PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION

Check the appropriate box: | |

☑ | Preliminary Proxy Statement |

☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §.240.14a-12 |

Payment of Filing Fee (Check all boxes that apply): | |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2025 Proxy Statement | i |

Revenue $187B (9%á compared to 2023) | ||

Return to Shareholders $7.6B (through share buybacks and dividends) | ||

ii |  |

|  |  |  |  |  | |||||

Mary T. Barra Chair and CEO | Patricia F. Russo Independent Lead Director | Wesley G. Bush | Joanne C. Crevoiserat | Joseph Jimenez | Alfred F. Kelly, Jr. |

|  |  |  |  | ||||

Jonathan McNeill | Judith A. Miscik | Mark A. Tatum | Jan E. Tighe | Devin N. Wenig |

2025 Proxy Statement | iii |

Notice of 2025 Annual Meeting of Shareholders |

|

Date and Time: June 3, 2025 12:00 p.m. Eastern Time | Place: Online via live webcast at: virtualshareholdermeeting.com/GM2025 | Record Date: April 4, 2025 | ||

| Grant Dixton Executive Vice President, Chief Legal, Public Policy Officer and Corporate Secretary |

Your Vote Is Important Please promptly submit your vote by internet or telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form in the postage-paid envelope provided so that your shares will be represented and voted at the meeting. We are first mailing these proxy materials to our shareholders on or about April , 2025. | How to Access the Proxy Materials Online Important Notice Regarding the Availability of Proxy Materials for the 2025 Annual Meeting of Shareholders to be Held on June 3, 2025: | |||

Our Proxy Statement and 2024 Annual Report are available at investor.gm.com/ shareholder. You may also scan the QR code with your smartphone or other mobile device to view our Proxy Statement and Annual Report. |  | |||

2025 Proxy Statement | 1 |

Proxy Summary |

|

ITEM 1 | The Board recommends a vote FOR each director nominee | ||

Annual Election of Directors •Our nominees possess the comprehensive skills and expertise the Company needs now to meet our strategic direction. See page 9 |  | ||

ITEM 2 | The Board recommends a vote FOR this proposal | ||

Proposal to Ratify the Selection of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for 2025 •Ernst & Young LLP is an independent auditing firm with the required knowledge and experience to effectively audit our financial statements. See page 39 |  | ||

ITEM 3 | The Board recommends a vote FOR this proposal | ||

Proposal to Approve, on an Advisory Basis, Named Executive Officer Compensation •Our executive compensation program is designed to align pay with shareholder interests and Company performance. See page 43 |  | ||

ITEM 4 | The Board recommends a vote FOR this proposal | ||

Proposal to Approve the Amended and Restated Certificate of Incorporation •The updates include amendments to officer exculpation, removal of outdated provisions that are no longer relevant, and certain clarifying enhancements. |  | ||

2 |  |

ITEM X | The Board recommends a vote AGAINST this proposal | ||

Shareholder Proposals, if properly presented at the meeting. |  | ||

2025 Proxy Statement | 3 |

|  |  |  | |||||||||||

ICE | EV | Software & Services | AV | |||||||||||

Maximize our winning ICE portfolio | Grow our EV business profitably | Deliver innovative software and services solutions | Continue progressing AV technology | |||||||||||

$6.0B Net income attributable to stockholders | 3.2% Net income margin | $6.37 EPS-diluted | ||||||||

$14.9B EBIT-adjusted(1) | 8.0% EBIT-adjusted(1) margin | $10.60 EPS-diluted-adjusted(1) | ||||||||

$187.4B Revenue | 50% TSR | $7.6B Returned to shareholders via dividends and share repurchases | ||||||||

U.S. Market Leader #1 in total sales #1 in retail sales #1 in full-size pickup trucks #1 in full-size SUVs #1 in commercial fleet deliveries | |||

•Total Company revenue of $187B, up more than 9% vs. 2023 and CAGR of ~10% since 2021 •EV portfolio variable profit positive in Q4, along with being the #2 seller of EVs in the U.S. H2-42 •Record profit-sharing payouts of ~$640M to United Auto Worker-represented employees | |||

4 |  |

| Mary T. Barra Age: 63 Director since: 2014 |  | Wesley G. Bush  Age: 64 Director since: 2019 |  | Joanne C. Crevoiserat  Age: 61 Director since: 2022 | ||

Chair and Chief Executive Officer, General Motors Company | Retired Chairman and Chief Executive Officer, Northrop Grumman Corporation | Chief Executive Officer, Tapestry, Inc. | |||||

Committee memberships: EC | Committee memberships: AC EC CC FC | Committee memberships: AC FC GC | |||||

| Joseph Jimenez  Age: 65 Director since: 2015 |  | Alfred F. Kelly, Jr.  Age: 66 Director since: 2024 |  | Jonathan McNeill  Age: 57 Director since: 2022 | ||

Co-Founder and Managing Director, Aditum Bio | Retired Chief Executive Officer and Chairman, Visa Inc. | Co-Founder and Chief Executive Officer, DVX Ventures | |||||

Committee memberships: EC CC FC RC | Committee memberships: AC RC | Committee memberships: GC RC | |||||

| Judith A. Miscik  Age: 66 Director since: 2018 |  | Patricia F. Russo  Age: 72 Director since: 2009 |  | Mark A. Tatum  Age: 55 Director since: 2021 | ||

Senior Advisor, Lazard Geopolitical Advisory | Chair, Hewlett Packard Enterprise Company | Deputy Commissioner and Chief Operating Officer, National Basketball Association | |||||

Committee memberships: EC FC RC | Committee memberships: EC CC FC GC | Committee memberships: AC GC | |||||

| Jan E. Tighe  Age: 62 Director Since: 2023 |  | Devin N. Wenig  Age: 58 Director since: 2018 | ||||

Retired Vice Admiral, U.S. Navy | Co-Founder and Chief Executive Officer, Symbolic.ai | ||||||

Committee memberships: AC RC | Committee memberships: CC | ||||||

AC – Audit Committee EC – Executive Committee | CC – Executive Compensation Committee FC – Finance Committee | GC – Governance and Corporate Responsibility Committee RC – Risk and Cybersecurity Committee | g – Committee Chair g – Committee Chair following Annual Meeting |

2025 Proxy Statement | 5 |

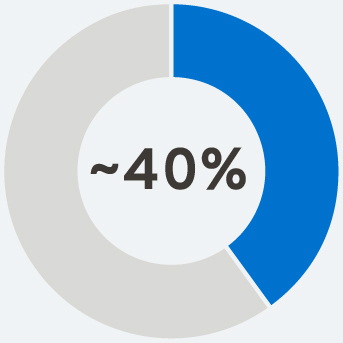

Conducted over 60 stewardship engagements since 2024 Who Participated •Members of the Board, including the Independent Lead Director and the Chair of the Executive Compensation Committee •Members of management, including over 10 executives and other senior subject matters experts from the Corporate Governance, Human Resources, Legal, Labor, Investor Relations, Supply Chain, and Sustainability organizations Who We Engaged  of outstanding common stock |

GM’s Commitment to Listen and Evolve | ||||||

Engaging with Investors The Company conducts outreach throughout the year to investors and other stakeholders; we also have a practice of inviting buy- and sell-side analysts to Board meetings | Robust Discussions We intentionally seek input from different perspectives, including each of the Company’s shareholder proponents | Enhancing Practices The constructive insights, experiences, and ideas exchanged during these engagements inform agenda items throughout the year and help the Board evaluate and assess key initiatives | ||||

|  | |||||

| ||||||

| Board and Governance •Encouraged to communicate to shareholders the Board’s succession plan given the retirements of Linda Gooden and continuously evolve the Board, including the addition of Alfred F. Kelly, Jr. since the last Annual Meeting of Shareholders. |

| |

| Capital Allocation •Encouraged to further explain to shareholders the Board’s role in capital allocation planning and continue the return of capital to shareholders pursuant to the Company’s Allocation Framework. In Q1 2025, the Board announced a $6 billion shareholder buyback authorization and announced its intent to increase the common stock dividend by $0.03 per share. |

Other focus areas of common themes discussed with shareholders: | |

•Human rights and supply chain sustainability issues, especially in regions with indigenous people; •Talent strategy and workforce matters especially with our represented team members; | •Product safety, especially with regards to the future of transportation and our AV strategy; and •Climate strategy, especially our efforts to reduce greenhouse gas emissions. |

6 |  |

Program Design Changes |

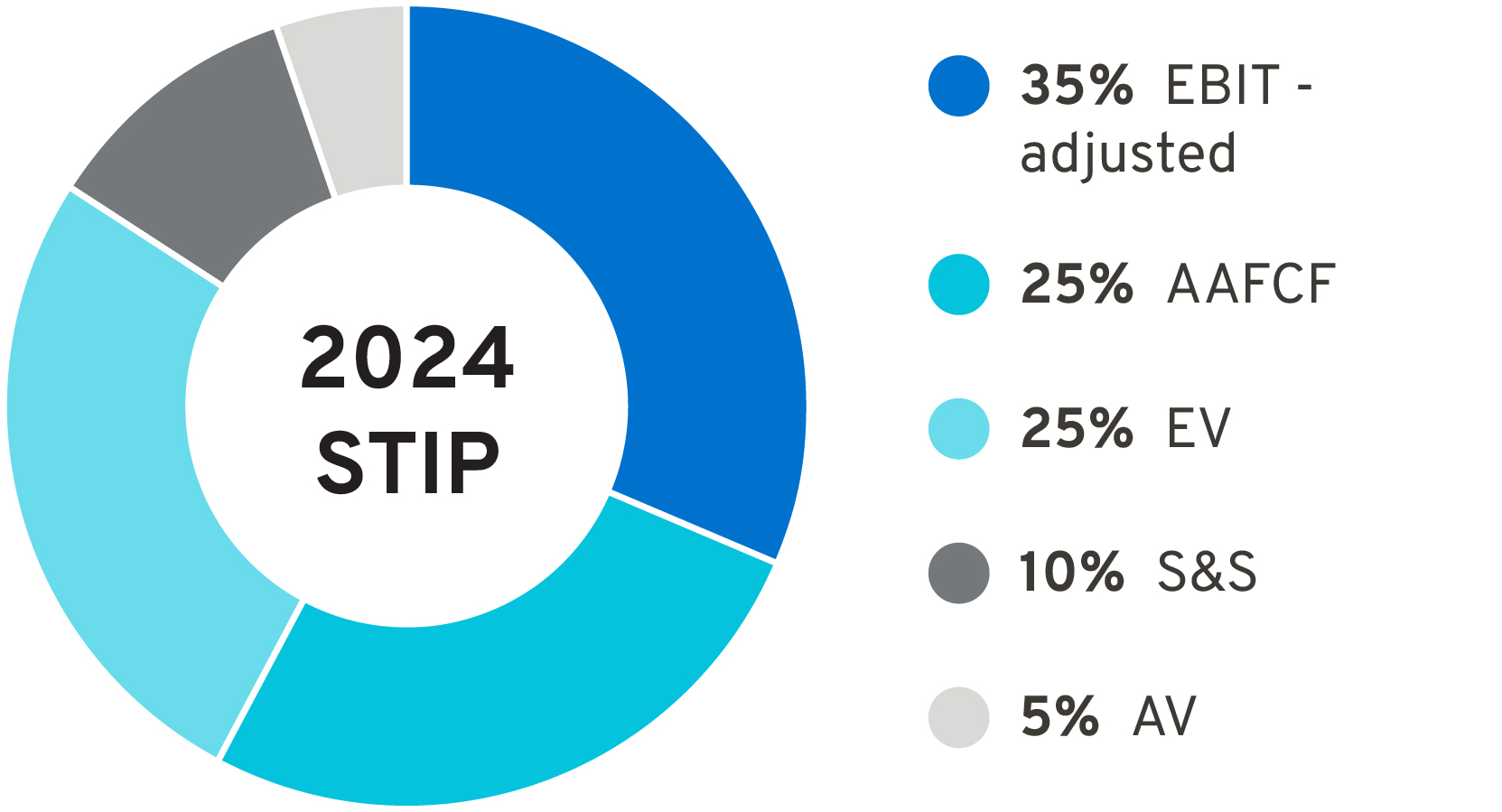

STIP •Incorporated quantifiable goals tied to GM’s strategic pillars for EV (25% of STIP), Software & Services (“S&S”) (10% of STIP), and AV strategy (5% of STIP), and rebalanced the weighting of these metrics to retain focus on driving profitability and cash flows while also further incentivizing key elements of our strategic transformation •Final STIP payout subject to an individual performance modifier not to exceed 110% of the STIP payout amount generated by Company performance; total payout remains capped at 200% of target •Eliminated the strategic goals component of the STIP, previously weighted 25% |

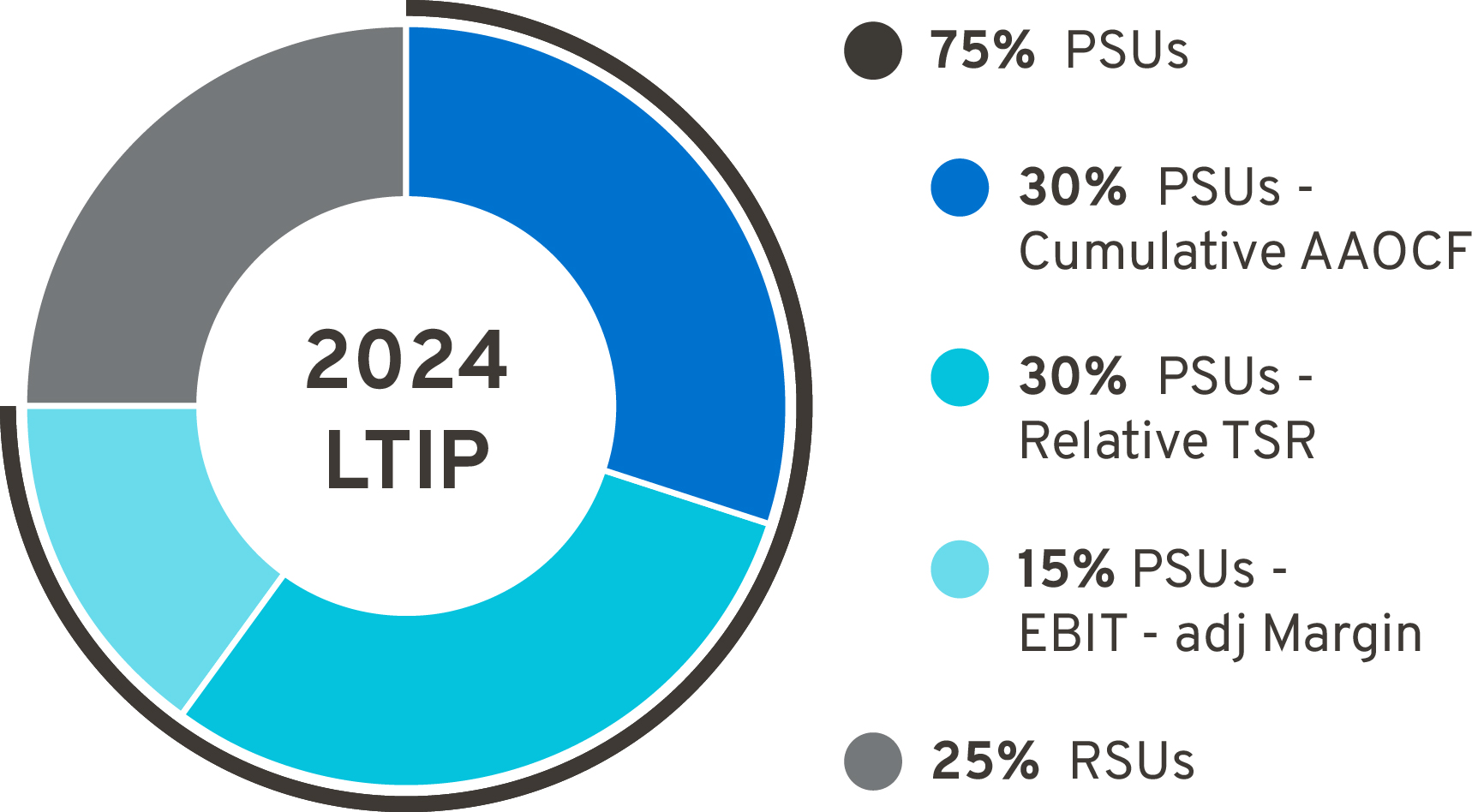

LTIP •Cumulative AAOCF was added to the 2024 PSU performance measures (30% of LTIP) to increase focus on long-term cash generation; EV measures were transitioned into our STIP as noted above •Incorporated RSUs (25% of LTIP) in lieu of stock options to improve our ability to attract and retain key talent •Increased target performance for the relative TSR PSUs from 50th percentile to 55th percentile starting with awards granted in 2025 |

2025 Proxy Statement | 7 |

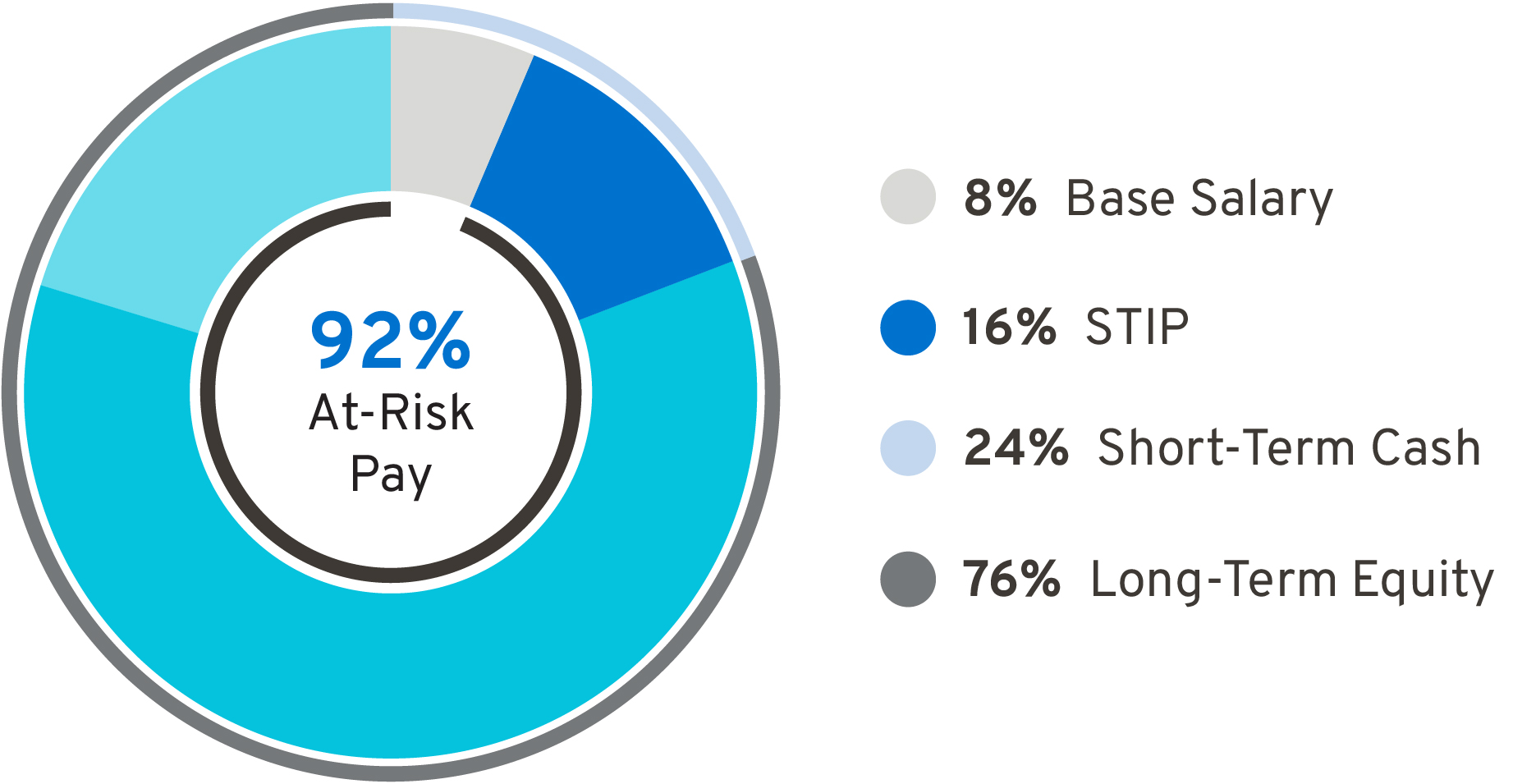

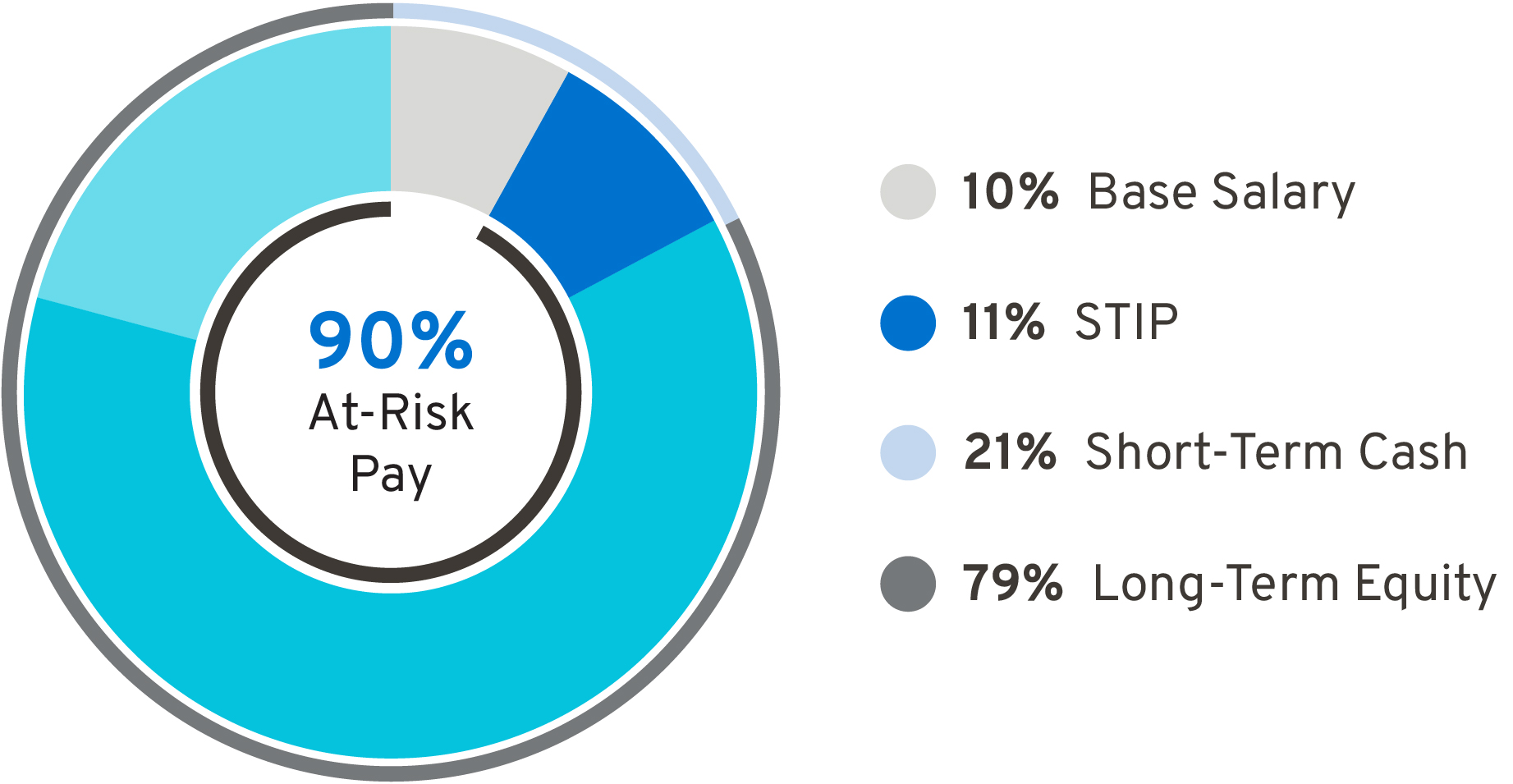

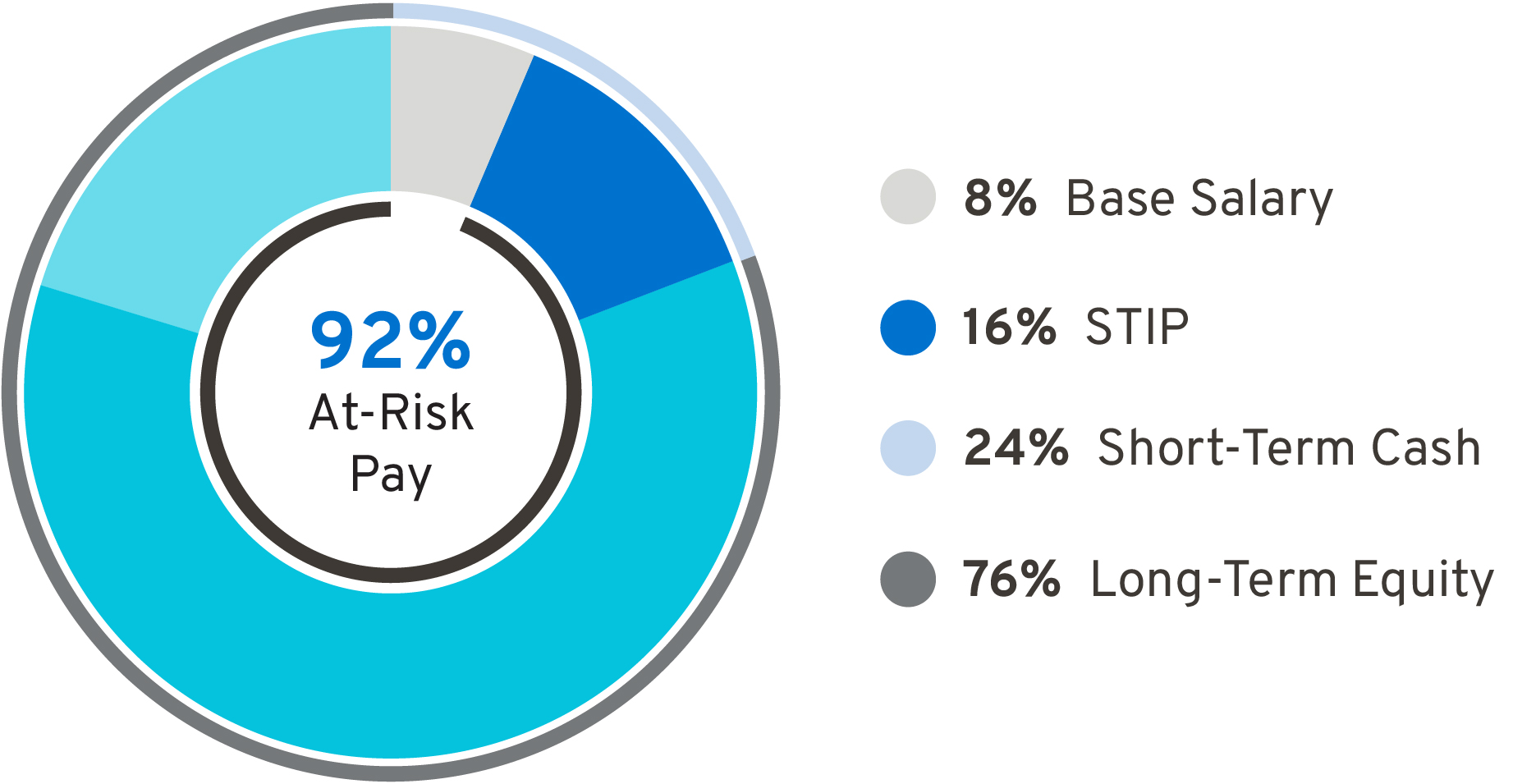

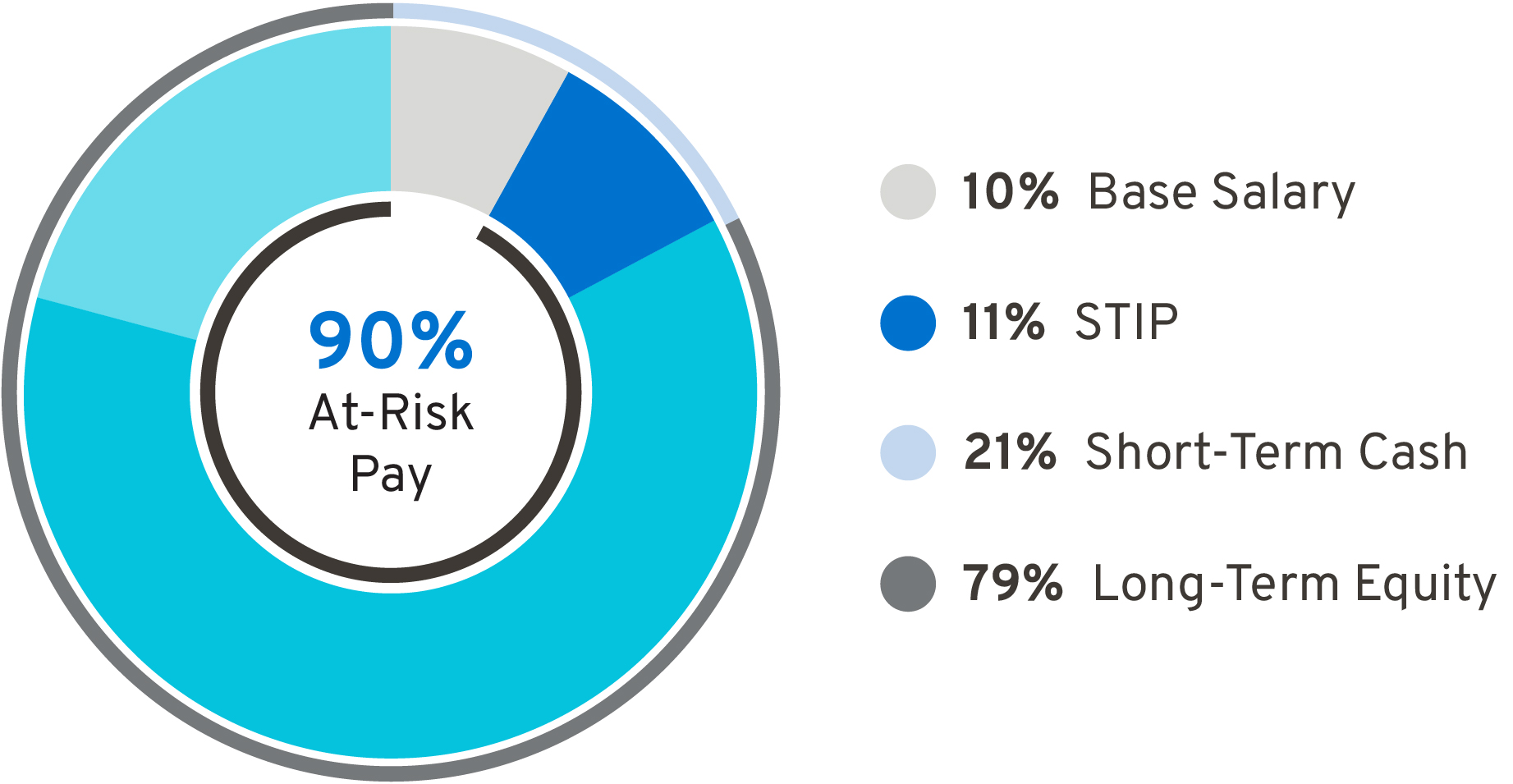

Compensation Components | Short-Term Cash | Long-Term Equity | ||

Salary | STIP | PSUs | RSUs | |

Link to Strategy | Market-competitive salary reflects contribution, experience, knowledge, skills, and performance | Annual cash incentive based on achievements of Company financial goals and goals linked to our strategic pillars | Align leadership with long-term Company goals and shareholder interests, with an increased focus on Company cash generation | Promotes executive retention, stock ownership, and alignment with shareholder interests |

|  |

8 |  |

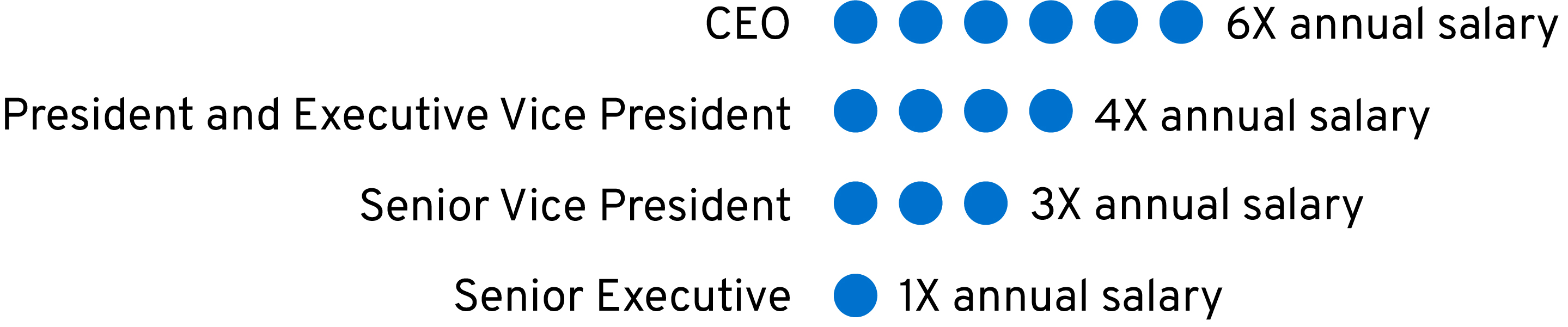

Independence •Ten out of eleven director nominees are independent •Strong Independent Lead Director with clearly delineated duties •All standing Board committees, other than the Executive Committee, composed entirely of independent directors •Regular executive sessions of independent directors without management present •Board and committees may hire outside advisors independently of management | Best Practices •CEO and executive leadership succession planning •Routine engagement with shareholders and other key stakeholders •Diverse Board in terms of gender, race and ethnicity, experiences, and specific skills and qualifications •Strategy and risk oversight by full Board and committees •Board and committee oversight of sustainability issues and priorities •Stock ownership requirements for all senior leaders and non-employee directors •“Overboarding” limits for our directors •Orientation program for new directors and continuing education for all directors | |||||

Accountability •Annual election of all directors •Annual election of Chair and, if CEO, Independent Lead Director, by non-employee directors •Majority voting with director resignation policy (plurality voting in contested elections) •Annual Board and committee self-evaluations •Annual evaluation of CEO (including compensation) by independent directors •Clawback policy that applies to our short- and long-term incentive plans •Oversight of political contributions and lobbying •Comprehensive code of conduct, “Winning with Integrity” | Shareholder Rights •Proxy access •Shareholder right to call special meetings •No poison pill or dual-class shares •One-share, one-vote standard | |||||

2025 Proxy Statement | 9 |

Board and Governance Matters |

|

ITEM 1 | |

Annual Election of Directors |

|

At the Annual Meeting, 11 directors will be nominated for election to GM’s Board of Directors. The Governance Committee evaluated the nominees in accordance with the Committee’s charter and our Corporate Governance Guidelines and submitted the nominees to the Board for approval. The Board believes that the director nominees’ diverse backgrounds, attributes, and experiences provide valuable insights for the Board’s oversight of the Company. Seven of the 11 nominees, or 63 percent, bring gender, racial, or ethnic diversity to the Board, including four of the six committee chairs. Of the 11 director nominees, ten were previously elected at the 2024 annual meeting. Alfred F. Kelly, Jr. was elected to the Board in September 2024. Further information on the Board’s composition, as well as each nominee’s qualifications and relevant experience, are provided on the following pages. If elected, the director nominees will serve on the Board until the next annual meeting of shareholders, or until their earlier resignation or removal. If any nominee becomes unable to serve, proxies will be voted for the election of such other person as the Board may designate, unless the Board chooses to reduce the number of directors standing for election. Each of the nominees has consented to being named in this Proxy Statement and serving on the Board, if elected. |

| The Board recommends a vote FOR each of the nominees identified in this Proxy Statement. |

10 |  |

2021 | 2023 | |||||||

Mark Tatum joins the Board, adding marketing, brand, and customer experience expertise. | Jan Tighe joins the Board, adding cybersecurity, risk management, and technology expertise. | |||||||

Continuous Board Refreshment | ||||||||

2022 | 2024 | |||||||

Joanne Crevoiserat and Jon McNeill join the Board, adding industry, financial, marketing, brand, and technological expertise. | Al Kelly joins the Board adding financial, risk management, and cybersecurity expertise. | |||||||

Board Spotlight: Recognizing Distinguished Service The Board would like to express its gratitude to Tom Schoewe for his dedication to the Audit Committee and to Linda Gooden for her role in establishing the Risk and Cybersecurity Committee. Both played critical roles in developing best-in-class procedures to oversee the audit, risk, and cybersecurity functions and therefore helped protect shareholder, customer, and Company interests. | ||

2025 Proxy Statement | 11 |

45% Women | 63% Board Committee Chairs of Gender or Racial/Ethnic Diversity | 6 Years Average Tenure | 63 Years Average Age | |||||||||||

Cyber 4 of 11 |  Finance 9 of 11 |  Global 11 of 11 | ||||||||

Industry 2 of 11 |  Manufacturing 6 of 11 |  Marketing 7 of 11 | ||||||||

Public Company CEO 7 of 11 |  Risk Management 11 of 11 |  Technology 8 of 11 | ||||||||

12 |  |

|  |  |  |  |  |  |  |  |  |  | ||

| Cyber | ¢ | ¢ | ¢ | ¢ | |||||||

| Environmental | ¢ | ¢ | ¢ | ¢ | |||||||

| Finance | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ||

| Global | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ |

| Governance | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ |

| Industry | ¢ | ¢ | |||||||||

| Manufacturing | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | |||||

| Marketing | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ||||

| Public Company CEO | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ||||

| Risk Management | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ |

| Social | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | |

| Technology | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ | ¢ |

2025 Proxy Statement | 13 |

Cyber | Experience managing cybersecurity security risks or understanding the cybersecurity threat landscape. |

Environmental | Expertise with environmental matters, including greenhouse gas (“GHG”) emissions; raw material sources; waste and hazardous materials management; product design and lifecycle management; water and wastewater management; and/or energy efficiency management. |

Finance | Expertise in complex financial and/or accounting matters to evaluate financial statements, capital structure and allocation, and business plans. |

Global | Relevant experience with business and cultural perspectives. |

Governance | Experience with public company board governance; legal and regulatory matters; executive compensation; compliance and business ethics; anti-competitive practices; risk management; and/or reporting principles and frameworks. |

Industry | Expertise in key businesses and proven knowledge of key customers and risks associated with the automotive industry. |

Manufacturing | Experience in, or experience in a senior management position responsible for, significant manufacturing operations. |

Marketing | Expertise regarding brand maintenance and expansion, product awareness, customer engagement, digital marketing, and/or social media experience. |

Public Company CEO | Experience over an extended period, especially as CEO; extraordinary leadership qualities; and the ability to identify and develop those qualities in others. |

Risk Management | Relevant experience in risk management and oversight. |

Social | Expertise with data privacy; human rights; community relations; workplace health and safety; supply chain management; human capital management; consumer privacy; product quality and safety; and/or labor practices. |

Technology | Expertise in, or understanding of, technology and innovation gained either through academia or industry experience. |

14 |  |

Gender: Female Director since: 2014 Race/Ethnicity: White Committees: Executive (Chair) | Mary T. Barra | 63 Chair and CEO, General Motors Company | |||||||||

Experience: Ms. Barra is Chair and CEO of General Motors. She has served as Chair of the Board of Directors since January 2016 and has served as CEO since January 2014. Prior to becoming CEO, Ms. Barra served as GM’s Executive Vice President, Global Product Development, Purchasing and Supply Chain from 2013 to 2014; Senior Vice President, Global Product Development from 2011 to 2013; Vice President, Global Human Resources from 2009 to 2011; and Vice President, Global Manufacturing Engineering from 2008 to 2009. Reasons for Nomination: Ms. Barra has in-depth knowledge of the Company and the global automotive industry; extensive senior leadership, strategic planning, operational, and business experience; and a strong engineering background with experience in global product development. She has spearheaded many initiatives to align the Company’s culture with its transformation efforts and holds herself and the leadership team accountable for driving a culture of safety for customers, employees, and communities. Other Public Company Directorships: The Walt Disney Company Prior Public Company Directorships (Past Five Years): None | What does the Company need to do to further increase shareholder value after its strong 2024 performance? | |||||||||

Q | ||||||||||

I said last year that 2024 needed to be a year dedicated to our four strategic pillars that are laid out in the Board’s letter to shareholders at the beginning of this Proxy Statement. Credit to the team for remaining focused and making significant progress on each of those pillars. As a result, our financial results and long-term shareholder value closely aligned last year. It is critical that we maintain that momentum this year as this is a multi-year strategy designed to keep GM leading the future of transportation. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Chevrolet Blazer EV | ||||||||||

Skillset: Finance Governance Industry Manufacturing Public Company CEO Risk Management Social Technology | ||||||||||

Gender: Female Director since: 2009 Race/Ethnicity: White Committees: Compensation Executive Finance Governance (Chair) | Patricia F. Russo | 72  Chair, Hewlett Packard Enterprise Company | |||||||||

Experience: Ms. Russo has served as the Chair of the Hewlett-Packard Enterprise Company’s (“HPE”) board of directors since her appointment in 2015. She also served as Lead Director of HPE from 2014 to 2015. Ms. Russo was GM’s Independent Lead Director from March 2010 to January 2014, and in 2021 she was re-appointed to that role. Ms. Russo served as CEO of Alcatel-Lucent S.A. from 2006 to 2008; Chairman and CEO of Lucent Technologies, Inc. from 2003 to 2006; and President and CEO of Lucent Technologies from 2002 to 2006. Reasons for Nomination: Ms. Russo has extensive senior leadership experience in corporate strategy, finance, sales and marketing, technology, and leadership development, as well as experience managing business-critical technology disruptions. Through her deep governance expertise – in particular, board governance – she works with management to develop enhanced disclosures and incorporate shareholder feedback. Other Public Company Directorships: Hewlett Packard Enterprise Company (Chair), KKR & Co. Inc., and Merck & Co., Inc. Prior Public Company Directorships (Past Five Years): None | As the Independent Lead Director, how do you help ensure the Board reviews the most critical topics? | |||||||||

Q | ||||||||||

I have regular 1:1s with Mary and frequently seek input from each Board member to make sure everyone has a voice into which topics get time at our Board meetings. I also meet regularly with shareholders, which helps the Board assess topics that are top of mind with them. We also conclude each Board meeting with an extended executive session, where each Board member provides their observations on the meeting and suggestions for future topics. The key is to be flexible while maintaining focus on those topics that directly impact the Company’s long-term strategic pillars. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Cadillac LYRIQ | ||||||||||

Skillset: Finance Governance Manufacturing Marketing Public Company CEO Risk Management Social Technology | ||||||||||

2025 Proxy Statement | 15 |

Gender: Male Director since: 2019 Race/Ethnicity: White Committees: Audit Compensation (Chair) Executive Finance | Wesley G. Bush | 64  Retired Chairman and CEO, Northrop Grumman Corporation | |||||||||

Experience: Mr. Bush served as Chairman of Northrop Grumman’s board of directors from 2011 to 2019. He also served as the CEO of Northrop Grumman from 2010 to 2018. Prior to that, Mr. Bush served in numerous leadership roles at Northrop Grumman, including President and Chief Operating Officer, CFO, and President of the Space Technology sector. He also served in a variety of leadership positions at TRW, Inc. before it was acquired by Northrop Grumman in 2002. Reasons for Nomination: Mr. Bush has valuable experience in leading a manufacturing enterprise known for its advanced engineering and technology. He also has strong financial acumen gained through his finance leadership roles and has knowledge of key governance issues, including risk management and executive compensation plan design. Mr. Bush has also developed environmental experience as a member of the board of Conservation International. Other Public Company Directorships: Dow Inc. and Cisco Systems, Inc. Prior Public Company Directorships (Past Five Years): None | How does the Board help the Company recruit from the technology industry? | |||||||||

Q | ||||||||||

Technology is a critical driver of every part of our business and underpins each pillar of our transformation strategy, so management needs to hire the right talent, often from premier technology companies. To make the Company an employer of choice, the Board is focused on creating a compensation structure that helps attract this critical talent. You can read more about our strategy on page 46 of this Proxy Statement. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: GMC Yukon | ||||||||||

Skillset: Cyber Environmental Finance Governance Manufacturing Public Company CEO Risk Management Social Technology | ||||||||||

Gender: Female Director since: 2022 Race/Ethnicity: White Committees: Audit Finance Governance | Joanne C. Crevoiserat | 61  CEO, Tapestry, Inc | |||||||||

Experience: Since October 2020, Ms. Crevoiserat has been CEO and a member of the board of Tapestry, Inc. Prior to her appointment as interim CEO in July 2020, she served as the CFO. She also previously served in senior roles at Abercrombie & Fitch Co., Kohl’s Inc., Wal-Mart Stores, Inc., and May Department Stores. Reasons for Nomination: Ms. Crevoiserat has cultivated an extensive background in financial expertise and brand development. Her leadership capabilities, demonstrated through her various senior leadership retail positions, help the Company as it grows its global consumer brands through consumer-centric, digital, and data-driven initiatives. Ms. Crevoiserat also has social and environmental proficiency which she has gained through her experience in the retail industry and which allows her to provide unique oversight of supply chain governance and sustainable material sourcing. Other Public Company Directorships: Tapestry, Inc. Prior Public Company Directorships (Past Five Years): At Home Group Inc. | How does the Board monitor culture to align with the Company’s values? | |||||||||

Q | ||||||||||

There are several ways that the Board oversees Company culture, including by regularly meeting with the Chief People Officer (who attends every Board meeting). We also receive regular updates from the Chief Compliance Officer during Audit Committee meetings and review certain metrics that show workplace trends. We prioritize transparent communication and have robust governance mechanisms in place to monitor the rigor of the Company’s cultural health, including starting our annual strategy review each year with a review of the culture values, which helps drive our performance. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Cadillac LYRIQ | ||||||||||

Skillset: Environmental Finance Governance Manufacturing Marketing Public Company CEO Risk Management Social | ||||||||||

16 |  |

Gender: Male Director since: 2015 Race/Ethnicity: Hispanic Committees: Compensation Executive Finance (Chair) Risk and Cybersecurity | Joseph Jimenez | 65  Co-Founder and Managing Director, Aditum Bio | |||||||||

Experience: Since 2019, Mr. Jimenez has served as Co-Founder and Managing Partner of Aditum Bio, a biotechnology-focused venture capital firm. Prior to that, he served as CEO of Novartis AG from 2010 until his retirement in 2018. Mr. Jimenez led Novartis’ Pharmaceuticals Division from October 2007 to 2010 and its Consumer Health Division in 2007. From 2006 to 2007, he served as Advisor to the Blackstone Group L.P. Mr. Jimenez was also Executive Vice President, President, and CEO of Heinz Europe from 2002 to 2006; and President and CEO of H.J. Heinz Company North America from 1999 to 2002. Reasons for Nomination: Mr. Jimenez has served as the CEO of a global company with significant research and development and capital spending in a highly regulated environment. He also has significant experience in finance, strategic planning, and consumer branding and marketing. Other Public Company Directorships: The Procter & Gamble Company and Century Therapeutics, Inc. Prior Public Company Directorships (Past Five Years): Graphite Bio | How does the Finance Committee help oversee evolving regulations to ensure a profitable portfolio? | |||||||||

Q | ||||||||||

The Finance Committee previews every vehicle program expenditure that requires Board approval and during those reviews we scrutinize costs, capital requirements, and the key assumptions underlying the business case for the programs. This helps ensure we remain committed to our ICE and EV strategic pillars and reach our profitability targets. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Chevrolet Colorado | ||||||||||

Skillset: Environmental Finance Governance Manufacturing Marketing Public Company CEO Risk Management Technology | ||||||||||

Gender: Male Director since: 2024 Race/Ethnicity: White Committees: Audit Risk and Cybersecurity | Alfred F. Kelly, Jr. | 66  Advisory Director, Berkshire Partners Retired CEO and Chairman, Visa Inc. | |||||||||

Experience: Mr. Kelly served as the CEO of Visa Inc. from 2016 to 2023 and was Chairman of the Board from 2019 to 2024. Prior to Visa, he served in numerous leadership roles, including at American Express, where he was President when he left in 2010, and with the New York-New Jersey Super Bowl Host Committee where he was President and CEO. Reasons for Nomination: Mr. Kelly has extensive expertise in industry disruption, which has been instrumental in driving innovation and competitive advantage. His strong financial acumen ensures robust fiscal oversight and strategic financial planning. Additionally, Mr. Kelly’s global leadership experience provides valuable insights into international markets and enhances the Board’s ability to navigate complex global challenges. Other Public Company Directorships: None Prior Public Company Directorships (Past Five Years): Visa Inc. | What have you learned about the auto industry since joining the Board? | |||||||||

Q | ||||||||||

I found that there are many similarities between the automotive industry and the disruption from new market entrants that I experienced while in the financial services sector, where I spent most of my career. I’ve enjoyed the opportunity to be part of this Board because we are leveraging technology to innovate and deliver new experiences to our customers. Our software and services strategy pillar is critical to effectively creating new revenue streams and differentiating us from our competitors. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Cadillac XT6 | ||||||||||

Skillset: Cyber Finance Governance Marketing Public Company CEO Risk Management Social Technology | ||||||||||

2025 Proxy Statement | 17 |

Gender: Male Director since: 2022 Race/Ethnicity: White Committees: Governance Risk and Cybersecurity | Jonathan McNeill | 57  Co-Founder and CEO, DVx Ventures | |||||||||

Experience: Since 2020, Mr. McNeill has served as CEO of DVx Ventures, a venture company focused on early-stage startups. Prior to founding DVx Ventures, he served as Chief Operating Officer of Lyft, Inc. from 2018 to 2019. From 2015 to 2018, he also served as President, global sales, delivery and service of Tesla, Inc., where he led the team to grow revenue from $2 billion to over $20 billion annually across 33 countries. Reasons for Nomination: Mr. McNeill has deep experience as both an entrepreneur and as an executive at companies of significant scale. He is a demonstrated leader in the EV space with expertise in business models, software architecture, and cyber. Through his experience in positions of senior leadership, he has founded and scaled multiple technology and retail companies. In addition, Mr. McNeill has GHG emissions, air quality, product design and lifecycle management experience, which he has gained through driving EV adoption. Other Public Company Directorships: Lululemon Athletica Inc. Prior Public Company Directorships (Past Five Years): None | How is the Board helping shape the Company’s autonomous vehicle strategy? | |||||||||

Q | ||||||||||

The Board continues to believe that GM is positioned to lead in autonomous and software-defined vehicles. We are closely monitoring how management is integrating the Cruise and GM technical teams into a single effort. We believe GM will achieve its autonomous goals of developing safe, driver-assistance technology for personal vehicles by using AI technology, engineering talent, scale, and manufacturing expertise. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Chevrolet Silverado EV | ||||||||||

Skillset: Cyber Environmental Finance Governance Industry Manufacturing Marketing Risk Management Social Technology | ||||||||||

Gender: Female Director since: 2018 Race/Ethnicity: White Committees: Executive Finance Risk and Cybersecurity (Chair) | Judith A. Miscik | 66  Senior Advisor, Lazard Geopolitical Advisory | |||||||||

Experience: Ms. Miscik is a Senior Advisor at Lazard Geopolitical Advisory. Prior to her current role, she served as CEO and Vice Chairman of Kissinger Associates, Inc., from 2017 to 2022 and before that in other senior leadership positions. Prior to joining Kissinger Associates, Ms. Miscik was the Global Head of Sovereign Risk at Lehman Brothers from 2005 to 2008; and from 2002 to 2005, she served as Deputy Director for Intelligence at the U.S. Central Intelligence Agency, where she worked from 1983 to 2005. Reasons for Nomination: Ms. Miscik has a unique and extensive background in intelligence, security, government affairs, and risk analysis, bringing valuable experience in assessing and mitigating geopolitical and macroeconomic risks in both the public and the private sectors. Other Public Company Directorships: Morgan Stanley and HP Inc. Prior Public Company Directorships (Past Five Years): None | What do you think is a key emerging risk for the Company? | |||||||||

Q | ||||||||||

As the new Chair of the Board’s Risk and Cybersecurity Committee, part of my responsibility is to help the Board oversee all enterprise risks. To do this, we rely on management’s quarterly risk dashboards and annual reviews of our enterprise risk profile. One example of an emerging risk that we are watching relates to geopolitical dynamics in the global supply chains. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Chevrolet Blazer | ||||||||||

Skillset: Finance Governance Risk Management Social Technology | ||||||||||

18 |  |

Gender: Male Director since: 2021 Race/Ethnicity: Black, Asian Committees: Audit Governance | Mark A. Tatum | 55  Deputy Commissioner and Chief Operating Officer, National Basketball Association | |||||||||

Experience: Mr. Tatum joined the National Basketball Association (NBA) in 1999 and was appointed NBA Deputy Commissioner and Chief Operating Officer in 2014. Prior to that, he served in numerous leadership roles at the NBA, including Executive Vice President of Global Marketing Partnerships; Senior Vice President; Vice President of Business Development; Senior Director and Group Manager of Marketing Properties; and Director of Marketing Partnerships. Reasons for Nomination: Mr. Tatum has extensive senior leadership experience in marketing and sales strategy, managing media relationships and global business operations. He also has significant experience driving customer engagement and operations globally through his leadership roles at the NBA. Other Public Company Directorships: None Prior Public Company Directorships (Past Five Years): None | How does the Board help shape the customer’s software experience? | |||||||||

Q | ||||||||||

Last year the Board conducted one of our meetings at the Company’s new Software and Services facility in California to evaluate the Company’s new technologies and meet the new software leadership team. Software and Services is a critical part of the Company’s strategy, and we believe advanced safety and technology platforms will help improve customer experiences and retention. Our strategic success was evident earlier this year when Super Cruise was recognized as the automotive industry’s best driver assistance program by MotorTrend, and the Company was recognized —for the tenth consecutive year—for having the highest overall manufacturer loyalty by S&P Global Mobility. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Cadillac ESCALADE IQ | ||||||||||

Skillset: Cyber Governance Marketing Risk Management Social | ||||||||||

Gender: Female Director since: 2023 Race/Ethnicity: White Committees: Audit Risk and Cybersecurity | Jan E. Tighe | 62  Retired Vice Admiral, U.S. Navy | |||||||||

Experience: Vice Admiral Tighe retired from the U.S. Navy in 2018, having served as the Deputy Chief of Naval Operations for Information Warfare and Director of Naval Intelligence. Her prior Flag Officer assignments include command of the Navy’s Fleet Cyber Command from 2014 to 2016, President of the Naval Postgraduate School from 2012 to 2013, and Deputy Director of Operations at U.S. Cyber Command from 2010 to 2011. Reasons for Nomination: Vice Admiral Tighe cultivated her operational experience in complex cybersecurity matters, including operational technologies, information systems technology, technology risk management, and strategic assessments, while serving in global operations roles for the U.S. Navy and the National Security Agency. Her extensive leadership experience of more than 20 years in the U.S. Navy during a significant period of transformation and provides valuable human capital insights that are essential for the Company as it transitions its workforce to implement EV and AV technologies. Other Public Company Directorships: The Goldman Sachs Group, Inc. and Huntsman Corporation Prior Public Company Directorships (Past Five Years): The Progressive Corporation and IronNet, Inc. | How does the Board oversee cybersecurity risks? | |||||||||

Q | ||||||||||

Cybersecurity is a significant enterprise risk that requires constant oversight and alignment with various stakeholders, including our plant operators, vehicle developers, suppliers and regulatory agencies. Last year, in addition to our regular assessments, several Board members participated with management in a simulation exercise that tested our cyber-response policies and procedures. Also, as part of our regular succession planning, we strive to make sure the Company has the technical talent necessary to build defensible networks and operational infrastructure. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Chevrolet Corvette E-Ray | ||||||||||

Skillset: Cyber Finance Governance Marketing Risk Management Social Technology | ||||||||||

2025 Proxy Statement | 19 |

Gender: Male Director since: 2018 Race/Ethnicity: White Committees: Compensation | Devin N. Wenig | 58  Co-Founder and CEO, Symbolic.ai | |||||||||

Experience: Since 2023, Mr. Wenig has served as Co-Founder and CEO of Symbolic.ai, a platform and application with advanced AI capabilities for publishers and professional writers in news, research, and communications. Previously, he served as President and CEO of eBay Inc. and as a member of its board of directors from July 2015 to August 2019. Mr. Wenig also served as President of eBay’s Marketplaces business from September 2011 to July 2015. Prior to joining eBay, Mr. Wenig was CEO of Thomson Reuters Corporation’s largest division, Thomson Reuters Markets, from 2008 to 2011; Chief Operating Officer of Reuters Group plc from 2006 to 2008; and President of Reuters’ business divisions from 2003 to 2006. Reasons for Nomination: Mr. Wenig has extensive senior leadership experience in software and technology, global operations, and strategic planning. He also has significant expertise leading both high-growth companies from the start-up phase and large, complex organizations. Other Public Company Directorships: None Prior Public Company Directorships (Past Five Years): None | How is the Board ensuring the Company does its part to build the charging infrastructure necessary to help drive EV adoption? | |||||||||

Q | ||||||||||

As a long time EV user, I relate to uncertainty about how to find charging stations and the Board is aware that is a hurdle for many prospective customers. To help, we have encouraged management to work with industry leaders to expand public charging options and improve the customer experience. Examples include opening access to Tesla Superchargers for our customers with a North American Charging Standard adapter, partnering with Pilot Travel Centers and EVgo to add fast charging stalls across the U.S., and opening the first “Rechargery,” the fast-charging concept by our joint venture, IONNA. | ||||||||||

A | ||||||||||

| ||||||||||

Current GM Model: Chevrolet Blazer EV | ||||||||||

Skillset: Finance Governance Marketing Public Company CEO Risk Management Social Technology | ||||||||||

20 |  |

Director Commitment and Availability Review The Governance Committee conducts an annual review of director commitment levels and affirms that all directors are able to comply with the Company’s expectations on a director’s time and availability. | ||

2025 Proxy Statement | 21 |

1 | 2 | 3 | 4 | 5 | |||||||||||||||||||

Source Candidate Pool from •Independent search firms •Directors •Management •Shareholders |  | In-Depth Review by the Governance Committee •Consider skills matrix •Screen qualifications •Review independence and potential conflicts |  | Recommend Selected Candidate for Election to Our Board |  | Review by Full Board |  | Select Director(s) | |||||||||||||||

To Recommend a Director Candidate, Write to: GM’s Corporate Secretary at General Motors Company, Mail Code 482-C24-A68, 300 Renaissance Center, Detroit, Michigan 48265 or by email to shareholder.relations@gm.com. | ||

Director Communications Shareholders and interested parties wishing to contact our Board may send a letter to GM’s Corporate Secretary at General Motors Company, Mail Code 482-C24-A68, 300 Renaissance Center, Detroit, Michigan 48265 or by email at shareholder.relations@gm.com. Communications received in writing will be distributed to the Independent Lead Director or independent members of the Board as a group, if appropriate, unless such communications are considered, in the reasonable judgment of the Corporate Secretary, improper for submission to the intended recipient(s). | ||

22 |  |

Corporate Governance |

|

|  | ||

Mary T. Barra Chair and CEO | Patricia F. Russo Independent Lead Director | ||

2025 Proxy Statement | 23 |

•Presiding over all Board meetings when the Board Chair is not present, including executive sessions of non-management directors, and advising the Board Chair of any actions taken; •Providing Board leadership if circumstances arise in which the Board Chair actually has, potentially has, or is perceived to have, a conflict of interest; •Calling executive sessions for non-management directors, relaying feedback from these sessions to the Board Chair, and implementing decisions made by the non-management directors; •Leading non-management directors in the annual evaluation of the CEO’s performance, communicating the results of that evaluation to the CEO, and overseeing CEO succession planning; •Approving Board meeting agendas to ensure sufficient time for discussion of all items; | •Advising on the scope, quality, quantity, and timeliness of the flow of information between management and the Board; •Serving as a liaison between non-management directors and the Board Chair when requested to do so (although all non-management directors have direct and complete access to the Board Chair at any time they may deem necessary or appropriate); •Interviewing all director candidates and making recommendations to the Governance Committee and the Board; •Being available to advise the Board committee chairs in fulfilling their designated roles and responsibilities to the Board; and •Engaging, when requested to do so, with shareholders. |

24 |  |

Audit | |

Thomas M. Schoewe Chair Committee Members: Wesley G. Bush^ Joanne C. Crevoiserat Linda R. Gooden* Alfred F. Kelly, Jr. Thomas M. Schoewe* Mark A. Tatum Jan E. Tighe Meetings held in 2024: 9 | Key Responsibilities •Monitors the effectiveness of GM’s financial reporting processes and systems, as well as disclosure and internal controls; •Selects and engages GM’s external auditors and reviews and evaluates the audit process; •Reviews and evaluates the scope and performance of the internal audit function; •Facilitates ongoing communications about GM’s financial position and affairs among the Board and the external auditors, GM’s financial and senior management, and GM’s internal audit staff; and •Reviews GM’s policies and procedures regarding ethics and compliance, including the office of the Chief Compliance Officer. |

Recent Activities and Key Focus Areas •Evaluated the Company’s Non-Generally Accepted Accounting Principles (non-GAAP) policy and reviewed the criteria for the determination of special items and the Company’s use of non-GAAP measures to assess performance. •Conducted a strategic review of the Company’s Global Business Services function that has delivered significant savings through streamlining financial and accounting processes. •Reviewed the Company’s earnings releases and quarterly and annual reports, including financial statements on Forms 10-Q and 10-K prior to filing with the SEC. •Reviewed the findings of the ethics, compliance, and internal audit service programs and approved staffing levels and budgets. | |

Executive Compensation | |

Wesley G. Bush Chair Committee Members: Wesley G. Bush Joseph Jimenez Patricia F. Russo Devin Wenig^ Meetings held in 2024: 4 | Key Responsibilities •Reviews the Company’s executive compensation policies, practices, and programs; •Reviews and approves corporate goals and objectives for compensation, evaluates performance (along with the full Board), and determines compensation levels for the CEO; •Reviews and approves compensation of NEOs, executive officers, and other senior leaders under its purview; and •Reviews compensation policies and practices so that the plans do not encourage unnecessary or excessive risk-taking. |

Recent Activities and Key Focus Areas •Conducted extensive shareholder outreach to seek feedback on the Company’s executive compensation plans. For more information on the Board’s response to •Continued to evolve the Company’s incentive compensation plans to further align incentives to the Company’s strategic pillars. •Conducted an assessment of the Company’s compensation programs to ensure that the company can attract talent to drive the transformation. | |

2025 Proxy Statement | 25 |

Finance | |

Joseph Jimenez Chair Committee Members: Wesley G. Bush Joanne C. Crevoiserat Joseph Jimenez Judith A. Miscik Patricia F. Russo Thomas M. Schoewe* Meetings held in 2024: 4 | Key Responsibilities •Reviews financial policies, strategies, and capital structure; •Reviews the Company’s cash management policies and proposed capital allocation plans, capital expenditures, dividend actions, stock repurchase programs, issuances of debt or equity securities, and credit facility and other borrowings; •Reviews any significant financial exposures and risks, including foreign exchange, interest rate, and commodities exposures, and the use of derivatives to hedge those exposures; and •Reviews any strategic investments and similar transactions, including acquisitions, divestitures and partnerships, and similar collaborations. |

Recent Activities and Key Focus Areas •Reviewed the Company’s capital allocation framework and recommended the Board increase the share repurchase program by $6 billion in Q2 2024 and monitored the quarterly dividend. •Regularly reviewed the financial performance of the Company’s vehicle portfolio and recommended the Board approve certain vehicle programs, while also monitoring momentum on EV sales and franchise profitability. •Continued to support the Company’s battery raw material strategy by reviewing strategic transactions that diversified the supply chain and enhanced resiliency. •Oversaw the Company’s long-term plan to deliver sustainable earnings amongst EV adoption and regulatory uncertainty and restructuring efforts in China. | |

Governance and Corporate Responsibility | |

Patricia F. Russo Chair Committee Members: Joanne C. Crevoiserat Jonathan McNeill Patricia F. Russo Mark A. Tatum Meetings held in 2024: 4 | Key Responsibilities •Reviews the Company’s governance framework; •Monitors Company policies and strategies related to corporate responsibility, sustainability, and political contributions and lobbying activities; •Reviews the appropriate composition of the Board and recommends director nominees; •Monitors the self-evaluation process of the Board and committees; •Recommends compensation of non-employee directors to the Board; and •Reviews and approves related party transactions and any potential conflicts of interest. |

Recent Activities and Key Focus Areas •Oversaw the Board’s five-year succession roadmap to ensure the successful transition of institutional knowledge that led to the election of Alfred F. Kelly, Jr. and key Committee leadership refreshments. •Recommended and oversaw the implementation of best practice corporate governance initiatives, including updating the Bylaws and advising shareholders to approve the Amended and Restated Certificate of Incorporation. •Received regular updates on various aspects of the Company’s public policy advocacy workstreams and spend. •Continued oversight of the Company’s sustainability strategy. •Oversaw the shareholder engagement program, which facilitated important feedback to the Board regarding sustainability, governance, and executive compensation issues. | |

26 |  |

Risk and Cybersecurity | |

Judith A. Miscik Chair Committee Members: Linda Gooden* Joseph Jimenez Alfred Kelly, Jr. Jonathan McNeill Judith A. Miscik Thomas M. Schoewe* Jan E. Tighe Meetings held in 2024: 3 | Key Responsibilities •Reviews the Company’s key strategic, enterprise, and cybersecurity and privacy risks; •Reviews the Company’s risk management framework and management’s implementation of risk policies, procedures, and governance to assess their effectiveness; •Reviews management’s evaluation of strategic and operating risks, including risk concentrations, product safety, quarterly information security reports, mitigating measures, and the types and levels of risk that are acceptable in the pursuit and protection of shareholder value; and •Reviews the Company’s risk culture, including the integration of risk management into the Company’s behaviors, decision-making, and processes. |

Recent Activities and Key Focus Areas •Conducted reviews of key enterprise risks, including cybersecurity and supply chain resiliency, with a particular focus on monitoring emerging risks to identify areas for further attention in 2025. •Approved the Company’s 2025 cybersecurity budget and engaged in a cybersecurity simulation exercise with external representatives from the Federal Bureau of Investigations (“FBI”). •Assessed emerging public policy and geopolitical risks, and reviewed management’s mitigating actions to enhance software quality across the product portfolio. •Regularly reviewed the Company’s cybersecurity maturity scorecard and received regular briefings from management on the cyber threat landscape. | |

Executive | |

Mary T. Barra Chair Committee Members: Mary T. Barra Wesley G. Bush Joseph Jimenez Judith A. Miscik Patricia F. Russo Thomas M. Schoewe* Meetings held in 2024: 0 | Key Responsibilities •Composed of the Board Chair and CEO, the Independent Lead Director, and the chairs of all other standing committees; •Chaired by Ms. Barra and acts on certain limited matters for the full Board in intervals between meetings of the Board; and •Meets as necessary, and all actions by the Executive Committee are reported and ratified at the next succeeding Board meeting. |

2025 Proxy Statement | 27 |

Board of Directors •The Board has overall responsibility for risk oversight and focuses on the most significant risks facing the Company. •The Board discharges its risk oversight responsibilities, in part, through delegation to its committees. •The Board delegates oversight for certain risks to each committee based on the risk categories relevant to the subject matter of the committee. | |||

| |||

Audit Committee | •Oversees risks related to (i) financial reporting, internal disclosure controls, and auditing matters; and (ii) legal, regulatory, and compliance programs. | ||

Executive Compensation Committee | •Oversees risks related to executive and employee compensation plans, including through the design of compensation plans that promote prudent risk management and do not encourage excessive risk taking. | ||

Finance Committee | •Oversees risks related to (i) significant financial exposures and contingent liabilities of the Company; (ii) regulatory compliance of employee-defined benefit plans; and (iii) M&A activity and impacts from changes to the Company’s shareholder base. | ||

Governance and Corporate Responsibility Committee | •Oversees risks related to (i) public policy and political activities; (ii) director independence and related party transactions; (iii) the sustainability of our operations and products; and (iv) sustainability disclosures in consultation with the Audit Committee. | ||

Risk and Cybersecurity Committee | •Oversees risks related to the Company’s key strategic, enterprise, and cybersecurity risks, including artificial intelligence, climate change, workplace and product safety, and privacy; •Coordinates with the chairs of the other committees to support them in managing the relationship between risk management policies and practices and their respective oversight responsibilities; and •Assists the Board by monitoring the overall effectiveness of the Company’s risk management framework and processes. | ||

| |||

Senior Leadership Team The Company’s risk governance is facilitated through a top-down and bottom-up structure, with the tone established at the top by Ms. Barra, our Board Chair and CEO, and other members of management, specifically the Senior Leadership Team. | |||

| |||

Risk Advisory Council An executive-level body with delegates from each business unit to discuss and monitor the most significant enterprise and emerging risks in a cross-functional setting. They are tasked with championing risk management practices and integrating them into their functional or regional business units. | |||

| |||

Risk Management Team GM’s Strategic Risk Management team executes a dynamic risk assessment process throughout the year and provides regular updates on enterprise and emerging risks to our Senior Leadership Team and the Risk and Cybersecurity Committee. The Committee also receives detailed management updates on critical risks throughout the year. | |||

28 |  |

Workforce Strategy | The Board along with the Compensation Committee oversees matters related to the Company’s workforce strategy, including attraction of critical skill sets, incentive compensation structure, enhancements to organizational design, and labor relations. |

Core Operations | The Board directly oversees matters related to the Company’s core operations, including workplace safety, sustainability initiatives, asset and plant management, and GM’s overall reputation. |

Product Execution | GM’s full Board directly oversees product strategy and execution and receives regular updates on product safety, software and services, and U.S. regulations related to product development. In addition, the Board directly engages with the Company’s brand leads to discuss and review product updates. |

Market and Competition | The Board reviews and discusses updates on global market competition with members of the Senior Leadership Team. These reports include updates on industry partnerships, infrastructure and adoption rates of electric vehicles, and analyses of competitive landscapes. |

New Ventures and Innovation | The Finance Committee, along with the Board, regularly reviews and discusses with the Senior Leadership Team GM’s diverse product portfolio, including the Company’s strategies for future retail models, new ventures, and innovation, ensuring alignment with long-term business objectives. |

Financial | The Audit and Finance Committees review and discuss with management financial reporting from the Chief Financial Officer, Compliance, and Internal Audit, as well as GM’s external independent auditor. These reports include updates on significant financial developments, financial policy, and cost discipline measures. |

Regulatory | Each of the Committees has direct oversight of specific legal and regulatory risks related to GM’s business. The Company’s full Board also receives regular updates on legal and regulatory developments, including updates on legislative developments, government investigations, litigation, and other legal proceedings. |

Geopolitical | The Senior Leadership Team addresses geopolitical risks, including conflicts and shifting trade policies, by managing relationships with customers, employees, business partners, and stakeholders across our supply chain. The Board oversees these efforts and receives regular updates regarding ongoing implementation and reporting on significant issues and progress. |

2025 Proxy Statement | 29 |

|  |  |  | |||||||||||

implementation and maturity of the cybersecurity program, risk management framework, including cybersecurity risk policies, procedures, and governance | cybersecurity and privacy risk, including potential impact to our employees, customers, supply chain, joint ventures, and other stakeholders | intelligence briefings on notable cyber events | cybersecurity budget and resource allocation, including industry benchmarking and economic modeling of various potential cybersecurity events | |||||||||||

Cybersecurity Spotlight In September 2024 members of the Board and Senior Leadership Team participated in a cyber crisis simulation with outside counsel, third-party technical support, and the FBI to work through a hypothetical supply chain ransomware attack. Key findings from the simulation led to continued improvement action items, which are being monitored by the Risk and Cybersecurity Committee. | ||

Focus on Next-Generation Talent Throughout 2024, the Board met with Company executives during meetings and other events, demonstrating the ongoing integration of talent management into board oversight. These interactions are designed to expose the Board to the next generation of leaders. For instance, the Board had dinner with new software hires in June 2024 and high performers in Detroit in December 2024. | ||

30 |  |

Hands-On Director Education Opportunities •In 2024, the GM Milford Proving Grounds celebrated its 100th anniversary as the world’s first dedicated automotive testing facility. Today, it remains one of the largest testing grounds globally. Every GM vehicle platform, from around the world, undergoes testing at this facility at some point during its lifecycle. In August 2024, the Board had the opportunity to experience learning demonstrations at the Milford Proving Grounds. These demonstrations showcased aspects of GM’s evolving vehicle portfolio and provided insights into international competitor strategies through hands-on experiences. •The Board actively seeks feedback from every aspect of the business to effectively drive strategy. In October 2024, they met with members of the diverse GM dealer partnership from various dealer councils, including the National Dealer Council, Dealer Executive Board, and the Women’s Dealer and Minority Dealer Advisory Councils. These groups provided direct feedback to the Board, helping to understand consumer sentiment and market concerns and ensure the Board stays attuned to the evolving market dynamics and industry conditions. | ||

2025 Proxy Statement | 31 |

1 | 2 | 3 | |||||||||||

Review of Evaluation Forms The Governance Committee annually reviews the form and process for Board and committee self-evaluations. |  | Self-Evaluation In 2024, the self-evaluation process for the Board and its committees included: •committee evaluations led by each committee chair; •interviews between the Board Chair and CEO and each director; and •an executive session of the Board to review the feedback received by the Board Chair and CEO. |  | Gathering Feedback The Independent Lead Director met in executive session after each Board meeting without the Board Chair and CEO to gather feedback from the other non-employee directors. | |||||||||

32 |  |

In 2024, the Board and its Committees met with the Chief Compliance Officer four times and also received in-person annual compliance training. | ||

In 2024, the Board and its Committees discussed human capital management issues at every meeting, including topics such as culture and charitable giving priorities. | ||

In 2024, the Board reviewed public policy priorities at every meeting, in addition to delegating annual oversight of political contributions and lobbying to its Governance Committee. | ||

In 2024, the Board and its Committees reviewed a variety of sustainability related topics, including supply chain resiliency, battery strategy, and GHG emissions. | ||

2025 Proxy Statement | 33 |

•Whether the terms of the related party transaction are fair to the Company and on the same basis as if the transaction had occurred on an arm’s-length basis; •Whether there are any compelling business reasons for the Company to enter into the related party transaction and the nature of alternative transactions, if any; •Whether grants or contributions made by the Company under one of its grant programs are in accordance with the Company’s corporate contribution guidelines; | •Whether the related party transaction would impair the independence of an otherwise independent director; and •Whether the related party transaction would present an improper conflict of interest for any director or executive officer of the Company, taking into account the specific facts and circumstances of such transaction. | ||

34 |  |

2025 Proxy Statement | 35 |

Non-Employee Director Compensation |

|

• Fairly compensate directors for their responsibilities and time commitments. •Attract and retain highly qualified directors by offering a compensation program consistent with those at companies of similar size, scope, and complexity. •Align the interests of directors with our shareholders by providing a significant portion of compensation in equity and requiring directors to continue to own our common stock (or common stock equivalents) throughout their tenure on the Board. •Provide compensation that is simple and transparent to shareholders. | ||

Compensation Element | 2024 Structure ($) | 2025 Structure ($) |

Board Retainer | 325,000 | 325,000 |

Independent Lead Director Fee | 100,000 | 100,000 |

Audit Committee Chair Fee | 35,000 | 35,000 |

All Other Committee Chair Fees (excluding the Executive Committee) | 25,000 | 25,000 |

36 |  |

Amount of compensation required or elected to be deferred each calendar year under the Director Compensation Plan |  | Amount of dividend equivalents earned during the calendar year |  | Average daily closing market price of our common stock for the applicable calendar year |  | DSUs Granted | |||

•Each non-employee director is required to own our common stock or DSUs with a market value of at least $650,000 and has up to five years from the date they are first elected to the Board to meet this ownership requirement. •Non-employee directors are prohibited from selling any GM securities or derivatives of GM securities, such as DSUs, while they are members of the Board. •Ownership guidelines are reviewed each year to confirm they continue to be effective in aligning the interests of the Board and our shareholders. | ||

Type | Purpose |

Company Vehicles | We provide directors with the use of Company vehicles and electric vehicle charging stations to provide feedback on our products as well as enhance the public image of our vehicles. Retired directors also receive the use of a Company vehicle for a period of time. Participants are charged with imputed income based on the lease value of the vehicles and are responsible for associated taxes. |

Personal Accident Insurance(1) | We provide personal accident insurance coverage in the event of accidental death or dismemberment. Directors are responsible for associated taxes on the imputed income from the coverage. |

2025 Proxy Statement | 37 |

Director | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) |

Aneel Bhusri(4) | 55,900 | 83,900 | 17,407 | 157,207 |

Wesley G. Bush | 185,000 | 195,021 | 33,032 | 413,053 |

Joanne C. Crevoiserat | 130,000 | 195,021 | 30,861 | 355,882 |

Linda R. Gooden | 155,000 | 195,021 | 24,157 | 374,178 |

Joseph Jimenez | 155,000 | 195,021 | 41,261 | 391,282 |

Alfred F. Kelly, Jr.(5) | 42,900 | 64,350 | 9,244 | 116,494 |

Jonathan McNeill | 160,000 | 195,021 | 14,344 | 369,365 |

Judith A. Miscik | 130,000 | 195,021 | 23,490 | 348,511 |

Patricia F. Russo | 255,000 | 195,021 | 12,490 | 462,511 |

Thomas M. Schoewe | 165,000 | 195,021 | 38,490 | 398,511 |

Mark A. Tatum | 130,000 | 195,021 | 45,740 | 370,761 |

Jan E. Tighe | 130,000 | 195,021 | 23,323 | 348,344 |

Devin N. Wenig | 160,000 | 195,021 | 34,573 | 389,594 |

38 |  |

Director | Company Vehicle Program(a) ($) | Other(b) ($) | Total ($) |

Aneel Bhusri(4) | 17,287 | 120 | 17,407 |

Wesley G. Bush | 32,792 | 240 | 33,032 |

Joanne C. Crevoiserat | 30,621 | 240 | 30,861 |

Linda R. Gooden | 23,917 | 240 | 24,157 |

Joseph Jimenez | 41,021 | 240 | 41,261 |

Alfred F. Kelly, Jr.(5) | 9,184 | 60 | 9,244 |

Jonathan McNeill | 14,104 | 240 | 14,344 |

Judith A. Miscik | 23,250 | 240 | 23,490 |

Patricia F. Russo | 12,250 | 240 | 12,490 |

Thomas M. Schoewe | 38,250 | 240 | 38,490 |

Mark A. Tatum | 45,500 | 240 | 45,740 |

Jan E. Tighe | 23,083 | 240 | 23,323 |

Devin N. Wenig | 34,333 | 240 | 34,573 |

2025 Proxy Statement | 39 |

Audit Matters |

|

ITEM 2 | |

Proposal to Ratify the Selection of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for 2025 |

|

The Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of the Company’s independent registered public accounting firm retained to audit the Company’s consolidated financial statements and internal control over financial reporting. The Audit Committee also oversees the rotation of the independent registered public accounting firm’s lead audit partner and is involved in the selection and approval of the lead audit partner. The lead audit partner rotates every five years in accordance with regulatory requirements. The Audit Committee evaluates the selection of the Company’s independent auditors each year and determines whether to re-engage the current independent auditors or consider other firms. Following this process, the Audit Committee made the determination to re-engage Ernst & Young LLP (“EY”) as the Company’s independent auditors for the fiscal year ending December 31, 2025. Criteria for Re-Engaging EY. EY has served as the Company’s independent registered public accounting firm since 2017 when the Audit Committee selected the firm as part of a competitive and comprehensive request for proposal process. Through this process, the Audit Committee evaluated firms based on several key factors, including audit quality; the benefits of tenure versus fresh perspective; cultural fit and business acumen; innovation and technology; auditor independence; and the appropriateness of fees relative to both efficiency and audit quality. These critical factors continue to drive the Audit Committee’s priorities with respect to the selection and retention of the Company’s independent auditors. Based on its annual review, the Audit Committee believes that the continued retention of EY as our independent auditors is in the best interests of our shareholders. Shareholder Ratification of Our Selection of EY. As a matter of good corporate governance, the Board submits the selection of the independent auditors to our shareholders for ratification. If shareholders do not ratify the selection of EY, the Audit Committee will reconsider whether to engage EY, but may ultimately determine to engage EY or another audit firm without resubmitting the matter to shareholders. Even if the shareholders ratify the selection of EY, the Audit Committee may, in its sole discretion, terminate the engagement of EY and direct the appointment of another independent registered public accounting firm at any time during the year, although it has no current intention to do so. We Expect EY to Attend Our Annual Meeting. We expect that representatives of EY will be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and are expected to be available to respond to appropriate questions from shareholders. For additional information concerning the Audit Committee and its activities with EY, see the “Audit Committee Report” below. |

| The Board recommends a vote FOR the proposal to ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2025. |

40 |  |

Reasons for Selection to the Audit Committee When selecting directors to serve on the Audit Committee, the Governance Committee and Board of Directors consider, among other factors: independence, financial literacy and expertise, and individual skills. | Financial Literacy and Expertise The Board has determined that all members of the Audit Committee meet heightened independence and qualification criteria and are financially literate in accordance with the NYSE Corporate Governance Standards and SEC rules, and that Messrs. Bush, Kelly, and Schoewe and Mses. Crevoiserat and Gooden are each qualified as an “audit committee financial expert” as defined by SEC rules. | |||||

2025 Proxy Statement | 41 |

Audit Committee | |

Thomas M. Schoewe (Chair) Wesley G. Bush Joanne C. Crevoiserat Linda R. Gooden | Alfred F. Kelly, Jr. Mark A. Tatum Jan E. Tighe |

42 |  |

Type of Fees | 2024 ($ in millions) | 2023 ($ in millions) |

Audit | 25 | 23 |

Audit-Related | 4 | 5 |

Tax | 1 | 1 |

Subtotal | 30 | 30 |

All Other Services | — | 2 |

TOTAL | 30 | 31 |

Amounts in the table above may not sum due to rounding | ||

2025 Proxy Statement | 43 |

Executive Compensation |

|

ITEM 3 | |

Proposal to Approve, on an Advisory Basis, Named Executive Officer Compensation |

|

Executive compensation is an important matter for our shareholders. The Dodd-Frank Wall Street Reform and Consumer Protection Act requires that we provide you with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our NEOs as disclosed in this Proxy Statement in accordance with the compensation disclosure rules of the SEC (sometimes referred to as “Say-on-Pay”). The Board has adopted a policy providing for an annual Say-on-Pay advisory vote. The Compensation Committee has approved the compensation arrangements for our NEOs described in the Compensation Discussion and Analysis section beginning on page 46 and the accompanying executive compensation tables beginning on page 69. We urge you to read the Compensation Discussion and Analysis for a more complete understanding of our executive compensation plans, including our compensation principles, our objectives, and the 2024 compensation of our NEOs. We are asking shareholders to vote in favor of the following resolution: RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, executive compensation tables, and the related narrative discussion, is hereby APPROVED. Although the vote on this item is non-binding, the Board and the Compensation Committee value the opinions of our shareholders and will consider the outcome of the vote when making future compensation decisions for NEOs. Each of the next Say-on-Pay vote and the next advisory vote on the frequency of future Say-on-Pay votes will occur at our 2026 annual meeting. |

| The Board recommends a vote FOR the advisory proposal to approve named executive officer compensation. |

44 |  |

2025 Proxy Statement | 45 |

|  |  |  |  |  |  |  | |||

Wesley G. Bush Chair | Joseph Jimenez | Patricia F. Russo | Devin N. Wenig |

46 |  |

| Mary T. Barra Chair and Chief Executive Officer |  | Paul A. Jacobson Executive Vice President and Chief Financial Officer |  | Mark L. Reuss President |

| Craig B. Glidden Strategic Advisor and Former Executive Vice President |  | Rory V. Harvey Executive Vice President and President, Global Markets |  | Michael Abbott Advisor and Former Executive Vice President, Software |

Trading GM Securities | |

2025 Proxy Statement | 47 |

| |

The General Motors team delivered another strong year. Our compelling portfolio of ICE vehicles and EVs continues to grow stronger. Our strong execution and capital discipline helped us achieve record financial results with strong margins, cash flow and a healthy balance sheet. Our shareholders and employees share in our success, and we’re committed to continuing our momentum.” | |

- Mary T. Barra, Chair and CEO |

Creating An Even Stronger GM | ||

We set new records for EBIT-adjusted, adjusted automotive free cash flow and EPS diluted-adjusted. Total company revenue increased more than 9% year- over-year. | ||

We separated from traditional industry peers by our market results, financial results and shareholder return. We returned $7.6B to shareholders, ending the year with the number of shares outstanding below 1B. | ||

We initiated restructuring actions with our joint venture partner in China to improve business results in a challenging environment. | ||

Building Vehicles Customers Love | ||

Our superb portfolio provided great new choices for customers. We led the industry in U.S. sales and became the #2 seller of EVs in the U.S. in the second half of 2024. | ||

We grew our U.S. market share to its highest quarterly point since the fourth quarter of 2018, with incentives significantly lower than the industry average.(1) | ||

We launched a series of redesigned gas-powered SUVs with higher margins than their predecessors. Our EV portfolio grew and reached positive variable profit. | ||

$187.4B Revenue | $6.0B Net Income Attributable to Stockholders | 3.2% Net Income Margin | $6.37 EPS-diluted | |||||||||||

20.8% ROIC-adjusted(2) | $14.9B EBIT-adjusted(2) | 8.0% EBIT-adjusted(2) Margin | $10.60 EPS-diluted-adjusted(2) | |||||||||||

48 |  |

Program Design Changes | Page Number(s) |

STIP •Incorporated EV (25% of STIP), S&S (10% of STIP), and AV (5% of STIP) goals •Final STIP payout subject to an individual performance modifier not to exceed 110% of the STIP payout amount generated by Company performance •Eliminated the Strategic Goals component of the STIP, previously weighted 25% | |

LTIP •Cumulative AAOCF was added to the 2024 PSU performance measures (30% of LTIP); EV measures were transitioned into our STIP as noted above •Incorporated RSUs (25% of LTIP) in lieu of stock options •Increased target performance for the relative TSR portion of the PSUs from 50th percentile to 55th percentile starting with awards granted in 2025 | |

Notable Enhanced Disclosure | |

Shareholder Outreach and Responsiveness •Provided detailed disclosure on our shareholder engagement, including director participation, summary of feedback themes, and key responsive actions taken | |

Target Rigor •Updated discussion of our STIP and LTIP target-setting processes including additional insight into the factors the Committee considers when setting targets | |

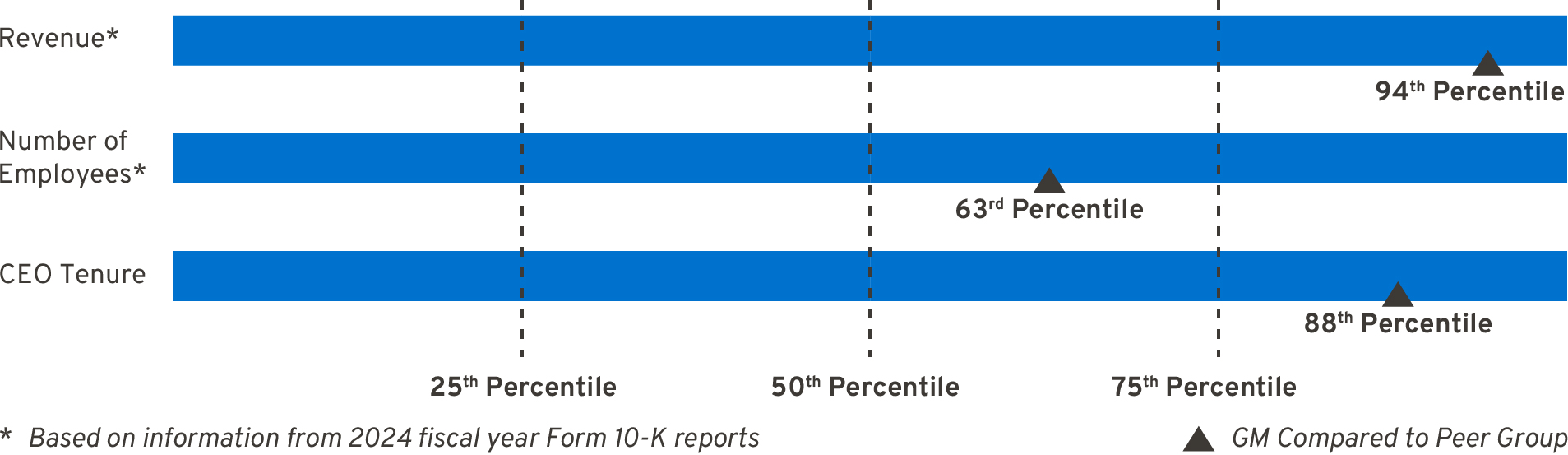

Compensation Peer Group •Enhanced discussion of peer group selection | |

2025 Relative TSR Target Starting with PSU awards granted in 2025, the Committee increased the relative TSR percentile required for target payout to the 55th percentile, previously at median, based on feedback received from shareholders in meetings held after our 2024 Annual Meeting. | ||

2025 Proxy Statement | 49 |

Key Themes | Feedback |

STIP Program Design | •Shareholders supported closer alignment of metrics with strategic pillars •Encouragement for incorporation of EV metrics in STIP instead of LTIP due to the dynamic nature of the EV market •Shareholders are more focused on EV profitability than production volume •Interest in improved metric transparency and objectivity |

LTIP Program Design | •Shareholders generally expressed preference for RSUs in lieu of options •Shareholders were supportive of requiring above-median relative TSR performance to achieve target payout on our PSUs |

Target Rigor | •Interest in more robust disclosure regarding target-setting process to assess rigor and performance |

Compensation Peer Group | •Interest in better understanding rationale for compensation peer group selection |

50 |  |

Key Themes | Company Perspective and Key Actions | ||

STIP Program Design |  | Incorporating EV, S&S, and AV Goals that Align with Company Strategy | •Starting in 2024, incorporated EV (25% of STIP), S&S (10% of STIP), and AV (5% of STIP) goals to better align with the strategic pillars of our business and the pace of the Company’s transformation strategy |

| Enhanced Disclosure of Plan Metrics | •Enhanced disclosures of plan metrics | |

| Strategic Goals Eliminated in Favor of Individual Performance Modifier | •Eliminated the Strategic Goals component of the STIP, previously weighted 25%; final STIP payout now subject to an individual performance modifier not to exceed 110% of the STIP payout amount generated by Company performance. Total payout remains capped at 200% of target | |

LTIP Program Design |  | Cumulative AAOCF Added to 2024 PSU Performance Measures | •Cumulative AAOCF was added to the 2024 PSU performance measures (30% of LTIP) to continue focus on driving shareholder value and Company profitability, while increasing focus on cash generation; EV measures were transitioned into our STIP as described above |

| RSUs Replace Stock Options | •Starting in 2024, incorporated RSUs (25% of LTIP) in lieu of stock options, to improve our ability to attract and retain critical talent and to more efficiently use the shares available in the equity plan | |