UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

KALA BIO, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

KALA

BIO

KALA BIO, INC.,

1167 Massachusetts Avenue

Arlington, Massachusetts 02476

(781) 996-5252

NOTICE OF 2025 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on January 30, 2026

Dear Stockholders:

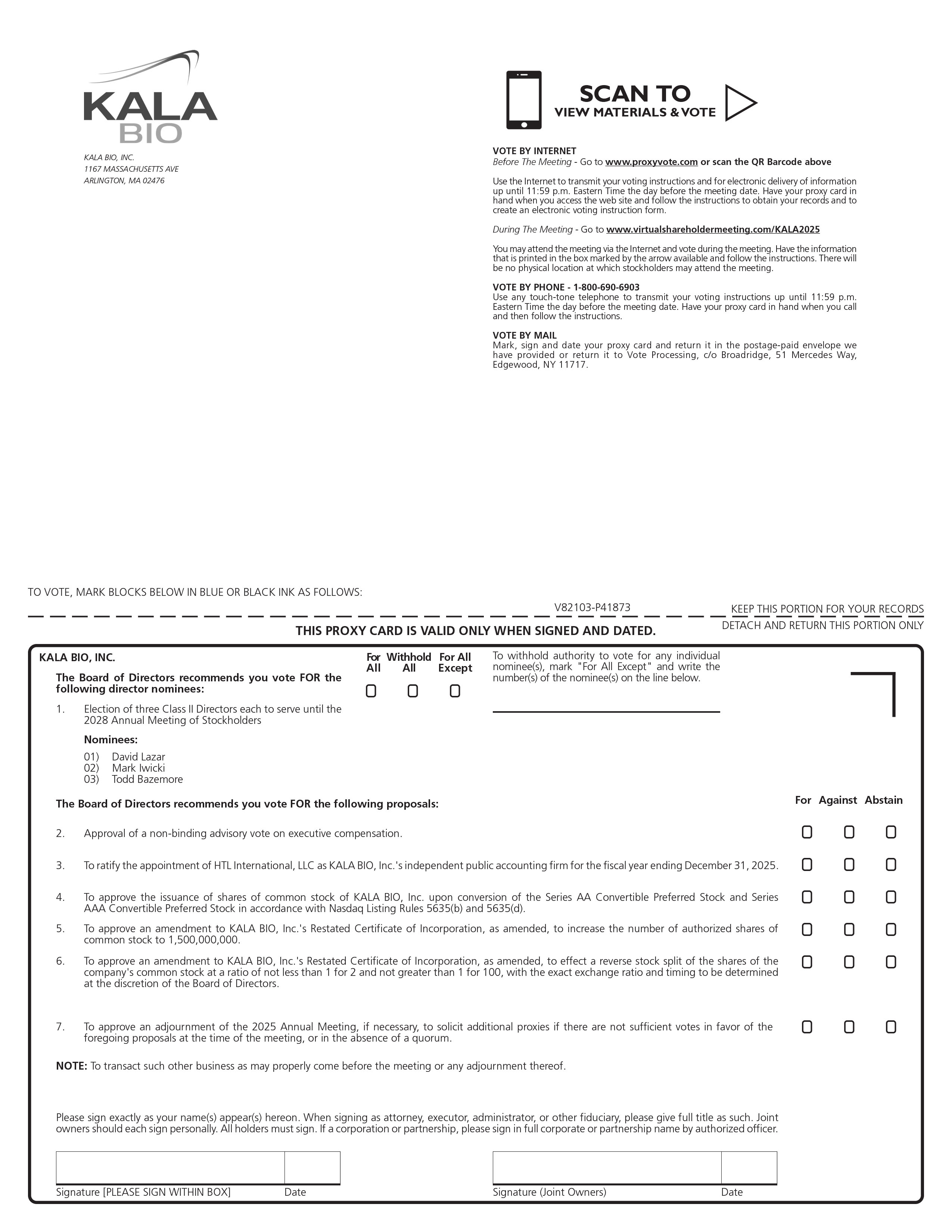

You are cordially invited to attend the 2025 annual meeting of stockholders of KALA BIO, Inc., which will be a virtual meeting held via the Internet at www.virtualshareholdermeeting.com/KALA2025 on Friday, January 30, 2026 at 11:00 a.m., Eastern Time. At the annual meeting, stockholders will consider and vote on the following matters:

| 1. | The election of three Class II directors, David Lazar, Mark Iwicki and Todd Bazemore, each to serve until the 2028 annual meeting of stockholders and until his successor has been duly elected and qualified; |

| 2. | The approval of a non-binding advisory vote on executive compensation; |

| 3. | The ratification of the appointment of HTL International, LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2025; |

| 4. | The approval of the issuance of shares of our common stock upon conversion of our Series AA Convertible Preferred Stock and Series AAA Convertible Preferred Stock in accordance with Nasdaq Listing Rules 5635(b) and 5635(d); |

| 5. | The approval of an amendment to our Restated Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock to 1,500,000,000. |

| 6. | The approval of an amendment to our Restated Certificate of Incorporation, as amended, to effect a reverse stock split of the shares of our common stock at a ratio of not less than 1‑for‑2 and not greater than 1‑for‑100 |

| 7. | The approval of an adjournment of the 2025 annual meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals at the time of the meeting, or in the absence of a quorum; and |

The transaction of any other business that may properly come before the annual meeting or any adjournment or postponement thereof.

As noted above, our annual meeting will be a “virtual meeting” of stockholders, which will be conducted exclusively via the Internet at a virtual web conference. There will not be a physical meeting location, and stockholders will not be able to attend the annual meeting in person. This means you can attend the annual meeting online, vote your shares electronically during the annual meeting and submit questions online during the annual meeting by accessing www.virtualshareholdermeeting.com/KALA2025 shortly prior to the scheduled start of the meeting and entering the 16-digit control number found on the proxy card, voting instruction form or notice of availability of proxy materials. We believe that hosting a “virtual meeting” will enable greater stockholder attendance and participation from any location around the world.

Stockholders of record at the close of business on December 30, 2025 will be entitled to notice of and to vote at the annual meeting or any adjournment or postponement thereof. A list of stockholders as of the close of business on the record date will be available for examination by our stockholders of record for any purpose germane to the meeting during the 10-day period ending on the day before the annual meeting. If you wish to view this list, please contact our Secretary at the address and phone number set forth above.

We are mailing a full set of our proxy materials, including this proxy statement, a proxy card (or voting instruction form) and our annual report, to stockholders of record as of the Record Date. These materials are also available at www.proxyvote.com.

We encourage all stockholders to attend the virtual annual meeting. However, whether or not you plan to attend the virtual annual meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. Please review the instructions of each of your voting options described in the proxy statement. If you have any questions or require any assistance with voting shares, please contact our proxy solicitor [ ].

Thank you for your ongoing support and continued interest in Kala.

By Order of the Board of Directors,

David Lazar

Chief Executive Officer

Arlington, Massachusetts

December 30, 2025

Important Information About the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on January 30, 2026: We will mail to stockholders of record a full set of our proxy materials, including this proxy statement, a proxy card (or voting instruction form) and our 2024 annual report. These materials are also available at www.proxyvote.com. If you would like additional copies, please contact our Investor Relations department at (781) 996-5252 or request materials at www.proxyvote.com.

