Investor Presentation FOURTH QUARTER 2025 .2

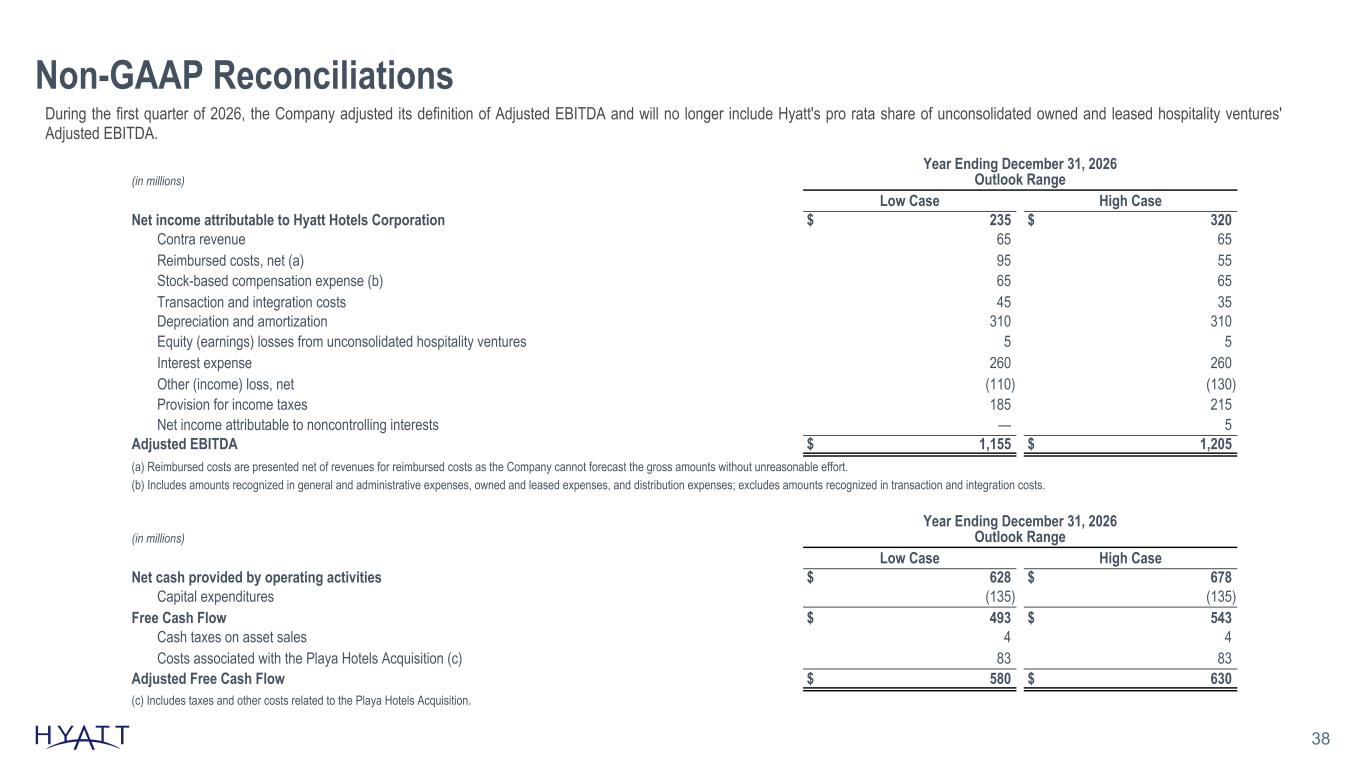

Disclaimers 2 Forward-Looking Statements Forward-Looking Statements in this presentation, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about Hyatt Hotels Corporation’s (“Hyatt,” “the Company,” “we,”, “us,”, or “our”) plans, strategies, outlook, the number of properties we expect to open in the future, the expected timing and payment of dividends, the Company's 2026 outlook, including the Company's expected System-wide Hotels RevPAR Growth, Net Rooms Growth, Net Income, Gross Fees, Adjusted G&A Expenses, Adjusted EBITDA, Capital Expenditures, and Adjusted Free Cash Flow, expected capital returns to shareholders, financial performance, prospective or future events and involve known and unknown risks that are difficult to predict. As a result, the Company's actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and the Company's management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth; the rate and pace of economic recovery following economic downturns; global supply chain constraints and interruptions, rising costs of construction- related labor and materials, and increases in costs due to inflation or other factors that may not be fully offset by increases in revenues in our business; risks affecting the luxury, resort, and all-inclusive lodging segments; levels of spending in business, leisure, and group segments, as well as consumer confidence; declines in occupancy and average daily rate; limited visibility with respect to future bookings; loss of key personnel; domestic and international political and geopolitical conditions, including political or civil unrest or changes in trade policy; the impact of global tariff policies or regulations; hostilities, or fear of hostilities, including future terrorist attacks, that affect travel; travel-related accidents; natural or man-made disasters, weather and climate-related events, such as hurricanes, earthquakes, tsunamis, tornadoes, droughts, floods, wildfires, oil spills, nuclear incidents, and global outbreaks of pandemics or contagious diseases, or fear of such outbreaks; our ability to successfully achieve specified levels of operating profits at hotels that have performance tests or guarantees in favor of our third-party owners; the impact of hotel renovations and redevelopments; risks associated with our capital allocation plans, share repurchase program, and dividend payments, including a reduction in, or elimination or suspension of, repurchase activity or dividend payments; the seasonal and cyclical nature of the real estate and hospitality businesses; changes in distribution arrangements, such as through internet travel intermediaries; changes in the tastes and preferences of our customers; relationships with colleagues and labor unions and changes in labor laws; the financial condition of, and our relationships with, third-party owners, franchisees, and hospitality venture partners; the possible inability of third-party owners, franchisees, or development partners to access the capital necessary to fund current operations or implement our plans for growth; risks associated with potential acquisitions and dispositions and our ability to successfully integrate completed acquisitions with existing operations or realize anticipated synergies; failure to successfully complete proposed transactions, including the failure to satisfy closing conditions or obtain required approvals; our ability to successfully complete dispositions of certain of our owned real estate assets within targeted timeframes and at expected values; our ability to maintain effective internal control over financial reporting and disclosure controls and procedures; declines in the value of our real estate assets; unforeseen terminations of our management and hotel services agreements or franchise agreements; changes in federal, state, local, or foreign tax law; increases in interest rates, wages, and other operating costs; foreign exchange rate fluctuations or currency restructurings; risks associated with the introduction of new brand concepts, including lack of acceptance of new brands or innovation; general volatility of the capital markets and our ability to access such markets; changes in the competitive environment in our industry, industry consolidation, and the markets where we operate; our ability to successfully grow the World of Hyatt loyalty program and manage the Unlimited Vacation Club paid membership program; cyber incidents and information technology failures; outcomes of legal or administrative proceedings; and violations of regulations or laws related to our franchising business and licensing businesses and our international operations; and other risks discussed in the Company's filings with the SEC, including our annual reports on Form 10-K and quarterly reports on Form 10-Q, which filings are available from the SEC. All forward-looking statements attributable to the Company or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this presentation. We do not undertake or assume any obligation to update publicly any of these forward- looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. Non-GAAP Financial Measures This presentation includes references to certain financial measures, each identified with the symbol "†", that are not calculated or presented in accordance with generally accepted accounting principles in the United States ("GAAP"). These non-GAAP financial measures have important limitations and should not be considered in isolation or as a substitute for measures of the Company's financial performance prepared in accordance with GAAP. In addition, these non-GAAP financial measures, as presented, may not be comparable to similarly titled measures of other companies due to varying methods of calculations. During the first quarter of 2026, the Company adjusted its definition of Adjusted EBITDA and will no longer include Hyatt's pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA. Key Business Metrics This presentation includes references to certain key business metrics used by the Company, each identified with the symbol "◊". References Numerical tickmarks noted throughout this presentation correspond to the slide and tickmark numbers included in the Appendix beginning on slide 28 and the references and general disclaimers referenced therein should be read in conjunction with information presented on each slide.

3 GLOBAL HOSPITALITY COMPANY FOCUSED ON SERVING THE HIGH-END TRAVELER 83 Countr ies Around the World and 6 Cont inents 372,763 Rooms 36 Global Brands1 1,528 Hotels and Al l - Inclusive Propert ies ~148,000 Rooms in Pipel ine A Company Record Source Notes: Slide Updated Quarterly Countries, Rooms, Hotel count, and Pipeline linked to ER Body and Consolidations workbook. Manually update Global brands based on Brand Bar and Ranking of Luxury branded rooms in Resort Locations. -Luxury branded rooms in Resort Locations based on STR census as of December 31, 2025 Colleagues as of December 31, 2025: 242,000 P A R K H Y A T T L O N D O N R I V E R T H A M E S Footnotes: Figures as of December 31, 2025. 1 Global brands inclusive of December 31, 2025 brand bar, displayed on slide 6. 2 Source: Smith Travel Research Global Census as of December 31, 2025. Luxury branded rooms as defined by Smith Travel Research chain scale classification. #1 World 's Largest Port fo l io of Luxury Branded Rooms in Resort Locat ions 2

Source Notes: Shareholder Returns (div + repurchases): – 2017: 743M – 2018: 1,014M – 2019: 501M – 2020: 89M – 2021: 0 – 2022: 369M – 2023: 491M – 2024: 1,250M Share file: CHICO-Team- Corporate FPA - Documents\Fact Pack and QA Document\2024\Investor Consideration Deck Support\Annual S E C R E T S H U A T U L C O R E S O R T & S P A Footnotes: HYATT KEY INVESTMENT CONSIDERATIONS 4 • Purpose driven company: We Care For People So They Can Be Their Best • Global portfolio of premium brands • World of Hyatt’s differentiated membership benefits drive loyalty • Significant white space enables long-term organic growth • Asset-light business model designed to drive compounding Free Cash Flow† growth

Fortune World’s Most Admired Companies 2026 Fortune 100 Best Companies To Work For 2025 Glassdoor Best Places To Work 2025 TIME World’s Best Companies of 2025 People 100 Companies That Care List 2025 AWARD-WINNING HOSPITALITY UNDERPINNED BY PURPOSE 5

BRAND PORTFOLIOS 1 DEMONSTRATE FOCUS & DIFFERENTIATION L u x u r y L i f e s t y l e I n c l u s i v e C l a s s i c s E s s e n t i a l s 6 Footnotes: 1 Brand portfolio as of December 31, 2025.

WORLD OF HYATT: REDEFINING LOYALTY Source Notes: Updated semi-annually based on filings for IHG, MAR, and HLT At June 30: – H: ~36K members per hotel – HLT: ~25K members per hotel – MAR: ~23K members per hotel – IHG: ~20K members per hotel At Sept 30: – H: ~37.4K members per hotel (51M members/ 326,845) – HLT: ~26.0K members per hotel – MAR: ~24.4K members per hotel – IHG: ~20.7K members per hotel H 37.4K vs HLT 26.0K = 43.8% At Dec 30: – H: – HLT: – MAR: – IHG: World of Hyatt Membership: – YE 2023: 43.8M – YE 2024: 53.5M (YoY Growth 22.1%) – YE 2025: XXX Award-Winning Recognition 7 ~63M World of Hyatt Members Hilton Marriott IHG Accor High-Quality Scale 43% More Members per Hotel vs. Closest Competitor1 19% Membership Growth Since 2024 2026 Best Hotel Elite Status 2026 Best Hotel Rewards Program T H E S T A N D A R D M A L D I V E S 2024 Best Hotel Credit Card Rewards Program Kiplingers Readers’ Choice THEPOINTSGUY AWARDS 2026 Footnotes: Figures as of December 31, 2025 unless otherwise noted, and growth rates represent year-over-year comparisons from years ended December 31, 2024 and December 31, 2025. 1 Members per hotel figures calculated based on public filings as of September 30, 2025.

Global Markets Global Market Coverage Hotels per Market As de f ined by Smi th T rave l Research marke ts Hya t t has s ign i f i can t oppor tun i t y to expand in to marke ts where i t cu r ren t l y has no b rand p resence Char t be low represen ts marke ts where there i s cu r ren t l y a t l eas t one ho te l Hyat t i s under represen ted in marke ts where i t has a b rand p resence Hyat t Peers Peers Top 50 10 33 51 to 150 5 19 151 to 674 3 12 99% 94% 76% 92% 77% 46% Footnotes: 1 Based on Smith Travel Research Global Census as of December 31, 2025. Global market ranking determined by aggregate room count. Markets as defined by Smith Travel Research: “A geographic area normally composed of a Metropolitan Statistical Area”. Peers referenced include Hilton Worldwide Holdings Inc., Marriott International Inc., and IHG Hotels & Resorts. 8 M I R A V A L A R I Z O N A R E S O R T & S P A WELL REPRESENTED IN THE TOP GLOBAL 1 MARKETS WITH SIGNIFICANT OPPORTUNITY FOR FUTURE GROWTH

