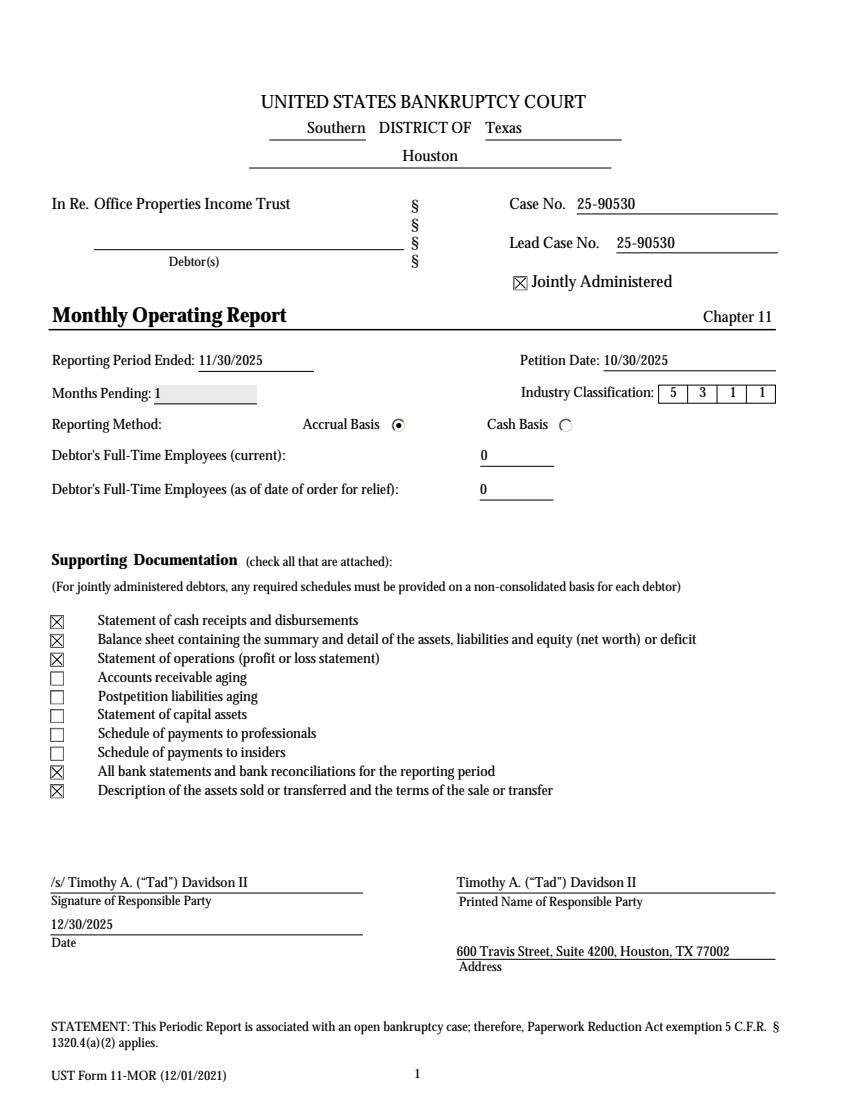

| UST Form 11-MOR (12/01/2021) 1 UNITED STATES BANKRUPTCY COURT Southern DISTRICT OF Texas Houston In Re. Office Properties Income Trust Debtor(s) § § § § Case No. 25-90530 Lead Case No. 25-90530 Jointly Administered Monthly Operating Report Chapter 11 Reporting Period Ended: 11/30/2025 Petition Date: 10/30/2025 Months Pending: 1 Industry Classification: 5 3 1 1 Reporting Method: Accrual Basis Cash Basis Debtor's Full-Time Employees (current): 0 Debtor's Full-Time Employees (as of date of order for relief): 0 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Signature of Responsible Party Printed Name of Responsible Party Date Address /s/ Timothy A. (“Tad”) Davidson II 12/30/2025 Timothy A. (“Tad”) Davidson II 600 Travis Street, Suite 4200, Houston, TX 77002 STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies. |

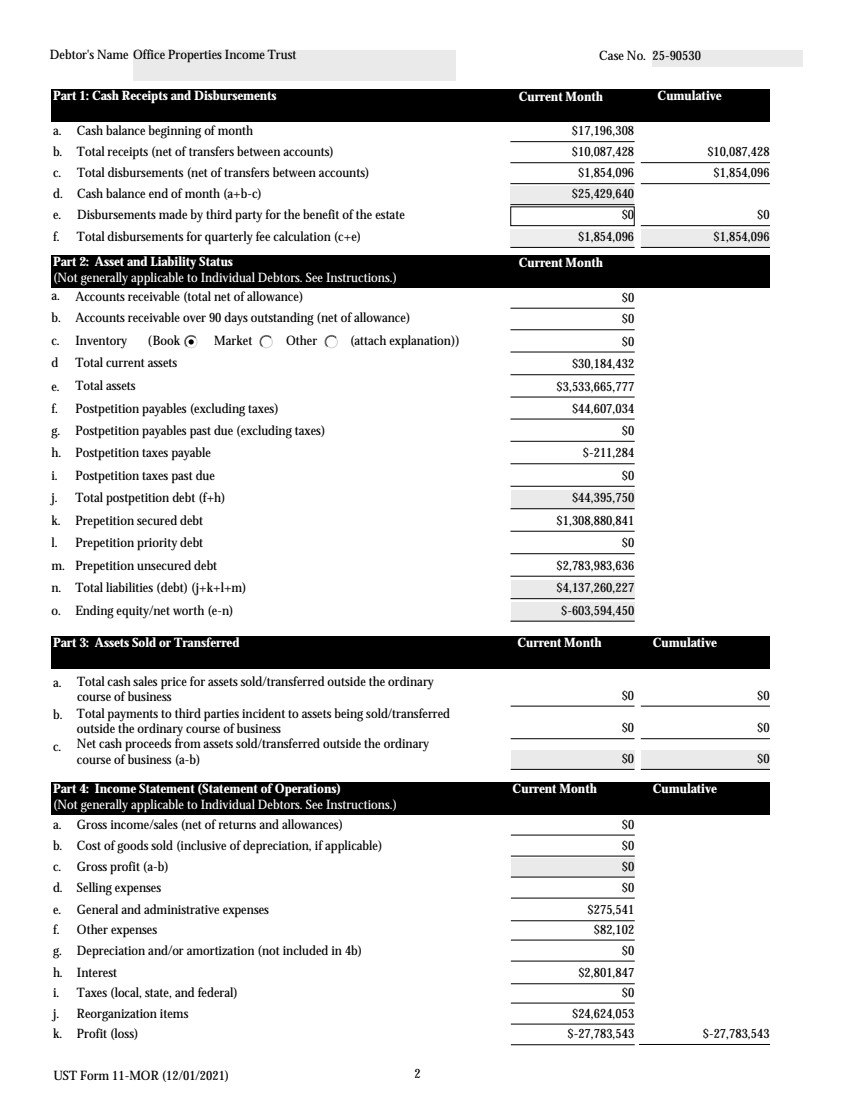

| UST Form 11-MOR (12/01/2021) 2 Debtor's Name Office Properties Income Trust Case No. 25-90530 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $17,196,308 b. Total receipts (net of transfers between accounts) $10,087,428 $10,087,428 c. Total disbursements (net of transfers between accounts) $1,854,096 $1,854,096 d. Cash balance end of month (a+b-c) $25,429,640 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $1,854,096 $1,854,096 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $0 b. Accounts receivable over 90 days outstanding (net of allowance) $0 c. Inventory (Book Market Other (attach explanation)) $0 d Total current assets $30,184,432 e. Total assets $3,533,665,777 f. Postpetition payables (excluding taxes) $44,607,034 g. Postpetition payables past due (excluding taxes) $0 h. Postpetition taxes payable $-211,284 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $44,395,750 k. Prepetition secured debt $1,308,880,841 l. Prepetition priority debt $0 m. Prepetition unsecured debt $2,783,983,636 n. Total liabilities (debt) (j+k+l+m) $4,137,260,227 o. Ending equity/net worth (e-n) $-603,594,450 Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. Gross income/sales (net of returns and allowances) $0 b. Cost of goods sold (inclusive of depreciation, if applicable) $0 c. Gross profit (a-b) $0 d. Selling expenses $0 e. General and administrative expenses $275,541 f. Other expenses $82,102 g. Depreciation and/or amortization (not included in 4b) $0 h. Interest $2,801,847 i. Taxes (local, state, and federal) $0 j. Reorganization items $24,624,053 k. Profit (loss) $-27,783,543 $-27,783,543 |

| UST Form 11-MOR (12/01/2021) 3 Debtor's Name Office Properties Income Trust Case No. 25-90530 Part 5: Professional Fees and Expenses Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total Itemized Breakdown by Firm Firm Name Role i ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi |

| UST Form 11-MOR (12/01/2021) 4 Debtor's Name Office Properties Income Trust Case No. 25-90530 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxviii |

| UST Form 11-MOR (12/01/2021) 5 Debtor's Name Office Properties Income Trust Case No. 25-90530 lxxix lxxx lxxxi lxxxii lxxxiii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total Itemized Breakdown by Firm Firm Name Role i ii iii iv v vi vii viii ix x xi xii xiii xiv |

| UST Form 11-MOR (12/01/2021) 6 Debtor's Name Office Properties Income Trust Case No. 25-90530 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi |

| UST Form 11-MOR (12/01/2021) 7 Debtor's Name Office Properties Income Trust Case No. 25-90530 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxviii lxxix lxxx lxxxi lxxxii lxxxiii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii |

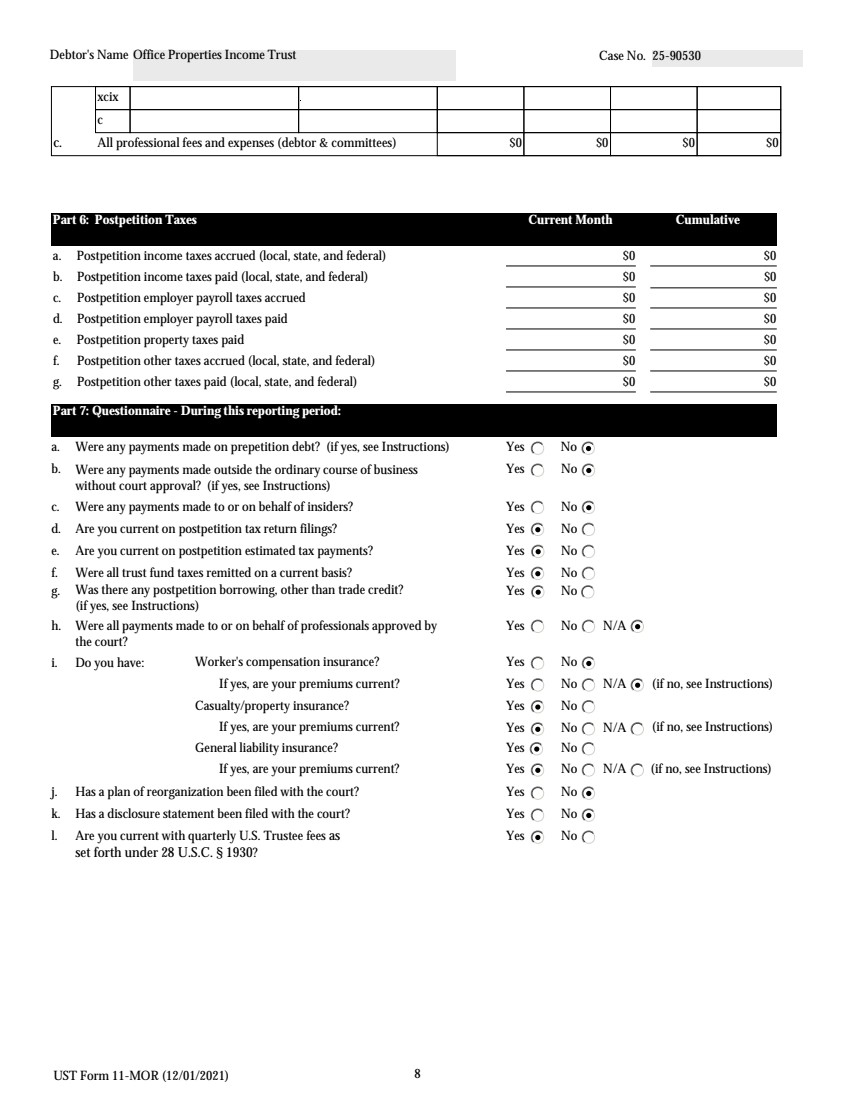

| UST Form 11-MOR (12/01/2021) 8 Debtor's Name Office Properties Income Trust Case No. 25-90530 xcix c c. All professional fees and expenses (debtor & committees) $0 $0 $0 $0 Part 6: Postpetition Taxes Current Month Cumulative a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $0 $0 d. Postpetition employer payroll taxes paid $0 $0 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) $0 $0 Part 7: Questionnaire - During this reporting period: a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No b. Were any payments made outside the ordinary course of business Yes No without court approval? (if yes, see Instructions) c. Were any payments made to or on behalf of insiders? Yes No d. Are you current on postpetition tax return filings? Yes No e. Are you current on postpetition estimated tax payments? Yes No f. Were all trust fund taxes remitted on a current basis? Yes No g. Was there any postpetition borrowing, other than trade credit? Yes No (if yes, see Instructions) h. Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) Casualty/property insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) General liability insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? Yes No k. Has a disclosure statement been filed with the court? Yes No l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. § 1930? Yes No |

| UST Form 11-MOR (12/01/2021) 9 Debtor's Name Office Properties Income Trust Case No. 25-90530 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages $0 b. Gross income (receipts) from self-employment $0 c. Gross income from all other sources $0 d. Total income in the reporting period (a+b+c) $0 e. Payroll deductions $0 f. Self-employment related expenses $0 g. Living expenses $0 h. All other expenses $0 i. Total expenses in the reporting period (e+f+g+h) $0 j. Difference between total income and total expenses (d-i) $0 k. List the total amount of all postpetition debts that are past due $0 l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C § 101(14A)? Yes No m. If yes, have you made all Domestic Support Obligation payments? Yes No N/A Privacy Act Statement 28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http://www.justice.gov/ust/ eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ John R. Castellano Signature of Responsible Party Chief Restructuring Officer Printed Name of Responsible Party 12/30/2025 Title Date John R. Castellano |

| UST Form 11-MOR (12/01/2021) 10 Debtor's Name Office Properties Income Trust Case No. 25-90530 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo |

| UST Form 11-MOR (12/01/2021) 11 Debtor's Name Office Properties Income Trust Case No. 25-90530 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 |

| UST Form 11-MOR (12/01/2021) 12 Debtor's Name Office Properties Income Trust Case No. 25-90530 PageFour PageThree |

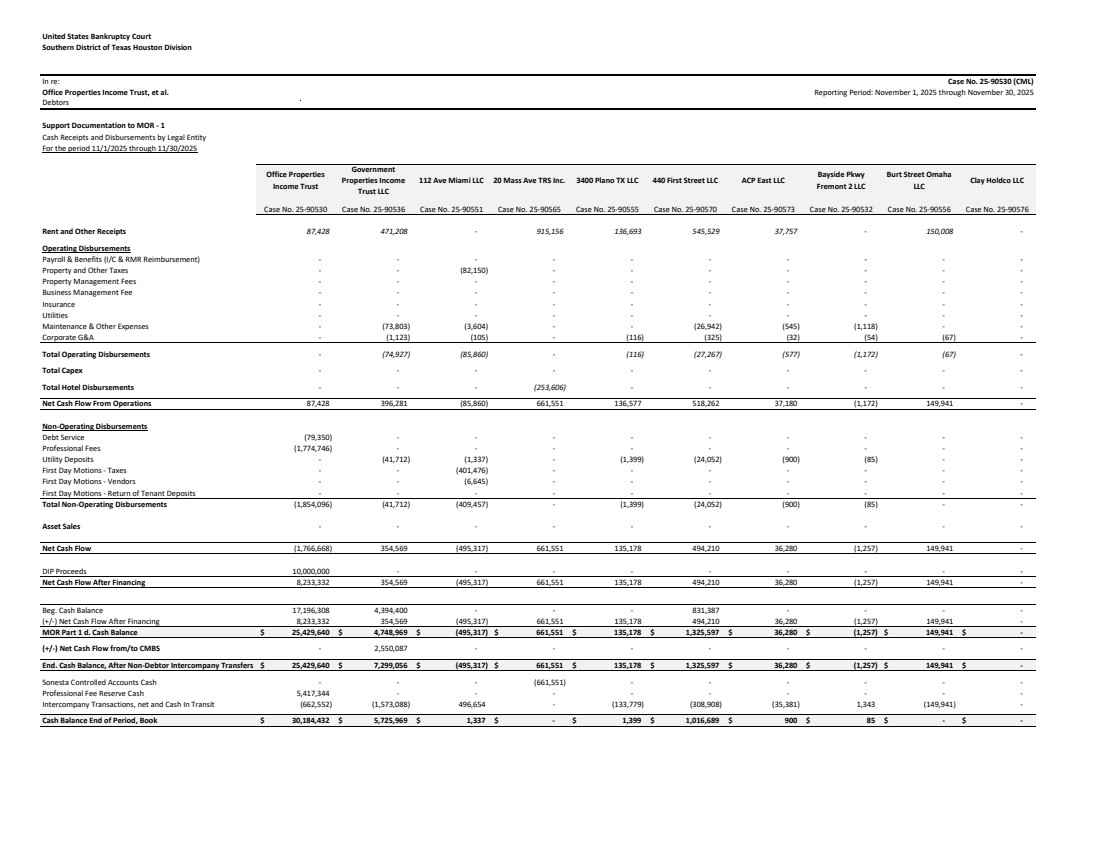

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Case No. 25-90530 (CML) Office Properties Income Trust, et al. Reporting Period: November 1, 2025 through November 30, 2025 Debtors Support Documentation to MOR - 1 Cash Receipts and Disbursements by Legal Entity For the period 11/1/2025 through 11/30/2025 Office Properties Income Trust Government Properties Income Trust LLC 112 Ave Miami LLC 20 Mass Ave TRS Inc. 3400 Plano TX LLC 440 First Street LLC ACP East LLC Bayside Pkwy Fremont 2 LLC Burt Street Omaha LLC Clay Holdco LLC Case No. 25-90530 Case No. 25-90536 Case No. 25-90551 Case No. 25-90565 Case No. 25-90555 Case No. 25-90570 Case No. 25-90573 Case No. 25-90532 Case No. 25-90556 Case No. 25-90576 Rent and Other Receipts 87,428 471,208 - 915,156 136,693 545,529 37,757 - 150,008 - Operating Disbursements Payroll & Benefits (I/C & RMR Reimbursement) - - - - - - - - - - Property and Other Taxes - - (82,150) - - - - - - - Property Management Fees - - - - - - - - - - Business Management Fee - - - - - - - - - - Insurance - - - - - - - - - - Utilities - - - - - - - - - - Maintenance & Other Expenses - (73,803) (3,604) - - (26,942) (545) (1,118) - - Corporate G&A - (1,123) (105) - (116) (325) (32) (54) (67) - Total Operating Disbursements - (74,927) (85,860) - (116) (27,267) (577) (1,172) (67) - Total Capex - - - - - - - - - - Total Hotel Disbursements - - - (253,606) - - - - - - Net Cash Flow From Operations 87,428 396,281 (85,860) 661,551 136,577 518,262 37,180 (1,172) 149,941 - Non-Operating Disbursements Debt Service (79,350) - - - - - - - - - Professional Fees (1,774,746) - - - - - - - - - Utility Deposits - (41,712) (1,337) - (1,399) (24,052) (900) (85) - - First Day Motions - Taxes - - (401,476) - - - - - - - First Day Motions - Vendors - - (6,645) - - - - - - - First Day Motions - Return of Tenant Deposits - - - - - - - - - - Total Non-Operating Disbursements (1,854,096) (41,712) (409,457) - (1,399) (24,052) (900) (85) - - Asset Sales - - - - - - - - - - Net Cash Flow (1,766,668) 354,569 (495,317) 661,551 135,178 494,210 36,280 (1,257) 149,941 - DIP Proceeds 10,000,000 - - - - - - - - - Net Cash Flow After Financing 8,233,332 354,569 (495,317) 661,551 135,178 494,210 36,280 (1,257) 149,941 - Beg. Cash Balance 17,196,308 4,394,400 - - - 831,387 - - - - (+/-) Net Cash Flow After Financing 8,233,332 354,569 (495,317) 661,551 135,178 494,210 36,280 (1,257) 149,941 - MOR Part 1 d. Cash Balance $ 25,429,640 $ 4,748,969 $ (495,317) $ 661,551 $ 135,178 $ 1,325,597 $ 36,280 $ (1,257) $ 149,941 $ - (+/-) Net Cash Flow from/to CMBS - 2,550,087 - - - - - - - - End. Cash Balance, After Non-Debtor Intercompany Transfers $ 25,429,640 $ 7,299,056 $ (495,317) $ 661,551 $ 135,178 $ 1,325,597 $ 36,280 $ (1,257) $ 149,941 $ - Sonesta Controlled Accounts Cash - - - (661,551) - - - - - - Professional Fee Reserve Cash 5,417,344 - - - - - - - - - Intercompany Transactions, net and Cash In Transit (662,552) (1,573,088) 496,654 - (133,779) (308,908) (35,381) 1,343 (149,941) - Cash Balance End of Period, Book $ 30,184,432 $ 5,725,969 $ 1,337 $ - $ 1,399 $ 1,016,689 $ 900 $ 85 $ - $ - |

