.2

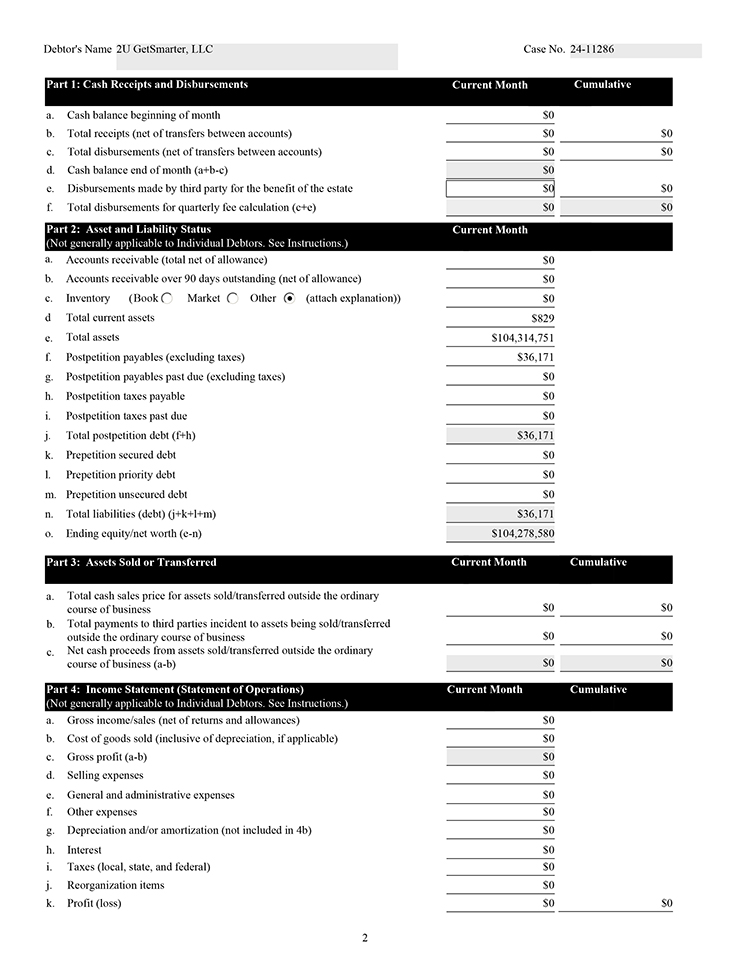

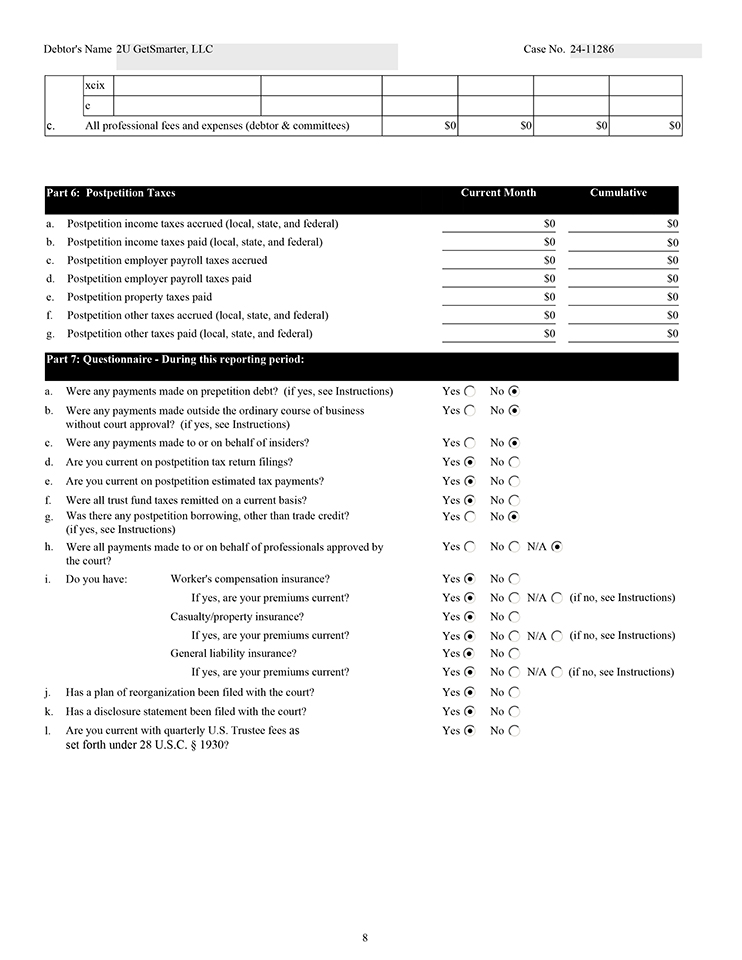

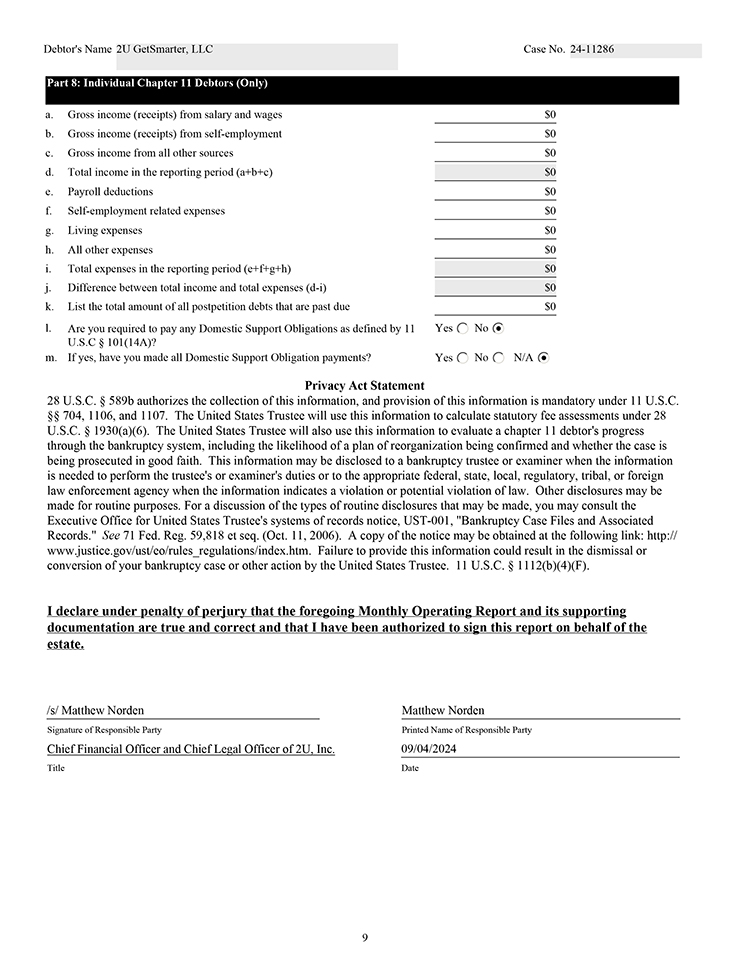

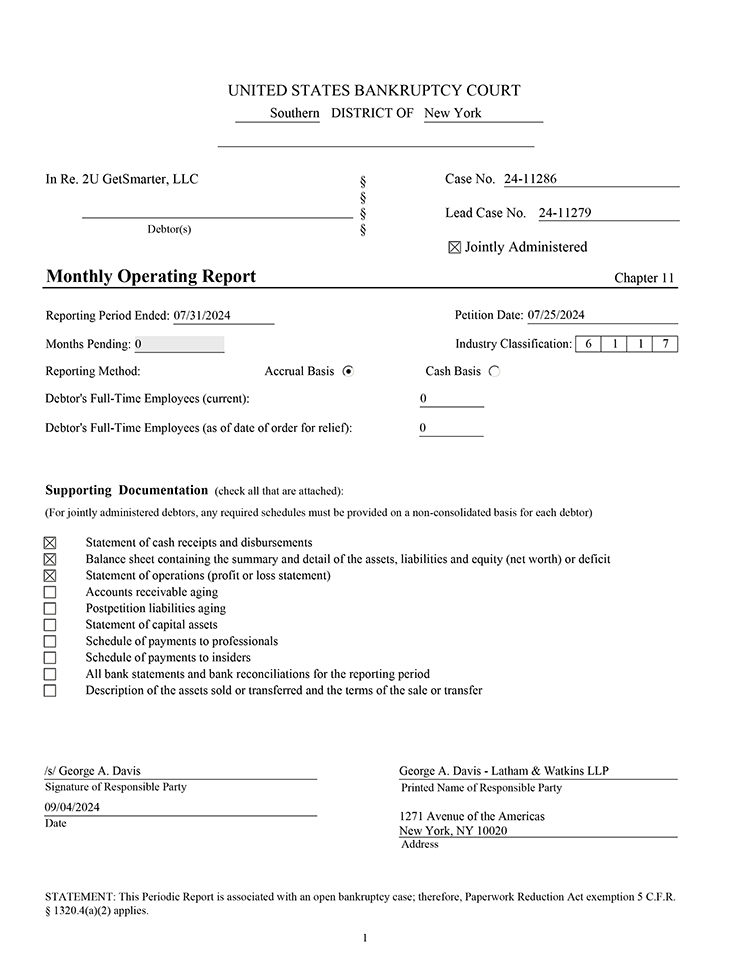

UNITED STATES BANKRUPTCY COURT Southern DISTRICT OF New York In Re. 2U GetSmarter, LLC Debtor(s) Case No. 24-11286 Lead Case No. 24-11279 Jointly Administered Monthly Operating Report Chapter 11 Reporting Period Ended: 07/31/2024 Months Pending: 0 Reporting Method: Debtor's Full-Time Employees (current): 0 Debtor's Full-Time Employees (as of date of order for relief): 0 Accrual Basis Cash Basis Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer /s/ George A. Davis Signature of Responsible Party George A. Davis - Latham & Watkins LLP Printed Name of Responsible Party 09/04/2024 Date 1271 Avenue of the Americas New York, NY 10020 Address STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies. Petition Date: 07/25/2024 Industry Classification: 6117