Page 2 of 32 Table of Contents Page Executive Summary 3 Corporate Information 6 Consolidated Balance Sheets 8 Consolidated Statements of Operations 9 Funds from Operations & Adjusted Funds from Operations 10 Consolidated Same-Store Property Performance 11 NOI Detail 12 Debt Summary & Debt Metrics 13 Debt Maturities, Composition & Hedging Instruments 14 Debt Covenant Compliance 15 Existing Portfolio Summary 16 Office Properties by Location 17 Office Properties Occupancy Detail 18 15 Largest Office Tenants 19 Studio Properties & Services 20 Office Leasing Activity 21 Expiring Office Leases Summary 22 Uncommenced, Backfilled & Expiring Office Leases—Next Eight Quarters 23 In Process & Future Development Pipeline 25 Consolidated & Unconsolidated Ventures 26 Definitions 27 Non-GAAP Reconciliations 30 Hudson Pacific Properties, Inc. is referred to herein as the “Company,” “Hudson Pacific,” “HPP,” “we,” “us,” or “our.” This Supplemental Information contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. You should not rely on forward-looking statements as predictions of future events. Forward-looking statements involve numerous risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statement made by us. These risks and uncertainties include, but are not limited to: adverse economic or real estate developments in our target markets; general economic conditions; defaults on, early terminations of or non-renewal of leases by tenants; fluctuations in interest rates and increased operating costs; our failure to obtain necessary outside financing, maintain an investment grade rating or maintain compliance with covenants under our financing arrangements; our failure to generate sufficient cash flows to service our outstanding indebtedness and maintain dividend payments; lack or insufficient amounts of insurance; decreased rental rates or increased vacancy rates; difficulties in identifying properties to acquire or dispose and completing acquisitions or dispositions; our failure to successfully operate acquired properties and operations; our failure to maintain our status as a REIT; the loss of key personnel; environmental uncertainties and risks related to adverse weather conditions and natural disasters; financial market and foreign currency fluctuations; risks related to acquisitions generally, including the diversion of management’s attention from ongoing business operations and the impact on customers, tenants, lenders, operating results and business; the inability to successfully integrate acquired properties, realize the anticipated benefits of acquisitions or capitalize on value creation opportunities; changes in the tax laws and uncertainty as to how those changes may be applied; changes in real estate and zoning laws and increases in real property tax rates; and other factors affecting the real estate industry generally. These factors are not exhaustive. For a discussion of important risks related to Hudson Pacific’s business and an investment in its securities, including risks that could cause actual results and events to differ materially from results and events referred to in the forward-looking information, see the discussion under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K as well as other risks described in documents we file with the Securities and Exchange Commission, or SEC. You are cautioned that the information contained herein speaks only as of the date hereof and Hudson Pacific assumes no obligation to update any forward-looking information, whether as a result of new information, future events or otherwise. This Supplemental Information also includes non-GAAP financial measures, which are accompanied by what we consider the most directly comparable financial measures calculated and presented in accordance with GAAP. In addition, quantitative reconciliations of the differences between the most directly comparable GAAP and non-GAAP financial measures presented are also provided within this Supplemental Information. Definitions of these non-GAAP financial measures, along with that of HPP’s Share of certain of these measures, can be found in the Definitions section of this Supplemental information.

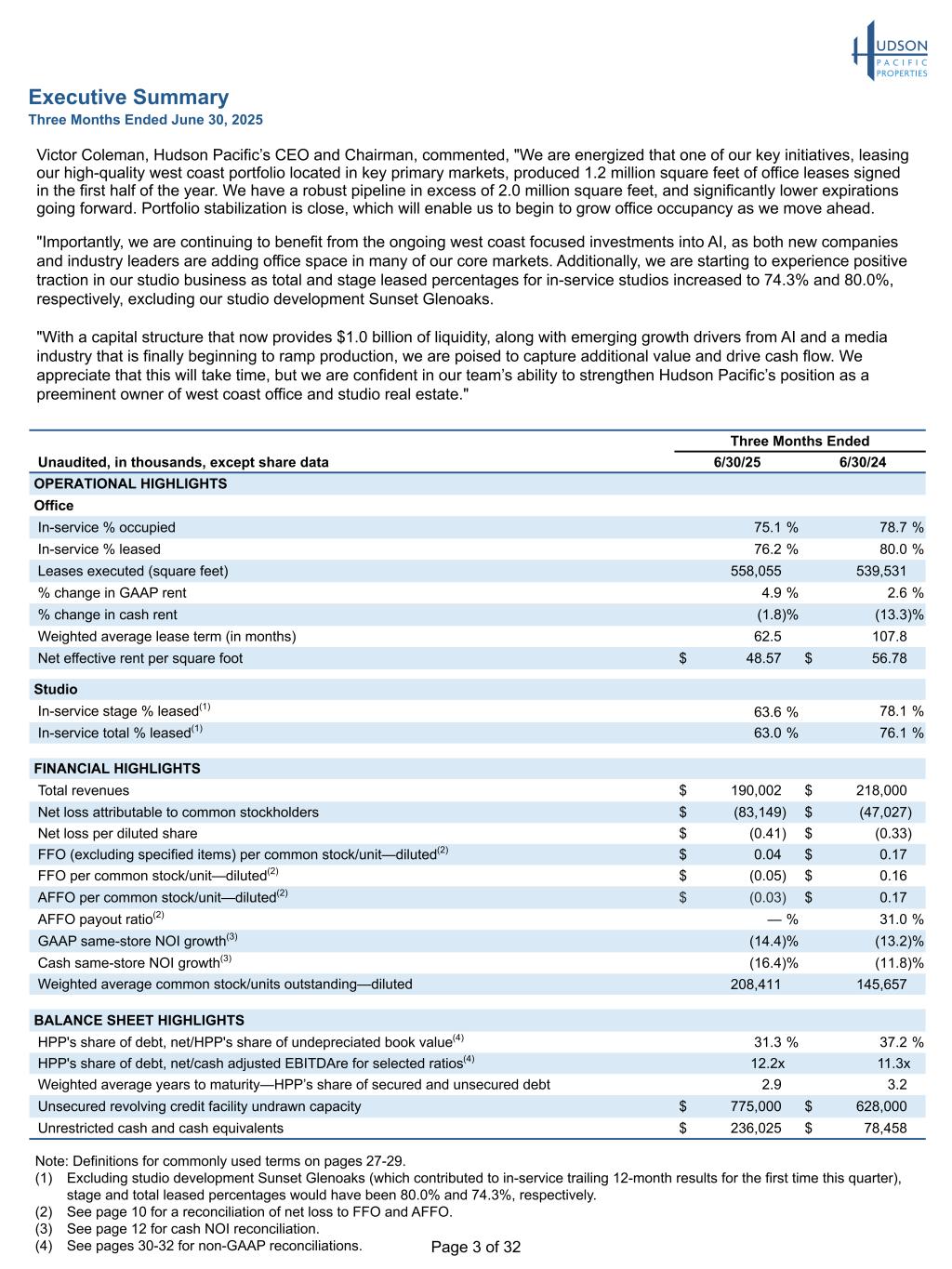

Page 3 of 32 Executive Summary Three Months Ended June 30, 2025 Victor Coleman, Hudson Pacific’s CEO and Chairman, commented, "We are energized that one of our key initiatives, leasing our high-quality west coast portfolio located in key primary markets, produced 1.2 million square feet of office leases signed in the first half of the year. We have a robust pipeline in excess of 2.0 million square feet, and significantly lower expirations going forward. Portfolio stabilization is close, which will enable us to begin to grow office occupancy as we move ahead. "Importantly, we are continuing to benefit from the ongoing west coast focused investments into AI, as both new companies and industry leaders are adding office space in many of our core markets. Additionally, we are starting to experience positive traction in our studio business as total and stage leased percentages for in-service studios increased to 74.3% and 80.0%, respectively, excluding our studio development Sunset Glenoaks. "With a capital structure that now provides $1.0 billion of liquidity, along with emerging growth drivers from AI and a media industry that is finally beginning to ramp production, we are poised to capture additional value and drive cash flow. We appreciate that this will take time, but we are confident in our team’s ability to strengthen Hudson Pacific’s position as a preeminent owner of west coast office and studio real estate." Three Months Ended Unaudited, in thousands, except share data 6/30/25 6/30/24 OPERATIONAL HIGHLIGHTS Office In-service % occupied 75.1 % 78.7 % In-service % leased 76.2 % 80.0 % Leases executed (square feet) 558,055 539,531 % change in GAAP rent 4.9 % 2.6 % % change in cash rent (1.8) % (13.3) % Weighted average lease term (in months) 62.5 107.8 Net effective rent per square foot $ 48.57 $ 56.78 Studio In-service stage % leased(1) 63.6 % 78.1 % In-service total % leased(1) 63.0 % 76.1 % FINANCIAL HIGHLIGHTS Total revenues $ 190,002 $ 218,000 Net loss attributable to common stockholders $ (83,149) $ (47,027) Net loss per diluted share $ (0.41) $ (0.33) FFO (excluding specified items) per common stock/unit—diluted(2) $ 0.04 $ 0.17 FFO per common stock/unit—diluted(2) $ (0.05) $ 0.16 AFFO per common stock/unit—diluted(2) $ (0.03) $ 0.17 AFFO payout ratio(2) — % 31.0 % GAAP same-store NOI growth(3) (14.4) % (13.2) % Cash same-store NOI growth(3) (16.4) % (11.8) % Weighted average common stock/units outstanding—diluted 208,411 145,657 BALANCE SHEET HIGHLIGHTS HPP's share of debt, net/HPP's share of undepreciated book value(4) 31.3 % 37.2 % HPP's share of debt, net/cash adjusted EBITDAre for selected ratios(4) 12.2x 11.3x Weighted average years to maturity—HPP’s share of secured and unsecured debt 2.9 3.2 Unsecured revolving credit facility undrawn capacity $ 775,000 $ 628,000 Unrestricted cash and cash equivalents $ 236,025 $ 78,458 Note: Definitions for commonly used terms on pages 27-29. (1) Excluding studio development Sunset Glenoaks (which contributed to in-service trailing 12-month results for the first time this quarter), stage and total leased percentages would have been 80.0% and 74.3%, respectively. (2) See page 10 for a reconciliation of net loss to FFO and AFFO. (3) See page 12 for cash NOI reconciliation. (4) See pages 30-32 for non-GAAP reconciliations.

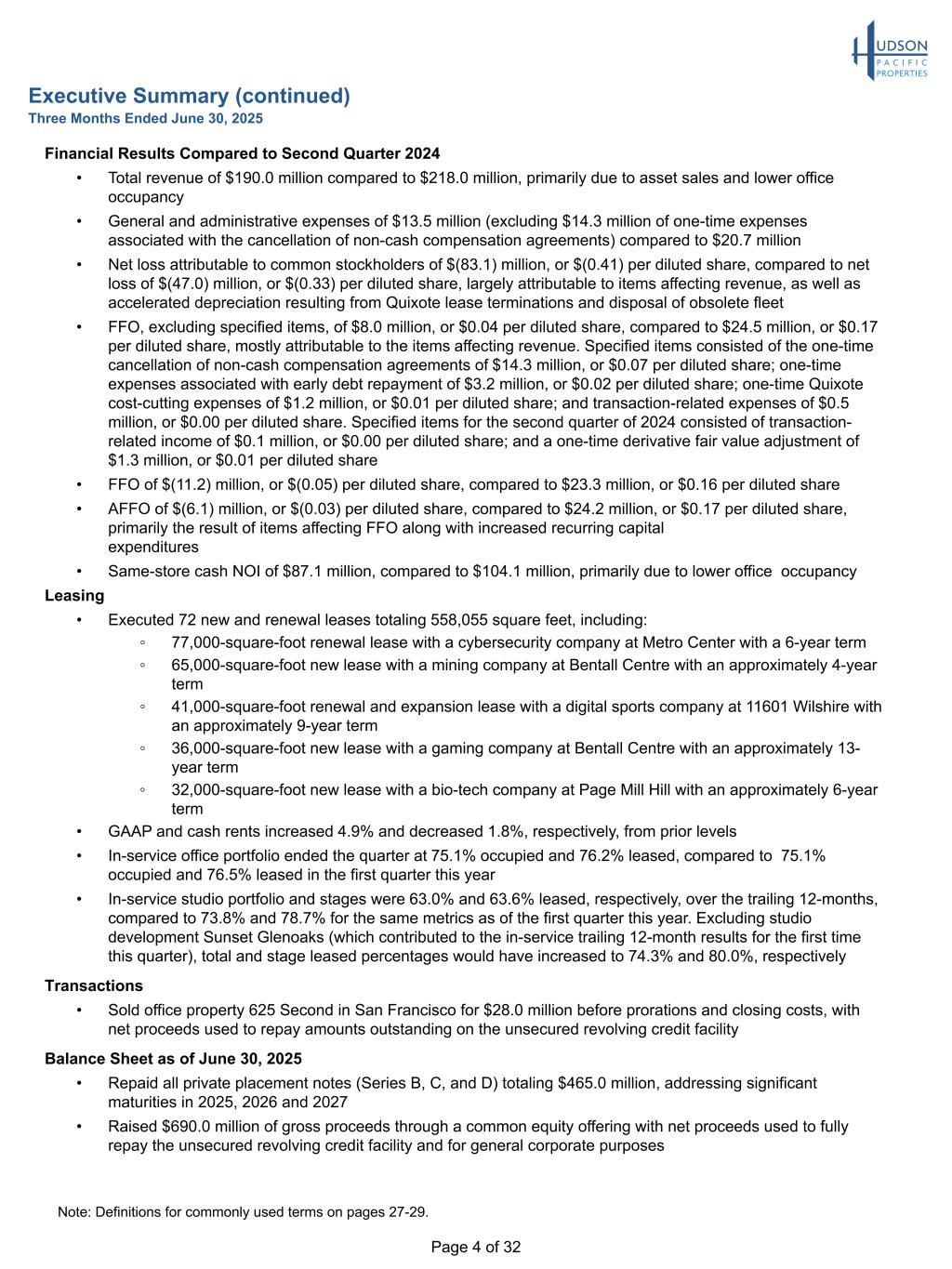

Page 4 of 32 Financial Results Compared to Second Quarter 2024 • Total revenue of $190.0 million compared to $218.0 million, primarily due to asset sales and lower office occupancy • General and administrative expenses of $13.5 million (excluding $14.3 million of one-time expenses associated with the cancellation of non-cash compensation agreements) compared to $20.7 million • Net loss attributable to common stockholders of $(83.1) million, or $(0.41) per diluted share, compared to net loss of $(47.0) million, or $(0.33) per diluted share, largely attributable to items affecting revenue, as well as accelerated depreciation resulting from Quixote lease terminations and disposal of obsolete fleet • FFO, excluding specified items, of $8.0 million, or $0.04 per diluted share, compared to $24.5 million, or $0.17 per diluted share, mostly attributable to the items affecting revenue. Specified items consisted of the one-time cancellation of non-cash compensation agreements of $14.3 million, or $0.07 per diluted share; one-time expenses associated with early debt repayment of $3.2 million, or $0.02 per diluted share; one-time Quixote cost-cutting expenses of $1.2 million, or $0.01 per diluted share; and transaction-related expenses of $0.5 million, or $0.00 per diluted share. Specified items for the second quarter of 2024 consisted of transaction- related income of $0.1 million, or $0.00 per diluted share; and a one-time derivative fair value adjustment of $1.3 million, or $0.01 per diluted share • FFO of $(11.2) million, or $(0.05) per diluted share, compared to $23.3 million, or $0.16 per diluted share • AFFO of $(6.1) million, or $(0.03) per diluted share, compared to $24.2 million, or $0.17 per diluted share, primarily the result of items affecting FFO along with increased recurring capital expenditures • Same-store cash NOI of $87.1 million, compared to $104.1 million, primarily due to lower office occupancy Leasing • Executed 72 new and renewal leases totaling 558,055 square feet, including: ◦ 77,000-square-foot renewal lease with a cybersecurity company at Metro Center with a 6-year term ◦ 65,000-square-foot new lease with a mining company at Bentall Centre with an approximately 4-year term ◦ 41,000-square-foot renewal and expansion lease with a digital sports company at 11601 Wilshire with an approximately 9-year term ◦ 36,000-square-foot new lease with a gaming company at Bentall Centre with an approximately 13- year term ◦ 32,000-square-foot new lease with a bio-tech company at Page Mill Hill with an approximately 6-year term • GAAP and cash rents increased 4.9% and decreased 1.8%, respectively, from prior levels • In-service office portfolio ended the quarter at 75.1% occupied and 76.2% leased, compared to 75.1% occupied and 76.5% leased in the first quarter this year • In-service studio portfolio and stages were 63.0% and 63.6% leased, respectively, over the trailing 12-months, compared to 73.8% and 78.7% for the same metrics as of the first quarter this year. Excluding studio development Sunset Glenoaks (which contributed to the in-service trailing 12-month results for the first time this quarter), total and stage leased percentages would have increased to 74.3% and 80.0%, respectively Transactions • Sold office property 625 Second in San Francisco for $28.0 million before prorations and closing costs, with net proceeds used to repay amounts outstanding on the unsecured revolving credit facility Balance Sheet as of June 30, 2025 • Repaid all private placement notes (Series B, C, and D) totaling $465.0 million, addressing significant maturities in 2025, 2026 and 2027 • Raised $690.0 million of gross proceeds through a common equity offering with net proceeds used to fully repay the unsecured revolving credit facility and for general corporate purposes Executive Summary (continued) Three Months Ended June 30, 2025 Note: Definitions for commonly used terms on pages 27-29.

Page 5 of 32 Executive Summary (continued) Three Months Ended June 30, 2025 Note: Definitions for commonly used terms on pages 27-29. • Secured commitments to increase capacity under the unsecured revolving credit facility by $20.0 million to $795.0 million through December 2026 (including extensions), and to extend $462.0 million of capacity through December 2029 (including extensions) • $1.0 billion of total liquidity comprised of $236.0 million of unrestricted cash and cash equivalents and $775.0 million of undrawn capacity under the unsecured revolving credit facility • $87.4 million, or $22.3 million at HPP's share, of undrawn capacity under the construction loan secured by Sunset Pier 94 Studios • HPP's share of net debt to HPP's share of undepreciated book value was 31.3% with 99.2% of debt fixed or capped with weighted average interest rate of 5.0% and no maturities until December 2025 Dividend • The Company's Board of Directors declared and paid a dividend on its 4.750% Series C cumulative preferred stock of $0.296875 per share

Page 6 of 32 Corporate Information Hudson Pacific Properties (NYSE: HPP) is a real estate investment trust serving dynamic tech and media tenants in global epicenters for these synergistic, converging and secular growth industries. Hudson Pacific’s unique and high-barrier tech and media focus leverages a full-service, end-to-end value creation platform forged through deep strategic relationships and niche expertise across identifying, acquiring, transforming and developing properties into world-class amenitized, collaborative and sustainable office and studio space. Mark D. Linehan President and Chief Executive Officer, Wynmark Company Michael Nash Co-Founder and Chairman (retired), Blackstone Real Estate Debt Strategies Barry Sholem Founder and Partner, MSD Partners, L.P. and Chairman and Senior Advisor, BDT & MSD Partners Andrea Wong President (retired), International Production, Sony Pictures Television Victor J. Coleman Chairman of the Board, Chief Executive Officer, Hudson Pacific Properties, Inc. Theodore R. Antenucci President and Chief Officer, Catellus Development Corporation Jonathan M. Glaser Managing Member, JMG Capital Management LLC Robert L. Harris II Executive Chairman (retired), Acacia Research Corporation Board of Directors: Drew B. Gordon Chief Investment Officer Kay L. Tidwell Executive Vice President, General Counsel and Chief Risk Officer Andy Wattula Chief Operating Officer Victor J. Coleman Chief Executive Officer and Chairman Mark Lammas President Lisa Burelli Chief People Officer Harout Diramerian Chief Financial Officer Executive Management:

Page 7 of 32 Corporate Information (continued) BMO Capital Markets John Kim (212) 885-4115 BTIG Tom Catherwood (212) 738-6140 Citigroup Global Markets Seth Bergey (212) 816-2066 Goldman Sachs Caitlin Burrows (212) 902-4736 Piper Sandler & Company Alexander Goldfarb (212) 466-7937 Wells Fargo Securities Blaine Heck (443) 263-6529 Wolfe Research Ally Yaseen (646) 582-9253 Fitch Ratings Peter Siciliano (646) 582-4760 Moody’s Investor Service Ranjini Venkatesan (212) 553-3828 Standard & Poor’s Hannah Gray (646) 784-0134 Equity Research Coverage: Green Street Advisors Dylan Burzinski (949) 640-8780 Jefferies LLC Peter Abramowitz (212) 336-7241 Mizuho Securities Vikram Malhotra (212) 282-3827 Morgan Stanley Ronald Kamdem (212) 296-8319 Rating Agencies: Corporate Contact: Corporate Headquarters 11601 Wilshire Boulevard Ninth Floor Los Angeles, CA 90025 (310) 445-5700 Website www.hudsonpacificproperties.com Investor Relations Laura Campbell Executive Vice President, Investor Relations and Marketing (310) 622-1702

