (%) | 2024 Calculated Bonus ($) | 2024 Approved Bonus Payout ($) | Approved Bonus Payout as a % of Base Salary | ||||||

Julie Iskow | 610,000 | 762,500 | 125% | 1,059,113 | 1,059,113 | 173.6% | ||||||

Jill Klindt | 412,000 | 309,000 | 75% | 429,201 | 429,201 | 104.2% | ||||||

Brandon Ziegler | 412,000 | 309,000 | 75% | 429,201 | 429,201 | 104.2% | ||||||

Michael Hawkins | 420,000 | 378,000 | 90% | 525,042 | 525,042 | 125.0% |

Performance Period | Average Annual Revenue Growth Rate Target | Average Annual Revenue Growth Rate Achieved | Payout as a % of Target | |||

Fiscal Years 2022 - 2024 | 20.0% | 18.6% | 65.0% | |||

Fiscal Years 2023 - 2024 | 16.5% | 17.2% | 121.2% | |||

Fiscal Year 2024 * | 14.7% | 17.2% | 186.2% |

Fiscal Years 2022 - 2024 (Third Tranche) | Fiscal Years 2023 - 2024 (Second Tranche) | Fiscal Year 2024 (First Tranche) | ||||||||||

NEO | PSU Target (#) | Actual PSUs earned (#) | PSU Target (#) | Actual PSUs earned (#) | PSU Target (#) | Actual PSUs earned (#) | ||||||

Iskow | 3,220 | 2,093 | 8,082 | 9,796 | 12,532 * | 23,336 * | ||||||

Klindt | 2,574 | 1,673 | 4,418 | 5,355 | 4,428 | 8,245 | ||||||

Ziegler | 1,828 | 1,188 | 3,664 | 4,442 | 3,670 | 6,834 | ||||||

Hawkins | 1,828 | 1,188 | 3,367 | 4,081 | 3,357 | 6,251 | ||||||

Position | Stock Ownership Requirement | |

Chief Executive Officer | Six times annual base salary | |

Other Executive Officer | Three times annual base salary | |

Non-Employee Member of Board of Directors | Five times annual cash retainer | |

COMPENSATION COMMITTEE |

Ms. Brigid A. Bonner (Chair) |

Mr. David S. Mulcahy |

Mr. Suku Radia |

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | ||||||||

Julie Iskow | 2024 | 610,000 | — | 11,710,220 | — | 1,059,113 | 145,110 | (2) | 13,524,443 | |||||||

President, Chief Executive Officer and Director | 2023 | 601,250 | — | 11,639,648 | — | 915,000 | 94,065 | 13,249,963 | ||||||||

2022 | 575,000 | — | 5,780,046 | — | 489,555 | 55,494 | 6,900,095 | |||||||||

Jill Klindt | 2024 | 412,000 | — | 4,206,246 | — | 429,201 | 44,826 | (3) | 5,092,273 | |||||||

Executive Vice President, Chief Financial Officer and Treasurer | 2023 | 400,000 | — | 4,039,704 | — | 360,000 | 25,139 | 4,824,843 | ||||||||

2022 | 400,000 | — | 3,697,035 | — | 255,420 | 3,700 | 4,356,155 | |||||||||

Brandon Ziegler | 2024 | 412,000 | — | 3,486,111 | — | 429,201 | 27,422 | (4) | 4,354,734 | |||||||

Executive Vice President, Chief Legal and Administrative Officer and Corporate Secretary | 2023 | 400,000 | — | 3,349,993 | — | 360,000 | 37,395 | 4,147,388 | ||||||||

2022 | 400,000 | — | 3,124,931 | — | 255,420 | 20,503 | 3,800,854 | |||||||||

Michael Hawkins | 2024 | 420,000 | — | 3,189,262 | — | 525,042 | 72,209 | (5) | 4,206,513 | |||||||

Executive Vice President, Chief Sales Officer | 2023 | 400,000 | — | 3,079,013 | — | 432,000 | 48,620 | 3,959,633 |

Estimated Possible Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Possible Payouts Under Equity Incentive Plan Awards(2) | All Other Stock Awards: Number of Shares of Stock or Units (#)(4) | Grant Date Fair Value of Stock Awards ($)(5) | ||||||||||||||||

Name | Grant Date(3) | Award Date(3) | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | |||||||||||

Julie Iskow | 02/01/2024 | (6) | 01/17/2024 | — | — | — | — | — | — | 73,398 | 6,999,967 | ||||||||

02/01/2024 | (7) | 01/17/2024 | — | — | — | 15,729 | 31,456 | 62,912 | — | 2,960,324 | |||||||||

02/15/2024 | 381,250 | 762,500 | 1,143,750 | — | — | — | — | — | |||||||||||

03/01/2024 | (6) | 02/15/2024 | — | — | — | — | — | — | 14,327 | 1,224,959 | |||||||||

03/01/2024 | (7) | 02/15/2024 | — | — | — | 3,071 | 6,140 | 12,280 | — | 524,970 | |||||||||

Jill Klindt | 02/01/2024 | (6) | 01/17/2024 | — | — | — | — | — | — | 30,996 | 2,956,089 | ||||||||

02/01/2024 | (7) | 01/17/2024 | — | — | — | 6,642 | 13,284 | 26,568 | — | 1,250,157 | |||||||||

02/15/2024 | 154,500 | 309,000 | 463,500 | — | — | — | — | — | |||||||||||

Brandon Ziegler | 02/01/2024 | (6) | 01/17/2024 | — | — | — | — | — | — | 25,689 | 2,449,960 | ||||||||

02/01/2024 | (7) | 01/17/2024 | — | — | — | 5,505 | 11,010 | 22,020 | — | 1,036,151 | |||||||||

02/15/2024 | 154,500 | 309,000 | 463,500 | — | — | — | — | — | |||||||||||

Michael Hawkins | 02/01/2024 | (6) | 01/17/2024 | — | — | — | — | — | — | 23,502 | 2,241,386 | ||||||||

02/01/2024 | (7) | 01/17/2024 | — | — | — | 5,037 | 10,072 | 20,144 | — | 947,876 | |||||||||

02/15/2024 | 189,000 | 378,000 | 567,000 | — | — | — | — | — | |||||||||||

Option Awards | Stock Awards | |||||||||||||||||

Name | Option/ Stock Award Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(1) | Number of Unearned Shares or Units of Stock That Have Not Vested (#) | Market Value of Unearned Shares or Units of Stock That Have Not Vested ($)(1) | |||||||||

Julie Iskow | 02/01/2022 | (5) | — | — | — | — | — | — | 3,220 | 352,590 | ||||||||

02/01/2022 | (2) | — | — | — | — | 9,661 | 1,057,880 | — | — | |||||||||

03/01/2022 | (2) | — | — | — | — | 3,554 | 389,163 | — | — | |||||||||

02/01/2023 | (4) | — | — | — | — | — | — | 32,330 | 3,540,135 | |||||||||

02/01/2023 | (2) | — | — | — | — | 37,719 | 4,130,231 | — | — | |||||||||

04/03/2023 | (2) | — | — | — | — | 28,092 | 3,076,074 | — | — | |||||||||

02/01/2024 | (6) | — | — | — | — | — | — | 15,729 | 1,722,326 | |||||||||

02/01/2024 | (2) | — | — | — | — | 73,398 | 8,037,081 | — | — | |||||||||

03/01/2024 | (6) | — | — | — | — | — | — | 3,070 | 336,165 | |||||||||

03/01/2024 | (2) | — | — | — | — | 14,327 | 1,568,807 | — | — | |||||||||

Jill Klindt | 07/03/2017 | (7) | 25,000 | — | 18.60 | 07/02/2027 | — | — | — | — | ||||||||

02/01/2022 | (5) | — | — | — | — | — | — | 2,574 | 281,853 | |||||||||

02/01/2022 | (2) | — | — | — | — | 7,723 | 845,669 | — | — | |||||||||

02/01/2023 | (4) | — | — | — | — | — | — | 17,674 | 1,935,303 | |||||||||

02/01/2023 | (2) | — | — | — | — | 20,620 | 2,257,890 | — | — | |||||||||

02/01/2024 | (6) | — | — | — | — | — | 6,642 | 727,299 | ||||||||||

02/01/2024 | (2) | — | — | — | — | 30,996 | 3,394,062 | — | ||||||||||

Brandon Ziegler | 02/01/2022 | (5) | — | — | — | — | — | — | 1,828 | 200,166 | ||||||||

02/01/2022 | (2) | — | — | — | — | 5,483 | 600,389 | — | — | |||||||||

03/01/2022 | (2) | — | — | — | — | 1,538 | 168,411 | — | — | |||||||||

02/01/2023 | (4) | — | — | — | — | — | — | 14,658 | 1,605,051 | |||||||||

02/01/2023 | (2) | — | — | — | — | 17,099 | 1,872,341 | — | — | |||||||||

02/01/2024 | (6) | — | — | — | — | — | — | 5,505 | 602,798 | |||||||||

02/01/2024 | (2) | — | — | — | — | 25,689 | 2,812,946 | — | — | |||||||||

Option Awards | Stock Awards | |||||||||||||||||

Name | Option/ Stock Award Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(1) | Number of Unearned Shares or Units of Stock That Have Not Vested (#) | Market Value of Unearned Shares or Units of Stock That Have Not Vested ($)(1) | |||||||||

Michael Hawkins | 02/01/2021 | (3) | — | — | — | — | 5,185 | 567,758 | — | — | ||||||||

02/01/2022 | (5) | — | — | — | — | — | — | 1,828 | 200,166 | |||||||||

02/01/2022 | (2) | — | — | — | — | 5,483 | 600,389 | — | — | |||||||||

02/01/2023 | (4) | — | — | — | — | — | — | 13,470 | 1,474,965 | |||||||||

02/01/2023 | (2) | — | — | — | — | 15,717 | 1,721,012 | — | — | |||||||||

02/01/2024 | (6) | — | — | — | — | — | — | 5,037 | 551,552 | |||||||||

02/01/2024 | (2) | — | — | — | — | 23,502 | 2,573,469 | — | — | |||||||||

Stock Awards | |||||

Name(1) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($)(2) | |||

Julie Iskow | 77,011 | 6,960,796 | |||

Jill Klindt | 39,591 | 3,589,113 | |||

Brandon Ziegler | 49,383 | 4,401,033 | |||

Michael Hawkins | 37,547 | 3,373,475 | |||

Named Executive Officer | Compensation | Termination on Death or Disability ($) | Termination Without Cause or for Good Reason ($) | Termination Without Cause or for Good Reason in connection with a Change in Control ($)(4) | |||||

Julie Iskow | Cash Severance (1) | 2,287,500 | 3,660,000 | 4,880,000 | |||||

Equity Acceleration (2) | 24,498,654 | 24,498,654 | 30,738,074 | ||||||

Benefit Continuation (3) | 24,302 | 24,302 | 24,302 | ||||||

Total | 26,810,456 | 28,182,956 | 35,642,376 | ||||||

Jill Klindt | Cash Severance (1) | 1,081,000 | 1,802,000 | 2,472,000 | |||||

Equity Acceleration (2) | 9,201,723 | 9,201,723 | 11,905,826 | ||||||

Benefit Continuation (3) | 33,899 | 33,899 | 33,899 | ||||||

Total | 10,316,622 | 11,037,622 | 14,411,725 | ||||||

Brandon Ziegler | Cash Severance (1) | 1,081,000 | 1,802,000 | 2,472,000 | |||||

Equity Acceleration (2) | 7,662,372 | 7,662,372 | 9,870,659 | ||||||

Benefit Continuation (3) | 34,575 | 34,575 | 34,575 | ||||||

Total | 8,777,947 | 9,498,947 | 12,377,234 | ||||||

Michael Hawkins | Cash Severance (1) | 1,230,000 | 2,028,000 | 2,772,000 | |||||

Equity Acceleration (2) | 7,503,159 | 7,503,159 | 9,543,692 | ||||||

Benefit Continuation (3) | — | 34,575 | 34,575 | ||||||

Total | 8,733,159 | 9,565,734 | 12,350,267 | ||||||

Summary Compensation Table Total for PEO ($) (1) | Compensation Actually Paid to PEO 1 ($) (2)(5)(6) | Value of initial Fixed $100 investment Based on: | ||||||||||||||||||

Year | Iskow | Vanderploeg | Iskow | Vanderploeg | Average Summary Compensation Table Total for non-PEO NEOs ($) (3) | Average Compensation Actually Paid to non- PEO NEOs ($) (2)(5)(6) | Total Stockholder Return ($) (4) | Peer Group Total Stockholder Return ($) (4) | Net Loss (in thousands) ($) | Revenue Growth(7) | ||||||||||

2024 | N/A | N/A | ( | |||||||||||||||||

2023 | ( | |||||||||||||||||||

2022 | N/A | N/A | ( | |||||||||||||||||

2021 | N/A | N/A | ( | |||||||||||||||||

2020 | N/A | N/A | ( | |||||||||||||||||

Year | Executives | SCT Total ($) | Deduct SCT Equity Awards ($) | Add Year-End Value of Unvested Equity Granted in Year ($) | Add Change in Value of Unvested Awards Granted in Prior Years ($) | Add FV at Vesting of Awards Granted and Vested in Same Year ($) | Add Change in Value of Vested Equity Granted in Prior Years ($) | Deduct Change in Value of Awards Forfeited in Year ($) | ||||||||

2024 | PEO - Iskow | ( | ( | |||||||||||||

Other NEOs | ( | ( |

Performance Metric | ||

Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights(2) | Weighted Average Exercise Price of Outstanding Options ($)(2)(3) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans(4) | |||

Equity Compensation Plans Approved By Stockholders(1) | 3,925,960 | 14.09 | 8,579,335 | |||

Total | 3,925,960 | 14.09 | 8,579,335 |

Suku Radia (Chair) Robert H. Herz David S. Mulcahy |

2024 | 2023 | |||

Audit Fees (1) | $1,214,000 | $1,170,000 | ||

Audit-Related Fees | — | — | ||

Tax Fees | — | — | ||

All Other Fees | — | — |