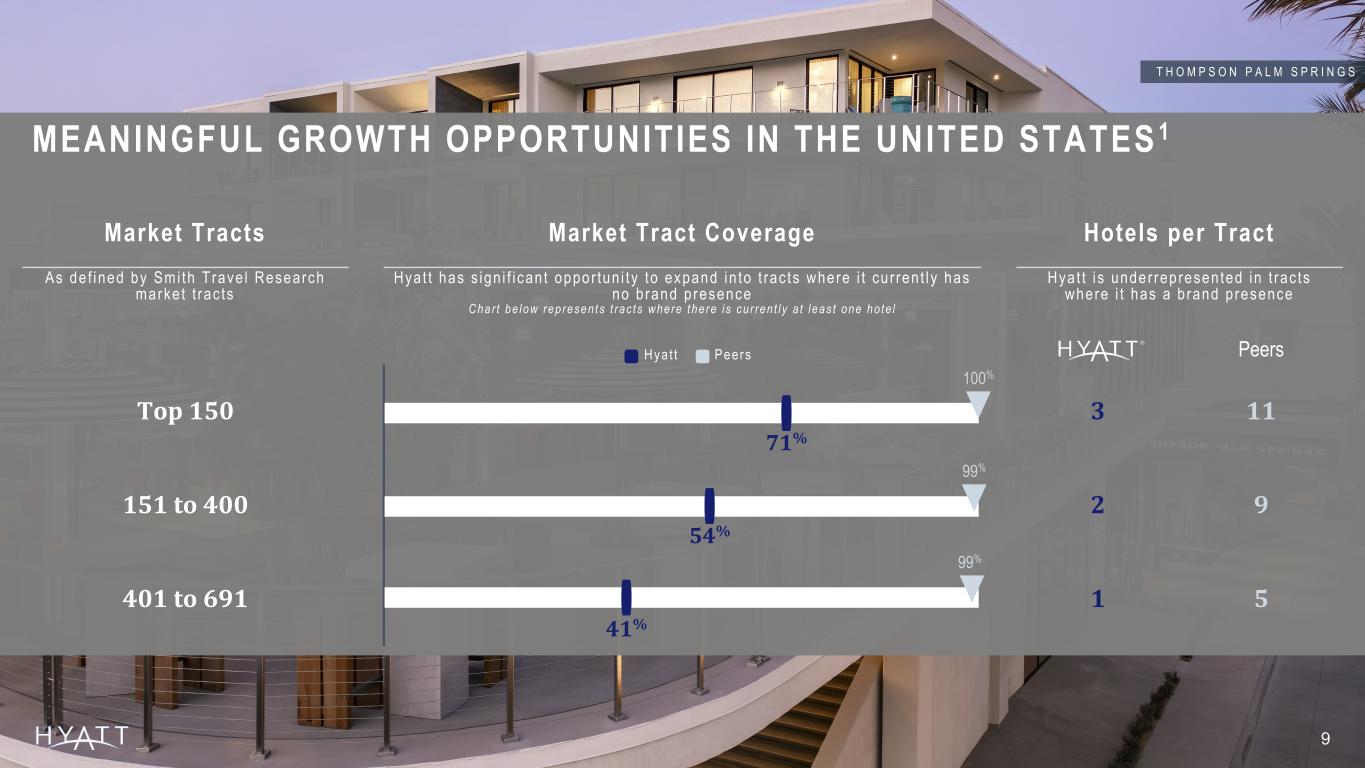

Market Tracts Market Tract Coverage Hotels per Tract As de f ined by Smi th T rave l Research marke t t rac ts Hya t t has s ign i f i can t oppor tun i t y to expand in to t rac ts where i t cu r ren t l y has no b rand p resence Char t be low represen ts t rac ts where there i s cu r ren t l y a t l eas t one ho te l Hyat t i s under represen ted in t rac ts where i t has a b rand p resence Hyat t Peers Peers Top 150 3 11 151 to 400 2 9 401 to 691 1 5 MEANINGFUL GROWTH OPPORTUNITIES IN THE UNITED STATES 1 100% 99% 99% 71% 54% 41% Footnotes: 1 Based on Smith Travel Research Global Census as of December 31, 2025. Market tract ranking determined by aggregate room count. Market Tracts as defined by Smith Travel Research: “A geographic subset of a STR market”. Peers referenced include Hilton Worldwide Holdings Inc., Marriott International Inc., and IHG Hotels & Resorts. 9 T H O M P S O N P A L M S P R I N G S

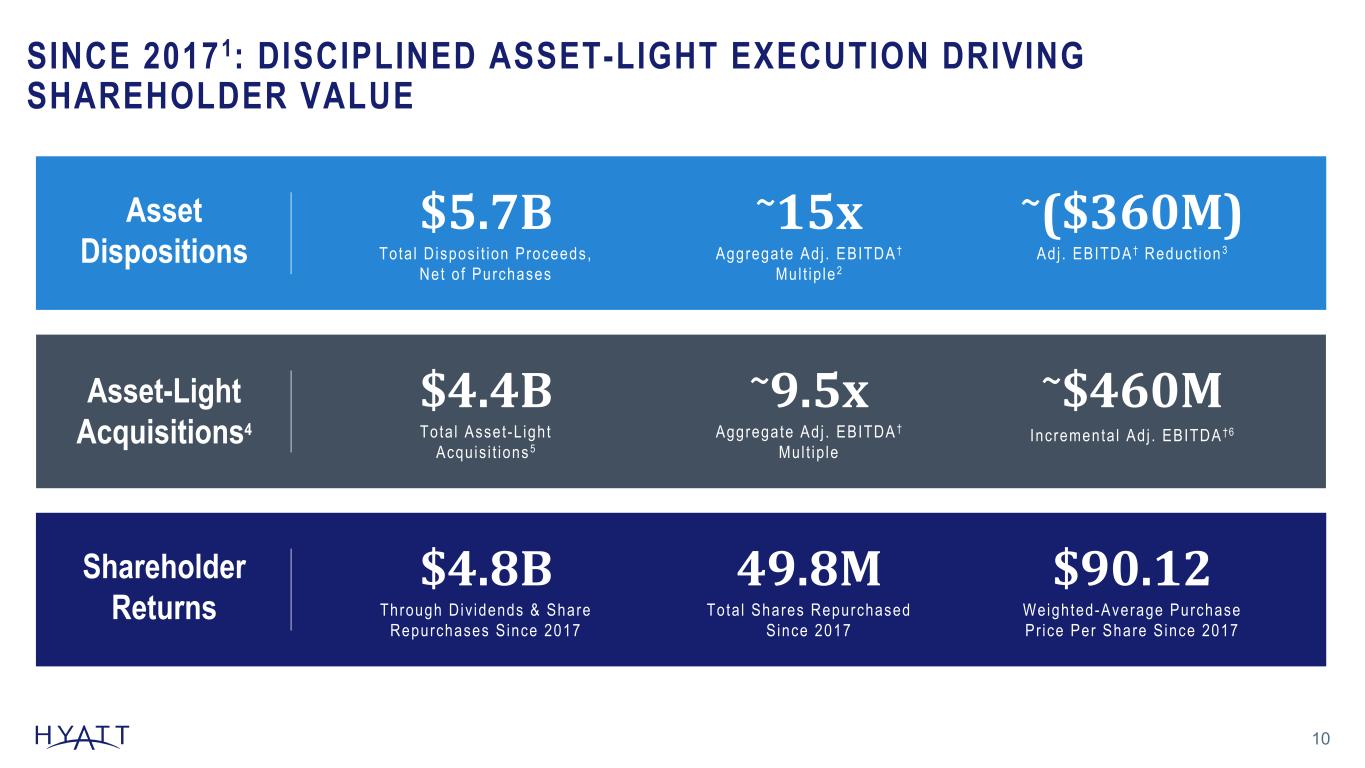

Footnotes: 1 Figures calculated from January 1, 2017 - December 31, 2025. 2 Aggregate Adjusted EBITDA† multiple based on the Adjusted EBITDA† for each respective year for sales prior to 2020, based on 2019 fiscal year for sales in 2021 and 2022, and based on the trailing 12 months prior to the sale for sales in 2024 and 2025. 3 Adjusted EBITDA† reduction of ~$410M from the assets sold netted against ~$50M of run-rate fees from the long-term management or franchise agreements signed as part of the asset sales. 4 Asset-Light Acquisitions includes Two Roads Hospitality, Apple Leisure Group, inclusive of the UVC Transaction, Dream Hotel Group, Mr & Mrs Smith, Me and All Hotels, Standard International, the Bahia Principe Transaction, and the net purchase price of Playa Hotels and Resorts after the completion of the Playa Real Estate Transaction. 5 Includes base consideration paid and assumption for variable consideration to be paid; variable consideration for Dream Hotel Group, Standard International, and Bahia Principe Transaction based on stabilized estimates. 6 Incremental Adjusted EBITDA† based on stabilized Adjusted EBITDA† estimates for Two Roads Hospitality, Apple Leisure Group, inclusive of the UVC Transaction, Dream Hotel Group, Mr & Mrs Smith, Me and All Hotels, Standard International, Playa Hotels & Resorts, and the Bahia Principe Transaction. 10 $5.7B Tota l D ispos i t ion Proceeds, Net o f Purchases ~15x Aggregate Ad j . EBITDA † Mul t ip le 2 Asset Dispositions ~($360M) Adj . EBITDA † Reduct ion 3 $4.4B Tota l Asset -L ight Acqu is i t ions 5 ~9.5x Aggregate Ad j . EBITDA † Mul t ip le Asset-Light Acquisitions4 ~$460M Incrementa l Ad j . EBITDA †6 $4.8B Through Div idends & Share Repurchases S ince 2017 Shareholder Returns 49.8M Tota l Shares Repurchased S ince 2017 $90.12 Weighted-Average Purchase Pr ice Per Share S ince 2017 Source Notes: Shareholder Returns $ (div + repurchases): – 2017: 743M – 2018: 1,014M – 2019: 501M – 2020: 89M – 2021: 0 – 2022: 369M – 2023: 492M – 2024: 1,250M Total # Shares Repurchased: – 2017: 12.19M – 2018: 12.72M – 2019: 5.62M – 2020: 0.83M – 2021: 0 – 2022: 4.23M – 2023: 4.12M – 2024: 7.99M CHICO-Team-Corporate FPA - Documents\Fact Pack and QA Document\2024\Investor Consideration Deck Support\Annual SINCE 20171: DISCIPLINED ASSET-LIGHT EXECUTION DRIVING SHAREHOLDER VALUE

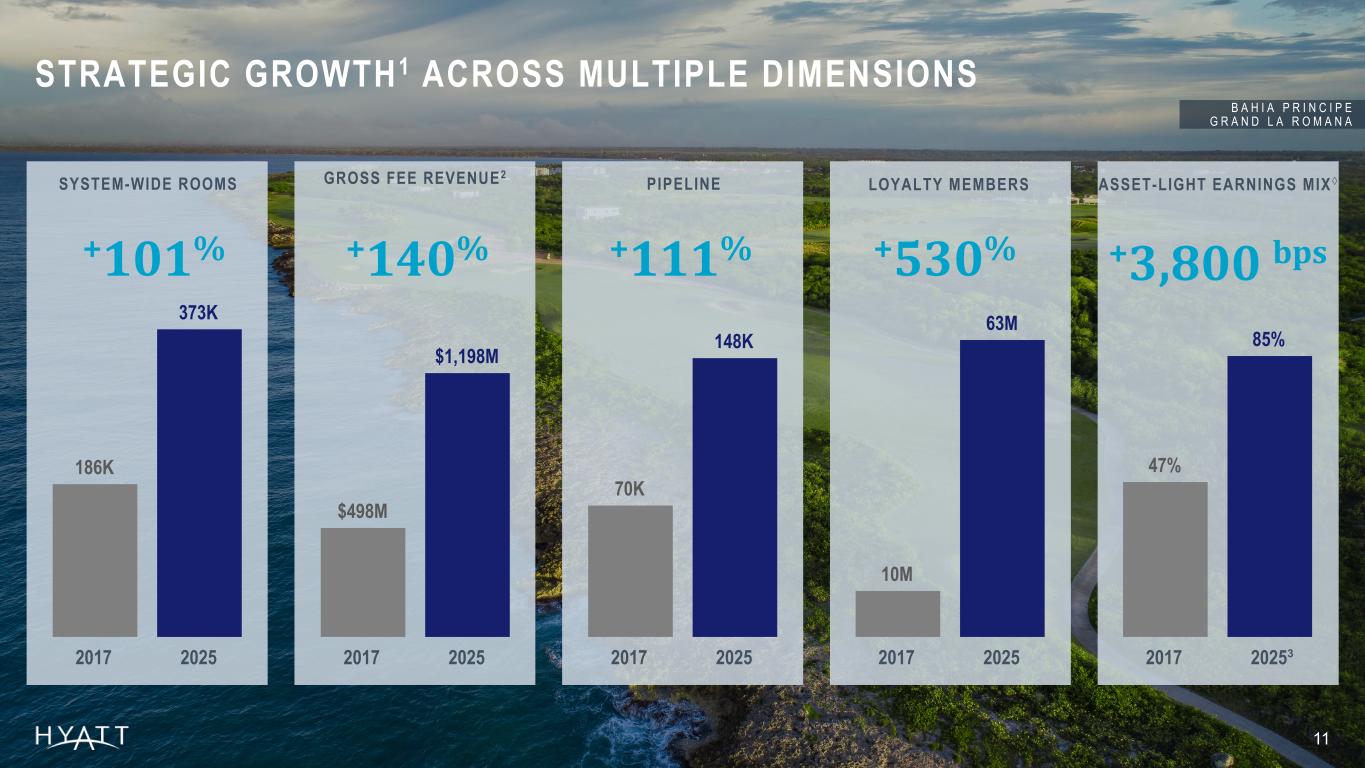

47% 85% 2017 2025 +101% +140% +111% +530% +3,800 bps SYSTEM-WIDE ROOMS GROSS FEE REVENUE2 PIPELINE LOYALTY MEMBERS ASSET-LIGHT EARNINGS MIX◊ Source Notes: Updated Annually Support: Hyatt Hotels\CHICO-Team-Corporate FPA - Documents\Fact Pack and QA Document\2024\Investor Consideration Deck Support\Annual \ Strategic Growth support file -2009 Data can be found under 2009 folder System-wide rooms based on Inventory as of December 31, 2009 Fee Revenue, pipeline, and loyalty members based on Hyatt 2009 Annual Report -2017 Data can be found under 2017 folder System-wide rooms based on Inventory as of December 31, 2017 Fee Revenue and pipeline based on Q4 2017 Earnings Release Loyalty members based on 10-K 2017 -2023 Data System-wide rooms based on Inventory as of December 31, 2023 Fee Revenue and pipeline based on Q4 2023 Earnings Release Loyalty members based on 10-K 2023 as well as Enrollment and Program member count Q4 2023 Footnotes: 1 Calculated growth comparisons based on years ended December 31, 2017 and December 31, 2025. 2 Gross fee revenue in 2017 represents management, franchise, and other fees following the adoption of ASC 606 during the year ended December 31, 2018 as disclosed in our 2018 Form 10-K. 3 Excludes the impact of the period of ownership of the Playa assets in 2025. 186K 373K 2017 2025 $498M $1,198M 2017 2025 70K 148K 2017 2025 10M 63M 2017 2025 B A H I A P R I N C I P E G R A N D L A R O M A N A 11 3 STRATEGIC GROWTH1 ACROSS MULTIPLE DIMENSIONS