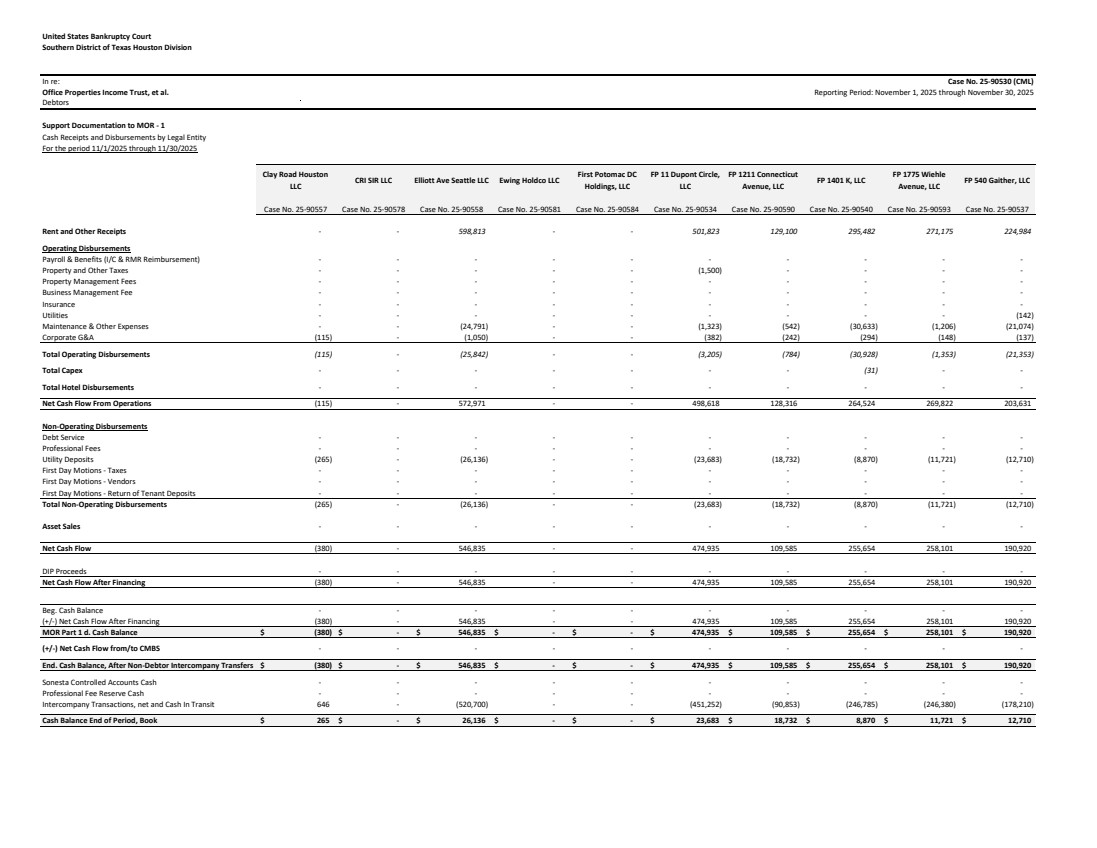

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 1 Cash Receipts and Disbursements by Legal Entity For the period 11/1/2025 through 11/30/2025 Rent and Other Receipts Operating Disbursements Payroll & Benefits (I/C & RMR Reimbursement) Property and Other Taxes Property Management Fees Business Management Fee Insurance Utilities Maintenance & Other Expenses Corporate G&A Total Operating Disbursements Total Capex Total Hotel Disbursements Net Cash Flow From Operations Non-Operating Disbursements Debt Service Professional Fees Utility Deposits First Day Motions - Taxes First Day Motions - Vendors First Day Motions - Return of Tenant Deposits Total Non-Operating Disbursements Asset Sales Net Cash Flow DIP Proceeds Net Cash Flow After Financing Beg. Cash Balance (+/-) Net Cash Flow After Financing MOR Part 1 d. Cash Balance (+/-) Net Cash Flow from/to CMBS End. Cash Balance, After Non-Debtor Intercompany Transfers Sonesta Controlled Accounts Cash Professional Fee Reserve Cash Intercompany Transactions, net and Cash In Transit Cash Balance End of Period, Book Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 Clay Road Houston LLC CRI SIR LLC Elliott Ave Seattle LLC Ewing Holdco LLC First Potomac DC Holdings, LLC FP 11 Dupont Circle, LLC FP 1211 Connecticut Avenue, LLC FP 1401 K, LLC FP 1775 Wiehle Avenue, LLC FP 540 Gaither, LLC Case No. 25-90557 Case No. 25-90578 Case No. 25-90558 Case No. 25-90581 Case No. 25-90584 Case No. 25-90534 Case No. 25-90590 Case No. 25-90540 Case No. 25-90593 Case No. 25-90537 - - 598,813 - - 501,823 129,100 295,482 271,175 224,984 - - - - - - - - - - - - - - - (1,500) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (142) - - (24,791) - - (1,323) (542) (30,633) (1,206) (21,074) (115) - (1,050) - - (382) (242) (294) (148) (137) (115) - (25,842) - - (3,205) (784) (30,928) (1,353) (21,353) - - - - - - - (31) - - - - - - - - - - - - (115) - 572,971 - - 498,618 128,316 264,524 269,822 203,631 - - - - - - - - - - - - - - - - - - - - (265) - (26,136) - - (23,683) (18,732) (8,870) (11,721) (12,710) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (265) - (26,136) - - (23,683) (18,732) (8,870) (11,721) (12,710) - - - - - - - - - - (380) - 546,835 - - 474,935 109,585 255,654 258,101 190,920 - - - - - - - - - - (380) - 546,835 - - 474,935 109,585 255,654 258,101 190,920 - - - - - - - - - - (380) - 546,835 - - 474,935 109,585 255,654 258,101 190,920 $ (380) $ - $ 546,835 $ - $ - $ 474,935 $ 109,585 $ 255,654 $ 258,101 $ 190,920 - - - - - - - - - - $ (380) $ - $ 546,835 $ - $ - $ 474,935 $ 109,585 $ 255,654 $ 258,101 $ 190,920 - - - - - - - - - - - - - - - - - - - - 646 - (520,700) - - (451,252) (90,853) (246,785) (246,380) (178,210) $ 265 $ - $ 26,136 $ - $ - $ 23,683 $ 18,732 $ 8,870 $ 11,721 $ 12,710 |

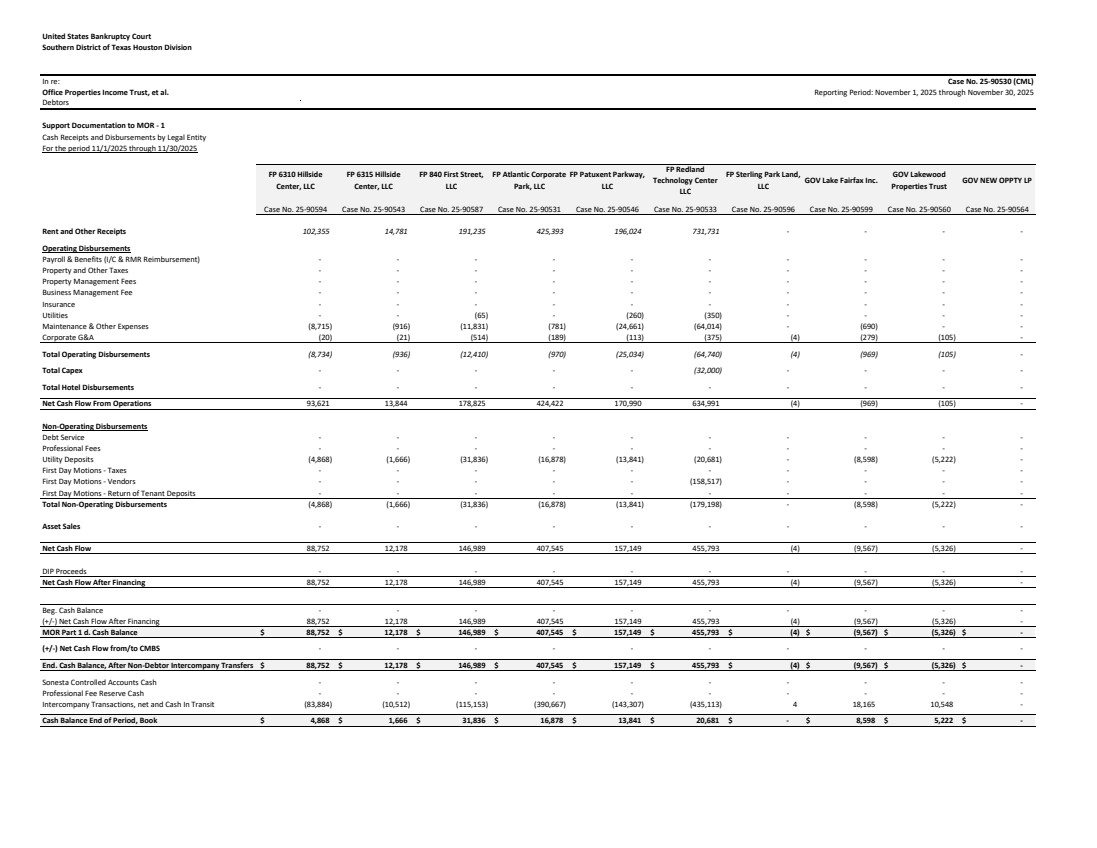

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 1 Cash Receipts and Disbursements by Legal Entity For the period 11/1/2025 through 11/30/2025 Rent and Other Receipts Operating Disbursements Payroll & Benefits (I/C & RMR Reimbursement) Property and Other Taxes Property Management Fees Business Management Fee Insurance Utilities Maintenance & Other Expenses Corporate G&A Total Operating Disbursements Total Capex Total Hotel Disbursements Net Cash Flow From Operations Non-Operating Disbursements Debt Service Professional Fees Utility Deposits First Day Motions - Taxes First Day Motions - Vendors First Day Motions - Return of Tenant Deposits Total Non-Operating Disbursements Asset Sales Net Cash Flow DIP Proceeds Net Cash Flow After Financing Beg. Cash Balance (+/-) Net Cash Flow After Financing MOR Part 1 d. Cash Balance (+/-) Net Cash Flow from/to CMBS End. Cash Balance, After Non-Debtor Intercompany Transfers Sonesta Controlled Accounts Cash Professional Fee Reserve Cash Intercompany Transactions, net and Cash In Transit Cash Balance End of Period, Book Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 FP 6310 Hillside Center, LLC FP 6315 Hillside Center, LLC FP 840 First Street, LLC FP Atlantic Corporate Park, LLC FP Patuxent Parkway, LLC FP Redland Technology Center LLC FP Sterling Park Land, LLC GOV Lake Fairfax Inc. GOV Lakewood Properties Trust GOV NEW OPPTY LP Case No. 25-90594 Case No. 25-90543 Case No. 25-90587 Case No. 25-90531 Case No. 25-90546 Case No. 25-90533 Case No. 25-90596 Case No. 25-90599 Case No. 25-90560 Case No. 25-90564 102,355 14,781 191,235 425,393 196,024 731,731 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (65) - (260) (350) - - - - (8,715) (916) (11,831) (781) (24,661) (64,014) - (690) - - (20) (21) (514) (189) (113) (375) (4) (279) (105) - (8,734) (936) (12,410) (970) (25,034) (64,740) (4) (969) (105) - - - - - - (32,000) - - - - - - - - - - - - - - 93,621 13,844 178,825 424,422 170,990 634,991 (4) (969) (105) - - - - - - - - - - - - - - - - - - - - - (4,868) (1,666) (31,836) (16,878) (13,841) (20,681) - (8,598) (5,222) - - - - - - - - - - - - - - - - (158,517) - - - - - - - - - - - - - - (4,868) (1,666) (31,836) (16,878) (13,841) (179,198) - (8,598) (5,222) - - - - - - - - - - - 88,752 12,178 146,989 407,545 157,149 455,793 (4) (9,567) (5,326) - - - - - - - - - - - 88,752 12,178 146,989 407,545 157,149 455,793 (4) (9,567) (5,326) - - - - - - - - - - - 88,752 12,178 146,989 407,545 157,149 455,793 (4) (9,567) (5,326) - $ 88,752 $ 12,178 $ 146,989 $ 407,545 $ 157,149 $ 455,793 $ (4) $ (9,567) $ (5,326) $ - - - - - - - - - - - $ 88,752 $ 12,178 $ 146,989 $ 407,545 $ 157,149 $ 455,793 $ (4) $ (9,567) $ (5,326) $ - - - - - - - - - - - - - - - - - - - - - (83,884) (10,512) (115,153) (390,667) (143,307) (435,113) 4 18,165 10,548 - $ 4,868 $ 1,666 $ 31,836 $ 16,878 $ 13,841 $ 20,681 $ - $ 8,598 $ 5,222 $ - |

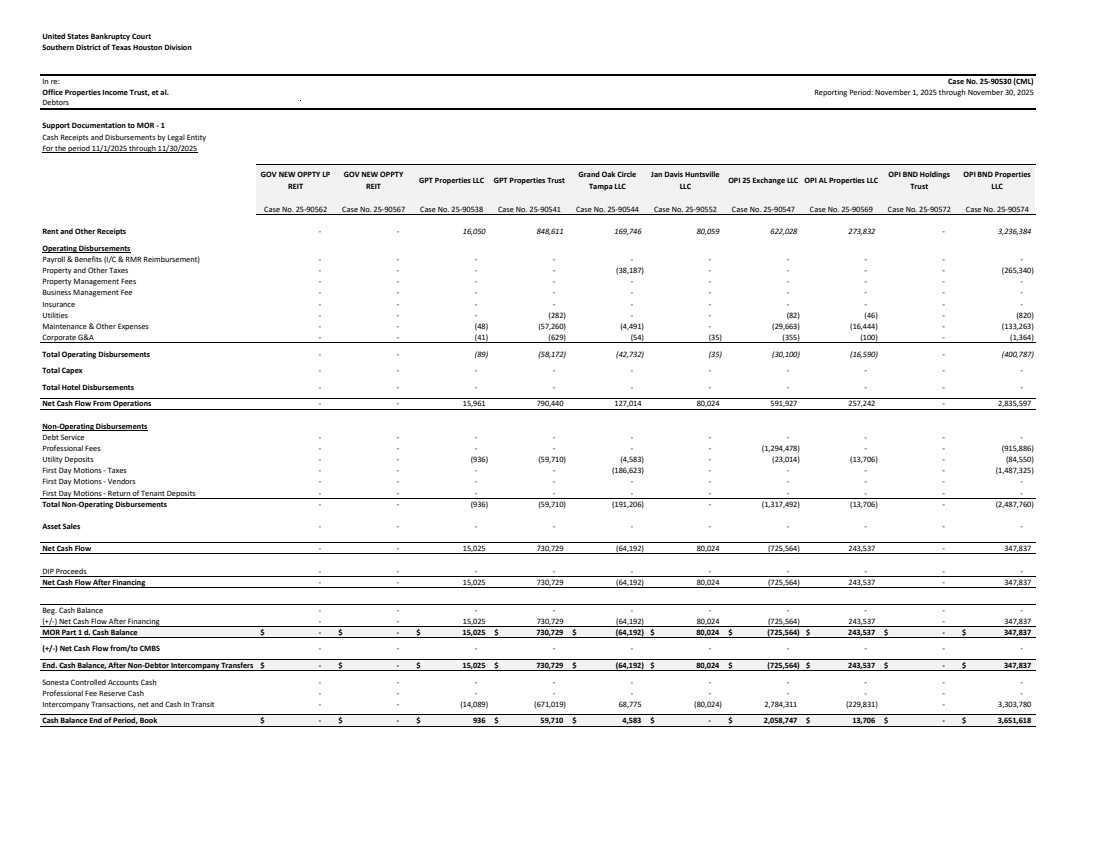

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 1 Cash Receipts and Disbursements by Legal Entity For the period 11/1/2025 through 11/30/2025 Rent and Other Receipts Operating Disbursements Payroll & Benefits (I/C & RMR Reimbursement) Property and Other Taxes Property Management Fees Business Management Fee Insurance Utilities Maintenance & Other Expenses Corporate G&A Total Operating Disbursements Total Capex Total Hotel Disbursements Net Cash Flow From Operations Non-Operating Disbursements Debt Service Professional Fees Utility Deposits First Day Motions - Taxes First Day Motions - Vendors First Day Motions - Return of Tenant Deposits Total Non-Operating Disbursements Asset Sales Net Cash Flow DIP Proceeds Net Cash Flow After Financing Beg. Cash Balance (+/-) Net Cash Flow After Financing MOR Part 1 d. Cash Balance (+/-) Net Cash Flow from/to CMBS End. Cash Balance, After Non-Debtor Intercompany Transfers Sonesta Controlled Accounts Cash Professional Fee Reserve Cash Intercompany Transactions, net and Cash In Transit Cash Balance End of Period, Book Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 GOV NEW OPPTY LP REIT GOV NEW OPPTY REIT GPT Properties LLC GPT Properties Trust Grand Oak Circle Tampa LLC Jan Davis Huntsville LLC OPI 25 Exchange LLC OPI AL Properties LLC OPI BND Holdings Trust OPI BND Properties LLC Case No. 25-90562 Case No. 25-90567 Case No. 25-90538 Case No. 25-90541 Case No. 25-90544 Case No. 25-90552 Case No. 25-90547 Case No. 25-90569 Case No. 25-90572 Case No. 25-90574 - - 16,050 848,611 169,746 80,059 622,028 273,832 - 3,236,384 - - - - - - - - - - - - - - (38,187) - - - - (265,340) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (282) - - (82) (46) - (820) - - (48) (57,260) (4,491) - (29,663) (16,444) - (133,263) - - (41) (629) (54) (35) (355) (100) - (1,364) - - (89) (58,172) (42,732) (35) (30,100) (16,590) - (400,787) - - - - - - - - - - - - - - - - - - - - - - 15,961 790,440 127,014 80,024 591,927 257,242 - 2,835,597 - - - - - - - - - - - - - - - - (1,294,478) - - (915,886) - - (936) (59,710) (4,583) - (23,014) (13,706) - (84,550) - - - - (186,623) - - - - (1,487,325) - - - - - - - - - - - - - - - - - - - - - - (936) (59,710) (191,206) - (1,317,492) (13,706) - (2,487,760) - - - - - - - - - - - - 15,025 730,729 (64,192) 80,024 (725,564) 243,537 - 347,837 - - - - - - - - - - - - 15,025 730,729 (64,192) 80,024 (725,564) 243,537 - 347,837 - - - - - - - - - - - - 15,025 730,729 (64,192) 80,024 (725,564) 243,537 - 347,837 $ - $ - $ 15,025 $ 730,729 $ (64,192) $ 80,024 $ (725,564) $ 243,537 $ - $ 347,837 - - - - - - - - - - $ - $ - $ 15,025 $ 730,729 $ (64,192) $ 80,024 $ (725,564) $ 243,537 $ - $ 347,837 - - - - - - - - - - - - - - - - - - - - - - (14,089) (671,019) 68,775 (80,024) 2,784,311 (229,831) - 3,303,780 $ - $ - $ 936 $ 59,710 $ 4,583 $ - $ 2,058,747 $ 13,706 $ - $ 3,651,618 |

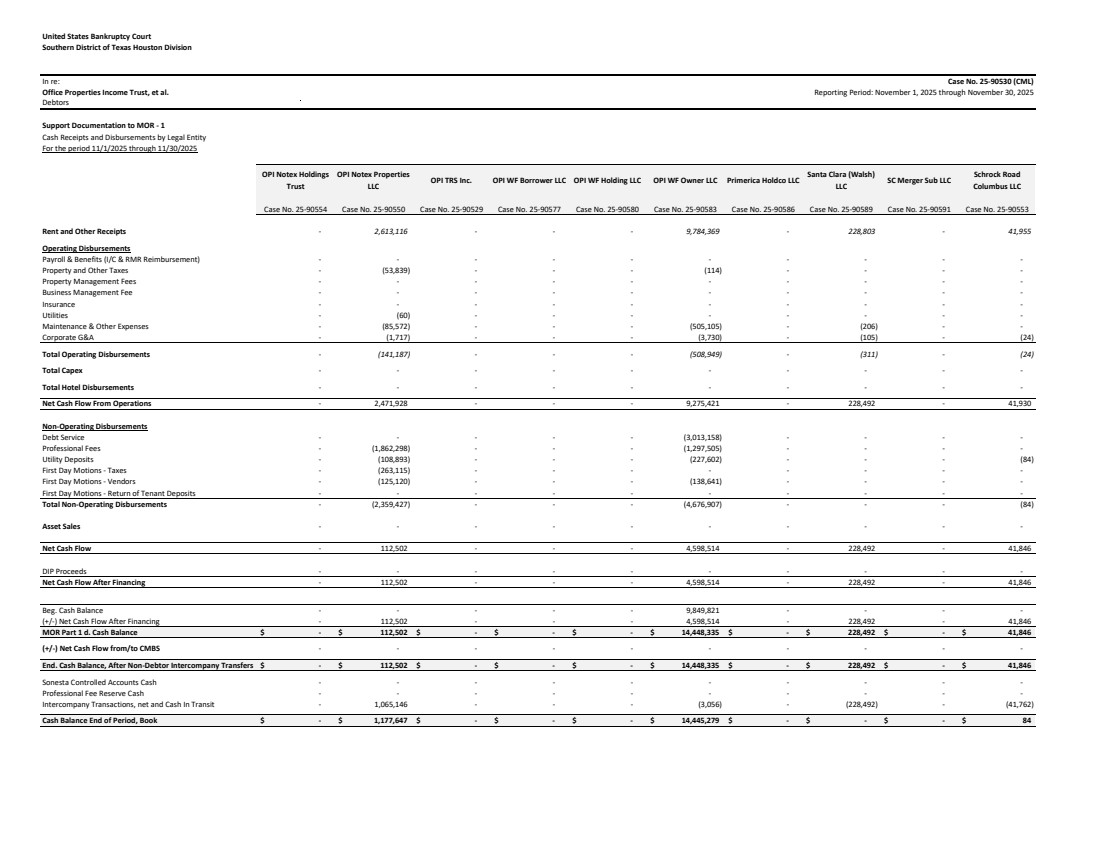

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 1 Cash Receipts and Disbursements by Legal Entity For the period 11/1/2025 through 11/30/2025 Rent and Other Receipts Operating Disbursements Payroll & Benefits (I/C & RMR Reimbursement) Property and Other Taxes Property Management Fees Business Management Fee Insurance Utilities Maintenance & Other Expenses Corporate G&A Total Operating Disbursements Total Capex Total Hotel Disbursements Net Cash Flow From Operations Non-Operating Disbursements Debt Service Professional Fees Utility Deposits First Day Motions - Taxes First Day Motions - Vendors First Day Motions - Return of Tenant Deposits Total Non-Operating Disbursements Asset Sales Net Cash Flow DIP Proceeds Net Cash Flow After Financing Beg. Cash Balance (+/-) Net Cash Flow After Financing MOR Part 1 d. Cash Balance (+/-) Net Cash Flow from/to CMBS End. Cash Balance, After Non-Debtor Intercompany Transfers Sonesta Controlled Accounts Cash Professional Fee Reserve Cash Intercompany Transactions, net and Cash In Transit Cash Balance End of Period, Book Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 OPI Notex Holdings Trust OPI Notex Properties LLC OPI TRS Inc. OPI WF Borrower LLC OPI WF Holding LLC OPI WF Owner LLC Primerica Holdco LLC Santa Clara (Walsh) LLC SC Merger Sub LLC Schrock Road Columbus LLC Case No. 25-90554 Case No. 25-90550 Case No. 25-90529 Case No. 25-90577 Case No. 25-90580 Case No. 25-90583 Case No. 25-90586 Case No. 25-90589 Case No. 25-90591 Case No. 25-90553 - 2,613,116 - - - 9,784,369 - 228,803 - 41,955 - - - - - - - - - - - (53,839) - - - (114) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (60) - - - - - - - - - (85,572) - - - (505,105) - (206) - - - (1,717) - - - (3,730) - (105) - (24) - (141,187) - - - (508,949) - (311) - (24) - - - - - - - - - - - - - - - - - - - - - 2,471,928 - - - 9,275,421 - 228,492 - 41,930 - - - - - (3,013,158) - - - - - (1,862,298) - - - (1,297,505) - - - - - (108,893) - - - (227,602) - - - (84) - (263,115) - - - - - - - - - (125,120) - - - (138,641) - - - - - - - - - - - - - - - (2,359,427) - - - (4,676,907) - - - (84) - - - - - - - - - - - 112,502 - - - 4,598,514 - 228,492 - 41,846 - - - - - - - - - - - 112,502 - - - 4,598,514 - 228,492 - 41,846 - - - - - 9,849,821 - - - - - 112,502 - - - 4,598,514 - 228,492 - 41,846 $ - $ 112,502 $ - $ - $ - $ 14,448,335 $ - $ 228,492 $ - $ 41,846 - - - - - - - - - - $ - $ 112,502 $ - $ - $ - $ 14,448,335 $ - $ 228,492 $ - $ 41,846 - - - - - - - - - - - - - - - - - - - - - 1,065,146 - - - (3,056) - (228,492) - (41,762) $ - $ 1,177,647 $ - $ - $ - $ 14,445,279 $ - $ - $ - $ 84 |

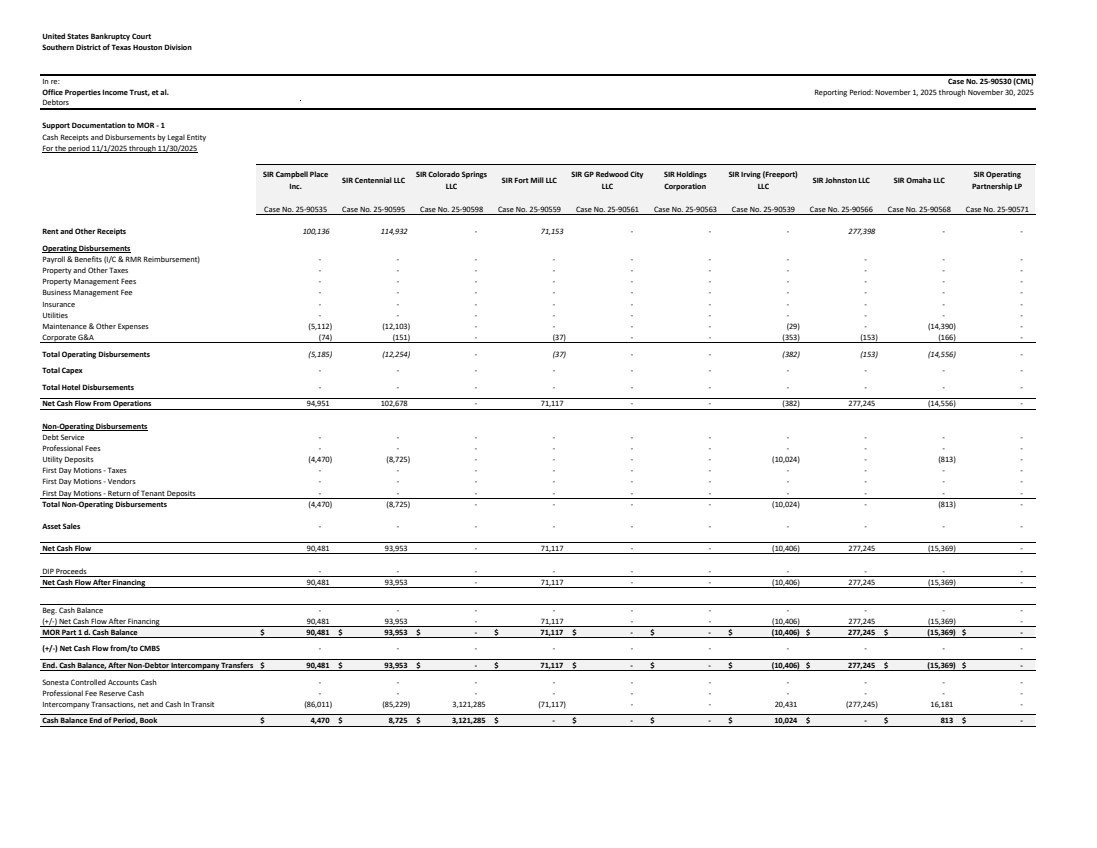

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 1 Cash Receipts and Disbursements by Legal Entity For the period 11/1/2025 through 11/30/2025 Rent and Other Receipts Operating Disbursements Payroll & Benefits (I/C & RMR Reimbursement) Property and Other Taxes Property Management Fees Business Management Fee Insurance Utilities Maintenance & Other Expenses Corporate G&A Total Operating Disbursements Total Capex Total Hotel Disbursements Net Cash Flow From Operations Non-Operating Disbursements Debt Service Professional Fees Utility Deposits First Day Motions - Taxes First Day Motions - Vendors First Day Motions - Return of Tenant Deposits Total Non-Operating Disbursements Asset Sales Net Cash Flow DIP Proceeds Net Cash Flow After Financing Beg. Cash Balance (+/-) Net Cash Flow After Financing MOR Part 1 d. Cash Balance (+/-) Net Cash Flow from/to CMBS End. Cash Balance, After Non-Debtor Intercompany Transfers Sonesta Controlled Accounts Cash Professional Fee Reserve Cash Intercompany Transactions, net and Cash In Transit Cash Balance End of Period, Book Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 SIR Campbell Place Inc. SIR Centennial LLC SIR Colorado Springs LLC SIR Fort Mill LLC SIR GP Redwood City LLC SIR Holdings Corporation SIR Irving (Freeport) LLC SIR Johnston LLC SIR Omaha LLC SIR Operating Partnership LP Case No. 25-90535 Case No. 25-90595 Case No. 25-90598 Case No. 25-90559 Case No. 25-90561 Case No. 25-90563 Case No. 25-90539 Case No. 25-90566 Case No. 25-90568 Case No. 25-90571 100,136 114,932 - 71,153 - - - 277,398 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (5,112) (12,103) - - - - (29) - (14,390) - (74) (151) - (37) - - (353) (153) (166) - (5,185) (12,254) - (37) - - (382) (153) (14,556) - - - - - - - - - - - - - - - - - - - - - 94,951 102,678 - 71,117 - - (382) 277,245 (14,556) - - - - - - - - - - - - - - - - - - - - - (4,470) (8,725) - - - - (10,024) - (813) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (4,470) (8,725) - - - - (10,024) - (813) - - - - - - - - - - - 90,481 93,953 - 71,117 - - (10,406) 277,245 (15,369) - - - - - - - - - - - 90,481 93,953 - 71,117 - - (10,406) 277,245 (15,369) - - - - - - - - - - - 90,481 93,953 - 71,117 - - (10,406) 277,245 (15,369) - $ 90,481 $ 93,953 $ - $ 71,117 $ - $ - $ (10,406) $ 277,245 $ (15,369) $ - - - - - - - - - - - $ 90,481 $ 93,953 $ - $ 71,117 $ - $ - $ (10,406) $ 277,245 $ (15,369) $ - - - - - - - - - - - - - - - - - - - - - (86,011) (85,229) 3,121,285 (71,117) - - 20,431 (277,245) 16,181 - $ 4,470 $ 8,725 $ 3,121,285 $ - $ - $ - $ 10,024 $ - $ 813 $ - |

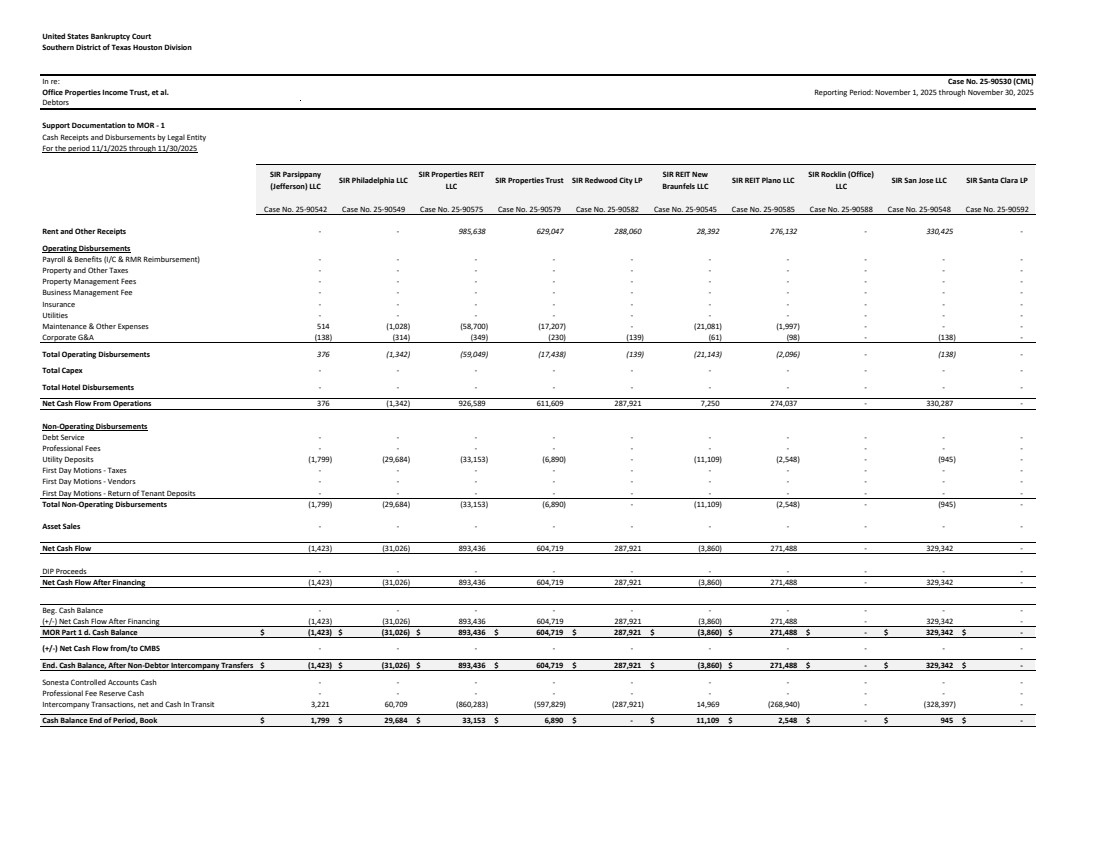

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 1 Cash Receipts and Disbursements by Legal Entity For the period 11/1/2025 through 11/30/2025 Rent and Other Receipts Operating Disbursements Payroll & Benefits (I/C & RMR Reimbursement) Property and Other Taxes Property Management Fees Business Management Fee Insurance Utilities Maintenance & Other Expenses Corporate G&A Total Operating Disbursements Total Capex Total Hotel Disbursements Net Cash Flow From Operations Non-Operating Disbursements Debt Service Professional Fees Utility Deposits First Day Motions - Taxes First Day Motions - Vendors First Day Motions - Return of Tenant Deposits Total Non-Operating Disbursements Asset Sales Net Cash Flow DIP Proceeds Net Cash Flow After Financing Beg. Cash Balance (+/-) Net Cash Flow After Financing MOR Part 1 d. Cash Balance (+/-) Net Cash Flow from/to CMBS End. Cash Balance, After Non-Debtor Intercompany Transfers Sonesta Controlled Accounts Cash Professional Fee Reserve Cash Intercompany Transactions, net and Cash In Transit Cash Balance End of Period, Book Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 SIR Parsippany (Jefferson) LLC SIR Philadelphia LLC SIR Properties REIT LLC SIR Properties Trust SIR Redwood City LP SIR REIT New Braunfels LLC SIR REIT Plano LLC SIR Rocklin (Office) LLC SIR San Jose LLC SIR Santa Clara LP Case No. 25-90542 Case No. 25-90549 Case No. 25-90575 Case No. 25-90579 Case No. 25-90582 Case No. 25-90545 Case No. 25-90585 Case No. 25-90588 Case No. 25-90548 Case No. 25-90592 - - 985,638 629,047 288,060 28,392 276,132 - 330,425 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 514 (1,028) (58,700) (17,207) - (21,081) (1,997) - - - (138) (314) (349) (230) (139) (61) (98) - (138) - 376 (1,342) (59,049) (17,438) (139) (21,143) (2,096) - (138) - - - - - - - - - - - - - - - - - - - - - 376 (1,342) 926,589 611,609 287,921 7,250 274,037 - 330,287 - - - - - - - - - - - - - - - - - - - - - (1,799) (29,684) (33,153) (6,890) - (11,109) (2,548) - (945) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (1,799) (29,684) (33,153) (6,890) - (11,109) (2,548) - (945) - - - - - - - - - - - (1,423) (31,026) 893,436 604,719 287,921 (3,860) 271,488 - 329,342 - - - - - - - - - - - (1,423) (31,026) 893,436 604,719 287,921 (3,860) 271,488 - 329,342 - - - - - - - - - - - (1,423) (31,026) 893,436 604,719 287,921 (3,860) 271,488 - 329,342 - $ (1,423) $ (31,026) $ 893,436 $ 604,719 $ 287,921 $ (3,860) $ 271,488 $ - $ 329,342 $ - - - - - - - - - - - $ (1,423) $ (31,026) $ 893,436 $ 604,719 $ 287,921 $ (3,860) $ 271,488 $ - $ 329,342 $ - - - - - - - - - - - - - - - - - - - - - 3,221 60,709 (860,283) (597,829) (287,921) 14,969 (268,940) - (328,397) - $ 1,799 $ 29,684 $ 33,153 $ 6,890 $ - $ 11,109 $ 2,548 $ - $ 945 $ - |

