Ryerson announces all stock merger with Olympic Steel Investor Presentation October 2025 .4

Expansive Solutions Offering across industrial metals 1 Source: Company filings Note: 1 Select products and services, not comprehensive 2 $4.6bn 2024 Revenue ~75k Industrial Metals Products ~110 Facilities $1.9bn 2024 Revenue Value-add Processing & End-Products Focus ~54 Facilities Coil Sheet & Plate Bar Pipe & Tube Aluminum Specialty Alloy Stainless Tin Mill Products Red Metals Coating Tempering Polishing Fabrication Slitting & CTL Machining Update to better picture of carbon steel Carbon Select materials Select material types Select value added processing capabilities Margin expansion through value-add ~$120mm synergies Complementary strategic fit Expanded presence Enhanced ability to serve customers

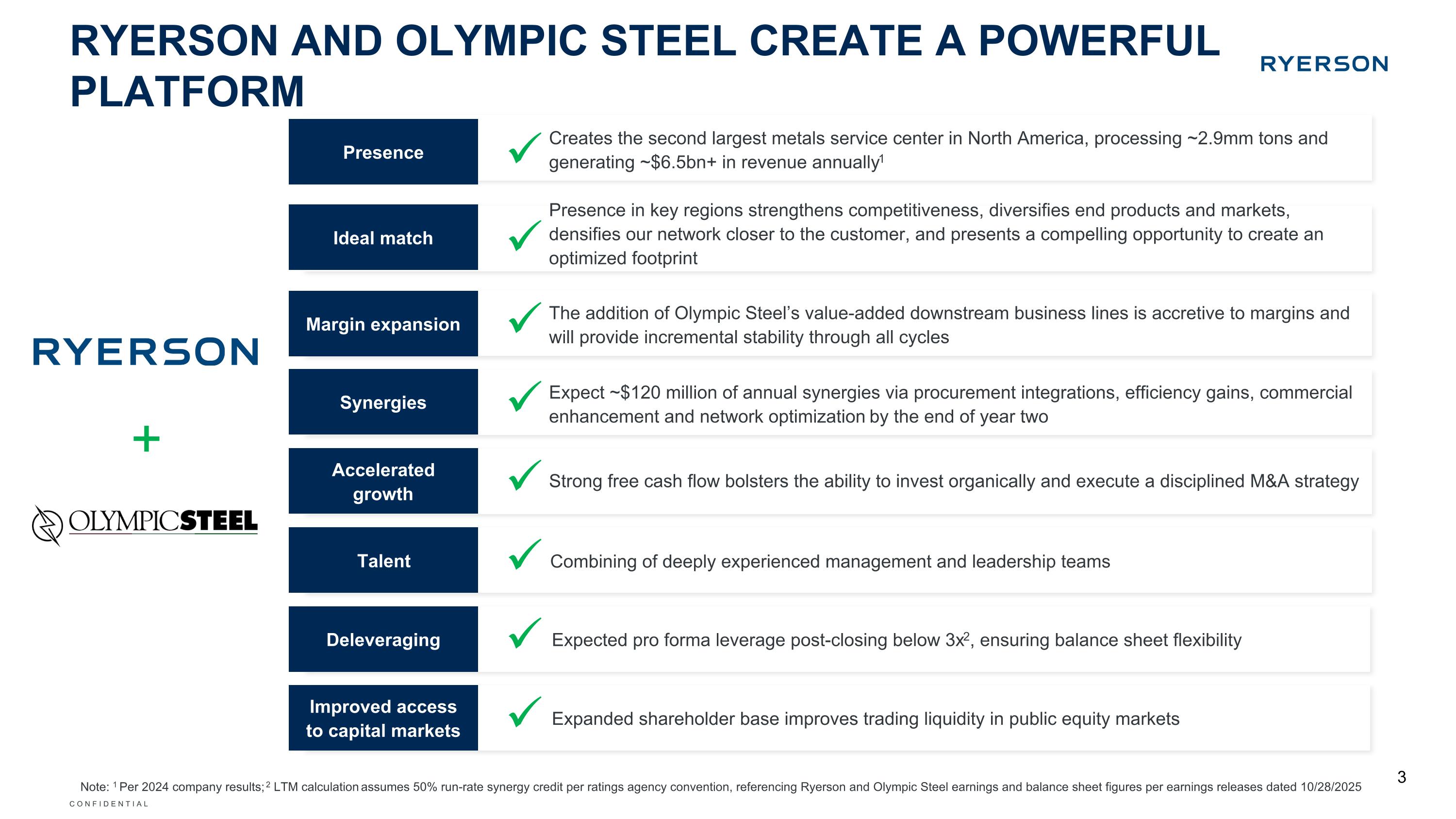

RYERSON AND OLYMPIC STEEL CREATE A POWERFUL PLATFORM 3 + Note: 1 Per 2024 company results; 2 LTM calculation assumes 50% run-rate synergy credit per ratings agency convention, referencing Ryerson and Olympic Steel earnings and balance sheet figures per earnings releases dated 10/28/2025 Presence Creates the second largest metals service center in North America, processing ~2.9mm tons and generating ~$6.5bn+ in revenue annually1 Synergies Expect ~$120 million of annual synergies via procurement integrations, efficiency gains, commercial enhancement and network optimization by the end of year two Accelerated growth Strong free cash flow bolsters the ability to invest organically and execute a disciplined M&A strategy Ideal match Presence in key regions strengthens competitiveness, diversifies end products and markets, densifies our network closer to the customer, and presents a compelling opportunity to create an optimized footprint Margin expansion The addition of Olympic Steel’s value-added downstream business lines is accretive to margins and will provide incremental stability through all cycles Talent Combining of deeply experienced management and leadership teams Expected pro forma leverage post-closing below 3x2, ensuring balance sheet flexibility Deleveraging Expanded shareholder base improves trading liquidity in public equity markets Improved access to capital markets

