Midland States Bancorp, Inc. Third Quarter 2025 Earnings Presentation October 30, 2025

2 Forward Looking Statement Forward-Looking Statements: Readers should note that in addition to the historical information contained herein, this press release includes "forward-looking statements" within the meanings of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including but not limited to statements about the Company’s plans, objectives, future performance, goals and future earnings levels, including currently anticipated levels of noninterest income and operating expenses. These statements are subject to many risks and uncertainties, including changes in interest rates and other general economic, business and political conditions; the impact of federal trade policy, inflation, increased deposit volatility and potential regulatory developments; changes in the financial markets; changes in business plans as circumstances warrant; changes to U.S. tax laws, regulations and guidance; and other risks detailed from time to time in filings made by the Company with the Securities and Exchange Commission. Readers should note that the forward-looking statements included in this press release are not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "will," "propose," "may," "plan," "seek," "expect," "intend," "estimate," "anticipate," "believe," "continue," or similar terminology. Any forward-looking statements presented herein are made only as of the date of this press release, and the Company does not undertake any obligation to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding. Use of Non-GAAP Financial Measures: Some of the financial measures included in this press release are not measures of financial performance recognized in accordance with GAAP. These non-GAAP financial measures include “Pre-provision net revenue,” “Pre-provision net revenue per diluted share,” “Pre-provision net revenue to average assets,” “Efficiency ratio,” “Tangible common equity to tangible assets,” and “Tangible book value per share.” The Company believes these non-GAAP financial measures provide both management and investors a more complete understanding of the Company’s funding profile and profitability. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Not all companies use the same calculation of these measures; therefore, the measures in this press release may not be comparable to other similarly titled measures as presented by other companies.

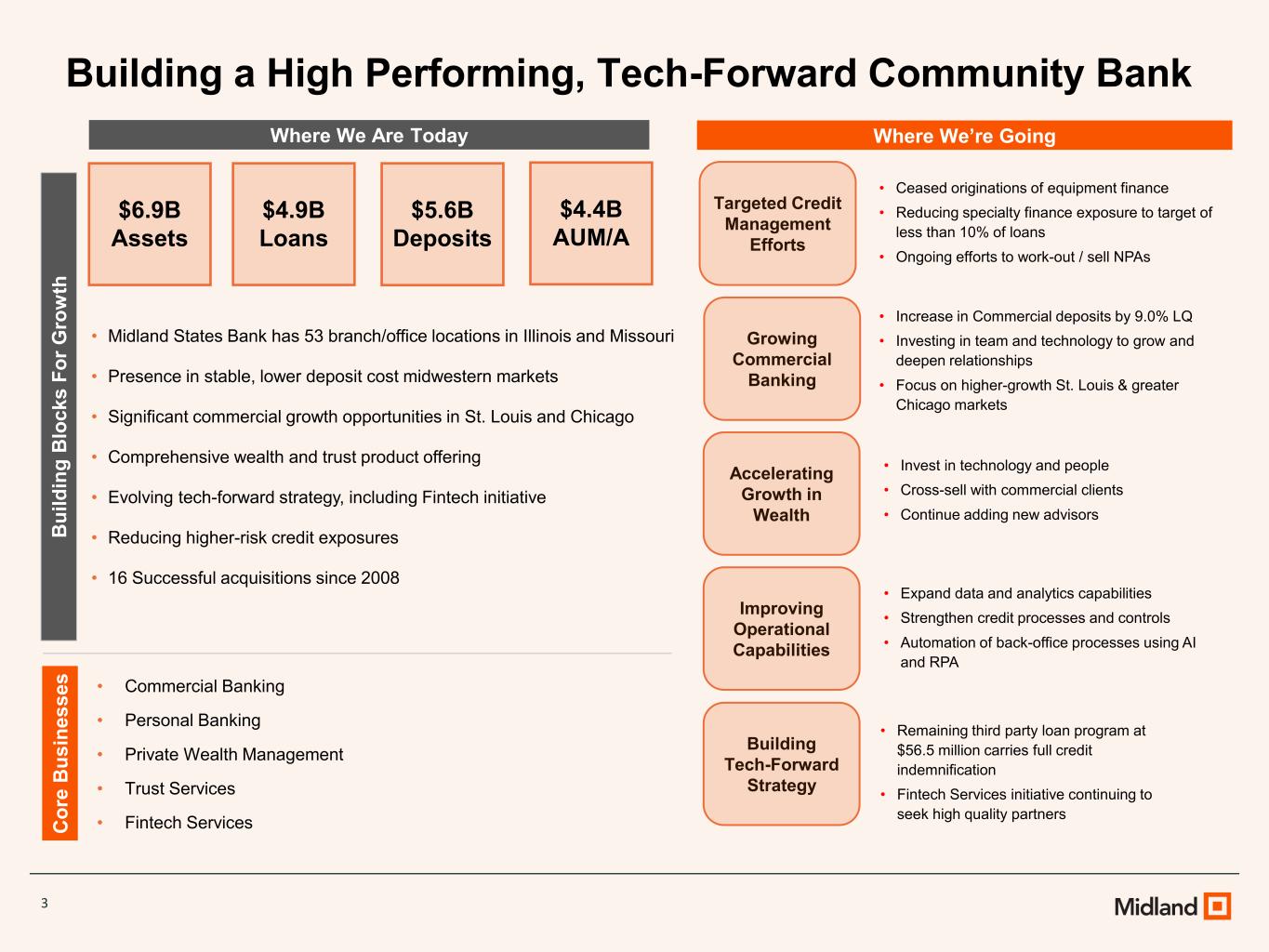

3 Where We Are Today Where We’re Going B u il d in g B lo c k s F o r G ro w th C o re B u s in e s s e s • Midland States Bank has 53 branch/office locations in Illinois and Missouri • Presence in stable, lower deposit cost midwestern markets • Significant commercial growth opportunities in St. Louis and Chicago • Comprehensive wealth and trust product offering • Evolving tech-forward strategy, including Fintech initiative • Reducing higher-risk credit exposures • 16 Successful acquisitions since 2008 • Commercial Banking • Personal Banking • Private Wealth Management • Trust Services • Fintech Services Targeted Credit Management Efforts Growing Commercial Banking Accelerating Growth in Wealth Improving Operational Capabilities • Ceased originations of equipment finance • Reducing specialty finance exposure to target of less than 10% of loans • Ongoing efforts to work-out / sell NPAs • Increase in Commercial deposits by 9.0% LQ • Investing in team and technology to grow and deepen relationships • Focus on higher-growth St. Louis & greater Chicago markets • Invest in technology and people • Cross-sell with commercial clients • Continue adding new advisors • Expand data and analytics capabilities • Strengthen credit processes and controls • Automation of back-office processes using AI and RPA Building Tech-Forward Strategy • Remaining third party loan program at $56.5 million carries full credit indemnification • Fintech Services initiative continuing to seek high quality partners $6.9B Assets $4.9B Loans $5.6B Deposits $4.4B AUM/A Building a High Performing, Tech-Forward Community Bank

4 Continued credit remediation: reduced non-performing assets by $11.4 million in Q3, NPAs to assets decreased to 1.02% from 1.15% 3.79% reported net interest margin, 3.69% excluding a $1.6 million interest recovery; driven by 7bp decline in deposit costs to 2.12%, new loan originations at ~6.7% Strong community bank trends; loan fundings of $129 million; deposits increasing 1.5%, added 3 new commercial bankers during Q3 Tangible book value1 of $21.16, most capital ratios grew sequentially, TCE / TA up 34 bps to 6.6%. Redeemed $51 million in subordinated notes using existing liquidity Third Quarter 2025 Highlights 1 Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

5 Third Quarter 2025 Financial Summary EPS PPNR1 Loans Deposits Capital • PPNR1 of $31.3 million, or $1.43 per share • Net interest income of $61.1 million benefitted from -7bps LQ reduction in deposit costs • Non-interest income rose 2.9% LQ excluding credit enhancement income • Loan balances decreased $168 million LQ, with $39 million decline for Community Bank reflecting several large payoffs and the reduction in nonperforming loans • Provision of $20.0 million, $15 million was due to increase in loss given default assumptions in equipment finance portfolio • Deposits decreased $342 million; high-cost servicing and brokered deposits declined $369 million LQ • Loan to deposit ratio remains stable at 87% • Tangible book value1 of $21.16, up $0.48 versus LQ and up $1.33 versus prior year end • Consolidated CET1 ratio of 9.37%; Total Capital ratio of 14.29% • Fully diluted EPS of $0.24 for third quarter of 2025 1 Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

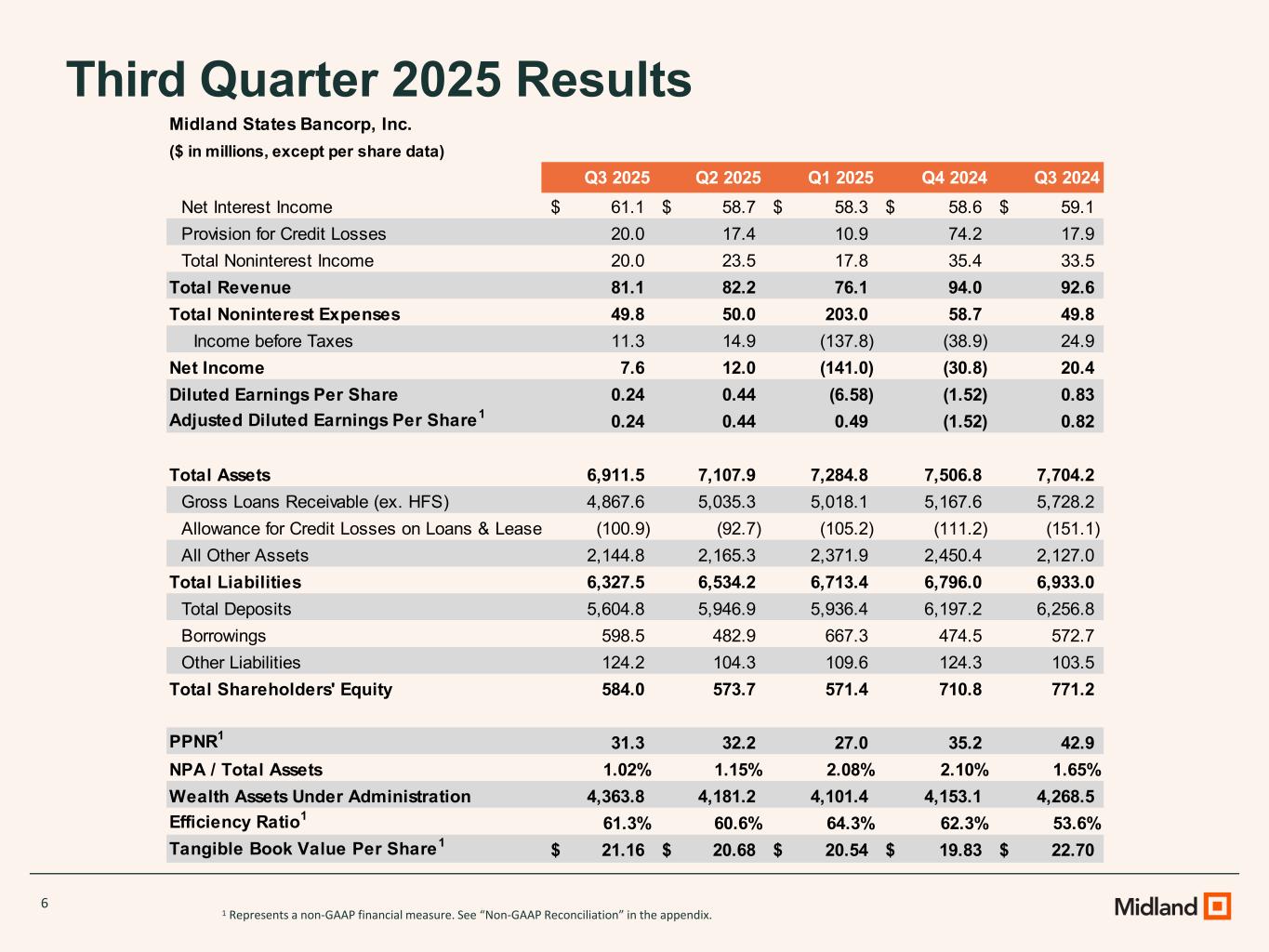

6 Third Quarter 2025 Results 1 Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Midland States Bancorp, Inc. ($ in millions, except per share data) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Net Interest Income 61.1$ 58.7$ 58.3$ 58.6$ 59.1$ Provision for Credit Losses 20.0 17.4 10.9 74.2 17.9 Total Noninterest Income 20.0 23.5 17.8 35.4 33.5 Total Revenue 81.1 82.2 76.1 94.0 92.6 Total Noninterest Expenses 49.8 50.0 203.0 58.7 49.8 Income before Taxes 11.3 14.9 (137.8) (38.9) 24.9 Net Income 7.6 12.0 (141.0) (30.8) 20.4 Diluted Earnings Per Share 0.24 0.44 (6.58) (1.52) 0.83 Adjusted Diluted Earnings Per Share1 0.24 0.44 0.49 (1.52) 0.82 Total Assets 6,911.5 7,107.9 7,284.8 7,506.8 7,704.2 Gross Loans Receivable (ex. HFS) 4,867.6 5,035.3 5,018.1 5,167.6 5,728.2 Allowance for Credit Losses on Loans & Leases (100.9) (92.7) (105.2) (111.2) (151.1) All Other Assets 2,144.8 2,165.3 2,371.9 2,450.4 2,127.0 Total Liabilities 6,327.5 6,534.2 6,713.4 6,796.0 6,933.0 Total Deposits 5,604.8 5,946.9 5,936.4 6,197.2 6,256.8 Borrowings 598.5 482.9 667.3 474.5 572.7 Other Liabilities 124.2 104.3 109.6 124.3 103.5 Total Shareholders' Equity 584.0 573.7 571.4 710.8 771.2 PPNR1 31.3 32.2 27.0 35.2 42.9 NPA / Total Assets 1.02% 1.15% 2.08% 2.10% 1.65% Wealth Assets Under Administration 4,363.8 4,181.2 4,101.4 4,153.1 4,268.5 Efficiency Ratio1 61.3% 60.6% 64.3% 62.3% 53.6% Tangible Book Value Per Share1 21.16$ 20.68$ 20.54$ 19.83$ 22.70$

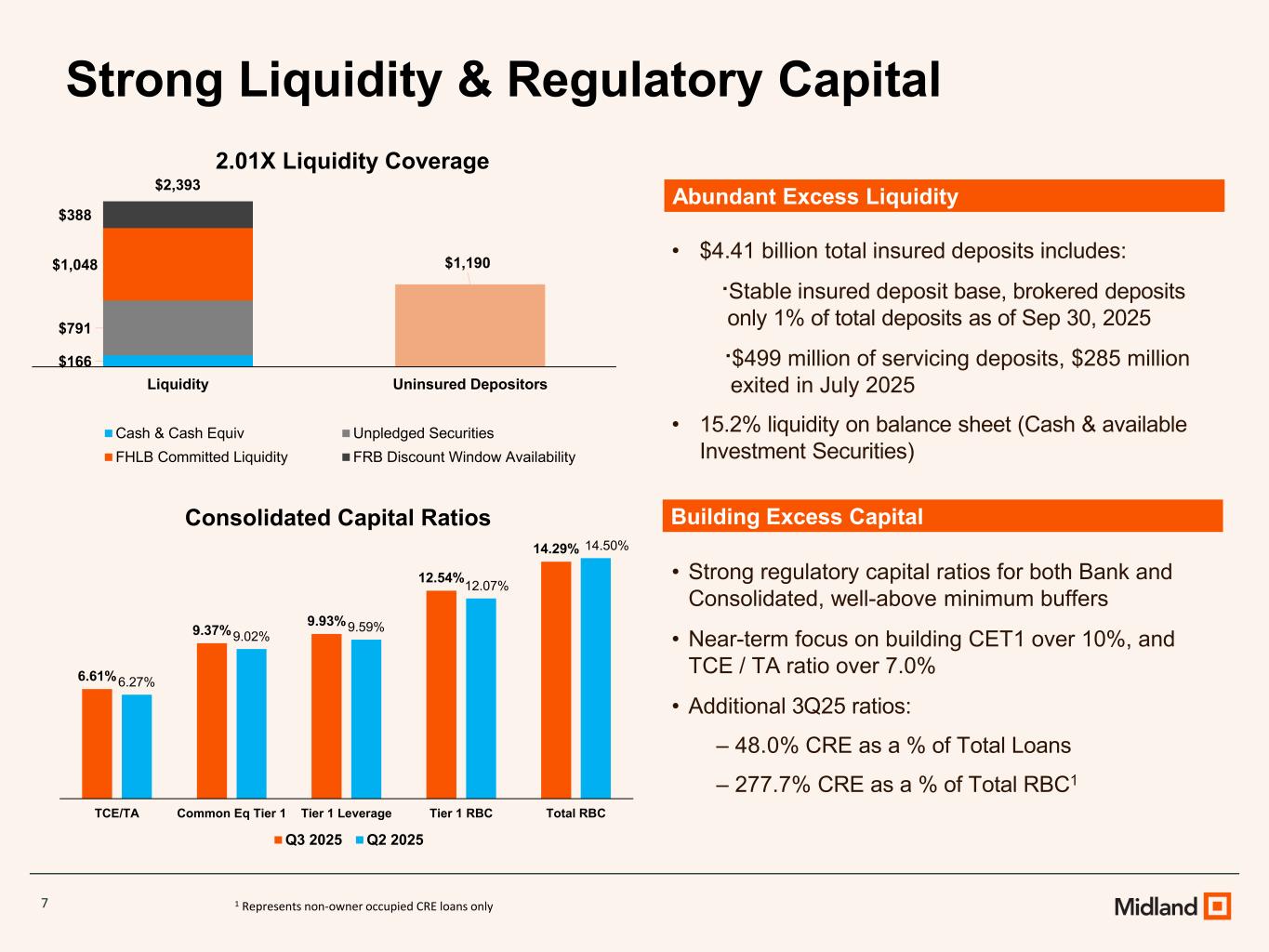

7 Strong Liquidity & Regulatory Capital • $4.41 billion total insured deposits includes: ·Stable insured deposit base, brokered deposits only 1% of total deposits as of Sep 30, 2025 ·$499 million of servicing deposits, $285 million exited in July 2025 • 15.2% liquidity on balance sheet (Cash & available Investment Securities) • Strong regulatory capital ratios for both Bank and Consolidated, well-above minimum buffers • Near-term focus on building CET1 over 10%, and TCE / TA ratio over 7.0% • Additional 3Q25 ratios: ‒ 48.0% CRE as a % of Total Loans ‒ 277.7% CRE as a % of Total RBC1 1 Represents non-owner occupied CRE loans only 6.61% 9.37% 9.93% 12.54% 14.29% 6.27% 9.02% 9.59% 12.07% 14.50% TCE/TA Common Eq Tier 1 Tier 1 Leverage Tier 1 RBC Total RBC Consolidated Capital Ratios Q3 2025 Q2 2025 $166 $1,190 $791 $1,048 $388 Liquidity Uninsured Depositors 2.01X Liquidity Coverage Cash & Cash Equiv Unpledged Securities FHLB Committed Liquidity FRB Discount Window Availability $2,393 Abundant Excess Liquidity Building Excess Capital

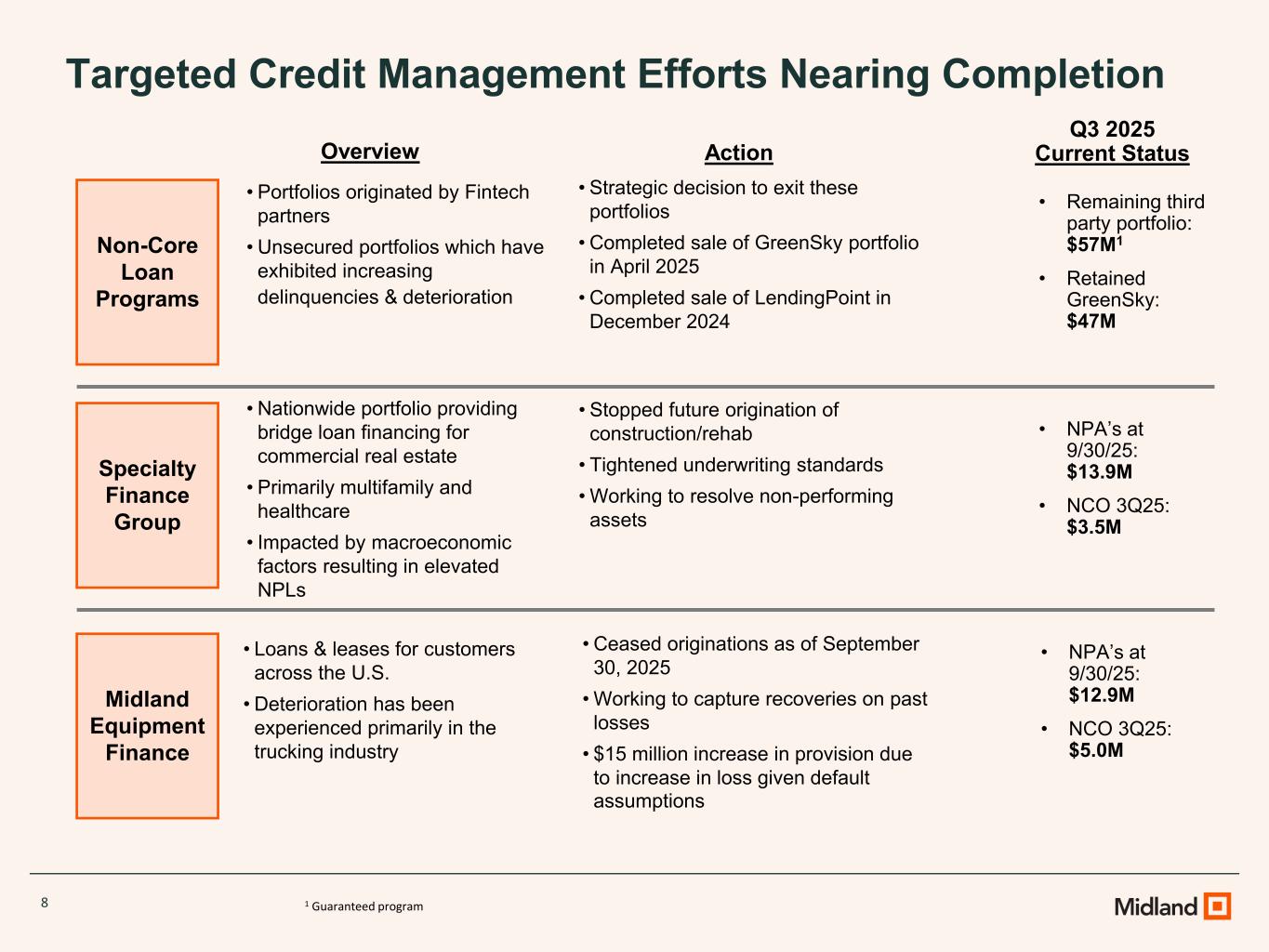

8 Targeted Credit Management Efforts Nearing Completion Non-Core Loan Programs Specialty Finance Group Midland Equipment Finance Q3 2025 Current StatusAction Overview • Remaining third party portfolio: $57M1 • Retained GreenSky: $47M • NPA’s at 9/30/25: $13.9M • NCO 3Q25: $3.5M • Strategic decision to exit these portfolios • Completed sale of GreenSky portfolio in April 2025 • Completed sale of LendingPoint in December 2024 • Portfolios originated by Fintech partners • Unsecured portfolios which have exhibited increasing delinquencies & deterioration • Nationwide portfolio providing bridge loan financing for commercial real estate • Primarily multifamily and healthcare • Impacted by macroeconomic factors resulting in elevated NPLs • Stopped future origination of construction/rehab • Tightened underwriting standards • Working to resolve non-performing assets • Loans & leases for customers across the U.S. • Deterioration has been experienced primarily in the trucking industry • Ceased originations as of September 30, 2025 • Working to capture recoveries on past losses • $15 million increase in provision due to increase in loss given default assumptions • NPA’s at 9/30/25: $12.9M • NCO 3Q25: $5.0M 1 Guaranteed program

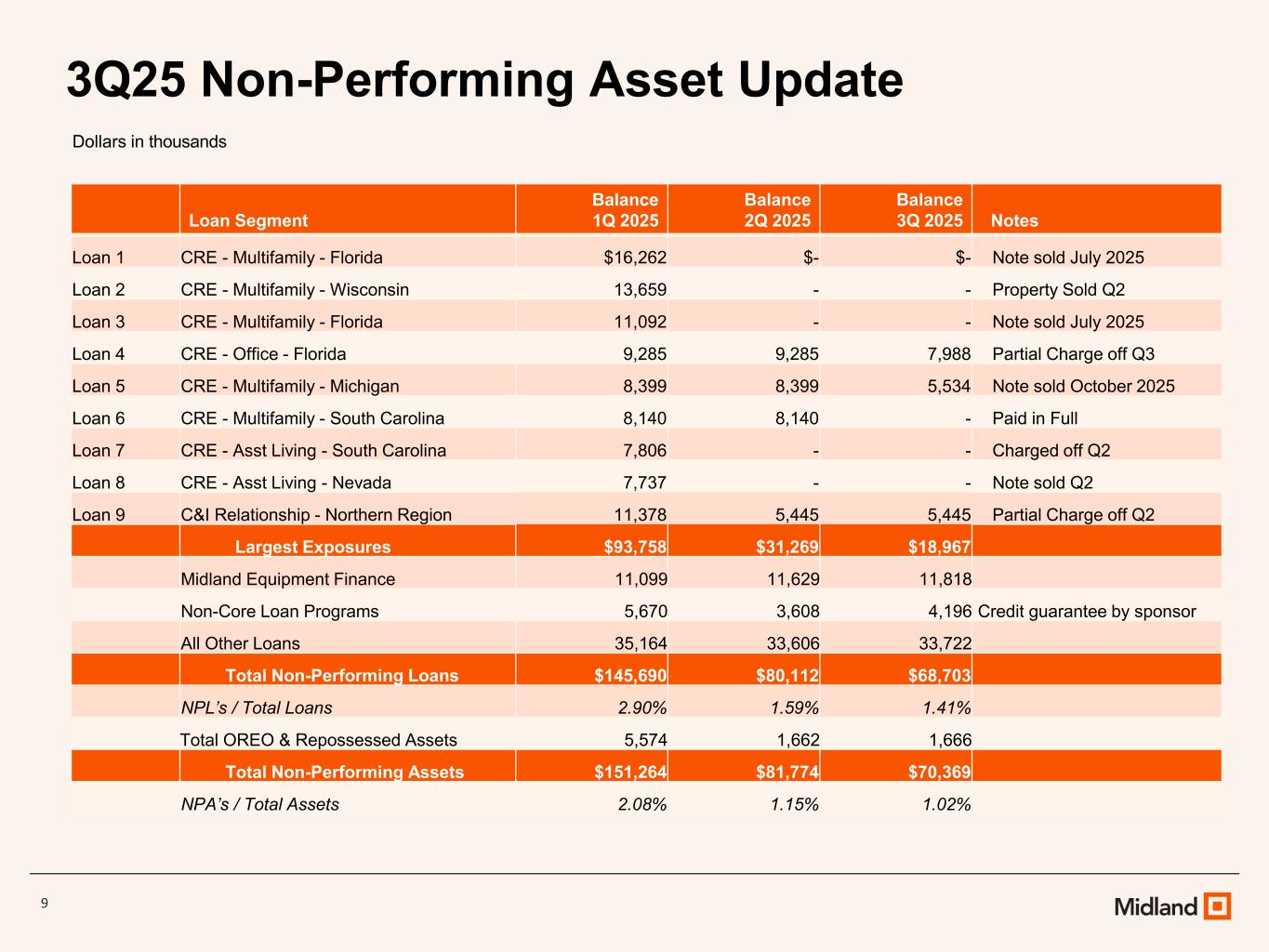

9 3Q25 Non-Performing Asset Update Dollars in thousands Loan Segment Balance 1Q 2025 Balance 2Q 2025 Balance 3Q 2025 Notes Loan 1 CRE - Multifamily - Florida $16,262 $- $- Note sold July 2025 Loan 2 CRE - Multifamily - Wisconsin 13,659 - - Property Sold Q2 Loan 3 CRE - Multifamily - Florida 11,092 - - Note sold July 2025 Loan 4 CRE - Office - Florida 9,285 9,285 7,988 Partial Charge off Q3 Loan 5 CRE - Multifamily - Michigan 8,399 8,399 5,534 Note sold October 2025 Loan 6 CRE - Multifamily - South Carolina 8,140 8,140 - Paid in Full Loan 7 CRE - Asst Living - South Carolina 7,806 - - Charged off Q2 Loan 8 CRE - Asst Living - Nevada 7,737 - - Note sold Q2 Loan 9 C&I Relationship - Northern Region 11,378 5,445 5,445 Partial Charge off Q2 Largest Exposures $93,758 $31,269 $18,967 Midland Equipment Finance 11,099 11,629 11,818 Non-Core Loan Programs 5,670 3,608 4,196 Credit guarantee by sponsor All Other Loans 35,164 33,606 33,722 Total Non-Performing Loans $145,690 $80,112 $68,703 NPL’s / Total Loans 2.90% 1.59% 1.41% Total OREO & Repossessed Assets 5,574 1,662 1,666 Total Non-Performing Assets $151,264 $81,774 $70,369 NPA’s / Total Assets 2.08% 1.15% 1.02%

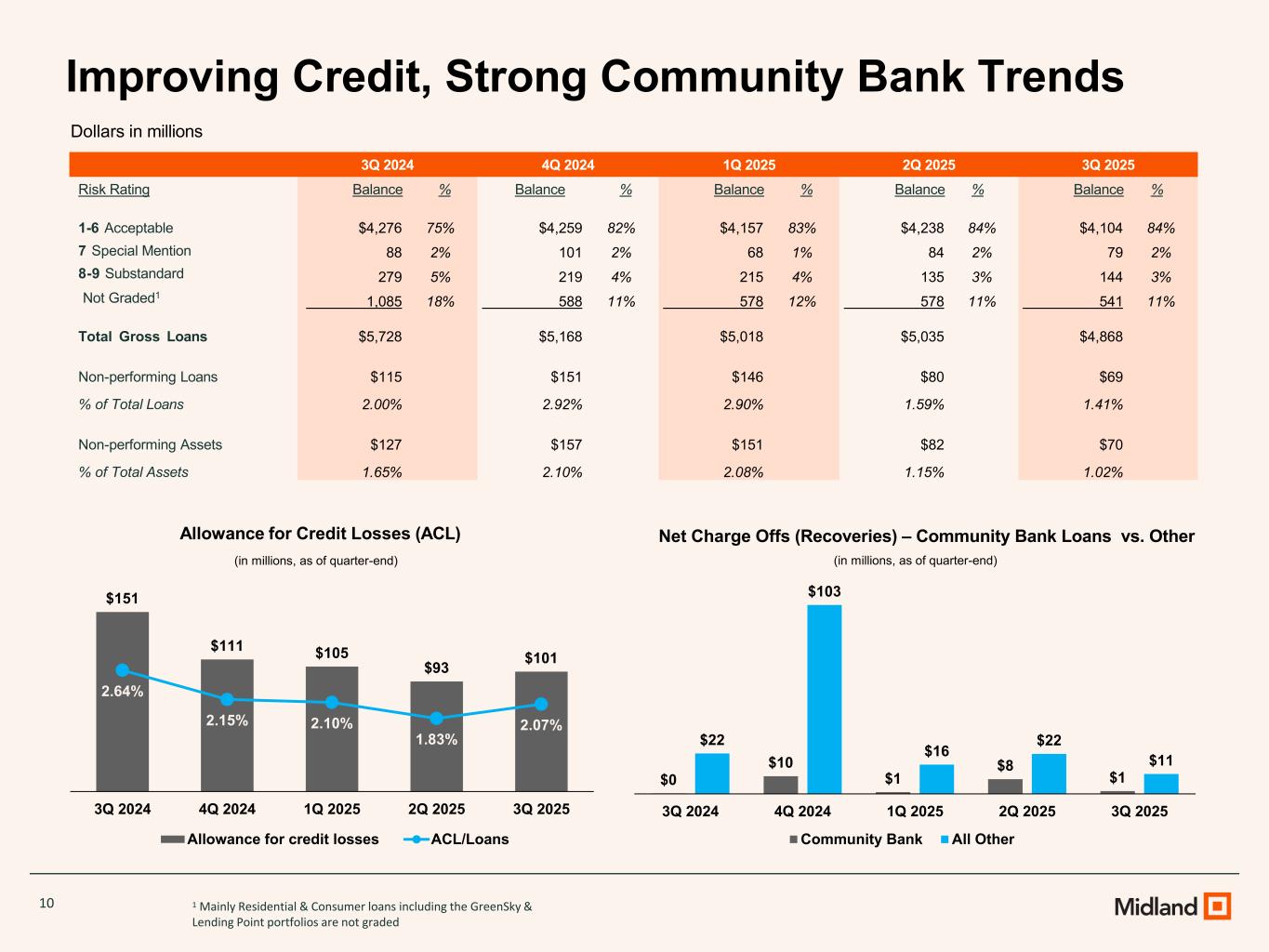

$151 $111 $105 $93 $101 2.64% 2.15% 2.10% 1.83% 2.07% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% -30 20 70 120 170 220 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Allowance for credit losses ACL/Loans $0 $10 $1 $8 $1 $22 $103 $16 $22 $11 -10 10 30 50 70 90 110 130 150 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Community Bank All Other 10 Improving Credit, Strong Community Bank Trends Allowance for Credit Losses (ACL) Net Charge Offs (Recoveries) – Community Bank Loans vs. Other 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Risk Rating Balance % Balance % Balance % Balance % Balance % 1-6 Acceptable $4,276 75% $4,259 82% $4,157 83% $4,238 84% $4,104 84% 7 Special Mention 88 2% 101 2% 68 1% 84 2% 79 2% 8-9 Substandard 279 5% 219 4% 215 4% 135 3% 144 3% Not Graded1 1,085 18% 588 11% 578 12% 578 11% 541 11% Total Gross Loans $5,728 $5,168 $5,018 $5,035 $4,868 Non-performing Loans $115 $151 $146 $80 $69 % of Total Loans 2.00% 2.92% 2.90% 1.59% 1.41% Non-performing Assets $127 $157 $151 $82 $70 % of Total Assets 1.65% 2.10% 2.08% 1.15% 1.02% (in millions, as of quarter-end)(in millions, as of quarter-end) Dollars in millions 1 Mainly Residential & Consumer loans including the GreenSky & Lending Point portfolios are not graded

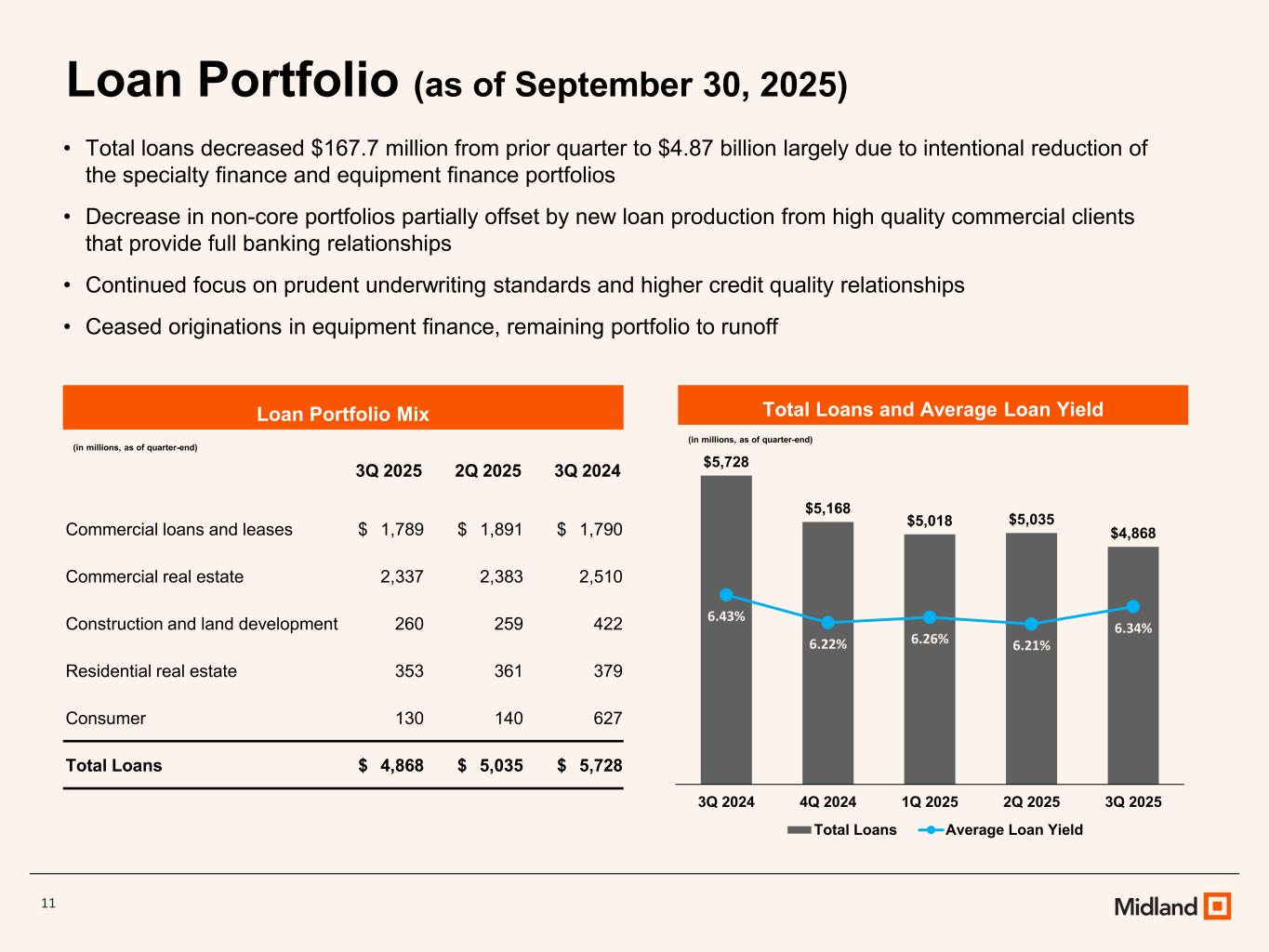

11 Loan Portfolio (as of September 30, 2025) Total Loans and Average Loan Yield (in millions, as of quarter-end) • Total loans decreased $167.7 million from prior quarter to $4.87 billion largely due to intentional reduction of the specialty finance and equipment finance portfolios • Decrease in non-core portfolios partially offset by new loan production from high quality commercial clients that provide full banking relationships • Continued focus on prudent underwriting standards and higher credit quality relationships • Ceased originations in equipment finance, remaining portfolio to runoff Loan Portfolio Mix (in millions, as of quarter-end) 3Q 2025 2Q 2025 3Q 2024 Commercial loans and leases $ 1,789 $ 1,891 $ 1,790 Commercial real estate 2,337 2,383 2,510 Construction and land development 260 259 422 Residential real estate 353 361 379 Consumer 130 140 627 Total Loans $ 4,868 $ 5,035 $ 5,728 $5,728 $5,168 $5,018 $5,035 $4,868 6.43% 6.22% 6.26% 6.21% 6.34% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 2000 2500 3000 3500 4000 4500 5000 5500 6000 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Total Loans Average Loan Yield

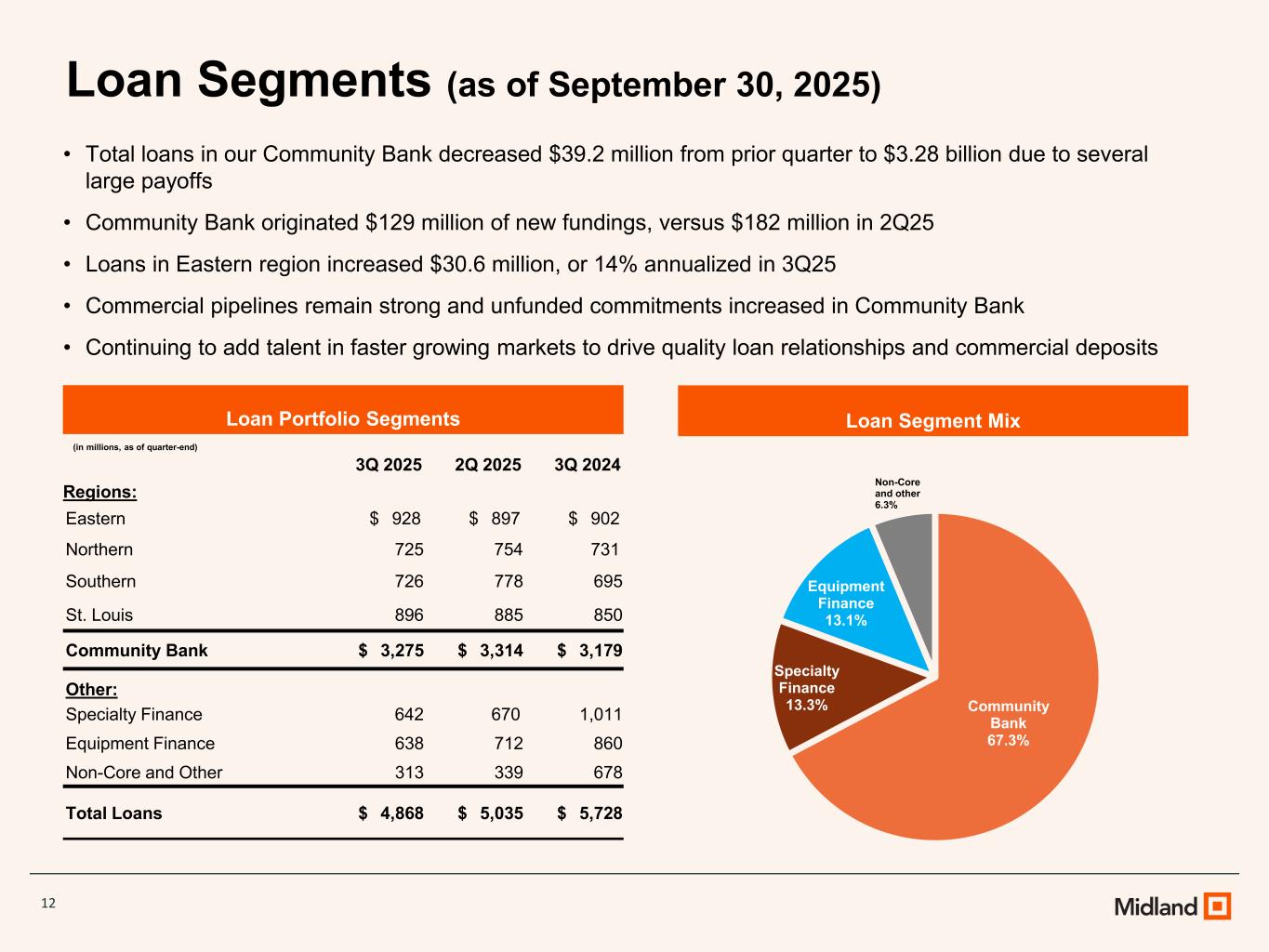

12 Loan Segments (as of September 30, 2025) Loan Segment Mix • Total loans in our Community Bank decreased $39.2 million from prior quarter to $3.28 billion due to several large payoffs • Community Bank originated $129 million of new fundings, versus $182 million in 2Q25 • Loans in Eastern region increased $30.6 million, or 14% annualized in 3Q25 • Commercial pipelines remain strong and unfunded commitments increased in Community Bank • Continuing to add talent in faster growing markets to drive quality loan relationships and commercial deposits Loan Portfolio Segments (in millions, as of quarter-end) 3Q 2025 2Q 2025 3Q 2024 Regions: Eastern $ 928 $ 897 $ 902 Northern 725 754 731 Southern 726 778 695 St. Louis 896 885 850 Community Bank $ 3,275 $ 3,314 $ 3,179 Other: Specialty Finance 642 670 1,011 Equipment Finance 638 712 860 Non-Core and Other 313 339 678 Total Loans $ 4,868 $ 5,035 $ 5,728 Community Bank 67.3% Specialty Finance 13.3% Equipment Finance 13.1% Non-Core and other 6.3%

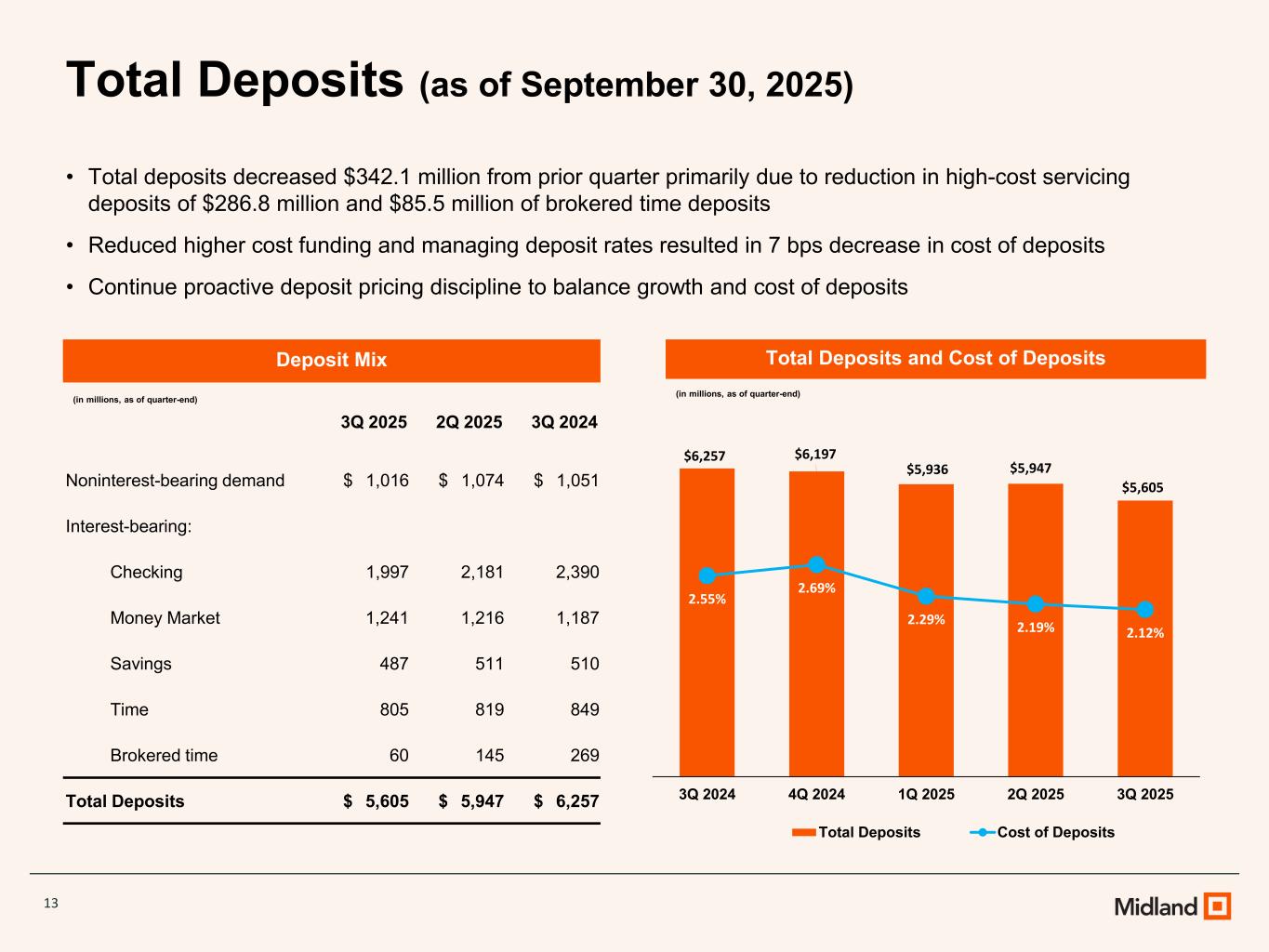

13 Total Deposits (as of September 30, 2025) • Total deposits decreased $342.1 million from prior quarter primarily due to reduction in high-cost servicing deposits of $286.8 million and $85.5 million of brokered time deposits • Reduced higher cost funding and managing deposit rates resulted in 7 bps decrease in cost of deposits • Continue proactive deposit pricing discipline to balance growth and cost of deposits Deposit Mix (in millions, as of quarter-end) 3Q 2025 2Q 2025 3Q 2024 Noninterest-bearing demand $ 1,016 $ 1,074 $ 1,051 Interest-bearing: Checking 1,997 2,181 2,390 Money Market 1,241 1,216 1,187 Savings 487 511 510 Time 805 819 849 Brokered time 60 145 269 Total Deposits $ 5,605 $ 5,947 $ 6,257 Total Deposits and Cost of Deposits (in millions, as of quarter-end) $6,257 $6,197 $5,936 $5,947 $5,605 2.55% 2.69% 2.29% 2.19% 2.12% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 0 1000 2000 3000 4000 5000 6000 7000 8000 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Total Deposits Cost of Deposits

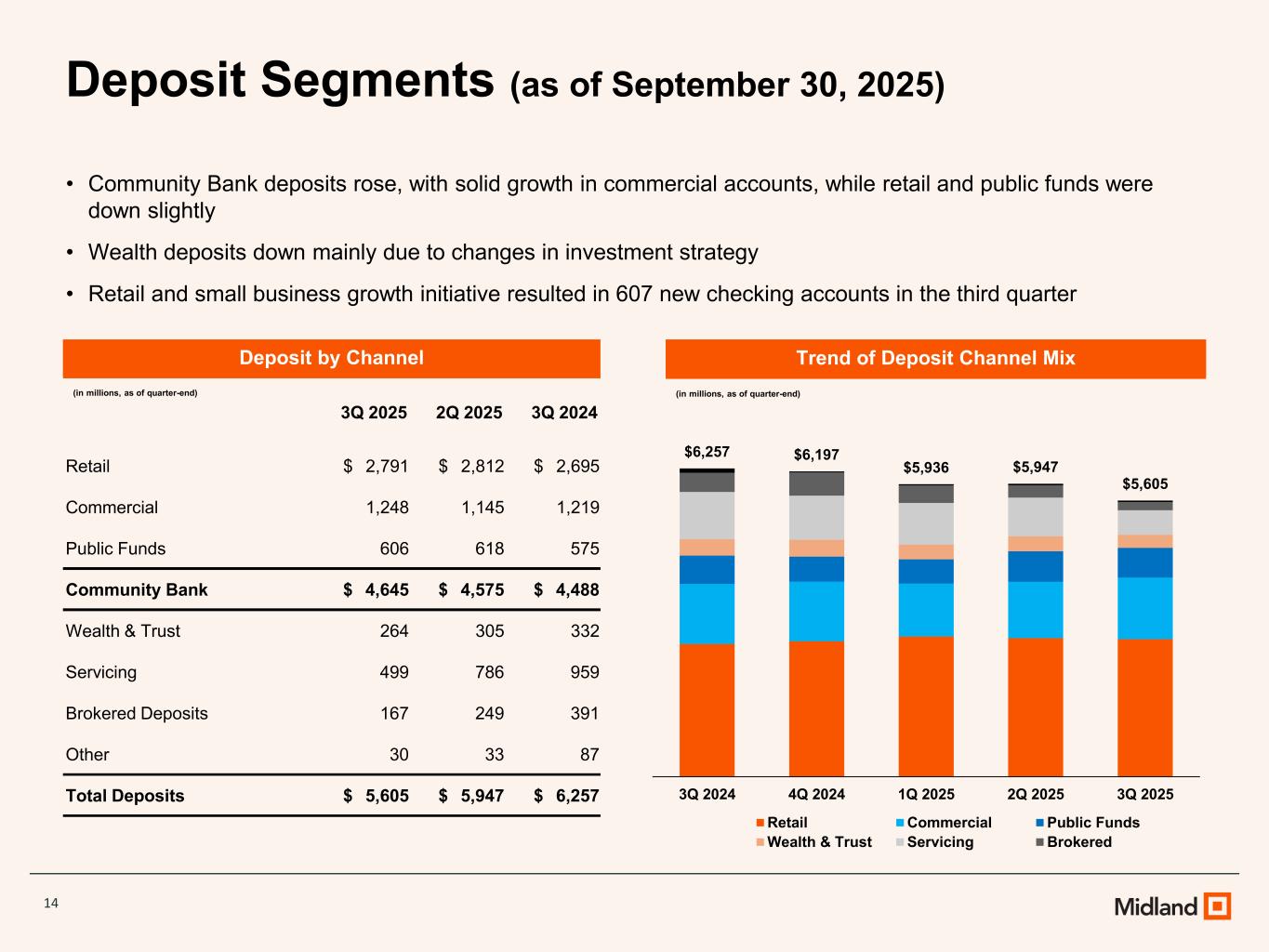

14 Deposit Segments (as of September 30, 2025) • Community Bank deposits rose, with solid growth in commercial accounts, while retail and public funds were down slightly • Wealth deposits down mainly due to changes in investment strategy • Retail and small business growth initiative resulted in 607 new checking accounts in the third quarter Deposit by Channel (in millions, as of quarter-end) 3Q 2025 2Q 2025 3Q 2024 Retail $ 2,791 $ 2,812 $ 2,695 Commercial 1,248 1,145 1,219 Public Funds 606 618 575 Community Bank $ 4,645 $ 4,575 $ 4,488 Wealth & Trust 264 305 332 Servicing 499 786 959 Brokered Deposits 167 249 391 Other 30 33 87 Total Deposits $ 5,605 $ 5,947 $ 6,257 Trend of Deposit Channel Mix (in millions, as of quarter-end) $6,257 $6,197 $5,936 $5,947 $5,605 0 1000 2000 3000 4000 5000 6000 7000 8000 0 1000 2000 3000 4000 5000 6000 7000 8000 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Retail Commercial Public Funds Wealth & Trust Servicing Brokered

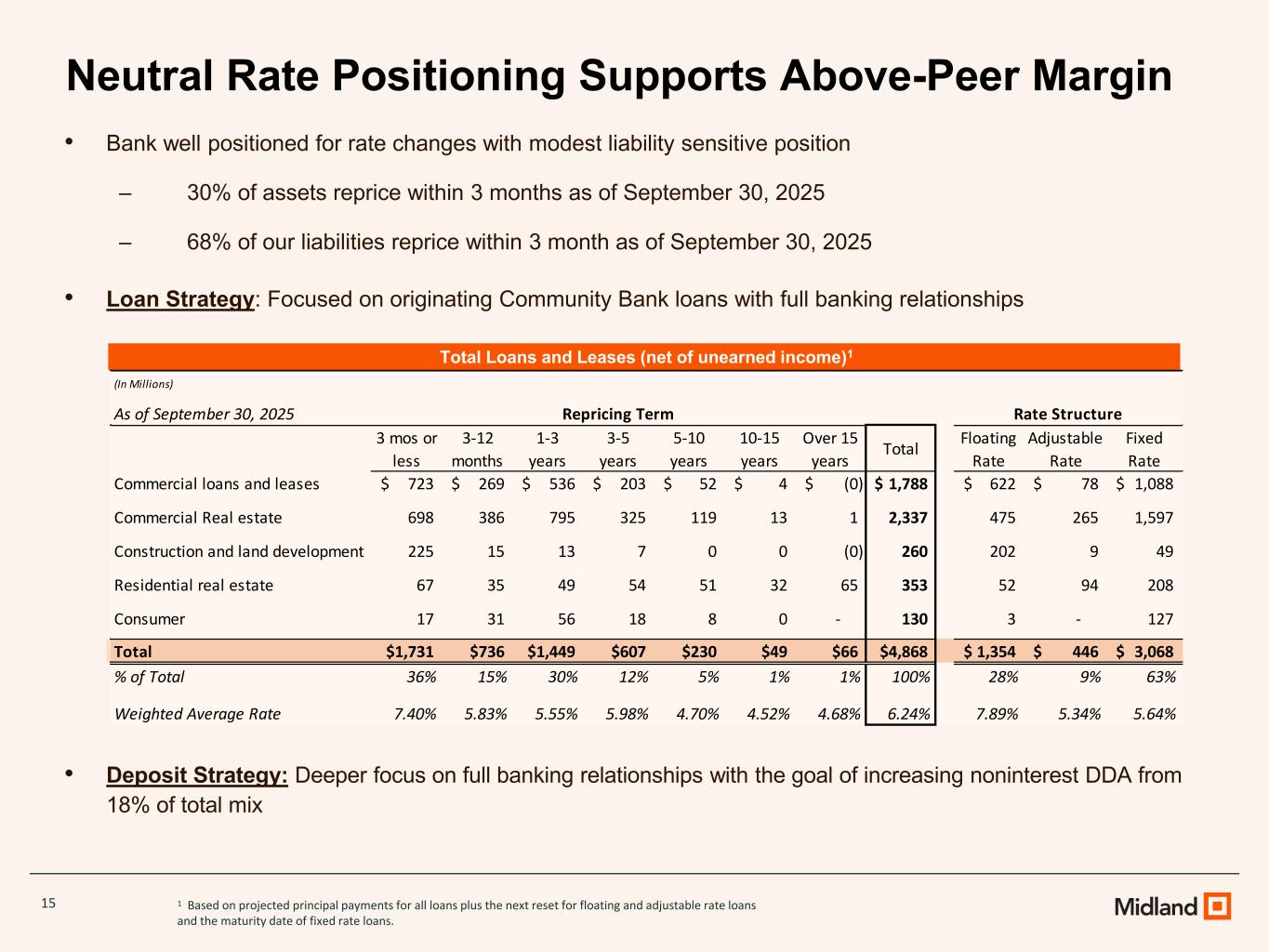

15 Neutral Rate Positioning Supports Above-Peer Margin • Bank well positioned for rate changes with modest liability sensitive position ‒ 30% of assets reprice within 3 months as of September 30, 2025 ‒ 68% of our liabilities reprice within 3 month as of September 30, 2025 • Loan Strategy: Focused on originating Community Bank loans with full banking relationships • Deposit Strategy: Deeper focus on full banking relationships with the goal of increasing noninterest DDA from 18% of total mix 1 Based on projected principal payments for all loans plus the next reset for floating and adjustable rate loans and the maturity date of fixed rate loans. Total Loans and Leases (net of unearned income)1 (In Millions) As of September 30, 2025 3 mos or less 3-12 months 1-3 years 3-5 years 5-10 years 10-15 years Over 15 years Total Floating Rate Adjustable Rate Fixed Rate Commercial loans and leases 723$ 269$ 536$ 203$ 52$ 4$ (0)$ 1,788$ 622$ 78$ 1,088$ Commercial Real estate 698 386 795 325 119 13 1 2,337 475 265 1,597 Construction and land development 225 15 13 7 0 0 (0) 260 202 9 49 Residential real estate 67 35 49 54 51 32 65 353 52 94 208 Consumer 17 31 56 18 8 0 - 130 3 - 127 Total $1,731 $736 $1,449 $607 $230 $49 $66 $4,868 1,354$ 446$ 3,068$ % of Total 36% 15% 30% 12% 5% 1% 1% 100% 28% 9% 63% Weighted Average Rate 7.40% 5.83% 5.55% 5.98% 4.70% 4.52% 4.68% 6.24% 7.89% 5.34% 5.64% Repricing Term Rate Structure (I illi 1-3 years 3-5 years

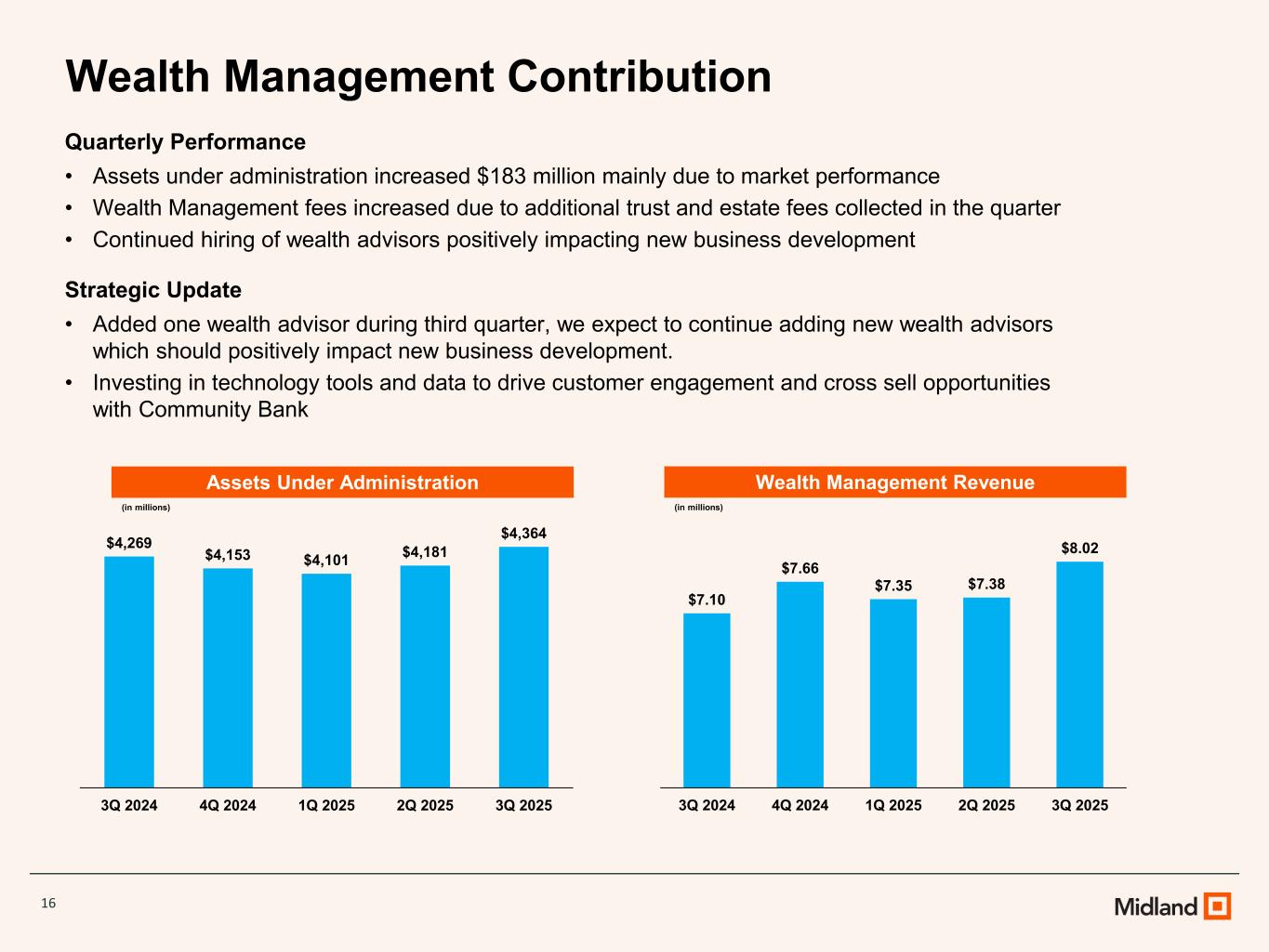

16 Wealth Management Contribution Quarterly Performance • Assets under administration increased $183 million mainly due to market performance • Wealth Management fees increased due to additional trust and estate fees collected in the quarter • Continued hiring of wealth advisors positively impacting new business development Strategic Update • Added one wealth advisor during third quarter, we expect to continue adding new wealth advisors which should positively impact new business development. • Investing in technology tools and data to drive customer engagement and cross sell opportunities with Community Bank Assets Under Administration (in millions) Wealth Management Revenue (in millions) $4,269 $4,153 $4,101 $4,181 $4,364 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 $7.10 $7.66 $7.35 $7.38 $8.02 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025

17 Financial Outlook • Lowering credit costs in 2026 • Continued focus on growing Community Bank • Building regulatory capital • Continued focus on efficiency • Expanding fee income through deeper core relationships

Appendix

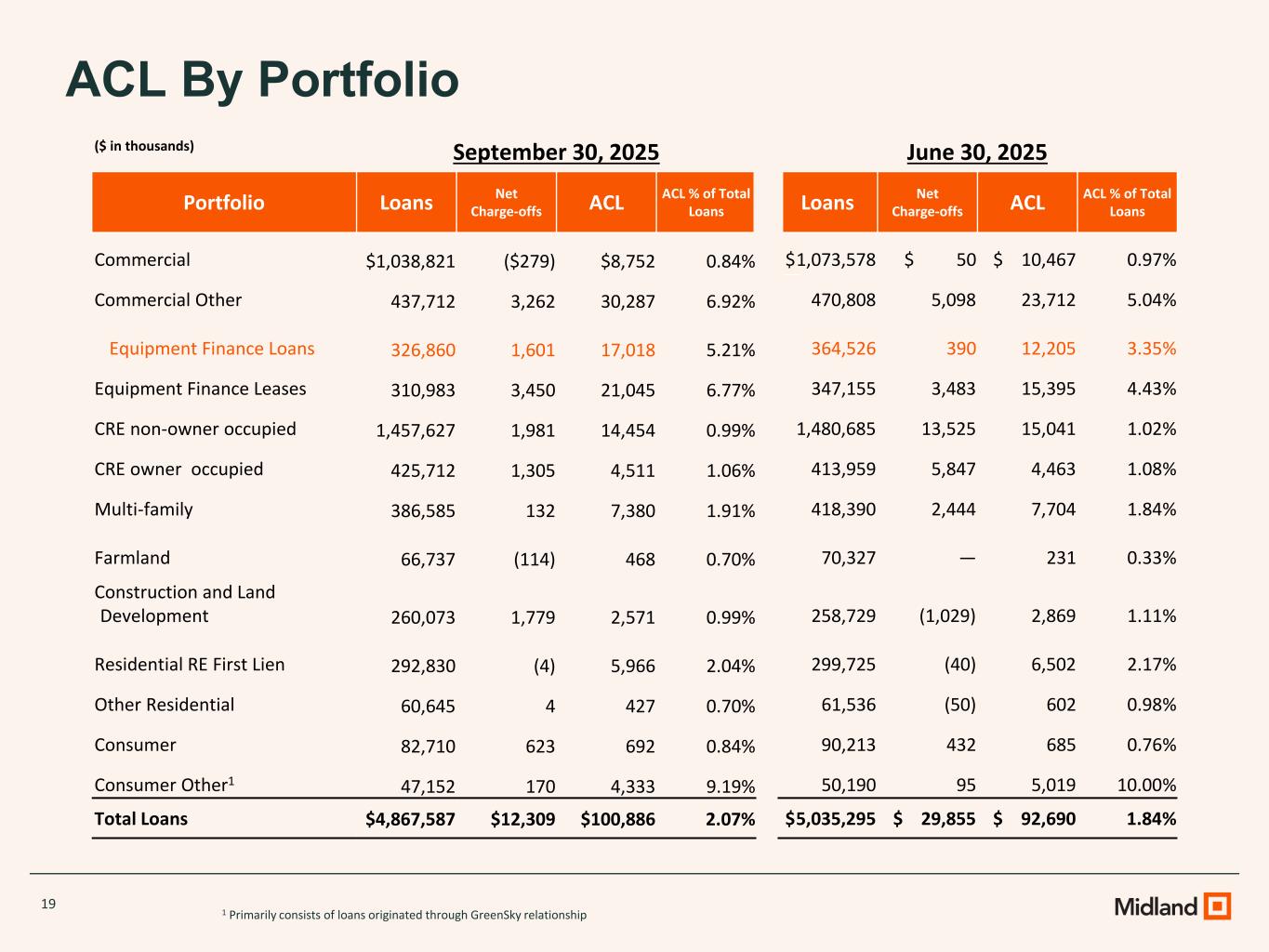

19 ACL By Portfolio 1 Primarily consists of loans originated through GreenSky relationship ($ in thousands) September 30, 2025 June 30, 2025 Portfolio Loans Net Charge-offs ACL ACL % of Total Loans Loans Net Charge-offs ACL ACL % of Total Loans Commercial $1,038,821 ($279) $8,752 0.84% $1,073,578 $ 50 $ 10,467 0.97% Commercial Other 437,712 3,262 30,287 6.92% 470,808 5,098 23,712 5.04% Equipment Finance Loans 326,860 1,601 17,018 5.21% 364,526 390 12,205 3.35% Equipment Finance Leases 310,983 3,450 21,045 6.77% 347,155 3,483 15,395 4.43% CRE non-owner occupied 1,457,627 1,981 14,454 0.99% 1,480,685 13,525 15,041 1.02% CRE owner occupied 425,712 1,305 4,511 1.06% 413,959 5,847 4,463 1.08% Multi-family 386,585 132 7,380 1.91% 418,390 2,444 7,704 1.84% Farmland 66,737 (114) 468 0.70% 70,327 — 231 0.33% Construction and Land Development 260,073 1,779 2,571 0.99% 258,729 (1,029) 2,869 1.11% Residential RE First Lien 292,830 (4) 5,966 2.04% 299,725 (40) 6,502 2.17% Other Residential 60,645 4 427 0.70% 61,536 (50) 602 0.98% Consumer 82,710 623 692 0.84% 90,213 432 685 0.76% Consumer Other1 47,152 170 4,333 9.19% 50,190 95 5,019 10.00% Total Loans $4,867,587 $12,309 $100,886 2.07% $5,035,295 $ 29,855 $ 92,690 1.84%

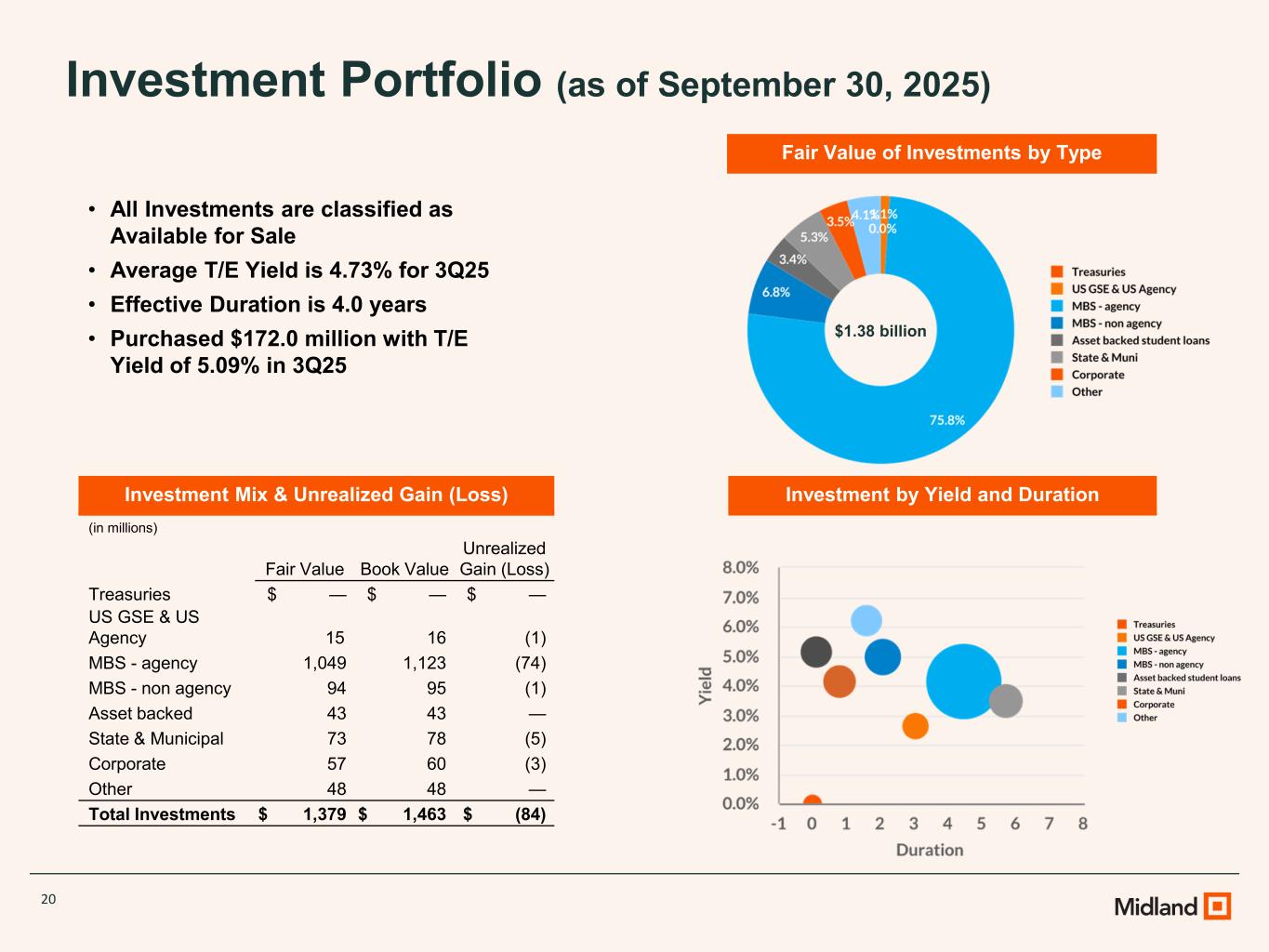

20 Investment Portfolio (as of September 30, 2025) Fair Value of Investments by Type • All Investments are classified as Available for Sale • Average T/E Yield is 4.73% for 3Q25 • Effective Duration is 4.0 years • Purchased $172.0 million with T/E Yield of 5.09% in 3Q25 Investment Mix & Unrealized Gain (Loss) (in millions) Fair Value Book Value Unrealized Gain (Loss) Treasuries $ — $ — $ — US GSE & US Agency 15 16 (1) MBS - agency 1,049 1,123 (74) MBS - non agency 94 95 (1) Asset backed 43 43 — State & Municipal 73 78 (5) Corporate 57 60 (3) Other 48 48 — Total Investments $ 1,379 $ 1,463 $ (84) Investment Mix & Unrealized Gain (Loss) Investment by Yield and Duration $1.38 billion

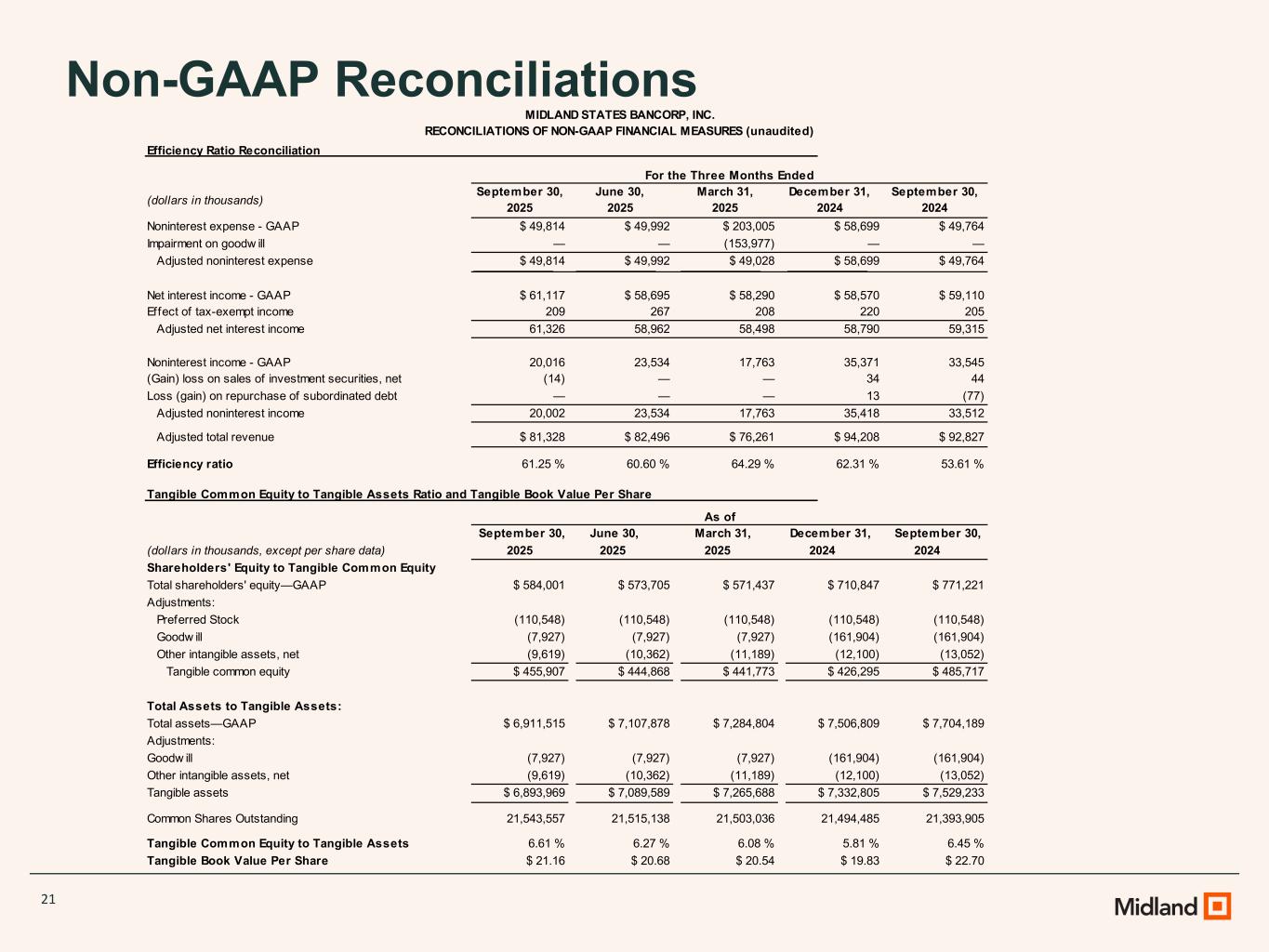

21 Non-GAAP Reconciliations For the Three Months Ended (dollars in thousands) September 30, 2025 Noninterest expense - GAAP $ 49,814 Impairment on goodw ill — Adjusted noninterest expense $ 49,814 Net interest income - GAAP $ 61,117 Effect of tax-exempt income 209 Adjusted net interest income 61,326 Noninterest income - GAAP 20,016 33,545 (Gain) loss on sales of investment securities, net (14) 44 Loss (gain) on repurchase of subordinated debt — (77) Adjusted noninterest income 20,002 33,512 Adjusted total revenue $ 81,328 $ 92,827 Efficiency ratio 61.25 % 53.61 % September 30, (dollars in thousands, except per share data) 2025 Total shareholders' equity—GAAP $ 584,001 $ 573,705 $ 571,437 $ 710,847 Adjustments: Preferred Stock (110,548) (110,548) (110,548) (110,548) Goodw ill (7,927) (7,927) (7,927) (161,904) Other intangible assets, net (9,619) (10,362) (11,189) (12,100) Tangible common equity $ 455,907 $ 444,868 $ 441,773 $ 426,295 Total Assets to Tangible Assets: Total assets—GAAP $ 6,911,515 $ 7,107,878 $ 7,284,804 $ 7,506,809 Adjustments: Goodw ill (7,927) (7,927) (7,927) (161,904) Other intangible assets, net (9,619) (10,362) (11,189) (12,100) Tangible assets $ 6,893,969 $ 7,089,589 $ 7,265,688 $ 7,332,805 Common Shares Outstanding 21,543,557 21,515,138 21,503,036 21,494,485 Tangible Common Equity to Tangible Assets 6.61 % 6.27 % 6.08 % 5.81 % Tangible Book Value Per Share $ 21.16 $ 20.68 $ 20.54 $ 19.83 MIDLAND STATES BANCORP, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) Efficiency Ratio Reconciliation June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 $ 49,992 $ 203,005 $ 58,699 $ 49,764 — (153,977) — — $ 49,992 $ 49,028 $ 58,699 $ 49,764 $ 58,695 $ 58,290 $ 58,570 $ 59,110 267 208 220 205 58,962 58,498 58,790 59,315 23,534 17,763 35,371 — — 34 — — 13 23,534 17,763 35,418 $ 82,496 $ 76,261 $ 94,208 60.60 % 64.29 % 62.31 % Tangible Common Equity to Tangible Assets Ratio and Tangible Book Value Per Share As of June 30, March 31, December 31, September 30, 2025 2025 2024 2024 Shareholders' Equity to Tangible Common Equity $ 771,221 (110,548) (161,904) (13,052) $ 485,717 $ 7,704,189 6.45 % $ 22.70 (161,904) (13,052) $ 7,529,233 21,393,905

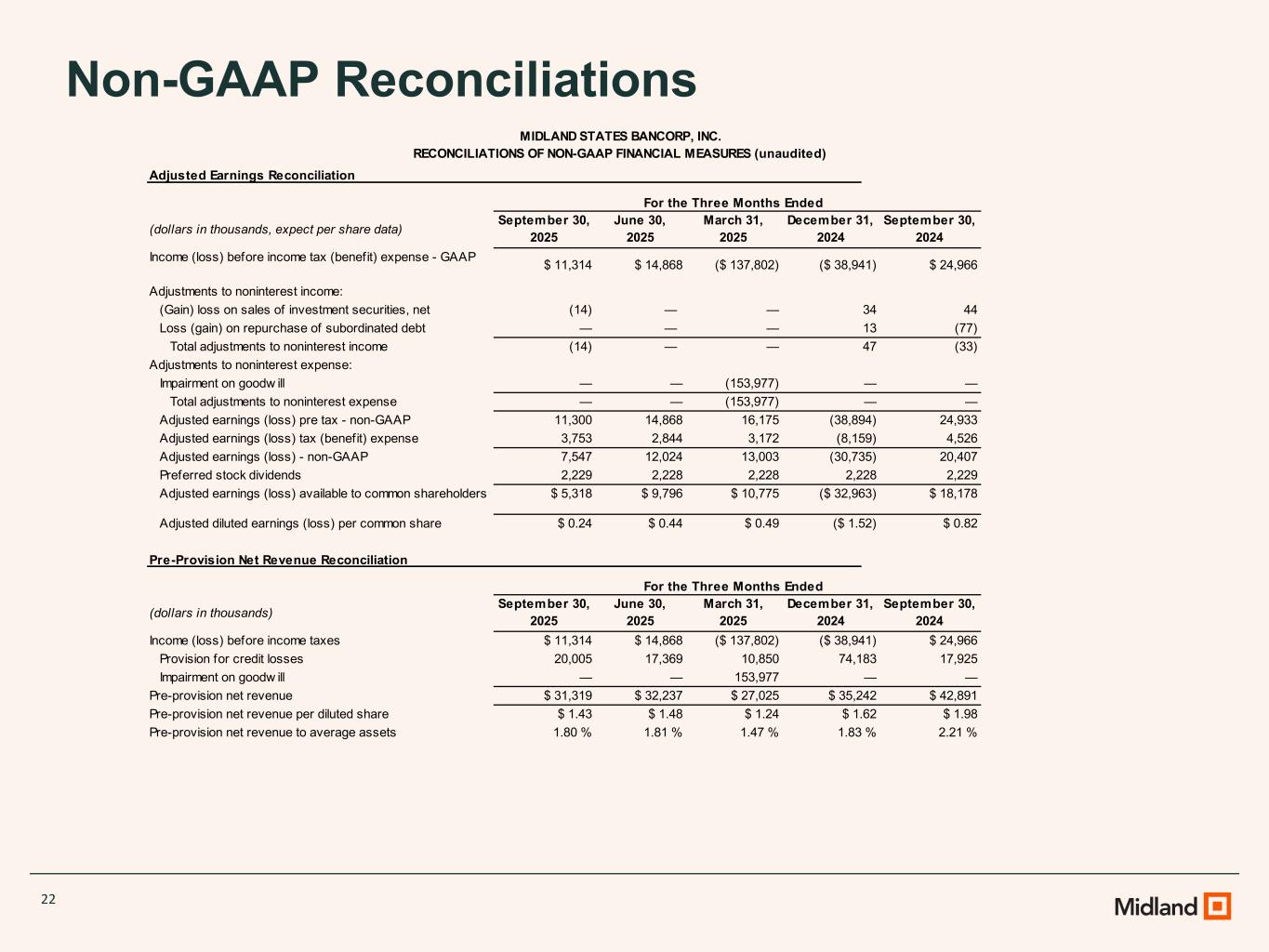

22 Non-GAAP Reconciliations For the Three Months Ended (dollars in thousands, expect per share data) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Income (loss) before income tax (benefit) expense - GAAP $ 11,314 $ 14,868 ($ 137,802) ($ 38,941) $ 24,966 Adjustments to noninterest income: (Gain) loss on sales of investment securities, net (14) 34 44 Loss (gain) on repurchase of subordinated debt — 13 (77) Total adjustments to noninterest income (14) 47 (33) Adjustments to noninterest expense: Impairment on goodw ill — — (153,977) — — Total adjustments to noninterest expense — — (153,977) — — Adjusted earnings (loss) pre tax - non-GAAP 11,300 14,868 16,175 (38,894) 24,933 Adjusted earnings (loss) tax (benefit) expense 3,753 2,844 3,172 (8,159) 4,526 Adjusted earnings (loss) - non-GAAP 7,547 12,024 13,003 (30,735) 20,407 Preferred stock dividends 2,229 2,228 2,228 2,228 2,229 Adjusted earnings (loss) available to common shareholders $ 5,318 $ 9,796 $ 10,775 ($ 32,963) $ 18,178 Adjusted diluted earnings (loss) per common share $ 0.24 $ 0.44 $ 0.49 ($ 1.52) $ 0.82 For the Three Months Ended (dollars in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Income (loss) before income taxes $ 11,314 $ 14,868 ($ 137,802) ($ 38,941) $ 24,966 Provision for credit losses 20,005 17,369 10,850 74,183 17,925 Impairment on goodw ill — — 153,977 — — Pre-provision net revenue $ 31,319 $ 32,237 $ 27,025 $ 35,242 $ 42,891 Pre-provision net revenue per diluted share $ 1.43 $ 1.48 $ 1.24 $ 1.62 $ 1.98 Pre-provision net revenue to average assets 1.80 % 1.81 % 1.47 % 1.83 % 2.21 % — — Pre-Provision Net Revenue Reconciliation MIDLAND STATES BANCORP, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) Adjusted Earnings Reconciliation — — — —