TABLE OF CONTENTS

i

ii

KALA

BIO

KALA BIO, INC.,

1167 Massachusetts Avenue

Arlington, Massachusetts 02476

(781) 996-5252

PROXY STATEMENT

2025 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on January 30, 2026

INFORMATION CONCERNING SOLICITATION AND VOTING

This proxy statement and the accompanying proxy card are being furnished in connection with the solicitation of proxies by the board of directors of KALA BIO, Inc. for use at the annual meeting of stockholders to be held on Friday, January 30, 2026 at 11:00 a.m., Eastern Time, and at any adjournment thereof. The 2025 annual meeting of stockholders will be a virtual meeting held via the Internet at www.virtualshareholdermeeting.com/KALA2025. There will not be a physical meeting location, and stockholders will not be able to attend the annual meeting in person. As always, we encourage you to vote your shares prior to the annual meeting regardless of whether you intend to attend.

Except where the context otherwise requires, references to “Kala,” “the Company,” “we,” “us,” “our” and similar terms refer to KALA BIO, Inc.

This proxy statement summarizes information about the proposals to be considered at the meeting and other information you may find useful in determining how to vote. The proxy card is a means by which you actually authorize the proxies to vote your shares in accordance with your instructions. On or about [December 30], 2025, we commenced mailing to stockholders of record as of the Record Date a full set of our proxy materials, including this proxy statement, a proxy card (or voting instruction form, as applicable) and our Annual Report. These materials are also available without charge upon request from our Investor Relations department and may be accessed at www.proxyvote.com.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as filed with the Securities and Exchange Commission, or SEC, except for exhibits, will be furnished without charge to any stockholder upon written or oral request to KALA BIO, Inc., 1167 Massachusetts Avenue, Arlington, Massachusetts 02476 or by calling 1-800-579-1639, by emailing sendmaterial@proxyvote.com or by submitting a request over the Internet at www.proxyvote.com. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 are also available on the SEC’s website at www.sec.gov.

The information contained on, or that can be accessed through, our website is not incorporated by reference into this proxy statement, and any reference to our website address is intended to be inactive textual reference only.

1

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

| Q. | Why did I receive these proxy materials? |

| A. | Our board of directors provided these proxy materials to you by mail and has also made them available to you on the Internet in connection with the solicitation of proxies for use at our 2025 annual meeting of stockholders to be held virtually on Friday, January 30, 2026 at 11:00 a.m., Eastern Time at www.virtualshareholdermeeting.com/KALA2025. As a holder of common stock, you are invited to attend the annual meeting and are requested to vote on the items of business described in this proxy statement. This proxy statement includes information that we are required to provide to you under SEC rules and that is designed to assist you in voting your shares. |

| Q. | Why did I receive a full set of proxy materials by mail rather than a Notice of Internet Availability? |

| A. | We are mailing a full set of our proxy materials to stockholders of record as of the Record Date. You can also access these materials online at www.proxyvote.com. Beneficial owners holding in “street name” may receive materials from their bank, broker or other nominee in accordance with that intermediary’s delivery practices. |

| Q. | What is the purpose of the annual meeting? |

| A. | At the annual meeting, stockholders will consider and vote on the following matters: |

| 1. | The election of three Class II directors, David Lazar, Mark Iwicki and Todd Bazemore, each to serve for a three-year term and until their successors have been duly elected and qualified (Proposal 1): |

| 2. | The approval of a non-binding, advisory vote on executive compensation (Proposal 2). |

| 3. | The ratification of the appointment of HTL International, LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2025 (Proposal 3). |

| 4. | The approval of the issuance of shares of our common stock upon conversion of our Series AA Convertible Preferred Stock and Series AAA Convertible Preferred Stock in accordance with Nasdaq Listing Rules 5635(b) and 5635(d) (Proposal 4). |

| 5. | The approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock to 1,500,000,000 (Proposal 5). |

| 6. | The approval of an amendment to our Restated Certificate of Incorporation to effect a reverse stock split of our common stock at a ratio of not less than 1-for-2 and not greater than 1-for-100, with the exact exchange ratio and timing to be determined at the discretion of the board of directors (Proposal 6). |

| 7. | The approval of an adjournment of the annual meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals at the time of the meeting, or in the absence of a quorum (Proposal 7). |

| 8. | The transaction of any other business that may properly come before the annual meeting or any adjournment or postponement thereof. |

| Q. | Why is the annual meeting a virtual, online meeting? |

| A. | We believe that hosting a virtual meeting will facilitate stockholder attendance and participation at our annual meeting by enabling stockholders to participate remotely from any location around the world. Our virtual meeting will be governed by our Rules of Conduct and Procedures which will be posted at www.proxyvote.com in advance of the meeting and will available during the online meeting at www.virtualshareholdermeeting.com/KALA2025. We have designed the virtual annual meeting to provide the same rights and opportunities to participate as stockholders have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform. |

2

| Q. | How do I virtually attend the annual meeting? |

| A. | We will host the annual meeting live online. The webcast of the annual meeting will start at 11:00 a.m., Eastern Time, on January 30, 2026. Online access to the webcast will open fifteen (15) minutes prior to the start of the annual meeting to allow time for you to log-in and test your device’s audio system. To be admitted to the virtual annual meeting, you will need to log-in at www.virtualshareholdermeeting.com/KALA2025 using the 16-digit control number on the proxy card or voting instruction form. |

Beginning fifteen (15) minutes prior to and during the annual meeting, we will have technicians standing by and ready to assist you with any technical difficulties you may have accessing or hearing the virtual meeting. If you encounter any difficulties accessing the virtual meeting or during the virtual meeting, please call the technical support team at the phone number available on www.virtualshareholdermeeting.com/KALA2025.

| Q. | Who can vote at the annual meeting? |

| A. | To be entitled to vote, you must have been a stockholder of record at the close of business on December 30, 2025, the record date for our annual meeting. There were [ ] shares of our common stock outstanding and entitled to vote at the annual meeting as of the record date. |

| Q. | How many votes do I have? |

| A. | Each share of our common stock that you own as of the record date will entitle you to one vote on each matter considered at the annual meeting. |

| Q. | How do I vote? |

| A. | If you are the “record holder” of your shares, meaning that your shares are registered in your name in the records of our transfer agent, Equiniti Trust Company, LLC, you may vote your shares during the annual meeting or by proxy prior to the annual meeting as follows: |

| 1. | Over the Internet prior to the Annual Meeting: To vote over the Internet prior to the annual meeting, please go to the following website: www.proxyvote.com, and follow the instructions at that site for submitting your proxy electronically. If you vote over the Internet prior to the annual meeting, you do not need to complete and mail your proxy card or vote your proxy by telephone. You must submit your Internet proxy before 11:59 p.m., Eastern Time, on January 29, 2026, the day before the annual meeting, for your proxy to be valid and your vote to count. |

| 2. | By Telephone prior to the Annual Meeting: To vote by telephone, please call 1-800-690-6903 in the United States, and follow the instructions provided on the proxy card. If you vote by telephone, you do not need to complete and mail your proxy card or vote your proxy over the Internet. You must submit your telephonic proxy before 11:59 p.m., Eastern Time, on January 29, 2026, the day before the annual meeting, for your proxy to be valid and your vote to count. |

| 3. | By Mail prior to the Annual Meeting: To vote by mail, you must mark, sign and date the proxy card and then mail the proxy card in accordance with the instructions on the proxy card. If you vote by mail, you do not need to vote your proxy over the Internet or by telephone. The proxy card must be received not later than January 29, 2026, the day before the annual meeting, for your proxy to be valid and your vote to count. If you return your proxy card but do not specify how you want your shares voted on any particular matter, they will be voted in accordance with the recommendations of our board of directors. |

3

| 4. | Over the Internet during the Annual Meeting: If you attend the annual meeting virtually, you may vote your shares online (up until the closing of the polls) by following the instructions available at www.virtualshareholdermeeting.com/KALA2025 during the annual meeting. You will need your 16-digit control number included on the proxy card or notice of availability of proxy materials. If you vote by proxy prior to the annual meeting and also virtually attend the annual meeting, there is no need to vote again at the annual meeting unless you wish to change your vote. |

If your shares are held in “street name,” meaning they are held for your account by an intermediary, such as a bank, broker or other nominee, then you are deemed to be the beneficial owner of your shares and the broker that actually holds the shares for you is the record holder and is required to vote the shares it holds on your behalf according to your instructions. The proxy materials, as well as voting and revocation instructions, should have been forwarded to you by the bank, broker or other nominee that holds your shares. In order to vote your shares, you will need to follow the instructions that your bank, broker or other nominee provides you. The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in “street name” will depend on the voting processes of the bank, broker or other nominee that holds your shares. Therefore, we urge you to carefully review and follow the voting instruction card and any other materials that you receive from that organization.

Banks, brokers and other nominees are permitted to vote shares for which they have received no voting instructions on “discretionary” matters, but they are not permitted to vote these shares on “non-discretionary” matters. A “broker non-vote” occurs when shares held by a bank, broker or other nominee are not voted with respect to a particular proposal because the bank, broker or other nominee does not have or did not exercise discretionary authority to vote on the matter and has not received voting instructions from its client.

The ratification of the appointment of HTL International, LLC as our independent registered public accounting firm (Proposal 3), the approval of an amendment to increase the number of authorized shares of common stock (Proposal 5), and the approval of an amendment to effect a reverse stock split (Proposal 6) are considered to be discretionary items. Accordingly, we expect that your bank, broker or other nominee may vote your shares in its discretion with respect to that matter if you do not give voting instructions on Proposal 3. If banks, brokers and other nominees exercise this discretionary authority (which they may not do), no broker non-votes are expected to occur in connection with Proposal 3.

However, under applicable stock exchange rules that regulate voting by registered brokerage firms, (i) the election of Class II directors (Proposal 1), (ii) the non-binding advisory vote on executive compensation (Proposal 2), (iii) the approval of the issuance of shares of our common stock upon conversion of our Series AA Convertible Preferred Stock and Series AAA Convertible Preferred Stock in accordance with Nasdaq Listing Rules 5635(b) and 5635(d) (Proposal 4), and (iv) the approval of an adjournment of the meeting, if necessary (Proposal 7) are considered to be non-discretionary items. Accordingly, if you do not give your bank, broker or other nominee voting instructions on Proposal 1, Proposal 2, Proposal 4, and/or Proposal 7, they may not vote your shares with respect to these matters, and we expect your shares would be counted as broker non-votes in connection with these proposals.

If your shares are held in “street name”, you will receive instructions from your bank, broker or other nominee explaining how you can attend the annual meeting online and vote your shares online during the annual meeting.

Even if you plan to attend the annual meeting online, we urge you to vote your shares by proxy in advance of the annual meeting so that if you should become unable to attend the annual meeting your shares will be voted.

4

| Q. | Can I change my vote? |

| A. | If your shares are registered directly in your name, you may revoke your proxy and change your vote at any time before the vote is taken at the annual meeting. To do so, you must do one of the following: |

| 1. | Vote over the Internet or by telephone as instructed above under “Over the Internet Prior to the Annual Meeting” or “By Telephone Prior to the Annual Meeting”. Only your latest Internet or telephone vote is counted. |

| 2. | Sign, date and return a new proxy card. Only your latest dated and timely received proxy card will be counted. |

| 3. | Attend the annual meeting virtually and vote online as instructed above under “Over the Internet during the Annual Meeting.” Your virtual attendance at the annual meeting, without voting online during the annual meeting, will not revoke your proxy. |

| 4. | Give our corporate secretary written notice before the annual meeting that you want to revoke your proxy. |

If your shares are held in “street name,” you may submit new voting instructions by contacting your bank, broker or other nominee. You may also vote online during the annual meeting, which will have the effect of revoking any previously submitted voting instructions if you follow the procedures described under “How do I vote?” above.

| Q. | How many shares must be represented to have a quorum and hold the annual meeting? |

| A. | The holders of one third of the voting power of the shares of our common stock issued and outstanding as of the record date must be present virtually or represented by proxy to hold the annual meeting. This is called a quorum. For purposes of determining whether a quorum exists, we count as present any shares that are voted over the Internet, by telephone, by completing and submitting a proxy card by mail or that are represented virtually at the meeting. Further, for purposes of establishing a quorum, we will count as present shares that a stockholder holds even if the stockholder votes to abstain or only votes on one of the proposals. In addition, we will count as present broker non-votes. If a quorum is not present, we expect to adjourn the annual meeting until we obtain a quorum. |

| Q. | What vote is required to approve each matter and how are votes counted? |

| A. | Proposal 1 - Election of Directors (Class II) |

The three nominees for director receiving the highest number of votes “for” election will be elected as Class II directors. This is called a plurality.

Each director nominee will be elected by a plurality of the votes cast by stockholders entitled to vote on the election at the annual meeting. You may vote “for” all nominees; vote “for” one or more nominees and “withhold” your vote from the other nominees; or “withhold” your vote from all nominees. Votes that are “withheld” and broker non‑votes are not votes cast and will not be included in the vote tally for the election of directors, and therefore will not affect the result. For information about what happens if a director nominee receives more “withhold” votes than “for” votes in an uncontested election, see “What happens if a director nominee receives more “WITHHOLD” votes than “FOR” votes in an uncontested election?” below.

5

Proposal 2 - Advisory Vote on Executive Compensation

The affirmative vote of the holders of shares of common stock representing a majority of the votes cast by holders of all shares of common stock present in person or represented by proxy at the meeting and voting affirmatively or negatively on Proposal 2 is required for approval of the advisory vote on executive compensation.

As described in more detail in Proposal 2, because this proposal is non-binding, our board of directors may decide that it is in our and our stockholders’ best interests to compensate our named executive officers in an amount or manner that differs from that which is approved by our stockholders.

Shares that abstain from voting and broker non-votes are not votes cast and will not be counted as votes cast or voting on Proposal 2. Accordingly, abstentions and broker non-votes will have no effect on the voting on Proposal 2.

Proposal 3 - Ratification of the Appointment of Independent Registered Public Accounting Firm

The affirmative vote of the holders of shares of common stock representing a majority of the votes cast by holders of all shares of common stock present in person or represented by proxy at the meeting and voting affirmatively or negatively on Proposal 3 is required for the ratification of the appointment of HTL International, LLC as our independent registered public accounting firm for the year ending December 31, 2025.

Shares that abstain from voting and broker non-votes (if any) are not votes cast and will not be counted as votes cast or voting on Proposal 3. Accordingly, abstentions and broker non-votes will have no effect on the voting on Proposal 3.

Proposal 4 - Approval of the Issuance of Shares of our Common Stock upon Conversion of our Series AA Convertible Preferred Stock and Series AAA Convertible Preferred Stock in accordance with Nasdaq Listing Rules 5635(b) and 5635(d).

The affirmative vote of a majority of the votes cast by holders of shares of common stock present in person or represented by proxy at the meeting and voting affirmatively or negatively on Proposal 4 is required for the approval of Proposal 4. Shares that abstain from voting and broker non-votes are not votes cast and will not be counted as votes cast or voting on Proposal 4. Accordingly, abstentions and broker non-votes will have no effect on the voting on Proposal 4.

Proposal 5 - Approval of an Amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock

The affirmative vote of a majority of the votes cast by holders of shares of common stock present in person or represented by proxy at the meeting and voting affirmatively or negatively on Proposal 5 is required for the approval of Proposal 5. Shares that abstain from voting and broker non-votes (if any) are not votes cast and will not be counted as votes cast or voting on Proposal 5. Accordingly, abstentions and broker non-votes will have no effect on the voting on Proposal 5.

Proposal 6 - Approval of an Amendment to our Restated Certificate of Incorporation to effect a Reverse Stock Split

The affirmative vote of a majority of the votes cast by holders of shares of common stock present in person or represented by proxy at the meeting and voting affirmatively or negatively on Proposal 6 is required for the approval of Proposal 6. Shares that abstain from voting and broker non-votes (if any) are not votes cast and will not be counted as votes cast or voting on Proposal 6. Accordingly, abstentions and broker non-votes will have no effect on the voting on Proposal 6.

6

Proposal 7 - Approval of an Adjournment of the Annual Meeting (if Necessary) to Solicit Additional Proxies, or in the Absence of a Quorum

The affirmative vote of a majority of the votes cast by holders of shares of common stock present in person or represented by proxy at the meeting and voting affirmatively or negatively on Proposal 7 is required to approve an adjournment of the annual meeting.

Shares that abstain from voting and broker non‑votes are not votes cast and therefore will not be counted as votes cast on Proposal 7; accordingly, abstentions and broker non‑votes will have no effect on the voting on Proposal 7.

| Q. | What happens if a director nominee receives more “WITHHOLD” votes than “FOR” votes in an uncontested election? |

| A. | Our corporate governance guidelines set forth a process that takes effect if any director nominee receives more “withhold” votes than “for” votes in an uncontested election, or a “Majority Withhold Vote”. Upon such occurrence, the affected director would be expected, promptly following certification of the stockholder vote, to offer to the board of directors to tender his or her resignation as a director for consideration by the board of directors. The board of directors will follow the following procedures in deciding whether or not to accept such director’s offer to resign, all of which procedures are to be completed within 90 days following the certification of the stockholder vote. |

The nominating and corporate governance committee will evaluate the best interests of the company and its stockholders and recommend to the board of directors the action to be taken with respect to such offer to resign. Such action may include requesting and accepting the resignation; retaining such director but addressing what the nominating and corporate governance committee believes to be the underlying cause of the Majority Withhold Vote; resolving that such director will not be re-nominated for election in the future; rejecting the offer to resign; or such other action that the nominating and corporate governance committee determines to be in the best interests of our company and our stockholders. In reaching its recommendation, the nominating and corporate governance committee will consider all factors it deems relevant, including, as it deems appropriate, any stated reasons of stockholders for the Majority Withhold Vote, any alternatives for curing the underlying cause of the Majority Withhold Vote, the total number of shares voted, how such shares were voted, the number of broker non-votes, the director’s tenure, the director’s qualifications, the criteria for nomination as a director set forth in the corporate governance guidelines, the director’s past and expected future contributions to the company and the overall composition of the board of directors, including whether the director’s resignation would cause the company to fail to meet any SEC or Nasdaq requirement.

The board of directors will then decide whether to accept, reject or modify the nominating and corporate governance committee’s recommendation, considering the factors considered by the nominating and corporate governance committee and such additional factors the board of directors believes to be relevant. After the board’s determination, we will promptly publicly disclose the board’s decision regarding the action to be taken with respect to such director’s resignation, and if such resignation is rejected by the board, such disclosure will include the rationale behind the decision. If the director’s resignation is accepted, then the board of directors may fill the resulting vacancy in accordance with our by-laws or may decrease the size of our board of directors.

Our corporate governance guidelines are available on the “Investors-Corporate Governance” section of our website, which is located at www.kalarx.com.

7

| Q. | How does the board of directors recommend that I vote on the proposals? |

| A. | Our board of directors recommends that you vote: |

FOR the election of the nominees to serve as Class II directors, each for a three‑year term;

FOR the approval of the advisory vote on executive compensation;

FOR the ratification of the appointment of HTL International, LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2025;

FOR the approval of the issuance of shares of our common stock upon conversion of our Series AA Convertible Preferred Stock and Series AAA Convertible Preferred Stock in accordance with Nasdaq Listing Rules 5635(b) and 5635(d);

FOR the amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock;

FOR the amendment to our Restated Certificate of Incorporation to effect a reverse stock split; and

FOR the adjournment of the annual meeting, if necessary, to solicit additional proxies, or in the absence of a quorum.

| Q. | Are there other matters to be voted on at the annual meeting? |

| A. | We do not know of any matters that may come before the annual meeting other than the election of our Class II directors, the advisory vote on executive compensation, the ratification of the appointment of HTL International, LLC as our independent registered public accounting firm, the approval of the issuance of shares of our common stock upon conversion of our Series AA Convertible Preferred Stock and Series AAA Convertible Preferred Stock in accordance with Nasdaq Listing Rules 5635(b) and 5635(d), the approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock, the approval of an amendment to our Restated Certificate of Incorporation to effect a reverse stock split, and the approval of an adjournment of the annual meeting, if necessary, to solicit additional proxies, or in the absence of a quorum. If any other matters are properly presented at the annual meeting, the persons named in the accompanying proxy intend to vote, or otherwise act, in accordance with their judgment on the matter. |

| Q. | Where can I find the voting results? |

| A. | We plan to announce preliminary voting results at the annual meeting and will report final voting results in a Current Report on Form 8-K filed with the SEC within four business days following the date of our annual meeting. |

| Q. | What are the costs of soliciting these proxies? |

| A. | We will bear the cost of soliciting proxies. We have retained , a proxy solicitation firm, or the proxy solicitor, to solicit proxies in connection with the annual meeting at an estimated cost of approximately $ plus expenses. We will also indemnify the proxy solicitor against losses arising out of its provisions of these services on our behalf. Proxies will be solicited by the proxy solicitor by mail, telephone, e-mail and in person. Proxies may also be solicited by our directors, officers and employees by mail, telephone, e-mail, facsimile, and in person without additional compensation. We may reimburse brokers or persons holding stock in their names, or in the names of their nominees, for their expenses in sending proxies and proxy material to beneficial owners. |

8

| Q. | How do I submit a question at the annual meeting? |

| A. | If you wish to submit a question, on the day of the annual meeting, beginning at 10:45 a.m., Eastern Time on January 30, 2026, you may log into the virtual meeting platform and follow the instructions there. Our virtual meeting will be governed by our Rules of Conduct and Procedures that will be posted at www.proxyvote.com in advance of the meeting. The Rules of Conduct and Procedures will address the ability of stockholders to ask questions during the meeting, including rules on permissible topics, and rules for how questions and comments will be recognized and disclosed to meeting participants. We will answer appropriate questions that are pertinent to the matters to be voted on by the stockholders at the annual meeting. Because time is limited at the annual meeting, we may not be able to answer all questions that are submitted. If there are any matters of individual concern to a stockholder and not of general concern to all stockholders, or if a question was not otherwise answered, such matters may be raised separately after the annual meeting by contacting Investor Relations at (781) 996-5252. To promote fairness and the efficient use of our resources and to address all stockholder questions, we will limit each stockholder to two questions, which should each be succinct and should cover only one topic. Questions from multiple stockholders on the same topic or that are otherwise related may be grouped, summarized and answered together. |

Implications of Being a “Smaller Reporting Company”