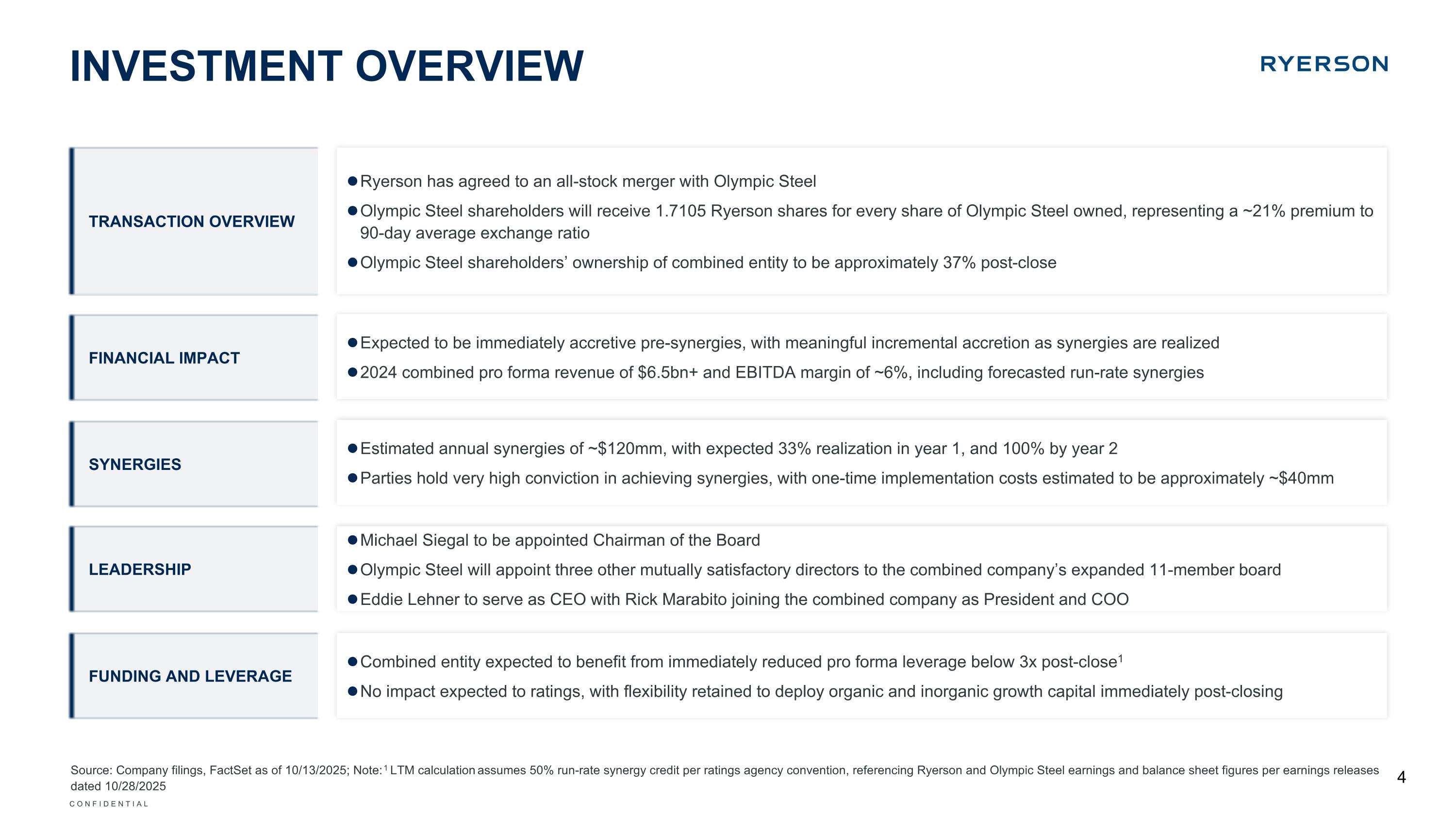

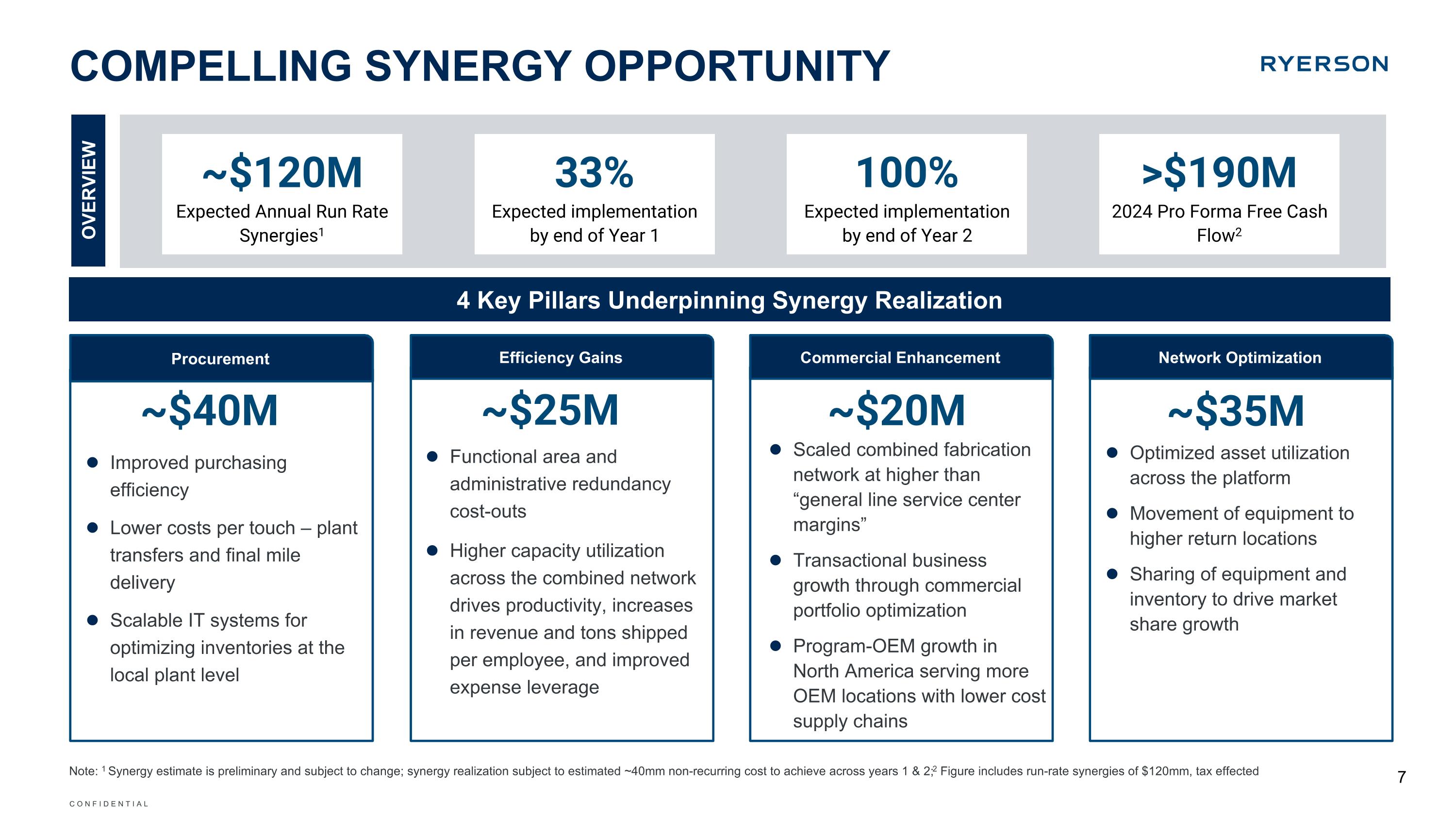

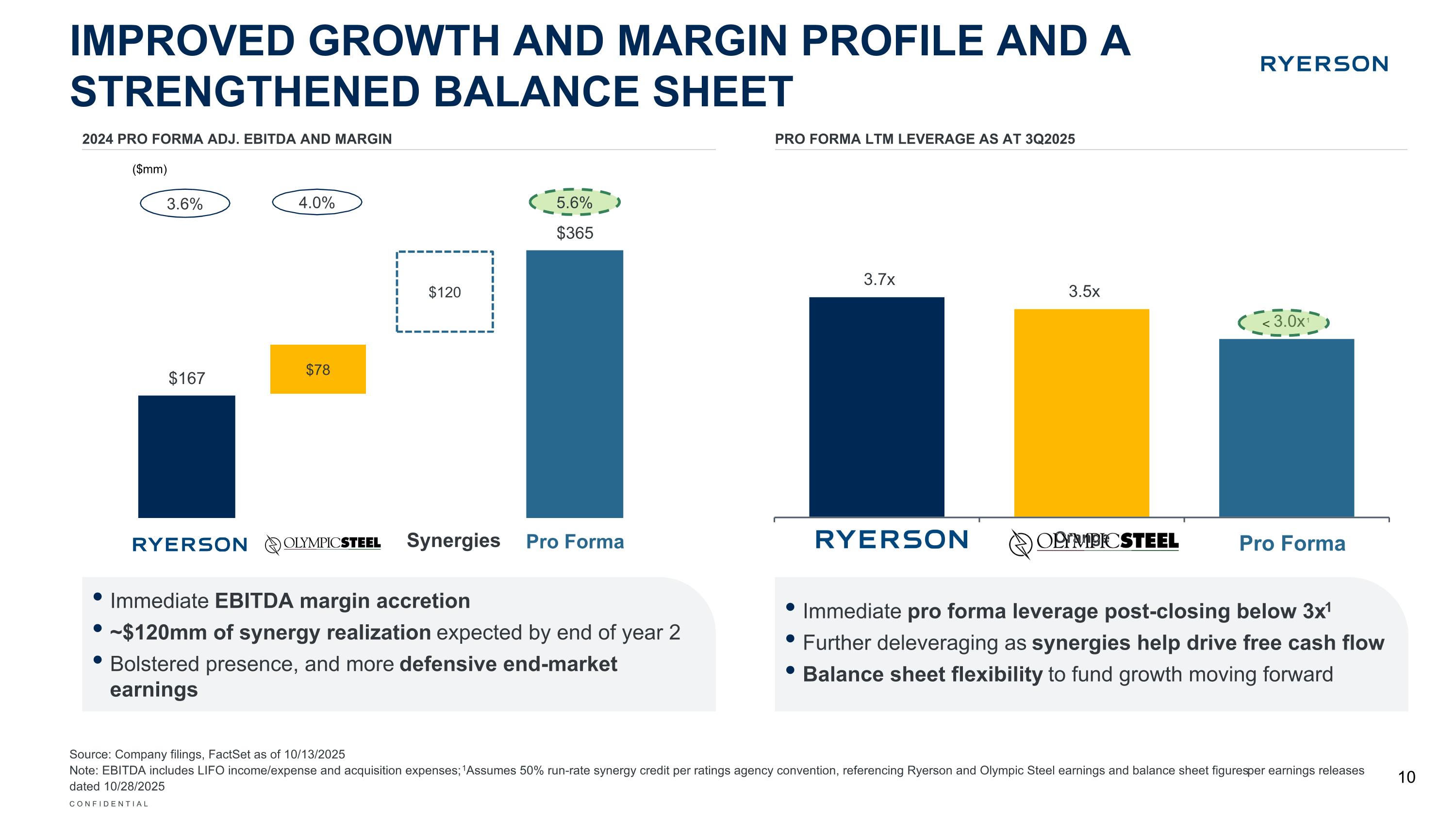

SYNERGIES Estimated annual synergies of ~$120mm, with expected 33% realization in year 1, and 100% by year 2 Parties hold very high conviction in achieving synergies, with one-time implementation costs estimated to be approximately ~$40mm LEADERSHIP Michael Siegal to be appointed Chairman of the Board Olympic Steel will appoint three other mutually satisfactory directors to the combined company’s expanded 11-member board Eddie Lehner to serve as CEO with Rick Marabito joining the combined company as President and COO TRANSACTION OVERVIEW Ryerson has agreed to an all-stock merger with Olympic Steel Olympic Steel shareholders will receive 1.7105 Ryerson shares for every share of Olympic Steel owned, representing a ~21% premium to 90-day average exchange ratio Olympic Steel shareholders’ ownership of combined entity to be approximately 37% post-close FINANCIAL IMPACT Expected to be immediately accretive pre-synergies, with meaningful incremental accretion as synergies are realized 2024 combined pro forma revenue of $6.5bn+ and EBITDA margin of ~6%, including forecasted run-rate synergies INVESTMENT OVERVIEW FUNDING AND LEVERAGE Combined entity expected to benefit from immediately reduced pro forma leverage below 3x post-close1 No impact expected to ratings, with flexibility retained to deploy organic and inorganic growth capital immediately post-closing Source: Company filings, FactSet as of 10/13/2025; Note: 1 LTM calculation assumes 50% run-rate synergy credit per ratings agency convention, referencing Ryerson and Olympic Steel earnings and balance sheet figures per earnings releases dated 10/28/2025 4

