Please wait

0001477449falseDEF 14Aiso4217:USD00014774492024-01-012024-12-310001477449tdoc:GorevicMember2024-01-012024-12-310001477449tdoc:MurthyMember2024-01-012024-12-310001477449tdoc:DivitaMember2024-01-012024-12-310001477449tdoc:GorevicMember2023-01-012023-12-3100014774492023-01-012023-12-310001477449tdoc:GorevicMember2022-01-012022-12-3100014774492022-01-012022-12-310001477449tdoc:GorevicMember2021-01-012021-12-3100014774492021-01-012021-12-310001477449tdoc:GorevicMember2020-01-012020-12-3100014774492020-01-012020-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembertdoc:GorevicMember2024-01-012024-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembertdoc:GorevicMember2023-01-012023-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembertdoc:GorevicMember2022-01-012022-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembertdoc:GorevicMember2021-01-012021-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembertdoc:GorevicMember2020-01-012020-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembertdoc:GorevicMember2024-01-012024-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembertdoc:GorevicMember2023-01-012023-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembertdoc:GorevicMember2022-01-012022-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembertdoc:GorevicMember2021-01-012021-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembertdoc:GorevicMember2020-01-012020-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembertdoc:GorevicMember2024-01-012024-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembertdoc:GorevicMember2023-01-012023-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembertdoc:GorevicMember2022-01-012022-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembertdoc:GorevicMember2021-01-012021-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembertdoc:GorevicMember2020-01-012020-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2024-01-012024-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2023-01-012023-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2022-01-012022-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2021-01-012021-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2020-01-012020-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2024-01-012024-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2023-01-012023-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2022-01-012022-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2021-01-012021-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembertdoc:GorevicMember2020-01-012020-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembertdoc:GorevicMember2024-01-012024-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembertdoc:GorevicMember2023-01-012023-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembertdoc:GorevicMember2022-01-012022-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembertdoc:GorevicMember2021-01-012021-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembertdoc:GorevicMember2020-01-012020-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembertdoc:MurthyMember2024-01-012024-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembertdoc:MurthyMember2024-01-012024-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembertdoc:MurthyMember2024-01-012024-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembertdoc:MurthyMember2024-01-012024-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembertdoc:MurthyMember2024-01-012024-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembertdoc:MurthyMember2024-01-012024-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembertdoc:DivitaMember2024-01-012024-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembertdoc:DivitaMember2024-01-012024-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembertdoc:DivitaMember2024-01-012024-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembertdoc:DivitaMember2024-01-012024-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembertdoc:DivitaMember2024-01-012024-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembertdoc:DivitaMember2024-01-012024-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001477449ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001477449ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001477449ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001477449ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001477449ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001477449ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-31000147744912024-01-012024-12-31000147744922024-01-012024-12-31000147744932024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

TELADOC HEALTH, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| x | No fee required |

| |

| o | Fee paid previously with preliminary materials |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of 2025 annual meeting of stockholders of Teladoc Health

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| When | | | | Virtual meeting | | | | Record date: March 27, 2025 | | | | Date of distribution |

| | | | | | | | | | | | | |

Thursday, May 22, 2025 2:00 p.m. EDT | | | www.virtualshareholdermeeting.com/TDOC2025 | | | Only stockholders of record at the close of business on March 27, 2025, may vote at the meeting or any adjournment(s) or postponement(s) of the meeting | | | On or about April 8, 2025 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Attending the virtual meeting |

•To enter the meeting, you must have your 16-digit control number that is shown on your 1) Notice of Internet Availability of Proxy Materials; or 2) proxy card if you elected to receive proxy materials by mail. •You will not be able to attend the Annual Meeting in person. •Details regarding accessing the Annual Meeting over the Internet and the business to be conducted are described in the Notice. |

|

Items of business

| | | | | | | | | | | | | | |

| Proposals | Board vote recommendation | For further details |

1 | To elect nine nominees to serve as directors | “FOR” | each director nominee | |

2 | To conduct an advisory vote to approve our executive compensation (Say-on-Pay) | “FOR” | | |

3 | To approve an amendment to the Teladoc Health, Inc. 2023 Incentive Award Plan | “FOR” | | |

4 | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2025 | “FOR” | | |

5 | To transact other business as may properly come before the meeting or any adjournment(s) or postponement(s) of the meeting | | |

| | | | |

| | | | | | | | |

|

| By Order of the Board of Directors, Adam C. Vandervoort

Chief Legal Officer and Secretary Purchase, New York

April 8, 2025 |

How to vote

Even if you plan to virtually attend the meeting, we encourage you to vote as soon as possible using one of the following methods. Have your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form with your 16-digit control number available and follow the instructions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Internet | | | Telephone | | | Mail | | | During the meeting |

visit www.proxyvote.com, 24/7 | | | call toll-free 1-800-690-6903 | | | complete, sign, date and return your proxy card or voting instruction form in the postage-paid envelope | | | attend the virtual Annual Meeting and cast your ballot online |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Important notice regarding the availability of proxy materials for the annual meeting of stockholders to be held on

May 22, 2025 The Teladoc Health proxy statement and annual report are available at www.proxyvote.com. |

Table of contents

Proxy summary

This summary contains highlights about Teladoc Health, Inc. (“Teladoc Health,” the “Company” or “we”) and its upcoming 2025 Annual Meeting of Stockholders (the “Annual Meeting”). This summary does not contain all of the information that you should consider in advance of the meeting, and we encourage you to read the entire proxy statement carefully before voting.

2025 Annual meeting

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| When | | | | Virtual meeting | | | | Record date |

Thursday, May 22, 2025 2:00 p.m. EDT | | | www.virtualshareholdermeeting.com/TDOC2025 | | | March 27, 2025 |

| | | | | | | | | |

| | | | | | | | | | | | | | |

| Voting matters | Board recommendations | For more information, see page |

| | | | |

1 | Election of nine director nominees | FOR each

nominee | | |

| | | | |

| | | | |

2 | Advisory vote to approve executive compensation (Say-on-Pay) | FOR | | |

| | | | |

| | | | |

3 | Approval of an amendment to the Teladoc Health, Inc. 2023 Incentive Award Plan | FOR | | |

| | | | |

| | | | |

4 | Ratification of the selection of Ernst & Young LLP as independent auditors for 2025 | FOR | | |

| | | | |

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 1 |

2024 Performance and company highlights

Executing our 2024 priorities:

| | | | | | | | | | | |

| | | |

| | | |

| $2.6B | $311M(1) | $1.3B | $410M |

| | | |

Total revenue | Total adjusted EBITDA; margin of 12.1% | Cash and cash equivalents, up 16% | International revenue, up 12% |

| | | |

| | | |

| | | |

| | | |

93.8M | 1.2M | 1.3M | 17.3M |

| | | |

U.S. integrated care members, up 5% | Chronic care program enrollment, up 4% | BetterHelp unique users in 2024 | Total visits |

| | | |

| | | |

| | | |

(1)For a full reconciliation of net loss, the most directly comparable GAAP financial measure, to adjusted EBITDA, please see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

| | | | | | | | |

2 | Teladoc Health | 2025 Proxy Statement |

Corporate governance highlights

| | |

| Corporate Governance Best Practices |

| | | | | | | | |

| | Annual election of directors |

| | 2 of our director nominees are women |

| | Independent Board chair |

| | Balance of new and experienced directors |

| | No overboarding |

| | Annual director self-evaluation and committee assessment to ensure Board effectiveness |

| | Multiple members of our Audit Committee qualify as “audit committee financial experts” |

