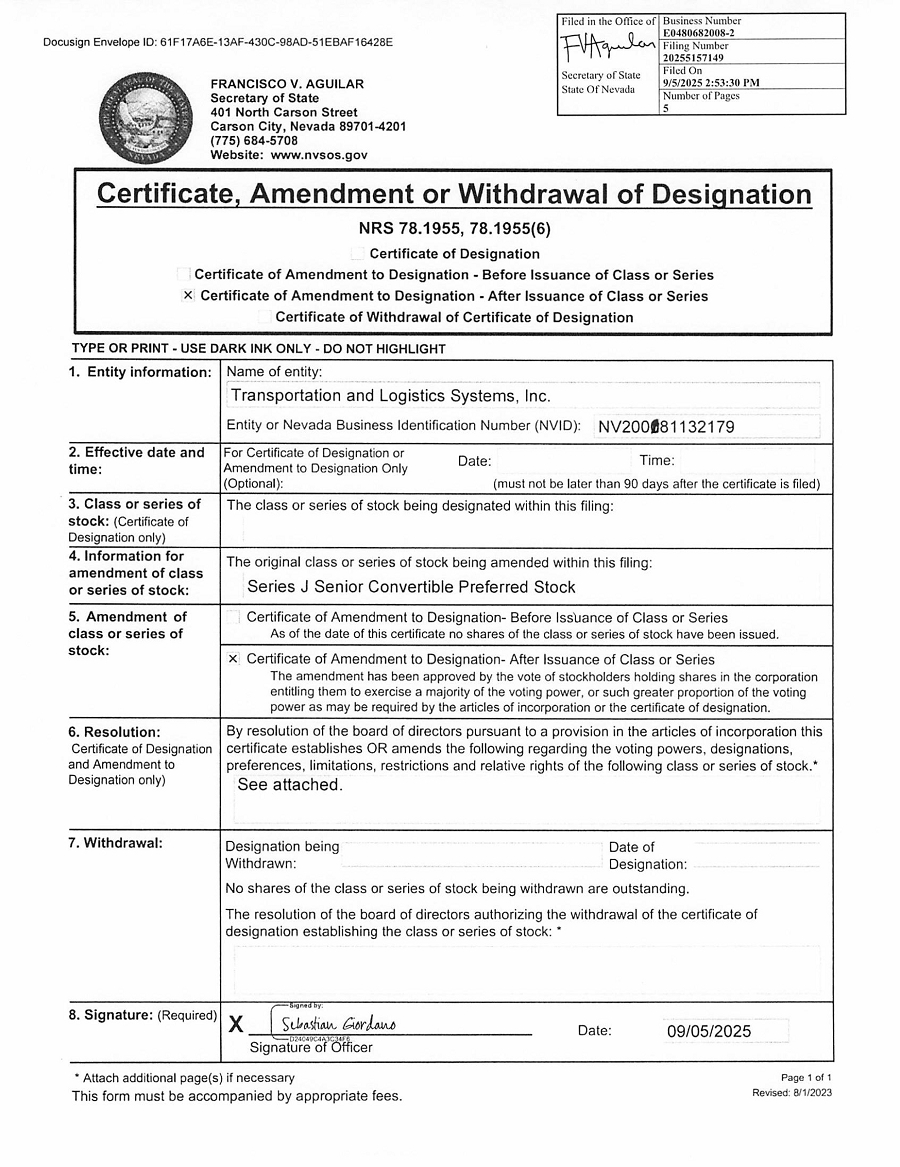

Exhibit 4.1

TRANSPORTATION AND LOGISTICS SYSTEMS, INC.

CERTIFICATE OF AMENDMENT TO

CERTIFICATE OF DESIGNATION, PREFERENCES, RIGHTS AND LIMITATIONS

OF

SERIES J SENIOR CONVERTIBLE PREFERRED STOCK

The undersigned, Sebastian Giordano, Chief Executive Officer of Transportation and Logistics Systems, Inc., (the “Corporation”), pursuant to the provisions of the Nevada Revised Statutes of the State of Nevada, does hereby certify and set forth as follows:

| 1. | The date on which the Certificate of Designation, Preferences, Rights and Limitations of Series J Senior Convertible Preferred Stock of the Corporation (the “Certificate of Designations”), was originally filed with the Secretary of State of the State of Nevada was May 5, 2025, and the Certificate of Designations has not been amended or modified and is in full force and effect as of the date hereof. | |

| 2. | Section 9 to the Certificate of Designations is hereby amended and restated in its entirety to read as follows: |

“Section 9. Redemption.

(a) The Series J Preferred Stock is perpetual and has no maturity date. Upon the occurrence of a Triggering Event (as defined below), each Holder shall have the right to cause the Corporation to redeem all or part of such Holder’s shares of Series J Preferred Stock at a price per share equal to 110% of the Stated Value in accordance with the terms of this Section 9.

(b) Each of the following events, to the extent they have occurred, or arisen from events, liabilities or other indebtedness, fact or circumstances in existence, subsequent to the date hereof, shall constitute a “Triggering Event” and each of the events in clauses (viii), (ix), and (x), to the extent they have occurred subsequent to the date hereof, shall constitute a “Bankruptcy Triggering Event”:

(i) from and after the sixth-month anniversary of the applicable Original Issue Date, the suspension from trading or quoting or the failure of the Common Stock to be traded, quoted or listed (as applicable) on an eligible Trading Market for a period of five (5) consecutive Trading Days;

(ii) the Corporation’s written notice to any Holder, including, without limitation, by way of public announcement or through any of its agents, at any time, of its intention not to comply, as required, with a request for conversion of any Series J Preferred Stock into shares of Common Stock that is requested in accordance with the provisions of this Certificate of Designations;

(iii) at any time following the tenth (10th) consecutive calendar day that the number of shares of Common Stock to be reserved hereunder is less than 100% of the sum of the number of shares of Common Stock that such Holder would be entitled to receive upon a conversion in full of the Series J Preferred Stock held by such Holder (without regard to any limitations on conversion set forth in this Certificate of Designations);

(iv) the Corporation’s Board of Directors fails to declare any Dividend to be paid in accordance with Section 3;

(v) the Corporation’s failure to pay to any Holder any Dividend (whether or not declared by the Board of Directors) or any other amount when and as due under this Certificate of Designations, including, without limitation, the Corporation’s failure to pay any redemption payments or amounts hereunder (as permitted pursuant to the Nevada Revised Statutes), except, in the case of a failure to pay Dividends and any other payment due hereunder when and as due, in each such case only if such failure remains uncured for a period of at least three (3) Trading Days;

(vi) the Corporation, either (A) fails to cure a Conversion Failure by delivery of the required number of shares of Common Stock within five (5) Trading Days after the applicable Conversion Date or (B) fails to remove any restrictive legend on any certificate or any shares of Common Stock issued to such Holder upon conversion of any Series J Preferred Stock acquired by such Holder, unless otherwise then prohibited by applicable federal securities laws, and any such failure remains uncured for at least five (5) Trading Days;

(vii) the occurrence of any default under, redemption of or acceleration prior to maturity of at least an aggregate of $250,000 of indebtedness of the Corporation or any of its Subsidiaries; provided, however, that any default, redemption or acceleration set forth in this Section 9(b)(vii) relating to liabilities in existence on or prior to the date hereof or with respect to a Subsidiary in existence on or prior to the date hereof shall not constitute a Triggering Event;

(viii) bankruptcy, insolvency, reorganization or liquidation proceedings or other proceedings for the relief of debtors shall be instituted by or against the Corporation or any Subsidiary and, if instituted against the Corporation or any Subsidiary by a third party, shall not be dismissed within thirty (30) days of their initiation, provided, however, that any such actions set forth in this Section 9(b)(viii) that have been taken prior to the date hereof or relating to a bankruptcy proceeding that is in existence prior to the date hereof or with respect to a Subsidiary in existence on or prior to the date hereof shall not constitute a Bankruptcy Triggering Event;

(ix) the commencement by the Corporation or any Subsidiary of a voluntary case or proceeding under any applicable federal, state or foreign bankruptcy, insolvency, reorganization or other similar law or of any other case or proceeding to be adjudicated a bankrupt or insolvent, or the consent by it to the entry of a decree, order, judgment or other similar document in respect of the Corporation or any Subsidiary in an involuntary case or proceeding under any applicable federal, state or foreign bankruptcy, insolvency, reorganization or other similar law or to the commencement of any bankruptcy or insolvency case or proceeding against it, or the filing by it of a petition or answer or consent seeking reorganization or relief under any applicable federal, state or foreign law, or the consent by it to the filing of such petition or to the appointment of or taking possession by a custodian, receiver, liquidator, assignee, trustee, sequestrator or other similar official of the Corporation or any Subsidiary or of any substantial part of its property, or the making by it of an assignment for the benefit of creditors, or the execution of a composition of debts, or the occurrence of any other similar federal, state or foreign proceeding, or the admission by it in writing of its inability to pay its debts generally as they become due, the taking of corporate action by the Corporation or any Subsidiary in furtherance of any such action or the taking of any action by any Person to commence a Uniform Commercial Code foreclosure sale or any other similar action under federal, state or foreign law, provided, however, that any such actions set forth in this Section 9(b)(ix) that have been taken prior to the date hereof or relating to a bankruptcy proceeding that is in existence prior to the date hereof or with respect to a Subsidiary in existence on or prior to the date hereof shall not constitute a Bankruptcy Triggering Event;

(x) the entry by a court of (i) a decree, order, judgment or other similar document in respect of the Corporation or any Subsidiary of a voluntary or involuntary case or proceeding under any applicable federal, state or foreign bankruptcy, insolvency, reorganization or other similar law or (ii) a decree, order, judgment or other similar document adjudging the Corporation or any Subsidiary as bankrupt or insolvent, or approving as properly filed a petition seeking liquidation, reorganization, arrangement, adjustment or composition of or in respect of the Corporation or any Subsidiary under any applicable federal, state or foreign law or (iii) a decree, order, judgment or other similar document appointing a custodian, receiver, liquidator, assignee, trustee, sequestrator or other similar official of the Corporation or any Subsidiary or of any substantial part of its property, or ordering the winding up or liquidation of its affairs, and the continuance of any such decree, order, judgment or other similar document or any such other decree, order, judgment or other similar document unstayed and in effect for a period of thirty (30) consecutive days, provided, however, that any such actions set forth in this Section 9(b)(x) relating to a bankruptcy proceeding that is in existence prior to the date hereof or with respect to a Subsidiary in existence on or prior to the date hereof shall not constitute a Bankruptcy Triggering Event;

(xi) a final judgment or judgments for the payment of money aggregating in excess of $250,000 are rendered against the Corporation and/or any of its Subsidiaries and which judgments are not, within thirty (30) days after the entry thereof, bonded, discharged, settled or stayed pending appeal, or are not discharged within thirty (30) days after the expiration of such stay; provided that any judgment which is covered by insurance or an indemnity from a credit worthy party shall not be included in calculating the $250,000 amount set forth above so long as the Corporation provides each Holder a written statement from such insurer or indemnity provider (which written statement shall be reasonably satisfactory to each Holder) to the effect that such judgment is covered by insurance or an indemnity and the Corporation or such Subsidiary (as the case may be) will receive the proceeds of such insurance or indemnity within thirty (30) days of the issuance of such judgment; provided, however, that any judgment set forth in this Section 9(b)(xi) relating to liabilities in existence on or prior to the date hereof or with respect to a Subsidiary in existence on or prior to the date hereof shall not constitute a Triggering Event;

(xii) a false or inaccurate certification (including a false or inaccurate deemed certification) by the Corporation has occurred, and such Holder suffers economic damage thereby;

(xiii) any breach or failure in any respect by the Corporation or any Subsidiary to comply with any covenant hereunder unless such breach does not have a material adverse effect; or

(xiv) (A) the Common Stock cannot be issued and transferred electronically to third parties via DTC through its Deposit/Withdrawal at Custodian system or (B) the Corporation has received notice from DTC to the effect that a suspension of, or restriction on, accepting additional deposits of the Common Stock, electronic trading or book-entry services by DTC with respect to the Common Stock is being imposed or is contemplated.

(c) For the avoidance of doubt, no event, liability or other indebtedness, facts or circumstances in existence as of the date hereof shall form a basis for a Triggering Event. Without limiting any other provision of this Certificate of Designation, the Required Holders may waive the occurrence of one or more Triggering Events and upon the effective date of such waiver, the Holders shall not have the right to cause the Corporation to redeem all or part of such Holder’s shares of Series J Preferred Stock pursuant to the terms of this Section 9 with respect to any such Triggering Events.

(d) Subject to the terms of this Section 9, to cause the Corporation to redeem all or part of its shares of Series J Preferred Stock, each Holder shall deliver written notice to the Corporation (each, a “Redemption Notice”) setting forth the number of shares of Series J Preferred Stock that each such Holder wishes to redeem. The Corporation shall redeem the shares of Series J Preferred Stock in cash in accordance with the Redemption Notice, no later than 5 days after the date on which the Redemption Notice is delivered to the Corporation. Upon receipt of full payment in cash for a complete redemption, each Holder will promptly submit to the Corporation such Holder’s Series J Preferred Stock certificates, if any, and such redeemed shares shall no longer be deemed to be outstanding.

| 3. | All other provisions of the Certificate of Designations shall remain in full force and effect. |

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to the Certificate of Designations to be signed by the undersigned, a duly authorized officer of the Corporation, and the undersigned has executed this Certificate of Amendment and affirms the foregoing as true and under penalty of perjury this 5th day of September, 2025.

| TRANSPORTATION AND LOGISTICS SYSTEMS, INC. | ||

| By: | /s/ Sebastian Giordano | |

| Name: | Sebastian Giordano | |

| Title: | Chief Executive Officer | |