Backblaze ©2024 Confidential | 1 Q3 2025 Results November 6, 2025 Gleb Budman CEO and Co-Founder Backblaze Marc Suidan CFO

Backblaze ©2025 | 2 Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements, which involve risks and uncertainties. These forward-looking statements are generally identified by the use of forward-looking terminology, including the terms “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and, in each case, their negative or other various or comparable terminology. All statements other than statements of historical facts contained in this presentation, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, planned investments and initiatives, prospects, plans, objectives of management and general economic trends and trends in the industry and markets are forward-looking statements. The forward-looking statements are contained principally in the sections entitled. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results to be materially different from any future results expressed or implied by the forward-looking statements. These forward-looking statements reflect our views with respect to future events as of the date of this presentation and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this presentation. Non-GAAP Financial Measures To supplement the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use non-GAAP Adjusted Gross Margin, Non-GAAP Net Income (Loss), Adjusted EBITDA Margin and Adjusted Free Cash Flow. These non-GAAP financial measures exclude certain items and are not prepared in accordance with GAAP; therefore, the information is not necessarily comparable to other companies and should be considered as a supplement to, not a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. We present these non-GAAP measures because management believes they are a useful measure of the Company’s performance and provides an additional basis for assessing our operating results. Please see the Appendix attached to this presentation for a reconciliation of non-GAAP Adjusted Gross Margin, non-GAAP Net Income, Adjusted EBITDA Margin and Adjusted Free Cash Flow to the most directly comparable GAAP financial measures. Important Information About This Presentation

Backblaze ©2025 | 3 Our Mission We make it astonishingly easy to store, use, and protect data.

Backblaze ©2025 | 4 ● Data infrastructure for AI economy ● Large deals & improved financials ● GtM Transformation Phase 2 Key Highlights

Backblaze ©2025 | 5 AI = Models x Compute x Data Data is where AI companies win Backblaze enables that ● Enables using any compute platform ● Avoids high egress costs ● Performance to move massive datasets ● Trusted by hundreds of AI companies NOTES: “AI customer” refers to customers whose account email domain ends in “.ai” or the customer has disclosed that its use of Backblaze cloud storage is primarily for an AI use case.

Backblaze ©2025 | 6 c Industry Recognition ● B2 Overdrive ○ “Best in Enterprise Tech Innovation” ● B2 Object Lock ○ “Cloud Computing Security Excellence Award”

Backblaze ©2025 | 7 Large Customer Win Highlights Customer 1 B2 Overdrive ● Vision-language AI startup ● Six-figure win ● Speed w/o complexity Customer 2 Customer Expansion ● AI-powered surveillance ● Seven-figure TCV win ● Streamlined workflows Customer 3 Powered By – Whitelabel ● Media App Developer ● Six-figure win ● Avoid surprise costs

Backblaze ©2025 | 8 Go-to-Market Transformation Phase 2 Initiatives Actions ● Streamline data heavy AI-use case adoption ● Deepen developer relationships ● Upgrade GtM systems ● Engage experienced GTM advisors Increase Direct Sales efficiency Drive Self-serve momentum

Backblaze ©2025 | 9 Financial Overview Marc Suidan CFO

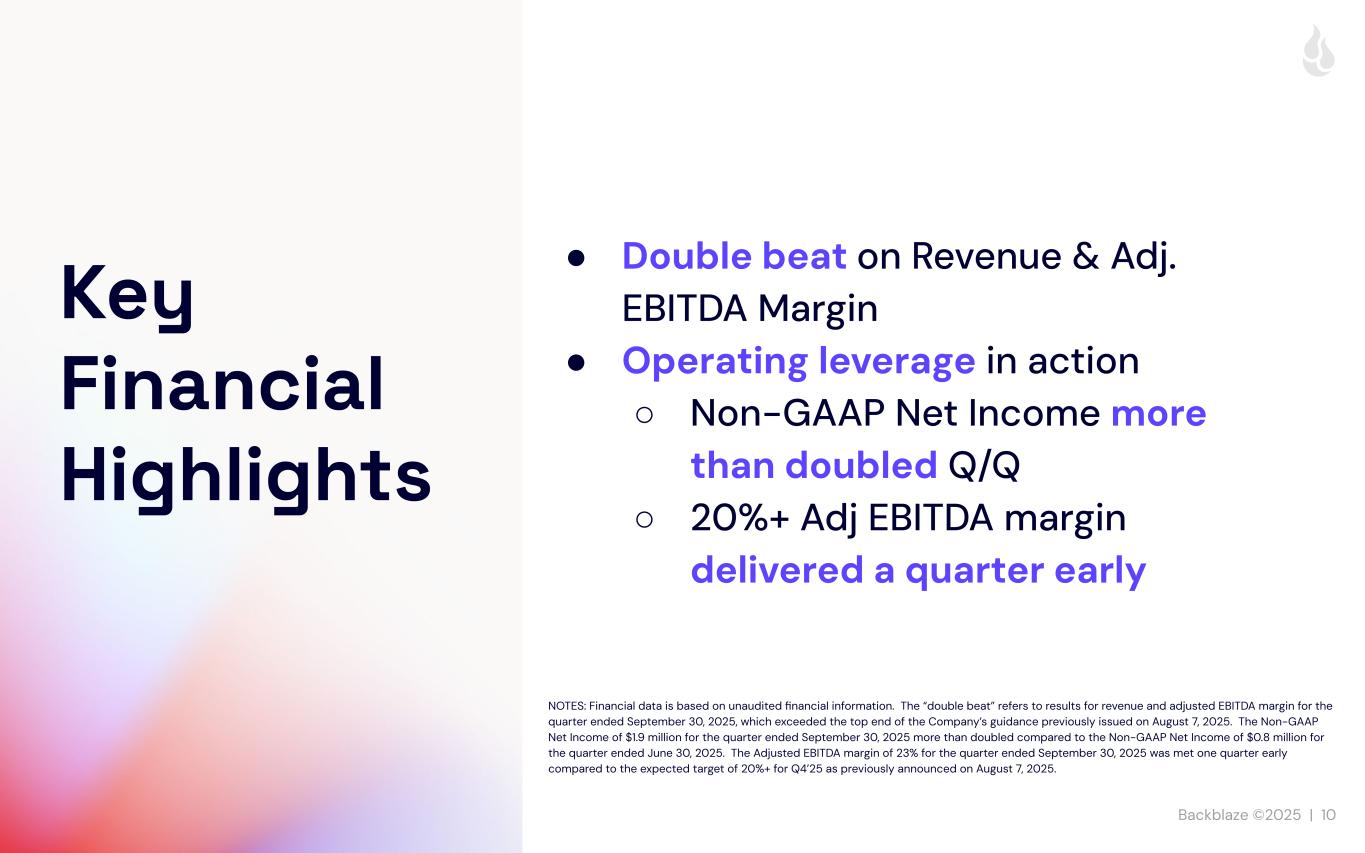

Backblaze ©2025 | 10 ● Double beat on Revenue & Adj. EBITDA Margin ● Operating leverage in action ○ Non-GAAP Net Income more than doubled Q/Q ○ 20%+ Adj EBITDA margin delivered a quarter early Key Financial Highlights NOTES: Financial data is based on unaudited financial information. The “double beat” refers to results for revenue and adjusted EBITDA margin for the quarter ended September 30, 2025, which exceeded the top end of the Company’s guidance previously issued on August 7, 2025. The Non-GAAP Net Income of $1.9 million for the quarter ended September 30, 2025 more than doubled compared to the Non-GAAP Net Income of $0.8 million for the quarter ended June 30, 2025. The Adjusted EBITDA margin of 23% for the quarter ended September 30, 2025 was met one quarter early compared to the expected target of 20%+ for Q4’25 as previously announced on August 7, 2025.

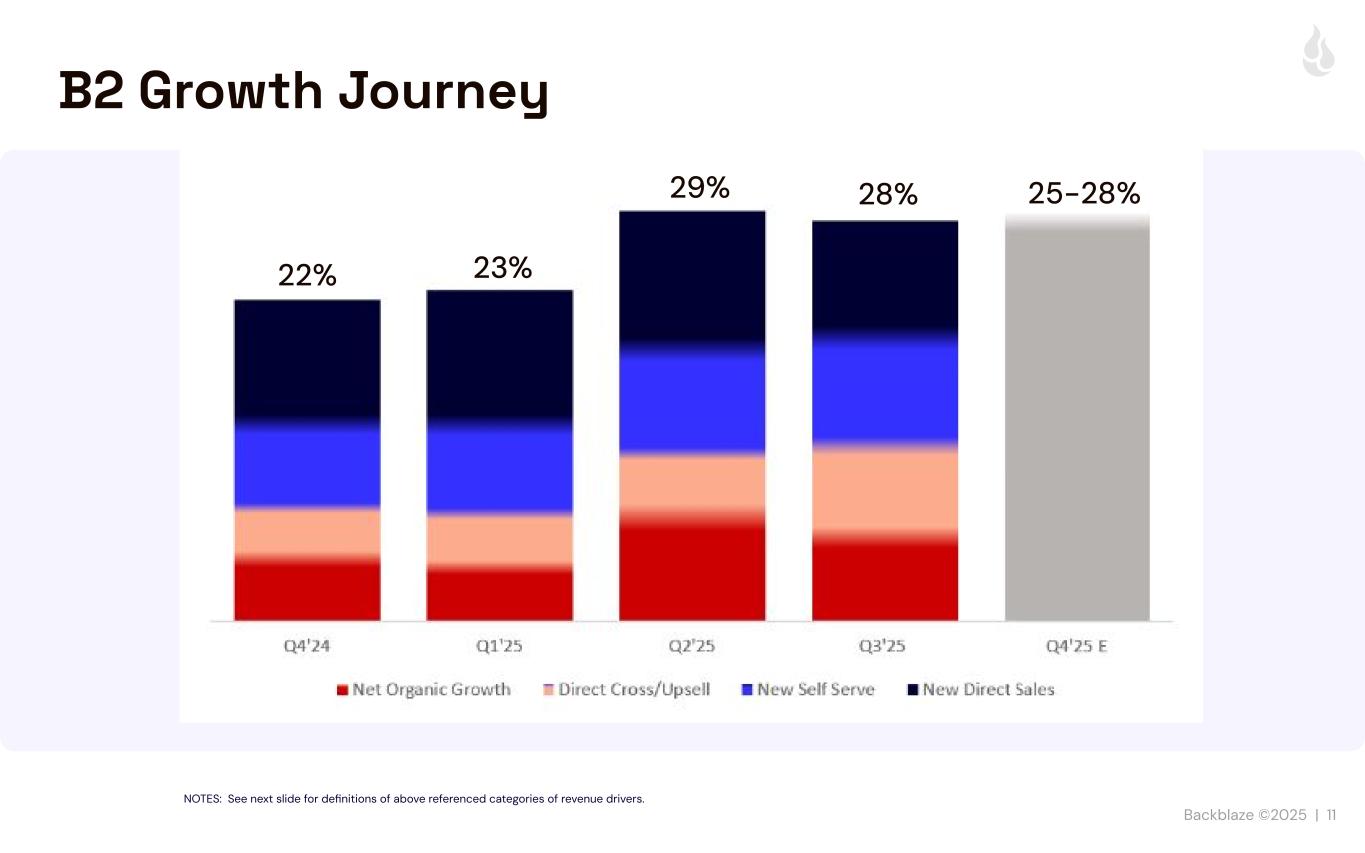

Backblaze ©2025 | 11 B2 Growth Journey 22% 23% 29% NOTES: See next slide for definitions of above referenced categories of revenue drivers. 28% 25-28%

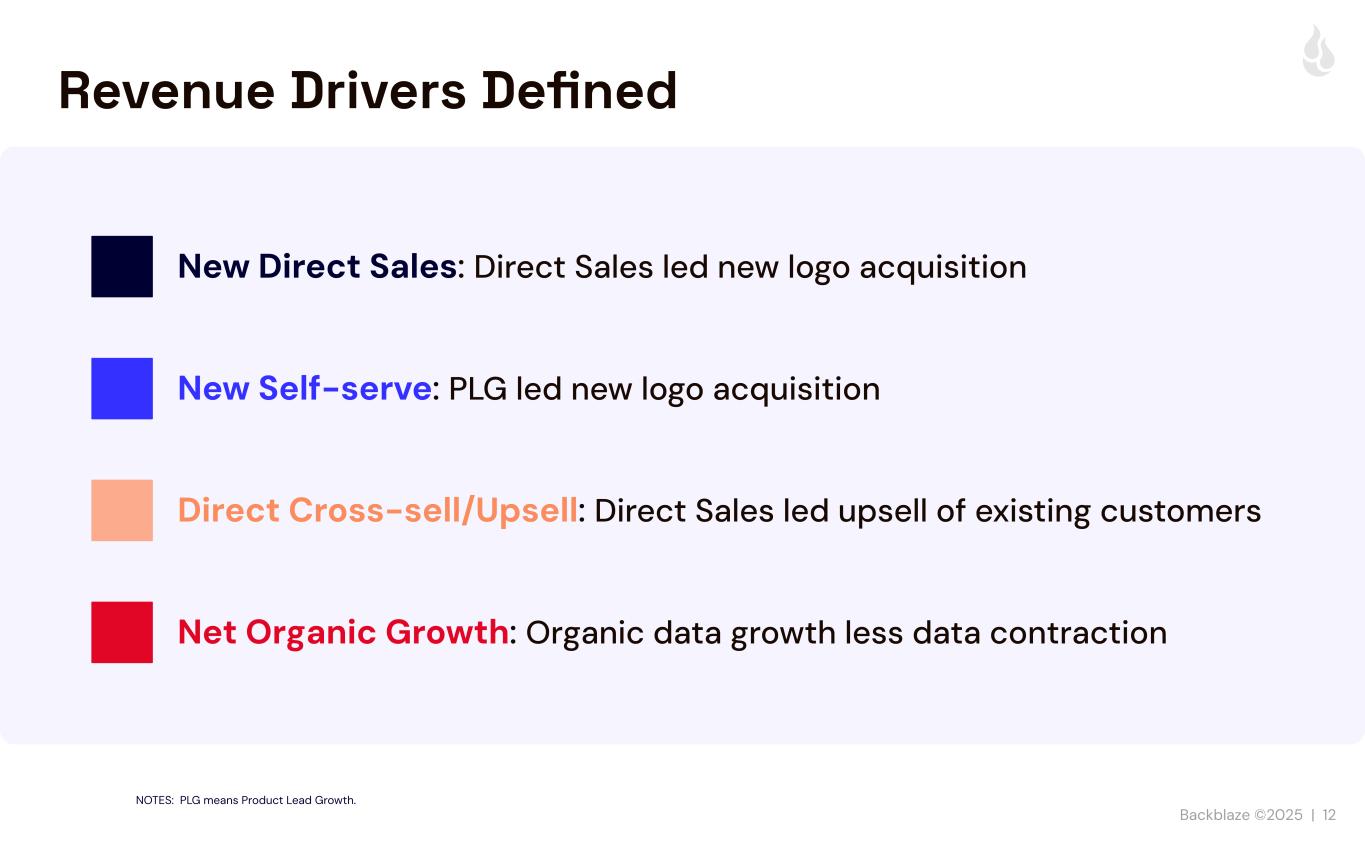

Backblaze ©2025 | 12 Revenue Drivers Defined Net Organic Growth: Organic data growth less data contraction Direct Cross-sell/Upsell: Direct Sales led upsell of existing customers New Self-serve: PLG led new logo acquisition New Direct Sales: Direct Sales led new logo acquisition NOTES: PLG means Product Lead Growth.

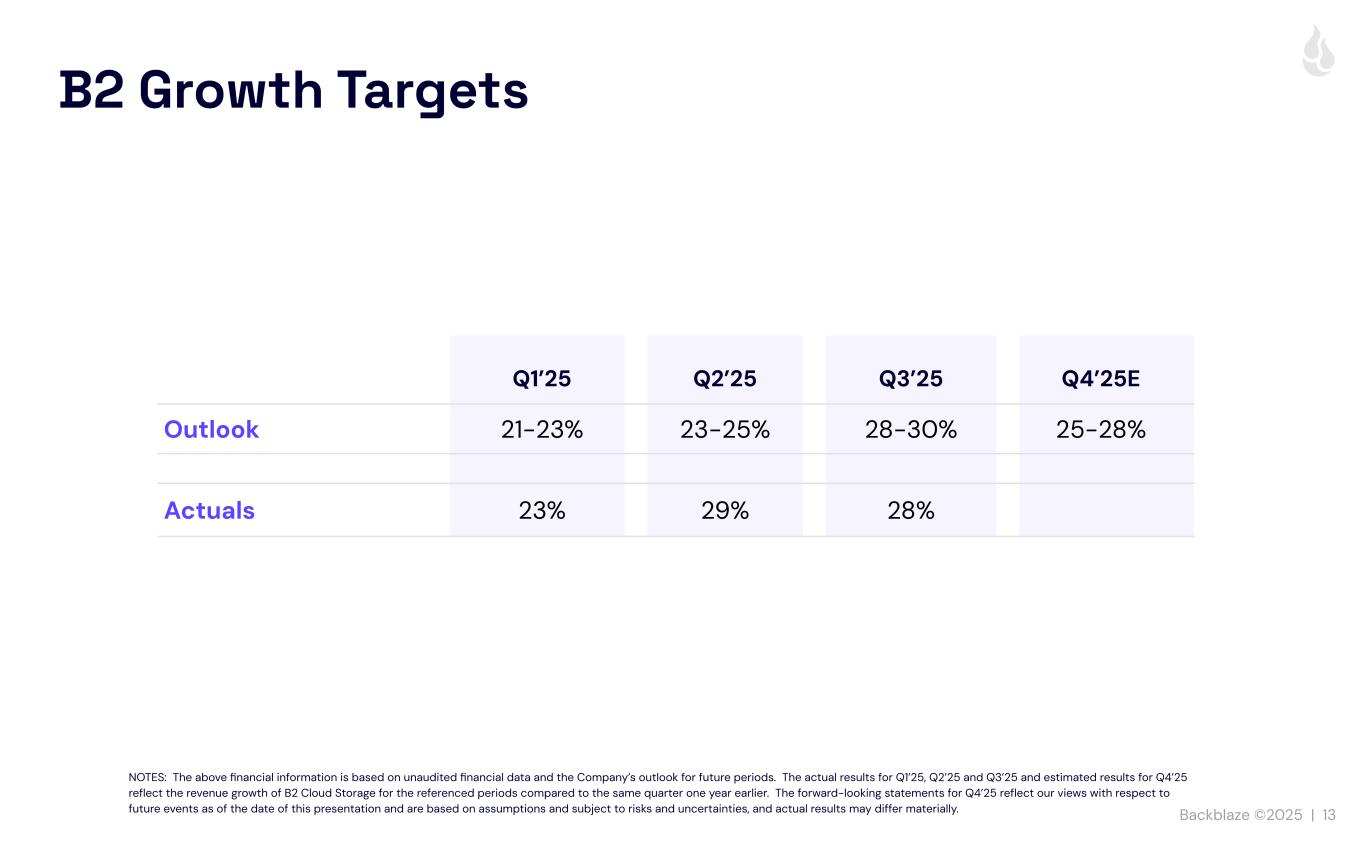

Backblaze ©2025 | 13 B2 Growth Targets Q1’25 Q2’25 Q3’25 Q4’25E Outlook 21-23% 23-25% 28-30% 25-28% Actuals 23% 29% 28% NOTES: The above financial information is based on unaudited financial data and the Company’s outlook for future periods. The actual results for Q1’25, Q2’25 and Q3’25 and estimated results for Q4’25 reflect the revenue growth of B2 Cloud Storage for the referenced periods compared to the same quarter one year earlier. The forward-looking statements for Q4’25 reflect our views with respect to future events as of the date of this presentation and are based on assumptions and subject to risks and uncertainties, and actual results may differ materially.

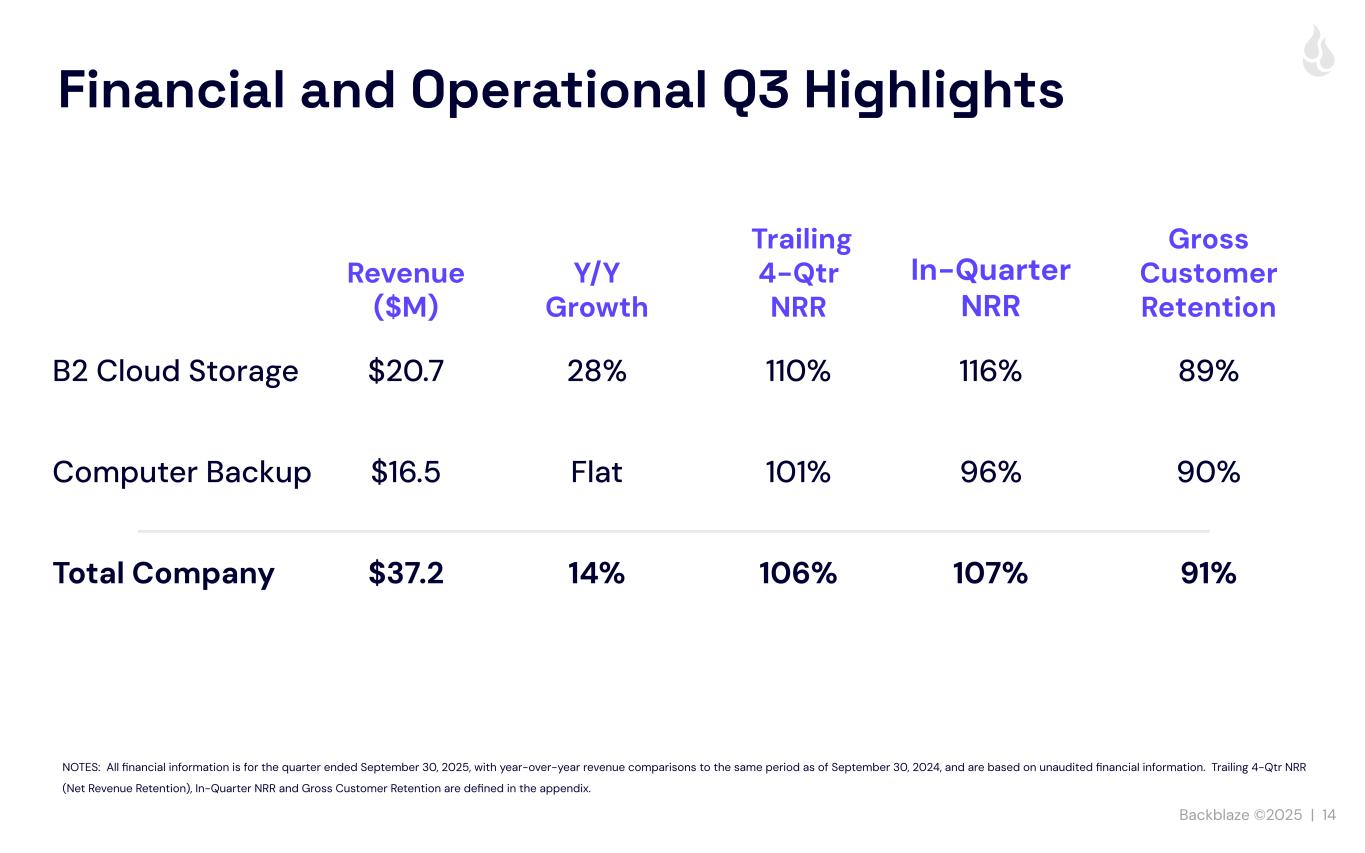

Backblaze ©2025 | 14 Financial and Operational Q3 Highlights Revenue ($M) Y/Y Growth Trailing 4-Qtr NRR In-Quarter NRR Gross Customer Retention B2 Cloud Storage $20.7 28% 110% 116% 89% Computer Backup $16.5 Flat 101% 96% 90% Total Company $37.2 14% 106% 107% 91% NOTES: All financial information is for the quarter ended September 30, 2025, with year-over-year revenue comparisons to the same period as of September 30, 2024, and are based on unaudited financial information. Trailing 4-Qtr NRR (Net Revenue Retention), In-Quarter NRR and Gross Customer Retention are defined in the appendix.

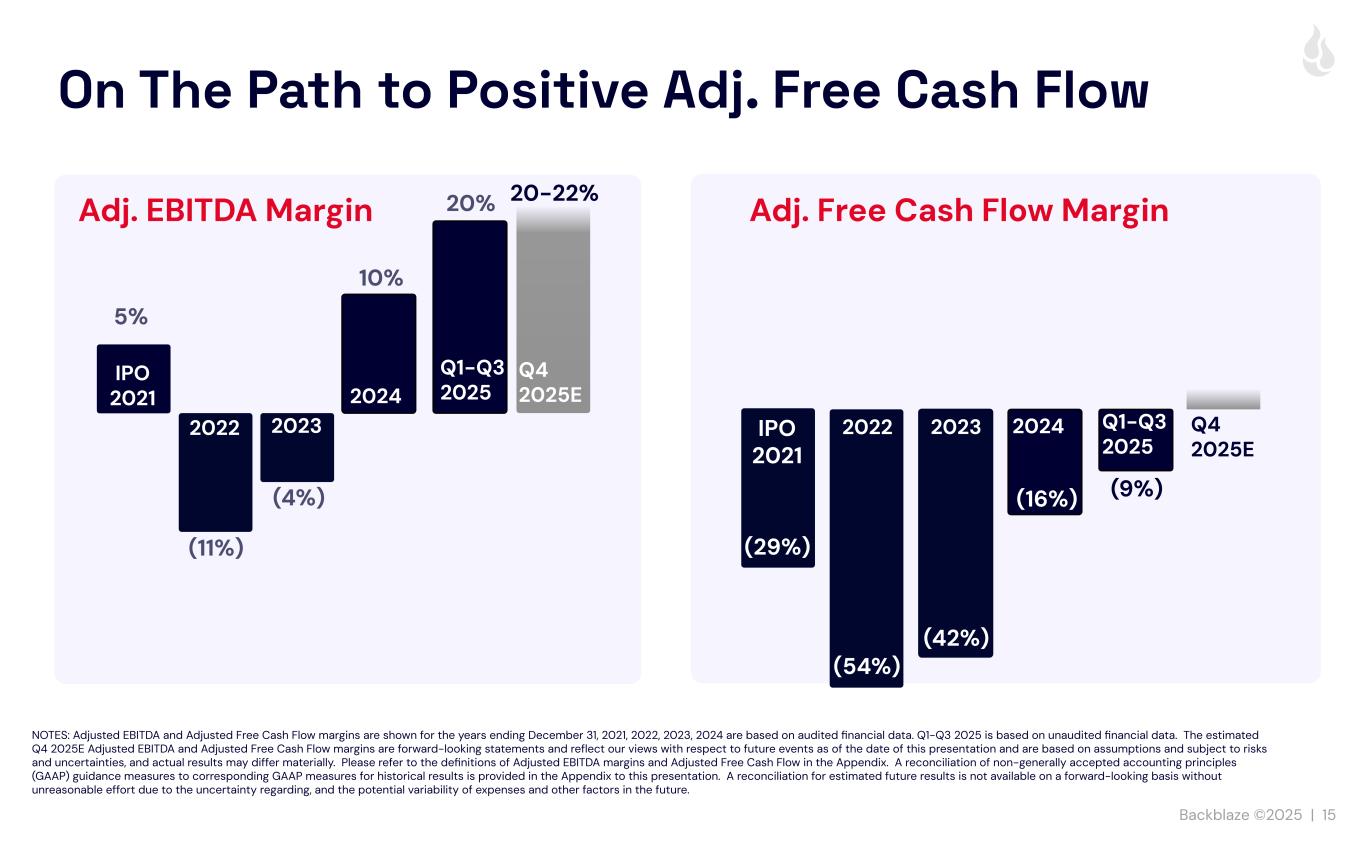

Backblaze ©2025 | 15 On The Path to Positive Adj. Free Cash Flow (4%) (11%) Adj. EBITDA Margin NOTES: Adjusted EBITDA and Adjusted Free Cash Flow margins are shown for the years ending December 31, 2021, 2022, 2023, 2024 are based on audited financial data. Q1-Q3 2025 is based on unaudited financial data. The estimated Q4 2025E Adjusted EBITDA and Adjusted Free Cash Flow margins are forward-looking statements and reflect our views with respect to future events as of the date of this presentation and are based on assumptions and subject to risks and uncertainties, and actual results may differ materially. Please refer to the definitions of Adjusted EBITDA margins and Adjusted Free Cash Flow in the Appendix. A reconciliation of non-generally accepted accounting principles (GAAP) guidance measures to corresponding GAAP measures for historical results is provided in the Appendix to this presentation. A reconciliation for estimated future results is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of expenses and other factors in the future. 5% IPO 2021 2022 2023 Adj. Free Cash Flow Margin 2024 IPO 2021 2022 2023 2024 (54%) (42%) (29%) Q4 2025E 20-22% Q4 2025E 10% (16%) Q1-Q3 2025 20% Q1-Q3 2025 (9%)

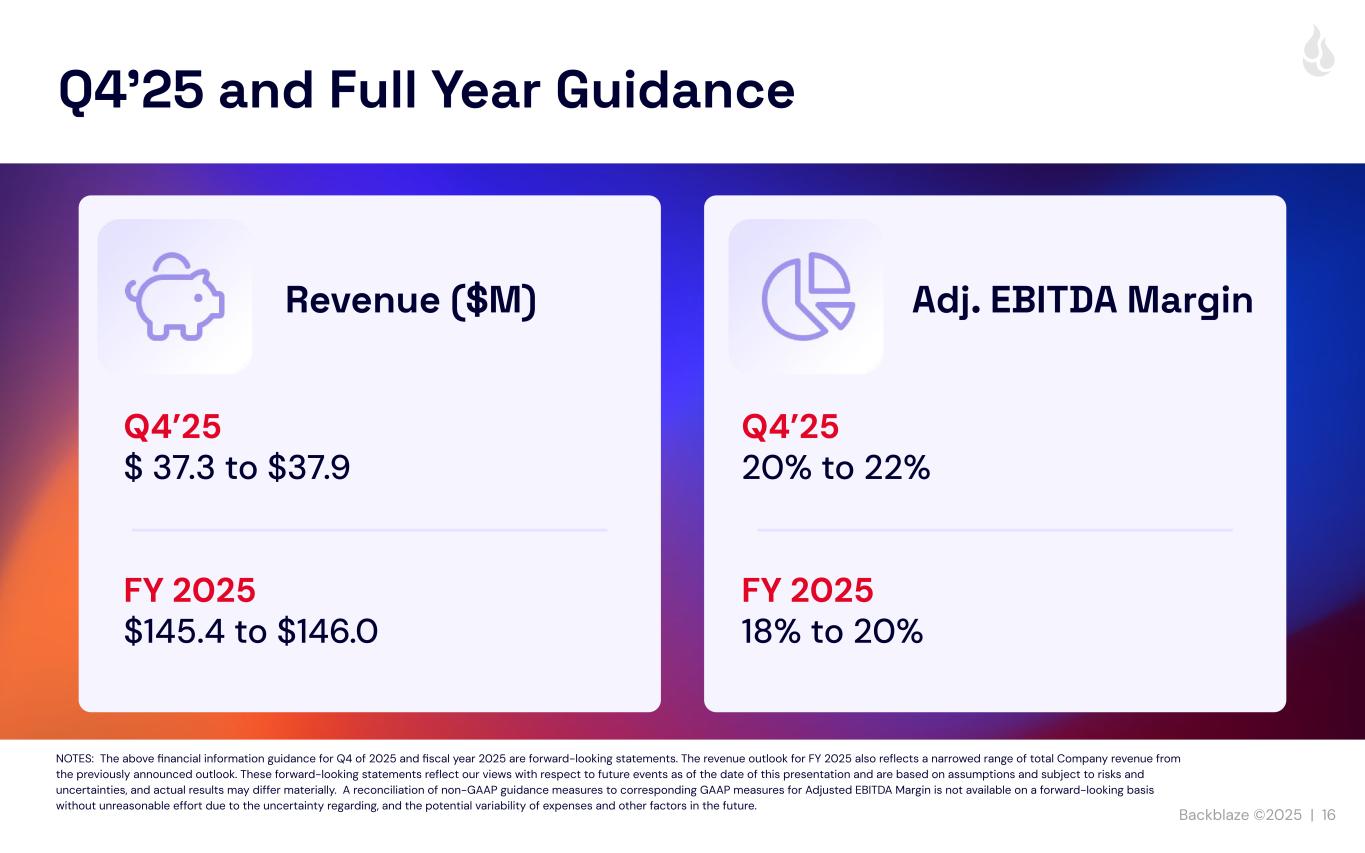

Backblaze ©2025 | 16 Q4’25 and Full Year Guidance Q4’25 $ 37.3 to $37.9 FY 2025 $145.4 to $146.0 Q4’25 20% to 22% FY 2025 18% to 20% NOTES: The above financial information guidance for Q4 of 2025 and fiscal year 2025 are forward-looking statements. The revenue outlook for FY 2025 also reflects a narrowed range of total Company revenue from the previously announced outlook. These forward-looking statements reflect our views with respect to future events as of the date of this presentation and are based on assumptions and subject to risks and uncertainties, and actual results may differ materially. A reconciliation of non-GAAP guidance measures to corresponding GAAP measures for Adjusted EBITDA Margin is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of expenses and other factors in the future. Revenue ($M) Adj. EBITDA Margin

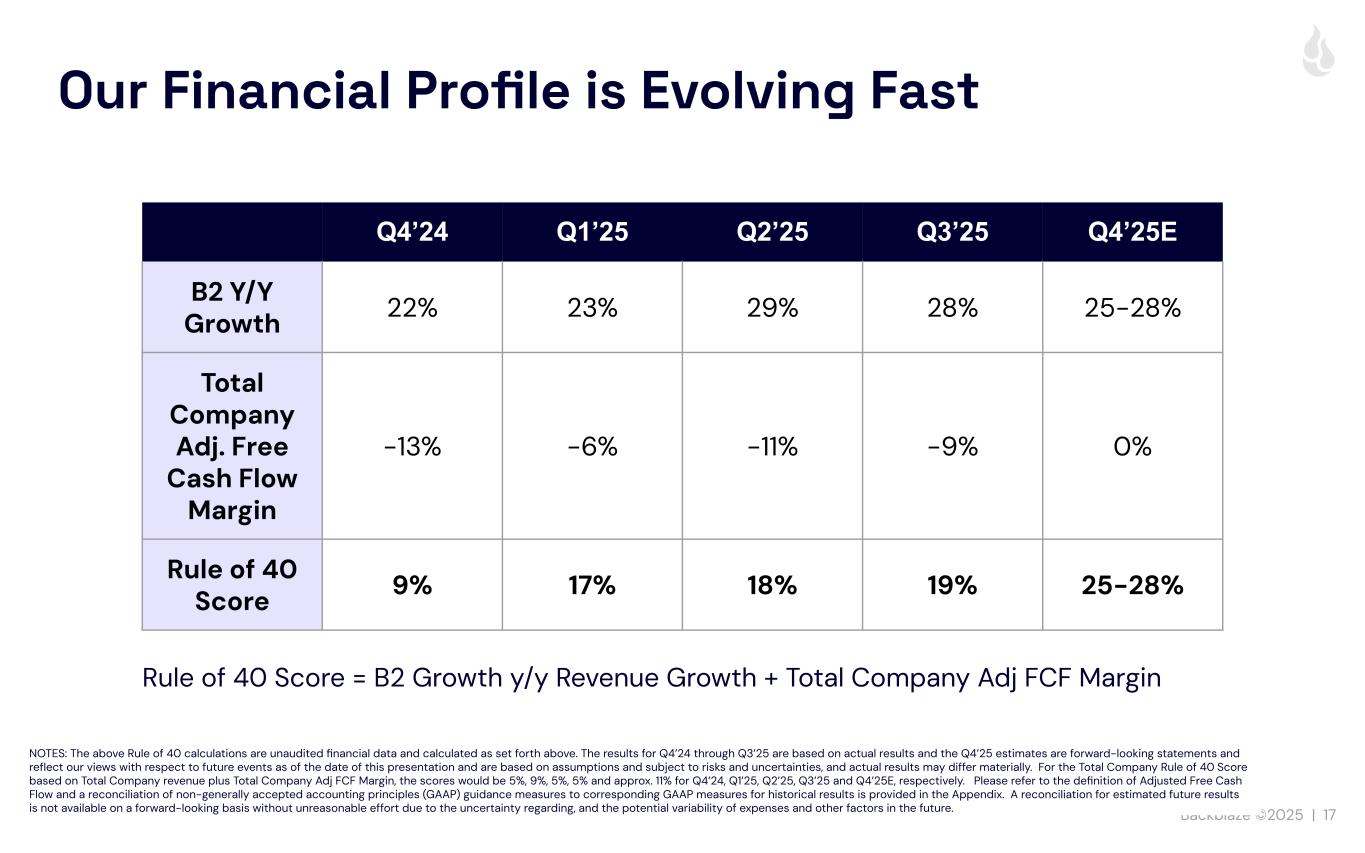

Backblaze ©2025 | 17 Our Financial Profile is Evolving Fast NOTES: The above Rule of 40 calculations are unaudited financial data and calculated as set forth above. The results for Q4’24 through Q3’25 are based on actual results and the Q4’25 estimates are forward-looking statements and reflect our views with respect to future events as of the date of this presentation and are based on assumptions and subject to risks and uncertainties, and actual results may differ materially. For the Total Company Rule of 40 Score based on Total Company revenue plus Total Company Adj FCF Margin, the scores would be 5%, 9%, 5%, 5% and approx. 11% for Q4’24, Q1’25, Q2’25, Q3’25 and Q4’25E, respectively. Please refer to the definition of Adjusted Free Cash Flow and a reconciliation of non-generally accepted accounting principles (GAAP) guidance measures to corresponding GAAP measures for historical results is provided in the Appendix. A reconciliation for estimated future results is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of expenses and other factors in the future. Q4’24 Q1’25 Q2’25 Q3’25 Q4’25E B2 Y/Y Growth 22% 23% 29% 28% 25-28% Total Company Adj. Free Cash Flow Margin -13% -6% -11% -9% 0% Rule of 40 Score 9% 17% 18% 19% 25-28% Rule of 40 Score = B2 Growth y/y Revenue Growth + Total Company Adj FCF Margin

Backblaze ©2025 | 18 Q&A

Backblaze ©2025 | 19 Thank You!

Backblaze ©2025 | 20 Appendix

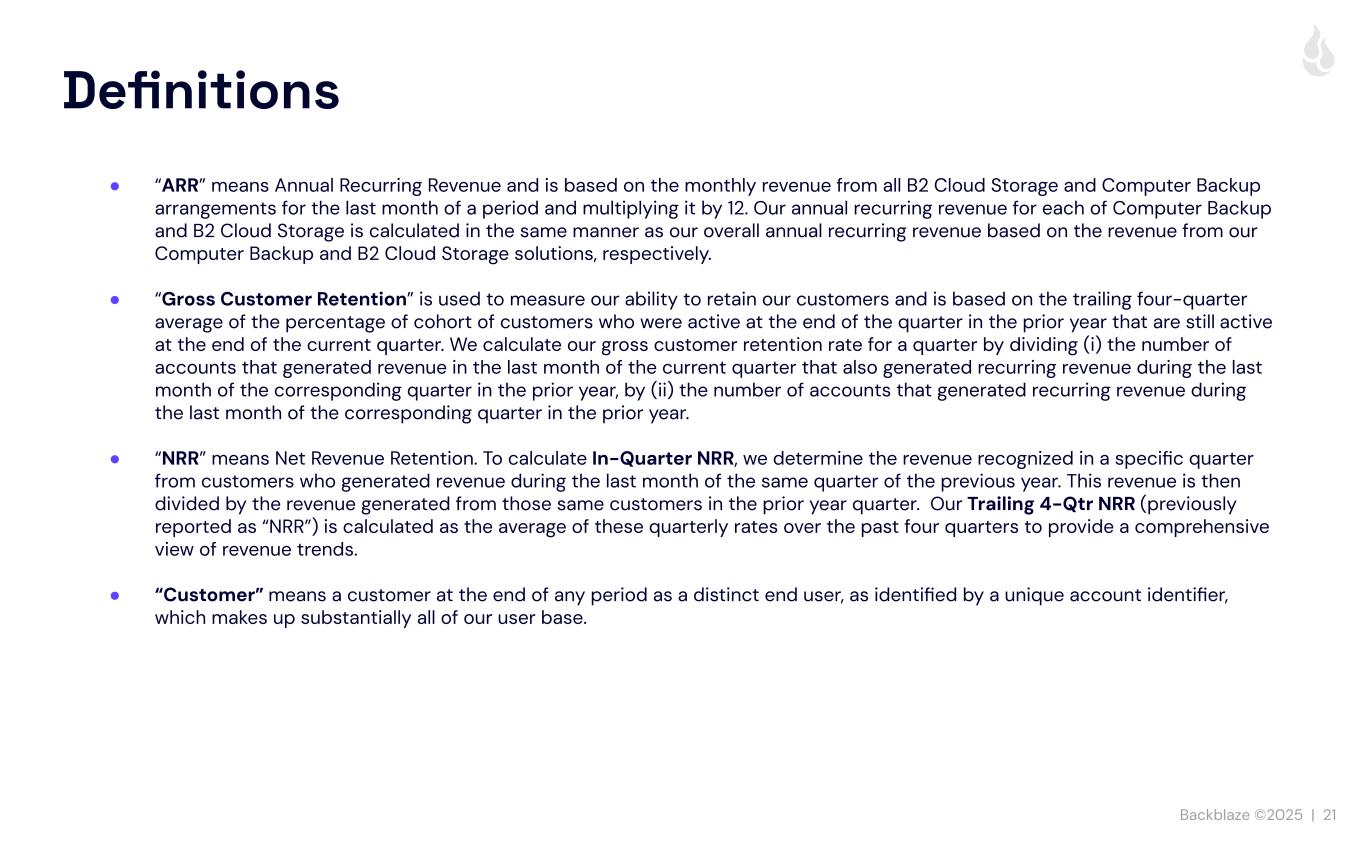

Backblaze ©2025 | 21 ● “ARR” means Annual Recurring Revenue and is based on the monthly revenue from all B2 Cloud Storage and Computer Backup arrangements for the last month of a period and multiplying it by 12. Our annual recurring revenue for each of Computer Backup and B2 Cloud Storage is calculated in the same manner as our overall annual recurring revenue based on the revenue from our Computer Backup and B2 Cloud Storage solutions, respectively. ● “Gross Customer Retention” is used to measure our ability to retain our customers and is based on the trailing four-quarter average of the percentage of cohort of customers who were active at the end of the quarter in the prior year that are still active at the end of the current quarter. We calculate our gross customer retention rate for a quarter by dividing (i) the number of accounts that generated revenue in the last month of the current quarter that also generated recurring revenue during the last month of the corresponding quarter in the prior year, by (ii) the number of accounts that generated recurring revenue during the last month of the corresponding quarter in the prior year. ● “NRR” means Net Revenue Retention. To calculate In-Quarter NRR, we determine the revenue recognized in a specific quarter from customers who generated revenue during the last month of the same quarter of the previous year. This revenue is then divided by the revenue generated from those same customers in the prior year quarter. Our Trailing 4-Qtr NRR (previously reported as “NRR”) is calculated as the average of these quarterly rates over the past four quarters to provide a comprehensive view of revenue trends. ● “Customer” means a customer at the end of any period as a distinct end user, as identified by a unique account identifier, which makes up substantially all of our user base. Definitions

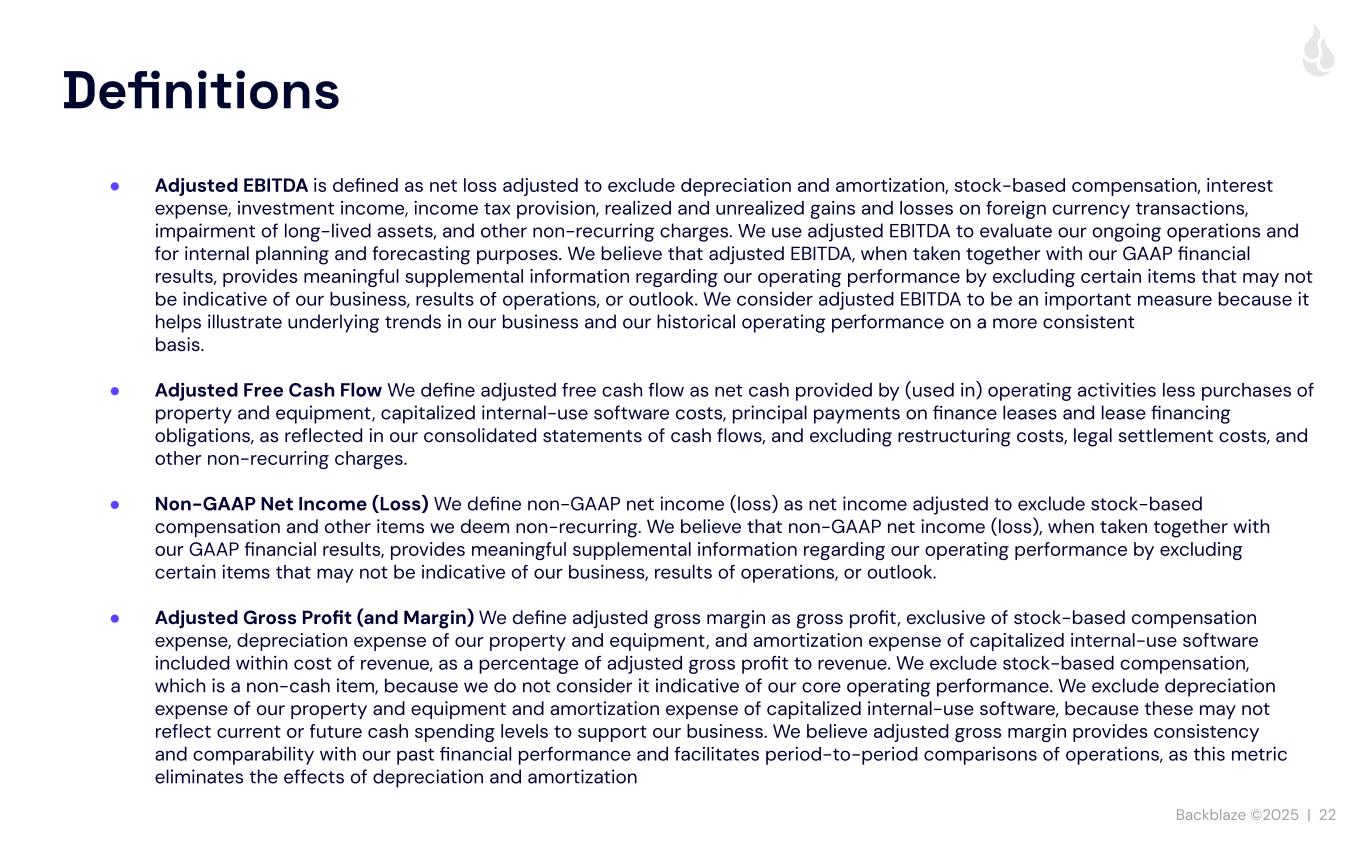

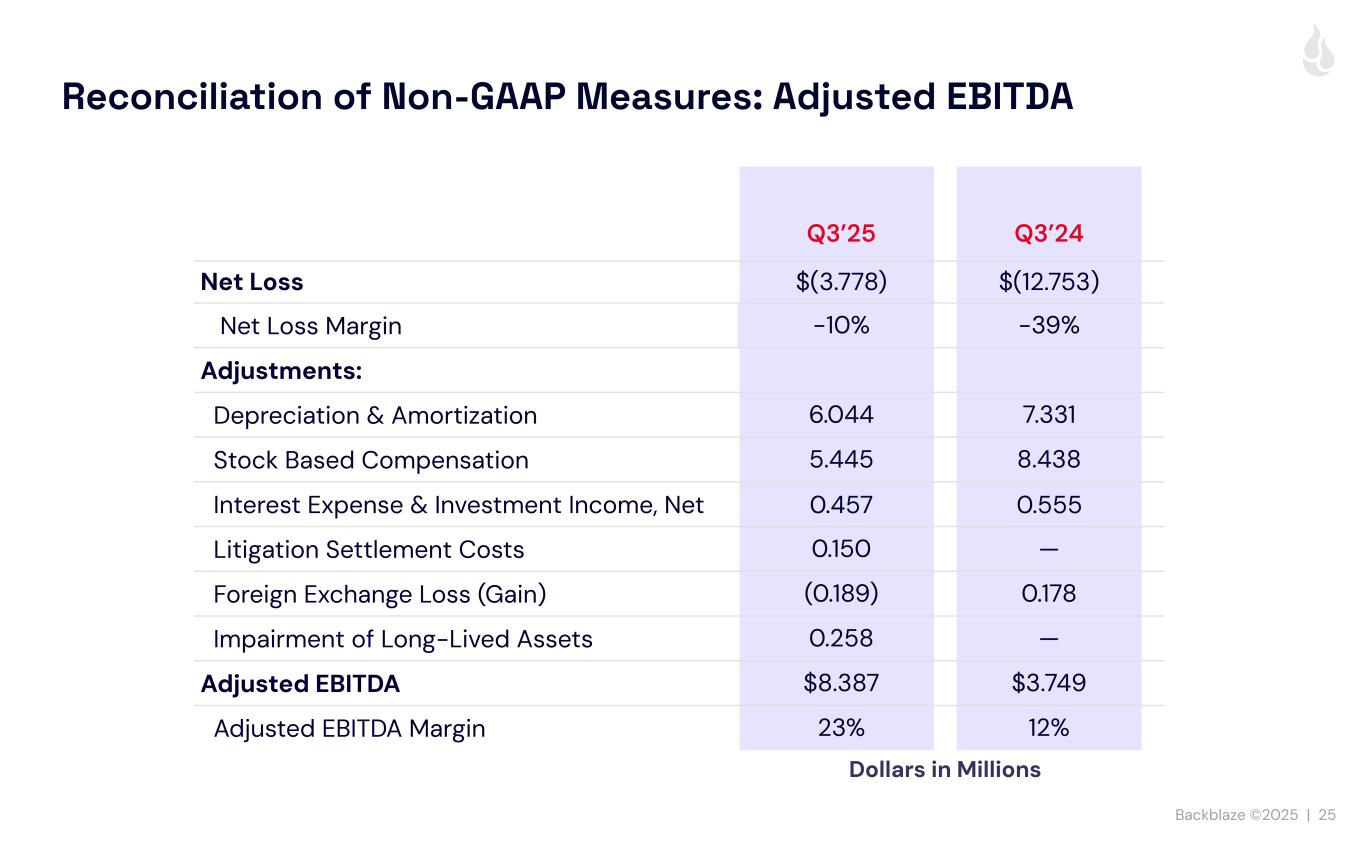

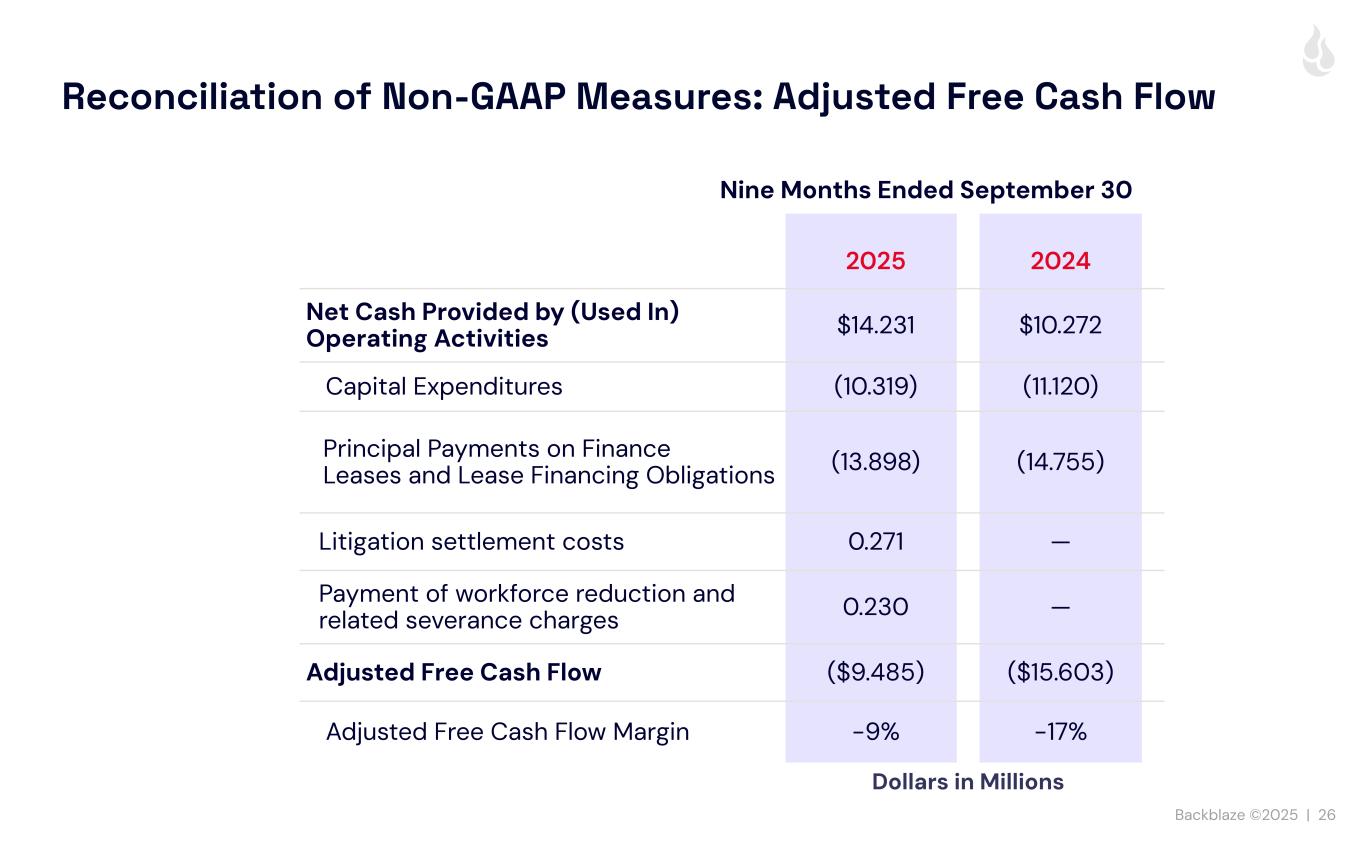

Backblaze ©2025 | 22 ● Adjusted EBITDA is defined as net loss adjusted to exclude depreciation and amortization, stock-based compensation, interest expense, investment income, income tax provision, realized and unrealized gains and losses on foreign currency transactions, impairment of long-lived assets, and other non-recurring charges. We use adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that adjusted EBITDA, when taken together with our GAAP financial results, provides meaningful supplemental information regarding our operating performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. We consider adjusted EBITDA to be an important measure because it helps illustrate underlying trends in our business and our historical operating performance on a more consistent basis. ● Adjusted Free Cash Flow We define adjusted free cash flow as net cash provided by (used in) operating activities less purchases of property and equipment, capitalized internal-use software costs, principal payments on finance leases and lease financing obligations, as reflected in our consolidated statements of cash flows, and excluding restructuring costs, legal settlement costs, and other non-recurring charges. ● Non-GAAP Net Income (Loss) We define non-GAAP net income (loss) as net income adjusted to exclude stock-based compensation and other items we deem non-recurring. We believe that non-GAAP net income (loss), when taken together with our GAAP financial results, provides meaningful supplemental information regarding our operating performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. ● Adjusted Gross Profit (and Margin) We define adjusted gross margin as gross profit, exclusive of stock-based compensation expense, depreciation expense of our property and equipment, and amortization expense of capitalized internal-use software included within cost of revenue, as a percentage of adjusted gross profit to revenue. We exclude stock-based compensation, which is a non-cash item, because we do not consider it indicative of our core operating performance. We exclude depreciation expense of our property and equipment and amortization expense of capitalized internal-use software, because these may not reflect current or future cash spending levels to support our business. We believe adjusted gross margin provides consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as this metric eliminates the effects of depreciation and amortization Definitions

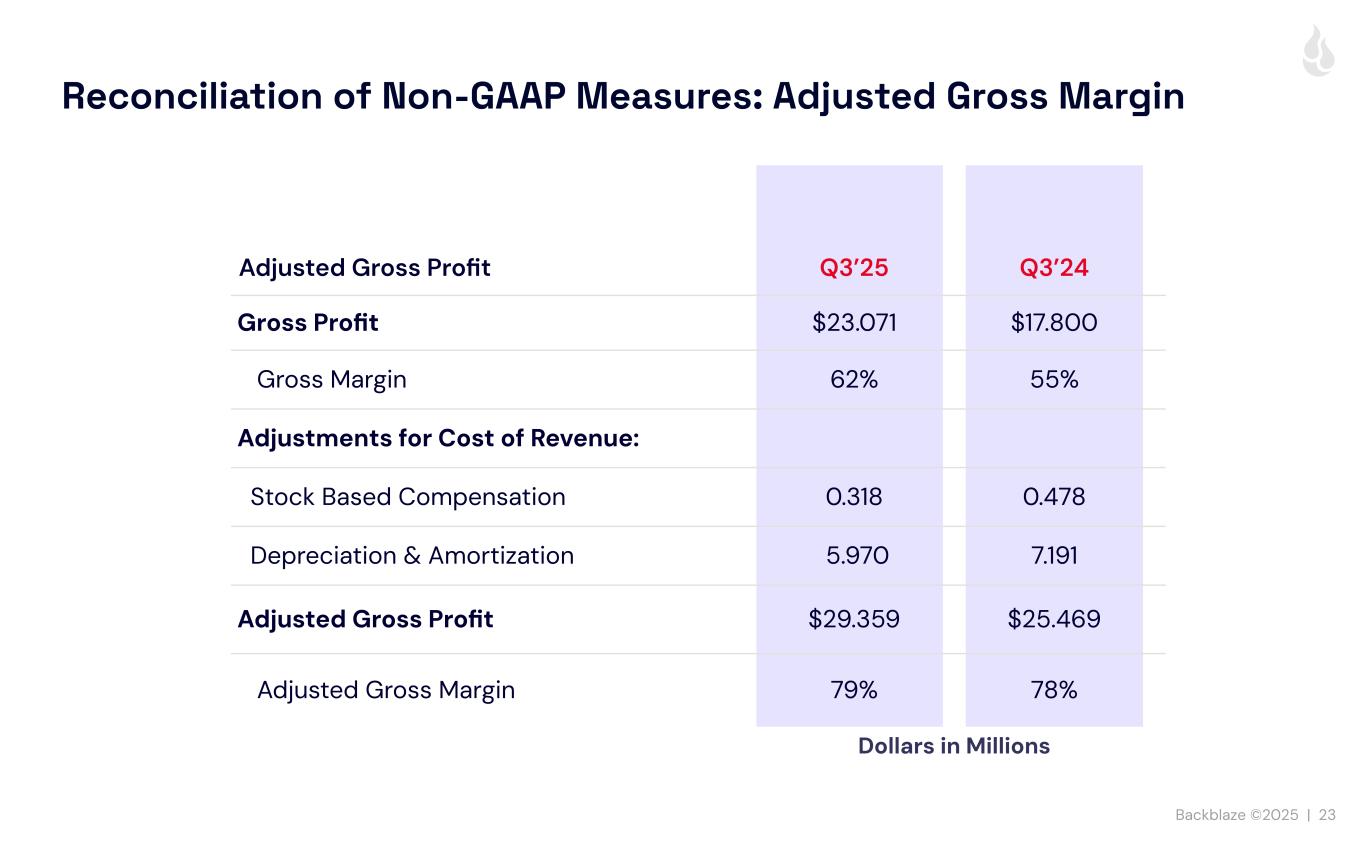

Backblaze ©2025 | 23 Reconciliation of Non-GAAP Measures: Adjusted Gross Margin Adjusted Gross Profit Q3’25 Q3’24 Gross Profit $23.071 $17.800 Gross Margin 62% 55% Adjustments for Cost of Revenue: Stock Based Compensation 0.318 0.478 Depreciation & Amortization 5.970 7.191 Adjusted Gross Profit $29.359 $25.469 Adjusted Gross Margin 79% 78% Dollars in Millions

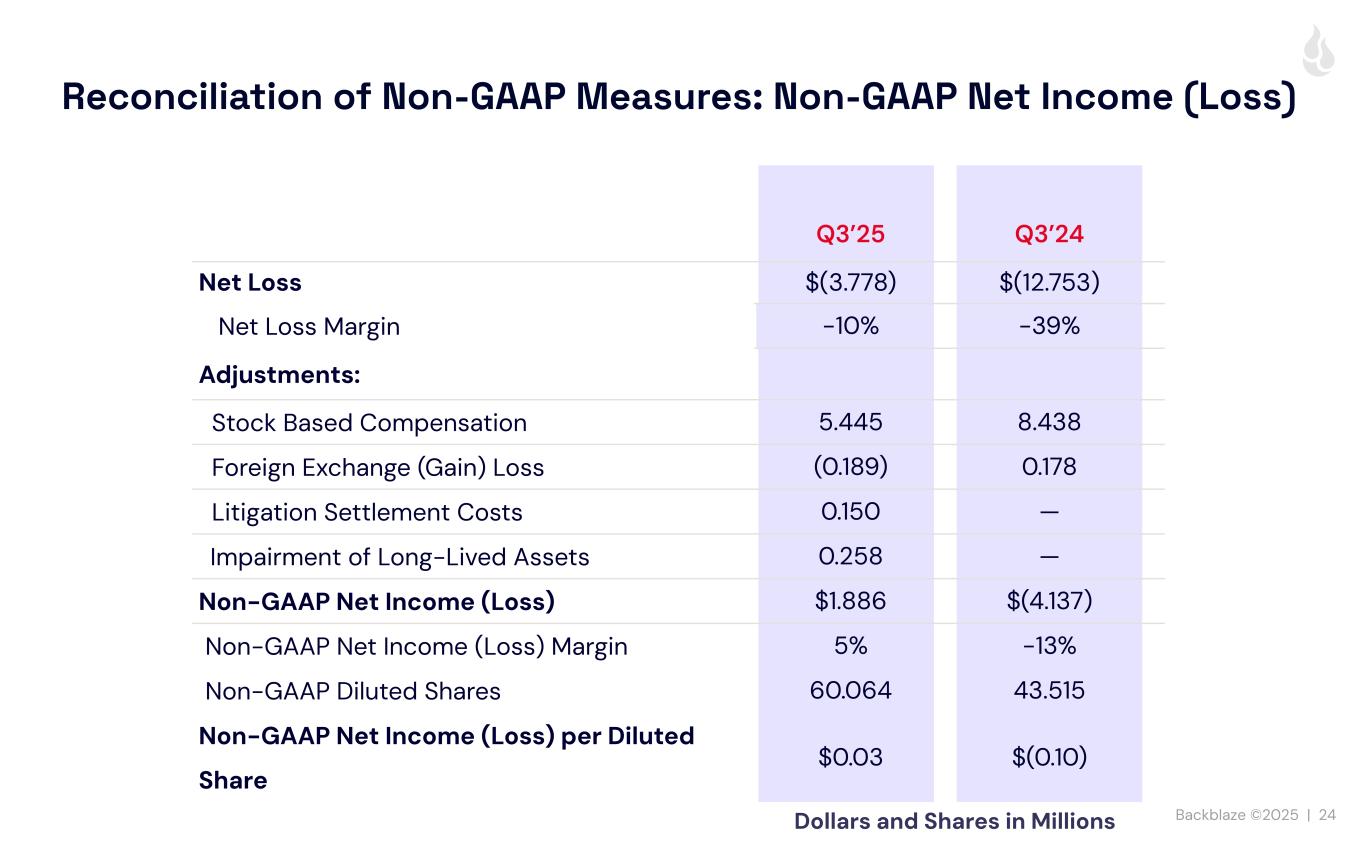

Backblaze ©2025 | 24 Reconciliation of Non-GAAP Measures: Non-GAAP Net Income (Loss) Q3’25 Q3’24 Net Loss $(3.778) $(12.753) Net Loss Margin -10% -39% Adjustments: Stock Based Compensation 5.445 8.438 Foreign Exchange (Gain) Loss (0.189) 0.178 Litigation Settlement Costs 0.150 — Impairment of Long-Lived Assets 0.258 — Non-GAAP Net Income (Loss) $1.886 $(4.137) Non-GAAP Net Income (Loss) Margin 5% -13% Non-GAAP Diluted Shares 60.064 43.515 Non-GAAP Net Income (Loss) per Diluted Share $0.03 $(0.10) Dollars and Shares in Millions

Backblaze ©2025 | 25 Reconciliation of Non-GAAP Measures: Adjusted EBITDA Q3’25 Q3’24 Net Loss $(3.778) $(12.753) Net Loss Margin -10% -39% Adjustments: Depreciation & Amortization 6.044 7.331 Stock Based Compensation 5.445 8.438 Interest Expense & Investment Income, Net 0.457 0.555 Litigation Settlement Costs 0.150 — Foreign Exchange Loss (Gain) (0.189) 0.178 Impairment of Long-Lived Assets 0.258 — Adjusted EBITDA $8.387 $3.749 Adjusted EBITDA Margin 23% 12% Dollars in Millions

Backblaze ©2025 | 26 Reconciliation of Non-GAAP Measures: Adjusted Free Cash Flow 2025 2024 Net Cash Provided by (Used In) Operating Activities $14.231 $10.272 Capital Expenditures (10.319) (11.120) Principal Payments on Finance Leases and Lease Financing Obligations (13.898) (14.755) Litigation settlement costs 0.271 — Payment of workforce reduction and related severance charges 0.230 — Adjusted Free Cash Flow ($9.485) ($15.603) Adjusted Free Cash Flow Margin -9% -17% Dollars in Millions Nine Months Ended September 30