| | All current directors attended at least 75% of 2024 meetings |

| | Regular executive sessions of independent directors |

| | Majority voting standard in uncontested elections |

| | Stockholder ability to call special meetings |

| | | | | | | | |

| | Proxy access (3/3/20/25) |

| | Enterprise Risk Management program to oversee organizational risk |

| | Code of Business Conduct and Ethics |

| | Annual Say-on-Pay vote |

| | Independent compensation consultant |

| | Pay-for-performance philosophy |

| | Stock ownership guidelines for directors and executives |

| | No hedging or pledging of company stock |

| | Clawback policy |

| | Active stockholder engagement |

| | Commitment to corporate social responsibility |

| | |

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 3 |

Board of directors overview

Director nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director nominee and principal occupation | Age | Director since | Independent | Current committee membership |

| AC | CC | NCGC | QCPSC | EC |

| Charles Divita, III

Chief Executive Officer, Teladoc Health | 55 | 2024 | | | | | | |

| J. Eric Evans

Chief Executive Officer, Surgery Partners | 48 | 2023 | | | | | | |

| Sandra L. Fenwick

Retired Chief Executive Officer, Boston Children’s Hospital | 74 | 2020 | | | | | | |

| Catherine A. Jacobson

Retired Chief Executive Officer, Froedtert ThedaCare Health | 61 | 2020 | | | | | | |

| Thomas G. McKinley

General Partner,

Cardinal Partners | 73 | 2009 | | | | | | |

| Kenneth H. Paulus

Retired President and Chief Executive Officer, Prime Therapeutics | 65 | 2017 | | | | | | |

| David L. Shedlarz

Retired Vice Chairman, Executive Vice President and CFO, Pfizer | 76 | 2016 | | | | | | |

| Mark Douglas Smith, M.D., MBA

Clinical Professor of Medicine, University of California at San Francisco; and a board-certified internist | 73 | 2018 | | | | | | |

| David B. Snow, Jr.

Chairman and Chief Executive Officer, Cedar Gate Technologies | 70 | 2014 | | | | | | |

Meetings in 2024 | | Board - 13 | | 6 | 11 | 8 | 4 | 6 |

| | | | | | | | | | | | | | | | | |

| Committee chair | | Committee member | A | Audit committee financial expert |

| AC | Audit | NCGC | Nominating & corporate governance | EC | Executive |

| CC | Compensation | QCPSC | Quality of care & patient safety | | |

| | | | | | | | |

4 | Teladoc Health | 2025 Proxy Statement |

Board attributes

Our director nominees compose a well-balanced Board of Directors (the “Board”).

| | | | | | | | | | | | | | |

| Independence | | Tenure | |

| | | |

| 89% Independent | | 7 years Average tenure |

| |

| |

|

|

| | | | |

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 5 |

Board refreshment

Three of our independent director nominees have joined our Board since 2020, representing 37.5% of our independent director nominees.

| | | | | | | | | | | |

| 2020 | | | 2023 |

| | | |

| | | |

| Sandra L. Fenwick | Catherine A. Jacobson | | J. Eric Evans |

| | | |

Key director skills and experience

This table summarizes the key skills, attributes and experiences of each of our director nominees that are most relevant to their board service. The fact that a specific area of focus or experience is not designated does not mean the director nominee does not possess that attribute or expertise.

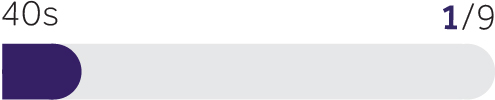

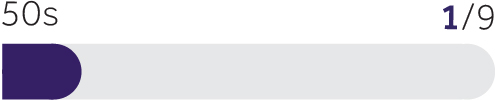

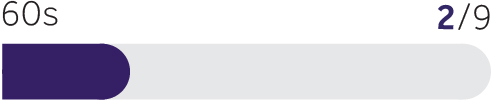

| | | | | | | | | | | |

| | | |

| Academics | | 2/9 | 22% |

| | | |

| | | |

| Audit and financial reporting | | 5/9 | 56% |

| | | |

| | | |

| Corporate governance | | 8/9 | 89% |

| | | |

| | | |

| Executive leadership | | 9/9 | 100% |

| | | |

| | | |

| Finance and investment industry | | 2/9 | 22% |

| | | |

| | | |

| Healthcare and medicine | | 9/9 | 100% |

| | | |

| | | |

| Human capital management | | 9/9 | 100% |

| | | |

| | | |

| Other public company board experience | | 7/9 | 78% |

| | | |

| | | |

| Regulatory, government and compliance | | 8/9 | 89% |

| | | |

| | | |

| Risk management | | 9/9 | 100% |

| | | |

| | | |

| Strategic planning and operations | | 9/9 | 100% |

| | | |

| | | |

| Technology and innovation | | 4/9 | 44% |

| | | |

| | | | | | | | |

6 | Teladoc Health | 2025 Proxy Statement |

Executive compensation highlights

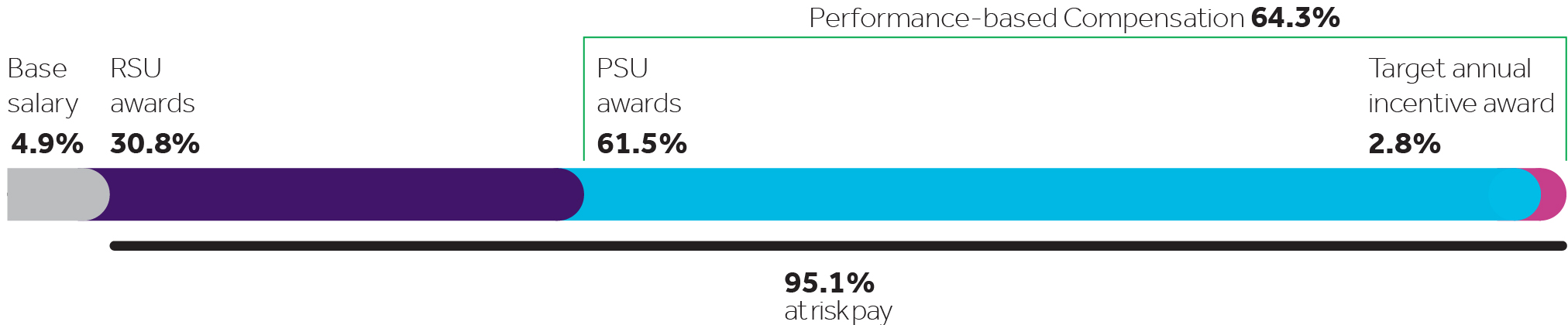

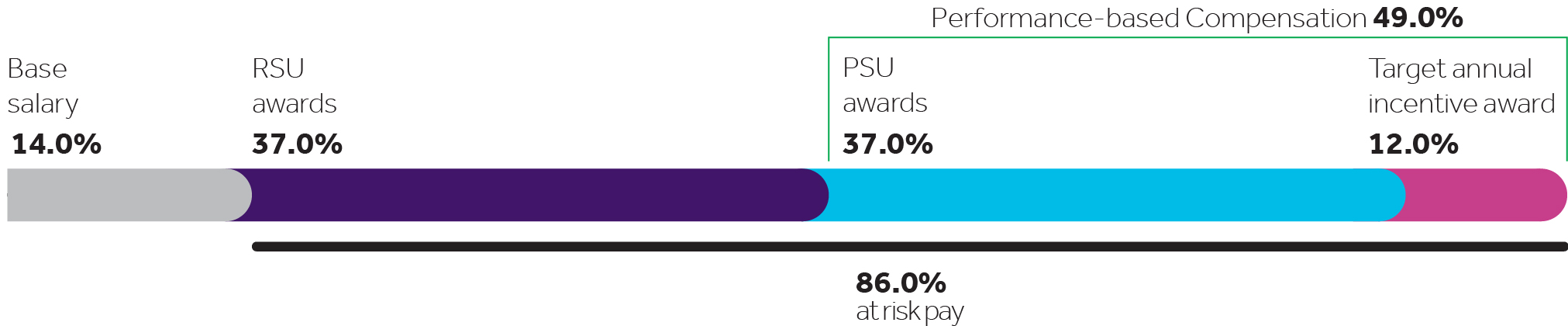

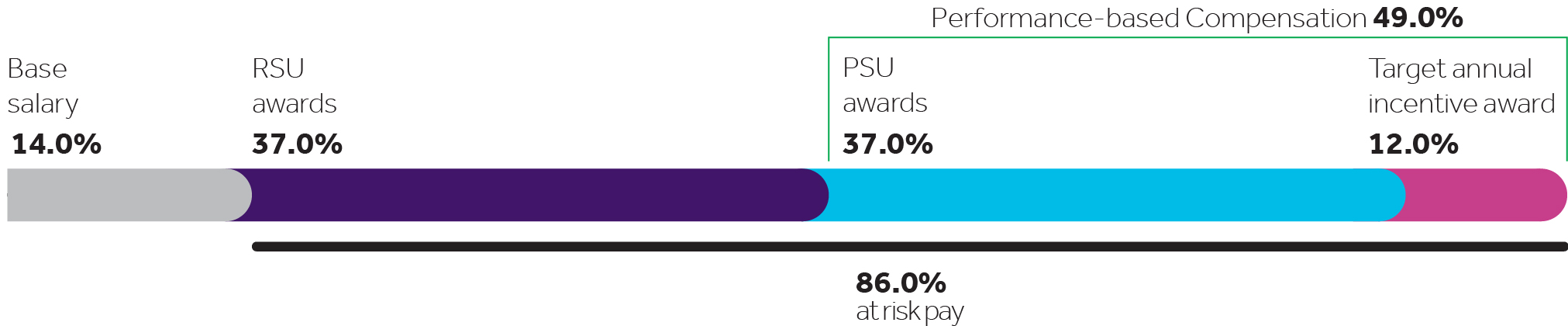

Our Compensation Committee has designed our executive compensation program in alignment with our key strategic priorities and commitment to aligning executive pay with corporate performance and stockholder interests. Accordingly, long-term incentives in the form of stock awards make up the significant majority of our named executive officers’ total target compensation such that their pay outcomes are directly linked to our stockholders’ experience.

Total 2024 target compensation mix

CEO(1)

Average of other NEOs(2)

(1)Reflects compensation of our current CEO, Mr. Divita, who was appointed on June 10, 2024.

(2)Excludes additional compensation paid to Ms. Murthy for her service as acting CEO.

Consideration of say-on-pay advisory vote

| | | | | |

•The most recent Say-on-Pay vote indicates significant stockholder support of the philosophy, strategy and objectives of our executive compensation programs. •Following the annual review of our executive compensation philosophy by our Compensation Committee, as well as our most recent Say-on-Pay results and engagement with stockholders, our overall approach to executive compensation did not change. •The Compensation Committee will continue to monitor stockholder feedback, including the results of the annual Say-on-Pay vote, in making future decisions affecting our compensation programs. | SIGNIFICANT STOCKHOLDER APPROVAL OF SAY-ON-PAY OVER LAST 3 YEARS 2022 – 91.6% 2023 – 81.9% 2024 – 95.9% |

| |

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 7 |

Corporate governance and board matters

Election of directors

Our Certificate of Incorporation and our Bylaws provide that the number of our directors shall be fixed from time to time by a resolution of the majority of the Board. Our Board currently consists of nine members.

Director nominees

Each of the nine directors elected at this Annual Meeting will serve for a one-year term expiring at the 2026 annual meeting and until their respective successors have been duly elected and qualified. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the following individuals for election to the Board for a one-year term:

•Charles Divita, III

•J. Eric Evans

•Sandra L. Fenwick

•Catherine A. Jacobson

•Thomas G. McKinley

•Kenneth H. Paulus

•David L. Shedlarz

•Mark Douglas Smith, M.D., MBA

•David B. Snow, Jr.

Each nominee has consented to being named in this proxy statement and has agreed to serve if elected. If a nominee is unable to stand for election, the Board may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee.

The affirmative vote of a majority of the votes cast (excluding abstentions and broker non-votes) at the Annual Meeting is required to elect the director nominees as directors. This means the number of votes cast “FOR” a director nominee must exceed the votes cast “against” that director nominee.

| | | | | |

| Your Board of Directors recommends that you vote FOR the election of each of the director nominees. |

| | | | | | | | |

8 | Teladoc Health | 2025 Proxy Statement |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Charles Divita, III, 55 | | | | | |

| | | | | |

Chief Executive Officer, Teladoc Health | Director since: June 2024 | |

| | | | | |

| | | | | | | |

| Career highlights TELADOC HEALTH, INC. •Chief Executive Officer and Director (2024 to present) GUIDEWELL MUTUAL HOLDING CORPORATION, a leading not-for-profit, policyholder-owned health solutions organization •Executive Vice President, Commercial Markets (2018 to 2024) •Senior Vice President, Chief Financial Officer (2014 to 2018) •Various leadership positions (2011 to 2014) FPIC INSURANCE GROUP, a property and casualty insurance company •Chief Financial Officer (2006 to 2011) •Various leadership positions (2000 to 2006) | Other current directorships •Vim (2025 to present; also served 2021 to 2024) Prior directorships •Availity (2018 to 2024) •Prime Therapeutics (2018 to 2024) Education •Bachelor of Science in Accounting and Finance, Florida State University Credentials •Certified Public Accountant | |

| | | | | | | |

| | | | | | | |

| Key experience and qualifications Our Board concluded that Mr. Divita should serve as a director because of his leadership role with Teladoc Health and his extensive executive leadership experience and knowledge of the healthcare industry. | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| J. Eric Evans, 48 | | | | | |

| | | | | |

Chief Executive Officer, Surgery Partners | Independent Director since: September 2023 Committees: Audit, Compensation (Chair) and Executive | |

| | | | | |

| | | | | | | |

| Career highlights SURGERY PARTNERS, INC., a leading provider of surgical services •Chief Executive Officer and Director (2020 to present) •Executive Vice President and Chief Operating Officer (2019 to 2020) TENET HEALTHCARE CORPORATION, a diversified healthcare services company •President of Hospital Operations (2016 to 2018) •Chief Executive Officer of former Texas region (2015 to 2016) THE HOSPITALS OF PROVIDENCE IN EL PASO •Market Chief Executive Officer (2012 to 2015) | Other current public company boards •Surgery Partners, Inc. Other current directorships and engagements •QuVa Pharma •SPOON Foundation •American Heart Association of Middle Tennessee •Nashville Health Care Council Education •M.B.A., Harvard Business School •Bachelor’s degree in Industrial Management, Purdue University | |

| | | | | | | |

| | | | | | | |

| Key experience and qualifications Our Board concluded that Mr. Evans should serve as a director because of his executive leadership experience and his extensive knowledge of the healthcare industry. | |

| | | | | | | |

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 9 |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Sandra L. Fenwick, 74 | | | | | |

| | | | | |

Retired Chief Executive Officer, Boston Children’s Hospital | Independent Director since: November 2020 Committees: Nominating and Corporate Governance and Quality of Care and Patient Safety | |

| | | | | |

| | | | | | | |

| Career highlights BOSTON CHILDREN’S HOSPITAL, the nation’s foremost independent pediatric hospital and the world’s leading center of pediatric medical and health research •Chief Executive Officer, where she was a driving force to improve the effectiveness and efficacy of the care provided at Boston Children’s, while at the same time reducing the cost of care (2013 to 2021) •President (2008 to 2013) •Chief Operating Officer (1999 to 2008) •Senior Vice President (1999) | Other current directorships and engagements •Harvard’s Wyss Institute for Biologically Inspired Engineering, Inc. •Risk Management Foundation of the Harvard Medical Institutions, Inc. •Patient Discovery Solutions, Inc. •BCH Foundation UK Limited •Member, International Women’s Forum/Massachusetts •Member, Women Corporate Directors Boston Prior directorships •Livongo Health, Inc. (2019 to the Teladoc Health/Livongo merger in 2020) Education •Ms. Fenwick has received numerous awards and honorary degrees for her contributions to healthcare •Master’s in Public Health in Health Services Administration, University of Texas School of Public Health •Bachelor’s degree, with distinction, Simmons College | |

| | | | | | | |

| | | | | | | |

| Key experience and qualifications Our Board concluded that Ms. Fenwick should serve as a director because of her executive leadership experience and her extensive knowledge of the healthcare industry. | |

| | | | | | | |

| | | | | | | | |

10 | Teladoc Health | 2025 Proxy Statement |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | | | | | | | | | | | | | | | | |

| Catherine A. Jacobson, 61 | | | | |

| | | | |

Former Chief Executive Officer, Froedtert ThedaCare Health | Independent Director since: February 2020 Committees: Audit and Quality of Care and Patient Safety | |

| | | | | | |

| | | | | | |

| Career highlights FROEDTERT THEDACARE HEALTH, a regional health care system based in Milwaukee, Wisconsin •Chief Executive Officer and Director (2024) •President, Chief Executive Officer and Director (2012 to 2023) •President (2011-2012) •Executive Vice President of Finance and Strategy, Chief Financial Officer and Chief Strategy Officer (2010-2011) RUSH UNIVERSITY MEDICAL CENTER •Various executive leadership roles including CFO, treasurer, SVP of finance and strategic planning, marketing and communications (1988 to 2010) Other current directorships and engagements •Vice Chair, Vizient •Bradley University •Siebert Lutheran Foundation | Prior directorships •Wisconsin Hospital Association (2012 to 2024) •United Way of Greater Milwaukee & Waukesha County (2012 to 2020) •Mercy Health (2014 to 2019) •Healthcare Financial Management Association (2004 to 2010) •Chair, Metropolitan Milwaukee Association of Commerce (2021 to 2022) Recognitions •Gail L. Warden Leadership Excellence Award of the National Center for Healthcare Leadership (2024) •Modern Healthcare, Top 25 Women Leaders (2021-2022) •Modern Healthcare, 100 Most Influential People in Healthcare (2019, 2022 and 2023) •Junior Achievement of Wisconsin, Distinguished Executives of the Year (2018) and induction into the Wisconsin Business Hall of Fame Education •Bachelor of Science in Accounting, Bradley University •Honorary Degree—Doctor of Healthcare Leadership, University of Wisconsin- Milwaukee | |

| | | | | | |

| | | | | | |

| Key experience and qualifications Our Board has concluded that Ms. Jacobson should serve as a director in view of her executive leadership experience and her extensive background in the healthcare industry. | |

| | | | | | |

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 11 |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | | | | | | | | | | | | | | | | |

| Thomas G. McKinley, 73 | | | | |

| | | | |

General Partner, Cardinal Partners | Independent Director since: November 2009 Committees: Audit and Compensation | |

| | | | |

| | | | | | |

| Career highlights CARDINAL PARTNERS, a venture capital firm focused exclusively on healthcare investing •General Partner and West Coast Representative, with a focus in healthcare investment technology, technology-enabled services, AI, ML and blockchain in healthcare (2009 to present) PARTECH INTERNATIONAL, a global venture capital firm with offices in U.S., Japan, Israel and France •Co-Founder and Managing Partner focused on healthcare information technology sector (1982 to 2008) PREALIZE HEALTH (formerly CARDINAL ANALYTX), a project in conjunction with Professors Arnold Milstein and Nigam Shah at Stanford University •Founding CEO (2016 to 2018) OPALA, a data automation partner that makes payer-provider collaboration radically easy •Founding CEO and helped spin out a team from Premera Blue Cross (2019 to 2021) | Other current directorships and engagements •Opala •Chairman, Prealize Health Prior directorships •Elected Director, Harvard Alumni Association (2001 to 2007) •Sapphire Digital (2017 to 2021) Education •MBA, Stanford University, Graduate School of Business •MS in Accounting, New York University, Stern School of Business •AB in Economics, Harvard University | |

| | | | | | |

| | | | | | |

| Key experience and qualifications Our Board has concluded that Mr. McKinley should serve as a director in view of his significant director experience and his broad experience in the healthcare and technology industries. | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Kenneth H. Paulus, 65 | | | | | |

| | | | | |

Former President and Chief Executive Officer, Prime Therapeutics | Independent Director since: February 2017 Committees: Nominating and Corporate Governance (Chair), Quality of Care and Patient Safety and Executive | |

| | | | | | | |

| | | | | | | |

| Career highlights PRIME THERAPEUTICS, one of the nation’s largest pharmacy benefit managers •President, Chief Executive Officer and Director (2019 to 2023) ALLINA HEALTH, one of the nation’s largest not-for-profit integrated delivery systems •Various executive leadership roles including, President, Chief Executive Officer and Chief Operating Officer (2005 to 2014) ATRIUS HEALTH SYSTEM, one of the largest integrated physician organizations in New England and a teaching affiliate of Harvard Medical School •President and Chief Executive Officer (2005 to 2009) PARTNERS COMMUNITY HEALTH CARE •Chief Operating Officer (1994 to 2000) | Other current directorships •Gravie Health •Compliance Solutions (Chair) Prior directorships •Breg (2017 to 2024) •AllyAlign Health (2017 to 2021) •Cogentix Medical (2015 to 2016) •Team Health (2015 to 2016) Education •Master of Healthcare Administration and Management, University of Minnesota •BA in Biology, Augustana College | |

| | | | | | | |

| | | | | | | |

| Key experience and qualifications Our Board concluded that Mr. Paulus should serve as a director because of his executive leadership experience in the healthcare industry. | |

| | | | | | | |

| | | | | | | | |

12 | Teladoc Health | 2025 Proxy Statement |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | | | | | | | | | | | | | | | | |

| David L. Shedlarz, 76 | | | | |

| | | | |

Retired Vice Chairman, Executive Vice President and CFO, Pfizer | Independent Director since: September 2016 Committees: Audit (Chair), Compensation and Executive | |

| | | | |

| | | | | | |

| Career highlights PFIZER, INC., a pharmaceutical company Former Vice Chair (2005 to 2007) •Executive Vice President and Chief Financial Officer having worldwide responsibility for Pfizer’s former Medical Technology Group (1999 to 2005) •Played key role in shaping the strategic direction that contributed to Pfizer’s impressive growth and helped establish it as an industry leader and innovator | Prior directorships •Pitney Bowes, Inc. (2001 to 2023) •The Hershey Company (2008 to 2021) •TIAA (2007 to 2021) Education •MBA, Finance and Accounting, New York University, Leonard N. Stern School of Business •BS in Economics and Mathematics, Michigan State University-Oakland | |

| | | | | | |

| | | | | | |

| Key experience and qualifications Our Board concluded that Mr. Shedlarz should serve as a director because of his deep experience in public company finance, his experience as a director of large public companies and his prior service as the chief financial officer of one of the world’s leading pharmaceutical corporations. | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Mark Douglas Smith, M.D., MBA, 73 | | | | |

| | | | | |

Clinical Professor of Medicine, University of California at San Francisco; and a board-certified internist | Independent Director since: October 2018 Committees: Nominating and Corporate Governance, Quality of Care and Patient Safety (Chair) and Executive | |

| | |

| | | | | | | |

| | | | | | | |

| Career highlights UNIVERSITY OF CALIFORNIA AT SAN FRANCISCO •Clinical professor of medicine (1994 to present) SAN FRANCISCO GENERAL HOSPITAL •Board-certified internist and maintains a clinical practice in HIV care (1994 to present) GUIDING COMMITTEE OF THE HEALTH CARE PAYMENT LEARNING AND ACTION NETWORK, a public-private partnership launched by the U.S. Department of Health and Human Services to promote the transition to value-based payment to improve care quality while lowering costs •Co-chair (2015 to 2019) CALIFORNIA HEALTH CARE FOUNDATION, an independently endowed philanthropy that works to improve healthcare access and quality for Californians •Founding President and Chief Executive Officer, helped build the foundation into a recognized leader in delivery system innovation, public reporting of care quality and applications of new technology in healthcare (1996 to 2013) | Other current public company boards •Jazz Pharmaceuticals plc •Phreesia, Inc. Other current directorships and engagements •Commonwealth Fund •Editorial Board, Health Affairs •Prealize Health Education •M.D., University of North Carolina at Chapel Hill •MBA with a concentration in health care administration, Wharton School, University of Pennsylvania •Bachelor’s degree in Afro-American Studies, Harvard College | |

| | | | | | | |

| | | | | | | |

| Key experience and qualifications Our Board concluded that Dr. Smith should serve as a director in view of his extensive background in the healthcare industry, including as a nationally recognized care delivery and health policy expert. | |

| | | | | | | |

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 13 |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

David B. Snow, Jr., 70 | Board Chairman | | | |

| | | | |

Chairman and Chief Executive Officer,

Cedar Gate Technologies | Independent Director since: February 2014 Chairman of the Board since: December 2014 Committees: Compensation, Nominating and Corporate Governance and Executive (Chair) | |

| | | | | | |

| | | | | | |

| Career highlights CEDAR GATE TECHNOLOGIES, INC., a provider of analytic and information technology services to providers, payers and self-insured employers entering risk-based/value-based care reimbursement arrangements •Chairman of the Board and Chief Executive Officer (2014 to present) MEDCO HEALTH SOLUTIONS, INC., a leading pharmacy benefit manager •Chairman and Chief Executive Officer (2003 to 2012) •Various leadership positions at WellChoice (Empire Blue Cross and Blue Shield) and Oxford Health Plans | Other current directorships •Premise Health •Fuqua School of Business Board of Visitors at Duke University (Chairman 2008-2014) Prior directorships •Pitney Bowes (2006 to 2019) •CareCentrix (2014 to 2018) •Medco Health Solutions, Inc. (2003 to 2012) Education •Master’s in Health Care Administration, Duke University •BS in Economics, Bates College | |

| | | | | | |

| | | | | | |

| Key experience and qualifications Our Board concluded that Mr. Snow should serve as a director because of his broad experience in the healthcare industry and his significant core business skills, including financial, operations and strategic planning. | |

| | | | | | |

| | | | | | | | |

14 | Teladoc Health | 2025 Proxy Statement |

| | | | | |

| |

Corporate governance and board matters |

| |

Corporate governance guidelines and code of business conduct and ethics

Our Board has adopted a Code of Business Conduct and Ethics applicable to directors, officers and employees that outlines our corporate values and standards of integrity and behavior and is designed to foster a culture of honesty and accountability, drive compliance with legal and regulatory requirements, protect and promote our reputation, as well as the preparation and maintenance of our financial and accounting information. Our Board has also adopted Corporate Governance Guidelines to assist it in the exercise of its responsibilities.

Our Chief Compliance Officer has responsibility to implement and maintain an effective ethics and compliance program and is responsible to provide updates on that program to the Nominating and Corporate Governance Committee. The Code of Business Conduct and Ethics and the Corporate Governance Guidelines are reviewed annually and periodically amended as the Board enhances our corporate governance practices and programs.

We intend to satisfy the disclosure requirements under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding any amendment to, or waiver from a material provision of our Code of Business Conduct and Ethics involving our principal executive, financial or accounting officer or controller by posting such information on our website. The Corporate Governance Guidelines and Code of Business Conduct and Ethics are available on our website at ir.teladochealth.com by clicking through “Corporate Governance.”

Board leadership structure

Our governance framework provides the Board with the flexibility to select the appropriate leadership structure for our organization. This will be driven by our strategic business needs, as well as the particular makeup of the Board at any point in time. As a result, no policy exists requiring the combination or separation of leadership roles, and our governing documents do not mandate a particular structure. The Nominating and Corporate Governance Committee annually reviews the structure and composition of our Board and its leadership structure to assess the effectiveness specific to our current business plans and

long-term strategy.

Our current leadership structure consists of the Chairman of the Board, a separate Chief Executive Officer and a strong, active roster of independent directors. We believe that the cornerstone of strong corporate governance includes having a separate Chairman of the Board from our Chief Executive Officer, which allows our Chief Executive Officer to focus on managing the Company while leveraging our independent Chairman’s experience to drive accountability at the Board level and promote independent leadership of the Board. Therefore, we do not currently anticipate having the two roles filled by a single individual. As part of its evaluation whether to combine the two roles, the Board would consider, among other things, the Chief Executive Officer’s tenure and experience, the experience of our independent directors and the Board as a whole, whether or not it would improve the Board’s ability to focus on key policy and operational issues and help the Company operate in the long-term interests of our stockholders, as well as input from stockholders. Any such change would be announced to stockholders following such a determination.

| | | | | |

| |

| |

Charles Divita, III | David B. Snow, Jr. |

Chief executive officer and director since June 2024 The Chief Executive Officer is responsible for setting the strategic direction of the Company and for its day-to-day leadership and management. | Independent director since February 2014 Chairman of the board since December 2014 The Chairman of the Board provides guidance to the Chief Executive Officer, directs the agenda for Board meetings and presides over meetings of the full Board. |

| |

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 15 |

| | | | | |

| |

Corporate governance and board matters |

| |

Another component of our leadership structure is the active role played by our independent directors in overseeing our strategic business objectives, both at the Board and committee levels. To promote open discussion among the independent directors concerning the business of the organization and matters concerning management, our Chairman of the Board presides over regularly scheduled executive sessions where the independent Board members meet without management present. The Chairman may also represent the Board in communications with stockholders or other key stakeholders and, along with the Nominating and Corporate Governance Committee, provide input on the design of the Board itself.

Eight of our director nominees are considered independent within the meaning of the rules of the New York Stock Exchange (the “NYSE”); the only non-independent member is Charles Divita, III, our Chief Executive Officer. All members of the Audit, Compensation and Nominating and Corporate Governance Committees satisfy the applicable independence criteria of the Securities and Exchange Commission (the “SEC”) and NYSE. Our Board has determined that each member of the Audit Committee is financially literate and each of Mr. Shedlarz and Ms. Jacobson is an “audit committee financial expert” according to Item 407 of Regulation S-K promulgated by the SEC.

During 2024, each of our current directors attended at least 75% of the aggregate of the total number of meetings of the full Board held during the period that he or she served as a director, and the total number of meetings held by all committees of the Board on which he or she served during the period that he or she served as a member of that committee.

Directors are expected to be active and engaged in discharging their duties and to keep themselves informed about our business and operations. Each director is expected to attend the Annual Meeting. All directors at the time of the 2024 annual meeting of stockholders attended the meeting.

Committees of the board

The Board has five standing committees:

•Audit

•Compensation

•Nominating and Corporate Governance

•Quality of Care and Patient Safety

•Executive

The charters for the Audit, Compensation and Nominating and Corporate Governance Committees are available on our website at ir.teladochealth.com by clicking through “Corporate Governance.” The Quality of Care and Patient Safety Committee and Executive Committee are also governed by charters.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Current committee membership |

| Name | | Independent | Audit | Compensation | Nominating &

corporate

governance | Quality of care &

patient safety | Executive |

Charles Divita, III | | | | | | |

J. Eric Evans | | | | | | |

| Sandra L. Fenwick | | | | | | |

Catherine A. Jacobson | | | | | | |

Thomas G. McKinley | | | | | | |

| Kenneth H. Paulus | | | | | | |

| David L. Shedlarz | | | | | | |

| Mark Douglas Smith, M.D., MBA | | | | | | |

| David B. Snow, Jr. | | | | | | | |

Number of 2024 Meetings | Board―13 | 6 | 11 | 8 | 4 | 6 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Committee chair | | Committee member | | Chairman of the board | | Audit committee financial expert |

| | | | | | | | |

16 | Teladoc Health | 2025 Proxy Statement |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | |

Audit committee | |

| |

FY2024 Meetings: 6 Current members •David L. Shedlarz, Chair •J. Eric Evans •Catherine A. Jacobson •Thomas G. McKinley Qualifications •All members of the Audit Committee are independent (as defined in the NYSE listing standards and Section 10A-3 of the Exchange Act) •Mr. Shedlarz and Ms. Jacobson are “audit committee financial experts” (as defined in Item 407(d)(5) of Regulation S-K) Report •The Audit Committee Report is on page 84 of this proxy statement | Key responsibilities The principal functions of the Audit Committee are to: •select, approve the compensation, and assess the independence of our independent registered public accounting firm •review and approve management’s plan for engaging our independent registered public accounting firm during the year to perform non-audit services and consider what effect these services will have on the independence of our independent registered public accounting firm •review our annual financial statements and other financial reports which require review and/or approval by the Board •oversee the integrity of our financial statements and our systems of disclosure and internal controls over financial reporting and our compliance with legal and regulatory requirements •review the scope of audit plans of our independent registered public accounting firm and the results of its audit •evaluate the performance of our independent registered public

accounting firm •review our quarterly earnings releases •review all related-party transactions for potential conflicts of interest and approve all such transactions •review and evaluate our risk management plans, including cybersecurity and data privacy compliance |

| |

| | | | | |

Compensation committee | |

| |

FY2024 Meetings: 11 Members •J. Eric Evans, Chair •Thomas G. McKinley •David L. Shedlarz •David B. Snow, Jr. Qualifications •All members of the Compensation Committee are independent Report •The Compensation Committee Report is on page 46 of this proxy statement | Key responsibilities The principal functions of the Compensation Committee are to: •review and approve corporate goals and objectives tied to the compensation of our Chief Executive Officer •evaluate the performance of our Chief Executive Officer specific to our corporate goals and objectives and determine his or her compensation •review and approve the compensation of our other executive officers •review and establish our overall compensation philosophy and policy •administer and oversee our equity plans •evaluate and assess potential and current compensation advisors in accordance with the applicable independence standards set by the NYSE •retain and approve the compensation of compensation advisors •review and approve our policies and procedures for equity-based incentive awards •review and make recommendations to the Board concerning our director compensation •approve the Compensation Committee Report required by the rules of the SEC to be included in our annual proxy statement •oversee our human capital management |

| |

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 17 |

| | | | | |

| |

Corporate governance and board matters |

| |

The Compensation Committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors (independent or otherwise) to assist in carrying out its responsibilities. The Committee may delegate its authority under its charter to one or more subcommittees as is appropriate from time to time. The Committee may also delegate to an officer the authority to grant equity awards to certain employees, subject to the terms of our equity plans.

The Compensation Committee has engaged Aon’s Human Capital Solutions practice, a division of Aon plc (“Aon”), to assess and make recommendations with respect to the amount and types of compensation for our executives and directors. Aon reports directly to the Committee; however, our Chief Executive Officer consults with Aon with respect to its assessments of the compensation of other executive officers.

The Compensation Committee reviewed compensation assessments provided by Aon comparing our compensation to competitive market data. The Committee met with Aon to discuss the compensation of our executive officers, including the Chief Executive Officer, and to receive input and advice. The Committee has considered the adviser independence factors required under SEC rules as they relate to Aon and believes Aon’s work in 2024 did not raise a conflict of interest. For additional information regarding executive compensation in 2024, please see the section titled “Compensation Discussion and Analysis―Determination of Compensation.”

| | | | | | | | |

Nominating and corporate governance committee | |

| | |

FY2024 Meetings: 8 Members •Kenneth H. Paulus, Chair •Sandra L. Fenwick •Mark Douglas Smith, M.D., MBA •David B. Snow, Jr. Qualifications •All members of the Nominating and Corporate Governance Committee are independent | Key responsibilities The principal functions of the Nominating and Corporate Governance Committee are to: •develop and recommend criteria for Board and committee membership •establish procedures for identifying and evaluating director candidates, including nominees recommended by stockholders •identify individuals qualified to become directors •recommend nominees for election as directors and to each of the Board’s committees •oversee the annual evaluation of the Board and its committees •together with the Compensation Committee, review and discuss with the Board corporate succession plans for our Chief Executive Officer and other key officers •oversee the development and administration of our Code of Business Conduct and Ethics and Corporate Governance Guidelines •oversee director education and training •oversee our compliance and ethics program •oversee our overall approach to environmental, social and governance and social responsibility matters |

| | |

| | | | | | | | |

18 | Teladoc Health | 2025 Proxy Statement |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | | | | |

Quality of care and patient safety committee | |

| | |

FY2024 Meetings: 4 Members •Mark Douglas Smith, M.D., MBA, Chair •Sandra L. Fenwick •Catherine A. Jacobson •Kenneth H. Paulus Qualifications •All members of the Quality of Care and Patient Safety Committee are independent | Key responsibilities The principal functions of the Quality of Care and Patient Safety Committee are to assist the Board in fulfilling its oversight responsibilities relating to the review of our policies and procedures relating to the delivery of quality medical care to our members. The Quality of Care and Patient Safety Committee maintains communication between the Board and senior officers with management responsibility for medical care and reviews matters concerning: •the quality of medical care delivered to our members •efforts to advance the quality of medical care provided •patient safety |

| | |

| | | | | |

Executive committee | |

| |

FY2024 Meetings: 6 Members •David B. Snow, Jr., Chair •J. Eric Evans •Kenneth H. Paulus •David L. Shedlarz •Mark Douglas Smith, M.D., MBA Qualifications •All members of the Executive Committee are independent | Key responsibilities The principal function of the Executive Committee is to support the Board in the performance of its duties and responsibilities between regularly scheduled meetings of the Board. Subject to any limitations imposed by the Board, applicable law and our Bylaws, the Executive Committee may exercise the power of the Board in the management of our business and affairs with respect to matters referred to it by the Board and urgent matters requiring Board action that, in the determination of the Chairman of the Board, should not await the Board’s next regularly scheduled meeting. The Executive Committee consists of the Chairman of the Board and the chairs of our other standing committees, and meets on an ad hoc basis when circumstances necessitate. |

| |

Board role in risk oversight

The Board believes that evaluating our executive team’s management of the risks confronting the Company is one of its most important areas of oversight. The Board further believes that taking an active role in the oversight of the Company’s corporate strategy and the related risks is appropriate, given our Board members’ combined breadth and depth of experience, and is critical to ensuring that the long-term interests of the Company and its stockholders are being served. The Board also encourages management to promote a culture that actively manages risks as a part of the Company’s corporate strategy and day-to-day business operations. The Board administers its risk oversight function both directly and through its committees. For risks that fall within a committee’s areas of primary responsibility and expertise, the Board assigns oversight to that committee, which then also apprises the full Board of significant matters and management’s response. The full Board directly oversees overall corporate risk and strategy and other matters that do not fall within the responsibility of a particular committee, including through an annual review of our most significant risks. The Board also conducts annual reviews of our enterprise risk management (“ERM”) program and our cybersecurity program.

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 19 |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Board | | | | Management | | |

| | •Our Board, acting as a whole and through its committees, has responsibility for the oversight of risk management •In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. If necessary, the Chairman of the Board may require additional information from, or that certain actions be taken by, management on particular risk matters | | | | •In general, management is responsible for the day-to-day management of the risks we may encounter. Management is responsible for developing and implementing the Company’s strategic plans and for identifying, evaluating, managing, and mitigating the risks inherent in those plans through our risk management program •Senior management attends the regular meetings of the Board and is available to address questions and concerns raised by the Board on risk management-related matters | | |

| | |

| | | | | | |

| | | | | | | | | | |

| | | This combination provides the focus, scope, expertise and continuous attention necessary for effective risk management. | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Audit committee | | Compensation committee | | | |

| | | The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of: •financial reporting •internal controls over financial reporting •cybersecurity and data protection •compliance with legal and regulatory requirements The Audit Committee regularly discusses risk assessment and risk management policies with management and our independent auditors, including our major risk exposures, such as cybersecurity, data privacy, and environmental and social concerns, their potential financial impact on our organization and the steps we take to mitigate and manage these risks, including financial reporting that encompasses disclosure controls and procedures. Additionally, the Audit Committee assists the Board with oversight of risk management by: •regularly reviewing the Company’s key risks, risk mitigation strategies, and available related risk mitigation metrics that are identified by our ERM program. The committee solicits input from directors on the steps taken to mitigate risks and plans for additional mitigation going forward. Our head of internal audit and ERM also reports to the Chairman of the Audit Committee •reviewing the Company’s financial statements and Company’s quarterly and annual reports filed with the SEC, including the risk factors disclosed therein •meeting with our independent auditors at regularly scheduled meetings of the Audit Committee to review their reports on the adequacy and effectiveness of our disclosure and internal controls •discussing with management our major financial risks and exposures and the steps management has taken to mitigate, monitor and control any risks and exposures | | The Compensation Committee assists our Board in fulfilling its oversight responsibilities in the management of risks arising from our human capital management and compensation policies and programs, and retains outside compensation and legal experts for that purpose. In establishing and reviewing our compensation philosophy and programs, we consider whether such programs encourage unnecessary or excessive risk taking. We believe our executive compensation program does not encourage excessive or unnecessary risk taking or create risks that are reasonably likely to have a material adverse effect on us. Our compensation programs are designed to encourage our executive officers and other employees to remain focused on both short-term and long-term strategic goals. | | | |

| | | | | | |

| | | | Nominating and corporate governance committee | | | |

| | | | |

| | | | The Nominating and Corporate Governance Committee assists our Board in fulfilling its oversight responsibilities in managing the risks associated with the organization including membership and structure of the Board, corporate governance, our compliance and ethics program, environmental, social and governance matters, and succession planning for our directors. The Committee receives frequent updates regarding key compliance issues from the Chief Compliance Officer, who reports to the Chief Legal Officer as well as to the Chairman of the Nominating and Corporate Governance Committee. | | | |

| | | | | | |

| | | | Quality of care and patient safety committee | | | |

| | | | The Quality of Care and Patient Safety Committee assists our Board in managing risks associated with the quality of medical care delivered to our members and our efforts to improve and advance medical care and patient safety. | | | |

| | | | | | | | | | |

| | | | | | | | |

20 | Teladoc Health | 2025 Proxy Statement |

| | | | | |

| |

Corporate governance and board matters |

| |

| | | | | | | | |

| | |

| ENTERPRISE RISK MANAGEMENT PROGRAM | |

| To better anticipate, identify, prioritize and manage the key risks we may encounter, we have implemented an ERM program that was developed under the oversight of our Board and management. The ERM program is designed to: •establish a consistent and systematic approach to identify, assess, mitigate, monitor, and report on key strategic, financial, legal, technology and operational enterprise-level risks in relation to our strategic objectives •confirm decisions are made within approved risk tolerance levels and with sufficient independent oversight to protect the organization’s profitability, assets, and reputation •establish a clear understanding of risk management roles and responsibilities •establish a framework that encourages innovation and assists management in making appropriate decisions •facilitate regular information sharing and collaboration between key risk assessing and monitoring organizations via our Aligned Risk Council (“ARC”) •validate the risk profile is maintained to depict current risks to each area of business operations •confirm risk owners have an up-to-date and accurate understanding of the material risks relevant to their areas of responsibility, as well as the strategies and controls in place to mitigate these risks •support the maximization of the value from our assets, projects, and other business opportunities As part of our ERM program we established the ARC: •align risk functions, enabling optimal exchange of risk and control information through a formal collaborative model •leverage internal subject matter expertise to evaluate and rank key risks in preparation for final interactive management key risk ranking •evaluate thought leadership for emerging risk areas and their applicability to the Company The outputs from the ERM process are reviewed by management in an interactive key risk ranking session. These outputs assist management validation of the Company’s risk profile. This session considers both current risks, including timeframes reflected by those risks, as well as emerging risks and future threats. The focus of the Board’s oversight varies based on the type and timing of the risk being discussed. For example, for a long-term risk, the Board focuses on advance planning. We believe our ERM program: •leads to enhanced corporate governance •improves our ability to respond to changing business demands •promotes an open, positive and risk-aware culture | |

| | |

We recognize the increasing significance that cybersecurity has to our operations and the success of our business, as well as the need to continually assess cybersecurity risk and evolve our response in the face of a rapidly and ever-changing environment. Cybersecurity risk oversight continues to remain a top priority for our Board. The Audit Committee maintains primary responsibility related to overseeing our cybersecurity risk as part of its program of regular risk management oversight. This includes, but is not limited to, the overall maturity and strategy of our cybersecurity program. We have a rigorous and comprehensive cybersecurity program managed by a dedicated team of subject matter experts and is led by our Chief Information Security Officer (“CISO”), who has extensive cybersecurity experience. We have implemented telehealth industry standard processes, policies, and tools, including regularly scheduled vulnerability scanning and third-party penetration testing to reduce the risk of vulnerabilities in systems. Our CISO regularly engages with other members of our executive management team to discuss cyber risk, including the Chief Technology Officer, Chief Legal Officer, and Chief Compliance Officer, among others, as well as the Audit Committee. Our executive management team has the appropriate expertise, background, and depth of experience to manage risk arising from cybersecurity threats. Executive management has also participated in cybersecurity tabletop exercises to test our cyber response playbooks.

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 21 |

| | | | | |

| |

Corporate governance and board matters |

| |

Identifying and evaluating director nominees

The Board is responsible for selecting director nominees. The Nominating and Corporate Governance Committee identifies candidates in consultation with management, through the use of search firms or other advisors, recommendations submitted by stockholders or current directors or other methods as the Committee deems to be helpful to identify candidates.

Once candidates have been identified, the Nominating and Corporate Governance Committee confirms that the candidates meet all of the qualifications for director nominees established by the Committee. The Committee may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks or any other means that the Committee feels appropriate in the evaluation process. Meeting as a group, the Committee discusses and evaluates the qualities and skills of each candidate, both on an individual basis and considering the overall composition and needs of the Board. Based on the results of this evaluation process, the Committee recommends candidates for the Board’s approval as director nominees.

When assessing director candidates, the Nominating and Corporate Governance Committee considers a nominee’s qualifications, skills and attributes, including depth and breadth of professional experience and independence. A nominee must, at a minimum, have demonstrated exceptional ability and judgment and be of the highest personal and professional integrity. The director nomination process is designed to ensure the Board considers members with diverse backgrounds including race, ethnicity, gender, knowledge, experience, skills and expertise, as applicable to our industry. The Board assesses its goals for diversity through the Board composition review process as part of the Board’s annual self-assessment process.

Director candidates recommended by stockholders

According to our Bylaws, a stockholder or a group of up to 25 stockholders owning 3% or more of the shares of our capital stock continuously for at least three years may nominate, and include in our proxy materials for an annual meeting of stockholders, director candidates constituting up to 20% of the Board, but not less than two, elected by the holders of our capital stock, provided the stockholder (or group) and each nominee satisfies the requirements specified in our Bylaws.

Stockholders may submit recommendations for director candidates to the Nominating and Corporate Governance Committee by sending the individual’s name and qualifications to our corporate secretary, who will forward all recommendations to the Committee.

| | | | | |

| |

| Teladoc Health, Inc. Nominating and Corporate Governance Committee c/o Corporate Secretary 2 Manhattanville Road, Suite 203 Purchase, New York 10577 |

| |

The Nominating and Corporate Governance Committee will evaluate any candidate recommended by stockholders against the same criteria and policies and procedures applicable to the evaluation of candidates proposed by directors or management. The Committee has full discretion in considering all nominations to the Board. Alternatively, stockholders who would like to nominate a candidate for director (in lieu of making a recommendation to the Committee) must comply with the requirements described in this proxy statement and our Bylaws. See “Additional Information―Procedures for Submitting Stockholder Proposals” on page 93. | | | | | | | | |

22 | Teladoc Health | 2025 Proxy Statement |

| | | | | |

| |

Corporate governance and board matters |

| |

Communications with directors

You may communicate directly with any member or committee of the Board by writing to our principal executive office at:

| | | | | |

| |

| Teladoc Health Board of Directors c/o Corporate Secretary 2 Manhattanville Road, Suite 203 Purchase, New York 10577 |

| |

Please specify to whom your letter should be directed. Our corporate secretary reviews all correspondence and regularly forwards to the Board a summary of all correspondence and copies of correspondence that, in his or her opinion, deals with the functions of the Board or its committees or that he or she otherwise determines requires the attention of any member, group or committee of the Board.

Interested parties who wish to communicate with non-management directors, or with the presiding director of the Board’s executive sessions, may contact:

| | | | | |

| |

| Teladoc Health Board of Directors c/o Corporate Secretary Attn: Non-Management Directors (or the Presiding Director for executive sessions, as applicable) 2 Manhattanville Road, Suite 203 Purchase, New York 10577 |

| |

All mail received will first be opened and screened for security purposes.

Related-party transactions

Our Board reviews and approves transactions with any “related party,” which includes directors, executive officers and holders of 5% or more of our capital stock and their affiliates. Pursuant to our written Related-Party Transaction Policy and Procedures, the Audit Committee reviews the relevant facts and circumstances of the transaction, taking into account, among other factors that are appropriate, whether the transaction is inconsistent with our or our stockholders’ interests, whether the transaction is on terms comparable to those that could be obtained in a transaction with an unrelated third party under the same or similar circumstances, and the extent of the related party’s interest in the transaction. No director may participate in any approval of a related-party transaction to which he or she is a related party.

Certain types of transactions, which would otherwise require individual review, have been pre-approved by the Audit Committee. These types of transactions include, for example, compensation to a director or executive officer where the compensation is required to be disclosed in our proxy statement or transactions where the interest of the related party arises only by way of a directorship or minority stake in another organization that is a party to the transaction. Additionally, according to our Related-Party Transaction Policy and Procedures, all related-party transactions are required to be disclosed in applicable filings as required by the Securities Act of 1933, as amended, and the Exchange Act and related rules. All related-party transactions are required to be disclosed to the full Board.

We are party to a contract with Cedar Gate Technologies (“Cedar Gate”) for data and value-based analytics tools. Mr. Snow, the Chairman of our Board, is the Chief Executive Officer at Cedar Gate and owns approximately 10% of its outstanding capital stock. Pursuant to this contract, we will pay approximately $6.3 million to Cedar Gate over the three-year term, which includes an option for us to terminate after one year. Pursuant to this agreement, we paid $517,250 to Cedar Gate in 2024 for data and value-based analytics tools. There was no other transaction or series of similar transactions during 2024 to which we were or will be a party for which the amount involved exceeds or will exceed $120,000 and in which any related party had or will have a direct or indirect material interest.

| | | | | | | | |

2025 Proxy Statement | Teladoc Health | 23 |

Director compensation

Non-employee director compensation program

Our Board’s non-employee director compensation program is reflective of our business and shifts in market practice, and is designed to provide a total compensation package that we feel will attract and retain, on a long-term basis, high-caliber non-employee directors and support the alignment of interests between our directors and long-term stockholders. The Board may amend, modify or terminate the program at any time. The program is reviewed regularly by the Compensation Committee and the full Board and references the policies and pay practices of a peer group of similar companies selected by the Committee in consultation with Aon.

Under the program, all non-employee directors receive a mix of cash and equity compensation. Cash compensation consists of annual retainers earned for serving on our Board, with additional retainers earned for serving as members of the committees of our Board or as chairpersons of the Board or its committees. Cash retainers are prorated for partial years of service. No additional compensation is paid to the chairperson or members of the Executive Committee.

Equity compensation consists of an initial equity award when a non-employee director is elected or appointed to the Board (“Initial Awards”) and an annual equity award on the date of our annual meeting to continuing non-employee directors who have served on the Board for at least six months (“Annual Awards”). Initial Awards are in the form of restricted stock units (“RSUs”), with one-third of the award vesting on the first anniversary of the grant date, and then in eight substantially equal quarterly installments over the subsequent two years. Annual Awards issued are also in the form of RSUs, which vest on the earlier of the first anniversary of the grant date or the day immediately prior to the date of the next annual meeting occurring after the date of grant. All outstanding unvested Initial Awards and Annual Awards also vest upon a change in control. The value of Initial Awards and Annual Awards is determined using the closing price of our common stock on the NYSE on the grant date of the award. The Board has reserved discretion under the program to pay all or a portion of the equity awards in any combination of equity-based awards available for grant under any applicable equity incentive plan then-maintained by us.

The table below summarizes compensation provided under the program during 2024. There were no changes made to the program during the year.

| | | | | |

| Annual cash retainers | ($) |

| All non-employee directors | 45,000 | |

| Chairman of the Board | 50,000 | |

| Committee chairs: | |

| Audit committee | 20,000 | |

| Compensation committee | 20,000 | |

| Nominating and corporate governance committee | 10,000 | |

| Quality of care and patient safety committee | 10,000 | |

| Committee members: | |

| Audit committee | 10,000 | |

| Compensation committee | 7,500 | |

| Nominating and corporate governance committee | 5,000 | |

| Quality of care and patient safety committee | 5,000 | |

| | | | | |

| Equity-based awards | ($) |

| Initial awards | 250,000 | |

| Annual awards | 200,000 | |

| | | | | | | | |

24 | Teladoc Health | 2025 Proxy Statement |

Deferred compensation plan for non-employee directors

We maintain a Deferred Compensation Plan for non-employee directors (the “Deferred Compensation Plan”) that permits our non-employee directors to defer payment of all or a portion of the awards of restricted stock or RSUs granted to them for their service as a director. A participant’s election to defer receipt of these awards must generally be made prior to the year to which the stock award relates (or, for a newly nominated director, within 30 days following the date of the commencement of the director’s service as a director).

Deferred awards are credited to an account in an equal amount of deferred stock units with dividend equivalent rights. Dividend equivalent rights entitle a participant, as of a dividend payment date, to have credited to the participant’s account under the plan a number of additional deferred stock units equal to the amount of any ordinary cash dividend paid by us on the number of shares of common stock equivalent to the number of deferred stock units in the participant’s deferred compensation account as of the record date for the dividend, divided by the fair market value of one share of common stock on the dividend payment date. Deferred stock units (including any additional deferred stock units resulting from dividend equivalent rights) are subject to the same vesting or other forfeiture conditions that would have otherwise applied to the deferred awards. For each deferred stock unit granted under the Deferred Compensation Plan, we will issue to the participant one share of our common stock (or, at the election of the Compensation Committee, an equivalent cash amount based on the fair market value of a share of common stock on the date immediately preceding the payment date) on the first to occur of: