C o r p o r a t e D e c k | D e c e m b e r 9 , 2 0 2 5 Unlocking Long-Term Growth through our Infrastructure, Expertise and Partnerships

Disclaimer This presentation contains statements about future events and expectations that constitute forward-looking statements. Forward-looking statements are based on our beliefs, assumptions and expectations of our future financial and operating performance and growth plans, taking into account the information currently available to us. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Factors that could contribute to these differences include the following: national, international, regional and local economic conditions, including impacts and uncertainty from trade disputes and tariffs on goods imported to the United States and goods exported to other countries; periods of economic slowdown or recession; the impact of supply chain disruptions, including, among others, the impact of labor availability, raw material availability, manufacturing and food production and transportation; uncertainties and risks related to public health crises; adverse economic or real estate developments in our geographic markets or the temperature-controlled warehouse industry; risks associated with the ownership of real estate generally and temperature-controlled warehouses in particular; general economic conditions; acquisition risks, including the failure to identify or complete attractive acquisitions or the failure of acquisitions to perform in accordance with projections or our failure to realize the intended benefits from our acquisitions, including synergies, or disruptions to our plans and operations or unknown or contingent liabilities related to our acquisitions; risks related to expansions of existing properties and developments of new properties, including failure to meet budgeted or stabilized returns within expected timeframes, or at all, in respect thereof; a failure of our information technology systems, systems conversions and integrations, cybersecurity attacks or a breach of our information security systems, networks or processes could cause business disruptions or loss of confidential information; risks related to privacy and data security concerns, and data collection and transfer restrictions and related foreign regulations; defaults or non-renewals of significant customer contracts; uncertainty of revenues, given the nature of our customer contracts; increased interest rates and operating costs; our failure to obtain necessary outside financing on attractive terms or at all; risks related to, or restrictions contained in, our debt financings; decreased storage rates or increased vacancy rates; risks related to current and potential international operations and properties; difficulties in expanding our operations into new markets, including international markets; risks related to the partial ownership of properties, including our JV investments; our failure to maintain our status as a Real Estate Investment Trust ("REIT"); possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently or previously owned by us; financial market fluctuations; actions by our competitors and their increasing ability to compete with us; geopolitical conflicts, such as the on-going conflict between Russia and Ukraine or a resurgence of conflict in the Middle East; rising inflationary pressures, increased interest rates and operating costs; labor and power costs; labor shortages; risks related to rising construction costs; risk related to implementation of the new enterprise resource planning system; risks related to natural disasters; changes in applicable governmental regulations and tax legislation, including in the international markets; additional risks with respect to the addition of European operations and properties; changes in real estate and zoning laws and increases in real property tax rates; our relationship with our associates; the occurrence of any work stoppages or any disputes under our collective bargaining agreements and employment related litigation; liabilities as a result of our participation in multi-employer pension plans; uninsured losses or losses in excess of our insurance coverage; the potential liabilities, costs and regulatory impacts associated with our in-house trucking services and the potential disruptions associated with the use of third-party trucking service providers to provide transportation services to our customers; the cost and time requirements as a result of our operation as a publicly traded REIT; changes in foreign currency exchange rates; the impact of anti-takeover provisions in our constituent documents and under Maryland law, which could make an acquisition of us more difficult, limit attempts by our shareholders to replace our directors and affect the price of our shares of common stock of beneficial interest, $0.01 par value per share; or the potential dilutive effect of our common stock offerings, including our ongoing at the market program. Words such as “anticipates,” “believes,” “continues,” “estimates,” “expects,” “goal,” “objectives,” “intends,” “may,” “opportunity,” “plans,” “potential,” “near-term,” “long-term,” “projections,” “assumptions,” “projects,” “guidance,” “forecasts,” “outlook,” “target,” “trends,” “should,” “could,” “would,” “will” and similar expressions are intended to identify such forward-looking statements, although not all forward-looking statements may contain such words. Examples of forward-looking statements included in this presentation include, among others, statements about our growth strategies and opportunities, improvement opportunities, including cost reductions, expected expansion and development pipeline and our targeted return on invested capital on expansion and development opportunities and statements about industry-wide headwinds. We qualify any forward-looking statements entirely by these cautionary factors. Other risks, uncertainties and factors, including those discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, and our other reports filed with the Securities and Exchange Commission, could cause our actual results to differ materially from those projected in any forward-looking statements we make. We assume no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available, in the future, except to the extent required by law. Non-GAAP Measures This presentation contains non-GAAP financial measures, including AFFO, Core EBITDA, Core EBITDA Margin, Pro Forma ("PF") Core EBITDA, NOI and margin, constant currency basis and maintenance capital expenditures. Definitions and reconciliations of these non-GAAP metrics to their most comparable GAAP metrics are included within our quarterly financial supplement for the three and nine months ended September 30, 2025 as filed with the SEC on November 6, 2025. Each of these non-GAAP measures included in this presentation has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of the Company's results calculated in accordance with GAAP. In addition, because not all companies use identical calculations, the Company's presentation of non-GAAP measures in this presentation may not be comparable to similarly titled measures disclosed by other companies, including other REITs. 2

3 Execution-focused and well positioned strategy centered on solutions, operational excellence, and experienced leadership 4 Multiple growth drivers with a capital allocation strategy supported by a blue-chip customer base, unique partnerships, and diverse asset network Americold – A Compelling Growth Opportunity 1 Global leader in the attractive cold storage industry with an integrated network of high-quality, strategically located mission-critical warehouses 3 2 Unique value proposition with unparalleled expertise, partnerships with industry experts, scalable infrastructure, and leading technology and operating systems

4

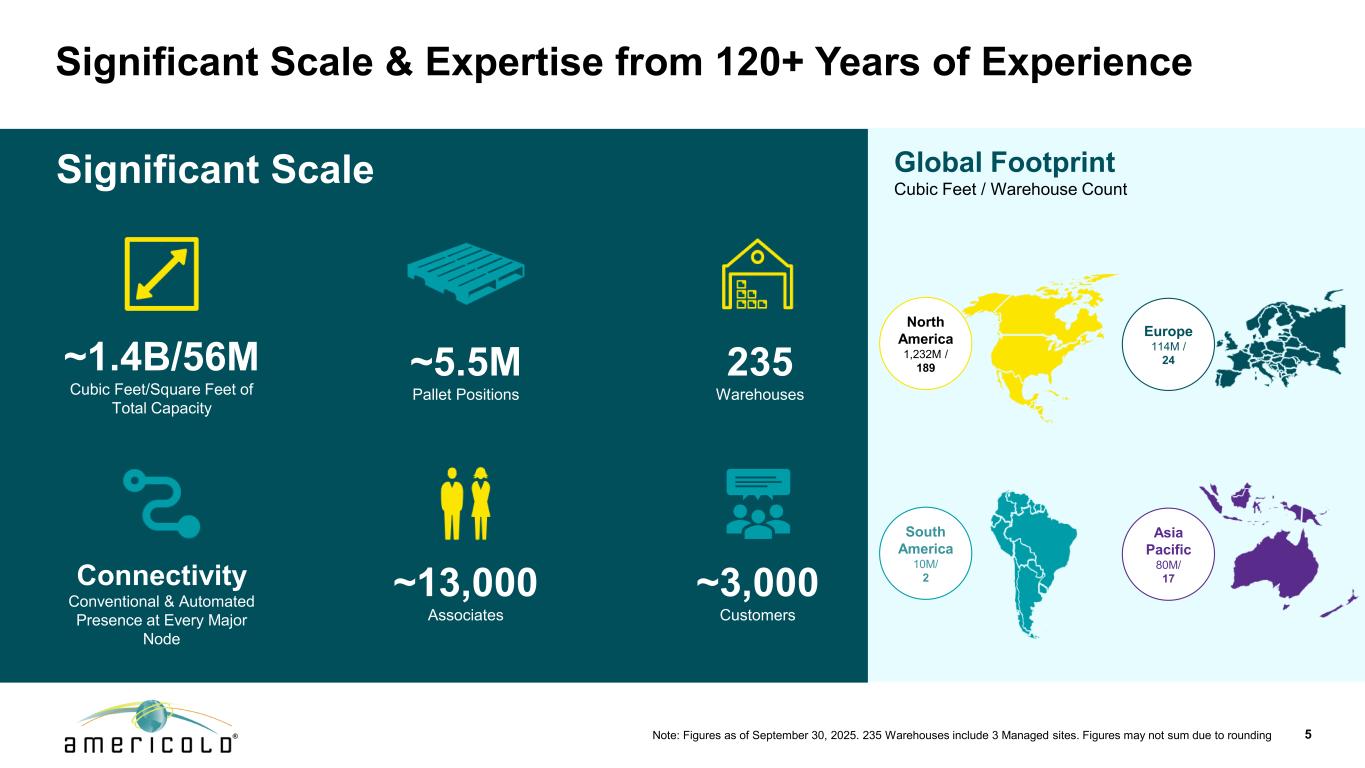

Significant Scale & Expertise from 120+ Years of Experience Note: Figures as of September 30, 2025. 235 Warehouses include 3 Managed sites. Figures may not sum due to rounding 5 Significant Scale Global Footprint Cubic Feet / Warehouse Count South America 10M/ 2 North America 1,232M / 189~5.5M Pallet Positions ~13,000 Associates 235 Warehouses ~3,000 Customers Europe 114M / 24~1.4B/56M Cubic Feet/Square Feet of Total Capacity Connectivity Conventional & Automated Presence at Every Major Node Asia Pacific 80M/ 17

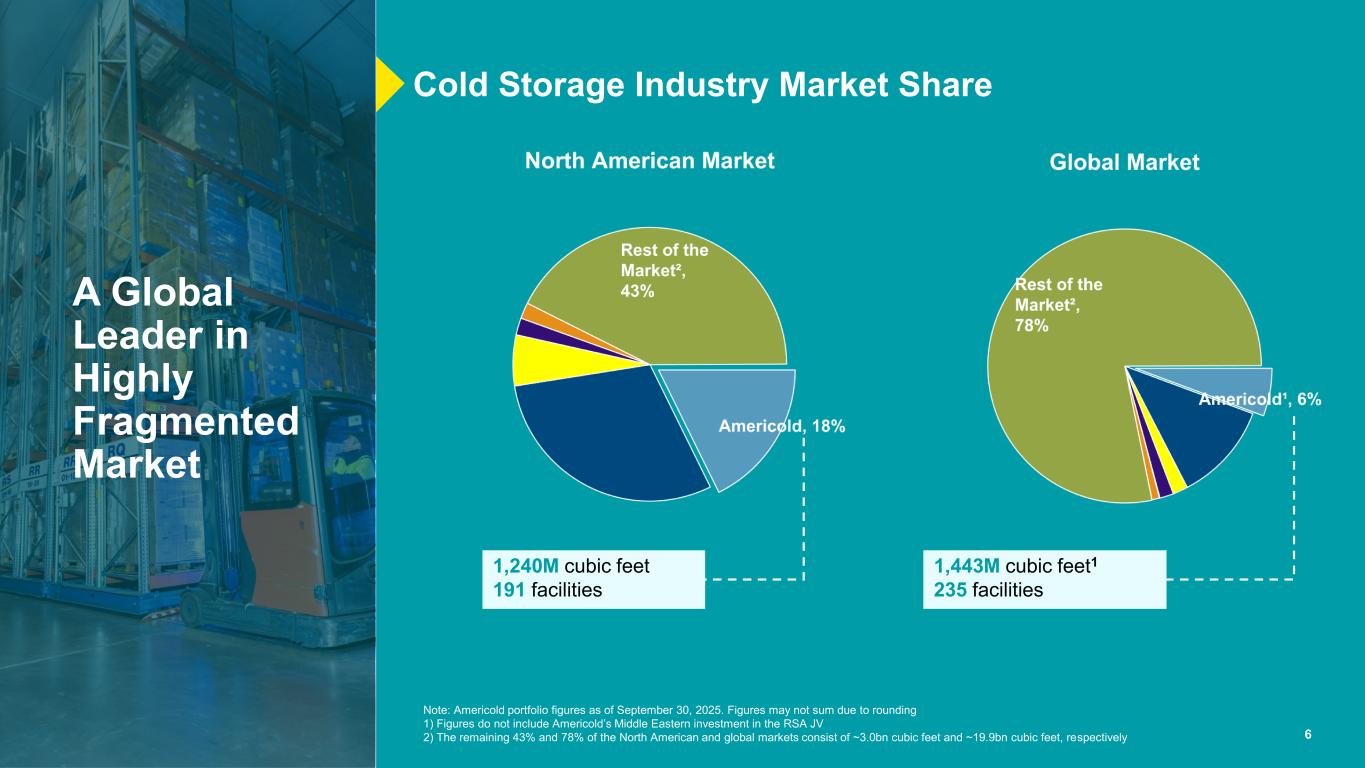

6 A Global Leader in Temperature- Controlled Warehousing Cold Storage Industry Market Share 1,240M cubic feet 191 facilities 1,443M cubic feet1 235 facilities Note: Americold portfolio figures as of September 30, 2025. Figures may not sum due to rounding 1) Figures do not include Americold’s Middle Eastern investment in the RSA JV 2) The remaining 43% and 78% of the North American and global markets consist of ~3.0bn cubic feet and ~19.9bn cubic feet, respectively A Global Leader in Highly Fragmented Market

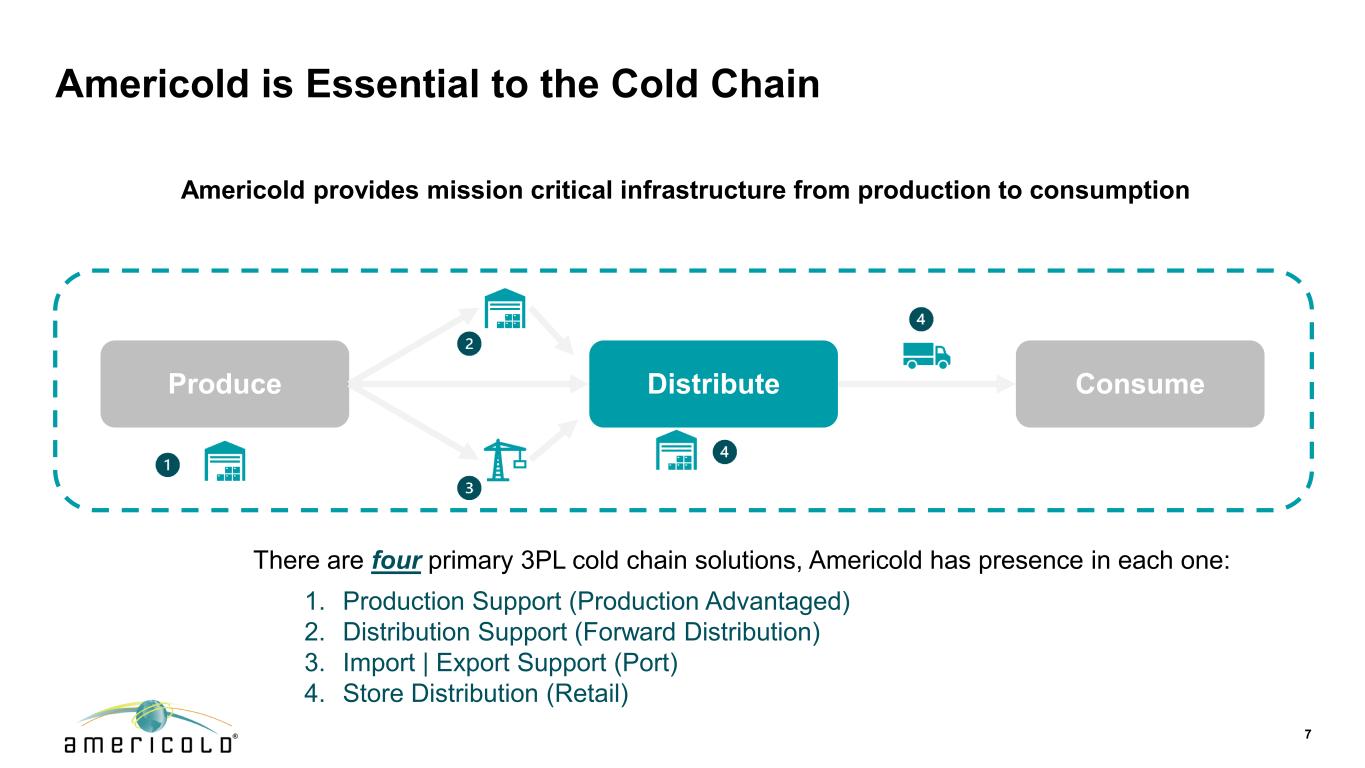

Americold is Essential to the Cold Chain Produce Distribute Consume Americold provides mission critical infrastructure from production to consumption There are four primary 3PL cold chain solutions, Americold has presence in each one: 1. Production Support (Production Advantaged) 2. Distribution Support (Forward Distribution) 3. Import | Export Support (Port) 4. Store Distribution (Retail) 7

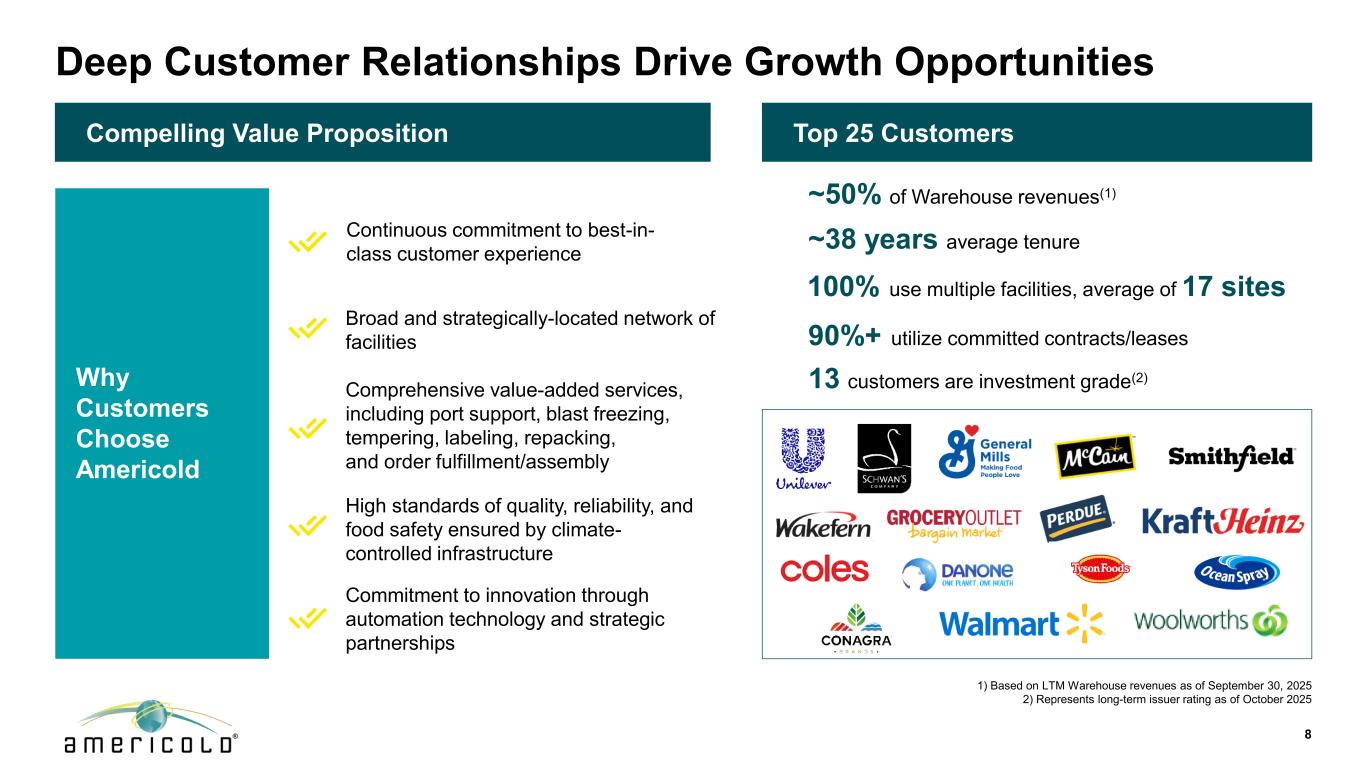

Why Customers Choose Americold Deep Customer Relationships Drive Growth Opportunities Broad and strategically-located network of facilities Comprehensive value-added services, including port support, blast freezing, tempering, labeling, repacking, and order fulfillment/assembly Top 25 Customers Continuous commitment to best-in- class customer experience High standards of quality, reliability, and food safety ensured by climate- controlled infrastructure Commitment to innovation through automation technology and strategic partnerships 8 ~38 years average tenure 13 customers are investment grade(2) 90%+ utilize committed contracts/leases ~50% of Warehouse revenues(1) 1) Based on LTM Warehouse revenues as of September 30, 2025 2) Represents long-term issuer rating as of October 2025 Compelling Value Proposition 100% use multiple facilities, average of 17 sites

9 Experienced Management Team Committed to Increasing Shareholder Value Richard Winnall President, International COLD: Joined 2019/Appointed 2024 ~23 years experience Scott Henderson Chief Investment Officer COLD: Joined 2018/Appointed 2023 ~23 years experience Nathan Harwell Chief Legal Officer COLD: Joined & Appointed 2023 ~26 years experience Michael Spires Chief Information Officer COLD: Joined & Appointed 2023 ~24 years experience Bryan Verbarendse President, Americas COLD: Joined 2023/Appointed 2025 ~32 years experience Significant Experience in Real Estate, Third-Party Logistics, Food Manufacturing, and Retail Jay Wells Chief Financial Officer COLD: Joined & Appointed 2024 ~40 years experience Robert Chambers Chief Executive Officer COLD: Joined 2013/Appointed 2025 ~20 years experience

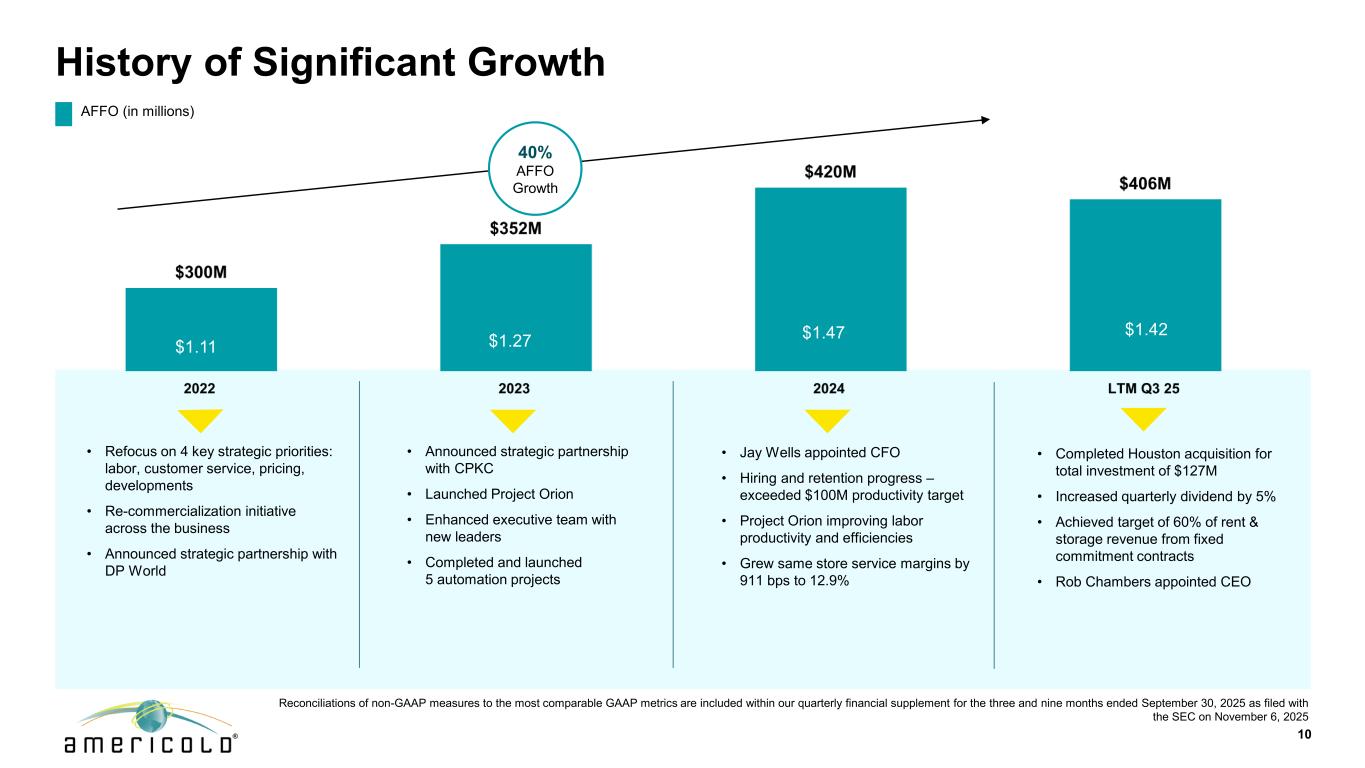

History of Significant Growth 10 • Jay Wells appointed CFO • Hiring and retention progress – exceeded $100M productivity target • Project Orion improving labor productivity and efficiencies • Grew same store service margins by 911 bps to 12.9% • Refocus on 4 key strategic priorities: labor, customer service, pricing, developments • Re-commercialization initiative across the business • Announced strategic partnership with DP World • Announced strategic partnership with CPKC • Launched Project Orion • Enhanced executive team with new leaders • Completed and launched 5 automation projects AFFO (in millions) 40% AFFO Growth $1.11 $1.27 $1.47$1.11 $1.42 $1.11 $1.47 • Completed Houston acquisition for total investment of $127M • Increased quarterly dividend by 5% • Achieved target of 60% of rent & storage revenue from fixed commitment contracts • Rob Chambers appointed CEO Reconciliations of non-GAAP measures to the most comparable GAAP metrics are included within our quarterly financial supplement for the three and nine months ended September 30, 2025 as filed with the SEC on November 6, 2025 $1.27

11

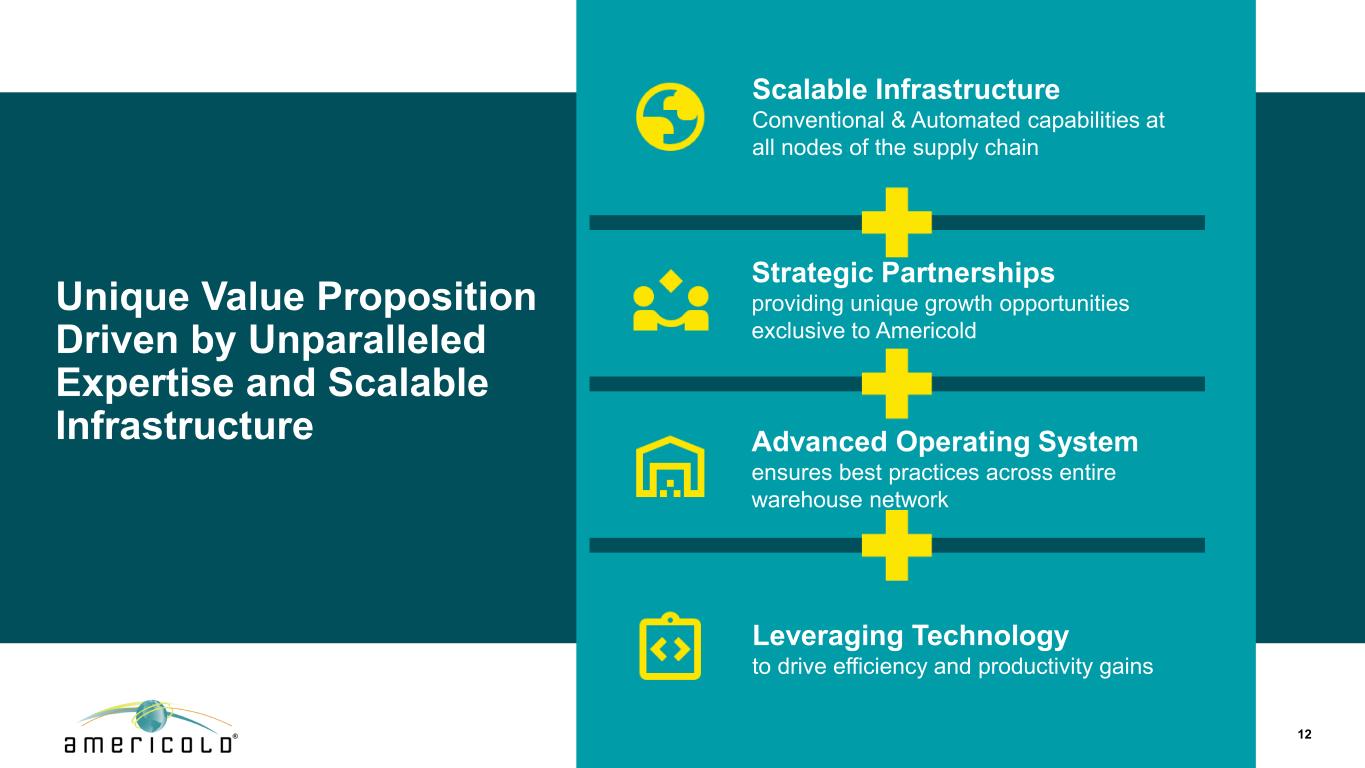

12 Unique Value Proposition Driven by Unparalleled Expertise and Scalable Infrastructure Strategic Partnerships providing unique growth opportunities exclusive to Americold Scalable Infrastructure Conventional & Automated capabilities at all nodes of the supply chain Advanced Operating System ensures best practices across entire warehouse network Leveraging Technology to drive efficiency and productivity gains

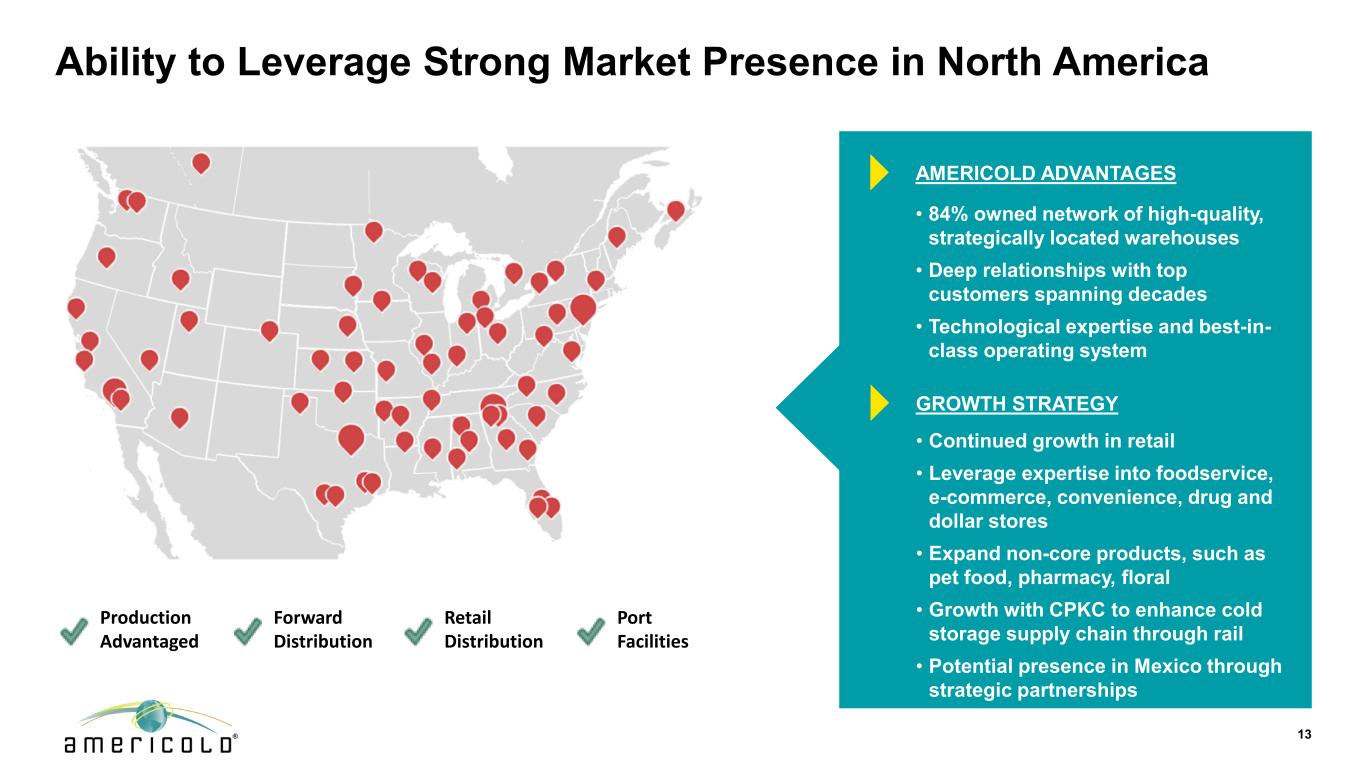

Ability to Leverage Strong Market Presence in North America 13 • 84% owned network of high-quality, strategically located warehouses • Deep relationships with top customers spanning decades • Technological expertise and best-in- class operating system Production Advantaged Forward Distribution Retail Distribution Port Facilities AMERICOLD ADVANTAGES • Continued growth in retail • Leverage expertise into foodservice, e-commerce, convenience, drug and dollar stores • Expand non-core products, such as pet food, pharmacy, floral • Growth with CPKC to enhance cold storage supply chain through rail • Potential presence in Mexico through strategic partnerships GROWTH STRATEGY

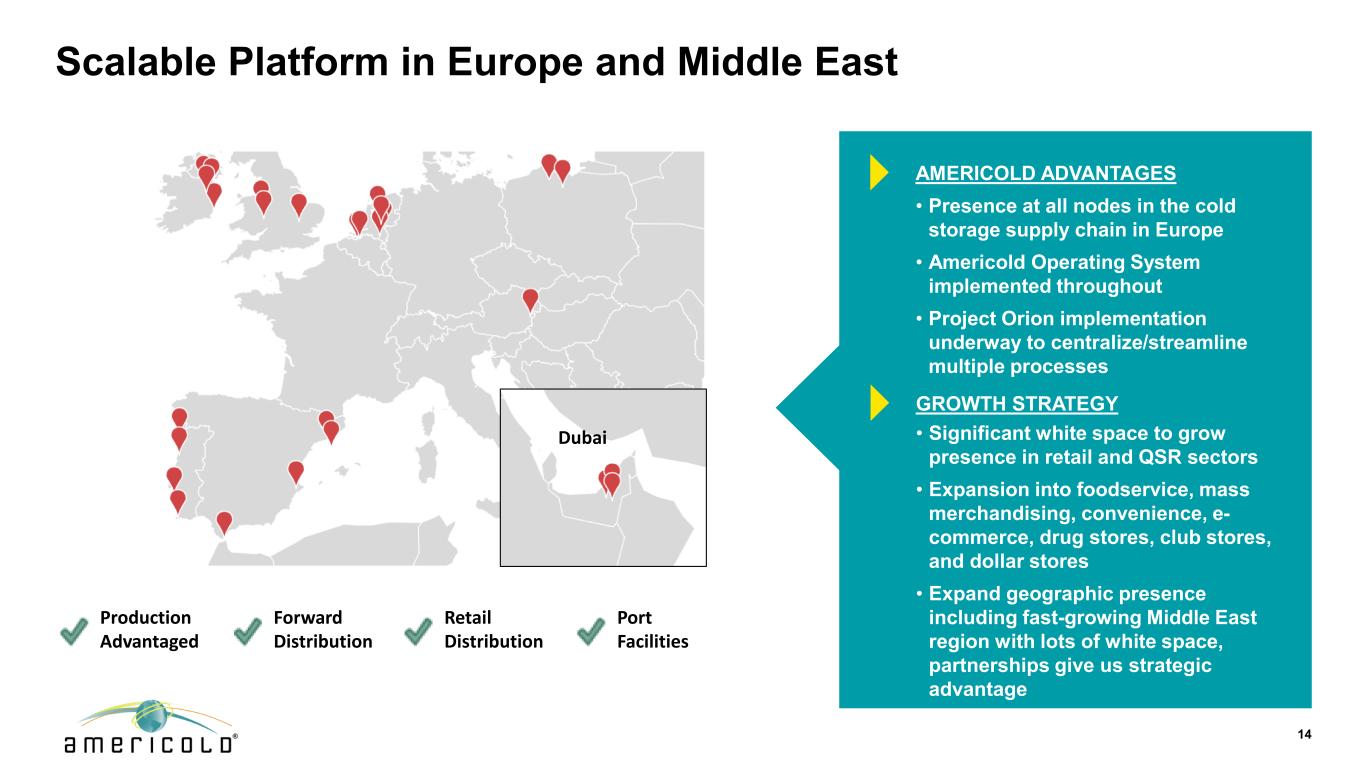

Scalable Platform in Europe and Middle East 14 • Presence at all nodes in the cold storage supply chain in Europe • Americold Operating System implemented throughout • Project Orion implementation underway to centralize/streamline multiple processes Production Advantaged Forward Distribution Retail Distribution Port Facilities AMERICOLD ADVANTAGES • Significant white space to grow presence in retail and QSR sectors • Expansion into foodservice, mass merchandising, convenience, e- commerce, drug stores, club stores, and dollar stores • Expand geographic presence including fast-growing Middle East region with lots of white space, partnerships give us strategic advantage GROWTH STRATEGY Dubai

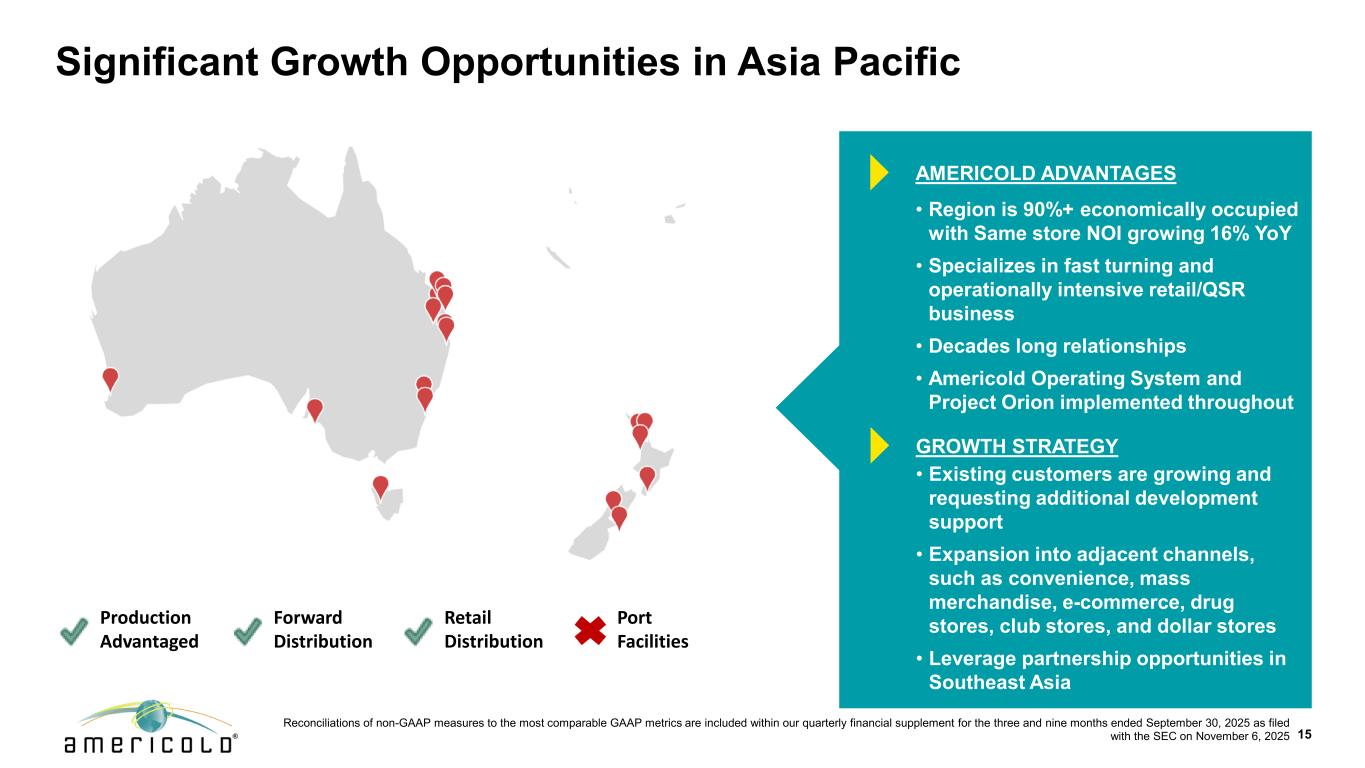

Significant Growth Opportunities in Asia Pacific 15 • Region is 90%+ economically occupied with Same store NOI growing 16% YoY • Specializes in fast turning and operationally intensive retail/QSR business • Decades long relationships • Americold Operating System and Project Orion implemented throughout Production Advantaged Forward Distribution Retail Distribution Port Facilities AMERICOLD ADVANTAGES • Existing customers are growing and requesting additional development support • Expansion into adjacent channels, such as convenience, mass merchandise, e-commerce, drug stores, club stores, and dollar stores • Leverage partnership opportunities in Southeast Asia GROWTH STRATEGY Reconciliations of non-GAAP measures to the most comparable GAAP metrics are included within our quarterly financial supplement for the three and nine months ended September 30, 2025 as filed with the SEC on November 6, 2025

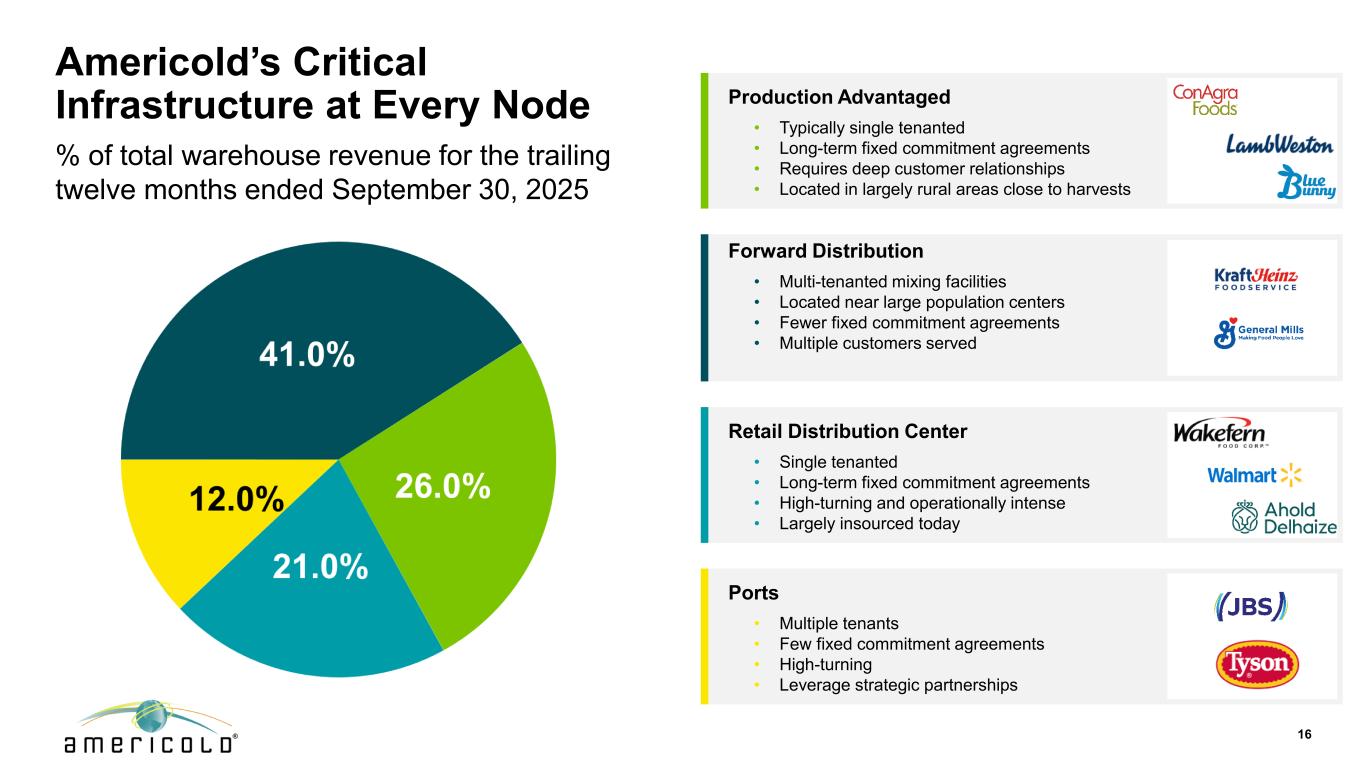

Americold’s Critical Infrastructure at Every Node % of total warehouse revenue for the trailing twelve months ended September 30, 2025 16 48% 14% 25% Forward Distribution • Multi-tenanted mixing facilities • Located near large population centers • Fewer fixed commitment agreements • Multiple customers served Retail Distribution Center • Single tenanted • Long-term fixed commitment agreements • High-turning and operationally intense • Largely insourced today Ports • Multiple tenants • Few fixed commitment agreements • High-turning • Leverage strategic partnerships Production Advantaged • Typically single tenanted • Long-term fixed commitment agreements • Requires deep customer relationships • Located in largely rural areas close to harvests

Partner Since Core Operating Expertise Enhanced by Best-in-Class Partnerships Operational Partners 17 Kansas City, Missouri • First-of-its-kind rail-attached facility supporting the closed loop cold chain service between Mexico and US utilizing intermodal, bypassing customs, reducing transit time by approximately one day and reducing total cost. Completed in partnership with CPKC, opened Q2 2025. Port St. John, New Brunswick, Canada • Import/Export Hub will store and handle temperature sensitive food moving through the port, providing a more efficient route for Canadian food imports & exports, in partnership with CPKC and DP World, opening Q3 2026 Port of Jebel Ali, Dubai • Import/Export Hub with DP World is the first to offer both bonded & non-bonded service and enables global food Producers to connect directly with regional Retailers and Distributors. Completed in partnership with DP World, opened Q2 2025. Highlights Top five global port operator 2022 One of NA’s largest railroad companies 2023

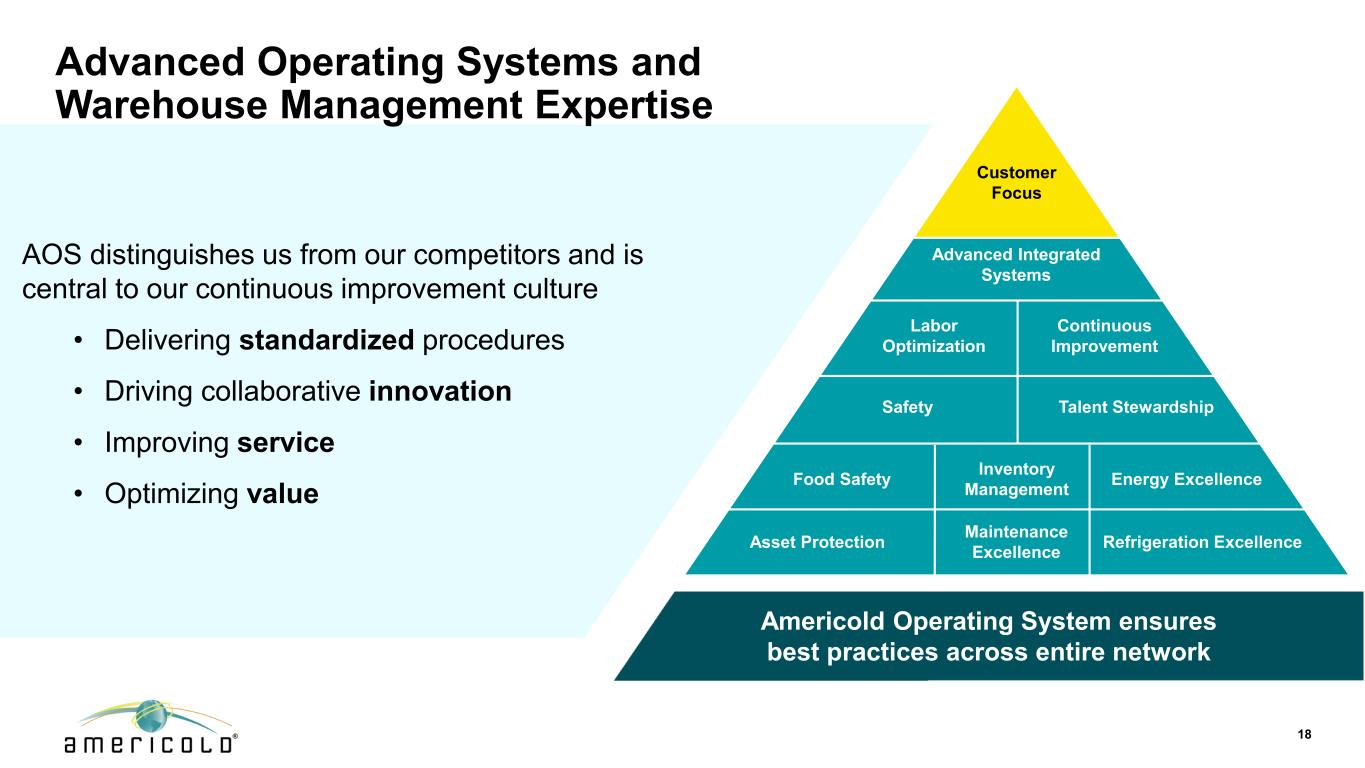

Advanced Operating Systems and Warehouse Management Expertise Americold Operating System ensures best practices across entire network 18 Customer Focus Labor Optimization Continuous Improvement Safety Talent Stewardship Food Safety Asset Protection Inventory Management Energy Excellence Refrigeration Excellence Advanced Integrated Systems Maintenance Excellence AOS distinguishes us from our competitors and is central to our continuous improvement culture • Delivering standardized procedures • Driving collaborative innovation • Improving service • Optimizing value

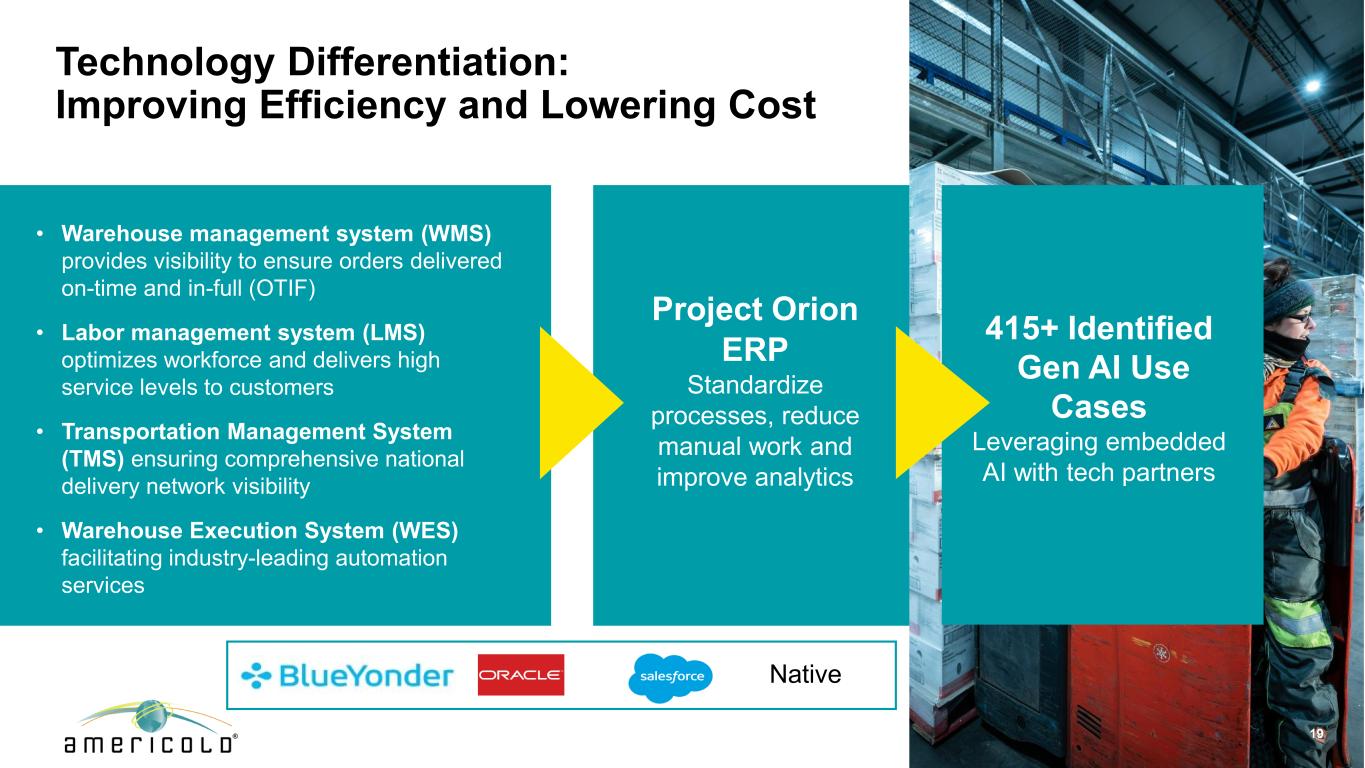

Technology Differentiation: Improving Efficiency and Lowering Cost 19 Native Project Orion ERP Standardize processes, reduce manual work and improve analytics • Warehouse management system (WMS) provides visibility to ensure orders delivered on-time and in-full (OTIF) • Labor management system (LMS) optimizes workforce and delivers high service levels to customers • Transportation Management System (TMS) ensuring comprehensive national delivery network visibility • Warehouse Execution System (WES) facilitating industry-leading automation services 415+ Identified Gen AI Use Cases Leveraging embedded AI with tech partners 19

20

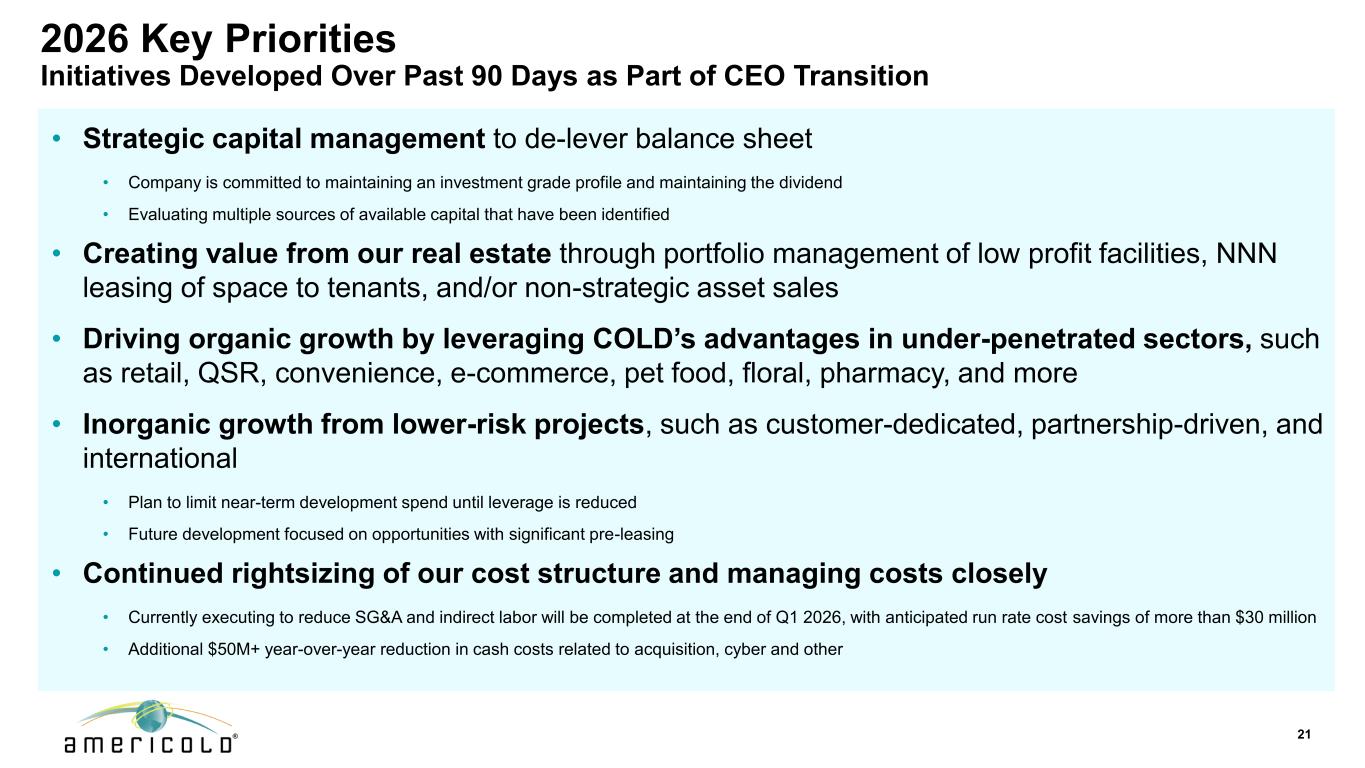

• Strategic capital management to de-lever balance sheet • Company is committed to maintaining an investment grade profile and maintaining the dividend • Evaluating multiple sources of available capital that have been identified • Creating value from our real estate through portfolio management of low profit facilities, NNN leasing of space to tenants, and/or non-strategic asset sales • Driving organic growth by leveraging COLD’s advantages in under-penetrated sectors, such as retail, QSR, convenience, e-commerce, pet food, floral, pharmacy, and more • Inorganic growth from lower-risk projects, such as customer-dedicated, partnership-driven, and international • Plan to limit near-term development spend until leverage is reduced • Future development focused on opportunities with significant pre-leasing • Continued rightsizing of our cost structure and managing costs closely • Currently executing to reduce SG&A and indirect labor will be completed at the end of Q1 2026, with anticipated run rate cost savings of more than $30 million • Additional $50M+ year-over-year reduction in cash costs related to acquisition, cyber and other 21 2026 Key Priorities Initiatives Developed Over Past 90 Days as Part of CEO Transition

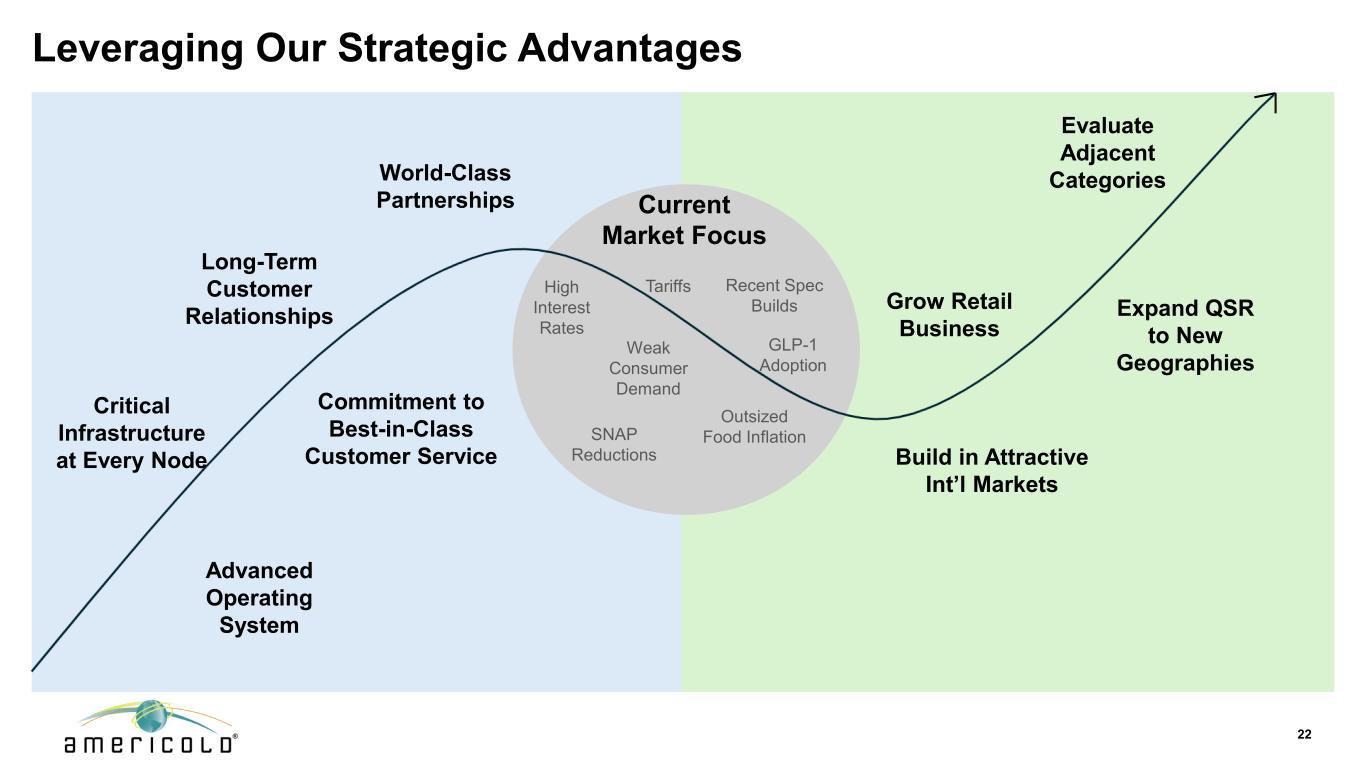

Leveraging Our Strategic Advantages Current Market Focus Weak Consumer Demand TariffsHigh Interest Rates GLP-1 Adoption Outsized Food Inflation Recent Spec Builds SNAP Reductions Critical Infrastructure at Every Node Advanced Operating System Commitment to Best-in-Class Customer Service Long-Term Customer Relationships World-Class Partnerships Expand QSR to New Geographies Build in Attractive Int’l Markets Grow Retail Business Evaluate Adjacent Categories 22

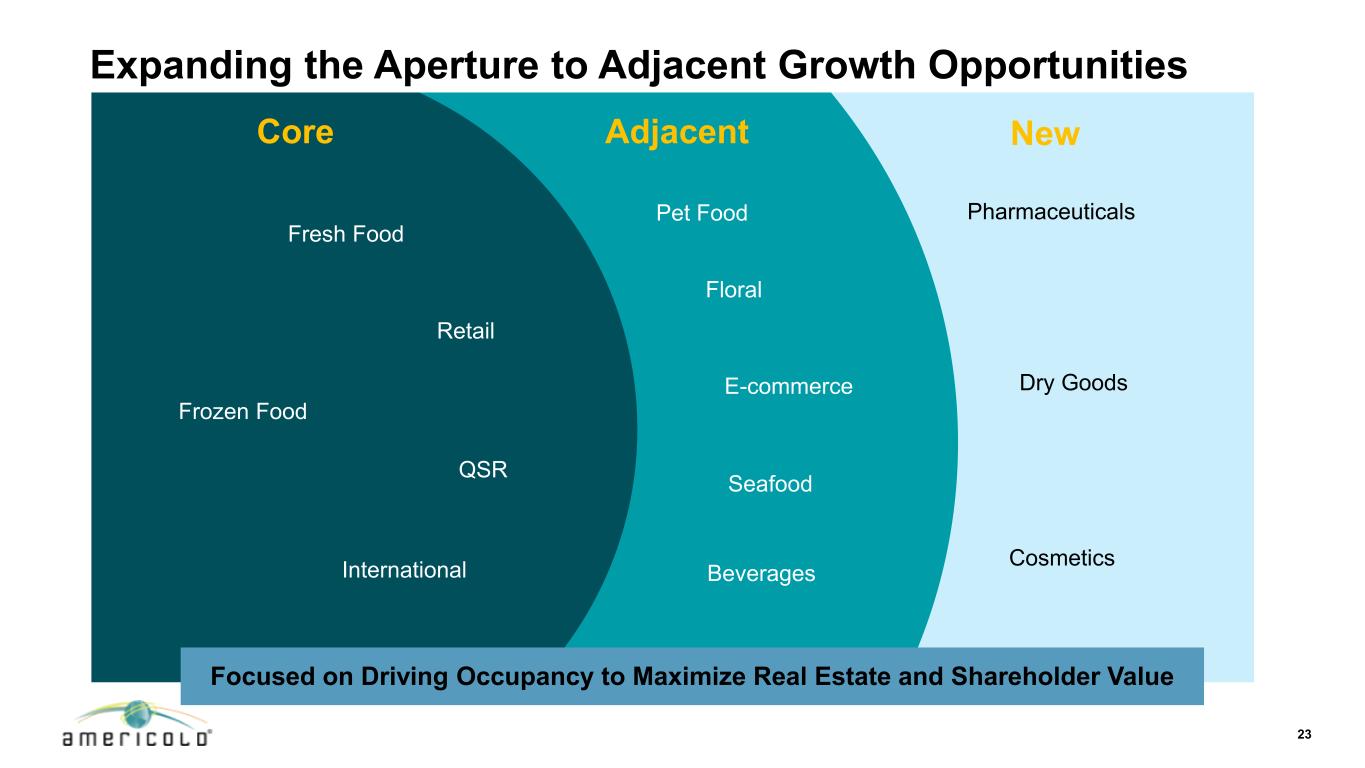

Frozen Food Pharmaceuticals Fresh Food Retail QSR International Pet Food Floral Seafood Beverages Expanding the Aperture to Adjacent Growth Opportunities Dry Goods Cosmetics E-commerce Core Adjacent New Focused on Driving Occupancy to Maximize Real Estate and Shareholder Value 23

Global Opportunity to Grow Retail and QSR Presence COLD Best in Class Operator Trusted by Largest Retailers & QSR Brands in the World Attractive Pipeline of Global Growth Opportunities What is Retail/QSR? • Pallets of product from multiple producers arrive at our facility • Product is warehoused until a store needs replenishment • Individual cases are picked (automated & manually) based on store order • Cases are assembled into new multi-vendor, multi-SKU pallets • Pallets are staged for loading based on the delivery route • Pallets arrive and placed into refrigerated/frozen coolers within the store Attractive Characteristics • 4 of our top-10 customers are retail/QSR companies • Generates ~$480M LTM revenue • Nearly twice the NOI/pallet compared to rest of the portfolio • Leading market share and challenging for competitors to enter complex value- added segment of market • Opportunity to expand into new geographies • Lots of whitespace as largely insourced by retailers today 24

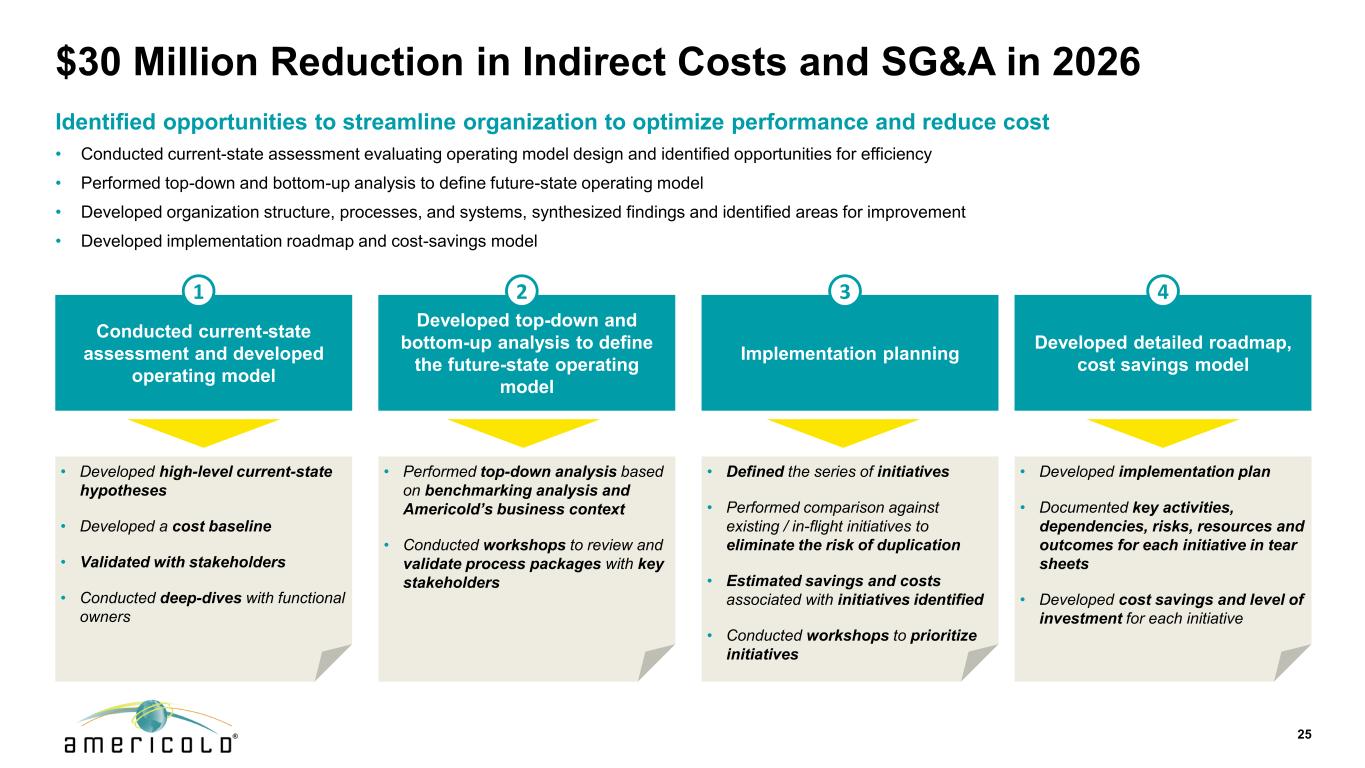

$30 Million Reduction in Indirect Costs and SG&A in 2026 Identified opportunities to streamline organization to optimize performance and reduce cost • Conducted current-state assessment evaluating operating model design and identified opportunities for efficiency • Performed top-down and bottom-up analysis to define future-state operating model • Developed organization structure, processes, and systems, synthesized findings and identified areas for improvement • Developed implementation roadmap and cost-savings model Conducted current-state assessment and developed operating model Developed top-down and bottom-up analysis to define the future-state operating model Implementation planning Developed detailed roadmap, cost savings model 1 3 42 • Developed high-level current-state hypotheses • Developed a cost baseline • Validated with stakeholders • Conducted deep-dives with functional owners • Performed top-down analysis based on benchmarking analysis and Americold’s business context • Conducted workshops to review and validate process packages with key stakeholders • Defined the series of initiatives • Performed comparison against existing / in-flight initiatives to eliminate the risk of duplication • Estimated savings and costs associated with initiatives identified • Conducted workshops to prioritize initiatives • Developed implementation plan • Documented key activities, dependencies, risks, resources and outcomes for each initiative in tear sheets • Developed cost savings and level of investment for each initiative 25

26

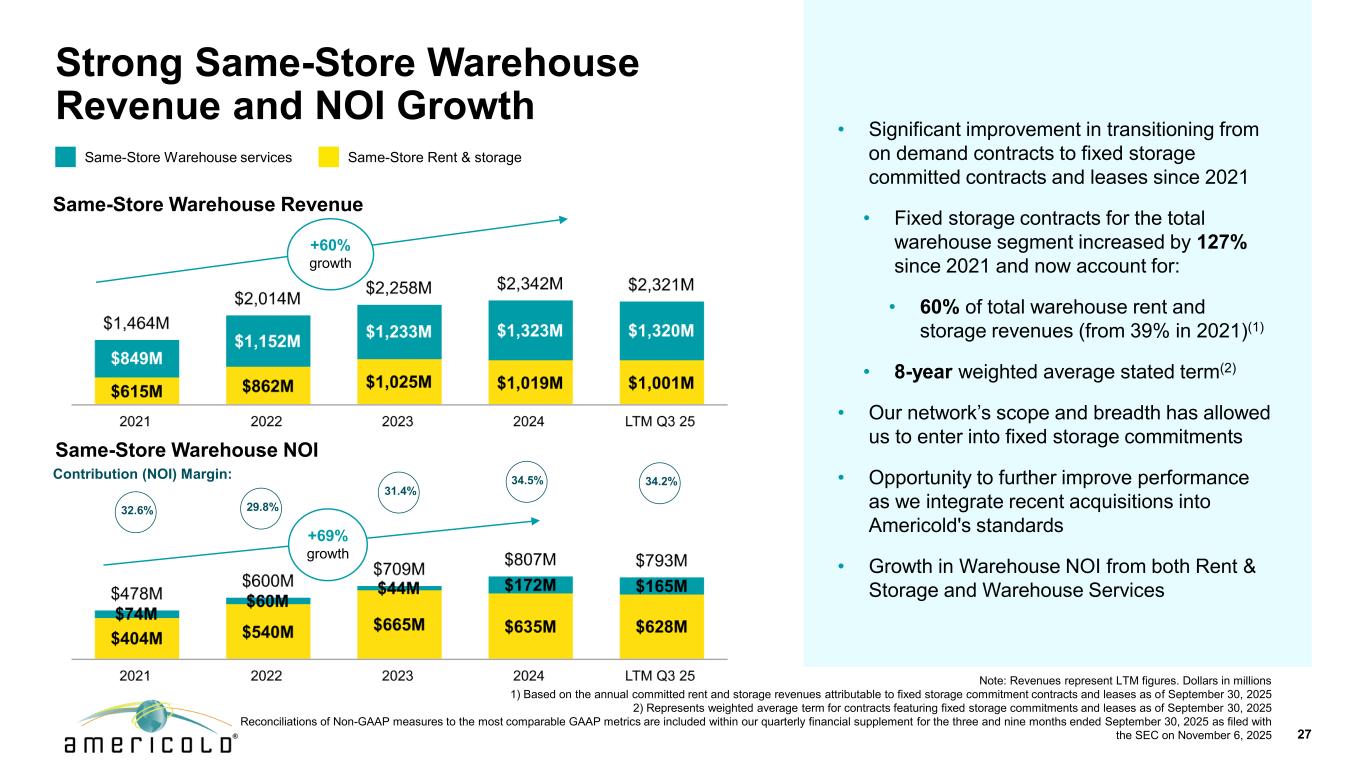

Strong Same-Store Warehouse Revenue and NOI Growth 27 Note: Revenues represent LTM figures. Dollars in millions 1) Based on the annual committed rent and storage revenues attributable to fixed storage commitment contracts and leases as of September 30, 2025 2) Represents weighted average term for contracts featuring fixed storage commitments and leases as of September 30, 2025 Reconciliations of Non-GAAP measures to the most comparable GAAP metrics are included within our quarterly financial supplement for the three and nine months ended September 30, 2025 as filed with the SEC on November 6, 2025 • Significant improvement in transitioning from on demand contracts to fixed storage committed contracts and leases since 2021 • Fixed storage contracts for the total warehouse segment increased by 127% since 2021 and now account for: • 60% of total warehouse rent and storage revenues (from 39% in 2021)(1) • 8-year weighted average stated term(2) • Our network’s scope and breadth has allowed us to enter into fixed storage commitments • Opportunity to further improve performance as we integrate recent acquisitions into Americold's standards • Growth in Warehouse NOI from both Rent & Storage and Warehouse Services Same-Store Warehouse Revenue Same-Store Warehouse NOI Contribution (NOI) Margin: 34.2% Same-Store Warehouse services Same-Store Rent & storage +60% growth 31.4% 29.8%32.6% +69% growth 34.5%

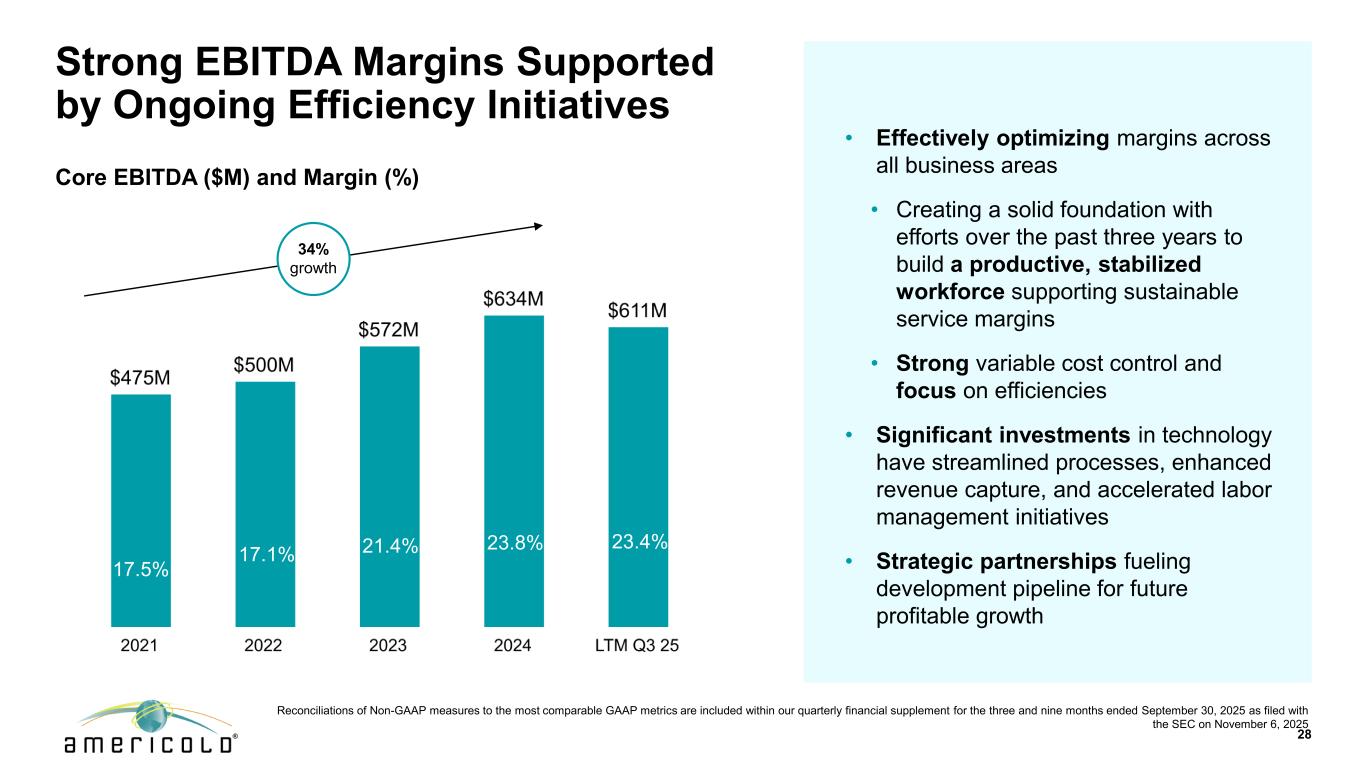

Strong EBITDA Margins Supported by Ongoing Efficiency Initiatives 28 Core EBITDA ($M) and Margin (%) 17.5% 17.1% 34% growth • Effectively optimizing margins across all business areas • Creating a solid foundation with efforts over the past three years to build a productive, stabilized workforce supporting sustainable service margins • Strong variable cost control and focus on efficiencies • Significant investments in technology have streamlined processes, enhanced revenue capture, and accelerated labor management initiatives • Strategic partnerships fueling development pipeline for future profitable growth 17.5% 17.1% 21.4% 23.8% 17.5% 21.4% 23.4% 17.1% 23.8% Reconciliations of Non-GAAP measures to the most comparable GAAP metrics are included within our quarterly financial supplement for the three and nine months ended September 30, 2025 as filed with the SEC on November 6, 2025

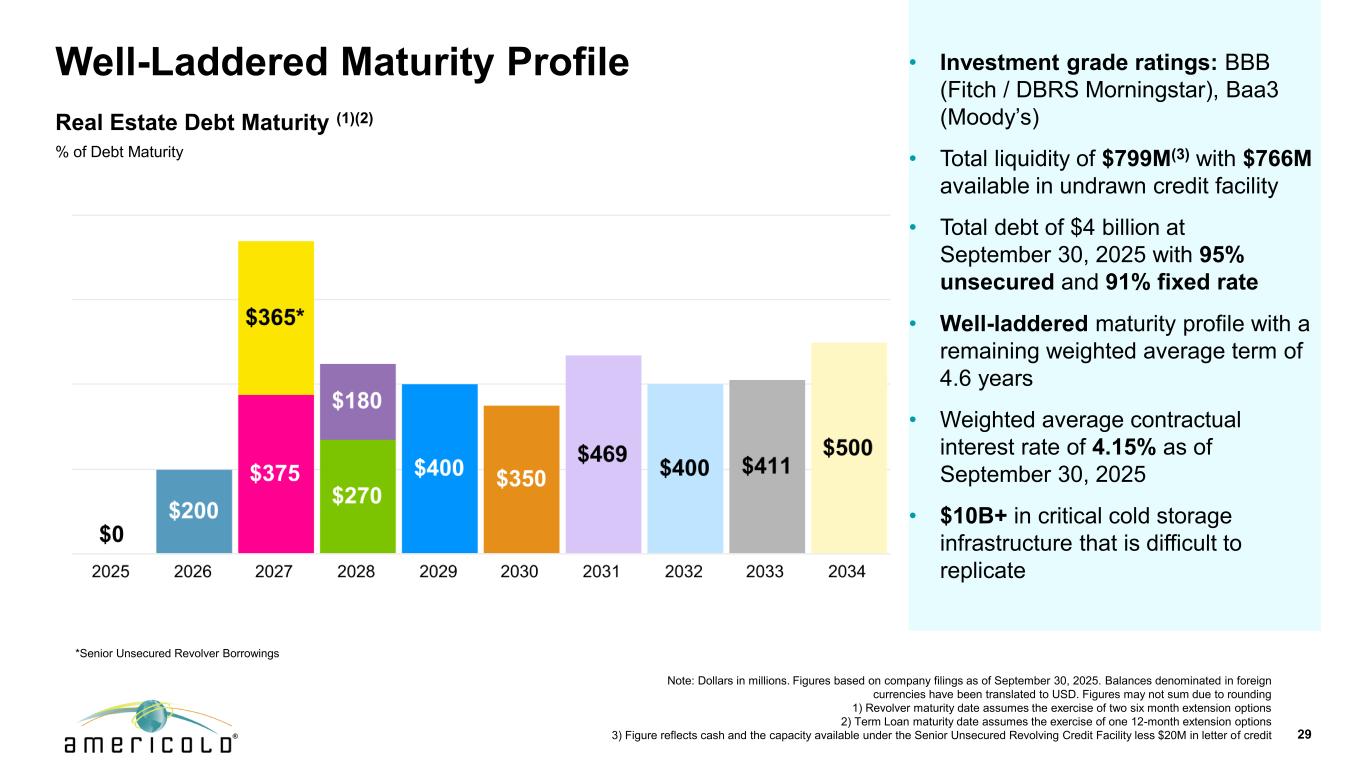

Well-Laddered Maturity Profile Note: Dollars in millions. Figures based on company filings as of September 30, 2025. Balances denominated in foreign currencies have been translated to USD. Figures may not sum due to rounding 1) Revolver maturity date assumes the exercise of two six month extension options 2) Term Loan maturity date assumes the exercise of one 12-month extension options 3) Figure reflects cash and the capacity available under the Senior Unsecured Revolving Credit Facility less $20M in letter of credit 29 Real Estate Debt Maturity (1)(2) % of Debt Maturity *Senior Unsecured Revolver Borrowings • Investment grade ratings: BBB (Fitch / DBRS Morningstar), Baa3 (Moody’s) • Total liquidity of $799M(3) with $766M available in undrawn credit facility • Total debt of $4 billion at September 30, 2025 with 95% unsecured and 91% fixed rate • Well-laddered maturity profile with a remaining weighted average term of 4.6 years • Weighted average contractual interest rate of 4.15% as of September 30, 2025 • $10B+ in critical cold storage infrastructure that is difficult to replicate

Disciplined Capital Allocation Strategy Focused on Driving Growth and Generating Shareholder Value Organic Reinvestment in the Business Returning Capital to Shareholders Opportunistic and Disciplined M&A • Maintain annualized dividend per share • Growth and expansion through acquisitions of desirable assets • Accretive to AFFO per share on Day 1 • Strategic maintenance capital deployment • Investing in accretive development projects with CPKC and DP World • Disciplined expansion and customer specific builds Maintain Healthy Balance Sheet 1 42 3 • Maintain Investment Grade rating • Access to sources of public and private capital • Potential asset sales and joint ventures 30 Reconciliations of Non-GAAP measures to the most comparable GAAP metrics are included within our quarterly financial supplement for the three and nine months ended September 30, 2025 as filed with the SEC on November 6, 2025

Commitment to Sustainability Initiatives Environmental Commitment to Energy Excellence and Efficiency • Recognized under the Global Cold Chain Alliance’s (GCCA) Energy Excellence Recognition Program with Gold, Silver or Bronze certifications at 213 facilities • 9.48% reduction in Scope 1 and 2 emissions from 2021, with an ultimate goal of 30% in 2030 • 24k MWh of renewable energy produced in 2024, with a goal of 150k hours in 2030 Social Social Initiatives • Serve the public good by maintaining the integrity of food supply and reducing waste • Corporate contributions / support to charities aligned with our core beliefs and focus, such as Feed the Children and HeroBox • $150K of financial assistance provided by the Americold Foundation to 79 associates in 2024 Governance Shareholder- friendly Corporate Governance • All members of the Board other than the CEO are independent • Code of Business Conduct and Ethics encourages the highest levels of integrity across the organization, training completed by 100% of associates Awards & Recognition Charitable Organizations 31

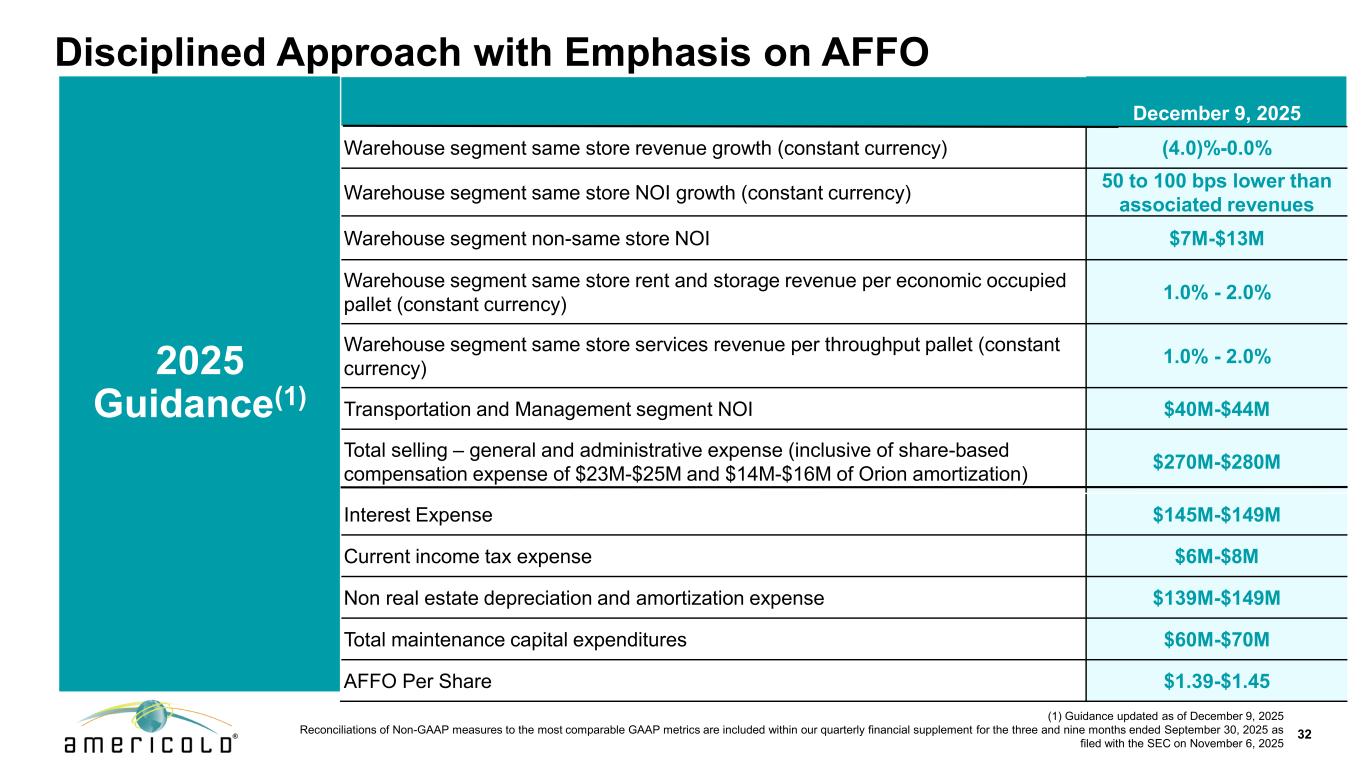

32 2025 Guidance(1) December 9, 2025 Warehouse segment same store revenue growth (constant currency) (4.0)%-0.0% Warehouse segment same store NOI growth (constant currency) 50 to 100 bps lower than associated revenues Warehouse segment non-same store NOI $7M-$13M Warehouse segment same store rent and storage revenue per economic occupied pallet (constant currency) 1.0% - 2.0% Warehouse segment same store services revenue per throughput pallet (constant currency) 1.0% - 2.0% Transportation and Management segment NOI $40M-$44M Total selling – general and administrative expense (inclusive of share-based compensation expense of $23M-$25M and $14M-$16M of Orion amortization) $270M-$280M Interest Expense $145M-$149M Current income tax expense $6M-$8M Non real estate depreciation and amortization expense $139M-$149M Total maintenance capital expenditures $60M-$70M AFFO Per Share $1.39-$1.45 Disciplined Approach with Emphasis on AFFO (1) Guidance updated as of December 9, 2025 Reconciliations of Non-GAAP measures to the most comparable GAAP metrics are included within our quarterly financial supplement for the three and nine months ended September 30, 2025 as filed with the SEC on November 6, 2025

3 Execution-focused and well positioned strategy centered on solutions, operational excellence, and experienced leadership 4 Multiple growth drivers with a capital allocation strategy supported by a blue-chip customer base, unique partnerships, and diverse asset network Americold – A Compelling Growth Opportunity 1 Global leader in the attractive cold storage industry with an integrated network of high-quality, strategically located mission-critical warehouses 33 2 Unique value proposition with unparalleled expertise, partnerships with industry experts, scalable infrastructure, and leading technology and operating systems