UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-2 | |

Pfenex Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Dear Stockholder:

I am pleased to invite you to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Pfenex Inc. (“Pfenex”), which will be held at the offices of Wilson Sonsini Goodrich & Rosati, P.C., outside counsel to Pfenex, located at 12235 El Camino Real, Suite 200, San Diego, CA, 92130 on April 21, 2015, at 10:00 a.m. Pacific Time. Doors open at 9:00 a.m. Pacific Time.

The attached Notice of Annual Meeting of Stockholders and Proxy Statement contain details of the business to be conducted at the Annual Meeting.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote and submit your proxy via the Internet, by phone, or by signing, dating and returning the enclosed proxy card in the enclosed envelope. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

On behalf of the Board of Directors, I would like to express our appreciation for your interest in Pfenex.

Sincerely,

Dr. Bertrand C. Liang

Chief Executive Officer

PFENEX INC.

10790 Roselle Street

San Diego, CA 92121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Time and Date | April 21, 2015 at 10:00 a.m. Pacific Time | |

| Place | The offices of Wilson Sonsini Goodrich & Rosati, P.C. outside counsel to Pfenex Inc. located at 12235 El Camino Real, Suite 200, San Diego, CA, 92130 | |

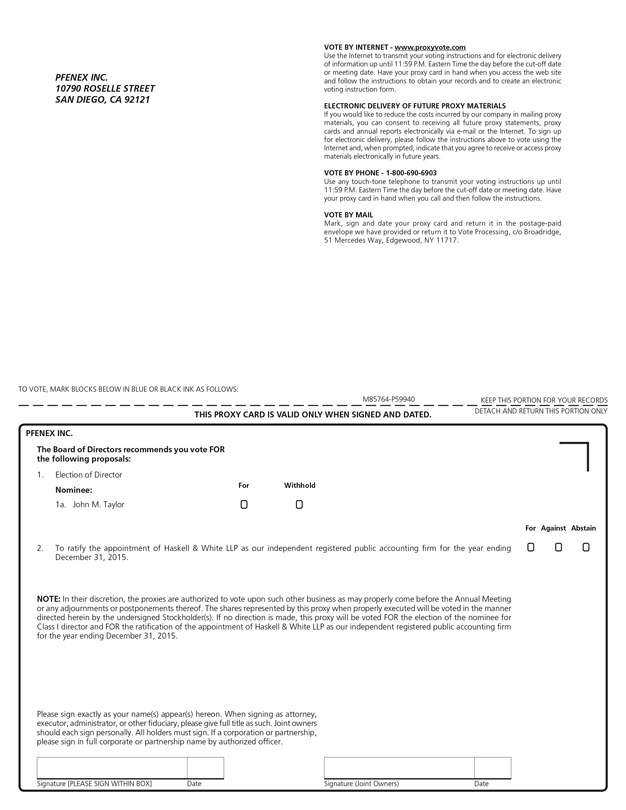

| Items of Business | • To elect as a Class I director the nominee named in this proxy statement to serve until the 2018 annual meeting of stockholders or until his successor is duly elected and qualified.

• To ratify the selection of Haskell & White LLP as our independent registered public accounting firm for fiscal year 2015.

• To transact other business that may properly come before the Annual Meeting. | |

| Record Date | March 19, 2015 (the “Record Date”). Only stockholders of record at the close of business on the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting. | |

| Proxy Voting | IMPORTANT | |

| YOUR VOTE IS IMPORTANT. Please vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card will save the expenses and extra work of additional solicitation. If you wish to vote by mail, we have enclosed an addressed envelope, postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares at the meeting, as your proxy is revocable at your option. | ||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on April 21, 2015. Our Proxy Statement and Annual Report to Stockholders are available at www.pfenex.investorroom.com.

| By order of the Board of Directors, |

|

|

| Dr. Bertrand C. Liang |

| Chief Executive Officer |

San Diego, California

March 20, 2015

The date of this proxy statement is March 20, 2015 and it is being mailed to stockholders on or about March 26, 2015.

| Page | ||||

| 1 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| Corporate Governance Principles and Code of Ethics and Conduct |

16 | |||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

20 | |||

| Fees Paid to the Independent Registered Public Accounting Firm |

20 | |||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

33 | |||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

-i-

TABLE OF CONTENTS

(cont’d)

| Page | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

-ii-

PFENEX INC.

10790 Roselle Street

San Diego, CA 92121

PROXY STATEMENT

FOR 2015 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 10:00 a.m. Pacific Time on April 21, 2015

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of Pfenex Inc. (the “Company” or “Pfenex”) for use at its 2015 annual meeting of stockholders (the “Annual Meeting”), and any postponements, adjournments or continuations thereof. The Annual Meeting will be held on April 21, 2015 at 10:00 a.m. Pacific Time, at the offices of Wilson Sonsini Goodrich & Rosati, P.C. outside counsel to the Company, located at 12235 El Camino Real, Suite 200, San Diego, CA, 92130.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

The information provided in the “question and answer” format below addresses certain frequently asked questions but is not intended to be a summary of all matters contained in this proxy statement. Please read the entire proxy statement carefully before voting your shares.

What is a proxy?

A proxy is your legal designation of another person to vote the stock you own. The person you designate is your “proxy,” and you give the proxy authority to vote your shares by submitting the enclosed proxy card or, if available, voting by telephone or over the Internet. We have designated our President, Chief Executive Officer, and Secretary, Bertrand C. Liang, and our Chief Financial Officer, Paul A. Wagner, to serve as proxies for the annual meeting.

Why am I receiving these materials?

The Board of Pfenex is providing these proxy materials to you in connection with the Board’s solicitation of proxies for use at Pfenex’s Annual Meeting, which will take place on April 21, 2015. Stockholders are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement. This proxy statement and the accompanying proxy card are being mailed on or about March 26, 2015 in connection with the solicitation of proxies on behalf of the Board.

What information is contained in these materials?

The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our most highly paid executive officers and our directors, and certain other required information. Pfenex’s 2014 Annual Report on Form 10-K, which includes our audited consolidated financial statements, is also enclosed with this proxy statement.

What proposals will be voted on at the Annual Meeting?

The proposals scheduled to be voted on at the Annual Meeting include:

| • | the election of one Class I director to hold office until the 2018 annual meeting of stockholders or until his successor is duly elected and qualified; |

| • | a proposal to ratify the appointment of Haskell & White LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2015; and |

| • | any other business that may properly come before the meeting. |

-1-

At the time this Proxy Statement was mailed, our management and Board were not aware of any other matters to be presented at the Annual Meeting other than those set forth in this Proxy Statement and in the notice accompanying this Proxy Statement.

How does our Board recommend that I vote?

Our Board recommends that you vote:

| • | FOR the election of the director nominated by our Board and named in this proxy statement as a Class I director to serve for a three-year term; and |

| • | FOR the ratification of the appointment of Haskell & White LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2015. |

Who is entitled to vote at the Annual Meeting?

Holders of our common stock at the close of business on March 19, 2015, the record date for the Annual Meeting (the “Record Date”), are entitled to notice of and to vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of our common stock held as of the Record Date. As of the Record Date, there were 20,522,557 shares of common stock outstanding and entitled to vote. Stockholders are not permitted to cumulate votes with respect to the election of directors. The shares you are entitled to vote include shares that are (1) held of record directly in your name, and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Stockholder of Record: Shares Registered in Your Name. If, at the close of business on the Record Date, your shares were registered directly in your name with American Stock Transfer & Trust Company, LLC, our transfer agent, then you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the Annual Meeting.

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If, at the close of business on the Record Date, your shares were held, not in your name, but rather in a stock brokerage account or by a bank or other nominee on your behalf, then you are considered the beneficial owner of shares held in “street name.” As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares by following the voting instructions your broker, bank or other nominee provides. If you do not provide your broker, bank or other nominee with instructions on how to vote your shares, your broker, bank or other nominee may, in its discretion, vote your shares with respect to routine matters but may not vote your shares with respect to any non-routine matters. Please see “What if I do not specify how my shares are to be voted?” for additional information.

How can I contact Pfenex’s transfer agent?

Contact our transfer agent by either writing to American Stock Transfer & Trust Company, LLC, Attn: Customer Service, 6201 15th Avenue Brooklyn, NY 11219, emailing info@amstock.com or by telephoning 800-937-5449.

Do I have to do anything in advance if I plan to attend the Annual Meeting in person?

Stockholder of Record: Shares Registered in Your Name. If you were a stockholder of record at the close of business on the Record Date, you do not need to do anything in advance to attend and/or vote your shares in person at the Annual Meeting, but you will need to present government-issued photo identification for entrance to the Annual Meeting.

-2-

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you were a beneficial owner at the close of business on the Record Date, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from your broker, bank or other nominee who is the stockholder of record with respect to your shares. You may still attend the Annual Meeting even if you do not have a legal proxy. For entrance to the Annual Meeting, you will need to provide proof of beneficial ownership as of the Record Date, such as the notice or voting instructions you received from your broker, bank or other nominee or a brokerage statement reflecting your ownership of shares as of the Record Date, and present government-issued photo identification.

Please note that no cameras, recording equipment, large bags, briefcases or packages will be permitted in the Annual Meeting.

Will the annual meeting be webcast?

We do not expect to webcast the annual meeting.

How do I vote and what are the voting deadlines?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you can vote in one of the following ways:

| • | You may vote via the Internet or by telephone. If you are a stockholder of record, you may vote by following the telephone or Internet voting instructions on your proxy card. |

| • | You may vote by mail. Please complete, date and sign the proxy card that accompanies this proxy statement and promptly mail it to the tabulation agent in the enclosed postage-paid envelope. If you are a stockholder of record and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote the shares represented by your proxy card as recommended by our Board. |

| • | You may vote in person. If you plan to attend the Annual Meeting, you may vote by delivering your completed proxy card in person or by completing and submitting a ballot, which will be provided at the Annual Meeting. |

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are the beneficial owner of shares held of record by a broker, bank or other nominee, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee how to vote your shares. The availability of Internet and telephone voting options will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a beneficial owner, you may not vote your shares in person at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

Can I change my vote or revoke my proxy?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you may revoke your proxy or change your proxy instructions at any time before your proxy is voted at the Annual Meeting by:

| • | entering a new vote by Internet or telephone; |

| • | signing and returning a new proxy card with a later date; |

| • | delivering a written revocation to our Secretary at Pfenex Inc., 10790 Roselle Street, San Diego, CA 92121; or |

| • | attending the Annual Meeting and voting in person. |

-3-

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are the beneficial owner of your shares, you must contact the broker, bank or other nominee holding your shares and follow their instructions to change your vote or revoke your proxy.

Is there a list of stockholders entitled to vote at the annual meeting?

The names of stockholders of record entitled to vote at the annual meeting will be available at the annual meeting and for ten days prior to the meeting for any purpose germane to the meeting, between the hours of 9:00 a.m. and 4:30 p.m., at our corporate headquarters at 10790 Roselle Street, San Diego, CA 92121, by contacting our corporate secretary.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board. The persons named in the proxy have been designated as proxy holders by our Board. When a proxy is properly dated, executed and returned, the shares represented by the proxy will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

What if I do not specify how my shares are to be voted?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record and you submit a proxy but you do not provide voting instructions, your shares will be voted:

| • | FOR the election of the director nominated by our Board and named in this proxy statement as a Class I director to serve for a three-year term (Proposal No. 1); |

| • | FOR the ratification of the appointment of Haskell & White LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2015 (Proposal No. 2); and |

| • | In the discretion of the named proxy holders regarding any other matters properly presented for a vote at the Annual Meeting. |

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are a beneficial owner and you do not provide your broker, bank or other nominee that holds your shares with voting instructions, then your broker, bank or other nominee will determine if it has discretion to vote on each matter. Brokers do not have discretion to vote on non-routine matters. Proposal No. 1 (election of directors) is a non-routine matter, while Proposal No. 2 (ratification of appointment of independent registered public accounting firm) is a routine matter. As a result, if you do not provide voting instructions to your broker, bank or other nominee, then your broker, bank or other nominee may not vote your shares with respect to Proposal No. 1, which would result in a “broker non-vote,” but may, in its discretion, vote your shares with respect to Proposal No. 2. For additional information regarding broker non-votes, see “What are the effects of abstentions and broker non-votes?” below.

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting for the meeting to be properly held under our bylaws and Delaware law. A majority of the shares of common stock issued and outstanding and entitled to vote, present in person or represented by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. As noted above, as of the Record Date, there were a total of

-4-

20,522,557 shares of common stock outstanding, which means that 10,261,279 shares of common stock must be represented in person or by proxy at the Annual Meeting to have a quorum. If there is no quorum, a majority of the shares present at the Annual Meeting may adjourn the meeting to a later date.

What are the effects of abstentions and broker non-votes?

An abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy card that it wishes to abstain from voting its shares, or if a broker, bank or other nominee holding its customers’ shares of record causes abstentions to be recorded for shares, these shares will be considered present and entitled to vote at the Annual Meeting. As a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against a proposal in cases where approval of the proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting (e.g., Proposal No. 2). However, because the outcome of Proposal No. 1 (election of directors) will be determined by a plurality vote, abstentions will have no impact on the outcome of such proposal as long as a quorum exists. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker, bank or other nominee does not have discretionary voting power with respect to such proposal and has not received voting instructions from the beneficial owner of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting but will not be counted for purposes of determining the number of votes cast. Therefore, a broker non-vote will make a quorum more readily attainable but will not otherwise affect the outcome of the vote on any proposal.

How many votes are needed for approval of each proposal?

| • | Proposal No. 1: The election of a Class I director requires a plurality vote of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. This means that the one nominee who receives the most FOR votes will be elected. You may (i) vote FOR the nominee or (ii) WITHHOLD your vote as to the nominee. Any shares not voted FOR a nominee (whether as a result of voting withheld or a broker non-vote) will not be counted in the nominee’s favor and will have no effect on the outcome of the election. |

| • | Proposal No. 2: The ratification of the appointment of Haskell & White LLP requires an affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. You may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on Proposal No. 2, the abstention will have the same effect as a vote AGAINST the proposal. |

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on our sole “routine” matter — the proposal to ratify the appointment of Haskell & White LLP. Absent direction from you, your broker will not have discretion to vote on the election of directors.

Who will count the votes?

A representative of our mailing agent, Broadridge Financial Solutions, Inc., will tabulate the votes and act as inspector of elections.

-5-

How are proxies solicited for the Annual Meeting and who is paying for such solicitation?

Our Board is soliciting proxies for use at the Annual Meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communication, or other means by our directors, officers, employees or agents. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation. We do not plan to retain a proxy solicitor to assist in the solicitation of proxies.

If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur.

What does it mean if I received more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Notice to ensure that all of your shares are voted.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Pfenex or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted an SEC-approved procedure called “householding,” under which we can deliver a single copy of the proxy materials and annual report to multiple stockholders who share the same address unless we received contrary instructions from one or more of the stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will promptly deliver a separate copy of the proxy materials and annual report to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of next year’s proxy materials and annual report, you may contact us as follows:

Pfenex Inc.

Attention: Secretary

10790 Roselle Street

San Diego, CA 92121

(858) 352-4400

Stockholders who hold shares in street name may contact their brokerage firm, bank, broker-dealer or other nominee to request information about householding.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual

-6-

Meeting. If final voting results are not available to us at that time, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amendment to the Form 8-K to publish the final results.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to our Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 2016 annual meeting of stockholders, our Secretary must receive the written proposal at our principal executive offices not later than November 27, 2015. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to:

Pfenex Inc.

Attention: Secretary

10790 Roselle Street

San Diego, CA 92121

Our bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our bylaws provide that the only business that may be conducted at an annual meeting is business that is (i) specified in our proxy materials with respect to such meeting, (ii) otherwise properly brought before the annual meeting by or at the direction of our board of directors, or (iii) properly brought before the annual meeting by a stockholder of record entitled to vote at the annual meeting who has delivered timely written notice to our Secretary, which notice must contain the information specified in our bylaws. To be timely for our 2016 annual meeting of stockholders, our Secretary must receive the written notice at our principal executive offices:

| • | not earlier than January 11, 2016; and |

| • | not later than February 10, 2016. |

In the event that we hold our 2016 annual meeting of stockholders more than 30 days before or more than 60 days after the first anniversary of the date of the Annual Meeting, then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before such annual meeting and no later than the close of business on the later of the following two dates:

| • | the 90th day prior to such annual meeting; or |

| • | the 10th day following the day on which public announcement of the date of such annual meeting is first made. |

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting does not appear to present his, her or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

Nomination of Director Candidates

You may propose director candidates for consideration by our compensation, nominating and governance committee. Any such recommendations should include the nominee’s name and qualifications for membership

-7-

on our board of directors and should be directed to our Secretary at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Board of Directors and Corporate Governance — Stockholder Recommendations for Nominations to the Board.”

In addition, our bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our bylaws. In addition, the stockholder must give timely notice to our Secretary in accordance with our bylaws, which, in general, require that the notice be received by our Secretary within the time period described above under “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.

Availability of Bylaws

A copy of our bylaws may be obtained by accessing our public filings on the SEC’s website at www.sec.gov. You may also contact our Secretary at our principal executive office for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

-8-

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our board of directors, which is currently comprised of six members. James C. Gale and Kenneth Van Heel, who have served as directors since 2009 and 2012, respectively, were not nominated for re-election and the term of each as a director will expire at the Annual Meeting. The Board would like to thank Messrs. Gale and Van Heel for their dedicated service to Pfenex. Although we presently have six directors, as a result of the departure of Messrs. Gale and Van Heel from the Board, the Board has reduced the number of directors from six to five, and reduced the size of Class I to one director, effective as of the date of the Annual Meeting. Messrs. Gale and Van Heel will continue to serve until their terms expire at the Annual Meeting, at which time the reduction to five directors will take effect. Thus, the Board is nominating one nominee for election. Four of our directors (including three of our continuing directors and our director nominee) are independent within the meaning of the independent director requirements of NYSE MKT. Our board of directors is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring.

The following table sets forth the names, ages as of March 1, 2015, and certain other information for each of our continuing directors and also our nominee for election as a director at the Annual Meeting:

| Name |

Class | Age | Position |

Director Since |

Current Term Expires |

Expiration of Term For Which Nominated |

||||||||||||||

| 1. Nominee for Director |

||||||||||||||||||||

| John M. Taylor |

I | 50 | Director | — | — | 2018 | ||||||||||||||

| 2. Continuing Directors |

||||||||||||||||||||

| Phillip M. Schneider(1)(2) |

II | 58 | Director | 2014 | 2016 | — | ||||||||||||||

| Robin D. Campbell(2) |

II | 60 | Director | 2014 | 2016 | — | ||||||||||||||

| Bertrand C. Liang |

III | 52 | President, Chief Executive Officer, Secretary, and Director | 2009 | 2017 | — | ||||||||||||||

| William R. Rohn(1)(2) |

III | 71 | Chairman | 2014 | 2017 | — | ||||||||||||||

| (1) | Member of our audit committee |

| (2) | Member of our compensation, nominating and governance committee |

John M. Taylor is a nominee for director. Mr. Taylor has served since September of 2014 as the Principal of Compliance and Regulatory Affairs of Greenleaf Health, LLC, a consulting firm that provides strategic guidance to FDA-regulated companies. Prior to joining Greenleaf, Mr. Taylor served as Counselor to the Commissioner, Acting Deputy Principal Commissioner, and Acting Deputy Commissioner for Global Regulatory Operations and Policy at the U.S. Food and Drug Administration (FDA) from October of 2009 to February of 2014. Prior to that, Mr. Taylor served as the Executive Vice President for Health at the Biotechnology Industry Organization (BIO), a biotechnology organization providing advocacy, business development and communications services, from 2007 to 2009. Prior to joining BIO, Mr. Taylor served as Divisional Vice President for Federal Government Affairs at Abbott Laboratories, a diversified healthcare company, from 2005 to 2007. Prior to joining Abbott, Mr. Taylor served at the FDA in a variety of positions, as Associate Commissioner for Regulatory Affairs from 2002 to 2005, Director of the Office of Enforcement from 2000 to 2002, Acting Director of the Office of Compliance in the Center for Drug Evaluation and Research in 2000, Special Assistant to the Associate Commissioner for Regulatory Affairs in 1999, Senior Advisor for Regulatory Policy within the Office of the Commissioner from 1996 to 1999, and as an Attorney in the Office of the Chief Counsel from 1991 to 1996. Mr. Taylor holds a Bachelor’s degree in History from Pennsylvania State University and a J.D. from the College of William and Mary. The board of directors believes Mr. Taylor is qualified to serve as a director because of his extensive regulatory experience and his unique knowledge of the healthcare industry.

-9-

Directors Not Nominated for Re-Election

James Gale, age 65 and currently a Class I director, was not nominated for re-election at our 2015 annual meeting. Mr. Gale has served as a member of our board of directors since 2009. Since 1998, Mr. Gale has served as the founding partner and a managing director of Signet Healthcare Partners, a private equity firm that invests in commercial stage healthcare companies, and an affiliate of SMH Capital, Inc. Prior to founding Signet Healthcare Partners, Mr. Gale was head of principal investment activities and head of investment banking for Gruntal & Co., LLC from 1992 to 1998. Prior to joining Gruntal, Mr. Gale originated and managed private equity investments for the Home Insurance Co., Gruntal’s parent from 1989 to 1992. Earlier in his career, Mr. Gale was a senior investment banker at E.F. Hutton & Co., an investment bank. He serves as a member of the board of directors of two public companies, IGI Laboratories, Inc. and Knight Therapeutics Inc., as well as several private companies. During the past five years, he also served on the board of directors of two additional public companies, Paladin Labs Inc. and Octoplus BV. Mr. Gale holds a Bachelor’s degree in Education from the University of Arizona and an M.B.A. from the University of Chicago. The board of directors believes Mr. Gale is qualified to serve as a director because of his extensive private equity experience and his unique knowledge of the healthcare industry.

Kenneth Van Heel, age 50 and currently a Class I director, was not nominated for re-election at our 2015 annual meeting. Mr. Van Heel joined our board of directors in 2012. Since 2007, Mr. Van Heel has served as Global Director of Portfolio Investments and Director of Dow Chemical Canada Pension Plan at The Dow Chemical Company, a chemicals manufacturer, and has held various positions with Dow and its wholly-owned subsidiaries, including: Senior Manager of Private Equity of The Dow Chemical Company from 2003 to 2006, Manager of Dow Corporate Venture Capital from 2000 until 2003 and other various positions with Dow since 1994. Mr. Van Heel holds a Bachelor’s degree in Materials Science and Engineering from Illinois Institute of Technology and an M.B.A. from DePaul University. The board of directors believes Mr. Van Heel is qualified to serve as a director because of his extensive finance and venture capital experience.

Phillip M. Schneider joined our board of directors in 2014. Most recently, Mr. Schneider held various positions with IDEC Pharmaceuticals Corporation, a biopharmaceutical company, from 1987 to 2003, including: Senior Vice President and Chief Financial Officer from 1997 to 2003; and Director of Finance and Administration from 1992 to 1997. Prior to that, Mr. Schneider held various management positions at Syntex Pharmaceuticals Corporation, a pharmaceutical company, from 1985 to 1987 and KPMG LLP, an audit and tax advisory firm, from 1982 to 1984, where he attained his CPA license. He currently serves as a member of the board of directors of Arena Pharmaceuticals Corporation, a pharmaceutical company, which he joined in 2008, and Auspex Pharmaceuticals, a pharmaceutical company, which he joined in 2014. He previously served as a member of the board of directors of Gen-Probe, Inc., a biotechnology company, from 2002 until its acquisition by Hologic Inc. in 2012. Mr. Schneider holds a B.S. in Biochemistry from the University of California, Davis and an M.B.A. from the University of Southern California. The board of directors believes Mr. Schneider is qualified to serve as a director because of his extensive experience in finance and accounting and his unique knowledge of the biotechnology industry.

Robin D. Campbell joined our board of directors in 2014. Dr. Campbell has served as a Technology Management Program Lecturer at the University of California, Santa Barbara since 2009. From 2008 to 2012, Dr. Campbell served as Managing Director of Campbell Management Solutions, LLC, a strategy and management consulting company. Prior to that, Dr. Campbell served as President and Chief Executive Officer of Naryx Pharma, Inc., a pharmaceutical company, from 2004 to 2008. From 1989 to 2002, Dr. Campbell held various management positions with Amgen, Inc., a biopharmaceutical company, including Vice President of the U.S. Oncology Business Unit and General Manager and Vice President of Asia Pacific and Latin American Operations. Dr. Campbell served as President of Kirin-Amgen, Inc., a biotechnology joint venture between Kirin Brewery Company, Limited and Amgen, Inc., from 1997 to 2000. Dr. Campbell served on the board of directors

-10-

of SEQUUS Pharmaceuticals, a public oncology therapeutics company, from 1998 to 1999. Dr. Campbell is currently the Chairman of the Board of Aptitude Medical Systems, a private research platform technology company. Dr. Campbell holds a Bachelor’s degree in Zoology from the University of North Carolina, Chapel Hill and a Ph.D. in Microbiology and Immunology from Wake Forest University. The board of directors believes Dr. Campbell is qualified to serve as a director because of his extensive industry background and management experience.

Bertrand C. Liang has served as our Chief Executive Officer and as a member of our board of directors since December 2009. Prior to joining us, Dr. Liang served as Vice Chairman of Paramount Biosciences, LLC, a venture capital firm investing in early-stage healthcare companies, from 2006 to 2008. Dr. Liang founded and held the position of President and Chief Executive Officer of Tracon Pharmaceuticals, Inc., a biopharmaceutical company, from 2005 to 2006 and formerly served as a member of the board of directors. From 2003 to 2005, Dr. Liang served as Vice President, New Ventures and Development of Biogen Idec, the successor company to IDEC Pharmaceuticals, a biotechnology company, and prior to the merger, as Vice President and Head, Hematology and Oncology at IDEC Pharmaceuticals, a biotechnology company, from July 2002 to December 2003. From 1999 to 2002, Dr. Liang held the position of Development Leader at Amgen, Inc., a biopharmaceutical company. He founded and previously served on the board of directors of Coronado Biosciences, Inc., a biopharmaceutical company. Dr. Liang holds a Bachelor’s degree in Chemistry, Biology and Philosophy from Boston University, an M.D. from Northwestern University Medical School, a Ph.D. from University of Bolton and an M.B.A. from Regis University. The board of directors believes Dr. Liang is qualified to serve as a director because of his extensive industry background and management experience.

William R. Rohn joined our board of directors in 2014, and he is our board’s Chairman. Most recently, Mr. Rohn served as Chief Operating Officer of Biogen Idec, the successor company to IDEC Pharmaceuticals, a biotechnology company, from 2003 until 2005. Mr. Rohn also held various management positions with IDEC Pharmaceuticals, a biotechnology company, including: President and Chief Operating Officer from 1998 to 2003, Senior Vice President, Commercial Operations from 1996 to 1998 and Senior Vice President, Commercial and Corporate Development from 1993 to 1996. He also held various management positions with Adria Laboratories, a pharmaceutical company acquired by Pfizer Inc., including Senior Vice President of Commercial Operations from 1991 to 1993 and Vice President of Business Development and Licensing from 1985 to 1990. Mr. Rohn currently serves on the board of directors of Hansen Medical, Inc., a medical device company, and Cebix Inc., a privately held biotechnology company. Mr. Rohn previously served on the boards of Intellikine, Inc., a pharmaceutical company acquired by Takeda America Holdings, Inc., Cerus Corporation, a biomedical products company, Elan Corporation, plc, a pharmaceutical company acquired by Perrigo Company plc, Metabasis Therapeutics, Inc., a biopharmaceutical company that merged with Ligand Pharmaceuticals Inc., Pharmacyclics Inc., a pharmaceutical company, and Sophoris Bio, Inc., a biopharmaceutical company. Mr. Rohn holds a Bachelor’s degree in Marketing from Michigan State University and has completed graduate-level coursework in Business Administration at Indiana State University. The board of directors believes Mr. Rohn is qualified to serve as a director because of his knowledge of our industry and his prior and current experience as a senior officer and director of other healthcare companies.

Our common stock is listed on the NYSE MKT. Under the rules of the NYSE MKT, independent directors must comprise a majority of a listed company’s board of directors within a specified period of the completion of our initial public offering. In addition, the rules of the NYSE MKT require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under the rules of the NYSE MKT, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

-11-

Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: (i) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (ii) be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors has undertaken a review of the independence of each director to determine whether each director has a material relationship with us that could compromise his ability to exercise independent judgment in carrying out his responsibilities, and determined that each of Messrs. Rohn, Schneider, and Gale and Dr. Campbell, representing four of our six directors, are “independent directors” as defined under the applicable rules and regulations of the SEC and the listing requirements and the rules of the NYSE MKT. Our board of directors has also determined that Mr. Taylor, our director nominee, is an “independent director” as defined under the applicable rules and regulations of the SEC and the listing requirements and the rules of the NYSE MKT.

Mr. Rohn currently serves as the chairman of our board of directors. Our board of directors believes the current board leadership structure provides effective independent oversight of management while allowing our board of directors and management to benefit from Mr. Rohn’s leadership and years of experience as an executive in the pharmaceutical industry. Mr. Rohn is best positioned to identify strategic priorities, lead critical discussion and execute our strategy and business plans. Mr. Rohn possesses detailed in-depth knowledge of the issues, opportunities, and challenges facing us. Independent directors and management sometimes have different perspectives and roles in strategy development. Our independent directors bring experience, oversight and expertise from outside of our company, while our Chief Executive Officer brings company-specific experience and expertise. Our board of directors believes that Mr. Rohn’s role enables strong leadership, creates clear accountability, facilitates information flow between management and our board of directors, and enhances our ability to communicate our message and strategy clearly and consistently to stockholders.

During 2014, our board of directors held six meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he served as a director and (ii) the total number of meetings held by all committees of our board of directors on which he served during the periods that he served.

It is the policy of our board of directors to regularly have separate meeting times for independent directors without management. Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we encourage, but do not require, our directors to attend.

We have established an audit committee and a compensation, nominating and governance committee. We believe that the composition of these committees meets the criteria for independence under, and the functioning of these committees comply with the requirements of, the Sarbanes-Oxley Act of 2002, the rules of the NYSE MKT, and SEC rules and regulations. We intend to comply with the requirements of the NYSE MKT with respect to committee composition of independent directors. Each committee has the composition and responsibilities described below.

Messrs. Schneider, Rohn and Van Heel, each of whom is a non-employee member of our board of directors, currently comprise our audit committee. Mr. Schneider serves as the chair of our audit committee. Our board of

-12-

directors has determined that Messrs. Rohn and Schneider satisfy the requirements for independence and each of the members satisfies the requirements for financial literacy under the rules and regulations of the NYSE MKT and the SEC. Mr. Van Heel, who is not independent, was not nominated for re-election and his term as a director will expire at our 2015 annual meeting. Because Mr. Van Heel is not independent, we will be required to change the composition of our audit committee to comply with NYSE MKT and SEC rules. However, as permitted by the applicable NYSE MKT and SEC rules, we have twelve months from the completion of our initial public offering to comply with such independence requirements and to have a fully independent audit committee. Our board has designated Dr. Campbell to replace Mr. Van Heel on our audit committee effective as of the annual meeting, and Dr. Campbell has agreed to serve on the audit committee. Our board of directors has determined that Dr. Campbell satisfies the requirements for independence and the requirements for financial literacy under the rules and regulations of the NYSE MKT and the SEC. Our board of directors has also determined that Mr. Schneider qualifies as an “audit committee financial expert,” as defined in the SEC rules, and satisfies the financial sophistication requirements of the NYSE MKT. The audit committee is responsible for, among other things, providing assistance to the board of directors in fulfilling its oversight responsibilities regarding the integrity of our financial statements, our compliance with applicable legal and regulatory requirements, the integrity of our financial reporting processes, including its systems of internal accounting and financial controls, the performance of our internal audit function and independent auditor and our financial policy matters by approving the services performed by our independent accountants and reviewing their reports regarding our accounting practices and systems of internal accounting controls. The audit committee also oversees the audit efforts of our independent accountants and takes those actions as it deems necessary to satisfy itself that the accountants are independent of management.

Our audit committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing requirements of NYSE MKT. A copy of the charter of our audit committee is available on our website at www.pfenex.com in the Corporate Governance section of our Investor Relations webpage. During 2014, our audit committee held four meetings.

Compensation, Nominating and Governance Committee

Messrs. Rohn, Schneider, and Gale and Dr. Campbell, each of whom is a non-employee member of our board of directors, comprise our compensation, nominating and governance committee. Dr. Campbell serves as the chair of our compensation, nominating and governance committee. Our board of directors has determined that each member of our compensation, nominating and governance committee meets the requirements for independence under the rules of the NYSE MKT and the SEC and is an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code. The compensation, nominating and governance committee is responsible for, among other things, overseeing our overall compensation structure, policies and programs, and assessing whether our compensation structure establishes appropriate incentives for officers and employees. The compensation, nominating and governance committee also reviews and approves corporate goals and objectives relevant to compensation of our chief executive officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives, sets the compensation of these officers based on such evaluations and reviews and approves or recommends to the board of directors any employment-related agreements, any proposed severance arrangements or change in control or similar agreements with these officers. While our chief executive officer provides input on his own compensation and the compensation of other executive officers, he does not participate in compensation, nominating and governance committee or board deliberations regarding his own compensation. Additionally, the compensation, nominating and governance committee administers the issuance of stock options and other awards under our stock plans. The compensation, nominating and governance committee may delegate limited authority to executive officers or other directors of the Company to grant equity awards to non-executive officers. Currently, our Chief Executive Officer and Chief Financial officer have been delegated authority to grant equity awards to certain non-executive officers, subject to terms, conditions and limitations previously approved by the compensation, nominating and governance committee. The compensation, nominating and governance committee will review and evaluate, at least annually, the performance of the compensation, nominating and

-13-

governance committee and its members and the adequacy of the charter of the compensation, nominating and governance committee. The compensation, nominating and governance committee will also prepare a report on executive compensation, when and as required by the SEC rules, to be included in our annual report and annual proxy statement. The compensation, nominating and governance committee is also responsible for, among other things, developing and recommending to the board of directors criteria for identifying and evaluating candidates for directorships and making recommendations to the board of directors regarding candidates for election or reelection to the board of directors at each annual stockholders’ meeting. In addition, the compensation, nominating and governance committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to the board of directors concerning corporate governance matters. The compensation, nominating and governance committee will also be responsible for making recommendations to the board of directors concerning the structure, composition and function of the board of directors and its committees. The compensation, nominating and governance committee may, in its sole discretion, retain and terminate any search firm (and approve such search firm’s fees and other retention terms) to assist in the identification of director candidates.

Our compensation, nominating and governance committee operates under a written charter that satisfies the listing standards of NYSE MKT. A copy of the charter of our compensation, nominating and governance committee is available on our website at www.pfenex.com in the Corporate Governance section of our Investor Relations webpage. During 2014, our compensation, nominating and governance committee held four meetings.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation, nominating and governance committee (which includes Robin D. Campbell, William R. Rohn, James C. Gale and Phillip M. Schneider) is or has at any time during the past year been an officer or employee of ours. None of our executive officers currently serves or in the past year has served as a member of the board of directors or compensation, nominating and governance committee of any entity that has one or more executive officers serving on our board or compensation, nominating and governance committee.

Identifying and Evaluating Nominees for Director

The compensation, nominating and governance committee will use the following procedures to identify and evaluate any individual recommended or offered for nomination to the Board:

| • | The compensation, nominating and governance committee will consider candidates recommended by stockholders in the same manner as candidates recommended to the compensation, nominating and governance committee from other sources. |

| • | In its evaluation of director candidates, including the members of the Board eligible for re-election, the compensation, nominating and governance committee will consider the following: |

| • | The current size and composition of the Board and the needs of the Board and the respective committees of the Board. |

| • | Such factors as character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like. The compensation, nominating and governance committee evaluates these factors, among others, and does not assign any particular weighting or priority to any of these factors. |

| • | Other factors that the compensation, nominating and governance committee may consider appropriate. |

The compensation, nominating and governance committee also focuses on issues of diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints

-14-

and skills. The committee does not have a formal policy with respect to diversity; however, our Board and the compensation, nominating and governance committee believe that it is essential that members of our Board represent diverse viewpoints.

| • | The compensation, nominating and governance committee requires the following minimum qualifications to be satisfied by any nominee for a position on the Board: |

| • | The highest personal and professional ethics and integrity. |

| • | Proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment. |

| • | Skills that are complementary to those of the existing Board. |

| • | The ability to assist and support management and make significant contributions to the Company’s success. |

| • | An understanding of the fiduciary responsibilities that is required of a member of the Board and the commitment of time and energy necessary to diligently carry out those responsibilities. |

| • | If the compensation, nominating and governance committee determines that an additional or replacement director is required, the compensation, nominating and governance committee may take such measures that it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the compensation, nominating and governance committee, the Board or management. |

The compensation, nominating and governance committee may propose to the Board a candidate recommended or offered for nomination by a stockholder as a nominee for election to the Board.

Stockholder Recommendations for Nominations to the Board

It is the policy of the compensation, nominating and governance committee of the Board of Pfenex Inc. to consider recommendations for candidates to the Board from stockholders holding no less than one percent (1%) of the outstanding shares of the Company’s common stock continuously for at least twelve (12) months prior to the date of the submission of the recommendation or nomination.

A stockholder that wants to recommend a candidate for election to the Board should direct the recommendation in writing by letter to the Company, attention of the Secretary, at 10790 Roselle Street, San Diego, CA 92121. The recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and the Company and evidence of the recommending stockholder’s ownership of Company stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for Board membership, including issues of character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like and personal references.

A stockholder that instead desires to nominate a person directly for election to the Board at an annual meeting of the stockholders must meet the deadlines and other requirements set forth in Section 2.4 of the Company’s Bylaws and the rules and regulations of the Securities and Exchange Commission. Section 2.4 of the Company’s Bylaws requires that a stockholder who seeks to nominate a candidate for director must provide a written notice to the Secretary of the Company not later than the 45th day nor earlier than the 75th day before the one-year anniversary of the date on which the corporation first mailed its proxy materials or a notice of

-15-

availability of proxy materials (whichever is earlier) for the preceding year’s annual meeting; provided, however, that in the event that no annual meeting was held in the previous year or if the date of the annual meeting is advanced by more than 30 days prior to or delayed by more than 60 days after the one-year anniversary of the date of the previous year’s annual meeting, then notice by the stockholder to be timely must be so received by the Secretary of the Company not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of (i) the 90th day prior to such annual meeting and (ii) the 10th day following the day on which Public Announcement (as defined below) of the date of such annual meeting is first made. That notice must state the information required by Section 2.4 of the Company’s Bylaws, and otherwise must comply with applicable federal and state law. The Secretary of the Company will provide a copy of the Bylaws upon request in writing from a stockholder. “Public Announcement” shall mean disclosure in a press release reported by the Dow Jones News Service, Associated Press or a comparable national news service or in a document publicly filed by the corporation with the Securities and Exchange Commission pursuant to Section 13, 14 or 15(d) of the Securities Exchange Act of 1934, as amended, or any successor thereto.

Communications with the Board of Directors

The Board believes that management speaks for the Company. Individual Board members may, from time to time, communicate with various constituencies that are involved with the Company, but it is expected that Board members would do this with knowledge of management and, in most instances, only at the request of management.

In cases where stockholders and other interested parties wish to communicate directly with our non-management directors, messages can be sent to our Secretary, at Pfenex Inc., Attention: Secretary, 10790 Roselle Street, San Diego, California 92121. Our Secretary monitors these communications and will provide a summary of all received messages to the Board at each regularly scheduled meeting of the Board. Our Board generally meets on a quarterly basis. Where the nature of a communication warrants, our Secretary may determine, in his or her judgment, to obtain the more immediate attention of the appropriate committee of the Board or non-management director, of independent advisors or of Company management, as our Secretary considers appropriate.

Our Secretary may decide in the exercise of his or her judgment whether a response to any stockholder or interested party communication is necessary.

This procedure for stockholder and other interest party communications with the non-management directors is administered by the Company’s compensation, nominating and governance committee. This procedure does not apply to (a) communications to non-management directors from officers or directors of the Company who are stockholders, (b) stockholder proposals submitted pursuant to Rule 14a-8 under the Securities and Exchange Act of 1934, as amended, or (c) communications to the audit committee pursuant to the Complaint Procedures for Accounting and Auditing Matters.

Corporate Governance Principles and Code of Ethics and Conduct

Our Board has adopted Corporate Governance Principles. These principles address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our Board has adopted a Code of Ethics and Conduct that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The full text of our Corporate Governance Principles and our Code of Ethics and Conduct is posted on our website at www.pfenex.com in the Corporate Governance section of our Investor Relations webpage. We intend to post any amendments to our Code of Ethics and Conduct, and any waivers of our Code of Ethics and Conduct for directors and executive officers, on the same website.

-16-

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our Board, as a whole and assisted by its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are appropriate and functioning as designed.

Our Board believes that open communication between management and our Board is essential for effective risk management and oversight. Our Board meets with our Chief Executive Officer and other members of the senior management team at quarterly meetings of our Board, where, among other topics, they discuss strategy and risks facing the company, as well as at such other times as they deemed appropriate.

While our Board is ultimately responsible for risk oversight, our board committees assist our Board in fulfilling its oversight responsibilities in certain areas of risk. Our audit committee assists our Board in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures, legal and regulatory compliance, and discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. Our audit committee also reviews our major financial risk exposures and the steps management has taken to monitor and control these exposures. In addition, our audit committee monitors certain key risks on a regular basis throughout the fiscal year, such as risk associated with internal control over financial reporting and liquidity risk. Our compensation, nominating and governance committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risk associated with board organization, membership and structure, and corporate governance. Our compensation, nominating and governance committee also oversees risks related to our compensation policies to ensure that our compensation programs do not encourage unnecessary risk-taking. Finally, our full Board reviews strategic and operational risk in the context of reports from the management team, receives reports on all significant committee activities at each regular meeting, and evaluates the risks inherent in significant transactions.

Cash Compensation. Following our initial public offering, all non-employee directors were entitled to receive the following cash compensation for their services during 2014:

| • | $35,000 per year for service as a board member; |

| • | $20,000 per year additionally for service as chairman of the board; |

| • | $10,000 per year additionally for service as chairman of the audit committee; |

| • | $8,000 per year additionally for service as an audit committee member; |

| • | $8,000 per year additionally for service as chairman of the compensation, nominating and governance committee; and |

| • | $5,000 per year additionally for service as a compensation, nominating and governance committee member. |

In 2015, all non-employee directors will be entitled to receive the following cash compensation for their services:

| • | $40,000 per year for service as a board member; |

| • | $20,000 per year additionally for service as chairman of the board; |

| • | $15,000 per year additionally for service as chairman of the audit committee; |

-17-

| • | $8,000 per year additionally for service as an audit committee member; |

| • | $8,000 per year additionally for service as chairman of the compensation, nominating and governance committee; and |

| • | $5,000 per year additionally for service as a compensation, nominating and governance committee member. |

All cash payments to non-employee directors will be paid quarterly in arrears on a prorated basis.

Options. Each non-employee director who first joins us will be granted an initial award of a nonstatutory stock option to purchase 20,000 shares (increasing to 25,000 shares in 2015) of our common stock and on the date of each annual meeting of stockholders beginning with the first annual meeting following the completion of this offering, each non-employee director who has been a non-employee director for 6 months or more on the date of the annual meeting will be granted an annual award of a nonstatutory stock option to acquire 18,000 shares of our common stock. The initial award shall vest fully on the next annual meeting. The annual award shall fully vest on the date of the next annual meeting subject to continued service as a director. These awards will vest and become immediately exercisable immediately prior to a change in control.

The table below shows compensation earned by our non-employee directors during 2014. Directors who are also our employees receive no additional compensation for their service as a director. During the year ended December 31, 2014, one director, Dr. Liang, was an employee. Dr. Liang’s compensation is discussed in “Executive Compensation.”

| Name |

Cash Compensation ($)(4) |

Option Awards ($)(5)(6) |

Total ($) | |||||||||

| William R. Rohn(1) |

30,702 | 51,136 | 81,838 | |||||||||

| Phillip M. Schneider(1) |

21,909 | 51,136 | 73,045 | |||||||||

| James C. Gale |

17,527 | — | 17,527 | |||||||||

| Kenneth Van Heel(2) |

— | — | — | |||||||||

| Robin D. Campbell, Ph.D.(3) |

10,519 | 61,246 | 71,765 | |||||||||

| (1) | Mr. Rohn and Mr. Schneider joined our Board in July 2014. |

| (2) | Mr. Van Heel elected to forego Director’s Compensation in 2014. |

| (3) | Dr. Campbell joined our Board in September 2014. |

| (4) | Amounts in this column reflect compensation earned in 2014. |

| (5) | The amounts shown represent the full grant date fair value of option awards granted in 2014 as determined pursuant to ASC 718. The assumptions used to calculate the value of such awards are included in Note 12 to our audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2014. |

| (6) | As of December 31, 2014, our non-employee directors held outstanding options to purchase the number of shares of common stock as follows: Mr. Rohn (20,000 options); Mr. Schneider (20,000 options); Mr. Gale (no options); Mr. Van Heel (no options); and Dr. Campbell (20,000 options). |

See “Executive Compensation” for information about the compensation of directors who are also our employees.

-18-

ELECTION OF DIRECTORS

Our Board is currently composed of six members, but will be reduced to five members, and the size of Class I will be reduced to one member, at the 2015 annual meeting in conjunction with Class I directors James C. Gale and Kenneth Van Heel not being nominated for re-election. In accordance with our certificate of incorporation, our board of directors is divided into three classes with staggered three-year terms. At the Annual Meeting, one Class I director will be elected for a three-year term to succeed the same class whose term is then expiring.

Each director’s term continues until the election and qualification of such director’s successor, or such director’s earlier death, resignation, or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of our board of directors may have the effect of delaying or preventing changes in control of our company.

Our compensation, nominating and governance committee has recommended, and our board of directors has approved, John M. Taylor as nominee for election as a Class I director at the Annual Meeting. Mr. Taylor was initially recommended by the Company’s chief executive officer. If elected, Mr. Taylor will serve as a Class I director until the 2018 annual meeting of stockholders or until his successor is duly elected and qualified. For information concerning the nominee, please see the section titled “Board of Directors and Corporate Governance.”

If you are a stockholder of record and you sign your proxy card or vote over the Internet or by telephone but do not give instructions with respect to the voting of directors, your shares will be voted FOR the election of John M. Taylor. We expect that John M. Taylor will accept such nomination; however, in the event that he is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by our board of directors to fill such vacancy. If you are a beneficial owner of shares of our common stock and you do not give voting instructions to your broker, bank or other nominee, then your broker, bank or other nominee will leave your shares unvoted on this matter.

The election of Class I directors requires a plurality vote of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Broker non-votes will have no effect on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE DIRECTOR NOMINATED BY OUR BOARD OF DIRECTORS AND NAMED IN THIS PROXY STATEMENT AS A CLASS I DIRECTOR TO SERVE FOR A THREE-YEAR TERM.

-19-

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has appointed Haskell & White LLP, as our independent registered public accounting firm to audit our consolidated financial statements for our fiscal year ending December 31, 2015. Haskell & White LLP also served as our independent registered public accounting firm for our fiscal year ended December 31, 2014.

At the Annual Meeting, stockholders are being asked to ratify the appointment of Haskell & White LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2015. Stockholder ratification of the appointment of Haskell & White LLP is not required by our bylaws or other applicable legal requirements. However, our board of directors is submitting the appointment of Haskell & White LLP to our stockholders for ratification as a matter of good corporate governance. In the event that this appointment is not ratified by the affirmative vote of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote, such appointment will be reconsidered by our audit committee. Even if the appointment is ratified, our audit committee, in its sole discretion, may appoint another independent registered public accounting firm at any time during our fiscal year ending December 31, 2015 if our audit committee believes that such a change would be in the best interests of Pfenex and its stockholders. If the appointment is not ratified by our stockholders, the audit committee may reconsider whether it should appoint another independent registered public accounting firm. A representative of Haskell & White LLP is expected to be present at the Annual Meeting, will have an opportunity to make a statement if he or she wishes to do so, and is expected to be available to respond to appropriate questions from stockholders.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees for professional audit services and other services rendered to us by Haskell & White LLP for our fiscal years ended December 31, 2014 and 2013.

| 2014 | 2013 | |||||||

| Audit Fees(1) |

$ | 505,745 | $ | 216,361 | ||||

| Audit-Related Fees(2) |

— | — | ||||||

| Tax Fees(3) |

— | — | ||||||