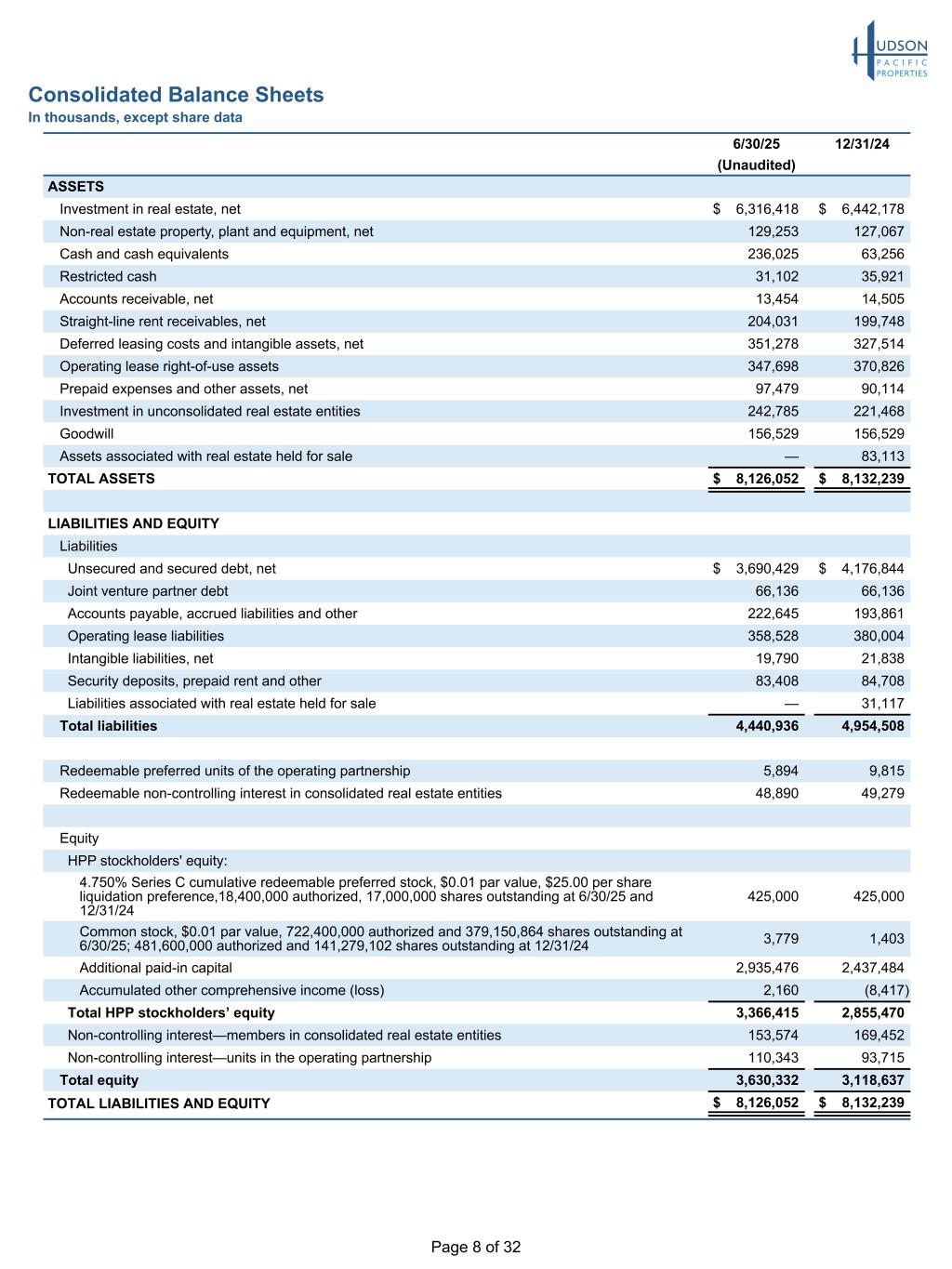

Page 8 of 32 Consolidated Balance Sheets In thousands, except share data 6/30/25 12/31/24 (Unaudited) ASSETS Investment in real estate, net $ 6,316,418 $ 6,442,178 Non-real estate property, plant and equipment, net 129,253 127,067 Cash and cash equivalents 236,025 63,256 Restricted cash 31,102 35,921 Accounts receivable, net 13,454 14,505 Straight-line rent receivables, net 204,031 199,748 Deferred leasing costs and intangible assets, net 351,278 327,514 Operating lease right-of-use assets 347,698 370,826 Prepaid expenses and other assets, net 97,479 90,114 Investment in unconsolidated real estate entities 242,785 221,468 Goodwill 156,529 156,529 Assets associated with real estate held for sale — 83,113 TOTAL ASSETS $ 8,126,052 $ 8,132,239 LIABILITIES AND EQUITY Liabilities Unsecured and secured debt, net $ 3,690,429 $ 4,176,844 Joint venture partner debt 66,136 66,136 Accounts payable, accrued liabilities and other 222,645 193,861 Operating lease liabilities 358,528 380,004 Intangible liabilities, net 19,790 21,838 Security deposits, prepaid rent and other 83,408 84,708 Liabilities associated with real estate held for sale — 31,117 Total liabilities 4,440,936 4,954,508 Redeemable preferred units of the operating partnership 5,894 9,815 Redeemable non-controlling interest in consolidated real estate entities 48,890 49,279 Equity HPP stockholders' equity: 4.750% Series C cumulative redeemable preferred stock, $0.01 par value, $25.00 per share liquidation preference,18,400,000 authorized, 17,000,000 shares outstanding at 6/30/25 and 12/31/24 425,000 425,000 Common stock, $0.01 par value, 722,400,000 authorized and 379,150,864 shares outstanding at 6/30/25; 481,600,000 authorized and 141,279,102 shares outstanding at 12/31/24 3,779 1,403 Additional paid-in capital 2,935,476 2,437,484 Accumulated other comprehensive income (loss) 2,160 (8,417) Total HPP stockholders’ equity 3,366,415 2,855,470 Non-controlling interest—members in consolidated real estate entities 153,574 169,452 Non-controlling interest—units in the operating partnership 110,343 93,715 Total equity 3,630,332 3,118,637 TOTAL LIABILITIES AND EQUITY $ 8,126,052 $ 8,132,239

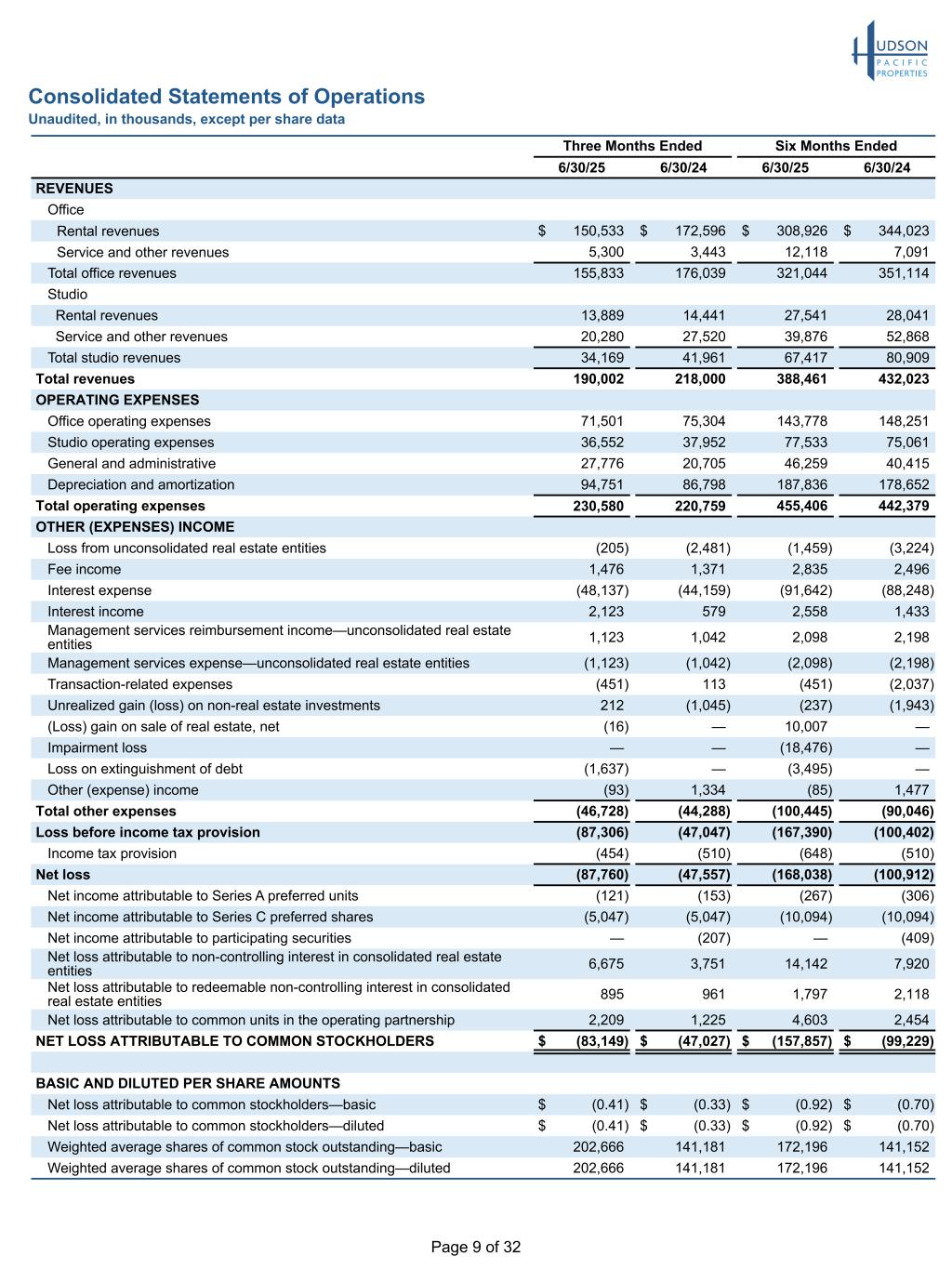

Page 9 of 32 Consolidated Statements of Operations Unaudited, in thousands, except per share data Three Months Ended Six Months Ended 6/30/25 6/30/24 6/30/25 6/30/24 REVENUES Office Rental revenues $ 150,533 $ 172,596 $ 308,926 $ 344,023 Service and other revenues 5,300 3,443 12,118 7,091 Total office revenues 155,833 176,039 321,044 351,114 Studio Rental revenues 13,889 14,441 27,541 28,041 Service and other revenues 20,280 27,520 39,876 52,868 Total studio revenues 34,169 41,961 67,417 80,909 Total revenues 190,002 218,000 388,461 432,023 OPERATING EXPENSES Office operating expenses 71,501 75,304 143,778 148,251 Studio operating expenses 36,552 37,952 77,533 75,061 General and administrative 27,776 20,705 46,259 40,415 Depreciation and amortization 94,751 86,798 187,836 178,652 Total operating expenses 230,580 220,759 455,406 442,379 OTHER (EXPENSES) INCOME Loss from unconsolidated real estate entities (205) (2,481) (1,459) (3,224) Fee income 1,476 1,371 2,835 2,496 Interest expense (48,137) (44,159) (91,642) (88,248) Interest income 2,123 579 2,558 1,433 Management services reimbursement income—unconsolidated real estate entities 1,123 1,042 2,098 2,198 Management services expense—unconsolidated real estate entities (1,123) (1,042) (2,098) (2,198) Transaction-related expenses (451) 113 (451) (2,037) Unrealized gain (loss) on non-real estate investments 212 (1,045) (237) (1,943) (Loss) gain on sale of real estate, net (16) — 10,007 — Impairment loss — — (18,476) — Loss on extinguishment of debt (1,637) — (3,495) — Other (expense) income (93) 1,334 (85) 1,477 Total other expenses (46,728) (44,288) (100,445) (90,046) Loss before income tax provision (87,306) (47,047) (167,390) (100,402) Income tax provision (454) (510) (648) (510) Net loss (87,760) (47,557) (168,038) (100,912) Net income attributable to Series A preferred units (121) (153) (267) (306) Net income attributable to Series C preferred shares (5,047) (5,047) (10,094) (10,094) Net income attributable to participating securities — (207) — (409) Net loss attributable to non-controlling interest in consolidated real estate entities 6,675 3,751 14,142 7,920 Net loss attributable to redeemable non-controlling interest in consolidated real estate entities 895 961 1,797 2,118 Net loss attributable to common units in the operating partnership 2,209 1,225 4,603 2,454 NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS $ (83,149) $ (47,027) $ (157,857) $ (99,229) BASIC AND DILUTED PER SHARE AMOUNTS Net loss attributable to common stockholders—basic $ (0.41) $ (0.33) $ (0.92) $ (0.70) Net loss attributable to common stockholders—diluted $ (0.41) $ (0.33) $ (0.92) $ (0.70) Weighted average shares of common stock outstanding—basic 202,666 141,181 172,196 141,152 Weighted average shares of common stock outstanding—diluted 202,666 141,181 172,196 141,152

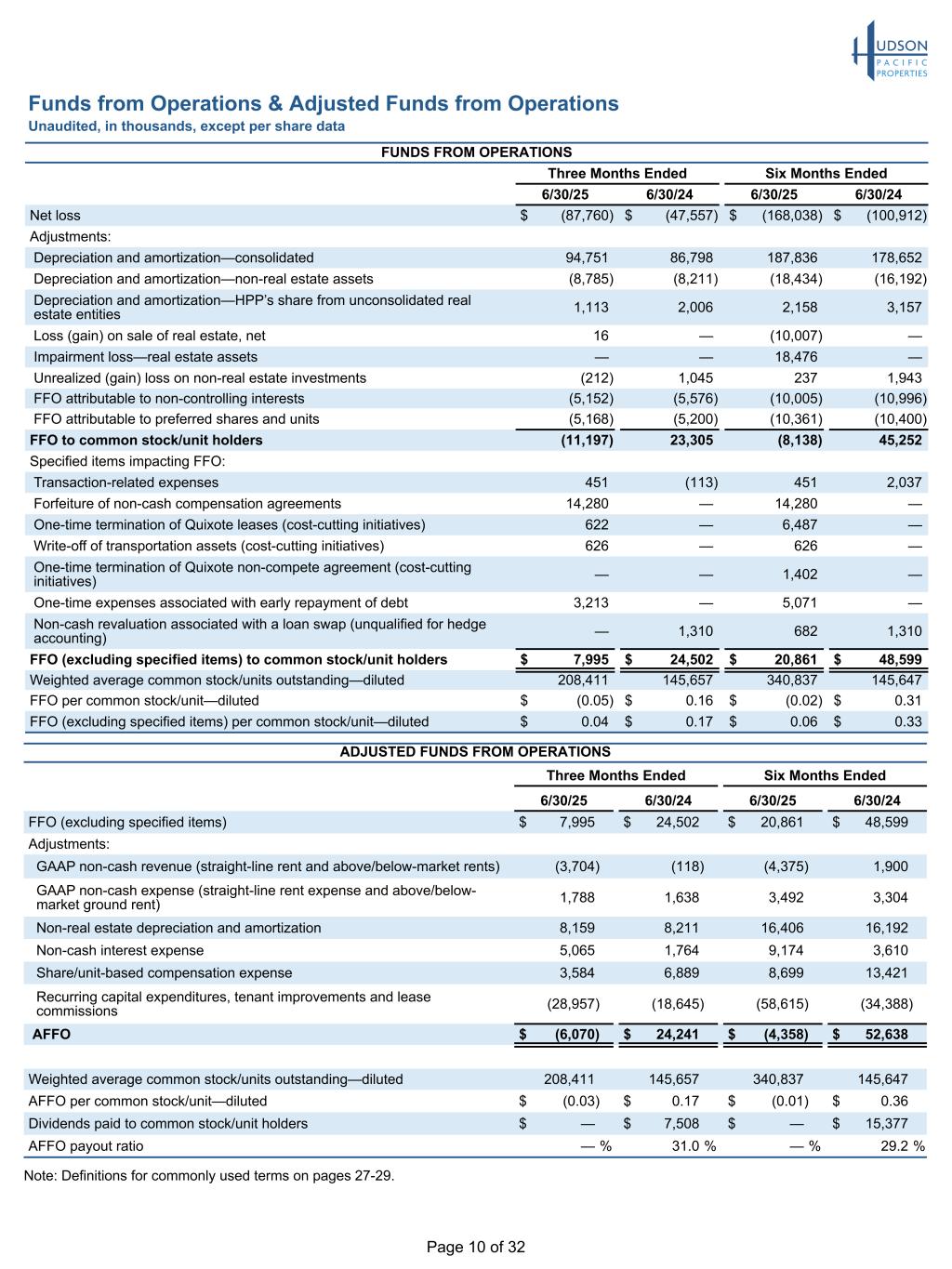

Page 10 of 32 Funds from Operations & Adjusted Funds from Operations Unaudited, in thousands, except per share data Note: Definitions for commonly used terms on pages 27-29. ADJUSTED FUNDS FROM OPERATIONS Three Months Ended Six Months Ended 6/30/25 6/30/24 6/30/25 6/30/24 FFO (excluding specified items) $ 7,995 $ 24,502 $ 20,861 $ 48,599 Adjustments: GAAP non-cash revenue (straight-line rent and above/below-market rents) (3,704) (118) (4,375) 1,900 GAAP non-cash expense (straight-line rent expense and above/below- market ground rent) 1,788 1,638 3,492 3,304 Non-real estate depreciation and amortization 8,159 8,211 16,406 16,192 Non-cash interest expense 5,065 1,764 9,174 3,610 Share/unit-based compensation expense 3,584 6,889 8,699 13,421 Recurring capital expenditures, tenant improvements and lease commissions (28,957) (18,645) (58,615) (34,388) AFFO $ (6,070) $ 24,241 $ (4,358) $ 52,638 Weighted average common stock/units outstanding—diluted 208,411 145,657 340,837 145,647 AFFO per common stock/unit—diluted $ (0.03) $ 0.17 $ (0.01) $ 0.36 Dividends paid to common stock/unit holders $ — $ 7,508 $ — $ 15,377 AFFO payout ratio — % 31.0 % — % 29.2 % FUNDS FROM OPERATIONS Three Months Ended Six Months Ended 6/30/25 6/30/24 6/30/25 6/30/24 Net loss $ (87,760) $ (47,557) $ (168,038) $ (100,912) Adjustments: Depreciation and amortization—consolidated 94,751 86,798 187,836 178,652 Depreciation and amortization—non-real estate assets (8,785) (8,211) (18,434) (16,192) Depreciation and amortization—HPP’s share from unconsolidated real estate entities 1,113 2,006 2,158 3,157 Loss (gain) on sale of real estate, net 16 — (10,007) — Impairment loss—real estate assets — — 18,476 — Unrealized (gain) loss on non-real estate investments (212) 1,045 237 1,943 FFO attributable to non-controlling interests (5,152) (5,576) (10,005) (10,996) FFO attributable to preferred shares and units (5,168) (5,200) (10,361) (10,400) FFO to common stock/unit holders (11,197) 23,305 (8,138) 45,252 Specified items impacting FFO: Transaction-related expenses 451 (113) 451 2,037 Forfeiture of non-cash compensation agreements 14,280 — 14,280 — One-time termination of Quixote leases (cost-cutting initiatives) 622 — 6,487 — Write-off of transportation assets (cost-cutting initiatives) 626 — 626 — One-time termination of Quixote non-compete agreement (cost-cutting initiatives) — — 1,402 — One-time expenses associated with early repayment of debt 3,213 — 5,071 — Non-cash revaluation associated with a loan swap (unqualified for hedge accounting) — 1,310 682 1,310 FFO (excluding specified items) to common stock/unit holders $ 7,995 $ 24,502 $ 20,861 $ 48,599 Weighted average common stock/units outstanding—diluted 208,411 145,657 340,837 145,647 FFO per common stock/unit—diluted $ (0.05) $ 0.16 $ (0.02) $ 0.31 FFO (excluding specified items) per common stock/unit—diluted $ 0.04 $ 0.17 $ 0.06 $ 0.33

