Financial Results and Supplemental Information THIRD QUARTER 2025 October 27, 2025 .2

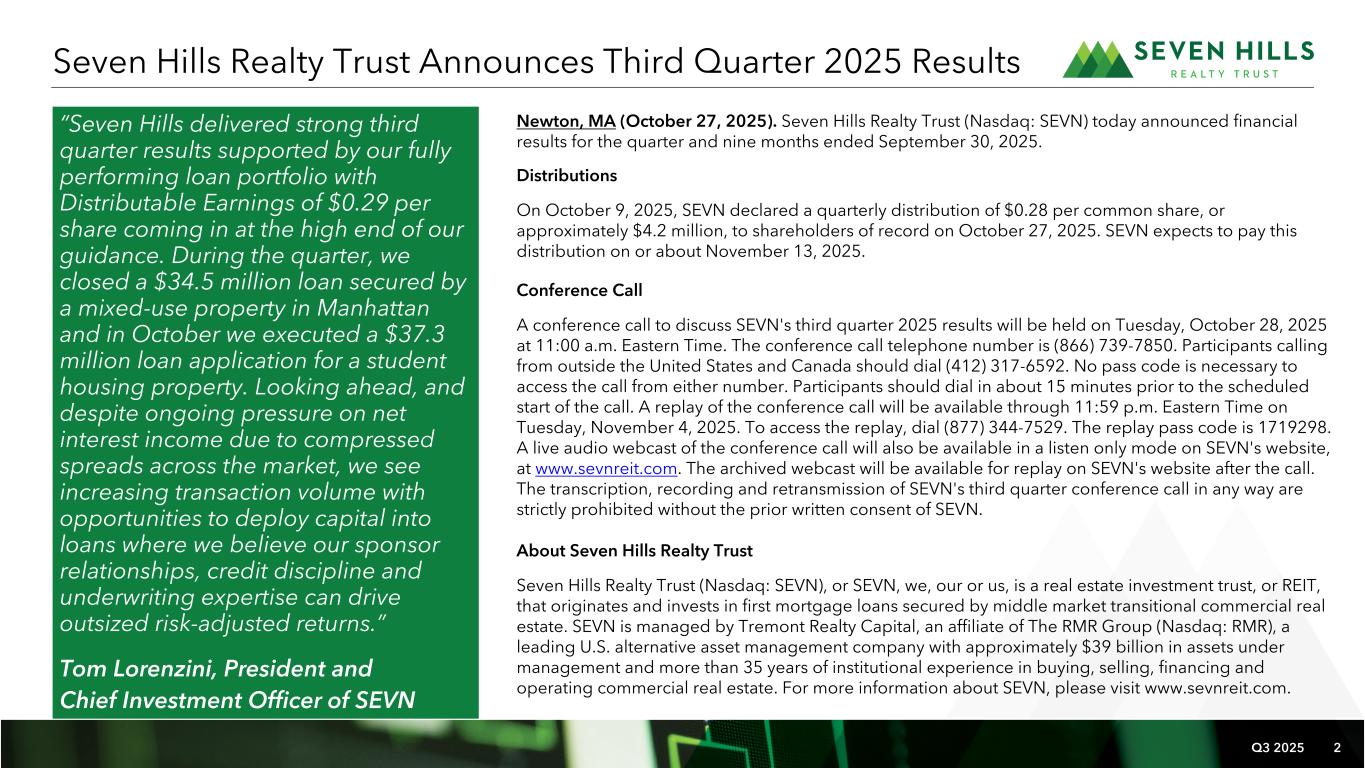

Q3 2025 2 Seven Hills Realty Trust Announces Third Quarter 2025 Results “Seven Hills delivered strong third quarter results supported by our fully performing loan portfolio with Distributable Earnings of $0.29 per share coming in at the high end of our guidance. During the quarter, we closed a $34.5 million loan secured by a mixed-use property in Manhattan and in October we executed a $37.3 million loan application for a student housing property. Looking ahead, and despite ongoing pressure on net interest income due to compressed spreads across the market, we see increasing transaction volume with opportunities to deploy capital into loans where we believe our sponsor relationships, credit discipline and underwriting expertise can drive outsized risk-adjusted returns.” Tom Lorenzini, President and Chief Investment Officer of SEVN Conference Call A conference call to discuss SEVN's third quarter 2025 results will be held on Tuesday, October 28, 2025 at 11:00 a.m. Eastern Time. The conference call telephone number is (866) 739-7850. Participants calling from outside the United States and Canada should dial (412) 317-6592. No pass code is necessary to access the call from either number. Participants should dial in about 15 minutes prior to the scheduled start of the call. A replay of the conference call will be available through 11:59 p.m. Eastern Time on Tuesday, November 4, 2025. To access the replay, dial (877) 344-7529. The replay pass code is 1719298. A live audio webcast of the conference call will also be available in a listen only mode on SEVN's website, at www.sevnreit.com. The archived webcast will be available for replay on SEVN's website after the call. The transcription, recording and retransmission of SEVN's third quarter conference call in any way are strictly prohibited without the prior written consent of SEVN. Distributions On October 9, 2025, SEVN declared a quarterly distribution of $0.28 per common share, or approximately $4.2 million, to shareholders of record on October 27, 2025. SEVN expects to pay this distribution on or about November 13, 2025. About Seven Hills Realty Trust Seven Hills Realty Trust (Nasdaq: SEVN), or SEVN, we, our or us, is a real estate investment trust, or REIT, that originates and invests in first mortgage loans secured by middle market transitional commercial real estate. SEVN is managed by Tremont Realty Capital, an affiliate of The RMR Group (Nasdaq: RMR), a leading U.S. alternative asset management company with approximately $39 billion in assets under management and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. For more information about SEVN, please visit www.sevnreit.com. Newton, MA (October 27, 2025). Seven Hills Realty Trust (Nasdaq: SEVN) today announced financial results for the quarter and nine months ended September 30, 2025.

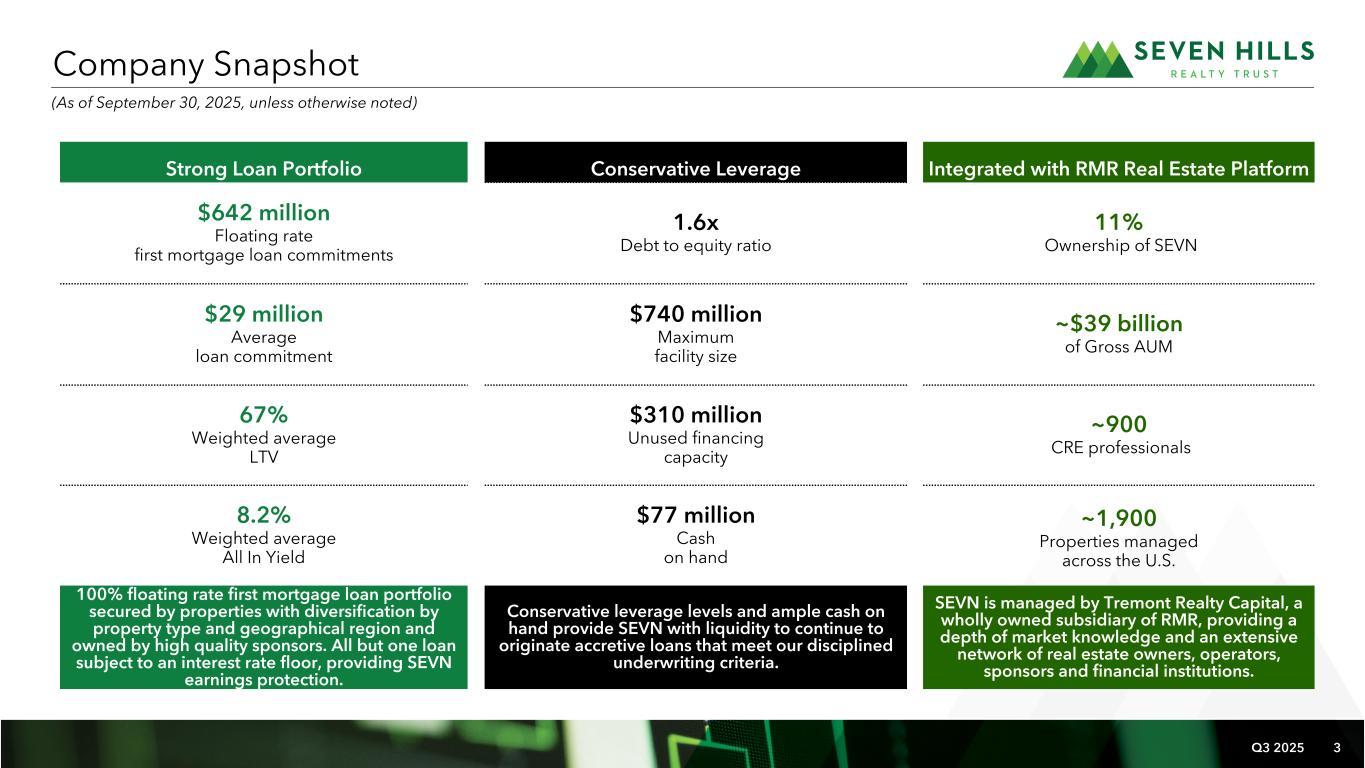

Q3 2025 3 Company Snapshot Strong Loan Portfolio Conservative Leverage Integrated with RMR Real Estate Platform $642 million Floating rate first mortgage loan commitments 1.6x Debt to equity ratio 11% Ownership of SEVN $29 million Average loan commitment $740 million Maximum facility size ~$39 billion of Gross AUM 67% Weighted average LTV $310 million Unused financing capacity ~900 CRE professionals 8.2% Weighted average All In Yield $77 million Cash on hand ~1,900 Properties managed across the U.S. 100% floating rate first mortgage loan portfolio secured by properties with diversification by property type and geographical region and owned by high quality sponsors. All but one loan subject to an interest rate floor, providing SEVN earnings protection. Conservative leverage levels and ample cash on hand provide SEVN with liquidity to continue to originate accretive loans that meet our disciplined underwriting criteria. SEVN is managed by Tremont Realty Capital, a wholly owned subsidiary of RMR, providing a depth of market knowledge and an extensive network of real estate owners, operators, sponsors and financial institutions. (As of September 30, 2025, unless otherwise noted)

