Outset Medical Investor Presentation 2026

Forward-looking statements and non-GAAP information This presentation and the accompanying oral statements contain forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expect,” “plan,” anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “would,” “continue,” “ongoing” or the negative of these terms or similar expressions. Forward-looking statements are based on management’s current assumptions and expectations of future events and trends, which affect or may affect our business, strategy, operations or financial performance, and actual results and other events may differ materially from those expressed or implied in such statements due to numerous risks and uncertainties. These forward-looking statements include, but are not limited to, statements about our expected results of operations, including 2025 revenue, year-end cash position and Tablo console shipments, statements about our possible or assumed future results of operations and financial position, including expectations regarding projected revenues, recurring revenues, and revenue growth rate, gross margin (including non-GAAP gross margin), operating expenses, capital expenditures, cash use, cash burn, cash position, profitability and outlook, statements regarding the sufficiency of our cash balances through cashflow breakeven; statements regarding the anticipated impacts and benefits of our cost reduction actions, initiatives to optimize the commercial organization and improve forecasting and order visibility, and restructurings; statements regarding our overall business strategy, plans and objectives of management, our expectations regarding the market sizes and growth potential for Tablo and the total addressable market opportunities for Tablo, continued execution of our initiatives designed to expand gross margins, our ability to respond to and resolve any reports, observations or other actions by the Food and Drug Administration (FDA) and other regulators in a timely and effective manner, as well as our expectations regarding the impact of macroeconomic factors on us, our customers and our suppliers. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause actual results to differ materially from those expressed or implied in these forward-looking statements. These risks and uncertainties include: our future financial performance, including our expectations regarding our revenues, cost of revenues, operating expenses, gross margin and our ability to achieve and maintain future profitability; continued execution of our initiatives designed to expand gross margins; our ability to attain market acceptance among providers and patients; our ability to manage our growth; our expansion into the home hemodialysis market; our ability to ensure strong product performance and reliability; our relations with third-party suppliers, including contract manufacturers and single source suppliers; our ability to overcome manufacturing disruptions; the impact of epidemics, natural or man-made disasters, and similar events, on our industry, business and results of operations; our ability to offer high-quality support for Tablo; our expectations of the sizes of the markets for Tablo; our ability to innovate and improve Tablo; our ability to effectively manage privacy, information and data security; concentration of our revenues in a single product and concentration of a large percentage of our revenues from a limited number of customers; our ability to compete effectively; our ability to accurately forecast customer demand and manage our inventory; our ability to ensure the proper training and use of Tablo; our compliance with FDA and other regulations applicable to our products and business operations and our ability to respond to and resolve any reports, observations or other actions by the FDA or other regulators in a timely and effective manner; as well as other risks and uncertainties described in the Risk Factors section of our public filings with the SEC, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. Forward-looking statements should be considered in light of these risks and uncertainties, and you should not rely on these forward-looking statements as predictions of future events. These forward-looking statements speak only as of their date and we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. This presentation and the accompanying oral presentation also contain statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to such information. We have not independently verified the accuracy or completeness of the information contained in the industry publications and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that information nor do we undertake to update such information after the date of this presentation. In addition to financial information presented in accordance with U.S. generally accepted accounting principles ("GAAP"), this presentation and the accompanying oral statements include certain non-GAAP financial measures, which may include Non- GAAP gross profit/loss, gross margin, operating expenses, net income/loss, and basic and diluted net income/loss per share. Any non-GAAP measure is presented for supplemental informational purposes only and should not be considered a substitute for or superior to financial information presented in accordance with GAAP. There are limitations related to the use of non-GAAP financial measures because they are not prepared in accordance with GAAP, may exclude significant expenses required by GAAP to be recognized in our financial statements, and may not be comparable to non-GAAP financial measures used by other companies. A reconciliation of these measures to the most directly comparable GAAP measures is included at the end of this presentation.

Dialysis care that improves patient outcomes with lower cost and less complexity.

Investment Highlights ~70+% recurring revenue powered by predictable utilization Enterprise dialysis solution differentiated by expert know-how, trusted technology and exceptional service Strong cash position, capitalized through breakeven More than 1,000 sites of care performing >1,000,000 treatments per year Scale in $2.5B acute/post-acute care market; emerging presence in $8.9B home market1 1. Company estimates based on data contained in USRDS Annual Data Report