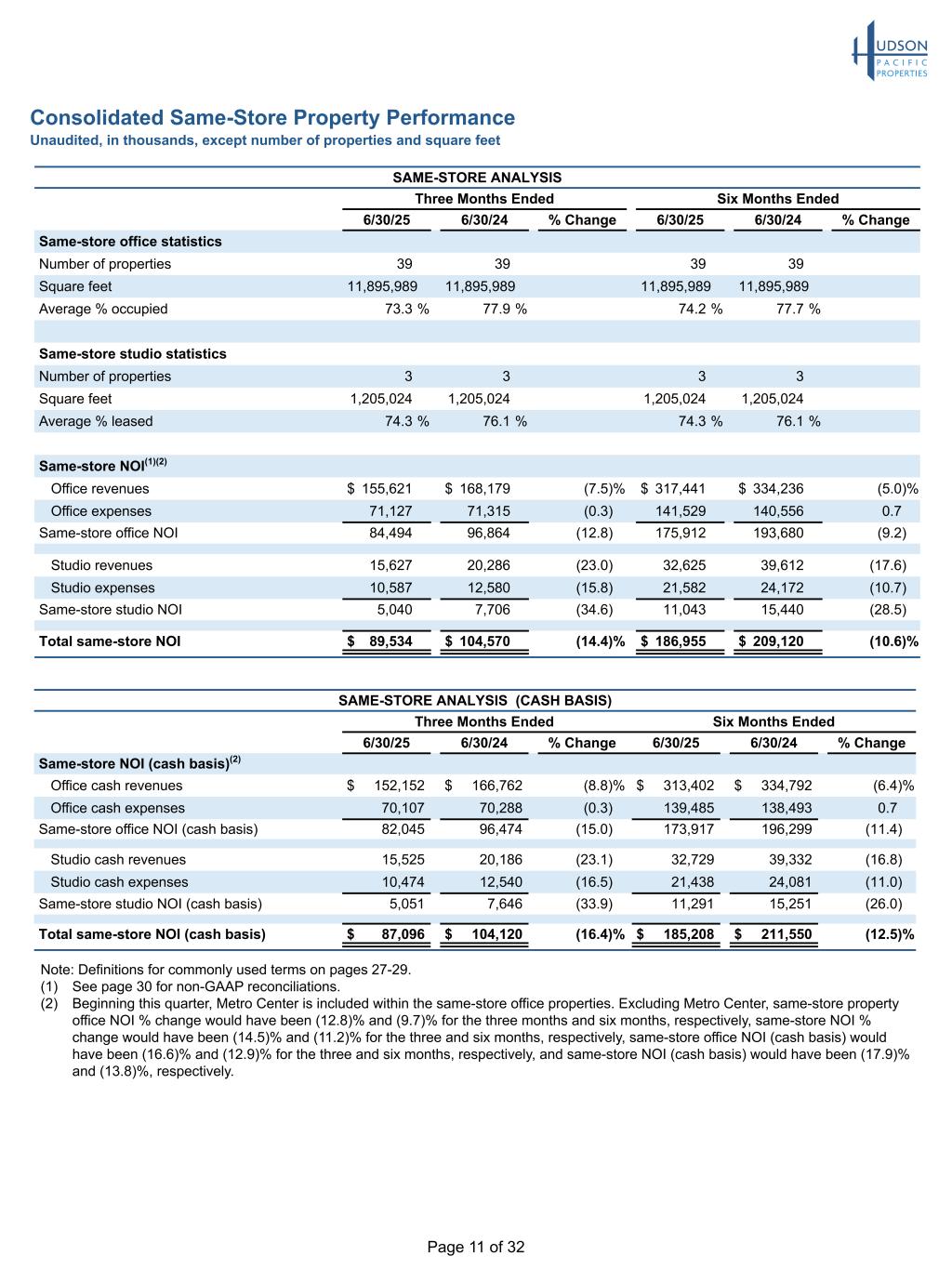

Page 11 of 32 Consolidated Same-Store Property Performance Unaudited, in thousands, except number of properties and square feet SAME-STORE ANALYSIS Three Months Ended Six Months Ended 6/30/25 6/30/24 % Change 6/30/25 6/30/24 % Change Same-store office statistics Number of properties 39 39 39 39 Square feet 11,895,989 11,895,989 11,895,989 11,895,989 Average % occupied 73.3 % 77.9 % 74.2 % 77.7 % Same-store studio statistics Number of properties 3 3 3 3 Square feet 1,205,024 1,205,024 1,205,024 1,205,024 Average % leased 74.3 % 76.1 % 74.3 % 76.1 % Same-store NOI(1)(2) Office revenues $ 155,621 $ 168,179 (7.5) % $ 317,441 $ 334,236 (5.0) % Office expenses 71,127 71,315 (0.3) 141,529 140,556 0.7 Same-store office NOI 84,494 96,864 (12.8) 175,912 193,680 (9.2) Studio revenues 15,627 20,286 (23.0) 32,625 39,612 (17.6) Studio expenses 10,587 12,580 (15.8) 21,582 24,172 (10.7) Same-store studio NOI 5,040 7,706 (34.6) 11,043 15,440 (28.5) Total same-store NOI $ 89,534 $ 104,570 (14.4) % $ 186,955 $ 209,120 (10.6) % SAME-STORE ANALYSIS (CASH BASIS) Three Months Ended Six Months Ended 6/30/25 6/30/24 % Change 6/30/25 6/30/24 % Change Same-store NOI (cash basis)(2) Office cash revenues $ 152,152 $ 166,762 (8.8) % $ 313,402 $ 334,792 (6.4) % Office cash expenses 70,107 70,288 (0.3) 139,485 138,493 0.7 Same-store office NOI (cash basis) 82,045 96,474 (15.0) 173,917 196,299 (11.4) Studio cash revenues 15,525 20,186 (23.1) 32,729 39,332 (16.8) Studio cash expenses 10,474 12,540 (16.5) 21,438 24,081 (11.0) Same-store studio NOI (cash basis) 5,051 7,646 (33.9) 11,291 15,251 (26.0) Total same-store NOI (cash basis) $ 87,096 $ 104,120 (16.4) % $ 185,208 $ 211,550 (12.5) % Note: Definitions for commonly used terms on pages 27-29. (1) See page 30 for non-GAAP reconciliations. (2) Beginning this quarter, Metro Center is included within the same-store office properties. Excluding Metro Center, same-store property office NOI % change would have been (12.8)% and (9.7)% for the three months and six months, respectively, same-store NOI % change would have been (14.5)% and (11.2)% for the three and six months, respectively, same-store office NOI (cash basis) would have been (16.6)% and (12.9)% for the three and six months, respectively, and same-store NOI (cash basis) would have been (17.9)% and (13.8)%, respectively.

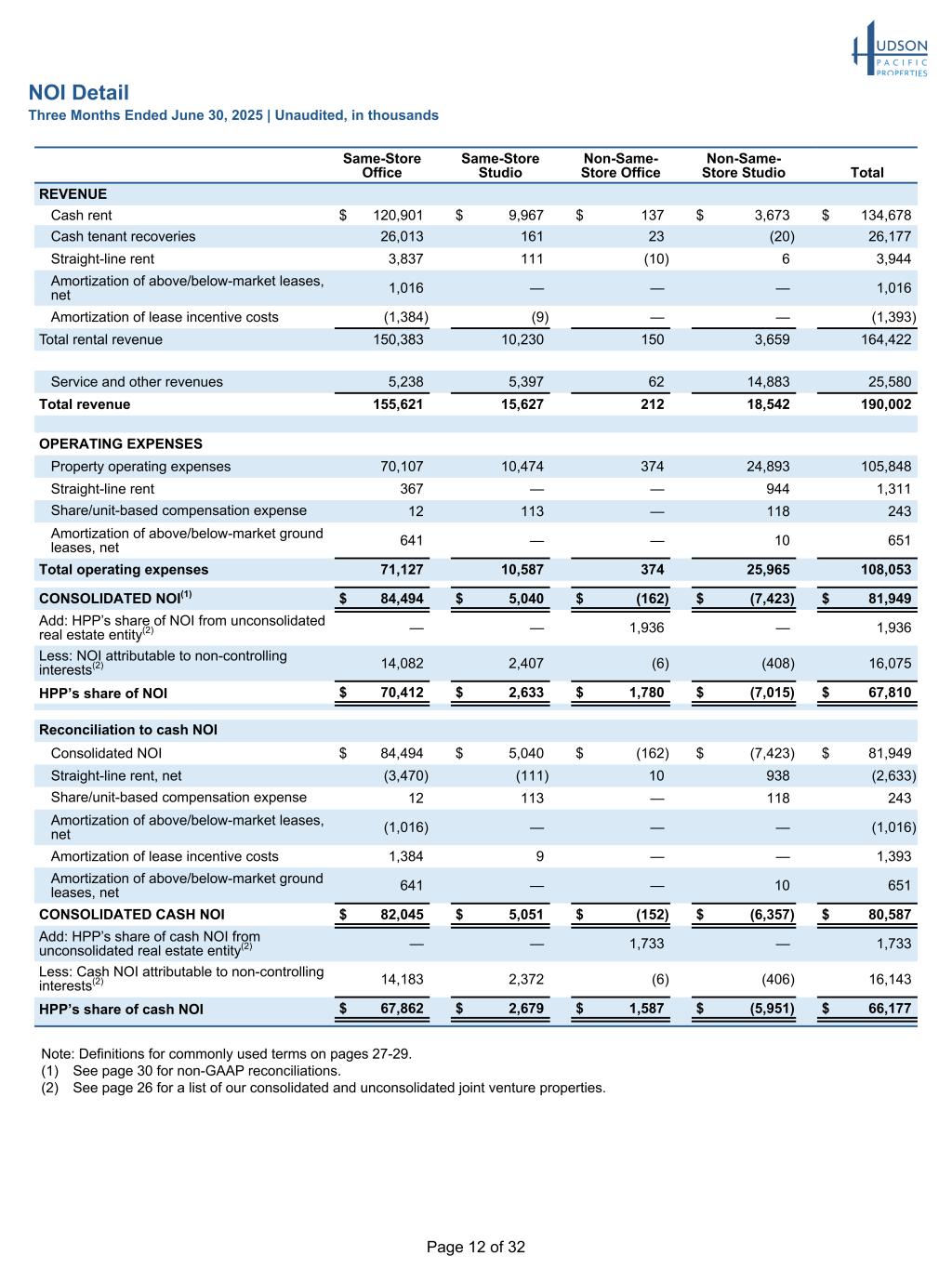

Page 12 of 32 NOI Detail Three Months Ended June 30, 2025 | Unaudited, in thousands Same-Store Office Same-Store Studio Non-Same- Store Office Non-Same- Store Studio Total REVENUE Cash rent $ 120,901 $ 9,967 $ 137 $ 3,673 $ 134,678 Cash tenant recoveries 26,013 161 23 (20) 26,177 Straight-line rent 3,837 111 (10) 6 3,944 Amortization of above/below-market leases, net 1,016 — — — 1,016 Amortization of lease incentive costs (1,384) (9) — — (1,393) Total rental revenue 150,383 10,230 150 3,659 164,422 Service and other revenues 5,238 5,397 62 14,883 25,580 Total revenue 155,621 15,627 212 18,542 190,002 OPERATING EXPENSES Property operating expenses 70,107 10,474 374 24,893 105,848 Straight-line rent 367 — — 944 1,311 Share/unit-based compensation expense 12 113 — 118 243 Amortization of above/below-market ground leases, net 641 — — 10 651 Total operating expenses 71,127 10,587 374 25,965 108,053 CONSOLIDATED NOI(1) $ 84,494 $ 5,040 $ (162) $ (7,423) $ 81,949 Add: HPP’s share of NOI from unconsolidated real estate entity(2) — — 1,936 — 1,936 Less: NOI attributable to non-controlling interests(2) 14,082 2,407 (6) (408) 16,075 HPP’s share of NOI $ 70,412 $ 2,633 $ 1,780 $ (7,015) $ 67,810 Reconciliation to cash NOI Consolidated NOI $ 84,494 $ 5,040 $ (162) $ (7,423) $ 81,949 Straight-line rent, net (3,470) (111) 10 938 (2,633) Share/unit-based compensation expense 12 113 — 118 243 Amortization of above/below-market leases, net (1,016) — — — (1,016) Amortization of lease incentive costs 1,384 9 — — 1,393 Amortization of above/below-market ground leases, net 641 — — 10 651 CONSOLIDATED CASH NOI $ 82,045 $ 5,051 $ (152) $ (6,357) $ 80,587 Add: HPP’s share of cash NOI from unconsolidated real estate entity(2) — — 1,733 — 1,733 Less: Cash NOI attributable to non-controlling interests(2) 14,183 2,372 (6) (406) 16,143 HPP’s share of cash NOI $ 67,862 $ 2,679 $ 1,587 $ (5,951) $ 66,177 Note: Definitions for commonly used terms on pages 27-29. (1) See page 30 for non-GAAP reconciliations. (2) See page 26 for a list of our consolidated and unconsolidated joint venture properties.

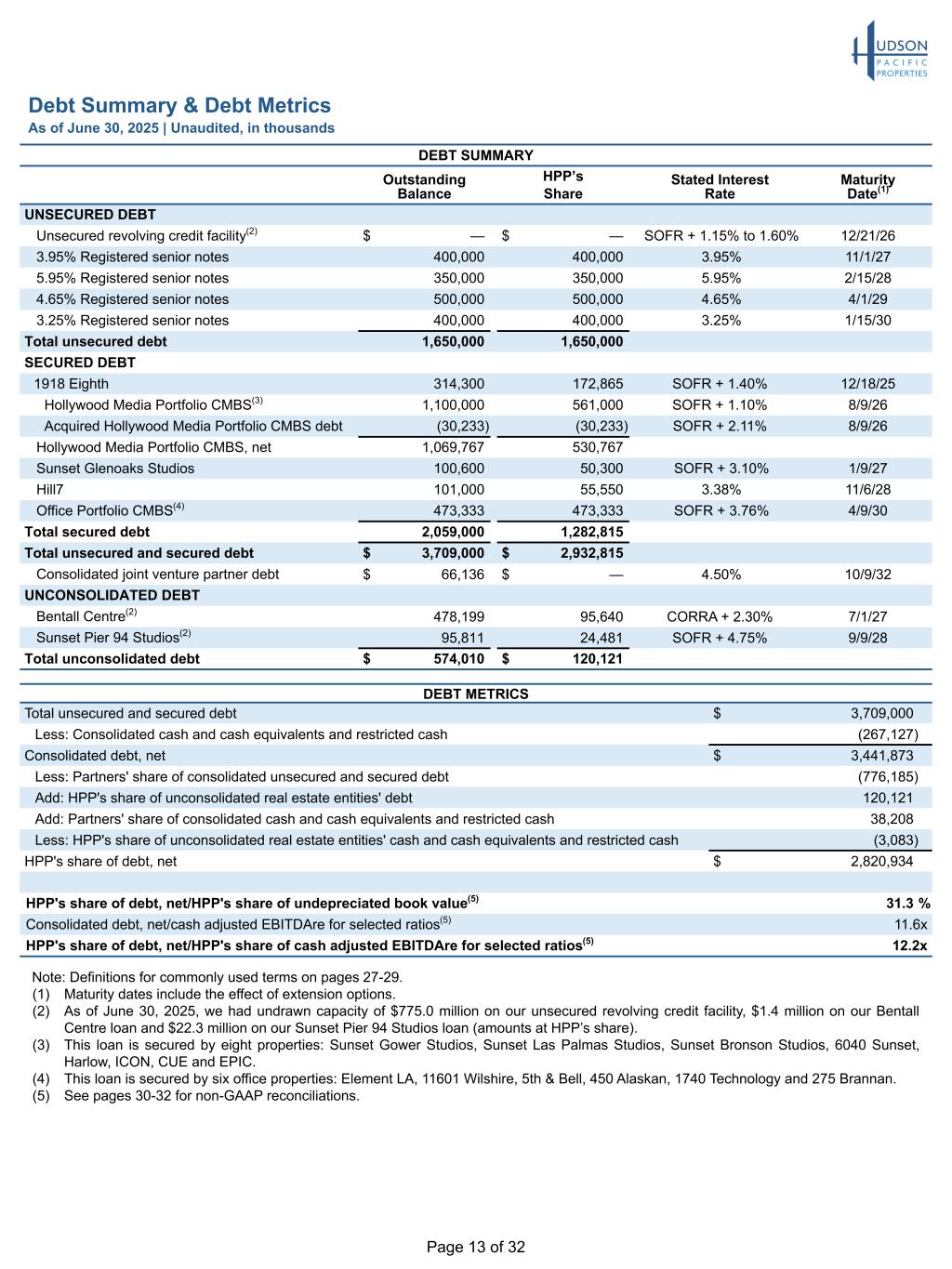

Page 13 of 32 Debt Summary & Debt Metrics As of June 30, 2025 | Unaudited, in thousands DEBT SUMMARY Outstanding Balance HPP’s Share Stated Interest Rate Maturity Date(1) UNSECURED DEBT Unsecured revolving credit facility(2) $ — $ — SOFR + 1.15% to 1.60% 12/21/26 3.95% Registered senior notes 400,000 400,000 3.95% 11/1/27 5.95% Registered senior notes 350,000 350,000 5.95% 2/15/28 4.65% Registered senior notes 500,000 500,000 4.65% 4/1/29 3.25% Registered senior notes 400,000 400,000 3.25% 1/15/30 Total unsecured debt 1,650,000 1,650,000 SECURED DEBT 1918 Eighth 314,300 172,865 SOFR + 1.40% 12/18/25 Hollywood Media Portfolio CMBS(3) 1,100,000 561,000 SOFR + 1.10% 8/9/26 Acquired Hollywood Media Portfolio CMBS debt (30,233) (30,233) SOFR + 2.11% 8/9/26 Hollywood Media Portfolio CMBS, net 1,069,767 530,767 Sunset Glenoaks Studios 100,600 50,300 SOFR + 3.10% 1/9/27 Hill7 101,000 55,550 3.38% 11/6/28 Office Portfolio CMBS(4) 473,333 473,333 SOFR + 3.76% 4/9/30 Total secured debt 2,059,000 1,282,815 Total unsecured and secured debt $ 3,709,000 $ 2,932,815 Consolidated joint venture partner debt $ 66,136 $ — 4.50% 10/9/32 UNCONSOLIDATED DEBT Bentall Centre(2) 478,199 95,640 CORRA + 2.30% 7/1/27 Sunset Pier 94 Studios(2) 95,811 24,481 SOFR + 4.75% 9/9/28 Total unconsolidated debt $ 574,010 $ 120,121 Note: Definitions for commonly used terms on pages 27-29. (1) Maturity dates include the effect of extension options. (2) As of June 30, 2025, we had undrawn capacity of $775.0 million on our unsecured revolving credit facility, $1.4 million on our Bentall Centre loan and $22.3 million on our Sunset Pier 94 Studios loan (amounts at HPP’s share). (3) This loan is secured by eight properties: Sunset Gower Studios, Sunset Las Palmas Studios, Sunset Bronson Studios, 6040 Sunset, Harlow, ICON, CUE and EPIC. (4) This loan is secured by six office properties: Element LA, 11601 Wilshire, 5th & Bell, 450 Alaskan, 1740 Technology and 275 Brannan. (5) See pages 30-32 for non-GAAP reconciliations. DEBT METRICS Total unsecured and secured debt $ 3,709,000 Less: Consolidated cash and cash equivalents and restricted cash (267,127) Consolidated debt, net $ 3,441,873 Less: Partners' share of consolidated unsecured and secured debt (776,185) Add: HPP's share of unconsolidated real estate entities' debt 120,121 Add: Partners' share of consolidated cash and cash equivalents and restricted cash 38,208 Less: HPP's share of unconsolidated real estate entities' cash and cash equivalents and restricted cash (3,083) HPP's share of debt, net $ 2,820,934 HPP's share of debt, net/HPP's share of undepreciated book value(5) 31.3 % Consolidated debt, net/cash adjusted EBITDAre for selected ratios(5) 11.6x HPP's share of debt, net/HPP's share of cash adjusted EBITDAre for selected ratios(5) 12.2x

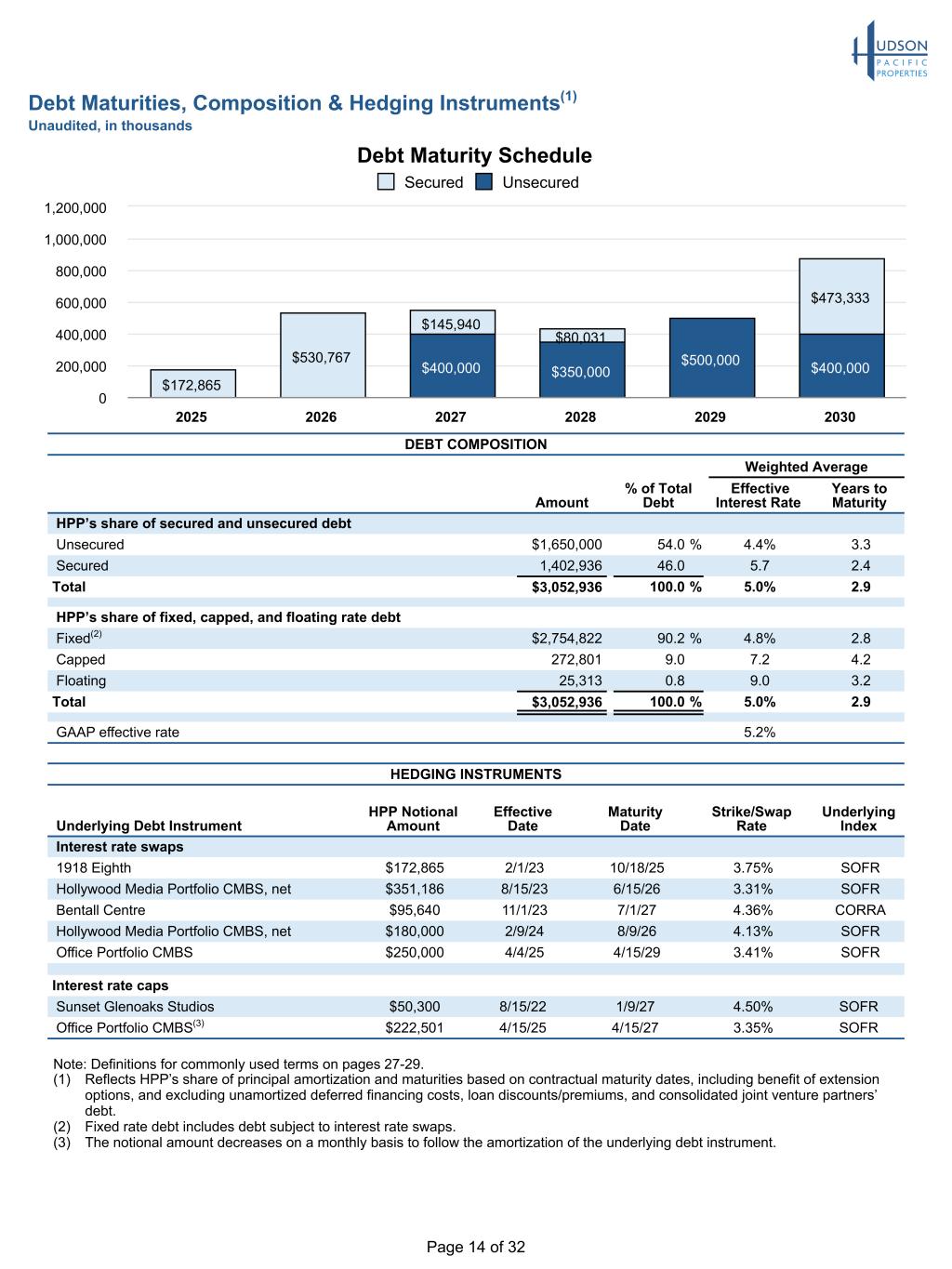

Page 14 of 32 Debt Maturities, Composition & Hedging Instruments(1) Unaudited, in thousands DEBT COMPOSITION Weighted Average Amount % of Total Debt Effective Interest Rate Years to Maturity HPP’s share of secured and unsecured debt Unsecured $1,650,000 54.0 % 4.4% 3.3 Secured 1,402,936 46.0 5.7 2.4 Total $3,052,936 100.0 % 5.0% 2.9 HPP’s share of fixed, capped, and floating rate debt Fixed(2) $2,754,822 90.2 % 4.8% 2.8 Capped 272,801 9.0 7.2 4.2 Floating 25,313 0.8 9.0 3.2 Total $3,052,936 100.0 % 5.0% 2.9 GAAP effective rate 5.2% Debt Maturity Schedule $400,000 $350,000 $500,000 $400,000 $172,865 $530,767 $145,940 $80,031 $473,333 Secured Unsecured 2025 2026 2027 2028 2029 2030 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 Note: Definitions for commonly used terms on pages 27-29. (1) Reflects HPP’s share of principal amortization and maturities based on contractual maturity dates, including benefit of extension options, and excluding unamortized deferred financing costs, loan discounts/premiums, and consolidated joint venture partners’ debt. (2) Fixed rate debt includes debt subject to interest rate swaps. (3) The notional amount decreases on a monthly basis to follow the amortization of the underlying debt instrument. HEDGING INSTRUMENTS Underlying Debt Instrument HPP Notional Amount Effective Date Maturity Date Strike/Swap Rate Underlying Index Interest rate swaps 1918 Eighth $172,865 2/1/23 10/18/25 3.75% SOFR Hollywood Media Portfolio CMBS, net $351,186 8/15/23 6/15/26 3.31% SOFR Bentall Centre $95,640 11/1/23 7/1/27 4.36% CORRA Hollywood Media Portfolio CMBS, net $180,000 2/9/24 8/9/26 4.13% SOFR Office Portfolio CMBS $250,000 4/4/25 4/15/29 3.41% SOFR Interest rate caps Sunset Glenoaks Studios $50,300 8/15/22 1/9/27 4.50% SOFR Office Portfolio CMBS(3) $222,501 4/15/25 4/15/27 3.35% SOFR

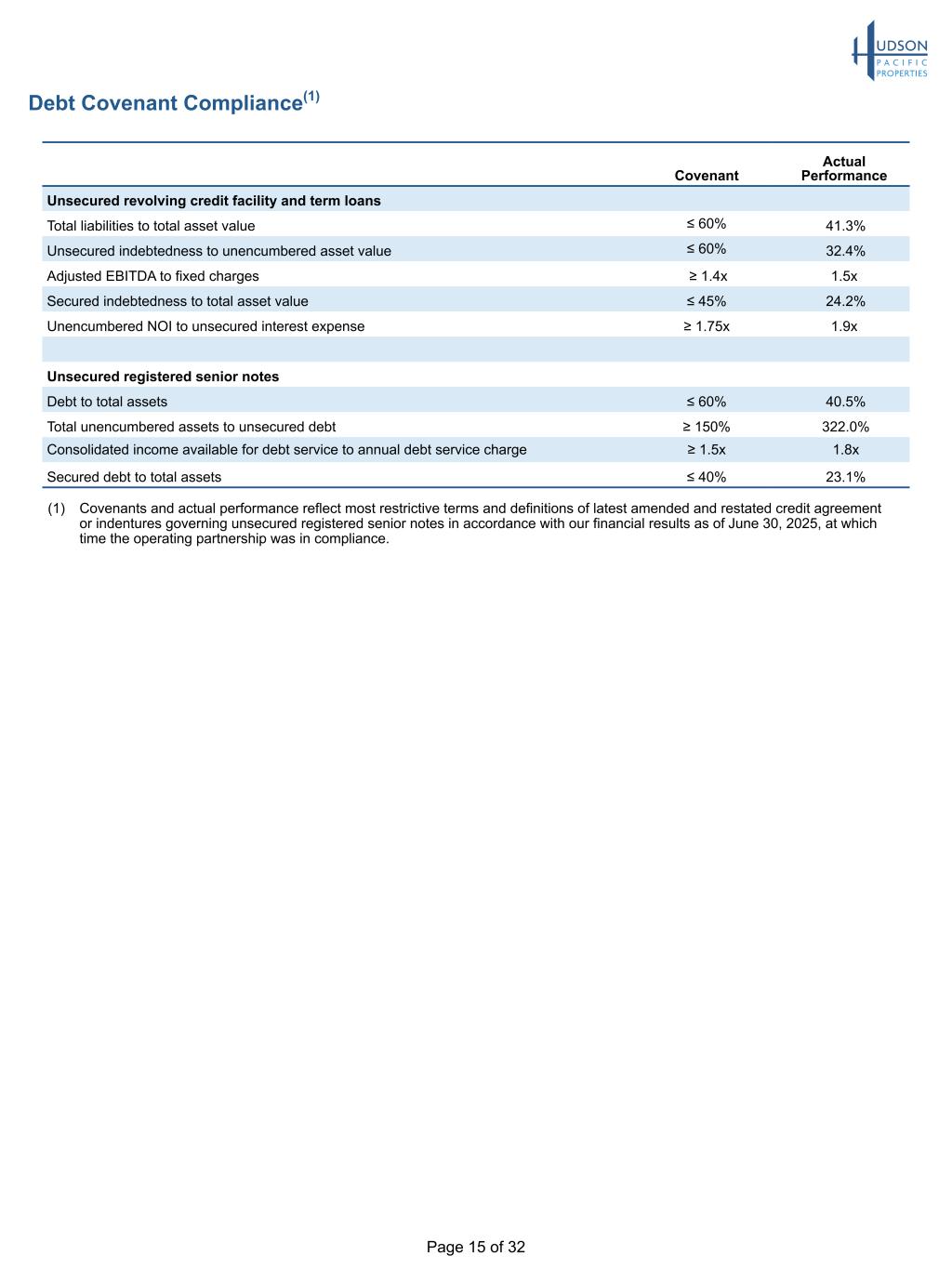

Page 15 of 32 Debt Covenant Compliance(1) Covenant Actual Performance Unsecured revolving credit facility and term loans Total liabilities to total asset value ≤ 60% 41.3% Unsecured indebtedness to unencumbered asset value ≤ 60% 32.4% Adjusted EBITDA to fixed charges ≥ 1.4x 1.5x Secured indebtedness to total asset value ≤ 45% 24.2% Unencumbered NOI to unsecured interest expense ≥ 1.75x 1.9x Unsecured registered senior notes Debt to total assets ≤ 60% 40.5% Total unencumbered assets to unsecured debt ≥ 150% 322.0% Consolidated income available for debt service to annual debt service charge ≥ 1.5x 1.8x Secured debt to total assets ≤ 40% 23.1% (1) Covenants and actual performance reflect most restrictive terms and definitions of latest amended and restated credit agreement or indentures governing unsecured registered senior notes in accordance with our financial results as of June 30, 2025, at which time the operating partnership was in compliance.

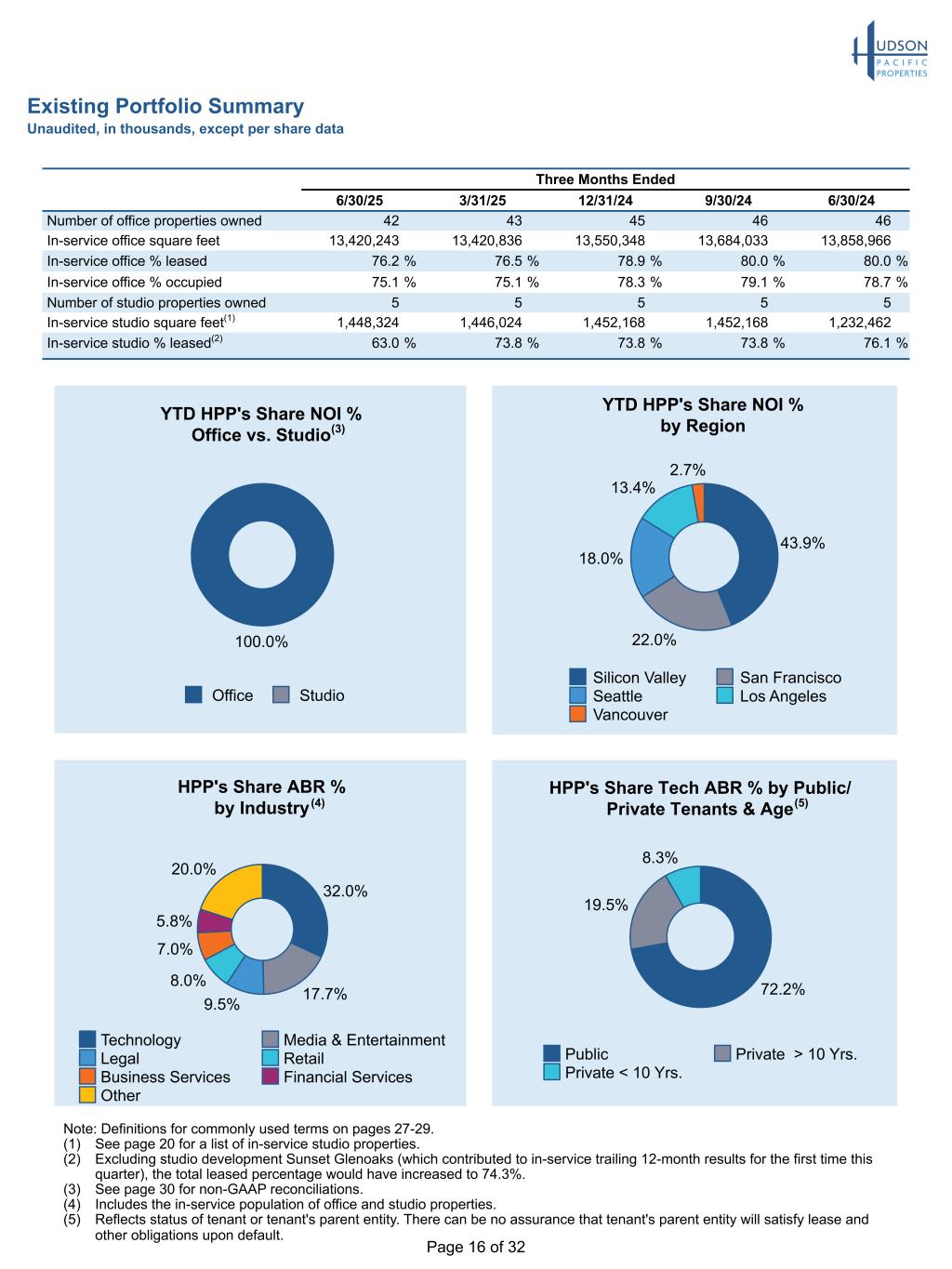

Page 16 of 32 Existing Portfolio Summary Unaudited, in thousands, except per share data Three Months Ended 6/30/25 3/31/25 12/31/24 9/30/24 6/30/24 Number of office properties owned 42 43 45 46 46 In-service office square feet 13,420,243 13,420,836 13,550,348 13,684,033 13,858,966 In-service office % leased 76.2 % 76.5 % 78.9 % 80.0 % 80.0 % In-service office % occupied 75.1 % 75.1 % 78.3 % 79.1 % 78.7 % Number of studio properties owned 5 5 5 5 5 In-service studio square feet(1) 1,448,324 1,446,024 1,452,168 1,452,168 1,232,462 In-service studio % leased(2) 63.0 % 73.8 % 73.8 % 73.8 % 76.1 % HPP's Share ABR % by Industry 32.0% 17.7%9.5% 8.0% 7.0% 5.8% 20.0% Technology Media & Entertainment Legal Retail Business Services Financial Services Other YTD HPP's Share NOI % by Region 43.9% 22.0% 18.0% 13.4% 2.7% Silicon Valley San Francisco Seattle Los Angeles Vancouver HPP's Share Tech ABR % by Public/ Private Tenants & Age 72.2% 19.5% 8.3% Public Private > 10 Yrs. Private < 10 Yrs. YTD HPP's Share NOI % Office vs. Studio 100.0% Office Studio Note: Definitions for commonly used terms on pages 27-29. (1) See page 20 for a list of in-service studio properties. (2) Excluding studio development Sunset Glenoaks (which contributed to in-service trailing 12-month results for the first time this quarter), the total leased percentage would have increased to 74.3%. (3) See page 30 for non-GAAP reconciliations. (4) Includes the in-service population of office and studio properties. (5) Reflects status of tenant or tenant's parent entity. There can be no assurance that tenant's parent entity will satisfy lease and other obligations upon default. (3) (5)(4)

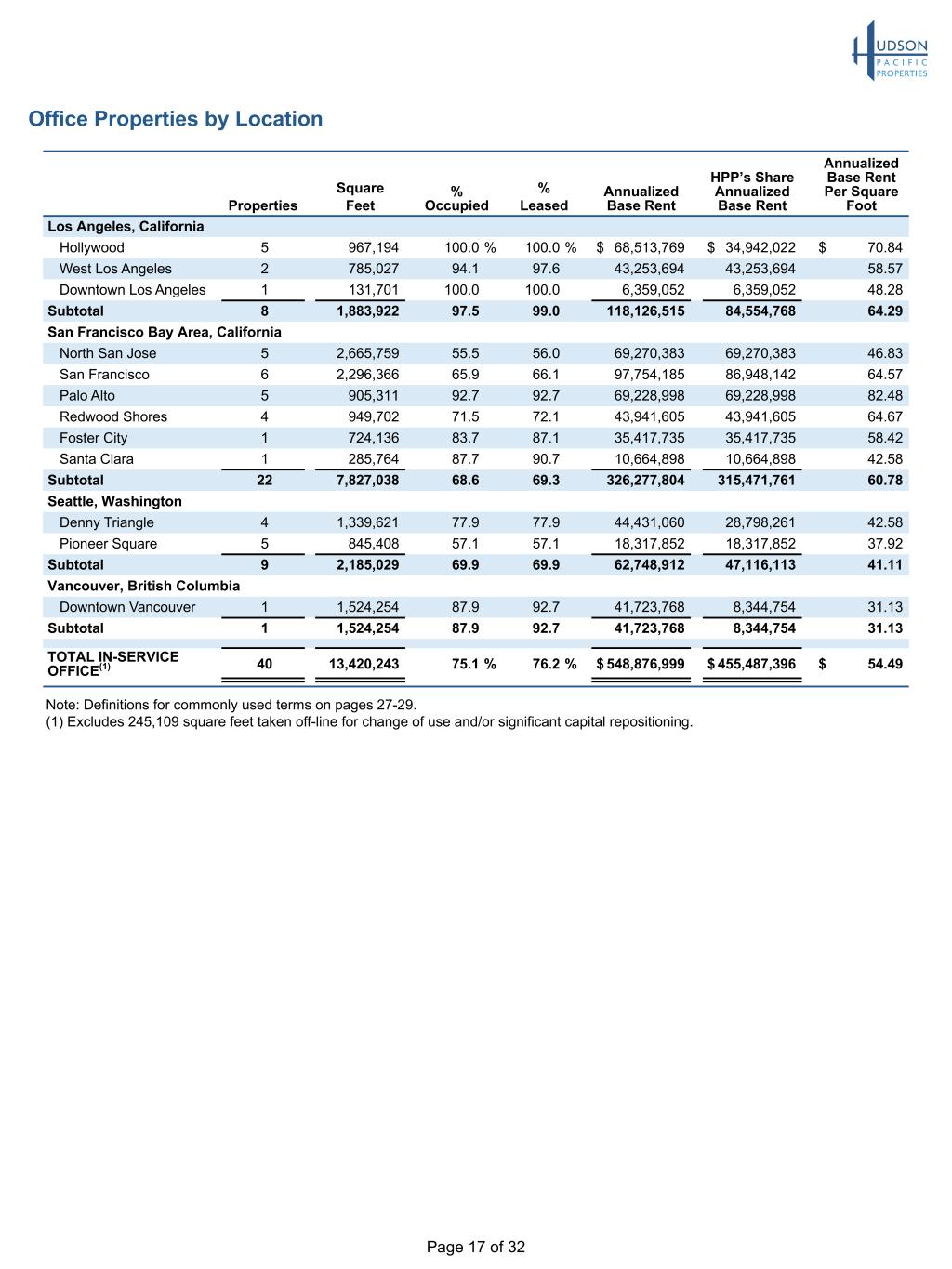

Page 17 of 32 Note: Definitions for commonly used terms on pages 27-29. (1) Excludes 245,109 square feet taken off-line for change of use and/or significant capital repositioning. Office Properties by Location Properties Square Feet % Occupied % Leased Annualized Base Rent HPP’s Share Annualized Base Rent Annualized Base Rent Per Square Foot Los Angeles, California Hollywood 5 967,194 100.0 % 100.0 % $ 68,513,769 $ 34,942,022 $ 70.84 West Los Angeles 2 785,027 94.1 97.6 43,253,694 43,253,694 58.57 Downtown Los Angeles 1 131,701 100.0 100.0 6,359,052 6,359,052 48.28 Subtotal 8 1,883,922 97.5 99.0 118,126,515 84,554,768 64.29 San Francisco Bay Area, California North San Jose 5 2,665,759 55.5 56.0 69,270,383 69,270,383 46.83 San Francisco 6 2,296,366 65.9 66.1 97,754,185 86,948,142 64.57 Palo Alto 5 905,311 92.7 92.7 69,228,998 69,228,998 82.48 Redwood Shores 4 949,702 71.5 72.1 43,941,605 43,941,605 64.67 Foster City 1 724,136 83.7 87.1 35,417,735 35,417,735 58.42 Santa Clara 1 285,764 87.7 90.7 10,664,898 10,664,898 42.58 Subtotal 22 7,827,038 68.6 69.3 326,277,804 315,471,761 60.78 Seattle, Washington Denny Triangle 4 1,339,621 77.9 77.9 44,431,060 28,798,261 42.58 Pioneer Square 5 845,408 57.1 57.1 18,317,852 18,317,852 37.92 Subtotal 9 2,185,029 69.9 69.9 62,748,912 47,116,113 41.11 Vancouver, British Columbia Downtown Vancouver 1 1,524,254 87.9 92.7 41,723,768 8,344,754 31.13 Subtotal 1 1,524,254 87.9 92.7 41,723,768 8,344,754 31.13 TOTAL IN-SERVICE OFFICE(1) 40 13,420,243 75.1 % 76.2 % $ 548,876,999 $ 455,487,396 $ 54.49