We are a “smaller reporting company,” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. The SEC has adopted rules allowing smaller reporting companies to provide scaled disclosure, and we are permitted and plan to rely on these exemptions from certain disclosure requirements for as long as we remain a smaller reporting company. We are a smaller reporting company so long as we have a public float of less than $250 million, or have annual revenues of less than $100 million and a public float less than $700 million, determined on an annual basis. Under the scaled disclosure obligations available to smaller reporting companies, we are not required to provide, among other things, Compensation Discussion and Analysis and certain other tabular and narrative disclosures relating to executive compensation. We have taken advantage of certain reduced reporting obligations in this proxy statement. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

9

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our board of directors currently consists of seven members divided into three classes, with members of each class holding office for staggered three‑year terms. There are currently two Class I directors, three Class II directors and two Class III directors (in all cases subject to the election and qualification of their successors or to their earlier death, resignation or removal). David Lazar serves as our Chief Executive Officer, Chief Financial Officer and Chair of the Board. Set forth below are the names of, and certain information for, each member of our board of directors, including the nominees for election as Class II directors, as of December 15, 2025. The information presented includes each director’s and nominee’s principal occupation and business experience for the past five years, and the names of other public companies of which he or she has served as a director during the past five years. The information presented below regarding the specific experience, qualifications, attributes and skills of each director and nominee led our nominating and corporate governance committee and our board of directors to conclude that he or she should serve as a director. In addition, we believe that all of our directors and nominees possess the attributes or characteristics described in “Corporate Governance Matters-Director Nomination Process” that the nominating and corporate governance committee expects of each director. There are no family relationships among any of our directors, nominees for director or executive officers.

| Name | Age | Position | ||

| Class I Directors | ||||

| Marjan Farid, M.D.(2)(3) | 51 | Director | ||

| Andrew I. Koven(1)(2) | 67 | Director | ||

| Class II Directors | ||||

| Mark Iwicki | 58 | Director | ||

| Todd Bazemore | 54 | Director | ||

| David Lazar | 35 | Chief Executive Officer, Chief Financial Officer, President, Chief Operating Officer and Chair of the Board | ||

| Class III Directors | ||||

| C. Daniel Myers(1)(2) | 70 | Director | ||

| Howard B. Rosen(1)(3) | 67 | Director | ||

| Director Nominees | ||||

| David Lazar | 35 | Class II Director Nominee | ||

| Mark Iwicki | 58 | Class II Director Nominee | ||

| Todd Bazemore | 54 | Class II Director Nominee |

| (1) | Member of the Audit Committee. | |

| (2) | Member of the Compensation Committee. | |

| (3) | Member of the Nominating and Corporate Governance Committee. |

At each annual meeting of stockholders, directors are elected for a full term of three years to succeed those directors whose terms are expiring. Each of our current directors, except for David Lazar, has agreed to tender a resignation, effective immediately following the conclusion of the Annual Meeting, if our stockholders approve Proposal 4 and Proposal 5. Subject to such resignations becoming effective, and if our stockholders approve Proposal 1, the Board currently expects David Lazar to stay on as a Class II director and the holder of the rights and obligations under the November 25, 2025 SPA to nominate up to eight director nominees. Any such nominees will be qualified and approved by the Company’s Nominating and Corporate Governance Committee.

10

David Lazar has served as a member of our board of directors and Chief Executive Officer since November 2025. He served as Chief Executive Officer of Novabay Pharmaceuticals, Inc. (NASDAQ: NBY) from August - November 2025, a public biopharmaceutical company previously focused on the development and sale of eyecare, wound care, and skin care products, from August 2025 to October 2025. Prior to that, Mr. Lazar previously served as director on the board of directors of FiEE, Inc. (formerly Minim, Inc.) (NASDAQ: FIEE) where he also previously served as the Chief Executive Officer and Chief Financial Officer from December 2023 to February 2025. Mr. Lazar served as interim Chief Executive Officer and principal financial officer of Bio Green Med Solution Inc. (NASDAQ: BGMS), from January 2, 2025 through February 26, 2025. Mr. Lazar served as the Chief Executive Officer of Black Titan Corporation listed on Nasdaq (NASDAQ: BTTC) from August 2022 to April 2024, where he also served as a director and board chairman from August 2022 until October 2023. Mr. Lazar also served as the chief executive officer and chairman of the board of directors of OpGen, Inc. (OTC: OPGN) from March 2024 to August 2024. Mr. Lazar also served as the president and a member of the board of directors of LQR House Inc. (NASDAQ: YHC) from October 2024 to April 2025. Mr. Lazar served as the Chief Executive Officer of Activist Investing from March 2018 to April 2022. We believe Mr. Lazar’s expertise as an investor with a diverse knowledge of capital markets and experience leading public companies qualifies him to serve as a member of our board of directors.

Mark Iwicki has served as a member of our board of directors since September 2015. Mr. Iwicki previously served as our President from August 2017 to December 2021 and as Executive Chair of our board of directors from April 2015 to September 2015. Prior to joining us, Mr. Iwicki served as President and Chief Executive Officer of Civitas Therapeutics, Inc., or Civitas, a biopharmaceutical company, from January 2014 to November 2014. Prior to Civitas, Mr. Iwicki served as President and Chief Executive Officer at Blend Therapeutics, Inc., or Blend, a biopharmaceutical company, from December 2012 to January 2014. Prior to Blend, Mr. Iwicki was President and Chief Executive Officer of Sunovion, a pharmaceutical company. Mr. Iwicki was at Sepracor Inc./Sunovion from October 2007 to June 2012. Prior to joining Sepracor Inc., Mr. Iwicki was Vice President and Business Unit Head at Novartis Pharmaceuticals Corporation, a biopharmaceutical company. He was at Novartis from March 1998 to October 2007. Prior to that, Mr. Iwicki held management positions at Astra Merck Inc. and Merck & Co., Inc. In addition to serving on our board of directors, Mr. Iwicki also currently serves on the boards of Aerovate Therapeutics, Inc., Merus, Akero Therapeutics, Inc., Third Harmonic Bio, Inc. and Q32 Bio Inc. and formerly served on the board of Aimmune Therapeutics, Inc. and Pulmatrix Inc., all publicly-traded companies. Mr. Iwicki holds a B.S. in Business Administration from Ball State University and an M.B.A. from Loyola University. We believe that Mr. Iwicki’s extensive experience as a pharmaceutical industry leader managing all stages of drug development and commercialization in multiple therapeutic areas qualifies him to serve as a member of our board of directors.

Todd Bazemore has served as a member of our board of directors since 2025. Previously, he served as Executive Vice President and Chief Operating Officer of Santhera Pharmaceuticals (USA) Inc., or Santhera, a pharmaceutical company and subsidiary of Santhera Pharmaceuticals Holdings AG, from September 2016 until November 2017. Prior to joining Santhera, Mr. Bazemore served as Executive Vice President and Chief Commercial Officer of Dyax Corp., or Dyax, a biopharmaceutical company focused on orphan diseases, between April 2014 and January 2016, when Dyax was acquired by Shire plc. At Dyax, Mr. Bazemore oversaw all aspects of Dyax’s commercial department including sales, marketing, commercial analytics, market access and patient services. Between April 2012 and September 2013, he served as Vice President, Managed Markets at Sunovion Pharmaceuticals, Inc., or Sunovion (a subsidiary of Dainippon Sumitomo Pharma Co. Ltd.), a global biopharmaceutical company focused on serious medical conditions. Prior to that, Mr. Bazemore held several roles of increasing responsibility at Sunovion, including Vice President of Sales and Vice President of Respiratory Business Unit. Since October 2020, Mr. Bazemore has served on the board of directors of Pulmatrix Inc., a clinical stage publicly traded biopharmaceutical company. He received his Bachelor of Science from the University of Massachusetts, Lowell.

11

Marjan Farid, M.D. has served as a member of our board of directors since October 2022. Since 2007, Dr. Farid has served as Professor of Clinical Ophthalmology, Director of Cornea, Refractive & Cataract Surgery, and Vice Chair of Ophthalmic Faculty at the Gavin Herbert Eye Institute, University of California Irvine. Her clinical practice is divided between patient care, teaching, and research. Dr. Farid’s research interests focus on corneal surgery, specifically the use of the femtosecond laser for corneal transplantation. Dr. Farid is also the founder of the Severe Ocular Surface Disease Center at the University of California Irvine, where she performs limbal stem cell transplants, as well as artificial corneal transplantation, for the treatment of patients with severe ocular surface disease. Dr. Farid also serves as the Chair of the Corneal Clinic Committee of the American Society of Cataract and Refractive Surgery. Dr. Farid received a B.S. in Biology from the University of California - Los Angeles and M.D. from the University of California - San Diego. We believe that Dr. Farid’s experience in the ophthalmology field qualifies her to serve as a member of our board of directors.

Andrew I. Koven has served as a member of our board of directors since September 2017 and as our Lead Independent Director since December 2018. Mr. Koven was, until his retirement in January 2019, the President and Chief Business Officer of Aralez Pharmaceuticals Inc., or Aralez, a public specialty pharmaceutical company, and served in that role with the company’s predecessor, Pozen Inc., or Pozen, commencing in June 2015. Prior to joining Pozen, Mr. Koven served as Executive Vice President, Chief Administrative Officer and General Counsel of Auxilium Pharmaceuticals Inc., a public specialty biopharmaceutical company, from February 2012 until January 2015, when it was acquired by Endo International plc. Mr. Koven served as President and Chief Administrative Officer and a member of the board of directors of Neurologix, Inc., a company focused on the development of multiple innovative gene therapy development programs, from September 2011 to November 2011. Before Neurologix, Mr. Koven served as Executive Vice President and Chief Administrative and Legal Officer of Inspire Pharmaceuticals, Inc., a public specialty pharmaceutical company, from July 2010 until May 2011 when it was acquired by Merck & Co., Inc. Previously, Mr. Koven served as Executive Vice President, General Counsel and Corporate Secretary of Sepracor Inc. (now Sunovion Pharmaceuticals, Inc., or Sunovion), a public specialty pharmaceutical company, from March 2007 until February 2010 when it was acquired by Dainippon Sumitomo Pharma Co., Ltd. Prior to joining Sepracor Inc., Mr. Koven served as Executive Vice President, General Counsel and Corporate Secretary of Kos Pharmaceuticals, Inc., a public specialty pharmaceutical company, from August 2003 until its acquisition by Abbott Laboratories (now AbbVie) in December 2006. Mr. Koven began his career in the pharmaceutical industry first as an Assistant General Counsel and then as Associate General Counsel at Warner-Lambert Company from 1993 to 2000, followed by his role as Senior Vice President and General Counsel at Lavipharm Corporation from 2000 to 2003. Mr. Koven also currently serves on the board of NeuroBo Pharmaceuticals, Inc., or NeuroBo, a publicly-traded company, and has served as its Chair since January 2022. Mr. Koven is also a member of NeuroBo’s Audit Committee and Chair of its Nominating and Corporate Governance Committee. From 1986 to 1992 he was a corporate associate at Cahill, Gordon & Reindel in New York. From 1992 to 1993 he served as Counsel, Corporate and Investment Division, at The Equitable Life Assurance Society of the U.S. Mr. Koven holds a Master of Laws (LL.M.) Degree from Columbia University School of Law and a Bachelor of Laws (LL.B.) Degree and Bachelor of Arts Degree in Political Science from Dalhousie University. We believe that Mr. Koven’s extensive experience in the pharmaceutical industry qualifies him to serve as a member of our board of directors.

Mark Iwicki has served as a member of our board of directors since September 2015. Additional biographical information appears earlier under “Nominees.”

12

Todd Bazemore has served as a member of our board of directors since 2025. Additional biographical information appears earlier under “Nominees.”

David Lazar has served as a member and the chair of our board of directors since November 2025. Additional biographical information appears earlier under “Nominees.”

C. Daniel Myers has served as a member of our board of directors since October 2021. Mr. Myers served as the Chief Executive Officer of MediPrint Ophthalmics, Inc. (formerly Leo Lens Pharma), a private eye-care company, from April 2020 to April 2022. Previously, Mr. Myers co-founded Alimera Sciences, Inc., or Alimera, a publicly traded pharmaceutical company, and served as its Chief Executive Officer from 2003 until January 2019. Before co-founding Alimera, Mr. Myers was an initial employee of Novartis Ophthalmics (formerly CIBA Vision Ophthalmics), a pharmaceutical company, and served as its Vice President of sales and marketing from 1991 to 1997 and as President from 1997 to 2003. Mr. Myers served as a director of Alimera from 2003 to August 2023, and as chairman of its board of directors from January 2019 to August 2023. Mr. Myers currently serves as Chairman Emeritus of Alimera. In addition, Mr. Myers served on the board of directors of Ocular Therapeutix, Inc., a publicly traded biopharmaceutical company, from 2009 to 2012. Mr. Myers holds a B.S. in Industrial Management from the Georgia Institute of Technology. We believe that Mr. Myers’ experience in the biopharmaceutical industry, including his specific experience with ophthalmology pharmaceutical companies, qualifies him to serve as a member of our board of directors.

Howard B. Rosen has served as a member of our board of directors since January 2014. Since 2008, Mr. Rosen has served as a consultant to several companies in the biotechnology industry. He has served at Stanford University as an adjunct professor in Chemical Engineering since 2021 and as a lecturer in Management since 2011, and he previously served as a lecturer in Chemical Engineering from 2009 until 2021. Mr. Rosen served as Chief Executive Officer of AcelRx Pharmaceuticals, Inc. (now Talphera, Inc.), or Talphera, a public specialty pharmaceutical company developing products for pain relief, from April 2016 to March 2017, and Interim Chief Executive Officer from April 2015 to March 2016. Mr. Rosen also served as Interim President and Chief Executive Officer of Pearl Therapeutics, Inc. from June 2010 to March 2011. From 2004 to 2008, Mr. Rosen was Vice President of Commercial Strategy at Gilead Sciences, Inc., a biopharmaceutical company. From 2003 until 2004, Mr. Rosen was President of ALZA Corporation, a pharmaceutical and medical systems company that merged in 2001 with Johnson & Johnson, a global healthcare company. Prior to that, from 1994 until 2003, Mr. Rosen held various positions at ALZA Corporation. Mr. Rosen served on the board of directors of Talphera until February 2024 and on the board of directors of Alcobra, Ltd., a public pharmaceutical company, until November 2017. Mr. Rosen is currently a member of the board of directors of private companies, including Firecycte Therapeutics, Inc., Hammerton, Inc., and Entrega, Inc., and was a member of the board of directors of Metera Pharmaceuticals, Inc. from 2018 to 2020, Aria Pharmaceuticals, Inc. from 2020 to 2023 and Hopewell Therapeutics, Inc. from 2022 to 2024. Mr. Rosen holds a B.S. in Chemical Engineering from Stanford University, an M.S. in Chemical Engineering from the Massachusetts Institute of Technology and an M.B.A. from the Stanford Graduate School of Business where he was an Arjay Miller Scholar and a Henry Ford II Scholar. We believe that Mr. Rosen’s experience in the biopharmaceutical industry, including his specific experience with the development and commercialization of pharmaceutical products, qualifies him to serve as a member of our board of directors.

Our board of directors believes that good corporate governance is important to ensure that our company is managed for the long-term benefit of stockholders. This section describes key corporate governance guidelines and practices that our board of directors has adopted. Complete copies of our corporate governance guidelines, committee charters and code of conduct are available on the “Investors-Corporate Governance” section of our website, which is located at www.kalarx.com. Alternatively, you can request a copy of any of these documents by writing us at KALA BIO, Inc., 1167 Massachusetts Avenue, Arlington, Massachusetts 02476, Attention: Chief Financial Officer.

13

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. These guidelines, which provide a framework for the conduct of our board of directors’ business, provide that, among other things:

| ● | the principal responsibility of our board of directors is to oversee our management; |

| ● | a majority of the members of our board of directors must be independent directors, unless otherwise permitted by Nasdaq rules; |

| ● | the independent directors meet at least twice a year in executive session; |

| ● | directors have full and free access to management and, as necessary and appropriate, independent advisors; |

| ● | new directors participate in an orientation program and all directors are expected to participate in continuing director education on an ongoing basis; and |

| ● | our nominating and corporate governance committee will oversee an annual self-evaluation of our board of directors to determine whether our board and its committees are functioning effectively. |

Our corporate governance guidelines provide that the nominating and corporate governance committee shall periodically assess the board of directors’ leadership structure, including whether the offices of Chief Executive Officer and Chair of the board of directors should be separate, whether we should have a Lead Independent Director, and why the board of directors’ leadership structure is appropriate given the specific characteristics or circumstances of our company. Our corporate governance guidelines provide the board of directors with flexibility to determine whether the two roles should be combined or separated based upon our needs and the board of directors’ assessment of its leadership from time to time.

Mr. Lazar currently serves as Chair of our board of directors and as Chief Executive Officer (as well as our Chief Financial Officer). Our board believes that combining the Chair and Chief Executive Officer positions fosters clear accountability, effective decision-making and alignment of corporate strategy and is the appropriate leadership structure for us at this time. Our board believes that Mr. Lazar’s combined role of Chair and Chief Executive Officer promotes effective execution of strategic goals and facilitates information flow between management and our board. Mr. Koven has served as our Lead Independent Director since December 2018. As our Lead Independent Director, Mr. Koven’s responsibilities include the following, among others:

| ● | chairing any meeting of the independent directors of our board in executive session; |

| ● | meeting with any director who is not adequately performing his or her duties as a member of our board or any committee; |

| ● | facilitating communications between other members of our board and our Chair and Chief Executive Officer; |

| ● | monitoring, with the assistance of our Chief Financial Officer or any general counsel, communications from stockholders and other interested parties and providing copies or summaries to the other directors as he considers appropriate; |

14

| ● | working with our Chair and Chief Executive Officer in the preparation of the agenda for each board meeting and in determining the need for special meetings of the board; and |

| ● | otherwise consulting with our Chair and Chief Executive Officer on matters relating to corporate governance and board performance. |

We believe this structure represents an appropriate allocation of roles and responsibilities for our company at this time. Our nominating and corporate governance committee evaluates our board leadership structure from time to time and may recommend further alterations of this structure in the future.

Board Determination of Independence

Applicable Nasdaq rules require a majority of a listed company’s board of directors to be comprised of independent directors. In addition, the Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act and compensation committee members must also satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act. Under applicable Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of the listed company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries. In order to be considered independent for purposes of Rule 10C-1, the board must consider, for each member of a compensation committee of a listed company, all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: (1) the source of compensation of the director, including any consulting advisory or other compensatory fee paid by such company to the director; and (2) whether the director is affiliated with the company or any of its subsidiaries or affiliates.

Our board of directors determined that each of our directors, with the exception of David Lazar, is an “independent director” as defined under applicable Nasdaq rules. In making such determinations, our board of directors considered the relationships that each such non-employee director has with our company and all other facts and circumstances that our board of directors deemed relevant in determining his or her independence, including the beneficial ownership of our capital stock by each non-employee director. Mr. Lazar, Mr. Iwicki and Mr. Bazemore are not an independent directors under these rules because they have been executive officers within the last three years. Under Nasdaq rules, a director shall not be considered independent if they are employed as an executive officer of another entity where at any time during the past three years any of our current executive officers served on the compensation committee of such other entity.

Board of Director Meetings and Attendance

Our board of directors held 8 meetings during the year ended December 31, 2024, or fiscal 2024. During fiscal 2024, each of the directors then in office attended at least 75% of the aggregate of the number of board of director meetings and the number of meetings held by all committees of the board of directors on which such director then served.

15

Our corporate governance guidelines provide that directors are expected to attend the annual meeting of stockholders. Each then-serving member of the board of directors attended the 2024 annual meeting of stockholders.

Communicating with the Independent Directors

Our board of directors will give appropriate attention to written communications that are submitted by stockholders and other interested parties, and will respond if and as appropriate. The Lead Independent Director, subject to advice and assistance from the company’s general counsel, if any, or an individual performing a similar function, if any, is primarily responsible for monitoring communications from stockholders and other interested parties and for providing copies or summaries of such communications to the other directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the Lead Independent Director, or chair of the nominating and corporate governance committee, as applicable, considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we receive repetitive or duplicative communications.

Stockholders who wish to send communications on any topic to our board of directors should address such communications to Andrew I. Koven, Lead Independent Director, c/o KALA BIO, Inc., 1167 Massachusetts Avenue, Arlington, Massachusetts 02476.

Committees of the Board of Directors

We have established an audit committee, a compensation committee and a nominating and corporate governance committee. Each of these committees operates under a charter that has been approved by our board of directors. A copy of each committee’s charter can be found under the “Investors-Corporate Governance” section of our website, which is located at www.kalarx.com.

Audit Committee

The members of our audit committee are Mr. Koven, Mr. Myers and Mr. Rosen. Mr. Rosen is the chair of the audit committee.

Our audit committee’s responsibilities include:

| ● | appointing, approving the compensation of, and assessing the independence of our registered public accounting firm; |

| ● | overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from that firm; |

| ● | reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| ● | monitoring our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics; |

| ● | overseeing our internal audit function; |

| ● | overseeing our risk assessment and risk management policies; |

16

| ● | reviewing with management our cybersecurity and other information technology risks, controls and procedures, including the our plans to mitigate cybersecurity risks and respond to data breaches; |

| ● | establishing policies regarding retention of accounting related complaints and concerns; |

| ● | meeting independently with our internal auditing staff, if any, our independent registered public accounting firm and management; |

| ● | reviewing and approving or ratifying any related person transactions; and |

| ● | preparing the audit committee report required by SEC rules. |

All audit and non-audit services, other than de minimis non-audit services, to be provided to us by our independent registered public accounting firm must be approved in advance by our audit committee. In 2020, the audit committee delegated to its chair authority to pre-approve any audit or non-audit services to be provided to us by our independent registered public accounting firm. By the terms of the delegated authority, the chair must report on any such approval of services pursuant to such authority at the first regularly scheduled meeting of the audit committee following such approval.

Our board of directors has determined that Mr. Rosen is an “audit committee financial expert” as defined in applicable SEC rules. We believe that each member of our audit committee possesses the financial sophistication required for audit committee members under Nasdaq rules and that the composition of our audit committee meets the requirements for independence under current Nasdaq and SEC rules and regulations. The audit committee held 5 meetings during fiscal 2024.

Compensation Committee

The members of our compensation committee are Dr. Farid, Mr. Koven and Mr. Myers. Mr. Koven is the chair of the compensation committee. Our compensation committee’s responsibilities include:

| ● | reviewing and approving, or making recommendations to our board of directors with respect to, the compensation of our Chief Executive Officer and our other executive officers; |

| ● | overseeing an evaluation of our senior executives; |

| ● | overseeing and administering our cash and equity incentive plans; |

| ● | reviewing and making recommendations to our board of directors with respect to director compensation; |

| ● | approving, or recommending for approval by our board of directors, the implementation or revision of any compensation recovery or “clawback” policies, and overseeing the administration of such policies; |

| ● | reviewing and discussing annually with management our “Compensation Discussion and Analysis” disclosure if and to the extent then required by SEC rules; and |

| ● | preparing the compensation committee report if and to the extent then required by SEC rules. |

We believe that the composition of our compensation committee meets the requirements for independence under current Nasdaq and SEC rules and regulations. The compensation committee held 6 meetings during fiscal 2024.

17

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Dr. Farid and Mr. Rosen. Dr. Farid is the chair of the nominating and corporate governance committee. Our nominating and corporate governance committee’s responsibilities include:

| ● | recommending to our board of directors the persons to be nominated for election as directors and to each of our board’s committees; |

| ● | reviewing and making recommendations to our board with respect to our board leadership structure; |

| ● | reviewing and making recommendations to our board with respect to management succession planning; |

| ● | developing and recommending to our board of directors corporate governance principles; and |

| ● | overseeing an annual evaluation of our board of directors. |

We believe that the composition of our nominating and corporate governance committee meets the requirements for independence under current Nasdaq and SEC rules and regulations. The nominating and corporate governance committee held 2 meetings during fiscal 2024.

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates includes requests to board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the nominating and corporate governance committee and our board of directors.

In considering whether to recommend to our board of directors any particular candidate for inclusion in our board of directors’ slate of recommended director nominees, including candidates recommended by stockholders, the nominating and corporate governance committee of our board of directors applies the criteria set forth in our corporate governance guidelines. These criteria include the candidate’s integrity, business acumen, knowledge of our business and industry, the ability to act in the interests of all stockholders and lack of conflicts of interest.

The director biographies in this proxy statement indicate each nominee’s experience, qualifications, attributes and skills that led our nominating and corporate governance committee and our board of directors to conclude that he or she should continue to serve as a director. Our nominating and corporate governance committee and our board of directors believe that each of the nominees has the individual attributes and characteristics required of each of our directors, and the nominees as a group possess the skill sets and specific experience desired of our board of directors as a whole.

Our nominating and corporate governance committee does not have a policy (formal or informal) with respect to diversity, but believes that our board, taken as a whole, should embody a diverse set of skills, experiences and backgrounds. In this regard, the nominating and corporate governance committee also takes into consideration the diversity (for example, with respect to gender, race and national origin) of our board members. While the nominating and corporate governance committee does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors, the committee deems diversity an important criteria to consider in evaluating future nominees and directors.

18

Stockholders may recommend individuals to our nominating and corporate governance committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials, to KALA BIO, Inc., Attention: Nominating and Corporate Governance Committee, 1167 Massachusetts Avenue, Arlington, Massachusetts 02476. Assuming that appropriate biographical and background material has been provided on or before the dates set forth in this proxy statement under the heading “Other Matters - Stockholder Proposals for our 2026 Annual Meeting of Stockholders”, the committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others. If the board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy card for the next annual meeting.

Stockholders also have the right under our by-laws to directly nominate director candidates, without any action or recommendation on the part of the nominating and corporate governance committee or our board of directors, by following the procedures set forth under “Other Matters-Stockholder Proposals for our 2026 Annual Meeting of Stockholders.”

Bankruptcies

Mr. Koven was, until his retirement on January 30, 2019, the President and Chief Business Officer of Aralez and served in that role with the company’s predecessor, Pozen, commencing on June 1, 2015. On August 10, 2018, Aralez and its affiliates each filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code.

Our board of directors oversees our risk management processes directly and through its committees. Our board of directors encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Our management is responsible for risk management on a day-to-day basis. The role of our board of directors and its committees is to oversee the risk management activities of management. Our board of directors fulfills this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our board of directors oversees risk management activities relating to business strategy, acquisitions and divestitures, capital allocation, organizational structure and certain operational risks. Our audit committee oversees risk management activities related to financial controls and legal and compliance risks. Such oversight by our audit committee includes direct communication with our independent registered public accounting firm. Our audit committee also provides director oversight over cybersecurity risks. Our compensation committee oversees risk management activities relating to our compensation policies and practices and assesses whether any of our compensation policies or practices has the potential to encourage excess risk-taking. Oversight by the compensation committee includes direct communication with our independent compensation consultants. Our nominating and corporate governance committee oversees risk management activities relating to the composition of our board of directors and committees and management succession planning.

Each committee reports to the full board of directors on a regular basis, including reports with respect to the committee’s risk oversight activities as appropriate. In addition, since risk issues often overlap, committees from time to time request that the full board of directors discuss particular risks. In addition, members of our senior management team regularly attend our board meetings and are available to address any questions or concerns raised by the board on major risk exposures, the potential impact of such risks, risk management and any other matters. Our board of directors believes that full and open communication between management and the board of directors is essential for effective risk management and oversight.

19

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. A copy of the code is available on the “Investors-Corporate Governance” section of our website, which is located at www.kalarx.com. Our board of directors is responsible for overseeing the code of business conduct and ethics and must approve any waivers of the code for directors, officers and employees. If we make any substantive amendments to, or grant any waivers from, the code of business conduct and ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

Policies and Procedures for Related Person Transactions

Our board of directors has adopted written policies and procedures for the review of any transaction, arrangement or relationship in which our company is a participant, the amount involved exceeds $120,000, and one of our executive officers, directors, director nominees or 5% stockholders, or their immediate family members, each of whom we refer to as a “related person,” has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship, which we refer to as a “related person transaction,” the related person must report the proposed related person transaction to our general counsel or, if none, to our chief financial officer, or individual performing a similar function. The policy calls for the proposed related person transaction to be reviewed and, if deemed appropriate, approved by our audit committee. Whenever practicable, the reporting, review and approval will occur prior to entry into the transaction. If advance review and approval is not practicable, the committee will review, and, in its discretion, may ratify the related person transaction. The policy also permits the chair of the audit committee to review and, if deemed appropriate, approve proposed related person transactions that arise between committee meetings, subject to ratification by the committee at its next meeting. Any related person transactions that are ongoing in nature will be reviewed annually.

A related person transaction reviewed under the policy will be considered approved or ratified if it is authorized by the audit committee after full disclosure of the related person’s interest in the transaction. As appropriate for the circumstances, the audit committee will review and consider:

| ● | the related person’s interest in the related person transaction; |

| ● | the approximate dollar value of the amount involved in the related person transaction; |

| ● | the approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss; |

| ● | whether the transaction was undertaken in the ordinary course of our business; |

| ● | whether the terms of the transaction are no less favorable to us than terms that could have been reached with an unrelated third party; |

| ● | the purpose of, and the potential benefits to us of, the transaction; and |

| ● | any other information regarding the related person transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction. |

Our audit committee may approve or ratify the transaction only if it determines that, under all of the circumstances, the transaction is in our best interests. Our audit committee may impose any conditions on the related person transaction that it deems appropriate.

20

In addition to the transactions that are excluded by the instructions to the SEC’s related person transaction disclosure rule, our board of directors has determined that the following transactions do not create a material direct or indirect interest on behalf of related persons and, therefore, are not related person transactions for purposes of this policy: