Please wait

.2

Cenovus Energy Inc.

Management’s Discussion and Analysis (unaudited)

For the Year Ended December 31, 2025

(Canadian Dollars)

MANAGEMENT’S DISCUSSION AND ANALYSIS

| | |

For the year ended December 31, 2025 |

This Management’s Discussion and Analysis (“MD&A”) for Cenovus Energy Inc. (which includes references to “we”, “our”, “us”, “its”, the “Company”, or “Cenovus”, and means Cenovus Energy Inc., the subsidiaries of, joint arrangements, and partnership interests held directly or indirectly by, Cenovus Energy Inc.) dated February 18, 2026, should be read in conjunction with our December 31, 2025 unaudited interim Consolidated Financial Statements and accompanying notes (“interim Consolidated Financial Statements”) and our December 31, 2025 audited Consolidated Financial Statements and accompanying notes (“Consolidated Financial Statements”). All of the information and statements contained in this MD&A are made as at February 18, 2026, unless otherwise indicated. This MD&A contains forward-looking information about our current expectations, estimates, projections and assumptions. See the Advisory for information on the risk factors that could cause actual results to differ materially and the assumptions underlying our forward-looking information. Cenovus management (“Management”) prepared the MD&A. The Audit Committee of the Cenovus Board of Directors (“the Board”) reviewed and recommended the MD&A for approval by the Board, which occurred on February 18, 2026. Additional information about Cenovus, including our quarterly and annual reports, Annual Information Form (“AIF”) and Form 40-F, is available on SEDAR+ at sedarplus.ca, on EDGAR at sec.gov and on our website at cenovus.com. Information on or connected to our website, even if referred to in this MD&A, do not constitute part of this MD&A. Cenovus holds equity ownership interests in a number of joint ventures, as classified under IFRS Accounting Standards (as defined below), that are accounted for using the equity method in our Consolidated Financial Statements. Unless otherwise indicated, operational results of these joint ventures are not reflected in this MD&A. For further information, see the Advisory section of this MD&A.

Basis of Presentation

This MD&A and the Consolidated Financial Statements were prepared in Canadian dollars (which includes references to “dollar” or “$”), except where another currency is indicated, and in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) (the “IFRS Accounting Standards”). Production volumes are presented on a before royalties basis. Refer to the Abbreviations and Definitions section for commonly used oil and gas terms.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 2 |

We are a Canadian-based integrated energy company headquartered in Calgary, Alberta. We are one of the largest Canadian-based crude oil and natural gas producers, with upstream operations in Canada and the Asia Pacific region, and one of the largest Canadian-based refiners and upgraders, with downstream operations in Canada and the United States (“U.S.”).

Our upstream operations include oil sands projects in northern Alberta; thermal and conventional crude oil, natural gas and natural gas liquids (“NGLs”) projects across Western Canada; crude oil production offshore Newfoundland and Labrador; and natural gas and NGLs production offshore China and Indonesia. Our downstream operations include upgrading and refining operations in Canada and the U.S., and commercial fuel operations across Canada.

Our operations involve activities across the full value chain to develop, produce, refine, transport and market crude oil, natural gas and refined petroleum products in North America and internationally. Our physically and economically integrated upstream and downstream operations help us mitigate the impact of volatility in light-heavy crude oil price differentials and contribute to our net earnings by capturing value from crude oil, natural gas and NGLs production through to the sale of finished products such as transportation fuels.

For a description of our business segments, see the Reportable Segments section of this MD&A.

Our Strategy

At Cenovus, our purpose is to energize the world to make people’s lives better. Our strategy is focused on maximizing shareholder value over the long-term through sustainable, low-cost, diversified and integrated energy leadership. Our five strategic objectives include: delivering top-tier safety performance and sustainability leadership; maximizing value through competitive cost structures and optimizing margins; a focus on financial discipline, including reaching and maintaining targeted debt levels while positioning Cenovus for resiliency through commodity price cycles; a disciplined approach to allocating capital to projects that generate returns at the bottom of the commodity price cycle; and absolute and per share free funds flow growth.

On December 11, 2025, we released our 2026 corporate guidance, which focused on disciplined capital allocation in support of increasing shareholder returns over time. We will continue to be focused on controlling costs, improving the profitability of our business and optimizing our advantaged portfolio to deliver value for our shareholders. For further details, see the Outlook section of this MD&A and our 2026 corporate guidance dated December 10, 2025, available on our website at cenovus.com.

Our 2025 results reflect strong operational performance in the upstream and downstream business. Despite a weakened commodity price environment, we delivered strong financial results, reached significant milestones in key growth projects and completed strategic acquisitions and divestitures, which enhance our asset portfolio.

•Delivered safe and reliable operations. We delivered safe operations across our business and safely completed turnarounds at Foster Creek, Sunrise and the Toledo Refinery. In late May, we responded to wildfire activity in northern Alberta by temporarily shutting-in production at Christina Lake to ensure the safety of our staff and assets. We resumed production in early June. Safety continues to be our top priority.

•Acquisition of MEG Energy Corp. On November 13, 2025, we completed the acquisition of MEG Energy Corp. (“MEG”) through a plan of arrangement (the “MEG Acquisition”). Purchase consideration for the MEG Acquisition included $3.4 billion in cash partially funded through the receipt of a $2.7 billion term loan facility, and the issuance of 143.9 million Cenovus common shares with a fair value of $3.7 billion. The acquired MEG assets immediately contributed to our Christina Lake production and results.

•Sale of interest in WRB Refining LP. On September 30, 2025, we divested our entire 50 percent interest in the jointly-owned Wood River and Borger refineries held through WRB Refining LP (“WRB”) (the “WRB Divestiture”) for proceeds of US$1.3 billion (C$1.9 billion) after closing adjustments. The divestiture aligns with our strategy of owning and operating assets that are core to our business.

•Record annual upstream production. We achieved record annual upstream production averaging 834.2 thousand BOE per day (2024 – 797.2 thousand BOE per day), primarily due to record annual Oil Sands production averaging 644.1 thousand BOE per day (2024 – 610.7 thousand). Oil Sands production increased due to successful results from new well pads, additional production volumes following the MEG Acquisition and the completion of key growth projects.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 3 |

•Completed and advanced key Oil Sands growth projects. We ramped-up production following the completion of the Narrows Lake tie-back to Christina Lake, and we completed the Foster Creek optimization project ahead of schedule. At Sunrise, we brought new well pads online to support continued production growth. At our Lloydminster conventional heavy oil assets, we made progress on our heavy oil development program.

•Achieved Offshore milestones at the West White Rose Project. The topsides were placed atop the concrete gravity structure, and we completed the subsea tie-ins to our existing production system at the SeaRose floating production, storage and offloading unit (“FPSO”). Hookup and commissioning of the platform continued to progress and was substantially completed in the fourth quarter of 2025, despite challenging offshore weather conditions.

•Strong utilization in our downstream assets. Average crude oil throughput (“throughput”) in our downstream assets was 626.6 thousand barrels per day, representing a crude unit utilization of 95 percent, compared with 646.9 thousand barrels per day in 2024, representing crude unit utilization of 90 percent. Our Canadian assets achieved record annual throughput and continue to run at or above capacity, while the completion of turnarounds and operational improvement initiatives in our operated U.S. assets resulted in higher reliability.

•Reported solid financial results. Adjusted Funds Flow was $8.9 billion, an increase of $707 million from 2024, reflecting strong operating performance in our upstream and downstream operations, despite a weakened commodity price environment. Brent and WTI benchmark prices both decreased by 14 percent, partially offset by higher market crack spreads and the narrowing of the WTI-WCS differential. Cash from operating activities was $8.2 billion, a decrease from $9.2 billion in 2024, mainly due to changes in non-cash working capital.

•Closed senior notes offerings. In connection with the closing of the MEG Acquisition and upcoming debt maturities, the Company closed public offerings in Canada and the U.S. of $2.6 billion of senior unsecured notes. The proceeds of the offerings were used to fund the redemption of select senior unsecured notes and for general corporate purposes.

•Completed the redemption of select senior notes. The Company redeemed US$973 million in principal of senior unsecured notes due in 2027 and 2029, in full, including the US$600 million senior unsecured notes assumed with the MEG Acquisition. The Company also redeemed $750 million in principal of senior unsecured notes due in 2027, in full.

•Delivered significant returns to shareholders. We returned $3.8 billion to common and preferred shareholders, including the purchase of 89.4 million common shares for $2.0 billion through our normal course issuer bid (“NCIB”), $1.4 billion through common and preferred share base dividends, and the redemption of the Company’s series 5 and series 7 preferred shares at a price of $25.00 per share for a total of $350 million. Following the MEG Acquisition, we have adjusted our shareholder returns framework to balance deleveraging with shareholder returns.

•Raised our common share base dividend. In the second quarter, the Board approved an 11 percent increase in the base dividend to $0.800 per common share annually. On February 18, 2026, the Board declared a first quarter dividend of $0.200 per common share.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 4 |

Summary of Annual Results

| | | | | | | | | | | | | | | | | | | | |

| ($ millions, except where indicated) | | 2025 | | 2024 | | 2023 |

| | | | | | |

Upstream Production Volumes (1) (2) (MBOE/d) | | 834.2 | | | 797.2 | | | 778.7 | |

| | | | | | |

Downstream Total Processed Inputs (3) (4) (Mbbls/d) | | 667.5 | | | 678.0 | | | 586.8 | |

| | | | | | |

Crude Oil Unit Throughput (3) (Mbbls/d) | | 626.6 | | | 646.9 | | | 560.4 | |

| | | | | | |

Downstream Production Volumes (3) (Mbbls/d) | | 687.2 | | | 693.1 | | | 599.2 | |

| | | | | | |

Revenues | | 49,696 | | | 54,277 | | | 52,204 | |

| | | | | | |

Operating Margin (5) | | 10,608 | | | 10,809 | | | 11,022 | |

Operating Margin – Upstream (6) | | 10,403 | | | 11,121 | | | 9,870 | |

Operating Margin – Downstream (6) | | 205 | | | (312) | | | 1,152 | |

| | | | | | |

| Cash From (Used In) Operating Activities | | 8,228 | | | 9,235 | | | 7,388 | |

| | | | | | |

Adjusted Funds Flow (5) | | 8,871 | | | 8,164 | | | 8,803 | |

Per Share – Basic (5) ($) | | 4.90 | | | 4.41 | | | 4.64 | |

Per Share – Diluted (5) ($) | | 4.87 | | | 4.38 | | | 4.54 | |

| | | | | | |

| Capital Investment | | 4,907 | | | 5,015 | | | 4,298 | |

| | | | | | |

Free Funds Flow (5) | | 3,964 | | | 3,149 | | | 4,505 | |

| | | | | | |

Net Earnings (Loss) | | 3,930 | | | 3,142 | | | 4,109 | |

Per Share – Basic ($) | | 2.16 | | | 1.68 | | | 2.15 | |

Per Share – Diluted ($) | | 2.15 | | | 1.67 | | | 2.09 | |

| | | | | | |

| Total Assets | | 63,424 | | | 56,539 | | | 53,915 | |

| | | | | | |

Total Long-Term Liabilities (5) | | 25,472 | | | 19,408 | | | 18,993 | |

| | | | | | |

Long-Term Debt, Including Current Portion | | 11,032 | | | 7,534 | | | 7,108 | |

| | | | | | |

Net Debt | | 8,292 | | | 4,614 | | | 5,060 | |

| | | | | | |

Cash Returns to Common and Preferred Shareholders | | 3,782 | | | 3,246 | | | 2,798 | |

| Common Shares – Base Dividends | | 1,423 | | | 1,255 | | | 990 | |

Base Dividends Per Common Share ($) | | 0.780 | | | 0.680 | | | 0.525 | |

| Common Shares – Variable Dividends | | — | | | 251 | | | — | |

Variable Dividends Per Common Share ($) | | — | | | 0.135 | | | — | |

| Purchase of Common Shares Under NCIB | | 1,995 | | | 1,445 | | | 1,061 | |

| Payment for Purchase of Warrants | | — | | | — | | | 711 | |

| Dividends Paid on Preferred Shares | | 14 | | | 45 | | | 36 | |

Preferred Share Redemption | | 350 | | | 250 | | | — | |

| | | | | | |

| | | | | | |

(1)Refer to the Operating and Financial Results section of this MD&A for a summary of total upstream production by product type.

(2)Includes results of the MEG Acquisition from November 13, 2025.

(3)Represent Cenovus’s net interest in refining operations. Following the WRB Divestiture, all refining operations are wholly-owned.

(4)Total processed inputs include crude oil and other feedstocks. Blending is excluded.

(5)Non-GAAP financial measure or contains a non-GAAP financial measure. See the Specified Financial Measures Advisory of this MD&A.

(6)Specified financial measure. See the Specified Financial Measures Advisory of this MD&A.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 5 |

| | |

|

OPERATING AND FINANCIAL RESULTS |

Selected Operating and Financial Results — Upstream

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | Percent Change | | | | | | |

| | | | | | 2025 | | | 2024 | | | |

Production Volumes by Segment (1) (MBOE/d) | | | | | | | | | | | | | | | |

Oil Sands (2) | | | | | | | 644.1 | | 5 | | | 610.7 | | | | |

Conventional (3) | | | | | | | 122.8 | | 2 | | | 119.9 | | | | |

Offshore (4) | | | | | | | 67.3 | | 1 | | | 66.6 | | | | |

Total Production Volumes | | | | | | | 834.2 | | 5 | | | 797.2 | | | | |

| | | | | | | | | | | | | | | |

Production Volumes by Product (1) | | | | | | | | | | | | | | | |

Bitumen (Mbbls/d) | | | | | | | 616.8 | | 4 | | | 591.3 | | | | |

Heavy Crude Oil (Mbbls/d) | | | | | | | 25.1 | | 43 | | | 17.6 | | | | |

Light Crude Oil (5) (Mbbls/d) | | | | | | | 18.1 | | 40 | | | 12.9 | | | | |

NGLs (Mbbls/d) | | | | | | | 28.8 | | (10) | | | 32.0 | | | | |

Conventional Natural Gas (MMcf/d) | | | | | | | 872.4 | | 1 | | | 860.2 | | | | |

Total Production Volumes (MBOE/d) | | | | | | | 834.2 | | 5 | | | 797.2 | | | | |

| | | | | | | | | | | | | | | |

Per-Unit Operating Expenses by Segment (6) ($/BOE) | | | | | | | | | | | | | | | |

Oil Sands (2) | | | | | | | 11.81 | | 4 | | | 11.40 | | | | |

Conventional (3) (7) | | | | | | | 9.84 | | (18) | | | 11.99 | | | | |

Offshore (4) (7) | | | | | | | 16.88 | | (12) | | | 19.27 | | | | |

| | | | | | | | | | | | | | | |

Oil and Gas Reserves (8) (MMBOE) | | | | | | | | | | | | | | | |

Total Proved | | | | | | | 6,135 | | 8 | | | 5,664 | | | | |

Probable | | | | | | | 3,472 | | 24 | | | 2,793 | | | | |

| Total Proved Plus Probable | | | | | | | 9,607 | | 14 | | | 8,457 | | | | |

(1)Refer to the Oil Sands, Conventional and Offshore reportable segments section of this MD&A for a summary of production by product type.

(2)For the year ended December 31, 2025, reported Oil Sands segment production and per-unit operating expenses includes results of the MEG Acquisition from November 13, 2025.

(3)For the year ended December 31, 2025, reported Conventional segment production and per-unit operating expenses include Cenovus’s 30 percent equity interest in the Duvernay Energy Corporation (“Duvernay”) joint venture, which is accounted for using the equity method in the Consolidated Financial Statements. Operating expenses for the Conventional segment, excluding our equity interests in the Duvernay joint venture, was $464 million.

(4)Reported Offshore segment production and per-unit operating expenses include Cenovus’s 40 percent equity interest in the Husky-CNOOC Madura Limited (“HCML”) joint venture, which is accounted for using the equity method in the Consolidated Financial Statements. Operating expenses for the Offshore segment, excluding our equity interests in the HCML joint venture, was $349 million (2024 – $423 million).

(5)Light crude oil corresponds to light crude oil and medium crude oil combined as defined by National Instrument 51-101 “Standards of Disclosure for Oil and Gas Activities” (“NI 51-101”). Cenovus does not produce medium crude oil.

(6)Specified financial measure. See the Specified Financial Measures Advisory of this MD&A.

(7)Contains a non-GAAP financial measure. See the Specified Financial Measures Advisory of this MD&A.

(8)Includes values attributable to Cenovus’s 30 percent equity interest in the Duvernay joint venture and Cenovus’s 40 percent equity interest in the HCML joint venture. See the Advisory – Interests in Joint Ventures section of this MD&A.

Production

Total upstream production increased in 2025, compared with 2024, due to:

•Incremental production at Christina Lake following the MEG Acquisition in November 2025 and the ramp-up of production from Narrows Lake.

•Successful results from new well pads at Foster Creek and the completion of the Foster Creek optimization project, which supported additional production.

•Production resuming at the White Rose field following the completion of the SeaRose asset life extension (“ALE”) project.

The increase was partially offset by the temporary shut-in of production at our Rush Lake facilities in our Lloydminster thermal assets, due to a casing failure at a steam injection well that occurred in the second quarter of 2025. In the fourth quarter, we successfully restarted production and the phased ramp-up is progressing as expected.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 6 |

Per-Unit Operating Expenses

For the year ended December 31, 2025, per-unit operating expenses increased in the Oil Sands segment compared with 2024, primarily due to higher fuel costs and higher costs at our Lloydminster thermal assets related to the incident at Rush Lake. Per-unit operating expenses decreased in the Conventional segment primarily due to lower turnaround costs, and processing and gathering costs compared with 2024. Per-unit operating expenses decreased in the Offshore segment compared with 2024, primarily due to higher sales volumes and lower repairs and maintenance expenses as the White Rose field resumed production following the completion of the SeaRose ALE project in the first quarter of 2025.

We continue to focus on controlling costs through securing long-term contracts, working with vendors and purchasing long-lead items to mitigate future cost escalations.

Selected Operating and Financial Results — Downstream

| | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | Percent Change | | |

| | | | | | 2025 | | | 2024 |

Crude Oil Unit Throughput by Segment (Mbbls/d) | | | | | | | | | | | |

Canadian Refining | | | | | | | 110.7 | | 22 | | | 90.5 |

U.S. Refining | | | | | | | 515.9 | | (7) | | | 556.4 |

Total Crude Oil Unit Throughput | | | | | | | 626.6 | | (3) | | | 646.9 | |

| | | | | | | | | | | |

Production Volumes by Product (1) (Mbbls/d) | | | | | | | | | | | |

Gasoline | | | | | | | 266.7 | | (5) | | | 280.5 |

Distillates (2) | | | | | | | 210.5 | | (4) | | | 219.9 |

Synthetic Crude Oil | | | | | | | 52.0 | | 27 | | | 41.0 |

Asphalt | | | | | | | 41.8 | | (5) | | | 44.0 |

Ethanol | | | | | | | 5.0 | | 4 | | | 4.8 |

Other | | | | | | | 111.2 | | 8 | | | 102.9 |

Total Production Volumes | | | | | | | 687.2 | | (1) | | | 693.1 |

| | | | | | | | | | | |

Per-Unit Operating Expenses by Segment (3) ($/bbl) | | | | | | | | | | | |

Canadian Refining | | | | | | | 11.59 | | (49) | | | 22.56 |

U.S. Refining | | | | | | | 12.73 | | (2) | | | 12.99 |

| | | | | | | | | | | |

Per-Unit Operating Expenses – Excluding Turnaround Costs by Segment (3) ($/bbl) | | | | | | | | | | | |

| Canadian Refining | | | | | | | 11.54 | | (25) | | | 15.38 |

| U.S. Refining | | | | | | | 10.88 | | (6) | | | 11.55 |

(1)Refer to the Canadian Refining and U.S. Refining reportable segments section of this MD&A for a summary of production by product type.

(2)Includes diesel and jet fuel.

(3)Specified financial measure. See the Specified Financial Measures Advisory of this MD&A. In the Canadian Refining segment, operating expenses represent expenses associated with the Lloydminster Upgrader (“Upgrader”), the Lloydminster Refinery and the commercial fuels business.

Total downstream throughput and refined product production decreased in 2025. The decrease was primarily due to the WRB Divestiture and the impact of turnarounds completed at our Toledo Refinery and non-operated Wood River and Borger refineries during the year. The decrease in throughput and refined product production was partially offset by our Canadian Refining assets running at, or above, full capacity and ongoing operational improvement initiatives at our operated U.S. Refining assets.

In 2025, per-unit operating expenses excluding turnaround costs decreased in the Canadian Refining segment compared with 2024, due to lower project costs and higher total processed inputs. Total processed inputs were lower and operating expenses were higher in 2024, due to a major turnaround completed at the Upgrader in the second quarter of 2024.

In 2025, per-unit operating expenses excluding turnaround costs decreased in the U.S. Refining segment compared with 2024, primarily due to lower controllable operating expenses, partially offset by higher electricity costs.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 7 |

Selected Consolidated Financial Results

Revenues

Revenues decreased eight percent compared with 2024, primarily due to a weakened commodity price environment combined with lower U.S. Refining sales volumes following the WRB Divestiture. The decrease was partially offset by higher sales volumes from our upstream assets and Canadian Refining segment.

Operating Margin

Operating Margin is a non-GAAP financial measure and is used to provide a consistent measure of the cash-generating performance of our assets for comparability of our underlying financial performance between periods.

| | | | | | | | | | | | | | | | | |

| | | | | |

| ($ millions) | | | | | 2025 | | 2024 | | |

Gross Sales | | | | | | | | | |

| External Sales | | | | | 52,751 | | | 57,726 | | | |

Intersegment Sales | | | | | 8,941 | | | 8,970 | | | |

| | | | | 61,692 | | | 66,696 | | | |

| Royalties | | | | | (3,055) | | | (3,449) | | | |

| Revenues | | | | | 58,637 | | | 63,247 | | | |

| Expenses | | | | | | | | | |

| Purchased Product | | | | | 30,078 | | | 33,926 | | | |

| Transportation and Blending | | | | | 11,243 | | | 11,331 | | | |

| Operating Expenses | | | | | 6,710 | | | 7,159 | | | |

Realized (Gain) Loss on Risk Management | | | | | (2) | | | 22 | | | |

Operating Margin | | | | | 10,608 | | | 10,809 | | | |

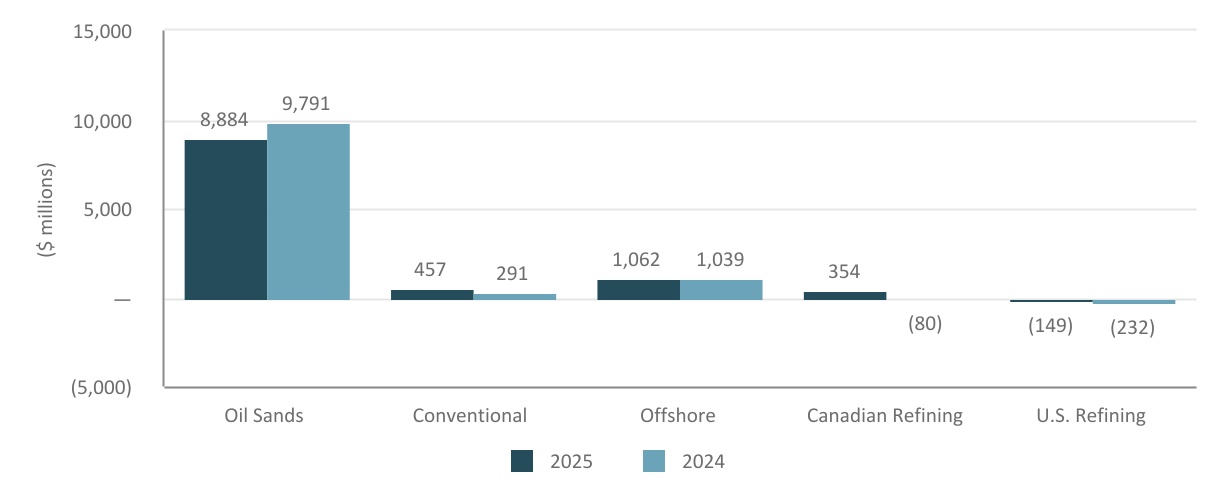

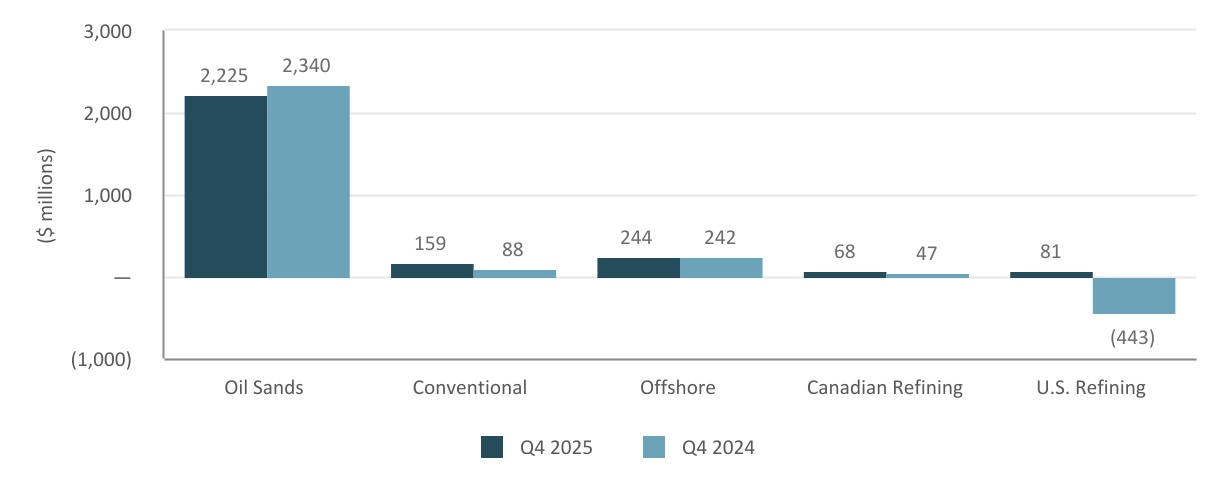

Operating Margin by Segment

Years Ended December 31, 2025 and 2024

Operating Margin decreased compared with 2024, primarily due to:

•Lower Realized Sales Prices impacting revenues in our Oil Sands segment due to lower benchmark WTI prices, partially offset by a narrower WTI-WCS differential.

•Increased operating expenses in our Oil Sands segment due to higher fuel costs and costs related to the incident at Rush Lake.

The decreases were partially offset by:

•The increase in Oil Sands production discussed above, which includes the accretive impact from the MEG Acquisition.

•Lower operating expenses and higher sales volumes in our Canadian Refining segment, as discussed above.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 8 |

Cash From (Used in) Operating Activities and Adjusted Funds Flow

Adjusted Funds Flow is a non-GAAP financial measure commonly used in the oil and gas industry to assist in measuring a company’s ability to finance its capital programs and meet its financial obligations.

| | | | | | | | | | | | | | | | | |

| | | | |

| ($ millions) | | | | | 2025 | | 2024 | | |

| Cash From (Used in) Operating Activities | | | | | 8,228 | | | 9,235 | | | |

| (Add) Deduct: | | | | | | | | | |

Settlement of Decommissioning Liabilities | | | | | (280) | | | (234) | | | |

| Net Change in Non-Cash Working Capital | | | | | (363) | | | 1,305 | | | |

Adjusted Funds Flow | | | | | 8,871 | | | 8,164 | | | |

Adjusted Funds Flow was higher in 2025, compared with 2024, primarily due to lower current tax expense and lower cash-settled long-term incentive costs, partially offset by higher integration, transaction and other costs, and lower Operating Margin.

Cash from operating activities decreased in 2025, compared with 2024, primarily due to changes in non-cash working capital, partially offset by higher Adjusted Funds Flow, as discussed above. The net change in non-cash working capital was primarily due to an increase in accounts receivable, and decreases in accounts payable and income tax payable, partially offset by a decrease in inventories, excluding the impact of the MEG Acquisition and the WRB Divestiture.

Net Earnings (Loss)

Net earnings in 2025 was $3.9 billion (2024 – $3.1 billion). The increase was primarily due to unrealized foreign exchange gains in 2025 compared with losses in 2024, and lower income tax expense, partially offset by higher depreciation, depletion and amortization expense and lower Operating Margin.

Net Debt

| | | | | | | | | | | | | | | | | |

As at December 31, ($ millions) | 2025 | | | | 2024 | | | | |

| Short-Term Borrowings | — | | | | | 173 | | | | | |

| Current Portion of Long-Term Debt | — | | | | | 192 | | | | | |

| Long-Term Portion of Long-Term Debt | 11,032 | | | | | 7,342 | | | | | |

| Total Debt | 11,032 | | | | | 7,707 | | | | | |

| Cash and Cash Equivalents | (2,740) | | | | | (3,093) | | | | | |

Net Debt | 8,292 | | | | | 4,614 | | | | | |

Total Debt and Net Debt increased as at December 31, 2025, primarily due to the receipt of a $2.7 billion term loan facility and the issuance of $2.6 billion of senior unsecured notes. The increase was partially offset by the redemption and repayment of senior unsecured notes totaling $2.3 billion, which includes the US$600 million notes assumed in the MEG Acquisition, and unrealized foreign exchange gains due to the strengthening of the Canadian dollar. The increase in Net Debt was further offset by the receipt of proceeds from the WRB Divestiture.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 9 |

Capital Investment (1)

| | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| ($ millions) | | | | | | 2025 | | 2024 | | |

| Upstream | | | | | | | | | | | |

| Oil Sands | | | | | | | 2,944 | | | 2,714 | | | |

| Conventional | | | | | | | 453 | | | 421 | | | |

| Offshore | | | | | | | 934 | | | 1,145 | | | |

| Total Upstream | | | | | | | 4,331 | | | 4,280 | | | |

| Downstream | | | | | | | | | | | |

| Canadian Refining | | | | | | | 117 | | | 208 | | | |

| U.S. Refining | | | | | | | 442 | | | 488 | | | |

| Total Downstream | | | | | | | 559 | | | 696 | | | |

| Corporate and Eliminations | | | | | | | 17 | | | 39 | | | |

| Total Capital Investment | | | | | | | 4,907 | | | 5,015 | | | |

(1)Includes expenditures on property, plant and equipment (“PP&E”), exploration and evaluation (“E&E”) assets, and capitalized interest. Excludes capital expenditures related to joint ventures accounted for using the equity method in the Consolidated Financial Statements.

Capital investment in 2025 was mainly related to:

•Sustaining, optimization and redevelopment programs in the Oil Sands segment, including the drilling of stratigraphic test wells as part of our integrated winter program.

•The progression of the West White Rose project.

•Growth projects in our Oil Sands segment, including the progression of the drilling program at our Lloydminster conventional heavy oil assets, the Sunrise growth program, the optimization project at Foster Creek and the Narrows Lake tie-back to Christina Lake.

•Reliability and sustaining activities in our refining segments.

•Drilling, completion, tie-in and infrastructure projects in the Conventional segment.

Drilling Activity

| | | | | | | | | | | | | | | | | | | | | | | |

| Net Stratigraphic Test Wells and Observation Wells | | Net Production Wells (1) |

| 2025 | | 2024 | | 2025 | | 2024 |

Foster Creek | 76 | | | 85 | | | 46 | | | 22 | |

Christina Lake (2) | 68 | | | 61 | | | 27 | | | 23 | |

| Sunrise | 21 | | | 40 | | | 11 | | | 14 | |

Lloydminster Thermal | 68 | | | 53 | | | 12 | | | 22 | |

| Lloydminster Conventional Heavy Oil | 2 | | | 19 | | | 83 | | | 49 | |

| | | | | | | |

Other (3) | — | | | — | | | 5 | | | — | |

| 235 | | | 258 | | | 184 | | | 130 | |

(1)Steam-assisted gravity drainage (“SAGD”) well pairs in the Oil Sands segment are counted as a single producing well.

(2)Includes results of the MEG Acquisition from November 13, 2025.

(3)Includes new resource plays.

Stratigraphic test wells were drilled to help identify future well pad locations and to further evaluate our assets. Observation wells were drilled to gather information and monitor reservoir conditions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2025 | | 2024 |

| (net wells) | Drilled | | Completed | | Tied-in | | Drilled | | Completed | | Tied-in |

Conventional (1) | 53 | | | 54 | | | 54 | | | 36 | | | 31 | | | 31 | |

(1)Includes values attributable to Cenovus’s 30 percent equity interest in the Duvernay joint venture.

In the Offshore segment, no wells were drilled or completed in 2025 (2024 – drilled and evaluated one exploration well in China).

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 10 |

| | |

|

COMMODITY PRICES UNDERLYING OUR FINANCIAL RESULTS |

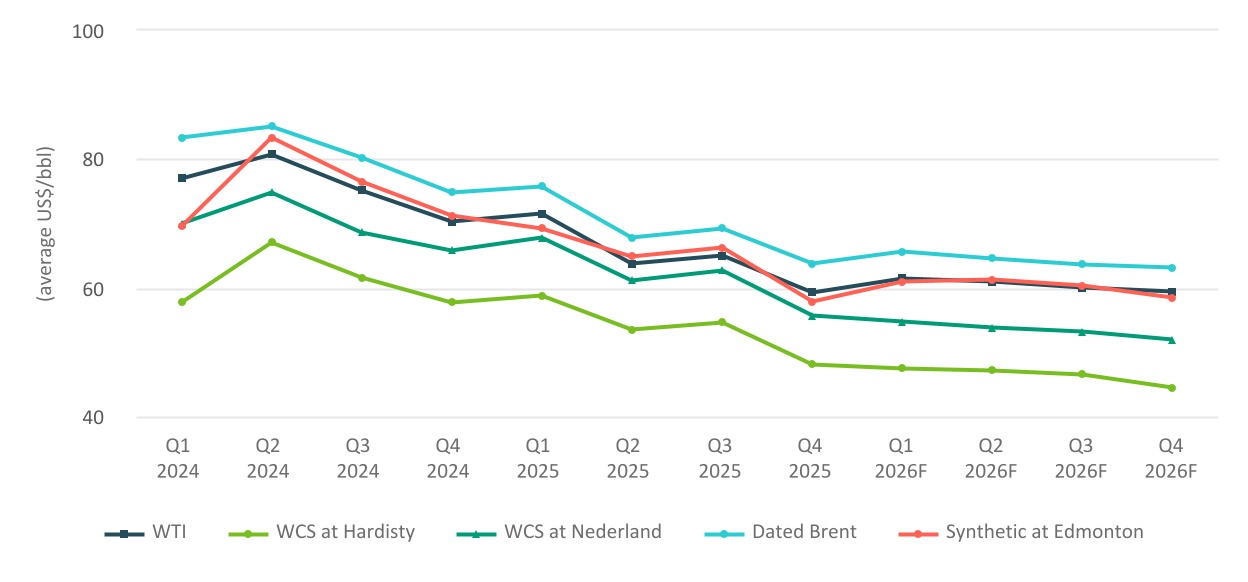

Key performance drivers for our financial results include commodity prices, quality and location price differentials, refined product prices and refining crack spreads, as well as the U.S./Canadian dollar and Chinese Yuan (“RMB”)/Canadian dollar exchange rates. The following table shows selected market benchmark prices and average exchange rates to assist in understanding our financial results.

Selected Benchmark Prices and Exchange Rates (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Year Ended December 31, |

| (Average US$/bbl, unless otherwise indicated) | | | Q4 2025 | | Percent Change | | | | | | | Q4 2024 | | 2025 | | Percent Change | | 2024 |

Dated Brent | | | 63.69 | | | (15) | | | | | | | | 74.69 | | | 69.06 | | | (14) | | | 80.76 | |

| WTI | | | 59.14 | | | (16) | | | | | | | | 70.27 | | | 64.81 | | | (14) | | | 75.72 | |

Differential Dated Brent – WTI | | | 4.55 | | | 3 | | | | | | | | 4.42 | | | 4.25 | | | (16) | | | 5.04 | |

| WCS at Hardisty | | | 47.94 | | | (17) | | | | | | | | 57.71 | | | 53.68 | | | (12) | | | 60.97 | |

Differential WTI – WCS at Hardisty | | | 11.20 | | | (11) | | | | | | | | 12.56 | | | 11.13 | | | (25) | | | 14.75 | |

WCS at Hardisty (C$/bbl) | | | 66.89 | | | (17) | | | | | | | | 80.74 | | | 75.07 | | | (10) | | | 83.52 | |

| WCS at Nederland | | | 55.63 | | | (15) | | | | | | | | 65.69 | | | 61.74 | | | (11) | | | 69.69 | |

Differential WTI – WCS at Nederland | | | 3.51 | | | (23) | | | | | | | | 4.58 | | | 3.07 | | | (49) | | | 6.03 | |

| Condensate (C5 at Edmonton) | | | 57.01 | | | (19) | | | | | | | | 70.66 | | | 63.36 | | | (13) | | | 72.94 | |

Differential Condensate – WTI Premium/(Discount) | | | (2.13) | | | (646) | | | | | | | | 0.39 | | | (1.45) | | | (48) | | | (2.78) | |

Differential Condensate – WCS at Hardisty Premium/(Discount) | | | 9.07 | | | (30) | | | | | | | | 12.95 | | | 9.68 | | | (19) | | | 11.97 | |

Condensate (C$/bbl) | | | 79.54 | | | (20) | | | | | | | | 98.84 | | | 83.63 | | | (16) | | | 99.92 | |

| Synthetic at Edmonton | | | 57.84 | | | (19) | | | | | | | | 71.11 | | | 64.47 | | | (14) | | | 75.07 | |

Differential Synthetic – WTI Premium/(Discount) | | | (1.30) | | | (255) | | | | | | | | 0.84 | | | (0.34) | | | (48) | | | (0.65) | |

Synthetic at Edmonton (C$/bbl) | | | 80.69 | | | (19) | | | | | | | | 99.45 | | | 90.15 | | | (12) | | | 102.83 | |

| Refined Product Prices | | | | | | | | | | | | | | | | | | |

| Chicago Regular Unleaded Gasoline (“RUL”) | | | 70.66 | | | (11) | | | | | | | | 78.95 | | | 80.81 | | | (10) | | | 89.95 | |

| Chicago Ultra-low Sulphur Diesel (“ULSD”) | | | 90.70 | | | 2 | | | | | | | | 89.28 | | | 91.13 | | | (7) | | | 97.47 | |

Refining Benchmarks | | | | | | | | | | | | | | | | | | |

Chicago 3-2-1 Crack Spread (2) | | | 18.20 | | | 50 | | | | | | | | 12.12 | | | 19.44 | | | 16 | | | 16.74 | |

Group 3 3-2-1 Crack Spread (2) | | | 19.25 | | | 52 | | | | | | | | 12.66 | | | 20.63 | | | 23 | | | 16.81 | |

| Renewable Identification Numbers (“RINs”) | | | 6.04 | | | 50 | | | | | | | | 4.02 | | | 5.81 | | | 55 | | | 3.74 | |

Upgrading Differential (3) (C$/bbl) | | | 13.53 | | | (27) | | | | | | | | 18.64 | | | 14.92 | | | (22) | | | 19.21 | |

| Natural Gas Prices | | | | | | | | | | | | | | | | | | |

AECO (4) (C$/Mcf) | | | 2.23 | | | 51 | | | | | | | | 1.48 | | | 1.68 | | | 15 | | | 1.46 | |

NYMEX (5) (US$/Mcf) | | | 3.55 | | | 27 | | | | | | | | 2.79 | | | 3.43 | | | 51 | | | 2.27 | |

| Foreign Exchange Rates | | | | | | | | | | | | | | | | | | |

US$ per C$1 – Average | | | 0.717 | | | — | | | | | | | | 0.715 | | | 0.716 | | | (2) | | | 0.730 | |

US$ per C$1 – End of Period | | | 0.730 | | | 5 | | | | | | | | 0.695 | | | 0.730 | | | 5 | | | 0.695 | |

RMB per C$1 – Average | | | 5.084 | | | (1) | | | | | | | | 5.142 | | | 5.144 | | | (2) | | | 5.255 | |

(1)These benchmark prices are not our Realized Sales Prices and represent approximate values. For our Realized Sales Prices refer to the Netback tables in the upstream reportable segments section of this MD&A.

(2)The average 3-2-1 crack spread is an indicator of the adjusted refining margin and is valued on a last-in, first-out accounting basis.

(3)The upgrading differential is the difference between synthetic crude oil at Edmonton and Lloydminster Blend crude oil at Hardisty. The upgrading differential does not precisely mirror the configuration and the product output of our Canadian Refining assets; however, it is used as a general market indicator.

(4)Alberta Energy Company (“AECO”) 5A natural gas daily index.

(5)New York Mercantile Exchange (“NYMEX”) natural gas monthly index.

Crude Oil and Condensate Benchmarks

In 2025, global crude oil benchmark prices, Brent and WTI, decreased compared with 2024, as global supply exceeded demand leading to inventory builds throughout the year. Global crude oil production increased considerably in 2025 as OPEC+ continued to unwind production cuts, while non-OPEC countries, including the United States, Canada and Brazil, also increased supply. Year-over-year demand growth in 2025 weakened compared with 2024 due to a combination of weaker macroeconomic conditions, trade tensions, and other softer industrial activity in major consuming regions.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 11 |

WTI is an important benchmark for Canadian crude oil since it reflects inland North American crude oil prices, and the Canadian dollar equivalent is the basis for determining royalty rates for a number of our crude oil properties.

WCS is a blended heavy oil which consists of both conventional heavy oil and unconventional diluted bitumen. The WCS at Hardisty differential to WTI is a function of the quality differential of light and heavy crude, and the cost of transport. The WTI-WCS differential at Hardisty narrowed in 2025, compared with 2024, due to:

•The Trans Mountain Pipeline expansion project (“TMX”) increasing market access for WCS crude.

•Low inventory levels in the Western Canadian Sedimentary Basin as well as strong global demand for heavy crudes.

•Strong pricing for fuel oil in which heavy grades yield more versus light grades.

WCS at Nederland is a heavy oil benchmark for sales of our product at the U.S. Gulf Coast (“USGC”). The WTI-WCS at Nederland differential is representative of the heavy oil quality differential and is influenced by global heavy oil refining capacity and global heavy oil supply. In 2025, the WTI-WCS at Nederland differential narrowed compared with 2024, due to strong global demand for heavy crudes, as well as other factors as mentioned above.

In Canada, we upgrade heavy crude oil and bitumen into a sweet synthetic crude oil, the Husky Synthetic Blend (“HSB”), at the Upgrader. The price realized for HSB is primarily driven by the price of WTI, and by the supply and demand of sweet synthetic crude oil from Western Canada, which influences the WTI-Synthetic differential.

In 2025, synthetic crude oil at Edmonton strengthened relative to WTI compared with 2024. The strength in pricing relative to 2024 was a function of deep discounts in the first quarter of 2024 due to high synthetic crude oil production in Alberta and the supply of light crude oil being above pipeline capacity on light crude oil pipelines with limited local storage capacity.

Crude Oil Benchmark Prices (1)

(1)Forward pricing as at February 2, 2026.

Blending condensate with bitumen enables our production to be transported through pipelines. Our blending ratios, calculated as diluent volumes as a percentage of total blended volumes, range from approximately 20 percent to 35 percent. The Condensate-WCS differential is an important benchmark, as a higher premium generally results in a decrease in Operating Margin when selling a barrel of blended crude oil. When the supply of condensate in Alberta does not meet the demand, Edmonton condensate prices may be driven by USGC condensate prices plus the cost to transport the condensate to Edmonton. Our blending costs are also impacted by the timing of purchases and deliveries of condensate into inventory to be available for use in blending, as well as timing of blended product sales.

In 2025, the average Edmonton condensate benchmark traded at a smaller discount to WTI compared with 2024, due to the same factors impacting the synthetic crude oil to WTI differential, as discussed above, as well as tight Canadian supply and low Canadian inventories.

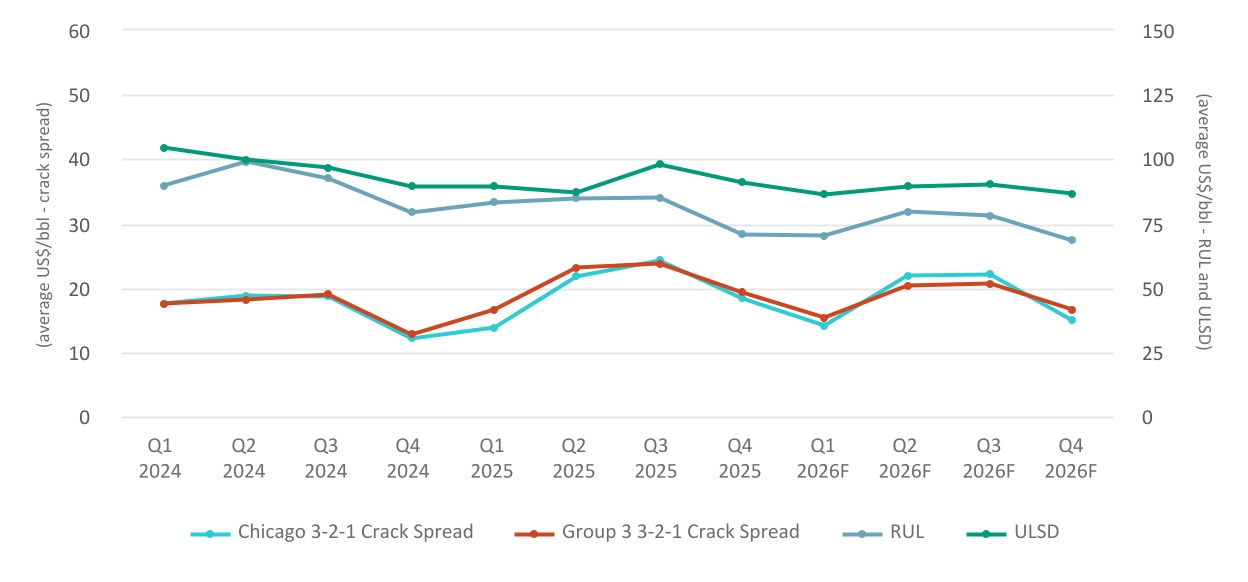

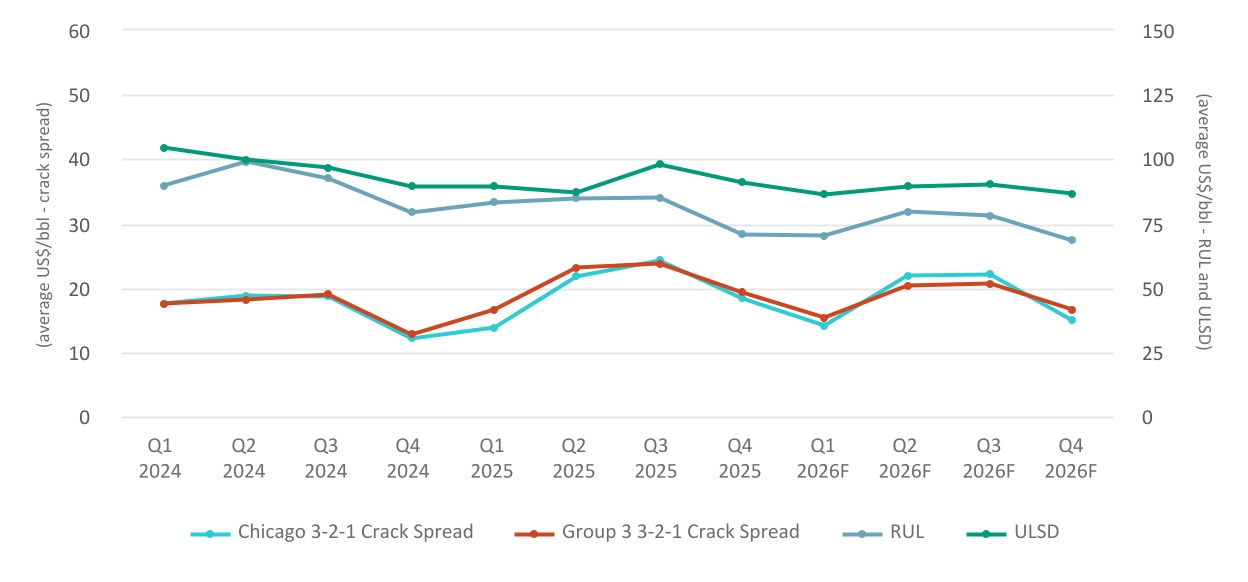

Refining Benchmarks

RUL and ULSD benchmark prices are representative of inland refined product prices and are used to derive the Chicago 3-2-1 market crack spread. The 3-2-1 market crack spread is an indicator of the adjusted refining margin generated by converting three barrels of crude oil into two barrels of regular unleaded gasoline and one barrel of ultra-low sulphur diesel, using current-month WTI-based crude oil feedstock prices and valued on a last-in, first-out basis.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 12 |

In 2025, refined product crack spreads in Chicago and Group 3 increased compared with 2024. The increase can be largely attributed to strong product cracks as unplanned global and North American refinery outages supported refined product pricing and new refining capacity has been slow to ramp up. The average cost of RINs was higher in 2025, compared with 2024, due to weaker U.S. production and imports of renewable diesel and biodiesel causing a decline in RINs generation.

North American refining crack spreads are expressed on a WTI basis, while refined products are generally set by global prices. The strength of refining market crack spreads in the U.S. Midwest and Midcontinent generally reflects the differential between Brent and WTI benchmark prices.

Our adjusted refining margin is affected by various other factors such as the quality and purchase location of crude oil feedstock, refinery configuration and product output. The benchmark market crack spreads do not precisely mirror the configuration and product output of our refineries, or the location we sell product; however, they are used as a general market indicator.

Refined Product Benchmarks (1)

(1)Forward pricing as at February 2, 2026.

Natural Gas Benchmarks

In 2025, AECO prices increased compared with 2024, though not as much as the increase in NYMEX pricing. NYMEX prices increased more than AECO as NYMEX prices were supported by strong liquified natural gas (“LNG”) demand, while AECO prices were impacted by limited Western Canadian takeaway capacity, causing the AECO discount to NYMEX to widen. In 2025, both Western Canadian and U.S. natural gas production increased compared with 2024. The price received for our Asia Pacific natural gas production is largely based on long-term contracts.

Foreign Exchange Benchmarks

Our revenues are subject to foreign exchange exposure as the sales prices of our crude oil, NGLs, natural gas and refined products are determined by reference to U.S. dollar benchmark prices. An increase in the value of the Canadian dollar compared with the U.S. dollar has a negative impact on our reported revenue. In addition to our revenues being denominated in U.S. dollars, a significant portion of our long-term debt is also U.S. dollar denominated. As the Canadian dollar strengthens or weakens, our U.S. dollar debt gives rise to unrealized foreign exchange gains or losses, respectively, when translated to Canadian dollars. Changes in foreign exchange rates also impact the translation of our U.S. and Asia Pacific operations.

In 2025, on average, the Canadian dollar weakened relative to the U.S. dollar compared with 2024, positively impacting our reported revenues and negatively impacting our U.S. Refining operating expenses. A portion of our long-term sales contracts in the Asia Pacific region are priced in RMB. An increase in the value of the Canadian dollar relative to the RMB will decrease the revenues received in Canadian dollars from the sale of natural gas commodities in the region. In 2025, on average, the Canadian dollar weakened relative to RMB, compared with 2024, positively impacting our reported revenues.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 13 |

Interest Rate Benchmarks

Our interest income, short-term and floating rate borrowing costs, reported decommissioning liabilities and fair value measurements are impacted by fluctuations in interest rates. A change in interest rates could change our net finance costs, affect how certain liabilities are measured, and impact our cash flow and financial results.

As at December 31, 2025, the Bank of Canada’s policy interest rate was 2.25 percent. On January 28, 2026, the Bank of Canada held the policy interest rate at 2.25 percent.

Commodity Price Outlook

Global crude oil prices softened in 2025 as supply growth outpaced demand following the unwinding of OPEC+ voluntary cuts. Entering 2026, markets remain oversupplied, but price direction is uncertain and subject to volatility driven by policy decisions and geopolitical developments. OPEC+ policy continues to remain crucial to global oil supply and demand balances, and prices. Sanctions on Russian and Iranian crude and refined products have introduced persistent logistical challenges and altered trade flows globally. Policies regarding these regions will continue to be key factors that will drive energy supply. Policy and sanction uncertainty related to Venezuelan crude exports continues to influence global heavy crude oil supply and trade flows.

The global trade war and ongoing geopolitical tensions have the potential to reduce global GDP growth and oil demand, while increasing recessionary risks; however, the actual effects have been less pronounced than expected, and repeated pauses to tariffs have limited the direct economic impacts. There is potential for heightened price volatility across all commodities to continue until there is a firm resolution on the duration and magnitude of tariffs.

In addition to the above, our commodity pricing outlook for the next 12 months is influenced by the following:

•OPEC+ policy and the pace at which OPEC+ unwinds production cuts.

•In the near-term, there is a higher risk of a tariff-induced global economic slowdown that could slow oil demand.

•We expect the WTI-WCS at Hardisty differential will remain largely tied to global supply factors and heavy crude oil processing capacity, as long as supply does not exceed Canadian crude oil export capacity.

•Refined product prices and market crack spreads are likely to continue to fluctuate, adjusting for seasonal trends and refinery utilization in North America and globally.

•AECO and NYMEX natural gas prices are expected to remain volatile. The prospect of new LNG facilities in the U.S. and Canada coming into service or ramping up in the next year could increase demand and support North American natural gas prices. Weather will also continue to be a key driver of demand and impact prices.

•We expect the Canadian dollar to continue to be impacted by the pace at which the U.S. Federal Reserve Board and the Bank of Canada raise or lower benchmark lending rates relative to each other, the U.S. Administration’s policies toward Canada-U.S. trade, crude oil prices and emerging macro-economic factors.

Most of our upstream crude oil and downstream refined product production is exposed to movements in the WTI crude oil price. Our integrated upstream and downstream operations help us to mitigate the impact of commodity price volatility. Crude oil production in our upstream assets is blended with condensate and butane and is used as crude oil feedstock at our downstream refining operations. Condensate extracted from our blended crude oil is sold back to our Oil Sands segment.

Our refining capacity is primarily focused in the U.S. Midwest, along with smaller exposures in the USGC and Alberta, exposing us to market crack spreads in these markets. We will continue to monitor market fundamentals and optimize run rates at our refineries accordingly.

Our exposure to crude oil differentials includes light-heavy and light-medium price differentials. The light-medium price differential exposure is focused on light-medium crudes in the U.S. Midwest market region where we have the majority of our refining capacity, and to a lesser degree, in the USGC and Alberta. Our exposure to light-heavy crude oil price differentials is composed of a global light-heavy component, a regional component in markets we transport barrels to, as well as the Alberta differentials, which could be subject to transportation constraints.

While we expect to see volatility in crude oil prices, we have the ability to partially mitigate the impact of crude oil and refined product differentials through the following:

•Transportation commitments and arrangements – using our existing firm service commitments for takeaway capacity and supporting transportation projects that move crude oil from our production areas to consuming markets, including tidewater markets.

•Integration – heavy oil refining capacity allows us to capture value from both the WTI-WCS differential for Canadian crude oil and spreads on refined products.

•Monitoring market fundamentals and optimizing run rates at our refineries accordingly.

•Traditional crude oil storage tanks in various geographic locations.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 14 |

Key Priorities for 2026

Our 2026 priorities are focused on top-tier safety performance, integration of MEG, maintaining and growing our competitive advantages in our heavy oil value chain, advancing our major projects and progressing our sustainability initiatives, while continuing to focus on cost leadership and balancing shareholder returns with deleveraging.

Top-tier Safety Performance

Safe and reliable operations are our number one priority. We strive to ensure safe and reliable operations across our portfolio, and aim to be best-in-class operators for each of our major assets and businesses.

Integration of MEG

The MEG Acquisition is expected to further strengthen our oil sands assets by integrating top-tier adjacent assets at Christina Lake. In 2026, we plan to complete a fully integrated development plan for Christina Lake intended to increase production, reduce costs and capture synergies across the combined asset.

Heavy Oil Value Chain

Our heavy oil value chain includes all of our bitumen and heavy oil producing, midstream and pipeline-connected downstream assets. Across the value chain, we will focus on increasing our optionality, optimizing our working capital, improving our margins and reducing our break-even pricing.

Project Execution

Investing in future growth and profitability is a priority for us with several key projects underway, including the West White Rose project, the Amine Claus project at Foster Creek, the Christina Lake North expansion project, the Sunrise growth program and development of our Lloydminster assets.

Downstream Competitiveness

A competitive, reliable downstream business is essential to our integrated business. It allows us to be agile in our response to fluctuating demand for refined products and serves as a natural partial hedge to heavy oil differentials.

We will continue to implement operational improvements to our downstream assets to maximize the long-term profitability of our assets.

Returns to Shareholders

Maintaining a strong balance sheet with the resilience to withstand price volatility and capitalize on opportunities throughout the commodity price cycle is a key element of Cenovus’s capital allocation framework. Upon closing of the MEG Acquisition, we adjusted our shareholder returns framework to balance deleveraging with shareholder returns. Our long-term Net Debt target of $4.0 billion remains unchanged and the adjusted framework allows us to make progress towards this target. For further details, see the Liquidity and Capital Resources section of this MD&A.

Cost Leadership

We aim to maximize shareholder value through a continued focus on low-cost structures and margin optimization across our business. We are focused on reducing operating, capital, and general and administrative costs, realizing the full value of our integrated strategy, while making decisions that support long-term value for Cenovus.

Sustainability

Sustainability is central to Cenovus’s culture. We have established goals in our sustainability focus areas and we continue to advance work to support progress against these commitments.

The Government of Canada and the Government of Alberta have announced a framework aimed at strengthening federal-provincial collaboration in the energy sector to support a number of overlapping goals, including Canada’s greenhouse gas (“GHG”) emissions reduction ambitions. We continue to support our commitment to the Pathways Alliance, including efforts to reach agreements with the federal and provincial governments that provide sufficient fiscal and regulatory support to progress large-scale carbon capture projects, while maintaining global competitiveness.

Cenovus’s updated social commitments and 2024 Corporate Social Responsibility report, highlighting our performance in safety, Indigenous reconciliation, and acceptance and belonging, are available on our website at cenovus.com.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 15 |

2026 Corporate Guidance

Our 2026 corporate guidance dated December 10, 2025, is available on our website at cenovus.com.

Our 2026 corporate guidance for total capital investment is between $5.0 billion and $5.3 billion. This includes $3.5 billion to $3.6 billion directed towards sustaining capital to maintain base production and support continued safe and reliable operations, and between $1.2 billion and $1.4 billion of investment directed towards growth projects, such as:

•The Christina Lake North expansion project.

•The drilling program and ramping-up of production at the West White Rose field.

•The Sunrise growth program and the development of our Lloydminster assets.

The following table is a sub-set of our full updated guidance for 2026:

| | | | | | | | | | | | | | | | | |

| Capital Investment ($ millions) | | Production (MBOE/d) | | Crude Oil Unit Throughput (Mbbls/d) |

| Upstream | | | | | |

| Oil Sands | 3,500 - 3,600 | | 755 - 780 | | |

| Conventional | 450 - 500 | | 120 - 125 | | |

| Offshore | 450 - 500 | | 70 - 80 | | |

Upstream Total | 4,400 - 4,600 | | 945 - 985 | | |

| | | | | |

Downstream | | | | | |

Canadian Refining | | | | | 105 - 110 |

U.S. Refining | | | | | 325 - 340 |

Downstream Total | 600 - 700 | | | | 430 - 450 |

| | | | | |

| Corporate and Eliminations | Up to 25 | | | | |

Our Operations

The Company operates through the following reportable segments:

Upstream Segments

•Oil Sands, includes the development and production of bitumen and heavy oil in northern Alberta and Saskatchewan. Cenovus’s oil sands assets include Foster Creek, Sunrise, Lloydminster thermal and Lloydminster conventional heavy oil assets, as well as Christina Lake, which includes the results of the MEG Acquisition completed in November 2025. Cenovus jointly owns and operates pipeline gathering systems and terminals through the equity-accounted investment in Husky Midstream Limited Partnership (“HMLP”). The sale and transportation of Cenovus’s production and third-party commodity trading volumes are managed and marketed through access to capacity on third-party pipelines and storage facilities in both Canada and the U.S. to optimize product mix, delivery points, transportation commitments and customer diversification.

•Conventional, includes assets rich in NGLs and natural gas in Alberta and British Columbia in the Edson, Clearwater and Rainbow Lake operating areas, in addition to the Northern Corridor, which includes Elmworth and Wapiti. The segment also includes interests in numerous natural gas processing facilities. Cenovus’s NGLs and natural gas production is marketed and transported, with additional third-party commodity trading volumes, through access to capacity on third-party pipelines, export terminals and storage facilities. These provide flexibility for market access to optimize product mix, delivery points, transportation commitments and customer diversification.

•Offshore, includes offshore operations, exploration and development activities in the east coast of Canada and the Asia Pacific region, representing China and the equity-accounted investment in HCML, which is engaged in the exploration for, and production of, NGLs and natural gas in offshore Indonesia.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 16 |

Downstream Segments

•Canadian Refining, includes the owned and operated Lloydminster upgrading and asphalt refining complex, which converts heavy oil and bitumen into synthetic crude oil, diesel, asphalt and other ancillary products. Cenovus also owns and operates the Bruderheim crude-by-rail terminal and two ethanol plants. The Company’s commercial fuels business across Canada is included in this segment. Cenovus markets its production and third-party commodity trading volumes in an effort to use its integrated network of assets to maximize value.

•U.S. Refining, includes the refining of crude oil to produce gasoline, diesel, jet fuel, asphalt and other products at the wholly-owned Lima, Superior and Toledo refineries. On September 30, 2025, Cenovus divested its entire 50 percent interest in the jointly-owned Wood River and Borger refineries held through WRB with operator Phillips 66. The U.S. Refining segment included the WRB results up to the date of divestiture. Cenovus markets its own and third-party refined products.

Corporate and Eliminations

Corporate and Eliminations, includes Cenovus-wide costs for general and administrative, financing activities, gains and losses on risk management for corporate-related derivative instruments and foreign exchange. Eliminations include adjustments for feedstock and internal usage of crude oil, natural gas, condensate, other NGLs and refined products between segments; transloading services provided to the Oil Sands segment by the Company’s crude-by-rail terminal; the sale of condensate extracted from blended crude oil production in the Canadian Refining segment and sold to the Oil Sands segment; and unrealized profits in inventory. Eliminations are recorded based on market prices.

UPSTREAM

Oil Sands

In 2025, we:

•Delivered safe and reliable operations, including the safe execution of turnarounds at Foster Creek and Sunrise.

•Completed the MEG Acquisition, which immediately contributed to our Christina Lake results.

•Produced 644.1 thousand BOE per day (2024 – 610.7 thousand BOE per day).

•Generated Operating Margin of $8.9 billion (2024 – $9.8 billion).

•Averaged a Netback of $38.37 per barrel (2024 – $44.88 per barrel).

•Invested capital of $2.9 billion for sustaining activities and growth projects.

In 2025, we completed the Narrows Lake tie-back to Christina Lake and ramped-up production. All major process units at the Foster Creek optimization project were brought online and the project was completed ahead of schedule, supporting incremental production. At Sunrise, we brought new well pads online to support continued production growth. At our Lloydminster conventional heavy oil assets, we made progress on our heavy oil development program.

Financial Results

| | | | | | | | | | | | | | | | | |

| | | | | |

| ($ millions) | | | | | 2025 | | 2024 | | |

| Gross Sales | | | | | | | | | |

External Sales | | | | | 21,541 | | | 21,857 | | | |

Intersegment Sales | | | | | 6,786 | | | 6,590 | | | |

| | | | | 28,327 | | | 28,447 | | | |

| Royalties | | | | | (2,920) | | | (3,274) | | | |

| Revenues | | | | | 25,407 | | | 25,173 | | | |

| Expenses | | | | | | | | | |

| Purchased Product | | | | | 2,886 | | | 1,851 | | | |

| Transportation and Blending | | | | | 10,875 | | | 11,000 | | | |

Operating | | | | | 2,754 | | | 2,511 | | | |

| Realized (Gain) Loss on Risk Management | | | | | 8 | | | 20 | | | |

| Operating Margin | | | | | 8,884 | | | 9,791 | | | |

Unrealized (Gain) Loss on Risk Management | | | | | 3 | | | (16) | | | |

| Depreciation, Depletion and Amortization | | | | | 3,433 | | | 3,117 | | | |

| Exploration Expense | | | | | 11 | | | 2 | | | |

| (Income) Loss from Equity-Accounted Affiliates | | | | | (38) | | | (14) | | | |

| Segment Income (Loss) | | | | | 5,475 | | | 6,702 | | | |

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 17 |

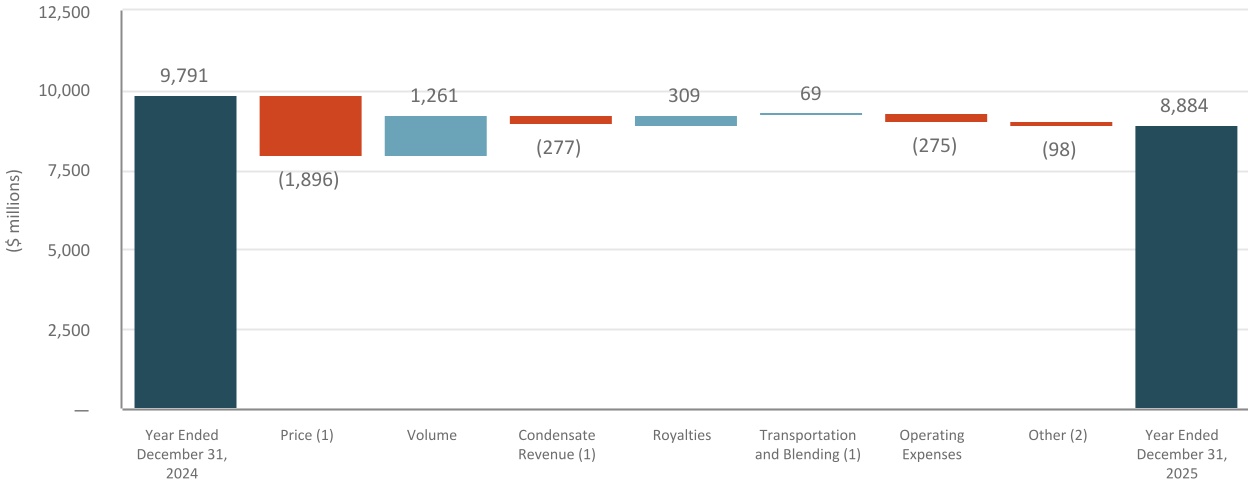

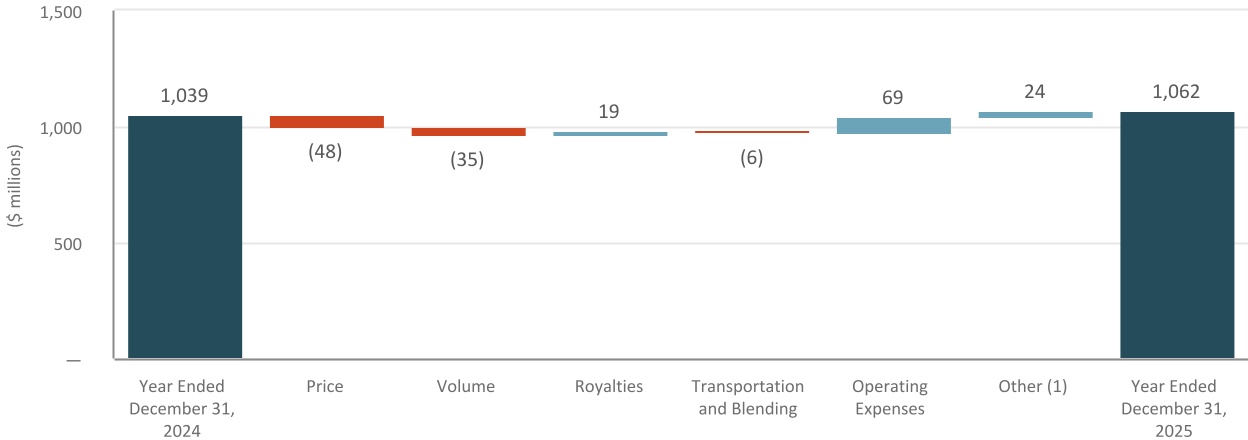

Operating Margin Variance

Year Ended December 31, 2025

(1)Reported revenues include the value of condensate sold as heavy oil blend. Condensate costs are recorded in transportation and blending expenses. The crude oil price excludes the impact of condensate purchases. Changes to price include the impact of realized risk management gains and losses.

(2)Includes third-party sourced volumes, construction and other activities not attributable to the production of crude oil or natural gas.

Operating Results

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | 2025 | | 2024 | | | | | |

Total Sales Volumes (1) (MBOE/d) | | | | | 644.7 | | | 599.5 | | | | | | |

| | | | | | | | | | | | |

Crude Oil Production by Asset (Mbbls/d) | | | | | | | | | | | | |

| Foster Creek | | | | | 206.1 | | | 196.0 | | | | | | |

Christina Lake (2) | | | | | 254.3 | | | 234.2 | | | | | | |

Sunrise | | | | | 53.8 | | | 49.6 | | | | | | |

| Lloydminster Thermal | | | | | 102.6 | | | 111.5 | | | | | | |

| Lloydminster Conventional Heavy Oil | | | | | 25.1 | | | 17.6 | | | | | | |

Total Crude Oil Production (3) (Mbbls/d) | | | | | 641.9 | | | 608.9 | | | | | | |

Natural Gas (1) (MMcf/d) | | | | | 13.8 | | | 11.1 | | | | | | |

Total Production (MBOE/d) | | | | | 644.1 | | | 610.7 | | | | | | |

| | | | | | | | | | | | |

Netback (4) ($/bbl) | | | | | | | | | | | | |

Realized Sales Price | | | | | 72.07 | | | 80.20 | | | | | | |

Royalties | | | | | 12.61 | | | 14.92 | | | | | | |

Transportation and Blending | | | | | 9.28 | | | 9.00 | | | | | | |

Operating | | | | | 11.81 | | | 11.40 | | | | | | |

Total Netback ($/bbl) | | | | | 38.37 | | | 44.88 | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1)Bitumen, heavy crude oil and natural gas. Natural gas is a conventional natural gas product type.

(2)Includes results of the MEG Acquisition from November 13, 2025.

(3)Crude oil production is primarily bitumen, except for Lloydminster conventional heavy oil, which is heavy crude oil.

(4)Contains a non-GAAP financial measure. See the Specified Financial Measures Advisory of this MD&A.

Revenues

Gross sales were relatively consistent in 2025 compared with 2024, due to lower Realized Sales Prices, offset by higher sales volumes.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 18 |

Price

Our bitumen and heavy oil production must be blended with condensate to reduce its viscosity in order to transport it to market through pipelines. Within our Netback calculations, our realized bitumen and heavy oil sales price excludes the impact of purchased condensate; however, it is influenced by the price of condensate. As the cost of condensate used for blending increases relative to the price of blended crude oil or our blend ratio increases, our realized bitumen and heavy oil sales price decreases.

Our Realized Sales Price decreased in 2025 compared with 2024, mainly due to a lower WTI benchmark price, partially offset by a narrower WTI-WCS differential.

Cenovus makes storage and transportation decisions to use our marketing and transportation infrastructure, including storage and pipeline assets, in order to optimize product mix, delivery points, transportation commitments and customer diversification. To price protect our inventories associated with storage or transport decisions, Cenovus may employ various price alignment and volatility management strategies, including risk management contracts, to reduce volatility in future cash flows and improve cash flow stability.

In 2025, approximately 37 percent (2024 – 33 percent) of our sales volumes were sold at destinations outside of Alberta and approximately 25 percent (2024 – 20 percent) of our sales volumes were sold to our downstream operations.

Production Volumes

Oil Sands crude oil production increased in 2025, compared with 2024, primarily due to:

•Incremental production at Christina Lake following the MEG Acquisition in November 2025 and the ramp-up of production from Narrows Lake.

•Successful results from new well pads at Foster Creek and the completion of the Foster Creek optimization project, which supported additional production.

•Strong base production and additional volumes from new development wells at our Lloydminster conventional heavy oil assets.

The increase was partially offset by the temporary shut-in of production at our Rush Lake facilities following an incident in the second quarter of 2025.

Royalties

Royalty calculations for our Oil Sands segment are based on government prescribed royalty regimes in Alberta and Saskatchewan.

In Alberta, oil sands royalties are based on government prescribed pre- and post-payout royalty rates, which are determined on a sliding scale using the Canadian dollar equivalent WTI benchmark price.

Royalties for a pre-payout project are based on a monthly calculation that applies a royalty rate (ranging from one percent to nine percent, based on the Canadian dollar equivalent WTI benchmark price) to the gross revenues from the project. Sunrise is a pre-payout project.

Royalties for a post-payout project are based on an annualized calculation which uses the greater of: (1) the gross revenues multiplied by the applicable royalty rate (one percent to nine percent, based on the Canadian dollar equivalent WTI benchmark price); or (2) the net revenues of the project multiplied by the applicable royalty rate (25 percent to 40 percent, based on the Canadian dollar equivalent WTI benchmark price). Gross revenues are a function of sales revenues less diluent costs and transportation costs. Net revenues are calculated as sales revenues less diluent costs, transportation costs, and allowed operating and capital costs.

In Saskatchewan, royalty calculations are based on an annual rate that is applied to each project, which includes each project's Crown and freehold split. For Crown royalties, the pre-payout calculation is based on one percent of product revenues and the post-payout calculation is based on 20 percent of operating margin. The freehold calculation is limited to post-payout projects and is based on an eight percent rate.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 19 |

Effective Royalty Rate (1)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Percent | | | | | 2025 | | 2024 | | | | | |

| Foster Creek | | | | | 22.5 | | | 24.0 | | | | | | |

| Christina Lake | | | | | 25.3 | | | 27.3 | | | | | | |

Sunrise | | | | | 6.2 | | | 6.1 | | | | | | |

Lloydminster (2) | | | | | 12.2 | | | 11.7 | | | | | | |

| Total Effective Royalty Rate | | | | | 20.0 | | | 21.0 | | | | | | |

(1)Effective royalty rates are equal to royalty expense divided by product revenue, net of transportation expenses, excluding realized (gain) loss on risk management.

(2)Composed of Lloydminster thermal and Lloydminster conventional heavy oil assets.

In 2025, Oil Sands royalties decreased compared with 2024, mainly due to lower realized pricing, partially offset by higher sales volumes. The Oil Sands effective royalty rate decreased, primarily due to lower realized prices and lower Alberta sliding scale oil sands royalty rates, combined with annual adjustments in 2025.

Expenses

Transportation and Blending

In 2025, blending expenses decreased compared with 2024, primarily due to lower condensate prices, partially offset by higher sales volumes.

In 2025, transportation expenses and per-unit transportation expenses increased compared with 2024, primarily due to higher sales volumes on TMX and increased pipeline transportation rates on shipments to U.S. destinations, partially offset by lower sales volumes at U.S. destinations.

Per-Unit Transportation Expenses (1)

| | | | | | | | | | | | | | | | | |

| | | | | |

| ($/bbl) | | | | | 2025 | | 2024 | | |

Foster Creek | | | | | 14.36 | | | 13.57 | | | |

Christina Lake | | | | | 6.86 | | | 6.53 | | | |

Sunrise | | | | | 15.42 | | | 16.07 | | | |

Lloydminster (2) | | | | | 3.23 | | | 3.95 | | | |

Total Oil Sands | | | | | 9.28 | | | 9.00 | | | |

(1)Specified financial measure. See the Specified Financial Measures Advisory of this MD&A.

(2)Includes Lloydminster thermal and Lloydminster conventional heavy oil assets.

At Foster Creek, per-unit transportation expenses increased primarily due to higher sales volumes sold at West Coast destinations through the use of TMX, increasing to 32 percent (2024 – 20 percent), partially offset by lower rail costs. In 2025, our sales volumes to U.S. destinations were relatively consistent at 36 percent, compared with 37 percent in 2024.

At Christina Lake, per-unit transportation expenses increased primarily due to higher pipeline rates and higher sales volumes at West Coast destinations through the use of TMX, which increased to one percent, compared with no sales volumes in 2024. In 2025, our sales volumes to U.S. destinations were relatively consistent at 17 percent, compared with 18 percent in 2024.

At Sunrise, per-unit transportation expenses decreased primarily due to lower sales volumes at U.S. destinations, partially offset by higher use of TMX. In 2025, 36 percent of our sales volumes were sold at U.S. destinations (2024 – 67 percent) and 51 percent of our sales volumes were sold at West Coast destinations (2024 – 18 percent).

At Lloydminster, per-unit transportation expenses decreased primarily due to sales volumes at U.S. destinations decreasing to one percent compared with three percent in 2024.

Operating

Primary drivers of our operating expenses in 2025 were fuel, repairs and maintenance, and workforce. Total operating expenses in 2025 increased compared with 2024, primarily due to higher fuel costs and higher costs at our Lloydminster thermal assets related to the incident at Rush Lake.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 20 |

Per-Unit Operating Expenses (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

($/bbl) | | | | | | | 2025 | | Percent

Change | | 2024 | | | | |

| Foster Creek | | | | | | | | | | | | | | | |

Fuel | | | | | | | 2.12 | | | 1 | | | 2.10 | | | | | |

Non-Fuel | | | | | | | 7.64 | | | (2) | | | 7.77 | | | | | |

Total | | | | | | | 9.76 | | | (1) | | | 9.87 | | | | | |

| Christina Lake | | | | | | | | | | | | | | | |

| Fuel | | | | | | | 2.23 | | | 7 | | | 2.09 | | | | | |

| Non-Fuel | | | | | | | 5.98 | | | (9) | | | 6.54 | | | | | |

Total | | | | | | | 8.21 | | | (5) | | | 8.63 | | | | | |

| Sunrise | | | | | | | | | | | | | | | |

| Fuel | | | | | | | 3.68 | | | 27 | | | 2.89 | | | | | |

| Non-Fuel | | | | | | | 13.85 | | | 21 | | | 11.47 | | | | | |

Total | | | | | | | 17.53 | | | 22 | | | 14.36 | | | | | |

Lloydminster (2) | | | | | | | | | | | | | | | |

| Fuel | | | | | | | 2.98 | | | 9 | | | 2.74 | | | | | |

| Non-Fuel | | | | | | | 17.03 | | | 15 | | | 14.78 | | | | | |

Total | | | | | | | 20.01 | | | 14 | | | 17.52 | | | | | |

| | | | | | | | | | | | | | | |

| Total Oil Sands | | | | | | | | | | | | | | | |

| Fuel | | | | | | | 2.46 | | | 7 | | | 2.30 | | | | | |

| Non-Fuel | | | | | | | 9.35 | | | 3 | | | 9.10 | | | | | |

| Total | | | | | | | 11.81 | | | 4 | | | 11.40 | | | | | |

(1)Specified financial measure. See the Specified Financial Measures Advisory of this MD&A.

(2)Includes Lloydminster thermal and Lloydminster conventional heavy oil assets.

Per-unit fuel expenses increased in 2025, compared with 2024, due to higher AECO benchmark pricing and increased consumption volumes from well pads coming online at our Sunrise assets.

Foster Creek per-unit non-fuel costs decreased slightly in 2025, compared with 2024, primarily due to higher sales volumes, partially offset by higher turnaround costs in the second quarter of 2025.

Christina Lake per-unit non-fuel costs decreased in 2025, primarily due to higher sales volumes and lower turnaround expenses, compared with 2024.

Sunrise per-unit non-fuel costs increased in 2025, compared with 2024, primarily due to turnaround activities in the second and third quarters of 2025, partially offset by higher sales volumes.

Lloydminster per-unit non-fuel costs increased in 2025, compared with 2024, due to higher costs related to the Rush Lake incident in the second quarter of 2025.

Conventional

In 2025, we:

•Delivered safe and reliable operations.

•Produced 122.8 thousand BOE per day (2024 – 119.9 thousand BOE per day).

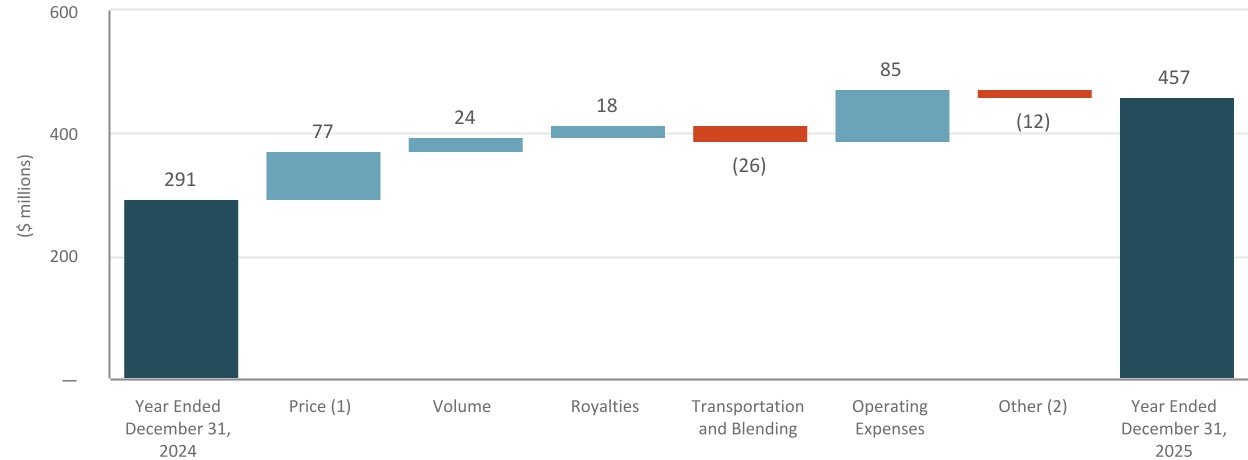

•Generated Operating Margin of $457 million, an increase of $166 million from 2024.

•Earned a Netback of $10.37 per BOE (2024 – $6.48 per BOE).

•Invested capital of $453 million, primarily related to drilling, completion, tie-in and infrastructure projects.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 21 |

Financial Results

| | | | | | | | | | | | | | | | | |

| | | | | |

| ($ millions) | | | | | 2025 | | 2024 | | |

| | | | | | | | | |

| Gross Sales | | | | | | | | | |

External Sales | | | | | 1,305 | | | 1,211 | | | |

Intersegment Sales | | | | | 1,355 | | | 1,848 | | | |

| | | | | 2,660 | | | 3,059 | | | |

| Royalties | | | | | (55) | | | (76) | | | |

| Revenues | | | | | 2,605 | | | 2,983 | | | |

| Expenses | | | | | | | | | |

| Purchased Product | | | | | 1,337 | | | 1,823 | | | |

Transportation and Blending | | | | | 351 | | | 320 | | | |

| Operating | | | | | 464 | | | 555 | | | |

| Realized (Gain) Loss on Risk Management | | | | | (4) | | | (6) | | | |

| Operating Margin | | | | | 457 | | | 291 | | | |

Unrealized (Gain) Loss on Risk Management | | | | | (4) | | | 4 | | | |

| Depreciation, Depletion and Amortization | | | | | 479 | | | 442 | | | |

| Exploration Expense | | | | | 22 | | | 1 | | | |

| (Income) Loss From Equity-Accounted Affiliates | | | | | — | | | 2 | | | |

| Segment Income (Loss) | | | | | (40) | | | (158) | | | |

Operating Margin Variance

Year Ended December 31, 2025

(1)Changes to price include the impact of realized risk management gains and losses.

(2)Includes reclassification of costs primarily related to third-party cogeneration, processing and transportation.

| | | | | |

| Cenovus Energy Inc. – 2025 Management's Discussion and Analysis | 22 |

Operating Results

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | 2025 | | 2024 | | |

Total Sales Volumes (1) (MBOE/d) | | | | | 122.8 | | | 119.9 | | | |

| | | | | | | | | |

Realized Sales Price (1) (2) ($/BOE) | | | | | | | | | |

Light Crude Oil ($/bbl) | | | | | 78.50 | | | 92.68 | | | |

NGLs ($/bbl) | | | | | 51.83 | | | 54.62 | | | |

Conventional Natural Gas ($/Mcf) | | | | | 3.13 | | | 2.51 | | | |

| | | | | | | | | |

Production by Product (1) | | | | | | | | | |

Light Crude Oil (Mbbls/d) | | | | | 5.0 | | | 4.9 | | | |

NGLs (Mbbls/d) | | | | | 21.2 | | | 21.0 | | | |

Conventional Natural Gas (MMcf/d) | | | | | 579.3 | | | 563.8 | | | |

Total Production (MBOE/d) | | | | | 122.8 | | 119.9 | | |

| | | | | | | | | |

Conventional Natural Gas Production (percentage of total) | | | | | 79 | | | 78 | | | |

Crude Oil and NGLs Production (percentage of total) | | | | | 21 | | | 22 | | | |

| | | | | | | | | |

Effective Royalty Rate (1) (3) (percent) | | | | | 8.0 | | | 10.3 | | | |

| | | | | | | | | |

Netback (1) (2) ($/BOE) | | | | | | | | | |

Realized Sales Price | | | | | 26.95 | | | 25.18 | | | |

Royalties | | | | | 1.30 | | | 1.73 | | | |

Transportation and Blending | | | | | 5.44 | | | 4.98 | | | |

Operating | | | | | 9.84 | | | 11.99 | | | |

Total Netback ($/BOE) | | | | | 10.37 | | | 6.48 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(1)For the year ended December 31, 2025, reported production volumes, sales volumes, associated per-unit values and effective royalty rates include Cenovus’s 30 percent equity interest in the Duvernay joint venture.

(2)Contains a non-GAAP financial measure. See the Specified Financial Measures Advisory of this MD&A.

(3)Effective royalty rates are equal to royalty expense divided by product revenue, net of transportation expenses, excluding realized (gain) loss on risk management.

Revenues

Gross sales decreased in 2025, compared with 2024, due to lower commodity trading volumes sourced from third parties, partially offset by higher Realized Sales Prices and sales volumes.

Price