NASDAQ: ATOS www.atossatherapeutics.com Corporate Presentation September 26, 2025 COVER

Disclaimer This presentation may contain certain forward-looking statements related to or Atossa Therapeutics, Inc. (the “Company”) that involve risks and uncertainties. 01 Actual results and events may differ significantly from results and events discussed in forward-looking statements. 02 Factors that might cause or contribute to such differences include, but are not limited to, those discussed in “Risk Factors” in the Company’s Annual Reports on Form 10-K and subsequent Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. 03 The Company undertakes no obligation to update publicly any forward-looking statements to reflect new information, events, or circumstances after the date they were made. 04 This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. 05 The Company may not yet have received clearance from the FDA or any other regulatory agency for some of the products described in this presentation. 06

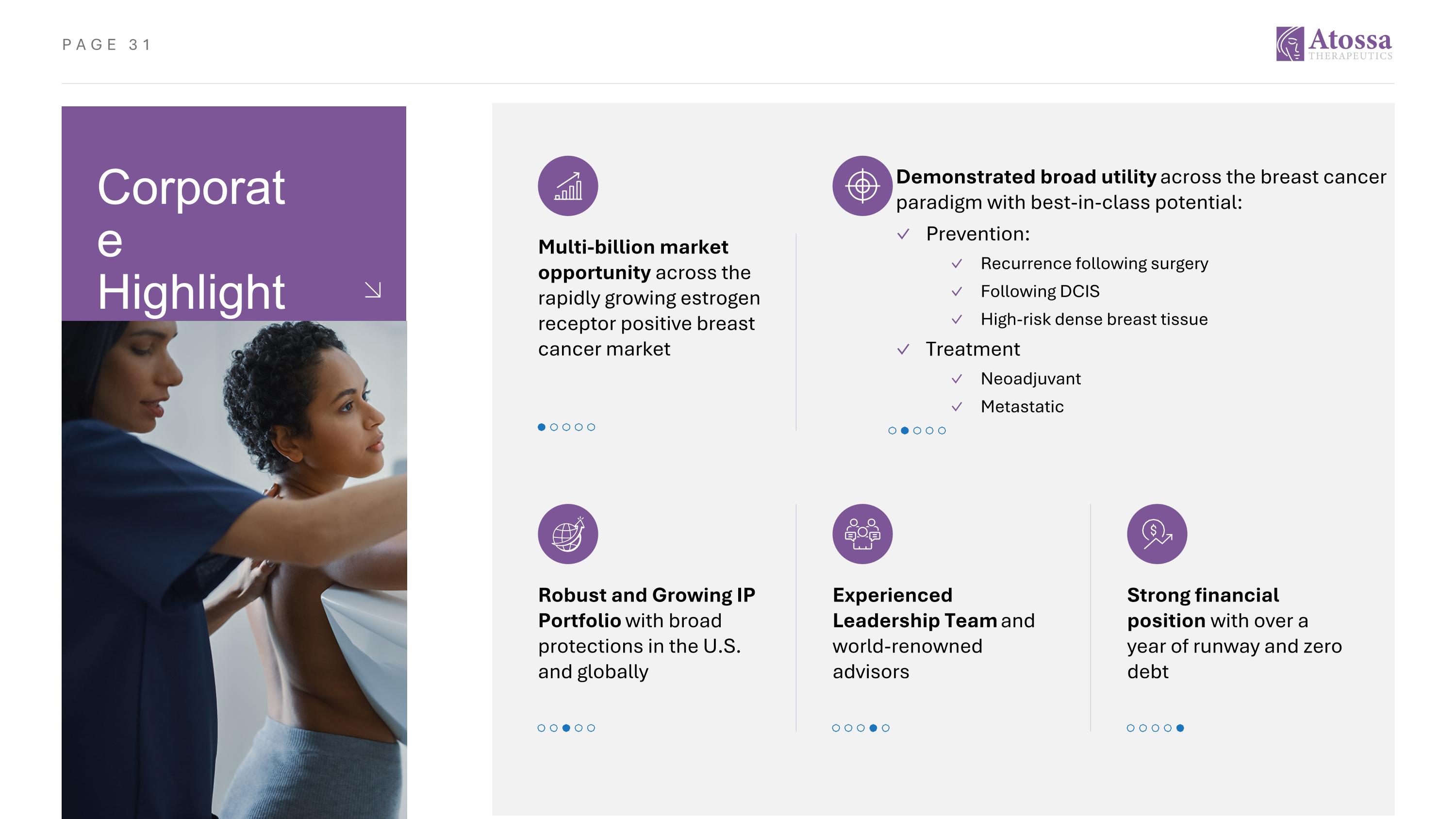

Corporate Highlights Multi-billion market opportunity across the rapidly growing estrogen receptor positive breast cancer market Demonstrated broad utility across the breast cancer paradigm with best-in-class potential: Prevention: Recurrence following surgery Following DCIS High-risk dense breast tissue Treatment Neoadjuvant Metastatic Robust and Growing IP Portfolio with broad protections in the U.S. and globally Strong financial position with over a year of runway and zero debt Experienced Leadership Team and world-renowned advisors

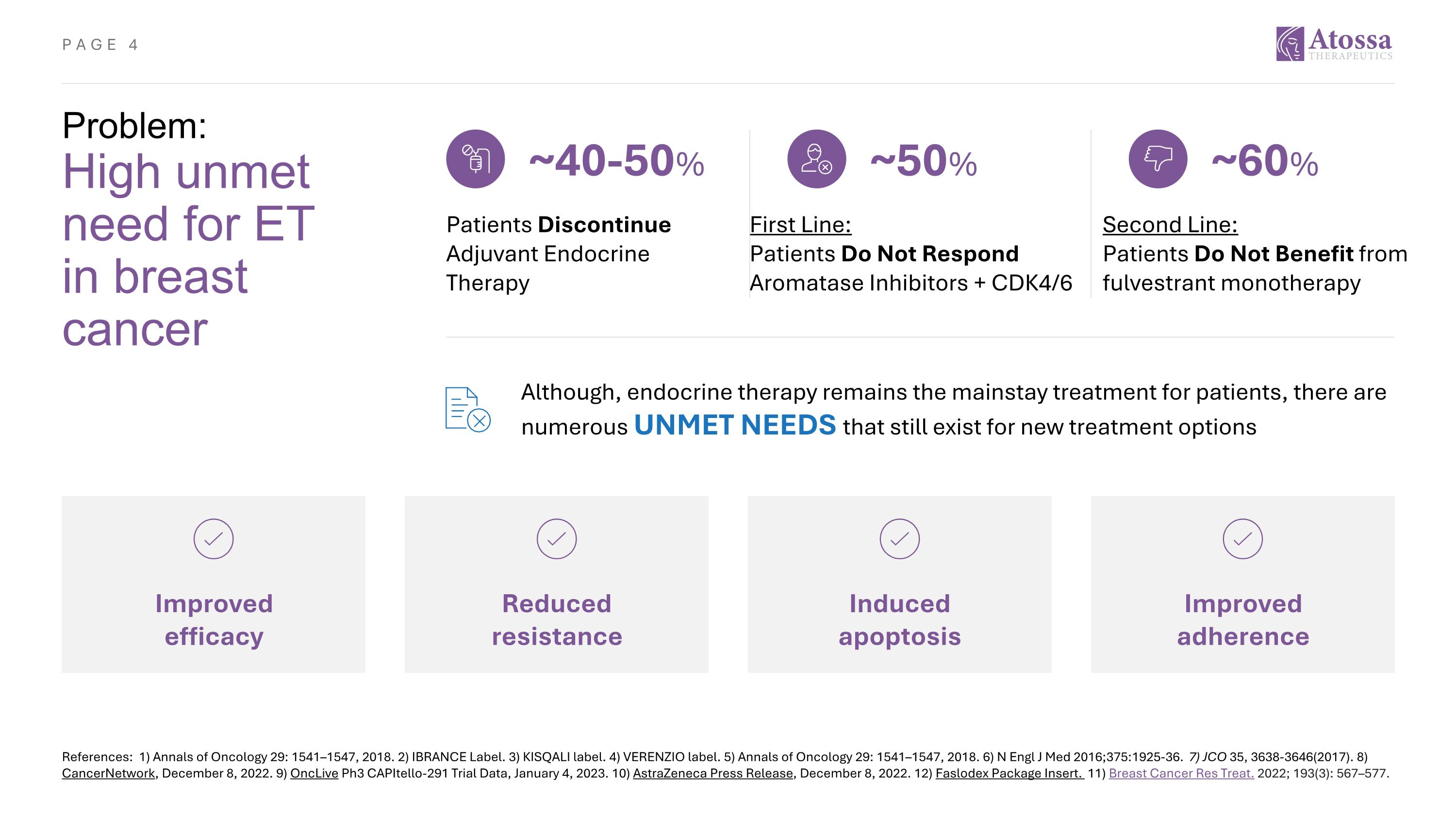

Problem: High unmet need for ET in breast cancer References: 1) Annals of Oncology 29: 1541–1547, 2018. 2) IBRANCE Label. 3) KISQALI label. 4) VERENZIO label. 5) Annals of Oncology 29: 1541–1547, 2018. 6) N Engl J Med 2016;375:1925-36. 7) JCO 35, 3638-3646(2017). 8) CancerNetwork, December 8, 2022. 9) OncLive Ph3 CAPItello-291 Trial Data, January 4, 2023. 10) AstraZeneca Press Release, December 8, 2022. 12) Faslodex Package Insert. 11) Breast Cancer Res Treat. 2022; 193(3): 567–577. Although, endocrine therapy remains the mainstay treatment for patients, there are numerous UNMET NEEDS that still exist for new treatment options ~50% First Line: Patients Do Not Respond Aromatase Inhibitors + CDK4/6 Patients Discontinue Adjuvant Endocrine Therapy ~40-50% ~60% Second Line: Patients Do Not Benefit from fulvestrant monotherapy Improved adherence Induced apoptosis Reduced resistance Improved efficacy

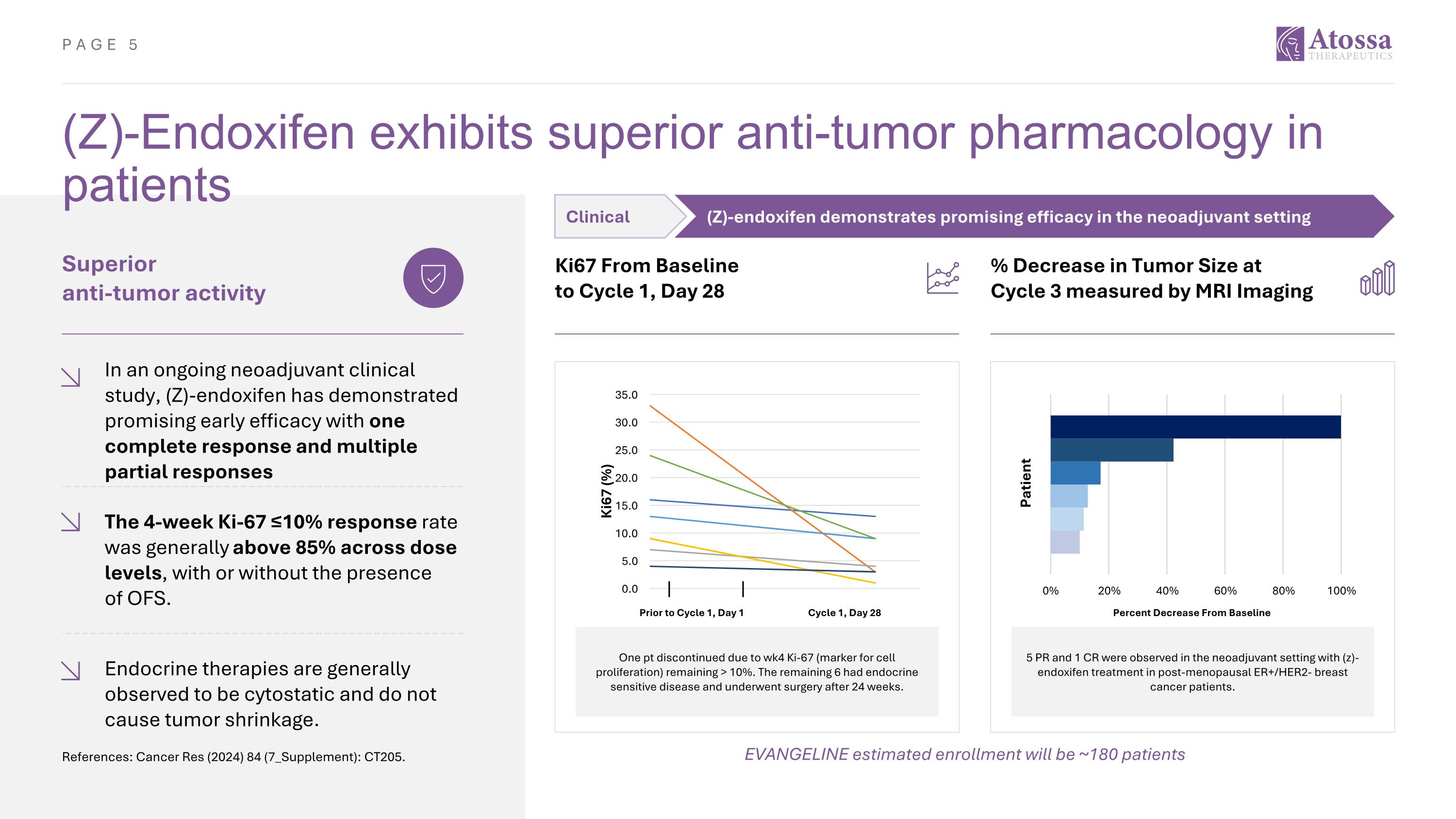

(Z)-Endoxifen exhibits superior anti-tumor pharmacology in patients Superior anti-tumor activity In an ongoing neoadjuvant clinical study, (Z)-endoxifen has demonstrated promising early efficacy with one complete response and multiple partial responses The 4-week Ki-67 ≤10% response rate was generally above 85% across dose levels, with or without the presence of OFS. Ki67 From Baseline to Cycle 1, Day 28 Endocrine therapies are generally observed to be cytostatic and do not cause tumor shrinkage. % Decrease in Tumor Size at Cycle 3 measured by MRI Imaging One pt discontinued due to wk4 Ki-67 (marker for cell proliferation) remaining > 10%. The remaining 6 had endocrine sensitive disease and underwent surgery after 24 weeks. Prior to Cycle 1, Day 1 Cycle 1, Day 28 5 PR and 1 CR were observed in the neoadjuvant setting with (z)-endoxifen treatment in post-menopausal ER+/HER2- breast cancer patients. Percent Decrease From Baseline EVANGELINE estimated enrollment will be ~180 patients References: Cancer Res (2024) 84 (7_Supplement): CT205. Clinical (Z)-endoxifen demonstrates promising efficacy in the neoadjuvant setting

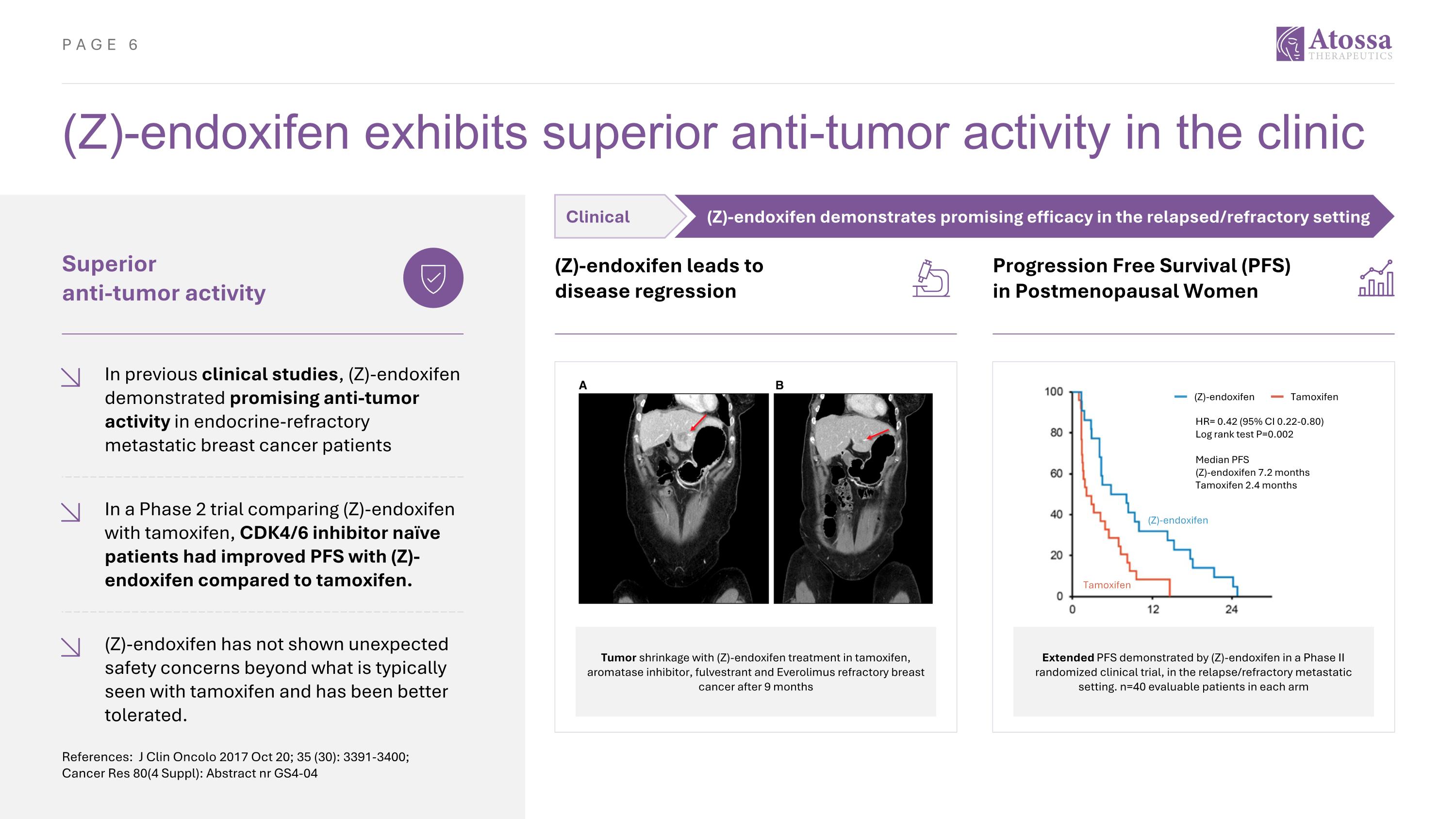

(Z)-endoxifen exhibits superior anti-tumor activity in the clinic References: J Clin Oncolo 2017 Oct 20; 35 (30): 3391-3400; Cancer Res 80(4 Suppl): Abstract nr GS4-04 Superior anti-tumor activity In previous clinical studies, (Z)-endoxifen demonstrated promising anti-tumor activity in endocrine-refractory metastatic breast cancer patients (Z)-endoxifen leads to disease regression Tumor shrinkage with (Z)-endoxifen treatment in tamoxifen, aromatase inhibitor, fulvestrant and Everolimus refractory breast cancer after 9 months In a Phase 2 trial comparing (Z)-endoxifen with tamoxifen, CDK4/6 inhibitor naïve patients had improved PFS with (Z)-endoxifen compared to tamoxifen. (Z)-endoxifen has not shown unexpected safety concerns beyond what is typically seen with tamoxifen and has been better tolerated. Progression Free Survival (PFS) in Postmenopausal Women Extended PFS demonstrated by (Z)-endoxifen in a Phase II randomized clinical trial, in the relapse/refractory metastatic setting. n=40 evaluable patients in each arm (Z)-endoxifen Tamoxifen HR= 0.42 (95% CI 0.22-0.80) Log rank test P=0.002 Median PFS (Z)-endoxifen 7.2 months Tamoxifen 2.4 months (Z)-endoxifen Tamoxifen Clinical (Z)-endoxifen demonstrates promising efficacy in the relapsed/refractory setting

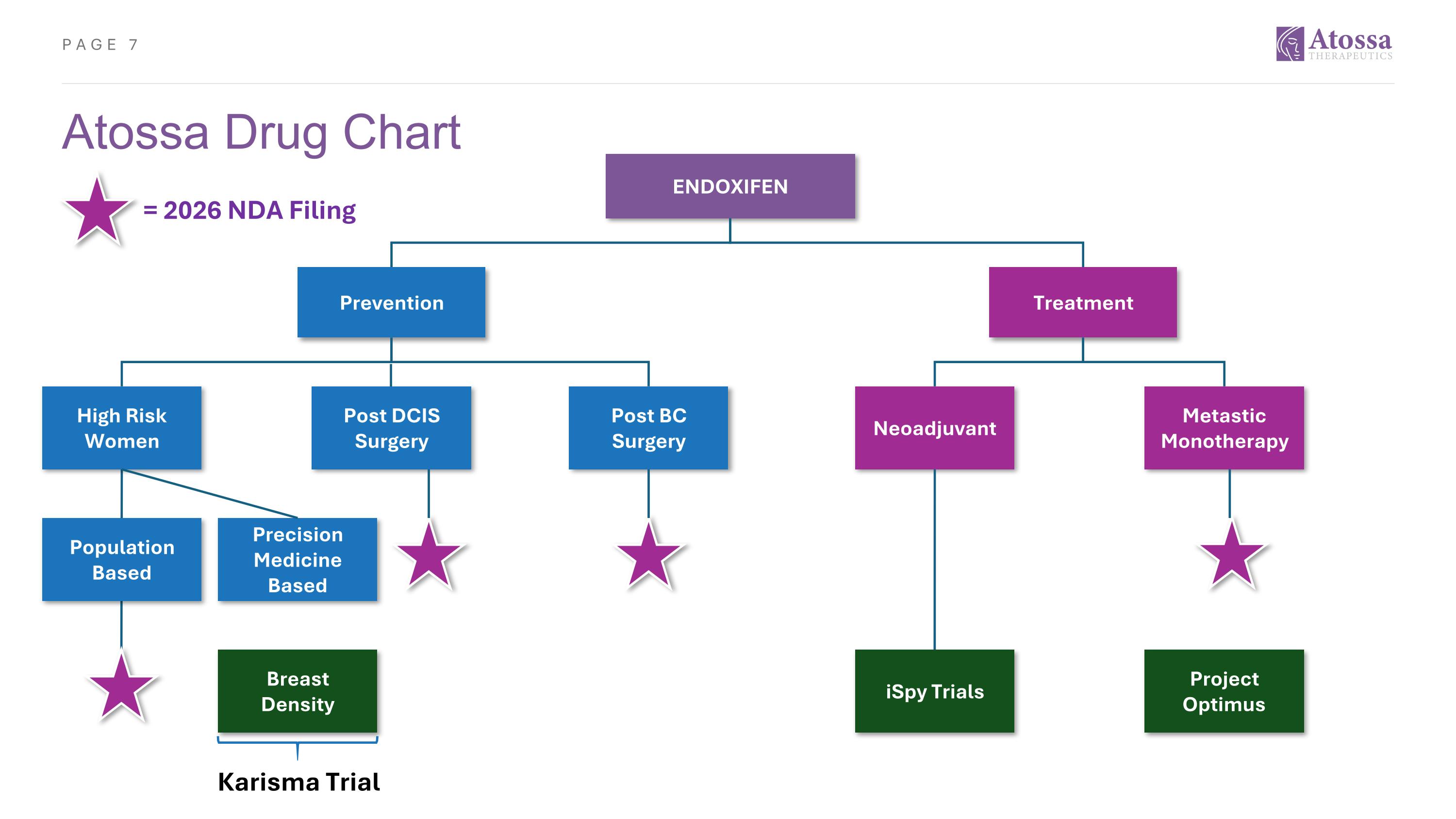

Atossa Drug Chart ENDOXIFEN Prevention Treatment High Risk Women Post DCIS Surgery Post BC Surgery Neoadjuvant Metastic Monotherapy Population Based Breast Density Precision Medicine Based iSpy Trials Project Optimus Karisma Trial = 2026 NDA Filing

Prevention: The 80% Opportunity Post-Surgery Adjuvant (700k–900k women annually on tamoxifen/aromatase inhibitors) DCIS (Stage 0) Post-Surgery – high 5-year progression risk (~25% if untreated) High-Risk Women (Pre-cancer) – ~1.7M eligible for prevention dosing Dose: 1–5mg/day Target Price: $5,000–$15,000 per year per patient Goal: Replace tamoxifen across all 3 prevention categories

Treatment: Two Distinct Use Cases Neoadjuvant (Evangeline): 86% Ki67 suppression within 28 days Unmet space (no currently approved ETs) Future NDA path after initial approval Metastatic (Project Optimus): Refractory patients (Tamoxifen/AI/Fulvestrant failures) High-dose strategy: 20–60 mg/day Target Price: $50,000–$150,000 per patient per year

Endoxifen Dose and Pricing: 10x Scale Logic Prevention dosing: 1–5 mg/day → $5K–$15K/year (Note) Treatment dosing: 20–60 mg/day → $50K–$150K/year (Note) Reflects 10x dose and 10x pricing logic across indications Enables commercial model to scale with clinical need Note: Based on comparable pricing for marketed breast cancer products in the U.S.

Clinical Rationale: Why We Started in Neoadjuvant Goal: Understand endoxifen’s value proposition quickly Neoadjuvant trials offer fast biomarker readouts: Ki67 (28 days), MRI (8 weeks), Surgery (4 months) Reframing: Early trials were foundational for de-risking and development

Upcoming Milestones Aligned to Strategy 505(b)(2) NDA for Prevention – 2026 filing Project Optimus IND and dose-ranging study – Q4 2025 Karisma prevention trial – readouts pending Evangeline trial update – reframed as clinical MoA study I-SPY trial (combination strategy) – to validate CDK4/6 pairing

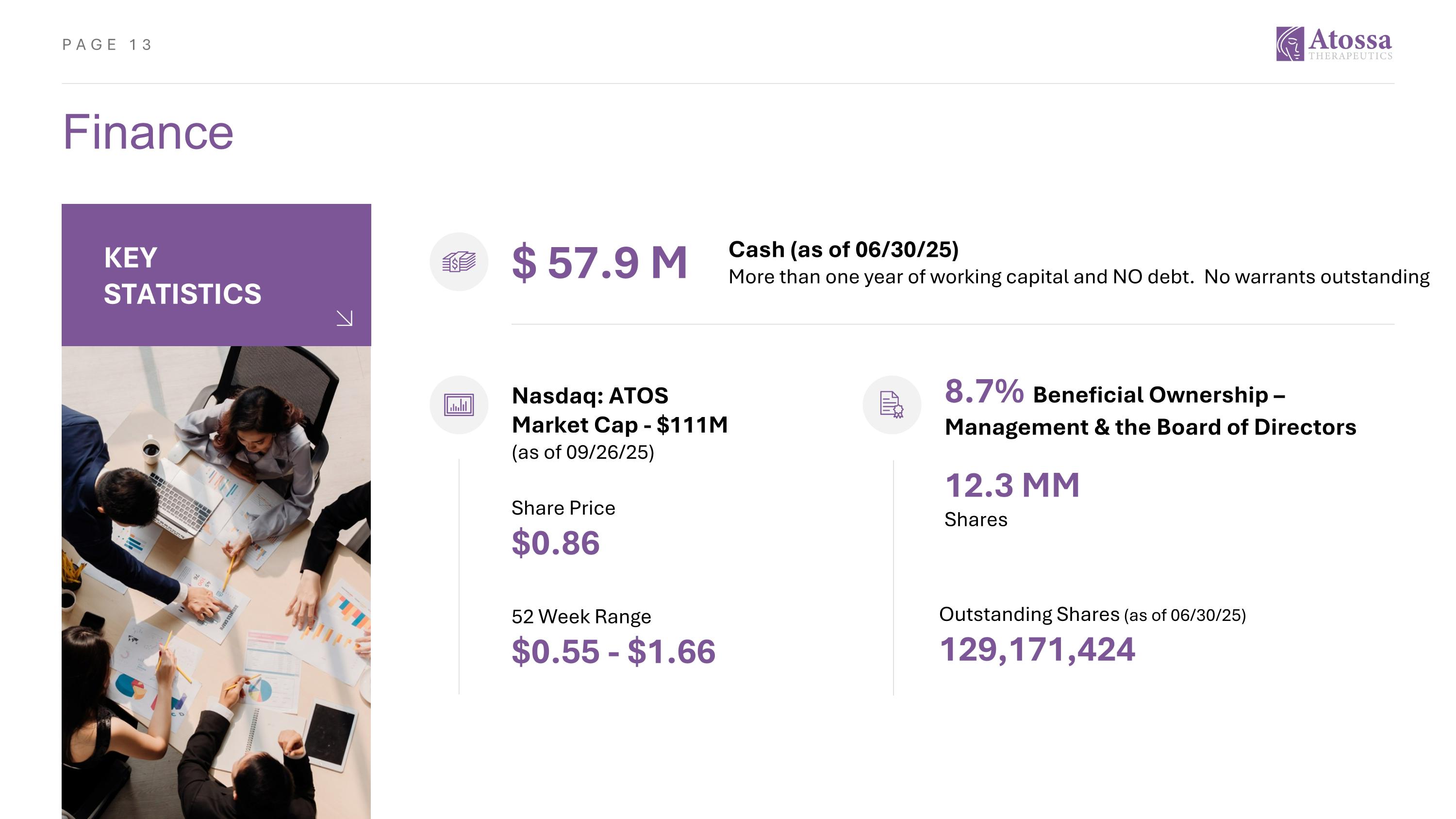

Finance $ 57.9 M Share Price $0.86 52 Week Range $0.55 - $1.66 Outstanding Shares (as of 06/30/25) 129,171,424 Nasdaq: ATOS Market Cap - $111M (as of 09/26/25) Cash (as of 06/30/25) More than one year of working capital and NO debt. No warrants outstanding KEY STATISTICS 12.3 MM Shares 8.7% Beneficial Ownership – Management & the Board of Directors

Experienced Leadership Chairman, CEO and President Chief Financial Officer and Secretary SVP, Business Operations Steven Quay, MD, PhD Heather Rees, CPA Delly Behen, PHR, SHRM-CP

World-renowned Thought Leadership Karisma Principal Investigator Per Hall, M.D., PhD i-Spy Principal Investigator Laura Esserman, M.D., MBA EVANGELINE Principal Investigator Matthew Goetz, M.D.

NASDAQ: ATOS www.atossatherapeutics.com Thank You Contact: Vivian Cervantes, CORE IR ir@atossatherapeutics.com (212) 655-0924 September 16, 2025 COVER

Appendix

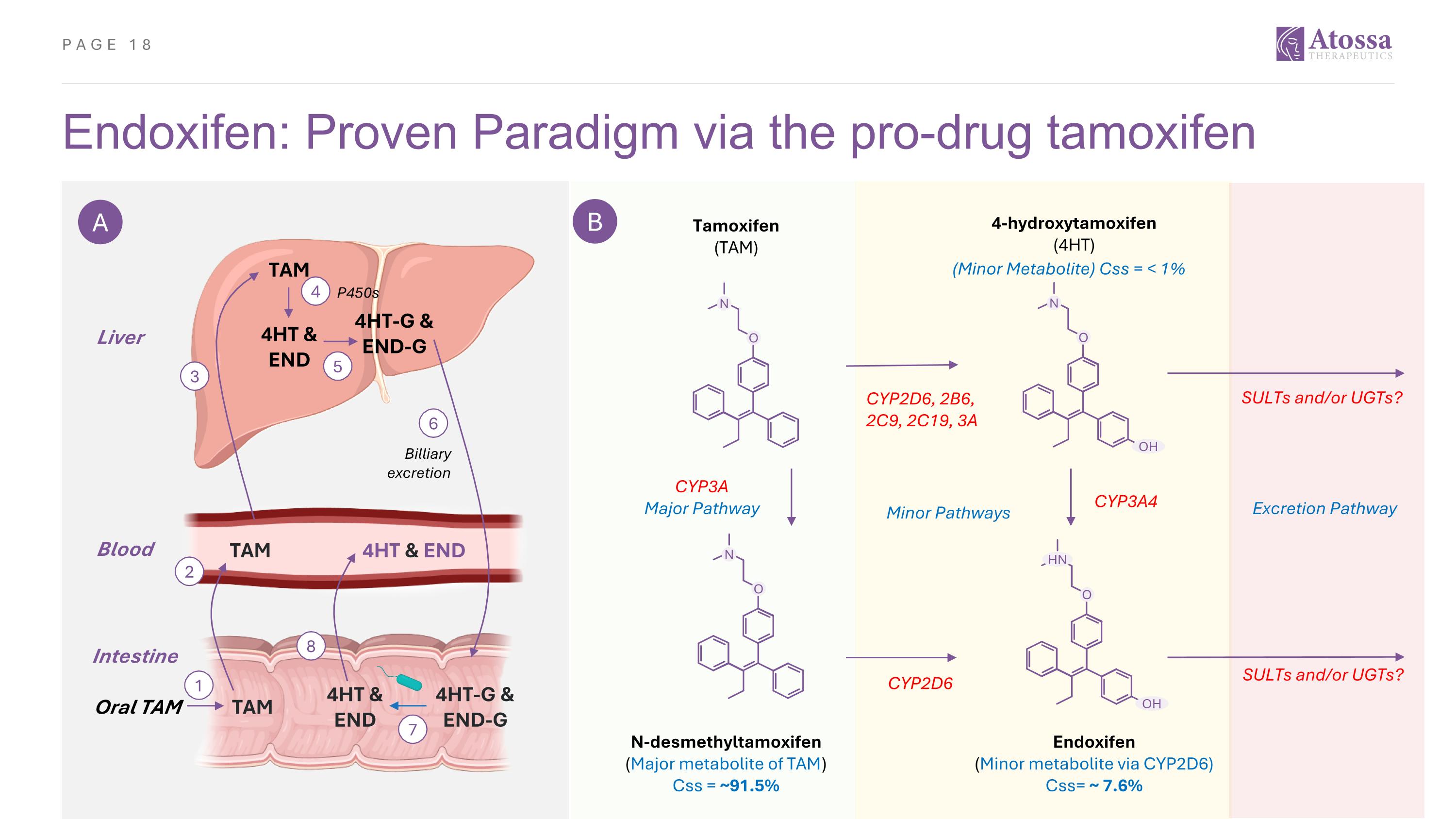

Endoxifen: Proven Paradigm via the pro-drug tamoxifen A B Liver Blood Oral TAM 3 TAM 4HT & END 4HT-G & END-G 4 5 TAM 4HT & END P450s 6 Billiary excretion 2 TAM 4HT & END 4HT-G & END-G 1 Intestine 8 7 Tamoxifen (TAM) 4-hydroxytamoxifen (4HT) N O N O OH N O HN O OH N-desmethyltamoxifen (Major metabolite of TAM) Css = ~91.5% Endoxifen (Minor metabolite via CYP2D6) Css= ~ 7.6% CYP2D6, 2B6, 2C9, 2C19, 3A SULTs and/or UGTs? CYP2D6 CYP3A Major Pathway CYP3A4 Excretion Pathway SULTs and/or UGTs? (Minor Metabolite) Css = < 1% Minor Pathways

(Z)-endoxifen – The New Paradigm with Broad Clinical Utility HN O OH Endoxifen (Z)-endoxifen is NOT your grandmother’s tamoxifen or your mother’s aromatase inhibitor

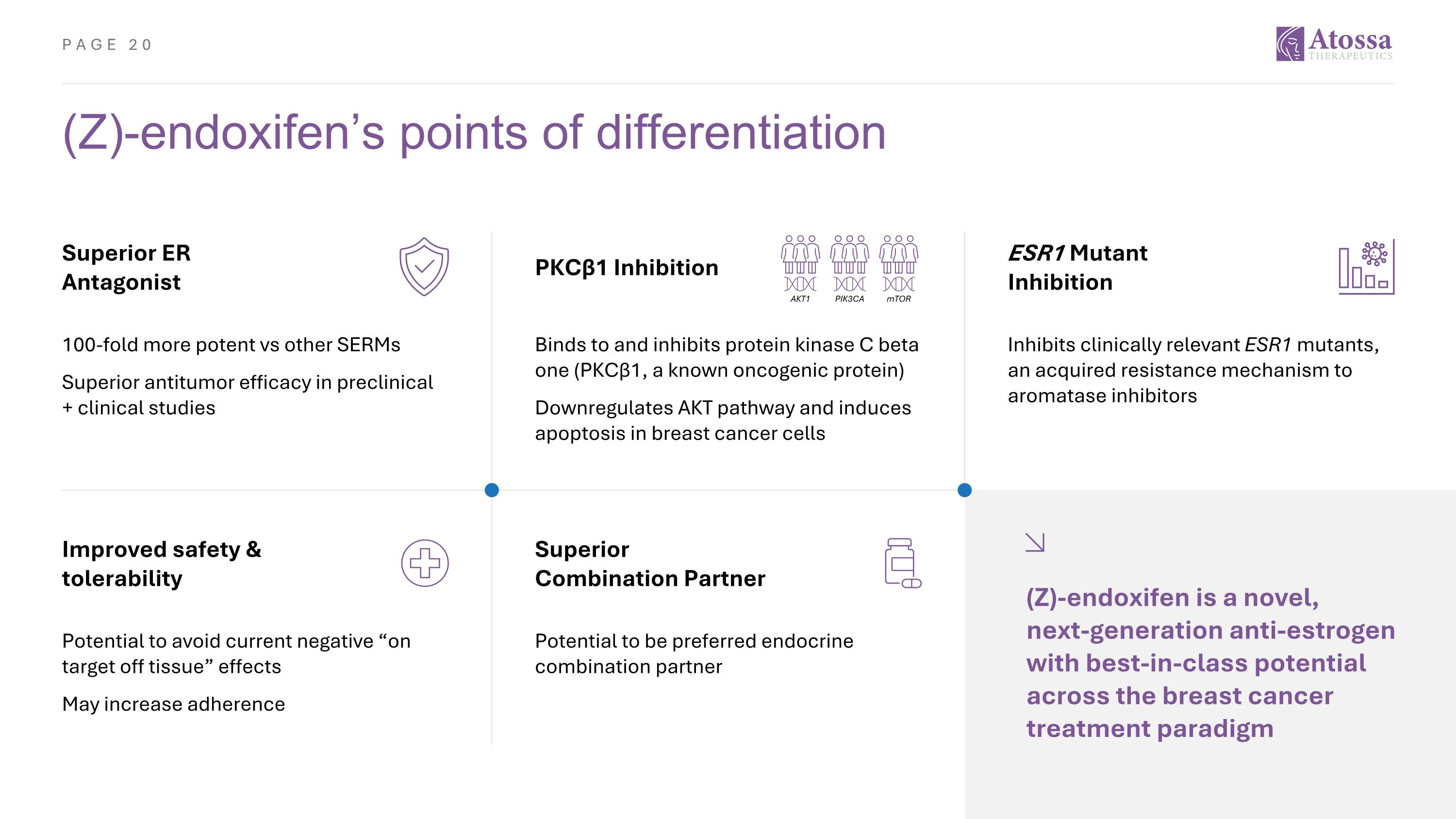

(Z)-endoxifen’s points of differentiation Improved safety & tolerability Potential to avoid current negative “on target off tissue” effects May increase adherence Superior Combination Partner Potential to be preferred endocrine combination partner (Z)-endoxifen is a novel, next-generation anti-estrogen with best-in-class potential across the breast cancer treatment paradigm Superior ER Antagonist 100-fold more potent vs other SERMs Superior antitumor efficacy in preclinical + clinical studies ESR1 Mutant Inhibition Inhibits clinically relevant ESR1 mutants, an acquired resistance mechanism to aromatase inhibitors PKCβ1 Inhibition Binds to and inhibits protein kinase C beta one (PKCβ1, a known oncogenic protein) Downregulates AKT pathway and induces apoptosis in breast cancer cells PIK3CA AKT1 mTOR

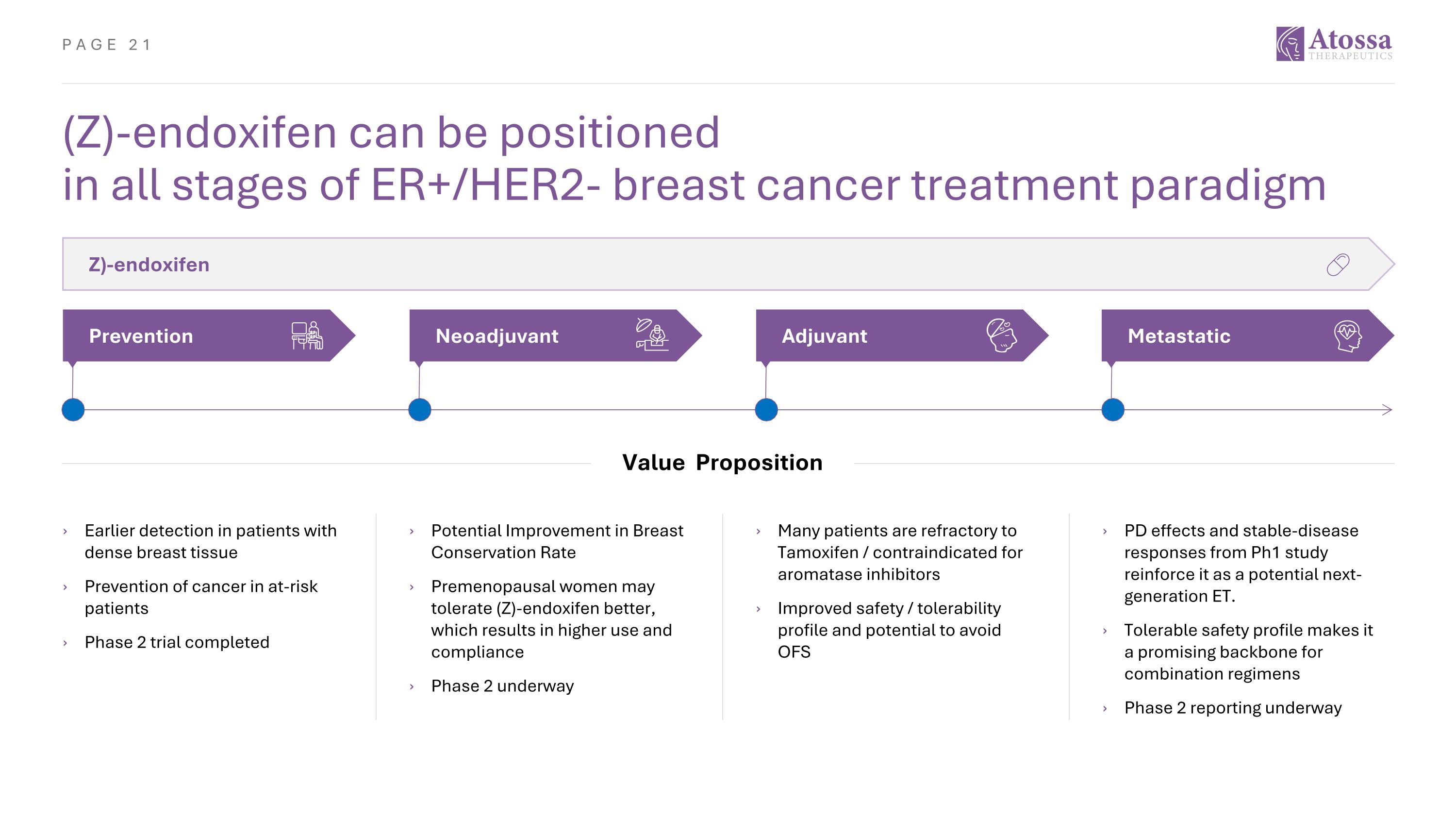

(Z)-endoxifen can be positioned in all stages of ER+/HER2- breast cancer treatment paradigm Z)-endoxifen Metastatic Adjuvant Neoadjuvant Prevention PD effects and stable-disease responses from Ph1 study reinforce it as a potential next-generation ET. Tolerable safety profile makes it a promising backbone for combination regimens Phase 2 reporting underway Many patients are refractory to Tamoxifen / contraindicated for aromatase inhibitors Improved safety / tolerability profile and potential to avoid OFS Potential Improvement in Breast Conservation Rate Premenopausal women may tolerate (Z)-endoxifen better, which results in higher use and compliance Phase 2 underway Value Proposition Earlier detection in patients with dense breast tissue Prevention of cancer in at-risk patients Phase 2 trial completed

(Z)-endoxifen Lead Program - Metastatic Value Proposition PD effects and stable-disease responses from Ph1 study reinforce it as a potential next-generation ET. Tolerable safety profile makes it a promising backbone for combination regimens Phase 2 reporting underway Z)-endoxifen Metastatic – Priority Indication and Major Focus Metastatic provides fastest path to market, highest probability of success Efficient Clinical and Regulatory Path Allows Atossa to more rapidly bring (Z)-endoxifen to patients who need it most. Strengthens foundation for the expansion of (Z)-endoxifen into earlier-stage disease settings. Right sized program for Atossa with significant upside in a therapeutic market projected to reach ~$42 billion by 2030.

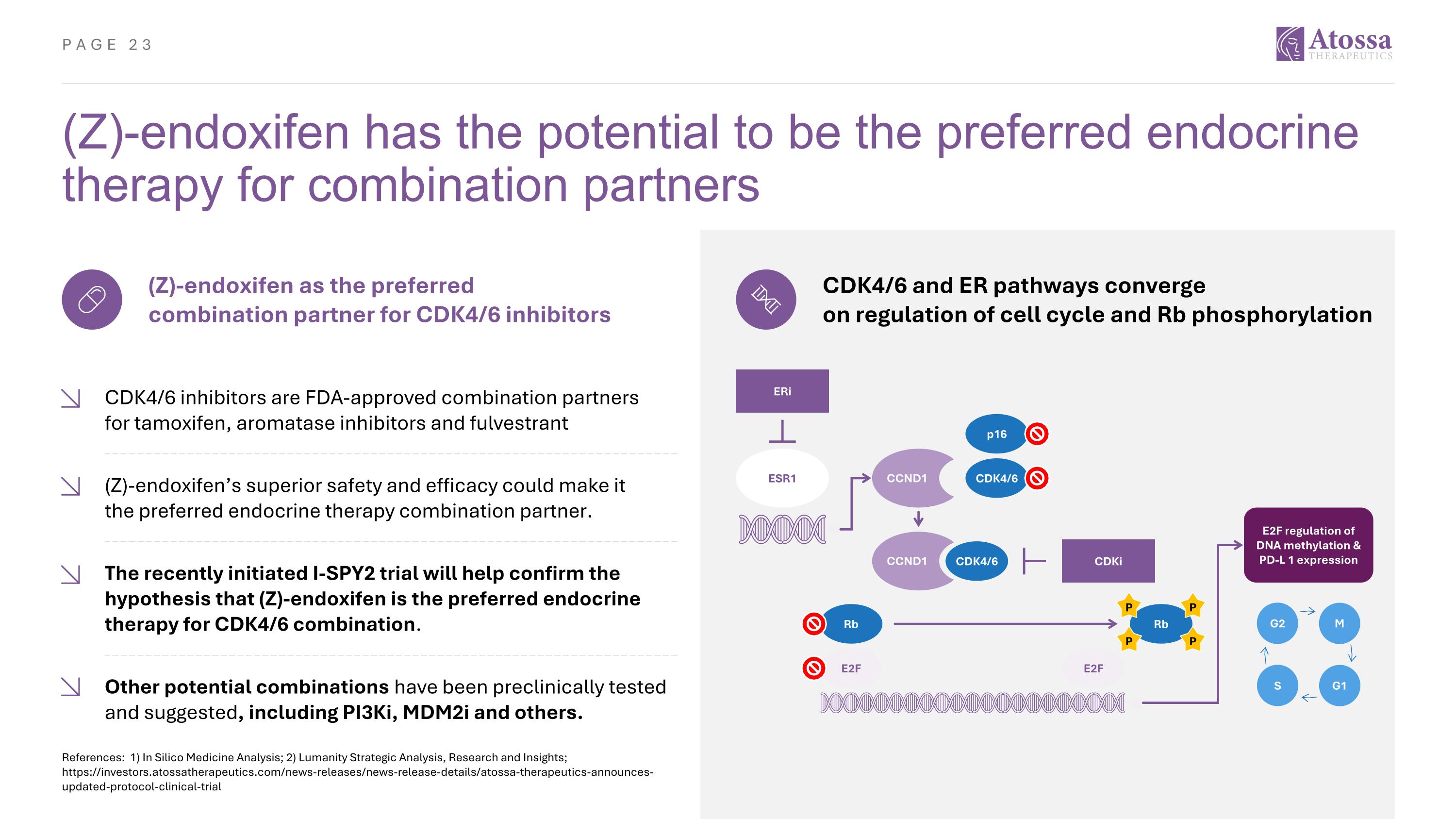

(Z)-endoxifen has the potential to be the preferred endocrine therapy for combination partners References: 1) In Silico Medicine Analysis; 2) Lumanity Strategic Analysis, Research and Insights; https://investors.atossatherapeutics.com/news-releases/news-release-details/atossa-therapeutics-announces-updated-protocol-clinical-trial (Z)-endoxifen as the preferred combination partner for CDK4/6 inhibitors CDK4/6 inhibitors are FDA-approved combination partners for tamoxifen, aromatase inhibitors and fulvestrant (Z)-endoxifen’s superior safety and efficacy could make it the preferred endocrine therapy combination partner. The recently initiated I-SPY2 trial will help confirm the hypothesis that (Z)-endoxifen is the preferred endocrine therapy for CDK4/6 combination. Other potential combinations have been preclinically tested and suggested, including PI3Ki, MDM2i and others. CDK4/6 and ER pathways converge on regulation of cell cycle and Rb phosphorylation ERi ESR1 CDK4/6 CDK4/6 p16 E2F Rb E2F Rb CDKi E2F regulation of DNA methylation & PD-L 1 expression P P P P CCND1 CCND1 G2 M G1 S

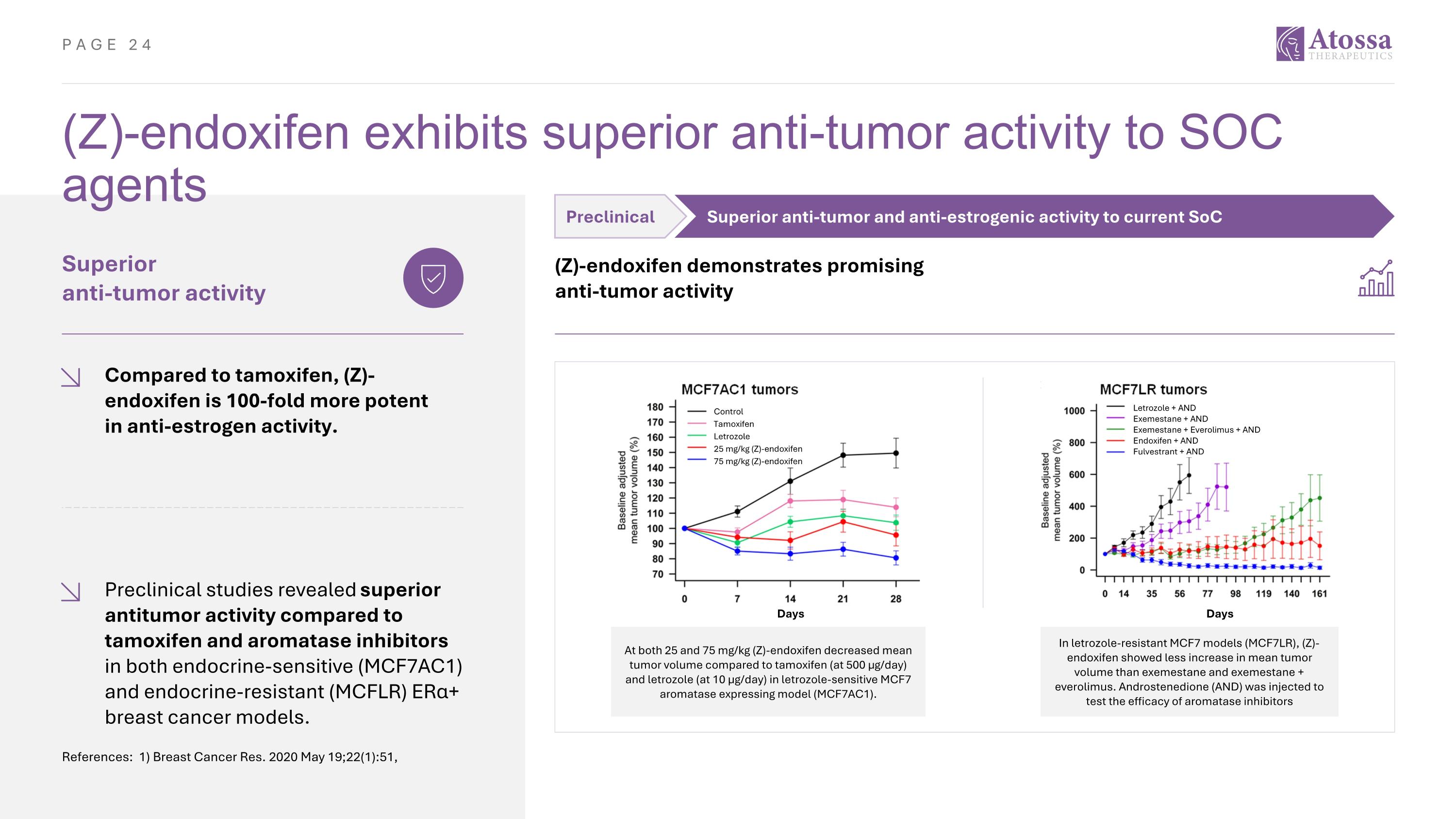

(Z)-endoxifen exhibits superior anti-tumor activity to SOC agents References: 1) Breast Cancer Res. 2020 May 19;22(1):51, Superior anti-tumor activity Compared to tamoxifen, (Z)-endoxifen is 100-fold more potent in anti-estrogen activity. Preclinical studies revealed superior antitumor activity compared to tamoxifen and aromatase inhibitors in both endocrine-sensitive (MCF7AC1) and endocrine-resistant (MCFLR) ERα+ breast cancer models. Preclinical Superior anti-tumor and anti-estrogenic activity to current SoC (Z)-endoxifen demonstrates promising anti-tumor activity At both 25 and 75 mg/kg (Z)-endoxifen decreased mean tumor volume compared to tamoxifen (at 500 μg/day) and letrozole (at 10 μg/day) in letrozole-sensitive MCF7 aromatase expressing model (MCF7AC1). In letrozole-resistant MCF7 models (MCF7LR), (Z)-endoxifen showed less increase in mean tumor volume than exemestane and exemestane + everolimus. Androstenedione (AND) was injected to test the efficacy of aromatase inhibitors Letrozole + AND Exemestane + AND Exemestane + Everolimus + AND Endoxifen + AND Fulvestrant + AND Control Tamoxifen Letrozole 25 mg/kg (Z)-endoxifen 75 mg/kg (Z)-endoxifen Days Days

Positive FDA Feedback for (Z)-Endoxifen Program FDA Affirmed Atossa’s Strategic Approach: FDA confirmed existing clinical and nonclinical data as sufficient for initiating Phase 2 monotherapy. Clear alignment with FDA’s Project Optimus for dosage optimization. Strategic Advantage: Agreement on combining (Z)-endoxifen with selected CDK4/6, PI3K, mTOR inhibitors, and capecitabine. No further toxicity or neurotoxicity studies required. Agreed to cardiac monitoring protocols, including serial electrocardiograms (ECGs) and QT interval assessments. FDA feedback significantly narrows strategic focus, enabling efficient clinical execution. Dose Optimization: Combination Therapies Supported: Nonclinical Data Deemed Adequate: Cardiac Safety Protocol Affirmed:

Path Forward for Atossa Therapeutics Finalize IND Submission: Incorporate FDA recommendations into the final protocol, targeting IND filing in Q4 2025. Dose-ranging Study: Identify optimal dosing regimens balancing efficacy and safety. Immediate Next Steps: Strategic Objectives: Announce Trial Specifics: Upcoming disclosure on patient populations, selected combination regimens, and trial design. Initiate Clinical Study: Prompt trial commencement following IND acceptance. Regulatory Alignment: Continued adherence to FDA guidance, enhancing potential regulatory approval pathway. Shareholder Value: Progress towards meaningful clinical milestones intended to address significant unmet medical needs in ER+/HER2- metastatic breast cancer and drive shareholder value.

(Z)-endoxifen may offer improved safety Preclinical Preclinical data supports that (Z)-endoxifen does not induce bone loss. Data have shown (Z)-endoxifen to be well tolerated in preclinical and early clinical trials Clinical Overall: In studies conducted by other groups, (Z)-endoxifen has been reported to be well tolerated at doses up to 360 mg/day in some patients, and up to 5 years in others with relatively few adverse events reported demonstrating a relatively wide therapeutic window. EVANGELINE is currently ongoing in premenopausal women with Grade 1 or 2 ER+/HER2- breast cancer in the neoadjuvant setting (40 and 80 mg/day; 22 participants to date). (Z)-endoxifen has been generally well-tolerated, the majority of AEs have been mild or moderate in severity, and one serious adverse event reported related to study drug (hemorrhagic ovarian cyst). Metastatic: In Phase I studies (including heavily pretreated metastatic ER+ breast cancer patients), (Z)-endoxifen was escalated from 20 mg to as high as 160 mg/day without identifying a clear maximum tolerated dose (MTD). Most adverse events were mild-to-moderate.

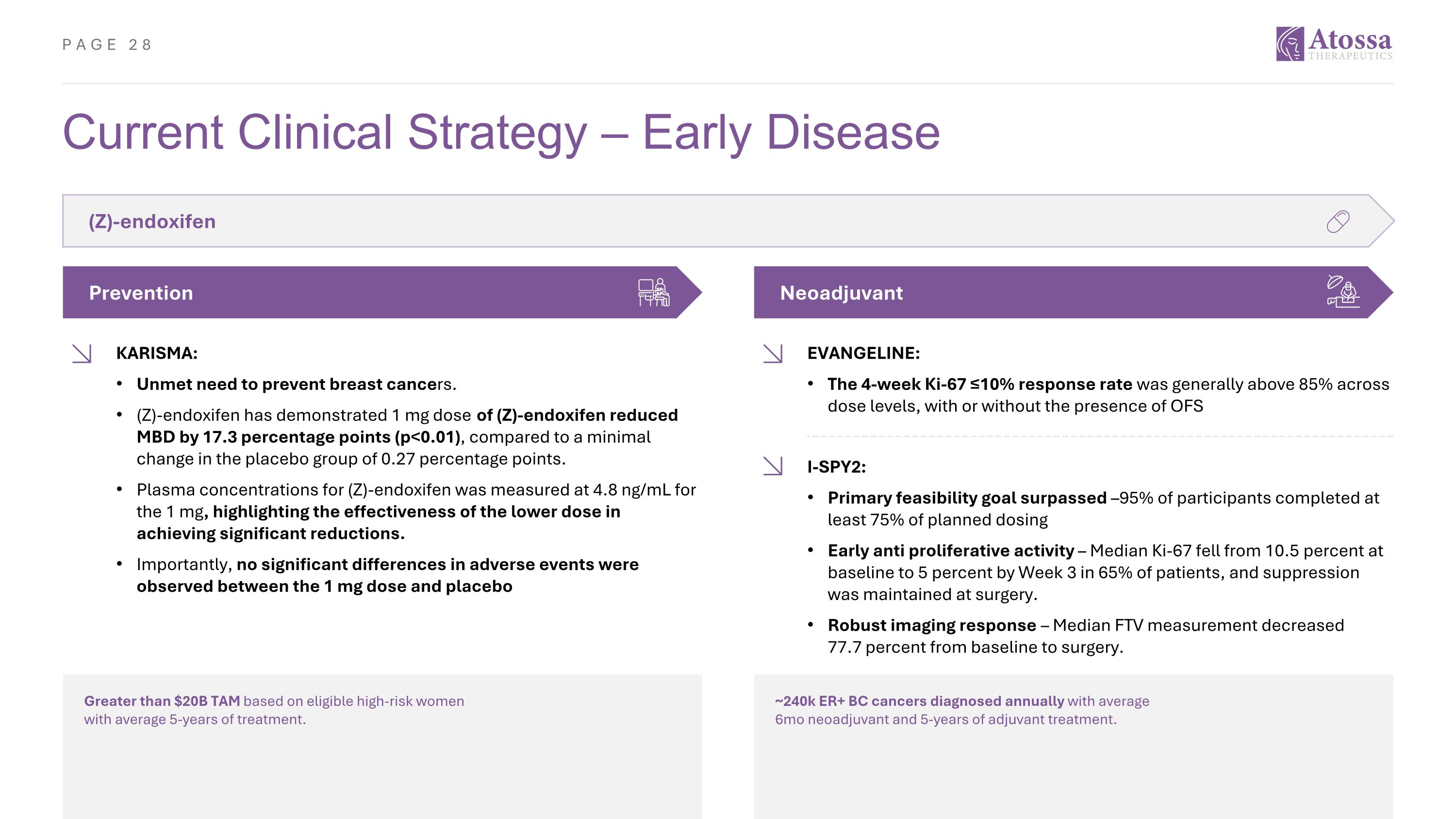

Current Clinical Strategy – Early Disease (Z)-endoxifen Neoadjuvant Prevention KARISMA: Unmet need to prevent breast cancers. (Z)-endoxifen has demonstrated 1 mg dose of (Z)-endoxifen reduced MBD by 17.3 percentage points (p<0.01), compared to a minimal change in the placebo group of 0.27 percentage points. Plasma concentrations for (Z)-endoxifen was measured at 4.8 ng/mL for the 1 mg, highlighting the effectiveness of the lower dose in achieving significant reductions. Importantly, no significant differences in adverse events were observed between the 1 mg dose and placebo EVANGELINE: The 4-week Ki-67 ≤10% response rate was generally above 85% across dose levels, with or without the presence of OFS I-SPY2: Primary feasibility goal surpassed –95% of participants completed at least 75% of planned dosing Early anti proliferative activity – Median Ki-67 fell from 10.5 percent at baseline to 5 percent by Week 3 in 65% of patients, and suppression was maintained at surgery. Robust imaging response – Median FTV measurement decreased 77.7 percent from baseline to surgery. Greater than $20B TAM based on eligible high-risk women with average 5-years of treatment. ~240k ER+ BC cancers diagnosed annually with average 6mo neoadjuvant and 5-years of adjuvant treatment.

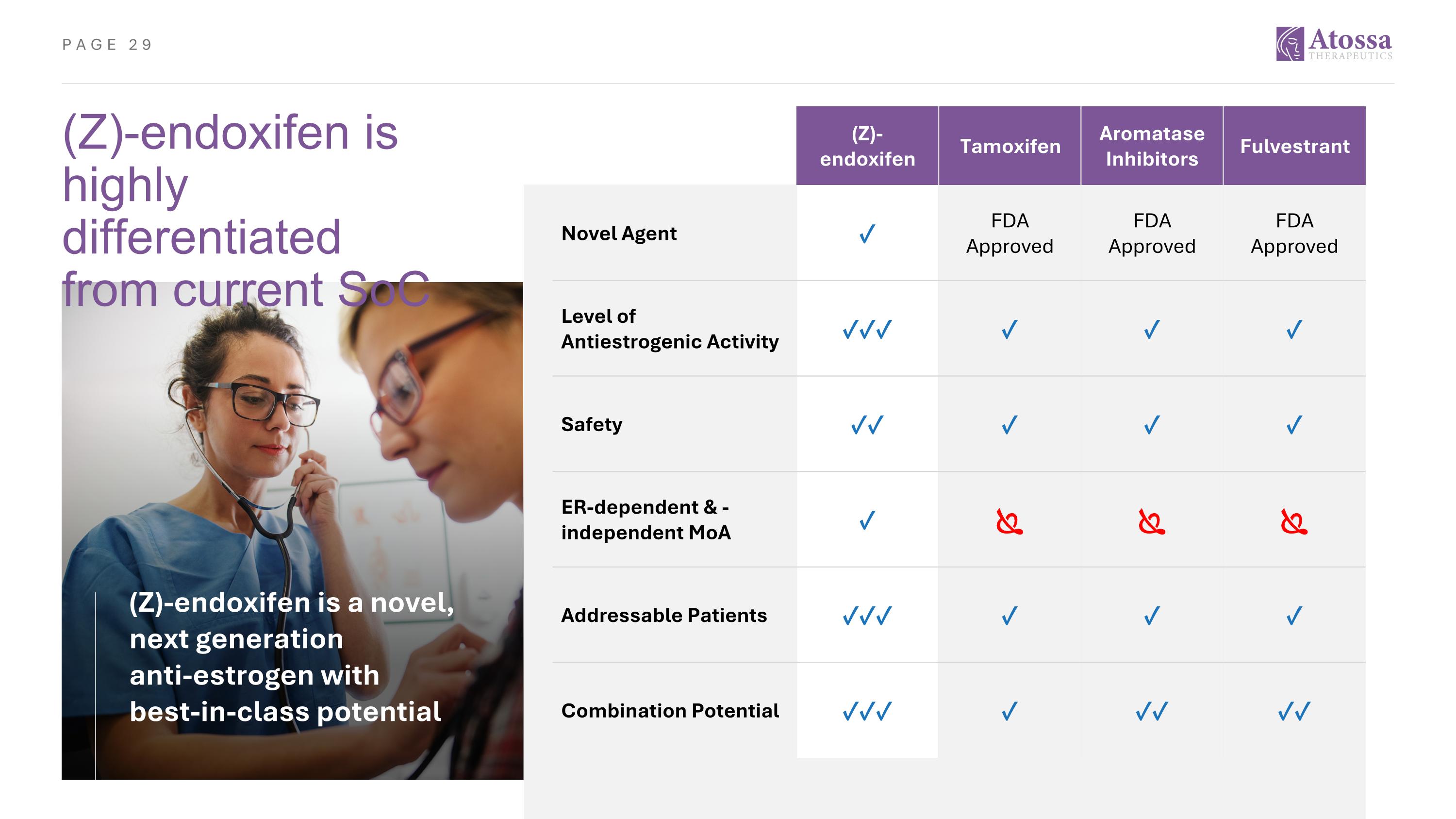

(Z)-endoxifen is highly differentiated from current SoC (Z)-endoxifen Tamoxifen Aromatase Inhibitors Fulvestrant Novel Agent ✓ FDA Approved FDA Approved FDA Approved Level of Antiestrogenic Activity ✓✓✓ ✓ ✓ ✓ Safety ✓✓ ✓ ✓ ✓ ER-dependent & -independent MoA ✓ Addressable Patients ✓✓✓ ✓ ✓ ✓ Combination Potential ✓✓✓ ✓ ✓✓ ✓✓ (Z)-endoxifen is a novel, next generation anti-estrogen with best-in-class potential

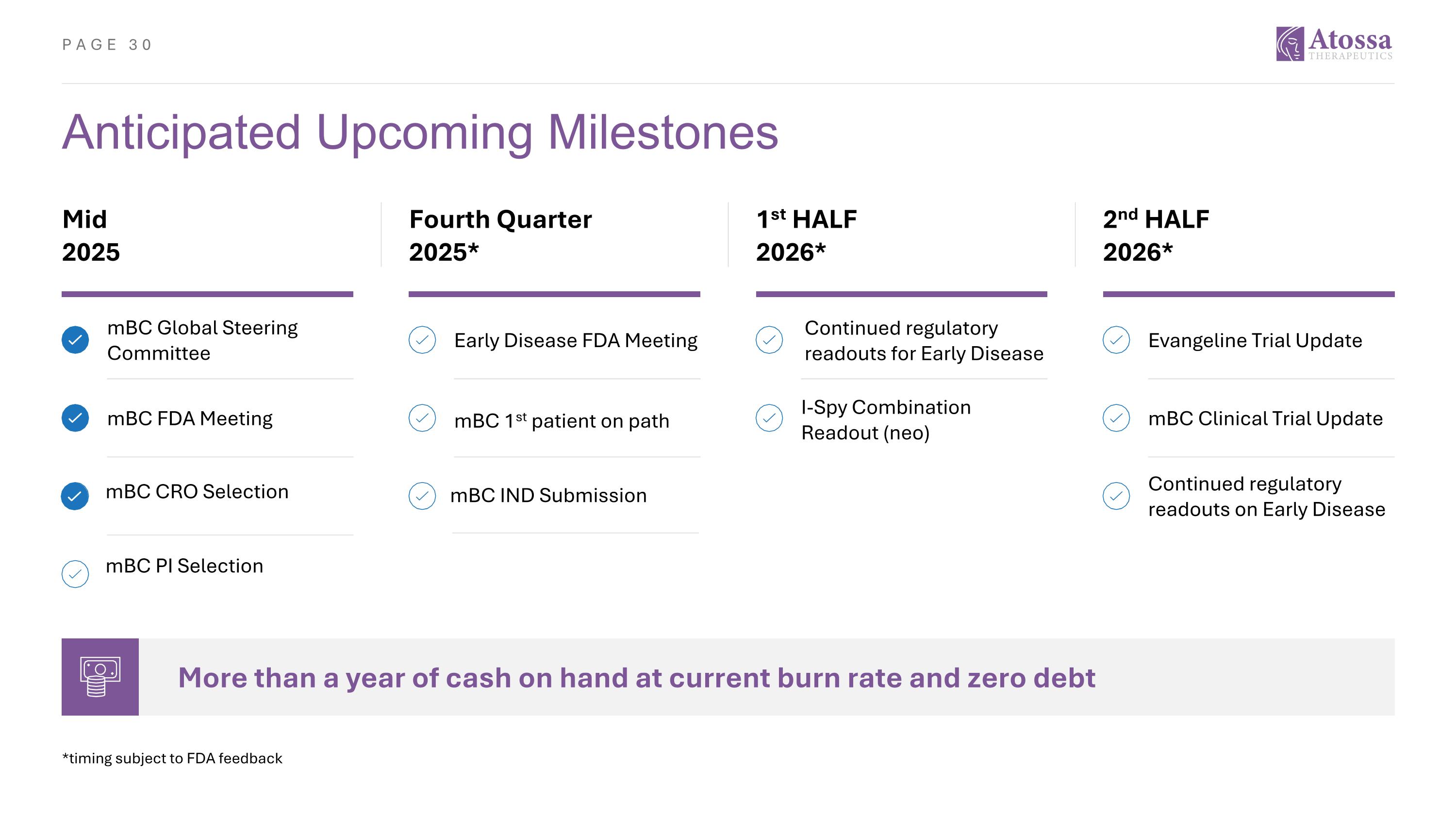

Anticipated Upcoming Milestones Mid 2025 Fourth Quarter 2025* 1st HALF 2026* 2nd HALF 2026* More than a year of cash on hand at current burn rate and zero debt *timing subject to FDA feedback mBC CRO Selection mBC PI Selection Continued regulatory readouts on Early Disease mBC Global Steering Committee Early Disease FDA Meeting I-Spy Combination Readout (neo) Evangeline Trial Update mBC FDA Meeting mBC 1st patient on path mBC Clinical Trial Update mBC IND Submission Continued regulatory readouts for Early Disease

Corporate Highlights Multi-billion market opportunity across the rapidly growing estrogen receptor positive breast cancer market Demonstrated broad utility across the breast cancer paradigm with best-in-class potential: Prevention: Recurrence following surgery Following DCIS High-risk dense breast tissue Treatment Neoadjuvant Metastatic Robust and Growing IP Portfolio with broad protections in the U.S. and globally Strong financial position with over a year of runway and zero debt Experienced Leadership Team and world-renowned advisors