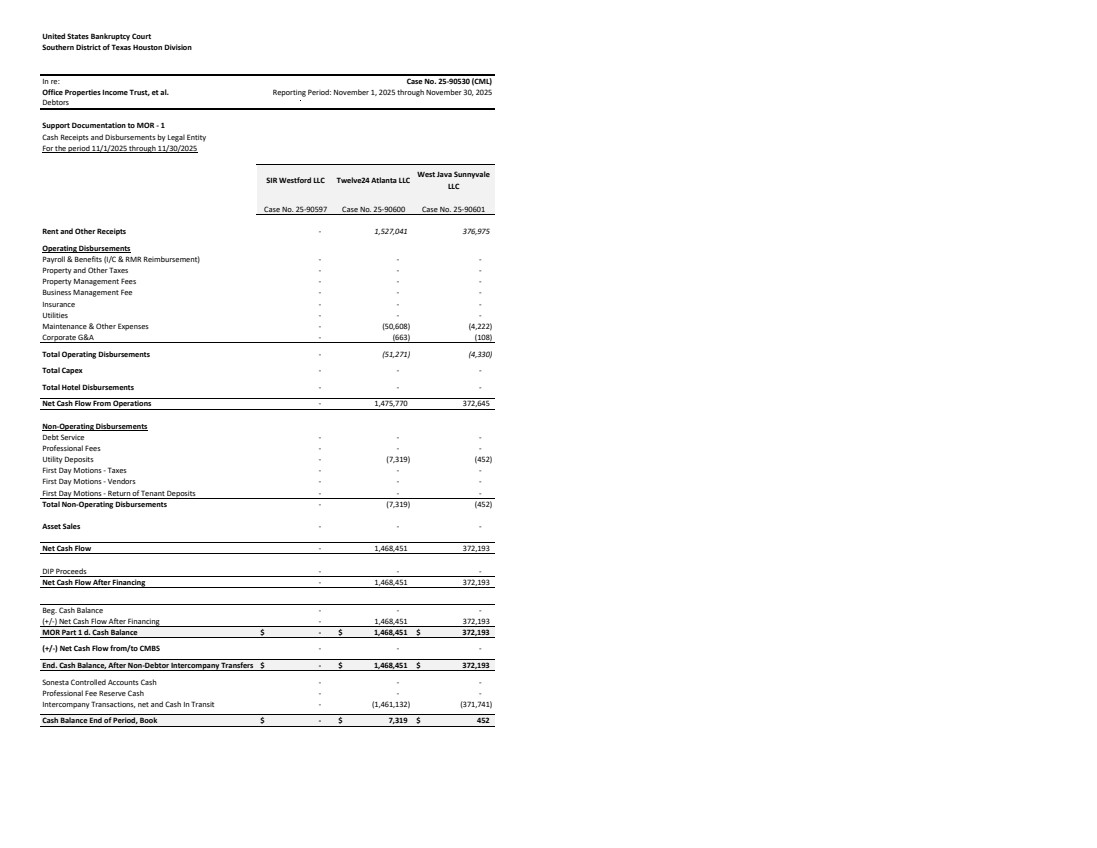

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 1 Cash Receipts and Disbursements by Legal Entity For the period 11/1/2025 through 11/30/2025 Rent and Other Receipts Operating Disbursements Payroll & Benefits (I/C & RMR Reimbursement) Property and Other Taxes Property Management Fees Business Management Fee Insurance Utilities Maintenance & Other Expenses Corporate G&A Total Operating Disbursements Total Capex Total Hotel Disbursements Net Cash Flow From Operations Non-Operating Disbursements Debt Service Professional Fees Utility Deposits First Day Motions - Taxes First Day Motions - Vendors First Day Motions - Return of Tenant Deposits Total Non-Operating Disbursements Asset Sales Net Cash Flow DIP Proceeds Net Cash Flow After Financing Beg. Cash Balance (+/-) Net Cash Flow After Financing MOR Part 1 d. Cash Balance (+/-) Net Cash Flow from/to CMBS End. Cash Balance, After Non-Debtor Intercompany Transfers Sonesta Controlled Accounts Cash Professional Fee Reserve Cash Intercompany Transactions, net and Cash In Transit Cash Balance End of Period, Book Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 SIR Westford LLC Twelve24 Atlanta LLC West Java Sunnyvale LLC Case No. 25-90597 Case No. 25-90600 Case No. 25-90601 - 1,527,041 376,975 - - - - - - - - - - - - - - - - - - - (50,608) (4,222) - (663) (108) - (51,271) (4,330) - - - - - - - 1,475,770 372,645 - - - - - - - (7,319) (452) - - - - - - - - - - (7,319) (452) - - - - 1,468,451 372,193 - - - - 1,468,451 372,193 - - - - 1,468,451 372,193 $ - $ 1,468,451 $ 372,193 - - - $ - $ 1,468,451 $ 372,193 - - - - - - - (1,461,132) (371,741) $ - $ 7,319 $ 452 |

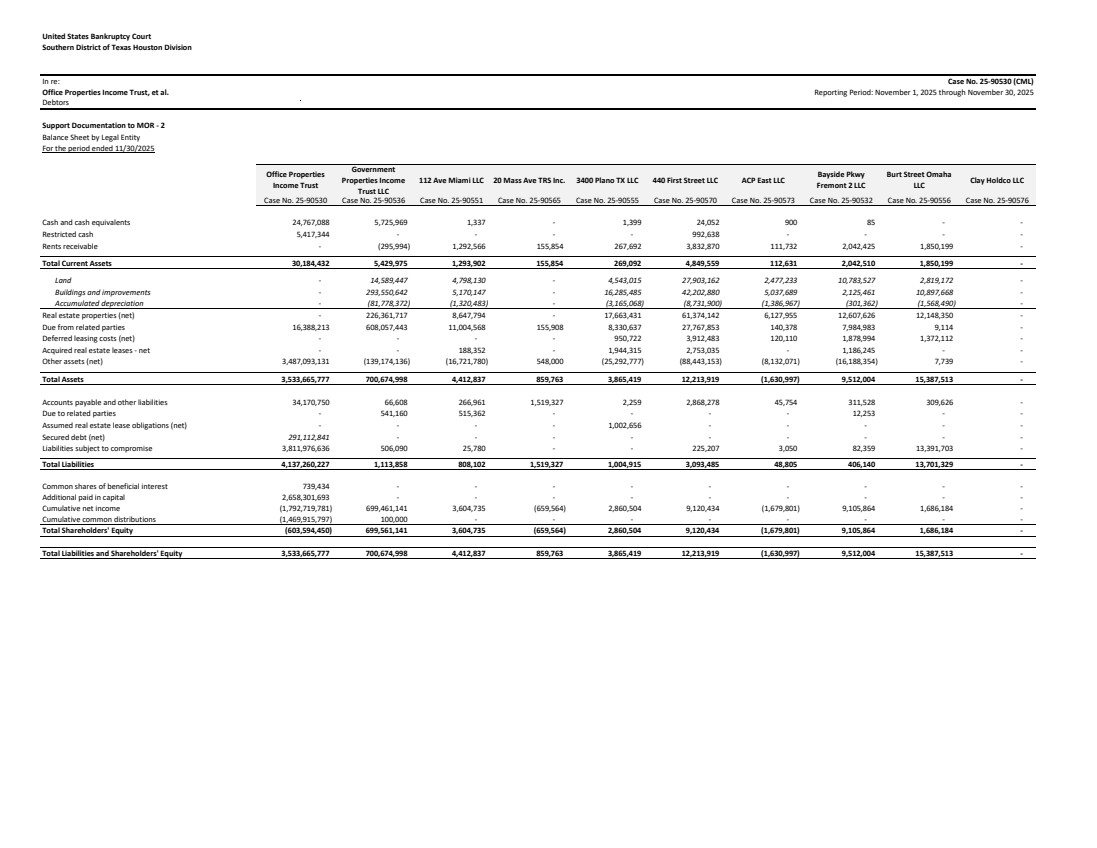

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Case No. 25-90530 (CML) Office Properties Income Trust, et al. Reporting Period: November 1, 2025 through November 30, 2025 Debtors Support Documentation to MOR - 2 Balance Sheet by Legal Entity For the period ended 11/30/2025 Office Properties Income Trust Government Properties Income Trust LLC 112 Ave Miami LLC 20 Mass Ave TRS Inc. 3400 Plano TX LLC 440 First Street LLC ACP East LLC Bayside Pkwy Fremont 2 LLC Burt Street Omaha LLC Clay Holdco LLC Case No. 25-90530 Case No. 25-90536 Case No. 25-90551 Case No. 25-90565 Case No. 25-90555 Case No. 25-90570 Case No. 25-90573 Case No. 25-90532 Case No. 25-90556 Case No. 25-90576 Cash and cash equivalents 24,767,088 5,725,969 1,337 - 1,399 24,052 900 85 - - Restricted cash 5,417,344 - - - - 992,638 - - - - Rents receivable - (295,994) 1,292,566 155,854 267,692 3,832,870 111,732 2,042,425 1,850,199 - Total Current Assets 30,184,432 5,429,975 1,293,902 155,854 269,092 4,849,559 112,631 2,042,510 1,850,199 - Land - 14,589,447 4,798,130 - 4,543,015 27,903,162 2,477,233 10,783,527 2,819,172 - Buildings and improvements - 293,550,642 5,170,147 - 16,285,485 42,202,880 5,037,689 2,125,461 10,897,668 - Accumulated depreciation - (81,778,372) (1,320,483) - (3,165,068) (8,731,900) (1,386,967) (301,362) (1,568,490) - Real estate properties (net) - 226,361,717 8,647,794 - 17,663,431 61,374,142 6,127,955 12,607,626 12,148,350 - Due from related parties 16,388,213 608,057,443 11,004,568 155,908 8,330,637 27,767,853 140,378 7,984,983 9,114 - Deferred leasing costs (net) - - - - 950,722 3,912,483 120,110 1,878,994 1,372,112 - Acquired real estate leases - net - - 188,352 - 1,944,315 2,753,035 - 1,186,245 - - Other assets (net) 3,487,093,131 (139,174,136) (16,721,780) 548,000 (25,292,777) (88,443,153) (8,132,071) (16,188,354) 7,739 - Total Assets 3,533,665,777 700,674,998 4,412,837 859,763 3,865,419 12,213,919 (1,630,997) 9,512,004 15,387,513 - Accounts payable and other liabilities 34,170,750 66,608 266,961 1,519,327 2,259 2,868,278 45,754 311,528 309,626 - Due to related parties - 541,160 515,362 - - - - 12,253 - - Assumed real estate lease obligations (net) - - - - 1,002,656 - - - - - Secured debt (net) 291,112,841 - - - - - - - - - Liabilities subject to compromise 3,811,976,636 506,090 25,780 - - 225,207 3,050 82,359 13,391,703 - Total Liabilities 4,137,260,227 1,113,858 808,102 1,519,327 1,004,915 3,093,485 48,805 406,140 13,701,329 - Common shares of beneficial interest 739,434 - - - - - - - - - Additional paid in capital 2,658,301,693 - - - - - - - - - Cumulative net income (1,792,719,781) 699,461,141 3,604,735 (659,564) 2,860,504 9,120,434 (1,679,801) 9,105,864 1,686,184 - Cumulative common distributions (1,469,915,797) 100,000 - - - - - - - - Total Shareholders' Equity (603,594,450) 699,561,141 3,604,735 (659,564) 2,860,504 9,120,434 (1,679,801) 9,105,864 1,686,184 - Total Liabilities and Shareholders' Equity 3,533,665,777 700,674,998 4,412,837 859,763 3,865,419 12,213,919 (1,630,997) 9,512,004 15,387,513 - |

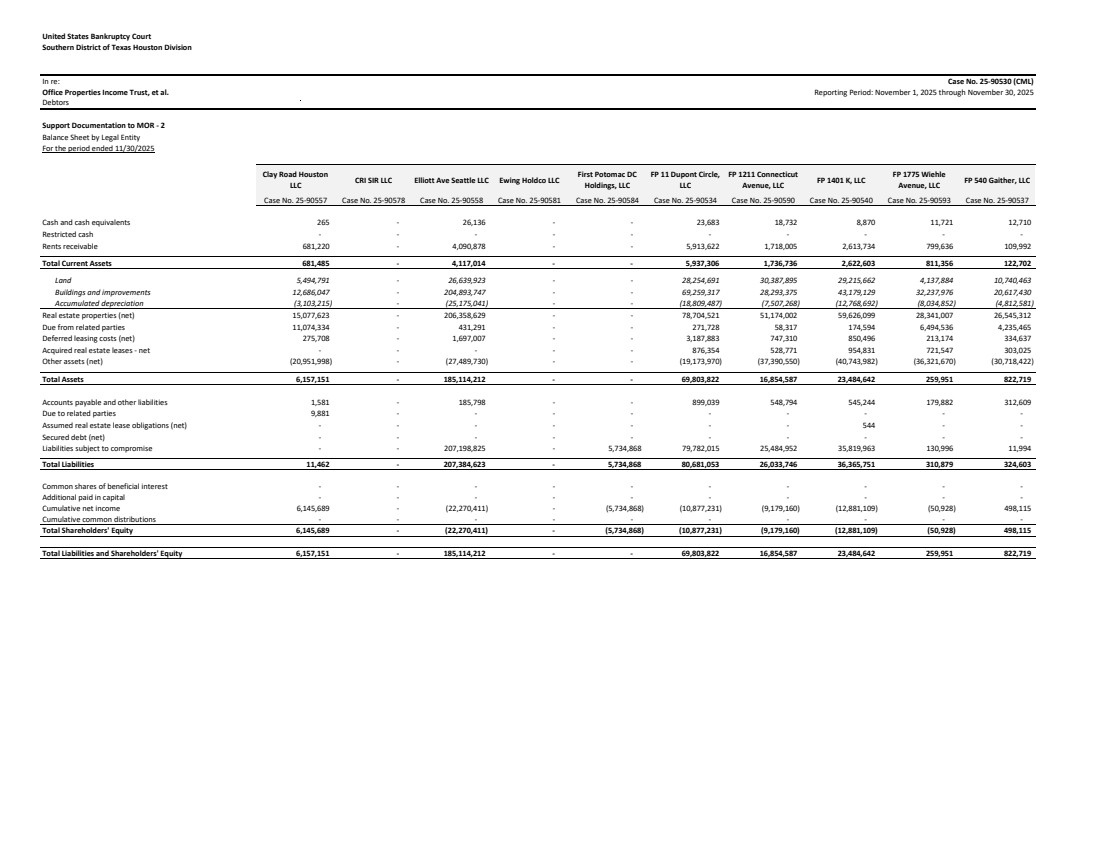

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 2 Balance Sheet by Legal Entity For the period ended 11/30/2025 Cash and cash equivalents Restricted cash Rents receivable Total Current Assets Land Buildings and improvements Accumulated depreciation Real estate properties (net) Due from related parties Deferred leasing costs (net) Acquired real estate leases - net Other assets (net) Total Assets Accounts payable and other liabilities Due to related parties Assumed real estate lease obligations (net) Secured debt (net) Liabilities subject to compromise Total Liabilities Common shares of beneficial interest Additional paid in capital Cumulative net income Cumulative common distributions Total Shareholders' Equity Total Liabilities and Shareholders' Equity Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 Clay Road Houston LLC CRI SIR LLC Elliott Ave Seattle LLC Ewing Holdco LLC First Potomac DC Holdings, LLC FP 11 Dupont Circle, LLC FP 1211 Connecticut Avenue, LLC FP 1401 K, LLC FP 1775 Wiehle Avenue, LLC FP 540 Gaither, LLC Case No. 25-90557 Case No. 25-90578 Case No. 25-90558 Case No. 25-90581 Case No. 25-90584 Case No. 25-90534 Case No. 25-90590 Case No. 25-90540 Case No. 25-90593 Case No. 25-90537 265 - 26,136 - - 23,683 18,732 8,870 11,721 12,710 - - - - - - - - - - 681,220 - 4,090,878 - - 5,913,622 1,718,005 2,613,734 799,636 109,992 681,485 - 4,117,014 - - 5,937,306 1,736,736 2,622,603 811,356 122,702 5,494,791 - 26,639,923 - - 28,254,691 30,387,895 29,215,662 4,137,884 10,740,463 12,686,047 - 204,893,747 - - 69,259,317 28,293,375 43,179,129 32,237,976 20,617,430 (3,103,215) - (25,175,041) - - (18,809,487) (7,507,268) (12,768,692) (8,034,852) (4,812,581) 15,077,623 - 206,358,629 - - 78,704,521 51,174,002 59,626,099 28,341,007 26,545,312 11,074,334 - 431,291 - - 271,728 58,317 174,594 6,494,536 4,235,465 275,708 - 1,697,007 - - 3,187,883 747,310 850,496 213,174 334,637 - - - - - 876,354 528,771 954,831 721,547 303,025 (20,951,998) - (27,489,730) - - (19,173,970) (37,390,550) (40,743,982) (36,321,670) (30,718,422) 6,157,151 - 185,114,212 - - 69,803,822 16,854,587 23,484,642 259,951 822,719 1,581 - 185,798 - - 899,039 548,794 545,244 179,882 312,609 9,881 - - - - - - - - - - - - - - - - 544 - - - - - - - - - - - - - - 207,198,825 - 5,734,868 79,782,015 25,484,952 35,819,963 130,996 11,994 11,462 - 207,384,623 - 5,734,868 80,681,053 26,033,746 36,365,751 310,879 324,603 - - - - - - - - - - - - - - - - - - - - 6,145,689 - (22,270,411) - (5,734,868) (10,877,231) (9,179,160) (12,881,109) (50,928) 498,115 - - - - - - - - - - 6,145,689 - (22,270,411) - (5,734,868) (10,877,231) (9,179,160) (12,881,109) (50,928) 498,115 6,157,151 - 185,114,212 - - 69,803,822 16,854,587 23,484,642 259,951 822,719 |

