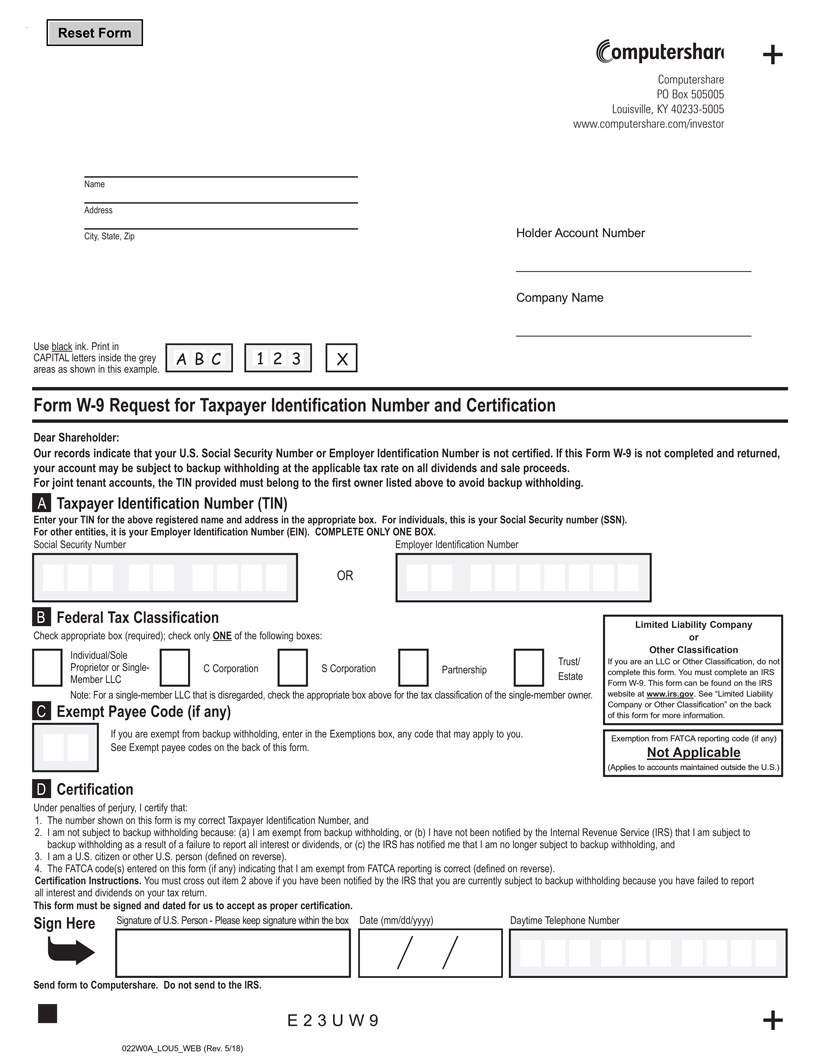

Reset Form

+

Computershare PO Box 505005 Louisville, KY 40233-5005 www.computershare.com/investor

Name

Address

City, State, Zip Holder Account Number

Company Name

Use black ink. Print in

CAPITAL letters inside the grey ABC 123 X areas as shown in this example.

Form W-9 Request for

Taxpayer Identification Number and Certification

Dear Shareholder:

Our

records indicate that your U.S. Social Security Number or Employer Identification Number is not certified. If this Form W-9 is your account may be subject to backup withholding at the applicable tax rate on all dividends and sale proceeds.

For joint tenant accounts, the TIN provided must belong to the first owner listed above to avoid backup withholding.

A Taxpayer Identification Number (TIN)

Enter your TIN for the above registered name and

address in the appropriate box. For individuals, this is your Social Security number (SSN). For other entities, it is your Employer Identification Number (EIN). COMPLETE ONLY ONE BOX.

Social Security Number Employer Identification Number

OR

B Federal Tax Classification

Check appropriate box (required); check only ONE of the following

boxes:

Individual/Sole

Trust/ Proprietor or Single- C Corporation S

Corporation Partnership Member LLC Estate Note: For a single-member LLC that is disregarded, check the appropriate box above for the tax classification of the single-member owner.

C Exempt Payee Code (if any)

If you are exempt from backup withholding, enter in the

Exemptions box, any code that may apply to you. See Exempt payee codes on the back of this form.

Limited Liability Company or Other Classification

If you are an LLC or Other Classification, do not complete this form. You must complete an IRS Form W-9. This form can be found on the IRS website at www.irs.gov. See “Limited

Liability Company or Other Classification” on the back of this form for more information.

Exemption from FATCA reporting code (if any)

Not Applicable

(Applies to accounts maintained outside the U.S.)

D Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct Taxpayer Identification Number, and

2. I am not

subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or

dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3. I am a U.S. citizen or other U.S. person (defined on reverse).

4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct (defined on reverse).

Certification Instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to

report all interest and dividends on your tax return.

This form must be signed and dated for us to accept as proper certification.

Sign a Here Signature of U.S. Person - Please keep signature within the box Date (mm/dd/yyyy) Daytime Telephone Number

Send form to Computershare. Do not send to the IRS.

E23UW 9 +

022W0A_LOU5_WEB (Rev. 5/18)

3