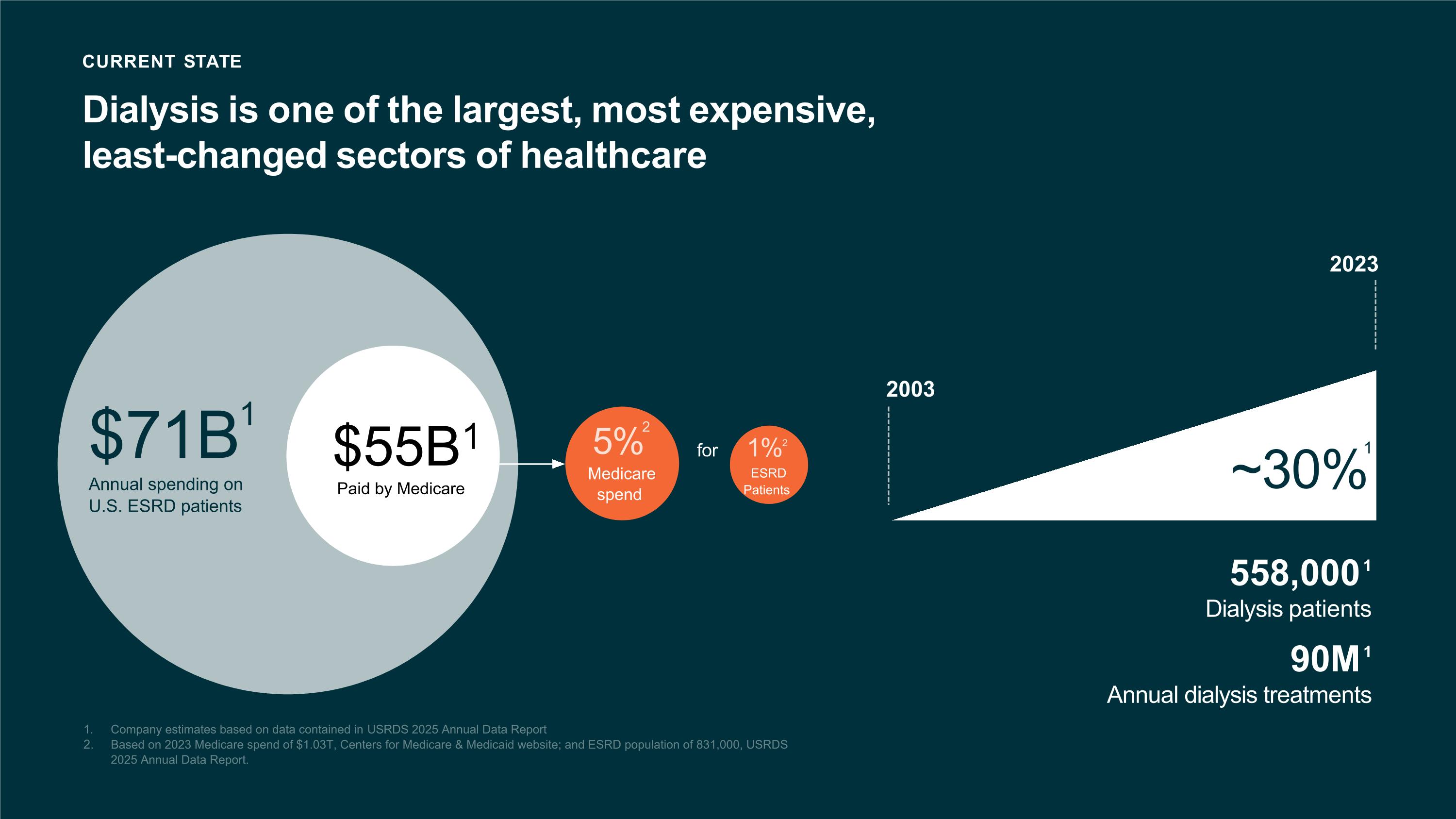

5%2 Medicare spend for 1%2 ESRD Patients CURRENT STATE Dialysis is one of the largest, most expensive, least-changed sectors of healthcare $71B1 Annual spending on U.S. ESRD patients $55B1 Paid by Medicare 558,0001 Dialysis patients 90M1 Annual dialysis treatments 1. Company estimates based on data contained in USRDS 2025 Annual Data Report Based on 2023 Medicare spend of $1.03T, Centers for Medicare & Medicaid website; and ESRD population of 831,000, USRDS 2025 Annual Data Report. ~30% 1 2023 2003