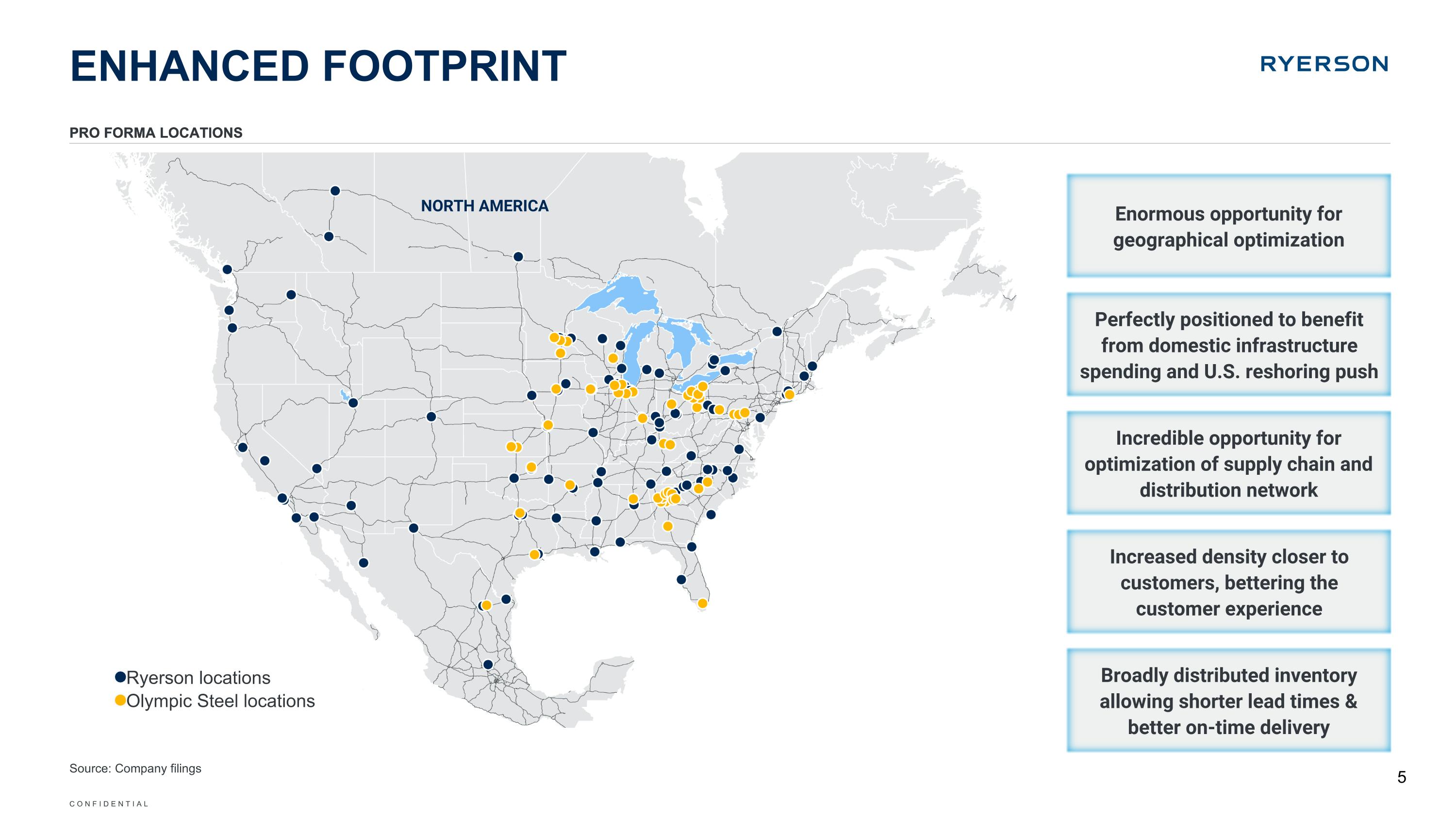

ENHANCED FOOTPRINT PRO FORMA LOCATIONS Source: Company filings 1 5 *PLEASE DO NOT DELETE THIS TEXT BOX* This map was created using ArcGIS Pro. This tag identifies the map allowing additional updates and edits using previously submitted materials and data. Contact GCFO-Presentations and use the workflow reference number below to make edits. ArcGIS Pro Workflow reference number is: 4609534-001 PRO FORMA LOCATIONS Enormous opportunity for geographical optimization Perfectly positioned to benefit from domestic infrastructure spending and U.S. reshoring push Incredible opportunity for optimization of supply chain and distribution network Ryerson locations Olympic Steel locations Increased density closer to customers, bettering the customer experience Broadly distributed inventory allowing shorter lead times & better on-time delivery NORTH AMERICA