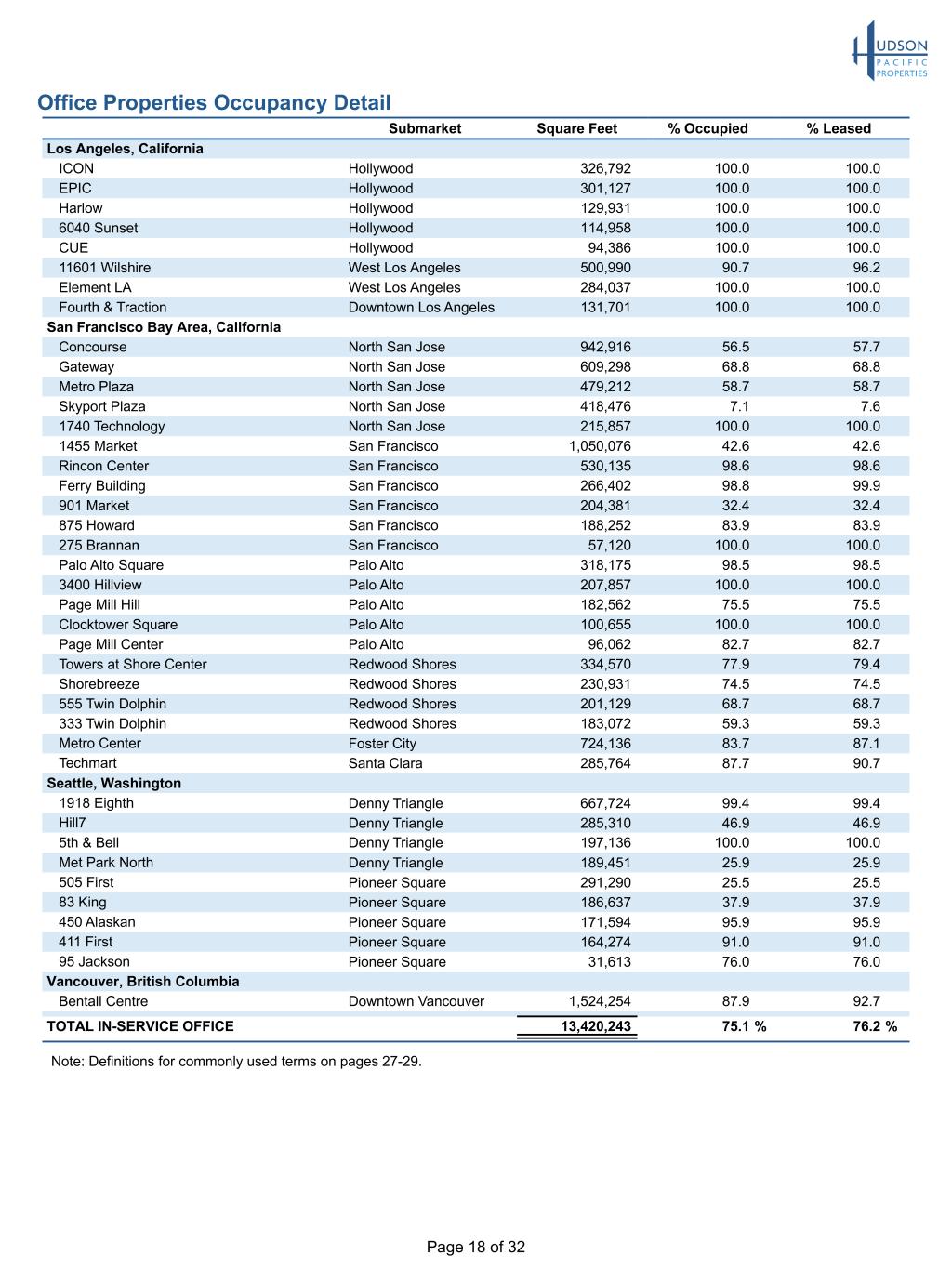

Page 18 of 32 Office Properties Occupancy Detail Submarket Square Feet % Occupied % Leased Los Angeles, California ICON Hollywood 326,792 100.0 100.0 EPIC Hollywood 301,127 100.0 100.0 Harlow Hollywood 129,931 100.0 100.0 6040 Sunset Hollywood 114,958 100.0 100.0 CUE Hollywood 94,386 100.0 100.0 11601 Wilshire West Los Angeles 500,990 90.7 96.2 Element LA West Los Angeles 284,037 100.0 100.0 Fourth & Traction Downtown Los Angeles 131,701 100.0 100.0 San Francisco Bay Area, California Concourse North San Jose 942,916 56.5 57.7 Gateway North San Jose 609,298 68.8 68.8 Metro Plaza North San Jose 479,212 58.7 58.7 Skyport Plaza North San Jose 418,476 7.1 7.6 1740 Technology North San Jose 215,857 100.0 100.0 1455 Market San Francisco 1,050,076 42.6 42.6 Rincon Center San Francisco 530,135 98.6 98.6 Ferry Building San Francisco 266,402 98.8 99.9 901 Market San Francisco 204,381 32.4 32.4 875 Howard San Francisco 188,252 83.9 83.9 275 Brannan San Francisco 57,120 100.0 100.0 Palo Alto Square Palo Alto 318,175 98.5 98.5 3400 Hillview Palo Alto 207,857 100.0 100.0 Page Mill Hill Palo Alto 182,562 75.5 75.5 Clocktower Square Palo Alto 100,655 100.0 100.0 Page Mill Center Palo Alto 96,062 82.7 82.7 Towers at Shore Center Redwood Shores 334,570 77.9 79.4 Shorebreeze Redwood Shores 230,931 74.5 74.5 555 Twin Dolphin Redwood Shores 201,129 68.7 68.7 333 Twin Dolphin Redwood Shores 183,072 59.3 59.3 Metro Center Foster City 724,136 83.7 87.1 Techmart Santa Clara 285,764 87.7 90.7 Seattle, Washington 1918 Eighth Denny Triangle 667,724 99.4 99.4 Hill7 Denny Triangle 285,310 46.9 46.9 5th & Bell Denny Triangle 197,136 100.0 100.0 Met Park North Denny Triangle 189,451 25.9 25.9 505 First Pioneer Square 291,290 25.5 25.5 83 King Pioneer Square 186,637 37.9 37.9 450 Alaskan Pioneer Square 171,594 95.9 95.9 411 First Pioneer Square 164,274 91.0 91.0 95 Jackson Pioneer Square 31,613 76.0 76.0 Vancouver, British Columbia Bentall Centre Downtown Vancouver 1,524,254 87.9 92.7 TOTAL IN-SERVICE OFFICE 13,420,243 75.1 % 76.2 % Note: Definitions for commonly used terms on pages 27-29.

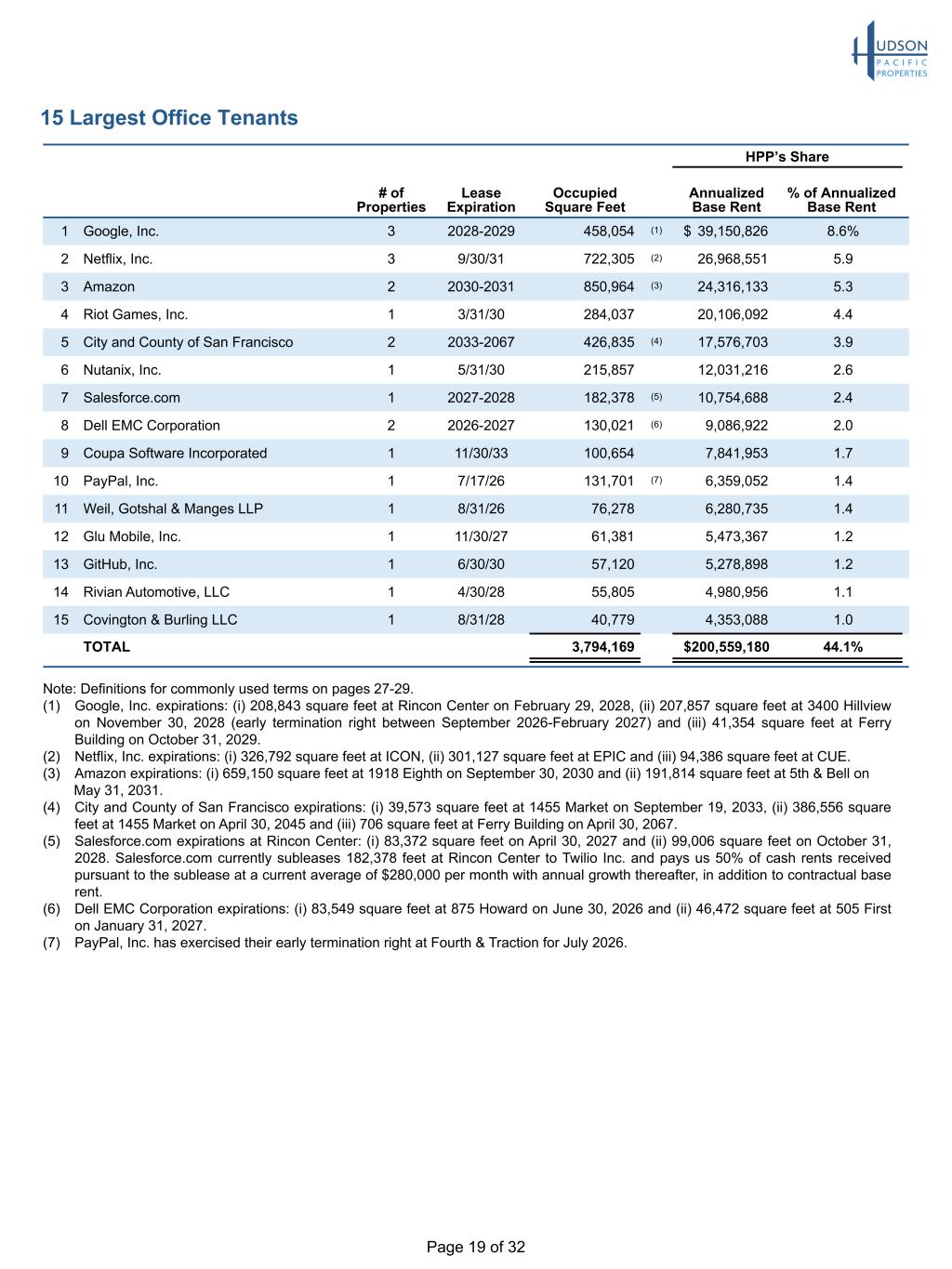

Page 19 of 32 Note: Definitions for commonly used terms on pages 27-29. (1) Google, Inc. expirations: (i) 208,843 square feet at Rincon Center on February 29, 2028, (ii) 207,857 square feet at 3400 Hillview on November 30, 2028 (early termination right between September 2026-February 2027) and (iii) 41,354 square feet at Ferry Building on October 31, 2029. (2) Netflix, Inc. expirations: (i) 326,792 square feet at ICON, (ii) 301,127 square feet at EPIC and (iii) 94,386 square feet at CUE. (3) Amazon expirations: (i) 659,150 square feet at 1918 Eighth on September 30, 2030 and (ii) 191,814 square feet at 5th & Bell on May 31, 2031. (4) City and County of San Francisco expirations: (i) 39,573 square feet at 1455 Market on September 19, 2033, (ii) 386,556 square feet at 1455 Market on April 30, 2045 and (iii) 706 square feet at Ferry Building on April 30, 2067. (5) Salesforce.com expirations at Rincon Center: (i) 83,372 square feet on April 30, 2027 and (ii) 99,006 square feet on October 31, 2028. Salesforce.com currently subleases 182,378 feet at Rincon Center to Twilio Inc. and pays us 50% of cash rents received pursuant to the sublease at a current average of $280,000 per month with annual growth thereafter, in addition to contractual base rent. (6) Dell EMC Corporation expirations: (i) 83,549 square feet at 875 Howard on June 30, 2026 and (ii) 46,472 square feet at 505 First on January 31, 2027. (7) PayPal, Inc. has exercised their early termination right at Fourth & Traction for July 2026. HPP’s Share # of Properties Lease Expiration Occupied Square Feet Annualized Base Rent % of Annualized Base Rent 1 Google, Inc. 3 2028-2029 458,054 (1) $ 39,150,826 8.6% 2 Netflix, Inc. 3 9/30/31 722,305 (2) 26,968,551 5.9 3 Amazon 2 2030-2031 850,964 (3) 24,316,133 5.3 4 Riot Games, Inc. 1 3/31/30 284,037 20,106,092 4.4 5 City and County of San Francisco 2 2033-2067 426,835 (4) 17,576,703 3.9 6 Nutanix, Inc. 1 5/31/30 215,857 12,031,216 2.6 7 Salesforce.com 1 2027-2028 182,378 (5) 10,754,688 2.4 8 Dell EMC Corporation 2 2026-2027 130,021 (6) 9,086,922 2.0 9 Coupa Software Incorporated 1 11/30/33 100,654 7,841,953 1.7 10 PayPal, Inc. 1 7/17/26 131,701 (7) 6,359,052 1.4 11 Weil, Gotshal & Manges LLP 1 8/31/26 76,278 6,280,735 1.4 12 Glu Mobile, Inc. 1 11/30/27 61,381 5,473,367 1.2 13 GitHub, Inc. 1 6/30/30 57,120 5,278,898 1.2 14 Rivian Automotive, LLC 1 4/30/28 55,805 4,980,956 1.1 15 Covington & Burling LLC 1 8/31/28 40,779 4,353,088 1.0 TOTAL 3,794,169 $ 200,559,180 44.1% 15 Largest Office Tenants

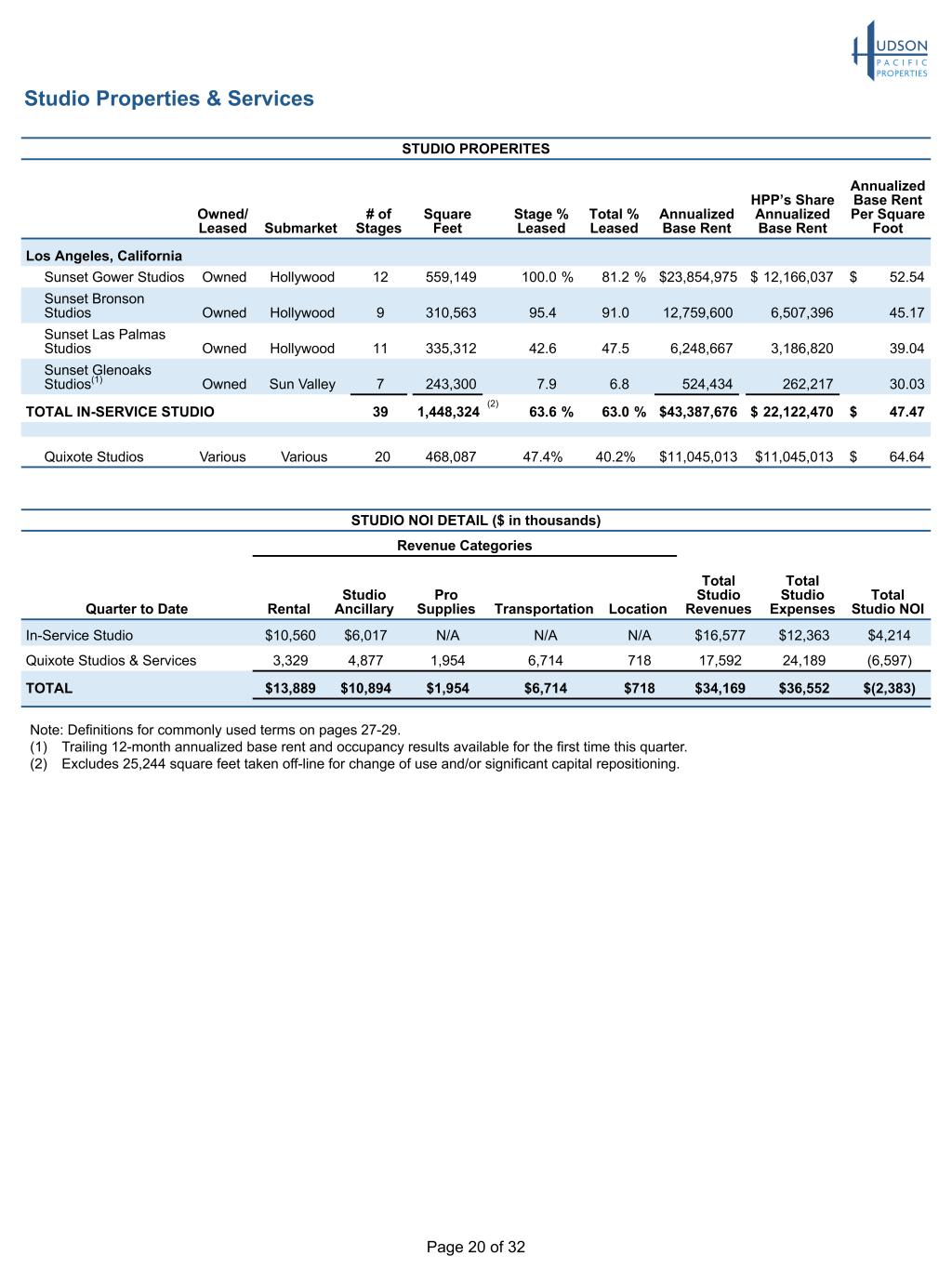

Page 20 of 32 Note: Definitions for commonly used terms on pages 27-29. (1) Trailing 12-month annualized base rent and occupancy results available for the first time this quarter. (2) Excludes 25,244 square feet taken off-line for change of use and/or significant capital repositioning. STUDIO PROPERITES Owned/ Leased Submarket # of Stages Square Feet Stage % Leased Total % Leased Annualized Base Rent HPP’s Share Annualized Base Rent Annualized Base Rent Per Square Foot Los Angeles, California Sunset Gower Studios Owned Hollywood 12 559,149 100.0 % 81.2 % $ 23,854,975 $ 12,166,037 $ 52.54 Sunset Bronson Studios Owned Hollywood 9 310,563 95.4 91.0 12,759,600 6,507,396 45.17 Sunset Las Palmas Studios Owned Hollywood 11 335,312 42.6 47.5 6,248,667 3,186,820 39.04 Sunset Glenoaks Studios(1) Owned Sun Valley 7 243,300 7.9 6.8 524,434 262,217 30.03 TOTAL IN-SERVICE STUDIO 39 1,448,324 (2) 63.6 % 63.0 % $ 43,387,676 $ 22,122,470 $ 47.47 Quixote Studios Various Various 20 468,087 47.4% 40.2% $11,045,013 $11,045,013 $ 64.64 Studio Properties & Services STUDIO NOI DETAIL ($ in thousands) Revenue Categories Quarter to Date Rental Studio Ancillary Pro Supplies Transportation Location Total Studio Revenues Total Studio Expenses Total Studio NOI In-Service Studio $10,560 $6,017 N/A N/A N/A $16,577 $12,363 $4,214 Quixote Studios & Services 3,329 4,877 1,954 6,714 718 17,592 24,189 (6,597) TOTAL $13,889 $10,894 $1,954 $6,714 $718 $34,169 $36,552 $(2,383)