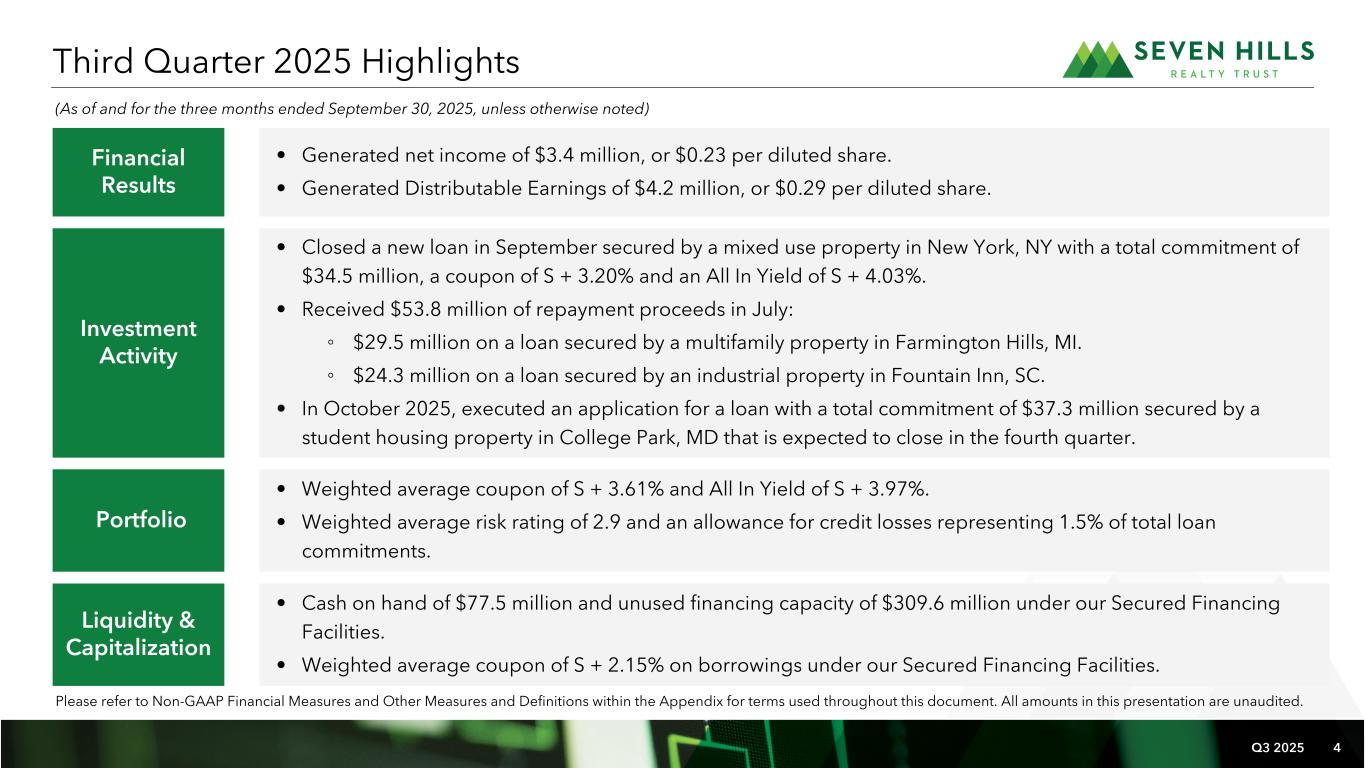

Q3 2025 4 Financial Results • Generated net income of $3.4 million, or $0.23 per diluted share. • Generated Distributable Earnings of $4.2 million, or $0.29 per diluted share. Investment Activity • Closed a new loan in September secured by a mixed use property in New York, NY with a total commitment of $34.5 million, a coupon of S + 3.20% and an All In Yield of S + 4.03%. • Received $53.8 million of repayment proceeds in July: ◦ $29.5 million on a loan secured by a multifamily property in Farmington Hills, MI. ◦ $24.3 million on a loan secured by an industrial property in Fountain Inn, SC. • In October 2025, executed an application for a loan with a total commitment of $37.3 million secured by a student housing property in College Park, MD that is expected to close in the fourth quarter. Portfolio • Weighted average coupon of S + 3.61% and All In Yield of S + 3.97%. • Weighted average risk rating of 2.9 and an allowance for credit losses representing 1.5% of total loan commitments. Liquidity & Capitalization • Cash on hand of $77.5 million and unused financing capacity of $309.6 million under our Secured Financing Facilities. • Weighted average coupon of S + 2.15% on borrowings under our Secured Financing Facilities. Third Quarter 2025 Highlights (As of and for the three months ended September 30, 2025, unless otherwise noted) Please refer to Non-GAAP Financial Measures and Other Measures and Definitions within the Appendix for terms used throughout this document. All amounts in this presentation are unaudited.

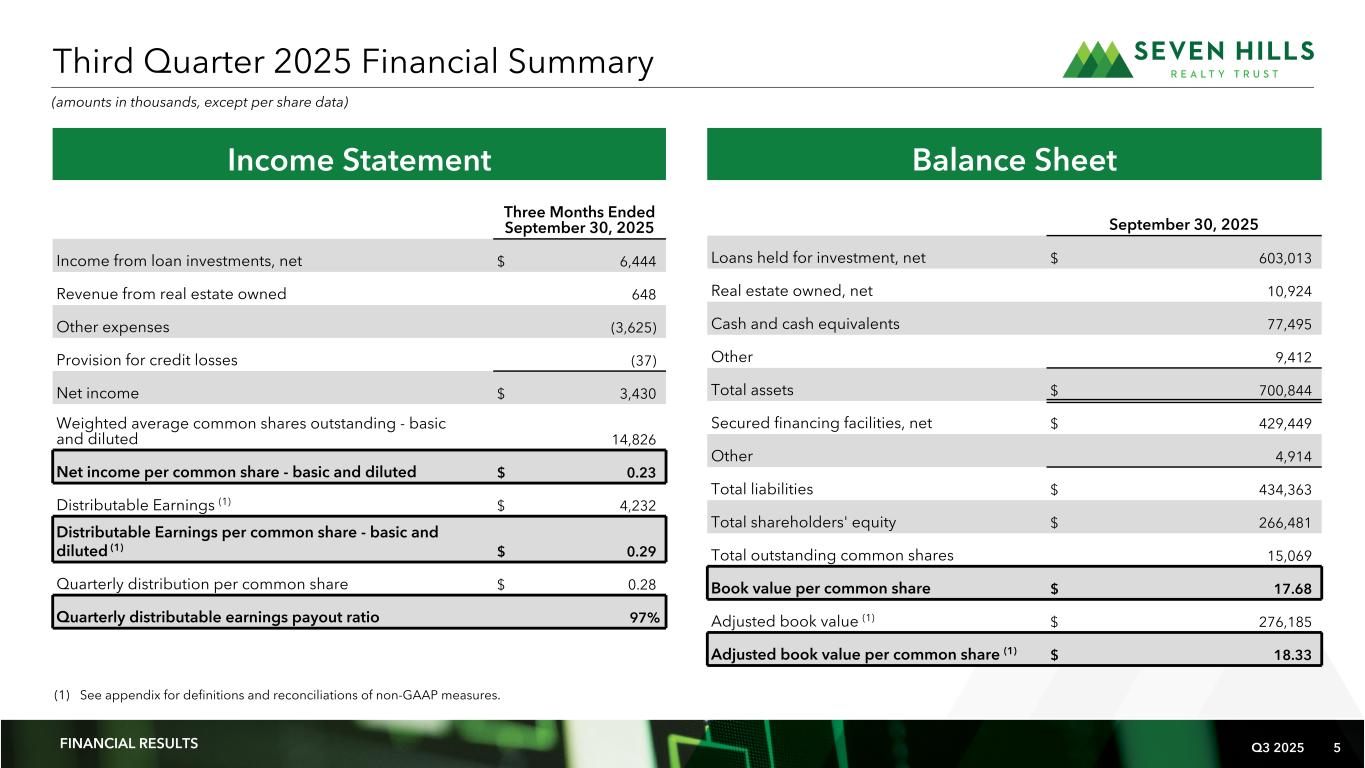

Q3 2025 5 Third Quarter 2025 Financial Summary Income Statement Three Months Ended September 30, 2025 Income from loan investments, net $ 6,444 Revenue from real estate owned 648 Other expenses (3,625) Provision for credit losses (37) Net income $ 3,430 Weighted average common shares outstanding - basic and diluted 14,826 Net income per common share - basic and diluted $ 0.23 Distributable Earnings (1) $ 4,232 Distributable Earnings per common share - basic and diluted (1) $ 0.29 Quarterly distribution per common share $ 0.28 Quarterly distributable earnings payout ratio 97% Balance Sheet September 30, 2025 Loans held for investment, net $ 603,013 Real estate owned, net 10,924 Cash and cash equivalents 77,495 Other 9,412 Total assets $ 700,844 Secured financing facilities, net $ 429,449 Other 4,914 Total liabilities $ 434,363 Total shareholders' equity $ 266,481 Total outstanding common shares 15,069 Book value per common share $ 17.68 Adjusted book value (1) $ 276,185 Adjusted book value per common share (1) $ 18.33 (amounts in thousands, except per share data) (1) See appendix for definitions and reconciliations of non-GAAP measures. FINANCIAL RESULTS

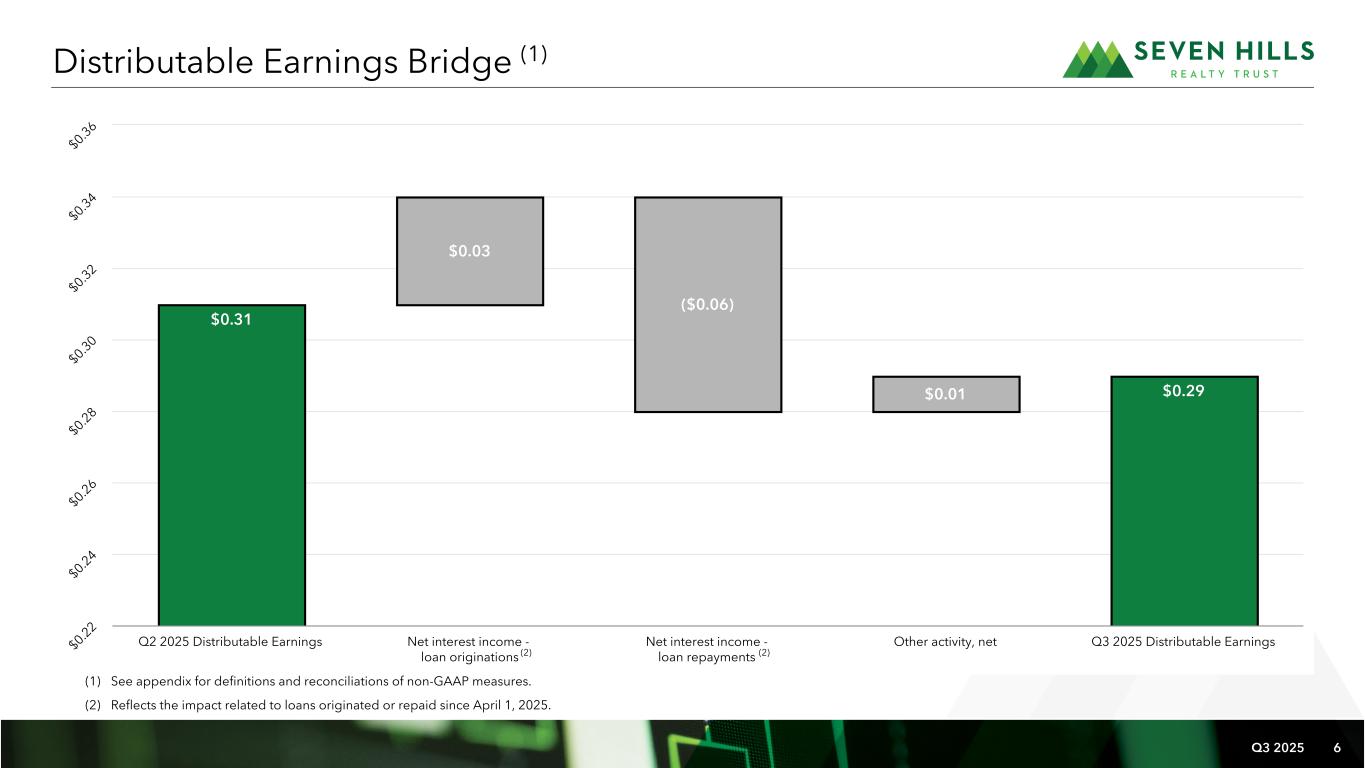

Q3 2025 6 Distributable Earnings Bridge (1) $0.31 $0.31 $0.28 $0.28 $0.29 $0.03 ($0.06) $0.01 Q2 2025 Distributable Earnings Net interest income - loan originations Net interest income - loan repayments Other activity, net Q3 2025 Distributable Earnings$0.22 $0.24 $0.26 $0.28 $0.30 $0.32 $0.34 $0.36 (1) See appendix for definitions and reconciliations of non-GAAP measures. (2) Reflects the impact related to loans originated or repaid since April 1, 2025. (2) (2)

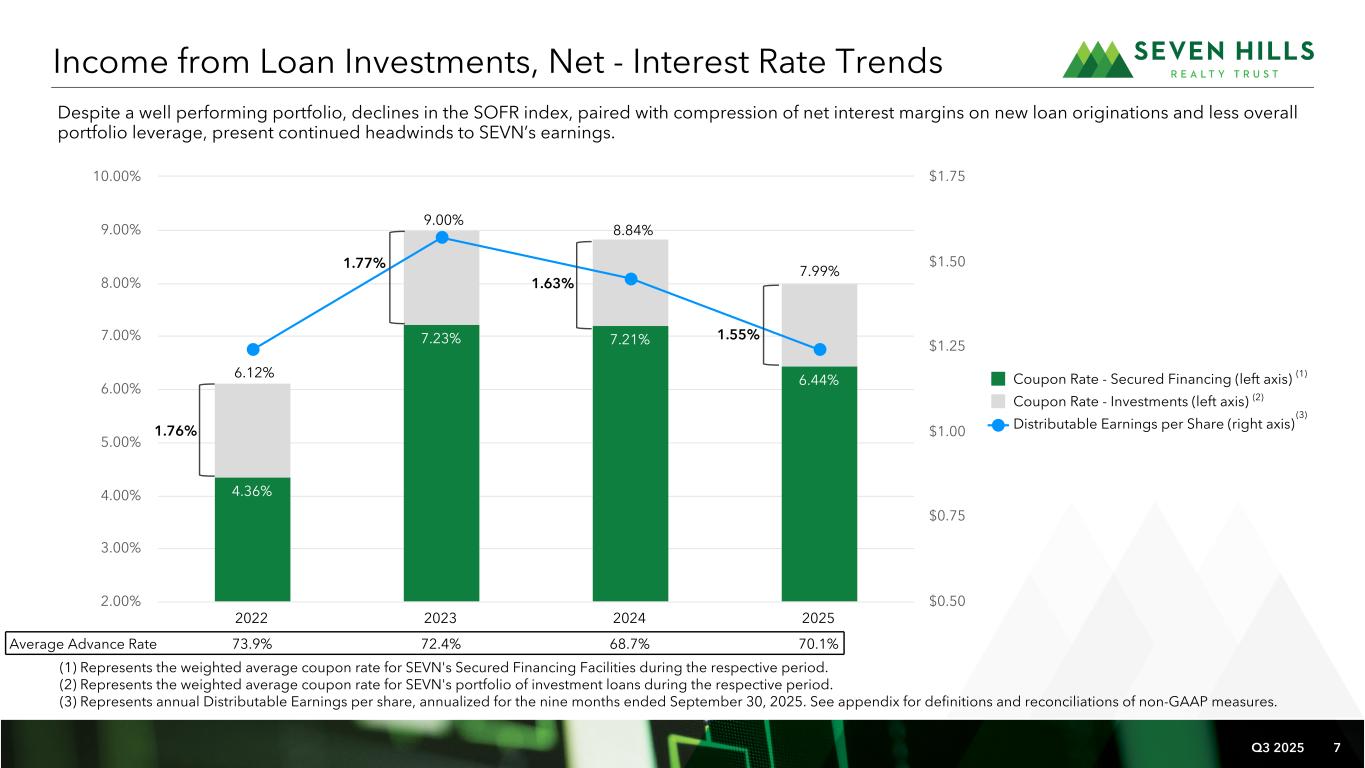

Q3 2025 7 Income from Loan Investments, Net - Interest Rate Trends 4.36% 7.23% 7.21% 6.44% Coupon Rate - Secured Financing (left axis) Coupon Rate - Investments (left axis) Distributable Earnings per Share (right axis) 2022 2023 2024 2025 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 (1) Represents the weighted average coupon rate for SEVN's Secured Financing Facilities during the respective period. (2) Represents the weighted average coupon rate for SEVN's portfolio of investment loans during the respective period. (3) Represents annual Distributable Earnings per share, annualized for the nine months ended September 30, 2025. See appendix for definitions and reconciliations of non-GAAP measures. Average Advance Rate 73.9% 72.4% 68.7% 70.1% 6.12% 9.00% 8.84% 7.99% 1.76% 1.77% 1.63% 1.55% Despite a well performing portfolio, declines in the SOFR index, paired with compression of net interest margins on new loan originations and less overall portfolio leverage, present continued headwinds to SEVN’s earnings. (1) (2) (3)

Q3 2025 8 $632.8 $632.8 $667.3 $614.3 $614.3 $34.5 $0.8 ($53.8)$32.6 $27.6 Q2 2025 Loan Portfolio Originations Fundings Repayments Q3 2025 Loan Portfolio Third Quarter 2025 Loan Portfolio Activity (dollars in millions) Total Loan Commitments (dollars in thousands) Third Quarter Originations As of September 30, 2025 Number of loans 1 22 Average loan commitment $34,500 $29,177 Total loan commitments $34,500 $641,901 Unfunded loan commitments $— $27,554 Principal balance $34,500 $614,347 Weighted average coupon rate 7.39% 7.85% Weighted average All In Yield 8.22% 8.21% Weighted average Maximum Maturity 4.9 2.6 Weighted average LTV 70% 67% Weighted average floor 3.00% 2.59% Weighted average risk rating 3.0 2.9 Principal Balance Loan Portfolio Summary FINANCIAL RESULTS $665.4 Unfunded Commitments (1) $641.9 (1) Loans repaid during Q3 2025 had an aggregate unfunded commitment balance of $4.2 million.

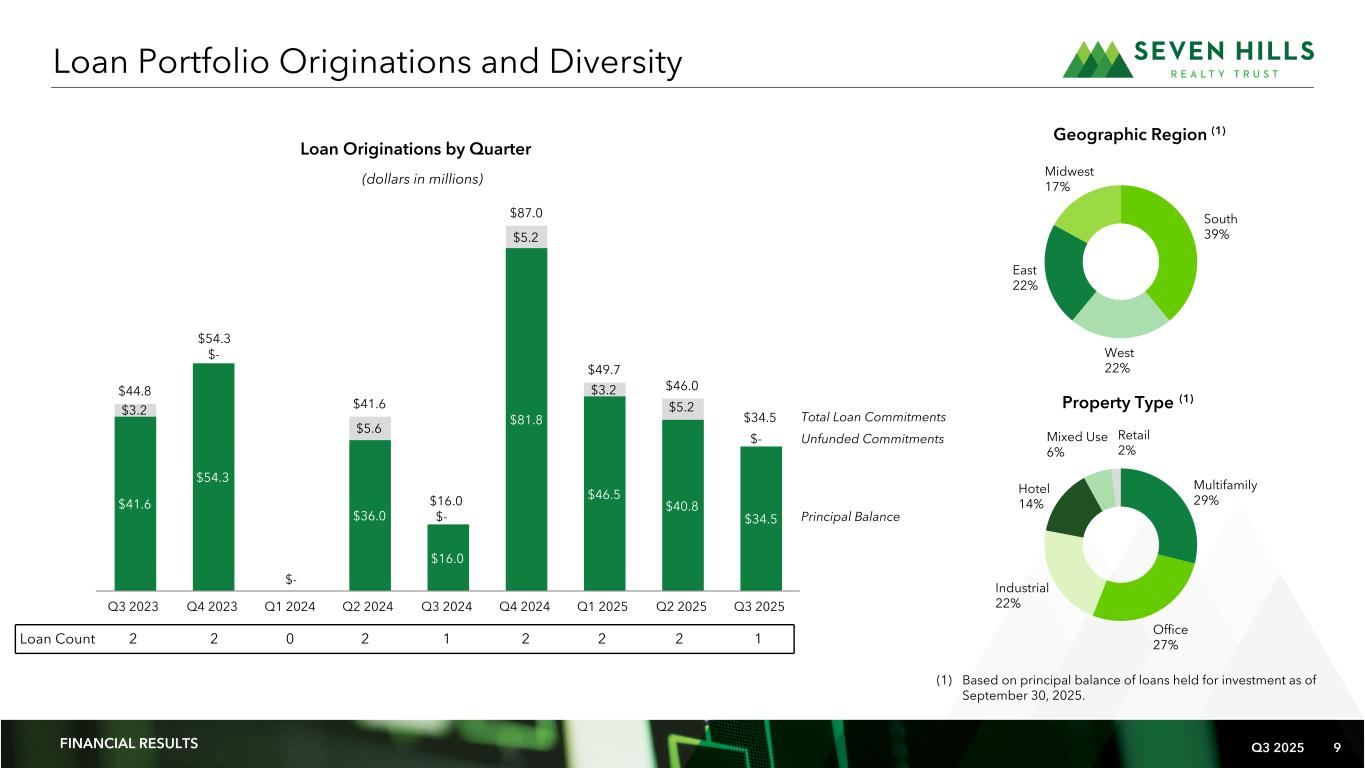

Q3 2025 9 Retail South 39% West 22% East 22% Midwest 17% Multifamily 29% Office 27% Industrial 22% Hotel 14% Mixed Use 6% Retail 2% Geographic Region (1) Property Type (1) (dollars in millions) Loan Portfolio Originations and Diversity (1) Based on principal balance of loans held for investment as of September 30, 2025. $41.6 $54.3 $36.0 $16.0 $81.8 $46.5 $40.8 $34.5 $3.2 $5.6 $5.2 $3.2 $5.2 $44.8 $41.6 $87.0 $49.7 $46.0 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Total Loan Commitments Principal Balance Loan Originations by Quarter FINANCIAL RESULTS Unfunded Commitments Loan Count 2 2 0 2 1 2 2 2 1 $- $54.3 $- $16.0 $- $34.5 $-

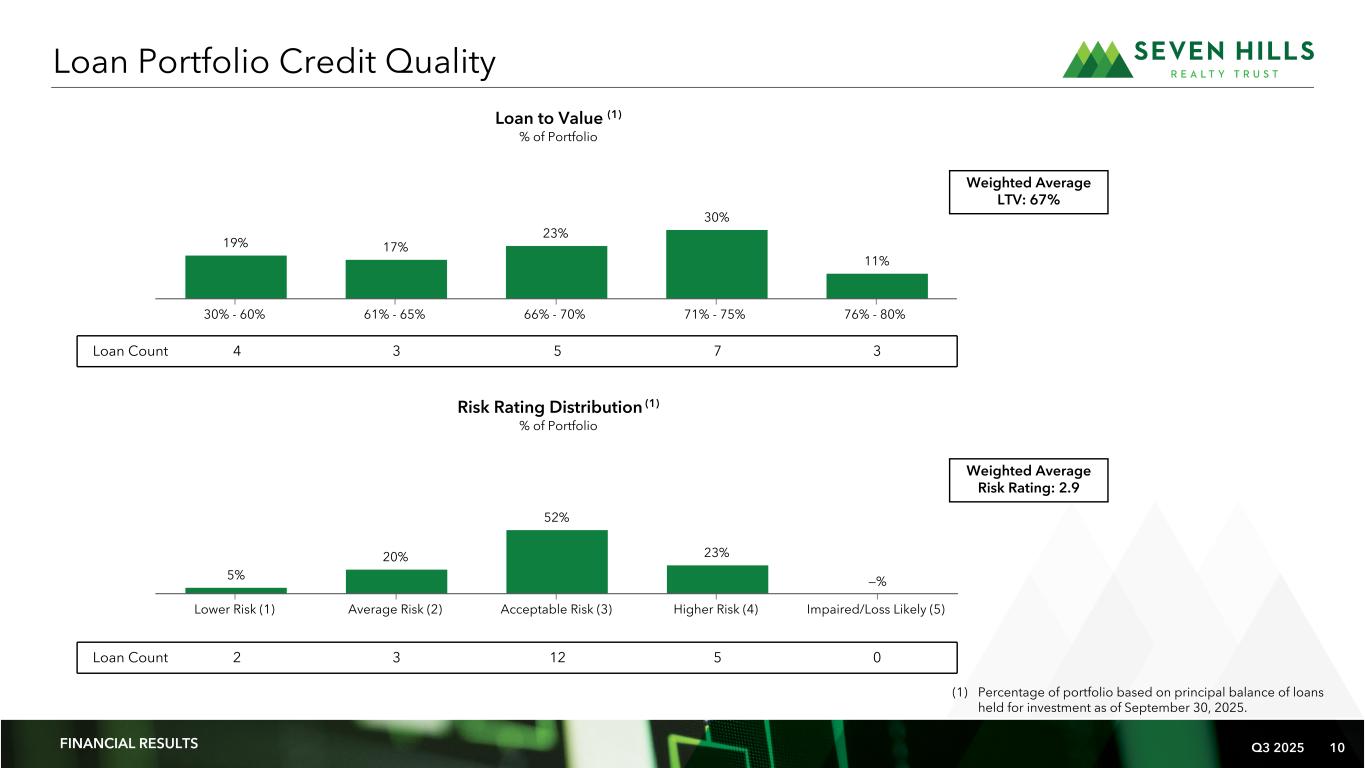

Q3 2025 10 19% 17% 23% 30% 11% 30% - 60% 61% - 65% 66% - 70% 71% - 75% 76% - 80% Loan to Value (1) % of Portfolio Loan Portfolio Credit Quality 5% 20% 52% 23% —% Lower Risk (1) Average Risk (2) Acceptable Risk (3) Higher Risk (4) Impaired/Loss Likely (5) Risk Rating Distribution (1) % of Portfolio Weighted Average LTV: 67% Weighted Average Risk Rating: 2.9 (1) Percentage of portfolio based on principal balance of loans held for investment as of September 30, 2025. FINANCIAL RESULTS Loan Count 4 3 5 7 3 Loan Count 2 3 12 5 0

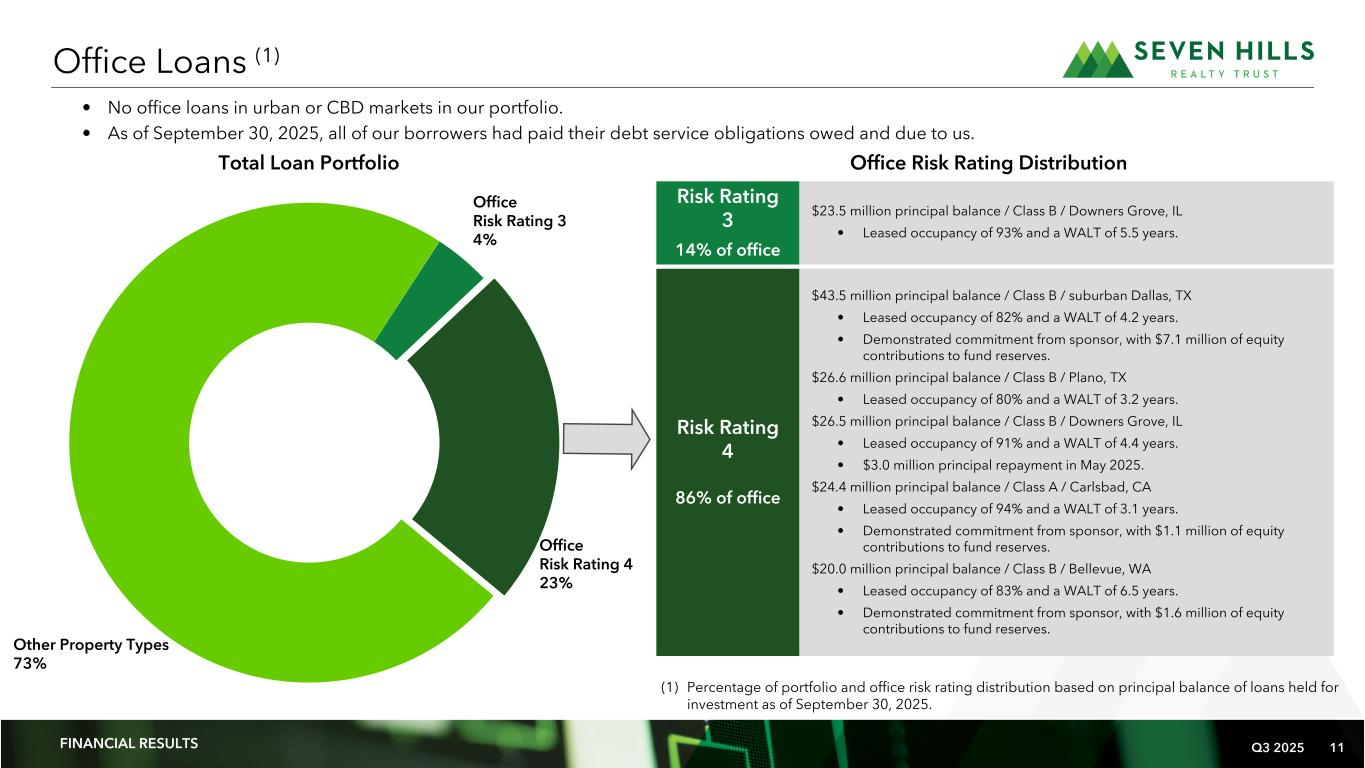

Q3 2025 11 Retail Office Risk Rating 3 4% Office Risk Rating 4 23% Other Property Types 73% Office Loans (1) Total Loan Portfolio FINANCIAL RESULTS (1) Percentage of portfolio and office risk rating distribution based on principal balance of loans held for investment as of September 30, 2025. • No office loans in urban or CBD markets in our portfolio. • As of September 30, 2025, all of our borrowers had paid their debt service obligations owed and due to us. Risk Rating 3 14% of office $23.5 million principal balance / Class B / Downers Grove, IL • Leased occupancy of 93% and a WALT of 5.5 years. Risk Rating 4 86% of office $43.5 million principal balance / Class B / suburban Dallas, TX • Leased occupancy of 82% and a WALT of 4.2 years. • Demonstrated commitment from sponsor, with $7.1 million of equity contributions to fund reserves. $26.6 million principal balance / Class B / Plano, TX • Leased occupancy of 80% and a WALT of 3.2 years. $26.5 million principal balance / Class B / Downers Grove, IL • Leased occupancy of 91% and a WALT of 4.4 years. • $3.0 million principal repayment in May 2025. $24.4 million principal balance / Class A / Carlsbad, CA • Leased occupancy of 94% and a WALT of 3.1 years. • Demonstrated commitment from sponsor, with $1.1 million of equity contributions to fund reserves. $20.0 million principal balance / Class B / Bellevue, WA • Leased occupancy of 83% and a WALT of 6.5 years. • Demonstrated commitment from sponsor, with $1.6 million of equity contributions to fund reserves. Office Risk Rating Distribution

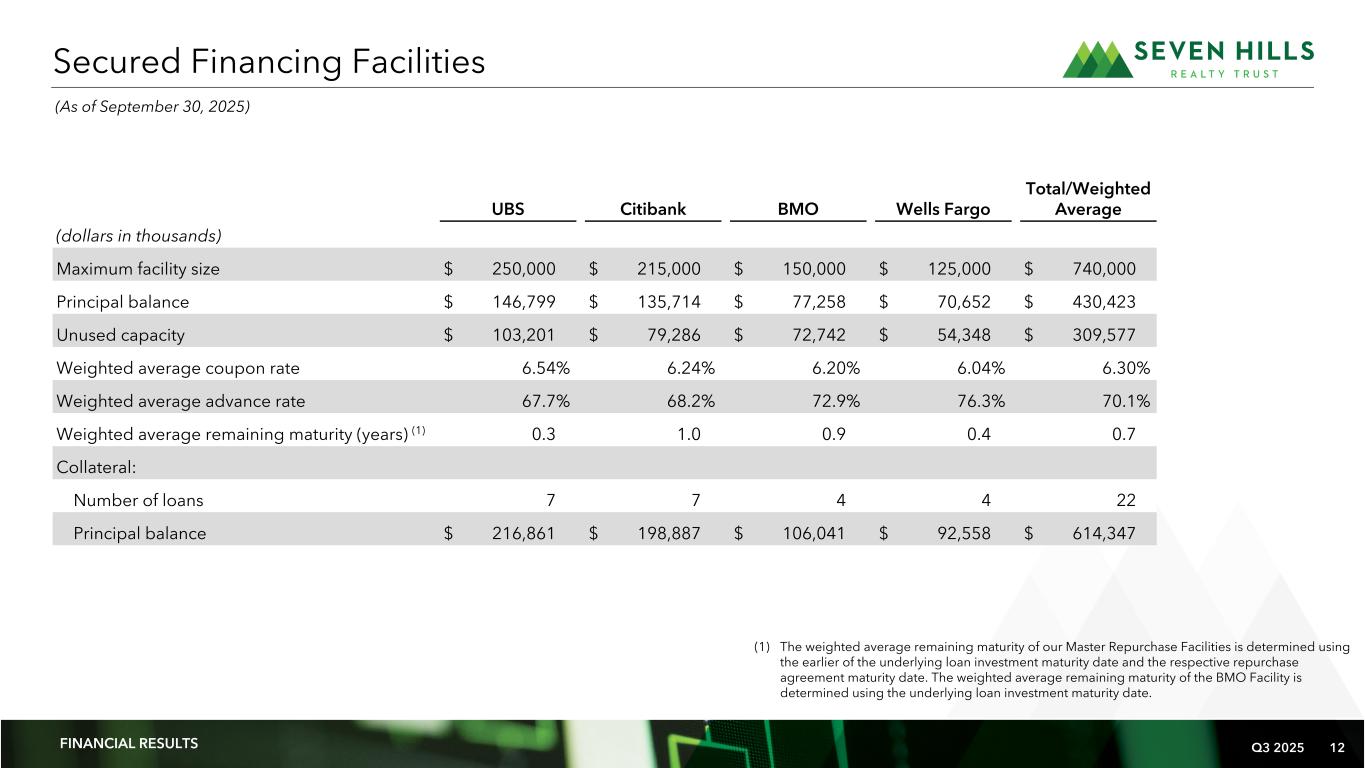

Q3 2025 12 (1) The weighted average remaining maturity of our Master Repurchase Facilities is determined using the earlier of the underlying loan investment maturity date and the respective repurchase agreement maturity date. The weighted average remaining maturity of the BMO Facility is determined using the underlying loan investment maturity date. Secured Financing Facilities FINANCIAL RESULTS (As of September 30, 2025) UBS Citibank BMO Wells Fargo Total/Weighted Average (dollars in thousands) Maximum facility size $ 250,000 $ 215,000 $ 150,000 $ 125,000 $ 740,000 Principal balance $ 146,799 $ 135,714 $ 77,258 $ 70,652 $ 430,423 Unused capacity $ 103,201 $ 79,286 $ 72,742 $ 54,348 $ 309,577 Weighted average coupon rate 6.54% 6.24% 6.20% 6.04% 6.30% Weighted average advance rate 67.7% 68.2% 72.9% 76.3% 70.1% Weighted average remaining maturity (years) (1) 0.3 1.0 0.9 0.4 0.7 Collateral: Number of loans 7 7 4 4 22 Principal balance $ 216,861 $ 198,887 $ 106,041 $ 92,558 $ 614,347

Q3 2025 13 Appendix

Q3 2025 14 Management Our manager, Tremont, is registered with the Securities and Exchange Commission, or SEC, as an investment adviser and is owned by RMR. As of September 30, 2025, RMR had approximately $39 billion in assets under management and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. We believe Tremont’s relationship with RMR provides us with a depth of market knowledge that may allow us to identify high quality investment opportunities and to evaluate them more thoroughly than many of our competitors, including other commercial mortgage REITs. We also believe RMR’s broad platform provides us with access to RMR’s extensive network of real estate owners, operators, intermediaries, sponsors, financial institutions and other real estate related professionals and businesses with which RMR has historical relationships. We also believe that Tremont provides us with significant experience and expertise in investing in middle market transitional CRE. Company Profile, Governance and Research Coverage APPENDIX SEVN is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding SEVN’s performance made by these analysts do not represent opinions, estimates or forecasts of SEVN or its management. SEVN does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts. Board of Trustees Ann M. Danner Barbara D. Gilmore William A. Lamkin Joseph L. Morea Independent Trustee Independent Trustee Independent Trustee Lead Independent Trustee Jeffrey P. Somers Matthew P. Jordan Adam D. Portnoy Independent Trustee Managing Trustee Chair of the Board & Managing Trustee Executive Officers Thomas J. Lorenzini Matthew C. Brown President and Chief Investment Officer Chief Financial Officer and Treasurer Jared R. Lewis Vice President Contact Information Investor Relations Inquiries Seven Hills Realty Trust Financial, investor and media inquiries Two Newton Place should be directed to: 255 Washington Street, Suite 300 Matt Murphy, Manager, Newton, MA 02458.1634 Investor Relations at (617) 796-8253 or (617) 796-8253 ir@sevnreit.com ir@sevnreit.com www.sevnreit.com Equity Research Coverage JMP Securities Janney Montgomery Scott Chris Muller Jason Stewart (212) 906-3559 (215) 665-2710 cmuller@jmpsecurities.com jstewart@janney.com Jones Trading Institutional Services, LLC Jason Weaver (646) 454-2710 jweaver@jonestrading.com

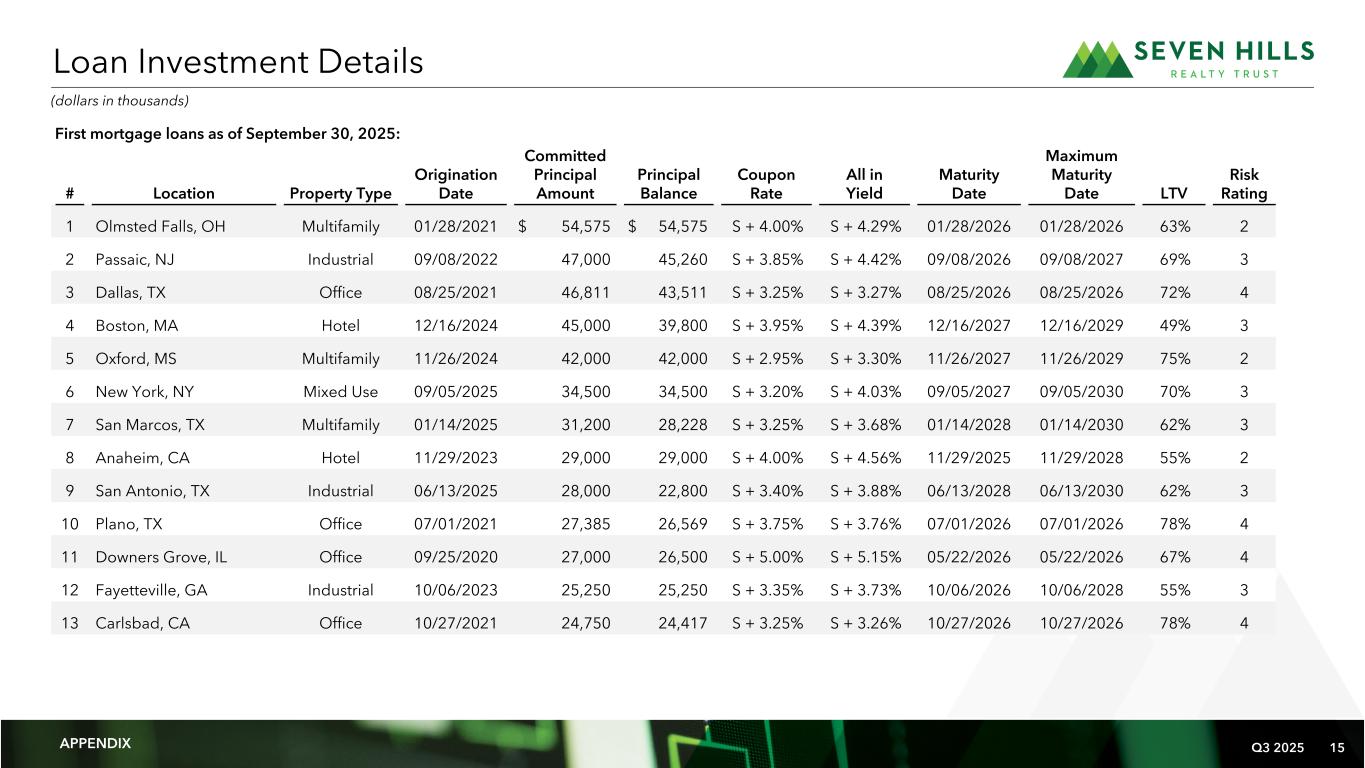

Q3 2025 15 First mortgage loans as of September 30, 2025: # Location Property Type Origination Date Committed Principal Amount Principal Balance Coupon Rate All in Yield Maturity Date Maximum Maturity Date LTV Risk Rating 1 Olmsted Falls, OH Multifamily 01/28/2021 $ 54,575 $ 54,575 S + 4.00% S + 4.29% 01/28/2026 01/28/2026 63% 2 2 Passaic, NJ Industrial 09/08/2022 47,000 45,260 S + 3.85% S + 4.42% 09/08/2026 09/08/2027 69% 3 3 Dallas, TX Office 08/25/2021 46,811 43,511 S + 3.25% S + 3.27% 08/25/2026 08/25/2026 72% 4 4 Boston, MA Hotel 12/16/2024 45,000 39,800 S + 3.95% S + 4.39% 12/16/2027 12/16/2029 49% 3 5 Oxford, MS Multifamily 11/26/2024 42,000 42,000 S + 2.95% S + 3.30% 11/26/2027 11/26/2029 75% 2 6 New York, NY Mixed Use 09/05/2025 34,500 34,500 S + 3.20% S + 4.03% 09/05/2027 09/05/2030 70% 3 7 San Marcos, TX Multifamily 01/14/2025 31,200 28,228 S + 3.25% S + 3.68% 01/14/2028 01/14/2030 62% 3 8 Anaheim, CA Hotel 11/29/2023 29,000 29,000 S + 4.00% S + 4.56% 11/29/2025 11/29/2028 55% 2 9 San Antonio, TX Industrial 06/13/2025 28,000 22,800 S + 3.40% S + 3.88% 06/13/2028 06/13/2030 62% 3 10 Plano, TX Office 07/01/2021 27,385 26,569 S + 3.75% S + 3.76% 07/01/2026 07/01/2026 78% 4 11 Downers Grove, IL Office 09/25/2020 27,000 26,500 S + 5.00% S + 5.15% 05/22/2026 05/22/2026 67% 4 12 Fayetteville, GA Industrial 10/06/2023 25,250 25,250 S + 3.35% S + 3.73% 10/06/2026 10/06/2028 55% 3 13 Carlsbad, CA Office 10/27/2021 24,750 24,417 S + 3.25% S + 3.26% 10/27/2026 10/27/2026 78% 4 Loan Investment Details APPENDIX (dollars in thousands)

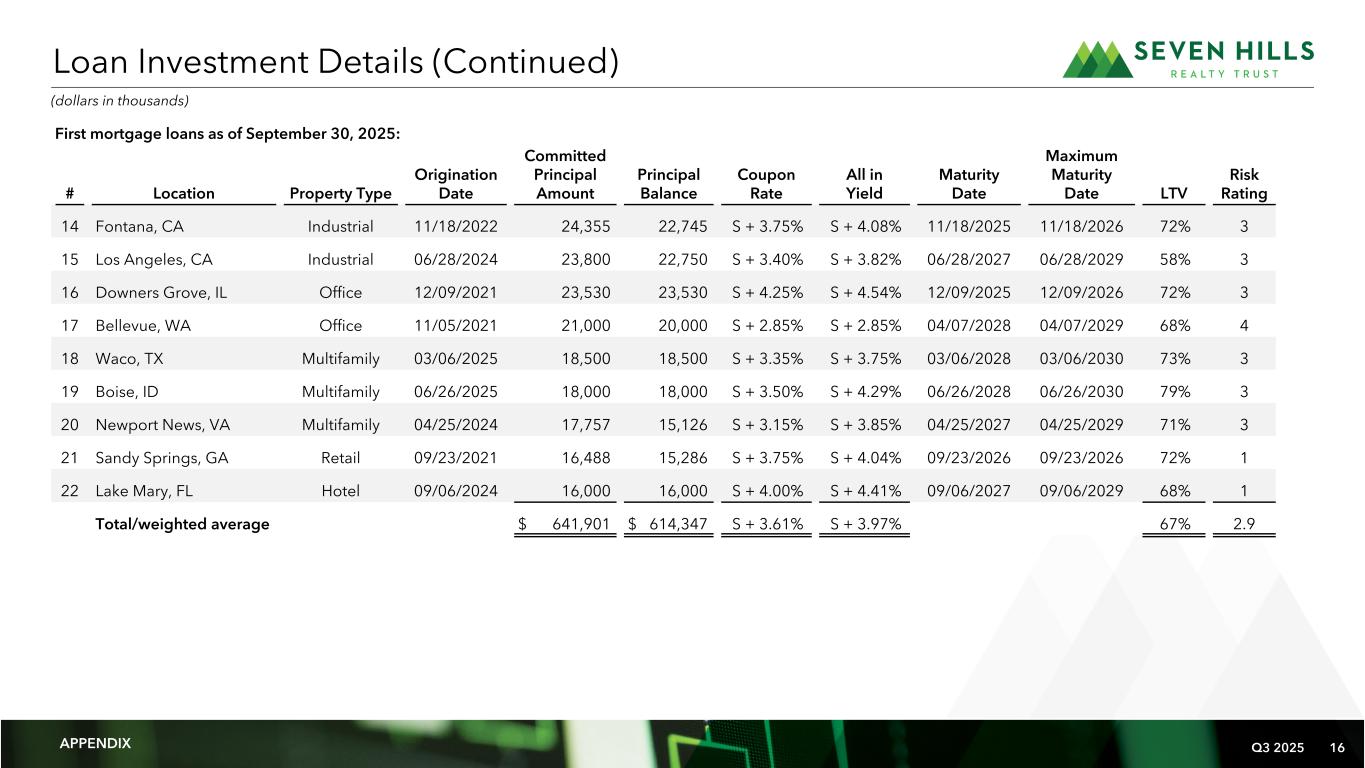

Q3 2025 16 First mortgage loans as of September 30, 2025: # Location Property Type Origination Date Committed Principal Amount Principal Balance Coupon Rate All in Yield Maturity Date Maximum Maturity Date LTV Risk Rating 14 Fontana, CA Industrial 11/18/2022 24,355 22,745 S + 3.75% S + 4.08% 11/18/2025 11/18/2026 72% 3 15 Los Angeles, CA Industrial 06/28/2024 23,800 22,750 S + 3.40% S + 3.82% 06/28/2027 06/28/2029 58% 3 16 Downers Grove, IL Office 12/09/2021 23,530 23,530 S + 4.25% S + 4.54% 12/09/2025 12/09/2026 72% 3 17 Bellevue, WA Office 11/05/2021 21,000 20,000 S + 2.85% S + 2.85% 04/07/2028 04/07/2029 68% 4 18 Waco, TX Multifamily 03/06/2025 18,500 18,500 S + 3.35% S + 3.75% 03/06/2028 03/06/2030 73% 3 19 Boise, ID Multifamily 06/26/2025 18,000 18,000 S + 3.50% S + 4.29% 06/26/2028 06/26/2030 79% 3 20 Newport News, VA Multifamily 04/25/2024 17,757 15,126 S + 3.15% S + 3.85% 04/25/2027 04/25/2029 71% 3 21 Sandy Springs, GA Retail 09/23/2021 16,488 15,286 S + 3.75% S + 4.04% 09/23/2026 09/23/2026 72% 1 22 Lake Mary, FL Hotel 09/06/2024 16,000 16,000 S + 4.00% S + 4.41% 09/06/2027 09/06/2029 68% 1 Total/weighted average $ 641,901 $ 614,347 S + 3.61% S + 3.97% 67% 2.9 Loan Investment Details (Continued) (dollars in thousands) APPENDIX

Q3 2025 17 The above table illustrates the incremental impact on our annual income from investments, net, from hypothetical immediate changes in SOFR, taking into consideration our borrowers’ interest rate floors as of September 30, 2025. The results in the table above are based on our loan portfolio and debt outstanding as of September 30, 2025. Any changes to the mix of our investments or debt outstanding could impact the interest rate sensitivity analysis. This illustration is not meant to forecast future results. Interest Rate Changes $(0.04) $(0.05) $(0.05) $(0.04) $(0.03) $— $0.03 $0.06 $0.09 $0.12 $0.16 -125bps -100 bps -75 bps -50 bps -25 bps 0 bps +25 bps +50 bps +75 bps +100 bps +125 bps $-0.10 $-0.05 $0.00 $0.05 $0.10 $0.15 $0.20 Interest Rate Sensitivity Annualized Impact to Net Interest Income per Share • Weighted average interest rate floor of 2.59%. All but one of our loan agreements contain floor provisions, ranging from 0.25% to 4.00%. • None of our loans currently have active interest rate floors. • No interest rate floors on advances under our Secured Financing Facilities. (As of September 30, 2025) APPENDIX Number of Loans Subject to Floor 15 8 6 5 2 0 0 0 0 0 0