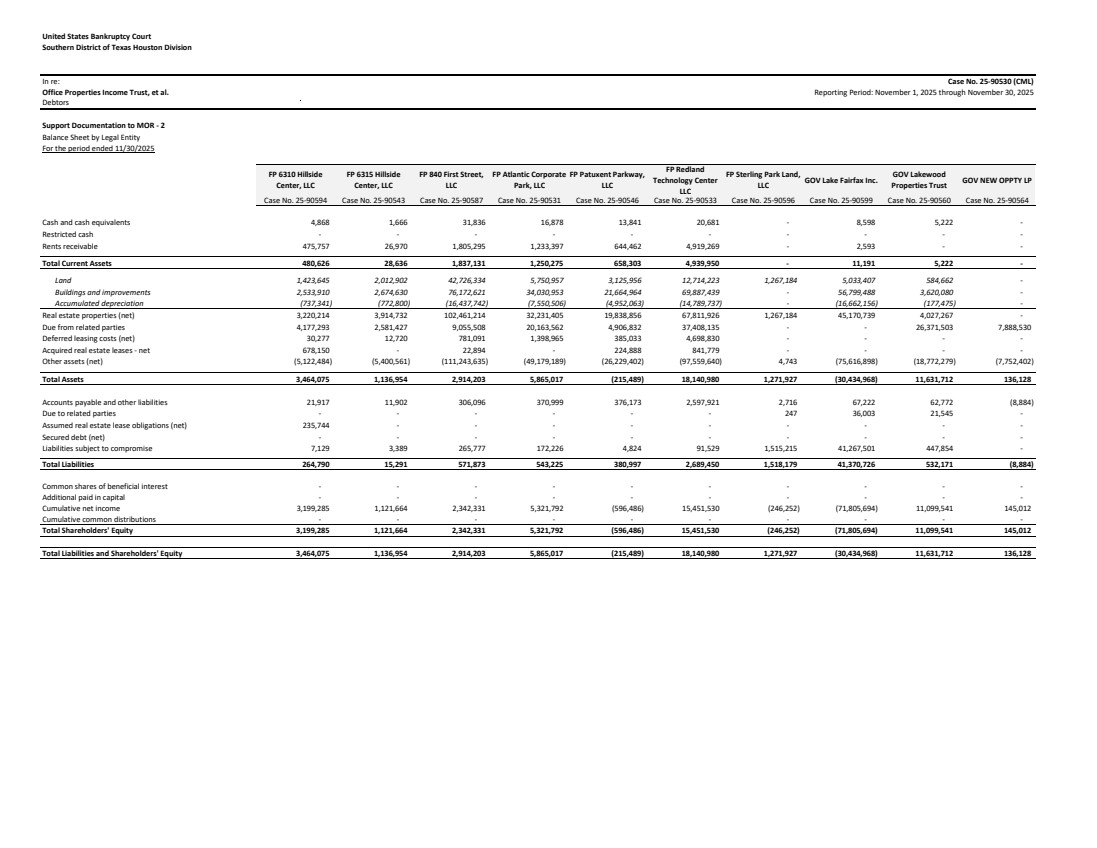

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 2 Balance Sheet by Legal Entity For the period ended 11/30/2025 Cash and cash equivalents Restricted cash Rents receivable Total Current Assets Land Buildings and improvements Accumulated depreciation Real estate properties (net) Due from related parties Deferred leasing costs (net) Acquired real estate leases - net Other assets (net) Total Assets Accounts payable and other liabilities Due to related parties Assumed real estate lease obligations (net) Secured debt (net) Liabilities subject to compromise Total Liabilities Common shares of beneficial interest Additional paid in capital Cumulative net income Cumulative common distributions Total Shareholders' Equity Total Liabilities and Shareholders' Equity Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 FP 6310 Hillside Center, LLC FP 6315 Hillside Center, LLC FP 840 First Street, LLC FP Atlantic Corporate Park, LLC FP Patuxent Parkway, LLC FP Redland Technology Center LLC FP Sterling Park Land, LLC GOV Lake Fairfax Inc. GOV Lakewood Properties Trust GOV NEW OPPTY LP Case No. 25-90594 Case No. 25-90543 Case No. 25-90587 Case No. 25-90531 Case No. 25-90546 Case No. 25-90533 Case No. 25-90596 Case No. 25-90599 Case No. 25-90560 Case No. 25-90564 4,868 1,666 31,836 16,878 13,841 20,681 - 8,598 5,222 - - - - - - - - - - - 475,757 26,970 1,805,295 1,233,397 644,462 4,919,269 - 2,593 - - 480,626 28,636 1,837,131 1,250,275 658,303 4,939,950 - 11,191 5,222 - 1,423,645 2,012,902 42,726,334 5,750,957 3,125,956 12,714,223 1,267,184 5,033,407 584,662 - 2,533,910 2,674,630 76,172,621 34,030,953 21,664,964 69,887,439 - 56,799,488 3,620,080 - (737,341) (772,800) (16,437,742) (7,550,506) (4,952,063) (14,789,737) - (16,662,156) (177,475) - 3,220,214 3,914,732 102,461,214 32,231,405 19,838,856 67,811,926 1,267,184 45,170,739 4,027,267 - 4,177,293 2,581,427 9,055,508 20,163,562 4,906,832 37,408,135 - - 26,371,503 7,888,530 30,277 12,720 781,091 1,398,965 385,033 4,698,830 - - - - 678,150 - 22,894 - 224,888 841,779 - - - - (5,122,484) (5,400,561) (111,243,635) (49,179,189) (26,229,402) (97,559,640) 4,743 (75,616,898) (18,772,279) (7,752,402) 3,464,075 1,136,954 2,914,203 5,865,017 (215,489) 18,140,980 1,271,927 (30,434,968) 11,631,712 136,128 21,917 11,902 306,096 370,999 376,173 2,597,921 2,716 67,222 62,772 (8,884) - - - - - - 247 36,003 21,545 - 235,744 - - - - - - - - - - - - - - - - - - - 7,129 3,389 265,777 172,226 4,824 91,529 1,515,215 41,267,501 447,854 - 264,790 15,291 571,873 543,225 380,997 2,689,450 1,518,179 41,370,726 532,171 (8,884) - - - - - - - - - - - - - - - - - - - - 3,199,285 1,121,664 2,342,331 5,321,792 (596,486) 15,451,530 (246,252) (71,805,694) 11,099,541 145,012 - - - - - - - - - - 3,199,285 1,121,664 2,342,331 5,321,792 (596,486) 15,451,530 (246,252) (71,805,694) 11,099,541 145,012 3,464,075 1,136,954 2,914,203 5,865,017 (215,489) 18,140,980 1,271,927 (30,434,968) 11,631,712 136,128 |

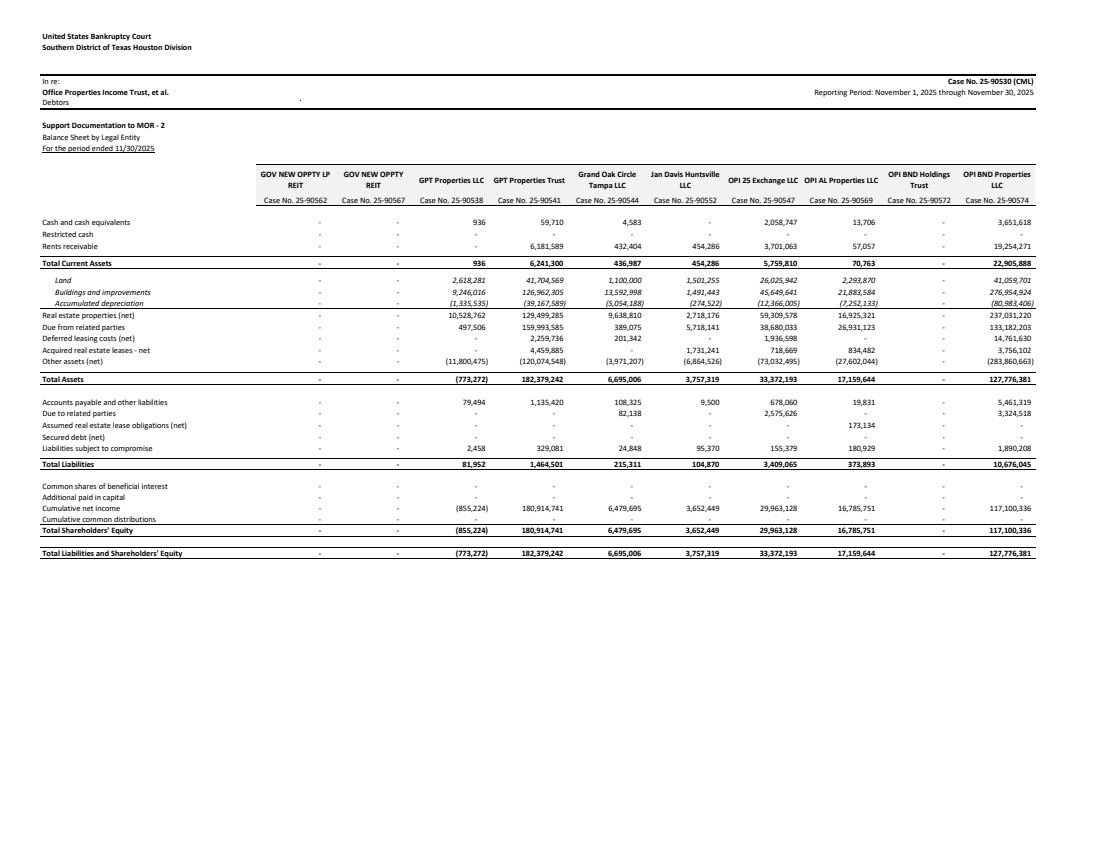

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 2 Balance Sheet by Legal Entity For the period ended 11/30/2025 Cash and cash equivalents Restricted cash Rents receivable Total Current Assets Land Buildings and improvements Accumulated depreciation Real estate properties (net) Due from related parties Deferred leasing costs (net) Acquired real estate leases - net Other assets (net) Total Assets Accounts payable and other liabilities Due to related parties Assumed real estate lease obligations (net) Secured debt (net) Liabilities subject to compromise Total Liabilities Common shares of beneficial interest Additional paid in capital Cumulative net income Cumulative common distributions Total Shareholders' Equity Total Liabilities and Shareholders' Equity Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 GOV NEW OPPTY LP REIT GOV NEW OPPTY REIT GPT Properties LLC GPT Properties Trust Grand Oak Circle Tampa LLC Jan Davis Huntsville LLC OPI 25 Exchange LLC OPI AL Properties LLC OPI BND Holdings Trust OPI BND Properties LLC Case No. 25-90562 Case No. 25-90567 Case No. 25-90538 Case No. 25-90541 Case No. 25-90544 Case No. 25-90552 Case No. 25-90547 Case No. 25-90569 Case No. 25-90572 Case No. 25-90574 - - 936 59,710 4,583 - 2,058,747 13,706 - 3,651,618 - - - - - - - - - - - - - 6,181,589 432,404 454,286 3,701,063 57,057 - 19,254,271 - - 936 6,241,300 436,987 454,286 5,759,810 70,763 - 22,905,888 - - 2,618,281 41,704,569 1,100,000 1,501,255 26,025,942 2,293,870 - 41,059,701 - - 9,246,016 126,962,305 13,592,998 1,491,443 45,649,641 21,883,584 - 276,954,924 - - (1,335,535) (39,167,589) (5,054,188) (274,522) (12,366,005) (7,252,133) - (80,983,406) - - 10,528,762 129,499,285 9,638,810 2,718,176 59,309,578 16,925,321 - 237,031,220 - - 497,506 159,993,585 389,075 5,718,141 38,680,033 26,931,123 - 133,182,203 - - - 2,259,736 201,342 - 1,936,598 - - 14,761,630 - - - 4,459,885 - 1,731,241 718,669 834,482 - 3,756,102 - - (11,800,475) (120,074,548) (3,971,207) (6,864,526) (73,032,495) (27,602,044) - (283,860,663) - - (773,272) 182,379,242 6,695,006 3,757,319 33,372,193 17,159,644 - 127,776,381 - - 79,494 1,135,420 108,325 9,500 678,060 19,831 - 5,461,319 - - - - 82,138 - 2,575,626 - - 3,324,518 - - - - - - - 173,134 - - - - - - - - - - - - - - 2,458 329,081 24,848 95,370 155,379 180,929 - 1,890,208 - - 81,952 1,464,501 215,311 104,870 3,409,065 373,893 - 10,676,045 - - - - - - - - - - - - - - - - - - - - - - (855,224) 180,914,741 6,479,695 3,652,449 29,963,128 16,785,751 - 117,100,336 - - - - - - - - - - - - (855,224) 180,914,741 6,479,695 3,652,449 29,963,128 16,785,751 - 117,100,336 - - (773,272) 182,379,242 6,695,006 3,757,319 33,372,193 17,159,644 - 127,776,381 |

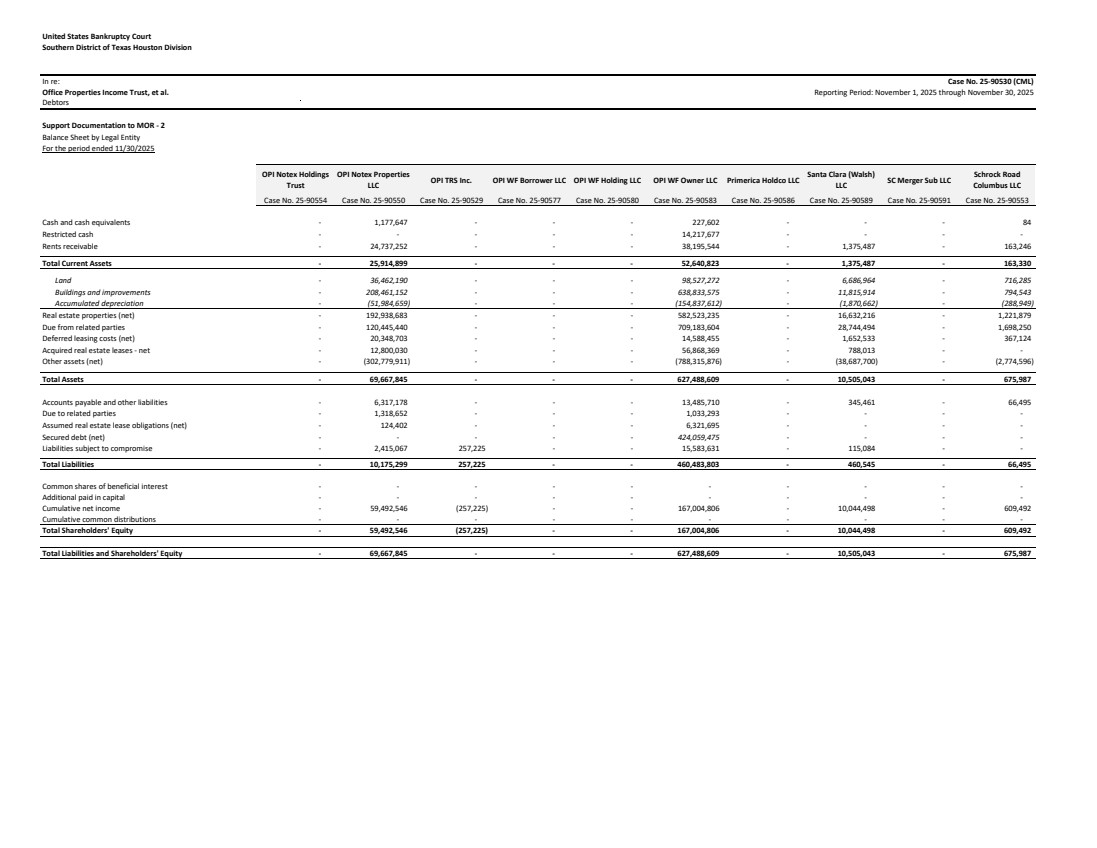

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 2 Balance Sheet by Legal Entity For the period ended 11/30/2025 Cash and cash equivalents Restricted cash Rents receivable Total Current Assets Land Buildings and improvements Accumulated depreciation Real estate properties (net) Due from related parties Deferred leasing costs (net) Acquired real estate leases - net Other assets (net) Total Assets Accounts payable and other liabilities Due to related parties Assumed real estate lease obligations (net) Secured debt (net) Liabilities subject to compromise Total Liabilities Common shares of beneficial interest Additional paid in capital Cumulative net income Cumulative common distributions Total Shareholders' Equity Total Liabilities and Shareholders' Equity Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 OPI Notex Holdings Trust OPI Notex Properties LLC OPI TRS Inc. OPI WF Borrower LLC OPI WF Holding LLC OPI WF Owner LLC Primerica Holdco LLC Santa Clara (Walsh) LLC SC Merger Sub LLC Schrock Road Columbus LLC Case No. 25-90554 Case No. 25-90550 Case No. 25-90529 Case No. 25-90577 Case No. 25-90580 Case No. 25-90583 Case No. 25-90586 Case No. 25-90589 Case No. 25-90591 Case No. 25-90553 - 1,177,647 - - - 227,602 - - - 84 - - - - - 14,217,677 - - - - - 24,737,252 - - - 38,195,544 - 1,375,487 - 163,246 - 25,914,899 - - - 52,640,823 - 1,375,487 - 163,330 - 36,462,190 - - - 98,527,272 - 6,686,964 - 716,285 - 208,461,152 - - - 638,833,575 - 11,815,914 - 794,543 - (51,984,659) - - - (154,837,612) - (1,870,662) - (288,949) - 192,938,683 - - - 582,523,235 - 16,632,216 - 1,221,879 - 120,445,440 - - - 709,183,604 - 28,744,494 - 1,698,250 - 20,348,703 - - - 14,588,455 - 1,652,533 - 367,124 - 12,800,030 - - - 56,868,369 - 788,013 - - - (302,779,911) - - - (788,315,876) - (38,687,700) - (2,774,596) - 69,667,845 - - - 627,488,609 - 10,505,043 - 675,987 - 6,317,178 - - - 13,485,710 - 345,461 - 66,495 - 1,318,652 - - - 1,033,293 - - - - - 124,402 - - - 6,321,695 - - - - - - - - - 424,059,475 - - - - - 2,415,067 257,225 - - 15,583,631 - 115,084 - - - 10,175,299 257,225 - - 460,483,803 - 460,545 - 66,495 - - - - - - - - - - - - - - - - - - - - - 59,492,546 (257,225) - - 167,004,806 - 10,044,498 - 609,492 - - - - - - - - - - - 59,492,546 (257,225) - - 167,004,806 - 10,044,498 - 609,492 - 69,667,845 - - - 627,488,609 - 10,505,043 - 675,987 |

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 2 Balance Sheet by Legal Entity For the period ended 11/30/2025 Cash and cash equivalents Restricted cash Rents receivable Total Current Assets Land Buildings and improvements Accumulated depreciation Real estate properties (net) Due from related parties Deferred leasing costs (net) Acquired real estate leases - net Other assets (net) Total Assets Accounts payable and other liabilities Due to related parties Assumed real estate lease obligations (net) Secured debt (net) Liabilities subject to compromise Total Liabilities Common shares of beneficial interest Additional paid in capital Cumulative net income Cumulative common distributions Total Shareholders' Equity Total Liabilities and Shareholders' Equity Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 SIR Campbell Place Inc. SIR Centennial LLC SIR Colorado Springs LLC SIR Fort Mill LLC SIR GP Redwood City LLC SIR Holdings Corporation SIR Irving (Freeport) LLC SIR Johnston LLC SIR Omaha LLC SIR Operating Partnership LP Case No. 25-90535 Case No. 25-90595 Case No. 25-90598 Case No. 25-90559 Case No. 25-90561 Case No. 25-90563 Case No. 25-90539 Case No. 25-90566 Case No. 25-90568 Case No. 25-90571 4,470 8,725 3,121,285 - - - 10,024 - 813 - - - - - - - - - - - 746,552 504,260 - 86,383 - - - 84,292 513,833 - 751,022 512,985 3,121,285 86,383 - - 10,024 84,292 514,645 - 2,687,482 6,682,058 - 834,031 - - 12,970,268 2,649,274 4,157,250 - 3,409,718 10,530,095 - 3,034,769 - - 32,416,907 7,996,883 8,741,411 - (1,131,655) (2,049,822) - (606,749) - - (6,051,693) (1,533,145) (1,206,955) - 4,965,545 15,162,331 - 3,262,051 - - 39,335,483 9,113,012 11,691,705 - 2,117,402 79,730 12,005,500 4,335,396 - - 36,884,894 21,424,409 27,144,240 - 418,117 1,121,290 - 147,469 - - - - 731,376 - - - - - - - - 2,220,262 - - (5,523,674) (20,246,585) - (6,224,967) - - (62,695,756) (26,360,166) (30,656,400) - 2,728,412 (3,370,249) 15,126,785 1,606,331 - - 13,534,645 6,481,809 9,425,566 - 256,399 469,691 0 73,215 - - 121,770 279,676 817,125 - - - 3,121,285 - - - 33,728 - - - - - - - - - - - - - - - - - - - - - - - 67,628 1,205,345 - - - - 526,878 - 265,426 - 324,027 1,675,036 3,121,285 73,215 - - 682,376 279,676 1,082,551 - - - - - - - - - - - - - - - - - - - - - 2,404,386 (5,045,285) 12,005,500 1,533,117 - - 12,852,269 6,202,133 8,343,015 - - - - - - - - - - - 2,404,386 (5,045,285) 12,005,500 1,533,117 - - 12,852,269 6,202,133 8,343,015 - 2,728,412 (3,370,249) 15,126,785 1,606,331 - - 13,534,645 6,481,809 9,425,566 - |

