| Announces the acquisition of January 28, 2026 |

| 2 Cautionary Note on Forward Looking Statements This presentation contains statements regarding the proposed transaction between Prosperity Bancshares, Inc. (“Prosperity”) and Stellar Bancorp, Inc. (“Stellar”); future financial and operating results; benefits and synergies of the proposed transaction; future opportunities for Prosperity; the issuance of common stock of Prosperity contemplated by the Agreement and Plan of Merger by and between Prosperity and Stellar (the “Merger Agreement”); the expected filing by Prosperity with the Securities and Exchange Commission (the “SEC”) of a registration statement on Form S-4 (the “Registration Statement”) and a prospectus of Prosperity and a proxy statement of Stellar to be included therein (the “Proxy Statement/Prospectus”); the expected timing of the closing of the proposed transaction; the ability of the parties to complete the proposed transaction considering the various closing conditions and any other statements about future expectations that constitute forward-looking statements within the meaning of the federal securities laws, including the meaning of the Private Securities Litigation Reform Act of 1995, as amended, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. From time to time, oral or written forward-looking statements may also be included in other information released to the public. Such forward-looking statements are typically, but not exclusively, identified by the use in the statements of words or phrases such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “goal,” “guidance,” “intend,” “is anticipated,” “is expected,” “is intended,” “objective,” “plan,” “projected,” “projection,” “will affect,” “will be,” “will continue,” “will decrease,” “will grow,” “will impact,” “will increase,” “will incur,” “will reduce,” “will remain,” “will result,” “would be,” variations of such words or phrases (including where the word “could,” “may,” or “would” is used rather than the word “will” in a phrase) and similar words and phrases indicating that the statement addresses some future result, occurrence, plan or objective. Forward-looking statements include all statements other than statements of historical fact, including forecasts or trends, and are based on current expectations, assumptions, estimates, and projections about Prosperity, Stellar and their respective subsidiaries or related to the proposed transaction between Prosperity and Stellar and are subject to significant risks and uncertainties that could cause actual results to differ materially from the results expressed in such statements. These forward-looking statements may include information about Prosperity’s and Stellar’s possible or assumed future economic performance or future results of operations, including future revenues, income, expenses, provision for loan losses, provision for taxes, effective tax rate, earnings per share and cash flows and Prosperity’s and Stellar’s future capital expenditures and dividends, future financial condition and changes therein, including changes in Prosperity’s and Stellar’s loan portfolio and allowance for loan losses, future capital structure or changes therein, as well as the plans and objectives of management for Prosperity’s and Stellar’s future operations, future or proposed acquisitions, the future or expected effect of acquisitions on Prosperity’s and Stellar’s operations, results of operations, financial condition, and future economic performance, statements about the anticipated benefits of the proposed transaction, and statements about the assumptions underlying any such statement. These forward-looking statements are not guarantees of future performance and are based on expectations and assumptions Prosperity and Stellar currently believe to be valid. Because forward-looking statements relate to future results and occurrences, many of which are outside of the control of Prosperity and Stellar, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Many possible events or factors could adversely affect the future financial results and performance of Prosperity, Stellar or the combined company and could cause those results or performance to differ materially from those expressed in or implied by the forward-looking statements. Such risks and uncertainties include, among others: (1) the risk that the cost savings and synergies from the proposed transaction may not be fully realized or may take longer than anticipated to be realized, (2) disruption to Prosperity’s and Stellar’s businesses as a result of the announcements and pendency of the proposed transaction, (3) the risk that the integration of Stellar’s businesses and operations into Prosperity will be materially delayed or will be more costly or difficult than expected, or that Prosperity is otherwise unable to successfully integrate Stellar’s business into its own, including as a result of unexpected factors or events, (4) the failure to obtain the necessary approval by the shareholders of Stellar, (5) the ability by Prosperity and/or Stellar to obtain required governmental approvals of the proposed transaction on the timeline expected, or at all, and the risk that such approvals may result in the imposition of conditions that could adversely affect Prosperity after the closing of the proposed transaction or adversely affect the expected benefits of the proposed transaction, (6) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the proposed transaction, (7) the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing the proposed transaction or the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (8) the dilution caused by the issuances of additional shares of Prosperity’s common stock in the proposed transaction, (9) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (10) the outcome of any legal or regulatory proceedings that may be currently pending or later instituted against Prosperity before or after the proposed transaction, or against Stellar, (11) diversion of management’s attention from ongoing business operations and (12) general competitive, economic, political and market conditions and other factors that may affect future results of Prosperity and Stellar. Prosperity and Stellar disclaim any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. These and various other risks, uncertainties, assumptions, and factors are discussed in the Annual Reports on Form 10-K for the year ended December 31, 2024, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, filed by Prosperity or Stellar and in other filings made by Prosperity and Stellar with the SEC from time to time. |

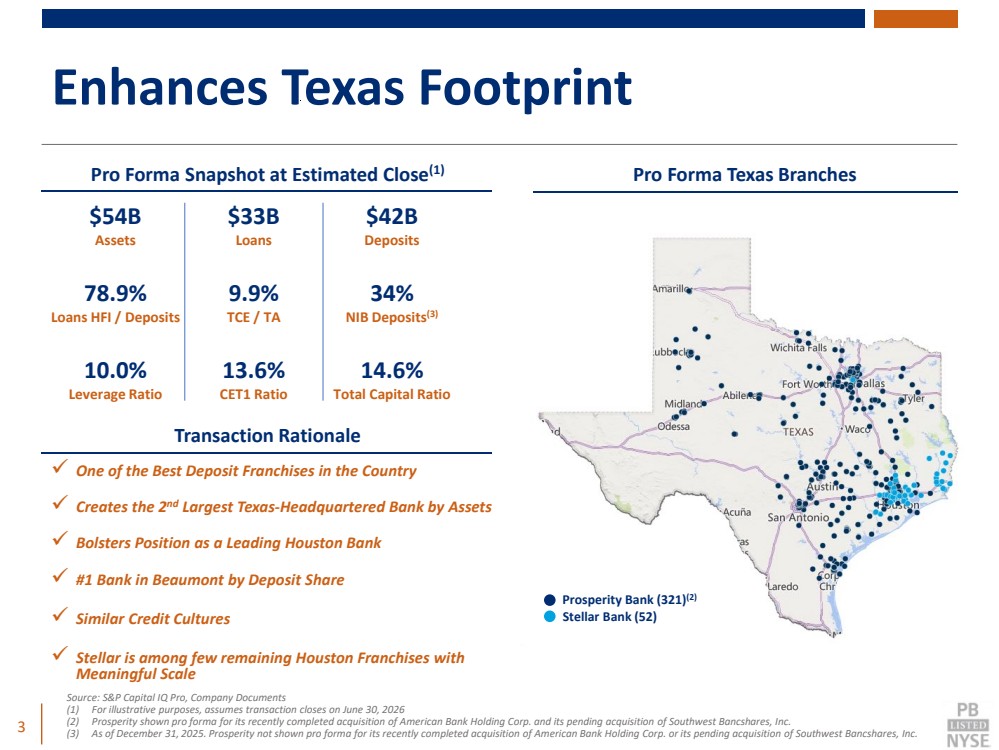

| Enhances Texas Footprint 3 Source: S&P Capital IQ Pro, Company Documents (1) For illustrative purposes, assumes transaction closes on June 30, 2026 (2) Prosperity shown pro forma for its recently completed acquisition of American Bank Holding Corp. and its pending acquisition of Southwest Bancshares, Inc. (3) As of December 31, 2025. Prosperity not shown pro forma for its recently completed acquisition of American Bank Holding Corp. or its pending acquisition of Southwest Bancshares, Inc. Stellar Bank (52) Prosperity Bank (321)(2) Pro Forma Texas Branches $33B Loans $42B Deposits 13.6% CET1 Ratio 9.9% TCE / TA 14.6% Total Capital Ratio One of the Best Deposit Franchises in the Country Creates the 2nd Largest Texas-Headquartered Bank by Assets Bolsters Position as a Leading Houston Bank #1 Bank in Beaumont by Deposit Share Similar Credit Cultures Stellar is among few remaining Houston Franchises with Meaningful Scale 34% NIB Deposits(3) Pro Forma Snapshot at Estimated Close(1) Transaction Rationale $54B Assets 78.9% Loans HFI / Deposits 10.0% Leverage Ratio |

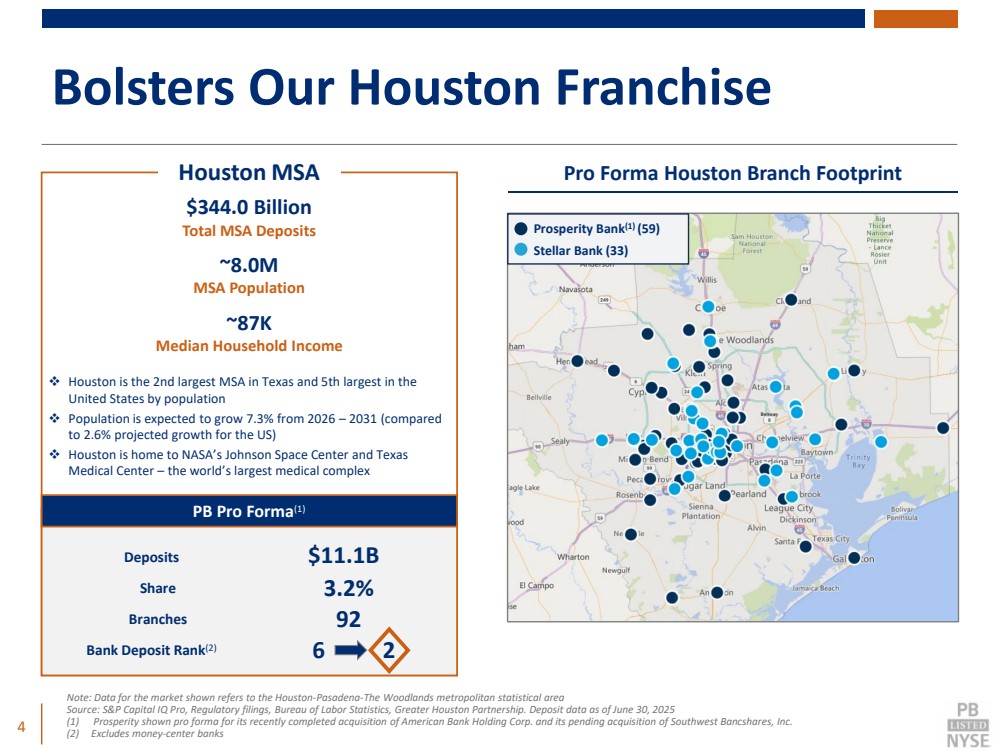

| Bolsters Our Houston Franchise 4 Note: Data for the market shown refers to the Houston-Pasadena-The Woodlands metropolitan statistical area Source: S&P Capital IQ Pro, Regulatory filings, Bureau of Labor Statistics, Greater Houston Partnership. Deposit data as of June 30, 2025 (1) Prosperity shown pro forma for its recently completed acquisition of American Bank Holding Corp. and its pending acquisition of Southwest Bancshares, Inc. (2) Excludes money-center banks Houston MSA $344.0 Billion Total MSA Deposits ~8.0M MSA Population Houston is the 2nd largest MSA in Texas and 5th largest in the United States by population Population is expected to grow 7.3% from 2026 – 2031 (compared to 2.6% projected growth for the US) Houston is home to NASA’s Johnson Space Center and Texas Medical Center – the world’s largest medical complex Bank Deposit Rank(2) 6 2 Deposits $11.1B Share 3.2% PB Pro Forma(1) Stellar Bank (33) Prosperity Bank(1) (59) ~87K Median Household Income Branches 92 Pro Forma Houston Branch Footprint |

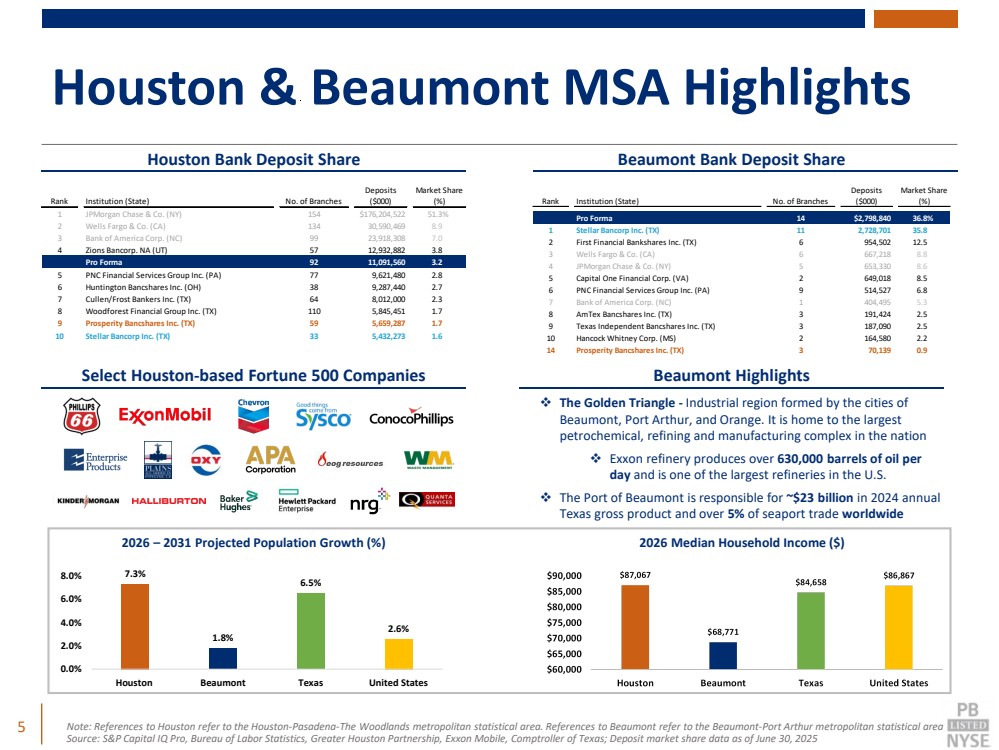

| 7.3% 1.8% 6.5% 2.6% 0.0% 2.0% 4.0% 6.0% 8.0% Houston Beaumont Texas United States Houston & Beaumont MSA Highlights 5 Note: References to Houston refer to the Houston-Pasadena-The Woodlands metropolitan statistical area. References to Beaumont refer to the Beaumont-Port Arthur metropolitan statistical area Source: S&P Capital IQ Pro, Bureau of Labor Statistics, Greater Houston Partnership, Exxon Mobile, Comptroller of Texas; Deposit market share data as of June 30, 2025 2026 – 2031 Projected Population Growth (%) 2026 Median Household Income ($) Beaumont Highlights The Golden Triangle - Industrial region formed by the cities of Beaumont, Port Arthur, and Orange. It is home to the largest petrochemical, refining and manufacturing complex in the nation Exxon refinery produces over 630,000 barrels of oil per day and is one of the largest refineries in the U.S. The Port of Beaumont is responsible for ~$23 billion in 2024 annual Texas gross product and over 5% of seaport trade worldwide Houston Bank Deposit Share Beaumont Bank Deposit Share Select Houston-based Fortune 500 Companies Rank Institution (State) No. of Branches Deposits ($000) Market Share (%) 1 JPMorgan Chase & Co. (NY) 154 $176,204,522 51.3% 2 Wells Fargo & Co. (CA) 134 30,590,469 8.9 3 Bank of America Corp. (NC) 99 23,918,308 7.0 4 Zions Bancorp. NA (UT) 57 12,932,882 3.8 Pro Forma 92 11,091,560 3.2 5 PNC Financial Services Group Inc. (PA) 77 9,621,480 2.8 6 Huntington Bancshares Inc. (OH) 38 9,287,440 2.7 7 Cullen/Frost Bankers Inc. (TX) 64 8,012,000 2.3 8 Woodforest Financial Group Inc. (TX) 110 5,845,451 1.7 9 Prosperity Bancshares Inc. (TX) 59 5,659,287 1.7 10 Stellar Bancorp Inc. (TX) 33 5,432,273 1.6 Rank Institution (State) No. of Branches Deposits ($000) Market Share (%) Pro Forma 14 $2,798,840 36.8% 1 Stellar Bancorp Inc. (TX) 11 2,728,701 35.8 2 First Financial Bankshares Inc. (TX) 6 954,502 12.5 3 Wells Fargo & Co. (CA) 6 667,218 8.8 4 JPMorgan Chase & Co. (NY) 5 653,330 8.6 5 Capital One Financial Corp. (VA) 2 649,018 8.5 6 PNC Financial Services Group Inc. (PA) 9 514,527 6.8 7 Bank of America Corp. (NC) 1 404,495 5.3 8 AmTex Bancshares Inc. (TX) 3 191,424 2.5 9 Texas Independent Bancshares Inc. (TX) 3 187,090 2.5 10 Hancock Whitney Corp. (MS) 2 164,580 2.2 14 Prosperity Bancshares Inc. (TX) 3 70,139 0.9 |

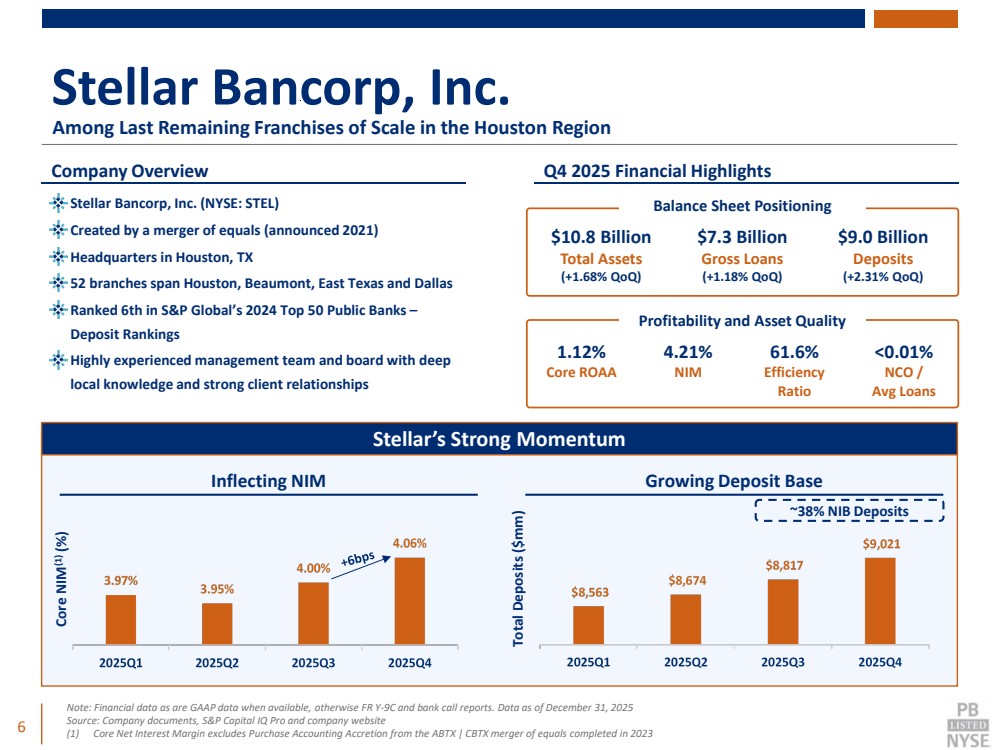

| 6 Note: Financial data as are GAAP data when available, otherwise FR Y-9C and bank call reports. Data as of December 31, 2025 Source: Company documents, S&P Capital IQ Pro and company website (1) Core Net Interest Margin excludes Purchase Accounting Accretion from the ABTX | CBTX merger of equals completed in 2023 Inflecting NIM STEL’s Strong Momentum Company Overview Among Last Remaining Franchises of Scale in the Houston Region Stellar Bancorp, Inc. Core NIM(1) (%) Total Deposits ($mm) ~38% NIB Deposits Growing Deposit Base Stellar’s Strong Momentum Q4 2025 Financial Highlights $7.3 Billion Gross Loans (+1.18% QoQ) $9.0 Billion Deposits (+2.31% QoQ) <0.01% NCO / Avg Loans 4.21% NIM 61.6% Efficiency Ratio 1.12% Core ROAA $10.8 Billion Total Assets (+1.68% QoQ) Profitability and Asset Quality Stellar Bancorp, Inc. (NYSE: STEL) Balance Sheet Positioning Created by a merger of equals (announced 2021) Headquarters in Houston, TX 52 branches span Houston, Beaumont, East Texas and Dallas Ranked 6th in S&P Global’s 2024 Top 50 Public Banks – Deposit Rankings Highly experienced management team and board with deep local knowledge and strong client relationships |

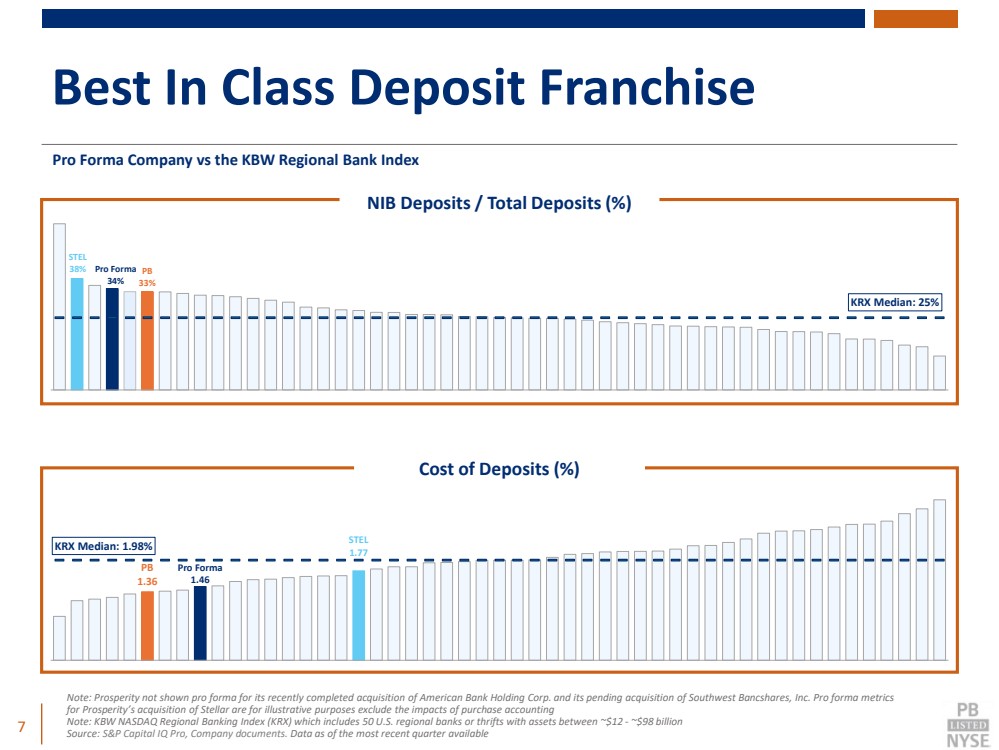

| Best In Class Deposit Franchise 7 Note: Prosperity not shown pro forma for its recently completed acquisition of American Bank Holding Corp. and its pending acquisition of Southwest Bancshares, Inc. Pro forma metrics for Prosperity’s acquisition of Stellar are for illustrative purposes exclude the impacts of purchase accounting Note: KBW NASDAQ Regional Banking Index (KRX) which includes 50 U.S. regional banks or thrifts with assets between ~$12 - ~$98 billion Source: S&P Capital IQ Pro, Company documents. Data as of the most recent quarter available Pro Forma Company vs the KBW Regional Bank Index STEL 38% Pro Forma 34% PB 33% KRX Median: 25% NIB Deposits / Total Deposits (%) PB 1.36 Pro Forma 1.46 STEL 1.77 KRX Median: 1.98% Cost of Deposits (%) |

| Financial Impact 8 |

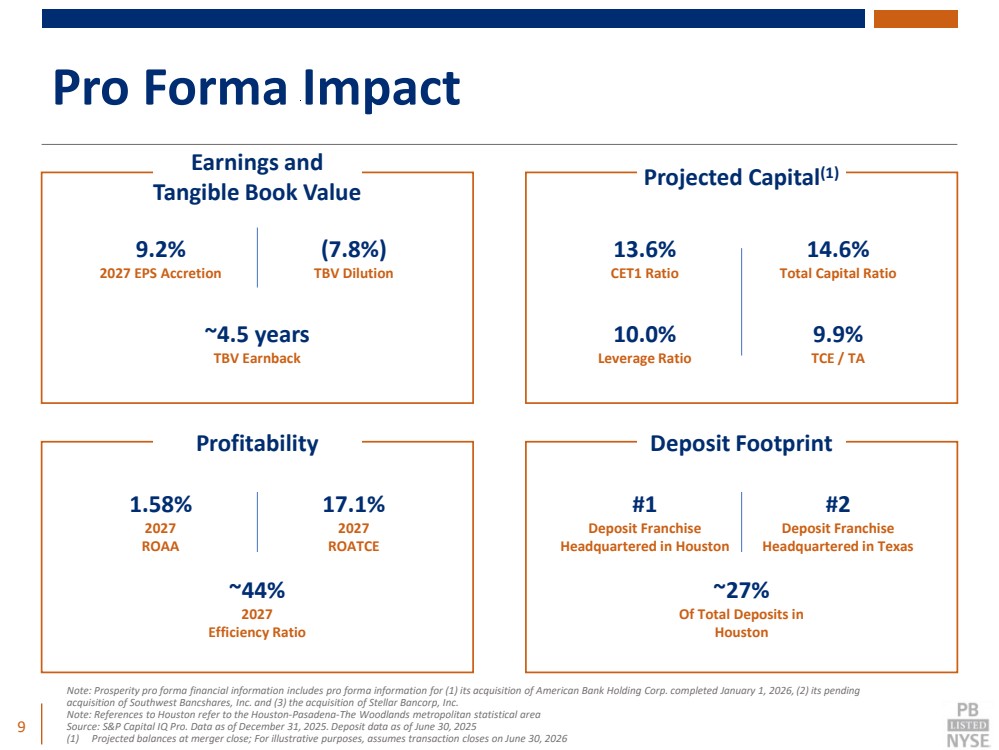

| Pro Forma Impact 9 Note: Prosperity pro forma financial information includes pro forma information for (1) its acquisition of American Bank Holding Corp. completed January 1, 2026, (2) its pending acquisition of Southwest Bancshares, Inc. and (3) the acquisition of Stellar Bancorp, Inc. Note: References to Houston refer to the Houston-Pasadena-The Woodlands metropolitan statistical area Source: S&P Capital IQ Pro. Data as of December 31, 2025. Deposit data as of June 30, 2025 (1) Projected balances at merger close; For illustrative purposes, assumes transaction closes on June 30, 2026 ~4.5 years TBV Earnback Earnings and Tangible Book Value Projected Capital(1) 14.6% Total Capital Ratio Profitability 1.58% 2027 ROAA 17.1% 2027 ROATCE ~44% 2027 Efficiency Ratio 13.6% CET1 Ratio 9.9% TCE / TA 10.0% Leverage Ratio 9.2% 2027 EPS Accretion (7.8%) TBV Dilution Deposit Footprint #2 Deposit Franchise Headquartered in Texas #1 Deposit Franchise Headquartered in Houston ~27% Of Total Deposits in Houston |

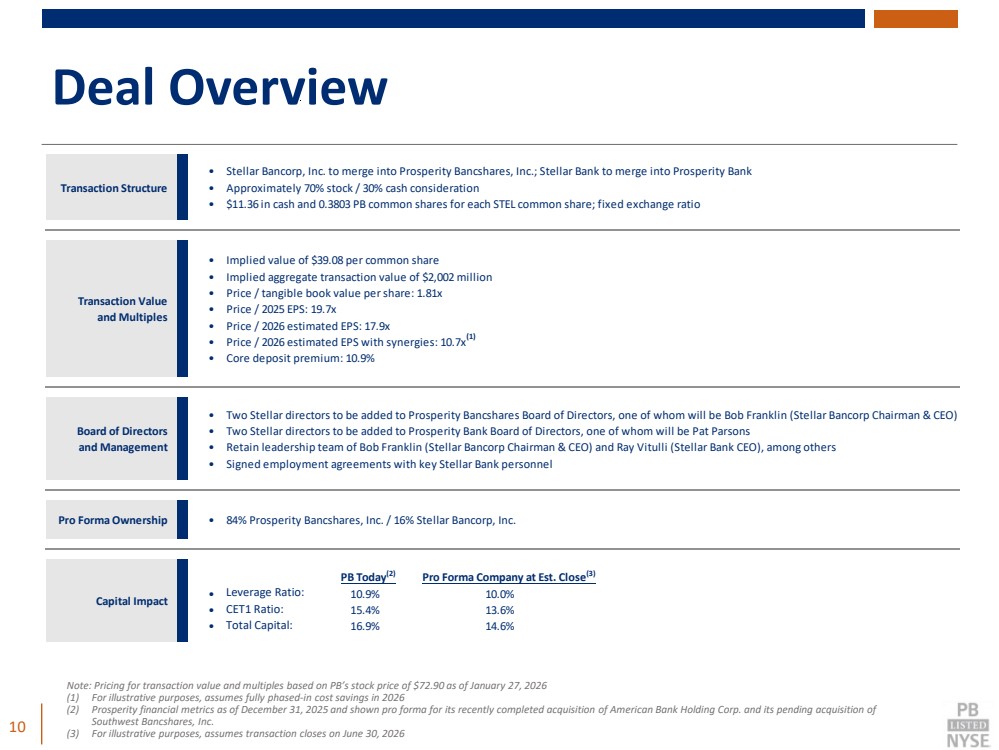

| Deal Overview 10 Transaction Structure • Stellar Bancorp, Inc. to merge into Prosperity Bancshares, Inc.; Stellar Bank to merge into Prosperity Bank • Approximately 70% stock / 30% cash consideration • $11.36 in cash and 0.3803 PB common shares for each STEL common share; fixed exchange ratio Transaction Value and Multiples • Implied value of $39.08 per common share • Implied aggregate transaction value of $2,002 million • Price / tangible book value per share: 1.81x • Price / 2025 EPS: 19.7x • Price / 2026 estimated EPS: 17.9x • Price / 2026 estimated EPS with synergies: 10.7x • Core deposit premium: 10.9% Board of Directors and Management • Two Stellar directors to be added to Prosperity Bancshares Board of Directors, one of whom will be Bob Franklin (Stellar Bancorp Chairman & CEO) • Two Stellar directors to be added to Prosperity Bank Board of Directors, one of whom will be Pat Parsons • Retain leadership team of Bob Franklin (Stellar Bancorp Chairman & CEO) and Ray Vitulli (Stellar Bank CEO), among others • Signed employment agreements with key Stellar Bank personnel Pro Forma Ownership • 84% Prosperity Bancshares, Inc. / 16% Stellar Bancorp, Inc. Capital Impact PB Today(2) Pro Forma Company at Est. Close(3) • Leverage Ratio: 10.9% 10.0% • Leverage Ratio: 15.4% 13.6% • Leverage Ratio: 16.9% 14.6% Note: Pricing for transaction value and multiples based on PB’s stock price of $72.90 as of January 27, 2026 (1) For illustrative purposes, assumes fully phased-in cost savings in 2026 (2) Prosperity financial metrics as of December 31, 2025 and shown pro forma for its recently completed acquisition of American Bank Holding Corp. and its pending acquisition of Southwest Bancshares, Inc. (3) For illustrative purposes, assumes transaction closes on June 30, 2026 Leverage Ratio: CET1 Ratio: Total Capital: (1) |

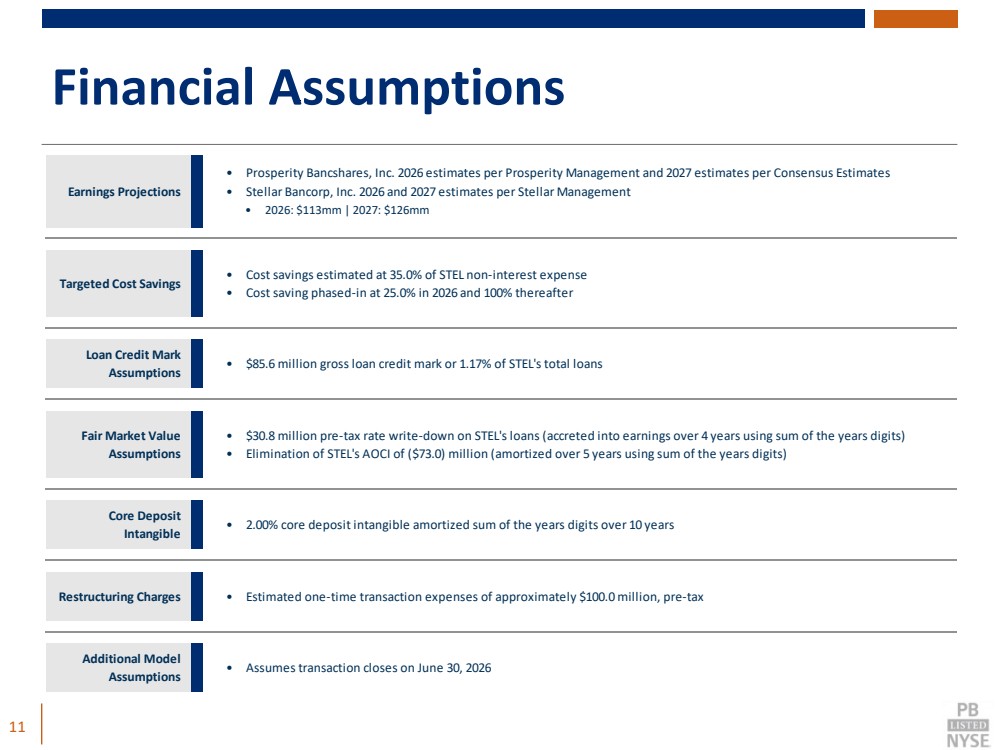

| Financial Assumptions 11 Earnings Projections • Prosperity Bancshares, Inc. 2026 estimates per Prosperity Management and 2027 estimates per Consensus Estimates • Stellar Bancorp, Inc. 2026 and 2027 estimates per Stellar Management • 2026: $113mm | 2027: $126mm Targeted Cost Savings • Cost savings estimated at 35.0% of STEL non-interest expense • Cost saving phased-in at 25.0% in 2026 and 100% thereafter Loan Credit Mark Assumptions • $85.6 million gross loan credit mark or 1.17% of STEL's total loans Fair Market Value Assumptions • $30.8 million pre-tax rate write-down on STEL's loans (accreted into earnings over 4 years using sum of the years digits) • Elimination of STEL's AOCI of ($73.0) million (amortized over 5 years using sum of the years digits) Core Deposit Intangible • 2.00% core deposit intangible amortized sum of the years digits over 10 years Restructuring Charges • Estimated one-time transaction expenses of approximately $100.0 million, pre-tax Additional Model Assumptions • Assumes transaction closes on June 30, 2026 |

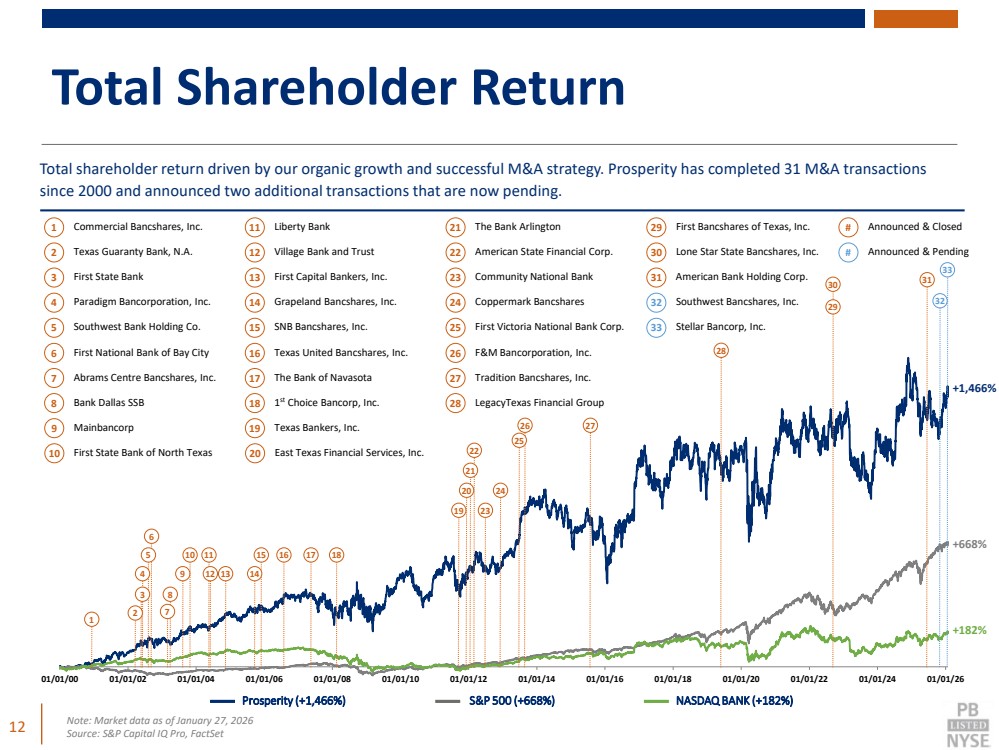

| 01/01/00 01/01/02 01/01/04 01/01/06 01/01/08 01/01/10 01/01/12 01/01/14 01/01/16 01/01/18 01/01/20 01/01/22 01/01/24 01/01/26 Total Shareholder Return 12 28 27 24 23 22 21 15 16 17 18 13 14 19 8 6 5 4 3 +1,466% +182% +668% 30 29 1 Commercial Bancshares, Inc. 11 Liberty Bank 21 The Bank Arlington 29 First Bancshares of Texas, Inc. 2 Texas Guaranty Bank, N.A. 12 Village Bank and Trust 22 American State Financial Corp. 30 Lone Star State Bancshares, Inc. 3 First State Bank 13 First Capital Bankers, Inc. 23 Community National Bank 4 Paradigm Bancorporation, Inc. 14 Grapeland Bancshares, Inc. 24 Coppermark Bancshares 5 Southwest Bank Holding Co. 15 SNB Bancshares, Inc. 25 First Victoria National Bank Corp. 6 First National Bank of Bay City 16 Texas United Bancshares, Inc. 26 F&M Bancorporation, Inc. 7 Abrams Centre Bancshares, Inc. 17 The Bank of Navasota 27 Tradition Bancshares, Inc. 8 Bank Dallas SSB 18 1st Choice Bancorp, Inc. 28 LegacyTexas Financial Group 9 Mainbancorp 19 Texas Bankers, Inc. 10 First State Bank of North Texas 20 East Texas Financial Services, Inc. 1 2 7 9 10 11 20 26 25 12 # Announced & Closed # Announced & Pending 32 Southwest Bancshares, Inc. 32 31 American Bank Holding Corp. 31 Total shareholder return driven by our organic growth and successful M&A strategy. Prosperity has completed 31 M&A transactions since 2000 and announced two additional transactions that are now pending. Note: Market data as of January 27, 2026 Source: S&P Capital IQ Pro, FactSet Prosperity (+1,466%) S&P 500 (+668%) NASDAQ BANK (+182%) 33 Stellar Bancorp, Inc. 33 |

| Appendix 13 |

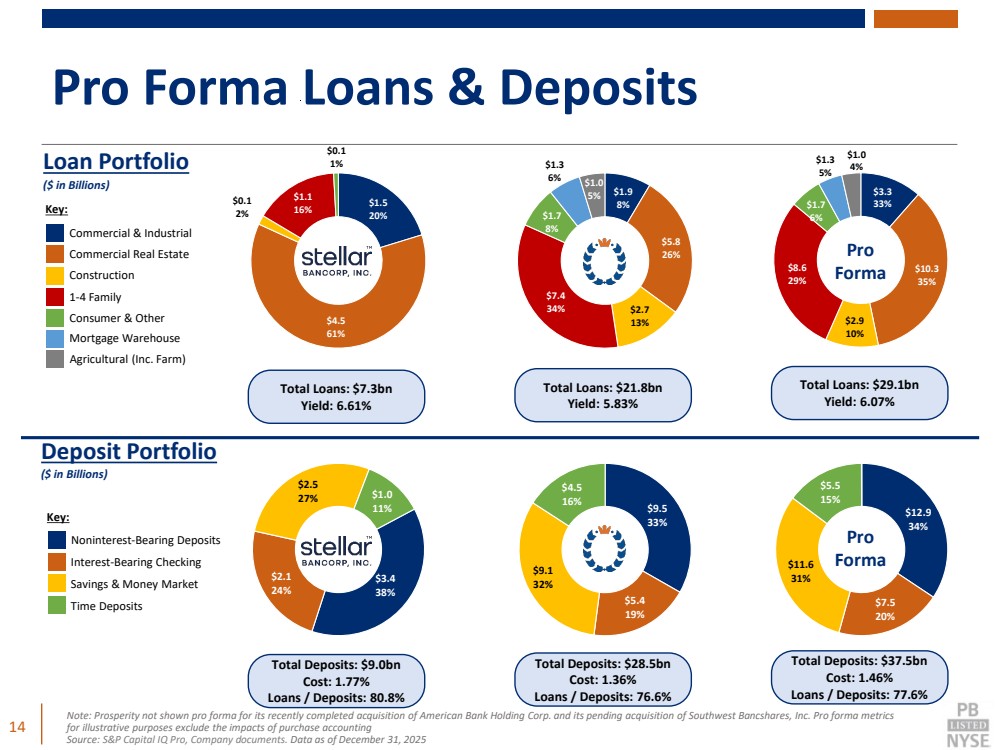

| $1.5 20% $4.5 61% $0.1 2% $1.1 16% $0.1 1% Pro Forma Loans & Deposits 14 Note: Prosperity not shown pro forma for its recently completed acquisition of American Bank Holding Corp. and its pending acquisition of Southwest Bancshares, Inc. Pro forma metrics for illustrative purposes exclude the impacts of purchase accounting Source: S&P Capital IQ Pro, Company documents. Data as of December 31, 2025 $3.4 38% $2.1 24% $2.5 27% $1.0 11% Pro Forma Commercial & Industrial Commercial Real Estate Construction 1-4 Family Key: Consumer & Other Mortgage Warehouse Agricultural (Inc. Farm) Pro Forma Noninterest-Bearing Deposits Interest-Bearing Checking Savings & Money Market Time Deposits Key: Total Loans: $7.3bn Yield: 6.61% Total Loans: $21.8bn Yield: 5.83% Total Loans: $29.1bn Yield: 6.07% Total Deposits: $9.0bn Cost: 1.77% Loans / Deposits: 80.8% Total Deposits: $28.5bn Cost: 1.36% Loans / Deposits: 76.6% Total Deposits: $37.5bn Cost: 1.46% Loans / Deposits: 77.6% Deposit Portfolio ($ in Billions) $9.5 33% $5.4 19% $9.1 32% $4.5 16% $12.9 34% $7.5 20% $11.6 31% $5.5 15% $0.0 0% $1.9 8% $5.8 26% $2.7 13% $7.4 34% $1.7 8% $1.3 6% $1.0 5% $3.3 33% $10.3 35% $2.9 10% $8.6 29% $1.7 6% $1.3 5% $1.0 Loan Portfolio 4% ($ in Billions) |

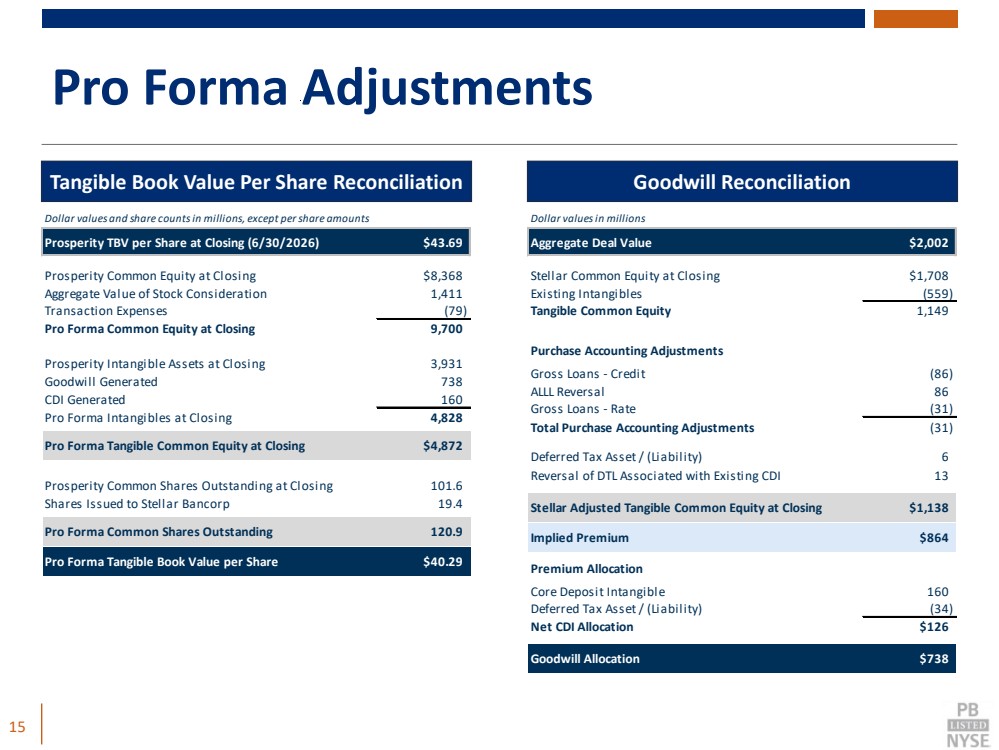

| Pro Forma Adjustments 15 Dollar values and share counts in millions, except per share amounts Prosperity TBV per Share at Closing (6/30/2026) $43.69 Prosperity Common Equity at Closing $8,368 Aggregate Value of Stock Consideration 1,411 Transaction Expenses (79) Pro Forma Common Equity at Closing 9,700 Prosperity Intangible Assets at Closing 3,931 Goodwill Generated 738 CDI Generated 160 Pro Forma Intangibles at Closing 4,828 Pro Forma Tangible Common Equity at Closing $4,872 Prosperity Common Shares Outstanding at Closing 101.6 Shares Issued to Stellar Bancorp 19.4 Pro Forma Common Shares Outstanding 120.9 Pro Forma Tangible Book Value per Share $40.29 Dollar values in millions Aggregate Deal Value $2,002 Stellar Common Equity at Closing $1,708 Existing Intangibles (559) Tangible Common Equity 1,149 Purchase Accounting Adjustments Gross Loans - Credit (86) ALLL Reversal 86 Gross Loans - Rate (31) Total Purchase Accounting Adjustments (31) Deferred Tax Asset / (Liability) 6 Reversal of DTL Associated with Existing CDI 13 Stellar Adjusted Tangible Common Equity at Closing $1,138 Implied Premium $864 Premium Allocation Core Deposit Intangible 160 Deferred Tax Asset / (Liability) (34) Net CDI Allocation $126 Goodwill Allocation $738 Tangible Book Value Per Share Reconciliation Goodwill Reconciliation |

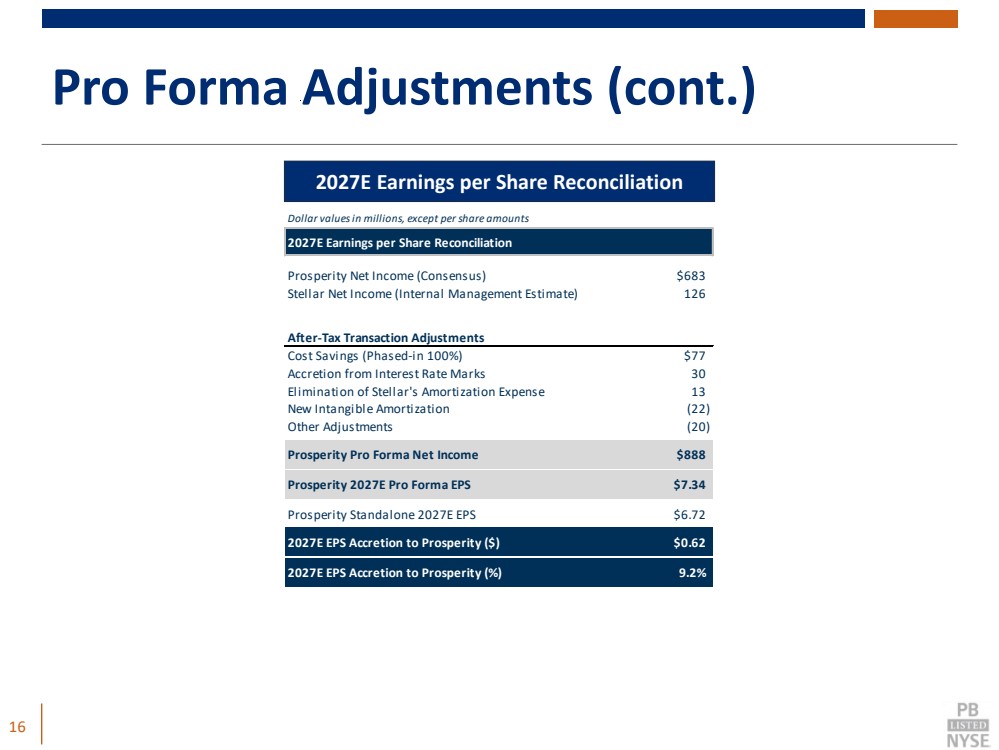

| Pro Forma Adjustments (cont.) 16 Dollar values in millions, except per share amounts 2027E Earnings per Share Reconciliation Prosperity Net Income (Consensus) $683 Stellar Net Income (Internal Management Estimate) 126 After-Tax Transaction Adjustments Cost Savings (Phased-in 100%) $77 Accretion from Interest Rate Marks 30 Elimination of Stellar's Amortization Expense 13 New Intangible Amortization (22) Other Adjustments (20) Prosperity Pro Forma Net Income $888 Prosperity 2027E Pro Forma EPS $7.34 Prosperity Standalone 2027E EPS $6.72 2027E EPS Accretion to Prosperity ($) $0.62 2027E EPS Accretion to Prosperity (%) 9.2% 2027E Earnings per Share Reconciliation |

| 17 Important Information Additional Information about the Transaction and Where to Find It Prosperity intends to file with the SEC the Registration Statement on Form S-4 to register the shares of Prosperity common stock to be issued to the shareholders of Stellar in connection with the proposed transaction. The Registration Statement will include the Proxy Statement/Prospectus which will be sent to the shareholders of Stellar in connection with the proposed transaction. This communication is not a substitute for the Registration Statement, the Proxy Statement/Prospectus or any other document that may be filed by Prosperity or Stellar with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY/STATEMENT PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain the Registration Statement and the Proxy Statement/Prospectus (when available) and other documents that are filed with the SEC by Prosperity or Stellar, as applicable, free of charge from the SEC’s website at https://www.sec.gov or through the investor relations section of Prosperity’s website at https://www.prosperitybankusa.com/investor-relations/ or Stellar’s website at https://ir.stellar.bank. Participants in the Solicitation Prosperity, Stellar and certain of their directors and executive officers and other employees may be deemed to be participants in the solicitation of proxies from Stellar’s shareholders in connection with the proposed transaction. Information about the directors and executive officers of Prosperity and their ownership of Prosperity common stock is contained in the definitive proxy statement for Prosperity’s 2025 annual meeting of shareholders (the “Prosperity Annual Meeting Proxy Statement”), which was filed with the SEC on March 13, 2025, including under the headings “Item 1. Election of Directors,” “Corporate Governance,” “Executive Compensation and Other Matters,” “Item 3. Advisory Vote on Executive Compensation,” and “Beneficial Ownership of Common Stock by Management of the Company and Principal Shareholders.” Information about the directors and executive officers of Stellar and their ownership of Stellar common stock is contained in the definitive proxy statement for Stellar’s 2025 annual meeting of shareholders (the “Stellar Annual Meeting Proxy Statement”), which was filed with the SEC on April 10, 2025, including under the headings “Proposal 1: Election of Directors,” “Certain Corporate Governance Matters,” “Executive Compensation and Other Matters,” “Executive Compensation Payments and Awards,” “Proposal 4: Advisory Vote on the Compensation of the Company’s Named Executive Officers (“Say-on-Pay Resolution”),” and “Beneficial Ownership of the Company’s Common Stock by Management and Principal Shareholders of the Company.” Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the shareholders of Stellar in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be included in the Proxy Statement/Prospectus relating to the proposed transaction when it is filed with the SEC. To the extent holdings of securities by potential participants (or the identity of such participants) have changed since the information printed in the Prosperity Annual Meeting Proxy Statement or the Stellar Annual Meeting Proxy Statement, such information has been or will be reflected on Statements of Change in Ownership on Forms 3 and 4 filed with the SEC, as applicable. Free copies of the Proxy Statement/Prospectus relating to the proposed transaction and free copies of the other SEC filings to which reference is made in this paragraph may be obtained from the SEC’s website at https://www.sec.gov or through the investor relations section of Prosperity’s website at https://www.prosperitybankusa.com/investor-relations/ or Stellar’s website at https://ir.stellar.bank. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, and otherwise in accordance with applicable law. |

| Greet The Customer With A Smile Address Our Customer By Name Try to Say Yes Instead of No Thank the Customer for Banking With Us |