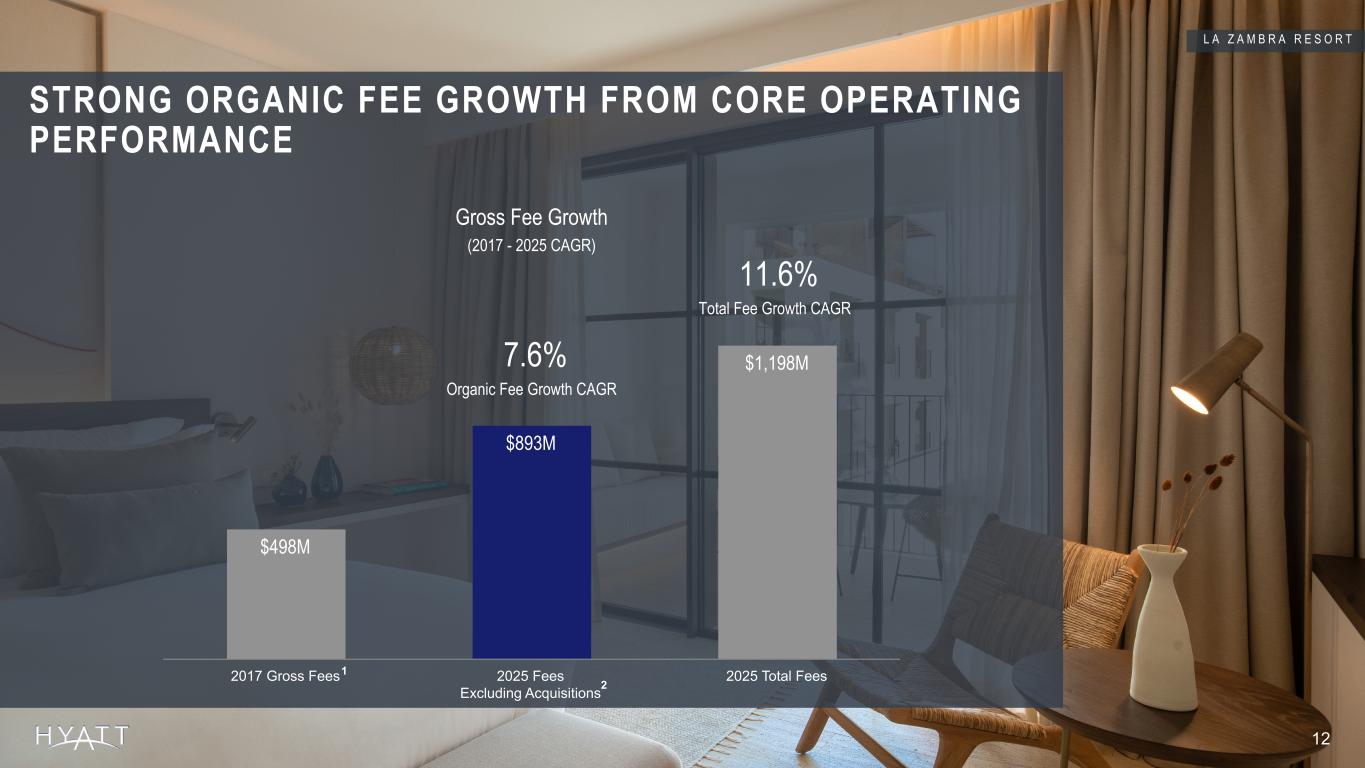

Footnotes: 1 Gross fees in 2017 represents management, franchise, and other fees following the adoption of ASC 606 during the year ended December 31, 2018 as disclosed in our 2018 Form 10-K. 2 Fees excluding acquisitions calculated as total fees excluding fees earned from the asset-light acquisitions of Two Roads Hospitality, Apple Leisure Group, inclusive of the UVC Transaction, Dream Hotel Group, Mr & Mrs Smith, Me and All Hotels, Standard International, Playa Hotels, and the Bahia Principe Transaction. STRONG ORGANIC FEE GROWTH FROM CORE OPERATING PERFORMANCE $498M $893M $1,198M 2017 Gross Fees 2025 Fees Excluding Acquisitions 2025 Total Fees (2017 - 2025 CAGR) L A Z A M B R A R E S O R T Gross Fee Growth 7.6% Organic Fee Growth CAGR 11.6% Total Fee Growth CAGR 2 12 1

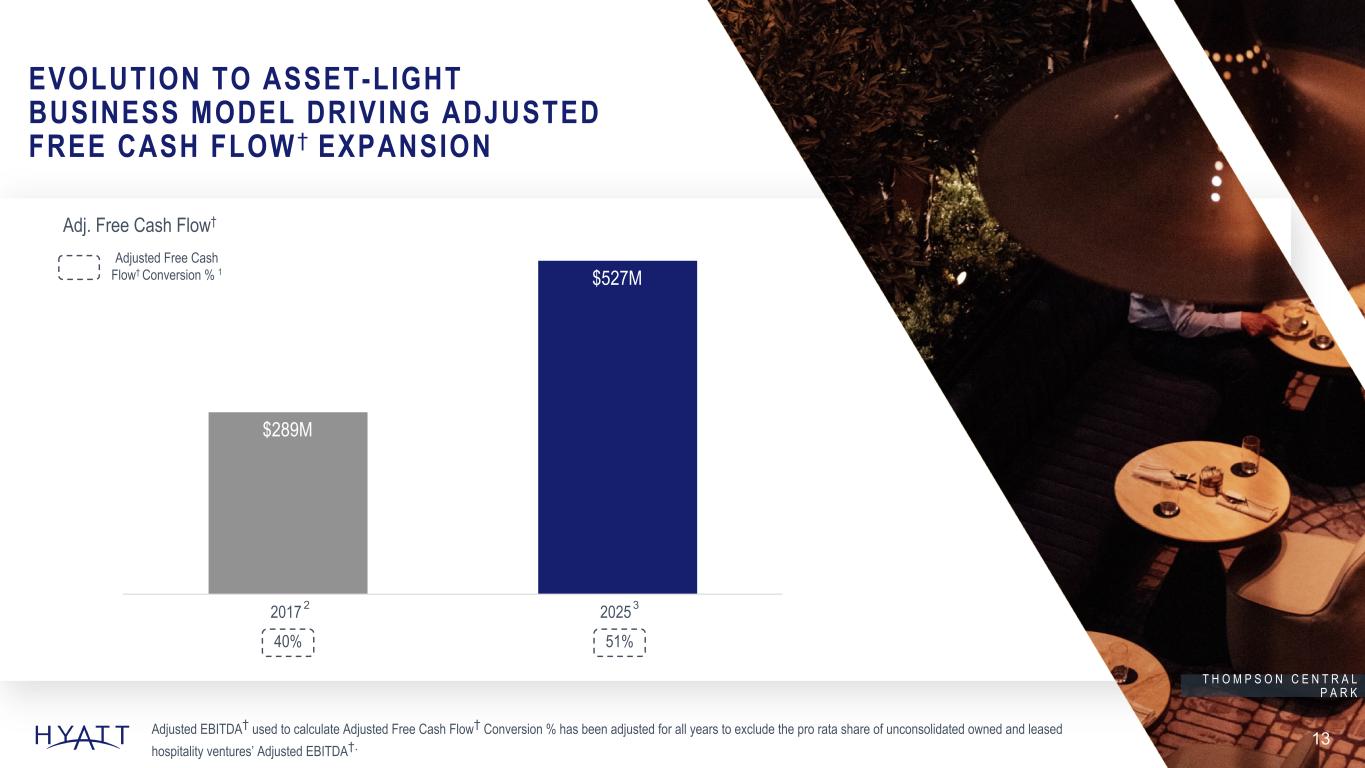

EVOLUTION TO ASSET-LIGHT BUSINESS MODEL DRIVING ADJUSTED FREE CASH FLOW† EXPANSION Adjusted EBITDA† used to calculate Adjusted Free Cash Flow† Conversion % has been adjusted for all years to exclude the pro rata share of unconsolidated owned and leased hospitality ventures’ Adjusted EBITDA†. $289M $527M 2017 2025 Adjusted Free Cash Flow† Conversion % 1 T H O M P S O N C E N T R A L P A R K 51%40% 3 Adj. Free Cash Flow† 13 Footnotes: 1 Adjusted Free Cash Flow Conversion % calculated as Adjusted Free Cash Flow divided by Adjusted EBITDA. 2 Adjusted EBITDA in 2017 represents Adjusted EBITDA following the adoption of ASC 606 during the year ended December 31, 2018 as disclosed in our 2018 Form 10-K 3 2025 figures exclude the impact of the Playa Hotels Acquisition. Full details of the Company’s 2026 outlook can be found in its fourth quarter and full year 2025 earnings release. The Company’s 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. 2

14 P A R K H Y A T T C A B O D E L S O L R E C E N T L Y O P E N E D I N Q 4 2 0 2 5 FULL YEAR HIGHLIGHTS

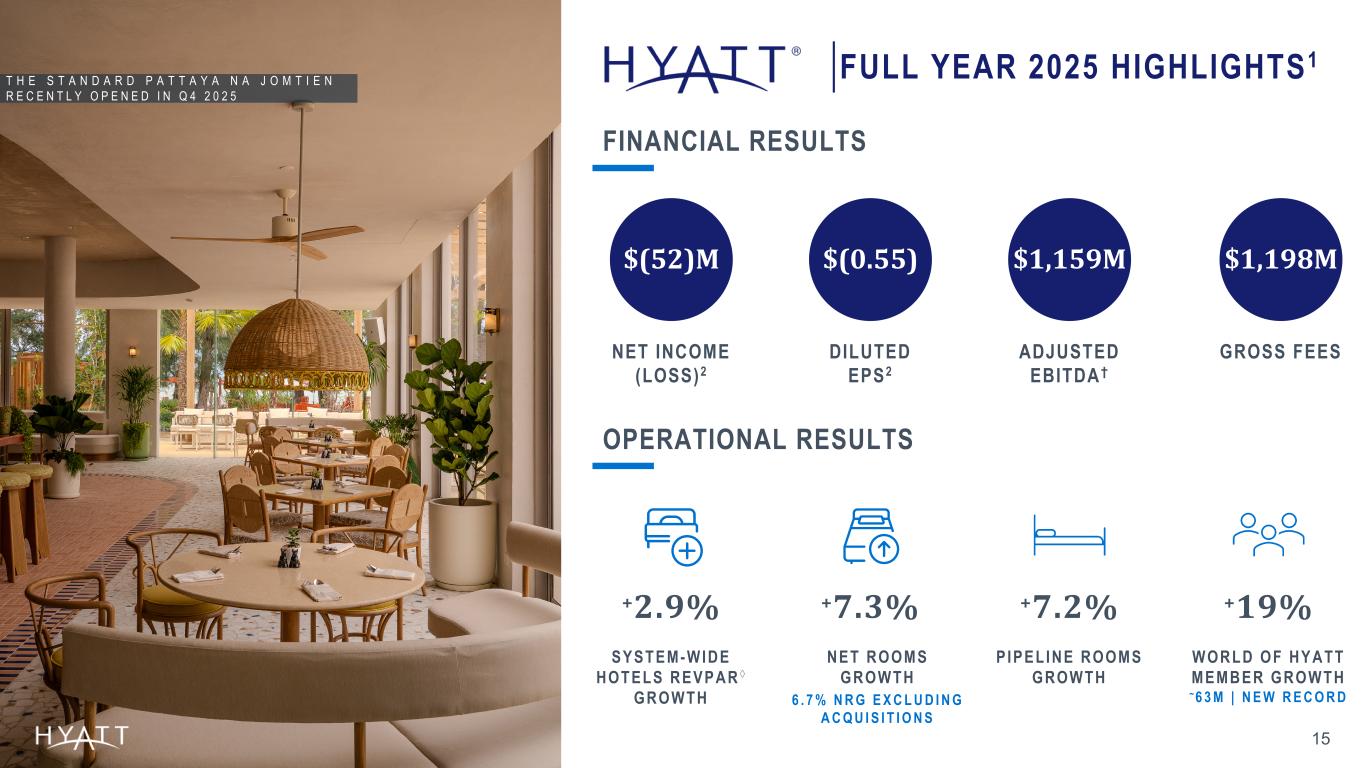

ADJUSTED EBITDA† DILUTED EPS2 GROSS FEES $(52)M NET INCOME (LOSS)2 $(0.55) $1,159M $1,198M OPERATIONAL RESULTS FINANCIAL RESULTS +7.2% PIPEL INE ROOMS GROWTH +7.3%+2.9% SYSTEM-WIDE HOTELS REVPAR ◊ GROWTH +19% WORLD OF HYATT MEMBER GROWTH ~6 3 M | N E W R E C O R D Source Notes: Operational Results: RevPAR and NRG are linked to ER. Pipeline increase should be calculated vs prior year’s ER (rounded pipeline) vs current year rounded pipeline #. World of Hyatt Member growth: Teams\Hyatt Hotels\CHICO-Team- Corporate FPA - Documents\Hotel FP&A\World of Hyatt Enrollments Reported Pipeline: – 2023 YE: 127K – 2024 YE: 138K – 2024 Q1: 129K 15 FULL YEAR 2025 HIGHLIGHTS1 T H E S T A N D A R D P A T T A Y A N A J O M T I E N R E C E N T L Y O P E N E D I N Q 4 2 0 2 5 NET ROOMS GROWTH 6 . 7 % N R G E X C L U D I N G A C Q U I S I T I O N S Footnotes: 1 Figures as of December 31, 2025, and growth rates represent year-over-year comparisons from years ended December 31, 2024 and December 31, 2025. 2 Represents amounts attributable to Hyatt Hotels Corporation.

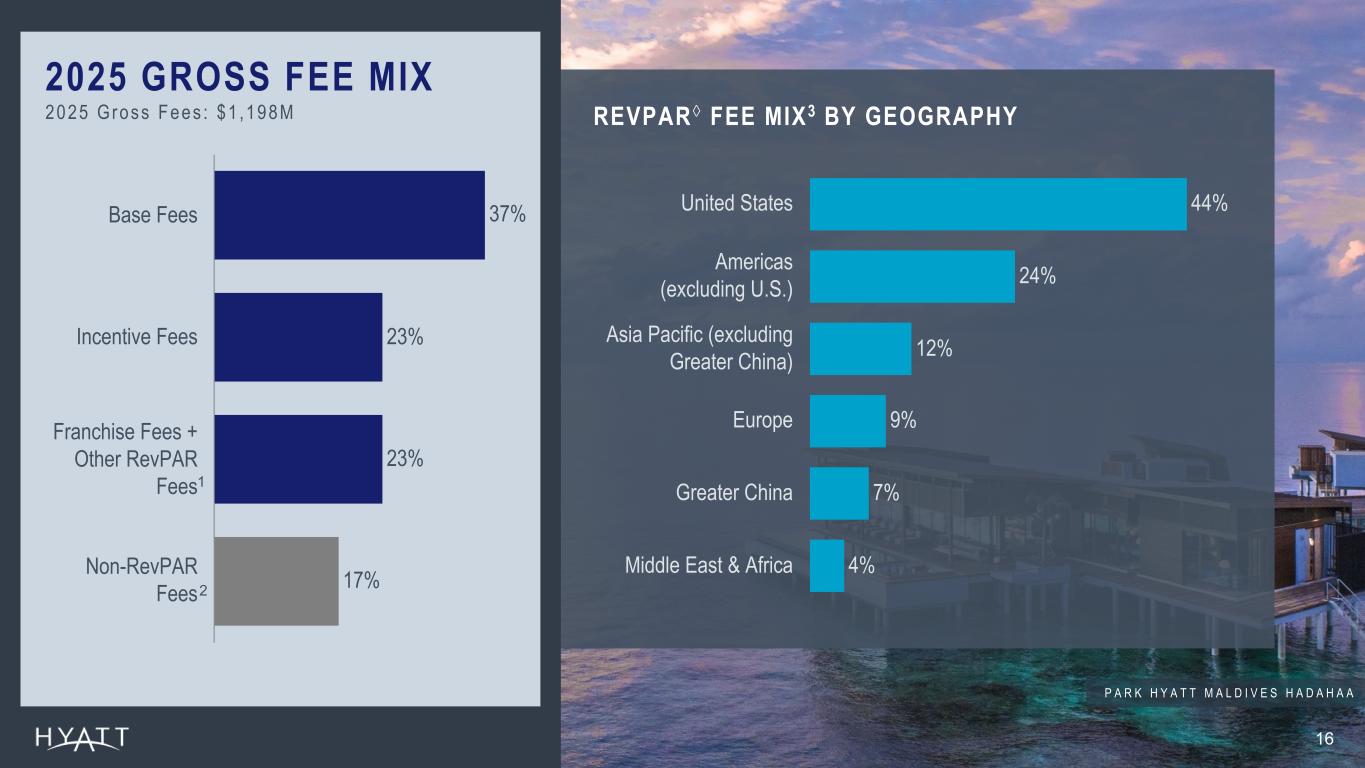

2025 GROSS FEE MIX 2025 Gross Fees : $1 ,198M 16 REVPAR◊ FEE MIX3 BY GEOGRAPHY P A R K H Y A T T M A L D I V E S H A D A H A A Source Notes: Footnotes: Figures as of December 31, 2025. 1 Other RevPAR fees primarily includes fees from hotel services provided to certain all-inclusive resorts. 2 Non-RevPAR fees includes license fees received in connection with the licensing of the Hyatt brand names through our co-branded credit card programs and vacation units; management and royalty fees related to the management and licensing of certain of our brands to the Unlimited Vacation Club business; termination fees; and all other fees. 3 Fee mix by geography is inclusive of base, incentive, franchise, and other RevPAR fees earned in the respective geographical regions. 44% 24% 12% 9% 7% 4% United States Americas (excluding U.S.) Asia Pacific (excluding Greater China) Europe Greater China Middle East & Africa 37% 23% 23% 17% Base Fees Incentive Fees Franchise Fees + Other RevPAR Fees Non-RevPAR Fees2 1