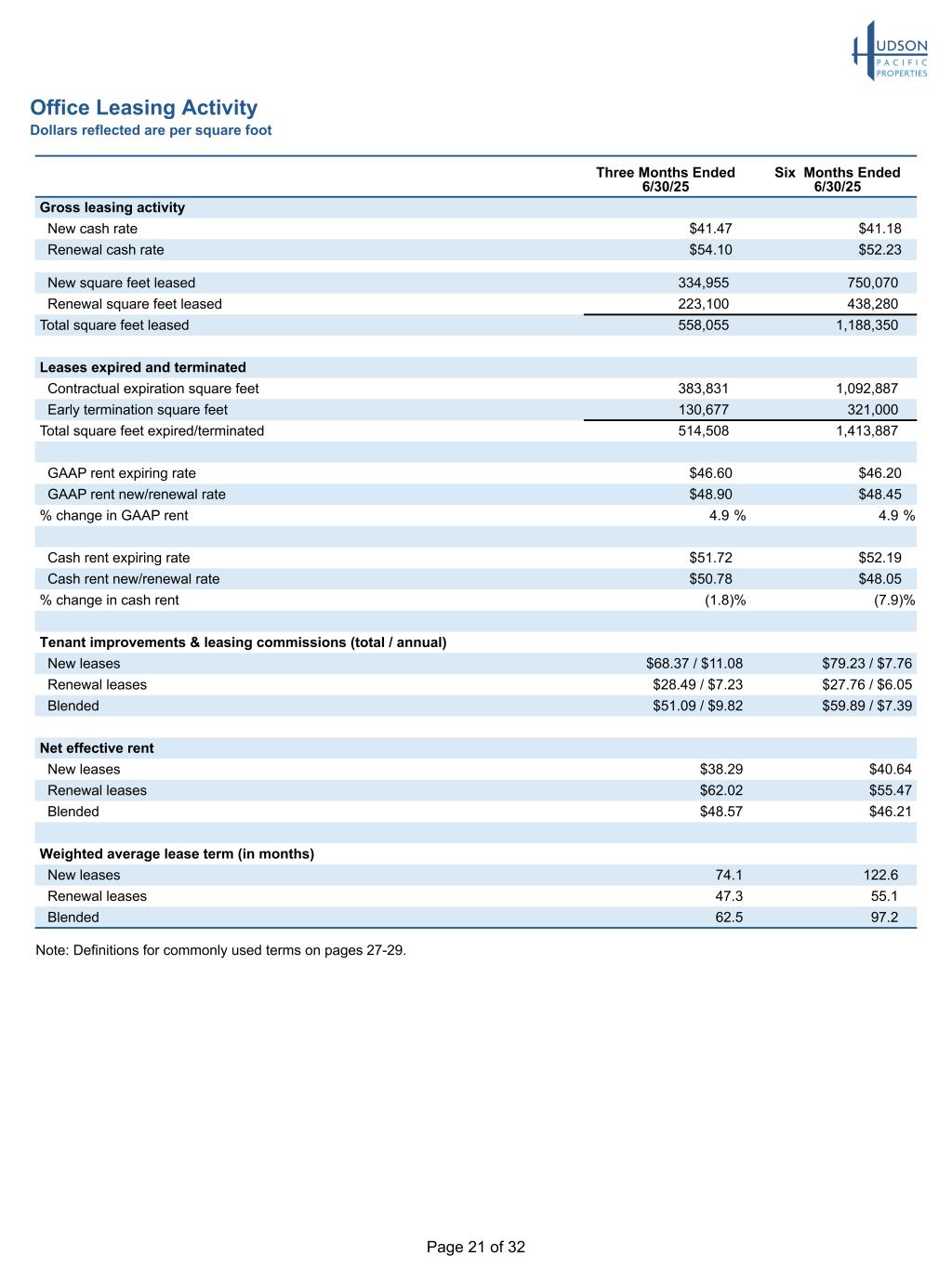

Page 21 of 32 Office Leasing Activity Dollars reflected are per square foot Three Months Ended 6/30/25 Six Months Ended 6/30/25 Gross leasing activity New cash rate $41.47 $41.18 Renewal cash rate $54.10 $52.23 New square feet leased 334,955 750,070 Renewal square feet leased 223,100 438,280 Total square feet leased 558,055 1,188,350 Leases expired and terminated Contractual expiration square feet 383,831 1,092,887 Early termination square feet 130,677 321,000 Total square feet expired/terminated 514,508 1,413,887 GAAP rent expiring rate $46.60 $46.20 GAAP rent new/renewal rate $48.90 $48.45 % change in GAAP rent 4.9 % 4.9 % Cash rent expiring rate $51.72 $52.19 Cash rent new/renewal rate $50.78 $48.05 % change in cash rent (1.8) % (7.9) % Tenant improvements & leasing commissions (total / annual) New leases $68.37 / $11.08 $79.23 / $7.76 Renewal leases $28.49 / $7.23 $27.76 / $6.05 Blended $51.09 / $9.82 $59.89 / $7.39 Net effective rent New leases $38.29 $40.64 Renewal leases $62.02 $55.47 Blended $48.57 $46.21 Weighted average lease term (in months) New leases 74.1 122.6 Renewal leases 47.3 55.1 Blended 62.5 97.2 Note: Definitions for commonly used terms on pages 27-29.

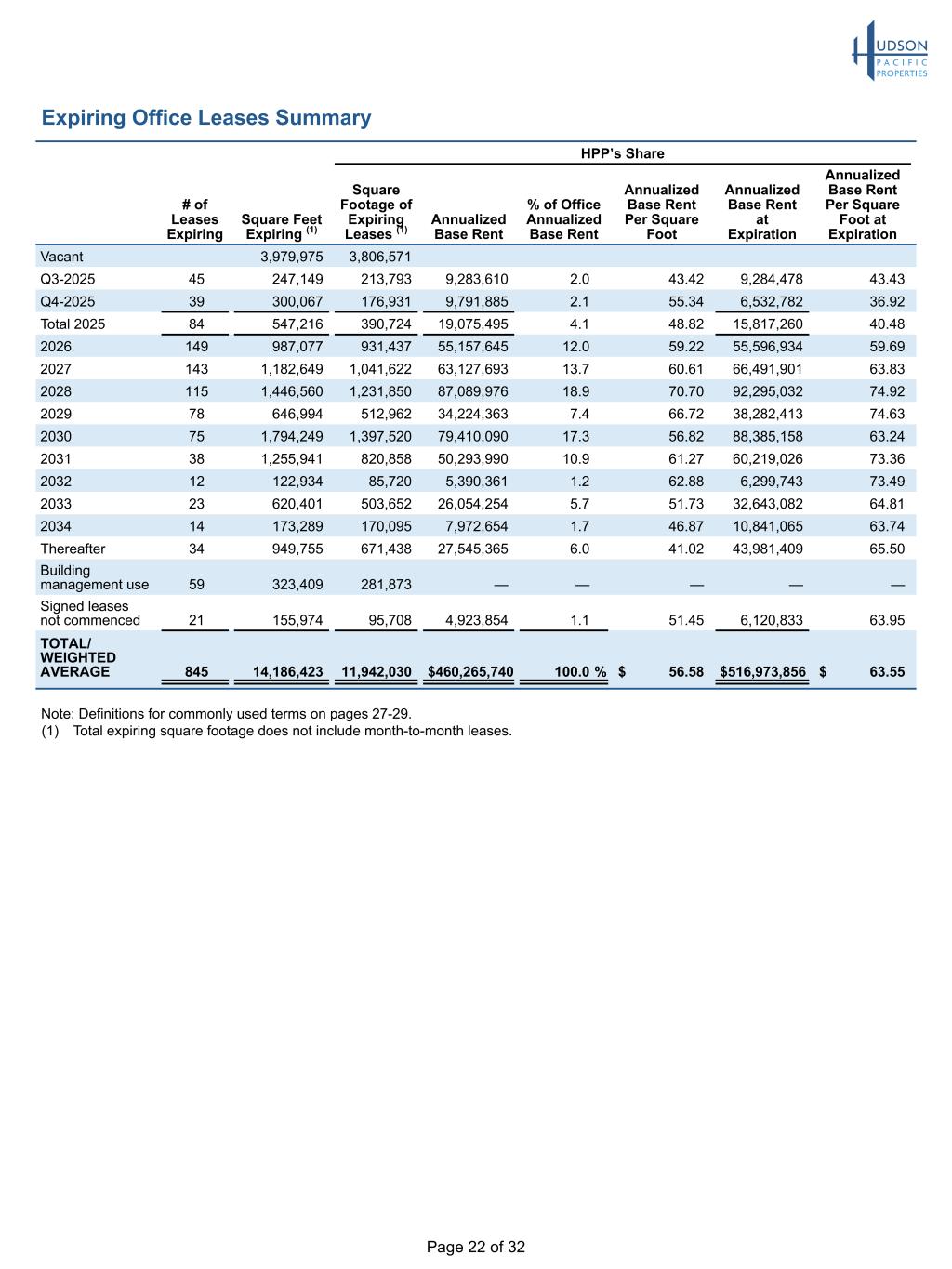

Page 22 of 32 Expiring Office Leases Summary HPP’s Share # of Leases Expiring Square Feet Expiring (1) Square Footage of Expiring Leases (1) Annualized Base Rent % of Office Annualized Base Rent Annualized Base Rent Per Square Foot Annualized Base Rent at Expiration Annualized Base Rent Per Square Foot at Expiration Vacant 3,979,975 3,806,571 Q3-2025 45 247,149 213,793 9,283,610 2.0 43.42 9,284,478 43.43 Q4-2025 39 300,067 176,931 9,791,885 2.1 55.34 6,532,782 36.92 Total 2025 84 547,216 390,724 19,075,495 4.1 48.82 15,817,260 40.48 2026 149 987,077 931,437 55,157,645 12.0 59.22 55,596,934 59.69 2027 143 1,182,649 1,041,622 63,127,693 13.7 60.61 66,491,901 63.83 2028 115 1,446,560 1,231,850 87,089,976 18.9 70.70 92,295,032 74.92 2029 78 646,994 512,962 34,224,363 7.4 66.72 38,282,413 74.63 2030 75 1,794,249 1,397,520 79,410,090 17.3 56.82 88,385,158 63.24 2031 38 1,255,941 820,858 50,293,990 10.9 61.27 60,219,026 73.36 2032 12 122,934 85,720 5,390,361 1.2 62.88 6,299,743 73.49 2033 23 620,401 503,652 26,054,254 5.7 51.73 32,643,082 64.81 2034 14 173,289 170,095 7,972,654 1.7 46.87 10,841,065 63.74 Thereafter 34 949,755 671,438 27,545,365 6.0 41.02 43,981,409 65.50 Building management use 59 323,409 281,873 — — — — — Signed leases not commenced 21 155,974 95,708 4,923,854 1.1 51.45 6,120,833 63.95 TOTAL/ WEIGHTED AVERAGE 845 14,186,423 11,942,030 $ 460,265,740 100.0 % $ 56.58 $ 516,973,856 $ 63.55 Note: Definitions for commonly used terms on pages 27-29. (1) Total expiring square footage does not include month-to-month leases.

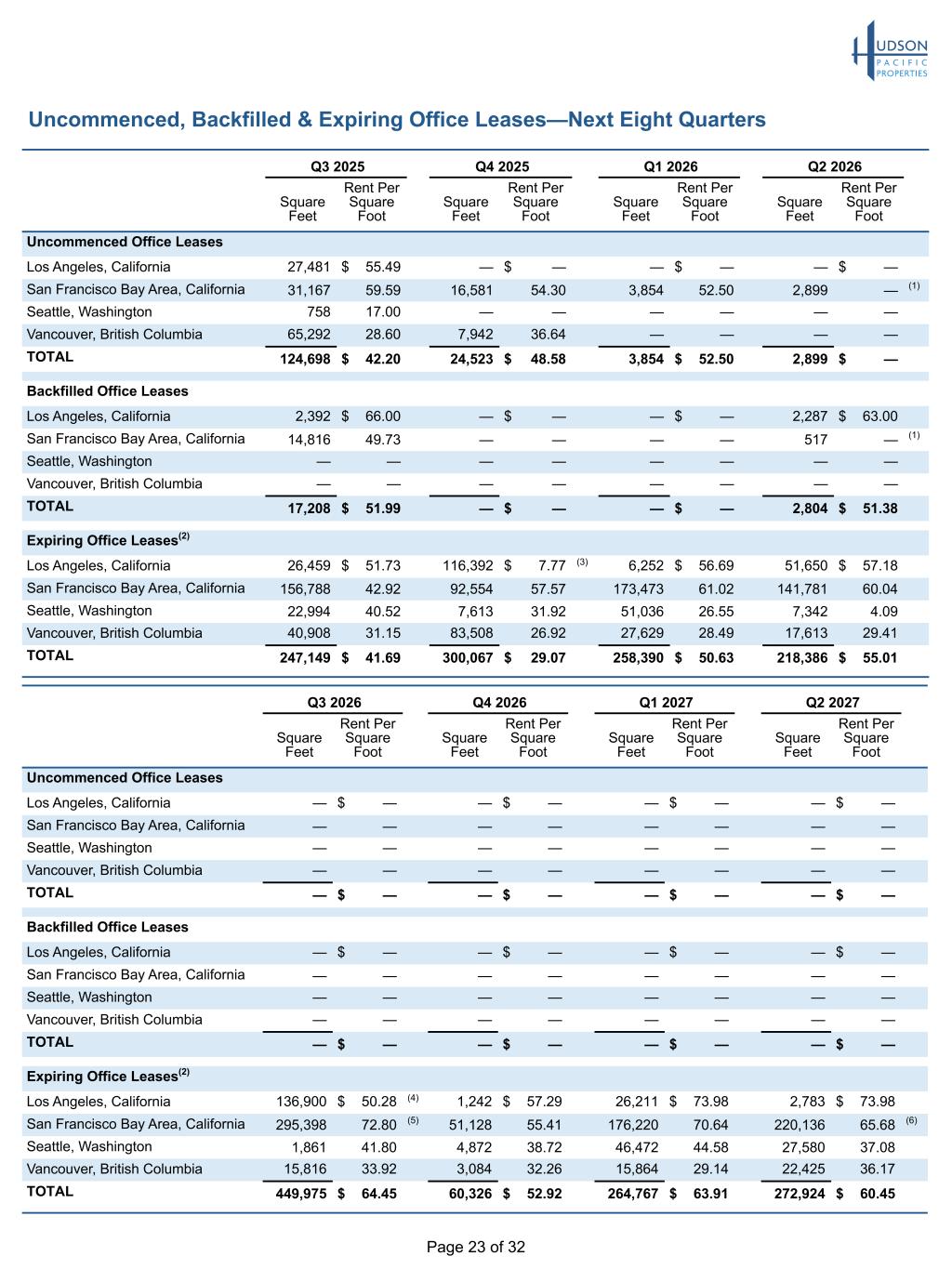

Page 23 of 32 Uncommenced, Backfilled & Expiring Office Leases—Next Eight Quarters Q3 2025 Q4 2025 Q1 2026 Q2 2026 Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Uncommenced Office Leases Los Angeles, California 27,481 $ 55.49 — $ — — $ — — $ — San Francisco Bay Area, California 31,167 59.59 16,581 54.30 3,854 52.50 2,899 — (1) Seattle, Washington 758 17.00 — — — — — — Vancouver, British Columbia 65,292 28.60 7,942 36.64 — — — — TOTAL 124,698 $ 42.20 24,523 $ 48.58 3,854 $ 52.50 2,899 $ — Backfilled Office Leases Los Angeles, California 2,392 $ 66.00 — $ — — $ — 2,287 $ 63.00 San Francisco Bay Area, California 14,816 49.73 — — — — 517 — (1) Seattle, Washington — — — — — — — — Vancouver, British Columbia — — — — — — — — TOTAL 17,208 $ 51.99 — $ — — $ — 2,804 $ 51.38 Expiring Office Leases(2) Los Angeles, California 26,459 $ 51.73 116,392 $ 7.77 (3) 6,252 $ 56.69 51,650 $ 57.18 San Francisco Bay Area, California 156,788 42.92 92,554 57.57 173,473 61.02 141,781 60.04 Seattle, Washington 22,994 40.52 7,613 31.92 51,036 26.55 7,342 4.09 Vancouver, British Columbia 40,908 31.15 83,508 26.92 27,629 28.49 17,613 29.41 TOTAL 247,149 $ 41.69 300,067 $ 29.07 258,390 $ 50.63 218,386 $ 55.01 Q3 2026 Q4 2026 Q1 2027 Q2 2027 Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Uncommenced Office Leases Los Angeles, California — $ — — $ — — $ — — $ — San Francisco Bay Area, California — — — — — — — — Seattle, Washington — — — — — — — — Vancouver, British Columbia — — — — — — — — TOTAL — $ — — $ — — $ — — $ — Backfilled Office Leases Los Angeles, California — $ — — $ — — $ — — $ — San Francisco Bay Area, California — — — — — — — — Seattle, Washington — — — — — — — — Vancouver, British Columbia — — — — — — — — TOTAL — $ — — $ — — $ — — $ — Expiring Office Leases(2) Los Angeles, California 136,900 $ 50.28 (4) 1,242 $ 57.29 26,211 $ 73.98 2,783 $ 73.98 San Francisco Bay Area, California 295,398 72.80 (5) 51,128 55.41 176,220 70.64 220,136 65.68 (6) Seattle, Washington 1,861 41.80 4,872 38.72 46,472 44.58 27,580 37.08 Vancouver, British Columbia 15,816 33.92 3,084 32.26 15,864 29.14 22,425 36.17 TOTAL 449,975 $ 64.45 60,326 $ 52.92 264,767 $ 63.91 272,924 $ 60.45

Page 24 of 32 Uncommenced, Backfilled & Expiring Office Leases—Next Eight Quarters (continued) Note: Definitions for commonly used terms on pages 27-29. (1) Comprised of tenants paying percentage rent in lieu of base rent. (2) Excludes building management offices with various expiration dates. (3) Includes Picture Shop, LLC at 6040 Sunset for 114,958 square feet on September 30, 2025. (4) Includes PayPal, Inc. at Fourth & Traction for 131,701 square feet on July 17, 2026. (5) Includes Dell EMC Corporation at 875 Howard for 83,549 square feet on June 30, 2026 and Weil, Gotshal & Manges LLP at Towers at Shore Center for 76,278 square feet on August 31, 2026. (6) Includes Salesforce.com at Rincon Center for 83,372 square feet on April 30, 2027.

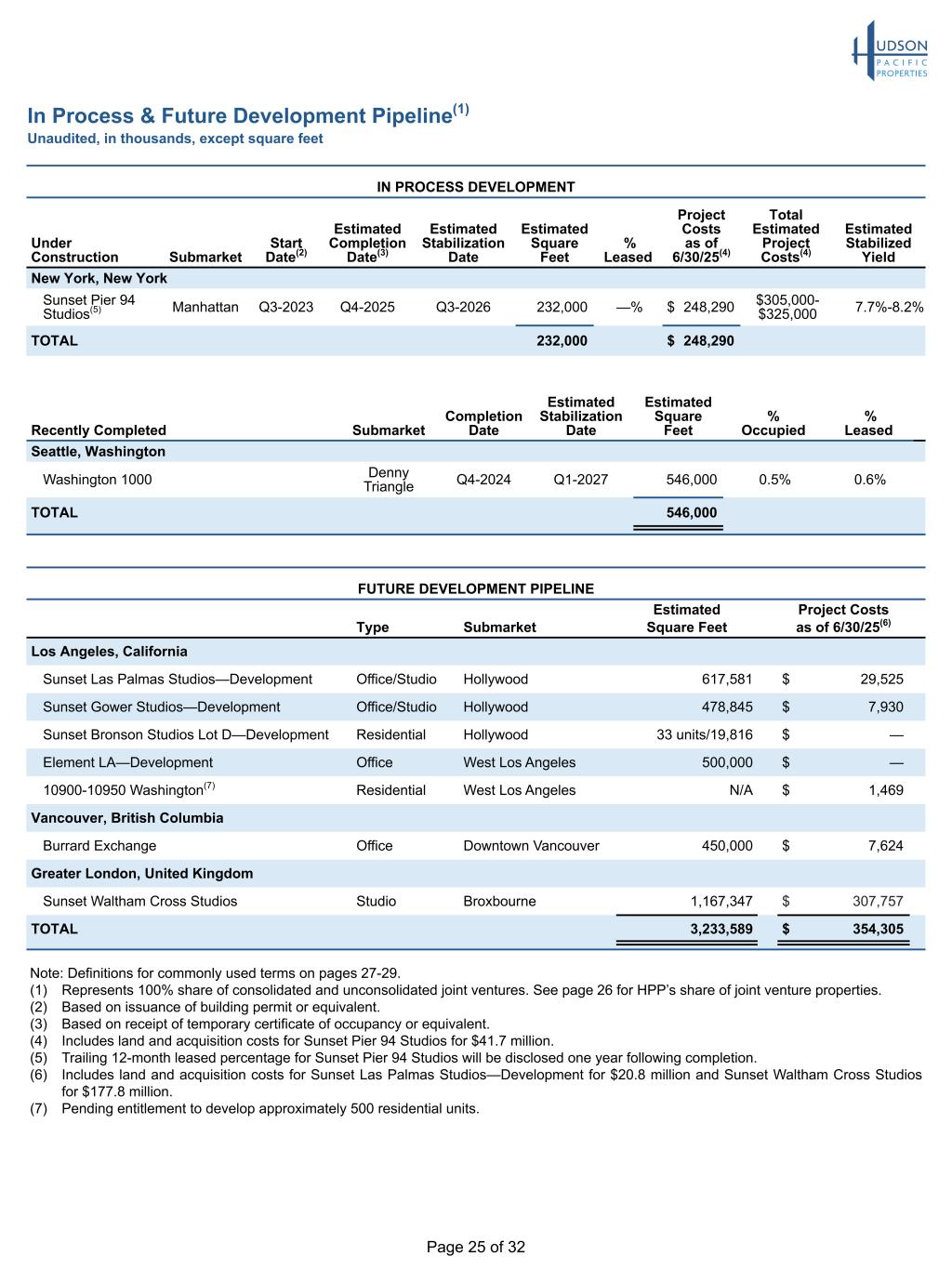

Page 25 of 32 In Process & Future Development Pipeline(1) Unaudited, in thousands, except square feet Note: Definitions for commonly used terms on pages 27-29. (1) Represents 100% share of consolidated and unconsolidated joint ventures. See page 26 for HPP’s share of joint venture properties. (2) Based on issuance of building permit or equivalent. (3) Based on receipt of temporary certificate of occupancy or equivalent. (4) Includes land and acquisition costs for Sunset Pier 94 Studios for $41.7 million. (5) Trailing 12-month leased percentage for Sunset Pier 94 Studios will be disclosed one year following completion. (6) Includes land and acquisition costs for Sunset Las Palmas Studios—Development for $20.8 million and Sunset Waltham Cross Studios for $177.8 million. (7) Pending entitlement to develop approximately 500 residential units. IN PROCESS DEVELOPMENT Under Construction Submarket Start Date(2) Estimated Completion Date(3) Estimated Stabilization Date Estimated Square Feet % Leased Project Costs as of 6/30/25(4) Total Estimated Project Costs(4) Estimated Stabilized Yield New York, New York Sunset Pier 94 Studios(5) Manhattan Q3-2023 Q4-2025 Q3-2026 232,000 —% $ 248,290 $305,000- $325,000 7.7%-8.2% TOTAL 232,000 $ 248,290 FUTURE DEVELOPMENT PIPELINE Type Submarket Estimated Square Feet Project Costs as of 6/30/25(6) Los Angeles, California Sunset Las Palmas Studios—Development Office/Studio Hollywood 617,581 $ 29,525 Sunset Gower Studios—Development Office/Studio Hollywood 478,845 $ 7,930 Sunset Bronson Studios Lot D—Development Residential Hollywood 33 units/19,816 $ — Element LA—Development Office West Los Angeles 500,000 $ — 10900-10950 Washington(7) Residential West Los Angeles N/A $ 1,469 Vancouver, British Columbia Burrard Exchange Office Downtown Vancouver 450,000 $ 7,624 Greater London, United Kingdom Sunset Waltham Cross Studios Studio Broxbourne 1,167,347 $ 307,757 TOTAL 3,233,589 $ 354,305 Recently Completed Submarket Completion Date Estimated Stabilization Date Estimated Square Feet % Occupied % Leased Seattle, Washington Washington 1000 Denny Triangle Q4-2024 Q1-2027 546,000 0.5% 0.6% TOTAL 546,000

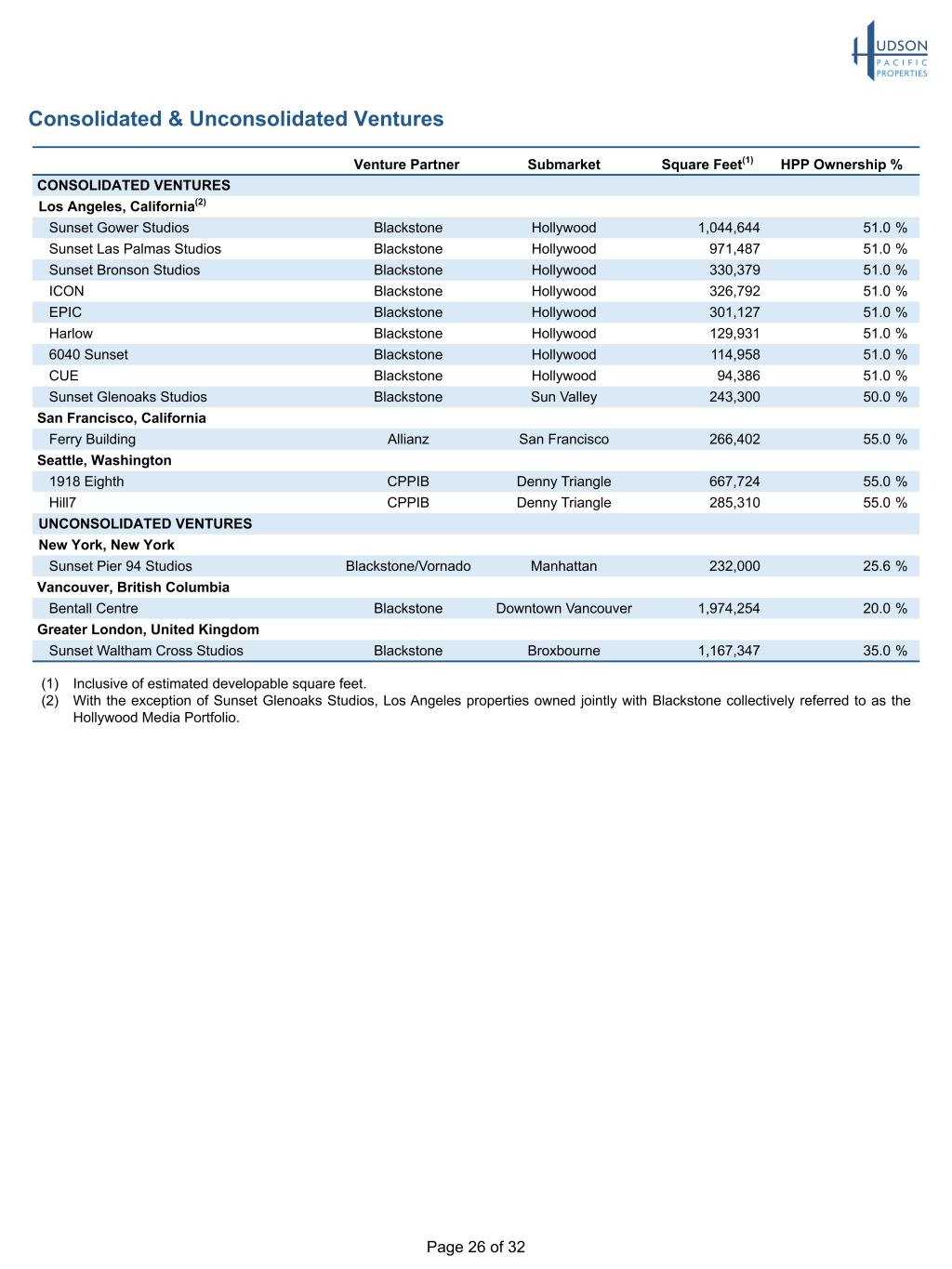

Page 26 of 32 Consolidated & Unconsolidated Ventures Venture Partner Submarket Square Feet(1) HPP Ownership % CONSOLIDATED VENTURES Los Angeles, California(2) Sunset Gower Studios Blackstone Hollywood 1,044,644 51.0 % Sunset Las Palmas Studios Blackstone Hollywood 971,487 51.0 % Sunset Bronson Studios Blackstone Hollywood 330,379 51.0 % ICON Blackstone Hollywood 326,792 51.0 % EPIC Blackstone Hollywood 301,127 51.0 % Harlow Blackstone Hollywood 129,931 51.0 % 6040 Sunset Blackstone Hollywood 114,958 51.0 % CUE Blackstone Hollywood 94,386 51.0 % Sunset Glenoaks Studios Blackstone Sun Valley 243,300 50.0 % San Francisco, California Ferry Building Allianz San Francisco 266,402 55.0 % Seattle, Washington 1918 Eighth CPPIB Denny Triangle 667,724 55.0 % Hill7 CPPIB Denny Triangle 285,310 55.0 % UNCONSOLIDATED VENTURES New York, New York Sunset Pier 94 Studios Blackstone/Vornado Manhattan 232,000 25.6 % Vancouver, British Columbia Bentall Centre Blackstone Downtown Vancouver 1,974,254 20.0 % Greater London, United Kingdom Sunset Waltham Cross Studios Blackstone Broxbourne 1,167,347 35.0 % (1) Inclusive of estimated developable square feet. (2) With the exception of Sunset Glenoaks Studios, Los Angeles properties owned jointly with Blackstone collectively referred to as the Hollywood Media Portfolio.

Page 27 of 32 Definitions Adjusted EBITDAre: Adjusted EBITDAre represents net income (loss) before interest, income taxes, depreciation and amortization, and before our share of interest and depreciation from unconsolidated real estate entities and further adjusted to eliminate the impact of certain non-cash items and items that we do not consider indicative of our ongoing performance. We believe that Adjusted EBITDAre is useful because it allows investors and management to evaluate and compare our performance from period to period in a meaningful and consistent manner, in addition to standard financial measurements under GAAP. Adjusted EBITDAre is not a measurement of financial performance under GAAP and should not be considered as an alternative to income attributable to common shareholders, as an indicator of operating performance or any measure of performance derived in accordance with GAAP. Our calculation of Adjusted EBITDAre may be different from the calculation used by other companies and, accordingly, comparability may be limited. Adjusted Funds from Operations (“AFFO”): Non-GAAP financial measure we believe is a useful supplemental measure of our performance. We compute AFFO by adding to FFO (excluding specified items) HPP’s share of share/unit-based compensation expense and amortization of deferred financing costs, and subtracting recurring capital expenditures related to HPP’s share of tenant improvements and leasing commissions (excluding pre-existing obligations on contributed or acquired properties funded with amounts received in settlement of prorations), and eliminating the net effect of HPP’s share of straight-line rents, amortization of lease buy-out costs, amortization of above- and below-market lease intangible assets and liabilities, amortization of above- and below-market ground lease intangible assets and liabilities and amortization of loan discounts/premiums. AFFO is not intended to represent cash flow for the period. We believe that AFFO provides useful information to the investment community about our financial position as compared to other REITs since AFFO is a widely reported measure used by other REITs. However, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to other REITs. Annualized Base Rent (“ABR”): For office properties, calculated by multiplying (i) cash base rents under commenced leases excluding tenant reimbursements as of June 30, 2025 by (ii) 12. On a per square foot basis, ABR is divided by square footage under commenced leases as of June 30, 2025. For all expiration years, ABR is calculated as (i) cash base rents at expiration under commenced leases divided by (ii) square footage under commenced leases as of June 30, 2025. The methodology is the same when calculating ABR per square foot either in place or at expiration for uncommenced leases. Rent data is presented without regard to cancellation options. Where applicable, rental rates converted to USD using the foreign currency exchange rate as of June 30, 2025. For studio properties, ABR reflects actual base rent for the 12 months ended June 30, 2025, excluding tenant reimbursements. ABR per leased square foot calculated as (i) annual base rent divided by (ii) square footage under lease as of June 30, 2025. Average Percent Occupied: For same-store office properties, represents the average percent occupied during the three months ended June 30, 2025. For same-store studio properties, represents the average percent leased for the 12 months ended June 30, 2025. Backfilled Office Leases: Defined as new leases with respect to occupied space executed on or prior to June 30, 2025, but with commencement dates after June 30, 2025, and within the next eight quarters. Cash Rent Growth: Initial stabilized cash rents on new and renewal leases compared to expiring cash rents in the same space. New leases are only included if the same space was leased within the previous 12 months. Excludes tenants paying percentage rent in lieu of base rent. Consolidated Debt: Consolidated unsecured and secured debt. Consolidated Debt, Net: Similar to consolidated debt, less consolidated cash and cash equivalents and restricted cash. Consolidated Unsecured and Secured Debt: Excludes joint venture partner debt, unamortized deferred financing costs and unamortized loan discounts/premiums related to our registered senior debt. Includes the full amount of debt related to the Hill7, Hollywood Media Portfolio CMBS, 1918 Eighth and Sunset Glenoaks Studios joint ventures. Diluted Shares: Includes an estimate of the total shares and units issuable under our 2023 Performance Stock Unit (“PSU”) Plan as of quarter end, based on the projected award potential of the program as of the end of the period, calculated in accordance with Accounting Standards Codification (“ASC”) 260, Earnings Per Share. Effective Interest Rate: Interest rate with respect to indebtedness calculated based on a 360-day year for actual days elapsed. Debt with a variable interest rate component reflects SOFR or CORRA as of June 30, 2025, except to the extent that such debt is subject to a rate which has been fixed pursuant to a swap is above the capped rate, in which case the rate is calculated based on the swapped or capped rate, as applicable. Page 14 details our interest rate hedging instruments. We have an option to make an irrevocable election to change the interest rate depending on our credit rating or a specified base rate plus an applicable margin. As of June 30, 2025, no such election had been made.

Page 28 of 32 Definitions (continued) Estimated Stabilized Yield: Calculated as the quotient of estimated NOI and our investment in a property once project stabilizes and initial rental concessions, if any, have elapsed, excluding the impact of leverage. Cash rents related to development and redevelopment projects are expected to increase over time and average cash yields are expected to be greater than estimated initial stabilized yields. Our estimates for cash yields and total costs at completion represent our current estimates, which may be updated upon project completion or sooner, if there are significant changes to expected yields or costs. We caution against placing undue reliance on the estimated stabilized yields which are based solely on our estimates, using data available to us during the development process. The amount of total investment required to reach stabilized occupancy may differ substantially from our estimates due to various factors. We can provide no assurance that the actual stabilized yields will be consistent with the estimated stabilized yields set forth herein. Estimated Project Costs: Estimated project costs exclude interest costs capitalized in accordance with ASC 835-20-50-1, personnel costs capitalized in accordance with ASC 970-360-25 and operating expenses capitalized in accordance with ASC 970-340. Estimated Square Feet: Represents management’s estimate of leasable square footage, which may be less or more than the Building Owners and Managers Association (BOMA) rentable area. Square footage may change over time due to re-measurement or re-leasing. For land properties, square footage represents management’s estimate of developable square footage, the majority of which remains subject to entitlement approvals not yet obtained. Estimated Stabilization Date: Based on management’s estimate of stabilized occupancy (92.0%). Occupancy for stabilization purposes defined as the commencement of cash rental payments. Funds from Operations (“FFO”): We calculate FFO in accordance with the White Paper on FFO approved by the Board of Governors of the National Association of Real Estate Investment Trusts. The White Paper defines FFO as net income or loss calculated in accordance with GAAP, excluding gains and losses from sales of depreciable real estate and impairment write-downs associated with depreciable real estate, plus HPP’s share of real estate-related depreciation and amortization, excluding amortization of deferred financing costs and depreciation of non-real estate assets. The calculation of FFO includes HPP’s share of amortization of deferred revenue related to tenant- funded tenant improvements and excludes the depreciation of the related tenant improvement assets. FFO is a non-GAAP financial measure we believe is a useful supplemental measure of our operating performance. The exclusion from FFO of gains and losses from the sale of operating real estate assets allows investors and analysts to readily identify the operating results of the assets that form the core of our activity and assists in comparing those operating results between periods. Also, because FFO is generally recognized as the industry standard for reporting the operations of REITs, it facilitates comparisons of operating performance to other REITs. However, other REITs may use different methodologies to calculate FFO, and accordingly, our FFO may not be comparable to all other REITs. Implicit in historical cost accounting for real estate assets in accordance with GAAP is the assumption that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, many industry investors and analysts have considered presentations of operating results for real estate companies using historical cost accounting alone to be insufficient. Because FFO excludes depreciation and amortization of real estate assets, we believe that FFO along with the required GAAP presentations provides a more complete measurement of our performance relative to our competitors and a more appropriate basis on which to make decisions involving operating, financing and investing activities than the required GAAP presentations alone would provide. We use FFO per share to calculate annual cash bonuses for certain employees. However, FFO should not be viewed as an alternative measure of our operating performance because it does not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which are significant economic costs and could materially impact our results from operations. GAAP Effective Rate: Similar to effective interest rate except it includes the amortization of deferred financing costs and loan discounts/ premiums. HPP’s Share: Non-GAAP financial measures calculated as the measure on a consolidated basis, in accordance with GAAP, plus our Operating Partnership’s share of the measure from our unconsolidated joint ventures (calculated based upon the Operating Partnership’s percentage ownership interest), minus our partners’ share of the measure from our consolidated joint ventures (calculated based upon the partners’ percentage ownership interests). We believe that presenting HPP’s share of these measures provides useful information to investors regarding the Company’s financial condition and/or results of operations because we have several significant joint ventures, and in some cases, we exercise significant influence over, but do not control, the joint venture. In such instances, GAAP requires us to account for the joint venture entity using the equity method of accounting, which we do not consolidate for financial reporting purposes. In other cases, GAAP requires us to consolidate the venture even though our partner(s) own(s) a significant percentage interest. HPP’s Share of Debt: Similar to consolidated debt except it includes HPP’s share of unconsolidated joint venture debt and excludes partners’ share of consolidated joint venture partner debt.

Page 29 of 32 In-Service Properties: Owned properties, excluding repositioning, redevelopment, development and held for sale properties. Studio development properties are incorporated into the in-service portfolio the earlier of one year following completion or the project’s estimated stabilization date. Office development properties are incorporated into the in-service portfolio the earlier of 92% occupancy or the project’s estimated stabilization date. Net Effective Rent: Weighted average straight-line annual cash rent, net of annualized tenant improvements and lease commissions. Triple net (NNN) and modified gross base rents are adjusted to include estimated annual expenses consistent with those included in comparable full service gross base rents. Net Operating Income (“NOI”): We evaluate performance based upon property NOI from continuing operations. NOI is not a measure of operating results or cash flows from operating activities or cash flows as measured by GAAP and should not be considered an alternative to income from continuing operations, as an indication of our performance, or as an alternative to cash flows as a measure of liquidity, or our ability to make distributions. All companies may not calculate NOI in the same manner. We consider NOI to be a useful performance measure to investors and management because when compared across periods, NOI reflects the revenues and expenses directly associated with owning and operating our properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing a perspective not immediately apparent from income from continuing operations. We calculate NOI as net income (loss) excluding corporate general and administrative expenses, depreciation and amortization, impairments, gains/losses on sales of real estate, interest expense, transaction-related expenses and other non-operating items. We define NOI as operating revenues (rental revenues, other property-related revenue, tenant recoveries and other operating revenues), less property-level operating expenses (external management fees, if any, and property-level general and administrative expenses). NOI on a cash basis is NOI adjusted to exclude the effect of straight- line rent and other non-cash adjustments required by GAAP. We believe that NOI on a cash basis is helpful to investors as an additional measure of operating performance because it eliminates straight-line rent and other non-cash adjustments to revenue and expenses. Operating Partnership: The Company conducts all of its operations through the Operating Partnership, Hudson Pacific Properties, L.P., and serves as its sole general partner. As of June 30, 2025, the Company owned 97.5% of the ownership interest in the Operating Partnership, including unvested restricted units. Outstanding Balance: Outstanding debt balances including partners’ share of consolidated entities and excludes unamortized deferred financing costs and loan discounts/premiums. Percent Occupied/Leased: For office properties, calculated as (i) square footage under commenced leases as of June 30, 2025, divided by (ii) total square feet, expressed as a percentage, whereas percent leased includes uncommenced leases. For studio properties, percent leased reflects the average percent leased for the 12 months ended June 30, 2025. Project Costs: Exclude interest costs capitalized in accordance with ASC 835-20-50-1, personnel costs capitalized in accordance with ASC 970-360-25 and operating expenses capitalized in accordance with ASC 970-340. Same-Store Office: Same-store office for the three months ended June 30, 2025 defined as all properties owned and included in our stabilized office portfolio as of April 1, 2024 and still owned and included in the stabilized office portfolio as of June 30, 2025. Same-store office for the six months ended June 30, 2025 defined as all properties owned and included in our stabilized office portfolio as of January 1, 2024 and still owned and included in the stabilized office portfolio as of June 30, 2025. Since its acquisition as part of a portfolio in the second quarter of 2015, Metro Center has not reached stabilized occupancy (92%) so has never been included in the same-store office portfolio, instead remaining the only office asset within that portfolio still held as a non-same-store, lease-up property. In an effort to simplify our in-service and same-store disclosures, Metro Center will be included within our same-store office properties for both the three and six months ended June 30, 2024 and June 30, 2025. Same-Store Studio: Same-store studio for the three months ended June 30, 2025 defined as all properties owned and included in our stabilized studio portfolio as of April 1, 2024 and still owned and included in the stabilized studio portfolio as of June 30, 2025. Same-store studio for the six months ended June 30, 2025 defined as all properties owned and included in our stabilized studio portfolio as of January 1, 2024 and still owned and included in the stabilized studio portfolio as of June 30, 2025. Straight-Line Rent Growth: Represents a comparison between initial straight-line rents on new and renewal leases as compared to the straight-line rents on expiring leases in the same space. New leases are only included if the same space was leased within the previous 12 months. Excludes tenants paying percentage rent in lieu of base rent. Uncommenced Office Leases: Defined as new leases with respect to vacant space executed on or prior to June 30, 2025, but with commencement dates after June 30, 2025 and within the next eight quarters. Definitions (continued)

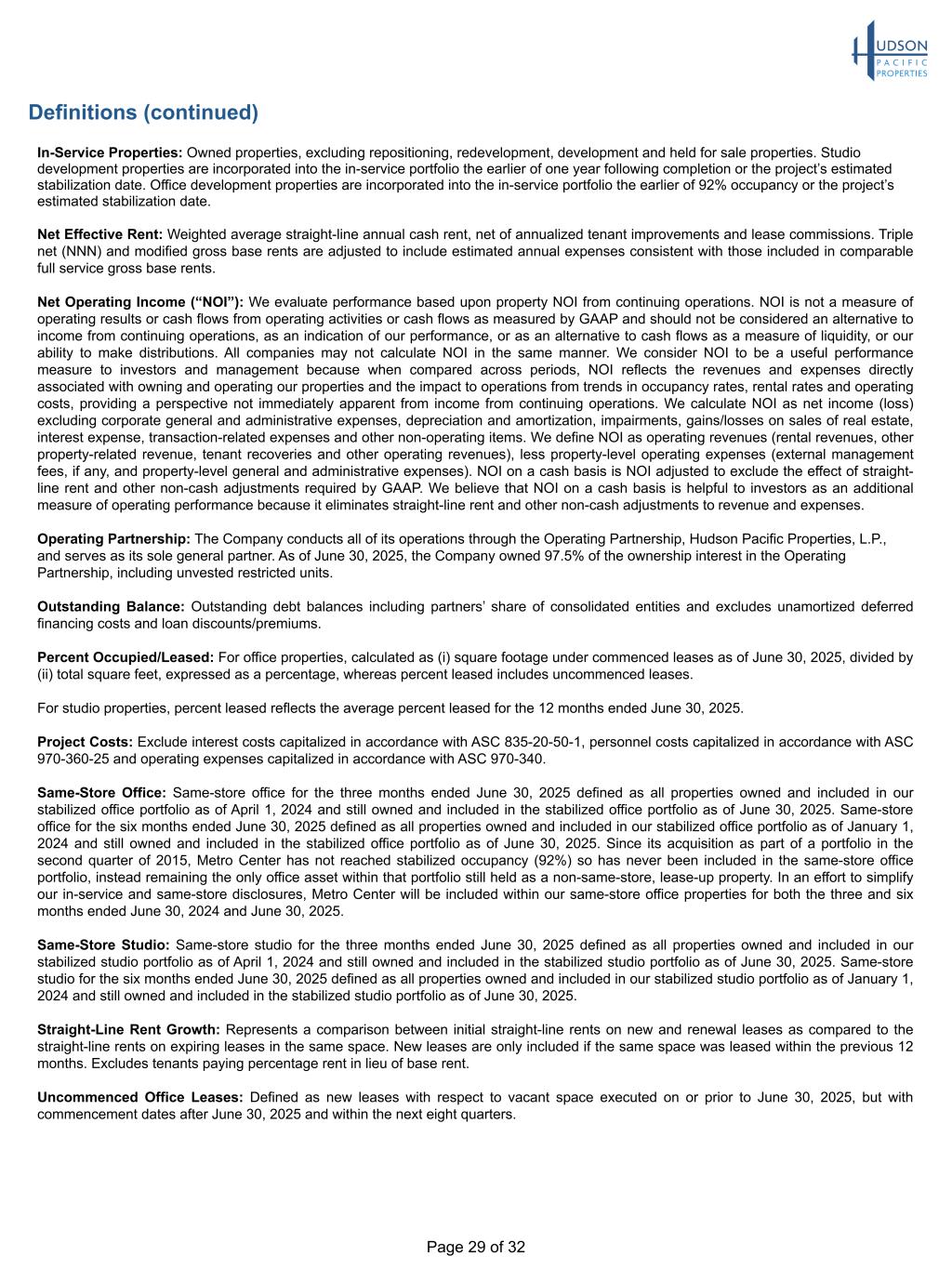

Page 30 of 32 Non-GAAP Reconciliations Unaudited, in thousands RECONCILIATION OF NET LOSS TO NOI Three Months Ended Six Months Ended 6/30/25 6/30/24 6/30/25 6/30/24 Net loss $ (87,760) $ (47,557) $ (168,038) $ (100,912) Adjustments: Loss from unconsolidated real estate entities 205 2,481 1,459 3,224 Fee income (1,476) (1,371) (2,835) (2,496) Interest expense 48,137 44,159 91,642 88,248 Interest income (2,123) (579) (2,558) (1,433) Management services reimbursement income—unconsolidated real estate entities (1,123) (1,042) (2,098) (2,198) Management services expense—unconsolidated real estate entities 1,123 1,042 2,098 2,198 Transaction-related expenses 451 (113) 451 2,037 Unrealized (gain) loss on non-real estate investments (212) 1,045 237 1,943 Loss (gain) on sale of real estate, net 16 — (10,007) — Impairment loss — — 18,476 — Loss on extinguishment of debt 1,637 — 3,495 — Other expense (income) 93 (1,334) 85 (1,477) Income tax provision 454 510 648 510 General and administrative 27,776 20,705 46,259 40,415 Depreciation and amortization 94,751 86,798 187,836 178,652 NOI $ 81,949 $ 104,744 $ 167,150 $ 208,711 Add: HPP’s share of NOI from unconsolidated real estate entities 1,936 3,283 3,803 5,805 Less: NOI attributable to non-controlling interests 16,075 17,442 31,497 34,384 HPP’s share of NOI $ 67,810 $ 90,585 $ 139,456 $ 180,132 NOI Detail Same-store office cash revenues $ 152,152 $ 166,762 $ 313,402 $ 334,792 Straight-line rent 3,837 531 4,198 (2,687) Amortization of above/below-market leases, net 1,016 1,147 1,882 2,431 Amortization of lease incentive costs (1,384) (261) (2,041) (300) Same-store office revenues 155,621 168,179 317,441 334,236 Same-store studios cash revenues 15,525 20,186 32,729 39,332 Straight-line rent 111 109 (85) 299 Amortization of lease incentive costs (9) (9) (19) (19) Same-store studio revenues 15,627 20,286 32,625 39,612 Same-store revenues 171,248 188,465 350,066 373,848 Same-store office cash expenses 70,107 70,288 139,485 138,493 Straight-line rent 367 371 739 748 Share/unit-based compensation expense 12 15 24 34 Amortization of above/below-market ground leases, net 641 641 1,281 1,281 Same-store office expenses 71,127 71,315 141,529 140,556 Same-store studio cash expenses 10,474 12,540 21,438 24,081 Share/unit-based compensation expense 113 40 144 91 Same-store studio expenses 10,587 12,580 21,582 24,172 Same-store expenses 81,714 83,895 163,111 164,728 Same-store NOI 89,534 104,570 186,955 209,120 Non-same-store NOI (7,585) 174 (19,805) (409) NOI $ 81,949 $ 104,744 $ 167,150 $ 208,711

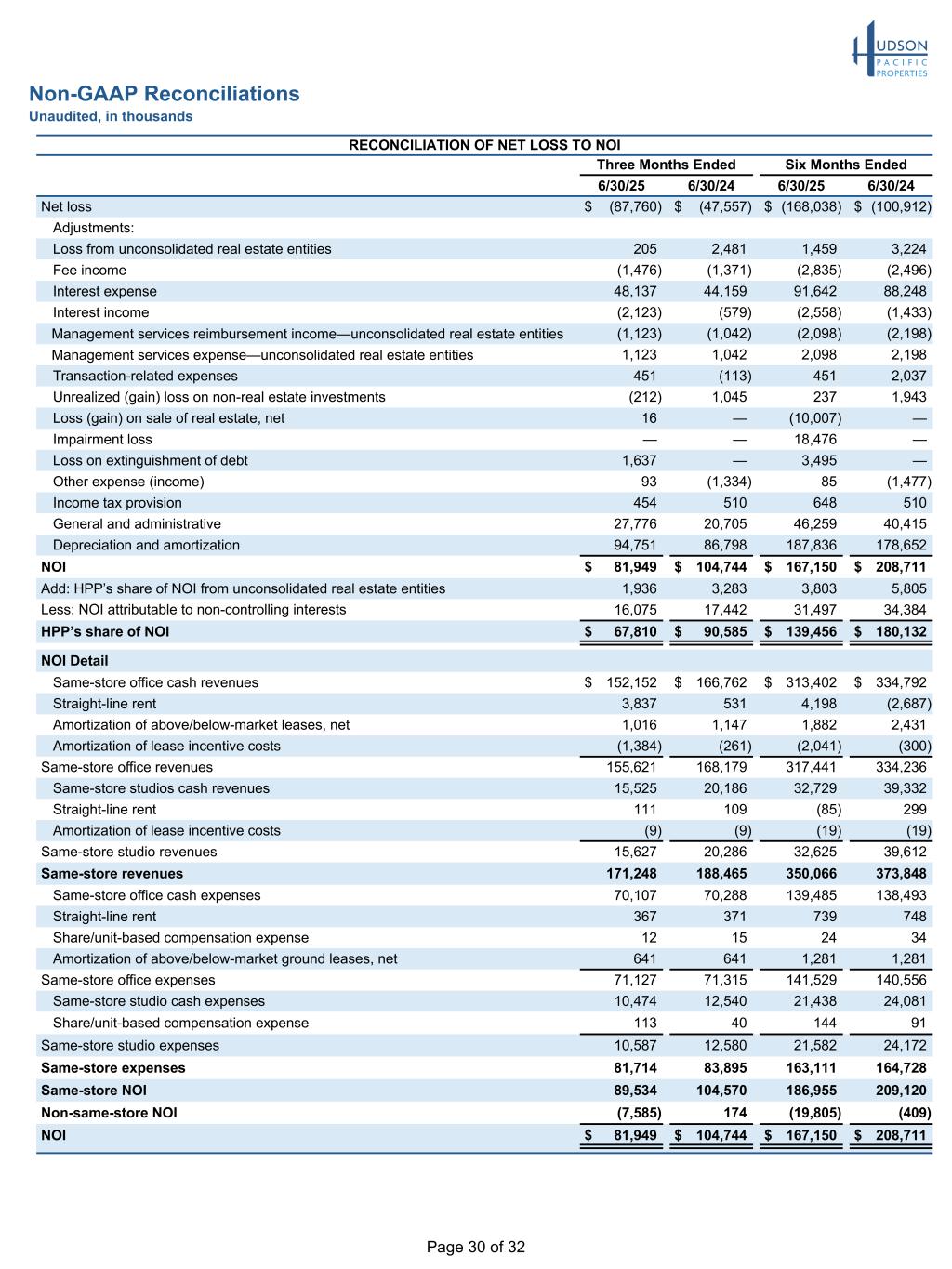

Page 31 of 32 Non-GAAP Reconciliations (continued) Unaudited, in thousands RECONCILIATIONS OF NET LOSS TO ADJUSTED EBITDARE (ANNUALIZED) AND TOTAL UNSECURED AND SECURED DEBT TO CONSOLIDATED DEBT, NET AND HPP’S SHARE OF DEBT, NET Three Months Ended 6/30/25 6/30/24(1) Net loss $ (87,760) $ (47,557) Interest income—consolidated (2,123) (579) Interest expense—consolidated 48,137 44,159 Depreciation and amortization—consolidated 94,751 86,798 EBITDA 53,005 82,821 Unconsolidated real estate entities depreciation and amortization 1,113 2,006 Unconsolidated real estate entities interest expense 886 3,052 EBITDAre 55,004 87,879 Share/unit-based compensation expense 17,887 6,919 Straight-line rent receivables, net (2,602) 1,147 Non-cash amortization of above/below-market leases, net (1,017) (1,283) Non-cash amortization of above/below-market ground leases, net 651 662 Amortization of lease incentive costs 1,393 361 Transaction-related expenses 451 (113) Unrealized (gain) loss on non-real estate investments (212) 1,045 Loss on debt extinguishment 1,637 — Loss on sale of real estate, net 16 — Other expense (income) 93 (1,334) Income tax provision 454 510 Other adjustments related to unconsolidated real estate entities (134) (898) Adjusted EBITDAre 73,621 94,895 One-time termination of Quixote leases (cost-cutting initiatives) 475 — Adjusted EBITDAre (excluding specified items) 74,096 94,895 Studio cash NOI 831 (4,653) Office adjusted EBITDAre 74,927 90,242 x Annualization factor 4 4 Annualized office adjusted EBITDAre 299,708 360,968 Trailing 12-month studio cash NOI (3,376) (1,389) Cash adjusted EBTIDAre for selected ratios 296,332 359,579 Less: Partners’ share of cash adjusted EBITDAre (65,339) (61,573) HPP’s share of cash adjusted EBITDAre $ 230,993 $ 298,006 Total consolidated unsecured and secured debt 3,709,000 4,127,268 Less: Consolidated cash and cash equivalents and restricted cash (267,127) (99,940) Consolidated debt, net $ 3,441,873 $ 4,027,328 Less: Partners’ share of debt, net (620,939) (645,856) HPP’s share of debt, net $ 2,820,934 $ 3,381,472 Consolidated debt, net/cash adjusted EBITDAre for selected ratios 11.6x 11.2x HPP’s share of debt, net/HPP’s share of cash adjusted EBITDAre for selected ratios 12.2x 11.3x (1) For Q2 2025, we refined our calculation of certain elements of Cash adjusted EBITDAre for selected ratios, HPP’s share of cash adjusted EBITDAre, Consolidated debt, net, and HPP’s share of debt, net in order to present a more comprehensive measure of performance. As part of this refinement, the calculation now includes the cash NOI of Quixote studios and services, which was previously excluded from the calculation and noted as such in prior period footnotes. To ensure comparability with the prior year period, we have retroactively applied the revised calculation to the results for Q2 2024. As a result, the amounts reflected for Q2 2024 differ from the amounts previously reported as follows (in thousands): (a) other adjustments to unconsolidated real estate entities decreased by $898, which resulted in a corresponding $898 decrease in Adjusted EBITDAre, Adjusted EBITDAre (excluding specified items) and Office adjusted EBITDAre; (b) Annualized office adjusted EBITDAre decreased by $3,592 and Trailing 12-month studio cash NOI decreased by $27,229, resulting in a corresponding decrease of $30,821 in Cash adjusted EBITDAre for selected ratios and HPP’s share of cash adjusted EBITDAre; (c) Consolidated cash and cash equivalents and restricted cash increased by $21,482, resulting in a corresponding $21,482 decrease in Consolidated debt, net; (d) Partners’ share of debt, net decreased by $8,934, resulting in a corresponding decrease in HPP’s share of debt, net of $12,548; and (e) as a result of the foregoing, the ratio of Consolidated debt, net to cash adjusted EBITDAre for selected ratios increased by 0.8x and the ratio of HPP’s share of debt, net to HPP’s share of cash adjusted EBITDAre for selected ratios increased by 1.0x.

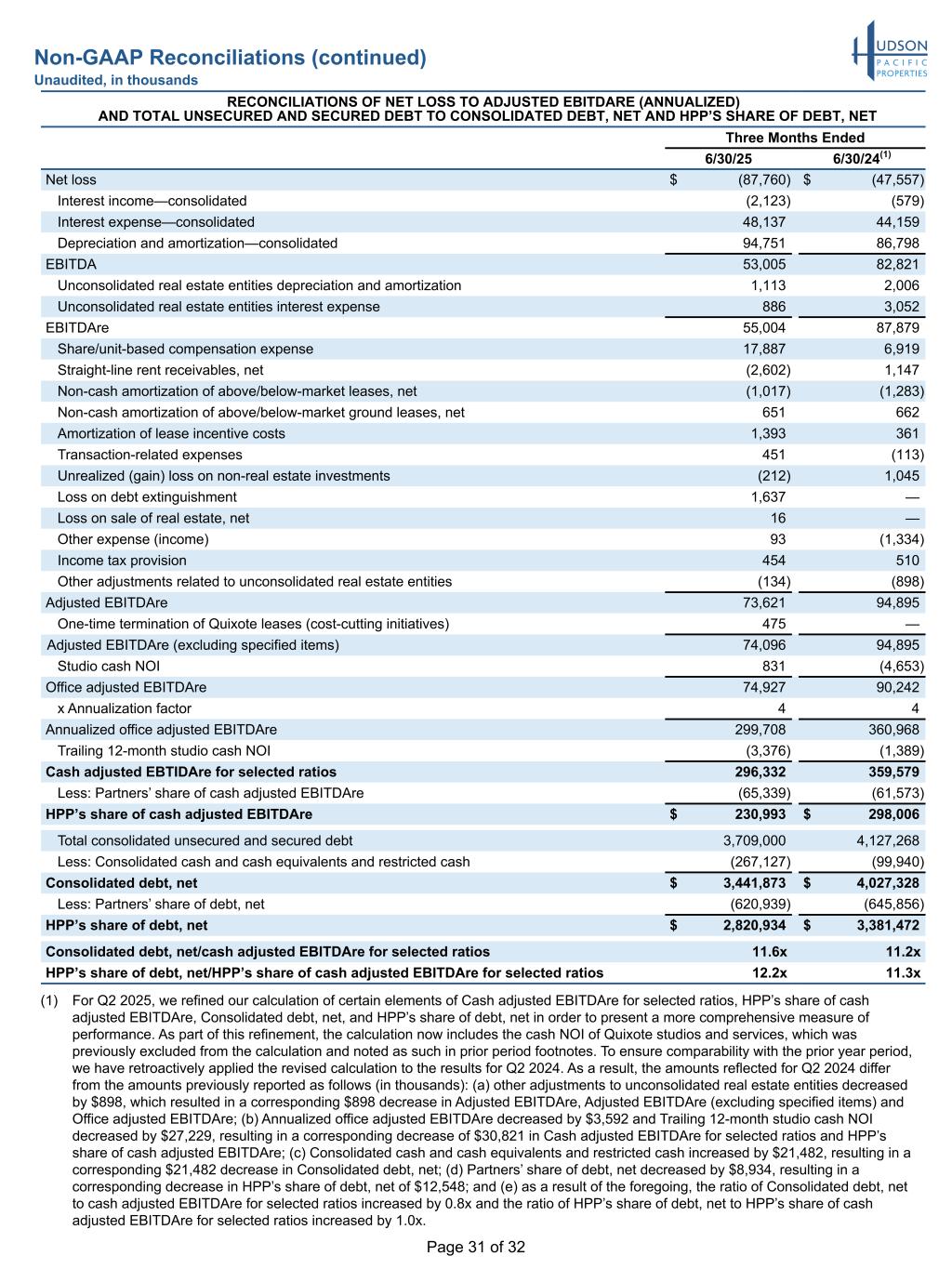

Page 32 of 32 Non-GAAP Reconciliations (continued) Unaudited, in thousands RECONCILIATIONS OF TOTAL ASSETS TO HPP’S SHARE OF UNDEPRECIATED BOOK VALUE AND TOTAL UNSECURED AND SECURED DEBT TO HPP’S SHARE OF DEBT, NET 6/30/25 6/30/24(1) Total assets $ 8,126,052 $ 8,352,782 Add: Accumulated depreciation 1,959,422 1,824,042 Add: Accumulated amortization 199,071 188,716 Less: Partners’ share of consolidated undepreciated book value (1,405,676) (1,385,536) Less: Investment in unconsolidated real estate entities (242,785) (212,130) Add: HPP’s share of unconsolidated undepreciated book value 371,926 319,210 HPP’s share of undepreciated book value $ 9,008,010 $ 9,087,084 Total consolidated unsecured and secured debt $ 3,709,000 $ 4,127,268 Less: Consolidated cash and cash equivalents and restricted cash (267,127) (99,940) Consolidated debt, net $ 3,441,873 $ 4,027,328 Less: Partners’ share of debt, net (620,939) (645,856) HPP’s share of debt, net $ 2,820,934 $ 3,381,472 HPP’s share of debt, net/HPP’s share of undepreciated book value 31.3 % 37.2 % (1) For Q2 2025, we refined our calculation of certain elements of Consolidated debt, net, and HPP’s share of debt, net in order to present a more comprehensive measure of performance. To ensure comparability with the prior year period, we have retroactively applied the revised calculation to the results for Q2 2024. As a result, the amounts reflected for Q2 2024 differ from the amounts previously reported as follows (in thousands): (a) Consolidated cash and cash equivalents and restricted cash increased by $21,482, resulting in a corresponding $21,482 decrease in Consolidated debt, net; (b) Partners’ share of debt, net decreased by $8,934, resulting in a corresponding decrease in HPP’s share of debt, net of $12,548; and (c) as a result of the foregoing, the ratio of HPP’s share of debt, net to HPP’s share of undepreciated book value decreased by 0.1%.