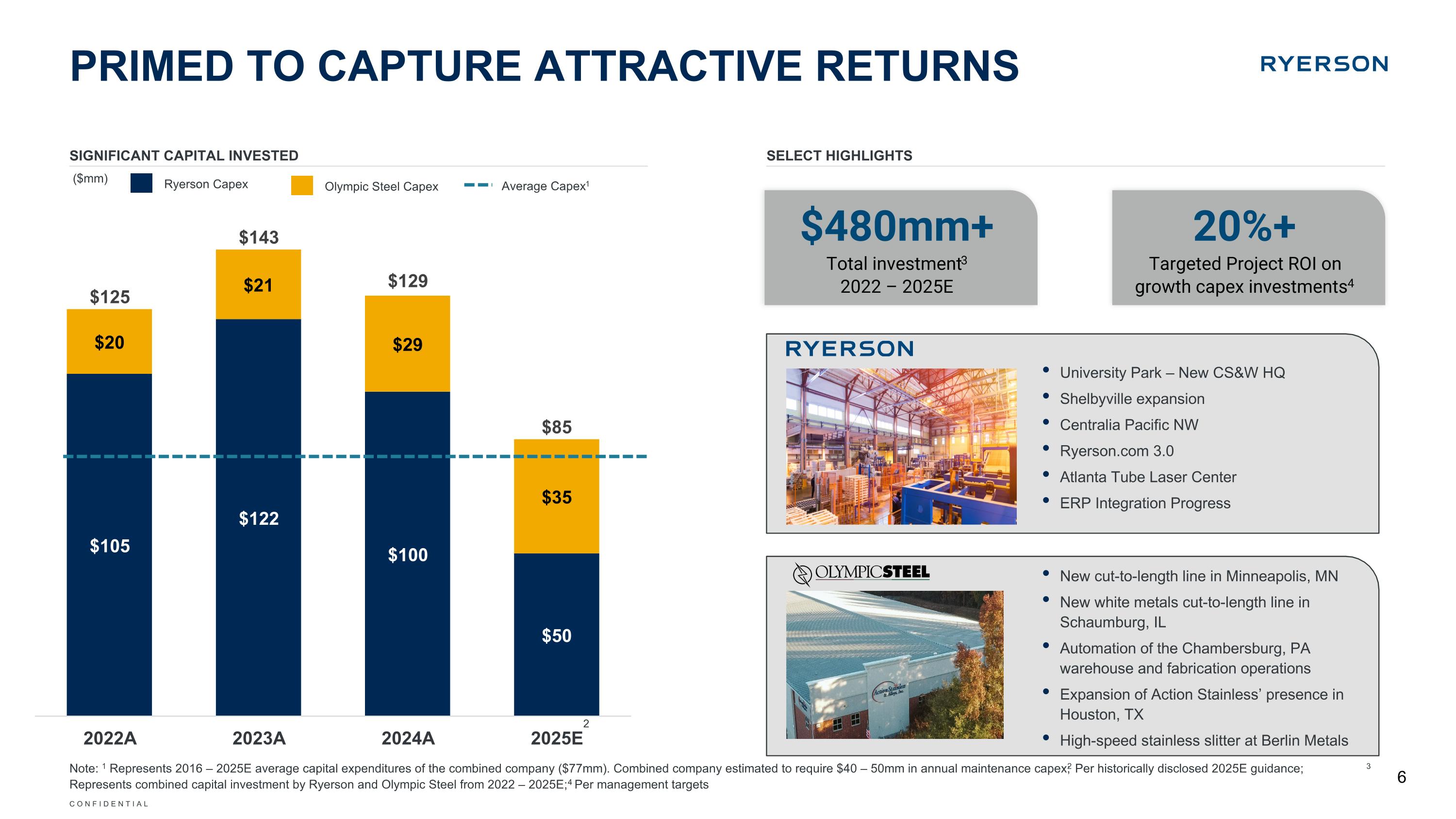

PRIMED TO CAPTURE ATTRACTIVE RETURNS Significant capital invested Note: 1 Represents 2016 – 2025E average capital expenditures of the combined company ($77mm). Combined company estimated to require $40 – 50mm in annual maintenance capex; 2 Per historically disclosed 2025E guidance; 3 Represents combined capital investment by Ryerson and Olympic Steel from 2022 – 2025E; 4 Per management targets 1 6 *PLEASE DO NOT DELETE THIS TEXT BOX* This map was created using ArcGIS Pro. This tag identifies the map allowing additional updates and edits using previously submitted materials and data. Contact GCFO-Presentations and use the workflow reference number below to make edits. ArcGIS Pro Workflow reference number is: 4609534-001 ($mm) SELECT HIGHLIGHTS Ryerson Capex Olympic Steel Capex Average Capex1 $480mm+ Total investment3 2022 – 2025E 20%+ Targeted Project ROI on growth capex investments4 University Park – New CS&W HQ Shelbyville expansion Centralia Pacific NW Ryerson.com 3.0 Atlanta Tube Laser Center ERP Integration Progress Update 2025 to guided capex figures (35m for O, 50mm for R) Leave picture, but update to snapshot bullets from recent capex announcements New cut-to-length line in Minneapolis, MN New white metals cut-to-length line in Schaumburg, IL Automation of the Chambersburg, PA warehouse and fabrication operations Expansion of Action Stainless’ presence in Houston, TX High-speed stainless slitter at Berlin Metals 2

Note: 1 Synergy estimate is preliminary and subject to change; synergy realization subject to estimated ~40mm non-recurring cost to achieve across years 1 & 2; 2 Figure includes run-rate synergies of $120mm, tax effected 4 Key Pillars Underpinning Synergy Realization Eliminate overlapping technology and duplicate third party spending (i.e., T&E, professional services) G&A and sales redundancies without impacting customer experience Optimize supply chain and factory logistics Higher volume on standard runs with less machine change over Footprint simplification reducing facility overhead and improving efficiency Optimized distribution / warehousing resulting in improved customer experience COMPELLING SYNERGY OPPORTUNITY OVERVIEW 7 ~$120M Expected Annual Run Rate Synergies1 33% Expected implementation by end of Year 1 100% Expected implementation by end of Year 2 >$190M 2024 Pro Forma Free Cash Flow2 Procurement Improved purchasing efficiency Lower costs per touch – plant transfers and final mile delivery Scalable IT systems for optimizing inventories at the local plant level Efficiency Gains Functional area and administrative redundancy cost-outs Higher capacity utilization across the combined network drives productivity, increases in revenue and tons shipped per employee, and improved expense leverage Network Optimization Optimized asset utilization across the platform Movement of equipment to higher return locations Sharing of equipment and inventory to drive market share growth Commercial Enhancement Scaled combined fabrication network at higher than “general line service center margins” Transactional business growth through commercial portfolio optimization Program-OEM growth in North America serving more OEM locations with lower cost supply chains ~$40M ~$20M ~$35M ~$25M

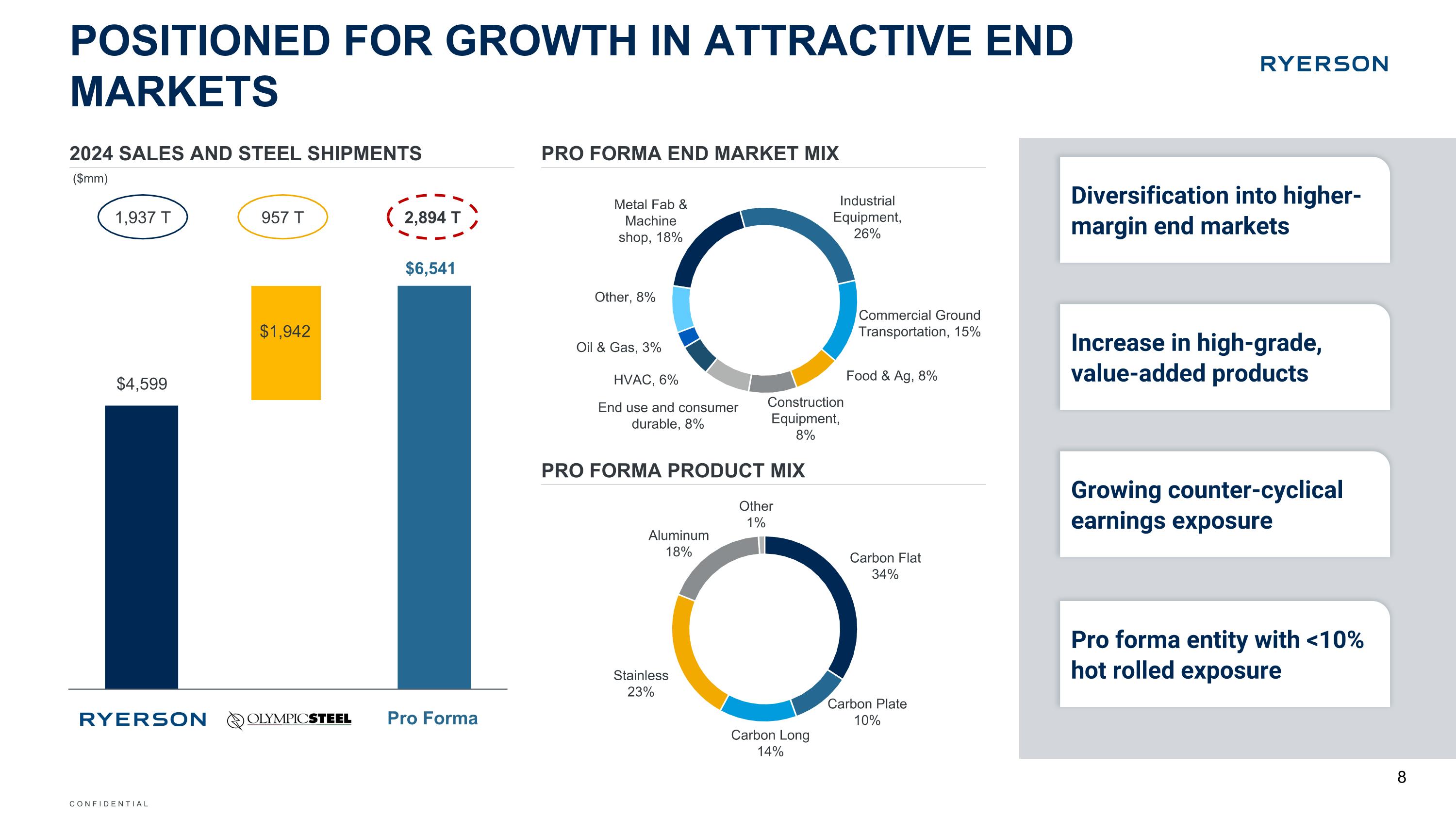

POSITIONED FOR GROWTH IN ATTRACTIVE END MARKETS 8 1,937 T 957 T 2,894 T ($mm) Pro Forma 2024 Sales and steel shipments PRO FORMA END MARKET MIX PRO FORMA PRODUCT MIX Pro forma entity with <10% hot rolled exposure Diversification into higher-margin end markets Increase in high-grade, value-added products Growing counter-cyclical earnings exposure

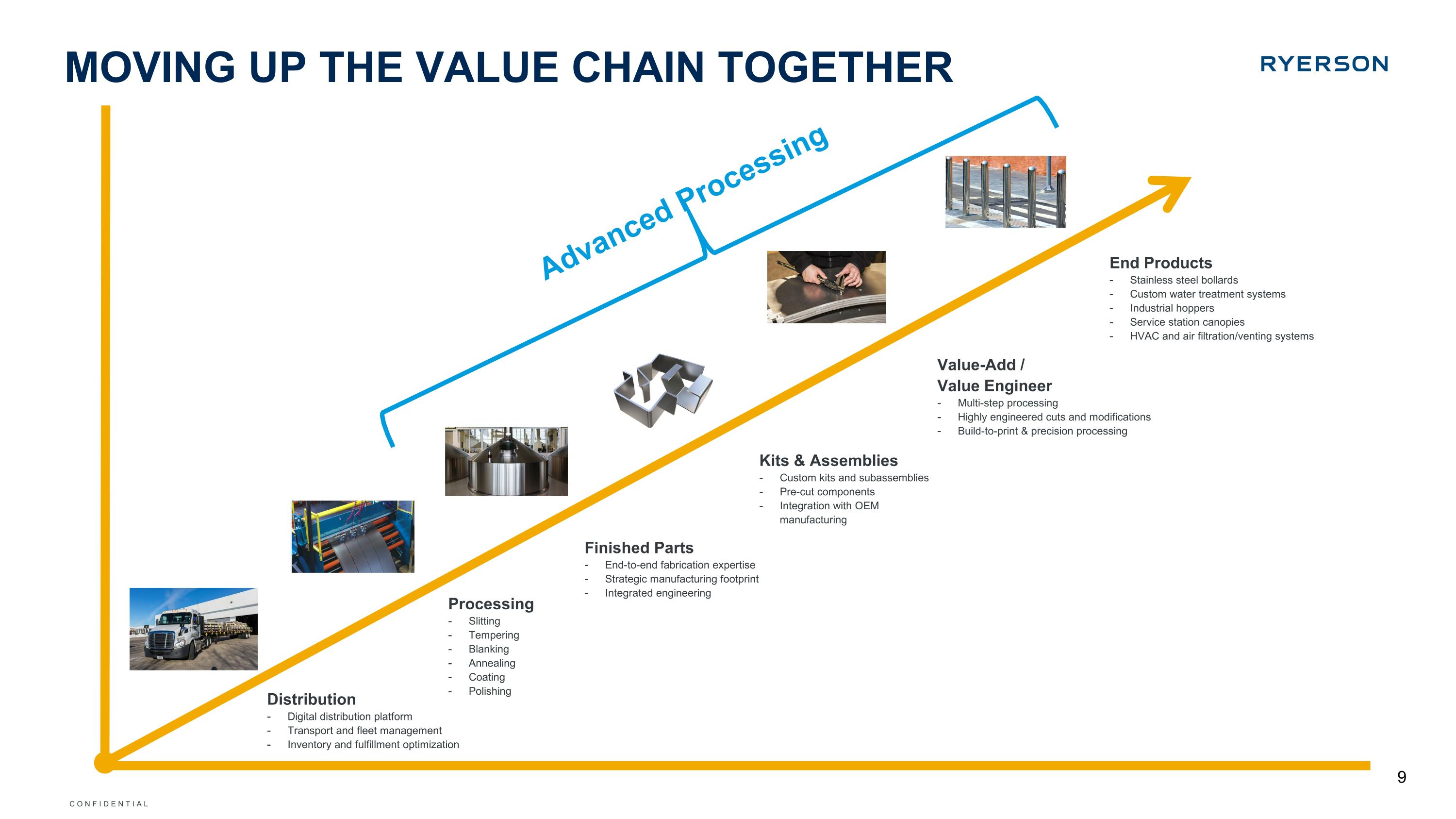

Moving Up the Value Chain TOGETHER 9 Distribution Digital distribution platform Transport and fleet management Inventory and fulfillment optimization Processing Slitting Tempering Blanking Annealing Coating Polishing Finished Parts End-to-end fabrication expertise Strategic manufacturing footprint Integrated engineering Kits & Assemblies Custom kits and subassemblies Pre-cut components Integration with OEM manufacturing Value-Add / Value Engineer Multi-step processing Highly engineered cuts and modifications Build-to-print & precision processing Advanced Processing Slide down, add “End products” picture and bullets top RHS of arrow End Products Stainless steel bollards Custom water treatment systems Industrial hoppers Service station canopies HVAC and air filtration/venting systems

IMPROVED GROWTH AND MARGIN PROFILE AND A STRENGTHENED BALANCE SHEET Source: Company filings, FactSet as of 10/13/2025 Note: EBITDA includes LIFO income/expense and acquisition expenses; 1Assumes 50% run-rate synergy credit per ratings agency convention, referencing Ryerson and Olympic Steel earnings and balance sheet figures per earnings releases dated 10/28/2025 Immediate pro forma leverage post-closing below 3x1 Further deleveraging as synergies help drive free cash flow Balance sheet flexibility to fund growth moving forward Pro Forma 1 PRO FORMA LTM Leverage AS AT 3Q2025 10 $78 $120 ($mm) Pro Forma 2024 PRO FORMA ADJ. ebitda and margin 3.6% 4.0% 5.6% Immediate EBITDA margin accretion ~$120mm of synergy realization expected by end of year 2 Bolstered presence, and more defensive end-market earnings Pro Forma Pro Forma < Synergies

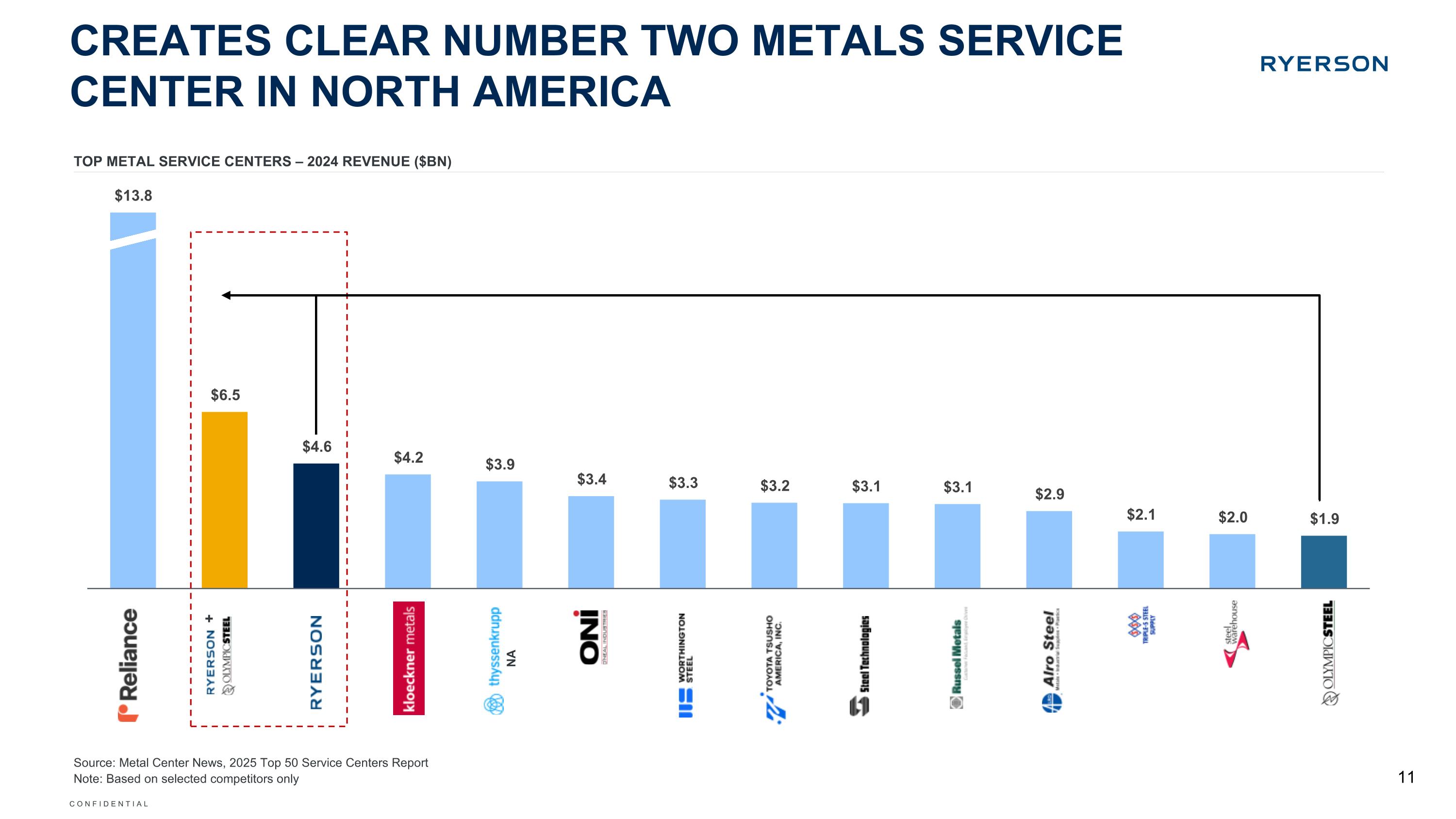

CREATES CLEAR NUMBER TWO METALS SERVICE CENTER IN NORTH AMERICA top metal service centers – 2024 revenue ($bn) Source: Metal Center News, 2025 Top 50 Service Centers Report Note: Based on selected competitors only Want to recreate this page 10/19 of Cliffs deck We did something similar on page 5/9 of this deck I can see, but want to update to look like this example so it’s more “sales” like Ideally show top 10 names NA + 11

Niche markets less cyclical and higher returns Highly engineered value-added processing Drives higher EBITDA, with % of revenue increasing OLYMPIC STEEL – DELIVERING STRONG RETURNS WITH LESS VOLATILITY Source: Company filings Note: Between 2014 – 2024 12 High-volume business Margin enhancement through value-added processing and successful acquisition of metal-intensive branded products Focus on higher margin products and fabrication Carbon & Coated Flat Products Stainless steel and aluminum Fastest-growing segment, serving growth markets Higher returns vs. carbon service centers Recent expansion of processing capabilities and successful M&A integration Exposure to broader end-markets $1.9b 2024 Revenue >10% CAGR 54 Sites in key US locations 8% Carbon Flat Products 57% of total revenue Specialty Metals Flat Products 26% of total revenue Tubular and Pipe Products 17% of total revenue 10 Well Regarded Brands in Specialty Metal Segment Revenue1 2024 Revenue from Olympic Manufactured Products

OLYMPIC STEEL HAS RELENTLESSLY FOCUSED ON MARGIN EXPANSION AND CONSISTENCY OF EARNINGS Reducing cyclicality through investment and M&A Focus on higher-margin and metal-intensive branded product Comprehensive portfolio of specialty end-products Track-record of accretive organic and inorganic growth initiatives Historical ability to produce free cash flow in counter-cyclical markets Four years of consecutive quarterly dividend increases Heavily U.S.-based supply chain and customer base Poised to benefit from Build America infrastructure spending, reshoring and increased fabrication outsourcing, and reshaping of manufacturing supply chain Rigorous management of operating expense, working capital and capital deployment over time Greater consistency in margins, with clear plan to continue expanding 1 Disciplined capital allocation Higher margin brand portfolio Positioned to capitalize on favorable environment Rigorous operating expense management Source: Olympic Steel company filings 13

RYERSON AND OLYMPIC STEEL CREATE A POWERFUL PLATFORM 14 + Note: 1 Per 2024 company results; 2 LTM calculation assumes 50% run-rate synergy credit per ratings agency convention, referencing Ryerson and Olympic Steel earnings and balance sheet figures per earnings releases dated 10/28/2025 Presence Creates the second largest metals service center in North America, processing ~2.9mm tons and generating ~$6.5bn+ in revenue annually1 Synergies Expect ~$120 million of annual synergies via procurement integrations, efficiency gains, commercial enhancement and network optimization by the end of year two Accelerated growth Strong free cash flow bolsters the ability to invest organically and execute a disciplined M&A strategy Ideal match Presence in key regions strengthens competitiveness, diversifies end products and markets, densifies our network closer to the customer, and presents a compelling opportunity to create an optimized footprint Margin expansion The addition of Olympic Steel’s value-added downstream business lines is accretive to margins and will provide incremental stability through all cycles Talent Combining of deeply experienced management and leadership teams Expected pro forma leverage post-closing below 3x2, ensuring balance sheet flexibility Deleveraging Expanded shareholder base improves trading liquidity in public equity markets Improved access to capital markets

FORWARD-LOOKING STATEMENTS This communication contains certain “forward-looking statements” within the meaning of federal securities laws. Forward-looking statements may be identified by words such as “anticipates,” “believes,” “could,” “continue,” “estimate,” “expects,” “intends,” “will,” “should,” “may,” “plan,” “predict,” “project,” “would” and similar expressions. Forward-looking statements are not statements of historical fact and reflect Ryerson’s and Olympic Steel’s current views about future events. Such forward-looking statements include, without limitation, statements about the benefits of the proposed transaction involving Ryerson and Olympic Steel, including future financial and operating results, Ryerson’s and Olympic Steel’s plans, objectives, expectations and intentions, the expected timing and likelihood of completion of the proposed transaction, and other statements that are not historical facts. No assurances can be given that the forward-looking statements contained in this communication will occur as projected, and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without limitation, the ability to obtain the requisite Ryerson and Olympic Steel shareholder approvals; the risk that Ryerson and Olympic Steel may be unable to obtain governmental and regulatory approvals required for the proposed transaction (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the risk that an event, change or other circumstance could give rise to the termination of the proposed transaction; the risk that a condition to the consummation of the proposed transaction may not be satisfied; the risk of delays in completing the proposed transaction, including as related to any government shutdown; the risk that the businesses will not be integrated successfully or will be more costly or difficult than expected; the risk that the cost savings and any other synergies from the proposed transaction may not be fully realized or may take longer to realize than expected or that the proposed transaction may be less accretive than expected; the risk that the merger will not provide shareholders with increased earnings potential; the risk that any announcement relating to the proposed transaction could have adverse effects on the market price of Ryerson’s or Olympic Steel’s common stock; the risk of litigation related to the proposed transaction; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the diversion of management time from ongoing business operations and opportunities as a result of the proposed transaction; the risk of adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; adverse economic conditions; highly cyclical fluctuations resulting from, among others, seasonality, market uncertainty, and costs of goods sold; each company’s ability to remain competitive and maintain market share in the highly competitive and fragmented metals distribution industry; managing the costs of purchased metals relative to the price at which each company sells its products during periods of rapid price escalation or deflation; customer, supplier and competitor consolidation, bankruptcy or insolvency; the impairment of goodwill that could result from, among other things, volatility in the markets in which each company operates; the impact of geopolitical events; future funding for postretirement employee benefits may require substantial payments from current cash flow; the regulatory and other operational risks associated with our operations located outside of the United States; currency rate fluctuations; the adequacy of each company’s efforts to mitigate cyber security risks and threats; reduced production schedules, layoffs or work stoppages by each company’s own, its suppliers’, or customers’ personnel; any underfunding of certain employee retirement benefit plans and the actual costs exceeding current estimates; prolonged disruption of each company’s processing centers; failure to manage potential conflicts of interest between or among customers or suppliers of each company; unanticipated changes to, or any inability to hire and retain key personnel at either company; currency exchange rate fluctuations; the incurrence of substantial costs of liabilities to comply with, or as a result of, violations of environmental laws; the risk of product liability claims; either company’s indebtedness or covenants in the instruments governing such indebtedness; the influence of a single investor group over the either company’s policies and procedures; and other risks inherent in Ryerson’s and Olympic Steel’s businesses and other factors described in Ryerson’s and Olympic Steel’s respective filings with the Securities and Exchange Commission (the “SEC”). Additional information concerning these and other factors that may impact such forward-looking statements can be found in filings and potential filings by Ryerson and Olympic Steel, or the combined company resulting from the proposed transaction with the SEC, including under the heading “Risk Factors.” If any of these risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Forward-looking statements are based on the estimates and opinions of management as of the date of this communication; subsequent events and developments may cause their assessments to change. Neither Ryerson nor Olympic Steel undertakes any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law and they specifically disclaim any obligation to do so. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. 15

NO OFFER OR SOLICITATION This communication is not intended to be, and shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC In connection with the proposed transaction, Ryerson and Olympic Steel intend to file a joint proxy statement with the SEC and Ryerson intends to file with the SEC a registration statement on Form S-4 that will include the joint proxy statement of Ryerson and Olympic Steel and that will also constitute a prospectus of Ryerson. Each of Ryerson and Olympic Steel may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that Olympic Steel or Ryerson may file with the SEC. The definitive joint proxy statement/prospectus (if and when available) will be mailed to stockholders of Ryerson and Olympic Steel. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT OLYMPIC STEEL, RYERSON, AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents containing important information about Olympic Steel, Ryerson and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents filed with the SEC by Ryerson may be obtained free of charge by directing a request by mail to Ryerson’s Corporate Secretary at Ryerson Holding Corporation, Attention: Secretary, 227 W. Monroe St., 27th Floor, Chicago, Illinois, 60606. Copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents filed with the SEC by Olympic Steel may be obtained free of charge by directing a request by mail to Olympic Steel’s Chief Financial Officer at Olympic Steel, Inc., 22901 Millcreek Boulevard, Suite 650, Highland Hills, OH, Attention: Chief Financial Officer. PARTICIPANTS IN THE SOLICITATION Olympic Steel, Ryerson and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies in connection with the proposed transaction. Information about Olympic Steel’s directors and executive officers is available in Olympic Steel’s proxy statement dated March 28, 2025 for its 2025 Annual Meeting of Shareholders. Information about Ryerson’s directors and executive officers is available in Ryerson’s proxy statement dated March 5, 2025, for its 2025 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement on Form S-4, including the joint proxy statement/prospectus, and all other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Investors should read the registration statement on Form S-4, including the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. NON-GAAP MEASURES Certain measures contained in these slides or the related presentation are not measures calculated in accordance with generally accepted accounting principles (“GAAP”). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnotes. A reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures is included in the Appendix. 16