50 Kiepersol Crescent, Atlas Gardens

Contermanskloof, Durbanville,7550

Cape Town, Republic of South Africa

t. +27 (0) 21 557 7257; f. +27 (0) 21 557 7381

|

LEATT® CORPORATION 50 Kiepersol Crescent, Atlas Gardens Contermanskloof, Durbanville,7550 Cape Town, Republic of South Africa t. +27 (0) 21 557 7257; f. +27 (0) 21 557 7381 |

July 25, 2012

| By EDGAR Transmission |

| Loan Lauren P. Nguyen |

| Special Counsel |

| Division of Corporation Finance |

| U.S. Securities and Exchange Commission |

| 100 F Street, N.E.; Mail Stop 5546 |

| Washington, D.C. 20549-5546 |

| Re: | Leatt Corporation | |

| Amendment No. 1 to Registration Statement on Form 10-12G | ||

| Filed June 18, 2012 | ||

| File No. 000-54693 |

Dear Ms. Nguyen:

We hereby submit the responses of Leatt Corporation (the "Company") to the comments of the staff (the "Staff") of the Securities and Exchange Commission (the "Commission") set forth in the Staff's letter, dated July 2, 2012, providing comments with respect to the Company's registration statement on Form 10‐12G filed on June 18, 2012, along with Amendment No. 2 thereto (the "Amendment").

We understand and agree that:

the Company is responsible for the adequacy and accuracy of the disclosure in the filing;

the Company’s comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and

the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

For the convenience of the Staff, the Staff’s comment is included and is followed by the response of the Company. Unless the context indicates otherwise, references in this letter to “we,” “us” and “our” refer to the Company on a consolidated basis.

| Division of Corporation Finance |

| July 25, 2012 |

| Page 2 |

General

| 1. |

We note your response to our prior comment 1 and reissue in part. Please disclose in the beginning of your registration statement that you are an emerging growth company. |

RESPONSE: We have expanded our disclosure below the “Our Business” heading to disclosure that we are an emerging growth company as follows:

We are an “emerging growth company” as defined in Title I of the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company is defined as an issuer, including a foreign private issuer, with less than $1 billion of total annual gross revenues during its most recently completed fiscal year. The JOBS Act eases restrictions on the sale of securities, increases the number of shareholders a company must have before becoming subject to the U.S. Securities and Exchange Commission’s (“SEC’s”) reporting and disclosure rules, and exempts qualifying companies from certain financial disclosure and governance requirements for up to five years. For details on the JOBS Act and the Company’s status, see our disclosure under “Regulations – 2012 JOBS Act” below.

| 2. |

We note your response to our prior comment 4 and reissue in part. Some images appearing on pages 8 and 12 are either incomplete or difficult to discern. Where applicable, please provide a description explaining the graphics. Please revise or delete these images. |

RESPONSE: We have deleted the images on pages 8 and 12 in response to your comment.

Explanatory Note, page 3

| 3. |

Please revise to delete the second paragraph in this section or advise. |

RESPONSE: We note your comment and we have deleted the paragraph in accordance with your request.

Our Industry and Market Trends, page 6

Off-Road Motorcycle Market, page 6

| 4. |

We note your response to our prior comments 11 and 26 and reissue in part. Please provide us with copies of the industry reports cited in this section and in the Competition section on page 13 because we cannot access them through the web links you provided. |

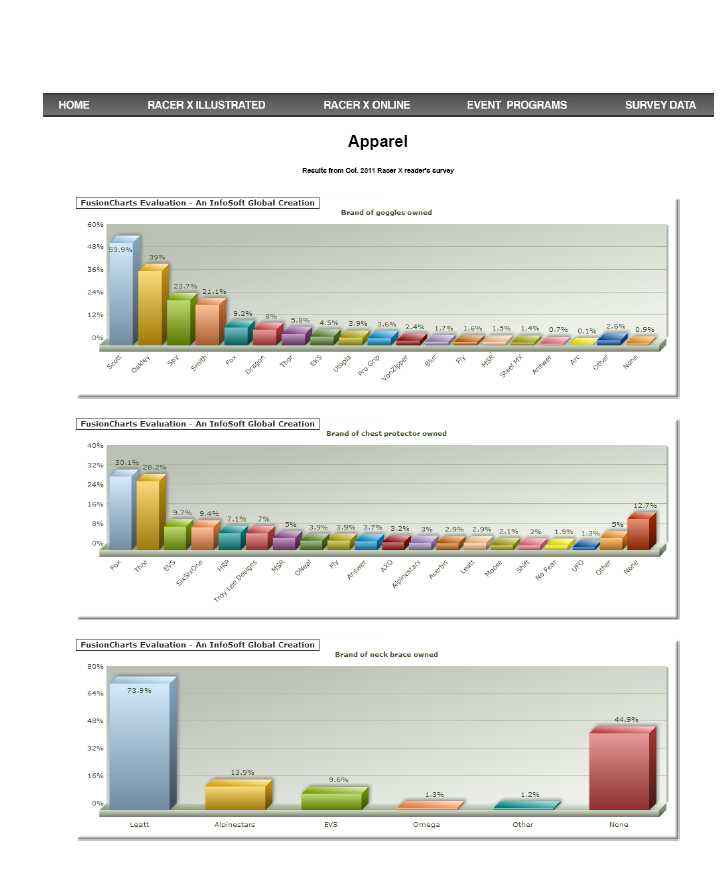

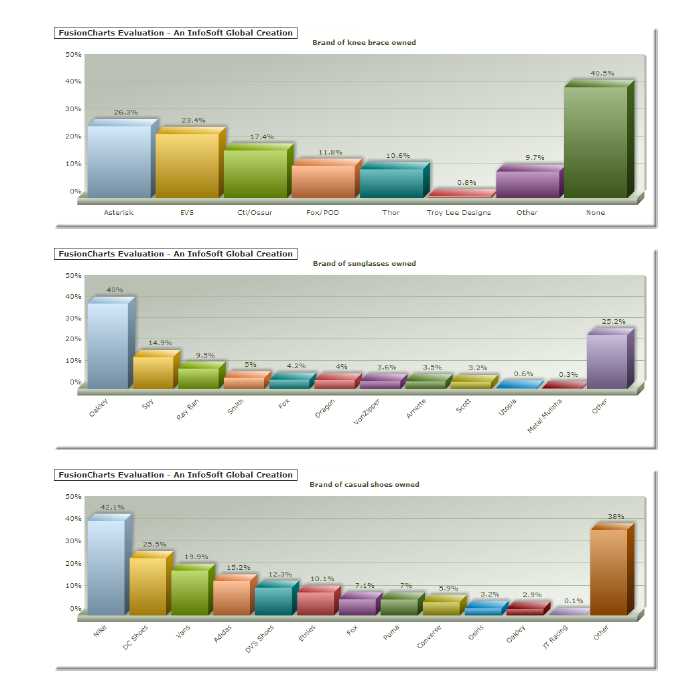

RESPONSE: The data provided in our disclosure was obtained from data published in the October 2011 issue of RacerX, available at http://filterpubs.com/mediakit/Apparel/Apparel_PAGE2.html. We have included a copy of the survey at Annex A hereto in accordance with your request.

Leatt Protection Range, page 8

| 5. |

Please revise to delete the reference to “top-of-the-line” outside chest protector as the term contains marketing language that is not appropriate for a registration statement. |

| Division of Corporation Finance |

| July 25, 2012 |

| Page 3 |

RESPONSE: We have deleted the reference in accordance with your request.

Raw Materials and Suppliers, page 9

| 6. |

We note your response to our prior comment 20 and reissue in part. If material, please disclose the amount that you spend to acquire the “highly specialized protection materials.” |

RESPONSE: We have expanded the disclosure under the “Raw Materials and Suppliers” heading to clarify that, the expenses incurred for such materials for the years ended December 31, 2011 and 2010, were not material and that we do not foresee these amounts being material in the near future.

Manufacturing, page 9

| 7. |

We note your responses to our prior comments 9 and 19. Given that the substantial majority, if not all, of your products are manufactured in China, please create a risk factor to disclose how this specific fact poses to preserving your intellectual property rights. Address how the legal regime relating to property rights differs and how it may be difficult to enforce. |

RESPONSE: We have expanded our Risk Factors to include the following risk regarding the manufacture of our products in China:

Our potential inability to adequately protect our intellectual property during the outsource manufacturing of our products in China could negatively impact our performance.

Our products are manufactured primarily in China through third-party outsource manufacturing arrangements. We rely on our third-party manufacturers to implement customary manufacturer safeguards onsite, such as the use of confidentiality agreements with employees, to protect our proprietary information and technologies during the manufacturing process, however, these safeguards may not effectively prevent unauthorized use of such information and technical knowhow, or prevent such manufacturers from retaining them. The legal regime governing intellectual property rights in China is relatively weak and it is often difficult to create and enforce intellectual property rights or protect trade secrets there. We face risks that our proprietary information may not be afforded the same protection in China as it is in countries with well-developed intellectual property laws, and local laws may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our proprietary rights in China, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position.

Our Competitive Strengths, page 13

| 8. |

We note your response to our prior comment 28 and reissue in part. Please substantiate your statement that you produce products at a “low cost.” |

RESPONSE: We have revised our disclosure in the third bullet under “Our Competitive Strengths” to reflect as follows:

| Division of Corporation Finance |

| July 25, 2012 |

| Page 4 |

Outsourced Manufacturing. We outsource our manufacturing to third-party manufacturers in order to produce large volumes of our products. The manufacturing process remains subject to our strict quality control guidelines safeguarded by our employees and the third party inspectors who we hire as consultants to ensure that these guidelines are being implemented at the production point. While such manufacturing arrangements pose a risk to our ability to safeguard our property technologies and may lead to increased costs, as discussed under the “Risk Factors” heading in this registration statement, we expect that the increase in expected sales volumes will contribute to a lower production cost per unit and that this will translate to better margins for our distributors and retailers.

| 9. |

We note your response to our prior comment 29 and your revised disclosure. As you have substantiated the statement that your brand is recognized by professional athletes by referencing only one athlete, please revise to delete your statement that “due to the technical and revolutionary nature of the Leatt-Brace®, the Leatt brand is recognized by professional athletes and other sports enthusiasts worldwide.” |

RESPONSE: We have revised the last bullet under the “Our Competitive Strengths” heading to delete the referenced statement in accordance with the Staff’s request and to reflect as follows:

Brand Recognition. A RacerX survey discussed elsewhere herein shows that, as at October 2011, Leatt had an approximately 74% market share for neck braces. We believe that public recognition of the Leatt® brand drives the sales of our products, regardless of the action of competitors and competitive products. We expect that the reputation of our brand in the market place, particularly our product testing and applicable CE certification, will continue to ensure market acceptance and facilitate market penetration of our new products. In order to bolster and grow the Leatt® brand, stringent quality control and assurance are our highest priority and our ongoing marketing, advertising and public relations efforts continue to stress the quality, safety and innovation of our products.

Risk Factors, page 22

| 10. |

We note your response to our prior comment 8 and reissue in part. Please revise the Risk Factors section to disclose that there is no guarantee that you will receive the accreditations described in Other Accreditation section on page 21. |

RESPONSE: We have expanded the Risk Factor section to include the following uncertainty regarding the accreditations sought by the Company:

We may not be able to receive certain industry certifications and accreditation for our products.

We have sought certification for certain of our products, such as the Moto R neck brace, by the SFI. To attain SFI certification, a safety device must, every five years, pass a series of impact sled tests with an instrumented crash test dummy at a SFI accredited test lab, as well as flammability tests on various parts of the safety device. These tests are done according to the SFI38.1 specification which can be found at http://www.sfifoundation.com. SFI 38.1 accreditation is mandatory for any safety device that is used by participants in SFI sanctioned events worldwide (except for V8 racing in Australia). We also voluntarily submitted our Moto GPX neck brace to be tested by the in-house engineers of BMW Motorrad (Germany) and to be reviewed by KTM (Austria). We believe that such testing, while not mandatory, will provide validation for our product’s performance. There is no guarantee that our products will receive SFI certification or meet BMW testing standards.

| Division of Corporation Finance |

| July 25, 2012 |

| Page 5 |

We are also in discussions with governing and racing bodies, such as the Fédération Internationale de l'Automobile (FIA), the Fédération Internationale de Motocyclisme (FIM) and the National Association for Stock Car Auto Racing (NASCAR), to have the Leatt-Brace® accredited by these bodies. To acquire NASCAR accreditation, the safety device must obtain SFI 38.1 accreditation, discussed above, and be recertified every 5 years. In addition, the safety device must undergo review and a series of NASCAR specific tests by NASCAR’s technical panel to ensure that it meets all the NASCAR safety requirements. NASCAR accreditation is mandatory for any safety device that is used by participants in NASCAR events. To acquire FIA accreditation, the safety device must obtain SFI 38.1 accreditation, discussed above, and be recertified every 5 years. In addition, the device must undergo review by a FIA technical panel, which reviews the device in accordance with FIA Standard 8858-2010 -Frontal Head Restraint (FHR) System and conduct more product specific testing if necessary. This standard can be found at: http://argent.fia.com/web/fiapublic.nsf/A12FB1536667511BC12578B700714F94/$FILE/8858-2010_Frontal_Head_Restraint.pdf. FIA accreditation is mandatory for any safety device that is used by participants in FIA sanctioned events worldwide. While there is currently no official accreditation for FIM sanctioned events, we have submitted test documents for FIM review. We cannot guarantee that we will secure any of these accreditations.

In Order to Grow at the Pace, page 22

| 11. |

We note your response to our prior comment 30 and reissue in part. Please provide an estimate of additional financing you may require to implement your long-term growth strategies and disclose whether you have taken any steps to seek additional financing. |

RESPONSE: We currently meet our working capital requirements and our long-term growth strategies are not sufficiently definitive for us to provide any estimates regarding additional financing. As such we have determined that the referenced risk factor is not necessary at this time.

We face an inherent business risk of exposure to claims, page 24

| 12. |

We note your response to our prior comment 33. Please revise to disclose the extent of your product liability insurance coverage. |

RESPONSE: We have revised the referenced risk factor in the Amendment to reflect as follows:

We face an inherent business risk of exposure to product liability claims that could have a material adverse effect on our operating results.

Because of the nature of our products, we face an inherent business risk of exposure to product liability claims arising from the claimed failure of our products to prevent the types of personal injury or death against which they are designed to protect. Plaintiffs may also advance other legal theories supporting claims that our products or actions resulted in harm to them. We maintain product liability insurance policies in excess of $1 million to attempt to manage this risk worldwide. In management’s opinion, any ultimate liability arising out of currently pending product liability claims will not have a material adverse effect on our financial condition or results of operations. Although we maintain product liability insurance coverage, there can be no absolute assurance that our coverage limits will be sufficient to cover any successful product liability claims made against us in the future. Any claim or aggregation of claims substantially in excess of our insurance coverage, or any substantial claim not covered by insurance, could have a material adverse effect on our financial condition and results of operations.

| Division of Corporation Finance |

| July 25, 2012 |

| Page 6 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 23

Results of Operations, page 24

| 13. |

We note your response to our prior comment 35. Your revised disclosure does not address the impacts of changes in prices on your revenues and cost of revenues and does not quantify the impacts of changes in volume. Please quantify the portion of the $3.5 million increase in sales and the $1.9 million increase in cost of revenues attributable to changes in prices as well as changes in volume. Refer to Item 303(a)(3)(iii) of Regulation S-K. |

RESPONSE: We note your comment and we have revised our disclosure under revenues and cost of revenues under the Results of Operations heading to reflect the impact of changes in sales volume on our revenues. Changes in prices did not impact the increase in revenues as our selling prices have not been increased by any significant level.

| 14. |

Your response to our prior comment 36 which refers to the response to comment 35, does not address our comment. We, therefore, reissue the comment in its entirety. Please revise to expand your discussion to explain in greater detail the factors causing all significant changes in your results and the underlying reasons for those factors. For example, you state gross profit percentage decreased in part due to additional logistics costs incurred to encourage increased customer orders and volumes globally. It is not clear whether this means you hired additional warehouse/order processing employees or something else. In addition, the impact of this factor and the change in product sales mix are not quantified. Please quantify each factor when two or more factors are cited as a cause of a variance between comparable periods to enable investors to understand the relative impact of each on your results. Refer to the “Interpretation: Commission Guidance Regarding Management's Discussion and Analysis of Financial Condition and Results of Operations” available on our website at http://www.sec.gov/rules/interp/33- 8350.htm for guidance. |

RESPONSE: We have revised our disclosure under the Results of Operations heading in the Amendment in accordance with Comments 14 - 17.

| 15. |

Your response to our prior comment 37, which refers to the response to comment 35, does not address our comment. We, therefore, reissue the comment in its entirety. We note you sell Leatt branded braces and OEM for other brands, apparel, accessories, and other safety devices, such as armor. We also note your disclosure on page 7 of the number of brace units sold. We believe your results of operations disclosure of revenues could be made more useful to investors by providing quantification, preferably in a table, of revenues by major product category and, with respect to braces, incorporating the units sold into the discussion of changes in related revenues. Please revise as appropriate. |

| Division of Corporation Finance |

| July 25, 2012 |

| Page 7 |

RESPONSE: Please see our response to Comment 14 above.

| 16. |

Please revise to include the more detailed level of discussion previously included in your results of operations disclosure. |

RESPONSE: Please see our response to Comment 14 above.

Three Months Ended March 31, 2012 compared to the Three Months Ended March 31, 2011, page F-1

| 17. |

Please revise to comply with the above MD&A comments for the results of operations discussion for the three months ended March 31st . |

RESPONSE: Please see our response to Comment 14 above.

Note 2. Summary of Significant Accounting Policies, page F-15

Revenue Recognition, page F-16

| 18. |

Your response to our prior comment 49 states that revenue is recognized upon delivery to the customer. Your revenue recognition policy states that products are sold to a global network of distributors and dealers, in addition to directly to consumers. Your accounts receivable policy references credit granted to distributors. Please reconcile these discrepancies and clarify whether there are instances where revenue is recognized upon transfer to a distributor, and if so, why the recognition is appropriate in accordance with ASC 605-15-25-1. In addition, please revise your policy to make clear when revenues are recognized for sales through each type of customer (such as distributors and direct sales). |

RESPONSE: ASC 605-15-25-1 provides guidance as to when to recognize revenue when the buyer has a right to return the product. Since the only right of return that exists to our distributors, dealers, and/or consumers is in the event of a manufacturing defect in our products, the criteria enumerated in ASC 605-15-25-1 is met and the revenue is properly recognized at the time the product is shipped to either the distributor, dealer, and/or consumer.

We have amended the revenue recognition policy, as follows, to address each type of customer:

| Division of Corporation Finance |

| July 25, 2012 |

| Page 8 |

Revenue and Cost Recognition - All manufacturing of Leatt-Brace products is performed by third party subcontractors in China. The Company's products are sold worldwide to a global network of distributors and dealers, and directly to consumers when there are no dealers or distributors in their geographic area (collectively the "customers"). Revenues from product sales are recognized when earned, net of applicable provisions for discounts and returns and allowances in the event of product defect. Revenue is considered to be realized or realizable and earned when all of the following criteria are met: title and risk of loss have passed to the customer, persuasive evidence of an arrangement exists, delivery has occurred, the price is fixed and determinable and collectability is reasonably assured. Since the Company (through its wholly owned subsidiary) serves as the distributor of Leatt products in the United States, the Company records its revenue and related cost of revenue for its product sales in the United States upon shipment of the merchandise to the dealer or to the ultimate consumer when there is no dealer in the geographic area and the sales order was received directly from, and paid by, the ultimate consumer. Since the Company (through its South African branch) serves as the distributor of Leatt products in South Africa, the Company records its revenue and related cost of revenue for its product sales in South Africa upon shipment of the merchandise from the branch to the dealer. International sales (other than in South Africa) are generally drop-shipped directly from the third party manufacturer to the international distributors. Revenue and related cost of revenue is recognized at the time of shipment from the manufacturer's port when the shipping terms are Free On Board ("FOB") shipping point. Cost and Freight ("CFR") or Cost and Insurance to named place ("CIP") as legal title and risk of loss to the product pass to the distributor. Sales to all customers (distributors, dealers and consumers) are generally final; however, in limited instances, product may be returned due to product quality issues. If a distributor relationship were to be terminated by Leatt, then product return may occur. Historically, returns due to product quality issues have not been material and there have been no distributor terminations that resulted in product returns. Cost of revenues also includes royalty fees associated with sales of Leatt-Brace products.

* * *

| Division of Corporation Finance |

| July 25, 2012 |

| Page 9 of 10 |

If you would like to discuss the foregoing response to the Staff’s comment or if you would like to discuss any other matters, please contact the undersigned at +27 (0) 21 557 7257 or Dawn Bernd-Schulz of Blank Rome LLP, our outside special securities counsel at (202) 772-5946.

| Sincerely, | |

| LEATT CORPORATION | |

| By:/s/ Sean Macdonald | |

| Name: Sean Macdonald | |

| Title: Chief Executive Officer |

cc: Dawn Bernd-Schulz, Esq.

ANNEX A

RacerX Survey

(see attached)