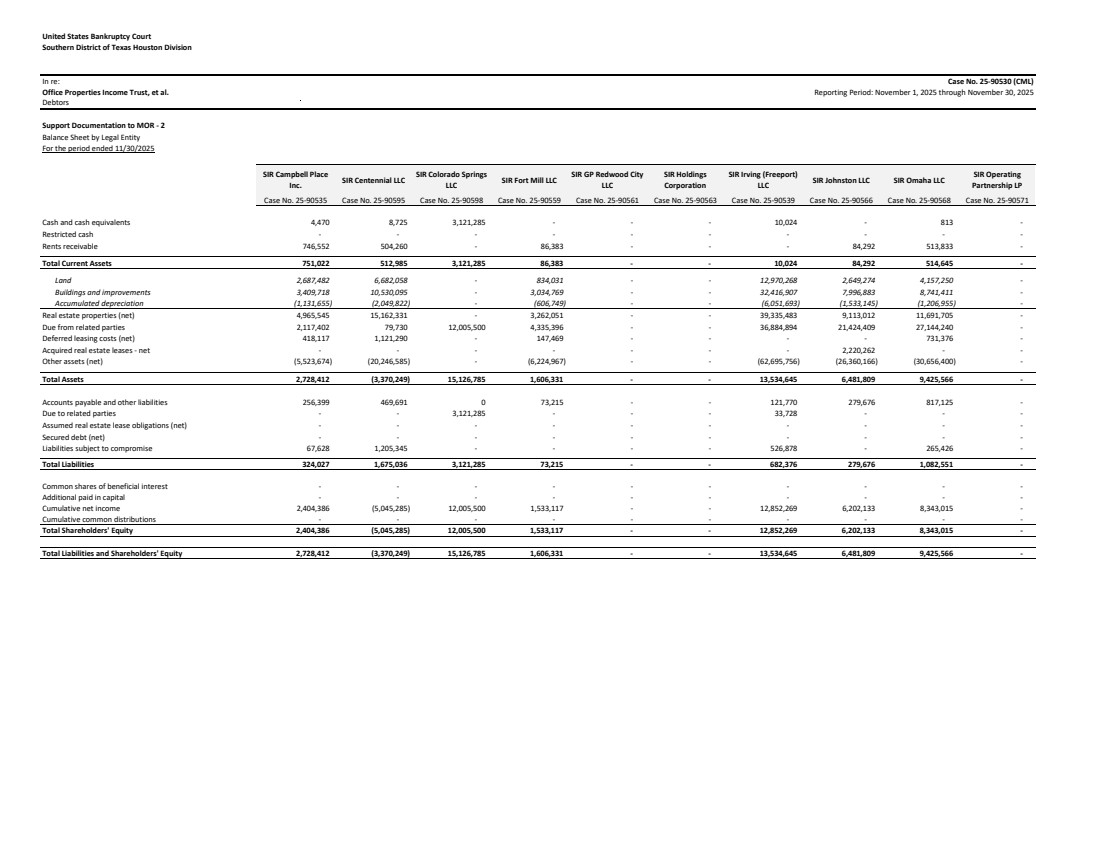

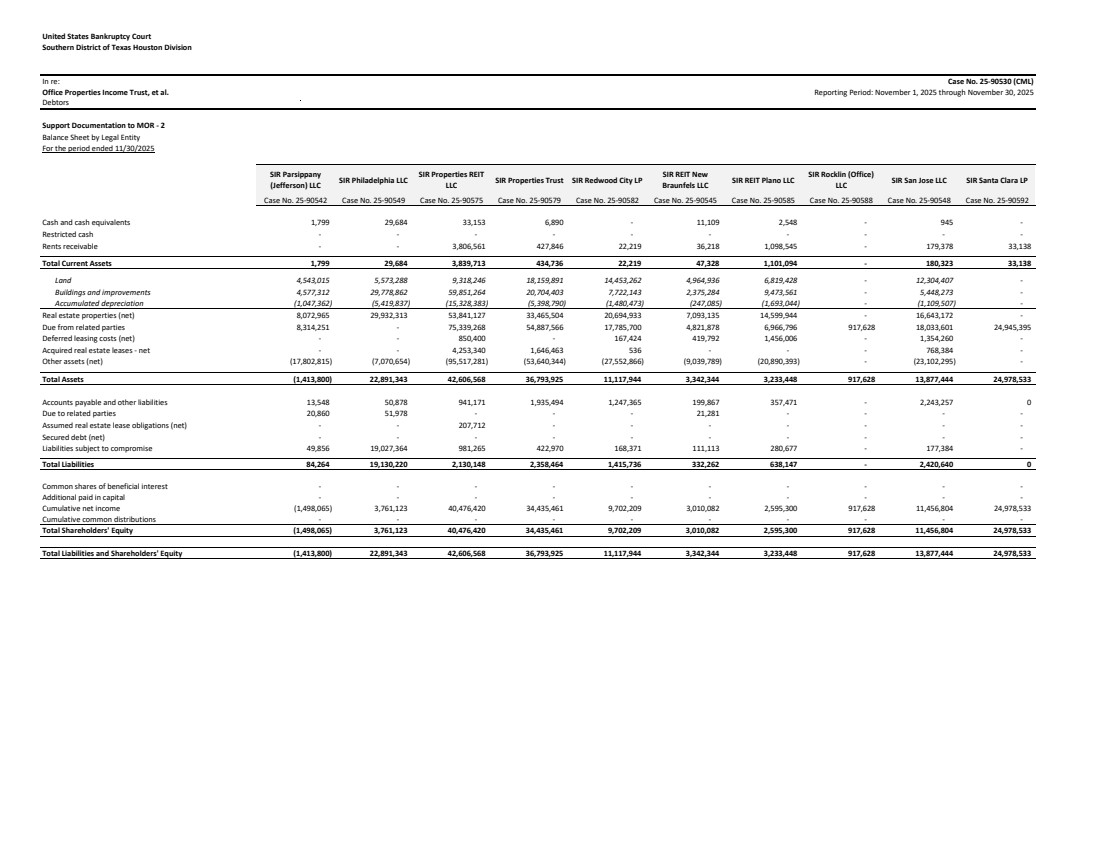

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 2 Balance Sheet by Legal Entity For the period ended 11/30/2025 Cash and cash equivalents Restricted cash Rents receivable Total Current Assets Land Buildings and improvements Accumulated depreciation Real estate properties (net) Due from related parties Deferred leasing costs (net) Acquired real estate leases - net Other assets (net) Total Assets Accounts payable and other liabilities Due to related parties Assumed real estate lease obligations (net) Secured debt (net) Liabilities subject to compromise Total Liabilities Common shares of beneficial interest Additional paid in capital Cumulative net income Cumulative common distributions Total Shareholders' Equity Total Liabilities and Shareholders' Equity Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 SIR Parsippany (Jefferson) LLC SIR Philadelphia LLC SIR Properties REIT LLC SIR Properties Trust SIR Redwood City LP SIR REIT New Braunfels LLC SIR REIT Plano LLC SIR Rocklin (Office) LLC SIR San Jose LLC SIR Santa Clara LP Case No. 25-90542 Case No. 25-90549 Case No. 25-90575 Case No. 25-90579 Case No. 25-90582 Case No. 25-90545 Case No. 25-90585 Case No. 25-90588 Case No. 25-90548 Case No. 25-90592 1,799 29,684 33,153 6,890 - 11,109 2,548 - 945 - - - - - - - - - - - - - 3,806,561 427,846 22,219 36,218 1,098,545 - 179,378 33,138 1,799 29,684 3,839,713 434,736 22,219 47,328 1,101,094 - 180,323 33,138 4,543,015 5,573,288 9,318,246 18,159,891 14,453,262 4,964,936 6,819,428 - 12,304,407 - 4,577,312 29,778,862 59,851,264 20,704,403 7,722,143 2,375,284 9,473,561 - 5,448,273 - (1,047,362) (5,419,837) (15,328,383) (5,398,790) (1,480,473) (247,085) (1,693,044) - (1,109,507) - 8,072,965 29,932,313 53,841,127 33,465,504 20,694,933 7,093,135 14,599,944 - 16,643,172 - 8,314,251 - 75,339,268 54,887,566 17,785,700 4,821,878 6,966,796 917,628 18,033,601 24,945,395 - - 850,400 - 167,424 419,792 1,456,006 - 1,354,260 - - - 4,253,340 1,646,463 536 - - - 768,384 - (17,802,815) (7,070,654) (95,517,281) (53,640,344) (27,552,866) (9,039,789) (20,890,393) - (23,102,295) - (1,413,800) 22,891,343 42,606,568 36,793,925 11,117,944 3,342,344 3,233,448 917,628 13,877,444 24,978,533 13,548 50,878 941,171 1,935,494 1,247,365 199,867 357,471 - 2,243,257 0 20,860 51,978 - - - 21,281 - - - - - - 207,712 - - - - - - - - - - - - - - - - - 49,856 19,027,364 981,265 422,970 168,371 111,113 280,677 - 177,384 - 84,264 19,130,220 2,130,148 2,358,464 1,415,736 332,262 638,147 - 2,420,640 0 - - - - - - - - - - - - - - - - - - - - (1,498,065) 3,761,123 40,476,420 34,435,461 9,702,209 3,010,082 2,595,300 917,628 11,456,804 24,978,533 - - - - - - - - - - (1,498,065) 3,761,123 40,476,420 34,435,461 9,702,209 3,010,082 2,595,300 917,628 11,456,804 24,978,533 (1,413,800) 22,891,343 42,606,568 36,793,925 11,117,944 3,342,344 3,233,448 917,628 13,877,444 24,978,533 |

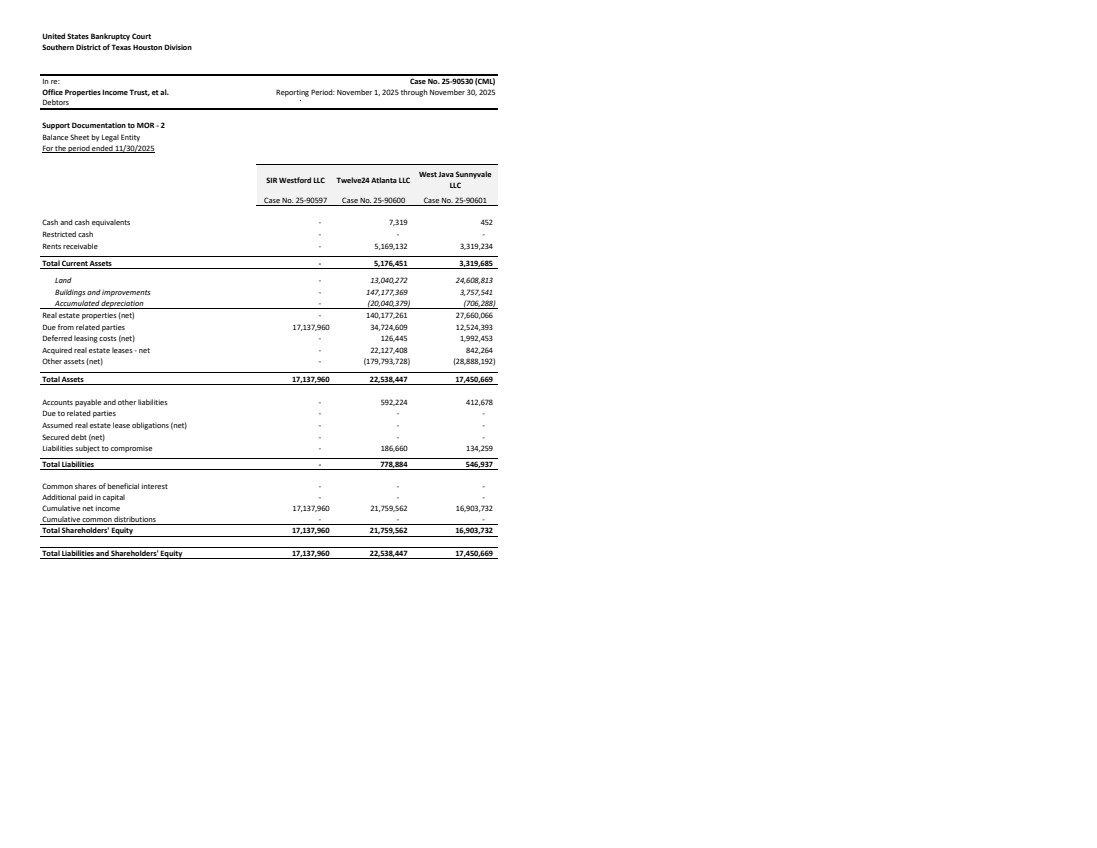

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 2 Balance Sheet by Legal Entity For the period ended 11/30/2025 Cash and cash equivalents Restricted cash Rents receivable Total Current Assets Land Buildings and improvements Accumulated depreciation Real estate properties (net) Due from related parties Deferred leasing costs (net) Acquired real estate leases - net Other assets (net) Total Assets Accounts payable and other liabilities Due to related parties Assumed real estate lease obligations (net) Secured debt (net) Liabilities subject to compromise Total Liabilities Common shares of beneficial interest Additional paid in capital Cumulative net income Cumulative common distributions Total Shareholders' Equity Total Liabilities and Shareholders' Equity Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 SIR Westford LLC Twelve24 Atlanta LLC West Java Sunnyvale LLC Case No. 25-90597 Case No. 25-90600 Case No. 25-90601 - 7,319 452 - - - - 5,169,132 3,319,234 - 5,176,451 3,319,685 - 13,040,272 24,608,813 - 147,177,369 3,757,541 - (20,040,379) (706,288) - 140,177,261 27,660,066 17,137,960 34,724,609 12,524,393 - 126,445 1,992,453 - 22,127,408 842,264 - (179,793,728) (28,888,192) 17,137,960 22,538,447 17,450,669 - 592,224 412,678 - - - - - - - - - - 186,660 134,259 - 778,884 546,937 - - - - - - 17,137,960 21,759,562 16,903,732 - - - 17,137,960 21,759,562 16,903,732 17,137,960 22,538,447 17,450,669 |

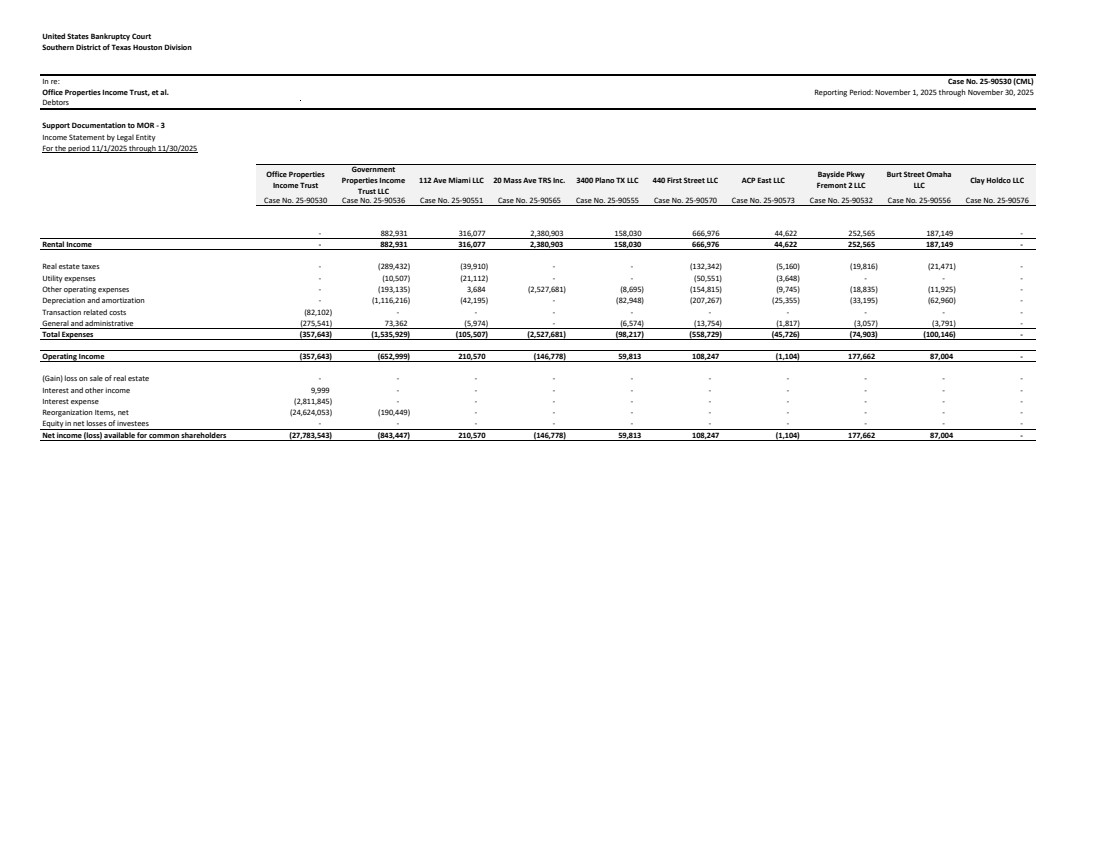

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Case No. 25-90530 (CML) Office Properties Income Trust, et al. Reporting Period: November 1, 2025 through November 30, 2025 Debtors Support Documentation to MOR - 3 Income Statement by Legal Entity For the period 11/1/2025 through 11/30/2025 Office Properties Income Trust Government Properties Income Trust LLC 112 Ave Miami LLC 20 Mass Ave TRS Inc. 3400 Plano TX LLC 440 First Street LLC ACP East LLC Bayside Pkwy Fremont 2 LLC Burt Street Omaha LLC Clay Holdco LLC Case No. 25-90530 Case No. 25-90536 Case No. 25-90551 Case No. 25-90565 Case No. 25-90555 Case No. 25-90570 Case No. 25-90573 Case No. 25-90532 Case No. 25-90556 Case No. 25-90576 - 882,931 316,077 2,380,903 158,030 666,976 44,622 252,565 187,149 - Rental Income - 882,931 316,077 2,380,903 158,030 666,976 44,622 252,565 187,149 - Real estate taxes - (289,432) (39,910) - - (132,342) (5,160) (19,816) (21,471) - Utility expenses - (10,507) (21,112) - - (50,551) (3,648) - - - Other operating expenses - (193,135) 3,684 (2,527,681) (8,695) (154,815) (9,745) (18,835) (11,925) - Depreciation and amortization - (1,116,216) (42,195) - (82,948) (207,267) (25,355) (33,195) (62,960) - Transaction related costs (82,102) - - - - - - - - - General and administrative (275,541) 73,362 (5,974) - (6,574) (13,754) (1,817) (3,057) (3,791) - Total Expenses (357,643) (1,535,929) (105,507) (2,527,681) (98,217) (558,729) (45,726) (74,903) (100,146) - Operating Income (357,643) (652,999) 210,570 (146,778) 59,813 108,247 (1,104) 177,662 87,004 - (Gain) loss on sale of real estate - - - - - - - - - - Interest and other income 9,999 - - - - - - - - - Interest expense (2,811,845) - - - - - - - - - Reorganization Items, net (24,624,053) (190,449) - - - - - - - - Equity in net losses of investees - - - - - - - - - - Net income (loss) available for common shareholders (27,783,543) (843,447) 210,570 (146,778) 59,813 108,247 (1,104) 177,662 87,004 - |

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 3 Income Statement by Legal Entity For the period 11/1/2025 through 11/30/2025 Rental Income Real estate taxes Utility expenses Other operating expenses Depreciation and amortization Transaction related costs General and administrative Total Expenses Operating Income (Gain) loss on sale of real estate Interest and other income Interest expense Reorganization Items, net Equity in net losses of investees Net income (loss) available for common shareholders Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 Clay Road Houston LLC CRI SIR LLC Elliott Ave Seattle LLC Ewing Holdco LLC First Potomac DC Holdings, LLC FP 11 Dupont Circle, LLC FP 1211 Connecticut Avenue, LLC FP 1401 K, LLC FP 1775 Wiehle Avenue, LLC FP 540 Gaither, LLC Case No. 25-90557 Case No. 25-90578 Case No. 25-90558 Case No. 25-90581 Case No. 25-90584 Case No. 25-90534 Case No. 25-90590 Case No. 25-90540 Case No. 25-90593 Case No. 25-90537 192,703 - 683,638 - - 673,085 214,332 325,025 257,614 162,122 192,703 - 683,638 - - 673,085 214,332 325,025 257,614 162,122 - - (141,428) - - (73,635) (61,081) (72,235) (24,283) (36,121) - - (40,766) - - (31,381) (27,642) (14,026) (27,121) (16,399) (3,356) - (228,181) - - (138,603) (75,904) (104,720) (80,140) (52,380) (62,968) - (866,606) - - (348,442) (104,636) (197,155) (155,443) (100,227) - - - - - - - - - - (6,506) - (59,511) - - (21,638) (13,696) (16,679) (8,363) (7,790) (72,830) - (1,336,492) - - (613,699) (282,958) (404,815) (295,350) (212,916) 119,873 - (652,854) - - 59,387 (68,626) (79,790) (37,736) (50,794) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 119,873 - (652,854) - - 59,387 (68,626) (79,790) (37,736) (50,794) |

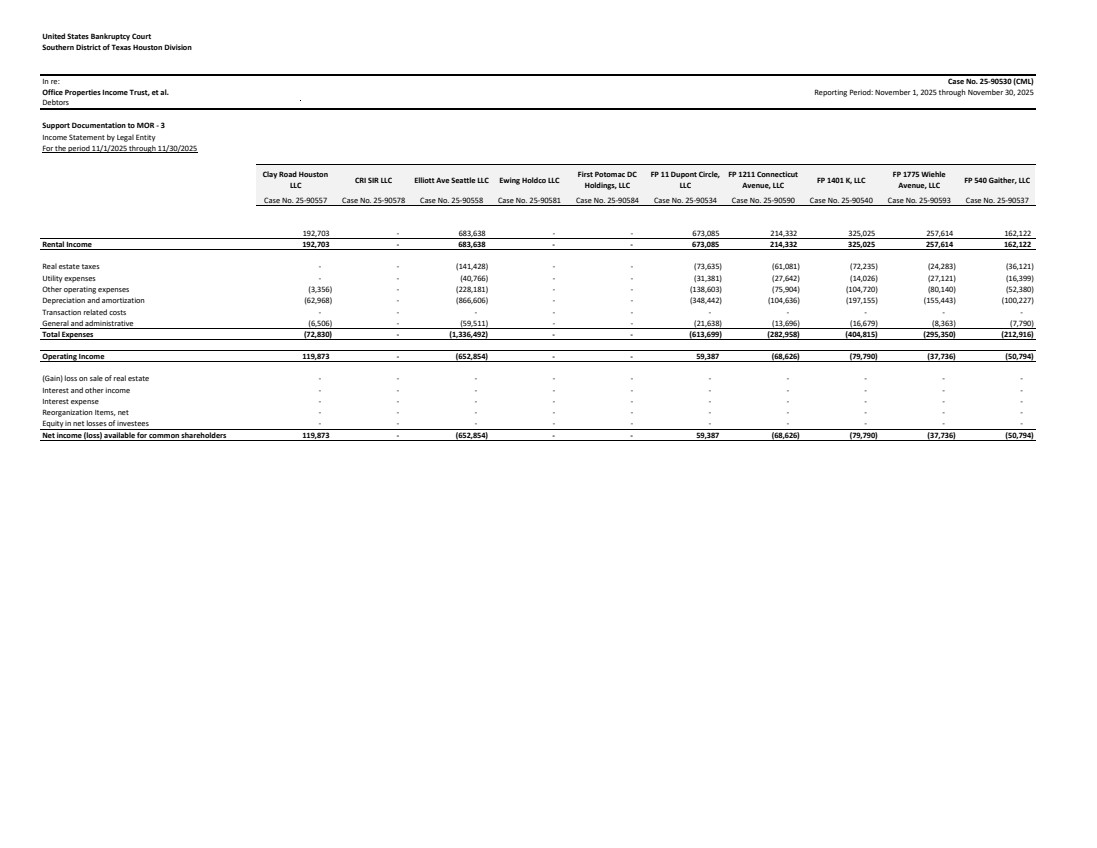

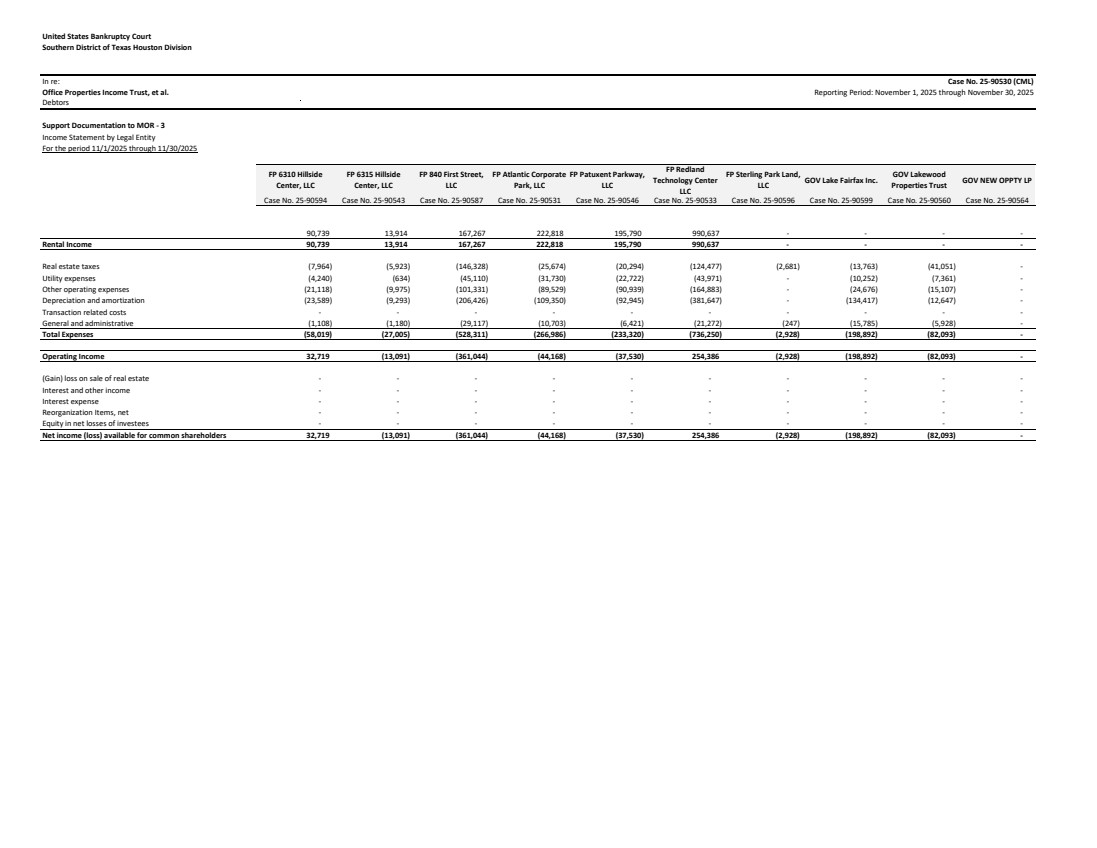

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 3 Income Statement by Legal Entity For the period 11/1/2025 through 11/30/2025 Rental Income Real estate taxes Utility expenses Other operating expenses Depreciation and amortization Transaction related costs General and administrative Total Expenses Operating Income (Gain) loss on sale of real estate Interest and other income Interest expense Reorganization Items, net Equity in net losses of investees Net income (loss) available for common shareholders Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 FP 6310 Hillside Center, LLC FP 6315 Hillside Center, LLC FP 840 First Street, LLC FP Atlantic Corporate Park, LLC FP Patuxent Parkway, LLC FP Redland Technology Center LLC FP Sterling Park Land, LLC GOV Lake Fairfax Inc. GOV Lakewood Properties Trust GOV NEW OPPTY LP Case No. 25-90594 Case No. 25-90543 Case No. 25-90587 Case No. 25-90531 Case No. 25-90546 Case No. 25-90533 Case No. 25-90596 Case No. 25-90599 Case No. 25-90560 Case No. 25-90564 90,739 13,914 167,267 222,818 195,790 990,637 - - - - 90,739 13,914 167,267 222,818 195,790 990,637 - - - - (7,964) (5,923) (146,328) (25,674) (20,294) (124,477) (2,681) (13,763) (41,051) - (4,240) (634) (45,110) (31,730) (22,722) (43,971) - (10,252) (7,361) - (21,118) (9,975) (101,331) (89,529) (90,939) (164,883) - (24,676) (15,107) - (23,589) (9,293) (206,426) (109,350) (92,945) (381,647) - (134,417) (12,647) - - - - - - - - - - - (1,108) (1,180) (29,117) (10,703) (6,421) (21,272) (247) (15,785) (5,928) - (58,019) (27,005) (528,311) (266,986) (233,320) (736,250) (2,928) (198,892) (82,093) - 32,719 (13,091) (361,044) (44,168) (37,530) 254,386 (2,928) (198,892) (82,093) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 32,719 (13,091) (361,044) (44,168) (37,530) 254,386 (2,928) (198,892) (82,093) - |

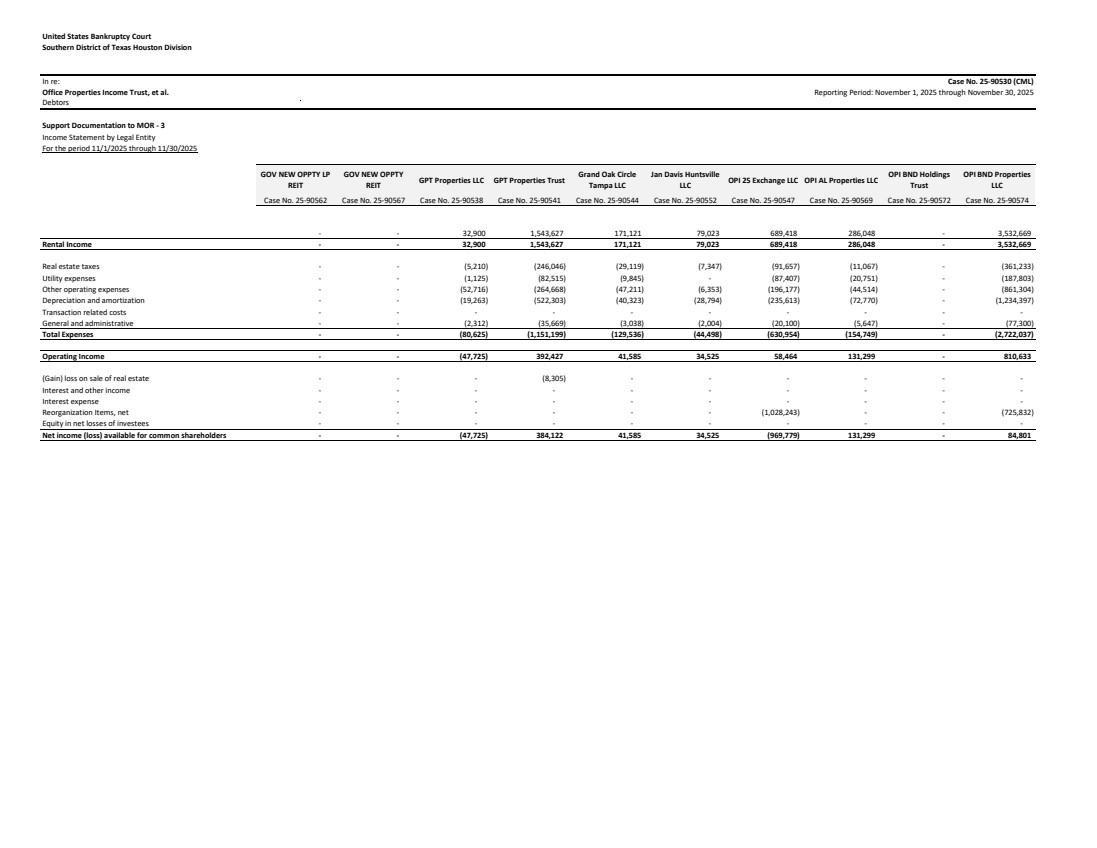

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 3 Income Statement by Legal Entity For the period 11/1/2025 through 11/30/2025 Rental Income Real estate taxes Utility expenses Other operating expenses Depreciation and amortization Transaction related costs General and administrative Total Expenses Operating Income (Gain) loss on sale of real estate Interest and other income Interest expense Reorganization Items, net Equity in net losses of investees Net income (loss) available for common shareholders Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 GOV NEW OPPTY LP REIT GOV NEW OPPTY REIT GPT Properties LLC GPT Properties Trust Grand Oak Circle Tampa LLC Jan Davis Huntsville LLC OPI 25 Exchange LLC OPI AL Properties LLC OPI BND Holdings Trust OPI BND Properties LLC Case No. 25-90562 Case No. 25-90567 Case No. 25-90538 Case No. 25-90541 Case No. 25-90544 Case No. 25-90552 Case No. 25-90547 Case No. 25-90569 Case No. 25-90572 Case No. 25-90574 - - 32,900 1,543,627 171,121 79,023 689,418 286,048 - 3,532,669 - - 32,900 1,543,627 171,121 79,023 689,418 286,048 - 3,532,669 - - (5,210) (246,046) (29,119) (7,347) (91,657) (11,067) - (361,233) - - (1,125) (82,515) (9,845) - (87,407) (20,751) - (187,803) - - (52,716) (264,668) (47,211) (6,353) (196,177) (44,514) - (861,304) - - (19,263) (522,303) (40,323) (28,794) (235,613) (72,770) - (1,234,397) - - - - - - - - - - - - (2,312) (35,669) (3,038) (2,004) (20,100) (5,647) - (77,300) - - (80,625) (1,151,199) (129,536) (44,498) (630,954) (154,749) - (2,722,037) - - (47,725) 392,427 41,585 34,525 58,464 131,299 - 810,633 - - - (8,305) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (1,028,243) - - (725,832) - - - - - - - - - - - - (47,725) 384,122 41,585 34,525 (969,779) 131,299 - 84,801 |

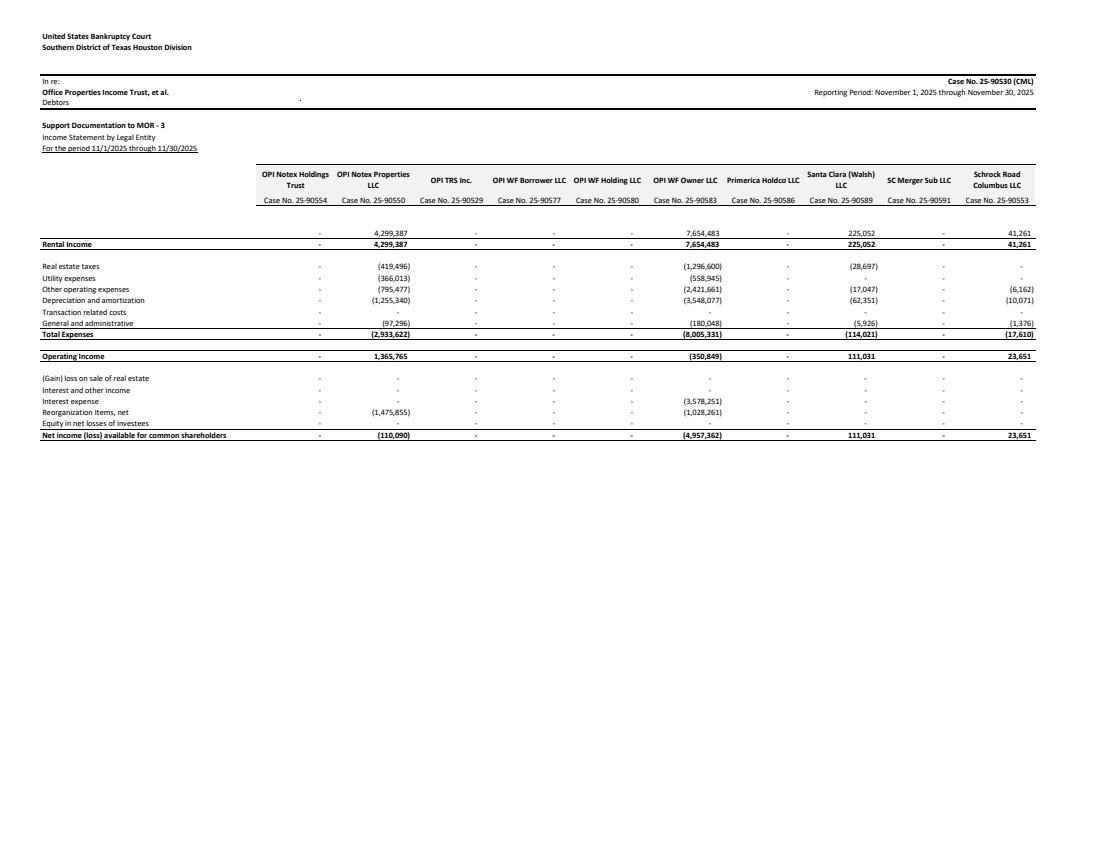

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 3 Income Statement by Legal Entity For the period 11/1/2025 through 11/30/2025 Rental Income Real estate taxes Utility expenses Other operating expenses Depreciation and amortization Transaction related costs General and administrative Total Expenses Operating Income (Gain) loss on sale of real estate Interest and other income Interest expense Reorganization Items, net Equity in net losses of investees Net income (loss) available for common shareholders Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 OPI Notex Holdings Trust OPI Notex Properties LLC OPI TRS Inc. OPI WF Borrower LLC OPI WF Holding LLC OPI WF Owner LLC Primerica Holdco LLC Santa Clara (Walsh) LLC SC Merger Sub LLC Schrock Road Columbus LLC Case No. 25-90554 Case No. 25-90550 Case No. 25-90529 Case No. 25-90577 Case No. 25-90580 Case No. 25-90583 Case No. 25-90586 Case No. 25-90589 Case No. 25-90591 Case No. 25-90553 - 4,299,387 - - - 7,654,483 - 225,052 - 41,261 - 4,299,387 - - - 7,654,483 - 225,052 - 41,261 - (419,496) - - - (1,296,600) - (28,697) - - - (366,013) - - - (558,945) - - - - - (795,477) - - - (2,421,661) - (17,047) - (6,162) - (1,255,340) - - - (3,548,077) - (62,351) - (10,071) - - - - - - - - - - - (97,296) - - - (180,048) - (5,926) - (1,376) - (2,933,622) - - - (8,005,331) - (114,021) - (17,610) - 1,365,765 - - - (350,849) - 111,031 - 23,651 - - - - - - - - - - - - - - - - - - - - - - - - - (3,578,251) - - - - - (1,475,855) - - - (1,028,261) - - - - - - - - - - - - - - - (110,090) - - - (4,957,362) - 111,031 - 23,651 |

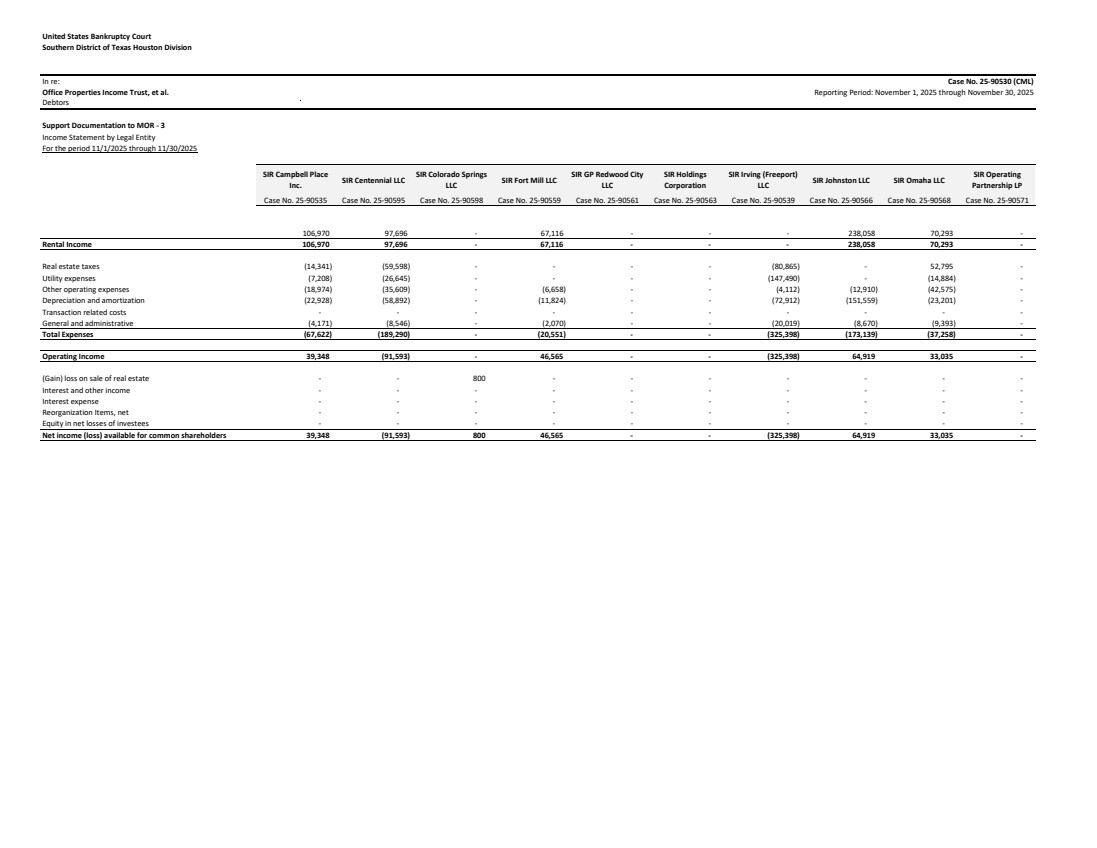

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 3 Income Statement by Legal Entity For the period 11/1/2025 through 11/30/2025 Rental Income Real estate taxes Utility expenses Other operating expenses Depreciation and amortization Transaction related costs General and administrative Total Expenses Operating Income (Gain) loss on sale of real estate Interest and other income Interest expense Reorganization Items, net Equity in net losses of investees Net income (loss) available for common shareholders Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 SIR Campbell Place Inc. SIR Centennial LLC SIR Colorado Springs LLC SIR Fort Mill LLC SIR GP Redwood City LLC SIR Holdings Corporation SIR Irving (Freeport) LLC SIR Johnston LLC SIR Omaha LLC SIR Operating Partnership LP Case No. 25-90535 Case No. 25-90595 Case No. 25-90598 Case No. 25-90559 Case No. 25-90561 Case No. 25-90563 Case No. 25-90539 Case No. 25-90566 Case No. 25-90568 Case No. 25-90571 106,970 97,696 - 67,116 - - - 238,058 70,293 - 106,970 97,696 - 67,116 - - - 238,058 70,293 - (14,341) (59,598) - - - - (80,865) - 52,795 - (7,208) (26,645) - - - - (147,490) - (14,884) - (18,974) (35,609) - (6,658) - - (4,112) (12,910) (42,575) - (22,928) (58,892) - (11,824) - - (72,912) (151,559) (23,201) - - - - - - - - - - - (4,171) (8,546) - (2,070) - - (20,019) (8,670) (9,393) - (67,622) (189,290) - (20,551) - - (325,398) (173,139) (37,258) - 39,348 (91,593) - 46,565 - - (325,398) 64,919 33,035 - - - 800 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 39,348 (91,593) 800 46,565 - - (325,398) 64,919 33,035 - |

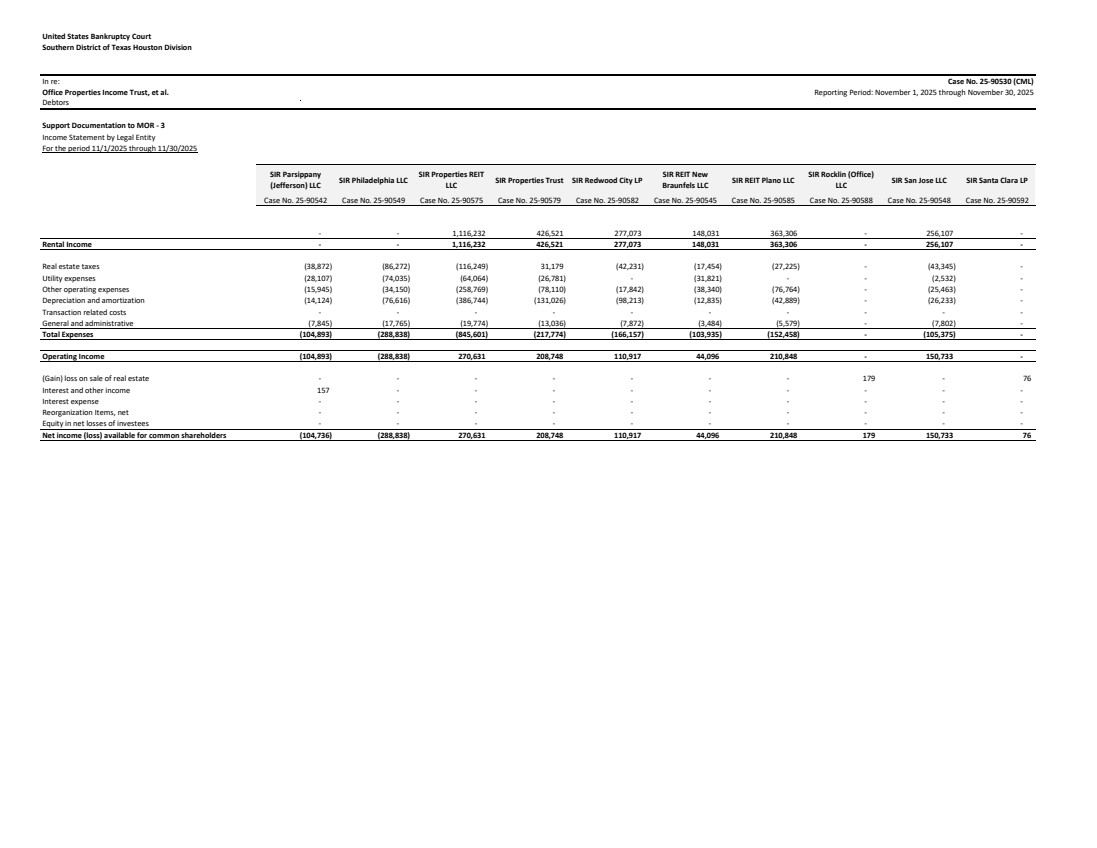

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 3 Income Statement by Legal Entity For the period 11/1/2025 through 11/30/2025 Rental Income Real estate taxes Utility expenses Other operating expenses Depreciation and amortization Transaction related costs General and administrative Total Expenses Operating Income (Gain) loss on sale of real estate Interest and other income Interest expense Reorganization Items, net Equity in net losses of investees Net income (loss) available for common shareholders Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 SIR Parsippany (Jefferson) LLC SIR Philadelphia LLC SIR Properties REIT LLC SIR Properties Trust SIR Redwood City LP SIR REIT New Braunfels LLC SIR REIT Plano LLC SIR Rocklin (Office) LLC SIR San Jose LLC SIR Santa Clara LP Case No. 25-90542 Case No. 25-90549 Case No. 25-90575 Case No. 25-90579 Case No. 25-90582 Case No. 25-90545 Case No. 25-90585 Case No. 25-90588 Case No. 25-90548 Case No. 25-90592 - - 1,116,232 426,521 277,073 148,031 363,306 - 256,107 - - - 1,116,232 426,521 277,073 148,031 363,306 - 256,107 - (38,872) (86,272) (116,249) 31,179 (42,231) (17,454) (27,225) - (43,345) - (28,107) (74,035) (64,064) (26,781) - (31,821) - - (2,532) - (15,945) (34,150) (258,769) (78,110) (17,842) (38,340) (76,764) - (25,463) - (14,124) (76,616) (386,744) (131,026) (98,213) (12,835) (42,889) - (26,233) - - - - - - - - - - - (7,845) (17,765) (19,774) (13,036) (7,872) (3,484) (5,579) - (7,802) - (104,893) (288,838) (845,601) (217,774) (166,157) (103,935) (152,458) - (105,375) - (104,893) (288,838) 270,631 208,748 110,917 44,096 210,848 - 150,733 - - - - - - - - 179 - 76 157 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (104,736) (288,838) 270,631 208,748 110,917 44,096 210,848 179 150,733 76 |

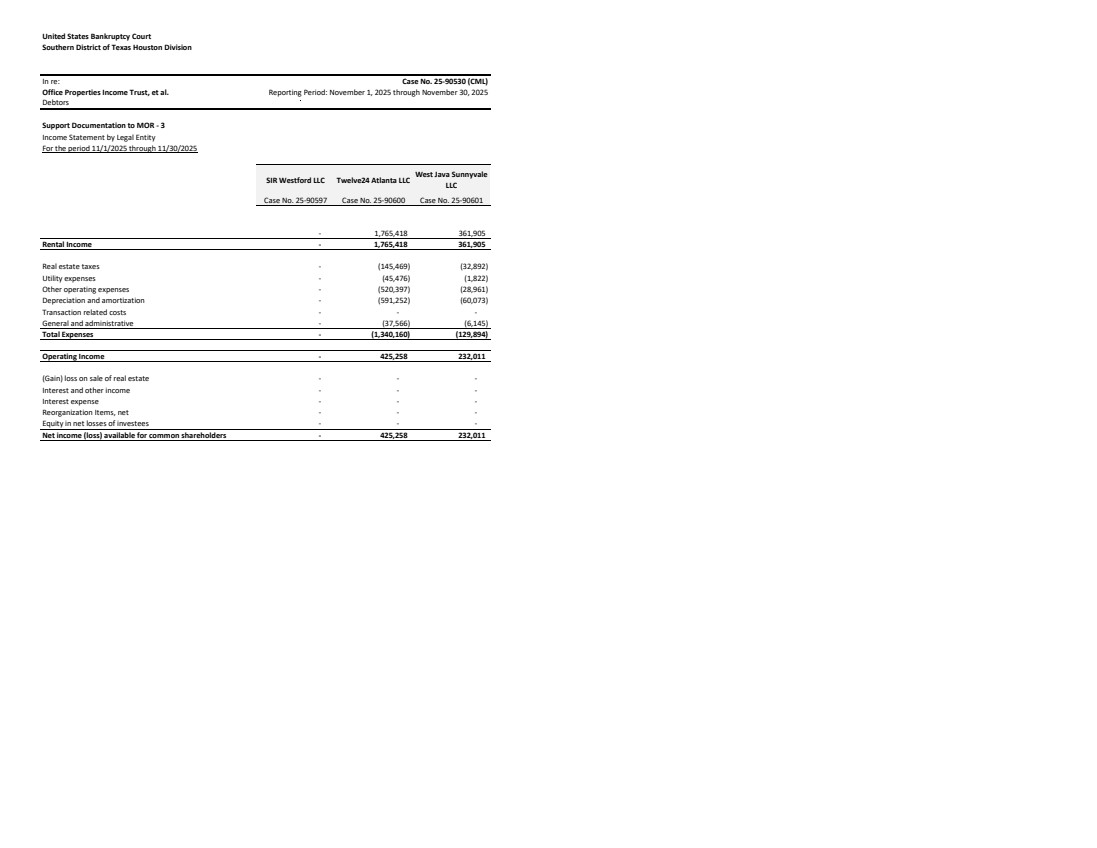

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Office Properties Income Trust, et al. Debtors Support Documentation to MOR - 3 Income Statement by Legal Entity For the period 11/1/2025 through 11/30/2025 Rental Income Real estate taxes Utility expenses Other operating expenses Depreciation and amortization Transaction related costs General and administrative Total Expenses Operating Income (Gain) loss on sale of real estate Interest and other income Interest expense Reorganization Items, net Equity in net losses of investees Net income (loss) available for common shareholders Case No. 25-90530 (CML) Reporting Period: November 1, 2025 through November 30, 2025 SIR Westford LLC Twelve24 Atlanta LLC West Java Sunnyvale LLC Case No. 25-90597 Case No. 25-90600 Case No. 25-90601 - 1,765,418 361,905 - 1,765,418 361,905 - (145,469) (32,892) - (45,476) (1,822) - (520,397) (28,961) - (591,252) (60,073) - - - - (37,566) (6,145) - (1,340,160) (129,894) - 425,258 232,011 - - - - - - - - - - - - - - - - 425,258 232,011 |

|

United States Bankruptcy Court Southern District of Texas Houston Division In re: Case No. 25-90530 (CML) Office Properties Income Trust, et al. Reporting Period: November 1, 2025 through November 30, 2025 Debtors Support Documentation to MOR - 4 Assets Sold or Transferred For the period 11/1/2025 through 11/30/2025 On November 10, 2025, the Debtors filed the Motion of Debtors for Entry of an Order (I) Authorizing and Approving Sale of Property, Free and Clear of All Liens, Claims and Interests, and Encumbrances, and (II) Granting Related Relief [Docket No. 177] (the "Tempe Sale Motion"). On December 3, 2025, the Bankruptcy Court entered the Order (I) Authorizing and Approving Sale of Property, Free and Clear of All Liens, Claims and Interests, and Encumbrances, and (II) Granting Related Relief [Docket No. 241] (the "Tempe Sale Order"), which, among other things, authorized the Debtors to enter into the asset purchase agreement and consummate the transactions contemplated thereunder. The transaction closed on December 19, 2025. In accordance with the Tempe Sale Order, proceeds from the sale have been received and deposited into a segregated account to be held pending further order of the Bankruptcy Court. The Purchase Price (as defined in the Tempe Sale Motion) for the property was approximately $10.7 million. /s/ John R. Castellano December 30, 2025 Signature of Authorized Individual Date John R. Castellano Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual |

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Case No. 25-90530 (CML) Office Properties Income Trust, et al. Reporting Period: November 1, 2025 through November 30, 2025 Debtors Support Documentation to MOR - 5 Schedule of Prepetition Payments For the period 11/1/2025 through 11/30/2025 The Debtors hereby submit this attestation regarding prepetition payments payments during the period of November 1, 2025 through November 30, 2025. /s/ John R. Castellano December 30, 2025 Signature of Authorized Individual Date John R. Castellano Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual All payments made by the Debtors on account of prepetition claims during the period of November 1, 2025 through November 30, 2025 were authorized under First Day Orders granted by the Bankruptcy Court. |

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Case No. 25-90530 (CML) Office Properties Income Trust, et al. Reporting Period: November 1, 2025 through November 30, 2025 Debtors Support Documentation to MOR - 6 Schedule of Payments to Insiders For the period 11/1/2025 through 11/30/2025 The Debtors hereby submit this attestation regarding insider payments payments during the period of November 1, 2025 through November 30, 2025. No payments to insiders were made during this period. /s/ John R. Castellano December 30, 2025 Signature of Authorized Individual Date John R. Castellano Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual |

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Case No. 25-90530 (CML) Office Properties Income Trust, et al. Reporting Period: November 1, 2025 through November 30, 2025 Debtors Support Documentation to MOR - 7 Schedule of Post-Petition Tax Payments For the period 11/1/2025 through 11/30/2025 The Debtors hereby submit this attestation regarding postpetition tax payments during the period of November 1, 2025 through November 30, 2025. The Debtors believe that they are current with respect to any postpetition Taxes and Fees that have come due. /s/ John R. Castellano December 30, 2025 Signature of Authorized Individual Date John R. Castellano Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual |

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Case No. 25-90530 (CML) Office Properties Income Trust, et al. Reporting Period: November 1, 2025 through November 30, 2025 Debtors Support Documentation to MOR - 8 Schedule of Post-Petition Borrowing For the period 11/1/2025 through 11/30/2025 The Debtors hereby submit this attestation regarding postpetition borrowing during the period of November 1, 2025 through November 30, 2025. /s/ John R. Castellano December 30, 2025 Signature of Authorized Individual Date John R. Castellano Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual On November 5, 2025, the Bankruptcy Court entered the Interim Order Pursuant to Sections 105, 361, 362, 363, and 364 of the Bankruptcy Code and Rules 2002, 4001, 6004, and 9014 of the Federal Rules of Bankruptcy Procedure (I) Authorizing the Debtors to Use Cash Collateral and Obtain Secured Postpetition Financing; (II) Granting Liens and Superpriority Administrative Claims; (III) Providing Adequate Protection; (IV) Scheduling a Final Hearing; and (V) Granting Related Relief [Docket No. 150] (the “Interim DIP Order”) authorizing the Debtors to enter into the DIP Documents (as defined in the Interim DIP Order) and obtain post-petition borrowing thereunder. On November 6, 2025, in accordance with the Interim DIP Order, the Debtors drew $10 million under the DIP Facility, net any fees payable to the DIP Agent and any of the DIP Lenders (each as defined in the Interim DIP Order). The Debtors received $9.7 million on November 6, 2025 into their Segregated Account (as defined in the Interim DIP Order). |

| United States Bankruptcy Court Southern District of Texas Houston Division In re: Case No. 25-90530 (CML) Office Properties Income Trust, et al. Reporting Period: November 1, 2025 through November 30, 2025 Debtors Support Documentation to MOR - 9 Bank Statements and Bank Reconciliations For the period 11/1/2025 through 11/30/2025 The Debtors hereby submit this attestation regarding bank account reconciliations in lieu of providing copies of bank reconciliations and journal entries. /s/ John R. Castellano December 30, 2025 Signature of Authorized Individual Date John R. Castellano Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual The Debtors’ standard practice is to ensure that bank reconciliations are completed as part of the month end close each reporting period. I attest that each of the Debtors’ bank accounts has been reconciled in accordance with their standard practices. The Debtors have seperately submitted bank statements for the Debtors' bank accounts covering the periods of November 1, 2025 through November 30, 2025 to the US Trustee. |