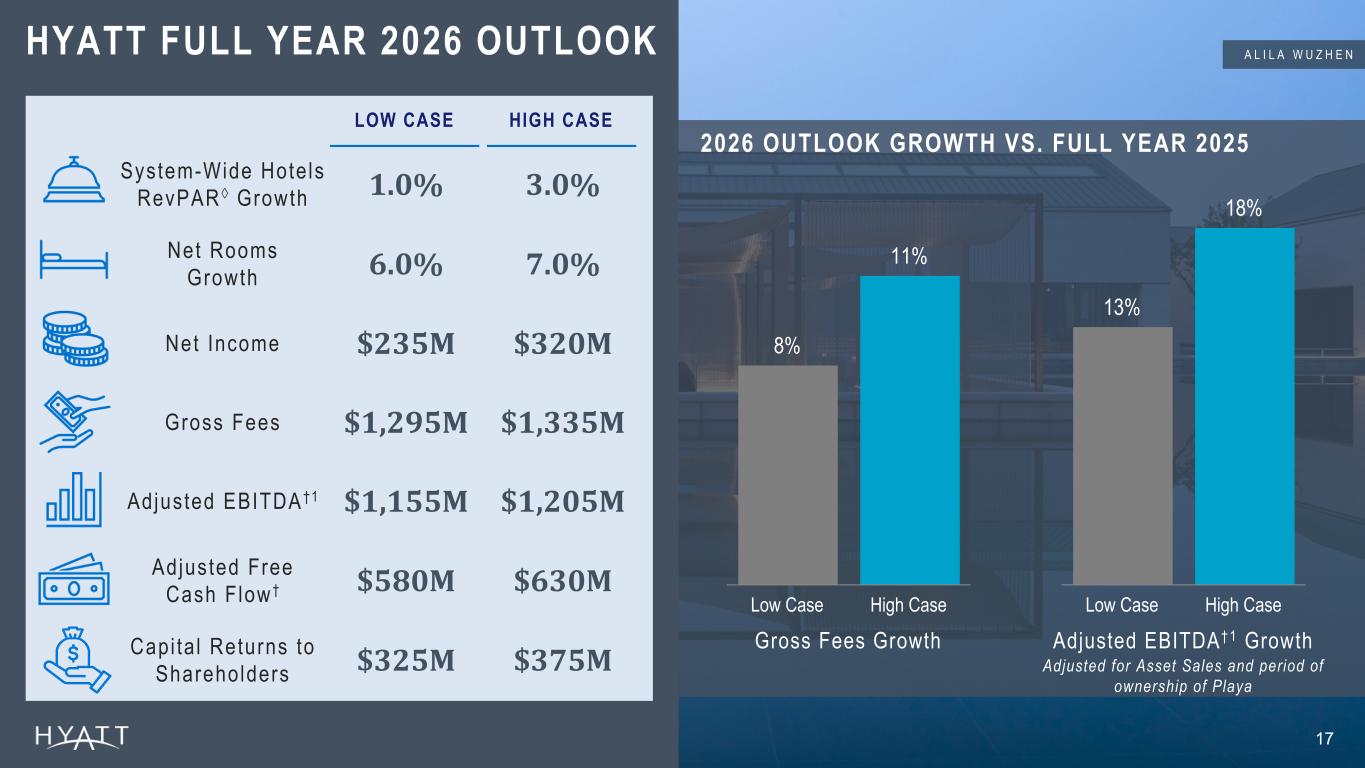

A L I L A W U Z H E N Footnotes: 1 Reflects a reduction of $78 million to 2025 owned and leased segment Adjusted EBITDA to account for period of ownership of the Playa hotels and the impact of sold hotels and $56 million of pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA to reflect the updated definition of Adjusted EBITDA. Refer to schedule A-11 in the fourth quarter and full year 2025 earnings release for furthers details. Full details of the Company’s 2026 outlook can be found in its fourth quarter 2025 earnings release. The Company’s 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. 8% 11% Low Case High Case 17 HYATT FULL YEAR 2026 OUTLOOK 2026 OUTLOOK GROWTH VS. FULL YEAR 2025 LOW CASE HIGH CASE System-Wide Hote ls RevPAR◊ Growth 1.0% 3.0% Net Rooms Growth 6.0% 7.0% Net Income $235M $320M Gross Fees $1,295M $1,335M Adjusted EBITDA †1 $1,155M $1,205M Adjusted Free Cash Flow † $580M $630M Capi ta l Returns to Shareholders $325M $375M Gross Fees Growth Adjusted EBITDA†1 Growth Adjusted for Asset Sales and period of ownership of Playa 13% 18% Low Case High Case

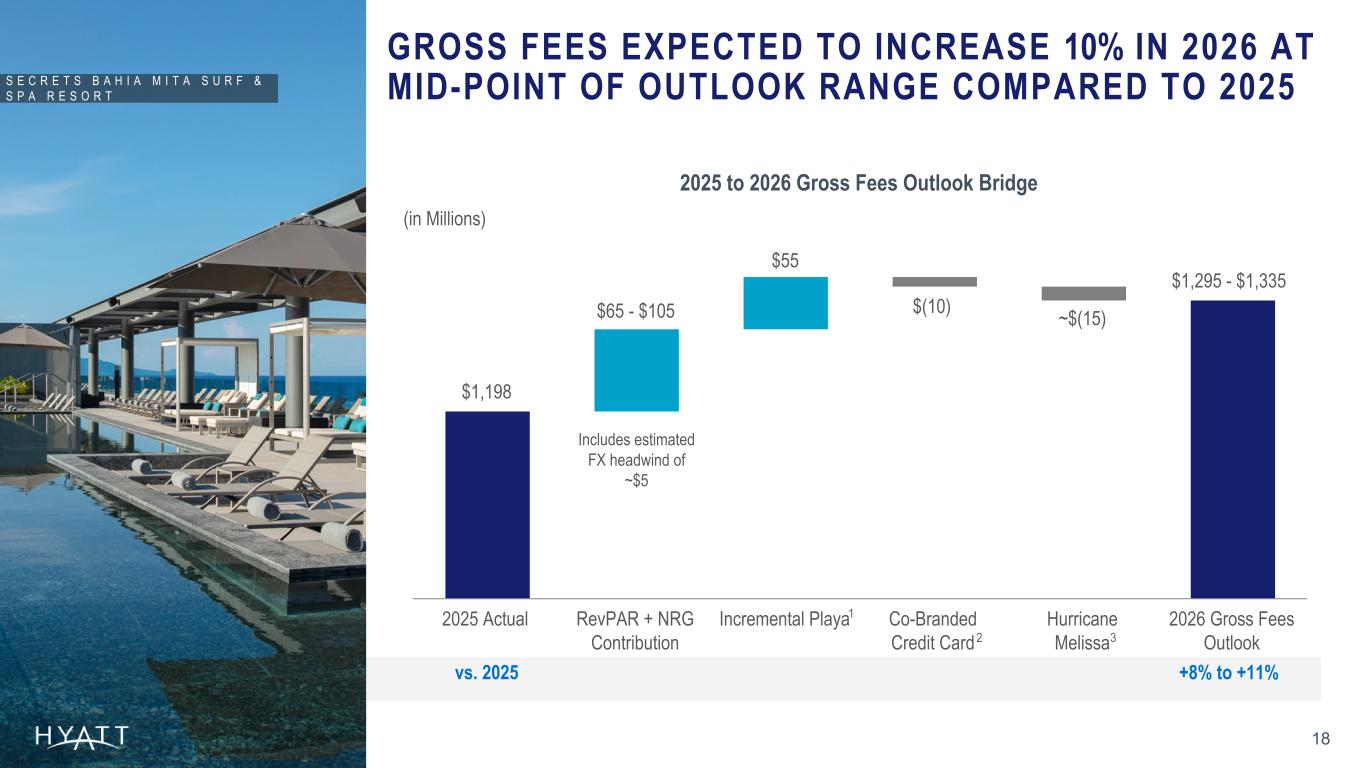

2025 Actual RevPAR + NRG Contribution Incremental Playa Co-Branded Credit Card Hurricane Melissa 2026 Gross Fees Outlook GROSS FEES EXPECTED TO INCREASE 10% IN 2026 AT MID-POINT OF OUTLOOK RANGE COMPARED TO 2025S E C R E T S B A H I A M I T A S U R F & S P A R E S O R T 2025 to 2026 Gross Fees Outlook Bridge $(10) $55 $65 - $105 $1,295 - $1,335 $1,198 (in Millions) 18 vs. 2025 +7.0% to +10.0% +8% to +11% Footnotes: 1 Incremental Playa reflects the incremental Gross Fees expected from the Playa Hotels Acquisition. Expectations were previously shared as part of the supplemental presentation published June 29, 2025. These expectations are adjusted for the impact of FX and the delayed re-opening of a hotel in Mexico after a renovation. 2 Co-Branded Credit Card reflects the impact of the expanded agreement with Chase to the Co-Branded Credit Card program that was announced on November 5, 2025. 3 Hurricane Melissa reflects the temporary closure of hotels in Jamaica due to the hurricane in October 2025 and includes both Playa and non-Playa hotels. Full details of the Company’s 2026 outlook can be found in its fourth quarter and full year 2025 earnings release. The Company’s 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. 2 ~$(15) Includes estimated FX headwind of ~$5 1 3

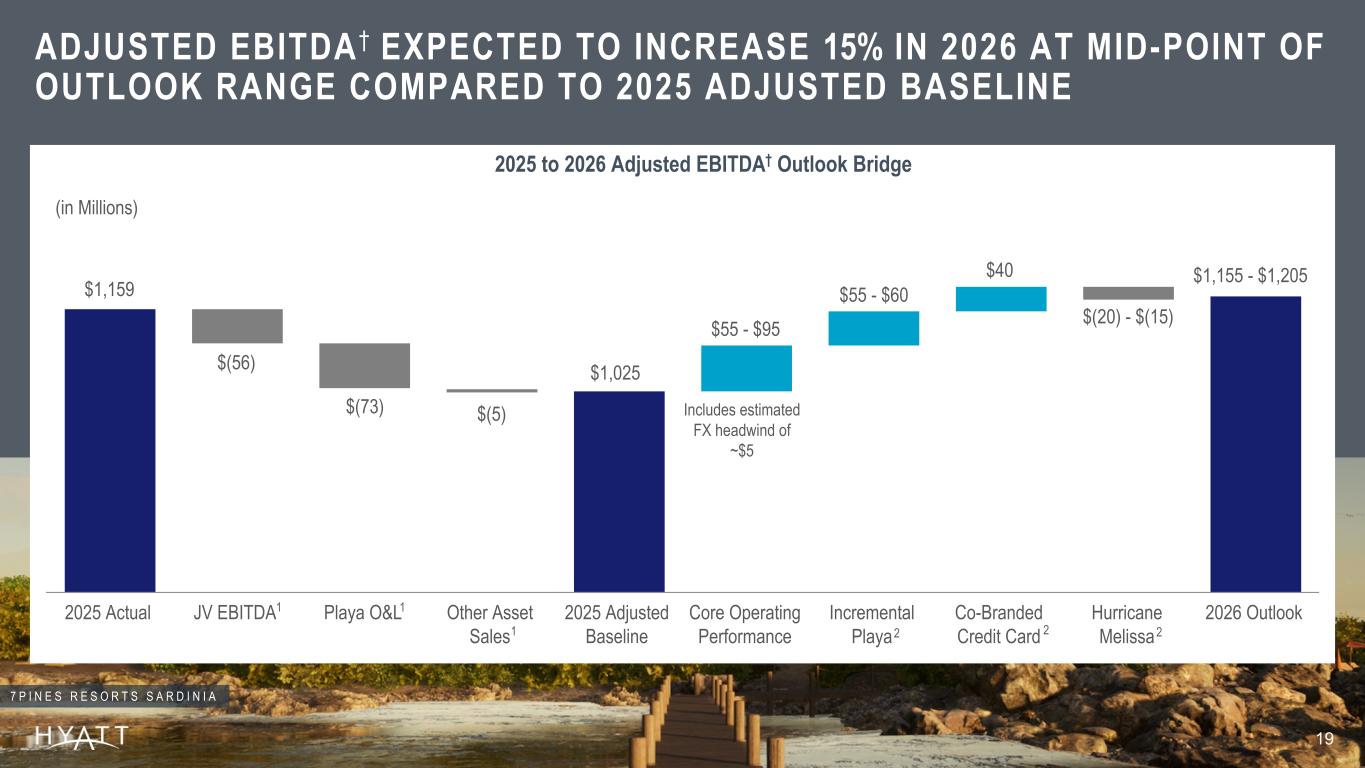

2025 Actual JV EBITDA Playa O&L Other Asset Sales 2025 Adjusted Baseline Core Operating Performance Incremental Playa Co-Branded Credit Card Hurricane Melissa 2026 Outlook 2025 to 2026 Adjusted EBITDA† Outlook Bridge $1,159 $(56) $(73) $(5) $1,025 $55 - $60 $40 $55 - $95 $1,155 - $1,205 (in Millions) 19 7 P I N E S R E S O R T S S A R D I N I A ADJUSTED EBITDA† EXPECTED TO INCREASE 15% IN 2026 AT MID-POINT OF OUTLOOK RANGE COMPARED TO 2025 ADJUSTED BASELINE Footnotes: 1 Adjustments to 2025: JV EBITDA Reflects updated Adjusted EBITDA definition effective in the first quarter of 2026. Please see schedule A-6 in the fourth quarter and full year 2025 earnings release; Playa O&L reflects the period of ownership of the hotels acquired as part of the Playa Hotels Acquisition and sold on December 30, 2025. Other Asset Sales reflect Adjusted EBITDA earned in 2025 for assets that have been sold. Please see schedule A-11 in the fourth quarter and full year 2025 earnings release for details on Playa O&L and Other Asset Sales 2 Adjustments to 2026 Outlook: Incremental Playa reflects the incremental Adjusted EBITDA expected from the Playa Hotels Acquisition. These expectations were shared as part of the supplemental presentation published June 30, 2025; Co-Branded Credit Card reflects the impact of the expanded agreement with Chase to the Co-Branded Credit Card program that was announced on November 5, 2025; Hurricane Melissa reflects the temporary closure of hotels in Jamaica due to the hurricane in October 2025 and includes both Playa and non-Playa hotels. Full details of the Company’s 2026 outlook can be found in its fourth quarter and full year 2025 earnings release. The Company’s 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. 1 $(20) - $(15) Includes estimated FX headwind of ~$5 1 1 2 2 2

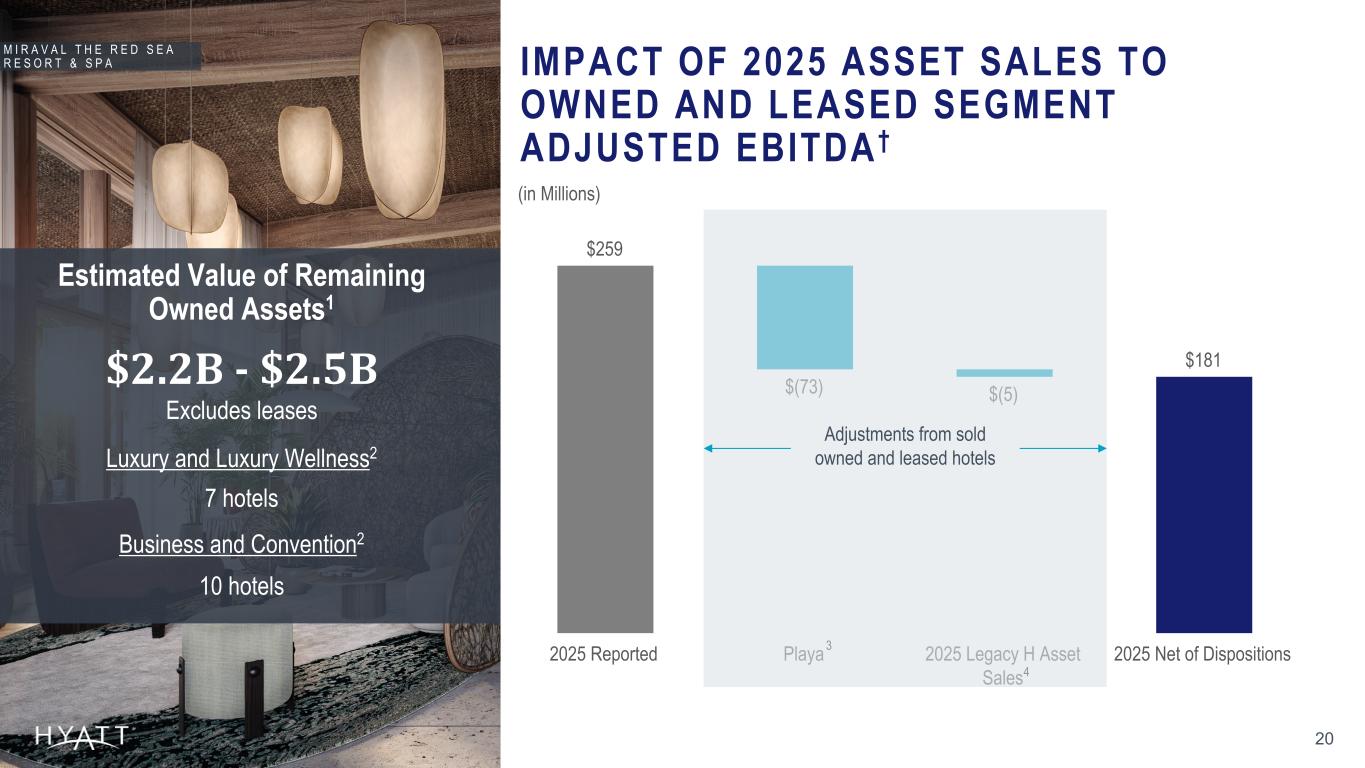

Footnotes: Additional details relating to the adjustments to owned and leased segment Adjusted EBITDA† from sold assets can be found on schedule A-11 in the fourth quarter and full year 2025 earnings release. 1 Value is based on the estimated gross sales price of the asset and does not include the value of the fee stream that Hyatt could retain upon sale of the asset. 2 Number of hotels remaining in the owned and leased portfolio. Leases are not included in the estimated value remaining or the hotel count. 3 Adjusted EBITDA contribution for hotels acquired as part of the Playa Hotels Acquisition that were sold as part of the Playa Real Estate transaction; excludes gross fees retained following the sale 4 Adjusted EBITDA contribution for hotels that have been sold as of December 31, 2025 and for which the Company entered into long-term management or franchise agreements; excludes gross fees retained following the sale. $259 $(73) $(5) $181 2025 Reported Playa 2025 Legacy H Asset Sales 2025 Net of Dispositions IMPACT OF 2025 ASSET SALES TO OWNED AND LEASED SEGMENT ADJUSTED EBITDA † 20 Estimated Value of Remaining Owned Assets1 Source Notes: Updated at YE, based on ER schedule Adjustments from sold owned and leased hotels 20 M I R A V A L T H E R E D S E A R E S O R T & S P A $2.2B - $2.5B (in Millions) 7 hotels Luxury and Luxury Wellness2 10 hotels Business and Convention2 Excludes leases 3 4

Footnotes: 1 System-wide hotels RevPAR◊ growth includes comparable hotels. 2 Adjusted Free Cash Flow Conversion % calculated as Adjusted Free Cash Flow divided by Adjusted EBITDA. The Company's illustrative outlook for 2026 is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. System-Wide Hotels RevPAR◊ Growth1 Net Rooms Growth EARNINGS GROWTH MODEL DRIVES FREE CASH FLOW† EARNINGS GROWTH MODEL SENSITIVITIES FOR 2026 $10M – $18M $8M – $10M 1.0% – 1.8% 0.8% – 1.0% ADJUSTED EBITDA† Adj. EBITDA† growth after adjust ing for 2025 Playa and legacy Hyatt asset sales ADJ. EBITDA† GROWTH + / - 1 POINT OTHER 2026 OUTLOOK CONSIDERATIONS >50% Adj . EBITDA † to Ad j . Free Cash F low † Convers ion 2 ~90% Asset -L ight Earn ings Mix ◊ ~3.0x Gross Debt to Ad j . EBITDA † Target for Investment Grade Rat ing P A R K H Y A T T S H A N G H A I 21

P A R K H Y A T T P A R I S - V E N D Ô M E CAPITAL ALLOCATION STRATEGY 22 WE HAVE AND WILL CONTINUE TO: Invest in growth to increase shareholder value Return excess cash to shareholders Maintain an investment-grade profile Footnotes:

Footnotes: 1 First quarter dividend payable on March 12, 2026 to shareholders of record as of March 2, 2026. 2 The Company expects to return capital to shareholders through a combination of cash dividends on its common stock and share repurchases. 3 Remaining share repurchase authorization as of December 31, 2025. Share repurchases may be made from time to time in the open market, in privately negotiated transactions, or otherwise, including pursuant to a Rule 10b5-1 plan or an accelerated share repurchase transaction, at prices that the Company deems appropriate and subject to market conditions, applicable law, and other factors deemed relevant in the Company’s sole discretion. The common stock repurchase program applies to the Company’s Class A common stock and/or the Company’s Class B common stock. The share repurchase program does not obligate the Company to repurchase any dollar amount or number of shares, and the program may be suspended or discontinued at any time and does not have an expiration date. The Company’s 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this presentation has been included in the 2026 Outlook. 23 H Y A T T R E G E N C Y İ Z M İ R İ S T İ N Y E P A R K Source Notes:COMMITTED TO RETURNING CAPITAL THROUGH DIVIDENDS & SHARE REPURCHASES $0.15 QUARTERLY DIVIDEND1 $325M - $375M $678M SHARE REPURCHASE AUTHORIZATION3SHAREHOLDER RETURNS 2026 OUTLOOK2

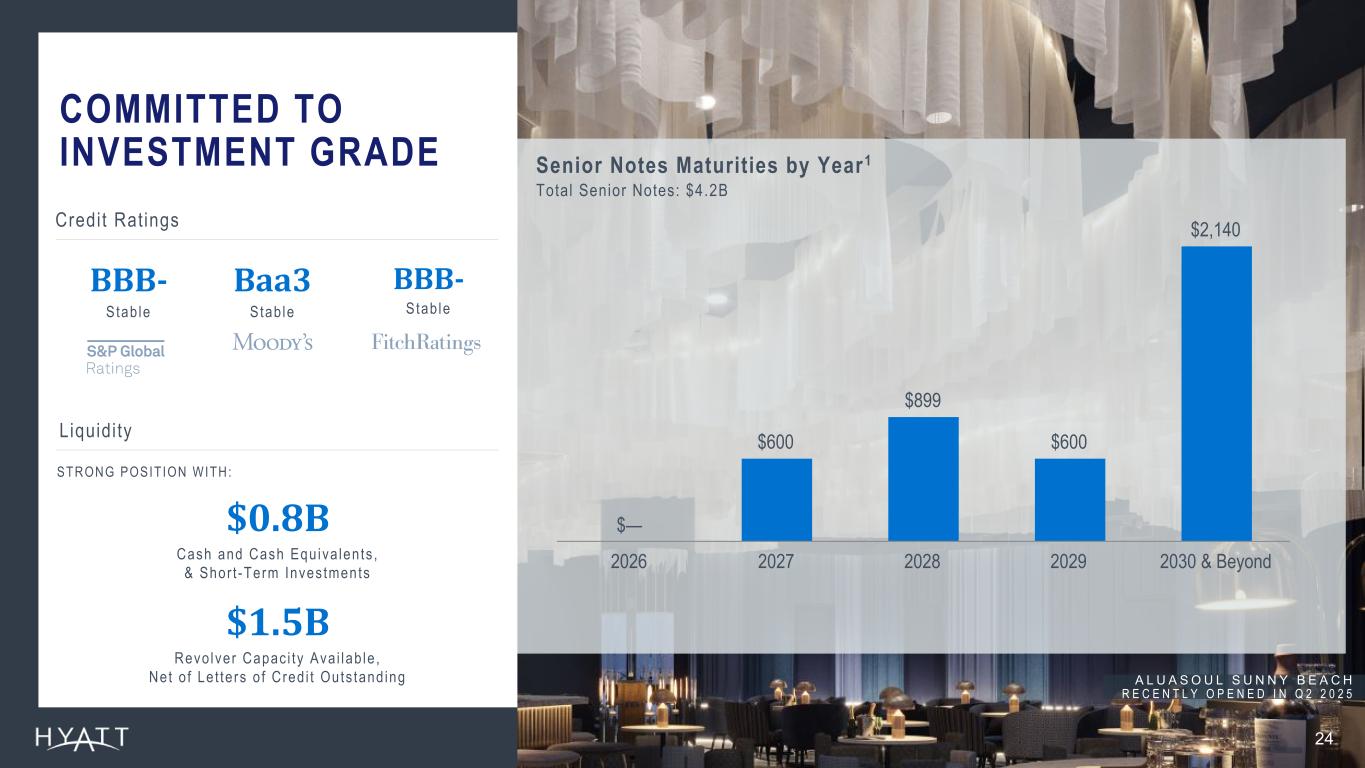

COMMITTED TO INVESTMENT GRADE 24 Credit Ratings BBB- Stab le BBB- Stab le Baa3 Stab le Liquidi ty $0.8B Cash and Cash Equ iva len ts , & Shor t -Term Inves tments $1.5B Revo lver Capac i ty Ava i lab le , Net o f Le t te rs o f Cred i t Outs tand ing STRONG POSIT ION WITH: A L U A S O U L S U N N Y B E A C H R E C E N T L Y O P E N E D I N Q 2 2 0 2 5 $— $600 $899 $600 $2,140 2026 2027 2028 2029 2030 & Beyond Source Notes: Senior Notes Maturities by Year1 Total Senior Notes: $4.2B Footnotes: Total debt and liquidity figures as of December 31, 2025. 1 Chart excludes a $51 million variable rate term loan, a $19 million floating average rate loan, $3 million of finance lease obligations, $34 million of unamortized discounts and deferred financing fees as well as Hyatt's revolving credit facility. At December 31, 2025, the Company had $1,497 million of borrowing capacity available under the revolving credit facility, net of letters of credit outstanding.