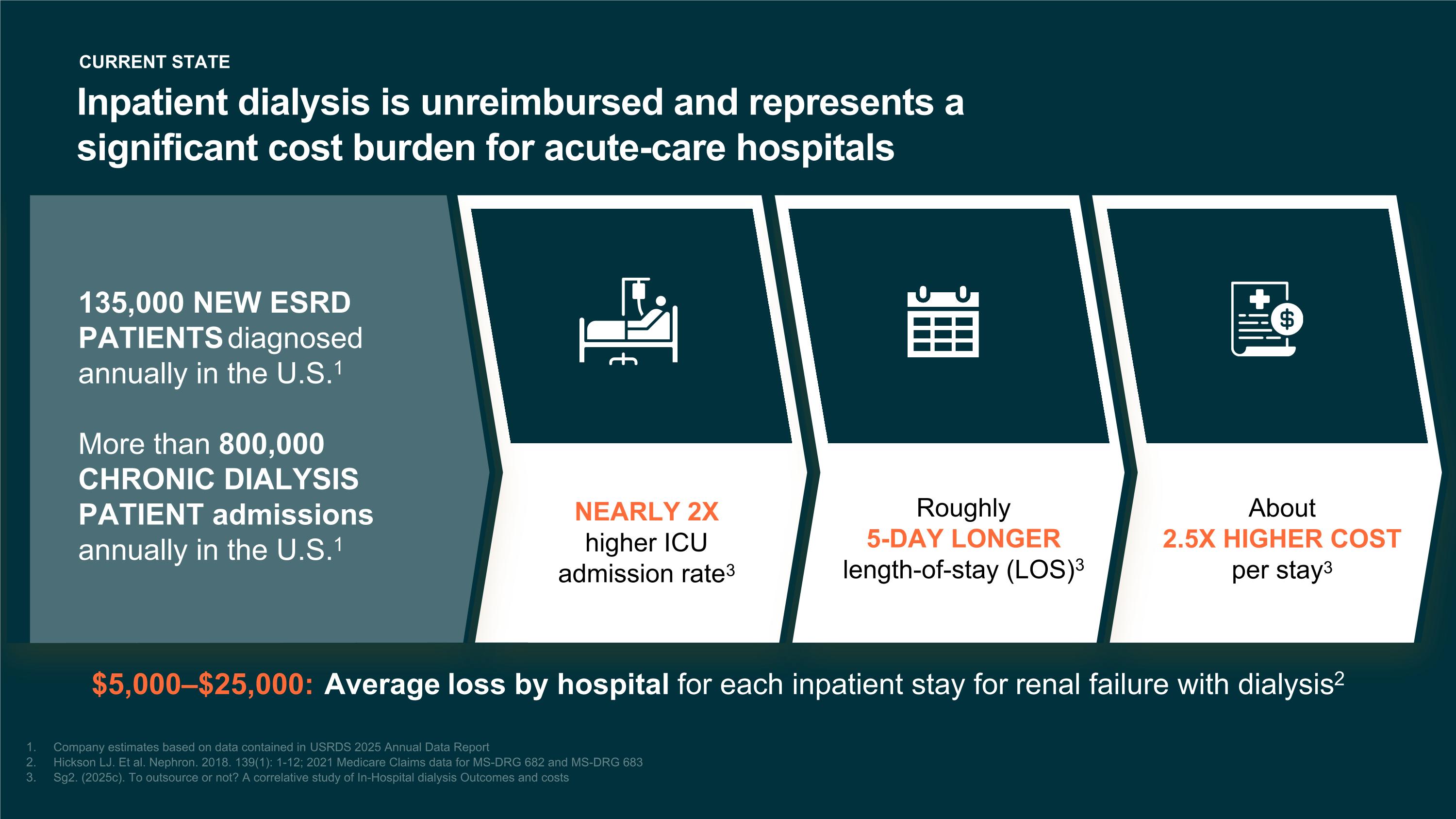

CURRENT STATE NEARLY 2X higher ICU admission rate3 About 2.5X HIGHER COST per stay3 Roughly 5-DAY LONGER length-of-stay (LOS)3 $5,000–$25,000: Average loss by hospital for each inpatient stay for renal failure with dialysis2 135,000 NEW ESRD PATIENTS diagnosed annually in the U.S.1 More than 800,000 CHRONIC DIALYSIS PATIENT admissions annually in the U.S.1 Inpatient dialysis is unreimbursed and represents a significant cost burden for acute-care hospitals Company estimates based on data contained in USRDS 2025 Annual Data Report Hickson LJ. Et al. Nephron. 2018. 139(1): 1-12; 2021 Medicare Claims data for MS-DRG 682 and MS-DRG 683 Sg2. (2025c). To outsource or not? A correlative study of In-Hospital dialysis Outcomes and costs

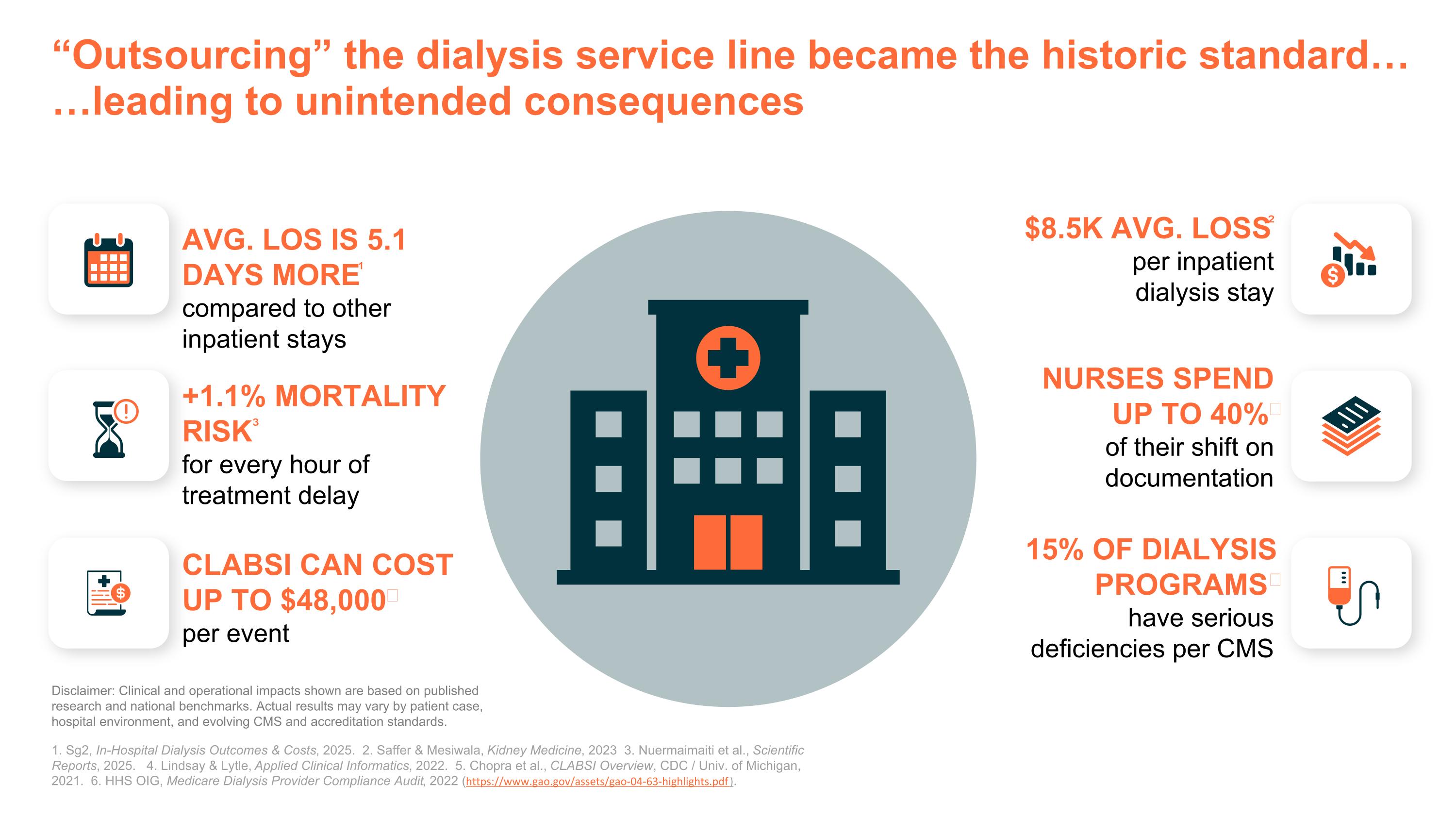

“Outsourcing” the dialysis service line became the historic standard… …leading to unintended consequences 1. Sg2, In-Hospital Dialysis Outcomes & Costs, 2025. 2. Saffer & Mesiwala, Kidney Medicine, 2023 3. Nuermaimaiti et al., Scientific Reports, 2025. 4. Lindsay & Lytle, Applied Clinical Informatics, 2022. 5. Chopra et al., CLABSI Overview, CDC / Univ. of Michigan, 2021. 6. HHS OIG, Medicare Dialysis Provider Compliance Audit, 2022 (https://www.gao.gov/assets/gao-04-63-highlights.pdf). $8.5K AVG. LOSS² per inpatient dialysis stay NURSES SPEND UP TO 40%⁴ of their shift on documentation +1.1% MORTALITY RISK³ for every hour of treatment delay CLABSI CAN COST UP TO $48,000⁵ per event AVG. LOS IS 5.1 DAYS MORE¹ compared to other inpatient stays 15% OF DIALYSIS PROGRAMS⁶ have serious deficiencies per CMS Disclaimer: Clinical and operational impacts shown are based on published research and national benchmarks. Actual results may vary by patient case, hospital environment, and evolving CMS and accreditation standards.

We see a better way forward

Tablo® is a first-of-its- kind technology designed to reduce the cost and complexity of dialysis Connected and intelligent Small and mobile Single device from bedside to ICU

A comprehensive enterprise dialysis solution Data Analytics & Fleet Management EMR Interoperability Implementation Services & Bridge Nursing Advanced Service & Support Tools

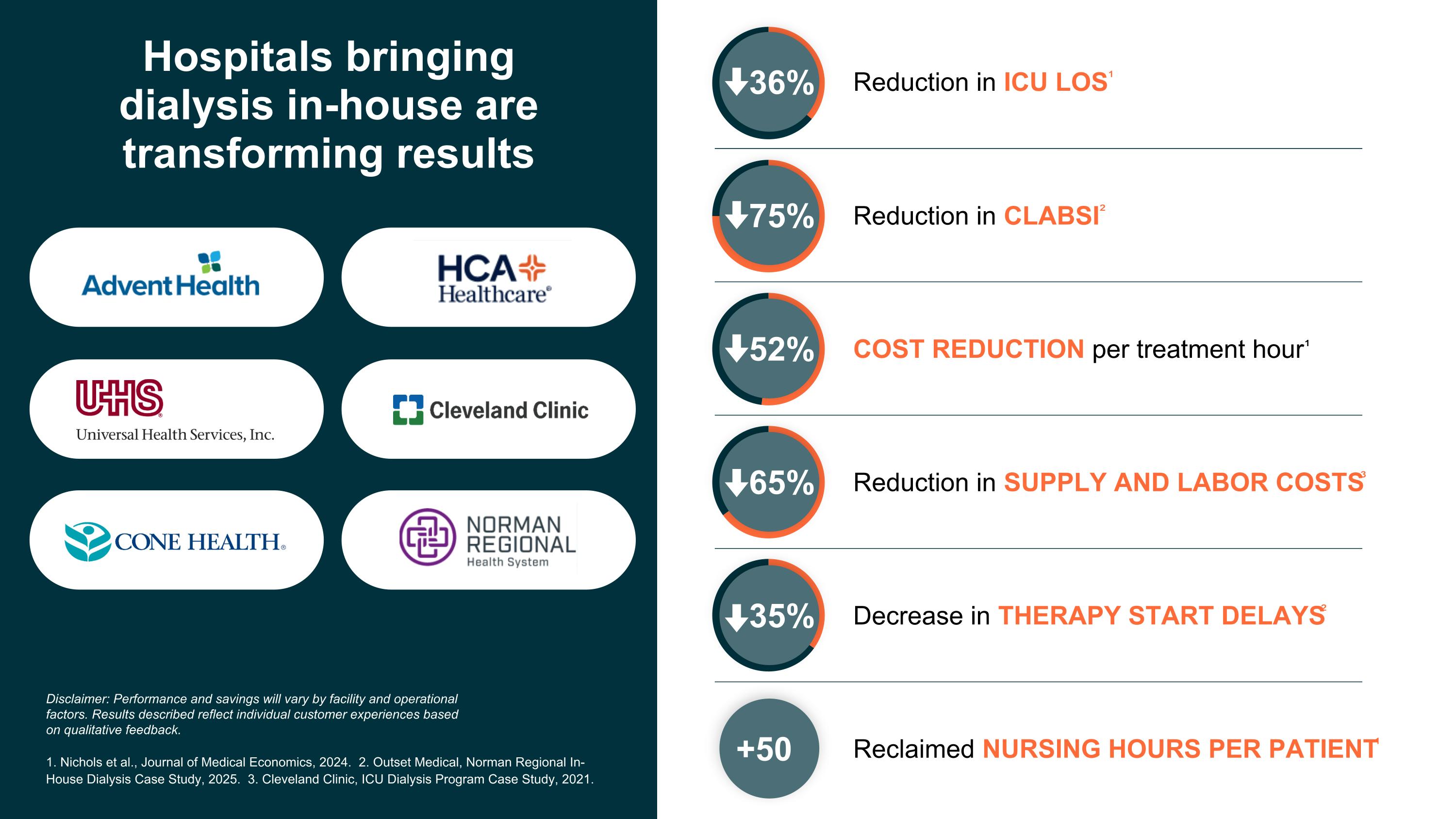

Hospitals bringing dialysis in-house are transforming results 1. Nichols et al., Journal of Medical Economics, 2024. 2. Outset Medical, Norman Regional In-House Dialysis Case Study, 2025. 3. Cleveland Clinic, ICU Dialysis Program Case Study, 2021. 36% Reduction in ICU LOS¹ Reduction in CLABSI² COST REDUCTION per treatment hour¹ Reduction in SUPPLY AND LABOR COSTS³ Decrease in THERAPY START DELAYS² Reclaimed NURSING HOURS PER PATIENT¹ Disclaimer: Performance and savings will vary by facility and operational factors. Results described reflect individual customer experiences based on qualitative feedback. 75% 52% 65% 35% +50

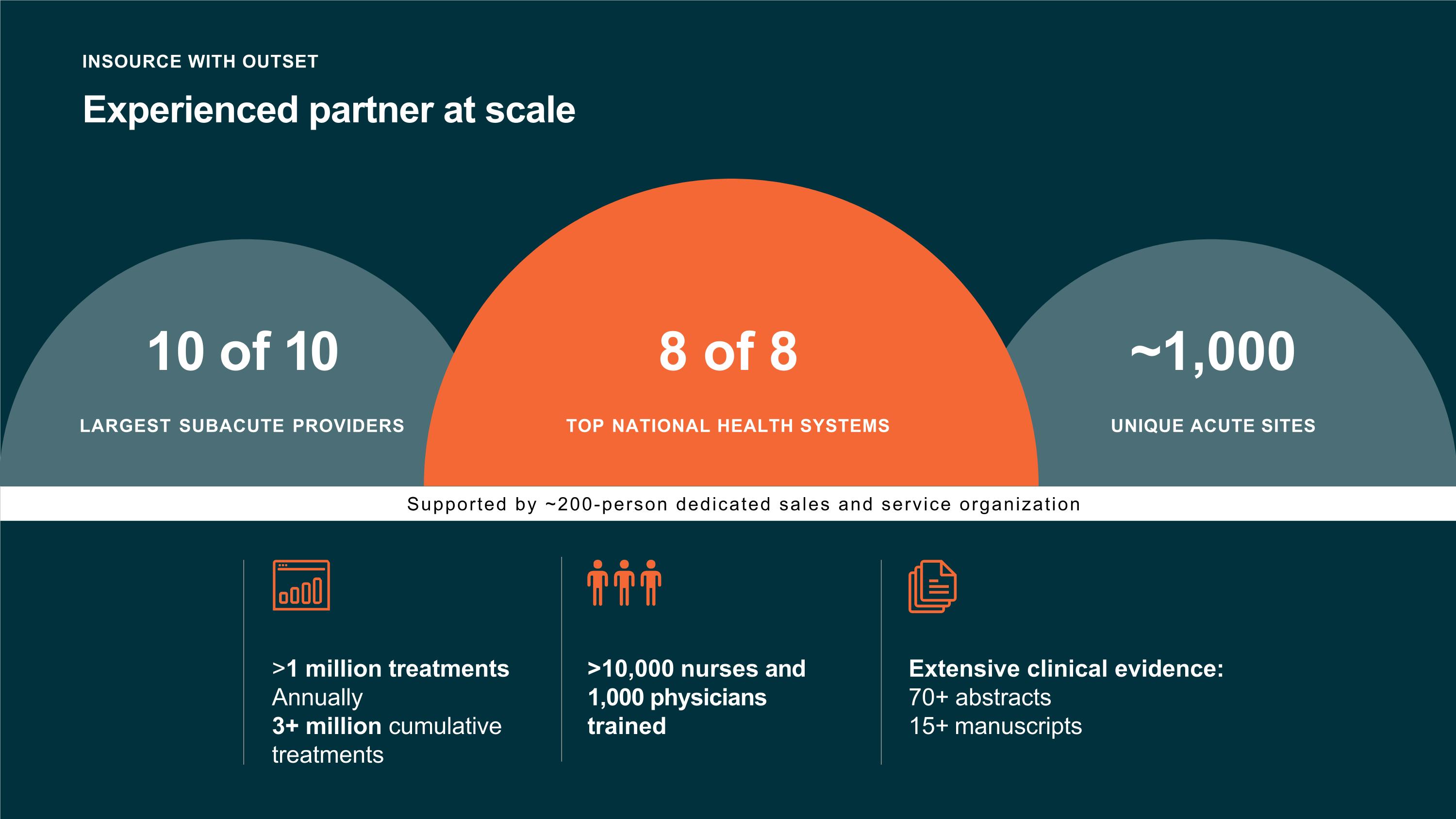

INSOURCE WITH OUTSET Experienced partner at scale >1 million treatments Annually 3+ million cumulative treatments >10,000 nurses and 1,000 physicians trained 10 of 10 LARGEST SUBACUTE PROVIDERS ~1,000 UNIQUE ACUTE SITES 8 of 8 TOP NATIONAL HEALTH SYSTEMS Extensive clinical evidence: 70+ abstracts 15+ manuscripts Supported by ~200-person dedicated sales and service organization

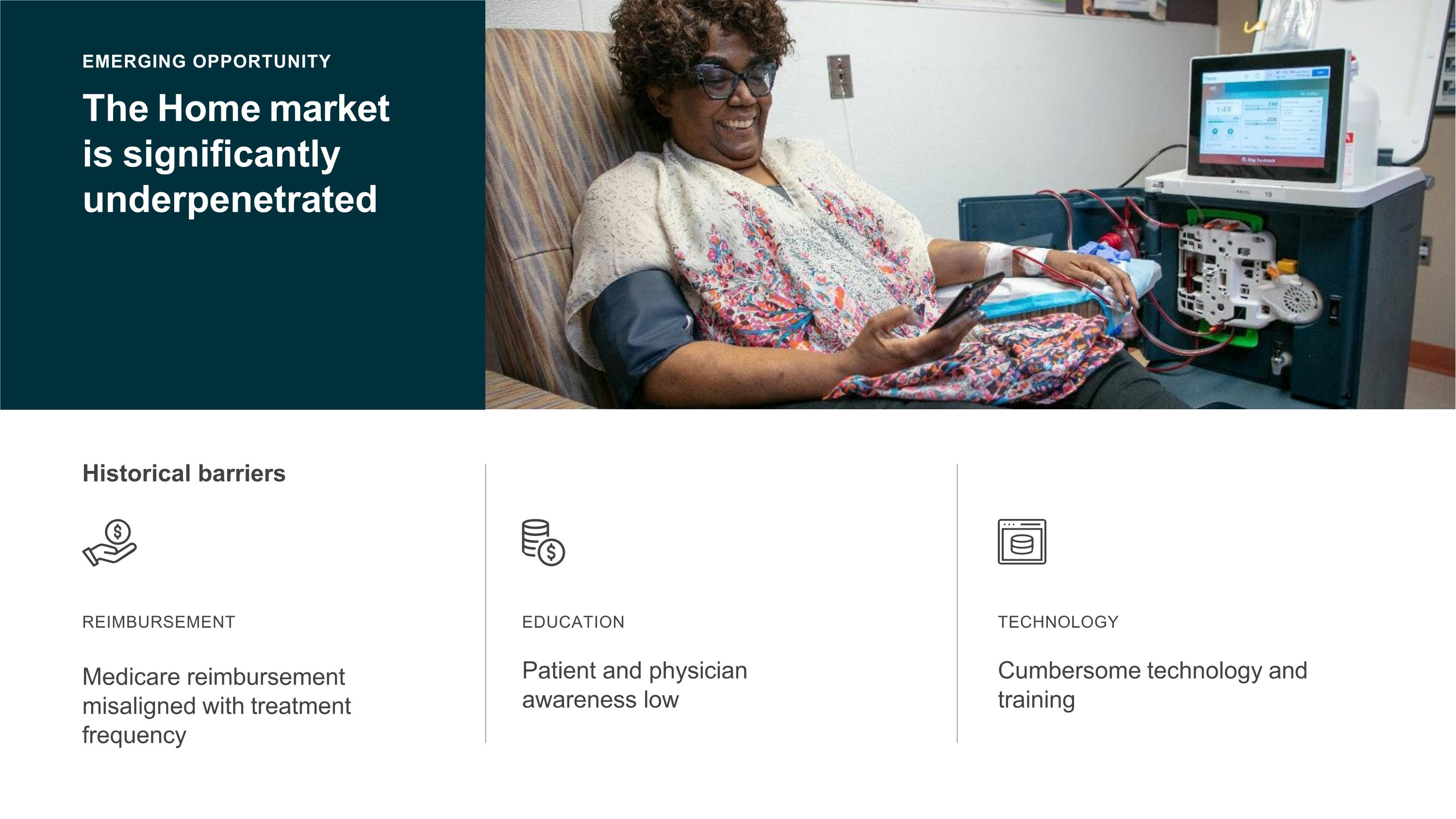

The Home market is significantly underpenetrated EMERGING OPPORTUNITY REIMBURSEMENT Medicare reimbursement misaligned with treatment frequency Historical barriers EDUCATION Patient and physician awareness low TECHNOLOGY Cumbersome technology and training

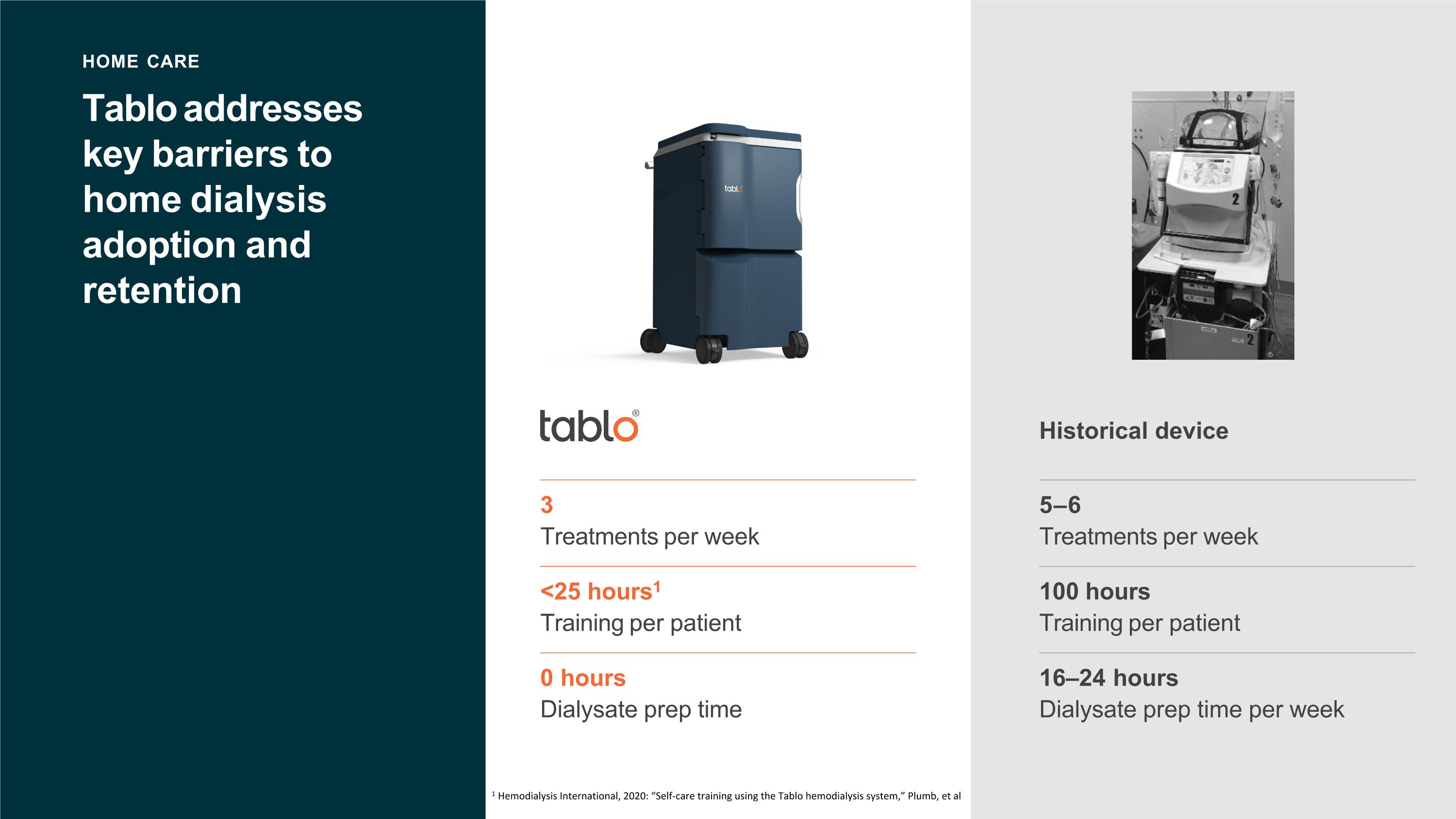

Tablo addresses key barriers to home dialysis adoption and retention HOME CARE 5–6 Treatments per week 100 hours Training per patient 16–24 hours Dialysate prep time per week Historical device 3 Treatments per week <25 hours1 Training per patient 0 hours Dialysate prep time 1 Hemodialysis International, 2020: “Self-care training using the Tablo hemodialysis system,” Plumb, et al

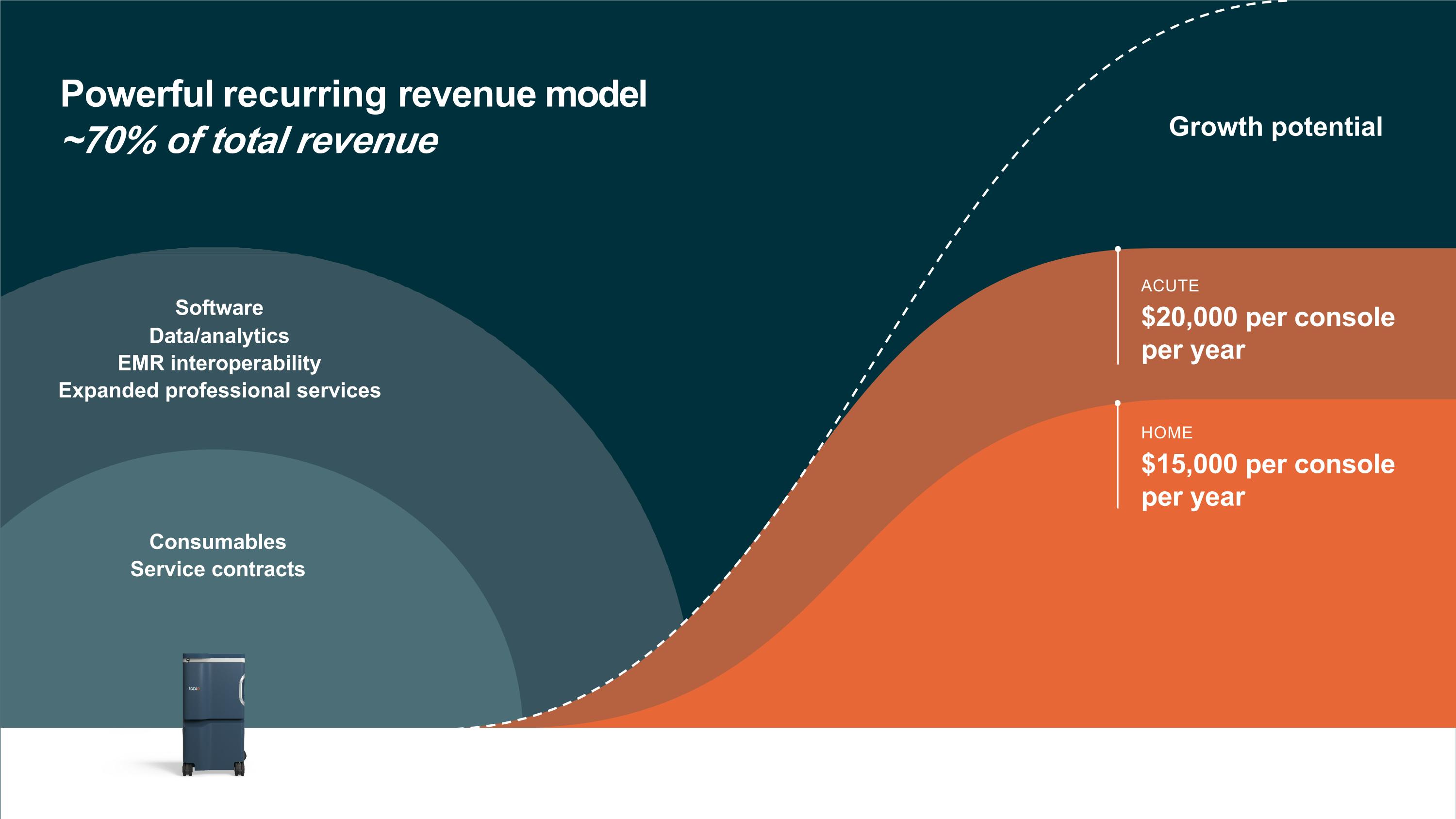

Software Data/analytics EMR interoperability Expanded professional services Consumables Service contracts Powerful recurring revenue model ~70% of total revenue ACUTE $20,000 per console per year HOME $15,000 per console per year Growth potential

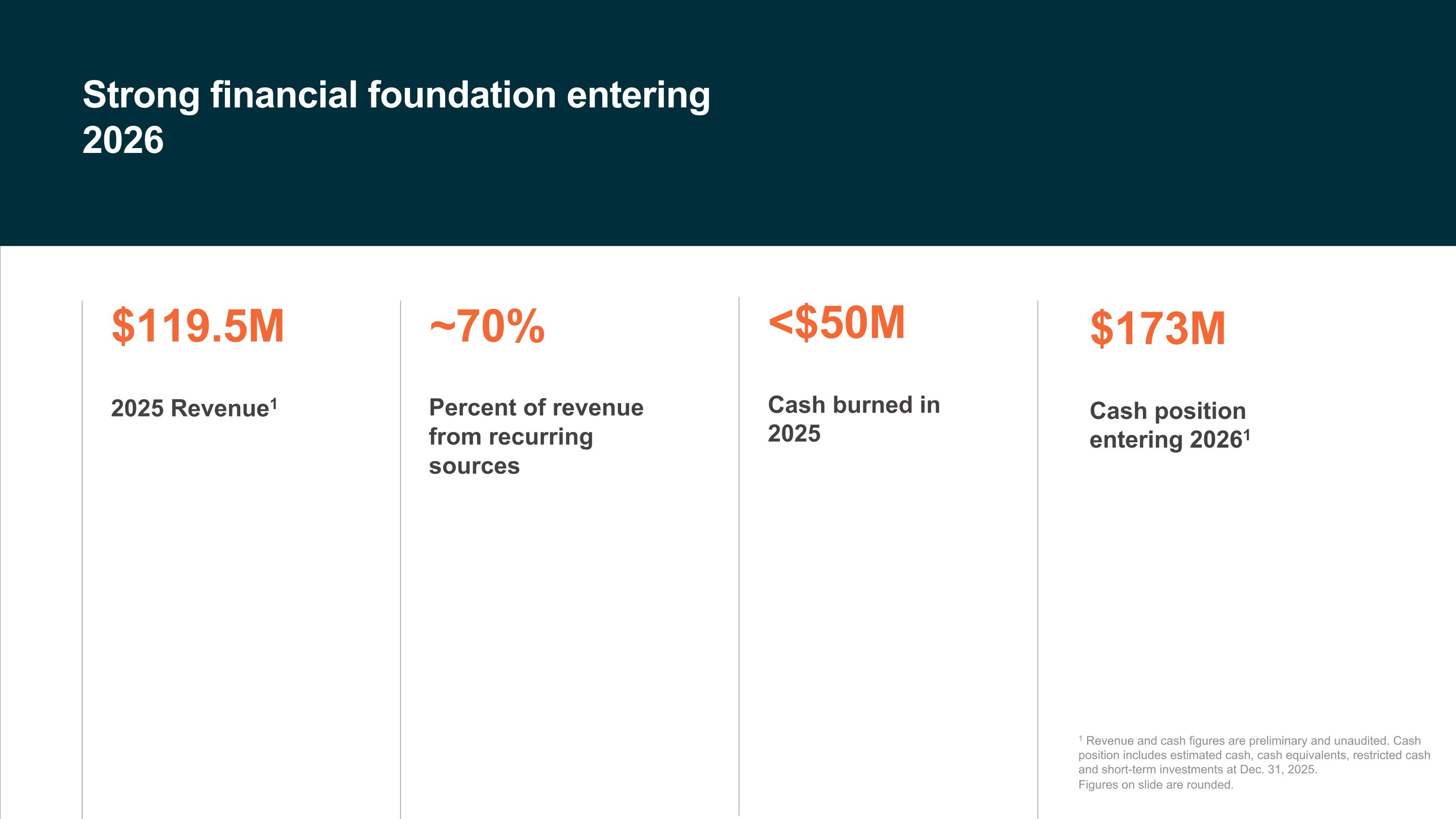

Strong financial foundation entering 2026 2025 Revenue1 $119.5M ~70% Percent of revenue from recurring sources 1 Revenue and cash figures are preliminary and unaudited. Cash position includes estimated cash, cash equivalents, restricted cash and short-term investments at Dec. 31, 2025. Figures on slide are rounded. Cash burned in 2025 <$50M Cash position entering 20261 $173M

Outset Medical 3052 Orchard Drive San Jose, CA 95134 outsetmedical.com For Important safety information, please refer to: https://www.outsetmedical.com/indications/