Let’s take on tomorrow. Investor Presentation: Q3’25 October 2025

Let’s take on tomorrow. 2 © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED In addition to historical information, this presentation may contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with respect to Customers Bancorp, Inc.’s strategies, goals, beliefs, expectations, estimates, intentions, capital raising efforts, financial condition and results of operations, future performance and business. Statements preceded by, followed by, or that include the words “may,” “could,” “should,” “pro forma,” “looking forward,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “project,” or similar expressions generally indicate a forward-looking statement. These forward-looking statements involve risks and uncertainties that are subject to change based on various important factors (some of which, in whole or in part, are beyond Customers Bancorp, Inc.’s control). Numerous competitive, economic, regulatory, legal and technological events and factors, among others, could cause Customers Bancorp, Inc.’s financial performance to differ materially from the goals, plans, objectives, intentions and expectations expressed in such forward-looking statements, including: a continuation of the recent turmoil in the banking industry, responsive measures taken by us and regulatory authorities to mitigate and manage related risks, regulatory actions taken that address related issues and the costs and obligations associated therewith, such as the FDIC special assessments; the potential for negative consequences resulting from regulatory violations, investigations and examinations, including potential supervisory actions, the assessment of fines and penalties, the imposition of sanctions, the need to undertake remedial actions and possible damage to our reputation; effects of competition on deposit rates and growth, loan rates and growth and net interest margin; failure to identify and adequately and promptly address cybersecurity risks, including data breaches and cyberattacks; public health crises and pandemics and their effects on the economic and business environments in which we operate; geopolitical conditions, including acts or threats of terrorism, actions taken by the United States or other governments in response to acts or threats of terrorism and military conflicts, including the war between Russia and Ukraine and ongoing conflict in the Middle East, which could impact economic conditions in the United States; the impact that changes in the economy have on the performance of our loan and lease portfolio, the market value of our investment securities, the demand for our products and services and the availability of sources of funding; the effects of actions by the federal government, including the Board of Governors of the Federal Reserve System and other government agencies, that affect market interest rates and the money supply; actions that we and our customers take in response to these developments and the effects such actions have on our operations, products, services and customer relationships; higher inflation and its impacts; the effects of changes in U.S. trade policies, including the imposition of tariffs and retaliatory tariffs on its trading partners; and the effects of any changes in accounting standards or policies. Customers Bancorp, Inc. cautions that the foregoing factors are not exclusive, and neither such factors nor any such forward-looking statement takes into account the impact of any future events. All forward-looking statements and information set forth herein are based on management’s current beliefs and assumptions as of the date hereof and speak only as of the date they are made. For a more complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review Customers Bancorp, Inc.’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K for the year ended December 31, 2024, subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K, including any amendments thereto, that update or provide information in addition to the information included in the Form 10-K and Form 10-Q filings, if any. Customers Bancorp, Inc. does not undertake to update any forward-looking statement whether written or oral, that may be made from time to time by Customers Bancorp, Inc. or by or on behalf of Customers Bank, except as may be required under applicable law. Forward-Looking Statements

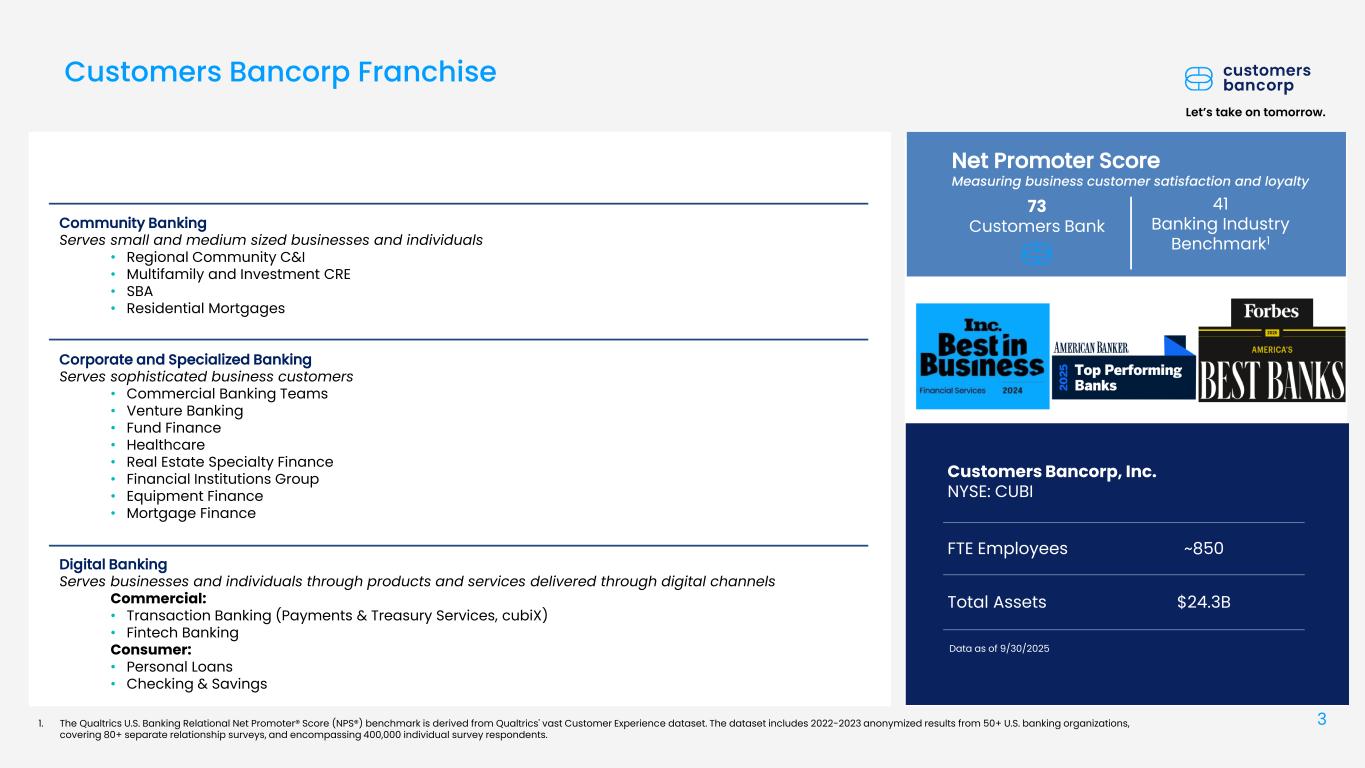

Let’s take on tomorrow. 3 © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Customers Bancorp Franchise Customers Bancorp, Inc. NYSE: CUBI FTE Employees ~850 Total Assets $24.3B Data as of 9/30/2025 41 Banking Industry Benchmark1 73 Customers Bank Net Promoter Score Measuring business customer satisfaction and loyalty Community Banking Serves small and medium sized businesses and individuals • Regional Community C&I • Multifamily and Investment CRE • SBA • Residential Mortgages Corporate and Specialized Banking Serves sophisticated business customers • Commercial Banking Teams • Venture Banking • Fund Finance • Healthcare • Real Estate Specialty Finance • Financial Institutions Group • Equipment Finance • Mortgage Finance Digital Banking Serves businesses and individuals through products and services delivered through digital channels Commercial: • Transaction Banking (Payments & Treasury Services, cubiX) • Fintech Banking Consumer: • Personal Loans • Checking & Savings 1. The Qualtrics U.S. Banking Relational Net Promoter® Score (NPS®) benchmark is derived from Qualtrics' vast Customer Experience dataset. The dataset includes 2022-2023 anonymized results from 50+ U.S. banking organizations, covering 80+ separate relationship surveys, and encompassing 400,000 individual survey respondents.

Let’s take on tomorrow. 4 © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Q3’25 Key Accomplishments 1. Includes commercial banking teams hired since Q2’23 2. 2025 proxy peers most recent quarter (“MRQ”); MRQ represents Q3’25 for proxy peer banks that have reported earnings data before October 23, 2025. Otherwise represents Q2’25 data 3. Non-GAAP measure, refer to appendix for reconciliation 4. Q4’2019 to Q3’2025 5. Net of issuance costs Let’s take on tomorrow. 6% QoQ loan growth and 11% YTD Diversified across the franchise driven by corporate and specialized banking groups $1.4 billion growth in deposits QoQ including $900 million of non-interest bearing deposits Achieved a record $6.4 billion of non-interest bearing balances, now 31% of total deposits $350 million of deposit growth from new banking teams1 Solid Loan GrowthAccretive Deposit Performance NIM expansion of 19 bps QoQ NII increased $25 million or 14% QoQ Fourth consecutive quarter of NIM expansion Net Interest Income (NII) & Net Interest Margin (NIM) Raised $163 million5 in common equity in an offering that was nearly 10x oversubscribed CET1 ratio increased to 13.0% TCE/TA4 increased 50 bps QoQ to 8.4% Tangible book value per share stood at approximately $60 per share3 QoQ growth of 6% or 25% annualized 15%+ CAGR over the last five+ years4 Strong Capital & LiquidityTangible Book Value Growth Efficiency Ratio improved to 45.4% Non-interest expense as percent of average assets of 1.74% is the lowest among regional bank peers2 Positive Operating Leverage

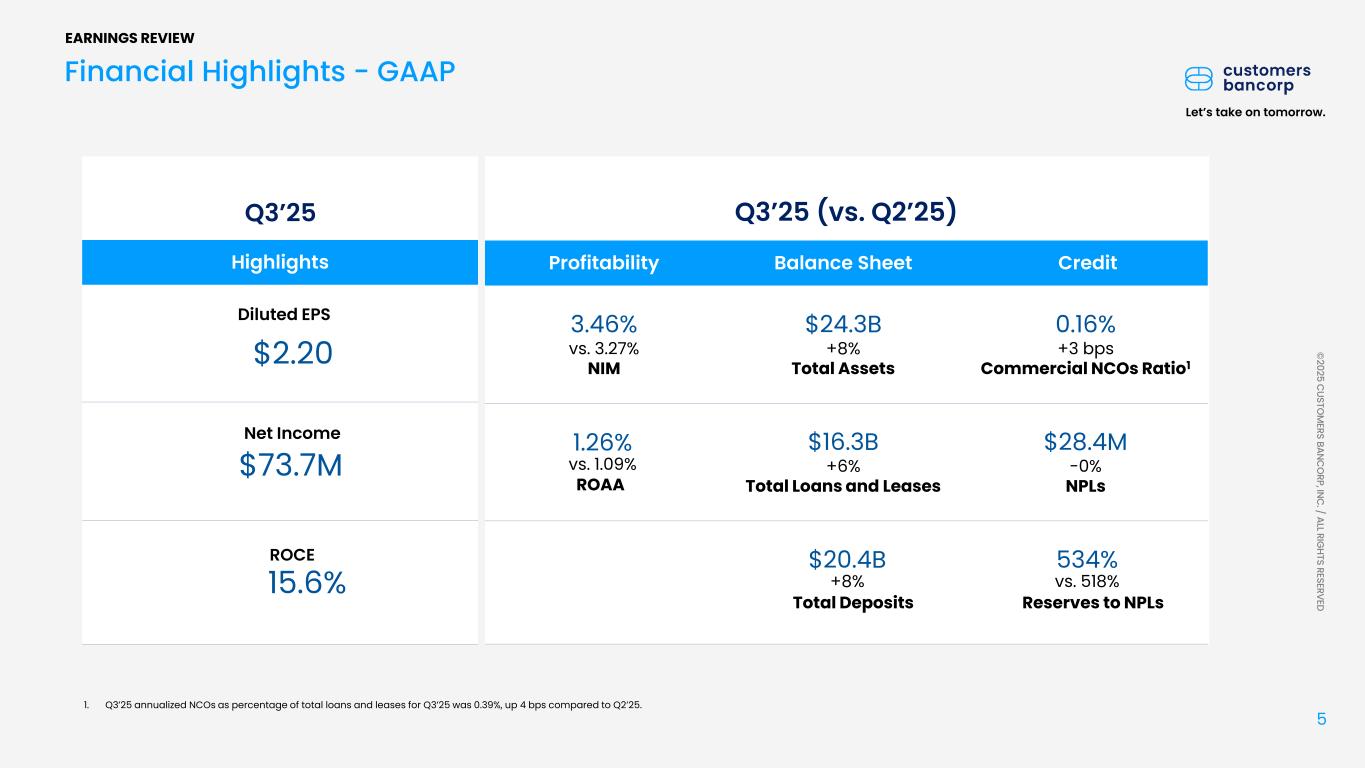

5 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Q3’25 (vs. Q2’25) Profitability Balance Sheet Credit 3.46% vs. 3.27% NIM $24.3B +8% Total Assets 0.16% +3 bps Commercial NCOs Ratio1 $16.3B +6% Total Loans and Leases $28.4M -0% NPLs Financial Highlights - GAAP Highlights Q3’25 EARNINGS REVIEW Total Deposits $20.4B +8% Reserves to NPLs 534% vs. 518% $2.20 Diluted EPS $73.7M Net Income ROCE 15.6% ROAA 1.26% vs. 1.09% 1. Q3’25 annualized NCOs as percentage of total loans and leases for Q3’25 was 0.39%, up 4 bps compared to Q2’25.

6 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Q3’25 (vs. Q2’25) Profitability Balance Sheet Credit 3.46% vs. 3.27% NIM $24.3B +8% Total Assets 0.16% +3 bps Commercial NCOs Ratio3 $16.3B +6% Total Loans and Leases $28.4M -0% NPLs Financial Highlights - Core Highlights Q3’25 EARNINGS REVIEW Total Deposits $20.4B +8% Reserves to NPLs 534% vs. 518% $2.20 Core EPS1,2 $73.5M Core Earnings1,2 Core ROCE1,2 15.5% Core ROAA1,2 1.25% vs. 1.10% 1. Excludes pretax gains on investment securities of $0.3 million. 2. Non-GAAP measure, refer to appendix for reconciliation 3. Q3’25 annualized NCOs as percentage of total loans and leases for Q3’25 was 0.39%, up 4 bps compared to Q2’25.

7 © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Let’s take on tomorrow. Total Deposits $ billions Steady Deposit Growth and Mix Improvement Over $20 billion in deposits with record non-interest bearing balances Average cost of deposits 2.85% ACCRETIVE DEPOSIT PERFORMANCE $4.7 $5.6 $7.8 Q3’24 $5.6 $5.6 $7.7 Q4’24 $5.6 $5.1 $8.2 Q1’25 $5.5 $4.9 $8.6 Q2’25 $6.4 (31%) $5.0 $9.0 Q3’25 $18.1 $18.8 $18.9 $19.0 $20.4 +13% Non-Interest Bearing DDA Interest Bearing DDA Non-DDA Non-interest Bearing Deposit Composition % 1. 2025 proxy peers most recent quarter (“MRQ”); MRQ represents Q3’25 for proxy peer banks that have reported earnings data before October 23, 2025. Otherwise represents Q2’25 data • New banking teams hired since Q2’23 continued deposit gathering momentum with approximately $350 million of growth in the quarter • Teams hired since Q2’23 manage $2.8 billion as of Q3’25 Top Quartile (29%) • Non-interest bearing deposits increased by about $900 million in the quarter to a record $6.4 billion or 31% of total deposits, representing top quartile of peer banks1 31%CUBI 2.77% Regional Bank Peers (MRQ) CUBI

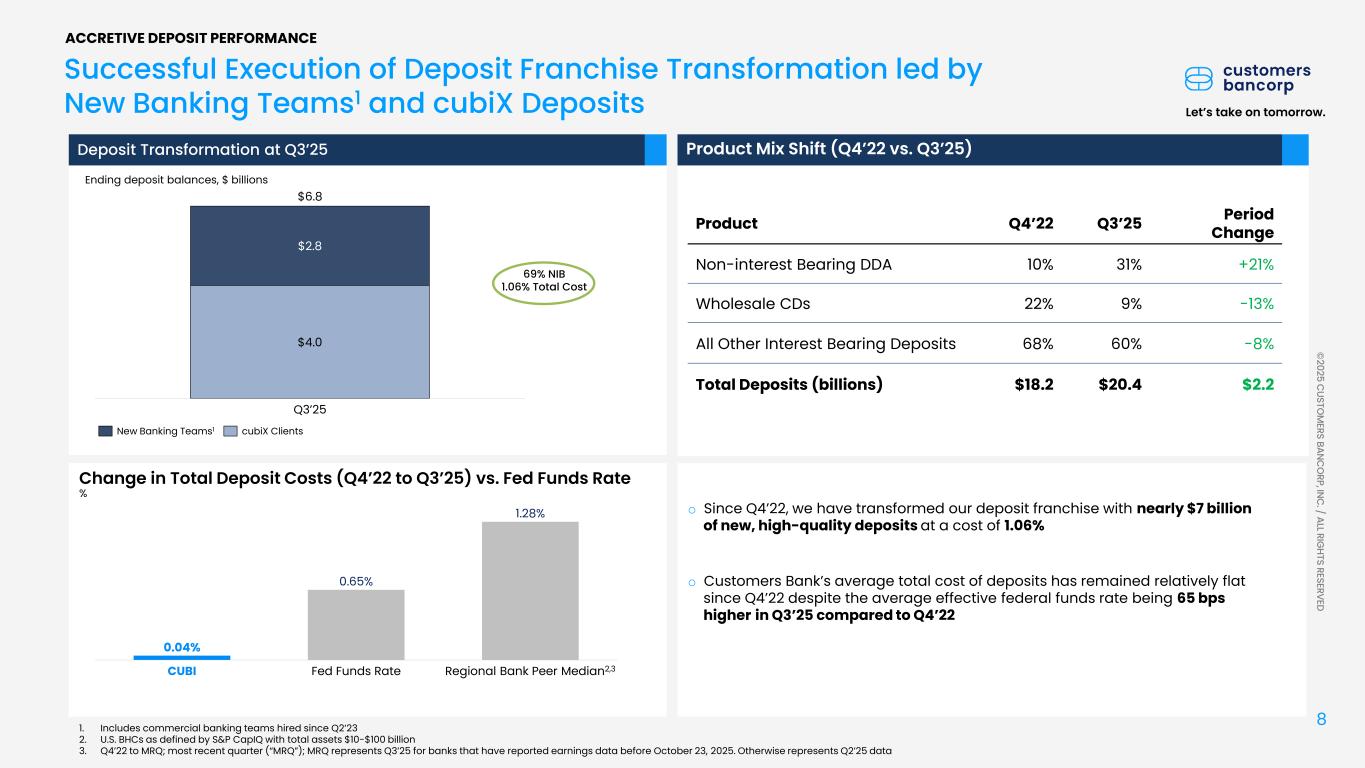

8 © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Let’s take on tomorrow. Kk s 1. Includes commercial banking teams hired since Q2’23 2. U.S. BHCs as defined by S&P CapIQ with total assets $10-$100 billion 3. Q4’22 to MRQ; most recent quarter (“MRQ”); MRQ represents Q3’25 for banks that have reported earnings data before October 23, 2025. Otherwise represents Q2’25 data Deposit Transformation at Q3’25 Successful Execution of Deposit Franchise Transformation led by New Banking Teams1 and cubiX Deposits 69% NIB 1.06% Total Cost ACCRETIVE DEPOSIT PERFORMANCE $4.0 $2.8 Q3’25 $6.8 New Banking Teams1 cubiX Clients o Since Q4’22, we have transformed our deposit franchise with nearly $7 billion of new, high-quality deposits at a cost of 1.06% o Customers Bank’s average total cost of deposits has remained relatively flat since Q4’22 despite the average effective federal funds rate being 65 bps higher in Q3’25 compared to Q4’22 Change in Total Deposit Costs (Q4’22 to Q3’25) vs. Fed Funds Rate % 0.04% 0.65% 1.28% CUBI Fed Funds Rate Regional Bank Peer Median2,3 Product Mix Shift (Q4’22 vs. Q3’25) Ending deposit balances, $ billions Product Q4’22 Q3’25 Period Change Non-interest Bearing DDA 10% 31% +21% Wholesale CDs 22% 9% -13% All Other Interest Bearing Deposits 68% 60% -8% Total Deposits (billions) $18.2 $20.4 $2.2

9 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED 2025 Team Recruitment Driving Franchise Value Building off 2023 and 2024 Success ACCRETIVE DEPOSIT PERFORMANCE Title Solutions • Outlined strategy in Q1’25 to continue team recruitment • Deepen market share in existing geographies • Bolster slate of specialized deposit focused verticals 2025 Organic Growth Strategy Entrepreneurial Culture Recruiter of Top Talent Comp. Model Driven by Client Success Single Point of Contact Client-Driven Tech Solutions • Approximately 30 FTEs across 7 new teams have joined the Bank YTD’25 • Continues strategy from 2023 (Venture Banking Group) and 2024 (commercial banking teams) • 2025 teams represent a mix of geographic C&I teams and national specialized verticals 2025 Team Recruitment – YTD Update • Attract franchise enhancing top talent from across banking industry • Future teams will continue building on the momentum of teams that have joined over last 2 years • Older vintage teams will continue scaling deposit portfolios while newest teams will begin to ramp up balances 2026+ Organic Growth Strategy Q4’23 Q4’24 Q4’25 Q4’26 2027+ 2023 Teams 2024 Teams 2025 Teams 2026+ Teams IllustrativeSports and Entertainment Municipal Finance ’25 Geographic C&I Team

10 © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Let’s take on tomorrow. Strong Loan Growth With Diversified Contributions Across The Franchise Loan Profile1 $ billions $0.7 $5.7 $7.4 Q3’24 $0.7 $5.8 $7.9 Q4’24 $0.9 $5.9 $8.2 Q1’25 $0.8 $5.9 $8.7 Q2’25 $0.9 $6.1 $9.3 Q3’25 $13.8 $14.4 $15.1 $15.4 $16.3 6.99% 6.78% 6.57% 6.61% 6.91% Yield on Loans • Loan growth of approximately $900 million or 6% QoQ • Growth has been diversified across business units with focus on holistic relationships ROBUST LOAN GROWTH Corporate & Specialized Banking Community Banking Consumer Installment HFI 1. HFI loans 2. Includes Investment CRE, Construction, and Multifamily 3. Includes Regional Community Banking C&I, Real Estate Specialty Finance, Mortgages, SBA, Financial Institution Group, PPP QoQ Loan Growth1 by Verticals $ millions Fund Finance CRE2 Venture Banking Consumer Installment HFI Commercial Banking Teams Equipment Finance Healthcare Other3 Mortgage Finance Total Loan Growth $505 $218 $99 $88 $22 $15 $6 -$13 -$49 $893 • Top growth verticals included fund finance, CRE, and venture banking • Diversified loan growth focused on adding franchise value

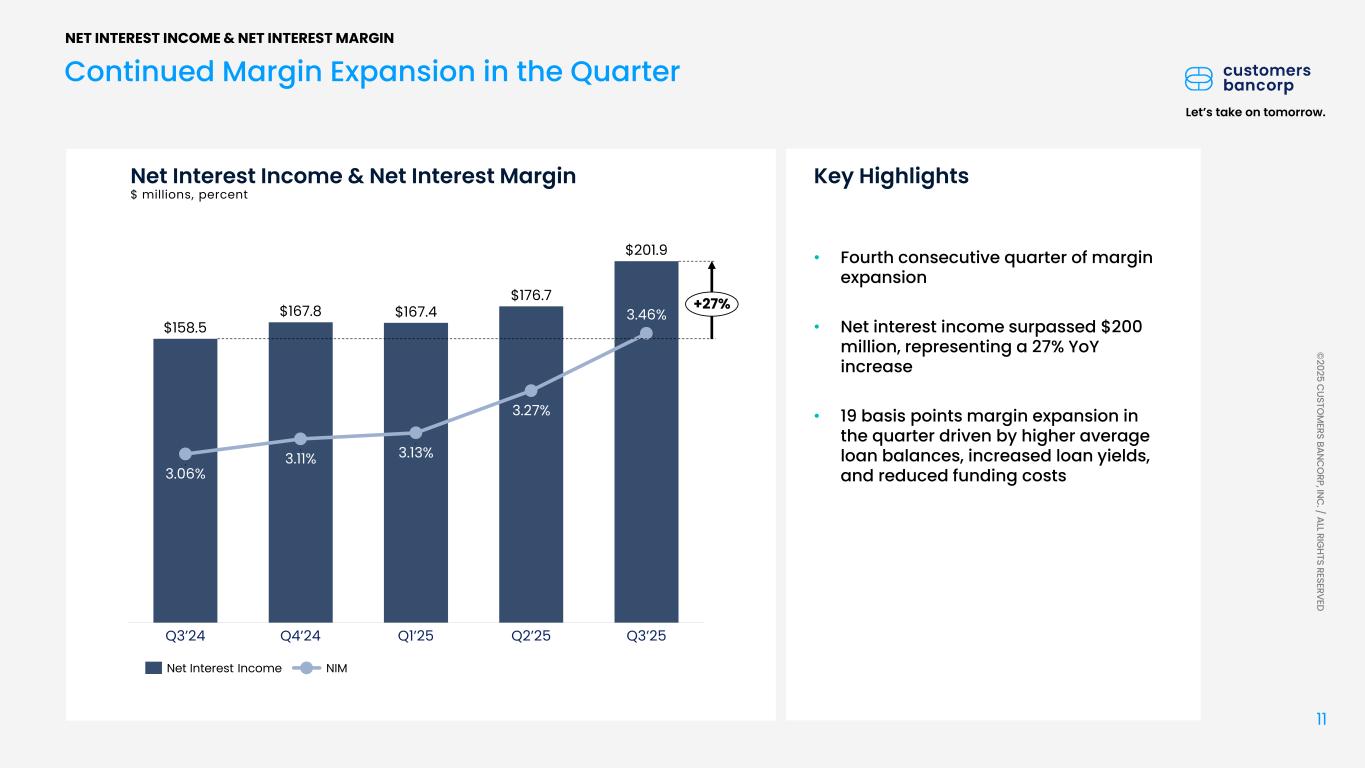

11 © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Let’s take on tomorrow. Continued Margin Expansion in the Quarter Net Interest Income & Net Interest Margin $ millions, percent 3.06% 3.11% 3.13% 3.27% 3.46% Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 $158.5 $167.8 $167.4 $176.7 $201.9 +27% NET INTEREST INCOME & NET INTEREST MARGIN • Fourth consecutive quarter of margin expansion • Net interest income surpassed $200 million, representing a 27% YoY increase • 19 basis points margin expansion in the quarter driven by higher average loan balances, increased loan yields, and reduced funding costs Key Highlights Net Interest Income NIM

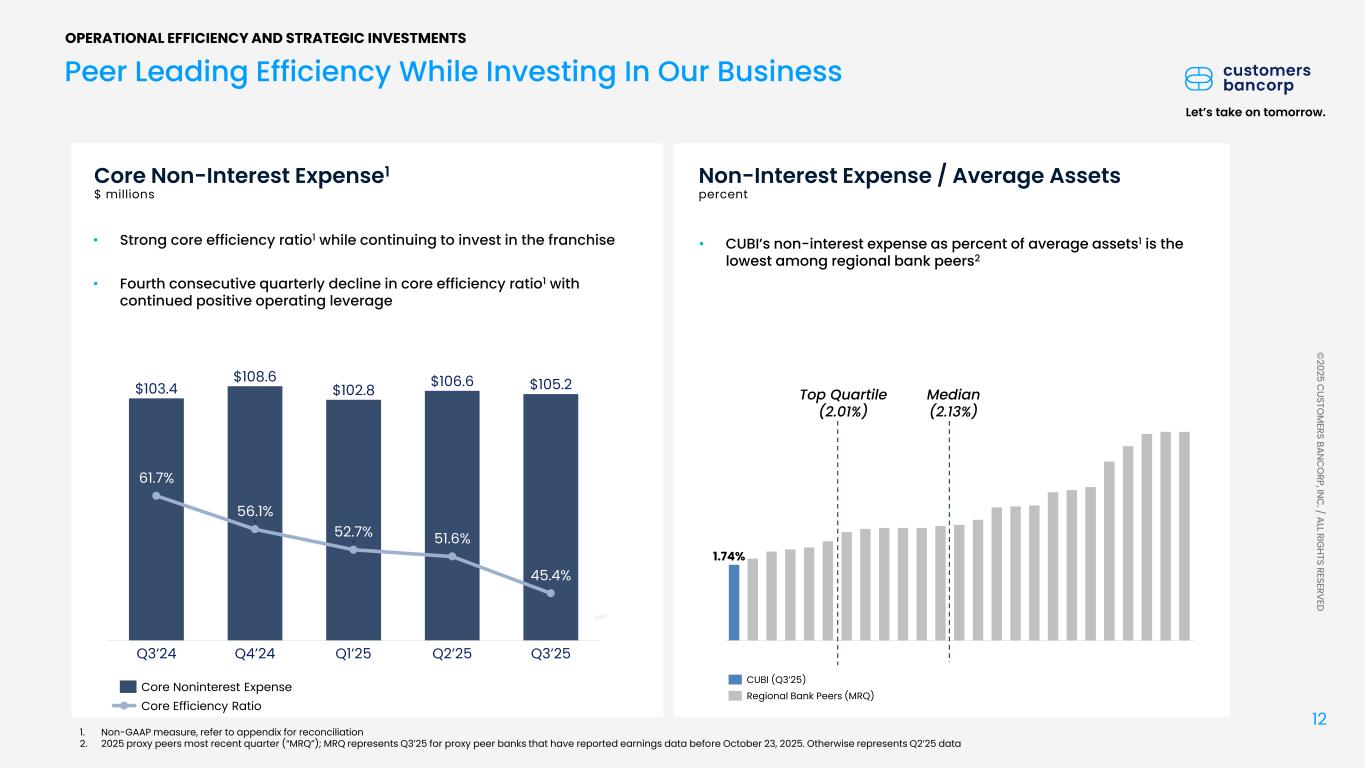

12 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Peer Leading Efficiency While Investing In Our Business $103.4 $108.6 $102.8 $106.6 $105.2 61.7% Q3’24 56.1% Q4’24 52.7% Q1’25 51.6% Q2’25 45.4% Q3’25 Core Non-Interest Expense1 $ millions • Strong core efficiency ratio1 while continuing to invest in the franchise • Fourth consecutive quarterly decline in core efficiency ratio1 with continued positive operating leverage Non-Interest Expense / Average Assets percent • CUBI’s non-interest expense as percent of average assets1 is the lowest among regional bank peers2 1.74% CUBI (Q3’25) Regional Bank Peers (MRQ) 1. Non-GAAP measure, refer to appendix for reconciliation 2. 2025 proxy peers most recent quarter (“MRQ”); MRQ represents Q3’25 for proxy peer banks that have reported earnings data before October 23, 2025. Otherwise represents Q2’25 data Top Quartile (2.01%) Median (2.13%) OPERATIONAL EFFICIENCY AND STRATEGIC INVESTMENTS Core Noninterest Expense Core Efficiency Ratio

13 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Tangible Book Value1 per share Tangible Book Value Approaching Approximately $60 Per Share 1. Non-GAAP measure, refer to appendix for reconciliation 2. CAGR from Q4’19 to Q3’25 inclusive of impact of AOCI mark-to-market; Q4’19 and Q3’25 AOCI impact of $(0.04) and $(1.58) per share, respectively 3. 2025 proxy peers most recent quarter (“MRQ”); MRQ represents Q3’25 for proxy peer banks that have reported earnings data before October 23, 2025. Otherwise represents Q2’25 data $26.17 $27.92 $37.21 $38.97 $47.61 $54.08 $59.72 2019 2020 2021 2022 2023 2024 Q3’25 +15% TANGIBLE BOOK VALUE GROWTH • TBVPS1 increased 6% QoQ or 25% annualized • Tangible book value1 per share has more than doubled since Q4’192 • 15+%2 CAGR in TBVPS1 since Q4’192 compared to 5% for regional bank peers3 Key Highlights 15+ 2

14 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED ` ` 15.4% 14.9% 14.6% 14.5% 15.4% Total Risk-Based Capital percent 7.7% 7.6% 7.7% 7.9% 8.4% TCE/TA2,3 percent 1. Capital ratios are estimated pending final regulatory report 2. TCE/TA negatively impacted by 20 bps in Q3’25 due to AOCI 3. Non-GAAP measure, refer to appendix for reconciliation Strong Capital Levels Provide Significant Flexibility 12.5% 12.1% 11.7% 12.1% 13.0% CET1 Risk-Based Capital percent STRONG CAPITAL AND LIQUIDITY • Common equity raise significantly increased capital ratios • Strong capital ratios provide flexibility • TCE/TA3 Ratio up 50 basis points QoQ and 70 basis points YoY Q3’24 Q4’24 Q1’25 8.6%2 Key Highlights AOCI Q2’25 Q3’251

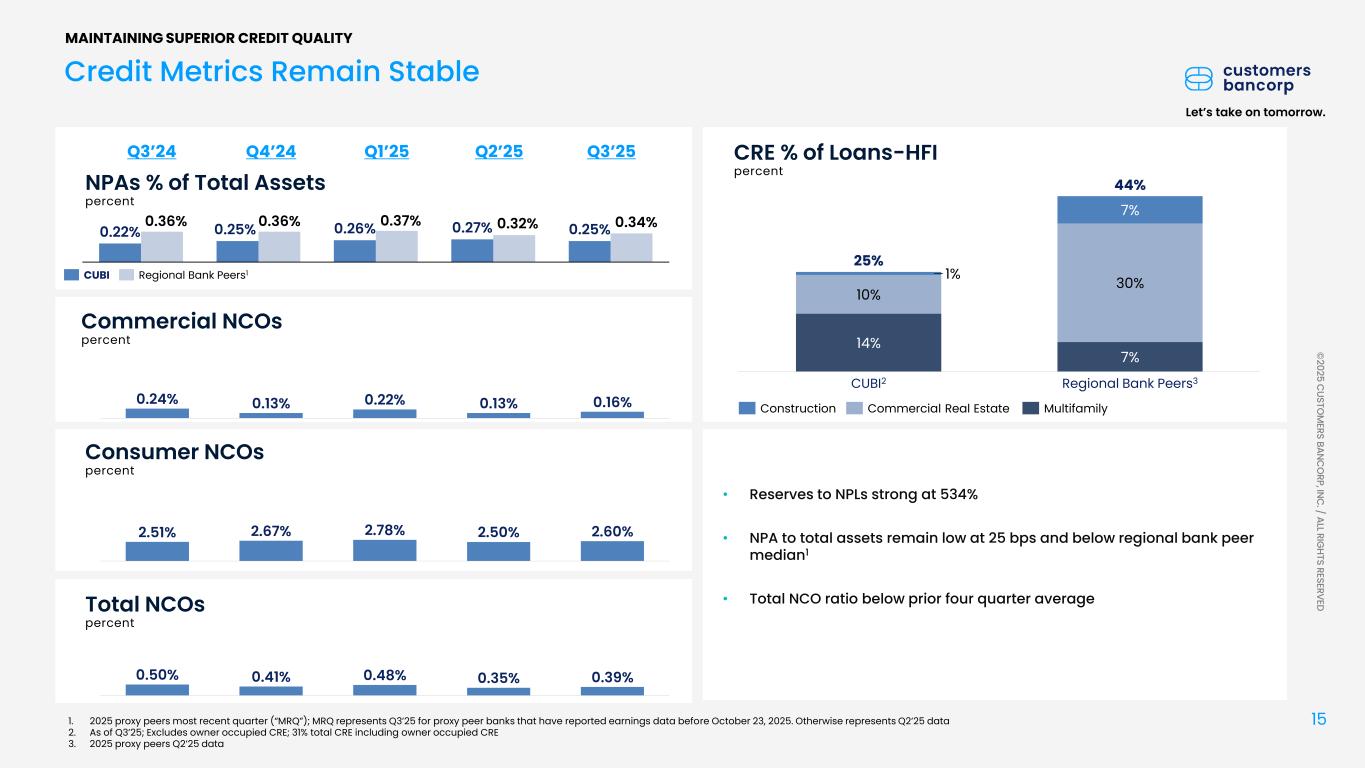

15 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Commercial NCOs percent NPAs % of Total Assets percent Credit Metrics Remain Stable 0.24% 0.13% 0.22% 0.13% 0.16% 2.51% 2.67% 2.78% 2.50% 2.60% 0.50% 0.41% 0.48% 0.35% 0.39% Consumer NCOs percent Total NCOs percent MAINTAINING SUPERIOR CREDIT QUALITY v 1. 2025 proxy peers most recent quarter (“MRQ”); MRQ represents Q3’25 for proxy peer banks that have reported earnings data before October 23, 2025. Otherwise represents Q2’25 data 2. As of Q3’25; Excludes owner occupied CRE; 31% total CRE including owner occupied CRE 3. 2025 proxy peers Q2’25 data 14% 7% 10% 30%1% 7% CUBI2 Regional Bank Peers3 25% 44% Construction Commercial Real Estate Multifamily CRE % of Loans-HFI percent V • Reserves to NPLs strong at 534% • NPA to total assets remain low at 25 bps and below regional bank peer median1 • Total NCO ratio below prior four quarter average Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 0.22% 0.25% 0.26% 0.27% 0.25%0.36% 0.36% 0.37% 0.32% 0.34% CUBI Regional Bank Peers1

16 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED 2025 Management Outlook Metrics Prior Outlook FY 2025 Core Efficiency Ratio Low-mid 50’s (Lower end of range) 5% - 9%Deposit Growth Loan Growth Net Interest Income 8% - 11% 7% - 10% Tax Rate 22% - 25% CET1 (%) 11.5% FY 2024 56% $18.8B $14.7B $654M 19% 12.1% NotesCurrent Outlook FY 2025 13% - 14% 13% - 15% 8% - 10% Below 50% ~13% YE’25

ANALYST COVERAGE D.A. Davidson Companies Peter Winter Hovde Group David Bishop Keefe, Bruyette & Woods Inc. Kelly Motta Maxim Group LLC Michael Diana Stephens Inc. Matt Breese Raymond James Steve Moss B. Riley Securities, Inc. Hal Goetsch TD Cowen Janet Lee 2025 New Analyst

APPENDIX

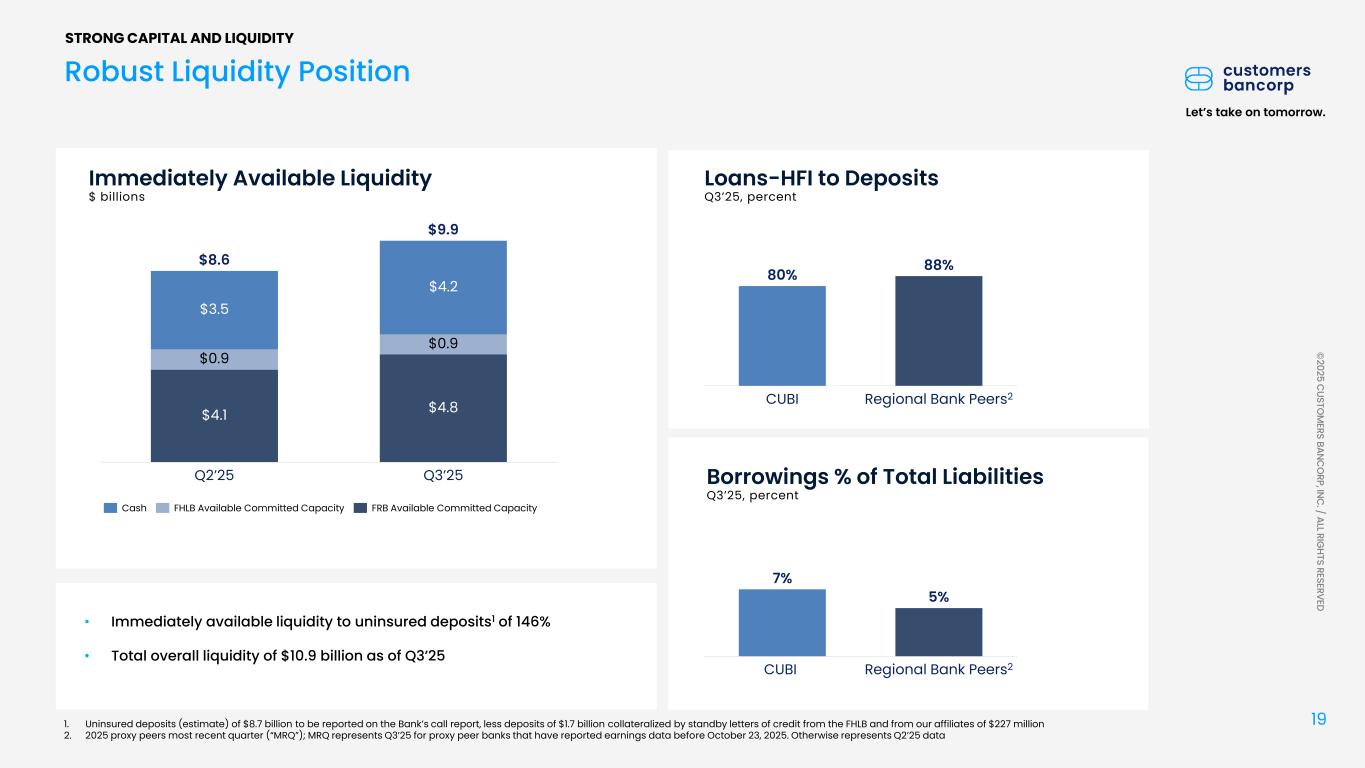

19 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Robust Liquidity Position Immediately Available Liquidity $ billions $3.5 $0.9 $4.1 Q2’25 $4.2 $0.9 $4.8 Q3’25 $8.6 $9.9 Cash FHLB Available Committed Capacity FRB Available Committed Capacity 1. Uninsured deposits (estimate) of $8.7 billion to be reported on the Bank’s call report, less deposits of $1.7 billion collateralized by standby letters of credit from the FHLB and from our affiliates of $227 million 2. 2025 proxy peers most recent quarter (“MRQ”); MRQ represents Q3’25 for proxy peer banks that have reported earnings data before October 23, 2025. Otherwise represents Q2’25 data STRONG CAPITAL AND LIQUIDITY • Immediately available liquidity to uninsured deposits1 of 146% • Total overall liquidity of $10.9 billion as of Q3’25 Loans-HFI to Deposits Q3’25, percent CUBI Regional Bank Peers2 80% 88% Borrowings % of Total Liabilities Q3’25, percent CUBI Regional Bank Peers2 7% 5%

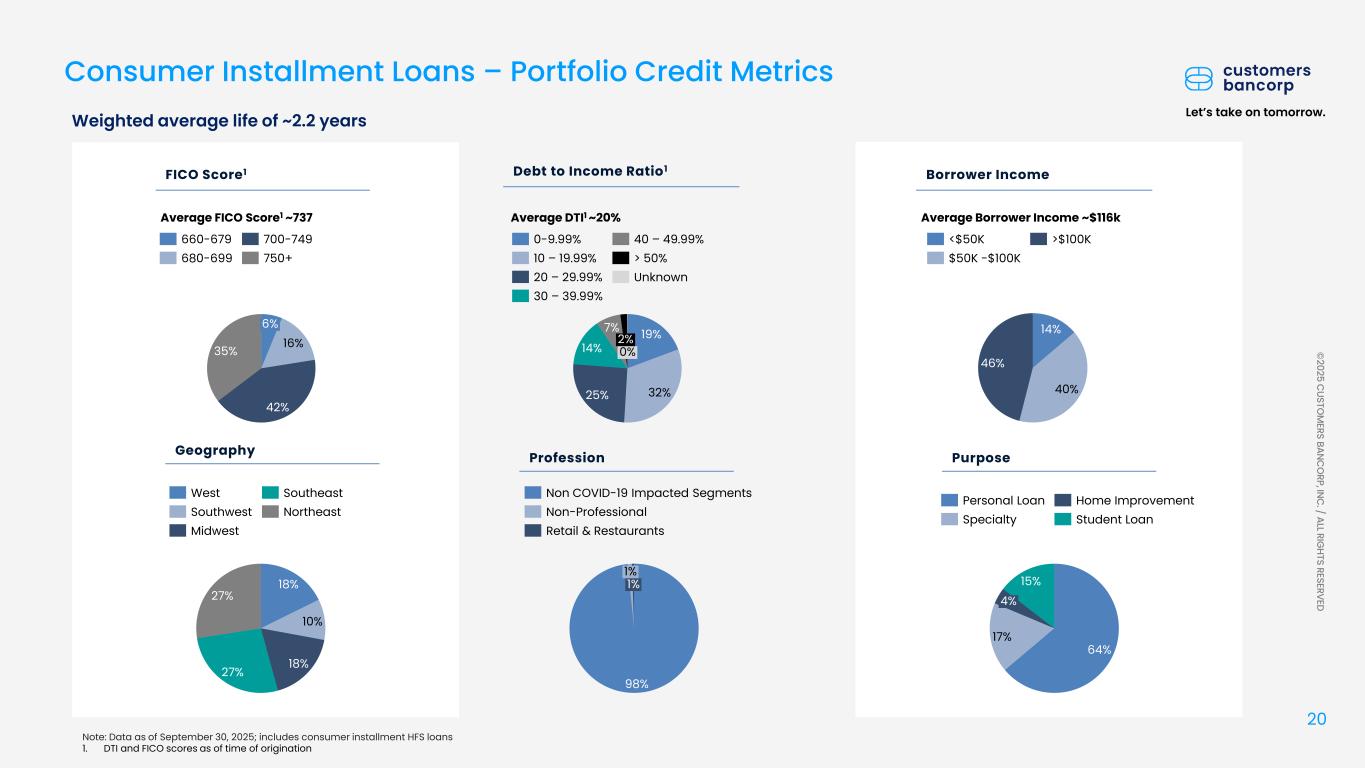

20 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED 16% 42% 35% 6% FICO Score1 660-679 680-699 700-749 750+ 19% 32%25% 14% 7% 2% 0% 0-9.99% 10 – 19.99% 20 – 29.99% 30 – 39.99% 40 – 49.99% > 50% Unknown Geography Profession Debt to Income Ratio1 Borrower Income 14% 40% 46% <$50K $50K -$100K >$100K 18% 10% 18% 27% 27% West Southwest Midwest Southeast Northeast Consumer Installment Loans – Portfolio Credit Metrics Purpose 64% 17% 15% 4% Personal Loan Specialty Home Improvement Student Loan 98% 1% 1% Non COVID-19 Impacted Segments Non-Professional Retail & Restaurants Average FICO Score1 ~737 Average DTI1 ~20% Average Borrower Income ~$116k Weighted average life of ~2.2 years Note: Data as of September 30, 2025; includes consumer installment HFS loans 1. DTI and FICO scores as of time of origination

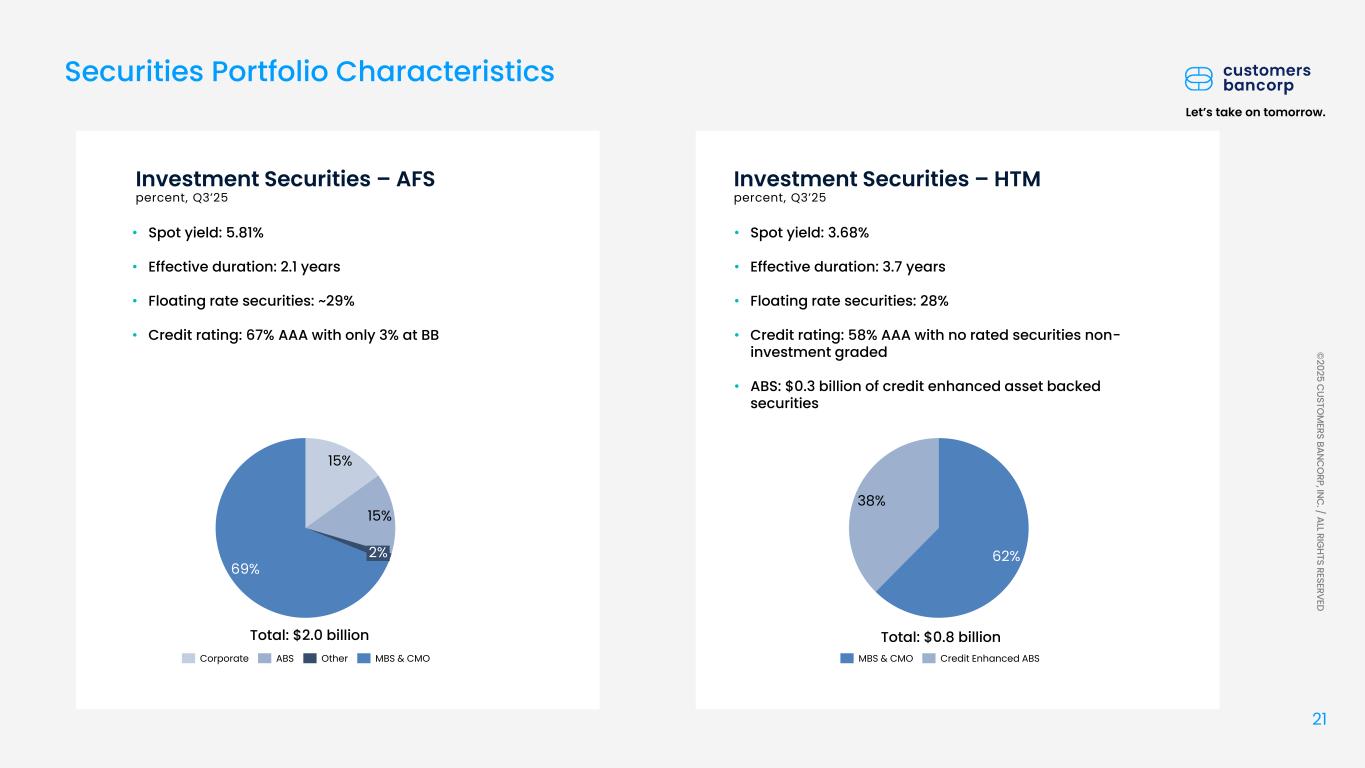

21 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Investment Securities – AFS percent, Q3’25 Securities Portfolio Characteristics • Spot yield: 5.81% • Effective duration: 2.1 years • Floating rate securities: ~29% • Credit rating: 67% AAA with only 3% at BB Investment Securities – HTM percent, Q3’25 • Spot yield: 3.68% • Effective duration: 3.7 years • Floating rate securities: 28% • Credit rating: 58% AAA with no rated securities non- investment graded • ABS: $0.3 billion of credit enhanced asset backed securities 62% 38% MBS & CMO Credit Enhanced ABS Total: $0.8 billion Corporate ABS Other MBS & CMO Total: $2.0 billion 15% 15% 69% 2%

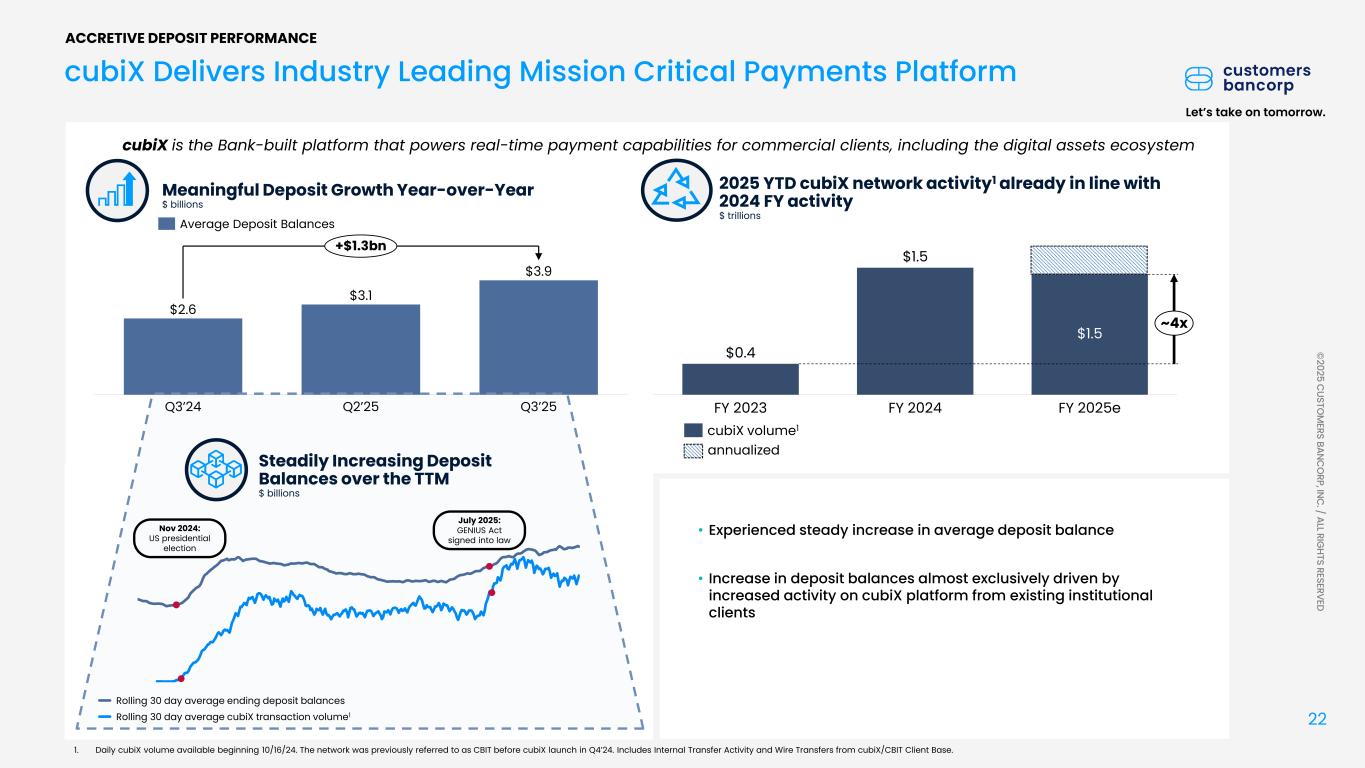

22 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVEDh h h cubiX Delivers Industry Leading Mission Critical Payments Platform ACCRETIVE DEPOSIT PERFORMANCE cubiX is the Bank-built platform that powers real-time payment capabilities for commercial clients, including the digital assets ecosystem $2.6 $3.1 $3.9 Q3’24 Q2’25 Q3’25 +$1.3bn Meaningful Deposit Growth Year-over-Year $ billions Average Deposit Balances • Experienced steady increase in average deposit balance • Increase in deposit balances almost exclusively driven by increased activity on cubiX platform from existing institutional clients Steadily Increasing Deposit Balances over the TTM $ billions FY 2023 FY 2024 $1.5 FY 2025e $0.4 $1.5 ~4x cubiX volume1 2025 YTD cubiX network activity1 already in line with 2024 FY activity $ trillions Rolling 30 day average ending deposit balances Rolling 30 day average cubiX transaction volume1 Nov 2024: US presidential election 1. Daily cubiX volume available beginning 10/16/24. The network was previously referred to as CBIT before cubiX launch in Q4’24. Includes Internal Transfer Activity and Wire Transfers from cubiX/CBIT Client Base. July 2025: GENIUS Act signed into law annualized

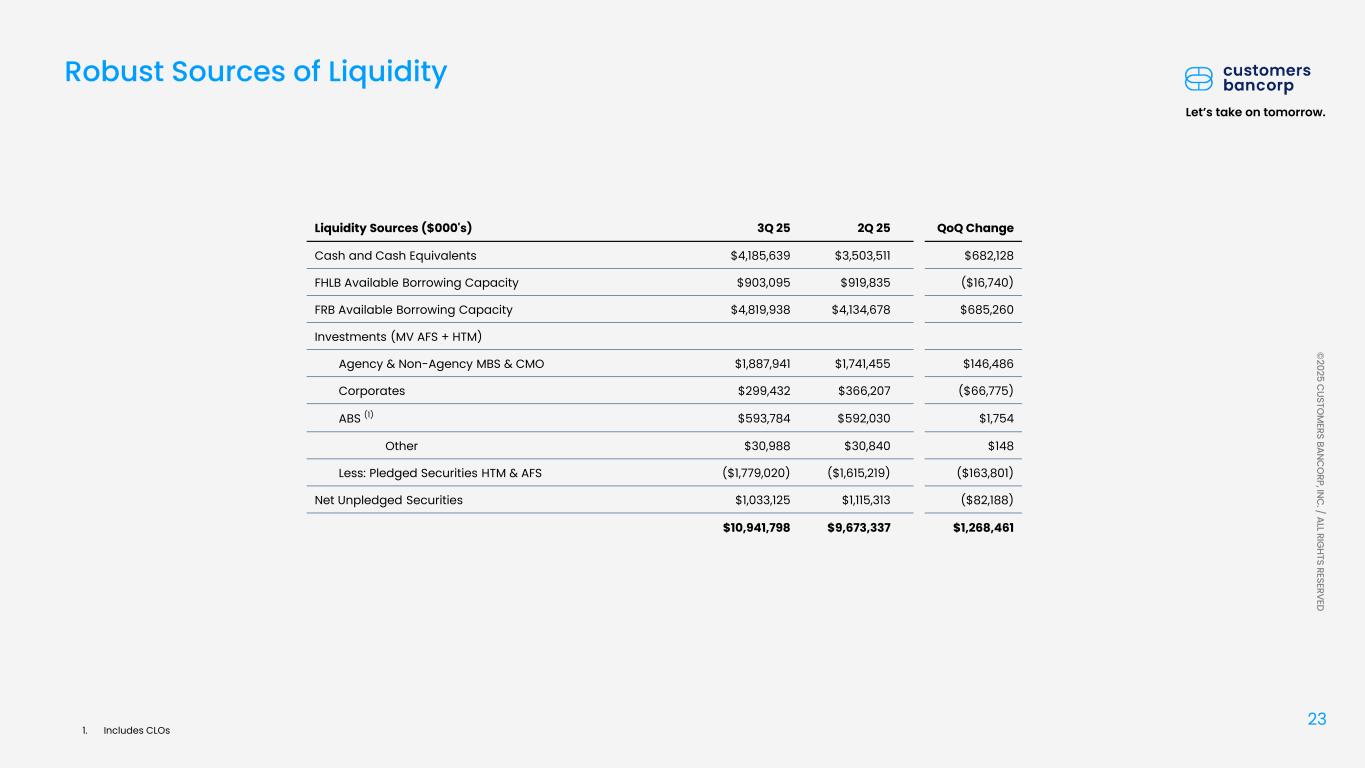

23 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Robust Sources of Liquidity 1. Includes CLOs Liquidity Sources ($000's) 3Q 25 2Q 25 QoQ Change Cash and Cash Equivalents $4,185,639 $3,503,511 $682,128 FHLB Available Borrowing Capacity $903,095 $919,835 ($16,740) FRB Available Borrowing Capacity $4,819,938 $4,134,678 $685,260 Investments (MV AFS + HTM) Agency & Non-Agency MBS & CMO $1,887,941 $1,741,455 $146,486 Corporates $299,432 $366,207 ($66,775) ABS (1) $593,784 $592,030 $1,754 Other $30,988 $30,840 $148 Less: Pledged Securities HTM & AFS ($1,779,020) ($1,615,219) ($163,801) Net Unpledged Securities $1,033,125 $1,115,313 ($82,188) $10,941,798 $9,673,337 $1,268,461

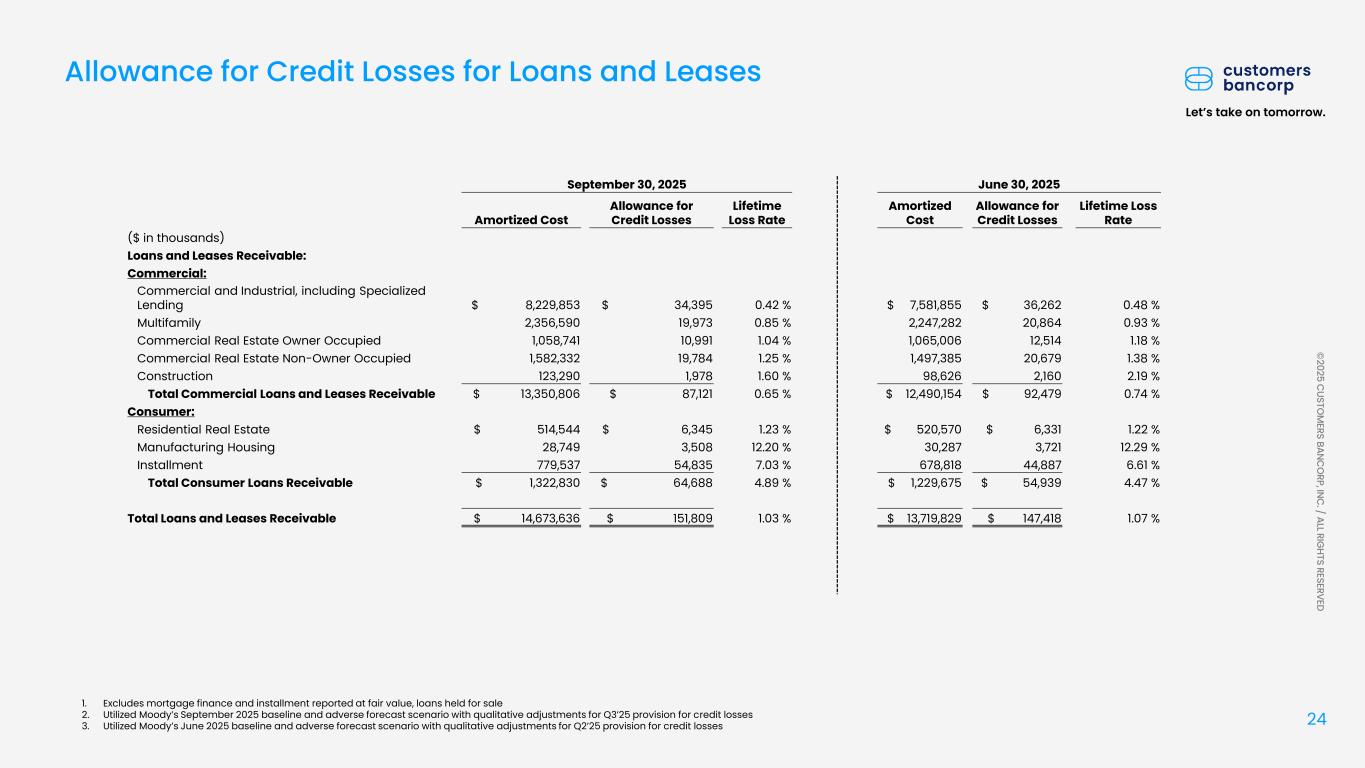

24 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED 1. Excludes mortgage finance and installment reported at fair value, loans held for sale 2. Utilized Moody’s September 2025 baseline and adverse forecast scenario with qualitative adjustments for Q3’25 provision for credit losses 3. Utilized Moody’s June 2025 baseline and adverse forecast scenario with qualitative adjustments for Q2’25 provision for credit losses Allowance for Credit Losses for Loans and Leases September 30, 2025 June 30, 2025 Amortized Cost Allowance for Credit Losses Lifetime Loss Rate Amortized Cost Allowance for Credit Losses Lifetime Loss Rate ($ in thousands) Loans and Leases Receivable: Commercial: Commercial and Industrial, including Specialized Lending $ 8,229,853 $ 34,395 0.42 % $ 7,581,855 $ 36,262 0.48 % Multifamily 2,356,590 19,973 0.85 % 2,247,282 20,864 0.93 % Commercial Real Estate Owner Occupied 1,058,741 10,991 1.04 % 1,065,006 12,514 1.18 % Commercial Real Estate Non-Owner Occupied 1,582,332 19,784 1.25 % 1,497,385 20,679 1.38 % Construction 123,290 1,978 1.60 % 98,626 2,160 2.19 % Total Commercial Loans and Leases Receivable $ 13,350,806 $ 87,121 0.65 % $ 12,490,154 $ 92,479 0.74 % Consumer: Residential Real Estate $ 514,544 $ 6,345 1.23 % $ 520,570 $ 6,331 1.22 % Manufacturing Housing 28,749 3,508 12.20 % 30,287 3,721 12.29 % Installment 779,537 54,835 7.03 % 678,818 44,887 6.61 % Total Consumer Loans Receivable $ 1,322,830 $ 64,688 4.89 % $ 1,229,675 $ 54,939 4.47 % Total Loans and Leases Receivable $ 14,673,636 $ 151,809 1.03 % $ 13,719,829 $ 147,418 1.07 %

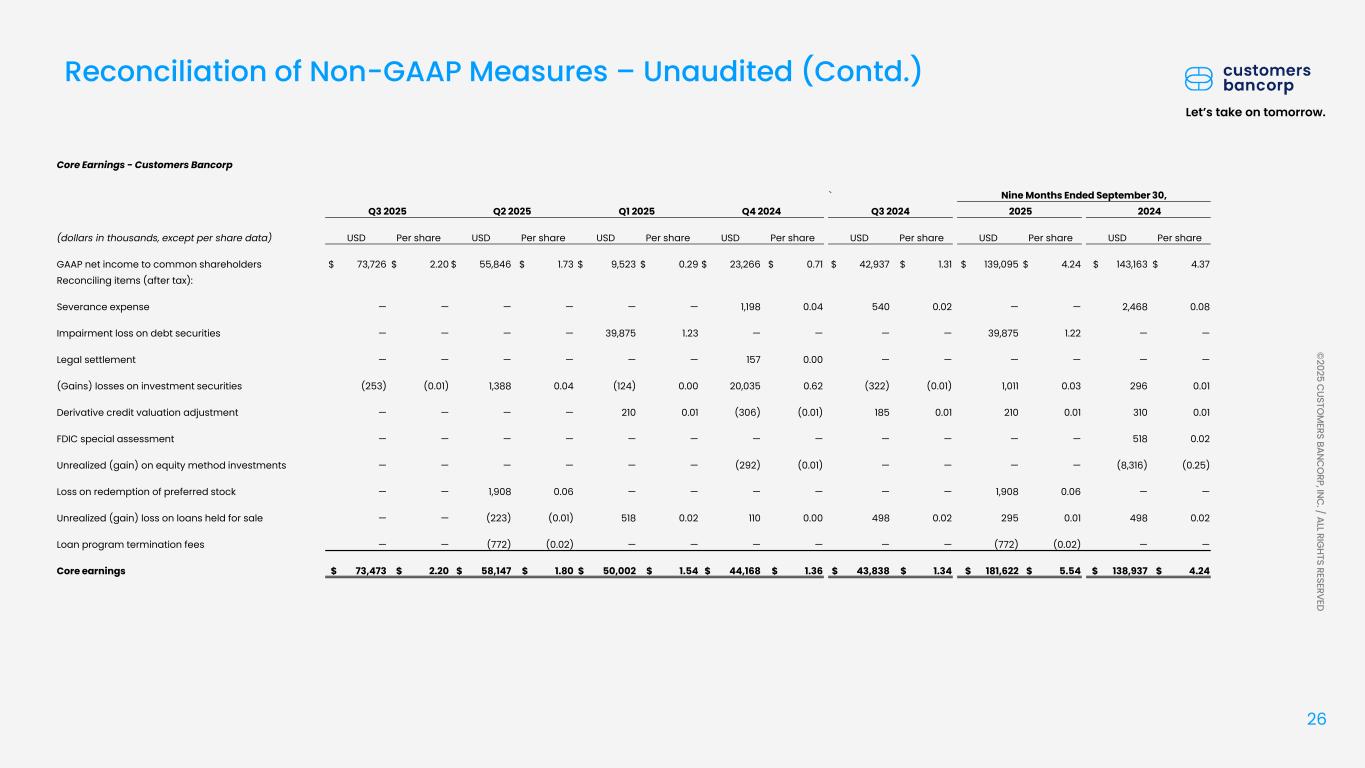

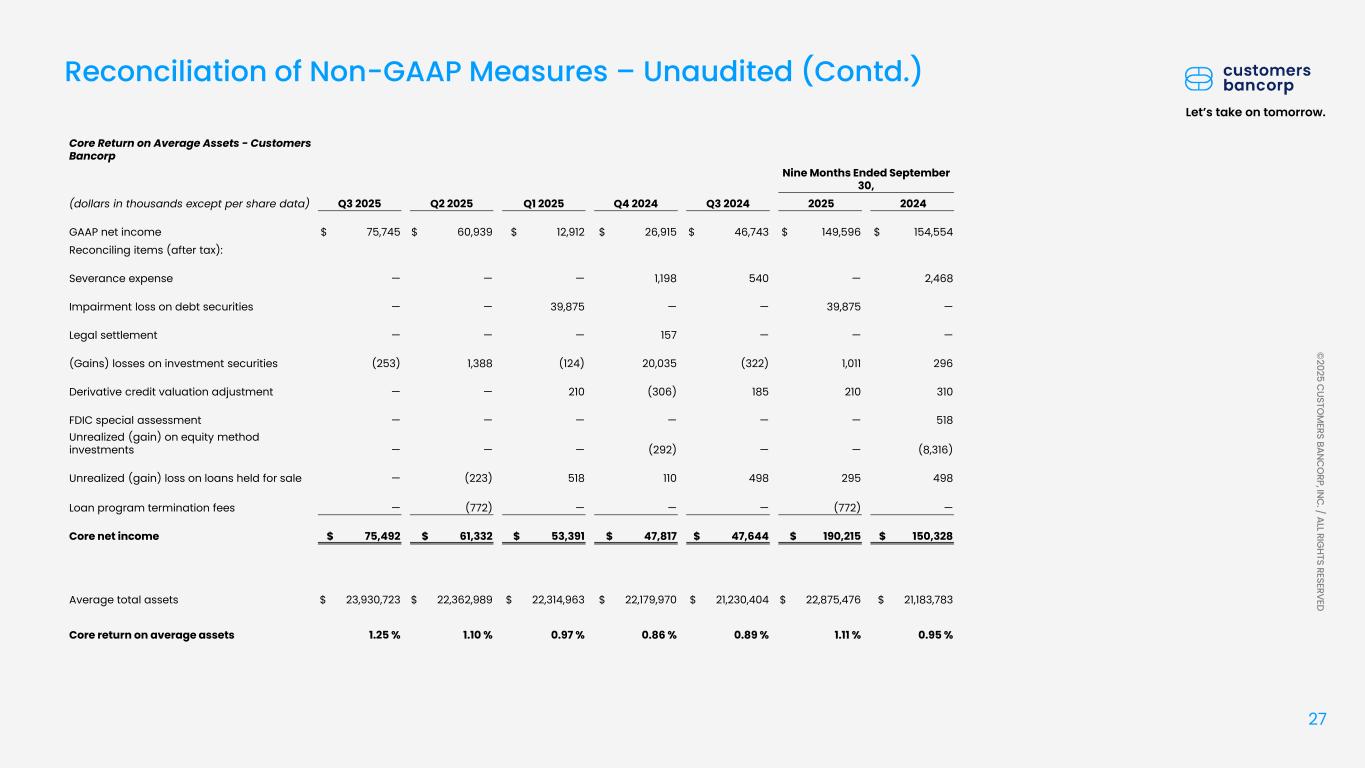

25 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Customers believes that the non-GAAP measurements disclosed within this document are useful for investors, regulators, management and others to evaluate our core results of operations and financial condition relative to other financial institutions. These non-GAAP financial measures are frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in Customers' industry. These non-GAAP financial measures exclude from corresponding GAAP measures the impact of certain elements that we do not believe are representative of our ongoing financial results, which we believe enhance an overall understanding of our performance and increases comparability of our period to period results. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. The non-GAAP measures presented are not necessarily comparable to non-GAAP measures that may be presented by other financial institutions. Although non-GAAP financial measures are frequently used in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results of operations or financial condition as reported under GAAP. Starting in Q3 2025, certain adjustments to GAAP measures were no longer included as our intention going forward is to limit these adjustments to those items of greatest significance. The following tables present reconciliations of GAAP to non-GAAP measures disclosed within this document. Reconciliation of Non-GAAP Measures - Unaudited

26 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Core Earnings - Customers Bancorp ` Nine Months Ended September 30, Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 2025 2024 (dollars in thousands, except per share data) USD Per share USD Per share USD Per share USD Per share USD Per share USD Per share USD Per share GAAP net income to common shareholders $ 73,726 $ 2.20 $ 55,846 $ 1.73 $ 9,523 $ 0.29 $ 23,266 $ 0.71 $ 42,937 $ 1.31 $ 139,095 $ 4.24 $ 143,163 $ 4.37 Reconciling items (after tax): Severance expense — — — — — — 1,198 0.04 540 0.02 — — 2,468 0.08 Impairment loss on debt securities — — — — 39,875 1.23 — — — — 39,875 1.22 — — Legal settlement — — — — — — 157 0.00 — — — — — — (Gains) losses on investment securities (253) (0.01) 1,388 0.04 (124) 0.00 20,035 0.62 (322) (0.01) 1,011 0.03 296 0.01 Derivative credit valuation adjustment — — — — 210 0.01 (306) (0.01) 185 0.01 210 0.01 310 0.01 FDIC special assessment — — — — — — — — — — — — 518 0.02 Unrealized (gain) on equity method investments — — — — — — (292) (0.01) — — — — (8,316) (0.25) Loss on redemption of preferred stock — — 1,908 0.06 — — — — — — 1,908 0.06 — — Unrealized (gain) loss on loans held for sale — — (223) (0.01) 518 0.02 110 0.00 498 0.02 295 0.01 498 0.02 Loan program termination fees — — (772) (0.02) — — — — — — (772) (0.02) — — Core earnings $ 73,473 $ 2.20 $ 58,147 $ 1.80 $ 50,002 $ 1.54 $ 44,168 $ 1.36 $ 43,838 $ 1.34 $ 181,622 $ 5.54 $ 138,937 $ 4.24

27 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Core Return on Average Assets - Customers Bancorp Nine Months Ended September 30, (dollars in thousands except per share data) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 2025 2024 GAAP net income $ 75,745 $ 60,939 $ 12,912 $ 26,915 $ 46,743 $ 149,596 $ 154,554 Reconciling items (after tax): Severance expense — — — 1,198 540 — 2,468 Impairment loss on debt securities — — 39,875 — — 39,875 — Legal settlement — — — 157 — — — (Gains) losses on investment securities (253) 1,388 (124) 20,035 (322) 1,011 296 Derivative credit valuation adjustment — — 210 (306) 185 210 310 FDIC special assessment — — — — — — 518 Unrealized (gain) on equity method investments — — — (292) — — (8,316) Unrealized (gain) loss on loans held for sale — (223) 518 110 498 295 498 Loan program termination fees — (772) — — — (772) — Core net income $ 75,492 $ 61,332 $ 53,391 $ 47,817 $ 47,644 $ 190,215 $ 150,328 Average total assets $ 23,930,723 $ 22,362,989 $ 22,314,963 $ 22,179,970 $ 21,230,404 $ 22,875,476 $ 21,183,783 Core return on average assets 1.25 % 1.10 % 0.97 % 0.86 % 0.89 % 1.11 % 0.95 %

28 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Core Return on Average Common Equity – Customers Bancorp Nine Months Ended September 30, (dollars in thousands except per share data) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 2025 2024 GAAP net income to common shareholders $ 73,726 $ 55,846 $ 9,523 $ 23,266 $ 42,937 $ 139,095 $ 143,163 Reconciling items (after tax): Severance expense — — — 1,198 540 — 2,468 Impairment loss on debt securities — — 39,875 — — 39,875 — Legal settlement — — — 157 — — — (Gains) losses on investment securities (253) 1,388 (124) 20,035 (322) 1,011 296 Derivative credit valuation adjustment — — 210 (306) 185 210 310 FDIC special assessment — — — — — — 518 Unrealized (gain) on equity method investments — — — (292) — — (8,316) Loss on redemption of preferred stock — 1,908 — — — 1,908 — Unrealized (gain) loss on loans held for sale — (223) 518 110 498 295 498 Loan program termination fees 0 (772) 0 0 0 (772) 0 Core earnings $ 73,473 $ 58,147 $ 50,002 $ 44,168 $ 43,838 $ 181,622 $ 138,937 Average total common shareholders' equity $ 1,878,115 $ 1,751,037 $ 1,730,910 $ 1,683,838 $ 1,636,242 $ 1,787,227 $ 1,580,885 Core return on average common equity 15.52 % 13.32 % 11.72 % 10.44 % 10.66 % 13.59 % 11.74 %

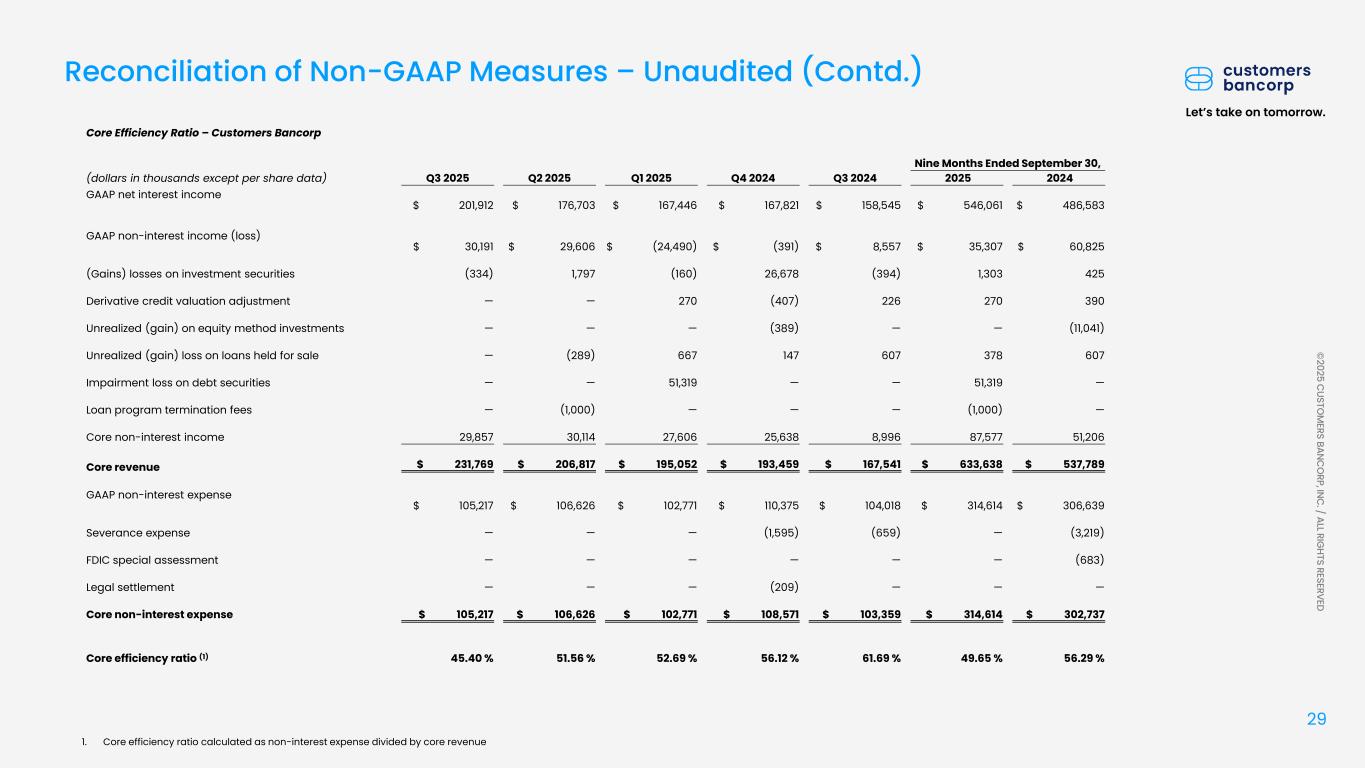

29 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) 1. Core efficiency ratio calculated as non-interest expense divided by core revenue Core Efficiency Ratio – Customers Bancorp Nine Months Ended September 30, (dollars in thousands except per share data) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 2025 2024 GAAP net interest income $ 201,912 $ 176,703 $ 167,446 $ 167,821 $ 158,545 $ 546,061 $ 486,583 GAAP non-interest income (loss) $ 30,191 $ 29,606 $ (24,490) $ (391) $ 8,557 $ 35,307 $ 60,825 (Gains) losses on investment securities (334) 1,797 (160) 26,678 (394) 1,303 425 Derivative credit valuation adjustment — — 270 (407) 226 270 390 Unrealized (gain) on equity method investments — — — (389) — — (11,041) Unrealized (gain) loss on loans held for sale — (289) 667 147 607 378 607 Impairment loss on debt securities — — 51,319 — — 51,319 — Loan program termination fees — (1,000) — — — (1,000) — Core non-interest income 29,857 30,114 27,606 25,638 8,996 87,577 51,206 Core revenue $ 231,769 $ 206,817 $ 195,052 $ 193,459 $ 167,541 $ 633,638 $ 537,789 GAAP non-interest expense $ 105,217 $ 106,626 $ 102,771 $ 110,375 $ 104,018 $ 314,614 $ 306,639 Severance expense — — — (1,595) (659) — (3,219) FDIC special assessment — — — — — — (683) Legal settlement — — — (209) — — — Core non-interest expense $ 105,217 $ 106,626 $ 102,771 $ 108,571 $ 103,359 $ 314,614 $ 302,737 Core efficiency ratio (1) 45.40 % 51.56 % 52.69 % 56.12 % 61.69 % 49.65 % 56.29 %

30 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Core Non-Interest Expense to Average Total Assets and Adjusted Core Non-Interest Expense to Average Total Assets- Customers Bancorp Nine Months Ended September 30, (dollars in thousands except per share data) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 2025 2024 GAAP non-interest expense $ 105,217 $ 106,626 $ 102,771 $ 110,375 $ 104,018 $ 314,614 $ 306,639 Severance expense — — — (1,595) (659) — (3,219) FDIC special assessment — — — — — — (683) Legal settlement — — — (209) — — — Core non-interest expense $ 105,217 $ 106,626 $ 102,771 $ 108,571 $ 103,359 $ 314,614 $ 302,737 One-time non-interest expense items recorded in 2024: Deposit servicing fees prior to 2024 — — — — — — (7,106) FDIC premiums prior to 2024 — — — — — — (4,208) Non-income taxes prior to 2024 — — — — 2,997 — 2,997 Total one-time non-interest expense items — — — — 2,997 — (8,317) Adjusted core non-interest expense $ 105,217 $ 106,626 $ 102,771 $ 108,571 $ 106,356 $ 314,614 $ 294,420 Average total assets $ 23,930,723 $ 22,362,989 $ 22,314,963 $ 22,179,970 $ 21,230,404 $ 22,875,476 $ 21,183,783 Core Non-interest Expense to average assets 1.74 % 1.91 % 1.87 % 1.95 % 1.94 % 1.84 % 1.91 %

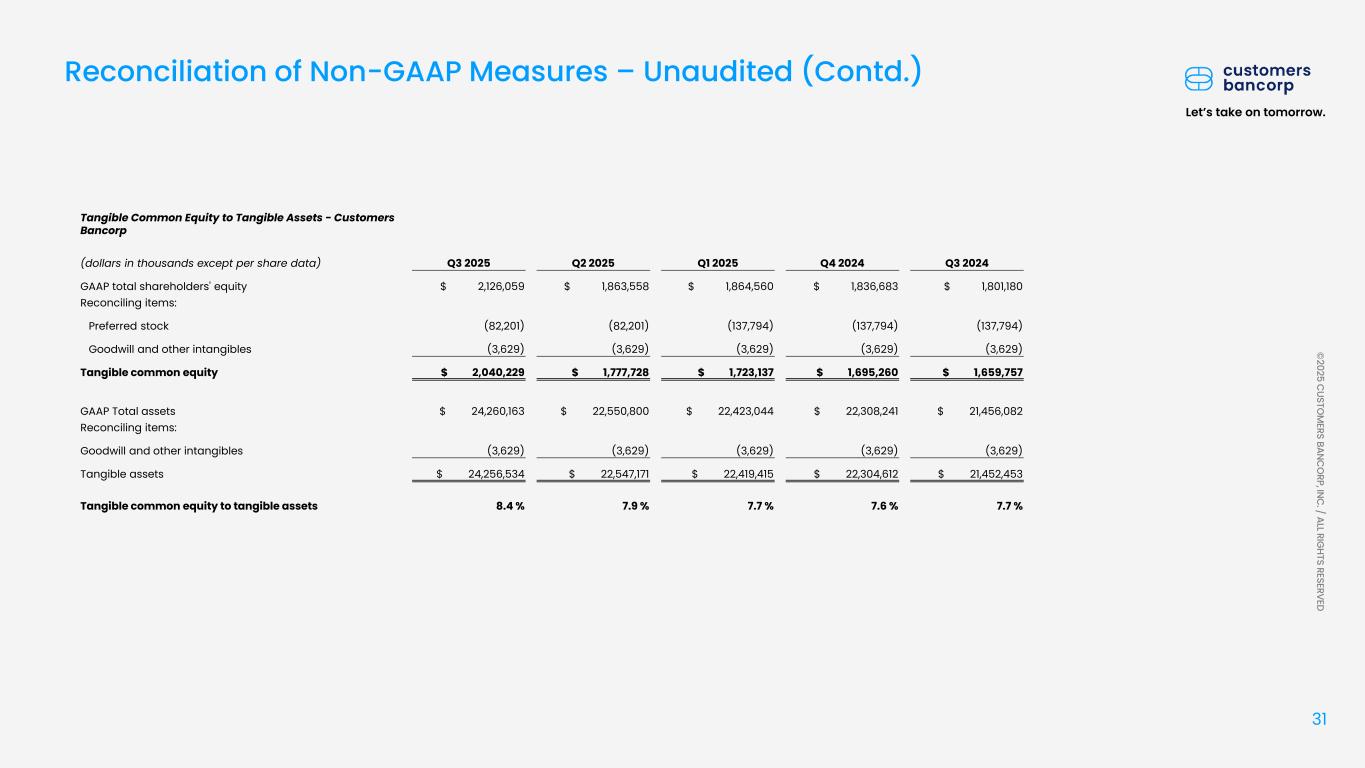

31 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Tangible Common Equity to Tangible Assets - Customers Bancorp (dollars in thousands except per share data) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 GAAP total shareholders' equity $ 2,126,059 $ 1,863,558 $ 1,864,560 $ 1,836,683 $ 1,801,180 Reconciling items: Preferred stock (82,201) (82,201) (137,794) (137,794) (137,794) Goodwill and other intangibles (3,629) (3,629) (3,629) (3,629) (3,629) Tangible common equity $ 2,040,229 $ 1,777,728 $ 1,723,137 $ 1,695,260 $ 1,659,757 GAAP Total assets $ 24,260,163 $ 22,550,800 $ 22,423,044 $ 22,308,241 $ 21,456,082 Reconciling items: Goodwill and other intangibles (3,629) (3,629) (3,629) (3,629) (3,629) Tangible assets $ 24,256,534 $ 22,547,171 $ 22,419,415 $ 22,304,612 $ 21,452,453 Tangible common equity to tangible assets 8.4 % 7.9 % 7.7 % 7.6 % 7.7 %

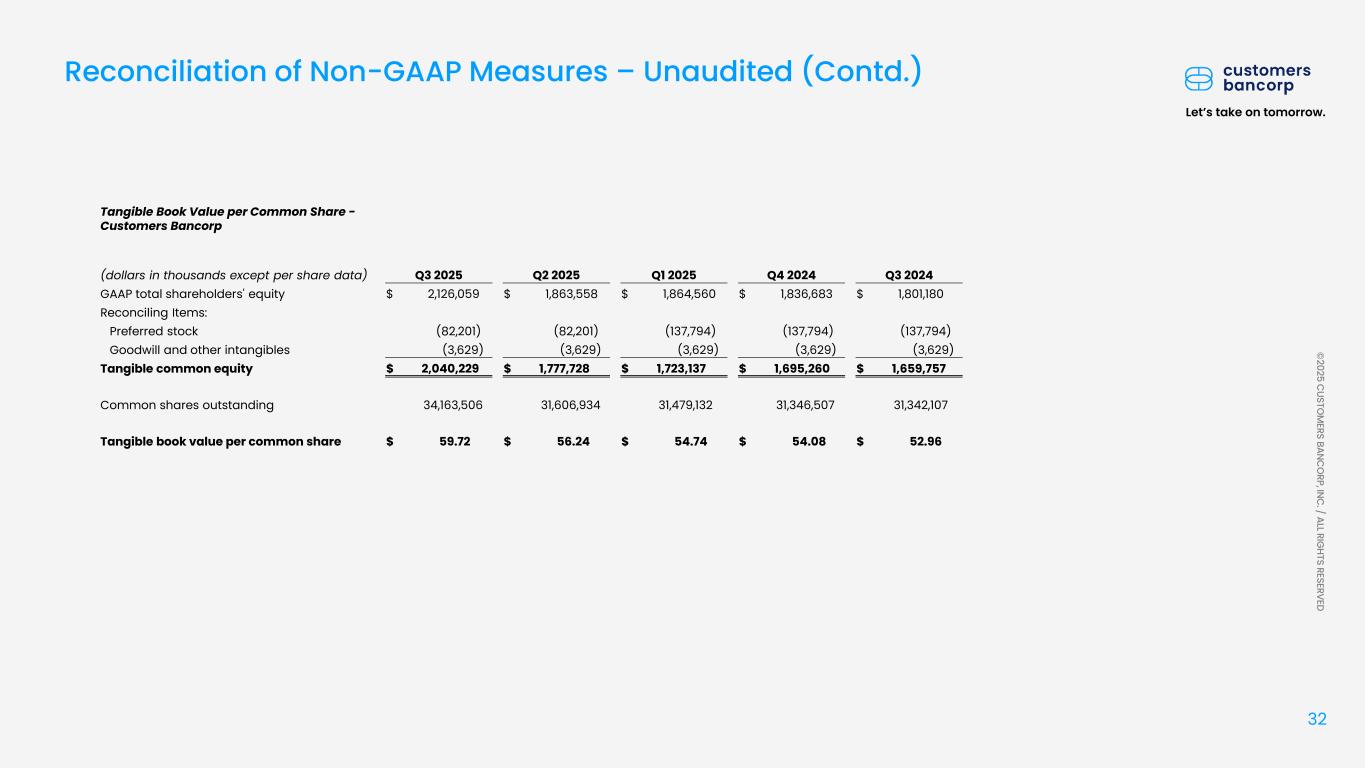

32 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Tangible Book Value per Common Share - Customers Bancorp (dollars in thousands except per share data) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 GAAP total shareholders' equity $ 2,126,059 $ 1,863,558 $ 1,864,560 $ 1,836,683 $ 1,801,180 Reconciling Items: Preferred stock (82,201) (82,201) (137,794) (137,794) (137,794) Goodwill and other intangibles (3,629) (3,629) (3,629) (3,629) (3,629) Tangible common equity $ 2,040,229 $ 1,777,728 $ 1,723,137 $ 1,695,260 $ 1,659,757 Common shares outstanding 34,163,506 31,606,934 31,479,132 31,346,507 31,342,107 Tangible book value per common share $ 59.72 $ 56.24 $ 54.74 $ 54.08 $ 52.96

33 Let’s take on tomorrow. © 2025 C USTO M ERS BANC O RP, INC . / ALL RIG HTS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Tangible Book Value per Common Share - Customers Bancorp (dollars in thousands except per share data) Q4 2024 Q4 2023 Q4 2022 Q4 2021 Q4 2020 Q4 2019 GAAP total shareholders' equity $ 1,836,683 $ 1,638,394 $ 1,402,961 $ 1,366,217 $ 1,117,086 $ 1,052,795 Reconciling Items: Preferred stock (137,794) (137,794) (137,794) (137,794) (217,471) (217,471) Goodwill and other intangibles (3,629) (3,629) (3,629) (3,736) (14,298) (15,195) Tangible common equity $ 1,695,260 $ 1,496,971 $ 1,261,538 $ 1,224,687 $ 885,317 $ 820,129 Common shares outstanding 31,346,507 31,440,906 32,373,697 32,913,267 31,705,088 31,336,791 Tangible book value per common share $ 54.08 $ 47.61 $ 38.97 $ 37.21 $ 27.92 $ 26.17