Award-winning loyalty program and focused portfol io of brands drive commercial results WHAT TO EXPECT IN 2026… Growth strategy enhances network effect , creating value for al l stakeholders Asset-Light Earnings Mix◊ of ~90% 25 Footnotes: The Company’s 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. H O T E L F L Ü E L A D A V O S

26

27 APPENDIX

28 References SLIDE 3: GLOBAL HOSPITALITY COMPANY FOCUSED ON SERVING THE HIGH-END TRAVELER Figures as of December 31, 2025. 1 Global brands inclusive of December 31, 2025 brand bar, displayed on slide 6. 2 Source: Smith Travel Research Global Census as of December 31, 2025. Luxury branded rooms as defined by Smith Travel Research chain scale classification. SLIDE 6: BRAND PORTFOLIOS DEMONSTRATE FOCUS & DIFFERENTIATION 1 As of December 31, 2025. SLIDE 7: WORLD OF HYATT: REDEFINING LOYALTY Figures as of December 31, 2025 unless otherwise noted, and growth rates represent year-over-year comparisons from years ended December 31, 2024 and December 31, 2025. 1 Members per hotel figures calculated based on public filings as of September 30, 2025. SLIDE 8: WELL REPRESENTED IN THE TOP GLOBAL MARKETS WITH SIGNIFICANT OPPORTUNITY FOR FUTURE GROWTH 1 Based on Smith Travel Research Global Census as of December 31, 2025. Global market ranking determined by aggregate room count. Markets as defined by Smith Travel Research: “A geographic area normally composed of a Metropolitan Statistical Area”. Peers referenced include Hilton Worldwide Holdings Inc., Marriott International Inc., and IHG Hotels & Resorts. SLIDE 9: MEANINGFUL GROWTH OPPORTUNITIES IN THE UNITED STATES 1 Based on Smith Travel Research Global Census as of December 31, 2025. Market tract ranking determined by aggregate room count. Market Tracts as defined by Smith Travel Research: “A geographic subset of a STR market”. Peers referenced include Hilton Worldwide Holdings Inc., Marriott International Inc., and IHG Hotels & Resorts. SLIDE 10: SINCE 2017: DISCIPLINED ASSET-LIGHT EXECUTION DRIVING SHAREHOLDER VALUE 1 Figures calculated from January 1, 2017 - December 31, 2025. 2 Aggregate Adjusted EBITDA† multiple based on the Adjusted EBITDA† for each respective year for sales prior to 2020, based on 2019 fiscal year for sales in 2021 and 2022, and based on the trailing 12 months prior to the sale for sales in 2024 and 2025. 3 Adjusted EBITDA† reduction of ~$410M from the assets sold netted against ~$50M of run-rate fees from the long-term management or franchise agreements signed as part of the asset sales. 4 Asset-Light Acquisitions includes Two Roads Hospitality, Apple Leisure Group, inclusive of the UVC Transaction, Dream Hotel Group, Mr & Mrs Smith, Me and All Hotels, Standard International, the Bahia Principe Transaction, and the net purchase price of Playa Hotels and Resorts after the completion of the Playa Real Estate Transaction. 5 Includes base consideration paid and assumption for variable consideration to be paid; variable consideration for Dream Hotel Group, Standard International, and Bahia Principe Transaction based on stabilized estimates. 6 Incremental Adjusted EBITDA† based on stabilized Adjusted EBITDA† estimates for Two Roads Hospitality, Apple Leisure Group, inclusive of the UVC Transaction, Dream Hotel Group, Mr & Mrs Smith, Me and All Hotels, Standard International, Playa Hotels & Resorts, and the Bahia Principe Transaction. SLIDE 11: STRATEGIC GROWTH ACROSS MULTIPLE DIMENSIONS 1 Calculated growth comparisons based on years ended December 31, 2017 and December 31, 2025. 2 Gross fee revenue in 2017 represents management, franchise, and other fees following the adoption of ASC 606 during the year ended December 31, 2018 as disclosed in our 2018 Form 10-K. 3 Excludes the impact of the period of ownership of the Playa assets in 2025.

References SLIDE 12: STRONG ORGANIC FEE GROWTH FROM CORE OPERATING PERFORMANCE 1 Gross fees in 2017 represents management, franchise, and other fees following the adoption of ASC 606 during the year ended December 31, 2018 as disclosed in our 2018 Form 10-K. 2 Fees excluding acquisitions calculated as total fees excluding fees earned from the asset-light acquisitions of Two Roads Hospitality, Apple Leisure Group, inclusive of the UVC Transaction, Dream Hotel Group, Mr & Mrs Smith, Me and All Hotels, Standard International, Playa Hotels, and the Bahia Principe Transaction. SLIDE 13: EVOLUTION TO ASSET-LIGHT BUSINESS MODEL DRIVING ADJUSTED FREE CASH FLOW EXPANSION 1 Adjusted Free Cash Flow Conversion % calculated as Adjusted Free Cash Flow divided by Adjusted EBITDA. 2 Adjusted EBITDA in 2017 represents Adjusted EBITDA following the adoption of ASC 606 during the year ended December 31, 2018 as disclosed in our 2018 Form 10-K 3 2025 figures exclude the impact of the Playa Hotels Acquisition. Full details of the Company’s 2026 outlook can be found in its fourth quarter and full year 2025 earnings release. The Company’s 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. SLIDE 15: FULL YEAR 2025 HIGHLIGHTS 1 Figures as of December 31, 2025, and growth rates represent year-over-year comparisons from years ended December 31, 2024 and December 31, 2025. 2 Represents amounts attributable to Hyatt Hotels Corporation. SLIDE 16: 2025 GROSS FEE MIX Figures as of December 31, 2025. 1 Other RevPAR fees primarily includes fees from hotel services provided to certain all-inclusive resorts. 2 Non-RevPAR fees primarily includes license fees received in connection with the licensing of the Hyatt brand names through our co-branded credit card programs and vacation units; management and royalty fees related to the management and licensing of certain of our brands to the Unlimited Vacation Club business; and termination fees. 3 Fee mix by geography is inclusive of base, incentive, franchise, and other RevPAR fees earned in the respective geographical regions. SLIDE 17: HYATT FULL YEAR 2026 OUTLOOK 1 Reflects a reduction of $78 million to 2025 owned and leased segment Adjusted EBITDA to account for period of ownership of the Playa hotels and the impact of sold hotels and $56 million of pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA to reflect the updated definition of Adjusted EBITDA. Refer to schedule A-11 in the fourth quarter and full year 2025 earnings release for furthers details. Full details of the Company’s 2026 outlook can be found in its fourth quarter and full year 2025 earnings release. The Company's 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. SLIDE 18: GROSS FEES EXPECTED TO INCREASE 10% IN 2026 AT MID-POINT OF OUTLOOK RANGE COMPARED TO 2025 1 Incremental Playa reflects the incremental gross fees expected from the Playa Hotels Acquisition. Expectations were previously shared as part of the supplemental presentation published June 29, 2025. These expectations are adjusted for the impact of FX and the delayed re-opening of a hotel in Mexico after a renovation. 2 Co-branded credit card reflects the expanded agreement with Chase that was announced on November 5, 2025. 3 Hurricane Melissa reflects the temporary closure of hotels in Jamaica due to the hurricane in October 2025 and includes both Playa and non-Playa hotels. Full details of the Company's 2026 outlook can be found in its fourth quarter and full year 2025 earnings release. The Company' 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. 29

References SLIDE 19: ADJUSTED EBITDA EXPECTED TO INCREASE 15% IN 2026 AT MID-POINT OF OUTLOOK RANGE COMPARED TO 2025 ADJUSTED BASELINE 1 Adjustments to 2025: JV EBITDA Reflects updated Adjusted EBITDA definition effective in the first quarter of 2026. Please see schedule A-6 in the fourth quarter and full year 2025 earnings release; Playa O&L reflects the period of ownership of the hotels acquired as part of the Playa Hotels Acquisition and sold on December 30, 2025. Other Asset Sales reflect Adjusted EBITDA earned in 2025 for assets that have been sold. Please see schedule A-11 in the fourth quarter and full year 2025 earnings release for details on Playa O&L and Other Asset Sales 2 Adjustments to 2026 Outlook: Incremental Playa reflects the incremental Adjusted EBITDA expected from the Playa Hotels Acquisition. These expectations were shared as part of the supplemental presentation published June 30, 2025; Co-Branded Credit Card reflects the impact of the expanded agreement with Chase to the Co-Branded Credit Card program that was announced on November 5, 2025; Hurricane Melissa reflects the temporary closure of hotels in Jamaica due to the hurricane in October 2025 and includes both Playa and non-Playa hotels. Full details of the Company's 2026 outlook can be found in its fourth quarter and full year 2025 earnings release. The Company's 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. SLIDE 20: IMPACT OF 2025 ASSET SALES TO OWNED AND LEASED SEGMENT ADJUSTED EBITDA Additional details relating to the adjustments to owned and leased segment Adjusted EBITDA from sold assets can be found on schedule A-11 of the fourth quarter and full year 2025 earnings release. 1 Value is based on the estimated gross sales price of the asset and does not include the value of the fee stream that Hyatt could retain upon sale of the asset. 2 Number of hotels remaining in the owned and leased portfolio. Leases are not included in the estimated value remaining or the hotel count. 3 Adjusted EBITDA contribution for hotels acquired as part of the Playa Hotels Acquisition that were sold as part of the Playa Real Estate Transaction; excludes gross fee revenues retained following the sale. 4 Adjusted EBITDA contribution for hotels that have been sold as of December 31, 2025 and for which the Company entered into long-term management or franchise agreements; excludes gross fee revenues retained following the sale. SLIDE 21: EARNINGS GROWTH MODEL DRIVES FREE CASH FLOW 1 System-wide hotels RevPAR◊ growth includes comparable hotels. 2 Adjusted Free Cash Flow Conversion % calculated as Adjusted Free Cash Flow divided by Adjusted EBITDA. The Company's illustrative outlook for 2026 is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2026 Outlook. SLIDE 23: COMMITTED TO RETURNING CAPITAL THROUGH DIVIDENDS & SHARE REPURCHASES 1 First quarter dividend payable on March 12, 2026 to shareholders of record as of March 2, 2026. 2 The Company expects to return capital to shareholders through a combination of cash dividends on its common stock and share repurchases. 3 Remaining share repurchase authorization as of December 31, 2025. Share repurchases may be made from time to time in the open market, in privately negotiated transactions, or otherwise, including pursuant to a Rule 10b5-1 plan or an accelerated share repurchase transaction, at prices that the Company deems appropriate and subject to market conditions, applicable law, and other factors deemed relevant in the Company's sole discretion. The common stock repurchase program applies to the Company's Class A common stock and/or the Company's Class B common stock. The share repurchase program does not obligate the Company to repurchase any dollar amount or number of shares, and the program may be suspended or discontinued at any time and does not have an expiration date. The Company’s 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this presentation has been included in the 2026 Outlook. 30

References SLIDE 24: COMMITTED TO INVESTMENT GRADE Total debt and liquidity figures as of December 31, 2025. 1 Chart excludes a $51 million variable rate term loan, a $19 million floating average rate loan, $3 million of finance lease obligations, $34 million of unamortized discounts and deferred financing fees as well as Hyatt's revolving credit facility. At December 31, 2025, the Company had $1,497 million million of borrowing capacity available under the revolving credit facility, net of letters of credit outstanding. SLIDE 25: WHAT TO EXPECT IN 2026 The Company's 2026 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. No disposition or acquisition activity beyond what has been completed as of the date of this presentation has been included in the 2026 Outlook. 31

32 Definitions Adjusted Earnings Before Interest Expense, Taxes, Depreciation, and Amortization ("Adjusted EBITDA"): We use the term Adjusted EBITDA throughout this Investor Presentation. Adjusted EBITDA, as we define it, is a measure that is not recognized in accordance with accounting principles generally accepted in the United States of America ("GAAP"). We define Adjusted EBITDA as net income (loss) attributable to Hyatt Hotels Corporation plus net income (loss) attributable to noncontrolling interests and our pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA, primarily based on our ownership percentage of each owned and leased venture, adjusted to exclude the following items: • payments to customers ("contra revenue"), including performance cure payments and amortization of management and hotel services agreement and franchise agreement assets ("key money assets"); • revenues for reimbursed costs; • reimbursed costs that we intend to recover over the long term; • stock-based compensation expense; • transaction and integration costs; • depreciation and amortization; • equity earnings (losses) from unconsolidated hospitality ventures; • interest expense; • gains (losses) on sales of real estate and other; • asset impairments; • other income (loss), net; and • benefit (provision) for income taxes. We calculate consolidated Adjusted EBITDA by adding the Adjusted EBITDA of each of our reportable segments and eliminations to unallocated overhead expenses. Our board of directors and executive management team focus on Adjusted EBITDA as one of the key performance and compensation measures both on a segment and on a consolidated basis. Adjusted EBITDA assists us in comparing our performance over various reporting periods on a consistent basis because it removes from our operating results the impact of items that do not reflect our core operations both on a segment and on a consolidated basis. Our President and Chief Executive Officer, who is our chief operating decision maker, also evaluates the performance of each of our reportable segments and determines how to allocate resources to those segments, in part, by assessing the Adjusted EBITDA of each segment. In addition, the talent and compensation committee of our board of directors determines the annual variable compensation and long-term incentive compensation for certain members of our management based in part on financial measures including and/or derived from consolidated Adjusted EBITDA, segment Adjusted EBITDA, or some combination of both. We believe Adjusted EBITDA is useful to investors because it provides investors with the same information that we use internally for purposes of assessing our operating performance and making compensation decisions and facilitates our comparison of results with our prior- period and forecasted results as well as our industry and competitors. Adjusted EBITDA excludes certain items that can vary widely across different industries and among companies within the same industry, including interest expense and benefit or provision for income taxes, which are dependent on company specifics, including capital structure, credit ratings, tax policies, and jurisdictions in which they operate; depreciation and amortization, which are dependent on company policies including how the assets are utilized as well as the lives assigned to the assets; contra revenue, which is dependent on company policies and strategic decisions regarding payments to hotel owners; and stock-based compensation expense, which varies among companies as a result of different compensation plans companies have adopted. We exclude revenues for reimbursed costs and reimbursed costs which relate to the reimbursement of payroll costs and system-wide services and programs that we operate for the benefit of our hotel owners as contractually we do not provide services or operate the related programs to generate a profit or bear a loss over the long term. If we collect amounts in excess of amounts spent, we have a commitment to our hotel owners to spend these amounts on the related system-wide services and programs. Additionally, if we spend in excess of amounts collected, we have a contractual right to adjust future collections or expenditures to recover prior-period costs. These timing differences are due to our discretion to spend in excess of revenues earned or less than revenues earned in a single period to ensure that the system-wide services and programs are operated in the best long-term interests of our hotel owners. Over the long term, these programs and services are not designed to impact our economics, either positively or negatively, and instead are designed to result in a cumulative break-even balance. Therefore, we exclude the net impact when evaluating period-over-period changes in our operating results. Adjusted EBITDA includes reimbursed costs related to system-wide services and programs that we do not intend to recover from hotel owners. Finally, we exclude other items that are not core to our operations and may vary in frequency or magnitude, such as transaction and integration costs, asset impairments, unrealized and realized gains and losses on marketable securities, and gains and losses on sales of real estate and other. Adjusted EBITDA is not a substitute for net income (loss) attributable to Hyatt Hotels Corporation, net income (loss), or any other measure prescribed by GAAP. There are limitations to using non-GAAP measures such as Adjusted EBITDA. Although we believe that Adjusted EBITDA can make an evaluation of our operating performance more consistent because it removes items that do not reflect our core operations, other companies in our industry may define Adjusted EBITDA differently than we do. As a result, it may be difficult to use Adjusted EBITDA or similarly named non-GAAP measures that other companies may use to compare the performance of those companies to our performance. Because of these limitations, Adjusted EBITDA should not be considered as a measure of the income or loss generated by our business. Our management compensates for these limitations by referencing our GAAP results and using Adjusted EBITDA supplementally.

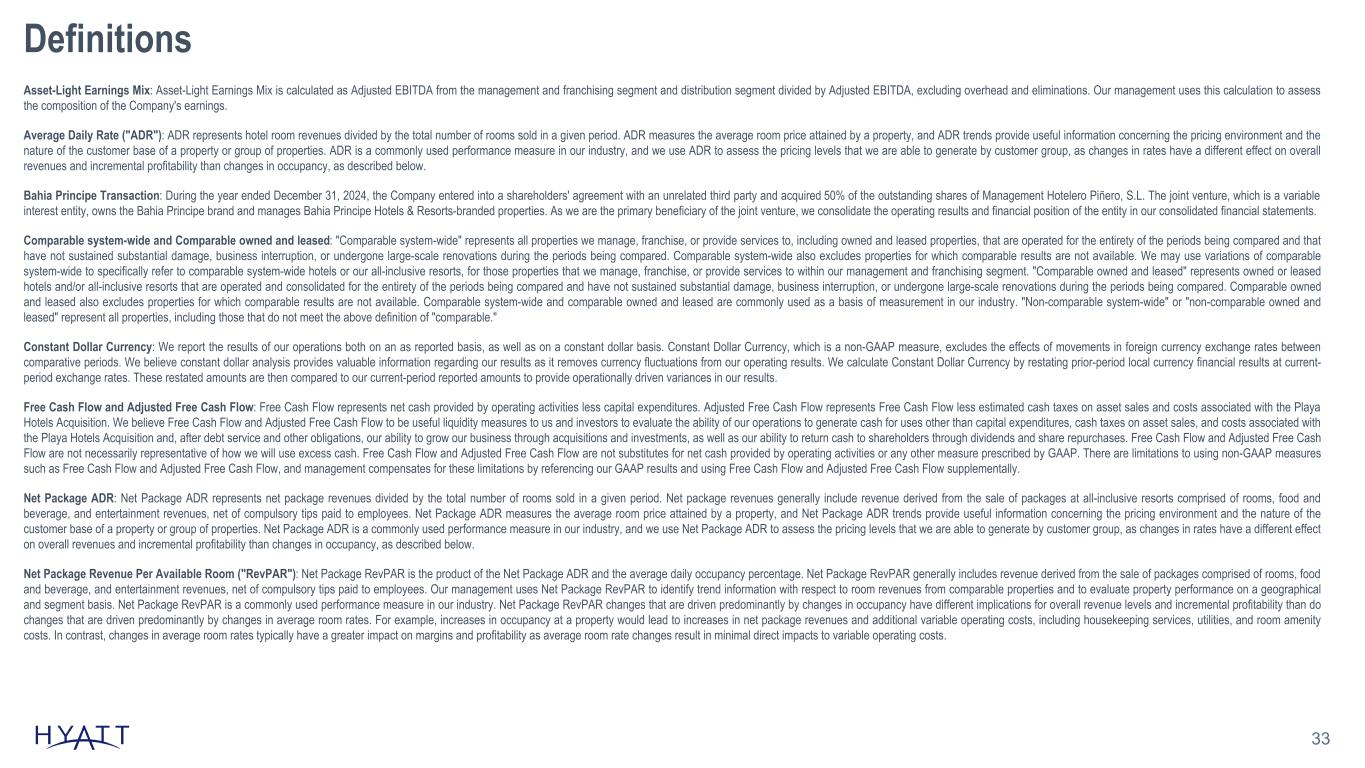

33 Definitions Asset-Light Earnings Mix: Asset-Light Earnings Mix is calculated as Adjusted EBITDA from the management and franchising segment and distribution segment divided by Adjusted EBITDA, excluding overhead and eliminations. Our management uses this calculation to assess the composition of the Company's earnings. Average Daily Rate ("ADR"): ADR represents hotel room revenues divided by the total number of rooms sold in a given period. ADR measures the average room price attained by a property, and ADR trends provide useful information concerning the pricing environment and the nature of the customer base of a property or group of properties. ADR is a commonly used performance measure in our industry, and we use ADR to assess the pricing levels that we are able to generate by customer group, as changes in rates have a different effect on overall revenues and incremental profitability than changes in occupancy, as described below. Bahia Principe Transaction: During the year ended December 31, 2024, the Company entered into a shareholders' agreement with an unrelated third party and acquired 50% of the outstanding shares of Management Hotelero Piñero, S.L. The joint venture, which is a variable interest entity, owns the Bahia Principe brand and manages Bahia Principe Hotels & Resorts-branded properties. As we are the primary beneficiary of the joint venture, we consolidate the operating results and financial position of the entity in our consolidated financial statements. Comparable system-wide and Comparable owned and leased: "Comparable system-wide" represents all properties we manage, franchise, or provide services to, including owned and leased properties, that are operated for the entirety of the periods being compared and that have not sustained substantial damage, business interruption, or undergone large-scale renovations during the periods being compared. Comparable system-wide also excludes properties for which comparable results are not available. We may use variations of comparable system-wide to specifically refer to comparable system-wide hotels or our all-inclusive resorts, for those properties that we manage, franchise, or provide services to within our management and franchising segment. "Comparable owned and leased" represents owned or leased hotels and/or all-inclusive resorts that are operated and consolidated for the entirety of the periods being compared and have not sustained substantial damage, business interruption, or undergone large-scale renovations during the periods being compared. Comparable owned and leased also excludes properties for which comparable results are not available. Comparable system-wide and comparable owned and leased are commonly used as a basis of measurement in our industry. "Non-comparable system-wide" or "non-comparable owned and leased" represent all properties, including those that do not meet the above definition of "comparable." Constant Dollar Currency: We report the results of our operations both on an as reported basis, as well as on a constant dollar basis. Constant Dollar Currency, which is a non-GAAP measure, excludes the effects of movements in foreign currency exchange rates between comparative periods. We believe constant dollar analysis provides valuable information regarding our results as it removes currency fluctuations from our operating results. We calculate Constant Dollar Currency by restating prior-period local currency financial results at current- period exchange rates. These restated amounts are then compared to our current-period reported amounts to provide operationally driven variances in our results. Free Cash Flow and Adjusted Free Cash Flow: Free Cash Flow represents net cash provided by operating activities less capital expenditures. Adjusted Free Cash Flow represents Free Cash Flow less estimated cash taxes on asset sales and costs associated with the Playa Hotels Acquisition. We believe Free Cash Flow and Adjusted Free Cash Flow to be useful liquidity measures to us and investors to evaluate the ability of our operations to generate cash for uses other than capital expenditures, cash taxes on asset sales, and costs associated with the Playa Hotels Acquisition and, after debt service and other obligations, our ability to grow our business through acquisitions and investments, as well as our ability to return cash to shareholders through dividends and share repurchases. Free Cash Flow and Adjusted Free Cash Flow are not necessarily representative of how we will use excess cash. Free Cash Flow and Adjusted Free Cash Flow are not substitutes for net cash provided by operating activities or any other measure prescribed by GAAP. There are limitations to using non-GAAP measures such as Free Cash Flow and Adjusted Free Cash Flow, and management compensates for these limitations by referencing our GAAP results and using Free Cash Flow and Adjusted Free Cash Flow supplementally. Net Package ADR: Net Package ADR represents net package revenues divided by the total number of rooms sold in a given period. Net package revenues generally include revenue derived from the sale of packages at all-inclusive resorts comprised of rooms, food and beverage, and entertainment revenues, net of compulsory tips paid to employees. Net Package ADR measures the average room price attained by a property, and Net Package ADR trends provide useful information concerning the pricing environment and the nature of the customer base of a property or group of properties. Net Package ADR is a commonly used performance measure in our industry, and we use Net Package ADR to assess the pricing levels that we are able to generate by customer group, as changes in rates have a different effect on overall revenues and incremental profitability than changes in occupancy, as described below. Net Package Revenue Per Available Room ("RevPAR"): Net Package RevPAR is the product of the Net Package ADR and the average daily occupancy percentage. Net Package RevPAR generally includes revenue derived from the sale of packages comprised of rooms, food and beverage, and entertainment revenues, net of compulsory tips paid to employees. Our management uses Net Package RevPAR to identify trend information with respect to room revenues from comparable properties and to evaluate property performance on a geographical and segment basis. Net Package RevPAR is a commonly used performance measure in our industry. Net Package RevPAR changes that are driven predominantly by changes in occupancy have different implications for overall revenue levels and incremental profitability than do changes that are driven predominantly by changes in average room rates. For example, increases in occupancy at a property would lead to increases in net package revenues and additional variable operating costs, including housekeeping services, utilities, and room amenity costs. In contrast, changes in average room rates typically have a greater impact on margins and profitability as average room rate changes result in minimal direct impacts to variable operating costs.

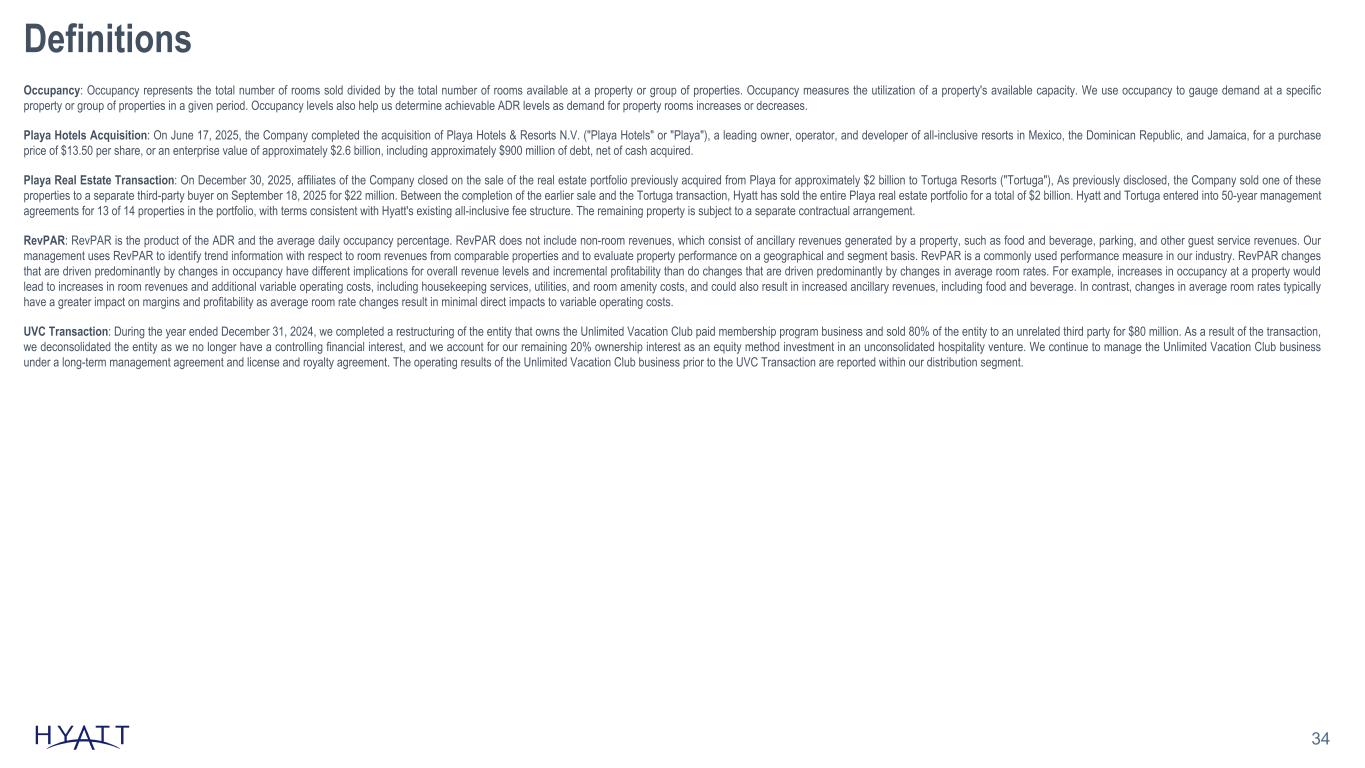

34 Definitions Occupancy: Occupancy represents the total number of rooms sold divided by the total number of rooms available at a property or group of properties. Occupancy measures the utilization of a property's available capacity. We use occupancy to gauge demand at a specific property or group of properties in a given period. Occupancy levels also help us determine achievable ADR levels as demand for property rooms increases or decreases. Playa Hotels Acquisition: On June 17, 2025, the Company completed the acquisition of Playa Hotels & Resorts N.V. ("Playa Hotels" or "Playa"), a leading owner, operator, and developer of all-inclusive resorts in Mexico, the Dominican Republic, and Jamaica, for a purchase price of $13.50 per share, or an enterprise value of approximately $2.6 billion, including approximately $900 million of debt, net of cash acquired. Playa Real Estate Transaction: On December 30, 2025, affiliates of the Company closed on the sale of the real estate portfolio previously acquired from Playa for approximately $2 billion to Tortuga Resorts ("Tortuga"), As previously disclosed, the Company sold one of these properties to a separate third-party buyer on September 18, 2025 for $22 million. Between the completion of the earlier sale and the Tortuga transaction, Hyatt has sold the entire Playa real estate portfolio for a total of $2 billion. Hyatt and Tortuga entered into 50-year management agreements for 13 of 14 properties in the portfolio, with terms consistent with Hyatt's existing all-inclusive fee structure. The remaining property is subject to a separate contractual arrangement. RevPAR: RevPAR is the product of the ADR and the average daily occupancy percentage. RevPAR does not include non-room revenues, which consist of ancillary revenues generated by a property, such as food and beverage, parking, and other guest service revenues. Our management uses RevPAR to identify trend information with respect to room revenues from comparable properties and to evaluate property performance on a geographical and segment basis. RevPAR is a commonly used performance measure in our industry. RevPAR changes that are driven predominantly by changes in occupancy have different implications for overall revenue levels and incremental profitability than do changes that are driven predominantly by changes in average room rates. For example, increases in occupancy at a property would lead to increases in room revenues and additional variable operating costs, including housekeeping services, utilities, and room amenity costs, and could also result in increased ancillary revenues, including food and beverage. In contrast, changes in average room rates typically have a greater impact on margins and profitability as average room rate changes result in minimal direct impacts to variable operating costs. UVC Transaction: During the year ended December 31, 2024, we completed a restructuring of the entity that owns the Unlimited Vacation Club paid membership program business and sold 80% of the entity to an unrelated third party for $80 million. As a result of the transaction, we deconsolidated the entity as we no longer have a controlling financial interest, and we account for our remaining 20% ownership interest as an equity method investment in an unconsolidated hospitality venture. We continue to manage the Unlimited Vacation Club business under a long-term management agreement and license and royalty agreement. The operating results of the Unlimited Vacation Club business prior to the UVC Transaction are reported within our distribution segment.

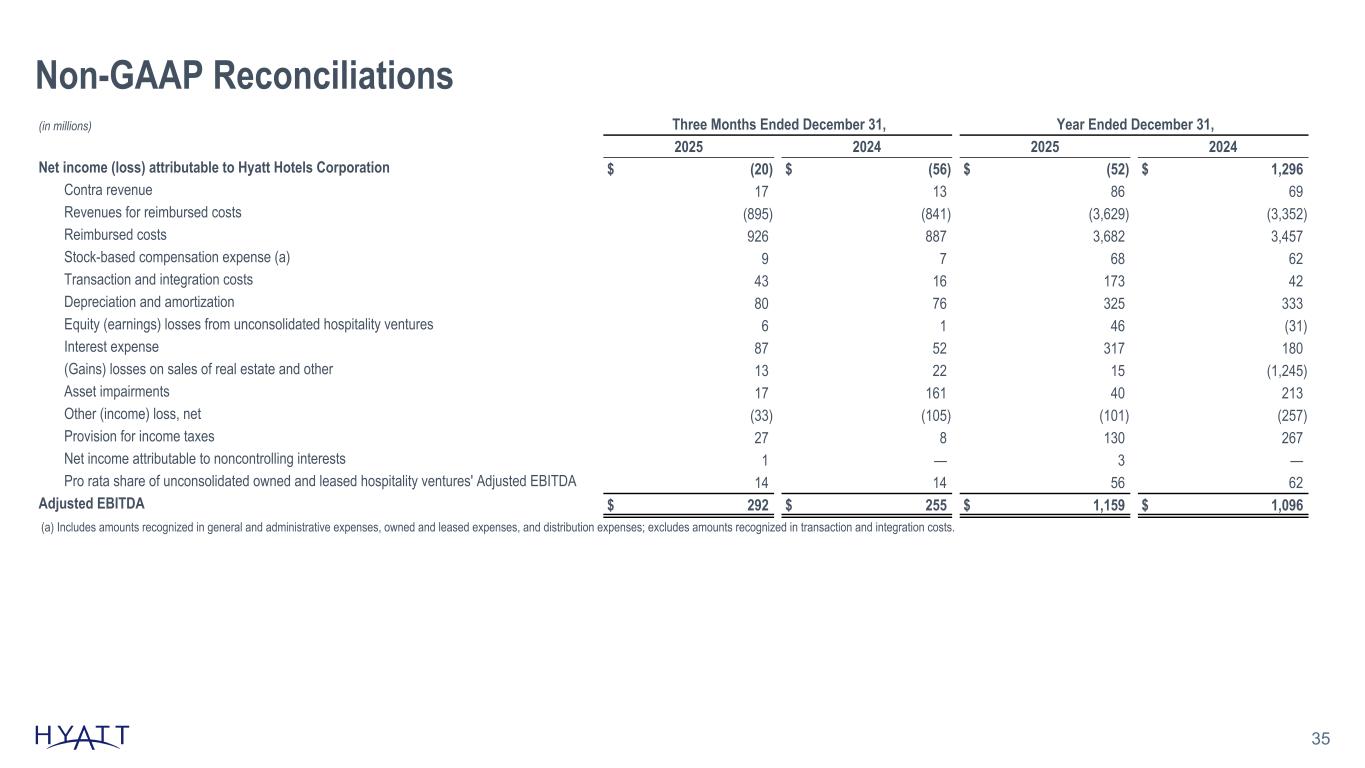

Non-GAAP Reconciliations 35 (in millions) Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Net income (loss) attributable to Hyatt Hotels Corporation $ (20) $ (56) $ (52) $ 1,296 Contra revenue 17 13 86 69 Revenues for reimbursed costs (895) (841) (3,629) (3,352) Reimbursed costs 926 887 3,682 3,457 Stock-based compensation expense (a) 9 7 68 62 Transaction and integration costs 43 16 173 42 Depreciation and amortization 80 76 325 333 Equity (earnings) losses from unconsolidated hospitality ventures 6 1 46 (31) Interest expense 87 52 317 180 (Gains) losses on sales of real estate and other 13 22 15 (1,245) Asset impairments 17 161 40 213 Other (income) loss, net (33) (105) (101) (257) Provision for income taxes 27 8 130 267 Net income attributable to noncontrolling interests 1 — 3 — Pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA 14 14 56 62 Adjusted EBITDA $ 292 $ 255 $ 1,159 $ 1,096 Source Notes: linked to ER schedule (a) Includes amounts recognized in general and administrative expenses, owned and leased expenses, and distribution expenses; excludes amounts recognized in transaction and integration costs.

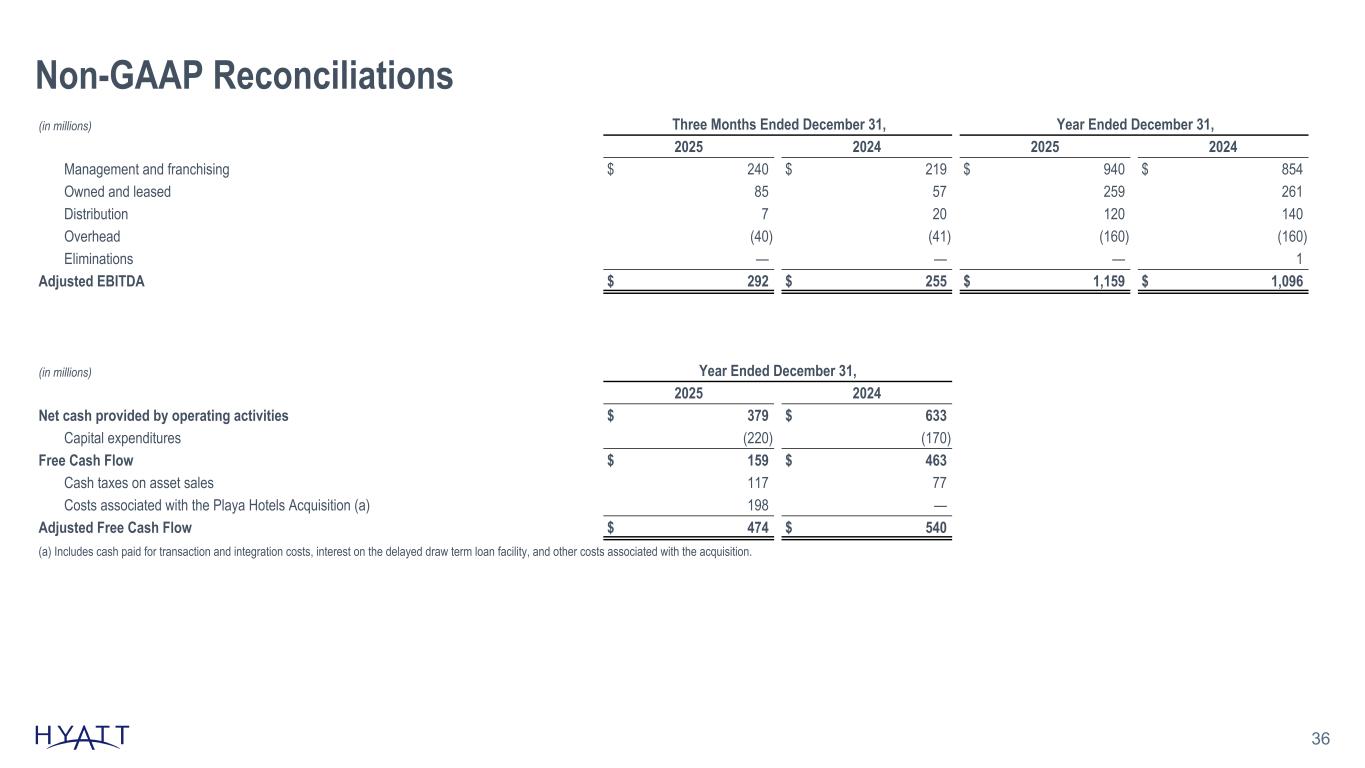

Non-GAAP Reconciliations 36 (in millions) Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Management and franchising $ 240 $ 219 $ 940 $ 854 Owned and leased 85 57 259 261 Distribution 7 20 120 140 Overhead (40) (41) (160) (160) Eliminations — — — 1 Adjusted EBITDA $ 292 $ 255 $ 1,159 $ 1,096 (in millions) Year Ended December 31, 2025 2024 Net cash provided by operating activities $ 379 $ 633 Capital expenditures (220) (170) Free Cash Flow $ 159 $ 463 Cash taxes on asset sales 117 77 Costs associated with the Playa Hotels Acquisition (a) 198 — Adjusted Free Cash Flow $ 474 $ 540 (a) Includes cash paid for transaction and integration costs, interest on the delayed draw term loan facility, and other costs associated with the acquisition. Source Notes: linked to ER schedule

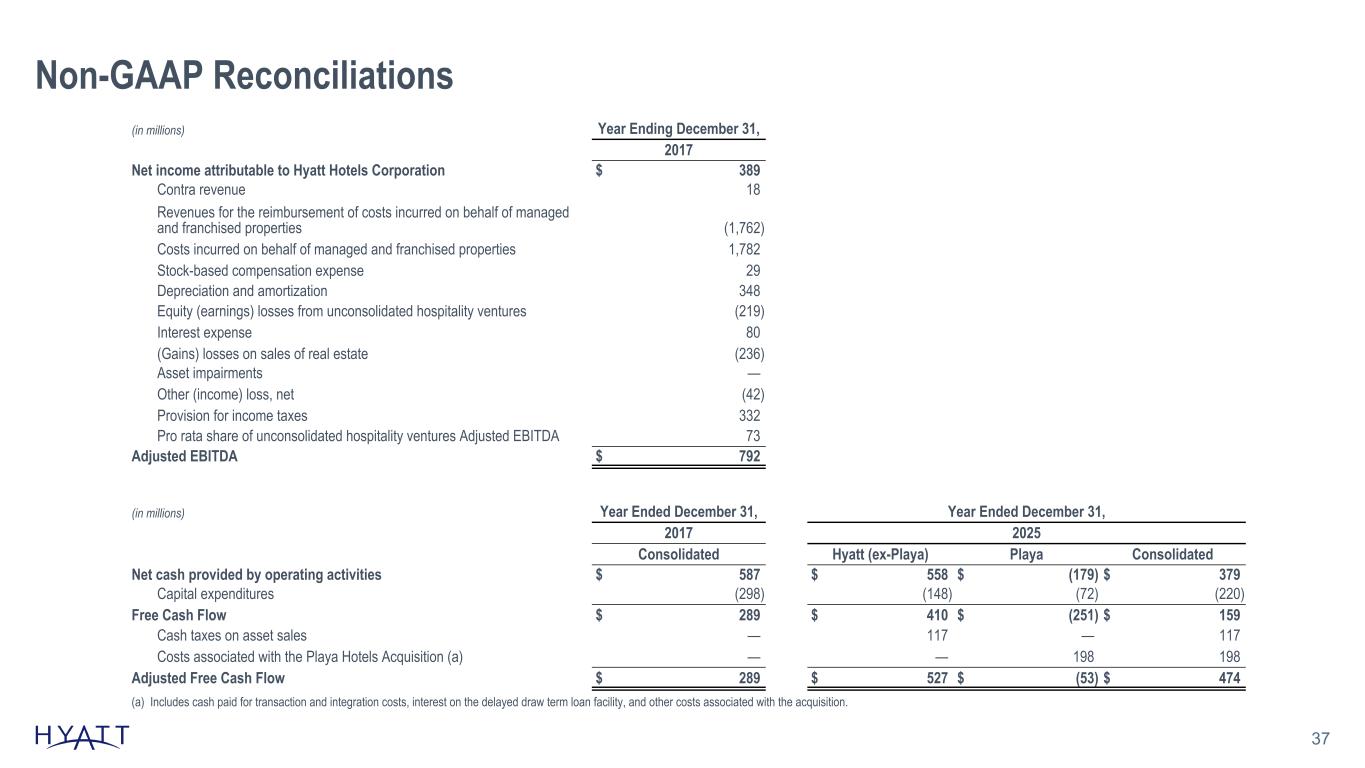

Non-GAAP Reconciliations 37 (in millions) Year Ending December 31, 2017 Net income attributable to Hyatt Hotels Corporation $ 389 Contra revenue 18 Revenues for the reimbursement of costs incurred on behalf of managed and franchised properties (1,762) Costs incurred on behalf of managed and franchised properties 1,782 Stock-based compensation expense 29 Depreciation and amortization 348 Equity (earnings) losses from unconsolidated hospitality ventures (219) Interest expense 80 (Gains) losses on sales of real estate (236) Asset impairments — Other (income) loss, net (42) Provision for income taxes 332 Pro rata share of unconsolidated hospitality ventures Adjusted EBITDA 73 Adjusted EBITDA $ 792 (in millions) Year Ended December 31, Year Ended December 31, 2017 2025 Consolidated Hyatt (ex-Playa) Playa Consolidated Net cash provided by operating activities $ 587 $ 558 $ (179) $ 379 Capital expenditures (298) (148) (72) (220) Free Cash Flow $ 289 $ 410 $ (251) $ 159 Cash taxes on asset sales — 117 — 117 Costs associated with the Playa Hotels Acquisition (a) — — 198 198 Adjusted Free Cash Flow $ 289 $ 527 $ (53) $ 474 (a) Includes cash paid for transaction and integration costs, interest on the delayed draw term loan facility, and other costs associated with the acquisition. Source Notes: linked to ER schedule

Non-GAAP Reconciliations 38 (in millions) Year Ending December 31, 2026 Outlook Range Low Case High Case Net income attributable to Hyatt Hotels Corporation $ 235 $ 320 Contra revenue 65 65 Reimbursed costs, net (a) 95 55 Stock-based compensation expense (b) 65 65 Transaction and integration costs 45 35 Depreciation and amortization 310 310 Equity (earnings) losses from unconsolidated hospitality ventures 5 5 Interest expense 260 260 Other (income) loss, net (110) (130) Provision for income taxes 185 215 Net income attributable to noncontrolling interests — 5 Adjusted EBITDA $ 1,155 $ 1,205 (a) Reimbursed costs are presented net of revenues for reimbursed costs as the Company cannot forecast the gross amounts without unreasonable effort. (b) Includes amounts recognized in general and administrative expenses, owned and leased expenses, and distribution expenses; excludes amounts recognized in transaction and integration costs. (in millions) Year Ending December 31, 2026 Outlook Range Low Case High Case Net cash provided by operating activities $ 628 $ 678 Capital expenditures (135) (135) Free Cash Flow $ 493 $ 543 Cash taxes on asset sales 4 4 Costs associated with the Playa Hotels Acquisition (c) 83 83 Adjusted Free Cash Flow $ 580 $ 630 (c) Includes taxes and other costs related to the Playa Hotels Acquisition. Source Notes: linked to ER schedule During the first quarter of 2026, the Company adjusted its definition of Adjusted EBITDA and will no longer include Hyatt's pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA.