SI-BONE Corporate Overview January 2026

The statements in this presentation regarding expectations of future events or results, including SI-BONE’s expectations of continued revenue and procedure growth and financial outlook, are “forward-looking” statements. These forward-looking statements are based on SI-BONE’s current expectations and inherently involve significant risks and uncertainties. These risks include SI-BONE's preliminary fourth quarter and full year 2025 revenue and cash and cash equivalents, which are subject to continued review by SI-BONE and its auditors and significant adjustments may be made before final results are determined, SI-BONE’s ability to introduce and commercialize new products and indications, SI-BONE’s ability to maintain favorable reimbursement for procedures using its products, the impact of any future economic weakness or deterioration in economic conditions as a result of tariffs and retaliation by U.S. trading partners on the ability and desire of patients to undergo elective procedures including those using SI-BONE’s products, SI-BONE’s ability to manage risks to its supply chain, future capital requirements driven by new surgical systems requiring instrument tray and implant inventory investment, and the pace of the re-normalization of the healthcare operating environment including the ability and desire of patients and physicians to undergo and perform procedures using SI-BONE’s products. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these and other risks and uncertainties, many of which are described in SI-BONE’s most recent filings on Form 10-K and Form 10-Q, and SI-BONE’s other filings with the Securities and Exchange Commission (SEC) available at the SEC’s Internet site (www.sec.gov), especially under the caption “Risk Factors.” SI-BONE does not undertake any obligation to update forward-looking statements and expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein, except as required by law. 2 Forward-Looking Statements

Financial Update

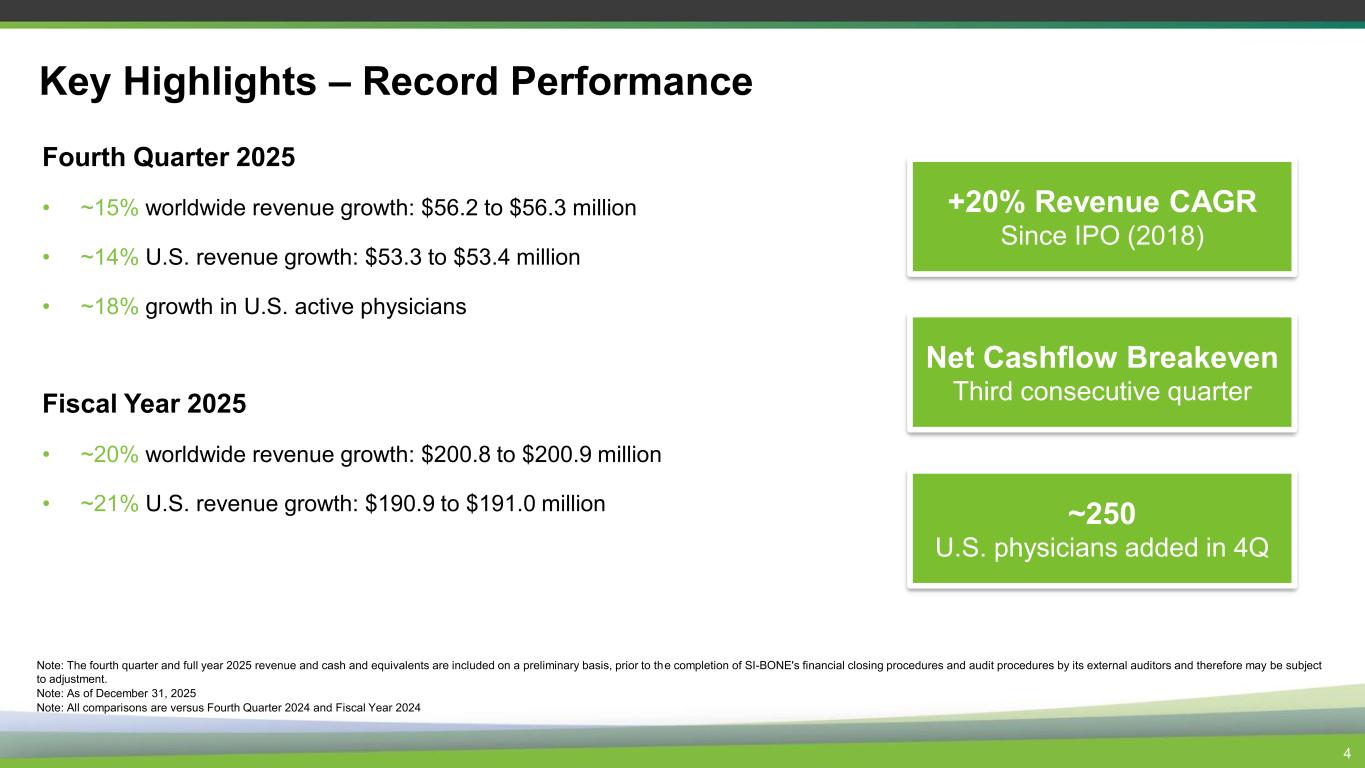

Key Highlights – Record Performance 4 Fourth Quarter 2025 • ~15% worldwide revenue growth: $56.2 to $56.3 million • ~14% U.S. revenue growth: $53.3 to $53.4 million • ~18% growth in U.S. active physicians Fiscal Year 2025 • ~20% worldwide revenue growth: $200.8 to $200.9 million • ~21% U.S. revenue growth: $190.9 to $191.0 million +20% Revenue CAGR Since IPO (2018) Net Cashflow Breakeven Third consecutive quarter Note: The fourth quarter and full year 2025 revenue and cash and equivalents are included on a preliminary basis, prior to the completion of SI-BONE's financial closing procedures and audit procedures by its external auditors and therefore may be subject to adjustment. Note: As of December 31, 2025 Note: All comparisons are versus Fourth Quarter 2024 and Fiscal Year 2024 ~250 U.S. physicians added in 4Q

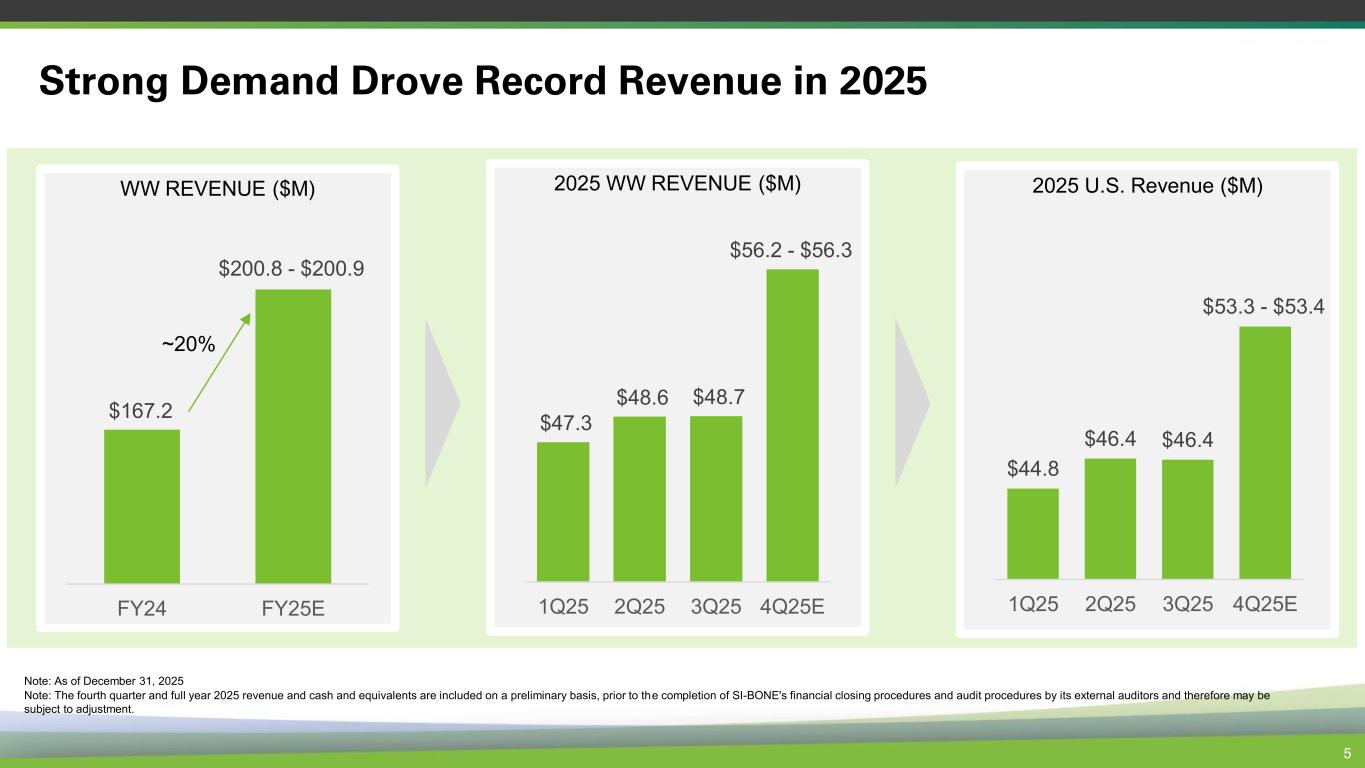

WW REVENUE ($M) Strong Demand Drove Record Revenue in 2025 5 2025 WW REVENUE ($M) 2025 U.S. Revenue ($M) Note: As of December 31, 2025 Note: The fourth quarter and full year 2025 revenue and cash and equivalents are included on a preliminary basis, prior to the completion of SI-BONE's financial closing procedures and audit procedures by its external auditors and therefore may be subject to adjustment. $167.2 FY24 FY25E ~20% $47.3 $48.6 $48.7 1Q25 2Q25 3Q25 4Q25E $44.8 $46.4 $46.4 1Q25 2Q25 3Q25 4Q25E $200.8 - $200.9 $56.2 - $56.3 $53.3 - $53.4

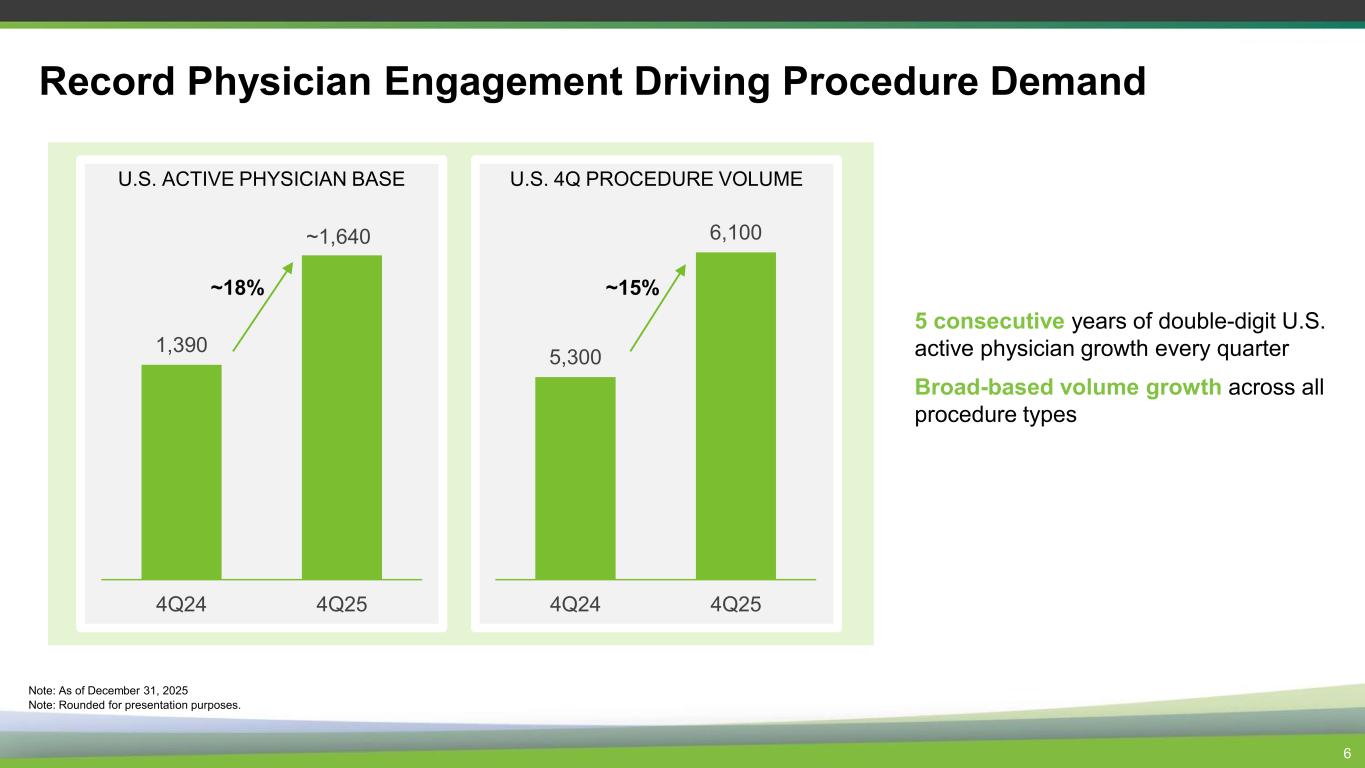

Record Physician Engagement Driving Procedure Demand 6 U.S. ACTIVE PHYSICIAN BASE 1,390 4Q24 4Q25 ~18% 5 consecutive years of double-digit U.S. active physician growth every quarter Broad-based volume growth across all procedure types Note: As of December 31, 2025 Note: Rounded for presentation purposes. U.S. 4Q PROCEDURE VOLUME 5,300 6,100 4Q24 4Q25 ~1,640 ~15%

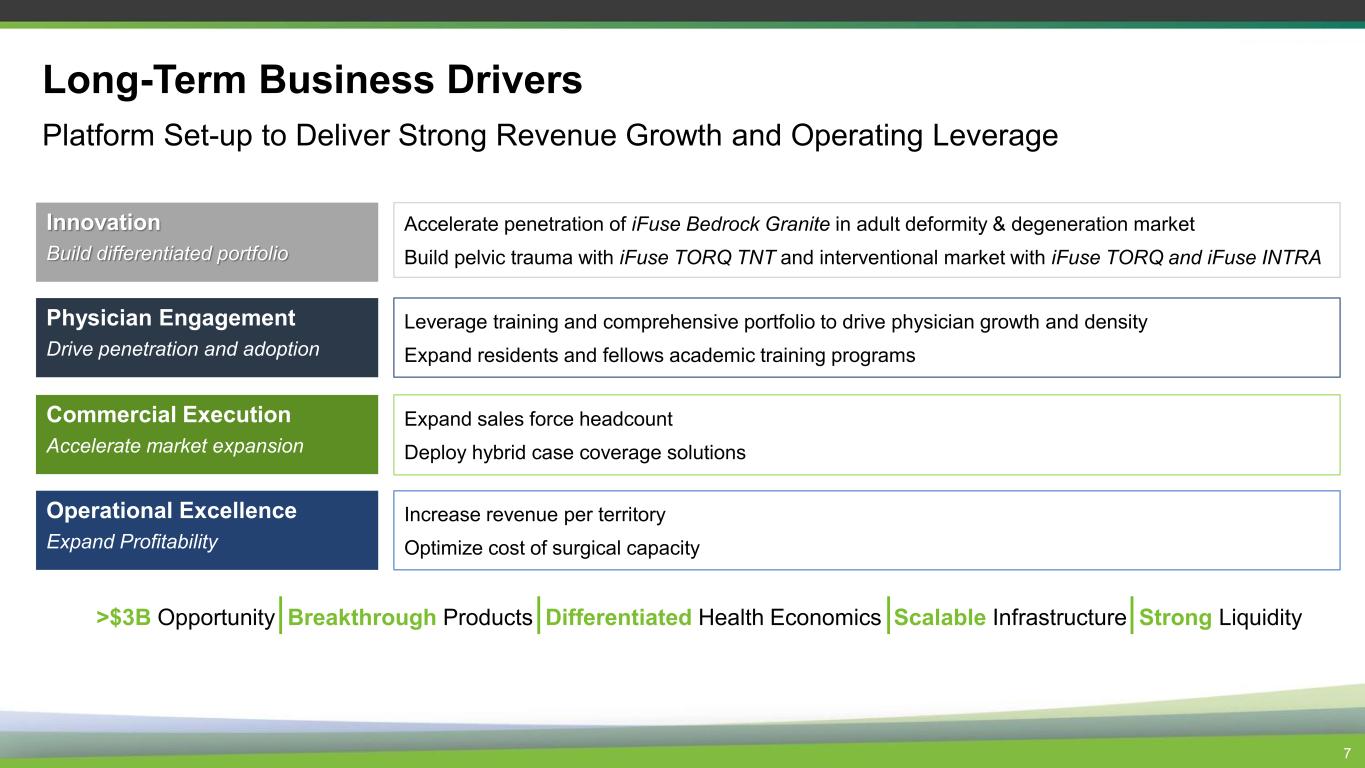

Commercial Execution Accelerate market expansion Physician Engagement Drive penetration and adoption Innovation Build differentiated portfolio Long-Term Business Drivers Platform Set-up to Deliver Strong Revenue Growth and Operating Leverage 7 Operational Excellence Expand Profitability Expand sales force headcount Deploy hybrid case coverage solutions Leverage training and comprehensive portfolio to drive physician growth and density Expand residents and fellows academic training programs Accelerate penetration of iFuse Bedrock Granite in adult deformity & degeneration market Build pelvic trauma with iFuse TORQ TNT and interventional market with iFuse TORQ and iFuse INTRA Increase revenue per territory Optimize cost of surgical capacity >$3B Opportunity Breakthrough Products Differentiated Health Economics Scalable Infrastructure Strong Liquidity

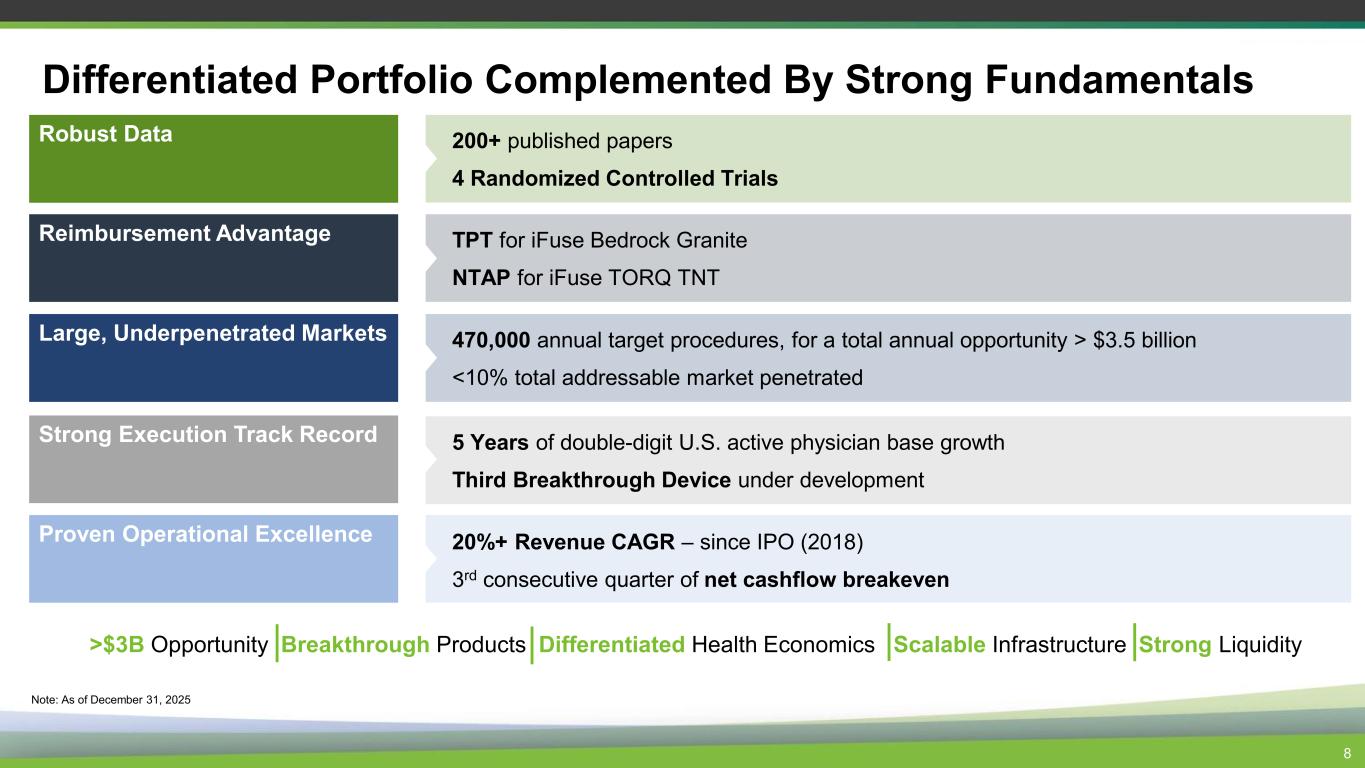

8 Differentiated Portfolio Complemented By Strong Fundamentals Robust Data Reimbursement Advantage Strong Execution Track Record Large, Underpenetrated Markets 200+ published papers 4 Randomized Controlled Trials TPT for iFuse Bedrock Granite NTAP for iFuse TORQ TNT 5 Years of double-digit U.S. active physician base growth Third Breakthrough Device under development 470,000 annual target procedures, for a total annual opportunity > $3.5 billion <10% total addressable market penetrated Proven Operational Excellence 20%+ Revenue CAGR – since IPO (2018) 3rd consecutive quarter of net cashflow breakeven Note: As of December 31, 2025 >$3B Opportunity Breakthrough Products Differentiated Health Economics Scalable Infrastructure Strong Liquidity

Company Overview

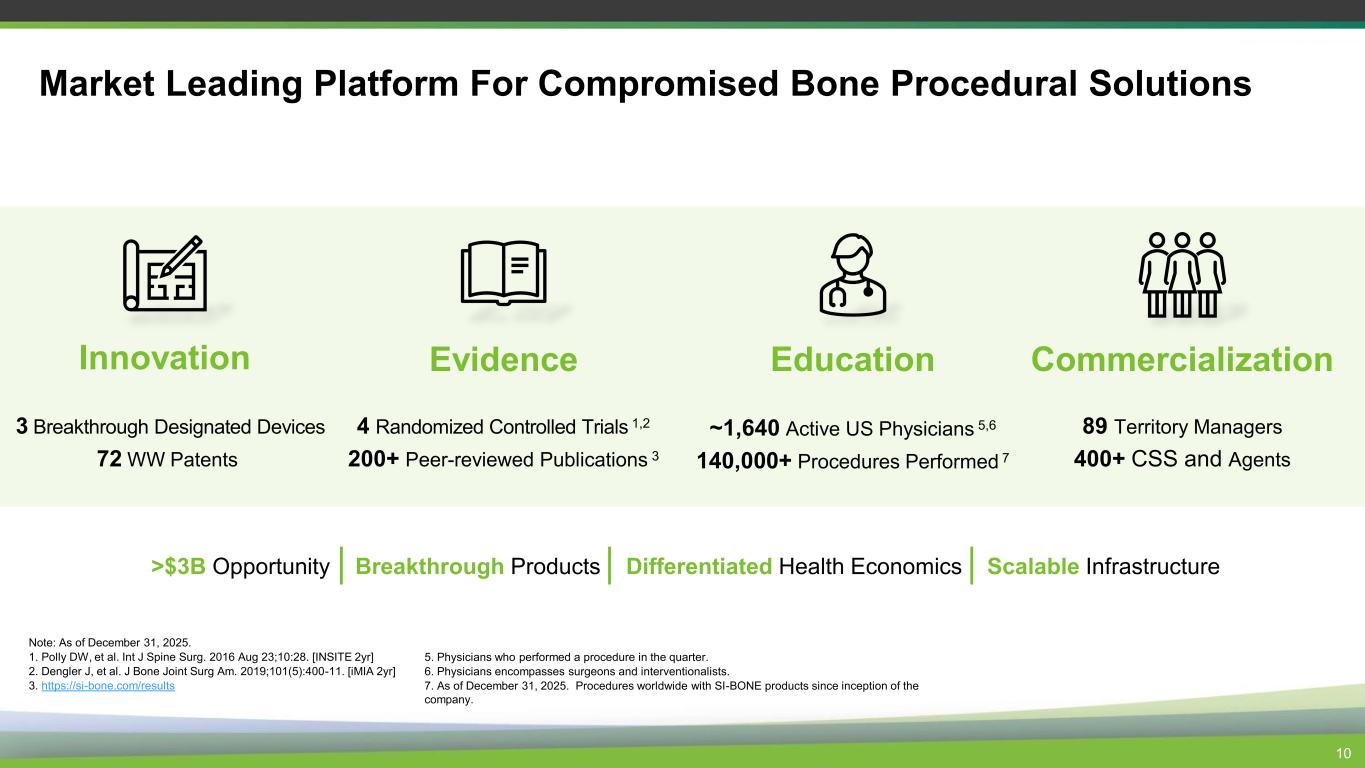

Market Leading Platform For Compromised Bone Procedural Solutions Innovation 3 Breakthrough Designated Devices 72 WW Patents Evidence 4 Randomized Controlled Trials 1,2 200+ Peer-reviewed Publications 3 Education ~1,640 Active US Physicians 5,6 140,000+ Procedures Performed 7 Commercialization 89 Territory Managers 400+ CSS and Agents >$3B Opportunity Breakthrough Products Differentiated Health Economics Scalable Infrastructure Note: As of December 31, 2025. 1. Polly DW, et al. Int J Spine Surg. 2016 Aug 23;10:28. [INSITE 2yr] 2. Dengler J, et al. J Bone Joint Surg Am. 2019;101(5):400-11. [iMIA 2yr] 3. https://si-bone.com/results 10 5. Physicians who performed a procedure in the quarter. 6. Physicians encompasses surgeons and interventionalists. 7. As of December 31, 2025. Procedures worldwide with SI-BONE products since inception of the company.

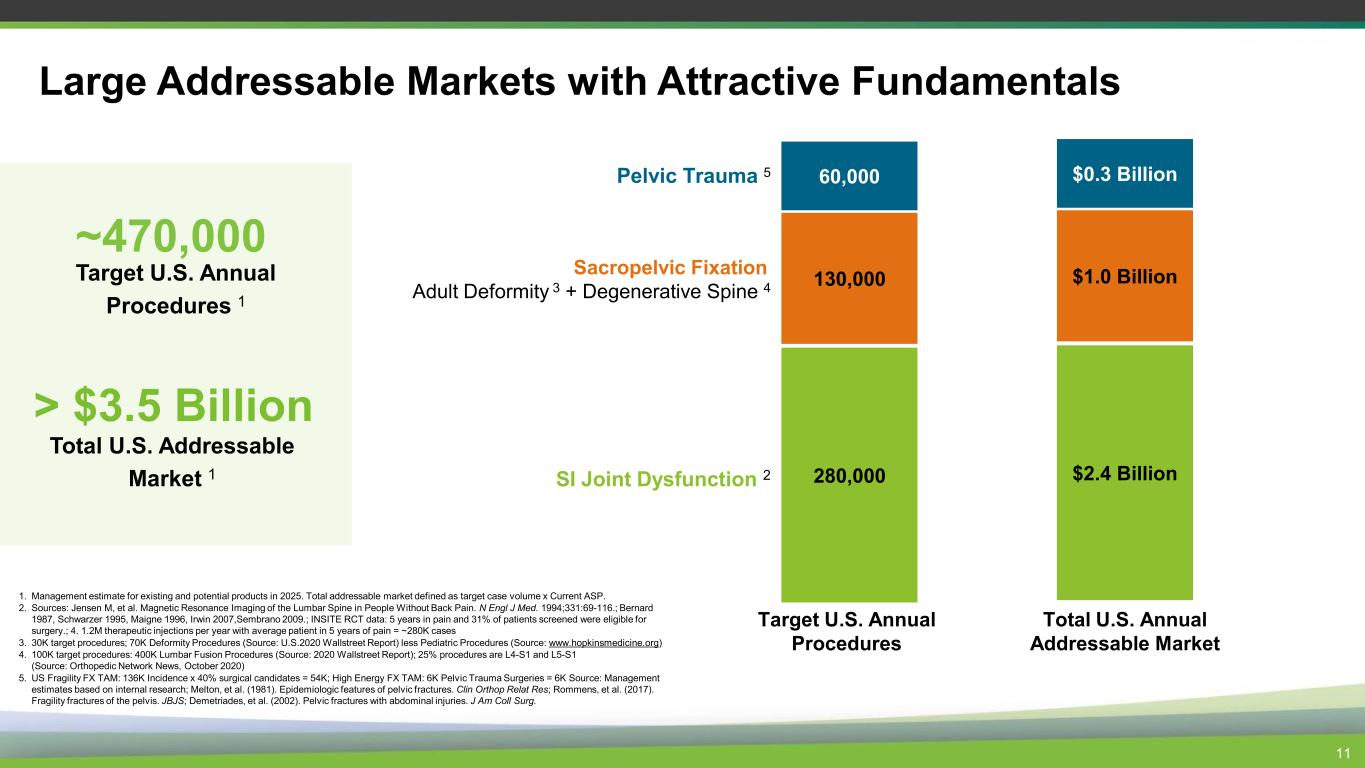

Large Addressable Markets with Attractive Fundamentals ~470,000 Target U.S. Annual Procedures 1 > $3.5 Billion Total U.S. Addressable Market 1 280,000 60,000 130,000 SI Joint Dysfunction 2 Pelvic Trauma 5 Sacropelvic Fixation Adult Deformity 3 + Degenerative Spine 4 $2.4 Billion $0.3 Billion $1.0 Billion Target U.S. Annual Procedures Total U.S. Annual Addressable Market 1. Management estimate for existing and potential products in 2025. Total addressable market defined as target case volume x Current ASP. 2. Sources: Jensen M, et al. Magnetic Resonance Imaging of the Lumbar Spine in People Without Back Pain. N Engl J Med. 1994;331:69-116.; Bernard 1987, Schwarzer 1995, Maigne 1996, Irwin 2007,Sembrano 2009.; INSITE RCT data: 5 years in pain and 31% of patients screened were eligible for surgery.; 4. 1.2M therapeutic injections per year with average patient in 5 years of pain = ~280K cases 3. 30K target procedures; 70K Deformity Procedures (Source: U.S.2020 Wallstreet Report) less Pediatric Procedures (Source: www.hopkinsmedicine.org) 4. 100K target procedures: 400K Lumbar Fusion Procedures (Source: 2020 Wallstreet Report); 25% procedures are L4-S1 and L5-S1 (Source: Orthopedic Network News, October 2020) 5. US Fragility FX TAM: 136K Incidence x 40% surgical candidates = 54K; High Energy FX TAM: 6K Pelvic Trauma Surgeries = 6K Source: Management estimates based on internal research; Melton, et al. (1981). Epidemiologic features of pelvic fractures. Clin Orthop Relat Res; Rommens, et al. (2017). Fragility fractures of the pelvis. JBJS; Demetriades, et al. (2002). Pelvic fractures with abdominal injuries. J Am Coll Surg. 11

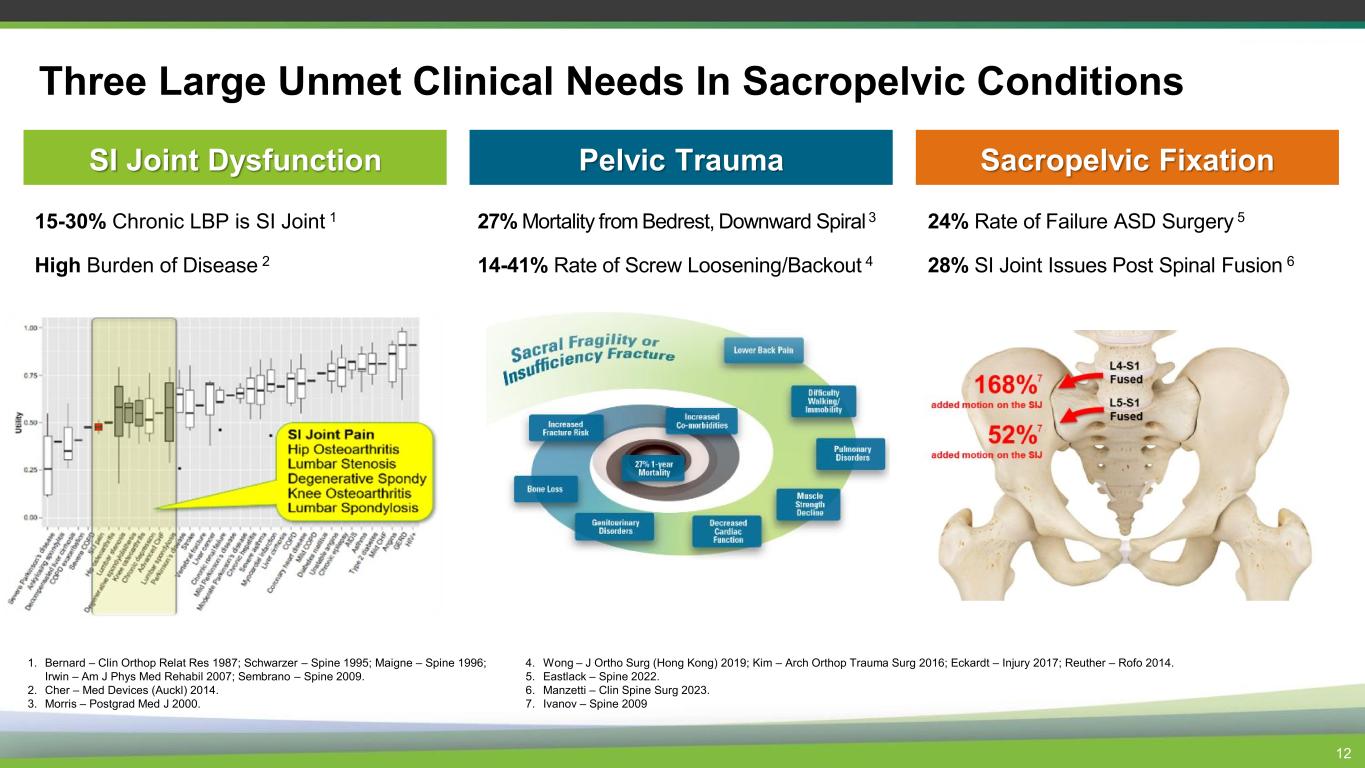

Three Large Unmet Clinical Needs In Sacropelvic Conditions 12 Pelvic Trauma Sacropelvic Fixation 24% Rate of Failure ASD Surgery 5 28% SI Joint Issues Post Spinal Fusion 6 SI Joint Dysfunction 15-30% Chronic LBP is SI Joint 1 High Burden of Disease 2 27% Mortality from Bedrest, Downward Spiral 3 14-41% Rate of Screw Loosening/Backout 4 1. Bernard – Clin Orthop Relat Res 1987; Schwarzer – Spine 1995; Maigne – Spine 1996; Irwin – Am J Phys Med Rehabil 2007; Sembrano – Spine 2009. 2. Cher – Med Devices (Auckl) 2014. 3. Morris – Postgrad Med J 2000. 4. Wong – J Ortho Surg (Hong Kong) 2019; Kim – Arch Orthop Trauma Surg 2016; Eckardt – Injury 2017; Reuther – Rofo 2014. 5. Eastlack – Spine 2022. 6. Manzetti – Clin Spine Surg 2023. 7. Ivanov – Spine 2009

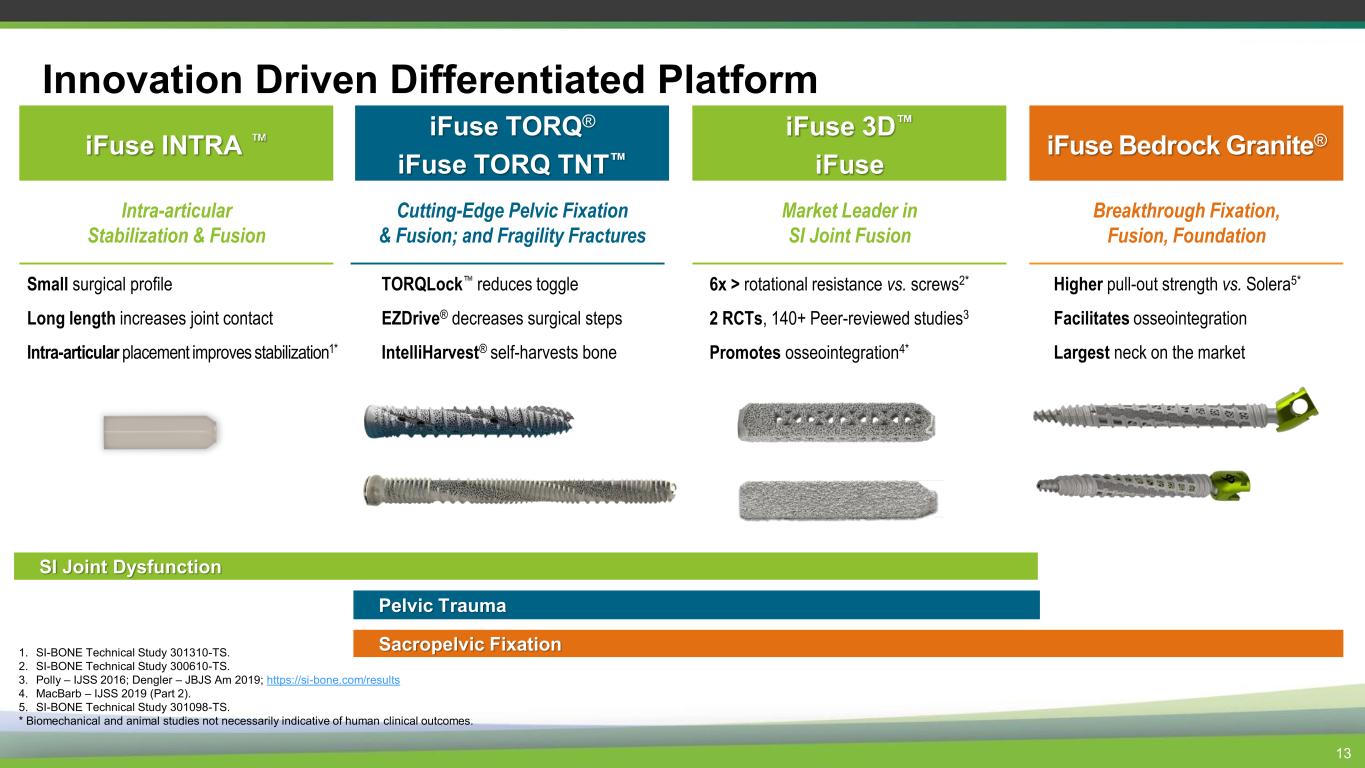

Innovation Driven Differentiated Platform iFuse 3D iFuse Market Leader in SI Joint Fusion iFuse TORQ® iFuse TORQ TNT Cutting-Edge Pelvic Fixation & Fusion; and Fragility Fractures Sacropelvic Fixation iFuse Bedrock Granite® Breakthrough Fixation, Fusion, Foundation 13 Higher pull-out strength vs. Solera5* Facilitates osseointegration Largest neck on the market 6x > rotational resistance vs. screws2* 2 RCTs, 140+ Peer-reviewed studies3 Promotes osseointegration4* TORQLock reduces toggle EZDrive® decreases surgical steps IntelliHarvest® self-harvests bone iFuse INTRA Intra-articular Stabilization & Fusion Small surgical profile Long length increases joint contact Intra-articular placement improves stabilization1* SI Joint Dysfunction Pelvic Trauma 1. SI-BONE Technical Study 301310-TS. 2. SI-BONE Technical Study 300610-TS. 3. Polly – IJSS 2016; Dengler – JBJS Am 2019; https://si-bone.com/results 4. MacBarb – IJSS 2019 (Part 2). 5. SI-BONE Technical Study 301098-TS. * Biomechanical and animal studies not necessarily indicative of human clinical outcomes.

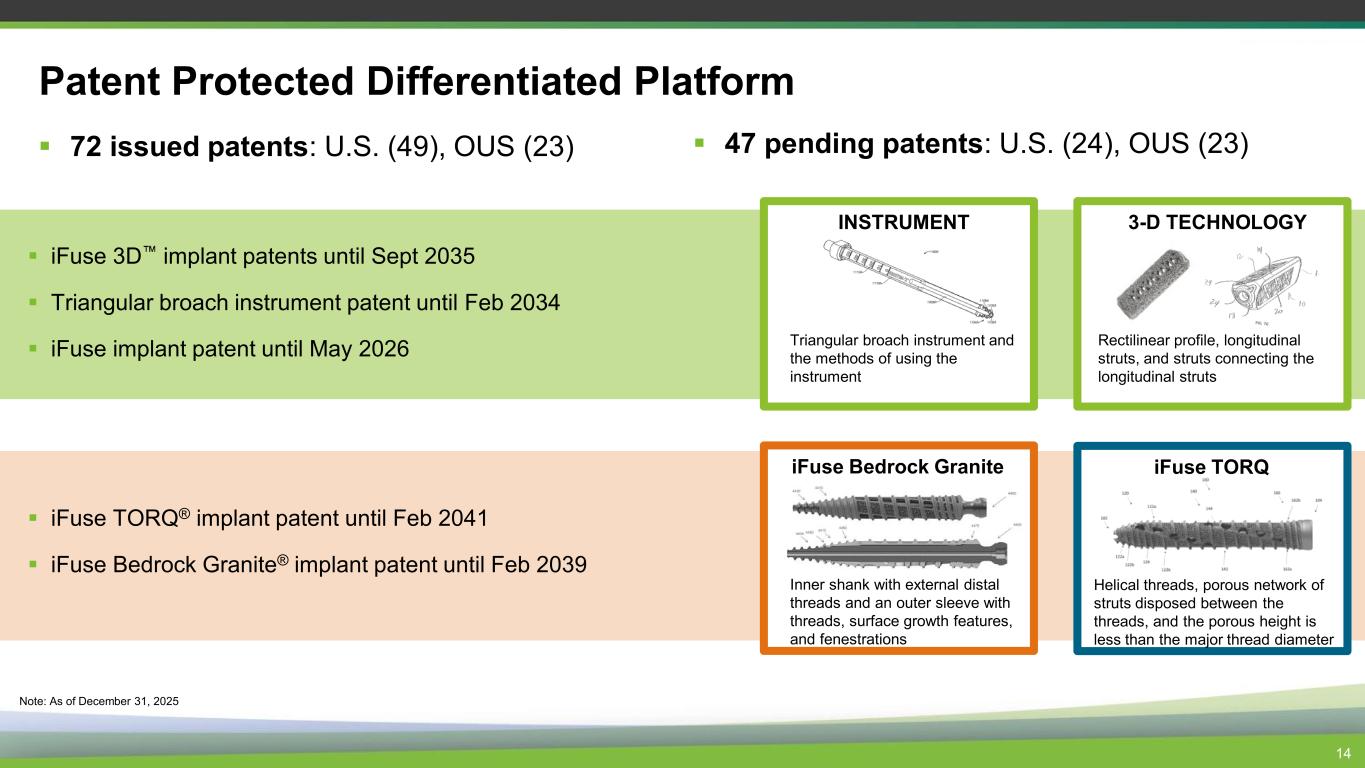

Patent Protected Differentiated Platform ▪ 72 issued patents: U.S. (49), OUS (23) ▪ iFuse 3D implant patents until Sept 2035 ▪ Triangular broach instrument patent until Feb 2034 ▪ iFuse implant patent until May 2026 3-D TECHNOLOGY Rectilinear profile, longitudinal struts, and struts connecting the longitudinal struts 14 Note: As of December 31, 2025 INSTRUMENT Triangular broach instrument and the methods of using the instrument ▪ 47 pending patents: U.S. (24), OUS (23) iFuse Bedrock Granite Inner shank with external distal threads and an outer sleeve with threads, surface growth features, and fenestrations iFuse TORQ Helical threads, porous network of struts disposed between the threads, and the porous height is less than the major thread diameter ▪ iFuse TORQ® implant patent until Feb 2041 ▪ iFuse Bedrock Granite® implant patent until Feb 2039

Portfolio Overview

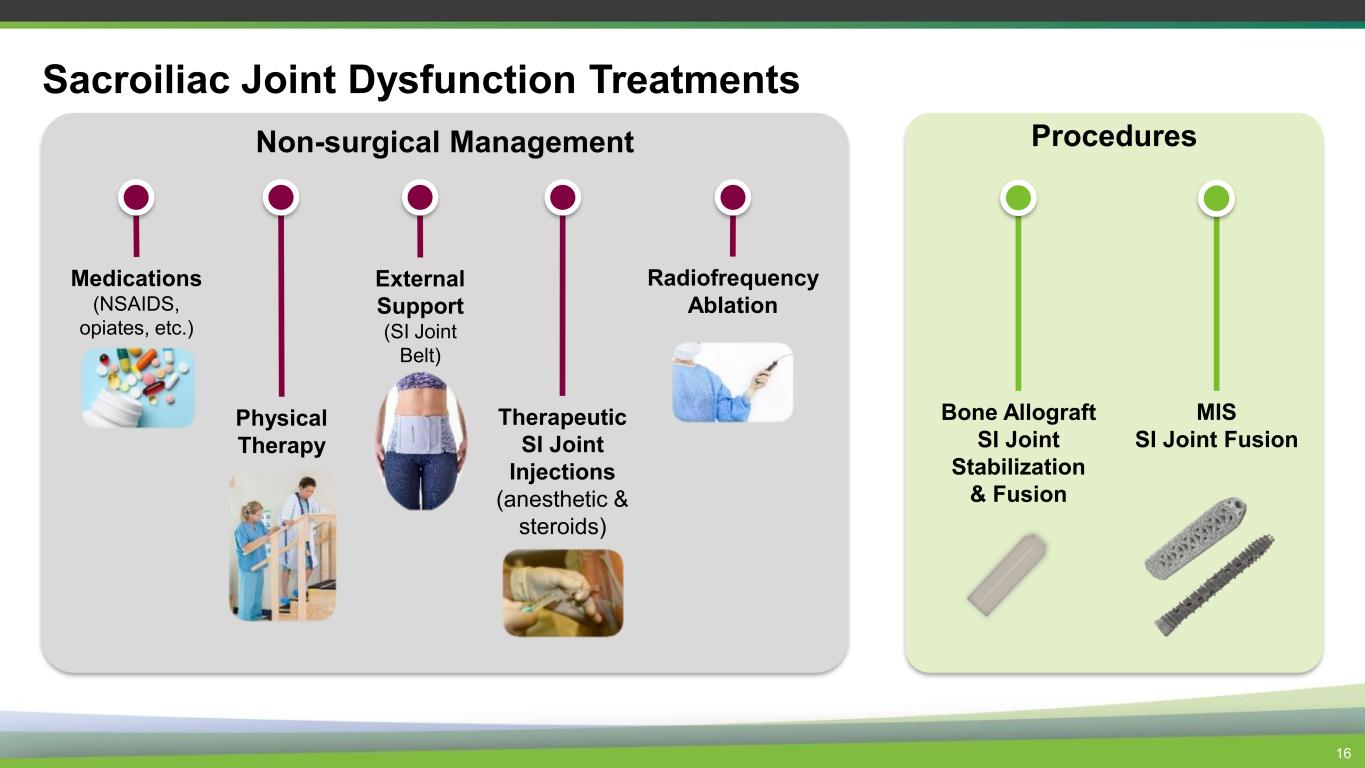

Procedures Non-surgical Management Sacroiliac Joint Dysfunction Treatments 16 MIS SI Joint Fusion Radiofrequency Ablation Therapeutic SI Joint Injections (anesthetic & steroids) External Support (SI Joint Belt) Physical Therapy Medications (NSAIDS, opiates, etc.) Bone Allograft SI Joint Stabilization & Fusion

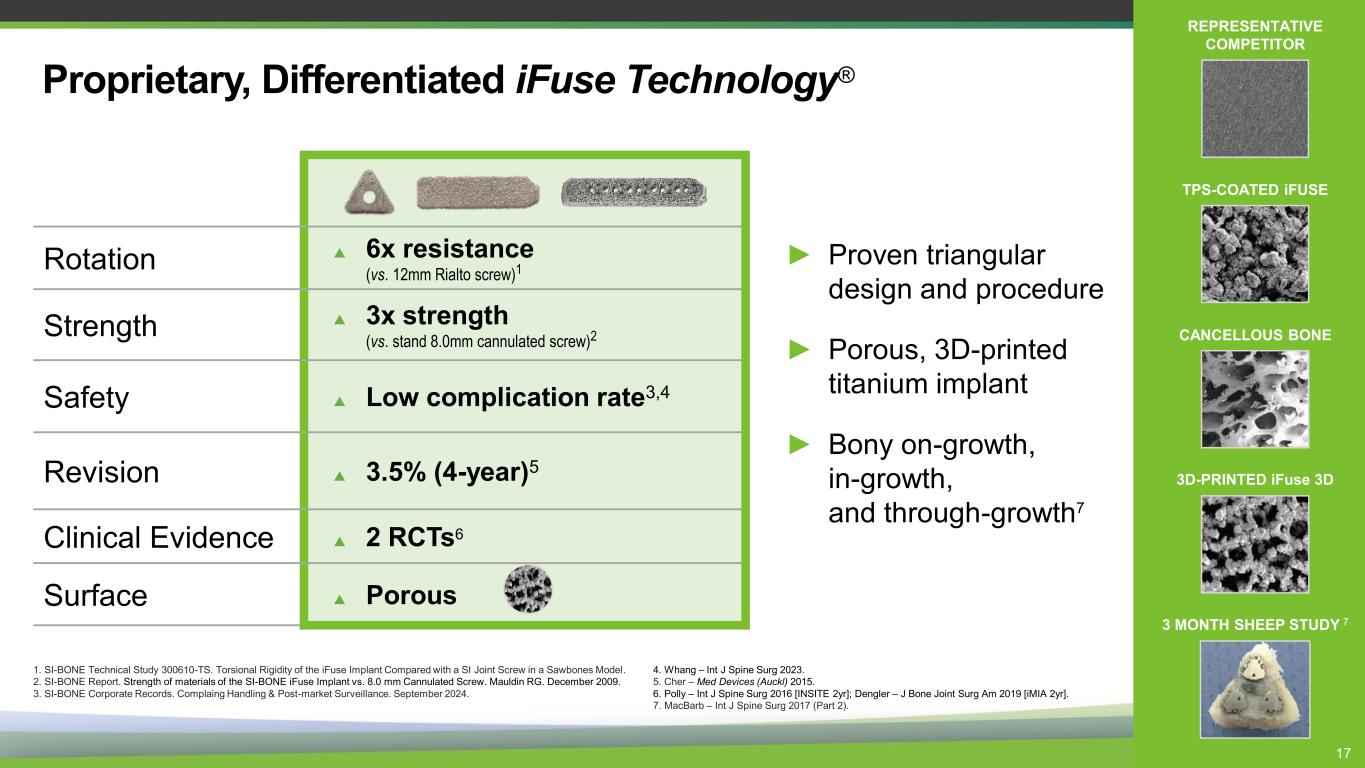

Proprietary, Differentiated iFuse Technology® Rotation 6x resistance (vs. 12mm Rialto screw)1 Strength 3x strength (vs. stand 8.0mm cannulated screw)2 Safety Low complication rate3,4 Revision 3.5% (4-year)5 Clinical Evidence 2 RCTs6 Surface Porous 1. SI-BONE Technical Study 300610-TS. Torsional Rigidity of the iFuse Implant Compared with a SI Joint Screw in a Sawbones Model. 2. SI-BONE Report. Strength of materials of the SI-BONE iFuse Implant vs. 8.0 mm Cannulated Screw. Mauldin RG. December 2009. 3. SI-BONE Corporate Records. Complaing Handling & Post-market Surveillance. September 2024. 4. Whang – Int J Spine Surg 2023. 5. Cher – Med Devices (Auckl) 2015. 6. Polly – Int J Spine Surg 2016 [INSITE 2yr]; Dengler – J Bone Joint Surg Am 2019 [iMIA 2yr]. 7. MacBarb – Int J Spine Surg 2017 (Part 2). REPRESENTATIVE COMPETITOR TPS-COATED iFUSE CANCELLOUS BONE 3D-PRINTED iFuse 3D 3 MONTH SHEEP STUDY 7 ► Proven triangular design and procedure ► Porous, 3D-printed titanium implant ► Bony on-growth, in-growth, and through-growth7 17

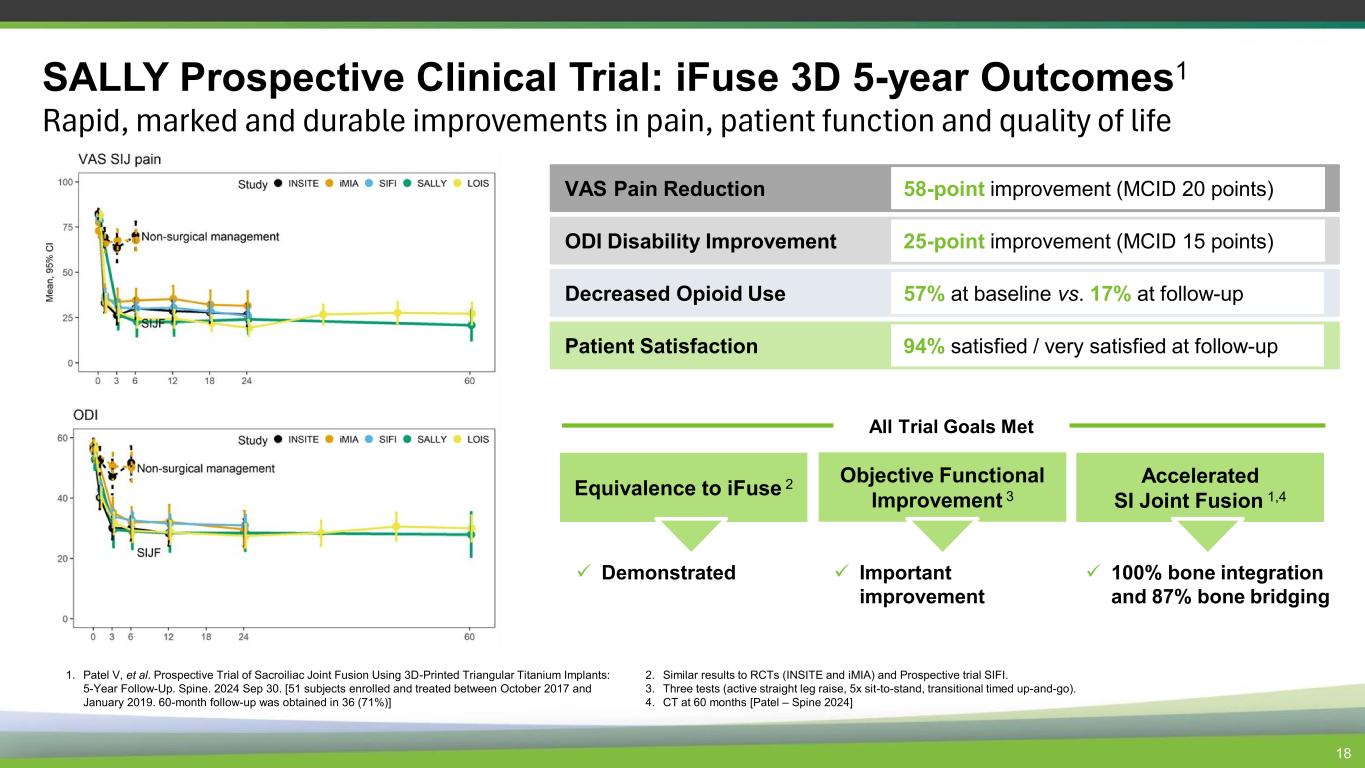

18 SALLY Prospective Clinical Trial: iFuse 3D 5-year Outcomes1 Rapid, marked and durable improvements in pain, patient function and quality of life Equivalence to iFuse 2 ✓ Demonstrated Objective Functional Improvement 3 Accelerated SI Joint Fusion 1,4 ✓ Important improvement ✓ 100% bone integration and 87% bone bridging All Trial Goals Met ODI Disability Improvement 25-point improvement (MCID 15 points) Decreased Opioid Use 57% at baseline vs. 17% at follow-up Patient Satisfaction 94% satisfied / very satisfied at follow-up VAS Pain Reduction 58-point improvement (MCID 20 points) 1. Patel V, et al. Prospective Trial of Sacroiliac Joint Fusion Using 3D-Printed Triangular Titanium Implants: 5-Year Follow-Up. Spine. 2024 Sep 30. [51 subjects enrolled and treated between October 2017 and January 2019. 60-month follow-up was obtained in 36 (71%)] 2. Similar results to RCTs (INSITE and iMIA) and Prospective trial SIFI. 3. Three tests (active straight leg raise, 5x sit-to-stand, transitional timed up-and-go). 4. CT at 60 months [Patel – Spine 2024]

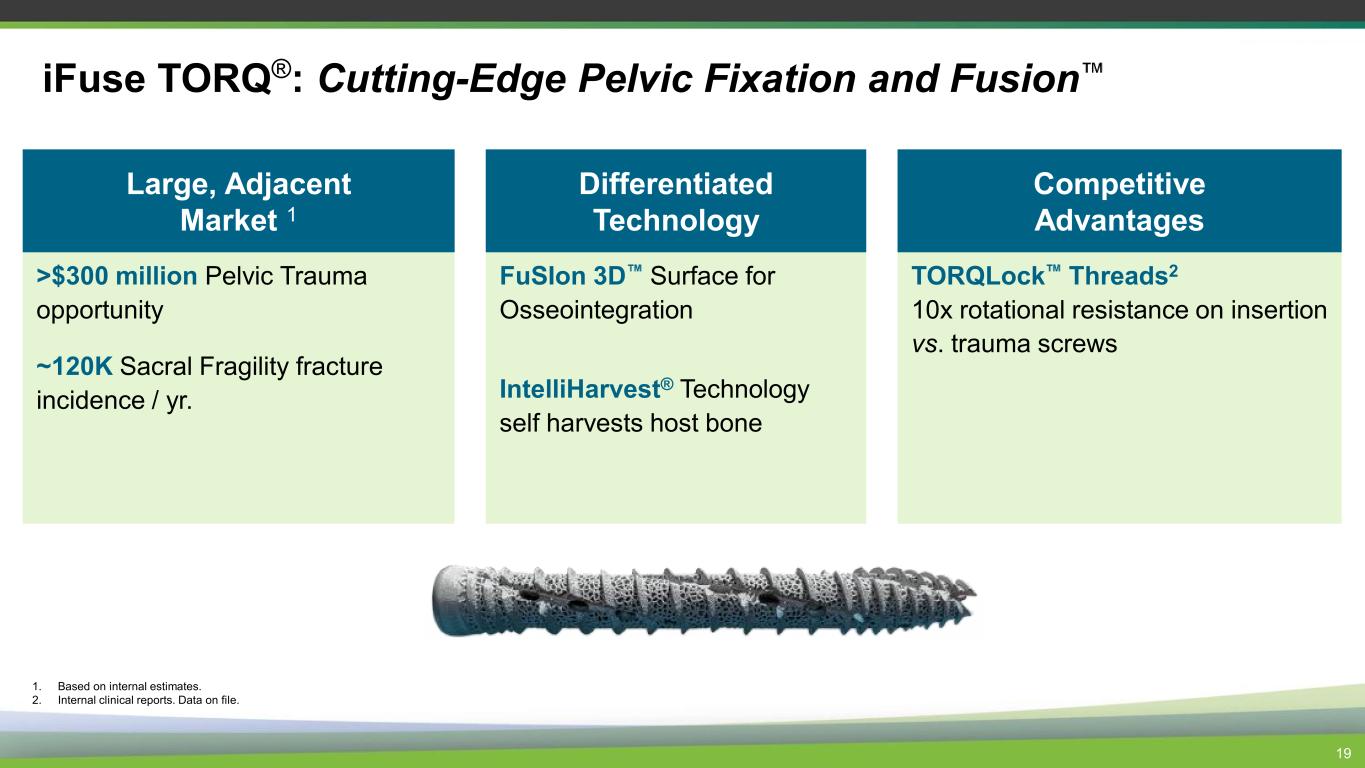

Large, Adjacent Market 1 Differentiated Technology Competitive Advantages >$300 million Pelvic Trauma opportunity ~120K Sacral Fragility fracture incidence / yr. FuSIon 3D Surface for Osseointegration IntelliHarvest® Technology self harvests host bone TORQLock Threads2 10x rotational resistance on insertion vs. trauma screws 19 iFuse TORQ®: Cutting-Edge Pelvic Fixation and Fusion 1. Based on internal estimates. 2. Internal clinical reports. Data on file.

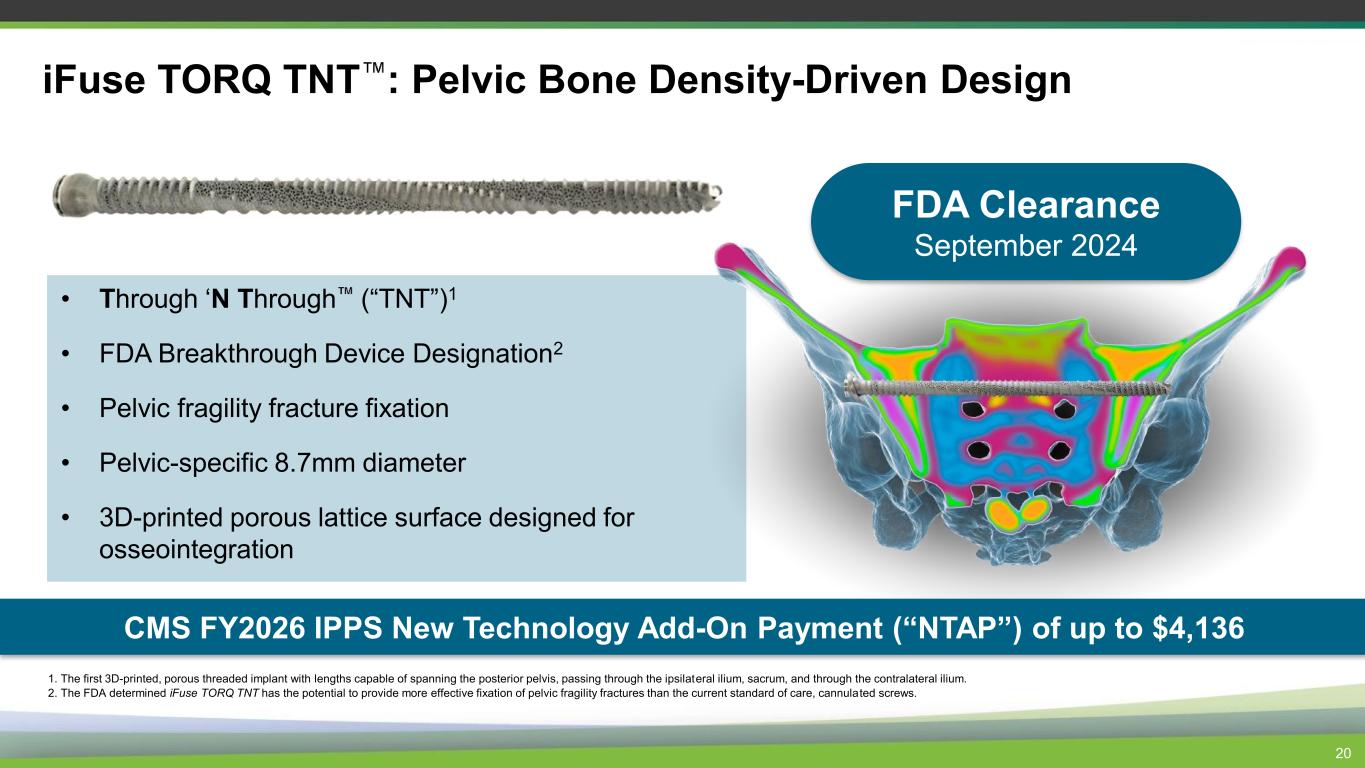

• Through ‘N Through (“TNT”)1 • FDA Breakthrough Device Designation2 • Pelvic fragility fracture fixation • Pelvic-specific 8.7mm diameter • 3D-printed porous lattice surface designed for osseointegration 20 iFuse TORQ TNT : Pelvic Bone Density-Driven Design 1. The first 3D-printed, porous threaded implant with lengths capable of spanning the posterior pelvis, passing through the ipsilateral ilium, sacrum, and through the contralateral ilium. 2. The FDA determined iFuse TORQ TNT has the potential to provide more effective fixation of pelvic fragility fractures than the current standard of care, cannulated screws. FDA Clearance September 2024 CMS FY2026 IPPS New Technology Add-On Payment (“NTAP”) of up to $4,136

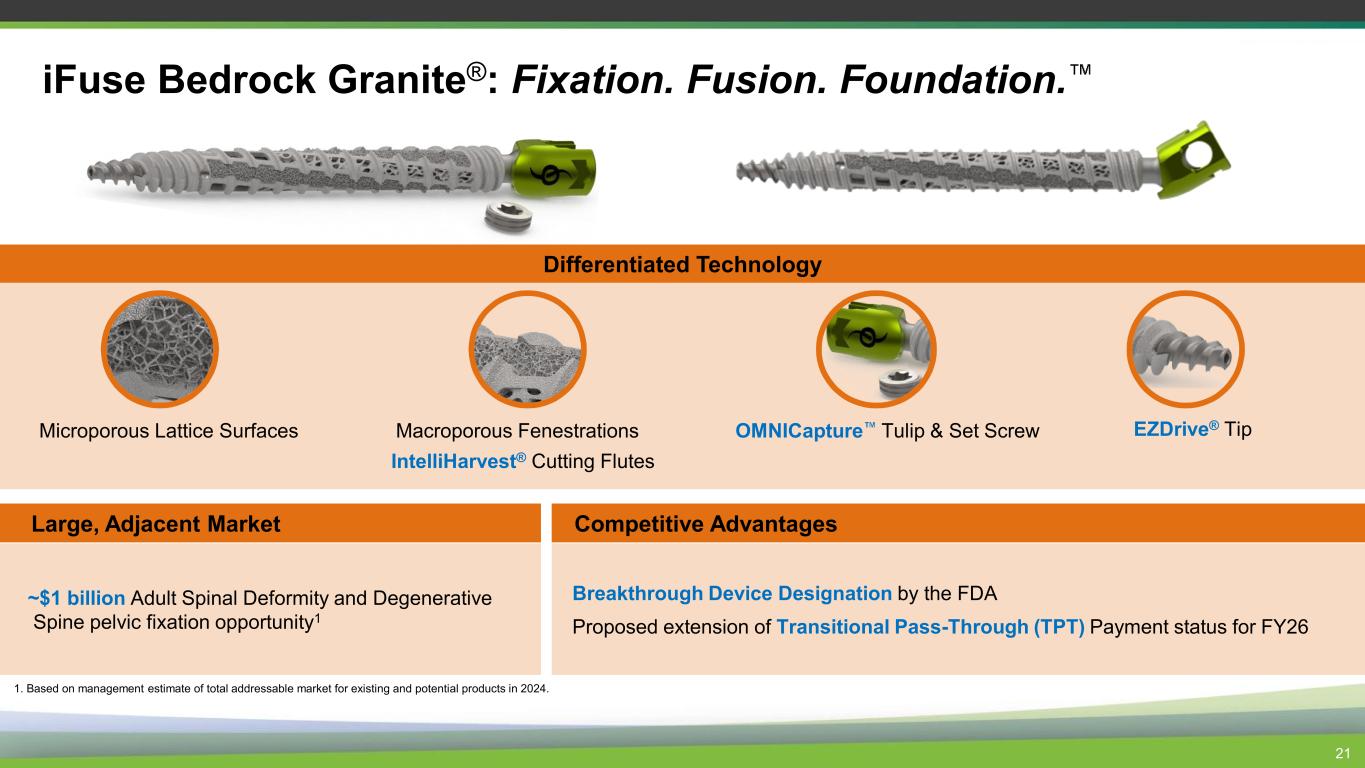

21 iFuse Bedrock Granite®: Fixation. Fusion. Foundation. Large, Adjacent Market ~$1 billion Adult Spinal Deformity and Degenerative Spine pelvic fixation opportunity1 Competitive Advantages Breakthrough Device Designation by the FDA Proposed extension of Transitional Pass-Through (TPT) Payment status for FY26 1. Based on management estimate of total addressable market for existing and potential products in 2024. OMNICapture Tulip & Set Screw EZDrive® TipMicroporous Lattice Surfaces IntelliHarvest® Cutting Flutes Macroporous Fenestrations Differentiated Technology

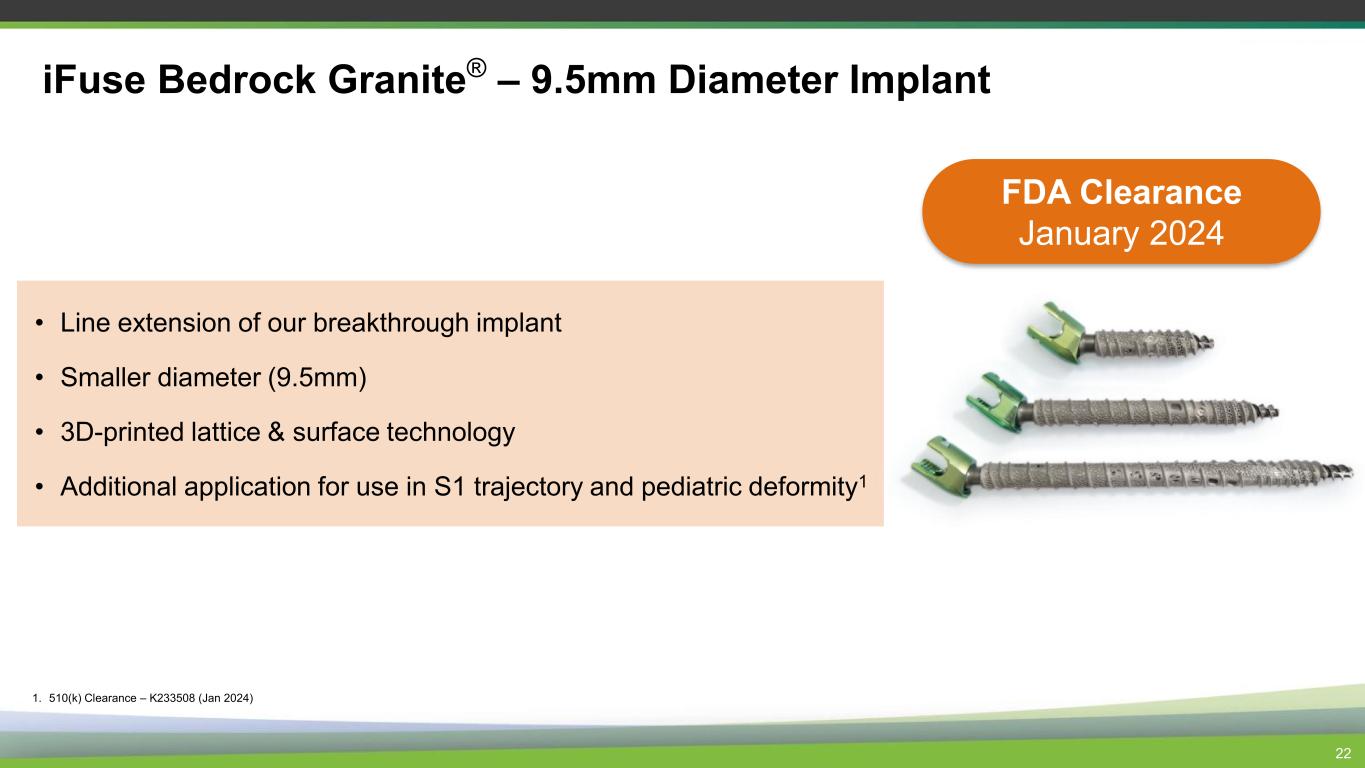

• Line extension of our breakthrough implant • Smaller diameter (9.5mm) • 3D-printed lattice & surface technology • Additional application for use in S1 trajectory and pediatric deformity1 22 iFuse Bedrock Granite® – 9.5mm Diameter Implant 1. 510(k) Clearance – K233508 (Jan 2024) FDA Clearance January 2024

Disclosure The iFuse Bedrock Granite® Implant System is intended for sacroiliac joint fusion in skeletally mature patients for the following conditions: • Sacroiliac joint dysfunction that is a direct result of sacroiliac joint disruption and degenerative sacroiliitis. This includes conditions whose symptoms began during pregnancy or in the peripartum period and have persisted postpartum for more than 6 months. • To augment immobilization and stabilization of the sacroiliac joint in skeletally mature patients undergoing sacropelvic fixation as part of a lumbar or thoracolumbar fusion. • Acute, non-acute, and non-traumatic fractures involving the sacroiliac joint. When connected to compatible pedicle screw systems with 5.5- or 6.0-mm posterior rods made from either titanium alloy or cobalt chore alloy the iFuse Bedrock Granite Implant System is intended to provide immobilization and stabilization of spinal segments in skeletally mature patients as an adjunct to thoracolumbosacral fusion for the following acute and chronic instabilities or deformities of the thoracic, lumbar, and sacral spine: • Degenerative disc disease (DDD) as defined by back pain of discogenic origin with degeneration of the disc confirmed by patient history and radiographic studies • Spondylolisthesis • Trauma (i.e., fracture or dislocation) • Spinal stenosis • Deformities or curvatures (i.e., scoliosis, kyphosis, and/or lordosis) • Spinal tumor • Pseudarthrosis • Failed previous fusion When connected to compatible pedicle screws with 5.5- or 6.0-mm posterior rods made from either titanium alloy or cobalt chrome alloys, the iFuse Bedrock Granite Implant System is intended to provide immobilization and stabilization of spinal segments in skeletally immature patients as an adjunct to thoracolumbar fusion for the treatment of progressive spinal deformities (i.e., scoliosis, kyphosis, or lordosis) including idiopathic scoliosis, neuromuscular scoliosis, and congenital scoliosis, as well as the following conditions: spondylolisthesis/spondylolysis, fracture caused by tumor and/or trauma, pseudarthrosis, and/or failed previous fusion. These devices are to be used with autograft and/or allograft. Pediatric pedicle screw fixation is limited to a posterior approach. Please refer to the additional information section in the Instructions for Use on compatible pedicle screw system rods. The iFuse Bedrock Granite Navigation instruments are intended to be used with the iFuse Bedrock Granite Implant System to assist the surgeon in precisely locating anatomical structures in iFuse Bedrock Granite Implant System procedures, in which the use of stereotactic surgery may be appropriate, and where reference to a rigid anatomical structure, such as the pelvis or vertebra, can be identified relative to the acquired image (CT, MR, 2D fluoroscopic image or 3D fluoroscopic image reconstruction) and/or an image data based model of the anatomy. iFuse Bedrock Granite Navigation instruments are intended to be used with the Medtronic® StealthStation® System. 23 Disclosures

Disclosure The iFuse TORQ® Implant System is indicated for: • Fusion of the sacroiliac joint for sacroiliac joint dysfunction including sacroiliac joint disruption and degenerative sacroiliitis. • Fracture fixation of the pelvis, including acute, non-acute and non-traumatic fractures. The iFuse TORQ Implant System is also indicated for fracture fixation of the pelvis, including acute, non-acute, and non-traumatic fractures. The iFuse TORQ Navigation instruments are intended to be used with the iFuse TORQ Implant System to assist the surgeon in precisely locating anatomical structures in iFuse TORQ Implant System procedures, in which the use of stereotactic surgery may be appropriate, and where reference to a rigid anatomical structure, such as the pelvis or vertebra, can be identified relative to the acquired image (CT, MR, 2D fluoroscopic image or 3D fluoroscopic image reconstruction) and/or an image data based model of the anatomy. iFuse TORQ Navigation instruments are intended to be used with the Medtronic® StealthStation® System. The iFuse TORQ TNT Implant System is indicated for fracture fixation of the pelvis, including acute, non-acute and non-traumatic fractures. The iFuse TORQ TNT Implant System is indicated for sacroiliac joint fusion for sacroiliac joint dysfunction including sacroiliac joint disruption and degenerative sacroiliitis. The iFuse TORQ TNT Navigation Instruments are intended to be used with the iFuse TORQ TNT Implant System to assist the physician in precisely locating anatomical structures in iFuse TORQ TNT Implant System procedures, in which the use of stereotactic surgery may be appropriate, and where reference to a rigid anatomical structure, such as the pelvis or vertebra, can be identified relative to the acquired image (CT, MR, 2D fluoroscopic image or 3D fluoroscopic image reconstruction) and/or an image data based model of the anatomy. iFuse TORQ TNT Navigation Instruments are intended to be used with the Medtronic StealthStation System. 24 Disclosures

Disclosure The iFuse Implant System® is intended for sacroiliac fusion for the following conditions: • Sacroiliac joint dysfunction that is a direct result of sacroiliac joint disruption and degenerative sacroiliitis. This includes conditions whose symptoms began during pregnancy or in the peripartum period and have persisted postpartum for more than 6 months. • To augment immobilization and stabilization of the sacroiliac joint in skeletally mature patients undergoing sacropelvic fixation as part of a lumbar or thoracolumbar fusion. • Acute, non-acute, and non-traumatic fractures involving the sacroiliac joint. If present, a pelvic fracture should be stabilized prior to the use of iFuse implants. The iFuse INTRA Allograft Implant System instruments are indicated for placement of the iFuse Bone allograft. The iFuse INTRA Allograft Implant System is indicated for homologous use. Healthcare professionals please refer to the Instructions For Use for indications, contraindications, warnings, and precautions at https://si-bone.com/label. There are potential risks associated with iFuse procedures. They may not be appropriate for all patients, and all patients may not benefit. For information about the risks, visit: https://si-bone.com/risks. 25 Disclosures SI-BONE, Sacropelvic Solutions, iFuse Implant System, iFuse Technology, Bedrock, iFuse Bedrock Granite, iFuse TORQ, iFuse Bone, EZDrive, and IntelliHarvest are registered trademarks of SI-BONE, Inc. iFuse 3D, SI-BONE SImulator, FuSIon 3D, TORQLock, iFuse INTRA, iFuse TORQ TNT, and Through ‘N Through are trademarks of SI-BONE, Inc. © 2026 SI-BONE, Inc. All rights reserved.

1/10/2026 h Pioneering Procedural Solutions For Compromised Bone ® 26 140,000+ Procedures 72+ Patents 200+ Publications Note: As of December 31, 2025