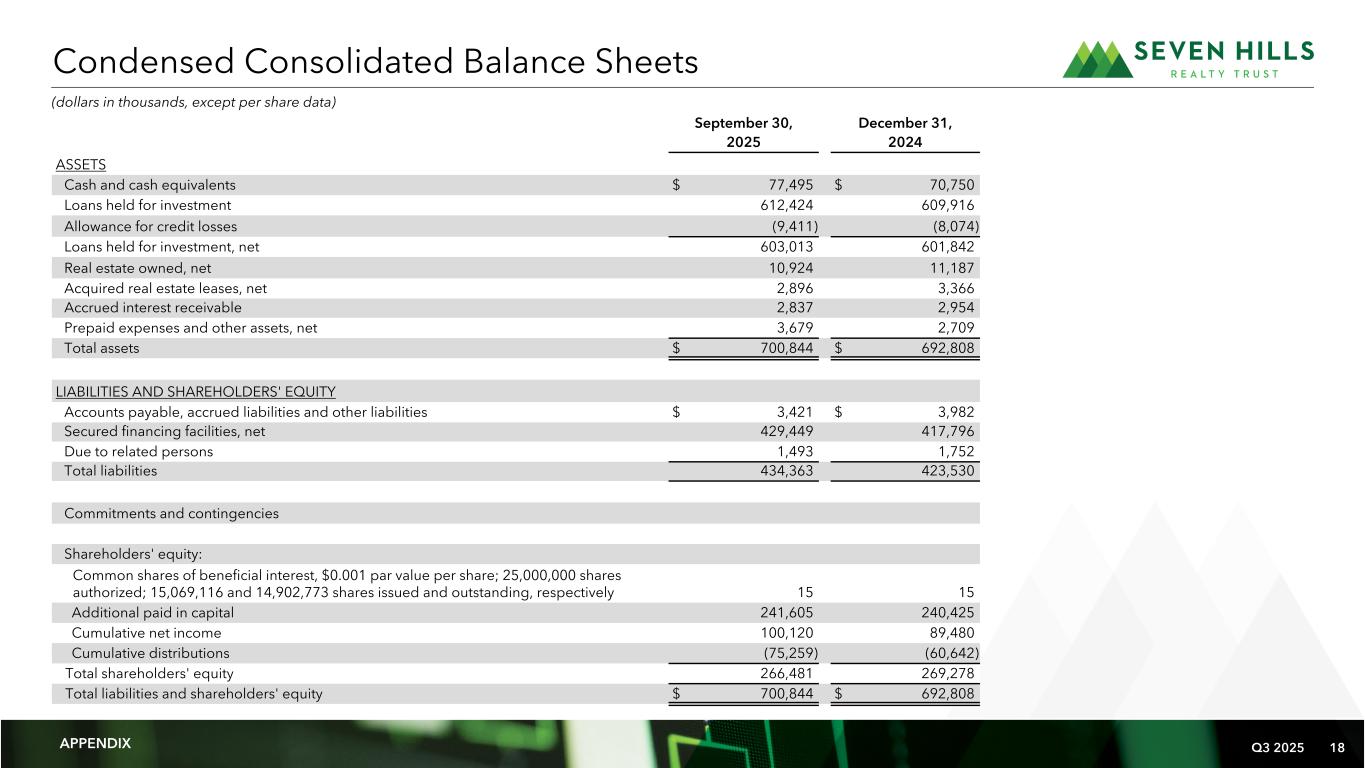

Q3 2025 18 Financial Summary September 30, December 31, 2025 2024 ASSETS Cash and cash equivalents $ 77,495 $ 70,750 Loans held for investment 612,424 609,916 Allowance for credit losses (9,411) (8,074) Loans held for investment, net 603,013 601,842 Real estate owned, net 10,924 11,187 Acquired real estate leases, net 2,896 3,366 Accrued interest receivable 2,837 2,954 Prepaid expenses and other assets, net 3,679 2,709 Total assets $ 700,844 $ 692,808 LIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable, accrued liabilities and other liabilities $ 3,421 $ 3,982 Secured financing facilities, net 429,449 417,796 Due to related persons 1,493 1,752 Total liabilities 434,363 423,530 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $0.001 par value per share; 25,000,000 shares authorized; 15,069,116 and 14,902,773 shares issued and outstanding, respectively 15 15 Additional paid in capital 241,605 240,425 Cumulative net income 100,120 89,480 Cumulative distributions (75,259) (60,642) Total shareholders' equity 266,481 269,278 Total liabilities and shareholders' equity $ 700,844 $ 692,808 Condensed Consolidated Balance Sheets (dollars in thousands, except per share data) APPENDIX

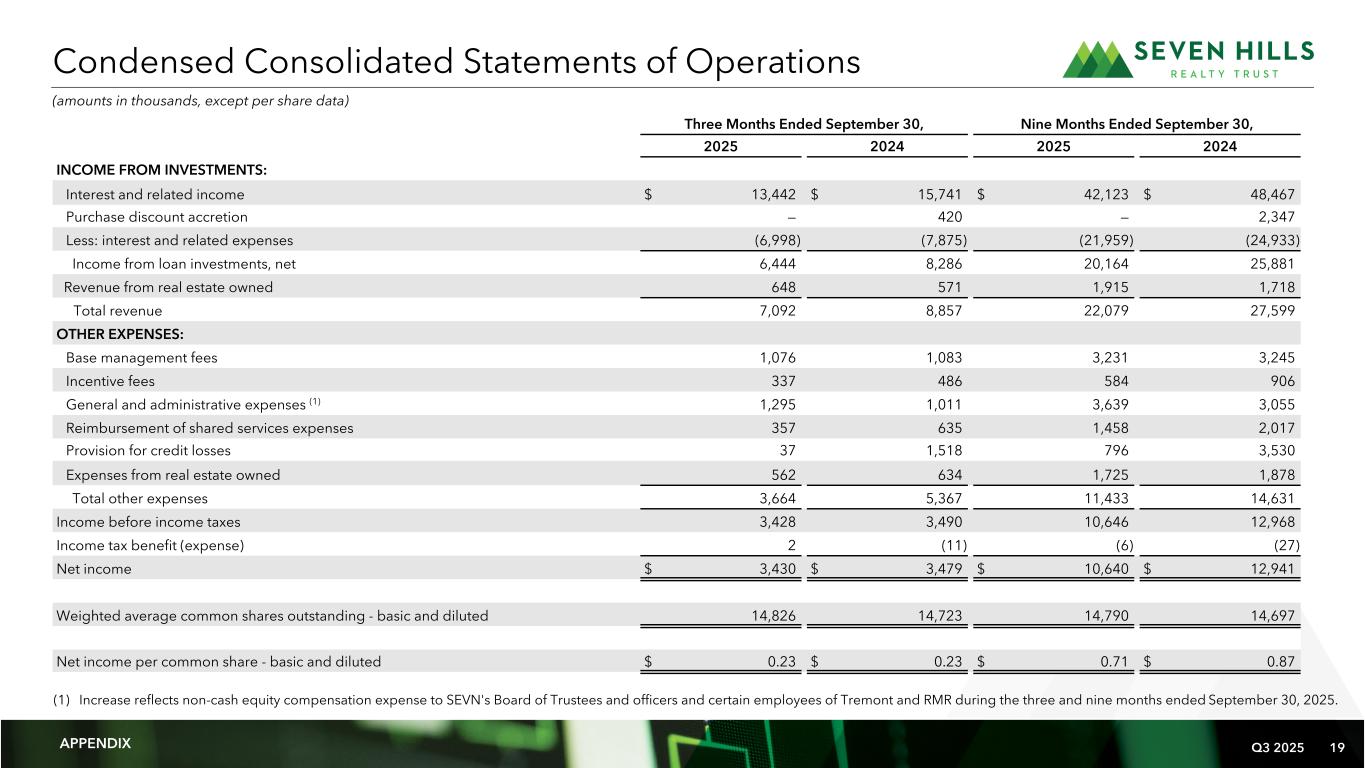

Q3 2025 19 Condensed Consolidated Statements of Operations Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 INCOME FROM INVESTMENTS: Interest and related income $ 13,442 $ 15,741 $ 42,123 $ 48,467 Purchase discount accretion — 420 — 2,347 Less: interest and related expenses (6,998) (7,875) (21,959) (24,933) Income from loan investments, net 6,444 8,286 20,164 25,881 Revenue from real estate owned 648 571 1,915 1,718 Total revenue 7,092 8,857 22,079 27,599 OTHER EXPENSES: Base management fees 1,076 1,083 3,231 3,245 Incentive fees 337 486 584 906 General and administrative expenses (1) 1,295 1,011 3,639 3,055 Reimbursement of shared services expenses 357 635 1,458 2,017 Provision for credit losses 37 1,518 796 3,530 Expenses from real estate owned 562 634 1,725 1,878 Total other expenses 3,664 5,367 11,433 14,631 Income before income taxes 3,428 3,490 10,646 12,968 Income tax benefit (expense) 2 (11) (6) (27) Net income $ 3,430 $ 3,479 $ 10,640 $ 12,941 Weighted average common shares outstanding - basic and diluted 14,826 14,723 14,790 14,697 Net income per common share - basic and diluted $ 0.23 $ 0.23 $ 0.71 $ 0.87 (amounts in thousands, except per share data) APPENDIX (1) Increase reflects non-cash equity compensation expense to SEVN's Board of Trustees and officers and certain employees of Tremont and RMR during the three and nine months ended September 30, 2025.

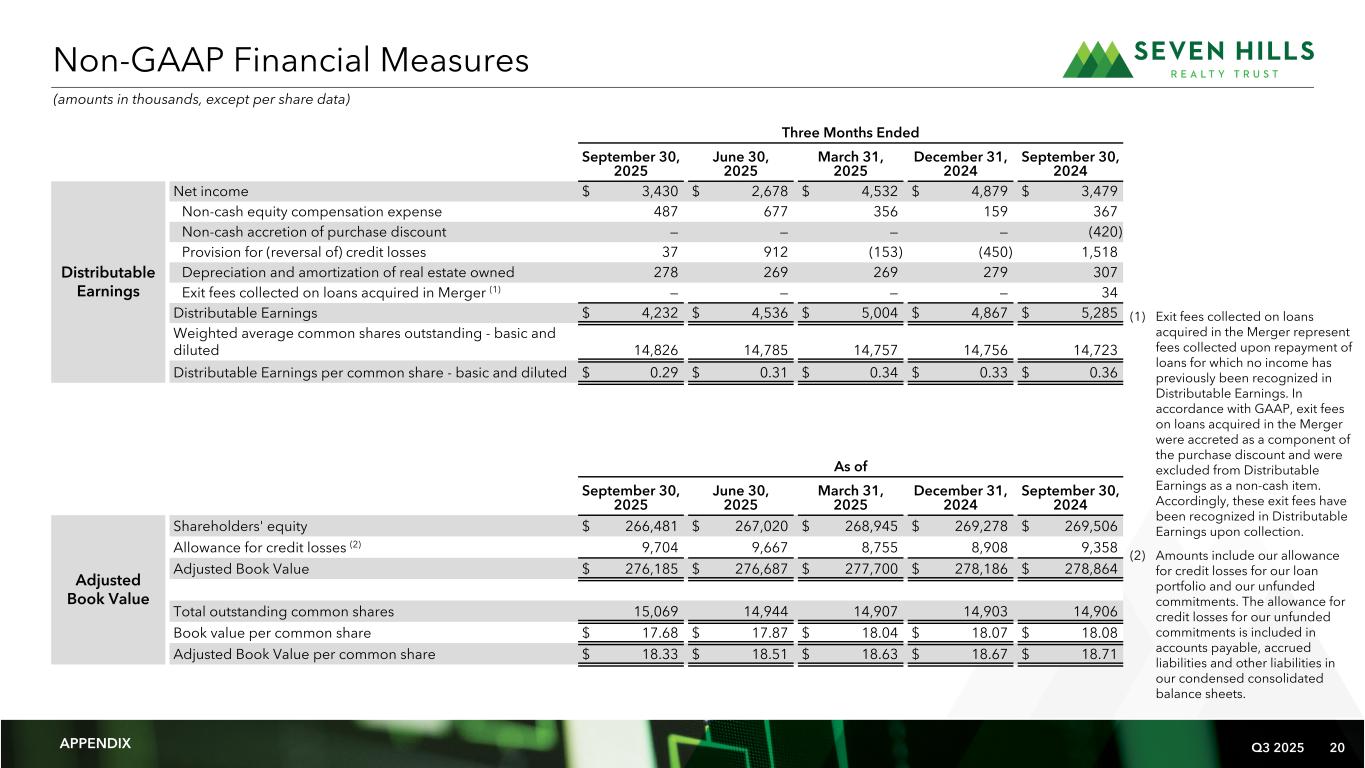

Q3 2025 20 Three Months Ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Distributable Earnings Net income $ 3,430 $ 2,678 $ 4,532 $ 4,879 $ 3,479 Non-cash equity compensation expense 487 677 356 159 367 Non-cash accretion of purchase discount — — — — (420) Provision for (reversal of) credit losses 37 912 (153) (450) 1,518 Depreciation and amortization of real estate owned 278 269 269 279 307 Exit fees collected on loans acquired in Merger (1) — — — — 34 Distributable Earnings $ 4,232 $ 4,536 $ 5,004 $ 4,867 $ 5,285 Weighted average common shares outstanding - basic and diluted 14,826 14,785 14,757 14,756 14,723 Distributable Earnings per common share - basic and diluted $ 0.29 $ 0.31 $ 0.34 $ 0.33 $ 0.36 As of September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Adjusted Book Value Shareholders' equity $ 266,481 $ 267,020 $ 268,945 $ 269,278 $ 269,506 Allowance for credit losses (2) 9,704 9,667 8,755 8,908 9,358 Adjusted Book Value $ 276,185 $ 276,687 $ 277,700 $ 278,186 $ 278,864 Total outstanding common shares 15,069 14,944 14,907 14,903 14,906 Book value per common share $ 17.68 $ 17.87 $ 18.04 $ 18.07 $ 18.08 Adjusted Book Value per common share $ 18.33 $ 18.51 $ 18.63 $ 18.67 $ 18.71 Non-GAAP Financial Measures (amounts in thousands, except per share data) APPENDIX (1) Exit fees collected on loans acquired in the Merger represent fees collected upon repayment of loans for which no income has previously been recognized in Distributable Earnings. In accordance with GAAP, exit fees on loans acquired in the Merger were accreted as a component of the purchase discount and were excluded from Distributable Earnings as a non-cash item. Accordingly, these exit fees have been recognized in Distributable Earnings upon collection. (2) Amounts include our allowance for credit losses for our loan portfolio and our unfunded commitments. The allowance for credit losses for our unfunded commitments is included in accounts payable, accrued liabilities and other liabilities in our condensed consolidated balance sheets.

Q3 2025 21 We present Distributable Earnings, Distributable Earnings per common share, Adjusted Book Value and Adjusted Book Value per common share, which are considered “non-GAAP financial measures” within the meaning of the applicable SEC rules. These non-GAAP financial measures do not represent book value per common share, net income, net income per common share or cash generated from operating activities and should not be considered as alternatives to net income, book value per common share, or net income per common share determined in accordance with GAAP or as an indication of our cash flows from operations determined in accordance with GAAP, a measure of our liquidity or operating performance or an indication of funds available for our cash needs. In addition, our methodologies for calculating these non-GAAP financial measures may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures; therefore, our reported Adjusted Book Value, Adjusted Book Value per common share, Distributable Earnings and Distributable Earnings per common share may not be comparable to adjusted book value, adjusted book value per common share, distributable earnings and distributable earnings per common share as reported by other companies. We believe that Adjusted Book Value per common share is a meaningful measure of our capital adequacy because it excludes the impact of certain non-cash estimates or adjustments, including our allowance for credit losses for our loan portfolio and unfunded loan commitments. Adjusted Book Value per common share does not represent book value per common share or alternative measures determined in accordance with GAAP. Our methodology for calculating Adjusted Book Value per common share may differ from the methodologies employed by other companies to calculate the same or similar supplemental capital adequacy measures; therefore, our Adjusted Book Value per common share may not be comparable to the adjusted book value per common share reported by other companies. In order to maintain our qualification for taxation as a REIT, we are generally required to distribute substantially all of our taxable income, subject to certain adjustments, to our shareholders. We believe that one of the factors that investors consider important in deciding whether to buy or sell securities of a REIT is its distribution rate. Over time, Distributable Earnings and Distributable Earnings per common share may be useful indicators of distributions to our shareholders and are measures that are considered by our Board of Trustees when determining the amount of distributions. We believe that Distributable Earnings and Distributable Earnings per common share provide meaningful information to consider in addition to net income, net income per common share and cash flows from operating activities determined in accordance with GAAP. These measures help us to evaluate our performance excluding the effects of certain transactions and GAAP adjustments that we believe are not necessarily indicative of our current loan portfolio and operations. In addition, Distributable Earnings, excluding incentive fees, is used in determining the amount of base management and management incentive fees payable by us to Tremont under our management agreement. Distributable Earnings: We calculate Distributable Earnings and Distributable Earnings per common share as net income and net income per common share, respectively, computed in accordance with GAAP, including realized losses not otherwise included in net income determined in accordance with GAAP, and excluding: (a) depreciation and amortization of real estate owned and related intangible assets, if any; (b) non-cash equity compensation expense; (c) unrealized gains, losses and other similar non-cash items that are included in net income for the period of the calculation (regardless of whether such items are included in or deducted from net income or in other comprehensive income under GAAP), if any; and (d) one-time events pursuant to changes in GAAP and certain non-cash items, if any. Distributable Earnings are reduced for realized losses on loan investments when amounts are deemed uncollectable. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but may also be when, in our determination, it is nearly certain that all amounts due will not be collected. The realized loss amount reflected in Distributable Earnings will equal the difference between the cash received or expected to be received and the carrying value of the asset. Non-GAAP Financial Measures (Continued) APPENDIX

Q3 2025 22 All In Yield: All In Yield represents the yield on a loan, including amortization of deferred fees over the initial term of the loan and excluding any purchase discount accretion. BMO Facility: Amounts advanced under the facility loan agreement and security agreement with BMO Harris Bank N.A., or BMO, are pursuant to separate facility loan agreements that we refer to as the BMO Facility. CBD: The central business district, or CBD, is the center of business and economic activity in major markets of the United States. GAAP: GAAP refers to generally accepted accounting principles. Gross AUM: Gross AUM refers to gross assets under management. LTV: Loan to value ratio, or LTV, represents the initial loan amount divided by the underwritten in-place value of the underlying collateral at closing. Master Repurchase Facilities: Collectively, we refer to the master repurchase facilities with UBS AG, or UBS, Citibank, N.A., or Citibank, and Wells Fargo, National Association, or Wells Fargo, as our Master Repurchase Facilities. Maximum Maturity: Maximum Maturity assumes all borrower loan extension options have been exercised, which options are subject to the borrower meeting certain conditions. Merger: On September 30, 2021, Tremont Mortgage Trust merged with and into us. We refer to this transaction as the Merger. Secured Financing Facilities: Collectively, we refer to the Master Repurchase Facilities and our BMO Facility as our Secured Financing Facilities. SOFR: SOFR refers to the Secured Overnight Financing Rate. WALT: WALT refers to weighted average lease term. Other Measures and Definitions APPENDIX

Q3 2025 23 This presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. These statements include words such as “believe”, "could", “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, "would", "should", “may” and negatives or derivatives of these or similar expressions. These forward- looking statements include, among others, statements about: SEVN's investment portfolio and loan investment performance; the quality of the sponsors of SEVN's borrowers; SEVN's office sector exposure; SEVN's future lending activity and opportunities; SEVN's liquidity and leverage levels and capacity; the ability of SEVN to capitalize on opportunities; SEVN's ability to achieve its investment objectives and generate attractive returns for its shareholders; the benefits and opportunities SEVN believes that Tremont's relationship with RMR provide to SEVN; and the amount and timing of future distributions. Forward-looking statements reflect SEVN's current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause SEVN's actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in any forward-looking statements. Some of the risks, uncertainties and other factors that may cause SEVN's actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: SEVN's borrowers’ ability to successfully execute their business plans, including SEVN's borrowers' ability to manage and stabilize properties; whether the diversity and other characteristics of its loan portfolio will benefit SEVN to the extent it expects; SEVN's ability to carry out its business strategy and take advantage of opportunities for its business that it believes exist; the impact of inflation, geopolitical instability, interest rate fluctuations, new trade policies, tariffs and economic recession or downturn on the commercial real estate, or CRE, industry generally and specific CRE sectors applicable to SEVN's investments and lending markets, SEVN and its borrowers; fluctuations in interest rates and credit spreads may reduce the returns SEVN may receive on its investments and increase its borrowing costs; fluctuations in market demand for CRE debt and the volume of transactions and available opportunities in the CRE debt market, including the middle market; dislocations and volatility in the capital markets; SEVN's ability to utilize its Secured Financing Facilities and to obtain additional capital to enable it to attain its target leverage, to make additional investments and to increase its potential returns and the cost of that capital; SEVN's ability to pay distributions to its shareholders and sustain or increase the amount of such distributions; SEVN's ability to successfully execute, achieve and benefit from its operating and investment targets, investment and financing strategies and leverage policies; the amount and timing of cash flows SEVN receives from its investments; the ability of SEVN's manager, Tremont Realty Capital LLC, or Tremont, to make suitable investments for it, to monitor, service and administer SEVN's existing investments and to otherwise implement its investment strategy and successfully manage SEVN; SEVN's ability to maintain and improve a favorable net interest spread between the interest it earns on its investments and the interest SEVN pays on its borrowings; the extent to which SEVN earns and receives origination, extension, exit, prepayment or other fees it may earn from its investments; yields that may be available to SEVN from mortgages on middle market and transitional CRE; the duration and other terms of SEVN's loan agreements with borrowers and its ability to match its loan investments with its repurchase lending arrangements; the credit qualities of SEVN's borrowers; the ability and willingness of SEVN's borrowers to repay its investments in a timely manner or at all; the extent to which SEVN's borrowers' sponsors provide support to its borrowers or SEVN regarding its loans; SEVN's ability to maintain its exemption from registration under the Investment Company Act of 1940, as amended; events giving rise to increases in SEVN's credit loss reserves; SEVN's ability to diversify its investment portfolio based on industry and market conditions; the ability of SEVN's manager to arrange for the successful management of real estate SEVN owns and SEVN's ability to sell those properties at prices that allow SEVN to recover amounts it invested; SEVN's ability to successfully compete; market trends in SEVN's industry or with respect to interest rates, real estate values, the debt securities markets or the economy generally; reduced demand for office or retail space; regulatory requirements and the effect they may have on SEVN or its competitors; competition within the CRE lending industry; changes in the availability, sourcing and structuring of CRE lending; defaults by SEVN's borrowers; compliance with, and changes to, federal, state and local laws and regulations, accounting rules, tax laws and similar matters; limitations imposed on SEVN's business and its ability to satisfy complex rules in order for SEVN to maintain its qualification for taxation as a REIT for U.S. federal income tax purposes; actual and potential conflicts of interest with SEVN's related parties, including its Managing Trustees, Tremont, RMR, and others affiliated with them; acts of God, earthquakes, hurricanes, outbreaks or continuation of pandemics, or other public health safety events or conditions, supply chain disruptions, climate change and other man-made or natural disasters or war, terrorism, social unrest or civil disturbances; and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in SEVN's periodic filings. The information contained in SEVN's filings with the SEC, including under the caption "Risk Factors" in its periodic reports, or incorporated therein, identifies important factors that could cause differences from the forward-looking statements in this presentation. SEVN's filings with the SEC are available on its website and at www.sec.gov. You should not place undue reliance on forward-looking statements. Except as required by law, SEVN does not intend to update or change any forward-looking statement, whether as a result of new information, future events or otherwise. Warning Concerning Forward-Looking Statements